Harry Sit's Blog, page 10

January 31, 2024

2023 Free E-File State Tax Return Directly on the State’s Website

[Updated on January 31, 2024 for 2023 tax filing.]

When I was ready to e-file my tax returns through TurboTax downloaded software, it said that federal e-file was free and I could pay another $25 to e-file the state tax return at the same time. Considering that I paid only $30 for the software that includes all the complex logic to prepare both the federal and the state tax returns, $25 for simply transmitting the data and only for the state portion seems outrageous.

It isn’t just TurboTax. H&R Block does the same. Federal e-file is free but you must pay extra if you also want to e-file the state return. Only New York bans tax software vendors from charging extra for e-filing the state return.

No doubt many people relent and just pay the $25. Tax software vendors know it, and they’re counting on this for their revenue. I can afford $25. I would have no problem with it if they included it in the price upfront and sold the software for $55 as opposed to $30. I just hate this sneaky tactic.

Printing and mailing the state return isn’t necessarily the only alternative though. Many states accept e-filing directly on the state revenue agency’s website. E-filing a return on the state’s website only takes a few minutes when you already have the completed forms from the tax software.

The web form on my state’s website is just an interactive representation of the same paper form. Besides personal information, I basically entered two numbers from my federal tax return – the AGI and the standard deduction. All the rest were automatically calculated.

Here I collected the available direct e-file links for all 50 states and Washington, DC. Please let me know if I missed any.

If your state offers direct e-file, at least try it once. You can always go back to paying $25 if you don’t like e-filing directly. If your state doesn’t offer direct e-file, printing and mailing isn’t that bad either. States don’t have a big backlog of paper returns as the IRS does. When I lived in California, they didn’t allow direct e-file if you had an HSA. I had mailed my state tax return for many years and I never had any problems.

You save $25, and more importantly, you feel good about not falling prey to a big corporation’s pricing game. You get the better product when you use downloaded tax software and you pay nearly half the price than using the software online.

StateFree Direct E-FileAlabamaMy Alabama TaxesAlaskaNo state income taxArizonaNo direct e-fileArkansasNo direct e-fileCaliforniaCalFileColoradoRevenue OnlineConnecticutmyconneCTDelawareDelaware Taxpayer PortalDistrict Of ColumbiaMyTax DCFloridaNo state income taxGeorgiaNo direct e-fileHawaiiHawaii Tax OnlineIdahoNo direct e-fileIllinoisMyTax IllinoisIndianaNo direct e-fileIowaNo direct e-fileKansasKansas WebFileKentuckyKY FileLouisianaLouisiana File and Pay OnlineMaineMaine Tax Portal (i-File)MarylandiFile MarylandMassachusettsMassTaxConnectMichiganNo direct e-fileMinnesotaNo direct e-fileMississippiNo direct e-fileMissouriMyTax MissouriMontanaMontana TransAction PortalNebraskaNebFileNevadaNo state income taxNew HampshireGranite Tax ConnectNew JerseyNew Jersey Online Income Tax FilingNew MexicoTaxpayer Access PointNew YorkSoftware vendors can’t charge extra for e-fileNorth CarolinaNo direct e-fileNorth DakotaNo direct e-fileOhioOH|TAX eServicesOklahomaOkTAPOregonRevenue OnlinePennsylvaniamyPATHRhode IslandNo direct e-fileSouth CarolinaNo direct e-fileSouth DakotaNo state income taxTennesseeNo state income taxTexasNo state income taxUtahTaxpayer Access PointVermontNo direct e-fileVirginiaNo direct e-fileWashingtonNo state income taxWest VirginiaNo direct e-fileWisconsinWisTaxWyomingNo state income taxLearn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2023 Free E-File State Tax Return Directly on the State’s Website appeared first on The Finance Buff.

January 30, 2024

Make Treasury Interest State Tax-Free in TurboTax, H&R Block, FreeTaxUSA

[Updated on January 30, 2024 for 2023 tax filing.]

When you earn interest from U.S. Treasuries in a taxable account, the interest is exempt from state and local taxes. How the interest is reported on tax forms depends on whether you hold Treasuries directly or through mutual funds and ETFs.

Table of ContentsInterest from Treasury Bills and NotesInterest from Savings BondsTreasuries in Mutual Funds and ETFsGovernment % from Fund ManagersVanguardFidelityCharles SchwabiSharesCA, NY, and CT ResidentsTax SoftwareTurboTaxH&R BlockFreeTaxUSAInterest from Treasury Bills and NotesWhen you buy individual Treasuries in a taxable brokerage account — see How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy Treasury Bills & Notes On the Secondary Market — you’ll see the interest reported on a 1099-INT form and/or a 1099-OID form (for TIPS).

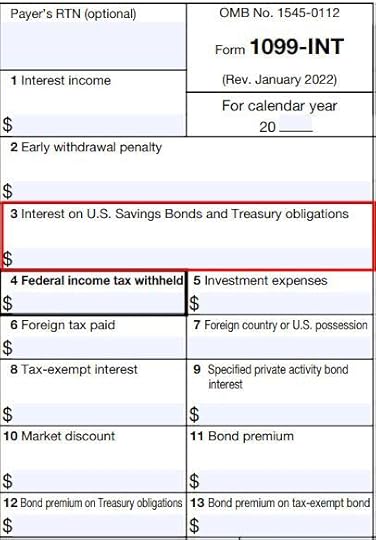

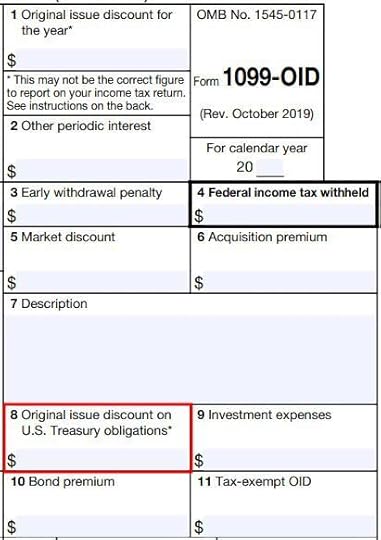

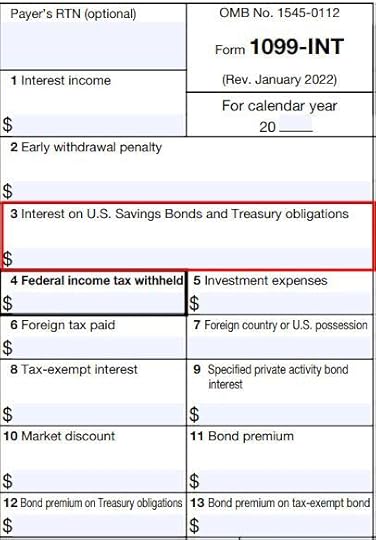

Interest from Treasuries is reported separately in Box 3 on a 1099-INT form.

Inflation adjustment for TIPS is reported separately in Box 8 on a 1099-OID form.

Your tax software knows about these special boxes in the tax forms. Whether you import the tax forms from your broker or enter them manually, the software will automatically mark the interest as exempt from your state income tax.

Interest from Savings BondsTreasuryDirect issues a 1099 form when you cash out savings bonds in your TreasuryDirect account. See Report I Bonds Interest in TurboTax, H&R Block, FreeTaxUSA for how to get the 1099 form and enter the interest in tax software.

Treasuries in Mutual Funds and ETFsMany money market funds, bond funds, and bond ETFs hold Treasuries. If you have these funds in a taxable brokerage account, a good part of the funds’ dividends may have come from Treasuries. The portion of fund dividends attributed to interest from Treasuries isn’t qualified dividends. It’s taxed at normal tax rates for federal income tax but it’s still exempt from state and local taxes.

When you have multiple mutual funds or ETFs in a taxable brokerage account, the broker reports dividends received from all sources on one 1099-DIV form. The 1099-DIV form doesn’t have a special box broken out for dividends attributed to Treasuries. Your tax software won’t know how much of the dividends were from Treasuries only by the numbers on the 1099-DIV form.

The broker supplies a breakdown of the dividends by source. It’s up to you to determine how much of the dividends from each source came from Treasuries. Suppose you own four funds in a taxable brokerage account that paid $6,500 in total dividends. Your goal is to fill out a table like this with the percentage of dividends from Treasuries for each fund and calculate your total dividends attributed to Treasuries:

FundTotal Dividend% from TreasuriesDividend from TreasuriesFund A$5000%$0Fund B$1,00065%$650Fund C$2,00010%$200Fund D$3,00090%$2,700Total$6,500$3,550When you give the result to your tax software, it then knows to exempt that portion of the dividends from state and local taxes.

Government % from Fund ManagersAlthough the 1099-DIV form and the dividend breakdown by funds are provided by the broker, you’ll have to get the number for the “% from Treasuries” column from the managers of your mutual funds and ETFs.

If you own Vanguard mutual funds or ETFs in a Fidelity brokerage account, you get this information from Vanguard, not from Fidelity. Similarly, if you own iShares ETFs in a Charles Schwab brokerage account, you get the information from iShares, not from Charles Schwab.

Google “[name of fund management company] tax center” to find the information from the fund manager.

VanguardVanguard publishes the information in its Tax Season Calendar. Look for “U.S. government obligations information.”

FidelityFidelity publishes the information in Fidelity Mutual Fund Tax Information. Look for “Percentage of Income From U.S. government securities.”

Charles SchwabCharles Schwab Asset Management publishes the information in its Distributions and Tax Center. Look for “2023 Supplementary Tax Information.”

iSharesiShares publishes the information in its Tax Library. Look for “2023 U.S. Government Source Income Information.”

CA, NY, and CT ResidentsCalifornia, New York, and Connecticut have additional requirements for exempting fund dividends earned from Treasuries. The fund management company will note in its published information whether a fund met the requirements of CA, NY, and CT. If a fund didn’t meet the requirements, the Treasuries percentage is treated as 0% for CA, NY, and CT residents.

For example, Vanguard Federal Money Market Fund earned 49.37% of its income from U.S. government obligations in 2023. Because it didn’t meet the requirements of CA, NY, and CT, investors in these three states must still pay state income tax on 100% of this fund’s dividends. People in other states pay state income tax on only 50.63% of this fund’s dividends.

Tax SoftwareYou need to give the result to your tax software after you get the “% from Treasuries” for each fund and calculate your dividend from Treasuries with a table like this:

FundTotal Dividend% from TreasuriesDividend from TreasuriesFund A$5000%$0Fund B$1,00065%$650Fund C$2,00010%$200Fund D$3,00090%$2,700Total$6,500$3,550It’s easy to miss the entry point for this input unless you really look for it.

TurboTax

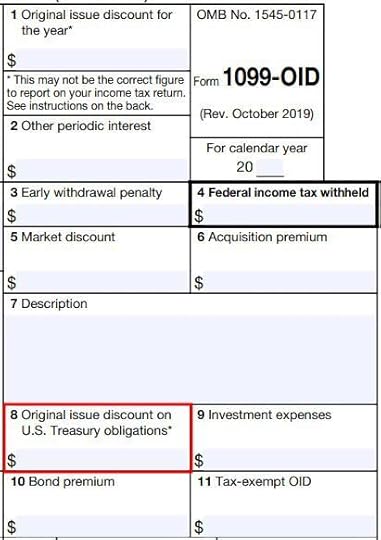

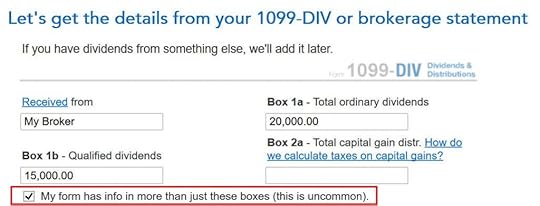

After you import or enter the 1099-DIV form in TurboTax download software, you need to check a box to say that a portion of the dividends is U.S. Government interest. It’s easy to miss because TurboTax says it’s uncommon, which isn’t true.

Now you enter the amount you calculated in your table.

Repeat this process for your other 1099-DIV forms.

H&R Block

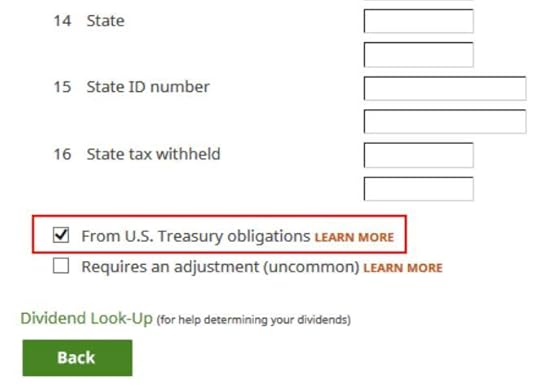

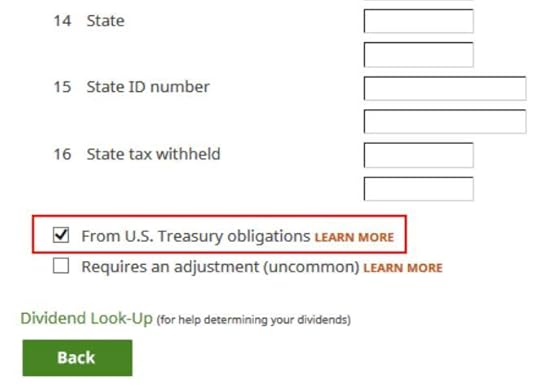

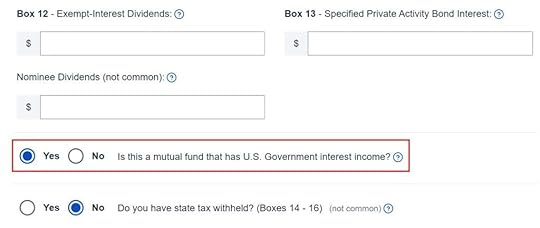

H&R Block download software shows a checkbox at the bottom of the 1099-DIV entries. This field doesn’t come in the import. It’s easy to miss because it’s at the bottom of a long form. You have to really look for it. Although the wording gives the impression of saying 100% of the dividends came from U.S. Treasury obligations, checking it only says that a part of the dividends came from U.S. Treasury obligations. Check the box and click on Next.

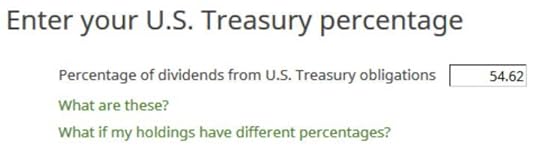

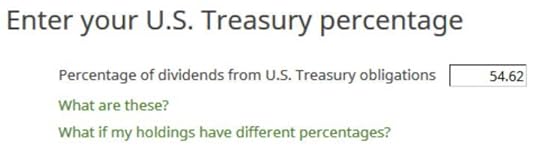

This shows up only if you check that box on the previous screen. Instead of asking for a dollar amount, H&R Block goes by percentage. It forces you to do a bit of math. In our example, $3,550 from Treasuries divided by $6,500 total ordinary dividends is 54.62%. So we enter 54.62.

Repeat this process for every 1099-DIV. H&R Block software will keep a tally of your state tax-exempt dividends.

FreeTaxUSA

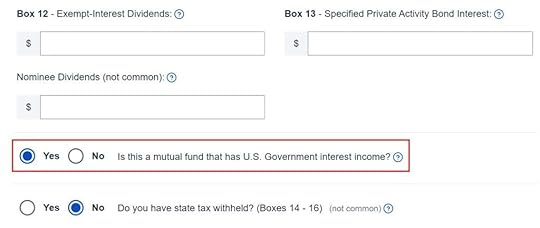

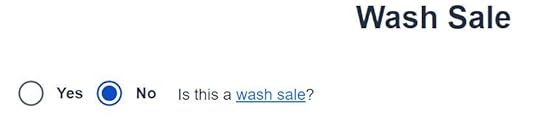

FreeTaxUSA has a radio button at the bottom of the 1099-DIV entries. It’s easy to miss because it’s at the bottom of a long form. You have to really look for it.

The question “Is this a mutual fund that has U.S. Government interest income?” isn’t accurate. A 1099-DIV form from a brokerage account includes dividends from all holdings. It isn’t a mutual fund that has U.S. Government interest income. The correct question should be “Does this include U.S. Government interest income?” Answer “Yes” anyway.

Now you give the dollar amount from your table.

***

Most of the work in calculating the amount of the fund dividends exempt from state and local taxes is in hunting down the percentage of income from Treasuries for each fund and ETF in your taxable brokerage account. You need to give the calculated amount to your tax software, which doesn’t make it obvious where the number should go.

A similar process also applies to muni bond funds and ETFs. A portion of the fund dividends is exempt from both federal income tax and state income tax (“double tax-free”). I cover that topic in a separate post State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Make Treasury Interest State Tax-Free in TurboTax, H&R Block, FreeTaxUSA appeared first on The Finance Buff.

2023 State Tax-Exempt Treasury Interest from Funds and ETFs

[Updated on January 30, 2024 for 2023 tax filing.]

When you earn interest from U.S. Treasuries in a taxable account, the interest is exempt from state and local taxes. How the interest is reported on tax forms depends on whether you hold Treasuries directly or through mutual funds and ETFs.

Table of ContentsInterest from Treasury Bills and NotesTreasuries in Mutual Funds and ETFsGovernment % from Fund ManagersVanguardFidelityCharles SchwabiSharesCA, NY, and CT ResidentsTax SoftwareTurboTaxH&R BlockFreeTaxUSAInterest from Treasury Bills and NotesWhen you buy individual Treasuries in a taxable brokerage account — see How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy Treasury Bills & Notes On the Secondary Market — you’ll see the interest reported on a 1099-INT form and/or a 1099-OID form (for TIPS).

Interest from Treasuries is reported separately in Box 3 on a 1099-INT form.

Inflation adjustment for TIPS is reported separately in Box 8 on a 1099-OID form.

Your tax software knows about these special boxes in the tax forms. Whether you import the tax forms from your broker or enter them manually, the software will automatically mark the interest as exempt from your state income tax.

Treasuries in Mutual Funds and ETFsMany money market funds, bond funds, and bond ETFs hold Treasuries. If you have these funds in a taxable brokerage account, a good part of the funds’ dividends may have come from Treasuries. The portion of fund dividends attributed to interest from Treasuries isn’t qualified dividends. It’s taxed at normal tax rates for federal income tax but it’s still exempt from state and local taxes.

When you have multiple mutual funds or ETFs in a taxable brokerage account, the broker reports dividends received from all sources on one 1099-DIV form. The 1099-DIV form doesn’t have a special box broken out for dividends attributed to Treasuries. Your tax software won’t know how much of the dividends were from Treasuries only by the numbers on the 1099-DIV form.

The broker supplies a breakdown of the dividends by source. It’s up to you to determine how much of the dividends from each source came from Treasuries. Suppose you own four funds in a taxable brokerage account that paid $6,500 in total dividends. Your goal is to fill out a table like this with the percentage of dividends from Treasuries for each fund and calculate your total dividends attributed to Treasuries:

FundTotal Dividend% from TreasuriesDividend from TreasuriesFund A$5000%$0Fund B$1,00065%$650Fund C$2,00010%$200Fund D$3,00090%$2,700Total$6,500$3,550When you give the result to your tax software, it then knows to exempt that portion of the dividends from state and local taxes.

Government % from Fund ManagersAlthough the 1099-DIV form and the dividend breakdown by funds are provided by the broker, you’ll have to get the number for the “% from Treasuries” column from the managers of your mutual funds and ETFs.

If you own Vanguard mutual funds or ETFs in a Fidelity brokerage account, you get this information from Vanguard, not from Fidelity. Similarly, if you own iShares ETFs in a Charles Schwab brokerage account, you get the information from iShares, not from Charles Schwab.

Google “[name of fund management company] tax center” to find the information from the fund manager.

VanguardVanguard publishes the information in its Tax Season Calendar. Look for “U.S. government obligations information.”

FidelityFidelity publishes the information in Fidelity Mutual Fund Tax Information. Look for “Percentage of Income From U.S. government securities.” It’s expected to be available in early February.

Charles SchwabCharles Schwab Asset Management publishes the information in its Distributions and Tax Center. Look for “2023 Supplementary Tax Information.”

iSharesiShares publishes the information in its Tax Library. Look for “2023 U.S. Government Source Income Information.”

CA, NY, and CT ResidentsCalifornia, New York, and Connecticut have additional requirements for exempting fund dividends earned from Treasuries. The fund management company will note in its published information whether a fund met the requirements of CA, NY, and CT. If a fund didn’t meet the requirements, the Treasuries percentage is treated as 0% for CA, NY, and CT residents.

For example, Vanguard Federal Money Market Fund earned 49.37% of its income from U.S. government obligations in 2023. Because it didn’t meet the requirements of CA, NY, and CT, investors in these three states must still pay state income tax on 100% of this fund’s dividends. People in other states pay state income tax on only 50.63% of this fund’s dividends.

Tax SoftwareYou need to give the result to your tax software after you get the “% from Treasuries” for each fund and calculate your dividend from Treasuries with a table like this:

FundTotal Dividend% from TreasuriesDividend from TreasuriesFund A$5000%$0Fund B$1,00065%$650Fund C$2,00010%$200Fund D$3,00090%$2,700Total$6,500$3,550It’s easy to miss the entry point for this input unless you really look for it.

TurboTax

After you import or enter the 1099-DIV form in TurboTax download software, you need to check a box to say that a portion of the dividends is U.S. Government interest. It’s easy to miss because TurboTax says it’s uncommon, which isn’t true.

Now you enter the amount you calculated in your table.

H&R Block

H&R Block download software shows a checkbox at the bottom of the 1099-DIV entries. This field doesn’t come in the import. It’s easy to miss because it’s at the bottom of a long form. You have to really look for it.

Instead of asking for a dollar amount, H&R Block goes by percentage. It forces you to do a bit of math. In our example, $3,550 from Treasuries divided by $6,500 total ordinary dividends is 54.62%. So we enter 54.62.

FreeTaxUSA

FreeTaxUSA has a radio button at the bottom of the 1099-DIV entries. It’s easy to miss because it’s at the bottom of a long form. You have to really look for it. The question “Is this a mutual fund … ?” isn’t accurate. It should be “Does this include … ?”

Now you give the dollar amount from your table.

***

Most of the work in calculating the amount of the fund dividends exempt from state and local taxes is in hunting down the percentage of income from Treasuries for each fund and ETF in your taxable brokerage account. You need to give the calculated amount to your tax software, which doesn’t make it obvious where the number should go.

A similar process also applies to muni bond funds and ETFs. A portion of the fund dividends is exempt from both federal income tax and state income tax (“double tax-free”). I cover that topic in a separate post State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2023 State Tax-Exempt Treasury Interest from Funds and ETFs appeared first on The Finance Buff.

2023 Mortgage Interest Limit in TurboTax, H&R Block, FreeTaxUSA

[Updated on January 30, 2024 with screenshots for 2023 tax filing.]

Many homeowners refinanced to a sub-3% mortgage when interest rates were low a couple of years ago. The mortgage interest most people pay isn’t large enough to make them itemize their deductions. They just take the standard deduction. Those who can still deduct their mortgage interest tend to have a large mortgage.

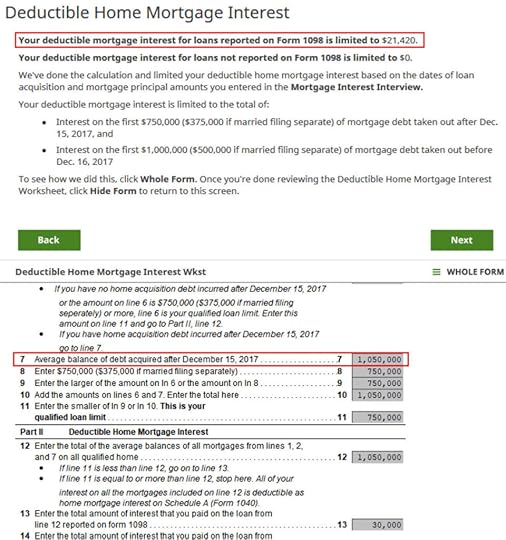

Table of ContentsLimit on DeductionAverage Mortgage BalanceTurboTaxH&R BlockFreeTaxUSALimit on DeductionThe Tax Cuts and Jobs Act of 2017 reduced the limit on the mortgage balance on which you can deduct the mortgage interest from $1 million to $750,000. The lower limit applies to homes acquired after December 15, 2017. The large increase in home prices in recent years makes recently bought homes in high-price areas more likely to exceed the $750,000 limit.

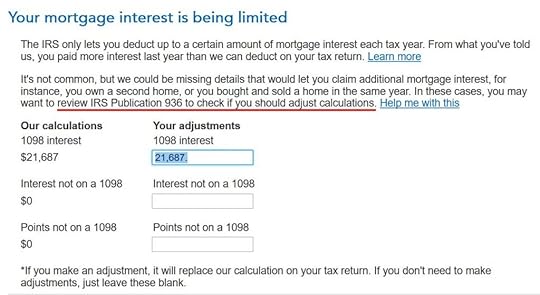

However, lenders still report 100% of the mortgage interest paid on the 1098 form without adjusting for either the old $1 million limit or the new $750,000 limit. If your mortgage balance is over the limit, deducting the mortgage interest is more complicated than just using the number from the 1098 form.

It isn’t simply multiplying $750,000 by your interest rate either when your mortgage balance started above $750,000 and ended below $750,000 or when you took out the loan in the middle of the year.

Average Mortgage BalanceA key concept is your average mortgage balance during the year. When your average mortgage balance exceeds the limit, your deductible mortgage interest is:

Loan Limit / Average Mortgage Balance * Actual Mortage Interest Paid

If you paid $30,000 in mortgage interest on an average mortgage balance of $1,000,000 and you’re subject to the $750,000 limit, your deductible mortgage interest is pro-rated to:

$750,000 / $1,000,000 * $30,000 = $22,500

IRS Publication 936 gives several ways to calculate your average mortgage balance:

Average of first and last balance methodInterest paid divided by interest rate methodMortgage statements methodThe first method is simpler and it gives you a slightly larger deduction but you can use it only if you didn’t prepay more than one month’s principal during the year.

Here’s how it works in TurboTax, H&R Block, and FreeTaxUSA tax software.

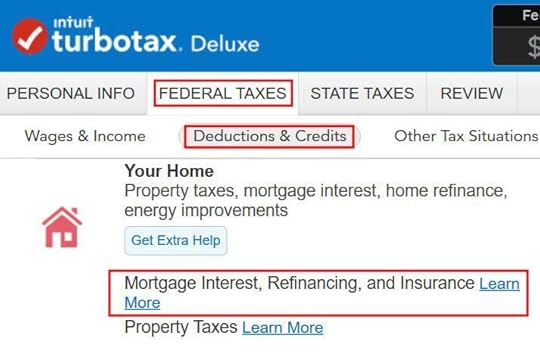

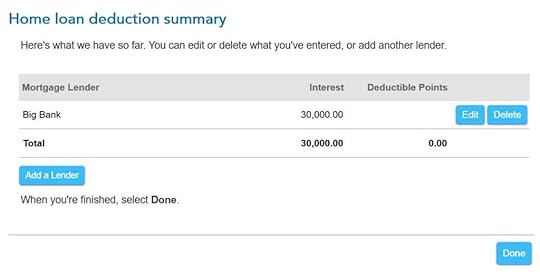

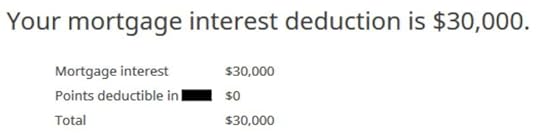

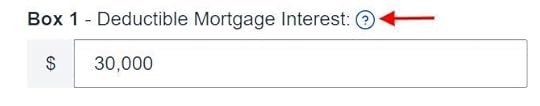

TurboTaxThe screenshots below are taken from TurboTax Deluxe downloaded software. The TurboTax downloaded software is both less expensive and more powerful than TurboTax online software. If you haven’t paid for your TurboTax online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax online to TurboTax download (see instructions for how to make the switch from TurboTax).

Find the mortgage interest topic in the Your Home section under Federal Taxes -> Deduction & Credits.

Form 1098

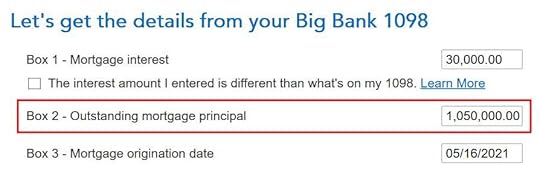

When it asks you to enter information from your 1098 form, enter the numbers as they appear on your form. If Box 2 is blank on your 1098, enter the mortgage balance at the beginning of the year (or your beginning loan balance if you took out the loan during the year).

You get to this summary after you answer a few more questions. Click on Done but you’re not done yet.

Purchase Date and Ending Balance

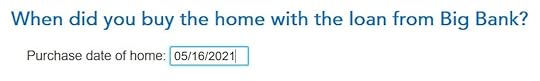

The purchase date of the home determines whether you have a $1 million limit or a $750,000 limit for the mortgage interest deduction. If this mortgage was from a refinance, you still enter the date when you originally bought the home.

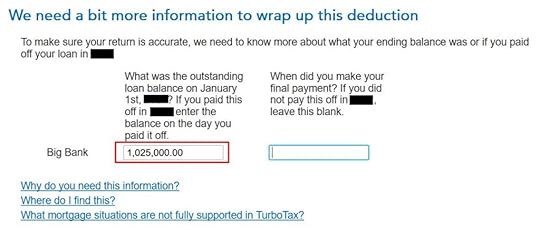

TurboTax asks for the balance as of January 1 of the following year because it uses the “average of first and last balance method” to calculate your average mortgage balance for the year. This works when you didn’t make extra principal payments during the year.

TurboTax calculates a deduction using the “average of first and last balance method” but you can’t legally use that method if you prepaid more than one month’s principal during the year. You must calculate your average mortgage balance in a different way and give the pro-rated deductible mortgage interest to TurboTax.

If You Prepaid PrincipalIf you had the mortgage for all 12 months and your interest rate didn’t change during the year, which is the case for most people with a fixed-rate mortgage, you can use the “interest paid divided by interest rate method” to calculate your average mortgage balance. Suppose you paid $30,000 in mortgage interest and your rate is 2.875%, your average mortgage balance is:

$30,000 / 0.02875 = $1,043,478

Your deductible mortgage interest is:

$750,000 / $1,043,478 * $30,000 = $21,562

If your interest changed during the year, you’re better off using the “mortgage statements method.” Download the monthly statements from your lender. Add up your balance from January to December and divide by 12. That’s your average mortgage balance during the year. Use that number to calculate your pro-rated deductible mortgage interest and give it to TurboTax:

Verify on Schedule ALoan Limit / Average Mortgage Balance * Actual Mortage Interest Paid

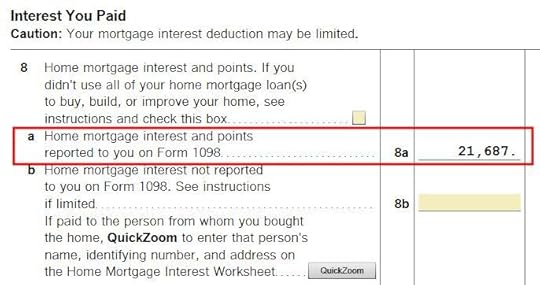

To confirm how much mortgage interest deduction you’re getting, click on Forms on the top right and find Schedule A in the list of forms in the left panel.

Scroll down to the middle and find Line 8. You’ll see the mortgage interest deduction.

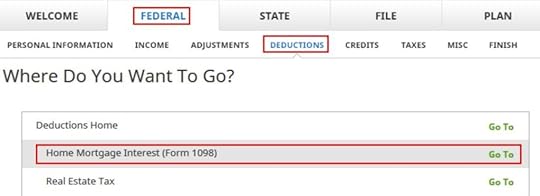

H&R BlockMortgage interest deduction works differently in the H&R Block software.

Find “Home Mortgage Interest (Form 1098)” under Federal -> Deductions.

1098 Entries

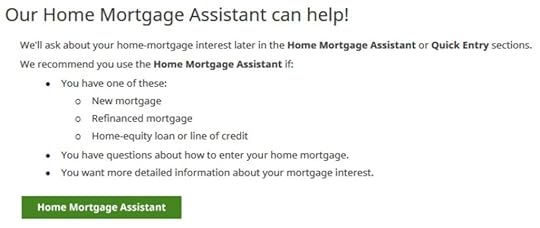

H&R Block offers a Home Mortgage Assistant. Click on that.

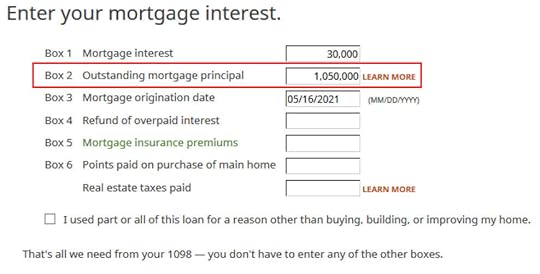

After saying we have a 1098 form and entering the name of the lender, we come to this form to enter the numbers on the 1098 form.

The IRS instructs banks to put in Box 2 your mortgage balance as of the beginning of the year (or your beginning loan balance if you took out the loan during the year) but H&R Block treats it as your average balance during the year. This is wrong and it reduces your mortgage interest deduction.

Calculate Average Mortgage BalanceYou should calculate the average mortgage balance yourself and put it in Box 2.

If you didn’t prepay more than one month’s principal, get the beginning balance and the ending balance. Take an average.If you prepaid more than one month’s principal but your interest rate didn’t change, divide the interest paid by your interest rate.If you prepaid more than one month’s principal and your interest rate changed during the year, get your balance as of the beginning of each month and take an average.Suppose your beginning balance was $1,100,000 and your ending balance was $1,000,000, and you didn’t prepay more than one month’s principal during the year, your average balance using the first method is

( $1,100,000 + $1,000,000 ) / 2 = $1,050,000

You also need to enter the date when you purchased the home in Box 3. This date determines whether you have a $1 million limit or a $750,000 limit for the mortgage interest deduction. If this mortgage was from a refinance and the bank put the refinance date in Box 3, you should overwrite it with the date when you originally bought the home.

Mortgage Interest Deduction

After answering some more questions about points and mortgage insurance premiums, which we don’t have, H&R Block says we can deduct 100% of the mortgage interest paid. This can’t be right. We entered a balance above $1 million on the 1098 form. H&R Block just uses the interest paid number from the 1098 form as if the loan limit doesn’t exist.

You see this when you click on “Finished” after you’re done with all your 1098 forms. H&R Block calculates a mortgage interest deduction subject to the loan limit. You can see it’s using the number from the 1098 form as the average mortgage balance. It would use the larger beginning balance reported by the bank and give you a smaller deduction if you didn’t overwrite the number with the average balance you calculated yourself.

Granted that TurboTax doesn’t cover all situations but at least it makes an attempt to cover the most common scenario (only regular payments without extra principal payments). H&R Block just uses a wrong number without telling you. That’s bad. Although only a small percentage of people deduct their mortgage interest now, among those who can still deduct, many have a mortgage above the limit.

FreeTaxUSAI also checked how the online tax software FreeTaxUSA does it.

FreeTaxUSA puts a small question mark link next to the mortgage interest entry. Clicking on the question mark opens a pop-up, which says toward the end:

If your debt is higher than the limits, use Publication 936 to figure out your deductible home mortgage interest amount and reduce the mortgage interest you enter accordingly.

You’re on your own when you use FreeTaxUSA. It doesn’t tell you clearly that you must do some extra work. You would’ve claimed more deduction that you’re eligible for if you didn’t know to click on that question mark and read the whole pop-up.

***

H&R Block tax software is less expensive than TurboTax but using a wrong number to calculate your mortgage interest deduction can cost you many times more than the price of the software. See another example in How to Enter Foreign Tax Credit Form 1116 in H&R Block. You really have to know where it cuts corners when you use H&R Block software. It works well only when those cut corners don’t affect you. The same also applies to FreeTaxUSA.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2023 Mortgage Interest Limit in TurboTax, H&R Block, FreeTaxUSA appeared first on The Finance Buff.

January 29, 2024

2023 Self-Employed ACA Health Insurance Subsidy In H&R Block

Updated on January 29, 2024, with updated screenshots from H&R Block software for tax year 2023. If you use TurboTax, see:

Self-Employed ACA Health Insurance Subsidy and Deduction In TurboTaxMany self-employed business owners buy health insurance from the Affordable Care Act (ACA) healthcare marketplace. Self-employed health insurance premiums are tax-deductible. When your income is low enough, you can also receive a subsidy in the form of a premium tax credit. The tax deduction and the subsidy form a circular relationship. The math is difficult to do by hand but tax software easily handles it for most people.

Use H&R Block Downloaded Software

Use H&R Block Downloaded SoftwareThe screenshots below are taken from H&R Block downloaded software. The downloaded software is way better than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

Self-Employment IncomeYou should enter all your self-employment income and expenses into the software before you start doing health insurance related to your self-employment.

Self-Employed Health InsuranceI’m using this scenario as an example:

You are single, self-employed, with no dependent. You had health insurance from the ACA healthcare marketplace for all 12 months in the year. The second lowest cost Silver plan was $600/month. The full unsubsidized premium for the plan you chose was $500/month. Based on your estimated income, you got a $150/month advance credit. You paid net $350/month out of pocket.

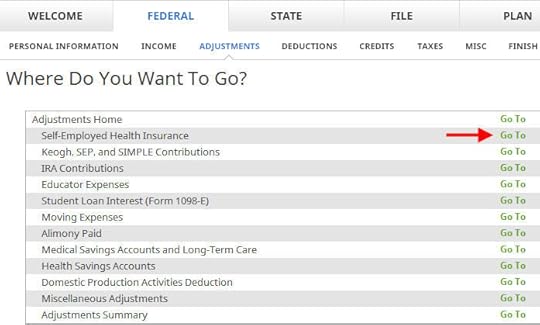

Go to Federal -> Adjustments -> Self-Employed Health Insurance.

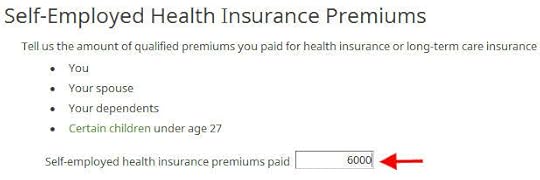

Enter the full unsubsidized premiums for your health insurance in the year. You find this number on the 1095-A form you receive from the ACA healthcare marketplace (line 33, column A). Include both what you paid out of pocket and the advance premium credit paid by the healthcare marketplace. You will reconcile the advance credit later.

If you also paid premiums for dental and vision insurance, add those as well. We don’t have dental and vision premiums in our example.

Right now it says 100% of your premium is deductible. It’ll change after you enter more information from your 1095-A form.

Enter 1095-A

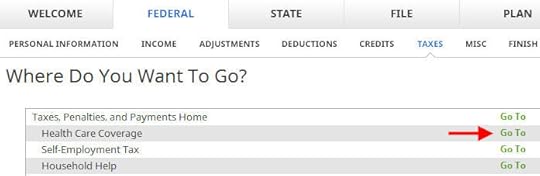

Go to Federal -> Taxes -> Health Care Coverage.

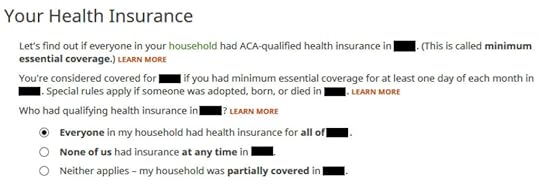

Everyone had insurance in our example.

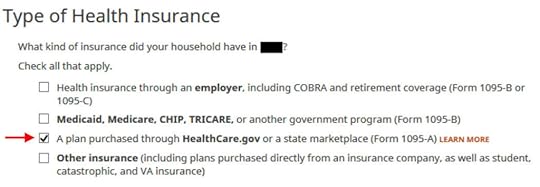

Check the box for a plan from the ACA healthcare marketplace.

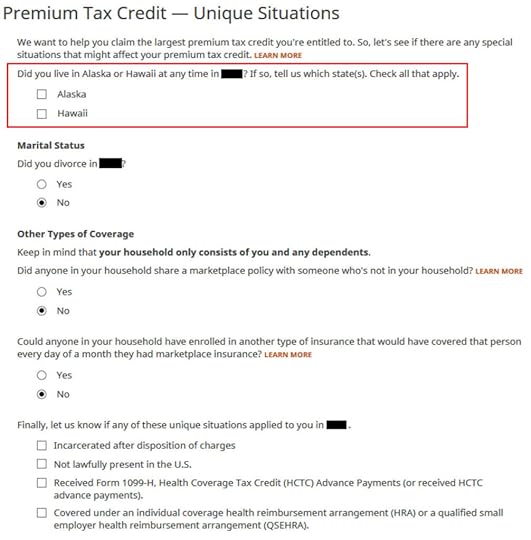

We don’t have any of these unique situations here. Check the box for Alaska or Hawaii if you lived there.

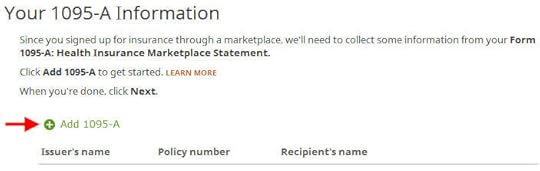

We need to add the 1095-A from the ACA healthcare marketplace.

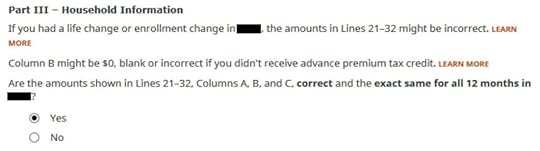

Enter the information as requested. Scroll down to Part III. The numbers on our 1095-A are the same for all 12 months and correct in our example. If you have different numbers for some months, choose ‘No’ and enter the month-by-month numbers from your Form 1095-A.

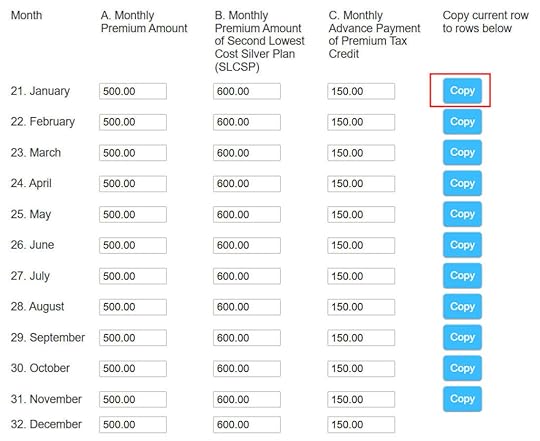

Enter the monthly amounts from the 1095-A. The full unsubsidized premium was $500/month. The full unsubsidized premium for the second lowest cost Silver plan was $600/month. The ACA healthcare marketplace paid $150/month in advance subsidy to the insurance company on our behalf.

We only have one 1095-A form in our example. If you have more than one, repeat and add them all.

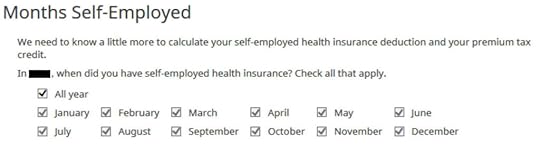

Which months you were self-employed determines how much counts as deductible self-employed health insurance. We were self-employed in all 12 months in our example.

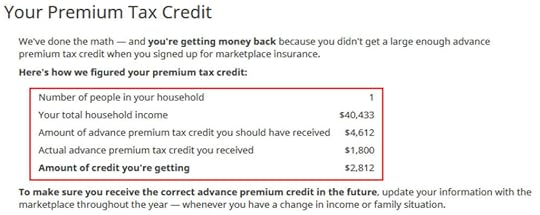

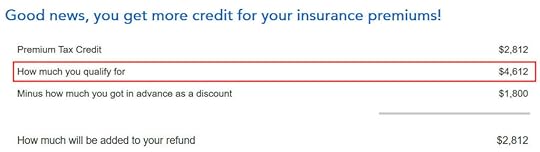

The software crunches the numbers. It says we are eligible for more premium tax credit than the advance subsidy the ACA healthcare marketplace already paid to the insurance company.

Self-Employed Health Insurance DeductionWe’re eligible for a tax deduction on the amount not covered by the re-calculated premium tax credit.

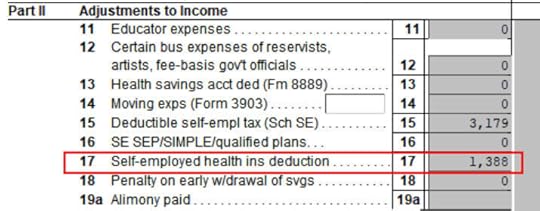

You can verify how much you are receiving a tax deduction. Click on Forms at the top. Double-click on Form 1040 and Schedules 1-3. Scroll down to Schedule 1 and look at line 17. That’s your self-employed health insurance deduction.

Premium Tax Credit

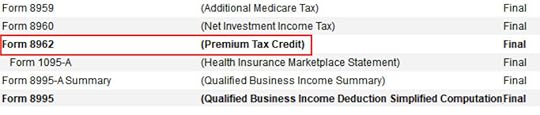

Close Form 1040 and Schedules 1-3 and find Form 8962 in the forms list. Double-click on it.

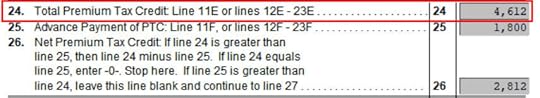

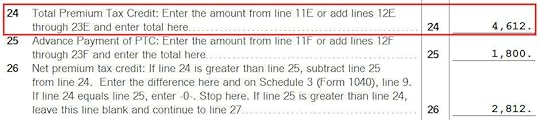

Scroll down to Line 24 on Form 8962. That’s our premium tax credit based on our actual income. Because we received less in advance subsidy, we’re getting the difference in our tax refund. If you received more in advance subsidy, you’ll have to pay back the difference (subject to a cap, see Cap On Paying Back ACA Health Insurance Subsidy Premium Tax Credit).

$1,388 in self-employed health insurance deduction plus $4,612 in premium tax credit equals $6,000. That’s the total unsubsidized premium for our health insurance (plus any dental and vision insurance premium, which we didn’t have in our example). The numbers add up!

The software figured out the split between the tax deduction and the tax credit. It also matched the result from TurboTax for the same example. This is where software does its best. If you take this to a tax professional, they will have to use their software to calculate the split anyway. I bet they aren’t able to do it by hand.

Edge CasesTax software works for most cases but it doesn’t work for everyone. You know you’re running into one of the edge cases for which the tax software doesn’t work when the numbers from the software fail this equation (except for a small difference due to rounding):

Self-Employed Health Insurance Deduction + Premium Tax Credit = Unsubsidized Health Insurance Premium (including any dental and vision premiums)

When this happens, you need a better calculator. See When TurboTax and H&R Block Give Self-Employed Wrong ACA Subsidy.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2023 Self-Employed ACA Health Insurance Subsidy In H&R Block appeared first on The Finance Buff.

2023 Self-Employed ACA Health Insurance Subsidy In TurboTax

Updated on January 29, 2024 with screenshots from TurboTax Deluxe downloaded software for 2023 tax filing. If you use H&R Block tax software, please read:

Self-Employed ACA Health Insurance Subsidy In H&R Block SoftwareMany self-employed business owners buy health insurance through the ACA healthcare marketplace (healthcare.gov or a state-specific exchange). If your estimated income qualifies for a subsidy, the marketplace will pay part of the premium directly to the insurance company.

Table of ContentsCircular RelationshipUse TurboTax DownloadSelf-Employment IncomeEnter 1095-ALink to Self-EmploymentCalculation ResultSelf-Employed Health Insurance DeductionS-Corp ShareholderPremium Tax CreditEdge CasesCircular RelationshipHowever, the advance subsidy is only an estimate based on the income estimate you provided when you signed up. As self-employed people know full well, the actual income from self-employment can vary greatly from year to year.

After the year is over, you have to square up and calculate the actual subsidy you qualify for. If your business didn’t do as well as you anticipated, you may qualify for a higher subsidy. If you had a great year, you may have to pay back some of it.

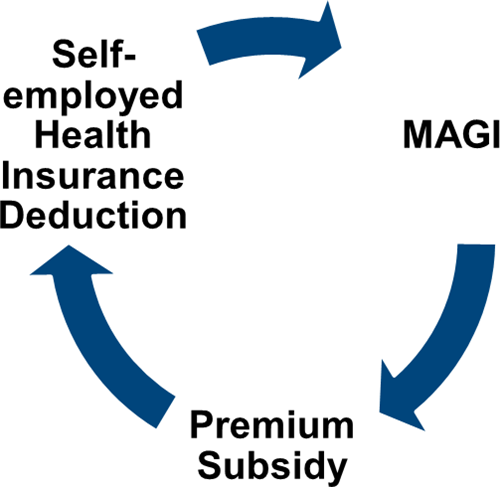

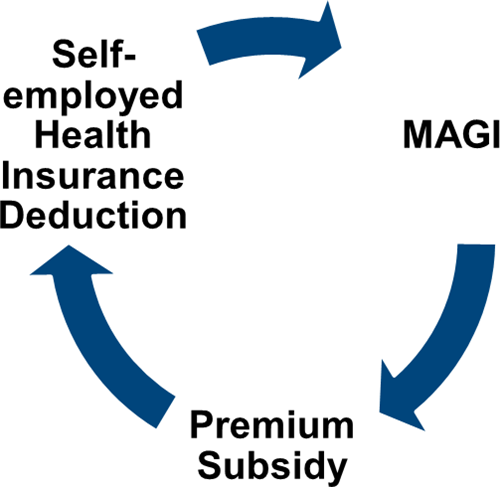

If you’re self-employed, you also qualify for a tax deduction for the health insurance premium. If you qualify for both a subsidy and a deduction, they form a circular relationship.

The IRS prescribed a method to calculate the split between the subsidy and the deduction. It’s difficult to calculate by hand but tax software will take care of it for most people.

Use TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

We will use this scenario as an example:

Self-Employment IncomeYou are single, self-employed, with no dependent. You had health insurance through the ACA healthcare marketplace for all 12 months in the year. The full unsubsidized preimium for the second lowest cost Silver plan was $600/month. The full unsubsidized premium for the plan you chose was $500/month. Based on your estimated income, you got a $150/month advance credit. You paid net $350/month.

You should enter all your self-employment income and expenses into TurboTax before you start doing health insurance related to your self-employment.

TurboTax offers you to upgrade to the Home & Business edition but the Deluxe edition of TurboTax download software works just fine for a simple service business.

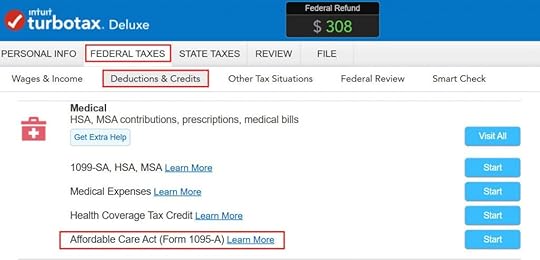

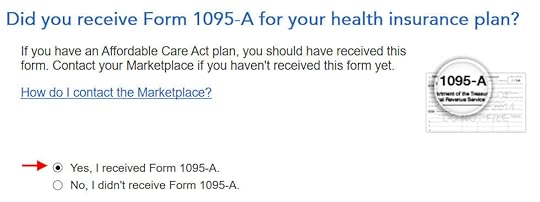

Enter 1095-A

Go to Federal Taxes -> Deductions & Credits. Scroll down and find Affordable Care Act (Form 1095-A) under Medical.

You should have a Form 1095-A from the ACA healthcare marketplace. If you didn’t get it in the mail, log in to your online account and look for a document download.

Enter the premium numbers from your Form 1095-A. If the numbers are the same for all months, enter the row for January and click on the Copy button next to it. It will put the same numbers for all other months.

The first column is the full unsubsidized monthly premium for your plan. The middle column is the full unsubsidized premium of the second lowest-cost Silver plan, which is used to calculate your subsidy. The last column is the advance subsidy the ACA marketplace already paid on your behalf to the insurance company.

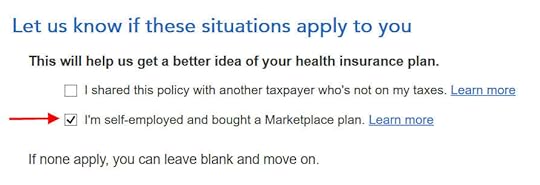

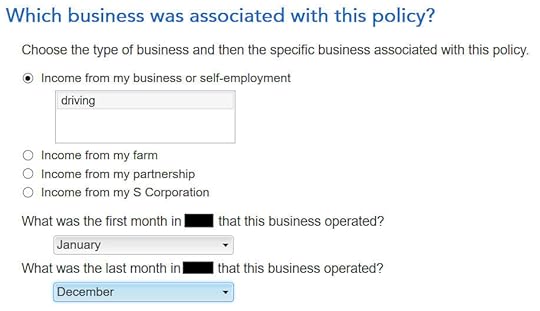

Link to Self-EmploymentYou get a tax deduction only when the insurance is linked to self-employment. TurboTax doesn’t know it only from the 1095-A form. You have to tell TurboTax it’s linked to your self-employment.

This is important but easy to miss. Even though TurboTax knows you’re self-employed and you have the 1095-A form from the ACA healthcare marketplace, you still must check this box.

Associate the health insurance with your self-employment. Choose the partnership or the S-Corp option if your business income is from a partnership or an S-Corp. Say during which months you had business income.

If you have more than one Form 1095-A, repeat and add them all. We only have one in our example.

Calculation Result

TurboTax crunches the numbers in a split second. It says we’re eligible for more tax credit than the ACA healthcare marketplace already paid directly to the insurance company. We’ll get the difference in our tax refund.

If you qualify for less subsidy than the advance already paid, you’ll pay back the difference, subject to a cap (see Cap On Paying Back ACA Health Insurance Subsidy Premium Tax Credit).

Self-Employed Health Insurance DeductionWe’re also eligible for a tax deduction for the portion not covered by the premium tax credit.

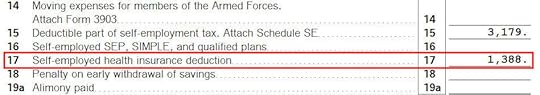

To see your self-employed health insurance deduction, click on Forms on the top right. Find Schedule 1 in the left navigation pane. Look at Line 17. It shows we’re getting a $1,388 tax deduction for self-employed health insurance.

S-Corp ShareholderIf you’re a greater-than-2% shareholder of an S-Corp, you’re eligible for a tax deduction for the health insurance premium paid by the S-Corp, which is added to your W-2 as wages.

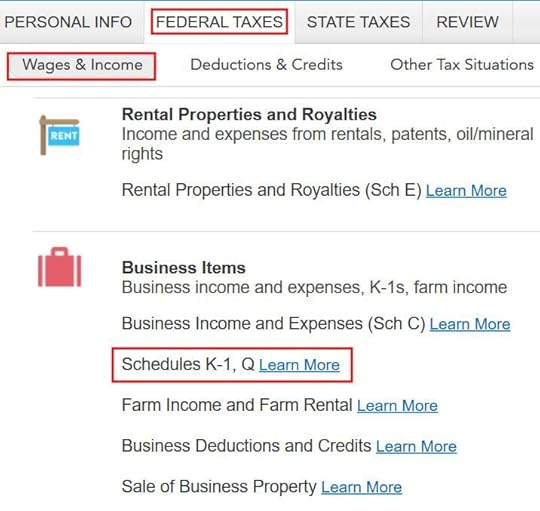

If you don’t see the self-employed health insurance deduction above, you need to enter a Schedule K-1 from the S-Corp.

Go to the Schedule K-1 from the S-Corp. Create a dummy K-1 even if you didn’t take any distribution from the S-Corp.

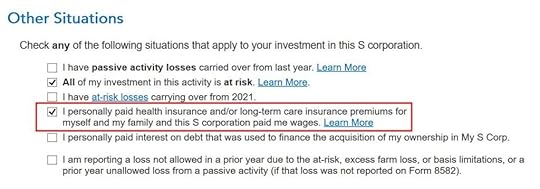

Be sure to check the box “I personally paid health insurance …” even if the S-Corp paid it directly.

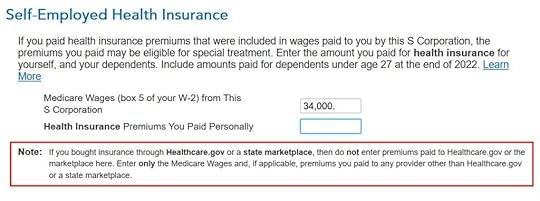

Enter the Medicare Wages from Box 5 of your W-2 from the S-Corp. Read the note carefully. Leave the second box blank if the S-Corp only paid for an ACA marketplace health insurance policy. Enter a number for any policy paid outside the ACA marketplace, such as any dental or vision premiums.

Premium Tax Credit

To see the subsidy you qualify for based on your actual income, find Form 8962 in the forms list navigation pane. Scroll down and look at Line 24. When you’re done looking for the form, click on Step-by-Step on the top right to get back to the interview.

$1,388 in self-employed health insurance tax deduction plus $4,612 in premium tax credit equals $6,000 ($500/month), which is the full unsubsidized premium for our health plan (plus any dental and vision insurance premium, which we didn’t have in our example). The numbers add up!

TurboTax figured out the split between the tax deduction and the tax credit. It also matched the result from H&R Block software for the same example.

Edge CasesTurboTax works for most cases but it doesn’t work for everyone. You know you’re running into one of the edge cases for which the software doesn’t work when the numbers from the software fail this equation (except for a small difference due to rounding):

Self-Employed Health Insurance Deduction + Premium Tax Credit = Unsubsidized Health Insurance Premium (including any dental and vision premiums)

When this happens, you need a better calculator. See When TurboTax and H&R Block Give Self-Employed Wrong ACA Subsidy.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2023 Self-Employed ACA Health Insurance Subsidy In TurboTax appeared first on The Finance Buff.

January 28, 2024

How to Enter 2023 Foreign Tax Credit Form 1116 in H&R Block

[Updated on January 28, 2024 with updated screenshots from H&R Block software for 2023 tax filing.]

When mutual funds and/or ETFs that invest in foreign countries receive dividends or interest, they have to pay taxes to those countries. These mutual funds and/or ETFs report to your broker after the end of the year how much they paid in foreign taxes on your behalf.

When you invest in these mutual funds and/or ETFs outside a tax-advantaged account, your broker will report to you the total foreign taxes you paid through all your funds and/or ETFs. The IRS allows a tax credit for the taxes you paid indirectly to foreign countries.

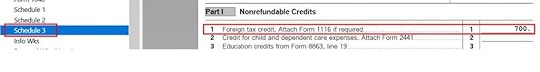

Table of ContentsForm 1116Use H&R Block Download1099-DIV EntriesForeign Tax CreditAMT Simplified ElectionForeign-Source IncomeAdjustment ExceptionForeign TaxesVerify on Schedule 3Excess Foreign Tax CreditSummaryForm 1116The foreign taxes paid are reported in Box 7 on the 1099-DIV form you receive from your broker. It’s easy to handle when the total foreign taxes paid from all your 1099-DIV forms is no more than a certain amount — $300 for single and $600 for married filing jointly. You enter the 1099-DIV forms into your tax software and the software will automatically put the total on your tax form (Schedule 3, Line 1).

When your total foreign taxes paid from all your 1099-DIV forms are over the $300/$600 threshold, you’ll need to include Form 1116 in your tax return. I’ll show you how to do this in H&R Block software.

If you use other tax software, please read:

How to Enter Foreign Tax Credit Form 1116 in TurboTaxUse H&R Block DownloadThe following screenshots came from H&R Block downloaded software. The downloaded software is both less expensive and more powerful than H&R Block’s online software.

If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

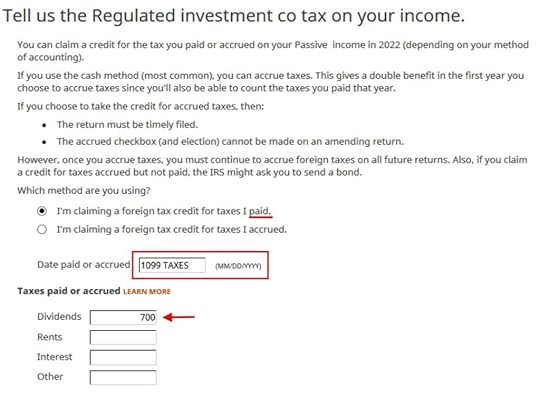

I’ll use the same example:

1099-DIV EntriesYou received a 1099-DIV from your broker. Box 7 “Foreign Tax Paid” on the 1099-DIV shows $700. 100% of this $700 came from a mutual fund or ETF. You only have this one 1099-DIV that has a number in Box 7.

If you import your 1099-DIV forms, double-check the import to make sure all the numbers match your downloaded copies. If you’re entering the 1099-DIV forms manually, type the numbers as shown on your forms.

H&R Block doesn’t say anything about the foreign tax paid or needing a Form 1116 after you enter the 1099-DIV forms. Just continue with your other entries.

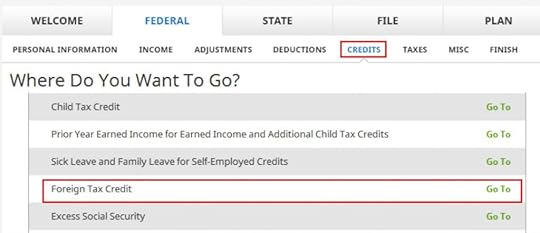

Foreign Tax Credit

Foreign Tax Credit comes up much later in the Credits section under Foreign Tax Credit.

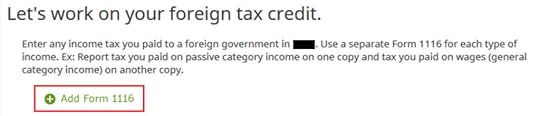

Click on “Add Form 1116.”

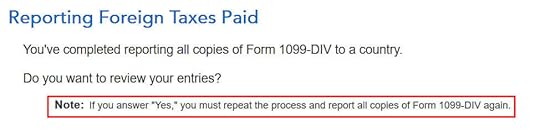

AMT Simplified Election

If this is the first year you’re claiming the Foreign Tax Credit, H&R Block software asks upfront about the simplified election. Select “Yes” for the simplified election.

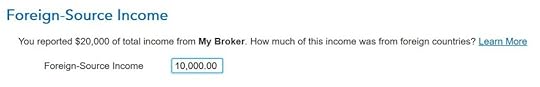

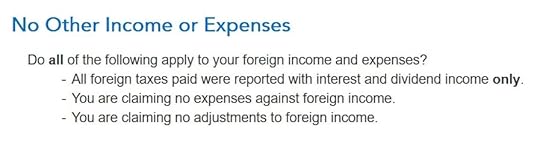

Foreign-Source Income

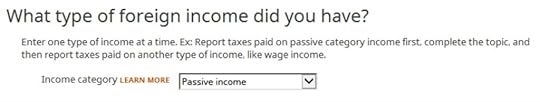

Dividend income falls under “passive income.”

The “learn more” popup says you should choose “RIC” as the country when your foreign income came through mutual funds and/or ETFs. “RIC” is the last item in the country dropdown.

You get the foreign income from the supplemental information in your 1099 package from your broker. If you have multiple 1099-DIV forms that reported foreign tax paid in Box 7, you’ll have to add up the foreign income numbers from the respective supplemental information.

Don’t overlook the small note under the gross income input. It says you might need to adjust the amount if it includes foreign capital gains or qualified dividends. When you’re reporting foreign taxes paid from mutual funds and ETFs, the income sure does include qualified dividends. H&R Block doesn’t do the adjustment for you. It asks you to read the IRS instructions, learn how to adjust, and report the adjusted income here. That’s lazy.

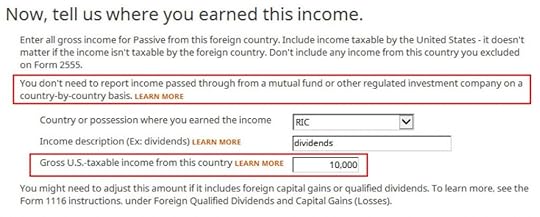

Adjustment ExceptionFortunately, many people qualify for an adjustment exception. From the IRS Form 1116 Instructions:

You qualify for the adjustment exception if you meet both of the following requirements.

1. Line 5 of the Qualified Dividends and Capital Gain Tax Worksheet doesn’t exceed:

a. $364,200 if married filing jointly or qualifying widow(er),

b. $182,100 if married filing separately,

c. $182,100 if single, or

d. $182,100 if head of household.

2. The amount of your foreign source capital gain distributions, plus the amount of your foreign source qualified dividends, is less than $20,000.

The dollar amounts in the first requirement correspond to the top of the 24% bracket. You are spared from figuring out how to adjust if your taxable income minus your qualified dividends and long-term capital gains isn’t in the 32% tax bracket or above, and your foreign source capital gain distributions and qualified dividends aren’t $20,000 or more.

If you’re eligible for the adjustment exception and you decide to take the easy route of not adjusting your foreign-source income, you need to claim a corresponding adjustment exception on your total income.

Click on Forms on the top right. Open Form 1116. Scroll down and find Mini-Worksheet for Line 18 just above Line 18. Check the box for using the adjustment exception.

Close the form and return to the interview.

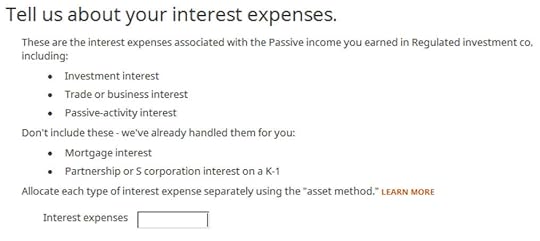

If you don’t qualify for the adjustment exception, good luck learning how to adjust from the Form 1116 instructions. You’re better off switching to TurboTax, which does the adjustment for you when you need it. See How to Enter Foreign Tax Credit Form 1116 in TurboTax.

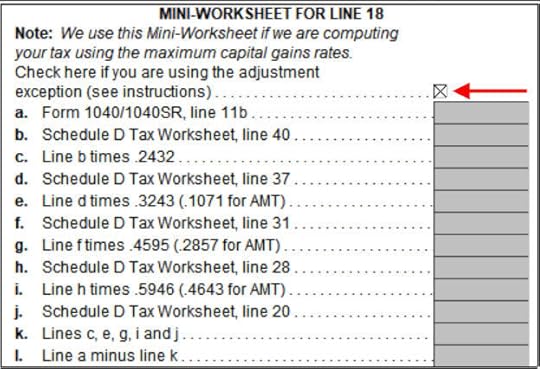

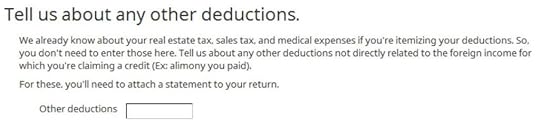

We leave this blank because we don’t have any interest expenses.

If you have any above-the-line deductions, such as an early withdrawal penalty from breaking a CD or an HSA contribution made outside payroll, enter the total here. We leave this blank in our simple example because we don’t have those deductions.

We don’t have any direct expenses either.

We have no losses to adjust.

Yes, our 1099-DIV was reported in U.S. dollars.

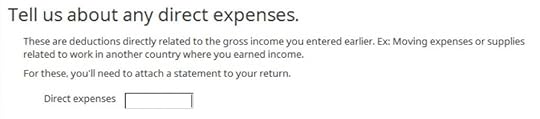

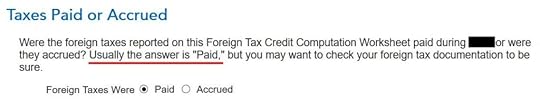

Foreign Taxes

I chose the simpler “paid” method. Although the “Date paid or accrued” asks for a date in “MM/DD/YYYY” format, you can type “1099 TAXES” to indicate that the foreign taxes were paid on various dates through the 1099 forms. Enter the total foreign tax paid into the Dividends box.

If you have multiple 1099-DIV forms that reported foreign tax paid in Box 7, you’ll have to add up those numbers yourself. I wish the software did the math and auto-populated this field.

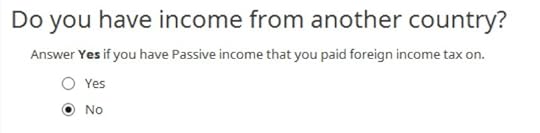

All our foreign taxes paid were through mutual funds and ETFs. RIC is the only country to use. We don’t have foreign income from any other countries.

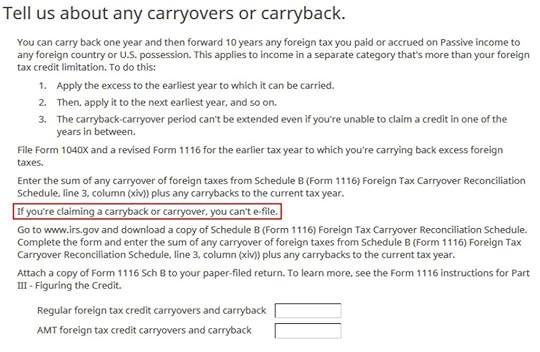

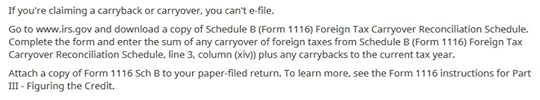

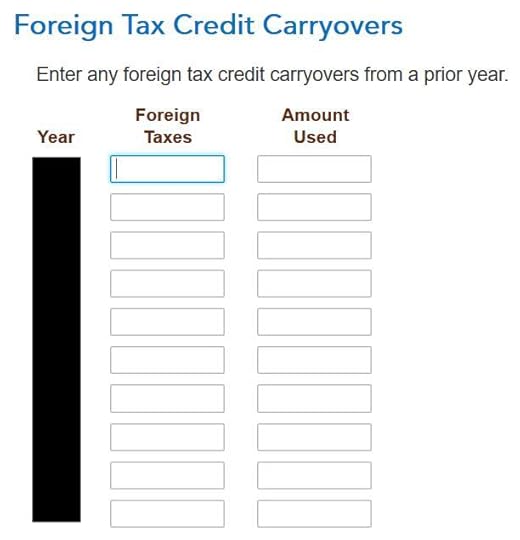

Fortunately, we don’t have any carryover or carryback. If we can’t get 100% credit for the foreign taxes paid this year, we’ll have to create a carryback or carryover, which means we can’t e-file with H&R Block.

We don’t have any reduction either.

We don’t know what the foreign tax rate was. We’re leaving this blank.

We don’t know how to adjust. We’re leaving it blank again.

This is getting ridiculous. All I want is to get the foreign tax credit!

We’re finally done with Form 1116. Are we getting the credit?

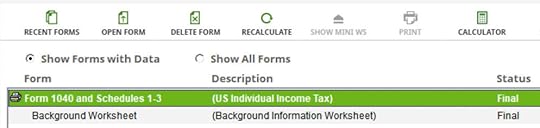

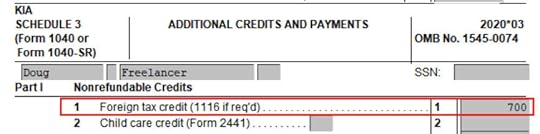

Verify on Schedule 3

Click on Forms on the top. Double-click on Form 1040 and Schedules 1-3.

Scroll down to Schedule 3. Line 1 shows our foreign tax credit. You can also look at Form 1116. It looks awfully complicated.

Excess Foreign Tax CreditWe received 100% of the foreign taxes paid as a tax credit in our example. If you paid higher foreign taxes on a lower US income, you may not be able to take 100% of the credit. You’ll have to wait until next year to take the rest of it.

Carrying over part of the credit to the following year requires filing a Form 1116 Schedule B. H&R Block doesn’t have this form in their program. H&R Block tells you to download the form from the IRS website, complete it yourself, and attach it to your paper return. That’s ridiculous.

SummaryH&R Block software works when you paid more in foreign taxes than the $300/$600 threshold that requires a Form 1116. You’ll have to gather the foreign income and the foreign dividends from the 1099 supplemental information from your brokers. After it’s all said and done, you’re getting a tax credit for taxes you paid to foreign countries through your mutual funds and/or ETFs.

H&R Block asks you to add up the foreign tax numbers yourself. It asks you to make any necessary adjustments to the foreign-source income, which is quite difficult. The option to activate the adjustment exception is hidden in the Forms mode. You’re on your own when you don’t qualify for the adjustment exception. It also asks you to handle any carryover yourself.

TurboTax does a better job of handling the foreign tax credit than the H&R Block software. See Foreign Tax Credit Form 1116 in TurboTax.

It’s better to avoid the complicated Form 1116 altogether next year by putting your international mutual funds and ETFs in a tax-advantaged account. See Too Much Hassle in Claiming Foreign Tax Credit on IRS Form 1116.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Enter 2023 Foreign Tax Credit Form 1116 in H&R Block appeared first on The Finance Buff.

How to Enter 2023 Foreign Tax Credit Form 1116 in TurboTax

[Updated on January 28, 2024 with updated screenshots from TurboTax for 2023 tax filing.]

When mutual funds and/or ETFs that invest in foreign countries receive dividends or interest, they have to pay taxes to those countries. These mutual funds and/or ETFs report to your broker after the end of the year how much they paid in foreign taxes on your behalf.

Table of ContentsForm 1116Use TurboTax Download1099-DIV EntriesForeign-Source IncomeSimplified Limitation for AMTAdjustmentsForeign Taxes PaidVerify on Schedule 3Excess Foreign Tax CreditSummaryForm 1116When you invest in these mutual funds and/or ETFs in a regular taxable brokerage account, your broker will report to you the total foreign taxes you paid through all your funds and/or ETFs. The IRS allows a tax credit for the taxes you pay indirectly to foreign countries.

The foreign taxes paid are reported in Box 7 on the 1099-DIV form you receive from your broker. It’s easy to handle when the total foreign taxes paid from all your 1099-DIV forms is no more than a certain amount — $300 for single and $600 for married filing jointly. You enter the 1099-DIV forms into your tax software and the software will automatically put the total on your tax form (Schedule 3, Line 1).

When your total foreign taxes paid from all your 1099-DIV forms are over the $300/$600 threshold, you’ll need to include Form 1116 in your tax return. It’s a complicated form. I’ll show you how to do this in TurboTax.

If you use other tax software, please read:

How to Enter Foreign Tax Credit Form 1116 in H&R BlockUse TurboTax DownloadThe screenshots below came from TurboTax Deluxe downloaded software. The downloaded software is way better than online software because it’s both less expensive and more powerful. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

I’ll use this simple scenario as an example:

1099-DIV EntriesYou received a 1099-DIV from your broker. Box 7 “Foreign Tax Paid” on the 1099-DIV shows $700. 100% of this $700 came from a mutual fund or ETF. You only have this one 1099-DIV that has a number in Box 7.

If you imported your 1099’s, double-check that all the numbers from the import match your downloaded copy.

If you’re entering your 1099-DIV manually, you have to check a box on the 1099-DIV entry screen to reveal the additional input fields. Then you put the foreign tax paid number into Box 7.

We don’t have any of these uncommon situations.

After you’re done with one 1099-DIV, continue with your other 1099-DIV forms. We only have one 1099-DIV form in our example.

Foreign-Source Income

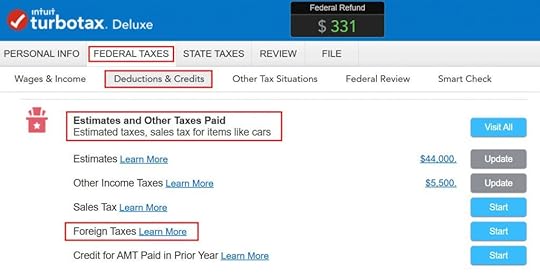

At a much later point, TurboTax will ask you about the foreign tax paid under Deductions & Credits -> Estimates and Other Taxes Paid -> Foreign Taxes.

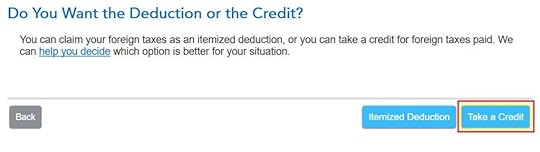

After a brief introduction, the first question is whether you’d like to take a tax deduction or a tax credit. The “help you decide” popup says in general you’re better off taking the credit. So click on “Take a Credit.”

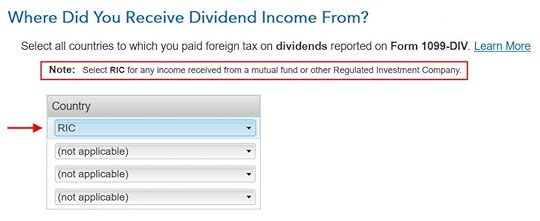

Next, TurboTax asks you which countries you received dividend income from. A small note says to select RIC for any income received from a mutual fund or other Regulated Investment Company. U.S.-based mutual funds and ETFs fall into this category.

RIC is the first item in the country dropdown.

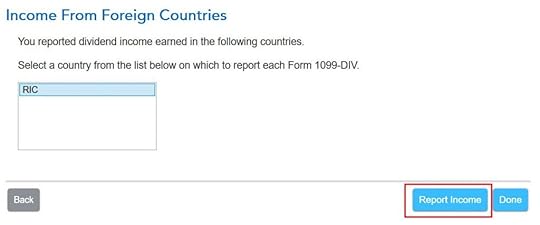

Then you report income received from the country “RIC.” Click on “Report Income.”

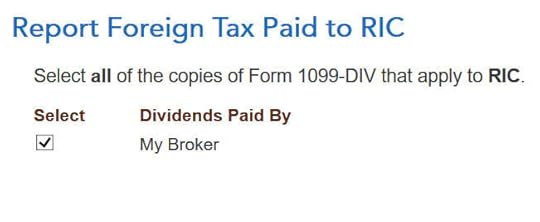

Now you say foreign tax paid from which 1099-DIVs were paid to the country RIC. If all your foreign taxes paid were from mutual funds and/or ETFs, select all your 1099-DIV’s that have a number in Box 7.

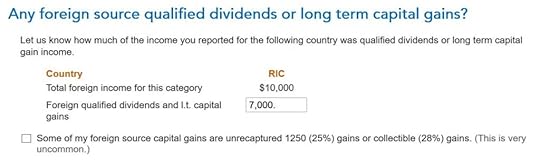

TurboTax asks you how much of the dividend on your 1099-DIV was from foreign countries.

This information isn’t on the 1099-DIV itself. Your broker may have included supplemental information with the 1099-DIV. For instance, Fidelity provides the breakdown of total foreign income in its 1099 package.

TurboTax asks whether you’d like to review the 1099-DIV forms you entered before. We answer “No” here because we already entered the 1099-DIV forms correctly.

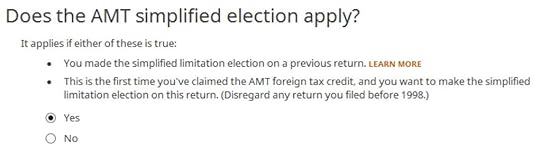

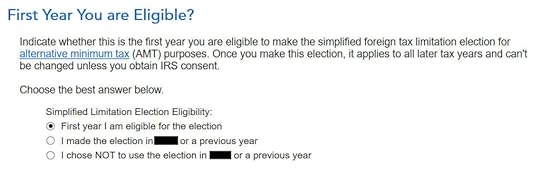

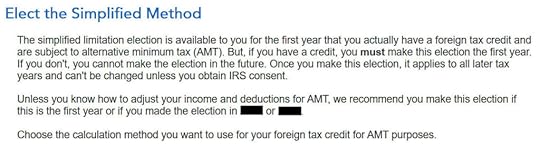

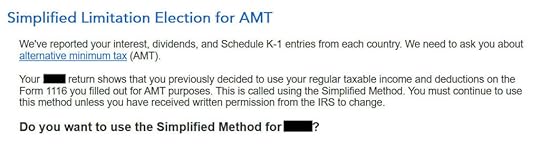

Simplified Limitation for AMT

Now it asks you about a “simplified foreign tax limitation election.” If this is the first year you encounter this, choose the first option.

TurboTax suggests you should elect the simplified method. Click on Elect Simplified Calculation.

If you used TurboTax last year and you already elected the simplified method, TurboTax reminds you that you should continue with the simplified method. Answer “Yes” here.

Adjustments

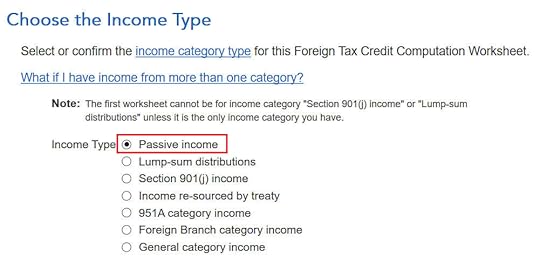

This is important but easy to miss. Click on “No” to trigger more questions. We gave the total foreign-source income in a previous screen but we didn’t get a chance to say how much of the income is from qualified dividends or long-term capital gains. It makes a difference.

Dividends fall in the Passive Income type.

You find the total foreign-source qualified dividends and long-term capital gains from the 1099 supplemental materials from your broker.

Go with the default “Paid.”

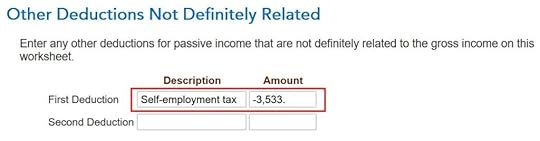

By default all your above-the-line deductions are categorized as “not definitely related” to your foreign income. If you have a deduction that’s definitely related to your U.S. income, such as the deductible 1/2 of your self-employment tax when your self-employment is 100% U.S., enter it here as a negative number to back it out.

Continue clicking through and accept the default in many screens after this one.

Foreign Taxes Paid

We don’t have any carryover from previous years in our example. A carryover is created when you paid more in foreign tax than the tax credit you’re allowed. Your leftover foreign tax paid is first carried back to the previous year and then carried over to the following year. If you have carryovers from previous years, they’ll show up here.

After going through all these, we’re getting 100% credit for the $700 foreign tax paid. Woo-hoo! You may get less than 100% credit depending on your income composition. If that’s the case, the credit you can’t take this year will carry over to next year.

Verify on Schedule 3

You can verify that you’re getting the foreign tax credit by clicking on Forms at the top right. Find Schedule 3 in the left navigation pane and look at the number on Line 1. You can also look at Form 1116. It looks awfully complicated.

Excess Foreign Tax CreditWe received 100% of the foreign taxes paid as a tax credit in our example. If you paid higher foreign taxes on a lower US income, you may not be able to take 100% of the credit. TurboTax will tell you that you’ll have to wait until next year to take a portion of the credit.

Carrying over part of the credit to the following year requires filing a Form 1116 Schedule B. TurboTax will automatically generate Schedule B when you need it.

SummaryTurboTax works when you paid more foreign taxes than the $300/$600 threshold that requires a Form 1116. You’ll have to gather the foreign income from the 1099 supplemental information from your brokers. After it’s all said and done, you’re getting a tax credit for taxes you paid to foreign countries through your mutual funds and/or ETFs.

Completing Form 1116 is complicated even with TurboTax. You’ll have a further complication in carryovers when you don’t get to use 100% of the credit. I try to avoid this situation by putting mutual funds and ETFs that invest in foreign countries in a tax-advantaged account. See Too Much Hassle in Claiming Foreign Tax Credit on IRS Form 1116.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Enter 2023 Foreign Tax Credit Form 1116 in TurboTax appeared first on The Finance Buff.

How to Enter 2023 ESPP Sold in FreeTaxUSA: Adjust Cost Basis

[Updated on January 28, 2024 with screenshots from FreeTaxUSA for 2023 tax filing.]

If your employer offers an Employee Stock Purchase Program (ESPP), you should max it out. You come out ahead even if you sell the shares as soon as you can. See Employee Stock Purchase Plan (ESPP) Is A Fantastic Deal.

After you sell the shares from the ESPP, part of the income will be included on your W-2. However, the 1099-B form you receive from the broker still reflects your discounted purchase price. This post shows you how to make the necessary adjustment on your tax return using FreeTaxUSA.

Don’t pay tax twice!

If you use other tax software, please read:

How To Report ESPP Sales In TurboTaxHow to Report ESPP Sales in H&R Block SoftwareTable of ContentsWhen to Report1099-B From BrokerFreeTaxUSAAdjust Cost BasisVerify on Form 8949When to ReportBefore you begin, be sure to understand when you need to report. You report when you sell the shares you bought under your ESPP. If you only bought shares but you didn’t sell during the tax year, there’s nothing to report yet.

Wait until you sell, but write down the full per-share price (before the discount) when you bought. If you purchased multiple times, write down for each purchase:

The purchase dateThe closing price on the grant dateThe closing price on the purchase dateThe number of shares you boughtThis information is very important when you sell.

Let’s use this example:

You bought 1,000 shares under your ESPP on 9/30/20xx. The closing price on the purchase date was $12 per share. The closing price on the grant date six months before was $10 per share. You bought at $8.50 per share with the discount.

You would write down:

Grant Date4/1/20xxMarket Price on the Grant Date$10 per sharePurchase Date9/30/20xxMarket Price on the Purchase Date$12 per shareShares Purchased1,000Discounted Price$8.50 per shareKeep this information until you sell.

1099-B From BrokerWhen you sell, you will receive a 1099-B form from the broker in the following year. You will report your gain or loss using this 1099-B form and the information you accumulated for each purchase. Some brokers will supply supplemental information for your purchases.

Let’s continue our example:

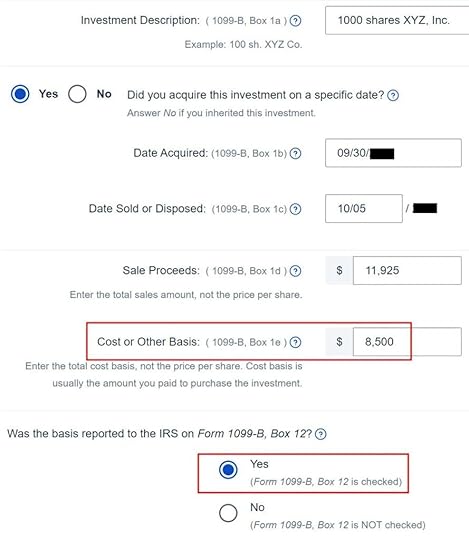

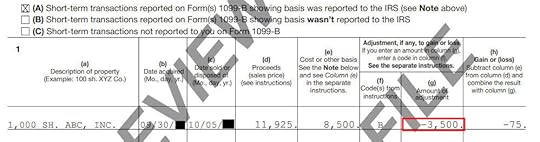

You sold 1,000 shares from your purchase above on 10/5/20xx at $11.95 per share. After commission and fees, you netted $11,925. You received a 1099-B form from your broker showing a sales proceed of $11,925 in the following year. The 1099-B form shows the cost basis as $8,500, which reflects your discounted purchase price.

Because you didn’t hold it for two years after the grant date and one year after the purchase date, your sale was a “disqualifying disposition.” The discount is added as income to your W-2. This raises your cost basis. If you just accept the 1099-B as-is, you will be double-taxed!

FreeTaxUSANow let’s do it in FreeTaxUSA.

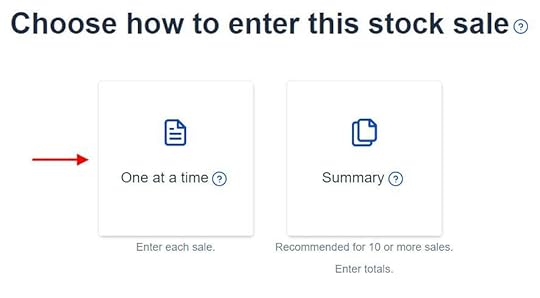

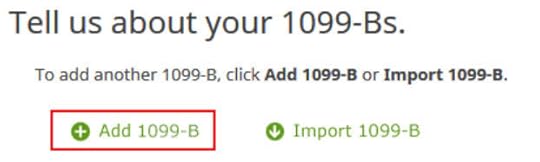

Find “Stocks or Investments Sold (1099-B)” in the “Common Income” section under “Income” in the menu. Click on “Add an Investment Sale.”

Choose “Stocks, Bonds, Mutual Funds” as the investment type.

Choose “One at a time.”

Enter the numbers on your 1099-B as they appear. The cost basis on your 1099-B was reported to the IRS but it was too low.

Don’t make any changes here. Your broker sent this information to the IRS. It has to match.

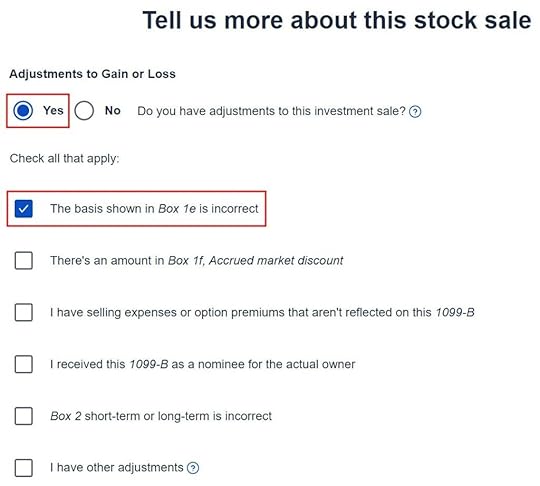

Adjust Cost Basis

You have this opportunity to make an adjustment. Check the “Yes” radio button and the box for “The basis shown in Box 1e is incorrect.”

Enter your purchase cost plus the amount added to your W-2. When you did a “disqualifying disposition” your cost basis was the full value of the shares on the date of the purchase. The market price was $12 per share when you purchased those 1,000 shares at $8.50 per share. Your employer added the $3,500 discount as income to your W-2. Therefore your true basis is $8,500 + $3,500 = $12,000.

If you didn’t sell all the shares purchased in that batch, multiply the number of shares you sold by the discount price on the date of purchase and add the discount included on your W-2. For example, if you sold only 500 shares and your employer added $1,750 to your W-2, your corrected cost basis is:

$8.50 * 500 + $1,750 = $6,000

If you had a wash sale, your 1099-B form would indicate it as such. We didn’t have a wash sale in our example.

We’re done with one ESPP sale. Repeat if you sold more than once during the year.

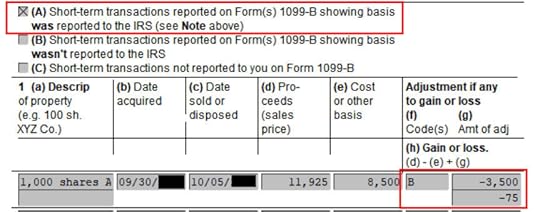

Verify on Form 8949We can verify that the adjustment makes it all the way to the tax form.

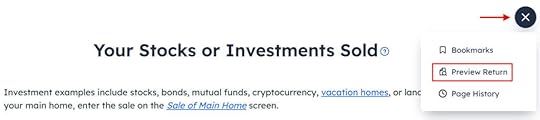

Click on the three dots on the top right above “Your Stocks or Investments Sold” and then click on “Preview Return.”

Scroll down to find Form 8949 in the popup. You see the negative adjustment in column (g).

If you didn’t make the adjustment and you just accepted the 1099-B as-is, you will pay capital gains tax again on the $3,500 discount you are already paying taxes through your W-2. Remember to make the adjustment!

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Enter 2023 ESPP Sold in FreeTaxUSA: Adjust Cost Basis appeared first on The Finance Buff.

How to Enter 2023 ESPP Sales in H&R Block: Adjust Cost Basis

[Updated on January 28, 2024 with screenshots from H&R Block tax software for 2023 tax filing.]

If your employer offers an Employee Stock Purchase Program (ESPP), you should max it out. You come out ahead even if you sell the shares as soon as you can. See Employee Stock Purchase Plan (ESPP) Is A Fantastic Deal.

After you sell the shares from the ESPP, part of the income will be included on your W-2. However, the tax form you receive from the broker still reflects your discounted purchase price. This post shows you how to make the necessary adjustment on your tax return using H&R Block tax software.

Don’t pay tax twice!

If you use other software, please read:

How to Report ESPP Sale in TurboTaxHow to Report ESPP Sale in FreeTaxUSATable of ContentsWhen to Report1099-B From BrokerUse H&R Block DownloadEnter 1099-B FormVerify on Form 8949When to ReportBefore you begin, be sure to understand when you need to report. You report when you sell the shares you bought under your ESPP. If you only bought shares but you didn’t sell during the tax year, there’s nothing to report yet.

Wait until you sell, but write down the full per-share price (before the discount) when you bought. If you purchased multiple times, write down for each purchase:

The purchase dateThe closing price on the grant dateThe closing price on the purchase dateThe number of shares you boughtThis information is very important when you sell.

Let’s use this example:

You bought 1,000 shares under your ESPP on 9/30/20xx. The closing price on the purchase date was $12 per share. The closing price on the grant date six months ago was $10 per share. You bought at $8.50 per share with the discount.

You would write down:

Grant Date4/1/20xxMarket Price on the Grant Date$10 per sharePurchase Date9/30/20xxMarket Price on the Purchase Date$12 per shareShares Purchased1,000Discounted Price$8.50 per shareKeep this information until you sell.

1099-B From BrokerWhen you sell, you will receive a 1099-B form from the broker in the following year. You will report your gain or loss using this 1099-B form and the information you accumulated for each purchase.

Let’s continue our example:

You sold 1,000 shares from your purchase above on 10/5/20xx at $11.95 per share. After commission and fees, you netted $11,925. You received a 1099-B form from your broker showing a sales proceed of $11,925 in the following year. The 1099-B form shows the cost basis as $8,500, which reflects your discounted purchase price.

Because you didn’t hold the shares for two years after the grant date and one year after the purchase date, your sale was a “disqualifying disposition.” The discount is added as income to your W-2. This raises your cost basis. If you just accept the 1099-B as-is, you will be double-taxed!

Now let’s account for it in the H&R Block software.

Use H&R Block DownloadThe screenshots below are from H&R Block Deluxe downloaded software. The downloaded software is both less expensive and more powerful than online software. If you haven’t paid for your H&R Block online filing yet, you can buy H&R Block download from Amazon, Walmart, and many other places. If you’re already too far along, make this year your last year of using the online service.

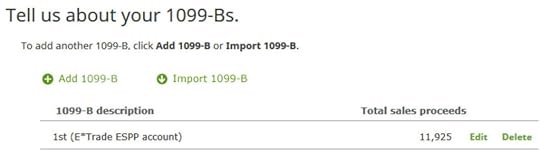

Enter 1099-B Form

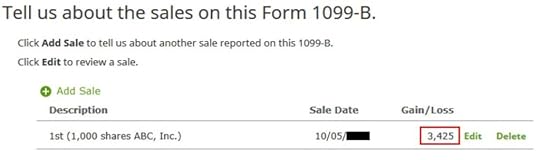

Click on Federal -> Income. Scroll down to find the Investments section. Click on the “Go To” link next to “Sale of Stocks, Bonds, Mutual Funds, and Other Securities (1099-B).”

Import your 1099-B if you’d like. I’m adding it manually.

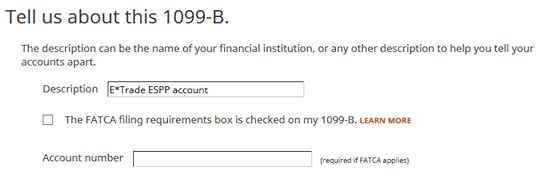

Give your account a description. Suppose this is from the ESPP account at E*Trade.

Now we add a sale.

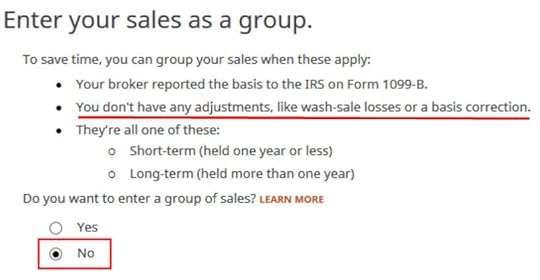

We don’t want to add sales as a group because we need to make an adjustment.

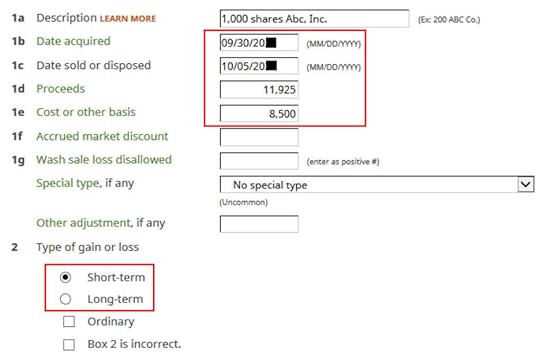

Enter a description. Enter the dates and numbers from the 1099-B form as they appear. Make sure to match the type of gain or loss reported on your 1099-B form. It was short-term on my form.

The cost basis on your 1099-B was reported to the IRS but it was too low. Don’t change it here directly.

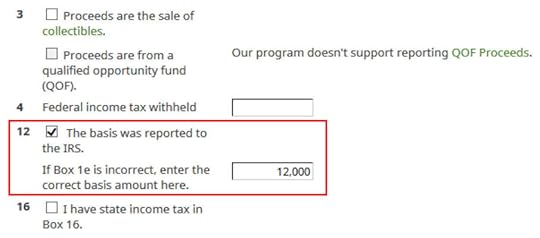

Scroll down and check the box for “The basis was reported to the IRS.” Enter your purchase cost plus the amount added to your W-2 as your correct basis amount.

When you did a “disqualifying disposition” your cost basis was the full value of the shares on the date of the purchase. The market price was $12 per share when you purchased those 1,000 shares at $8.50 per share. Your employer added the $3,500 discount as income to your W-2. Therefore your true basis is $8,500 + $3,500 = $12,000.

If you didn’t sell all the shares purchased in that batch, multiply the number of shares you sold by the discount price on the date of purchase and add the discount included on your W-2. For example, if you sold only 500 shares and your employer added $1,750 to your W-2, your corrected cost basis is:

$8.50 * 500 + $1,750 = $6,000

You are done with this entry. The summary gives the impression that you are paying tax again on a large gain, but don’t panic. We’ll verify it’s done correctly in the next section.

This shows a summary of the 1099-B form.

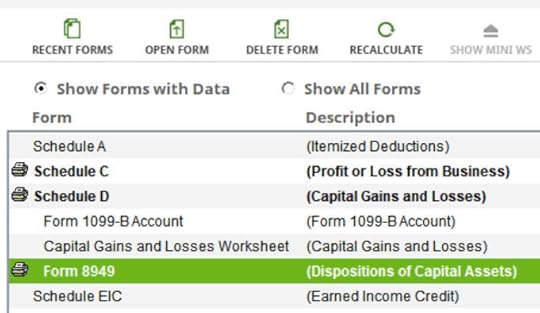

Verify on Form 8949

Click on the “Forms” button in the toolbar. Find Form 8949 and double-click on it.

Find your sale in either Part I or Part II depending on whether it was short-term or long-term on your 1099-B form.

You see the negative adjustment in column (g). If you didn’t make the adjustment and you just accepted the 1099-B as-is, you will pay capital gains tax again on the $3,500 discount you are already paying taxes through your W-2. Remember to make the adjustment!

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Enter 2023 ESPP Sales in H&R Block: Adjust Cost Basis appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower