Harry Sit's Blog, page 13

August 28, 2023

Which Treasury to Buy While Keeping Your Taxes Simple

Many people are interested in buying Treasuries but they hesitate because they don’t want to complicate their taxes. That’s a legitimate concern. How much buying Treasuries will complicate your taxes depends on which Treasuries you buy and how you buy them.

We go from the simplest to the most complicated in this post. It’s better to learn how to walk before you run when you aren’t familiar with how taxes on Treasuries work.

Table of ContentsNo Worries in Tax-Advantaged AccountsHold Treasury Bills to MaturityThrough a Mutual Fund or an ETFHold New-Issue Treasury Notes and Bonds to MaturityHold New-Issue TIPS to MaturitySell Treasury Bills Before MaturityBuy or Sell on the Secondary MarketNo Worries in Tax-Advantaged AccountsBuying Treasuries in a tax-advantaged account doesn’t affect your taxes. These tax-advantaged accounts include workplace retirement accounts such as 401k or 403b, Traditional IRA, Roth IRA, or HSA. You don’t pay tax when you buy, hold, or sell investments inside a tax-advantaged account. Taxes on withdrawals from these accounts depend only on the account type. It doesn’t matter what investments you buy or how you buy them in tax-advantaged accounts.

It makes no difference in terms of taxes whether you buy Treasury Bills, Notes, or Bonds, whether you buy regular Treasuries or TIPS, whether you buy a new issue through an auction or you buy an existing bond on the secondary market, or whether you hold to maturity or you sell before maturity on the secondary market. Buy or sell to your heart’s content when you’re in a tax-advantaged account. See How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy Treasury Bills & Notes On the Secondary Market.

Tax treatments are different only when you buy Treasuries outside tax-advantaged accounts.

Hold Treasury Bills to MaturityTaxes outside tax-advantaged accounts are also easy if you only buy Treasury Bills and hold them to maturity.

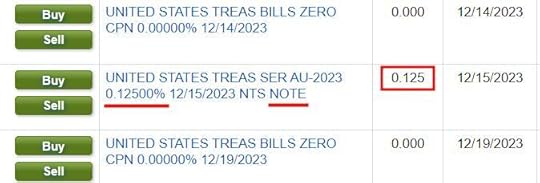

We’re talking about strictly Treasury Bills here. A Treasury Bill has no “coupon,” which means it doesn’t pay any interest while you hold it. A Treasury note with a coupon that was issued some time ago but now has less than one year left to maturity isn’t really a Treasury Bill. The first and the third listings in the screenshot below are Treasury Bills. The middle one isn’t.

Treasury Bills are sold at a discount to the face value. The difference between the purchase price and the face value you receive at maturity is your interest. It doesn’t matter whether you buy Treasury Bills as a new issue at a Treasury auction or on the secondary market as long as you hold them to maturity. Taxes are simple because the purchase price is the only variable.

Your broker will include the difference between the purchase price and the face value as interest on a 1099-INT form. If you buy at TreasuryDirect, make sure to download the 1099-INT form from TreasuryDirect. The specific field on the 1099-INT form says it’s exempt from state and local taxes. Your tax software will calculate both federal and state taxes automatically after you enter the 1099-INT form.

Through a Mutual Fund or an ETFBuying Treasuries through a mutual fund or an ETF in a regular taxable brokerage account also doesn’t make your taxes too complicated. The dividends from the mutual fund or ETF will be included on a 1099-DIV form. If you sell shares in a mutual fund or an ETF for a capital gain or loss, it will be included on a 1099-B form.

These tax forms aren’t new. You will have them when you buy or sell other mutual funds or ETFs as well. Your tax software will automatically handle the federal taxes without any additional steps.

Extra Step for State TaxesThe extra wrinkle is in state taxes. You’ll need to get a report from the fund manager on what percentage of the fund’s income came from Treasuries. That portion is exempt from state and local taxes. It takes an extra step but it’s not that difficult. Please read how to do that in State Tax-Exempt Treasury Interest from Mutual Funds and ETFs.

Maturity ChoicesBuying through a mutual fund or an ETF doesn’t mean that you’re buying long-term Treasuries. You have many choices in funds that invest in different maturities. Choose a fund that only invests in short-term Treasuries if you only want short maturities. Choose a fund that only invests in TIPS if you only want TIPS. The expense ratio is very low in many funds and ETFs.

Regular TreasuriesMutual Fund or ETFMoney MarketFidelity Treasury Only Money Market Fund (FDLXX)Schwab U.S. Treasury Money Fund (SNSXX)

Vanguard Treasury Money Market Fund (VUSXX)0 – 3 monthsiShares 0-3 Month Treasury Bond ETF (SGOV) 0 – 1 yeariShares Short Treasury Bond ETF (SHV)Short-TermFidelity Short-Term Treasury Bond Index Fund (FUMBX)

iShares 1-3 Year Treasury Bond ETF (SHY)

Schwab Short-Term U.S. Treasury ETF (SCHO)

Vanguard Short-Term Treasury Index Fund (VSBSX)

Vanguard Short-Term Treasury ETF (VGSH)Intermediate-TermFidelity Intermediate Treasury Bond Index Fund (FUAMX)

iShares 3-7 Year Treasury Bond ETF (IEI)

iShares 7-10 Year Treasury Bond ETF (IEF)

Schwab Intermediate-Term U.S. Treasury ETF (SCHR)

Vanguard Intermediate-Term Treasury Index Fund (VSIGX)

Vanguard Intermediate-Term Treasury ETF (VGIT)Long-TermFidelity Long-Term Treasury Bond Index Fund (FNBGX)

iShares 10-20 Year Treasury Bond ETF (TLH)

iShares 20+ Year Treasury Bond ETF (TLT)

Schwab Long-Term U.S. Treasury ETF (SCHQ)

Vanguard Long-Term Treasury Index Fund (VLGSX)

Vanguard Long-Term Treasury ETF (VGLT)TIPSMutual Fund or ETFShort-TermiShares 0-5 Year TIPS Bond ETF (STIP)

Vanguard Short-Term Inflation-Protected Securities ETF (VTIP)

Vanguard Short-Term Inflation-Protected Securities Index Fund (VTAPX)Broad TermsFidelity Inflation-Protected Bond Index Fund (FIPDX)

Schwab Treasury Inflation Protected Securities Index Fund (SWRSX)

Schwab U.S. TIPS ETF (SCHP)

Vanguard Inflation-Protected Securities Fund Admiral Shares (VAIPX)

With so many choices in funds and ETFs at a very low cost, you really don’t need to get into individual Treasury notes and bonds unless you must withdraw in a short period on a preset schedule or you just prefer the psychological comfort. See Two Types of Bond Ladder: When to Replace a Bond Fund or ETF.

Hold New-Issue Treasury Notes and Bonds to MaturityNew-issue Treasury Notes and Bonds bought at a Treasury auction and held to maturity are a little more complicated but they’re still not too bad in terms of tax complexity.

Buying at a Treasury auction doesn’t mean you must use TreasuryDirect. You can buy new issues at a Treasury auction in your brokerage account through Fidelity, Charles Schwab, Vanguard, or E*Trade with no fee whatsoever. See How To Buy Treasury Notes Without Fee at Online Brokers.

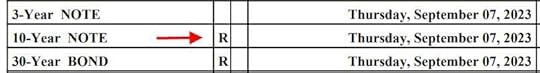

Avoid ReopeningsNot all Treasury Notes and Bonds sold at an auction are true new issues though. Some Treasury auctions are reopenings. A reopening happens when the government is selling additional quantities of a bond that was already issued some time ago. The tax treatment of buying a reopening is the same as buying on the secondary market, which is more complicated than the tax treatment of buying a true new issue.

Reopenings are marked with the letter “R” in Treasury’s auction schedule. Avoid reopenings if you’d like to keep your taxes simple.

The price of a true new issue from a Treasury auction will be at a slight discount to the face value. You’ll handle this small discount when the bond matures. Treasury Notes and Bonds pay interest every six months. Your broker will report these interest payments in the right place on a 1099-INT form. Your tax software will automatically calculate both federal and state taxes.

Accrued InterestUsually there’s zero accrued interest on a true new issue. If there is any, it’s very small. The small accrued interest doesn’t show up on the 1099 form. It’s only in the 1099 supplement. You’re allowed to add a negative entry for the accrued interest to offset the coupon payments but because it’s small, it’s not a big deal even if you don’t know how to do it or you simply forget.

Hold New-Issue TIPS to MaturityTIPS adds a little more complexity than regular Treasury Notes and Bonds because TIPS receives both interest payments and inflation adjustments. It’s still not too bad if you stay with true new issues (avoid reopenings) and you hold them to maturity.

In addition to the 1099-INT form, the inflation adjustment will be on a 1099-OID form. It’s one extra form but your tax software knows how to handle it.

Similar to regular Treasuries, the price of a true new issue TIPS from a Treasury auction will be at a slight discount to the face value. You’ll handle this small discount when the bond matures.

A true new issue TIPS has only a small amount of accrued interest. You’ll find it in the 1099 supplement and add a negative entry on your tax return to offset the interest. It’s not a big deal if you can’t figure out how to do it or you simply forget.

Buying a TIPS reopening at a Treasury auction is the same as buying on the secondary market in terms of taxes. It’s more complicated than buying a true new issue.

Sell Treasury Bills Before MaturitySelling Treasury Bills before maturity adds one variable to the otherwise simple tax treatment of holding them to maturity. Now you’ll have both interest and a capital gain or loss. Please note we’re still only talking about Treasury Bills that don’t have a coupon. It’s more complicated if you sell a Treasury note, bond, or TIPS that has a coupon.

The concept goes like this. If you bought $10,000 worth of a 13-week Treasury Bill for $9,865, you were supposed to earn $135 in interest in 91 days by holding it to maturity. Suppose you sold it for $9,947 after holding it for 60 days, you do a linear proration to calculate the interest earned:

( $10,000 – $9,865 ) / 91 * 60 = $89

Your capital gain or loss is the sale price minus the purchase price minus the interest:

$9,947 – $9,865 – $89 = -$7

You earned $89 in interest and you had a $7 capital loss when you sold this Treasury Bill before maturity.

You’ll have to calculate this split between interest and capital gain/loss yourself if your broker doesn’t do it for you. If your broker reports the difference between your purchase price and your sale price as 100% interest or 100% capital gain/loss on the 1099 form, you’ll have to correct it on your tax return.

You have this complexity from selling before maturity. You can avoid it if you hold your Treasury Bills to maturity. If you must sell something before maturity though, sell Treasury Bills. It’s still simpler than selling bonds with a coupon before maturity.

Buy or Sell on the Secondary MarketThe more complicated tax treatment comes from buying or selling Treasury notes or bonds with a coupon on the secondary market (including buying a reopening through an auction).

The current market rate can be quite different from the coupon rate of an existing bond. This results in a large discount or premium in the price. The large discount or premium makes taxes more complicated. Buying or selling on the secondary market often involves paying or receiving a meaningful amount of accrued interest, which you must also handle on the tax return.

How to handle these complexities is beyond the scope of this already long post. If you can help it, for the sake of keeping your taxes simple in a taxable account, don’t buy Treasury notes or bonds with a coupon on the secondary market, don’t buy them in a reopening, and don’t sell them on the secondary market. Use the secondary market only for Treasury Bills. If you must do those things, do them in a tax-advantaged account.

***

Taxes on Treasuries get progressively more complicated as you move down the list. Learn to walk before you run.

1. Do everything in tax-advantaged accounts. No tax worries there.

2. Buy some Treasury Bills and hold them to maturity. That’s easy too.

3. Use a fund or an ETF. Not too bad there.

4. If you want longer maturities in individual Treasuries (including TIPS) in a regular taxable account, only buy true new issues in an auction, avoid reopenings, and hold them to maturity.

5. Finally, if you must sell something before maturity in a regular taxable account, only sell Treasury Bills.

That’s as far as I would go. Any more complications aren’t worth it to me.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Which Treasury to Buy While Keeping Your Taxes Simple appeared first on The Finance Buff.

August 23, 2023

Bank of America Travel Rewards Card Pays 2.625% on Everything

[Originally published in 2014. Updated on August 23, 2023. Links aren’t affiliate links. We don’t get paid if you apply for any credit cards.]

I have a brokerage account at Merrill Edge and a free checking account at Bank of America. I qualified for Bank of America’s Preferred Rewards program after three months. Then I added a Bank of America Travel Rewards credit card to the Preferred Rewards program.

This credit card isn’t that special on a stand-alone basis. It gives 1.5% rewards on every purchase with no caps or specific categories. It has no annual fee and no foreign transaction fee. There’s a small sign-up bonus. The Preferred Rewards program makes it much nicer.

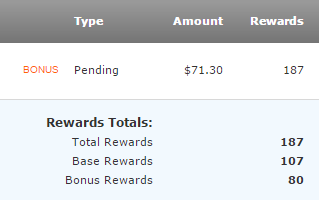

75% Bonus from Preferred RewardsWhen you enroll in the Preferred Rewards program, you get a boost in the credit card rewards. $100k in assets held at Merrill Edge puts you in the Platinum Honor tier, which gives you a 75% bonus on credit card rewards. 1.5% rewards on everything then becomes 2.625% rewards on everything with no caps.

For example, $71.30 purchase earned 187 reward points worth $1.87. That’s 2.625%. You get the 75% bonus after you qualify for the Platinum Honor tier in Preferred Rewards. If your Bank of America checking account is new, it has to go through three month-ends before you qualify.

This Bank of America card with a 75% bonus gives more rewards than other 2%-rewards cards such as the Fidelity Visa and the Citi Double Cash card.

Hold ETFs at Merrill EdgeThe best way to qualify for the Platinum Honor tier in the Preferred Rewards program is by transferring $100,000 worth of assets to Merrill Edge. The $100,000 doesn’t have to sit in cash. It can be stocks, mutual funds, or ETFs held in IRA or regular brokerage accounts.

You don’t have to trade in the Merrill Edge accounts either if you prefer to use a different broker. Just holding $100,000 worth of an S&P 500 ETF and setting up free automatic dividend reinvestment will do. Merrill Edge doesn’t charge any maintenance fee.

If you do use Merrill Edge to trade, Merrill Edge charges zero commission on online stock and mutual fund trades.

Redeem Against Travel ChargesLike some other travel cards, the reward points from the Travel Rewards card are worth the most when you redeem them as a statement credit against past travel charges (100 points = $1). As long as you put some travel expenses on this card once in a while, you should be able to redeem the points easily.

These charges all counted as travel in my account:

Airlines (both tickets and baggage fees)HotelsAirbnbCar rentalsUberPublic transitSki passes and lunch at ski resortsThe minimum number of points for redemption is 2,500 points (earned by spending $952 at 2.625%). You have one year from the time of the travel charge to redeem points against it. You can redeem points against the same charge multiple times until the charge is fully covered by points redemption.

Premium Rewards CardBank of America also offers a Premium Rewards card that’s similar to the Travel Rewards card.

Travel RewardsPremium RewardsAnnual FeeNone$95Foreign Transaction FeeNoneNoneAirline incidental statement creditNoneup to $100/yearTSA PreCheck or Global Entry fee creditNoneup to $100 every 4 yearsRewards on travel charges1.5% base2.625% with 75% bonus2% base

3.5% with 75% bonusRewards on everything else1.5% base

2.625% with 75% bonus1.5% base

2.625% with 75% bonusRedeem rewardsStatement credit against travel charges in the last 12 monthsCash

You’ll get more from the Premium Rewards card to offset the annual fee if you pay airline baggage fees or charge a good amount for travel.

Auto Pay Full BalanceIt’s not obvious how you set up for automatically paying the full balance every month on Bank of America credit cards. Please follow the steps in Set Up Autopay On Bank of America Credit Card.

***

I use the Bank of America Travel Rewards card as my primary card. It works to its full potential when you also have Merrill Edge and Bank of America accounts and you make it to the Platinum Honor tier in the Preferred Rewards program.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Bank of America Travel Rewards Card Pays 2.625% on Everything appeared first on The Finance Buff.

August 14, 2023

Roth IRA Withdrawal After 59-1/2 in TurboTax and H&R Block

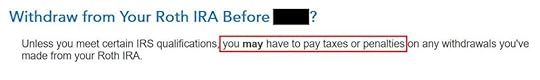

Everyone knows the point of putting money into a Roth IRA is that withdrawals are tax-free. That’s true at a high level but it isn’t that simple when you go one level down into the details. Withdrawals from a Roth IRA follow a set of complex rules to determine how much of a withdrawal is tax-free and penalty-free.

Table of ContentsRoth IRA Withdrawal RulesRelief After 59-1/2H&R BlockTurboTaxNot Yet 59-1/2?Roth IRA Withdrawal RulesThe rules require that you understand normal contributions and conversions including backdoor Roth and mega backdoor Roth, rollovers from Roth 401k to Roth IRA, a 5-year clock on each conversion, the taxable and non-taxable amount in the conversion, and earnings in the Roth account, etc., etc. Gathering and keeping records to put dollar amounts into each bucket year by year requires another level of attention. See Maintain a Roth IRA Contributions and Withdrawals Spreadsheet.

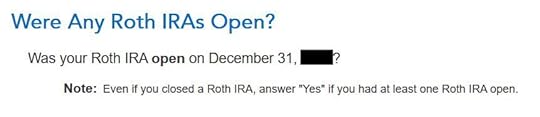

Relief After 59-1/2The great news is that all these complexities go away when you’re 59-1/2. You only need to answer this one question when you withdraw from your Roth IRA after age 59-1/2:

Did you have a Roth IRA at least five years ago?

The answer is obviously “Yes” for most people. It’s the simplest way to make your Roth IRA withdrawal 100% tax-free. That’s the path I’m aiming for.

You’ll get a 1099-R from your Roth IRA custodian in the following year after you take a withdrawal. Let’s look at how it works on your tax return when you use tax software TurboTax and H&R Block.

H&R BlockI normally start with TurboTax when I do these tax software walkthroughs but I’m starting with H&R Block this time for reasons that will become apparent later.

The screenshots below are from H&R Block Deluxe downloaded software. The downloaded software is both less expensive and more powerful than the online version. You can buy H&R Block downloaded software from Amazon, Walmart, Newegg, Office Depot, and many other retailers.

I started the tax return with a 67-year-old single taxpayer.

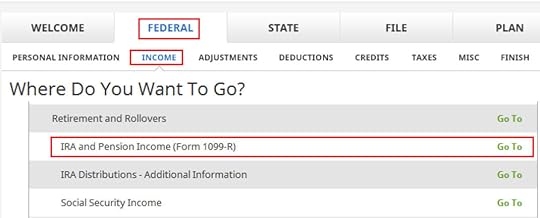

Go to Federal -> Income -> IRA and Pension Income (Form 1099-R). You can import the 1099-R or enter it manually. I’m showing manual entries.

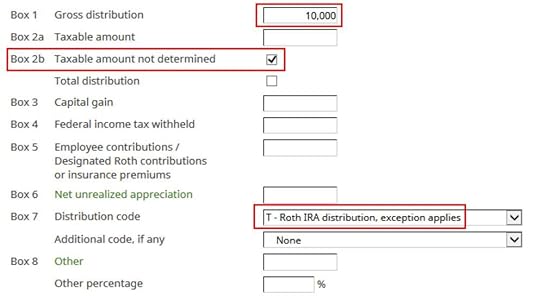

My test 1099-R is a normal 1099-R. Enter the numbers from your 1099-R as-is. It looks like this for a $10,000 withdrawal from the Roth IRA:

The amount of the withdrawal shows up in Box 1. Yours may have the same amount repeated in Box 2a and that’s OK too. It’s important to have a checkmark in Box 2b “Taxable amount not determined.” Your Roth IRA custodian isn’t determining whether your distribution is taxable. The box 7 distribution code is “T.”

I didn’t inherit it.

Here it’s asking whether I had my first Roth IRA at least five years ago. Of course I did.

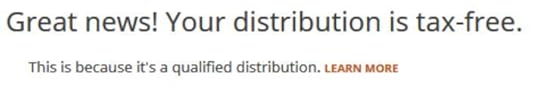

That’s it. It’s tax-free after I answer just two simple questions. I didn’t have to give any detail for the past contributions, recharacterizations, conversions, rollovers, or distributions. It doesn’t matter how the money got into the Roth IRA or when.

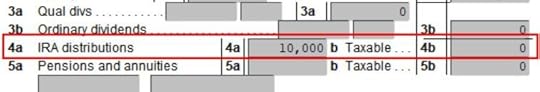

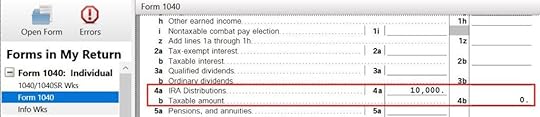

We can see how this shows up on the tax form. Click on Forms on the top and open Form 1040 and Schedules 1-3. Click on Hide Mini WS. Scroll down to lines 4a and 4b.

It shows the withdrawal on Line 4a and zero on Line 4b. Line 4b is the taxable amount. A zero there means it’s tax-free. If you have other IRA distributions such as RMDs on Lines 4a and 4b, this tax-free withdrawal from your Roth IRA adds to your other distributions on Line 4a but it doesn’t add to the taxable amount on Line 4b.

TurboTaxNow let’s look at how it works in TurboTax. The screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

I started the tax return with a 67-year-old single taxpayer.

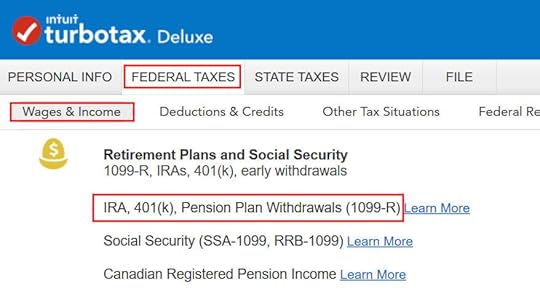

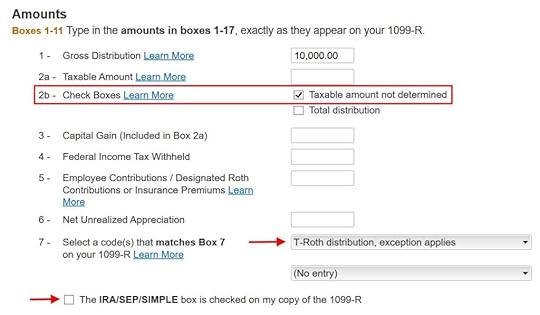

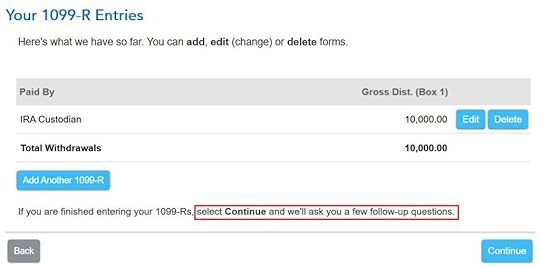

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R). Import the 1099-R if you’d like. I’m choosing to type it myself.

Just the regular 1099-R.

Box 1 shows the amount taken out of the Roth IRA. You may have the same amount copied as the taxable amount in Box 2a. That’s OK when Box 2b is checked saying “taxable amount not determined.” Pay attention to the code in Box 7. Make sure your entry matches your 1099-R exactly. I have a code “T” in my test 1099-R. The IRA/SEP/SIMPLE box is not checked because it’s from a Roth IRA.

I didn’t inherit it.

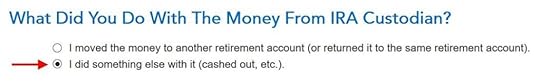

I didn’t move the money to another retirement account.

I didn’t buy a home.

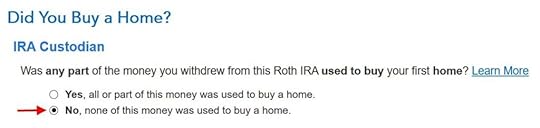

It wasn’t due to a disaster. I took the money out and spent it.

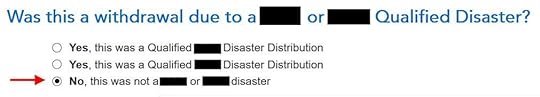

We come to this 1099-R summary but we’re not done yet. TurboTax will ask more follow-up questions.

I didn’t take disaster distributions or repay them.

This is the most relevant question. Yes, I owned a Roth IRA for at least five years.

I don’t know why it matters whether I have an open Roth IRA but whatever.

Now TurboTax is trying to scare us. Why does it matter? I’m already 59-1/2!

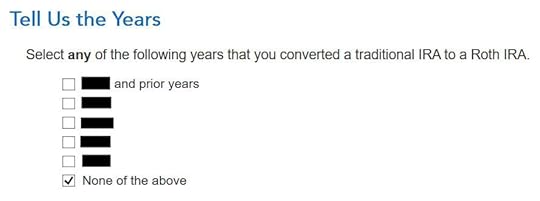

Now TurboTax will go through the rigmarole of Roth IRA distribution ordering rules, which are irrelevant when you’re already 59-1/2 and you had your Roth IRA for at least five years. I’m going to lie to TurboTax now because I know the answers just don’t matter at this point.

If you answer truthfully which year you did a Roth conversion, TurboTax will take you through the details of your prior conversions. You will waste time doing a lot of unnecessary work. So don’t cooperate.

Again, irrelevant.

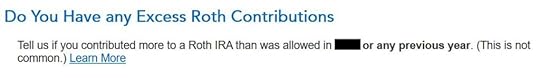

No excess contributions.

TurboTax is finally done with its irrelevant questions. Are you taxed on the withdrawal from your Roth IRA? Click on Forms on the top right.

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b.

It shows the withdrawal amount on Line 4a and zero on Line 4b. A zero on Line 4b means it’s tax-free. If you have other IRA distributions such as RMDs on Lines 4a and 4b, this Roth IRA withdrawal adds to your other distributions on Line 4a but it doesn’t add to the taxable amount on Line 4b.

TurboTax arrives at the same results as H&R Block but it takes such a long and unnecessary journey. It uses a one-size-fits-all approach that doesn’t distinguish by whether you’re 59-1/2 or not.

Nothing matters when you’re already 59-1/2 and you had your first Roth IRA at least five years ago. All your withdrawals from the Roth IRA are tax-free, end of story. You get a big relief when you’re 59-1/2. You don’t have to provide any other data or records. So don’t think you must meticulously keep everything. Just save one statement from a Roth IRA to show that you had it open at least five years ago.

Not Yet 59-1/2?It’s a whole different story if you’re planning to withdraw from your Roth IRA before age 59-1/2. You do need detailed records to answer those questions from TurboTax. You can use something like the spreadsheet I included in Maintain a Roth IRA Contributions and Withdrawals Spreadsheet.

To be honest, I gave up on keeping track of Roth IRA contributions, recharacterizations, conversions, rollovers, and distributions. I’ll take the easy path and wait until the year I’m 59-1/2.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Roth IRA Withdrawal After 59-1/2 in TurboTax and H&R Block appeared first on The Finance Buff.

August 10, 2023

2023 2024 Tax Brackets, Standard Deduction, Capital Gains, etc.

My other post listed 2023 2024 401k and IRA contribution and income limits. I also calculated the inflation-adjusted tax brackets and some of the most commonly used numbers in tax planning for 2024 using the published inflation numbers and the same formula prescribed in the tax law. The official numbers will be announced by the IRS in October or November.

Table of Contents2023 2024 Standard Deduction2023 2024 Tax Brackets2023 2024 Capital Gains Tax2023 2024 Estate and Trust Tax Brackets2023 2024 Gift Tax Exclusion2023 2024 Savings Bonds Tax-Free Redemption for College Expenses2023 2024 Standard DeductionYou don’t pay federal income tax on every dollar of your income. You deduct an amount from your income before you calculate taxes. About 90% of all taxpayers take the standard deduction. The other ~10% itemize deductions when their total deductions exceed the standard deduction. In other words, you’re deducting a larger amount than your allowed deductions when you take the standard deduction. Don’t feel bad about taking the standard deduction!

The basic standard deduction in 2023 and 2024 are:

20232024 (projected)Single or Married Filing Separately$13,850$14,600Head of Household$20,800$21,900Married Filing Jointly$27,700$29,200Basic Standard DeductionSource: IRS Rev. Proc. 2022-38, author’s calculation.

People who are age 65 and over have a higher standard deduction than the basic standard deduction.

20232024 (projected)Single, age 65 and over$15,700$16,550Head of Household, age 65 and over$22,650$23,850Married Filing Jointly, one person age 65 and over$29,200$30,750Married Filing Jointly, both age 65 and over$30,700$32,300Standard Deduction for age 65 and overSource: IRS Rev. Proc. 2022-38, author’s calculation.

People who are blind have an additional standard deduction.

20232024 (projected)Single or Head of Household, blind+$1,850+$1,950Married Filing Jointly, one person is blind+$1,500+$1,550Married Filing Jointly, both are blind+$3,000+$3,100Additional Standard Deduction for BlindnessSource: IRS Rev. Proc. 2022-38, author’s calculation.

2023 2024 Tax BracketsThe tax brackets are based on taxable income, which is AGI minus various deductions. The tax brackets in 2023 are:

SingleHead of HouseholdMarried Filing Jointly10%$0 – $11,000$0 – $15,700$0 – $22,00012%$11,000 – $44,725$15,700 – $59,850$22,000 – $89,45022%$44,725 – $95,375$59,850 – $95,350$89,450 – $190,75024%$95,375 – $182,100$95,350 – $182,100$190,750 – $364,20032%$182,100 – $231,250$182,100 – $231,250$364,200 – $462,50035%$231,250 – $578,125$231,250 – $578,100$462,500 – $693,75037%Over $578,125Over $578,100Over $693,7502023 Tax BracketsSource: IRS Rev. Proc. 2022-38.

The projected 2024 tax brackets are:

SingleHead of HouseholdMarried Filing Jointly10%$0 – $11,600$0 – $16,550$0 – $23,20012%$11,600 – $47,150$16,550 – $63,100$23,200 – $94,30022%$47,150 – $100,525$63,100 – $100,500$94,300 – $201,05024%$100,525 – $191,900$100,500 – $191,900$201,050 – $383,80032%$191,900 – $243,700$191,900 – $243,700$383,800 – $487,40035%$243,700 – $609,250$243,700 – $609,250$487,400 – $731,10037%Over $609,250Over $609,250Over $731,100Projected 2024 Tax BracketsSource: author’s calculation.

A common misconception is that when you get into a higher tax bracket, all your income is taxed at the higher rate and you’re better off not having the extra income. That’s not true. Tax brackets work incrementally. If you’re $1,000 into the next tax bracket, only $1,000 is taxed at the higher rate. It doesn’t affect the income in the previous brackets.

For example, someone single with a $60,000 AGI in 2023 will pay:

First 13,850 (the standard deduction)0%Next $11,00010%Next $33,725 ($44,725 – $11,000)12%Final $1,42522%Progressive Tax RatesThis person is in the 22% tax bracket but only a tiny fraction of the $60,000 AGI is really taxed at 22%. The bulk of the income is taxed at 0%, 10%, and 12%. The blended tax rate is only 9.1%. If this person doesn’t earn the final $1,425, he or she is in the 12% bracket instead of the 22% bracket but the blended tax rate only goes down slightly from 9.1% to 8.8%. Making the extra income doesn’t cost this person more in taxes than the extra income.

Don’t be afraid of going into the next tax bracket.

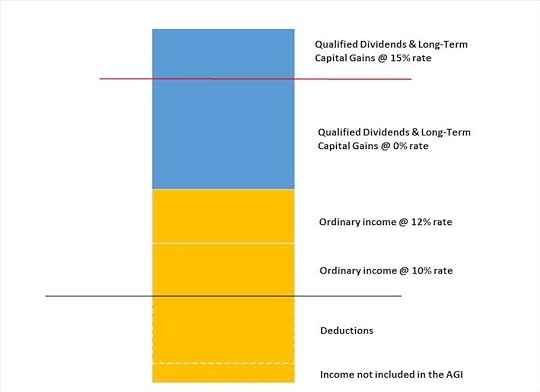

2023 2024 Capital Gains TaxWhen your other taxable income (after deductions) plus your qualified dividends and long-term capital gains are below a cutoff, you will pay 0% federal income tax on your qualified dividends and long-term capital gains under this cutoff.

This is illustrated by the chart below. Taxable income is the part above the black line, after subtracting deductions. A portion of the qualified dividends and long-term capital gains is taxed at 0% when the other taxable income plus these qualified dividends and long-term capital gains are under the red line.

The red line is close to the top of the 12% tax bracket but they don’t line up exactly.

20232024 (projected)Single or Married Filing Separately$44,625$47,025Head of Household$59,750$62,950Married Filing Jointly$89,250$94,050Maximum Zero Rate Amount for Qualified Dividends and Long-term Capital GainsSource: IRS Rev. Proc. 2022-38, author’s calculation.

For example, suppose a married couple filing jointly has $70,000 in other taxable income (after deductions) and $20,000 in qualified dividends and long-term capital gains in 2023. The maximum zero rate amount cutoff is $89,250. $19,250 of the qualified dividends and long-term capital gains ($89,250 – $70,000) is taxed at 0%. The remaining $20,000 – $19,250 = $750 is taxed at 15%.

A similar threshold exists on the upper end for qualified dividends and long-term capital gains. When your other taxable income (after deductions) plus your qualified dividends and long-term capital gains are above a cutoff, you will pay 20% federal income tax instead of 15% on your qualified dividends and long-term capital gains above this cutoff.

20232024 (projected)Single$492,300$518,850Head of Household$523,050$551,250Married Filing Jointly$553,850$583,650Married Filing Separately$276,900$291,800Maximum 15% Rate Amount for Qualified Dividends and Long-term Capital GainsSource: IRS Rev. Proc. 2022-38, author’s calculation.

2023 2024 Estate and Trust Tax BracketsEstates and trusts have different tax brackets than individuals. These apply to non-grantor trusts and estates that retain income as opposed to distributing the income to beneficiaries. Grantor trusts (including the most common revocable living trusts) don’t pay taxes separately. The income of a grantor trust is taxed to the grantor at the grantor’s tax brackets.

Here are the tax brackets for estates and trusts in 2023 and 2024:

20232024 (projected)10%$0 – $2,900$0 – $3,10024%$2,900 – $10,550$3,100 – $11,10035%$10,550 – $14,450$11,100 – $15,20037%over $14,450over $15,200Estate and Trust Tax BracketsSource: IRS Rev. Proc. 2022-38, author’s calculation.

2023 2024 Gift Tax ExclusionEach person can give another person up to a set amount in a calendar year without having to file a gift tax form. Not that filing a gift tax form is onerous, but many people avoid it if they can. This gift tax exclusion amount will increase from $17,000 in 2023 to $18,000 in 2024.

20232024 (projected)Gift Tax Exclusion$17,000$18,000Gift Tax ExclusionSource: IRS Rev. Proc. 2022-38, author’s calculation.

The gift tax exclusion is counted by each giver to each recipient. As a giver, you can give up to $17,000 each in 2023 to an unlimited number of people without having to file a gift tax form. If you give $17,000 to each of your 10 grandkids in 2023 for a total of $170,000, you still won’t be required to file a gift tax form. Any recipient can also receive a gift from an unlimited number of people. If a grandchild receives $17,000 from each of his or her four grandparents in 2023, no taxes or tax forms will be required.

2023 2024 Savings Bonds Tax-Free Redemption for College ExpensesIf you cash out U.S. Savings Bonds (Series I or Series EE) for college expenses or transfer to a 529 plan, your modified adjusted gross income must be under certain limits to get a tax exemption on the interest. See Cash Out I Bonds Tax Free For College Expenses Or 529 Plan.

Here are the income limits in 2023 and 2024. The limits are in a phaseout range. You get a full exemption if your income is below the lower number in the range. You get no exemption if your income is above the higher number in the range. You get a partial exemption if your income falls within the range.

20232024 (projected)Single, Head of Household$91,850 – $106,850$96,800 – $111,800Married Filing Jointly$137,800 – $167,800$145,200 – $175,200Income Limit for Tax-Free Savings Bond Redemption for Higher EducationSource: IRS Rev. Proc. 2022-38, author’s calculation.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2023 2024 Tax Brackets, Standard Deduction, Capital Gains, etc. appeared first on The Finance Buff.

August 8, 2023

2023 2024 Cap on Paying Back ACA Health Insurance Subsidy

[Originally published in 2020. Updated on August 8, 2023.]

The ACA health insurance subsidy, aka the premium tax credit, is set up such that, for the most part, it doesn’t matter how much subsidy you receive upfront when you enroll. The upfront subsidy is only an estimate. The final subsidy will be squared up when you file your tax return next year.

If you didn’t receive the subsidy when you enrolled but your actual income qualifies, you get the subsidy as a tax credit when you file your tax return. If the government paid more subsidies than your actual income qualifies for, you pay back the difference on your tax return.

Repayment CapThere’s a cap on how much you need to pay back. The cap varies depending on your Modified Adjusted Gross Income (MAGI) relative to the Federal Poverty Level (FPL) and your tax filing status. It’s also adjusted for inflation each year. Here are the caps on paying back the subsidy for 2023 and 2024.

MAGI2023 Coverage2024 Coverage< 200% FPLSingle: $350Other: $700Single: $375

Other: $750< 300% FPLSingle: $900

Other: $1,800Single: $950

Other: $1,900< 400% FPLSingle: $1,500

Other: $3,000Single: $1,575

Other: $3,150>= 400% FPLNo CapNo Cap

Source: IRS Rev. Proc. 2022-38, author’s calculation.

No Cap Above 400% of FPLThe repayment caps in 2023 and 2024 apply only when your actual income is below 400% of FPL. There’s no repayment cap if your actual income exceeds 400% of FPL — you will have to pay back 100% of the difference between what you received and what your actual income qualifies for.

Large Change in IncomeThe caps are also set sufficiently high such that the amount you need to pay back will fall below the cap unless there’s a big difference between your actual income and your estimated income at the time of enrollment.

For example, suppose you’re married filing jointly and you estimated your income would be $50,000 in 2023 when you enrolled. Suppose by the time you file your tax return, your income turns out to be $60,000. Because your income is $10,000 higher than you originally estimated, you qualify for a lower subsidy now. You will be required to pay back the $1,554 difference. The cap doesn’t really help you because this $1,554 difference is well under the $3,000 repayment cap.

In addition, because you’re required to notify the healthcare marketplace of your income changes during the year in a timely manner so that they can adjust your advance subsidy, normally the difference between the advance subsidy you received and the subsidy you finally qualify for should be well under the cap. The cap helps only when your income increases close to the end of the year to make it too late to adjust your advance subsidy.

Easier for SinglesStill, a late income change can happen, and the change can be large enough to make the difference in the health insurance subsidy higher than the repayment cap. This is true especially when you’re single with a lower repayment cap.

For example, suppose you’re single and you estimated your income would be $30,000 in 2023 when you enrolled. Suppose in December 2023 you decide to convert $20,000 from a Traditional IRA to a Roth IRA. This pushes your income to $50,000. The extra $20,000 income lowers your health insurance subsidy by $3,001, but because your repayment cap is $1,500, you only need to pay back $1,500. You get to keep the other $1,501. In this case, you’re better off asking for the subsidy upfront during enrollment. If you only wait until you file your tax return, you won’t benefit from the repayment cap.

Bottom line: You should try to estimate your income conservatively and qualify for as much subsidy as you can upfront when you enroll. Maybe it won’t help. Maybe it will.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2023 2024 Cap on Paying Back ACA Health Insurance Subsidy appeared first on The Finance Buff.

August 6, 2023

Fidelity Debit Card Foreign Transaction Fee on ATM Withdrawals

You can request a debit card when you use Fidelity as a checking or savings account. Fidelity says this in their debit card FAQs:

For each foreign transaction, there is a foreign transaction fee (currently, 1% of the transaction for non-US dollar transactions), which may be included in the amount charged to your account. This charge may apply whether or not there is a currency conversion.

Fidelity customer service also repeated this as an official response in this Reddit post. Because I don’t use a debit card for purchases whether in the U.S. or in foreign countries (no rewards), the only way this foreign transaction fee could be relevant to me is on ATM withdrawals when we travel internationally.

The FAQ says that a foreign transaction fee “may be included.” It implies that the fee isn’t always included. When exactly is it included and not included?

A Real-World TestI had a chance to see in real life whether a foreign transaction fee applied to ATM withdrawals using a Fidelity debit card.

My wife took a trip to Canada. She withdrew $200 Canadian from an ATM at a gas station. Fidelity sent me this debit card activity alert in real-time:

A bank teller withdrawal on card ending in XXXX for $153.06 from CANCO #XXX XXXXXXXXX was posted to your account on 08/03.

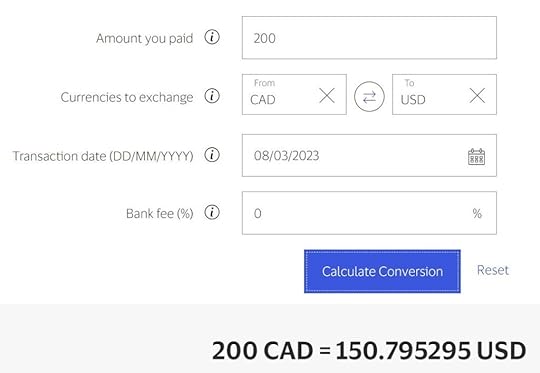

$200 Canadian for $153.06 U.S. gave an exchange rate of 1 US dollar = 1.307 Canadian dollars. Google showed that the exchange rate on that day was 1 US dollar = 1.33 Canadian dollars. Using that exchange rate, we should be charged $200 Canadian / 1.33 = $150.38. Fidelity charged us $2.68 more than that. Did Fidelity include a foreign transaction fee in the amount charged to us?

Fidelity posted another entry to our account a day later:

ADJUST FEE CHARGED ATM FEE REBATE (Cash) +$2.26

Ah, the original $153.06 included an ATM fee charged by the machine. Fidelity reimbursed us that fee. The net charge after the ATM fee reimbursement was $153.06 – $2.26 = $150.80. This makes the exchange rate $200 Canadian / $150.80 U.S. = 1.326. That’s close to the 1.33 number from Google but it still doesn’t quite match it. Was the difference a foreign transaction fee that Fidelity included?

Card Network Exchange RateFidelity’s debit card is a Visa debit card. Visa has an online Exchange Rate Calculator to show how the Visa network converted currencies each day. The calculator showed this when I put in the transaction date and a 0% bank fee:

$150.795295 USD rounds to $150.80. That’s exactly the net amount Fidelity charged us after the ATM fee reimbursement. There was NO foreign transaction fee from Fidelity on the ATM withdrawal.

Visa has a small markup in the exchange rate used on its network. Fidelity is only passing along the exchange rate from Visa. It’s the best exchange rate you can get as long you’re using a Visa card. A Schwab Visa debit card can’t do any better.

***

Some side notes on spending money in a foreign country:

Getting Local CurrencyThe best way to get local currency is to use a local ATM machine. You pay no ATM fee and you get the best exchange rate when you have the right card. Don’t buy foreign currency in the U.S. before you leave. Don’t use the currency exchange booths at the airport. You don’t need to bring US dollar bills to exchange them except as a backup just in case. Just take your debit card and use an ATM machine when you’re there.

It doesn’t matter which ATM you use. An ATM at the airport works. One at a gas station also works, as you see in my wife’s ATM withdrawal. So does an ATM outside a bank branch.

If your bank charges an out-of-network ATM fee plus a foreign transaction fee and it doesn’t reimburse you the ATM fee charged by the machine, you’re with the wrong bank. Consider one of the 3 Ways to Use Fidelity as a Checking or Savings Account.

Act as a LocalAct as a local when you’re in a foreign country. If you see any mention of the U.S. dollar on any ATM machine or credit card terminal, back out and press a different button to transact in the local currency. They certainly don’t offer to charge locals in U.S. dollars and you shouldn’t pay any differently.

If you’d like to verify whether your bank included a foreign transaction fee on your international charges, use the Exchange Rate Calculator from Visa (or the Currency Converter Calculator from MasterCard if your card is a MasterCard). MasterCard may give better exchange rates on its network than Visa. If you do a lot of foreign transactions, get a MasterCard when all else is equal.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Fidelity Debit Card Foreign Transaction Fee on ATM Withdrawals appeared first on The Finance Buff.

July 30, 2023

3 Ways to Use Fidelity as a Checking or Savings Account

Fidelity Investments is best known as an administrator for workplace retirement plans and an online broker for retail investors. In addition to 401k/403b accounts, Traditional and Roth IRAs, HSAs, and taxable brokerage accounts, Fidelity also offers accounts that can be used for the same purpose as a checking account and a savings account.

Because Fidelity is interested in having a full relationship with its customers for both banking and investing and its primary focus is on the investing part, it’s in a good position to offer better rates and features than other banks in the banking part.

This is not a sponsored post. Fidelity isn’t paying me to promote it. I’m only writing as a satisfied customer. Here are three ways to use a Fidelity account to manage day-to-day spending and savings.

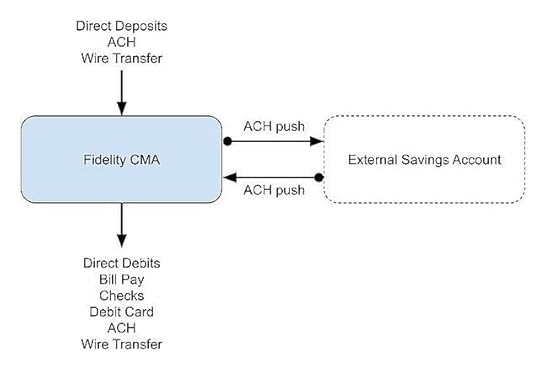

Table of ContentsCMA as CheckingIncluded FeaturesRouting Number and Account NumberLimitationsCMA as Checking/Savings ComboBuy Money Market FundAdd Treasury Bills or Brokered CDsSeparate Regular Brokerage AccountSet and ForgetCMA as CheckingFidelity Cash Management Account (CMA) is a separate account type from Fidelity’s regular taxable brokerage account officially called “The Fidelity Account.” You have to choose the account type when you open the account. A Cash Management Account can’t be changed to a regular taxable brokerage account after you open the account. Nor can an existing regular taxable brokerage account be changed to a CMA.

Included FeaturesThe Cash Management Account is specifically designed to meet banking needs. It has pretty much everything people need for a checking account and nearly everything is free.

– FDIC-insured balance. Pays interest (2.6% APY as of July 31, 2023).

– No minimum balance. No monthly maintenance fee. Does not require direct deposit.

– Provides a routing number and an account number for direct deposits and direct debits.

– Accepts check deposits by mobile app or dropoff at a Fidelity branch.

– Free checkbook. No minimum amount for each check.

– Free Visa debit card for purchase, ATM withdrawal, and teller cash advance. Does not require using the debit card a minimum number of times per month.

– Reimburses ATM fee charged by any ATM worldwide.

– Free Bill Pay service with eBill.

– Free same-day ACH.

– Free wire transfers.

The 2.6% interest rate is lower than the rate on many high yield savings accounts but it’s a lot higher than the rate on most online checking accounts. For example, although Ally Bank pays 4% on its savings account as I’m writing this, its checking account pays only 0.25%. Most high yield savings accounts don’t have all the checking features such as check writing, debit card, and Bill Pay.

Routing Number and Account NumberYou see the routing number and account number for direct deposits and direct debits when you click on the three dots next to the account name.

Limitations

LimitationsFidelity Cash Management Account has some limitations that aren’t a deal-breaker to me.

– Does not accept deposits of physical cash.

– Does not support Zelle (but it works with PayPal, Venmo, Cash App, Apple Pay, and Google Pay).

– Does not link instantly through Plaid.

– Does not offer goal-based sub-accounts.

– Does not offer cashier’s checks.

– Recurring outgoing transfers only support monthly and annual frequencies.

– 1% transaction fee on debit card purchases in foreign countries. This fee doesn’t apply to international ATM withdrawals.

– ACH pulls and check deposits are held for up to four business days. The money still earns interest. It’s just not available for withdrawal while on hold.

I’ve used Fidelity CMA for at least 15 years. It’s my primary checking account. I use my otherwise dormant Bank of America checking account on those rare occasions when I need to deposit physical cash, use Zelle, link instantly through Plaid, get a cashier’s check, or set up recurring transfers on an odd schedule. I don’t use a debit card for purchases or track my savings by separate goals.

The hold time on ACH pulls and check deposits will shrink over time for established accounts on smaller amounts. My ACH pulls and check deposits are usually available for withdrawal on the second business day. I do an ACH push from the other side when I need it to be available immediately. See ACH Push or Pull: The Right Way to Transfer Money.

When you use the Fidelity CMA as your checking account, you can link it to an existing high yield savings account as you normally do with a checking account. You earn much higher interest in the Fidelity CMA than in a typical checking account.

CMA as Checking/Savings Combo

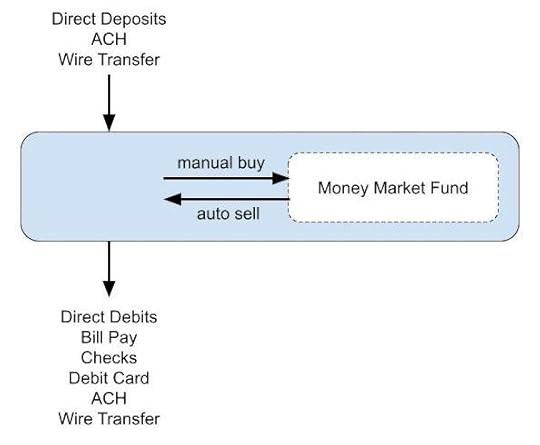

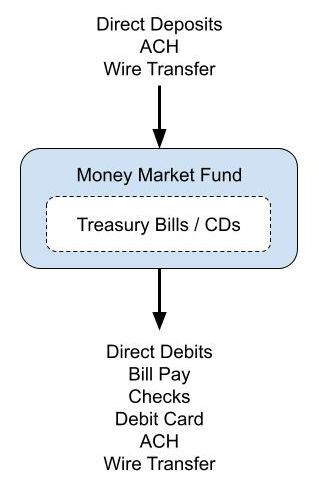

CMA as Checking/Savings ComboInstead of linking to an external savings account, you can buy a money market fund in the Cash Management Account and keep both checking and savings in the same account.

Buy Money Market FundAlthough the CMA is designed for banking needs, it’s still a brokerage account. With some exceptions (no margin or options), you can buy in the CMA pretty much everything that’s available in a regular brokerage account. That includes stocks, bonds, brokered CDs, mutual funds, and ETFs. A Fidelity money market fund pays about 4.8% annualized yield as of July 31, 2023, which is higher than the rate paid by many high yield savings accounts.

A money market fund isn’t FDIC-insured but when you buy a government or Treasury money market fund, the underlying investments in the money market fund are backed by the government. See No FDIC Insurance – Why a Brokerage Account Is Safe.

The CMA becomes a checking/savings combo when you buy a money market fund in it. The core balance in the CMA serves as the checking part and the money market fund serves as the savings part. You have to buy the money market fund manually but Fidelity will automatically sell from the money market fund when your core balance in the CMA is insufficient to cover a debit. This is like having free automatic overdraft transfers from savings to checking.

Because Fidelity will automatically sell from the money market fund to cover debits, if you’re so inclined, you can be aggressive in keeping the core balance in the CMA close to zero while keeping the bulk of your account in the money market fund earning a higher yield. Or you can set a maximum target balance alert with the Cash Manager to buy more shares of the money market fund when you have excess cash in the “checking” part.

Add Treasury Bills or Brokered CDsIf you’d like to take it one step further, you can also buy Treasury Bills or brokered CDs in the CMA when you have money that you know you won’t need for some time. The CMA then becomes a checking/savings/CD combo. The money automatically goes into the “checking” part when the Treasury Bill or brokered CD matures. For example, the amount set aside for the next property tax bill can go into a Treasury Bill or a brokered CD. See How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy CDs in a Fidelity Brokerage Account.

Please note if you enable the “auto roll” feature when you buy new-issue Treasury Bills or brokered CDs in the CMA, the amount for the next roll reduces your “available to withdraw” number for a few days during the roll. A debit may fail if you don’t have enough available to withdraw. It’s not a problem if you don’t use auto roll or if you keep a substantially higher amount in cash and money market fund than the amount on auto roll.

I use a Fidelity Cash Management Account as a checking/savings/CD combo this way. I buy into the Fidelity Government Money Market Fund (FZCXX) when I have a large core balance. I also buy Treasury Bills with money I know I won’t need for some time. Fidelity automatically sells from the money market fund as needed to cover direct debits and outgoing transfers.

My setup works well but I’m moving to a different setup below.

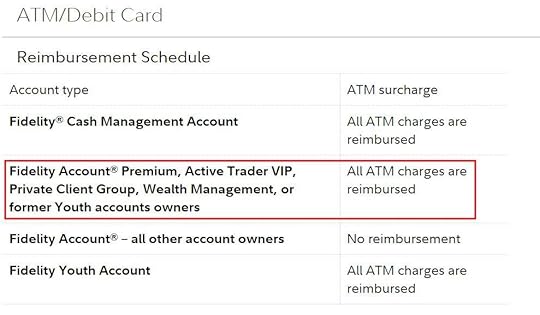

Separate Regular Brokerage AccountA regular Fidelity taxable brokerage account (“The Fidelity Account”) also provides a routing number and an account number for direct deposits and direct debits, free checks, debit cards, and Bill Pay. It includes basically everything in the CMA except ATM fee reimbursement but it uses a money market fund that pays a higher yield as the core position instead of the FDIC-insured balance as in the CMA.

The ATM fee reimbursement is also included when you have Premium Services or Private Client Group status, which generally requires having $250k or more with Fidelity in all accounts. It doesn’t matter whether you have an assigned advisor.

You see your service level at the top right when you log in to Fidelity’s website. Contact customer service if you have more than $250k with Fidelity but you’re not given a premium service level.

Even if you don’t get ATM fee reimbursement, the higher yield on the core balance may very well cover the ATM fees several times over. Suppose your core position has an average balance of $3,000 during the year (the “checking” part in the CMA), a 2% higher yield pays $60 more in interest. That’s plenty to pay for ATM fees unless you frequently take ATM withdrawals. My account records show that I used an ATM only once in seven months so far this year.

CMARegular Brokerage AccountCore PositionFDIC insuredgovernment money market fundYield on core position(as of July 31, 2023)2.6%4.8%ATM fee reimbursementincludedincluded for some accounts

The same missing features and limitations of the CMA also apply to the regular taxable brokerage account — no physical cash deposits, no Zelle, no cashier’s check, no instant Plaid, 1% foreign transaction fee on debit card purchases, and hold on ACH pulls and check deposits for up to four business days.

Set and ForgetUsing a regular brokerage account for spending and savings becomes truly set-and-forget. You don’t have to manually buy a money market fund. All deposits automatically go into a money market fund that pays about a 4.8% yield as of July 31, 2023. All debits come out of this money market fund. It’s like using a savings account as a checking account.

You can still buy Treasury Bills or brokered CDs to set aside money for specific bills in the future. The same caveat on “auto roll” and “available to withdraw” as mentioned above also applies.

Name Your Accounts

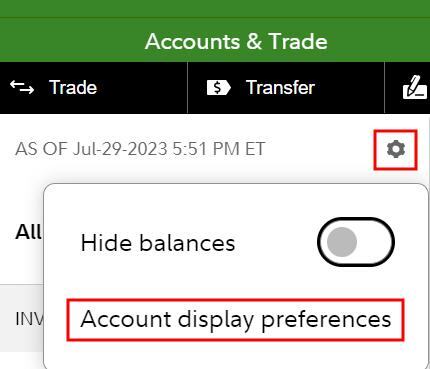

Name Your AccountsAlthough you can keep the money for spending and short-term reserves in the same regular taxable brokerage account that also holds your long-term investments, most people probably prefer to keep them separate. You can have two (or more) regular taxable brokerage accounts for different purposes. You just give them different names so that you know which is which.

To change the display name of an account, click on the setup icon near the top left and then click on “Account display preferences.”

Check the box next to the account you’d like to name and then click on the “Rename” link on the top. Change the name to “Spending Account” or something to that effect.

You can also move an account to a different group to help you organize. There’s a built-in “Spend & Save Accounts” group but I leave my account in the “Investment Accounts” group so that it shows up on the top.

***

The biggest draw of using a Fidelity brokerage account for spending and short-term reserves is the checking features. You effectively use a savings account as a checking account and earn a good yield from the first dollar. Everything is seamlessly together.

A Vanguard money market fund and some less well-known high yield savings accounts pay more but they don’t offer checking features. When you pair it with a checking account that pays close to zero, the blended yield on all your cash goes down. For example, if you have $5,000 in a checking account that pays 0.25% and you have $50,000 in a Vanguard money market fund that pays 5.18%, your blended yield on $55,000 is 4.73%. You might as well put the whole $55,000 in a Fidelity brokerage account earning 4.8% and eliminate the need to transfer back and forth between two accounts.

If you’re going to open a new account, check Fidelity’s current special offers page first (not an affiliate link). You might as well get a small bonus when you meet the terms of the special offer.

Transitioning a checking account takes some time and effort. Banks know it. That’s why they pay you close to zero in checking accounts. They bet that you think it takes too much work to switch. Don’t fall for it. It’s easier than you think when you take your time to make the move.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 3 Ways to Use Fidelity as a Checking or Savings Account appeared first on The Finance Buff.

July 24, 2023

PSA: Secure Your Email Account to Prevent Wire Fraud

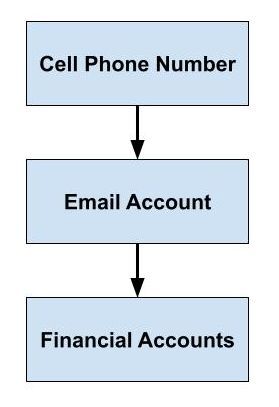

What does it take to reset the password to your email account? What happens next if someone hacks into your email?

Log out of your email and try the “forgot password” link. If it takes a security code sent by SMS text message to your cell phone, consider upgrading your security setting.

I read this report on the Bogleheads investment forum: $250k lost in unauthorized wire fraud – experience/advice? An elderly couple lost $250,000 because thieves got into their email account by resetting the password. It can happen to you too.

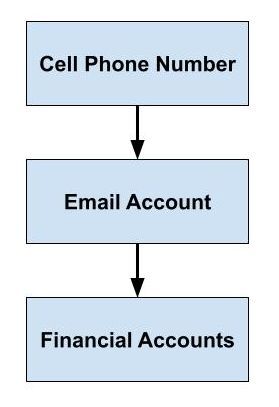

Password Reset AttacksFraudsters fooled the couple’s cell phone company to transfer their cell phone number to another company. One break-in then led to another. They used the security code sent to that number (now under their control) to reset the password to the couple’s email account. They logged in and looked in old emails for where the couple had bank accounts. Access to the email account and security codes sent to the cell phone number gave these criminals access to the bank accounts. They requested wire transfers from three banks.

Two banks stopped a pending wire when the couple reported unauthorized access within 24 hours. A third bank promised to freeze the account but they sent out a wire later on a fraudulent request anyway. It took more than a month for the bank to finally return the money to the elderly couple. The couple almost had to sue the bank to get their money back.

Secure Your Email AccountIt isn’t clear whether the bank paid lost interest. If not, the lost interest on $250k is well over $1,000, and think about the aggravation for over a month! You don’t want this to happen to you.

Try the “forgot password” link for each of your financial accounts and see what it takes to reset your password. If access to your email is part of the process, for example, to receive a password reset link, you should secure your email account with something stronger than SMS text messages sent to a cell phone number.

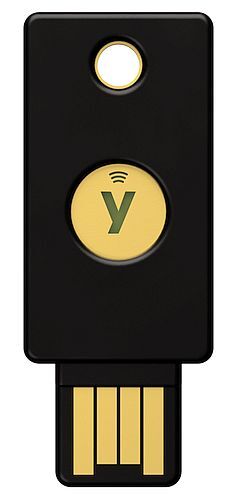

I wrote about using security hardware to protect investment accounts in this blog post: Security Hardware for Vanguard, Fidelity, and Schwab Accounts. The Yubikey security hardware mentioned in that post can be used to secure email accounts by GMail, Microsoft (Hotmail, Outlook), Apple iCloud, Yahoo, and AOL. It costs $50-60 to buy two Yubikeys but it’s worth the peace of mind.

Use a Better Bank

Use a Better BankWhich bank failed to freeze the couple’s account after getting a report of fraud and then dragged their feet for over a month to return the money? This is totally unacceptable. The poster only said it was an online bank headquartered in Utah. Does the name start with the letter A?

If you have an account with an online bank headquartered in Utah, maybe consider using a different bank. You can search for a bank’s headquarters by its name or web address on this FDIC web page.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post PSA: Secure Your Email Account to Prevent Wire Fraud appeared first on The Finance Buff.

How to Secure Your Email Account and Prevent Wire Fraud

What does it take to reset the password to your email account? What happens next if someone hacks into your email?

Log out of your email and try the “forgot password” link. If it takes a security code sent by SMS text message to your cell phone, consider upgrading your security setting.

I read this report on the Bogleheads investment forum: $250k lost in unauthorized wire fraud – experience/advice? An elderly couple lost $250,000 because their email account was set to send a security code by SMS text message to their cell phone number for resetting the password. It can happen to you too.

Password Reset AttacksFraudsters fooled the couple’s cell phone company to transfer their cell phone number to another company. It then started cascading from there. They used the security code sent to that number (now under their control) to reset the password to the couple’s email account. They logged in and looked in old emails for where the couple had bank accounts. Access to the email account and security codes sent to the cell phone number gave these criminals access to the bank accounts. They requested wire transfers from three banks.

Two banks stopped a pending wire when the couple reported unauthorized access. A third bank promised to freeze the account but they sent out a wire on a fraudulent request anyway. It took more than a month for the bank to finally return the money to the elderly couple. The couple almost had to sue the bank to get their money back.

Secure Your Email AccountIt isn’t clear whether the bank paid lost interest. If not, the lost interest on $250k is well over $1,000, and think about the aggravation for over a month! You don’t want this to happen to you. Secure your email account with something stronger than text message codes sent to a cell phone number.

I wrote about using security hardware to protect investment accounts in this blog post: Security Hardware for Vanguard, Fidelity, and Schwab Accounts. The Yubikey security hardware mentioned in that post can be used to secure email accounts by GMail, Microsoft (Hotmail, Outlook), and Yahoo. It costs $50-60 to buy two Yubikeys but it’s worth the peace of mind.

Use a Better Bank

Use a Better BankWhich bank failed to freeze the couple’s account after getting a report of fraudulent access and then dragged their feet over a month to return the money? This is totally unacceptable. The poster only said it was an online bank headquartered in Utah. Does the name start with the letter A?

If you have an account with an online bank headquartered in Utah, maybe consider using a different bank. You can search for a bank’s headquarters by its name or web address on this FDIC web page.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Secure Your Email Account and Prevent Wire Fraud appeared first on The Finance Buff.

July 17, 2023

ACH Push or Pull: The Right Way to Transfer Money

Most electronic payments and transfers to and from a bank account in the U.S. go through ACH, which stands for Automated Clearing House. To make money go from A to B, you can initiate the transfer from the sending account or you can initiate it from the receiving account. When I see complaints about ACH, it’s usually caused by not doing it the right way.

Table of ContentsACH Push vs PullODFI and RDFIACH LimitsACH FeesACH HoldACH SpeedSame-Day ACHFedNow Instant PaymentsWhen to Use ACH PullInternal TransfersACH Push vs PullIf an ACH transaction is initiated from the sending account, it’s an ACH credit or figuratively an ACH push — you are pushing the money out of the sending account. When you receive a payroll direct deposit, the payroll provider is doing an ACH push into your account.

If an ACH transaction is initiated from the receiving account, it’s an ACH debit or figuratively an ACH pull — you are pulling the money into the receiving account. When you link your checking account to a mortgage or a credit card for autopay, the bank is doing an ACH pull against your checking account. When you write a paper check, the recipient’s bank uses the routing number and the account number on the check to do an ACH pull.

An ACH transfer isn’t a wire transfer. A wire transfer is faster but it usually costs more. Most banks charge $10-15 for sending a wire. Some banks also charge $10 for receiving a wire. An ACH transfer is usually free on both sides.

ODFI and RDFIAs members of the ACH network, financial institutions go by the operating rules set by an association (NACHA).

Whether it’s an ACH push or an ACH pull, the bank that initiates the ACH transaction is called the Originating Depository Financial Institution (ODFI). The bank that receives the ACH request is called the Receiving Depository Financial Institution (RDFI).

Originating and receiving refer to the ACH request, not which direction the money flows. The money flows in the same direction as the ACH request in an ACH push — from the ODFI to the RDFI. In an ACH pull, the money flows in the opposite direction of the ACH request. The ACH request goes from the ODFI to the RDFI but the money flows from the RDFI to the ODFI.

The fundamental rule in ACH is that the bank that initiates the ACH (the ODFI) is liable for the transaction. The RDFI can reject the ACH if the account isn’t in good standing but otherwise they must honor the transaction. The RDFI can’t place any hold on the incoming ACH credit or delay the outgoing ACH debit. After posting the ACH transaction, if the account holder says the transaction isn’t authorized, the RDFI can reverse it.

ACH LimitsBecause the ODFI is liable, some banks and credit unions set limits on the frequency and/or the amount of ACH transactions they initiate. For example, a credit union has a policy of not initiating any ACH pull into its checking account. It also limits any ACH push it initiates to $5,000 per business day and $15,000 over any five business days.

These limits only apply when the credit union initiates the ACH. If the ACH is initiated by another bank, the credit union must faithfully accept it.

When you see limits on the frequency or the amount of ACH transfers, the limits only apply to ACH transactions initiated by that institution. It doesn’t mean you can’t transfer more frequently or in larger amounts. It just means you have to initiate the ACH on the other side.

ACH FeesThe ACH operator charges banks less than one penny for each ACH transaction. Because this cost is so low, most banks don’t charge consumers for ACH transfers but some large banks still do. For example, Bank of America doesn’t charge for ACH pulls but it charges $3 for each ACH push to be delivered in three business days and $10 for next-day delivery.

Similar to the ACH limits, these fees only apply when this bank initiates the ACH. The fees don’t apply when the ACH transaction is initiated outside this bank. If your bank charges a fee for ACH, initiate your ACH on the other side. If I need to transfer money from Bank of America to Fidelity, I initiate a pull from Fidelity.

ACH HoldACH goes by the principle of “No news is good news.” The ODFI will hear back if anything goes wrong but they won’t have any positive confirmation that the ACH transaction “cleared.” The ODFI only knows that it hasn’t been reversed yet. The RDFI has 60 days to reverse an ACH transaction.

The RDFI is given 60 days to reverse an ACH transaction because customers can’t be expected to watch their accounts daily. In the old days, banks issue paper statements monthly and that was the only opportunity for customers to review their accounts. Customers are given time to receive the statement in the mail, review the statement, and object to any errors. With online and mobile banking and paperless statements today, consumer protection laws still go by the monthly statements as the official account records.

This creates a problem especially for ACH pull transactions and check deposits. You see that your other account is already debited but the ODFI can’t trust that it won’t be reversed. That’s why the credit union I mentioned has a policy of not initiating any ACH pulls into its checking account. That’s why Fidelity holds any ACH pull and check deposit for up to four business days before making it available for withdrawals (it’s available immediately for trading, just not for withdrawals). That’s also why if you made a deposit to Vanguard recently, your withdrawal can only go back to the same bank where it came from originally. These policies limit their liability when they initiate the ACH pull.

On the other hand, when you do an ACH push, the sending bank processes it only if you have enough money in your account. The receiving bank treats the incoming ACH credit as good funds because the sending bank is liable. The receiving bank can’t put a hold on the money pushed in.

Therefore, when you have a choice, push the money from the source to avoid a hold. Don’t do it as an ACH pull.

ACH SpeedACH traditionally processes overnight. The ODFI sends a batch of ACH transactions to the ACH operator in the evening. The RDFI posts the transactions to the accounts the next morning.

There is no 3-day ACH versus next-day ACH on the ACH platform. If the ACH transaction takes longer than one business day, it’s only caused by the ODFI delaying it on purpose. It takes 3 business days when the ODFI intentionally delays sending it on a push or when it intentionally delays crediting your account on a pull.

If you want faster ACH, use a better bank to initiate it.

Same-Day ACHThe current gold standard in ACH is same-day ACH. When you request the ACH in the morning, you see it arrive on the other side in the afternoon.

This is again controlled by the bank that initiates the ACH. If the ODFI sends ACH requests to the ACH operator multiple times a day, your ACH transaction will arrive at your destination on the same day. If the ODFI only sends once in the evening, your ACH will arrive on the next business day.

For example, Fidelity does same-day ACH. When I ask Fidelity to transfer money to Bank of America before a cutoff time, I see the money in my Bank of America account in a few hours.

Not all financial institutions process same-day ACH but you should use one that does it at least overnight. Any slower than that is just lame. Because Fidelity’s same-day ACH is fast enough, I don’t bother using wire transfers even though Fidelity also offers free wire transfers.

FedNow Instant PaymentsThe Federal Reserve will launch a new real-time payment system soon. It’s called FedNow. It’ll work even faster than same-day ACH. Chase, Wells Fargo, and a number of other banks are already certified to work with FedNow.

We’ll have to see which banks will offer FedNow to consumer accounts and how it works in the real world. For the time being, let’s make sure all your transfers arrive at least the next business day.

When to Use ACH PullTo minimize hold on your ACH, in general you should do your ACH as a push. Request the ACH at the institution where your money is at. Ask them to send the money to the receiving account.

However, you should do an ACH pull in the following situations (writing a check also counts as an ACH pull):

Bill PaymentsWhen you pay a bill, it’s important to associate the payment with your bill. You can use your bank’s Bill Pay service and include a reference for your bill but involving a third party creates the potential for finger-pointing when there’s a problem. Did the Bill Pay service fail to make the payment on time? Did the Bill Pay service pay but the biller didn’t apply it correctly?

It’s much cleaner to let the biller pull from your bank account. Their billing system will apply the pull to your bill. You can always dispute the pull with your bank if the amount is wrong.

When It May Not Go ThroughIf there’s a chance that the ACH won’t go through, you should do it as a pull.

If you do a push but it doesn’t show up in the receiving account, the money already left your sending account. If you do a pull and it doesn’t come through, at least the money is still in your original account. If the money left your account and the receiving bank doesn’t credit you, you can ask your bank to reverse it.

Overcoming Limits and FeesAs I mentioned previously, if the sending bank has low limits or charges a fee for a push, you can initiate a pull from the receiving side. The pull may be subject to a hold though.

Contributing to an IRAWhen you contribute to an IRA between January 1 and April 15, it can be for the previous year or it can be for the current year. If you do an ACH push into your IRA, the custodian doesn’t know which year it’s for. They can assume but their assumption can be wrong. If you ask the IRA custodian to pull, you’ll have an opportunity to say whether it’s for the previous year or the current year.

Buying a CDA CD at a bank or a credit union doesn’t have an account number that accepts ACH. You can push to a checking account or a savings account at that bank and then use the money to buy a CD but it’s easier to just let the bank pull from your current account.

Depositing to VanguardVanguard accounts don’t have a routing number for ACH except for its new Cash Plus Account currently in pilot. To transfer funds into your Vanguard account, you link your bank account at Vanguard and ask Vanguard to pull.

Internal TransfersThe fastest transfers happen within the same institution or between two institutions owned by the same parent company. Both sides trust each other and they know that you have sufficient funds for the transfer.

Some large financial institutions offer both banking and investment services. Bank of America owns Merrill Edge. Chase has J.P. Morgan Self-Directed Investing. Fidelity offers a Cash Management Account. Charles Schwab owns Schwab Bank. Vanguard will have the Cash Plus Account when it’s made available to everyone. An internal transfer between the banking side and the brokerage side happens instantly and there won’t be any hold.

In a way, internal transfers are the best way to transfer money — no limit, no time delay, no hold. Using the same company as a one-stop shop for both banking and investing doesn’t give you everything in the best of breed but it’s a lot easier when you make fewer things matter.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post ACH Push or Pull: The Right Way to Transfer Money appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower