Brokered CD vs Direct CD vs Treasury: Is It Worth It?

The debt ceiling has been resolved. While it was hanging in the air, you may have come across brokered CDs, which you can buy in a brokerage account without having to open a separate account with a bank. Are they worth it?

Table of ContentsWhat Is a Brokered CDHow a Brokered CD WorksBrokered CD vs Direct CDEverything In One AccountCompetitive RatesNo Renewal TrapCall RiskCan’t Withdraw EarlyReinvestment RiskBrokered CD vs TreasuryYield May Be LowerNo State Tax ExemptionTreasuries Aren’t CallableLarge Haircut When You SellWhat Is a Brokered CDA brokered CD is a CD issued by a bank and sold through brokers. When you see a CD offered in your Fidelity, Vanguard, or Charles Schwab account, that’s a brokered CD.

The CD is issued by a bank. It has FDIC insurance. If you have other money at the same bank that issues the CD, your FDIC insurance limit is aggregated across your direct holdings and your brokered CDs from that bank.

A brokered CD is safe as long as you stay under the FDIC insurance limit. I bought a brokered CD from a bank in Puerto Rico during the 2008 financial crisis. FDIC paid me in full with interest when that bank failed.

How a Brokered CD WorksExcept for having FDIC insurance, a brokered CD works more like a bond.

1 CD is $1,000 of principal. You buy them in $1,000 increments. Fidelity offers “fractional CD” on some CDs. You will see fluctuating prices for the CD after you buy it in your brokerage account.

Periodic interest payments from the CD are paid into your brokerage accounts as cash. They aren’t automatically reinvested into the same CD. You get the principal back as cash when the CD matures. If you want to get out of the CD before it matures, you must sell it on the secondary market to another buyer.

Brokered CD vs Direct CDBrokerage CDs have some advantages over CDs you buy directly at a bank or a credit union. They also have two large disadvantages.

Everything In One AccountIt’s more convenient to buy brokered CDs from several different banks in one brokerage account than to open a separate account at each bank. This is helpful especially when you buy short-term CDs, but if you’re considering a 5-year CD, you only open an account once when you buy directly from a bank or a credit union and you’re good for five years.

Competitive RatesBecause banks know that brokers present brokered CDs in a table sorted by the yield, they have to offer a competitive yield to show up on top. They can’t prey on customers not being up to speed on the going rates. Many banks still offer very low rates on their websites but they have competitive rates on brokered CDs.

Not all banks offer brokered CDs though. Some banks, and especially credit unions, offer CD specials only to their direct customers. You should check the best rates on DepositAccounts.com to see whether a bank or a credit union offers a better rate than the rate you see from a brokered CD.

No Renewal TrapBy default, a brokered CD is automatically cashed out when it matures. Some brokers offer an “auto roll” feature to buy another brokered CD of the same term when one CD matures but you specifically sign up for that feature only if you want it.

Most banks and credit unions automatically renew a matured CD. The new CD they renew you into often has a low rate. You’ll have to tell them to stop the renewal within a short window. If you aren’t on top of it, you’ll either be stuck with a low rate or you’ll have to pay a big early withdrawal penalty that can eat into your principal. See Beware: Banks Auto-Renew CDs with a Short Window to Back Out.

Call RiskMany brokered CDs are callable, which means the bank has the right to terminate (“call”) the CD before the stated maturity date.

Having your CD terminated prematurely is the opposite of you refinancing your mortgage when the market rate goes down. The bank has the choice to terminate the CD or not. You have no right to refuse.

Some callable CDs have preset dates when the bank may exercise its right to terminate. Some are continuously callable, which means the bank has the right to terminate at any time after a certain date.

Naturally, the bank will only terminate the CD when the going rate goes down. You were counting on earning the guaranteed interest for the full term. All of a sudden the bank decides to pay you out early. You get your money back but you can only earn less now because the going rate is lower. On the other hand, if the going rate goes up, the bank chooses not to terminate the CD, and you’re stuck with a below-market rate until maturity.

