Harry Sit's Blog, page 14

July 4, 2023

Use Google Calendar to Manage Bills, Taxes, and Investing Tasks

When I started my first full-time job years ago, the first thing my manager asked me to do was to order a Franklin Covey Day Planner. It was the standard issue for all employees of that company.

Technology evolved over the years. The standard tool was Microsoft Outlook at my last full-time job. We used the calendar features in Outlook to book conference rooms and manage meeting invites.

I use Google Calendar now to track personal events such as dentist appointments and recurring household chores.

A computer-based calendar makes it easy to create recurring events, whether it’s monthly, quarterly, or annually. You set it only once and you’ll have it on your calendar every month, every quarter, or every year. For really important tasks, you can set up the calendar to send you not just one reminder but several reminders — for example, seven days before, three days before, and one day before — to make sure you don’t forget.

I have repeating events on my calendar to change the furnace filter, add salt to the water softener, run a cleaning cycle on the dishwasher, check the engine oil, and replace the air filters in my car. If I think of something else that needs to be done on a set schedule, I add it to the calendar.

Bills and TaxesI also started using Google Calendar to manage financial chores.

I set all my bills on autopay to let them charge a credit card or debit a bank account but I understand not everyone is comfortable with autopay. Some bills, especially those from government entities, can’t be set on autopay.

For example, your state DMV may not have autopay for annual vehicle registration renewals. You have to renew and pay manually each time. Rather than using the renewal notice you get in the mail as the prompt, you can set a calendar reminder to look for the renewal on the DMV website yourself a month before your sticker expires. That way you won’t forget to renew even if you don’t receive the renewal notice. You’ll have this reminder on your calendar every year after you set it up only once.

If you pay estimated tax because you’re self-employed or retired, the IRS and the state revenue agency don’t send you invoices. You have to pay them proactively four times a year. I use EFTPS to schedule payments to the IRS. If you set up the four quarterly due dates as annually repeating events, your calendar will remind you every time without fail.

The same goes for the property tax if you’re not paying it through mortgage escrow. If the property tax bill is lost in the mail or if their email notification gets filtered into spam, you still owe the property tax. Property tax is due on a set date every year. You can set an annually repeating calendar reminder to make sure you pay it on time.

Investing TasksIf you’re not automatically reinvesting dividends, you can set a recurring calendar event to go into your account and reinvest manually.

If you invest in Treasuries or brokered CDs, the interest payments can’t be automatically rolled into the same Treasury or brokered CD but you know when the interest will be paid out as cash. If the amount is substantial, you can set a recurring calendar reminder to reinvest.

You also know when your Treasury or CD will mature. If your broker doesn’t have the “auto roll” feature or if you choose not to use it, as soon as you buy the Treasury or CD, you can set a calendar reminder to reinvest the principal repayment at maturity.

If you’re required to take the Required Minimum Distribution from your retirement accounts, you can set up an annually repeating calendar event to help you remember to take it. The IRA custodian may also remind you but the ultimate responsibility falls on you.

If you’re planning to cash out I Bonds to buy new ones at a higher fixed rate, set a calendar reminder for the best time to sell. After you sell, set another calendar reminder to download the 1099 form from TreasuryDirect next January because they don’t send it by mail.

Automation is usually my first choice. If I can’t make it happen automatically, I put it on my calendar to make sure I don’t forget. I use Google Calendar but any other calendar system works too.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Use Google Calendar to Manage Bills, Taxes, and Investing Tasks appeared first on The Finance Buff.

June 27, 2023

How to Buy CDs in a Fidelity or Vanguard Brokerage Account

The previous post Buying CD in a Brokerage Account vs Bank CD or Treasury talked about the advantages and disadvantages of buying brokered CDs versus buying CDs directly from a bank or a credit union or buying Treasuries. It ended with these steps when you’re considering buying brokered CDs:

1. Decide what term you want because selling brokered CDs before maturity will be costly.

2. Check DepositAccounts.com for the best rate on a direct CD for your term. Weigh the convenience of brokered CDs against giving up yield and the early withdrawal option.

3. Check the yield on Treasuries for your term. Adjust it for the state and local tax exemption if you’re buying in a regular taxable account.

4. Only compare non-callable brokered CDs with direct CDs and Treasuries. Demand a large yield difference if you don’t mind callable CDs.

Now we go into the logistics of how to buy a CD in a Fidelity or Vanguard brokerage account with a real-life example.

Suppose we want a 3-year CD because we’re comfortable committing to holding it for three years.

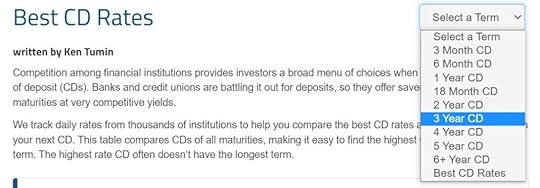

Table of ContentsResearch Direct CDsResearch TreasuriesNew IssueSecondary CDsFidelityNew IssuesSecondary CDsVanguardNew IssuesSecondary CDsResearch Direct CDsWe go to DepositAccounts.com to see the current best rates offered directly by a bank or a credit union. We want the yield on a brokered CD not to be too far off.

We select the 3-year term in the term dropdown. The highest rate offered is 5.65%. Going into the details of the CDs that offer the highest rates shows that they’re variable-rate CDs, which means the rate can drop during the term. We don’t want that.

We go down the list to find a CD with a fixed rate. We see that the best 3-year fixed-rate CD pays 5.13%. It requires opening a new account at a credit union though. We like the convenience of using our existing brokerage account without having to open another account but we don’t want to give up too much on the yield.

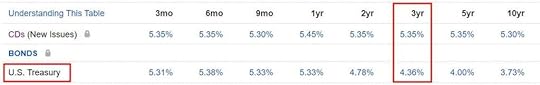

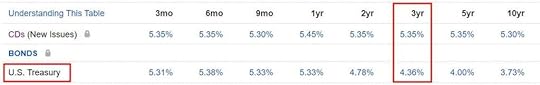

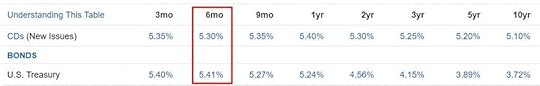

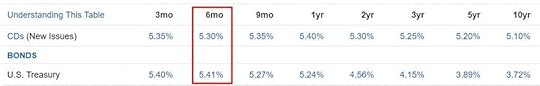

Research TreasuriesWe also check Treasuries. This bond yields page from Fidelity doesn’t require a login.

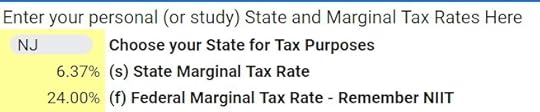

We see the 3-year Treasury yield is 4.36% right now. Because Treasuries are exempt from state and local taxes and we’re buying in a regular taxable account, we calculate the Treasury’s tax-equivalent yield using this formula:

treasury yield * ( 1 – federal tax rate ) / ( 1 – federal tax rate – state tax rate )

It comes out to 4.36% * ( 1 – .22 ) / ( 1 – .22 – .06 ) = 4.72% when our federal tax rate is 22% and our state tax rate is 6%. A CD that’s fully taxable for both federal and state must have a yield this high to beat the Treasury. We don’t have to make this adjustment if we’re buying in an IRA or if we live in a no-tax state.

Now we want to see if we can beat the 3-year Treasury if we buy a brokered CD and how close we can get to the best rate from a direct CD.

There are two ways to buy a brokered CD: new issue and secondary market. Whether you’re looking for new issues or the secondary market, it’s best to look when the market is open (9:30 – 4:00 Eastern Time). You’ll see more choices during those hours.

New IssueBuying a new-issue brokered CD means buying a brand-new CD offered by a bank through the broker. You see the rate and the terms of the CD set by the bank. You pay the face value to get the CD if you like the rate and the terms. The broker doesn’t charge you a fee because they’re getting paid by the bank to sell it.

Secondary CDsBuying on the secondary market means buying from a dealer who bought the CD from a previous owner. The price the dealer asks for may be above or below the face value of the CD depending on the existing rate of the CD relative to the current market rate. The interest payments and the principal repayment from the bank are still based on the face value and the original rate because the bank doesn’t care whether you’re the first owner or the second or the third owner. The CD still has FDIC insurance.

The broker charges you a commission to buy CDs on the secondary market. The commission is typically $1 per $1,000 in face value. Paying a commission reduces the yield you get from the CD.

You also must pay accrued interest to the dealer. If the CD pays interest every six months and it’s been two months since the last interest payment date, you owe two months’ worth of interest to the dealer. You’ll still receive six months’ worth of interest from the bank when the CD pays interest next time, which reimburses you for the accrued interest you paid to the dealer.

If the price of the CD is above 100 because the coupon rate of the CD is higher than the quoted yield, you’re paying more than the face value of the CD. The difference above the face value isn’t insured by the FDIC. Avoid this type of CD or, if you must, only choose one from a bank that’s too big to fail.

If you’re buying in a regular taxable brokerage account, paying a price above or below the face value with the trading commission and accrued interest complicates your taxes. If you prefer to avoid this complication, stick with new-issue brokered CDs when you’re buying in a regular taxable brokerage account. The tax complication doesn’t apply when you’re buying in an IRA.

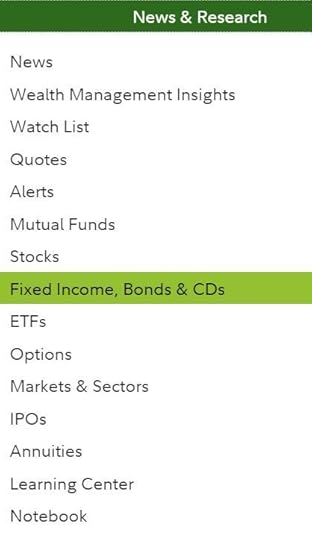

FidelityIf you use Fidelity, click on “News & Research” and then “Fixed Income, Bonds & CDs” after you log in to your Fidelity account. If you use Vanguard, please jump ahead to the next section for Vanguard.

You get to the same bond yields page.

New Issues

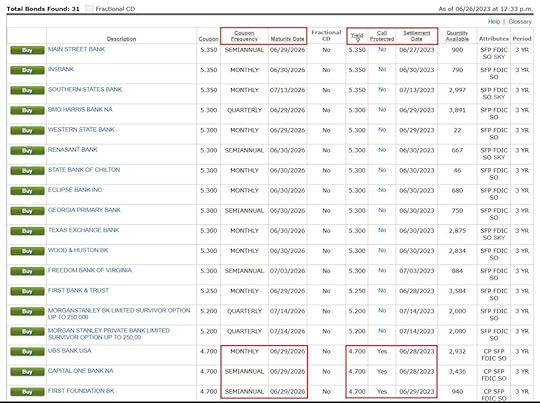

New IssuesClicking on the link under the term we want gives us this list of new issue CDs being offered:

“No” in the “Call Protected” column means the CD is callable (not protected from a call). In general, we want to avoid callable CDs because although the advertised rate is higher, we’re not locked in to earn it for the full term. We see in this list that the highest yield on a non-callable 3-year CD is 4.7%.

“Coupon Frequency” shows how often the CD pays interest. Some CDs pay monthly, some pay quarterly, and some pay semi-annually. Which way is better is only personal preference. We prefer less frequent payments so that we don’t have to deal with the received cash. Some others may prefer to receive cash more frequently to meet cash flow needs.

“Maturity Date” is when we’ll get our principal back. “Settlement Date” is when the broker will debit our cash to buy the CD. Our cash earns interest in the money market fund until the settlement date.

Suppose we want to buy that CD from Capital One. We see this page after we click on “Buy.”

We must buy in $1,000 increments. We enter 50 under “Quantity” if we want to buy $50,000 in face value. Fidelity offers an optional “Auto Roll” feature. If we choose to use it, Fidelity will automatically buy another brokered CD of the same term and interest payment frequency when this CD matures. We choose not to use the “Auto Roll” feature because Fidelity can pick a callable CD for the auto roll and we don’t like callable CDs. We can set a reminder in Google Calendar to reinvest when our CD matures.

If we’re buying in an IRA or if we live in a no-tax state, the 4.7% rate on a non-callable CD is still higher than the 4.3% rate on a 3-year Treasury. We can decide whether the 0.4% extra yield is worth the poor liquidity in a brokered CD. However, when we’re buying in a regular taxable account, the 4.7% rate on a non-callable CD isn’t any better than the tax-equivalent yield of a 3-year Treasury after we adjust for the state and local tax exemption from the Treasury. We might as well just buy a Treasury note.

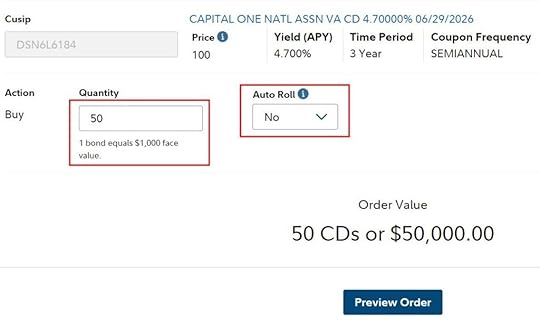

Secondary CDsBefore we abandon the idea of buying a brokered CD in favor of buying a Treasury note, we’re curious whether we can do better by buying a brokered CD on the secondary market.

We go back to the bond yields page by clicking on “News & Research” and then “Fixed Income, Bonds & CDs.”

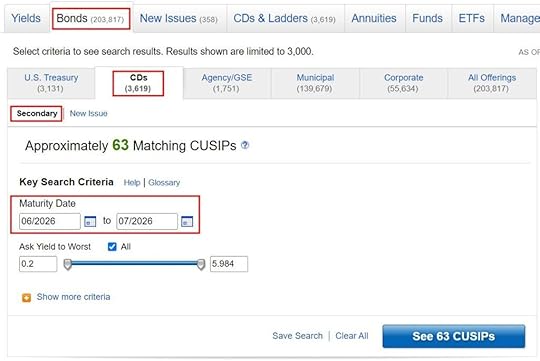

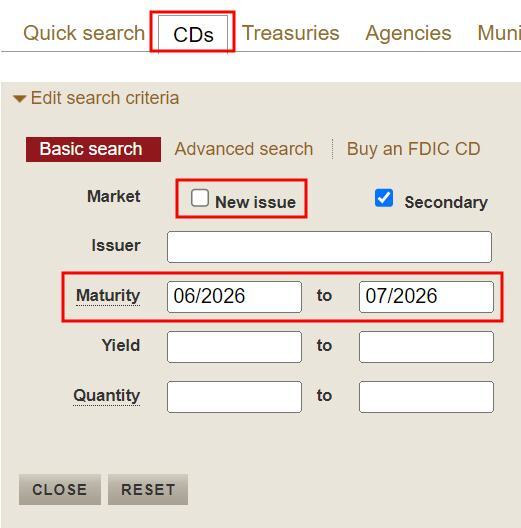

Click on the “Bonds” tab and then the “CDs” sub-tab. We’re now searching for CDs on the secondary market. Enter a date range for the maturity date and then click on “See xx CUSIPs.”

First, click on “Yield to Worst” in the “Ask” columns to sort the list by the offered yield.

When we see a date in the “Next Call Date” column, that CD is callable. As we still want to avoid callable CDs, we see the highest yield for a non-callable CD is 4.751%.

The “Price Qty(Min)” column gives us three numbers. The first number is the price. It’s expressed as a percentage of the face value. 99.585 means $995.85 per $1,000 face value. We’ll have full FDIC insurance when the price is below 100. The second number shows how much in face value is available to buy. 8 means $8,000 in face value is available in that one. The third number in parenthesis shows the minimum purchase. 1 means a minimum of $1,000 in face value. The CD in the next row at a yield of 4.750% has $95,000 in face value available but we must buy at least $20,000 in face value.

Because we must pay a commission when we buy a secondary CD, our net yield will be lower than the gross yield we see in the table. This makes it not worth the hassle to buy a secondary CD when the 4.75% rate isn’t much higher than the 4.7% rate on a new issue CD to begin with.

In summary, our round of research shows:

3-year CD directly from a credit union5.13%3-year Treasury4.7% (tax-equivalent), 4.3% in IRA3-year new issue non-callable brokered CD4.7%3-year secondary non-callable brokered CD4.7%Given these rates, if we prefer the convenience of keeping everything in the brokerage account, we’ll buy a 3-year Treasury note (see How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy Treasury Bills & Notes On the Secondary Market). We’ll buy a CD directly from a credit union for a slightly higher yield if we don’t mind opening a new account there. If we’re buying in an IRA, we’ll consider a new issue brokered CD but we have to weigh it against the poor liquidity. Buying a brokered CD on the secondary market doesn’t give us a meaningful bargain at the moment we looked.

The tradeoffs will change as rates change. Sometimes brokered CDs are more competitive and sometimes they’re less competitive. Sometimes you find a bargain in a secondary CD and sometimes you don’t. The research process I’m showing in this example will stay the same.

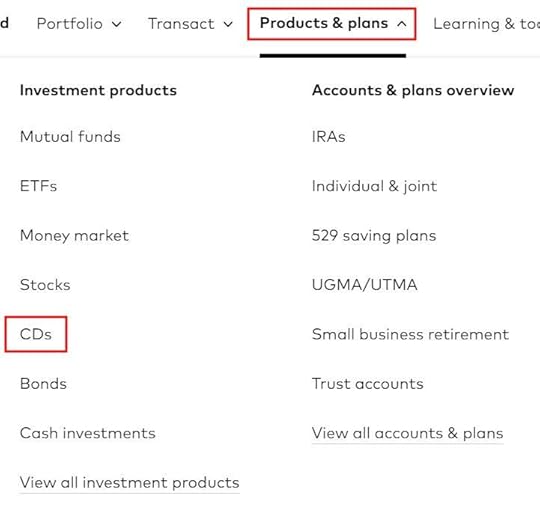

VanguardIt works similarly in a Vanguard brokerage account. Click on “Products & plans” and then “CDs” after you log in to your Vanguard account.

New Issues

New IssuesScroll down a little and click on the big “View detailed CD rates” button.

The next page displays an old-style page in a frame. If you’re using the Safari browser on a Mac and you don’t see anything, turn off “Prevent cross-site tracking” in your Safari settings.

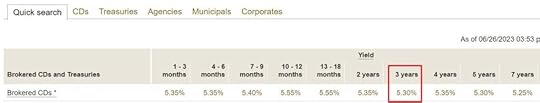

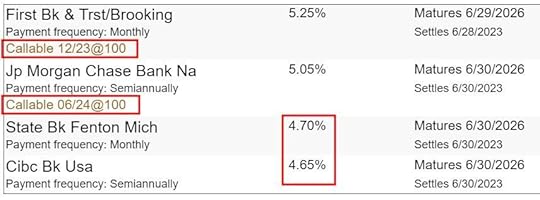

Find the term you’re interested in and click on the rate. The displayed rate may be from a callable CD.

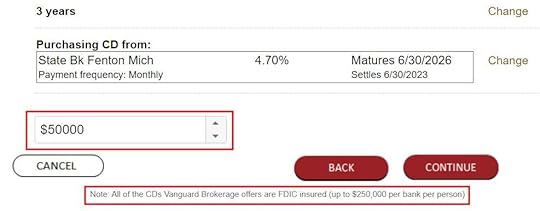

We keep scrolling down to find the first non-callable CD. It pays 4.7%. This is the same rate we see in Fidelity but it’s from a different bank. Suppose we want to buy $50,000 in this CD. We click on that row and then the “Continue” button. We see this order page:

It doesn’t matter that the CD is from a bank we haven’t heard of because it has FDIC insurance. We also must buy in $1,000 increments. We enter 50,000 in the quantity box. Vanguard doesn’t offer an “Auto Roll” feature. We can set a reminder in Google Calendar to reinvest when our CD matures.

Secondary CDsWe’re also curious whether we can find a better bargain on the secondary market. Click on “Cancel” to go back to the previous page.

Click on the “CDs” tab. Uncheck the box for “New issue” and check the box for “Secondary” because we’re looking for secondary CDs. Enter a date range for the maturity date and click on “Search.”

We look carefully to skip the callable CDs. The second row in the “Yield to worst” column shows the yield when we buy. The search results show that the highest yield available in a non-callable CD on the secondary market is 4.772%. The second row in the “Qty” and “Min. qty” columns shows how much is available and the minimum purchase amount. 48 under “Qty” means $48,000 in face value is available and 25 under “Min. qty” means we must buy at least $25,000 in face value. The second row in the “Price” column shows the price we must pay. We want to see a number below 100 to get full FDIC insurance.

If we want to buy $50,000 worth of CDs, that CD from Cross River Bank only has $48,000 available. We’ll have to mix and match or go down to the next one from Discover Bank for a slightly lower yield at 4.754%. Either 4.772% or 4.754% still has to be reduced by the trading commission we must pay for buying secondary CDs.

We come to the same conclusion using Vanguard as we did using Fidelity:

3-year CD directly from a credit union5.13%3-year Treasury4.7% (tax-equivalent), 4.3% in IRA3-year new issue non-callable brokered CD4.7%3-year secondary non-callable brokered CD4.7%Given these rates, if we prefer the convenience of keeping everything in the brokerage account, we’ll buy a 3-year Treasury note (see How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy Treasury Bills & Notes On the Secondary Market). We’ll buy a CD directly from a credit union for a slightly higher yield if we don’t mind opening a new account there. If we’re buying in an IRA, we’ll consider a new issue brokered CD but we have to weigh it against the poor liquidity. Buying a brokered CD on the secondary market doesn’t give us a meaningful bargain at the moment we looked.

The tradeoffs will change as rates change. Sometimes brokered CDs are more competitive and sometimes they’re less competitive. Sometimes you find a bargain in a secondary CD and sometimes you don’t. The research process I’m showing in this example will stay the same.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Buy CDs in a Fidelity or Vanguard Brokerage Account appeared first on The Finance Buff.

June 13, 2023

2023 2024 401k 403b 457 IRA FSA HSA Contribution Limits

[Updated on June 13, 2023.]

Retirement account contribution limits are adjusted for inflation each year. Inflation has moderated in recent months. Some contribution limits and income limits will go up in 2024.

Before the IRS publishes the official adjustments in late October or early November, I’m able to calculate them using the published inflation numbers and going by the same rules the IRS uses as stipulated by law. I’ve maintained a record of 100% accuracy ever since I started doing these calculations.

I offer preliminary projections before all the inflation data are available. These preliminary projections will become more accurate as we have more data.

Table of Contents2023 2024 401k/403b/457/TSP Elective Deferral Limit2023 2024 Annual Additions Limit2023 2024 SEP-IRA Contribution Limit2023 2024 Annual Compensation Limit2023 2024 Highly Compensated Employee Threshold2023 2024 SIMPLE 401k and SIMPLE IRA Contribution Limit2023 2024 Traditional and Roth IRA Contribution Limit2023 2024 Deductible IRA Income Limit2023 2024 Roth IRA Income Limit2023 2024 Healthcare FSA Contribution Limit2023 2024 HSA Contribution Limit2023 2024 Saver’s Credit Income LimitAll Together2023 Tax Brackets and Standard Deduction2023 2024 401k/403b/457/TSP Elective Deferral LimitThe 401k/403b/457/TSP contribution limit is $22,500 in 2023. It will likely go up by $500 to $23,000 in 2024.

If you are age 50 or over by December 31, the catch-up contribution limit is $7,500 in 2023. It will likely stay the same at $7,500 in 2024.

Employer match or profit-sharing contributions aren’t included in these limits. If you work for multiple employers in the same year or if your employer offers multiple plans, you have one single employee contribution limit for 401k, 403b, and the federal government’s Thrift Savings Plan (TSP) across all plans.

The 457 plan limit is separate from the 401k/403b/TSP limit. You can contribute the maximum to both a 401k/403b/TSP plan and a 457 plan.

2023 2024 Annual Additions LimitThe total contributions from both the employer and the employee to all defined contribution plans by the same employer is $66,000 in 2023. It will likely increase to $68,000 in 2024. If we get high inflation in the upcoming months, it might go up to $69,000 in 2024.

The age-50-or-over catch-up contribution is separate from this limit. If you work for multiple employers in the same year, you have a separate annual additions limit for each unrelated employer.

2023 2024 SEP-IRA Contribution LimitThe SEP-IRA contribution limit is always the same as the annual additions limit for a 401k plan. It is $66,000 in 2023, and it will likely increase to $68,000 or $69,000 in 2024.

Because the SEP-IRA doesn’t allow employee contributions, unless your self-employment income is well above $200,000, you have a higher contribution limit if you use a solo 401k. See Solo 401k When You Have Self-Employment Income.

2023 2024 Annual Compensation LimitThe maximum annual compensation that can be considered for making contributions to a retirement plan is always 5x the annual additions limit. Therefore the annual compensation limit is $330,000 in 2023. It will likely increase to $340,000 or $345,000 in 2024.

2023 2024 Highly Compensated Employee ThresholdIf your employer limits your contribution because you’re a Highly Compensated Employee (HCE), the minimum compensation to be counted as an HCE is $150,000 in 2023. It will likely go up to $155,000 in 2024.

2023 2024 SIMPLE 401k and SIMPLE IRA Contribution LimitSome smaller employers offer a SIMPLE 401K or a SIMPLE IRA plan instead of a regular 401k plan. SIMPLE 401k and SIMPLE IRA plans have a lower contribution limit than standard 401k plans. The contribution limit for SIMPLE 401k and SIMPLE IRA plans is $15,500 in 2023. It will likely go up to $16,000 in 2024.

If you are age 50 or over by December 31, the catch-up contribution limit in a SIMPLE 401k or SIMPLE IRA plan is $3,500 in 2023. It will stay the same at $3,500 in 2024.

Employer contributions to a SIMPLE 401k or SIMPLE IRA plan aren’t included in these limits.

2023 2024 Traditional and Roth IRA Contribution LimitThe Traditional IRA or Roth IRA contribution limit is $6,500 in 2023. It will likely go up to $7,000 in 2024.

If you are age 50 or over by December 31, the catch-up limit is $1,000 in 2023. It will stay the same at $1,000 in 2024.

The IRA contribution limit is shared between Traditional IRA and Roth IRA. If you contribute the maximum to a Roth IRA, you aren’t eligible to contribute to a Traditional IRA, and vice-versa.

The IRA contribution limit and the 401k/403b/TSP or SIMPLE contribution limit are separate. You can contribute the respective maximum to both a 401k/403b/TSP/SIMPLE plan and a Traditional IRA or Roth IRA.

2023 2024 Deductible IRA Income LimitThe income limit for taking a full deduction for your contribution to a Traditional IRA while participating in a workplace retirement plan in 2023 is $73,000 for single filers and $116,000 for a married couple filing jointly. The deduction completely phases out when your income goes above $83,000 in 2023 for singles and $136,000 for married filing jointly.

The full-deduction limits will likely go up in 2024 to $77,000 for single filers and $123,000 for a married couple filing jointly. The deduction will completely phase out when your income goes above $87,000 in 2024 for singles; and $143,000 for married filing jointly.

When you’re not covered in a workplace retirement plan but your spouse is, the income limit for taking a full deduction for your contribution to a Traditional IRA is $218,000 in 2023. The deduction completely phases out when your joint income goes above $228,000 in 2023.

The full-deduction limit will likely go up to $231,000 in 2024. The deduction completely phases out when your joint income goes above $241,000 in 2024.

2023 2024 Roth IRA Income LimitThe income limit for contributing the maximum to a Roth IRA depends on your filing status. It is $138,000 for singles and $218,000 for married filing jointly in 2023. These limits will go up to $146,000 for singles and $231,000 for married filing jointly in 2024.

You can’t contribute anything directly to a Roth IRA when your income goes above $153,000 in 2023 for singles and $228,000 in 2023 for married filing jointly. These limits will go up to $161,000 for singles and $241,000 for married filing jointly in 2024.

Your contribution eligibility is prorated in the income phase-out range.

2023 2024 Healthcare FSA Contribution LimitThe Healthcare FSA contribution limit is $3,050 per person in 2023. It will go up to $3,200 or $3,250 in 2024.

Some employers allow carrying over some unused amount to the following year. The maximum amount that can be carried over to the following year is set to 20% of the contribution limit in the current tax year. As a result, the carryover limit is $610 per person in 2023. It will go up to $640 or $650 in 2024.

2023 2024 HSA Contribution LimitThe HSA contribution limit for single coverage is $3,850 in 2023. The HSA contribution limit for family coverage is $7,750 in 2023. These limits will go up to $4,150 for single coverage and $8,300 for family coverage in 2024. The new limits were announced previously in the spring. Please see HSA Contribution Limits.

Those who are 55 or older by December 31 can contribute an additional $1,000. If you are married and both of you are 55 or older by December 31, each of you can contribute the additional $1,000 but they must go into separate HSAs in each person’s name.

You don’t need earned income to contribute to an HSA.

2023 2024 Saver’s Credit Income LimitThe income limits for receiving a Retirement Savings Contributions Credit (“Saver’s Credit”) in 2023 for married filing jointly are $43,500 (50% credit), $47,500 (20% credit), and $73,000 (10% credit). These limits in 2024 will likely be $46,000 (50% credit), $50,000 (20% credit), and $77,000 (10% credit).

The limits for singles are half of the limits for married filing jointly. The 2023 limits are $21,750 (50% credit), $23,750 (20% credit), and $36,500 (10% credit). The 2024 limits will likely be $23,000 (50% credit), $25,000 (20% credit), and $38,500 (10% credit)

All Together20232024 (Preliminary)IncreaseLimit on employee contributions to 401k, 403b, or 457 plan$22,500$23,000$500Limit on age 50+ catch-up contributions to 401k, 403b, or 457 plan$7,500$7,500NoneSIMPLE 401k or SIMPLE IRA contributions limit$15,500$16,000$500SIMPLE 401k or SIMPLE IRA age 50+ catch-up contributions limit$3,500$3,500NoneMaximum annual additions to all defined contribution plans by the same employer$66,000$68,000 or $69,000$2,000 or $3,000SEP-IRA contribution limit$66,000$68,000 or $69,000$2,000 or $3,000Highly Compensated Employee definition$150,000$155,000$5,000Annual Compensation Limit$330,000$340,000 or $345,000$10,000 or $15,000Traditional and Roth IRA contribution limit$6,500$7,000$500Traditional and Roth IRA age 50+ catch-up contribution limit$1,000$1,000NoneDeductible IRA income limit, single, active participant in workplace retirement plan$73,000 – $83,000$77,000 – $87,000$4,000Deductible IRA income limit, married, active participant in workplace retirement plan$116,000 – $136,000$123,000 – $143,000$7,000Deductible IRA income limit, married, spouse is active participant in workplace retirement plan$218,000 – $228,000$231,000 – $241,000$13,000Roth IRA income limit, single$138,000 – $153,000$146,000 – $161,000$8,000Roth IRA income limit, married filing jointly$218,000 – $228,000$231,000 – $241,000$13,000Healthcare FSA Contribution Limit$3,050$3,200 or $3,250$150 or $200HSA Contribution Limit, single coverage$3,850$4,150$300HSA Contribution Limit, family coverage$7,750$8,300$550HSA, age 55 catch-up$1,000$1,000NoneSaver’s Credit income limit, married filing jointly$43,500 (50%)$47,500 (20%)

$73,000 (10%)$46,000 (50%)

$50,000 (20%)

$77,000 (10%)$2,500 (50%)

$2,500 (20%)

$4,000 (10%)Saver’s Credit income limit, single$21,750 (50%)

$23,750 (20%)

$36,500 (10%)$23,000 (50%)

$25,000 (20%)

$38,500 (10%)$1,250 (50%)

$1,250 (20%)

$2,500 (10%)

Source: IRS Notice 2022-55, author’s calculation.

2023 Tax Brackets and Standard DeductionI also have the 2023 income tax brackets, standard deduction, capital gains, and gift tax exclusion limit. Please read 2023 Tax Brackets, Standard Deduction, Capital Gains, etc.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2023 2024 401k 403b 457 IRA FSA HSA Contribution Limits appeared first on The Finance Buff.

2024 Social Security Cost of Living Adjustment (COLA) Projections

Retirees on Social Security receive an increase of their Social Security benefits each year known as the Cost of Living Adjustment or COLA. The COLA was 8.7% in 2023, which was the largest in 40 years. Retirees on Social Security will once again receive a COLA in 2024 but it won’t be as big as the one in 2023.

Table of ContentsAutomatic Link to InflationCPI-WQ3 Average2024 Social Security COLAMedicare PremiumsRoot for a Lower COLAAutomatic Link to InflationSome retirees think the COLA is given at the discretion of the President or Congress and they want their elected officials to take care of seniors by declaring a higher COLA. They blame the President or Congress when they think the increase is too small.

It was done that way before 1975 but the COLA has been automatically linked to inflation for nearly 50 years. How much the COLA will be is determined strictly by the inflation numbers. The COLA is high when inflation is high. It’s low when inflation is low. There’s no COLA when inflation is zero or negative, which happened in 2010, 2011, and 2016.

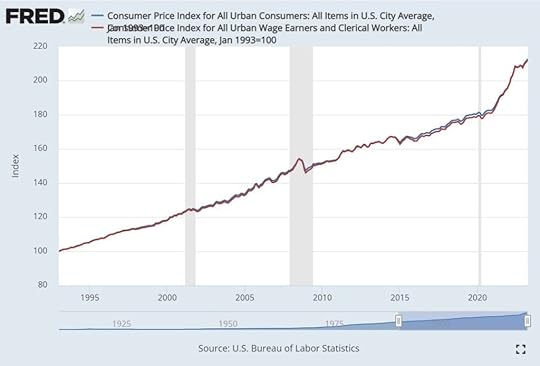

CPI-WSpecifically, the Social Security COLA is determined by the increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). CPI-W is a separate index from the Consumer Price Index for All Urban Consumers (CPI-U), which is more often referenced by the media when they talk about inflation.

CPI-W tracks inflation experienced by workers. CPI-U tracks inflation experienced by consumers. There are some minor differences in how much weight different goods and services have in each index but CPI-W and CPI-U look practically identical when you put them in a chart.

CPI-W and CPI-U 1993-2023

CPI-W and CPI-U 1993-2023The red line is CPI-W and the blue line is CPI-U. They differed by only smidges in 30 years.

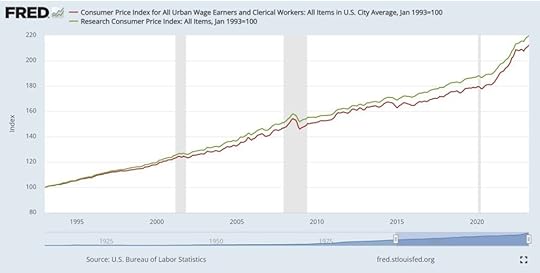

There’s also a research CPI index called the Consumer Price Index for Americans 62 years of age and older, or R-CPI-E. This index weighs more by the spending patterns of older Americans. Some researchers argue that the Social Security COLA should use R-CPI-E, which has increased more than CPI-W in the last 30 years.

CPI-W and R-CPI-E 1993-2023

CPI-W and R-CPI-E 1993-2023The green line is R-CPI-E. The red line is CPI-W. R-CPI-E outpaced CPI-W in 30 years between 1993 and 2023 but not by much. Had the Social Security COLA used R-CPI-E instead of CPI-W, Social Security benefits would’ve been higher by 0.1% per year, or a little over 3% after 30 years. That’s still not much difference.

Regardless of which exact CPI index is used to calculate the Social Security COLA, it’s subject to the same overall price environment. Congress chose CPI-W 50 years ago. That’s the one we’re going with.

Q3 AverageMore specifically, Social Security COLA for next year is calculated by the increase in the average of CPI-W from the third quarter of last year to the third quarter of this year. You get the CPI-W numbers in July, August, and September. Add them up and divide by three. You do the same for July, August, and September last year. Compare the two numbers and round the change to the nearest 0.1%. That’ll be the Social Security COLA for next year.

The government releases the CPI-W for September in mid-October each year. The Social Security Administration makes the calculation and announces the Social Security COLA for the following year at that time.

2024 Social Security COLAAlthough we won’t know for sure what the Social Security COLA will be in 2024 until we have the CPI-W for September, we can make educated guesses based on the inflation numbers in recent months and different scenarios for inflation in the coming months.

I project the CPI-W under three scenarios – low, mid, and high. If inflation in the coming months through September is 0%, meaning that prices freeze at the latest level, that’s our low inflation scenario. If inflation in the coming months is 3% per year, which means that prices will increase by approximately 0.25% per month through September, that’s our mid-line scenario. Finally, if inflation in the coming months is 5% per year, which means that prices will increase by approximately 0.4% per month through September, that’s our high scenario.

Here’s what the Social Security COLA will be in each scenario:

Inflation through SeptemberProjected 2024 Social Security COLA0% annualized2.2%3% annualized3.0%5% annualized3.5%Projected 2024 Social Security COLAIn the low inflation scenario, even though prices will freeze at the latest level, Social Security recipients will still receive a 2.2% COLA in 2024 because current prices are already higher than prices in the third quarter of last year. As we progress toward September and we see positive inflation, this 2.2% number will go up.

The mid-line is probably the most likely scenario. Inflation in recent months is down but not zero. If inflation continues at a moderate pace, Social Security recipients will see approximately a 3% COLA in 2024.

The high scenario requires a 0.4%/month increase in the CPI-W through September. This isn’t out of the question. If inflation stays high, Social Security will have a 3.5% COLA in 2024.

The differences in these three scenarios aren’t huge. Between a 2.2% COLA in the low inflation scenario and a 3.5% COLA in the high inflation scenario, it comes down to a difference of about $25/month on a $2,000/month Social Security benefit or a difference of about $40/month on a $3,000/month benefit.

Medicare PremiumsIf you’re on Medicare, the Social Security Administration automatically deducts the Medicare premium from your Social Security benefits. The Social Security COLA is given on the “gross” Social Security benefits before deducting the Medicare premium and any tax withholding.

Medicare announces the premium for next year around the same time Social Security announces the COLA but not necessarily on the same date. The increase in healthcare costs is part of the cost of living that the COLA is intended to cover. You’re still getting the full COLA even though a part of the COLA will be used toward the increase in Medicare premiums.

Retirees with a higher income pay more than the standard Medicare premiums. This is called Income-Related Monthly Adjustment Amount (IRMAA). I cover IRMAA in 2023 2024 2025 Medicare IRMAA Premium MAGI Brackets.

Root for a Lower COLAPeople intuitively want a higher COLA but a higher COLA can only be caused by higher inflation. Higher inflation is bad for retirees.

Whether inflation is high or low, your Social Security benefits will have the same purchasing power. It’s the purchasing power of your savings and investments outside Social Security that you should worry about. When inflation is high, even though your Social Security benefits get a bump, your other money loses more value to inflation. Your savings and investments outside Social Security will last longer when inflation is low.

You want a lower Social Security COLA, which means lower inflation and lower expenses.

Some people say that the government deliberately under-reports inflation. Even if that’s the case, you still want a lower COLA.

Suppose the true inflation for seniors is 3% higher than the reported inflation. If you get a 1% COLA when the true inflation is 4% and you get a 5% COLA when the true inflation is 8%, you are much better off with a lower 1% COLA together with 4% inflation than getting a 5% COLA together with 8% inflation. Your Social Security benefits lag inflation by the same amount either way, but you’d rather your other money outside Social Security loses to 4% inflation than to 8% inflation.

Root for lower inflation and lower Social Security COLA when you are retired.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2024 Social Security Cost of Living Adjustment (COLA) Projections appeared first on The Finance Buff.

June 5, 2023

Buying CD in a Brokerage Account vs Bank CD or Treasury

Buying CDs in a brokerage account doesn’t require opening a separate account with a bank. Is it worth it?

Table of ContentsWhat Is a Brokered CDHow a Brokered CD WorksBrokered CD vs Direct CDEverything In One AccountCompetitive RatesNo Renewal TrapCall RiskCan’t Withdraw EarlyReinvestment RiskBrokered CD vs TreasuryYield May Be LowerNo State Tax ExemptionTreasuries Aren’t CallableLarge Haircut When You SellWhat Is a Brokered CDWhen you see CDs offered in your Fidelity, Vanguard, or Charles Schwab account, they’re brokered CDs. A brokered CD is issued by a bank and sold through brokers.

The CD has FDIC insurance. If you have other money at the same bank that issues the CD, your FDIC insurance limit is aggregated across your direct holdings and your brokered CDs from that bank.

A brokered CD is safe as long as you stay under the FDIC insurance limit. I bought a brokered CD from a bank in Puerto Rico during the 2008 financial crisis. FDIC paid me in full with interest when that bank failed. I didn’t have to file any claim. The cash just showed up in my account about a week after the announced bank failure.

How a Brokered CD WorksExcept for having FDIC insurance, a brokered CD works more like a bond.

1 CD is $1,000 of principal. You buy them in $1,000 increments. Fidelity offers “fractional CD” at $100 increments on some CDs. Brokers typically don’t charge fees for buying brokered CDs or holding them in your account. You will see fluctuating prices for the CD after you buy it in your brokerage account but you’ll be paid the full face value when it matures.

Brokered CDs don’t compound. Interest payments from the CD are paid into your brokerage accounts as cash. The payment frequency varies depending on the CD. It can be monthly, quarterly, or semi-annually. Some short-term CDs only pay interest at maturity. If the interest rate on a brokered CD is 5% and it pays semi-annually, you’ll receive $25 in interest per $1,000 of principal every six months.

You get the principal back as cash when the CD matures. If you want to get out of the CD before it matures, you must sell it on the secondary market to another buyer.

Brokered CD vs Direct CDBrokered CDs have some advantages over CDs you buy directly at a bank or a credit union. They also have two large disadvantages.

Everything In One AccountIt’s more convenient to buy brokered CDs from several different banks in one brokerage account than to open a separate account at each bank. This is helpful especially when you buy short-term CDs, but if you’re considering a 5-year CD, you only open an account once when you buy directly from a bank or a credit union and you’re good for five years.

Competitive RatesBecause banks know that brokers present brokered CDs in a table sorted by the yield, they have to offer a competitive yield to show up on top. They can’t prey on customers not being up to speed on the going rates. Many banks still offer very low rates on their websites but they have competitive rates on brokered CDs.

Not all banks offer brokered CDs though. Some banks, and especially credit unions, offer CD specials only to their direct customers. You should check the best rates on DepositAccounts.com to see whether a bank or a credit union offers a better rate than the rate you see from a brokered CD.

No Renewal TrapBy default, a brokered CD is automatically cashed out when it matures. Some brokers offer an “auto roll” feature to buy another brokered CD of the same term when one CD matures but you specifically sign up for that feature only if you want it.

Most banks and credit unions automatically renew a matured CD. The new CD they renew you into often has a low rate. You’ll have to tell them to stop the renewal within a short window. If you aren’t on top of it, you’ll either be stuck with a low rate or you’ll have to pay a big early withdrawal penalty that can eat into your principal. See Beware: Banks Auto-Renew CDs with a Short Window to Back Out.

Call RiskMany brokered CDs are callable, which means the bank has the right to terminate (“call”) the CD before the stated maturity date.

Having your CD terminated prematurely is the opposite of you refinancing your mortgage when the market rate goes down. The bank has the choice to terminate the CD or not. You have no right to refuse.

Some callable CDs have preset dates when the bank may exercise its right to terminate. Some are continuously callable, which means the bank has the right to terminate at any time after a certain date.

Naturally, the bank will only terminate the CD when the going rate goes down. You were counting on earning the guaranteed interest for the full term. All of a sudden the bank decides to pay you out early. You get your money back but you can only earn less now because the going rate is lower. On the other hand, if the going rate goes up, the bank chooses not to terminate the CD, and you’re stuck with a below-market rate until maturity.

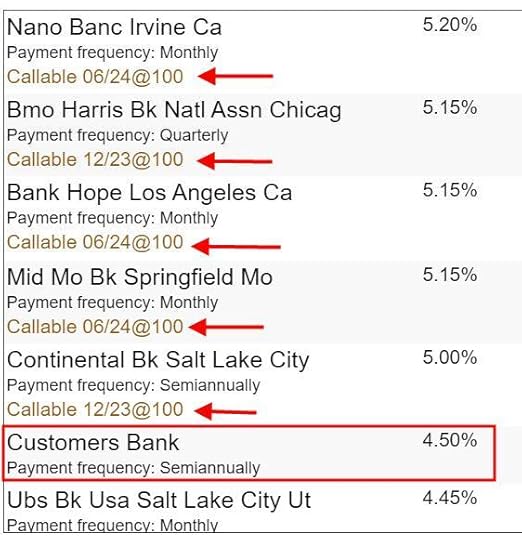

A callable CD gives you the worst of both worlds. Most direct CDs aren’t callable. You’re guaranteed to enjoy the rate you locked in for the full term when you buy a CD directly from a bank or a credit union. You should compare only non-callable brokered CDs with direct CDs or demand a substantially higher yield from a callable brokered CD.

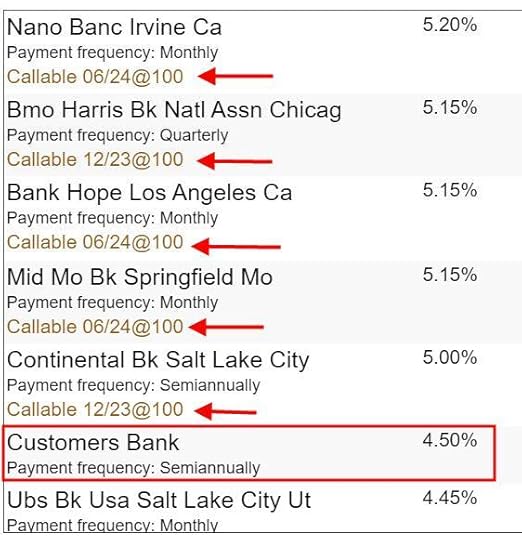

For example, as I’m writing this, Vanguard shows the best 5-year brokered CD pays 5.2% and DepositAccounts.com shows the best 5-year direct CD from a credit union pays 4.68%. That makes brokerage CDs look attractive until you find out that the brokered CDs with higher rates are all callable.

Callable and Non-Callable CDs

Callable and Non-Callable CDsThe best rate on a 5-year non-callable brokered CD is only 4.5%. This is lower than the 4.68% yield on a 5-year CD you can get from a credit union. You will have to weigh the convenience of buying a brokered CD against getting a lower yield or taking the call risk.

Can’t Withdraw EarlyA CD bought directly from a bank or a credit union has a big advantage over a brokered CD because you can break it by paying a preset early withdrawal penalty. Some direct CDs have no early withdrawal penalty (“no-penalty CDs”).

A brokered CD doesn’t offer an option to withdraw early. You must sell the brokered CD on the secondary market to a bond dealer if you want to get out early.

There may not be a dealer interested in your CD when you want to sell. If there’s a dealer, the price you receive from selling the CD is determined by the current market rate at that time minus a large haircut. It may be much lower than paying the preset early withdrawal penalty on a direct CD.

Breaking a CD isn’t only for an unexpected need for cash. When interest rates go up sharply, it makes sense to pay an early withdrawal penalty and reinvest at a higher yield. I broke all my direct CDs last year by paying the early withdrawal penalty because the CD Early Withdrawal Penalty Calculator shows that I will end up with a higher value than holding the CDs to maturity. I wouldn’t have had this option had I bought brokered CDs.

Reinvestment RiskWhen you have a CD directly from a bank or a credit union, you have the option to have the interest paid out to you or to reinvest the interest in the CD. If the going rate goes up, you choose to have the interest paid out and earn a higher yield elsewhere. If the going rate falls, you choose to reinvest the interest at the original higher yield.

You don’t have this option with a brokered CD. All interest is paid out in cash. If the going rate goes down, you can only earn a lower yield on the interest.

Brokered CD vs TreasurySuppose you like the convenience of brokered CDs and you don’t mind giving up a small difference in yield and the option to withdraw early. Still don’t pull the trigger just yet. You always have the option to buy Treasuries instead.

Brokers sell brokered CDs because they’re paid by the banks to sell the CDs. You see more advertising from the broker for brokered CDs than for Treasuries but you may be better off buying Treasuries anyway.

Because Treasuries have a direct guarantee from the government versus through a separate government agency (the FDIC), brokered CDs must overcome several hurdles before you consider them. Otherwise you just buy Treasuries.

Yield May Be LowerBrokered CDs don’t always pay more than Treasuries of a comparable term. For example, as I’m writing this, the best six-month brokered CD pays 5.3% APY whereas a six-month Treasury pays 5.4%.

Don’t buy a brokered CD only because the rate sounds attractive on the surface. Always find out first what a Treasury is paying for the same term. See How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy Treasury Bills & Notes On the Secondary Market. Don’t bother with a brokered CD when a Treasury pays more.

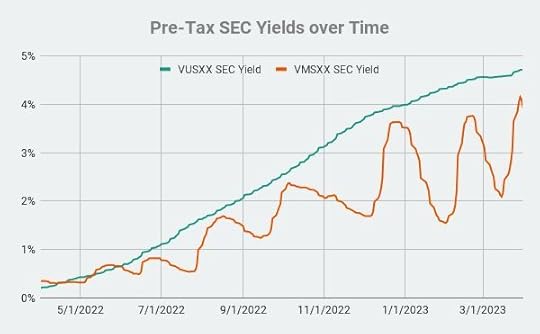

No State Tax ExemptionIf you buy in a regular taxable brokerage account, interest from Treasuries is exempt from state and local taxes. Interest from brokered CDs is fully taxable by the state and local governments. Brokered CDs must pay more than Treasuries after adjusting for this state and local tax exemption.

If you take the standard deduction or if you itemize deductions but your state and local taxes are already capped by the $10,000 limit, you don’t get any federal tax deduction for paying additional state and local taxes. When your federal marginal tax rate is f and your state and local marginal tax rate is s, the tax-equivalent yield of a Treasury with a quoted yield of t is:

t * ( 1 – f ) / ( 1 – f – s )

For example, as I’m writing this, the best 1-year brokered CD has a yield of 5.4% and a one-year Treasury has a yield of 5.24%. When your federal marginal tax rate is 22% and your state and local marginal tax rate is 6%, the tax-equivalent yield of the Treasury is:

5.24% * ( 1 – .22 ) / ( 1 – .22 – .06 ) = 5.68%

That means a CD must have a yield of 5.68% to earn the same amount after all taxes as a Treasury with a yield of 5.24%. Although the brokered CD with a yield of 5.4% appears to pay more than the Treasury with a yield of 5.24% at first glance, it actually pays less than the Treasury after you take all taxes into account.

If you itemize deductions and your state and local taxes aren’t already capped by the $10,000 limit, you still get a federal tax deduction for the state and local taxes you pay on the interest from the CD. The tax-equivalent yield formula is:

t / ( 1 – s )

In that case, the CD still needs to yield 5.24% / ( 1 – .06 ) = 5.57% to beat the Treasury.

You don’t have to make a tax-equivalent yield adjustment if you’re buying in an IRA or if you don’t have state and local taxes.

Treasuries Aren’t CallableMany brokered CDs are callable whereas all Treasuries aren’t callable. You should compare only non-callable brokered CDs with Treasuries or demand a substantially higher yield from a callable brokered CD.

For example, as I’m writing this, Fidelity shows the best 5-year brokered CD pays 5.2% when the yield on a 5-year Treasury is 3.89% but the best yield on a 5-year non-callable brokered CD is only 4.5%.

The yield advantage shrinks further when you adjust the Treasury yield for the state and local tax exemption. If we use the same federal marginal tax rate of 22% and state and local marginal tax rate of 6% in the example above, the tax-equivalent yield of the 3.89% Treasury is 4.21%. The 4.5% brokered CD only has a marginally higher yield than the Treasury. It’s more competitive in an IRA and in no-tax states.

Large Haircut When You SellIf you want to get out of a brokered CD before it matures, you must sell it to a willing buyer. That’s the same for Treasuries but there are far fewer buyers for brokered CDs than for Treasuries. The buyer for your brokered CD will demand a substantial price concession to take over the CD from you.

Treasuries are highly liquid and competitive. If you must sell your Treasuries before maturity, you may get a lower price than your original purchase price but it’s going to be a fair price based on the market condition at that time.

Any slight yield advantage you have from a brokered CD over a comparable Treasury vanishes quickly if you must sell before maturity. Don’t even consider brokered CDs if there’s any chance you won’t hold them to maturity.

***

Before you explore whether it makes sense to buy a brokered CD, you should:

1. Decide what term you want because selling brokered CDs before maturity will be costly.

2. Check DepositAccounts.com for the best rate on a direct CD for your term. Weigh the convenience of brokered CDs against giving up yield and the early withdrawal option.

3. Check the yield on Treasuries for your term. Adjust it for the state and local tax exemption if you’re buying in a regular taxable account.

4. Only compare non-callable brokered CDs with direct CDs and Treasuries. Demand a large yield difference if you don’t mind callable CDs.

I give a detailed walkthrough of how to buy a CD at Fidelity or Vanguard in the next post: How to Buy CDs in a Fidelity or Vanguard Brokerage Account.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Buying CD in a Brokerage Account vs Bank CD or Treasury appeared first on The Finance Buff.

Brokered CD vs Direct CD vs Treasury: Is It Worth It?

The debt ceiling has been resolved. While it was hanging in the air, you may have come across brokered CDs, which you can buy in a brokerage account without having to open a separate account with a bank. Are they worth it?

Table of ContentsWhat Is a Brokered CDHow a Brokered CD WorksBrokered CD vs Direct CDEverything In One AccountCompetitive RatesNo Renewal TrapCall RiskCan’t Withdraw EarlyReinvestment RiskBrokered CD vs TreasuryYield May Be LowerNo State Tax ExemptionTreasuries Aren’t CallableLarge Haircut When You SellWhat Is a Brokered CDA brokered CD is a CD issued by a bank and sold through brokers. When you see a CD offered in your Fidelity, Vanguard, or Charles Schwab account, that’s a brokered CD.

The CD is issued by a bank. It has FDIC insurance. If you have other money at the same bank that issues the CD, your FDIC insurance limit is aggregated across your direct holdings and your brokered CDs from that bank.

A brokered CD is safe as long as you stay under the FDIC insurance limit. I bought a brokered CD from a bank in Puerto Rico during the 2008 financial crisis. FDIC paid me in full with interest when that bank failed.

How a Brokered CD WorksExcept for having FDIC insurance, a brokered CD works more like a bond.

1 CD is $1,000 of principal. You buy them in $1,000 increments. Fidelity offers “fractional CD” on some CDs. You will see fluctuating prices for the CD after you buy it in your brokerage account.

Periodic interest payments from the CD are paid into your brokerage accounts as cash. They aren’t automatically reinvested into the same CD. You get the principal back as cash when the CD matures. If you want to get out of the CD before it matures, you must sell it on the secondary market to another buyer.

Brokered CD vs Direct CDBrokerage CDs have some advantages over CDs you buy directly at a bank or a credit union. They also have two large disadvantages.

Everything In One AccountIt’s more convenient to buy brokered CDs from several different banks in one brokerage account than to open a separate account at each bank. This is helpful especially when you buy short-term CDs, but if you’re considering a 5-year CD, you only open an account once when you buy directly from a bank or a credit union and you’re good for five years.

Competitive RatesBecause banks know that brokers present brokered CDs in a table sorted by the yield, they have to offer a competitive yield to show up on top. They can’t prey on customers not being up to speed on the going rates. Many banks still offer very low rates on their websites but they have competitive rates on brokered CDs.

Not all banks offer brokered CDs though. Some banks, and especially credit unions, offer CD specials only to their direct customers. You should check the best rates on DepositAccounts.com to see whether a bank or a credit union offers a better rate than the rate you see from a brokered CD.

No Renewal TrapBy default, a brokered CD is automatically cashed out when it matures. Some brokers offer an “auto roll” feature to buy another brokered CD of the same term when one CD matures but you specifically sign up for that feature only if you want it.

Most banks and credit unions automatically renew a matured CD. The new CD they renew you into often has a low rate. You’ll have to tell them to stop the renewal within a short window. If you aren’t on top of it, you’ll either be stuck with a low rate or you’ll have to pay a big early withdrawal penalty that can eat into your principal. See Beware: Banks Auto-Renew CDs with a Short Window to Back Out.

Call RiskMany brokered CDs are callable, which means the bank has the right to terminate (“call”) the CD before the stated maturity date.

Having your CD terminated prematurely is the opposite of you refinancing your mortgage when the market rate goes down. The bank has the choice to terminate the CD or not. You have no right to refuse.

Some callable CDs have preset dates when the bank may exercise its right to terminate. Some are continuously callable, which means the bank has the right to terminate at any time after a certain date.

Naturally, the bank will only terminate the CD when the going rate goes down. You were counting on earning the guaranteed interest for the full term. All of a sudden the bank decides to pay you out early. You get your money back but you can only earn less now because the going rate is lower. On the other hand, if the going rate goes up, the bank chooses not to terminate the CD, and you’re stuck with a below-market rate until maturity.

A callable CD gives you the worst of both worlds. Most direct CDs aren’t callable. You’re guaranteed to enjoy the rate you locked in for the full term when you buy a CD directly from a bank or a credit union. You should compare only non-callable brokered CDs with direct CDs or demand a substantially higher yield from a callable brokered CD.

For example, as I’m writing this, Vanguard shows the best 5-year brokered CD pays 5.2% and DepositAccounts.com shows the best 5-year direct CD from a credit union pays 4.68%. That makes brokerage CDs look attractive until you find out that the brokered CDs with higher rates are all callable.

Callable and Non-Callable CDs

Callable and Non-Callable CDsThe best rate on a 5-year non-callable brokered CD is only 4.5%. This is lower than the 4.68% yield on a 5-year CD you can get from a credit union. You will have to weigh the convenience of buying a brokered CD against getting a lower yield or taking the call risk.

Can’t Withdraw EarlyA CD bought directly from a bank or a credit union has a big advantage over a brokered CD because you can break it by paying a preset early withdrawal penalty. Some direct CDs have no early withdrawal penalty (“no-penalty CDs”).

A brokered CD doesn’t offer an option to withdraw early. You must sell the brokered CD on the secondary market to another buyer if you want to get out early.

There may not be a buyer for your CD when you want to sell. If there’s a buyer, the price you receive from selling the CD is determined by the current market rate at that time minus a large haircut. It may be much lower than paying the preset early withdrawal penalty on a direct CD.

Breaking a CD isn’t only for an unexpected need for cash. When interest rates go up sharply, it makes sense to pay an early withdrawal penalty and reinvest at a higher yield. I broke all my direct CDs last year by paying the early withdrawal penalty because the CD Early Withdrawal Penalty Calculator shows that I will end up with a higher value than holding the CDs to maturity. I wouldn’t have had this option had I bought brokered CDs.

Reinvestment RiskWhen you have a CD directly from a bank or a credit union, you have the option to have the interest paid out to you or to reinvest the interest in the CD. If the going rate goes up, you choose to have the interest paid out and earn a higher yield elsewhere. If the going rate falls, you choose to reinvest the interest at the original higher yield.

You don’t have this option with a brokered CD. All interest is paid out in cash. If the going rate goes down, you can only earn a lower yield on the interest.

Brokered CD vs TreasurySuppose you like the convenience of brokered CDs and you don’t mind giving up a small difference in yield and the option to withdraw early. Still don’t pull the trigger just yet. You always have the option to buy Treasuries instead.

Brokers sell brokered CDs because they’re paid by the banks to sell the CDs. You see more advertising from the broker for brokered CDs than for Treasuries but you may be better off buying Treasuries anyway.

Because Treasuries have a direct guarantee from the government versus through a separate government agency (the FDIC), brokered CDs must overcome several hurdles before you consider them. Otherwise you just buy Treasuries.

Yield May Be LowerBrokered CDs don’t always pay more than Treasuries of a comparable term. For example, as I’m writing this, the best six-month brokered CD pays 5.3% APY whereas a six-month Treasury pays 5.4%.

Don’t buy a brokered CD only because the rate sounds attractive on the surface. Always find out first what a Treasury is paying for the same term. See How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy Treasury Bills & Notes On the Secondary Market. Don’t bother with a brokered CD when a Treasury pays more.

No State Tax ExemptionIf you buy in a regular taxable brokerage account, interest from Treasuries is exempt from state and local taxes. Interest from brokered CDs is fully taxable by the state and local governments. Brokered CDs must pay more than Treasuries after adjusting for this state and local tax exemption.

If your federal marginal tax rate is f and your state and local marginal tax rate is s, the tax-equivalent yield of a Treasury with a quoted yield of t is:

t * ( 1 – f ) / ( 1 – f – s )

For example, as I’m writing this, the best 1-year brokered CD has a yield of 5.4% and a one-year Treasury has a yield of 5.24%. When your federal marginal tax rate is 22% and your state and local marginal tax rate is 6%, the tax-equivalent yield of the Treasury is:

5.24% * ( 1 – .22 ) / ( 1 – .22 – .06 ) = 5.68%

That means a CD must have a yield of 5.68% to earn the same amount after all taxes as a Treasury with a yield of 5.24%. Although the brokered CD with a yield of 5.4% appears to pay more than the Treasury with a yield of 5.24% at first glance, it actually pays less than the Treasury after you take all taxes into account.

You don’t have to make this adjustment if you’re buying in an IRA or if you don’t have state and local taxes.

Treasuries Aren’t CallableMany brokered CDs are callable whereas all Treasuries aren’t callable. You should compare only non-callable brokered CDs with Treasuries or demand a substantially higher yield from a callable brokered CD.

For example, as I’m writing this, Fidelity shows the best 5-year brokered CD pays 5.2% when the yield on a 5-year Treasury is 3.89% but the best yield on a 5-year non-callable brokered CD is only 4.5%.

The yield advantage shrinks further when you adjust the Treasury yield for the state and local tax exemption. If we use the same federal marginal tax rate of 22% and state and local marginal tax rate of 6% in the example above, the tax-equivalent yield of the 3.89% Treasury is 4.21%. The 4.5% brokered CD only has a marginally higher yield than the Treasury. It’s more competitive in an IRA and in no-tax states.

Large Haircut When You SellIf you want to get out of a brokered CD before it matures, you must sell it to a willing buyer. That’s the same for Treasuries but there are far fewer buyers for brokered CDs than for Treasuries. The buyer for your brokered CD will demand a substantial price concession to take over the CD from you.

Treasuries are highly liquid and competitive. If you must sell your Treasuries before maturity, you may get a lower price than your original purchase price but it’s going to be a fair price based on the market condition at that time.

Any slight yield advantage you have from a brokered CD over a comparable Treasury vanishes quickly if you must sell before maturity. Don’t even consider brokered CDs if there’s any chance you won’t hold them to maturity.

***

Before you explore whether it makes sense to buy a brokered CD, you should:

1. Decide what term you want because selling brokered CDs before maturity will be costly.

2. Check DepositAccounts.com for the best rate on a direct CD for your term. Weigh the convenience of brokered CDs against giving up yield and the early withdrawal option.

3. Check the yield on Treasuries for your term. Adjust it for the state and local tax exemption if you’re buying in a regular taxable account.

4. Only compare non-callable brokered CDs with direct CDs and Treasuries. Demand a large yield difference if you don’t mind callable CDs.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Brokered CD vs Direct CD vs Treasury: Is It Worth It? appeared first on The Finance Buff.

May 15, 2023

Tax Planning with TurboTax What-If Worksheet: Roth Conversion

The tax season is over for most people but if you used TurboTax downloaded software, don’t uninstall it just yet.

I showed in previous posts some unwelcoming features in TurboTax that you may want to opt out of — underpayment penalty and estimated tax payment vouchers. Ironically, TurboTax downloaded software also has a very useful feature hidden deep inside. You have to know to dig it out.

Project for Current YearIt’s called the What-If Worksheet. After you’re done with your previous year’s taxes, you use the What-If Worksheet to project your taxes for the current year. It also makes it easy to compare different scenarios.

The idea of the What-If Worksheet is that you can create alternative scenarios and see how your taxes will change.

What if you earn more income?

What if your income drops?

What if you take on a mortgage?

What if you sell some investments and realize capital gains?

What if you convert some IRA money to Roth AND you sell some investments with a capital loss?

The What-If Worksheet is only available in TurboTax downloaded software, not in its online software. It’s another reason to use TurboTax downloaded software, not the online software. As far as I know, only TurboTax has it. H&R Block doesn’t have it. Neither does FreeTaxUSA.

Plan for Roth ConversionI’ll use the same example I used in the previous post Roth Conversion with Social Security and Medicare IRMAA to show how you can plan for Roth conversion with this Work-If Worksheet in TurboTax.

A retired couple, both age 66, Florida residents, married filing jointly with no dependents. They live on $60,000 of Social Security benefits, $20,000 of Traditional IRA withdrawals, $5,000 of interest income, and $10,000 of qualified dividends. They have no other income or deductions. Both of them enrolled in Medicare Part B and Part D.

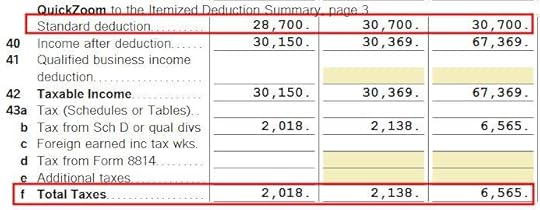

TurboTax shows that this couple with $95,000 of income paid $2,018 in federal income tax. That’s only 2% of their income. They are interested in doing a Roth conversion next year to take advantage of their low tax rate.

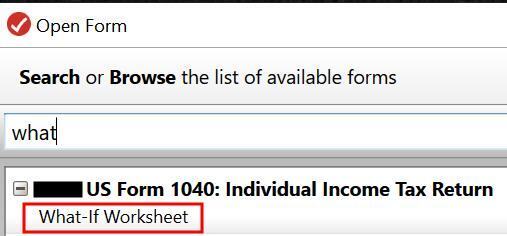

Find What-If WorksheetYou’ll have to know that the What-If Worksheet exists and really look for it.

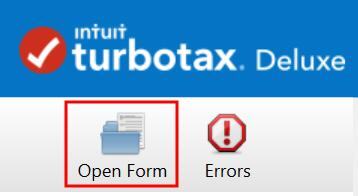

Click on Forms on the top right in TurboTax downloaded software and then click on the Open Form button.

This opens a pop-up window. Type “what” or “what-if” in the search box. Double-click on the “What-If Worksheet” in the search results to open it.

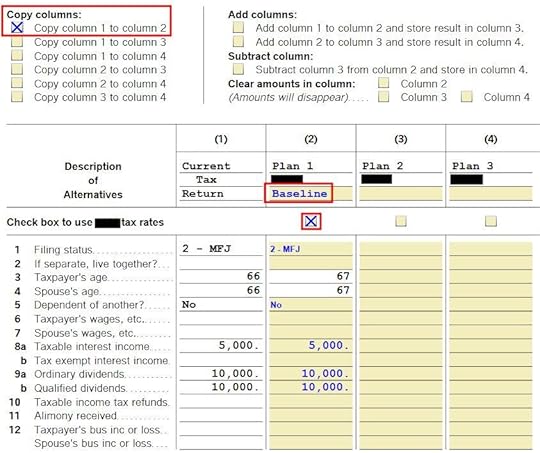

Create a Baseline

Create a BaselineThe What-If Worksheet has four columns. Column 1 is auto-populated with data from your tax return. Columns 2 to 4 are used for tax planning.

First, you create a baseline for the current year. Checking the box “Copy column 1 to column 2” under “Copy columns” copies your tax return for last year to Column 2. Checking the box “Check box to use XXXX tax rates” under Column 2 applies the current year’s tax brackets. You can give it a short name such as “Baseline.”

Change the numbers under Column 2 with what you already know will be different this year. For example, you know you will earn more interest because interest rates have gone up, you know you will have less in dividends because you sold some investments last year, your Social Security benefits will go up because of COLA, etc.

Column 2 is your best guess of your current year’s taxes before you take any deliberate actions.

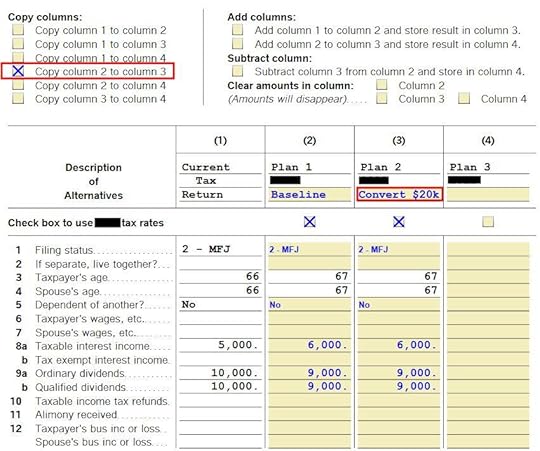

Test AlternativesAfter you create a good baseline for the current year, suppose you want to see how converting $20,000 from your Traditional IRA to Roth will affect your taxes.

Copy Column 2 to Column 3 by checking the box under “Copy columns.” Check the box to use the current year’s tax brackets again. Give it a short description such as “Convert $20k.”

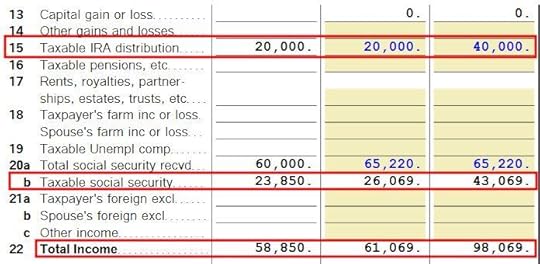

Scroll down to the line for taxable IRA distribution and raise the number by $20,000 from the baseline in Column 2 to your alternative scenario in Column 3.

The What-If Worksheet shows this additional income will increase the taxable amount of the Social Security benefits for this couple in the example by $17,000. Together with the $20,000 Roth conversion, the AGI will increase by $37,000.

Scroll down further. The What-If Worksheet shows that converting $20,000 to Roth will increase the total tax from $2,138 in the baseline to $6,565. That’s a difference of $4,427, which translates into $4,427 / $20,000 = 22% average marginal tax rate on converting $20k.

Now you can decide whether paying a 22% tax to convert $20,000 is worth it. Do it if you think your future tax rate will be higher than 22%. Don’t do it if you think your future tax rate will be lower than 22%.

If you’d like to test another alternative, such as converting $50k, repeat the above to copy the baseline in Column 2 to Column 4 and increase the IRA withdrawal by $50k in Column 4. Calculate the difference in total tax and the average marginal tax rate when you convert $50k.

Case Study SpreadsheetThe Case Study Spreadsheet in the previous post shows the same effect for converting $20k in this same example.

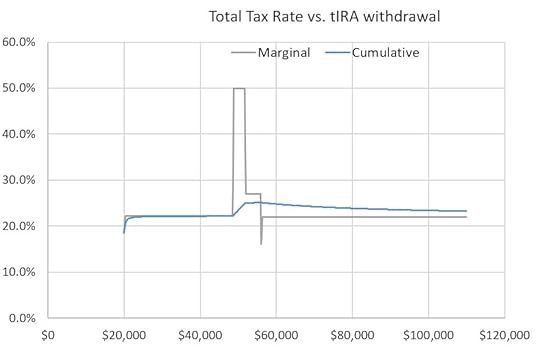

The chart from the Case Study Spreadsheet shows that increasing the IRA withdrawal from $20k to $40k produces a 22% marginal tax rate. It also shows that this same marginal tax rate continues before hitting a spike when the IRA withdrawal reaches $45k (converting $25k to Roth on top of a $20k withdrawal).

The What-If Worksheet in TurboTax doesn’t show the marginal tax rate directly. You have to calculate it yourself by dividing the difference in total tax by the conversion amount. Nor does it show the marginal tax rate for different conversion amounts in a chart. You don’t know where it may hit a spike. You’d have to do trial-and-error with different inputs: $20k is OK, what about $30k; $50k is too high, what about $40k, …

It also only shows the difference in federal income tax. It doesn’t include the effect on state income tax or Medicare IRMAA. The Case Study Worksheet includes both the state income tax and Medicare IRMAA.

The What-If Worksheet in TurboTax is easier to use though. TurboTax already has your tax data. You don’t have to find the right places to enter them in a spreadsheet. You don’t need to learn how to use a spreadsheet if that sounds intimidating.

Professional SoftwareI heard great praises for a professional tax planning software called Holistiplan. Many financial advisors use it to do tax planning for their clients. I watched a demo of Holistiplan on YouTube:

Holistiplan DemoHolistiplan uses the same technique as the What-If Worksheet in TurboTax.

Copy data from the tax return for the previous year to the current year. Make known changes to create a baseline. Copy the baseline to an alternative scenario. Make changes to the alternative scenario and compare it with the baseline.It also produces a chart of the marginal tax rate similar to the Case Study Spreadsheet.

If you go to a financial advisor this type of planning, it may cost you $1,000 or more. After you use TurboTax downloaded software to file your taxes, you already have the What-If Worksheet in TurboTax for tax planning estimates. It doesn’t show a chart or include the effect on state tax or Medicare IRMAA but it gets you 80% there. Use the Case Study Spreadsheet if you want 100%.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Tax Planning with TurboTax What-If Worksheet: Roth Conversion appeared first on The Finance Buff.

May 8, 2023

Two Fundamental Drivers of Financial Success in Retirement

Despite a long list of things that Fidelity’s retirement planning tool doesn’t do, I still use it as a high-level model. The planning exercise I did at the end of last year revealed two fundamental drivers of financial success in retirement.

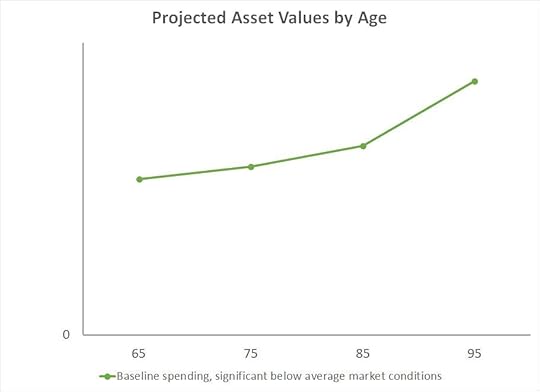

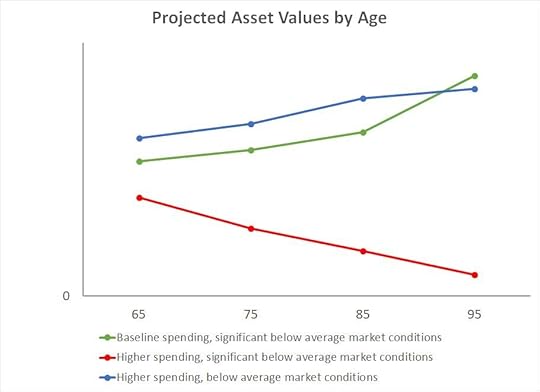

Baseline SpendingFirst, I created a baseline annual spending. The planning tool showed a table of the projected values of our investments at different ages when the investment returns are “significantly below average.” Significantly below average means “a scenario in which your outcome was successful 90% of the time” using historical data. I created this chart by sampling a few age milestones from the table:

All values are in today’s dollars. I’m not showing numbers on the vertical axis for obvious reasons.

Our investment portfolio is projected to increase while we take withdrawals to support the planned annual spending. That’s both good and bad. It’s good because it shows we have enough for our retirement. It’s bad because we don’t need or want 60% more money at age 95 than at age 65.

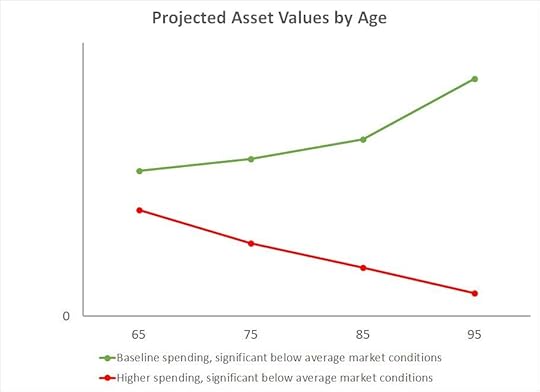

Higher SpendingNext, I increased the annual spending by 20%. The planning tool showed a different set of projected values:

Now the projected values go down with age. It gets dangerously close to zero at age 95. This means that our sustainable spending is somewhere between these two levels. If the future market returns are below 90% of returns in the past, we can still spend a little more than the baseline plan but not 20% more.

Better Market ConditionsThe planning tool also produced a table of projected values for returns merely below average but not significantly below average. Below average means “a scenario in which your outcome was successful 75% of the time” as opposed to 90%. The projected asset values under these better market conditions while supporting the higher spending looks like the blue line in this chart:

It shows that if the returns are only below average — not significantly below average — our assets would be higher than the baseline scenario through age 90 while supporting 20% higher spending every year.

Fundamental DriversWhen I presented these three scenarios to my wife, she pointed out that it was only too obvious.

“You didn’t have to run a fancy tool to tell me that higher spending will drain our investments faster and better returns will help.”

She told me the same thing when I said I discovered the secrets to a fat 401k 11 years ago.

It’s obvious because it’s true. Spending and investment returns are indeed the two fundamental drivers of financial success in retirement because they compound. We can handle low returns (the green line) or higher spending (the blue line) but not both year after year if we live long (the red line).

When we think of the usual consternations in retirement planning — when to claim Social Security, which accounts to withdraw from first, when and how much to convert to Roth, buckets strategy or proportional withdrawals, buy an annuity or not, … — everything added together can’t alter our retirement trajectory as much as our annual spending and investment returns.

If we’re on the red line because our annual spending is too high relative to the investment returns, the most optimal tactics in Social Security claiming, Roth conversion, and withdrawal sequencing won’t yank us back to the green line. We’ll need to reduce spending. If we’re on the blue line because we aren’t so unlucky with investment returns, we’ll do just fine even if we aren’t so clever in retirement planning tactics.

You don’t have to use Fidelity’s retirement planning tool to see this effect. Any other tool will show the same two fundamental drivers.

Make It RobustRetirement planning tactics are useful but we should make our plan NOT rely on them. If optimal executions of Social Security claiming, Roth conversion, and withdrawal sequencing make or break our retirement, it means our plan is too fragile. It isn’t robust enough when a slip in execution, a miscalculation, or a change of laws will knock us off track.

The goal should be to make our retirement successful regardless. When we get our spending right for the market conditions, any optimization tactics will only be icing on the cake, and suboptimal executions won’t jeopardize our retirement. If we get our spending wrong for the market conditions, no amount of optimization will rescue our retirement.

***

We’ll be watching the trajectory of our investments. If we see we’re at risk of going on the red line when we have a combination of high spending and low returns, we’ll reduce spending and try to move toward the green line. If we see that the market returns aren’t too bad, we’ll know we have more leeway in our spending. That’s how we’ll keep our eyes on the two fundamental drivers of financial success in retirement.

I told my wife that’s all she needs to do if something happens to me. Everything else is optional. How does SECURE Act 2.0 alter the financial success of our retirement? It does not, because it doesn’t change the two fundamental drivers.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Two Fundamental Drivers of Financial Success in Retirement appeared first on The Finance Buff.

April 30, 2023

Cash Out Old I Bonds to Buy New Ones for a Better Rate

TreasuryDirect announced that I Bonds bought between May and October 2023 will have a 0.9% fixed rate plus a variable rate that changes every six months. This new fixed rate is the highest we’ve ever seen in 15 years.

Table of ContentsLow Fixed Rate on Older I BondsEarly Withdrawal PenaltyNew 12-Month Holding PeriodPay Tax on Accrued InterestAnnual Purchase LimitLow Fixed Rate on Older I BondsIf you bought I Bonds between May 2020 and October 2022, the fixed rate on those older I Bonds is 0%. This 0% fixed rate stays with the bonds for their entire life up to 30 years. If you cash out the older I Bonds to buy new ones, you will benefit from the higher fixed rate over the long run.

I Bonds bought between November 2022 and April 2023 are still in the 12-month mandatory holding period by October 2023. They can’t be switched to new bonds until their mandatory holding period is over.

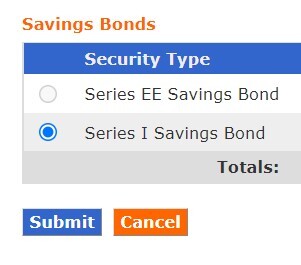

You see a list of your existing I Bonds by clicking on Current Holdings after you log in to your TreasuryDirect account. Then you choose Series I Savings Bond and click on Submit.

Here’s a reminder of the fixed rate on existing I Bonds issued since November 2010: