Harry Sit's Blog, page 9

March 3, 2024

Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year

The previous post Backdoor Roth in TurboTax: Recharacterize and Convert, 1st Year dealt with contributing to a Traditional IRA for the previous year and recharacterizing a previous year’s Roth IRA contribution as a Traditional IRA contribution. This post handles the conversion part.

Here’s the first example scenario:

You contributed $6,000 to a Traditional IRA for 2022 in 2023. The value increased to $6,200 when you converted it to Roth in 2023. You received a 1099-R form listing this $6,200 Roth conversion.

You should’ve already reported the contribution part on your 2022 tax return by following Backdoor Roth in TurboTax: Recharacterize & Convert, 1st Year. The IRA custodian sent you a 1099-R form for the conversion in 2023. This post shows you how to put it into TurboTax.

Here’s the second example scenario:

You contributed $6,000 to a Roth IRA for 2022 in 2022. You realized that your income was too high when you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Traditional contribution before April 15, 2023. The IRA custodian moved $6,100 from your Roth IRA to your Traditional IRA because your original $6,000 contribution had some earnings. The value increased again to $6,200 when you converted it to Roth in 2023. You received two 1099-R forms, one for $6,100 and another for $6,200.

You should’ve already reported the recharacterized contribution on your 2022 tax return by following Backdoor Roth in TurboTax: Recharacterize & Convert, 1st Year. The IRA custodian sent you two 1099-R forms, one for the recharacterization, and the other for the conversion. This post shows you how to put both of them into TurboTax.

If you contributed for 2023 in 2024 or if you recharacterized a 2023 contribution in 2024, you’re still in the first year of this journey. Please follow Backdoor Roth in TurboTax: Recharacterize and Convert, 1st Year. If you recharacterized your 2023 contribution in 2023 and converted in 2023, please follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year.

If neither of these example scenarios fits you, please consult our guide for a normal “clean” backdoor Roth: How To Report Backdoor Roth In TurboTax (Updated).

If you’re married and both you and your spouse did the same thing, you should follow the steps below once for yourself and once again for your spouse.

Table of ContentsUse TurboTax Download1099-R for RecharacterizationNo Need to Amend1099-R for ConversionConvertedBasisTaxable IncomeClean Traditional IRA ContributionUse TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

1099-R for RecharacterizationThis section only applies to the second example scenario. If you didn’t recharacterize (the first example scenario), please skip this section and jump over to the conversion section.

We handle the 1099-R form for recharacterization first. This 1099-R form has a code ‘R’ in Box 7.

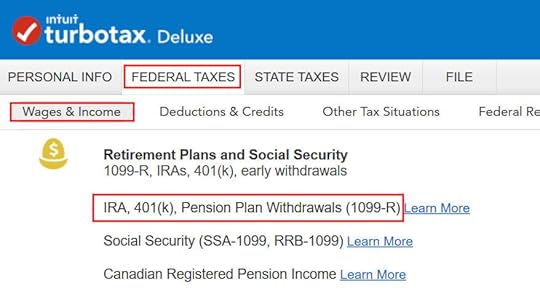

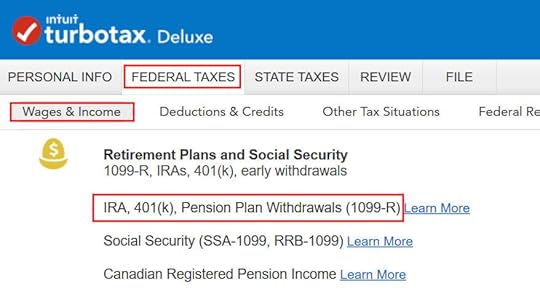

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

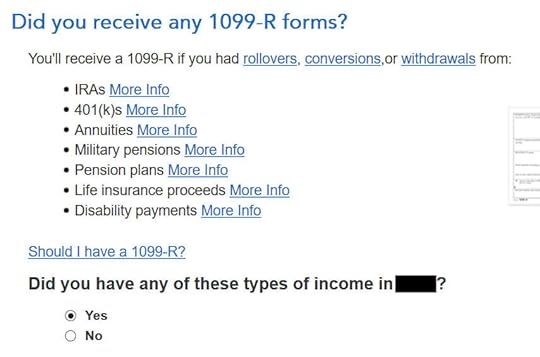

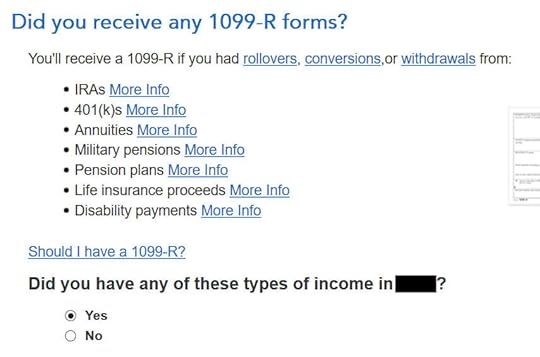

Confirm that you have received a 1099-R form. Import the 1099-R if you’d like. I’m choosing to type it myself.

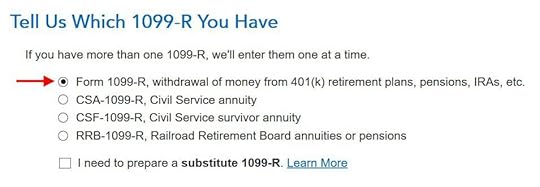

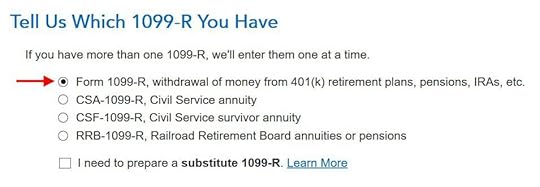

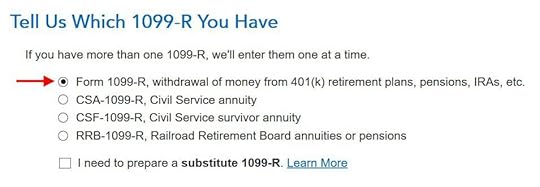

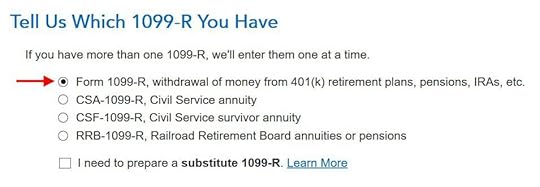

It’s a regular 1099-R.

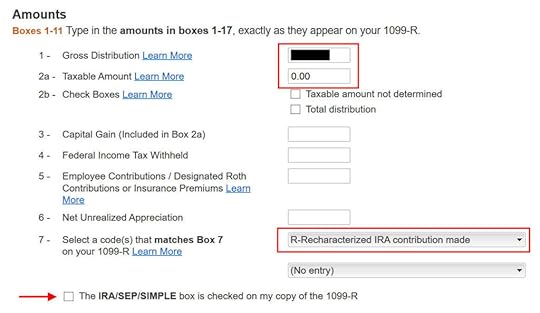

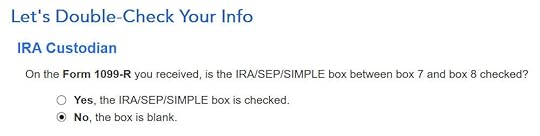

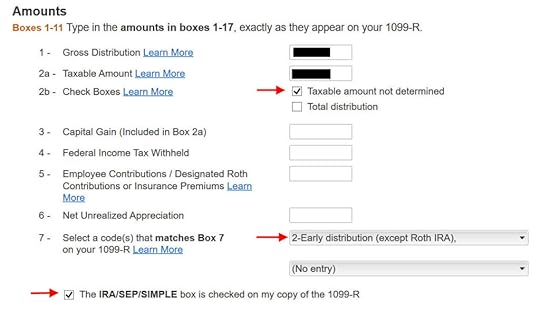

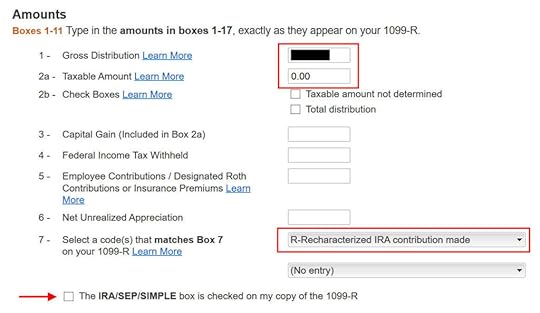

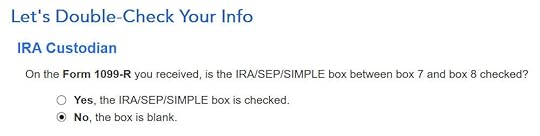

The amount that moved from your Roth IRA to your Traditional IRA shows in Box 1. The taxable amount in Box 2a is zero. The two checkboxes in Box 2b aren’t checked. The code in Box 7 is “R.” The “IRA/SEP/SIMPLE” box under Box 7 may or may not be checked. It’s not checked in our sample 1099-R.

That box is blank in our 1099-R, and that’s OK.

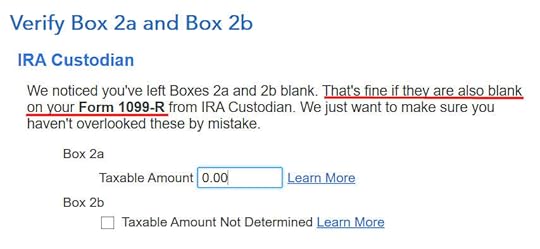

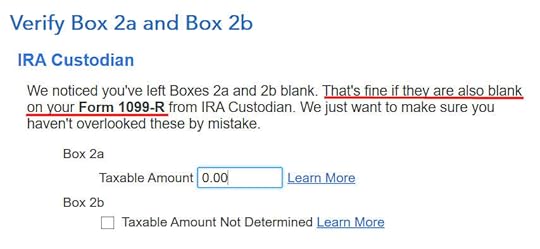

It’s normal to see zero in Box 2a and blank in Box 2b. TurboTax just wants to double-check.

Not a Public Safety Officer.

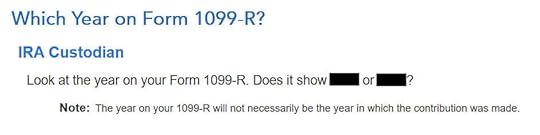

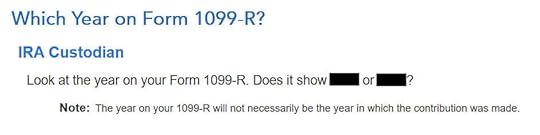

When you’re doing taxes for 2023, chances are the 1099-R form is for 2023. Click on the button that matches the year on the form.

No Need to Amend

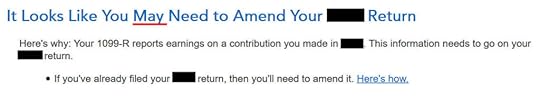

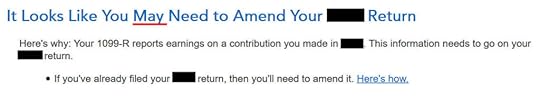

This is unnecessary if you already reported the recharacterization in the previous year’s tax return as shown in our previous post. You only need to amend your previous tax return if you didn’t follow those steps.

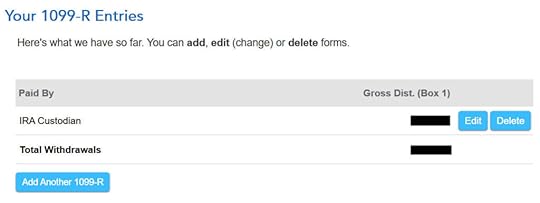

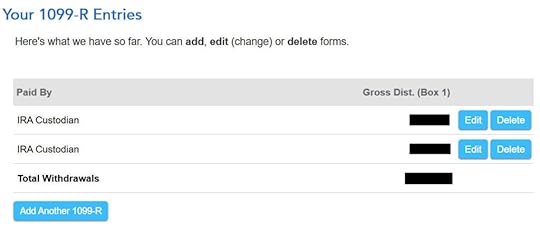

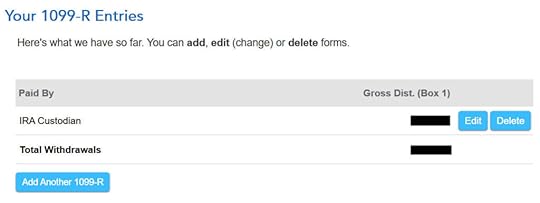

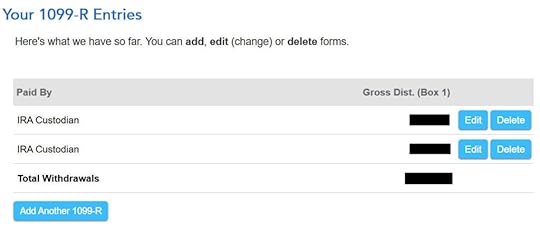

You’re done with the first 1099-R form. Click on “Add Another 1099-R” to add the second one if you don’t already have both 1099-R forms imported.

1099-R for Conversion

The second 1099-R form is also a regular 1099-R.

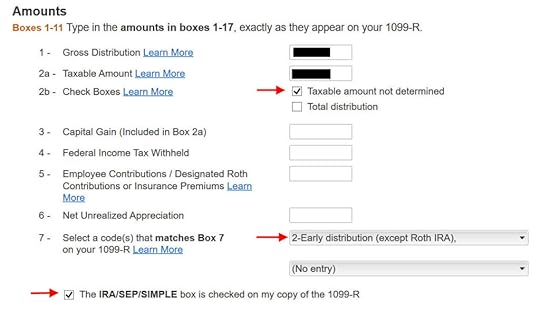

It’s normal to see the conversion reported in Box 2a as the taxable amount when Box 2b is checked to say “Taxable amount not determined.” The code in Box 7 is ‘2‘ when you’re under 59-1/2 or ‘7‘ when you’re over 59-1/2. The “IRA/SEP/SIMPLE” box is checked on this 1099-R form for the conversion.

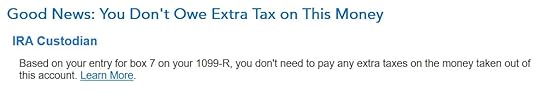

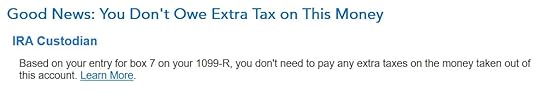

It says that you don’t owe extra tax on this money. If your refund meter drops, don’t panic. It’s normal and temporary.

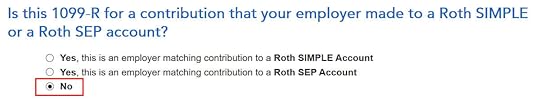

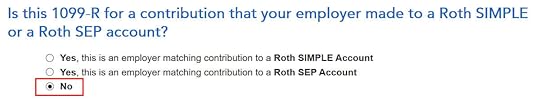

It’s not a Roth SIMPLE or a Roth SEP.

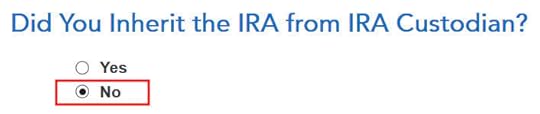

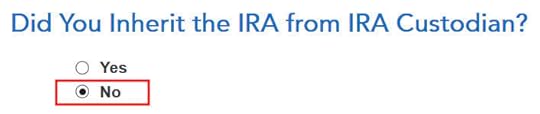

Did not inherit it.

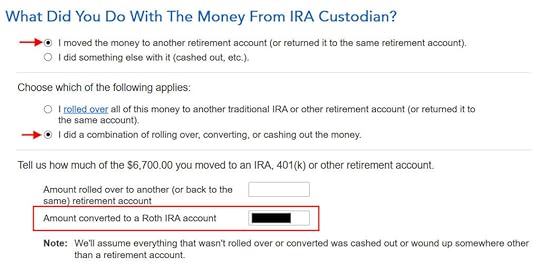

Converted

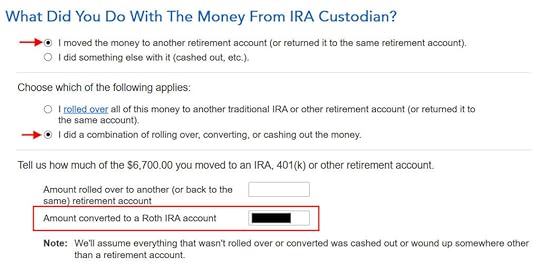

First click on “I moved …” then click on “I did a combination …” Enter the amount you converted to Roth in the box. Don’t choose the “I rolled over …” option. A rollover means Traditional-to-Traditional. Converting to Roth isn’t a rollover.

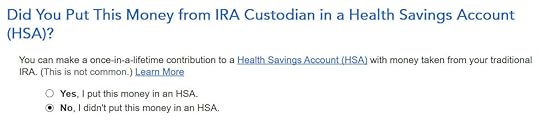

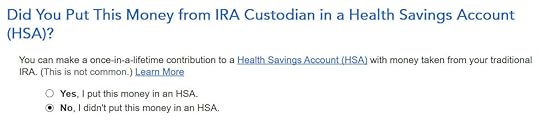

Didn’t put it in an HSA.

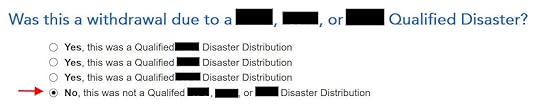

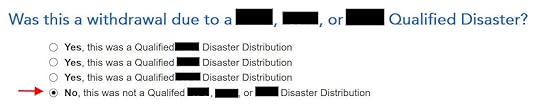

Not due to a disaster.

Now the 1099-R summary includes both 1099-R forms. Keep going by clicking on “Continue.”

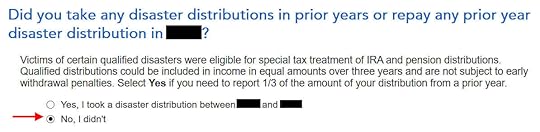

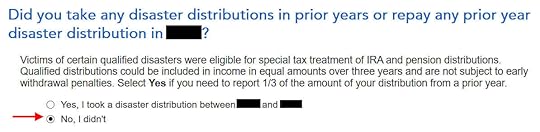

No disaster distributions.

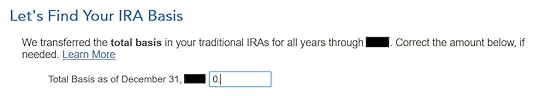

Basis

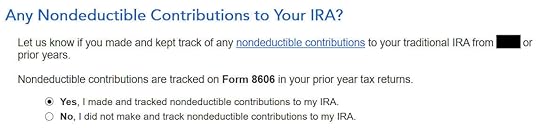

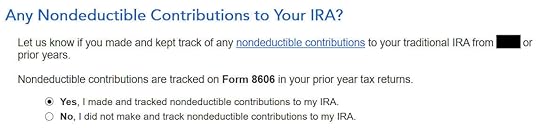

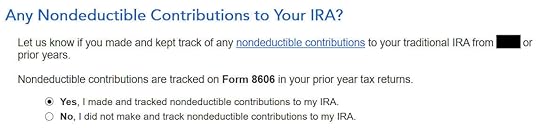

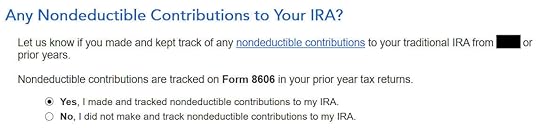

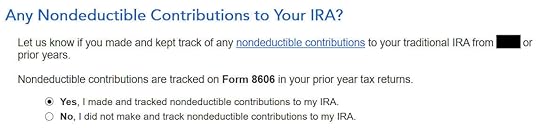

Choose “Yes” because the 2022 Roth IRA contribution you recharacterized in 2023 counts as a nondeductible Traditional IRA contribution for 2022.

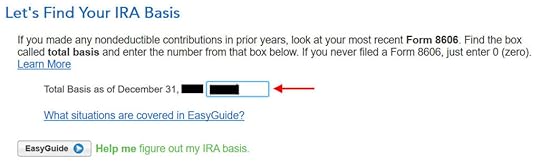

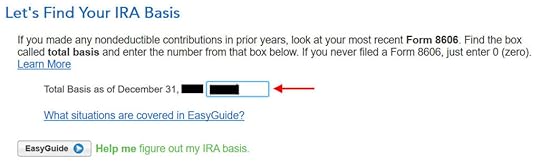

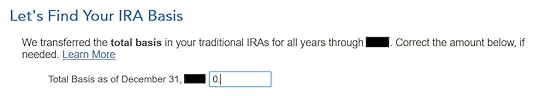

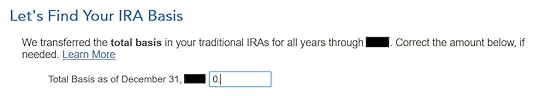

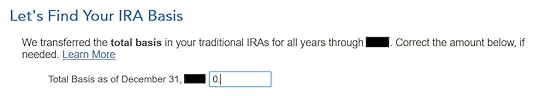

TurboTax should populate this value from last year’s return. If it doesn’t, get the value from your last year’s Form 8606 Line 14, which was generated when you followed the previous post Backdoor Roth in TurboTax: Recharacterize & Convert, 1st Year.

The refund meter goes back up after you enter the total basis.

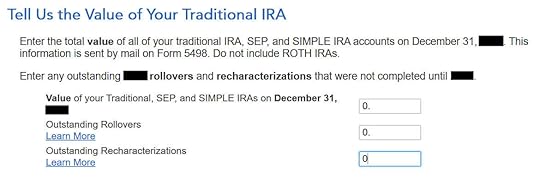

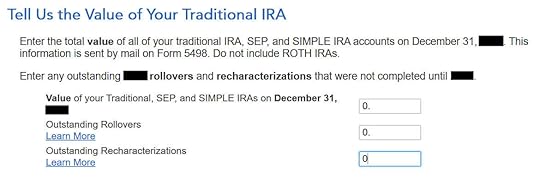

This is normally zero if you converted everything. If you have a few dollars left in the account from earnings posted after you converted, enter the value from your year-end statement in the first box.

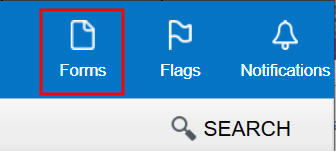

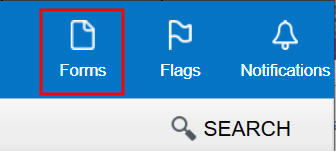

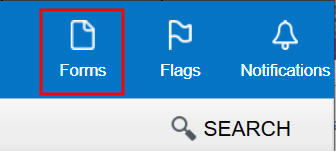

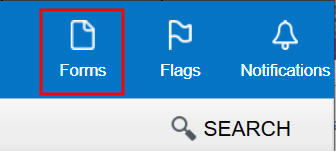

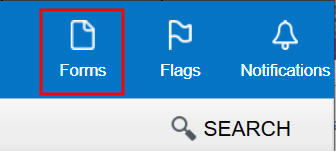

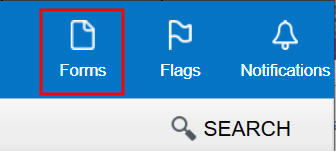

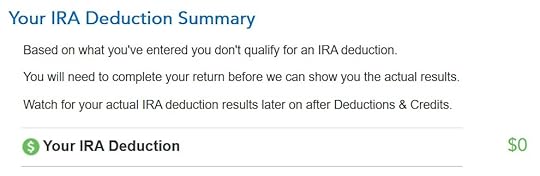

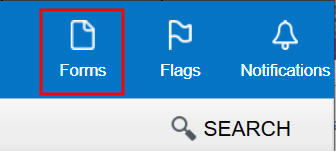

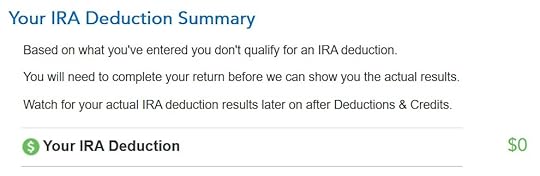

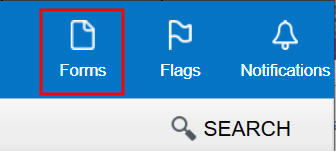

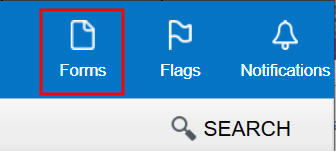

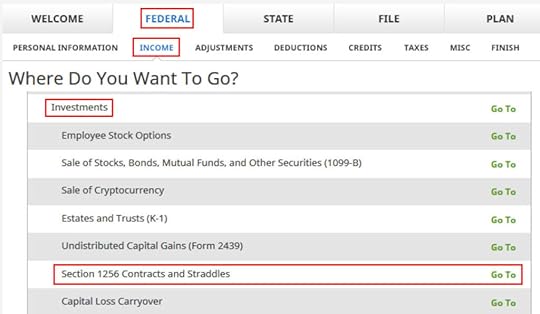

Taxable IncomeYou’re done with the two 1099-R forms. Let’s look at how they show up on your tax return. Click on “Forms” on the top right.

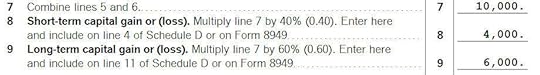

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b. They show a $6,200 distribution from the IRA and only $200 of the $6,200 is taxable. That’s the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth.

When you’re done examining the form, click on Step-by-Step on the top right to go back to the interview.

Clean Traditional IRA Contribution

Clean Traditional IRA ContributionIf you also did a “clean” backdoor Roth in 2023 on top of converting your contribution for 2022, in other words, you contributed to a Traditional IRA for 2023 in 2023 and converted in 2023, your 1099-R includes converting two year’s worth of contributions in a single year. All the steps in the previous section are still the same except that you have a larger amount on your 1099-R form.

The basis from the previous year’s tax return took care of one-half of the conversion. You also need to report your 2023 Traditional IRA contribution. Please follow the steps in the Non-Deductible Contribution to Traditional IRA section in our walkthrough for a clean backdoor Roth for 2023.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year appeared first on The Finance Buff.

Backdoor Roth in TurboTax: Recharacterize and Convert, 2nd Year

The previous post Backdoor Roth in TurboTax: Recharacterize and Convert, 1st Year dealt with contributing to a Traditional IRA for the previous year and recharacterizing a previous year’s Roth IRA contribution as a Traditional IRA contribution. This post handles the conversion part.

Here’s the first example scenario:

You contributed $6,500 to a Traditional IRA for 2022 in 2023. The value increased to $6,700 when you converted it to Roth in 2023.

You already reported the contribution part on your 2022 tax return. The IRA custodian sent you a 1099-R form for the conversion in 2023. This post shows you how to put it into TurboTax.

Here’s the second example scenario:

You contributed $6,500 to a Roth IRA for 2022 in 2022. You realized that your income was too high when you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Traditional contribution before April 15, 2023. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. The value increased again to $6,700 when you converted it to Roth in 2023.

You already reported the recharacterized contribution on your 2022 tax return. The IRA custodian sent you two 1099-R forms, one for the recharacterization, and the other for the conversion. This post shows you how to put both of them into TurboTax.

If you contributed for 2023 in 2024 or if you recharacterized a 2023 contribution in 2024, you’re still in the first year of this journey. Please follow Backdoor Roth in TurboTax: Recharacterize and Convert, 1st Year.

If neither of these example scenarios fits you, please consult our guide for a normal “clean” backdoor Roth: How To Report Backdoor Roth In TurboTax (Updated).

Table of ContentsUse TurboTax Download1099-R for RecharacterizationNo Need to Amend1099-R for ConversionConvertedBasisClean Traditional IRA ContributionUse TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

1099-R for RecharacterizationThis section only applies to the second example scenario. If you didn’t recharacterize (the first example scenario), please skip this section and jump over to the conversion section.

We handle the 1099-R form for recharacterization first. This 1099-R form has a code ‘R’ in Box 7.

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

Confirm that you have received a 1099-R form. Import the 1099-R if you’d like. I’m choosing to type it myself.

It’s a regular 1099-R.

The amount that moved from your Roth IRA to your Traditional IRA shows in Box 1. The taxable amount in Box 2a is zero. The two checkboxes in Box 2b aren’t checked. The code in Box 7 is “R.” The “IRA/SEP/SIMPLE” box under Box 7 may or may not be checked. It’s not checked in our sample 1099-R.

That box is blank in our 1099-R, and that’s OK.

It’s normal to see zero in Box 2a and blank in Box 2b. TurboTax just wants to double-check.

Not a Public Safety Officer.

When you’re doing taxes for 2023, chances are the 1099-R form is for 2023. Click on the button that matches the year on the form.

No Need to Amend

This is misleading. You already reported the recharacterization in the previous year’s tax return if you followed our previous post. You only need to amend your previous tax return if you didn’t follow those steps.

You’re done with the first 1099-R form. Click on “Add Another 1099-R” to add the second one if you don’t already have both 1099-R forms imported.

1099-R for Conversion

The second 1099-R form is also a regular 1099-R.

It’s normal to see the conversion reported in Box 2a as the taxable amount when Box 2b is checked to say “Taxable amount not determined.” The code in Box 7 is ‘2’ when you’re under 59-1/2. It’s ‘7’ when you’re over 59-1/2. The “IRA/SEP/SIMPLE” box is checked on this 1099-R form for the conversion.

It says that you don’t owe extra tax on this money. If your refund meter drops, don’t panic. It’s normal and temporary.

It’s not a Roth SIMPLE or a Roth SEP.

Did not inherit it.

Converted

First click on “I moved …” then click on “I did a combination …” Enter the amount you converted to Roth in the box. Don’t choose the “I rolled over …” option. A rollover means Traditional-to-Traditional. Converting to Roth isn’t a rollover.

Didn’t put it in an HSA.

Not due to a disaster.

Now the 1099-R summary includes both 1099-R forms. Keep going by clicking on “Continue.”

No disaster distributions.

Basis

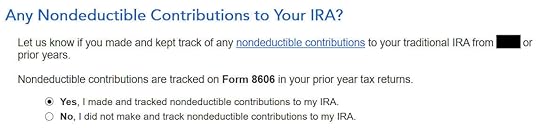

Choose “Yes” because the 2022 Roth IRA contribution you recharacterized in 2023 counts as a nondeductible Traditional IRA contribution for 2022.

TurboTax should populate this value from last year’s return. If it doesn’t, get the value from your last year’s Form 8606 Line 14, which you generated if you followed the previous post Backdoor Roth in TurboTax: Recharacterize and Convert, 1st Year.

The refund meter goes back up after you enter the total basis.

This is normally zero if you converted everything. If you have a few dollars left in the account from earnings posted after you converted, enter the value from your year-end statement in the first box.

Clean Traditional IRA ContributionIf you also did a “clean” backdoor Roth in 2023 on top of converting your contribution for 2022, in other words, you contributed to a Traditional IRA for 2023 in 2023 and converted in 2023, your 1099-R includes converting two year’s worth of contributions in a single year. All the steps in the previous section are still the same except that you have a larger amount on your 1099-R form.

The basis from the previous year’s tax return took care of one-half of the conversion. You also need to report your 2023 Traditional IRA contribution. Please follow the steps in the Non-Deductible Contribution to Traditional IRA section in our walkthrough for a clean backdoor Roth for 2023.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Backdoor Roth in TurboTax: Recharacterize and Convert, 2nd Year appeared first on The Finance Buff.

Split-Year Backdoor Roth IRA in TurboTax, 1st Year

The best way to do a backdoor Roth is to do it “clean” by contributing *for* and converting in the same year — contribute for 2023 in 2023 and convert in 2023, contribute for 2024 in 2024 and convert in 2024, and contribute for 2025 in 2025 and convert in 2025. Don’t split them into two years such as contributing for 2022 in 2023 and converting in 2023 or contributing for 2023 in 2024 and converting in 2024. If you did a “clean” backdoor Roth, please follow How To Report Backdoor Roth In TurboTax (Updated).

However, many people didn’t know they should’ve done it “clean.” Some people thought it was natural to contribute to an IRA for 2023 between January 1 and April 15 in 2024. Some people contributed directly to a Roth IRA for 2023 in 2023 and only found out their income was too high when they did their taxes in 2024. They had to recharacterize the previous year’s Roth IRA contribution as a Traditional IRA contribution and convert it again to Roth after the fact.

When you contribute for the previous year and convert (or recharacterize and convert in the following year), you have to report them on your tax return in two different years: the contribution in one year and the conversion in the following year. It’s more confusing than a straight “clean” backdoor Roth but that’s the price you pay for not knowing the right way. This post shows you how to do the contribution part in TurboTax for the first year. The follow-up post Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year shows you how to do the conversion part in TurboTax for the second year.

If you recharacterized your 2023 contribution in 2023 and converted in 2023, please follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year.

I’m showing two examples — (1) a direct contribution to a Traditional IRA for the previous year; and (2) recharacterizing a Roth contribution for the previous year as a Traditional contribution. Please see which example matches your scenario and follow along accordingly.

Table of ContentsUse TurboTax DownloadContributed for the Previous YearContributed to Traditional IRAConverted, Did Not RecharacterizeBasisMake It NondeductibleForm 8606Break the CycleRecharacterized Before ConvertingContributed to Roth IRARecharacterizedRoth BasisMake It NondeductibleForm 8606Switch to Clean Backdoor RothUse TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

Contributed for the Previous YearHere’s the example scenario for a direct contribution to the Traditional IRA:

You contributed $6,500 to a Traditional IRA for 2023 between January 1 and April 15, 2024. You then converted it to Roth in 2024.

Because your contribution was *for* 2023, you need to report it on your 2023 tax return by following this guide. Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion when you do your 2024 tax return. Come again next year to follow Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

If you contributed to a Traditional IRA in 2023 for 2022, everything below should’ve happened in your 2022 tax return. In other words,

You contributed $6,000 to a Traditional IRA for 2022 between January 1 and April 15, 2023. You then converted it to Roth in 2023.

Then you should’ve gone through the steps below in your 2022 tax return. If you didn’t, you should fix your 2022 return. The conversion part is covered in Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

If you’re married and both you and your spouse did the same thing, you must follow the same steps below once for you and once again for your spouse.

If you first contributed to a Roth IRA and then recharacterized it as a Traditional contribution, please jump over to the next example.

Contributed to Traditional IRA

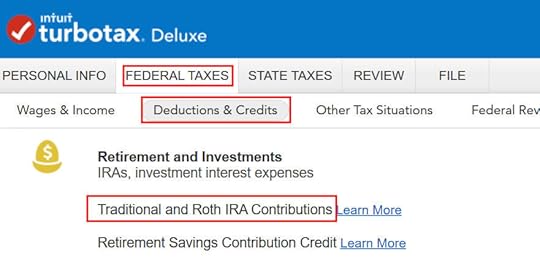

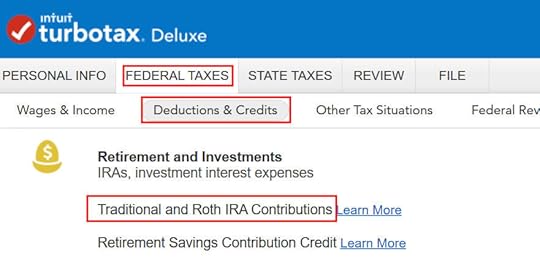

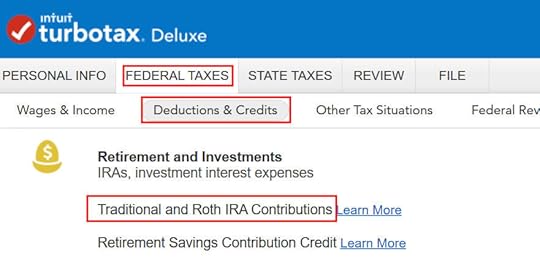

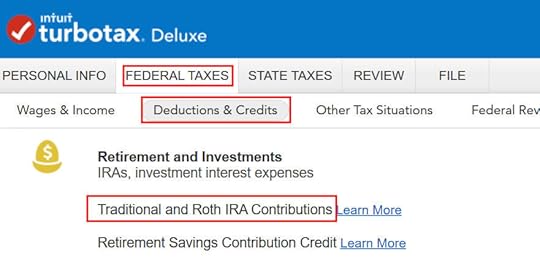

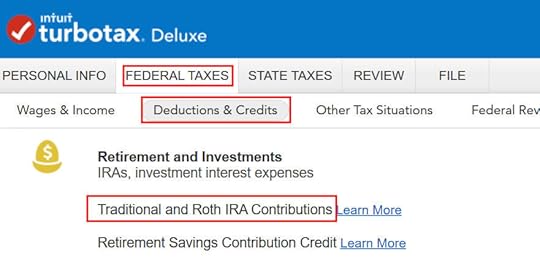

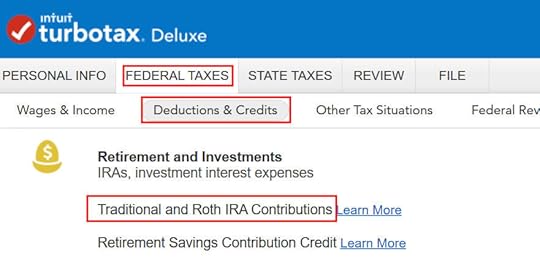

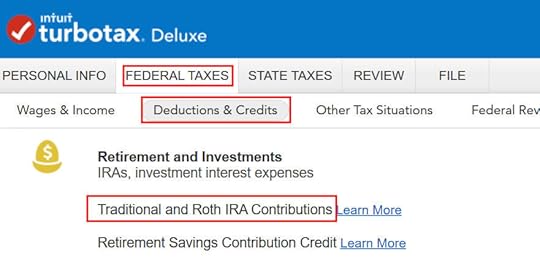

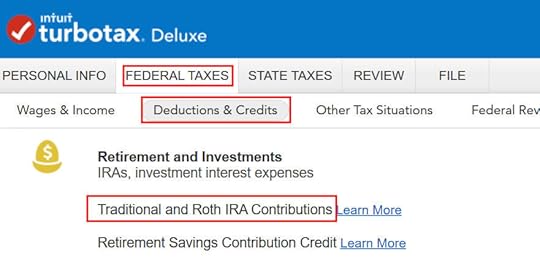

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

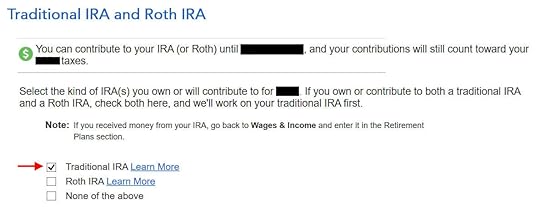

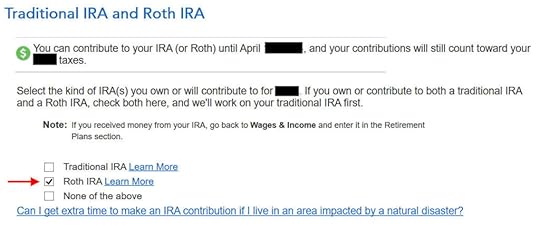

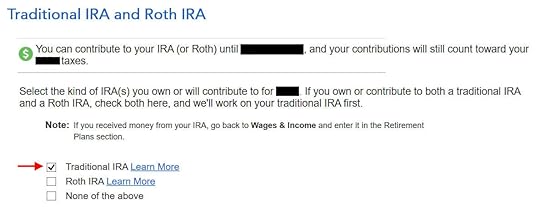

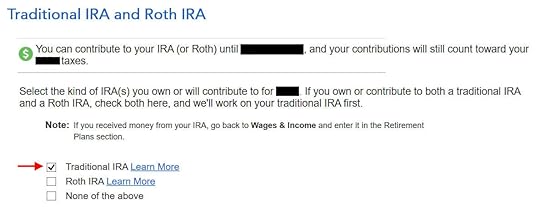

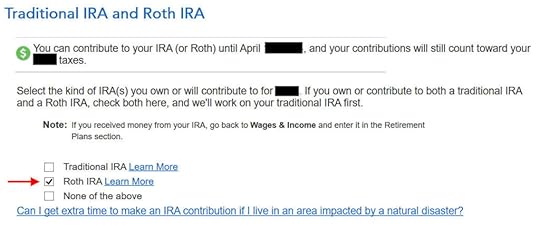

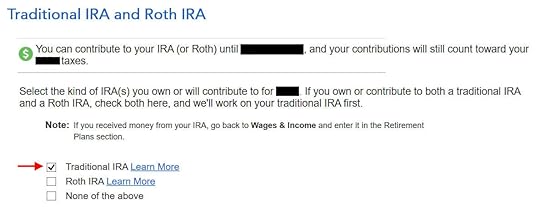

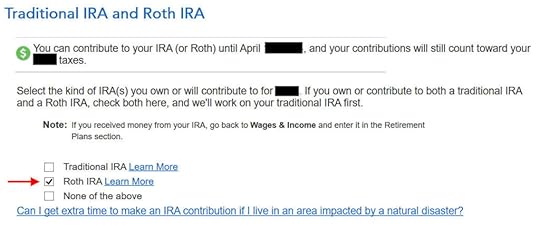

Check the box for Traditional IRA because you contributed to the Traditional IRA directly. See the next example if you contributed to a Roth IRA first and then recharacterized it.

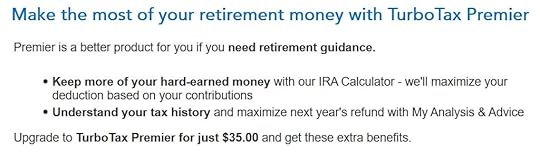

TurboTax offers an upgrade but we don’t need it. Choose to continue in TurboTax Deluxe.

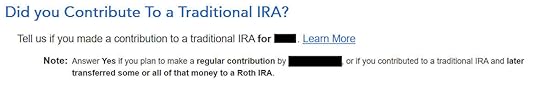

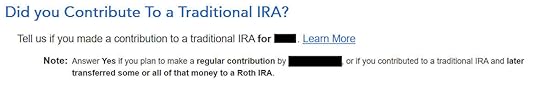

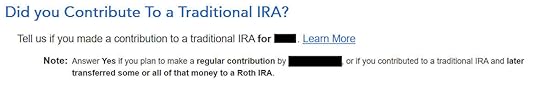

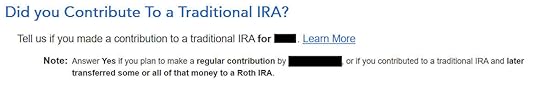

We already checked the box for Traditional but TurboTax just wants to make sure. Answer Yes here.

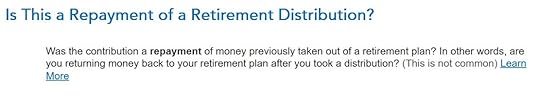

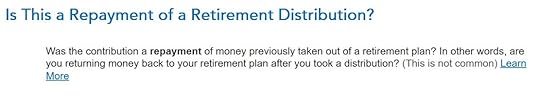

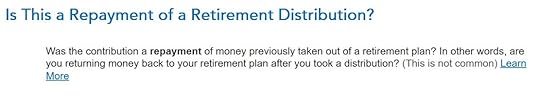

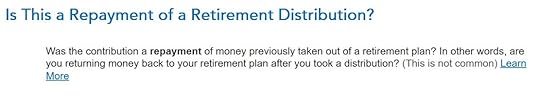

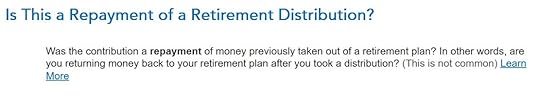

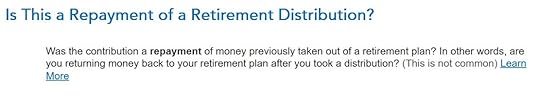

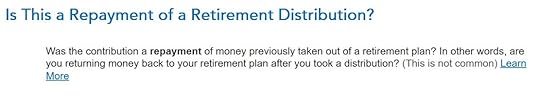

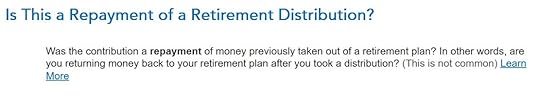

It was not a repayment of a retirement distribution.

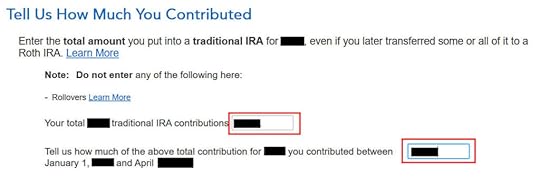

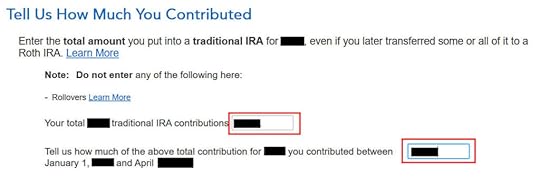

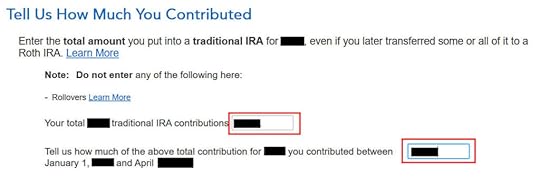

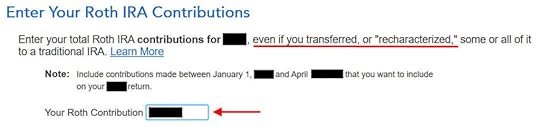

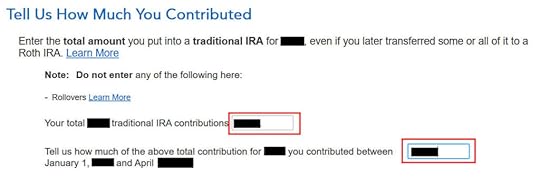

Enter your contribution amount in both boxes. The first box says you contributed. The second box says you contributed in 2024, not in 2023.

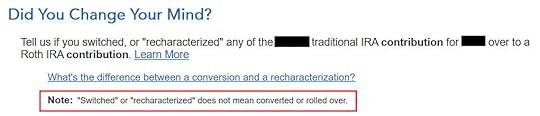

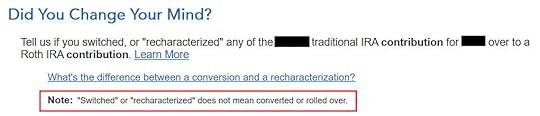

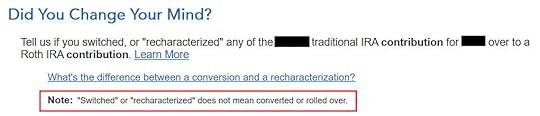

Converted, Did Not Recharacterize

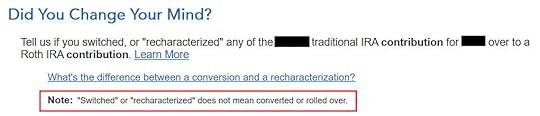

This is a critical question. Answer “No.” You converted the money, not switched or recharacterized.

You may not get this question if TurboTax sees that you’re covered by a retirement plan at work from Box 13 in your W-2. Answer yes if you’re covered by a retirement plan but the box on your W-2 wasn’t checked.

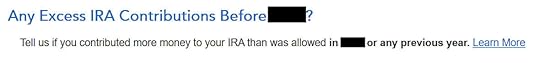

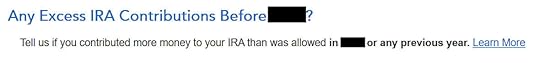

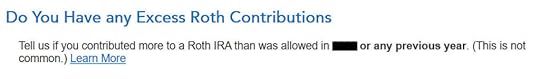

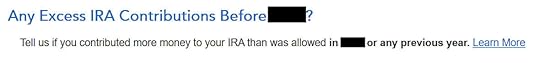

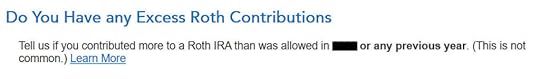

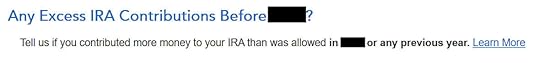

You have excess contributions only if you contributed over the limit. Don’t do that.

Basis

You can answer “No” if this is the first time you contributed to a Traditional IRA but answering “Yes” with a 0 has the same effect and it allows you to correct errors.

This is normally zero if this is the first time you contributed to a Traditional IRA. If you put in a number because you didn’t understand what it was asking, now is the chance to correct it.

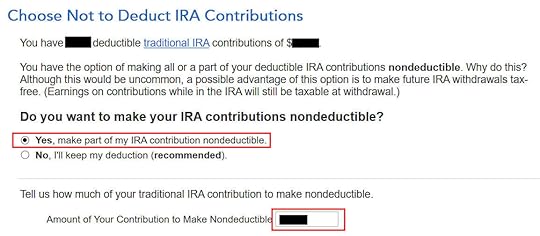

Make It Nondeductible

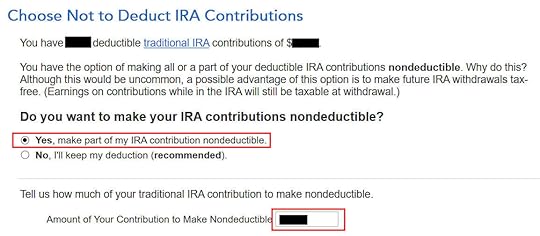

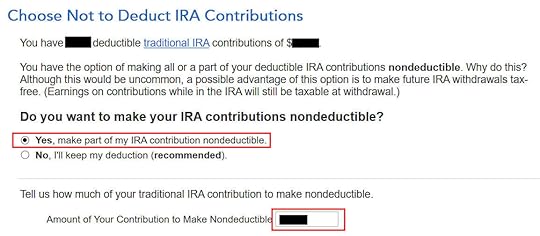

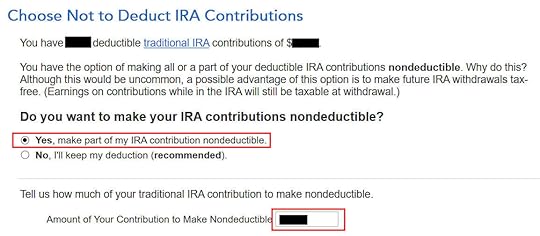

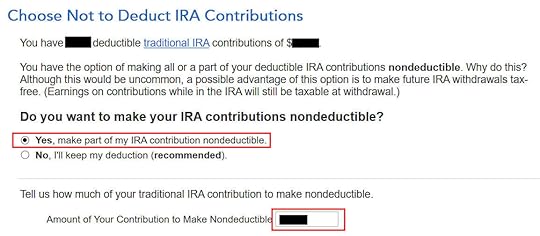

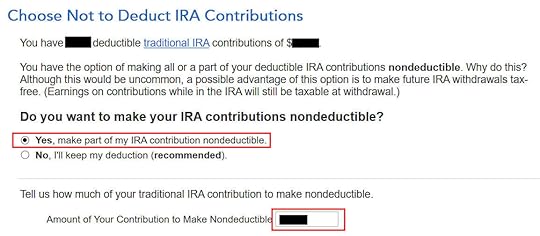

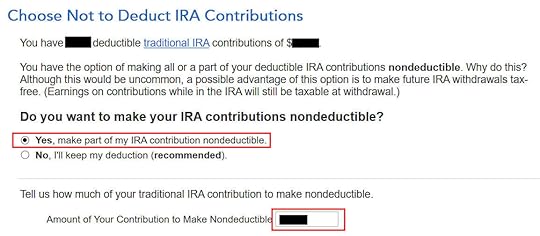

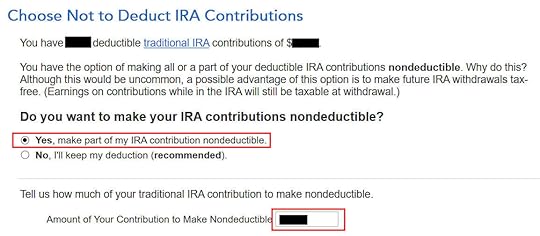

TurboTax won’t show you this if it sees clearly that your income is too high to qualify for a deduction. If you see this question, it means you have the option to take a deduction or decline the deduction. Taking the deduction in 2023 will make your conversion in 2024 taxable. It’s simpler if you make your full Traditional IRA contribution nondeductible, and then your 2024 Roth conversion won’t be taxable. Enter the amount of your contribution in the last box. It was $6,500 in our example.

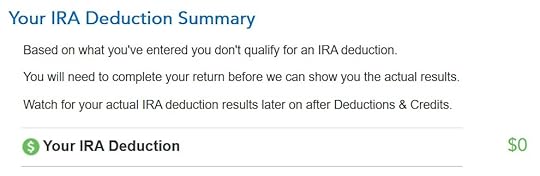

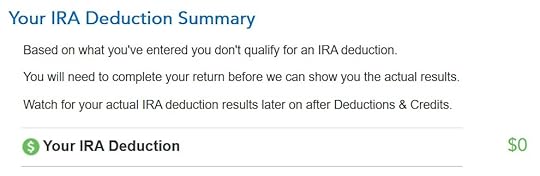

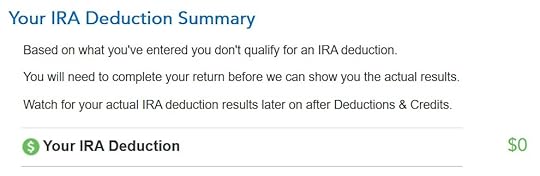

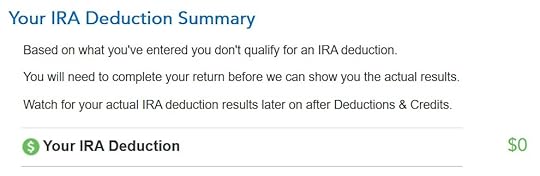

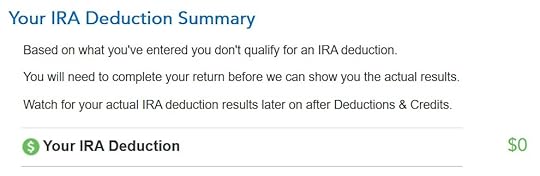

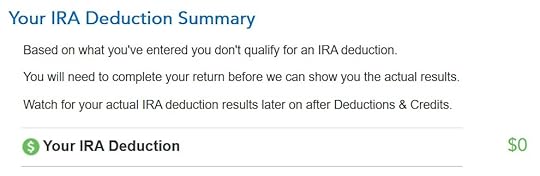

Your Traditional IRA deduction is zero, which is OK because it makes your conversion in 2024 not taxable.

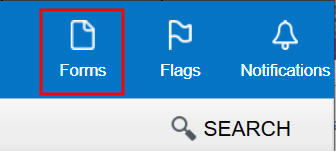

Form 8606Let’s take a look at Form 8606. Click on Forms on the top right.

Find “Form 8606-T” (and “Form 8606-S” for your spouse) in the list of forms in the left pane. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2024. It’ll make your conversion in 2024 not taxable.

Break the CycleWhile you’re at it, you should break the cycle of contributing for the previous year and create a new habit of contributing for the current year. Contribute to a Traditional IRA for 2024 in 2024 and convert in 2024.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

Recharacterized Before ConvertingNow let’s look at our second example scenario.

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your income was too high when you did your taxes in 2024. You recharacterized the Roth contribution for 2023 as a Traditional contribution before April 15, 2024. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. Then you converted it to Roth in 2024.

Because your contribution was for 2023, you need to report it on your 2023 tax return by following this guide. Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion when you do your 2024 tax return. Come back again next year to follow Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

Similar to our first example, if you did the same in 2023 for 2022, you should’ve done everything below when you did your taxes for 2022. In other words,

You contributed $6,000 to a Roth IRA for 2022 in 2022. You realized that your income was too high when you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Traditional contribution before April 15, 2023. The IRA custodian moved $6,100 from your Roth IRA to your Traditional IRA because your original $6,000 contribution had some earnings. Then you converted it to Roth in 2023.

Then you should’ve taken all the steps below last year in your 2022 tax return. If you didn’t, you need to fix your 2022 return. The conversion part is covered in Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

Contributed to Roth IRA

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

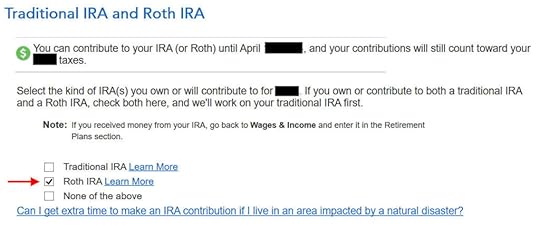

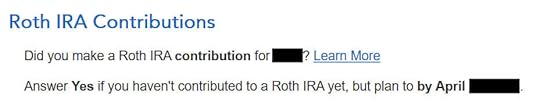

Check the box for Roth IRA because you originally contributed to a Roth IRA.

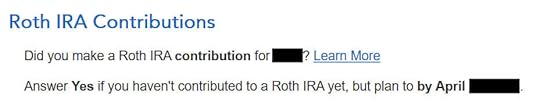

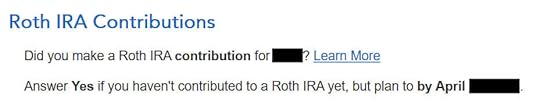

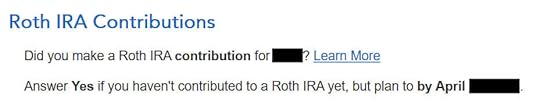

We already checked the box for Roth IRA but TurboTax just wants to make sure.

It was not a repayment of a retirement distribution.

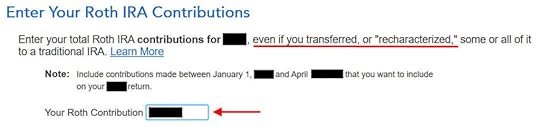

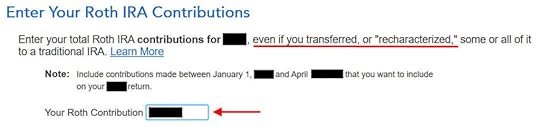

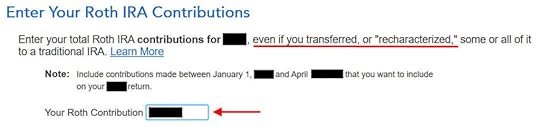

Enter the amount of your original Roth contribution. It was $6,500 in our example.

Recharacterized

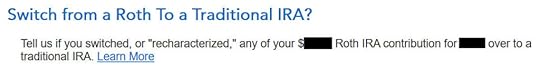

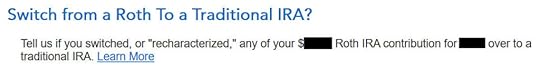

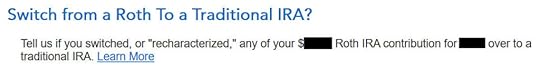

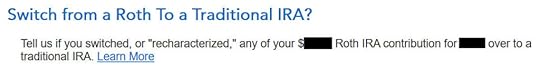

Now we confess that we recharacterized the contribution as a Traditional IRA contribution. Answer Yes here.

The amount here is relative to the original contribution amount. If you recharacterized the whole thing, enter $6,500 in our example, not $6,600 which was the amount with earnings that the IRA custodian moved into the Traditional IRA.

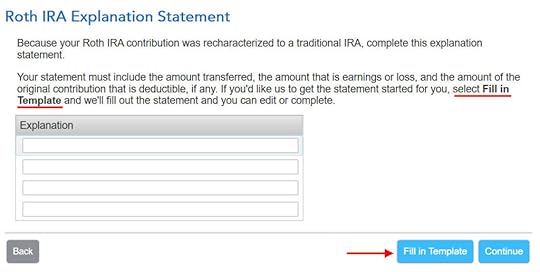

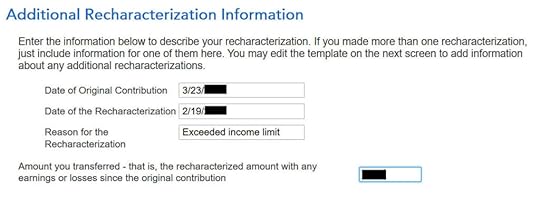

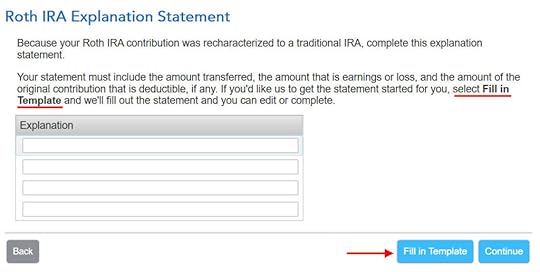

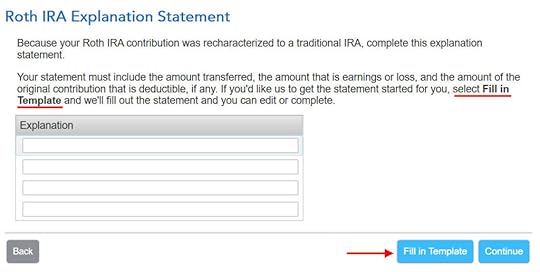

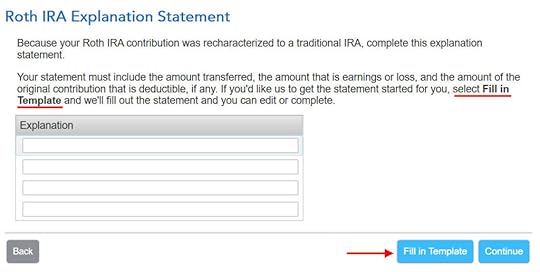

The IRS wants a statement to explain the recharacterization. Click on “Fill in Template.”

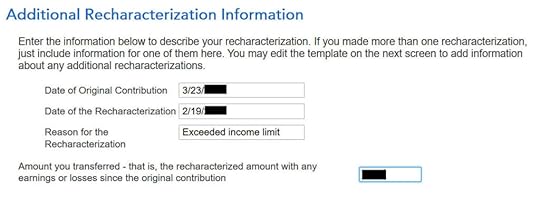

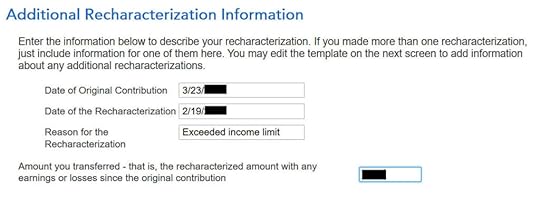

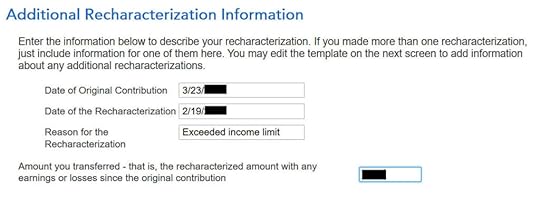

Fill in the dates of your original contribution and your recharacterization. The amount in the last box includes earnings. It’s $6,600 in our example.

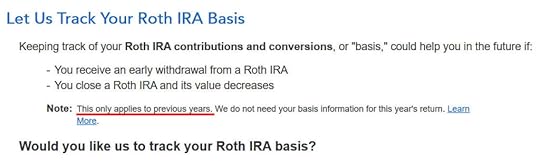

Roth Basis

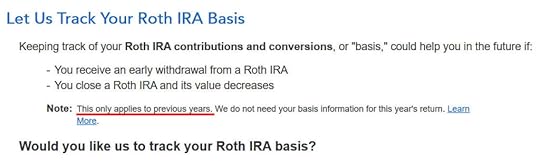

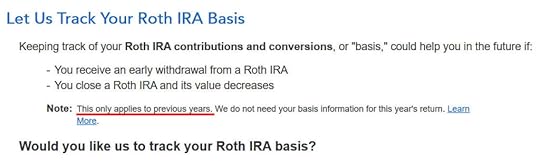

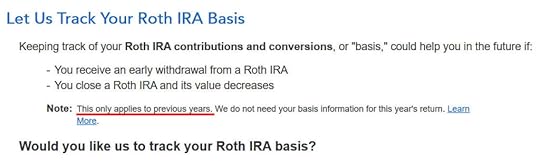

If you take up this offer from TurboTax to track your Roth IRA basis, it’s going to ask you questions about previous years, which is more trouble than it’s worth to me. I answered No. You don’t need to track your Roth IRA basis if you’re planning to withdraw from your Roth account only after age 59-1/2 and after you’ve had your first Roth IRA for five years. See Roth IRA Withdrawal After 59-1/2 in TurboTax.

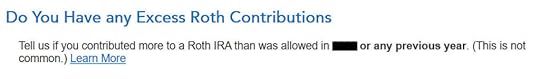

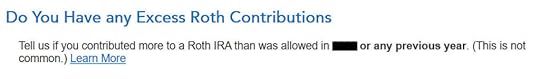

No excess contributions.

Make It Nondeductible

TurboTax shows this only when it sees your income qualifies for a deduction. You have the option to take the deduction or decline the deduction. Taking the deduction in 2023 will make your conversion in 2024 taxable. It’s simpler if you make your full contribution nondeductible and then your 2024 Roth conversion won’t be taxable. Enter the amount of your original contribution in the last box. It was $6,500 in our example.

Your Traditional IRA deduction is zero, which is OK because it makes your conversion in 2024 not taxable.

Form 8606Let’s take a look at Form 8606. Click on “Forms” on the top right.

Find “Form 8606-T” (and “Form 8606-S” for your spouse) in the list of forms in the left pane. You should see that only lines 1, 3, and 14 are filled in with your original contribution amount. After recharacterizing, it’s as if you contributed directly to a Traditional IRA in the first place. It’s important to see the number in Line 14. This number will carry over to 2024. It’ll make your conversion in 2024 not taxable.

Switch to Clean Backdoor RothWhile you are at it, you should switch to a clean backdoor Roth for 2024. Rather than contributing directly to a Roth IRA, seeing that you exceed the income limit, recharacterizing it, and converting it again, you should simply contribute to a Traditional IRA for 2024 in 2024 and convert it to Roth in 2024 if there’s any possibility that your income will be over the limit again.

You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Split-Year Backdoor Roth IRA in TurboTax, 1st Year appeared first on The Finance Buff.

Recharacterize & Convert in TurboTax, 1st Year

The best way to do a backdoor Roth is to do it “clean” by contributing *for* and converting in the same year — contribute for 2023 in 2023 and convert in 2023, contribute for 2024 in 2024 and convert in 2024, and contribute for 2025 in 2025 and convert in 2025. Don’t split them into two years such as contributing for 2022 in 2023 and converting in 2023 or contributing for 2023 in 2024 and converting in 2024. If you did a “clean” backdoor Roth, please follow How To Report Backdoor Roth In TurboTax (Updated).

However, many people didn’t know they should’ve done it “clean.” Some people thought it was natural to contribute to an IRA for 2023 between January 1 and April 15 in 2024. Some people contributed directly to a Roth IRA for 2023 in 2023 and only found out their income was too high when they did their taxes in 2024. They had to recharacterize the previous year’s Roth IRA contribution as a Traditional IRA contribution and convert it again to Roth after the fact.

When you contribute for the previous year and convert (or recharacterize and convert in the following year), you have to report them on your tax return in two different years: the contribution in one year and the conversion in the following year. It’s more confusing than a straight “clean” backdoor Roth but that’s the price you pay for not knowing the right way. This post shows you how to do the contribution part in TurboTax for the first year. The follow-up post Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year shows you how to do the conversion part in TurboTax for the second year.

If you recharacterized your 2023 contribution in 2023 and converted in 2023, please follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year.

I’m showing two examples — (1) a direct contribution to a Traditional IRA for the previous year; and (2) recharacterizing a Roth contribution for the previous year as a Traditional contribution. Please see which example matches your scenario and follow along accordingly.

Table of ContentsUse TurboTax DownloadContributed for the Previous YearContributed to Traditional IRAConverted, Did Not RecharacterizeBasisMake It NondeductibleForm 8606Break the CycleRecharacterized Before ConvertingContributed to Roth IRARecharacterizedRoth BasisMake It NondeductibleForm 8606Switch to Clean Backdoor RothUse TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

Contributed for the Previous YearHere’s the example scenario for a direct contribution to the Traditional IRA:

You contributed $6,500 to a Traditional IRA for 2023 between January 1 and April 15, 2024. You then converted it to Roth in 2024.

Because your contribution was *for* 2023, you need to report it on your 2023 tax return by following this guide. Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion when you do your 2024 tax return. Come again next year to follow Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

If you contributed to a Traditional IRA in 2023 for 2022, everything below should’ve happened in your 2022 tax return. In other words,

You contributed $6,000 to a Traditional IRA for 2022 between January 1 and April 15, 2023. You then converted it to Roth in 2023.

Then you should’ve gone through the steps below in your 2022 tax return. If you didn’t, you should fix your 2022 return. The conversion part is covered in Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

If you’re married and both you and your spouse did the same thing, you must follow the same steps below once for you and once again for your spouse.

If you first contributed to a Roth IRA and then recharacterized it as a Traditional contribution, please jump over to the next example.

Contributed to Traditional IRA

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

Check the box for Traditional IRA because you contributed to the Traditional IRA directly. See the next example if you contributed to a Roth IRA first and then recharacterized it.

TurboTax offers an upgrade but we don’t need it. Choose to continue in TurboTax Deluxe.

We already checked the box for Traditional but TurboTax just wants to make sure. Answer Yes here.

It was not a repayment of a retirement distribution.

Enter your contribution amount in both boxes. The first box says you contributed. The second box says you contributed in 2024, not in 2023.

Converted, Did Not Recharacterize

This is a critical question. Answer “No.” You converted the money, not switched or recharacterized.

You may not get this question if TurboTax sees that you’re covered by a retirement plan at work from Box 13 in your W-2. Answer yes if you’re covered by a retirement plan but the box on your W-2 wasn’t checked.

You have excess contributions only if you contributed over the limit. Don’t do that.

Basis

You can answer No if this is the first time you contributed to a Traditional IRA but answering Yes with a 0 has the same effect and it allows you to correct errors.

This is normally zero if this is the first time you contributed to a Traditional IRA. If you put in a number because you didn’t understand what it was asking, now is the chance to correct it.

Make It Nondeductible

TurboTax won’t show you this if it sees clearly that your income is too high to qualify for a deduction. If you see this question, it means you have the option to take a deduction or decline the deduction. Taking the deduction in 2023 will make your conversion in 2024 taxable. It’s simpler if you make your full Traditional IRA contribution nondeductible, and then your 2024 Roth conversion won’t be taxable. Enter the amount of your contribution in the last box. It was $6,500 in our example.

Your Traditional IRA deduction is zero, which is OK because it makes your conversion in 2024 not taxable.

Form 8606Let’s take a look at Form 8606. Click on Forms on the top right.

Find “Form 8606-T” (and “Form 8606-S” for your spouse) in the list of forms in the left pane. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2024. It’ll make your conversion in 2024 not taxable.

Break the CycleWhile you’re at it, you should break the cycle of contributing for the previous year and create a new habit of contributing for the current year. Contribute to a Traditional IRA for 2024 in 2024 and convert in 2024.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

Recharacterized Before ConvertingNow let’s look at our second example scenario.

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your income was too high when you did your taxes in 2024. You recharacterized the Roth contribution for 2023 as a Traditional contribution before April 15, 2024. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. Then you converted it to Roth in 2024.

Because your contribution was for 2023, you need to report it on your 2023 tax return by following this guide. Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion when you do your 2024 tax return. Come back again next year to follow Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

Similar to our first example, if you did the same in 2023 for 2022, you should’ve done everything below when you did your taxes for 2022. In other words,

You contributed $6,000 to a Roth IRA for 2022 in 2022. You realized that your income was too high when you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Traditional contribution before April 15, 2023. The IRA custodian moved $6,100 from your Roth IRA to your Traditional IRA because your original $6,000 contribution had some earnings. Then you converted it to Roth in 2023.

Then you should’ve taken all the steps below last year in your 2022 tax return. If you didn’t, you need to fix your 2022 return. The conversion part is covered in Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

Contributed to Roth IRA

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

Check the box for Roth IRA because you originally contributed to a Roth IRA.

We already checked the box for Roth IRA but TurboTax just wants to make sure.

It was not a repayment of a retirement distribution.

Enter the amount of your original Roth contribution. It was $6,500 in our example.

Recharacterized

Now we confess that we recharacterized the contribution as a Traditional IRA contribution. Answer Yes here.

The amount here is relative to the original contribution amount. If you recharacterized the whole thing, enter $6,500 in our example, not $6,600 which was the amount with earnings that the IRA custodian moved into the Traditional IRA.

The IRS wants a statement to explain the recharacterization. Click on “Fill in Template.”

Fill in the dates of your original contribution and your recharacterization. The amount in the last box includes earnings. It’s $6,600 in our example.

Roth Basis

If you take up this offer from TurboTax to track your Roth IRA basis, it’s going to ask you questions about previous years, which is more trouble than it’s worth to me. I answered No. You don’t need to track your Roth IRA basis if you’re planning to withdraw from your Roth account only after age 59-1/2 and after you’ve had your first Roth IRA for five years. See Roth IRA Withdrawal After 59-1/2 in TurboTax.

No excess contributions.

Make It Nondeductible

TurboTax shows this only when it sees your income qualifies for a deduction. You have the option to take the deduction or decline the deduction. Taking the deduction in 2023 will make your conversion in 2024 taxable. It’s simpler if you make your full contribution nondeductible and then your 2024 Roth conversion won’t be taxable. Enter the amount of your original contribution in the last box. It was $6,500 in our example.

Your Traditional IRA deduction is zero, which is OK because it makes your conversion in 2024 not taxable.

Form 8606Let’s take a look at Form 8606. Click on “Forms” on the top right.

Find “Form 8606-T” (and “Form 8606-S” for your spouse) in the list of forms in the left pane. You should see that only lines 1, 3, and 14 are filled in with your original contribution amount. After recharacterizing, it’s as if you contributed directly to a Traditional IRA in the first place. It’s important to see the number in Line 14. This number will carry over to 2024. It’ll make your conversion in 2024 not taxable.

Switch to Clean Backdoor RothWhile you are at it, you should switch to a clean backdoor Roth for 2024. Rather than contributing directly to a Roth IRA, seeing that you exceed the income limit, recharacterizing it, and converting it again, you should simply contribute to a Traditional IRA for 2024 in 2024 and convert it to Roth in 2024 if there’s any possibility that your income will be over the limit again.

You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Recharacterize & Convert in TurboTax, 1st Year appeared first on The Finance Buff.

Backdoor Roth in TurboTax: Recharacterize & Convert, 1st Year

The best way to do a backdoor Roth is to do it “clean” by contributing *for* and converting in the same year — contribute for 2023 in 2023 and convert in 2023, contribute for 2024 in 2024 and convert in 2024, and contribute for 2025 in 2025 and convert in 2025. Don’t split them into two years such as contributing for 2022 in 2023 and converting in 2023 or contributing for 2023 in 2024 and converting in 2024. If you did a “clean” backdoor Roth, please follow How To Report Backdoor Roth In TurboTax (Updated).

However, many people didn’t know they should’ve done it “clean.” Some people thought it was natural to contribute to an IRA for 2023 between January 1 and April 15 in 2024. Some people contributed directly to a Roth IRA for 2023 in 2023 and only found out their income was too high when they did their taxes in 2024. They had to recharacterize the previous year’s Roth IRA contribution as a Traditional IRA contribution and convert it again to Roth after the fact.

When you contribute for the previous year and convert (or recharacterize and convert in the following year), you have to report them on your tax return in two different years: the contribution in one year and the conversion in the following year. It’s more confusing than a straight “clean” backdoor Roth but that’s the price you pay for not knowing the right way. This post shows you how to do the contribution part in TurboTax for the first year. The follow-up post Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year shows you how to do the conversion part in TurboTax for the second year.

If you recharacterized your 2023 contribution in 2023 and converted in 2023, please follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year.

I’m showing two examples — (1) a direct contribution to a Traditional IRA for the previous year; and (2) recharacterizing a Roth contribution for the previous year as a Traditional contribution. Please see which example matches your scenario and follow along accordingly.

Table of ContentsUse TurboTax DownloadContributed for the Previous YearContributed to Traditional IRAConverted, Did Not RecharacterizeBasisMake It NondeductibleForm 8606Break the CycleRecharacterized Before ConvertingContributed to Roth IRARecharacterizedRoth BasisMake It NondeductibleForm 8606Switch to Clean Backdoor RothUse TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

Contributed for the Previous YearHere’s the example scenario for a direct contribution to the Traditional IRA:

You contributed $6,500 to a Traditional IRA for 2023 between January 1 and April 15, 2024. You then converted it to Roth in 2024.

Because your contribution was *for* 2023, you need to report it on your 2023 tax return by following this guide. Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion when you do your 2024 tax return. Come again next year to follow Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

If you contributed to a Traditional IRA in 2023 for 2022, everything below should’ve happened in your 2022 tax return. In other words,

You contributed $6,000 to a Traditional IRA for 2022 between January 1 and April 15, 2023. You then converted it to Roth in 2023.

Then you should’ve gone through the steps below in your 2022 tax return. If you didn’t, you should fix your 2022 return. The conversion part is covered in Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

If you’re married and both you and your spouse did the same thing, you must follow the same steps below once for you and once again for your spouse.

If you first contributed to a Roth IRA and then recharacterized it as a Traditional contribution, please jump over to the next example.

Contributed to Traditional IRA

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

Check the box for Traditional IRA because you contributed to the Traditional IRA directly. See the next example if you contributed to a Roth IRA first and then recharacterized it.

TurboTax offers an upgrade but we don’t need it. Choose to continue in TurboTax Deluxe.

We already checked the box for Traditional but TurboTax just wants to make sure. Answer Yes here.

It was not a repayment of a retirement distribution.

Enter your contribution amount in both boxes. The first box says you contributed. The second box says you contributed in 2024, not in 2023.

Converted, Did Not Recharacterize

This is a critical question. Answer “No.” You converted the money, not switched or recharacterized.

You may not get this question if TurboTax sees that you’re covered by a retirement plan at work from Box 13 in your W-2. Answer yes if you’re covered by a retirement plan but the box on your W-2 wasn’t checked.

You have excess contributions only if you contributed over the limit. Don’t do that.

Basis

You can answer No if this is the first time you contributed to a Traditional IRA but answering Yes with a 0 has the same effect and it allows you to correct errors.

This is normally zero if this is the first time you contributed to a Traditional IRA. If you put in a number because you didn’t understand what it was asking, now is the chance to correct it.

Make It Nondeductible

TurboTax won’t show you this if it sees clearly that your income is too high to qualify for a deduction. If you see this question, it means you have the option to take a deduction or decline the deduction. Taking the deduction in 2023 will make your conversion in 2024 taxable. It’s simpler if you make your full Traditional IRA contribution nondeductible, and then your 2024 Roth conversion won’t be taxable. Enter the amount of your contribution in the last box. It was $6,500 in our example.

Your Traditional IRA deduction is zero, which is OK because it makes your conversion in 2024 not taxable.

Form 8606Let’s take a look at Form 8606. Click on Forms on the top right.

Find “Form 8606-T” (and “Form 8606-S” for your spouse) in the list of forms in the left pane. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2024. It’ll make your conversion in 2024 not taxable.

Break the CycleWhile you’re at it, you should break the cycle of contributing for the previous year and create a new habit of contributing for the current year. Contribute to a Traditional IRA for 2024 in 2024 and convert in 2024.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

Recharacterized Before ConvertingNow let’s look at our second example scenario.

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your income was too high when you did your taxes in 2024. You recharacterized the Roth contribution for 2023 as a Traditional contribution before April 15, 2024. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. Then you converted it to Roth in 2024.

Because your contribution was for 2023, you need to report it on your 2023 tax return by following this guide. Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion when you do your 2024 tax return. Come back again next year to follow Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

Similar to our first example, if you did the same in 2023 for 2022, you should’ve done everything below when you did your taxes for 2022. In other words,

You contributed $6,000 to a Roth IRA for 2022 in 2022. You realized that your income was too high when you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Traditional contribution before April 15, 2023. The IRA custodian moved $6,100 from your Roth IRA to your Traditional IRA because your original $6,000 contribution had some earnings. Then you converted it to Roth in 2023.

Then you should’ve taken all the steps below last year in your 2022 tax return. If you didn’t, you need to fix your 2022 return. The conversion part is covered in Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

Contributed to Roth IRA

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

Check the box for Roth IRA because you originally contributed to a Roth IRA.

We already checked the box for Roth IRA but TurboTax just wants to make sure.

It was not a repayment of a retirement distribution.

Enter the amount of your original Roth contribution. It was $6,500 in our example.

Recharacterized

Now we confess that we recharacterized the contribution as a Traditional IRA contribution. Answer Yes here.

The amount here is relative to the original contribution amount. If you recharacterized the whole thing, enter $6,500 in our example, not $6,600 which was the amount with earnings that the IRA custodian moved into the Traditional IRA.

The IRS wants a statement to explain the recharacterization. Click on “Fill in Template.”

Fill in the dates of your original contribution and your recharacterization. The amount in the last box includes earnings. It’s $6,600 in our example.

Roth Basis

If you take up this offer from TurboTax to track your Roth IRA basis, it’s going to ask you questions about previous years, which is more trouble than it’s worth to me. I answered No. You don’t need to track your Roth IRA basis if you’re planning to withdraw from your Roth account only after age 59-1/2 and after you’ve had your first Roth IRA for five years. See Roth IRA Withdrawal After 59-1/2 in TurboTax.

No excess contributions.

Make It Nondeductible

TurboTax shows this only when it sees your income qualifies for a deduction. You have the option to take the deduction or decline the deduction. Taking the deduction in 2023 will make your conversion in 2024 taxable. It’s simpler if you make your full contribution nondeductible and then your 2024 Roth conversion won’t be taxable. Enter the amount of your original contribution in the last box. It was $6,500 in our example.

Your Traditional IRA deduction is zero, which is OK because it makes your conversion in 2024 not taxable.

Form 8606Let’s take a look at Form 8606. Click on “Forms” on the top right.

Find “Form 8606-T” (and “Form 8606-S” for your spouse) in the list of forms in the left pane. You should see that only lines 1, 3, and 14 are filled in with your original contribution amount. After recharacterizing, it’s as if you contributed directly to a Traditional IRA in the first place. It’s important to see the number in Line 14. This number will carry over to 2024. It’ll make your conversion in 2024 not taxable.

Switch to Clean Backdoor RothWhile you are at it, you should switch to a clean backdoor Roth for 2024. Rather than contributing directly to a Roth IRA, seeing that you exceed the income limit, recharacterizing it, and converting it again, you should simply contribute to a Traditional IRA for 2024 in 2024 and convert it to Roth in 2024 if there’s any possibility that your income will be over the limit again.

You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Backdoor Roth in TurboTax: Recharacterize & Convert, 1st Year appeared first on The Finance Buff.

Backdoor Roth in TurboTax: Recharacterize and Convert, 1st Year

The best way to do a backdoor Roth is to do it “clean” by contributing *for* and converting in the same year — contribute for 2023 in 2023 and convert in 2023, contribute for 2024 in 2024 and convert in 2024, and contribute for 2025 in 2025 and convert in 2025. Don’t split them into two years such as contributing for 2022 in 2023 and converting in 2023 or contributing for 2023 in 2024 and converting in 2024. If you did a “clean” backdoor Roth, please follow How To Report Backdoor Roth In TurboTax (Updated).

However, many people didn’t know they should’ve done it “clean.” Some people thought it was natural to contribute to an IRA after the year was over between January 1 and April 15 of the following year. Some people contributed directly to a Roth IRA and only found out their income was too high when they did their taxes the following year. They had to recharacterize the previous year’s Roth IRA contribution as a Traditional IRA contribution and convert it again to Roth after the fact.

When you contribute for the previous year and convert (or recharacterize and convert in the following year), you have to report them on your tax return in two different years: the contribution in one year and the conversion in the following year. It’s more confusing than a straight “clean” backdoor Roth but that’s the price you pay for not knowing the right way. This post shows you how to do the first year. A follow-up post will show you how to do the second year.

I’m showing two examples — (1) a direct contribution to a Traditional IRA for the previous year; and (2) recharacterizing a Roth contribution for the previous year as a Traditional contribution. Please see which example matches your scenario and follow along accordingly.

Table of ContentsUse TurboTax DownloadContributed for the Previous YearContributed to Traditional IRAConverted, Did Not RecharacterizeBasisMake It NondeductibleForm 8606Break the CycleRecharacterized Before ConvertingContributed to Roth IRARecharacterizedRoth BasisMake It NondeductibleForm 8606Switch to Clean Backdoor RothUse TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

Contributed for the Previous YearHere’s the example scenario for a direct contribution to the Traditional IRA:

You contributed $6,500 to a Traditional IRA for 2023 between January 1 and April 15, 2024. You then converted it to Roth in 2024.

Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion in 2024 on your 2024 tax return. Because your contribution was *for* 2023, you need to report it on your 2023 tax return.

If you contributed to a Traditional IRA in 2023 for 2022, everything below should’ve happened in your 2022 tax return. In other words,

You contributed $6,500 to a Traditional IRA for 2022 between January 1 and April 15, 2023. You then converted it to Roth in 2023.

Then you should’ve gone through the steps below in your 2022 tax return. If you didn’t, you should fix your 2022 return.

If you first contributed to a Roth IRA and then recharacterized it as a Traditional contribution, please jump over to the next example.

Contributed to Traditional IRA

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

Check the box for Traditional IRA because you contributed to the Traditional IRA directly. See the next example if you contributed to a Roth IRA first and then recharacterized it.

TurboTax offers an upgrade but we don’t need it. Choose to continue in TurboTax Deluxe.

We already checked the box for Traditional but TurboTax just wants to make sure. Answer Yes here.

It was not a repayment of a retirement distribution.

Enter your contribution amount in both boxes. The first box says you contributed. The second box says you contributed in 2024, not in 2023.

Converted, Did Not Recharacterize

This is a critical question. Answer “No.” You converted the money, not switched or recharacterized.

You may not get this question if TurboTax sees that you’re covered by a retirement plan at work from Box 13 in your W-2. Answer yes if you’re covered by a retirement plan but the box on your W-2 wasn’t checked.

You have excess contributions only if you contributed over the limit. Don’t do that.

Basis

You can answer No if this is the first time you contributed to a Traditional IRA but answering Yes with a 0 has the same effect and it allows you to correct errors.

This is normally zero if this is the first time you contributed to a Traditional IRA. If you put in a number because you didn’t understand what it was asking, now is the chance to correct it.

Make It Nondeductible

TurboTax won’t show you this if it sees clearly that your income is too high to qualify for a deduction. If you see this question, it means you have the option to take a deduction or decline the deduction. Taking the deduction in 2023 will make your conversion in 2024 taxable. It’s simpler if you make your full Traditional IRA contribution nondeductible, and then your 2024 Roth conversion won’t be taxable. Enter the amount of your contribution in the last box. It was $6,500 in our example.

Your Traditional IRA deduction is zero, which is OK because it makes your conversion in 2024 not taxable.

Form 8606Let’s take a look at Form 8606. Click on Forms on the top right.

Find “Form 8606-T” in the list of forms in the left pane. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2024. It will make your conversion in 2024 not taxable.

Break the CycleWhile you’re at it, you should break the cycle of contributing for the previous year and create a new habit of contributing for the current year. Contribute to a Traditional IRA for 2024 in 2024 and convert in 2024.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

Recharacterized Before ConvertingNow let’s look at our second example scenario.

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your income was too high when you did your taxes in 2024. You recharacterized the Roth contribution for 2023 as a Traditional contribution before April 15, 2024. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. Then you converted it to Roth in 2024.

Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion in 2024 on your 2024 tax return. Because your contribution was for 2023, you need to report it on your 2023 tax return.

Similar to our first example, if you did the same in 2023 for 2022, you should’ve done everything below when you did your taxes for 2022. In other words,

You contributed $6,500 to a Roth IRA for 2022 in 2022. You realized that your income was too high when you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Traditional contribution before April 15, 2023. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. Then you converted it to Roth in 2023.

Then you should’ve taken all the steps below last year in your 2022 tax return. If you didn’t, you need to fix your 2022 return.

Contributed to Roth IRA

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

Check the box for Roth IRA because you originally contributed to a Roth IRA.

We already checked the box for Roth IRA but TurboTax just wants to make sure.

It was not a repayment of a retirement distribution.

Enter the amount of your original Roth contribution. It was $6,500 in our example.

Recharacterized

Now we confess that we recharacterized the contribution as a Traditional IRA contribution. Answer Yes here.

The amount here is relative to the original contribution amount. If you recharacterized the whole thing, enter $6,500 in our example, not $6,600 which was the amount with earnings that the IRA custodian moved into the Traditional IRA.

The IRS wants a statement to explain the recharacterization. Click on “Fill in Template.”

Fill in the dates of your original contribution and your recharacterization. The amount in the last box includes earnings. It’s $6,600 in our example.

Roth Basis

If you take up this offer from TurboTax to track your Roth IRA basis, it’s going to ask you questions about previous years, which is more trouble than it’s worth to me. I answered No. You don’t need to track your Roth IRA basis if you’re planning to withdraw from your Roth account only after age 59-1/2 and after you’ve had a Roth IRA for five years. See Roth IRA Withdrawal After 59-1/2 in TurboTax.

No excess contributions.

Make It Nondeductible

TurboTax shows this only when it sees your income qualifies for a deduction. You have the option to take the deduction or decline the deduction. Taking the deduction in 2023 will make your conversion in 2024 taxable. It’s simpler if you make your full contribution nondeductible and then your 2024 Roth conversion won’t be taxable. Enter the amount of your original contribution in the last box. It was $6,500 in our example.

Your Traditional IRA deduction is zero, which is OK because it makes your conversion in 2024 not taxable.

Form 8606Let’s take a look at Form 8606. Click on “Forms” on the top right.

Find “Form 8606-T” in the list of forms in the left pane. You should see that only lines 1, 3, and 14 are filled in with your original contribution amount. After recharacterizing, it’s as if you contributed directly to a Traditional IRA to begin with. It’s important to see the number in Line 14. This number will carry over to 2024. It will make your conversion in 2024 not taxable.

Switch to Clean Backdoor RothWhile you are at it, you should switch to a clean backdoor Roth for 2024. Rather than contributing directly to a Roth IRA, seeing that you exceed the income limit, recharacterizing it, and converting it again, you should simply contribute to a Traditional IRA for 2024 in 2024 and convert it to Roth in 2024 if there’s any possibility that your income will be over the limit again.

You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Backdoor Roth in TurboTax: Recharacterize and Convert, 1st Year appeared first on The Finance Buff.

February 23, 2024

Our Experience in Building a Home Over Buying an Existing Home

I mentioned in the previous post Beyond the Numbers: a Closer Look at Renting By Choice that I became a homeowner again after renting for four years. We did it by building a house as opposed to buying an existing house.

Of course we didn’t physically build the house. We paid a builder to have a house built for us. The builder didn’t physically build the house either. They only directed the build. All the physical work was done by their subcontractors.

New Construction vs Existing HomeThe news media report two numbers about residential real estate sales in the country: existing-home sales and new-home sales. Existing homes make up 85% – 90% of all homes sold in a year.

New construction homes are often in undesirable locations in many areas because all the good locations have already been taken by existing homes. New homes may be next to a freeway or a major road. Or they may be far away from jobs, good schools, and amenities.

According to the Census Bureau, over 60% of new home sales are in the South region, with another 20%+ in the West region. There are much fewer new home sales in the Northeast and Midwest regions (see Census region map for where region lines are drawn).

A new home isn’t necessarily better even though it’s new. Fortunately, the area we’re in still has available land in good locations to build new homes. We chose to build a new home as opposed to buying an existing home because building new lets us choose what we want with less waste, it adds to the overall housing supply, and it creates jobs. The major downsides are that it takes a longer time and requires more time and energy from the homeowner.

Less WasteWhen you buy an existing home, location, size, floor plan, and finish materials all come in one package. The parts you like about the home and the parts you don’t like are all included in the package. Many people buy an existing home and remodel the parts they don’t like before they move in. They basically treat some parts they just bought at a negative value because it costs money to demolish existing things in addition to installing new items.

You don’t pay for something and then throw it away when you build a new home. For example, we wanted a taller garage door in case we get a van for camping. Making a larger door opening costs no more than making the standard size opening when you’re building new. It possibly costs a little less because a larger opening uses less building materials. The incremental cost of a taller door over a standard-size door isn’t that much. It would be a much bigger undertaking if we want to make the garage door taller in an existing home. We would have to throw away a perfectly working garage door, remove a part of the exterior and interior walls, and install a new door.

Add to Housing SupplyYou probably heard of people saying “We need to build more housing in this country.” Who’s “we” exactly? We don’t live in a centrally planned economy. Homebuilders are private businesses. They don’t just build more housing because doing so is good for the macroeconomy. The builder we worked with only builds when they have a paying customer signing up to build a house. If the country needs more housing, homeowners must step up to build new housing.

By paying to have a new house built, we added this house to the local housing supply. The local government will receive a higher property tax for the life of this house.

Create JobsIf we buy an existing home, the current owner gets the bulk of the money. People involved in the transaction — realtors, the title company, the home inspector, and mortgage loan officers — receive some fees and that’s about it.

Building a home involves many more people. 60 different subcontractors worked on building our house. The smallest subcontractor received less than $200. The largest subcontractor received over $100,000. We feel good about creating jobs in the local economy.

Long OverlapIt took almost a year to build our home. It would’ve taken only a month if we bought an existing home. You have to pay for both your existing housing (rent, mortgage, or opportunity cost) and the cost of building the new home during this overlap.

Because many people can’t afford to pay for both at the same time during a long overlap or don’t want to spend the time and energy required to build a home, an existing home often commands a price premium over the cost to build. I’ve seen existing homes advertised as “No waiting, why build when you can have this now!”

Time and EnergyBuilding a home requires a lot of attention and decisions. We must have made over a thousand decisions, most of which were permanent and costly to change. This can be stressful if you’re the type that must research every detail in everything.

How high should the closet shelves be? What color do we want for the roof shingles? Where do we want to place the hose bibb?

On the other hand, if you buy an existing home, you’re only inheriting previous decisions by someone else. Every home was built by someone at some point. The previous owners made those decisions based on their needs and constraints at the time. Their decisions aren’t necessarily better than yours.

Planned Unit Development (PUD)Our home is in a Planned Unit Development (PUD), which is described as a cross between single-family homes and a condominium. A developer bought a large parcel of land. They drew up a plan and got it approved by the city to develop the land into a residential subdivision of about 100 homes. They built roads and brought in utilities. Then they started offering homesites to build new homes.

Each homeowner owns the land beneath their home. The rest of the subdivision is owned by the HOA. The HOA collects dues and hires contractors to maintain the common areas. Instead of each homeowner hiring lawn service individually, the HOA hires one large contractor to maintain landscaping for everyone. It’s like socialism with a flat tax.

I know some people don’t like HOAs but it works well for us. The subdivision has attracted many retirees although it isn’t designated as a 55+ or active adult community. It’s currently 90% built. It’ll be full in another year.

Semi-Custom HomeSome new construction homes are spec homes, which means that you choose one of several models from the builder based on the size and the floor plan. The builder also offers some upgrades such as using hardwood floors versus carpet or different grades of countertops.

You can also build a custom home, which means that you engage an architect to come up with a design and then hire a builder to build it.

Our house is a semi-custom home, which falls somewhere in between. The builder has five base models for this subdivision. The outside perimeter and the basic outline of a model can’t change but everything inside can be modified. For example, you can have fewer but larger bedrooms or you can shrink a bathroom but make the closet bigger. You can arrange the rooms in a way that flows better for you. It’s just a matter of drawing the interior walls and doorways within the floor space. Of course if you don’t care to make changes you can also take the base model as-is.

The builder assigned a floor plan designer to work with us. The base model we chose had a theater room next to a guest bedroom. We combined the two rooms and made it a nice home gym. This was easy when we had a blank slate. It wasn’t any more difficult to build a home gym than a theater room plus a guest bedroom. It would be more involved to make this type of change to an existing home.

Semi-custom also means that homeowners have wide choices in the materials that go into the home. The builder had a designated supplier for everything. We went to the appliance supplier to pick appliances, the flooring supplier to pick flooring, the door supplier to pick doors, and so on. We could choose anything available at each supplier. It was time-consuming but we learned new vocabulary (baluster, transom, soffit, …) and now we know nearly everything that went into our home.

Cost Plus ContractOur contract with the builder was cost-plus, which means that the builder billed us whatever their suppliers and subcontractors billed them plus a 12% fee for managing the project as the general contractor. The builder gave us an estimate of the total cost before we signed the contract but it was only an estimate. We would still pay whatever the actual cost came out to be from their suppliers and subcontractors plus the 12% fee.

This felt risky but we trusted the builder. This reputable local builder has built several hundred homes in our town over many years. Customers are happy with the homes they built. The owner of the builder is selling his mansion to move into our subdivision.

If you must have a fixed-price contract, the builder has to pad the price to maintain its profit. They would have to set a strict allowance on everything to differentiate between “standard” and “change orders.” A fixed-price contract is more for building a spec home. If the builder runs into unexpected cost increases they may skip things or use lower-quality materials. A cost-plus contract removes the incentive to cut corners.

Schedule Delay and Cost OverrunTwo risks we hear about in building a home are schedule delays and cost overruns. We had a little of both but it wasn’t too bad.

The original estimate from the builder was to complete the construction in 10 months. It took 11-1/2 months. The final cost came within 5% of the estimate the builder gave us at the beginning of the project even though they didn’t know what materials we would choose.

Both the schedule delay and the small cost overrun were acceptable to us. We didn’t go too much above the estimate because we didn’t go overboard in selecting fancy materials. Some neighbors chose high-end Wolf, Sub-Zero, and Thermaldor appliances. We went with Kitchenaid and Bosch. It was a small miracle that we came less than 5% above the original estimate when it was all said and done.

FinancingInflation and supply chain problems subsided when our project started. Prices of building materials and labor that went up sharply during previous years stopped going up sharply but they didn’t come down. Still, I would much prefer to pay tradespersons who work on the home than the owner of an existing home.

If you need the equity from your existing home but you can only sell it after you move into the new home, you can get a HELOC or you can finance the project with a one-close construction loan, also known as a Construction-to-Permanent (CTP) loan.

The bank qualifies you for the construction loan based on an appraisal of the project using the blueprints. The interest rate is set when the loan is approved. The bank pays the builder during construction. You make interest-only payments to the bank. The construction loan converts to a regular mortgage when the home is built. You can pay down or pay off the mortgage after you sell your previous home.

Our builder had a contact at a bank to arrange for loans but we didn’t get a construction loan because the interest rate had already gone up at that time. I didn’t sell stocks either when stocks were down. I sold some short box spreads and used the cash to pay the builder every month when they sent us a stack of invoices from their suppliers and subcontractors plus the 12% fee.

I sold stocks now to close out the short box spreads after stocks bounced back. By coincidence, interest rates went further up after I sold the short box spreads. Closing them out now actually generated a small gain.

***

A new home isn’t necessarily better than an existing home in many places but when the right opportunity comes along, building a home can be a satisfying experience if you don’t mind investing the time and energy. You need a good location and a reliable builder.

This is the view from my home gym. The grassland is a reserved open space for the subdivision. I often see deer, geese, and cranes in the open space when I work out. I love it.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Our Experience in Building a Home Over Buying an Existing Home appeared first on The Finance Buff.

February 16, 2024

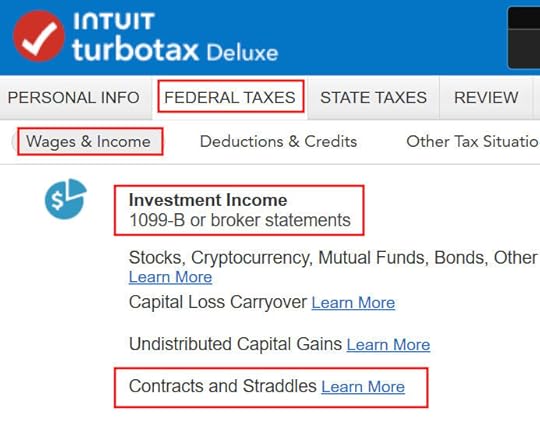

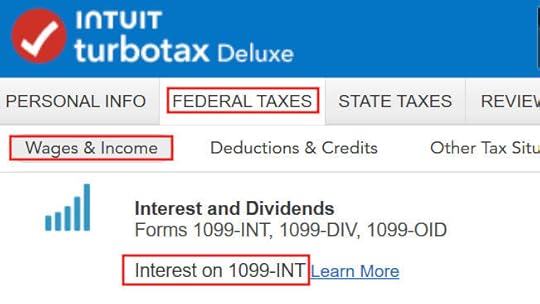

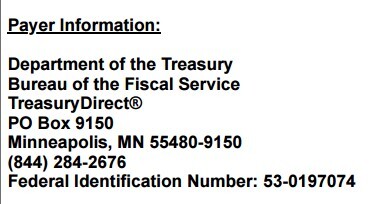

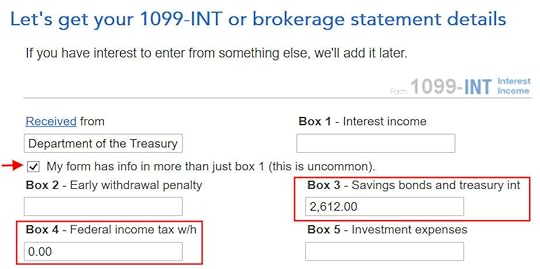

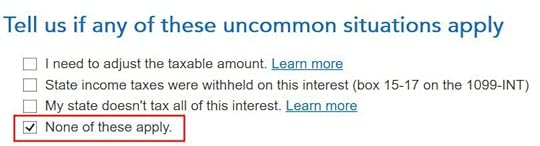

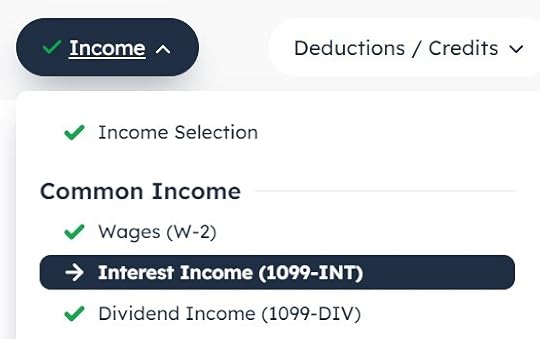

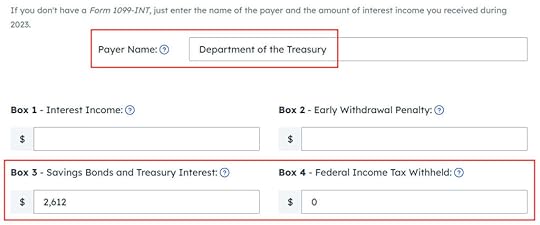

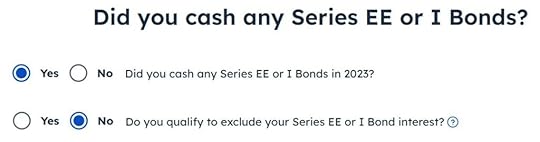

Taxes on Box Spread Trades in TurboTax, H&R Block, FreeTaxUSA

A long box spread trade earns a little more than buying Treasuries or CDs. A short box spread trade gives you a loan at a good rate. If you trade box spreads, whether long or short, you’ll have to report taxes on these trades.

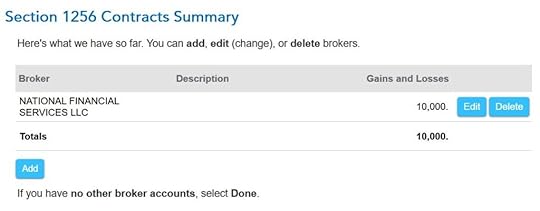

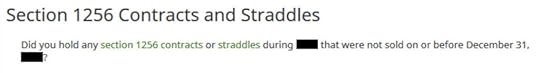

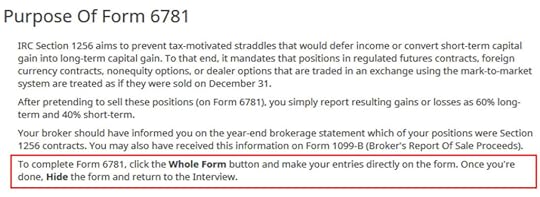

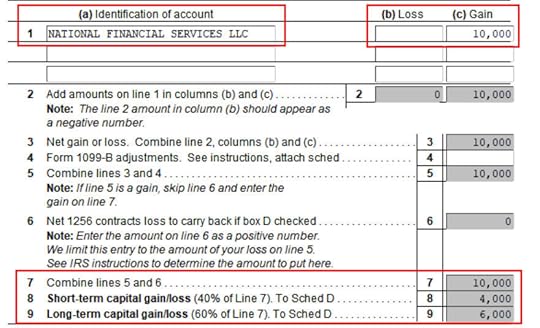

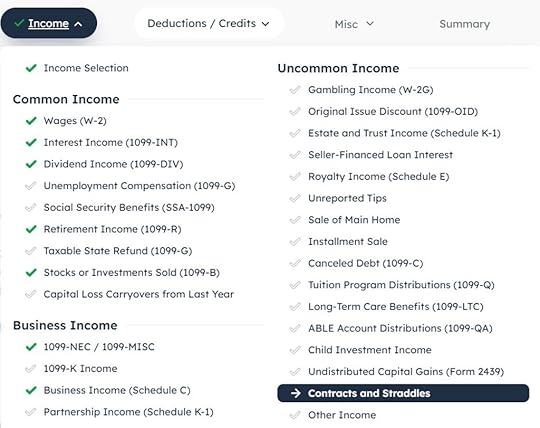

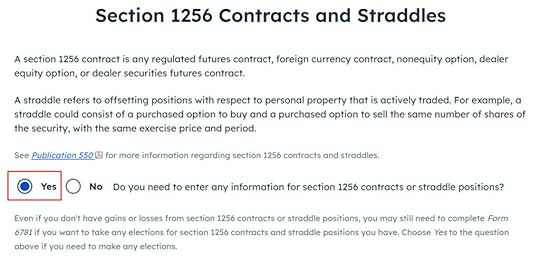

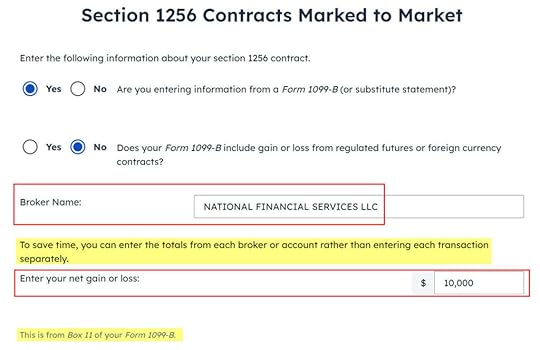

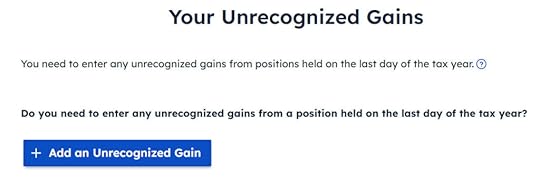

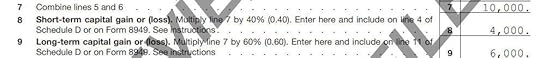

Table of ContentsForm 1099-BTurboTaxH&R BlockFreeTaxUSAForm 1099-BClosed contracts generate realized gains and losses. Open contracts at the end of the year are “marked to market” and you pay taxes on any unrealized gains and losses up to that point.