A callable CD gives you the worst of both worlds. Most direct CDs aren’t callable. You’re guaranteed to enjoy the rate you locked in for the full term when you buy a CD directly from a bank or a credit union. You should compare only non-callable brokered CDs with direct CDs or demand a substantially higher yield from a callable brokered CD.

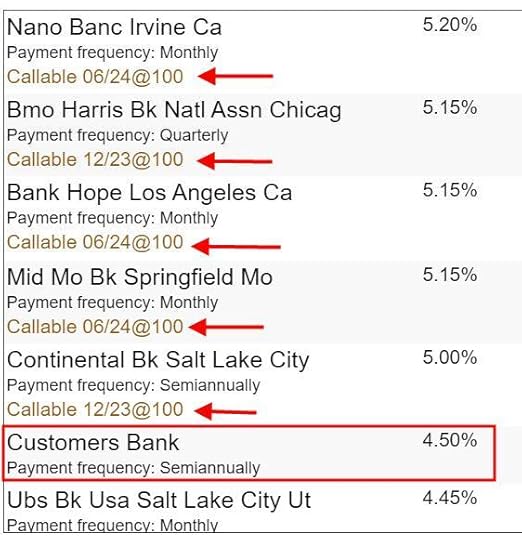

For example, as I’m writing this, Vanguard shows the best 5-year brokered CD pays 5.2% and DepositAccounts.com shows the best 5-year direct CD from a credit union pays 4.68%. That makes brokerage CDs look attractive until you find out that the brokered CDs with higher rates are all callable.

Callable and Non-Callable CDs

Callable and Non-Callable CDsThe best rate on a 5-year non-callable brokered CD is only 4.5%. This is lower than the 4.68% yield on a 5-year CD you can get from a credit union. You will have to weigh the convenience of buying a brokered CD against getting a lower yield or taking the call risk.

Can’t Withdraw EarlyA CD bought directly from a bank or a credit union has a big advantage over a brokered CD because you can break it by paying a preset early withdrawal penalty. Some direct CDs have no early withdrawal penalty (“no-penalty CDs”).

A brokered CD doesn’t offer an option to withdraw early. You must sell the brokered CD on the secondary market to another buyer if you want to get out early.

There may not be a buyer for your CD when you want to sell. If there’s a buyer, the price you receive from selling the CD is determined by the current market rate at that time minus a large haircut. It may be much lower than paying the preset early withdrawal penalty on a direct CD.

Breaking a CD isn’t only for an unexpected need for cash. When interest rates go up sharply, it makes sense to pay an early withdrawal penalty and reinvest at a higher yield. I broke all my direct CDs last year by paying the early withdrawal penalty because the CD Early Withdrawal Penalty Calculator shows that I will end up with a higher value than holding the CDs to maturity. I wouldn’t have had this option had I bought brokered CDs.

Reinvestment RiskWhen you have a CD directly from a bank or a credit union, you have the option to have the interest paid out to you or to reinvest the interest in the CD. If the going rate goes up, you choose to have the interest paid out and earn a higher yield elsewhere. If the going rate falls, you choose to reinvest the interest at the original higher yield.

You don’t have this option with a brokered CD. All interest is paid out in cash. If the going rate goes down, you can only earn a lower yield on the interest.

Brokered CD vs TreasurySuppose you like the convenience of brokered CDs and you don’t mind giving up a small difference in yield and the option to withdraw early. Still don’t pull the trigger just yet. You always have the option to buy Treasuries instead.

Brokers sell brokered CDs because they’re paid by the banks to sell the CDs. You see more advertising from the broker for brokered CDs than for Treasuries but you may be better off buying Treasuries anyway.

Because Treasuries have a direct guarantee from the government versus through a separate government agency (the FDIC), brokered CDs must overcome several hurdles before you consider them. Otherwise you just buy Treasuries.

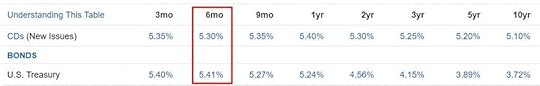

Yield May Be LowerBrokered CDs don’t always pay more than Treasuries of a comparable term. For example, as I’m writing this, the best six-month brokered CD pays 5.3% APY whereas a six-month Treasury pays 5.4%.

Don’t buy a brokered CD only because the rate sounds attractive on the surface. Always find out first what a Treasury is paying for the same term. See How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy Treasury Bills & Notes On the Secondary Market. Don’t bother with a brokered CD when a Treasury pays more.

No State Tax ExemptionIf you buy in a regular taxable brokerage account, interest from Treasuries is exempt from state and local taxes. Interest from brokered CDs is fully taxable by the state and local governments. Brokered CDs must pay more than Treasuries after adjusting for this state and local tax exemption.

If your federal marginal tax rate is f and your state and local marginal tax rate is s, the tax-equivalent yield of a Treasury with a quoted yield of t is:

t * ( 1 – f ) / ( 1 – f – s )

For example, as I’m writing this, the best 1-year brokered CD has a yield of 5.4% and a one-year Treasury has a yield of 5.24%. When your federal marginal tax rate is 22% and your state and local marginal tax rate is 6%, the tax-equivalent yield of the Treasury is:

5.24% * ( 1 – .22 ) / ( 1 – .22 – .06 ) = 5.68%

That means a CD must have a yield of 5.68% to earn the same amount after all taxes as a Treasury with a yield of 5.24%. Although the brokered CD with a yield of 5.4% appears to pay more than the Treasury with a yield of 5.24% at first glance, it actually pays less than the Treasury after you take all taxes into account.

You don’t have to make this adjustment if you’re buying in an IRA or if you don’t have state and local taxes.

Treasuries Aren’t CallableMany brokered CDs are callable whereas all Treasuries aren’t callable. You should compare only non-callable brokered CDs with Treasuries or demand a substantially higher yield from a callable brokered CD.

For example, as I’m writing this, Fidelity shows the best 5-year brokered CD pays 5.2% when the yield on a 5-year Treasury is 3.89% but the best yield on a 5-year non-callable brokered CD is only 4.5%.

The yield advantage shrinks further when you adjust the Treasury yield for the state and local tax exemption. If we use the same federal marginal tax rate of 22% and state and local marginal tax rate of 6% in the example above, the tax-equivalent yield of the 3.89% Treasury is 4.21%. The 4.5% brokered CD only has a marginally higher yield than the Treasury. It’s more competitive in an IRA and in no-tax states.

Large Haircut When You SellIf you want to get out of a brokered CD before it matures, you must sell it to a willing buyer. That’s the same for Treasuries but there are far fewer buyers for brokered CDs than for Treasuries. The buyer for your brokered CD will demand a substantial price concession to take over the CD from you.

Treasuries are highly liquid and competitive. If you must sell your Treasuries before maturity, you may get a lower price than your original purchase price but it’s going to be a fair price based on the market condition at that time.

Any slight yield advantage you have from a brokered CD over a comparable Treasury vanishes quickly if you must sell before maturity. Don’t even consider brokered CDs if there’s any chance you won’t hold them to maturity.

***

Before you explore whether it makes sense to buy a brokered CD, you should:

1. Decide what term you want because selling brokered CDs before maturity will be costly.

2. Check DepositAccounts.com for the best rate on a direct CD for your term. Weigh the convenience of brokered CDs against giving up yield and the early withdrawal option.

3. Check the yield on Treasuries for your term. Adjust it for the state and local tax exemption if you’re buying in a regular taxable account.

4. Only compare non-callable brokered CDs with direct CDs and Treasuries. Demand a large yield difference if you don’t mind callable CDs.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Brokered CD vs Direct CD vs Treasury: Is It Worth It? appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower