Harry Sit's Blog, page 29

November 10, 2020

The Intersection Between Income and Wealth and The Role of Frugality

President-elect Biden’s tax plan drew a line at an income of $400,000 for taxing the wealthy. It prompted some comments as confusing income with wealth. Some people have a high income but they aren’t wealthy, because they live in areas with high costs of living or because they have high debt from mortgage and student loans and they haven’t had enough time to accumulate wealth yet. They’re referred to as HENRYs — High Earners, Not Rich Yet. On the other hand, some people with high wealth, especially those who are older and had the time to grow their wealth, no longer have a high income. Increasing taxes on higher incomes won’t affect them.

Meanwhile, Stanley and Danko said in their book The Millionaire Next Door that frugality, not high income, is the key to become wealthy. They said most millionaires became wealthy because they shunned flashy spending. If that’s true, increasing taxes on higher incomes won’t stop savers from becoming wealthy.

What’s the relationship between income and wealth? What percentage of people with a high income are HENRYs, and increasing taxes on them doesn’t really increase taxes on the wealthy? What percentage of wealthy people don’t have a high income, and they will be unscathed by a tax increase on higher incomes? Is The Millionaire Next Door correct in saying that wealth comes from frugality, not high income?

Survey of Consumer Finances

The Federal Reserve does a Survey of Consumer Finances every three years to look at the assets, liabilities, income, and demographic characteristics of U.S. families. I found a small gem at the end of one of their research notes — Wealth and Income Concentration in the SCF: 1989–2019. It shows the joint distribution of income and wealth. I reproduce the table here for easy reading:

Table C. Share of families in income group, by wealth group, 2019 SCF

Income groups

Wealth groups

Bottom 50

Next 40

Next 9

Top 1

Bottom 50

0.72

0.34

0.03

0.04

Next 40

0.27

0.56

0.46

0.05

Next 9

0.01

0.10

0.47

0.41

Top 1

0.00

0.00

0.05

0.49

All

1.00

1.00

1.00

1.00

The table divides income and wealth into four groups: bottom 50%, next 40% (top 10-50%), next 9% (top 1-10%), and the top 1%. The table should be read from top to bottom. For example, the last column means that among families in the top 1% in wealth, 4% of them have income in the bottom 50%, 5% of them have income in the top 10-50%, 41% of them have income in the top 1-10%, and 49% of them have income in the top 1%.

To put the percentiles in context, here are the approximate ranges for each group:

Income GroupWealth GroupBottom 50< $68k< $121kNext 40$68k – $201k$121k – $1.2 millionNext 9$201k – $531k$1.2 million – $11 millionTop 1> $531k> $11 million

Source:

Average, Median, Top 1%, and all United States Household Income Percentiles in 2020Average, Median, Top 1%, and all United States Net Worth Percentiles in 2020

To make the joint distribution table also readable from left to right, I created a hypothetical group of 10,000 families. 5,000 families are in the first column. Their wealth is in the bottom 50%. Multiplying the percentages in the rows puts them into different income groups. Doing the same for all the columns produces this table:

Income groups

Wealth groups

Bottom 50

Next 40

Next 9

Top 1

All

Bottom 50

3,600

1,360

27

4

5,000

Next 40

1,350

2,240

414

5

4,000

Next 9

50

400

423

41

900

Top 1

0

0

45

49

100

All

5,000

4,000

900

100

10,000

The totals don’t add up exactly due to rounding in the original table, but it’s close enough for our purpose. Now we can see a clearer picture of the relationship between income and wealth.

Reading across the “Top 1” row from left to right, we see if increasing taxes on the top 1% in income is used as a proxy to increase taxes on the top 1% in wealth, it has a “hit ratio” of about 50%. 50% of the families in the top 1% of income also have their wealth in the top 1%. The wealth of the other 50% caught by the higher taxes isn’t quite in the top 1% but it’s still in the top 10%. On the other hand, 50% of families in the top 1% in wealth will escape the higher taxes. In terms of paying less in taxes, the sweet spots are in the upper right parts of the table — asset rich, income poor.

When we look at each row, we see, as a group, wealth increases with income. An individual person in a lower income group may save more and have more wealth, but when you’re in a higher income group, you only have to be average. Although having a high income doesn’t automatically put you into the same group in wealth, it at least puts you one group below. 100% of the top 1% income group have their wealth in the top 10%. 95% of the top 10% income group have their wealth in the top 50%. It’s very difficult to advance one group from income to wealth. Only 10% of the “Next 40” income group have their wealth in a higher group. Only 5% of the “Next 9” income group have their wealth in a higher group.

Although income isn’t wealth, at least in these broad strokes, income is clearly the driver for wealth. If your income is there, your wealth isn’t too far behind. If your income isn’t there, it’s very difficult to move up by frugality. Conditioned on having the necessary income, frugality then plays its role. I heard this quote from Morgan Housel on a White Coat Investor podcast:

Wealth, in fact, is what you don’t see. It’s the car that’s not purchased. The diamonds not bought. The renovations postponed, the clothes forgone, and the first-class upgrade declined.

I have a feeling if a researcher goes to the DMV and randomly selects 100 registered Porsche owners and 100 registered Honda owners, they will find the Porsche owners as a group still have more wealth despite having spent more money on their cars.

The post The Intersection Between Income and Wealth and The Role of Frugality appeared first on The Finance Buff.

November 2, 2020

CARES Act 2020 Charity Donation Deduction: $300 or $600 for Married?

Since the Trump tax law in 2017 increased the standard deduction and capped the deduction for state and local taxes, the number of people who take the standard deduction increased from 70% of all taxpayers to 88%. I was part of the change. I switched to taking the much simpler standard deduction in the last two years. It also means I didn’t get an extra tax deduction for donating to charities. It was all included in the standard deduction.

The CARES Act passed earlier this year created a new above-the-line charitable contributions deduction for the 88% of all taxpayers who don’t itemize deductions. To qualify for this new deduction, the donations have to be in cash, and they have to be donated directly to charities. Donating household items to Goodwill doesn’t count. Donating appreciated stocks doesn’t count. Giving to a donor-advised fund doesn’t count. Because TisBest is officially a donor-advised fund, buying a charity gift card there probably doesn’t count either.

It’s a one-off deal for only 2020 (see CARES Act Charity Donation Deduction: Ongoing or Only 2020?). The deduction is capped at $300. While it’s clear when you’re single, it’s a little ambiguous whether it’s $600 per married couple filing jointly or still $300. Here’s the relevant part from the text of the CARES Act (bold added by me):

SEC. 2204. ALLOWANCE OF PARTIAL ABOVE THE LINE DEDUCTION FOR CHARITABLE CONTRIBUTIONS.

CARES Act (page 65)

(a) IN GENERAL.—Section 62(a) of the Internal Revenue Code of 1986 is amended by inserting after paragraph (21) the following new paragraph:

‘‘(22) CHARITABLE CONTRIBUTIONS.—In the case of taxable years beginning in 2020, the amount (not to exceed $300) of qualified charitable contributions made by an eligible individual during the taxable year.’’.

Because it said “individual,” a literal reading may interpret it as $600 per married couple filing jointly. From the TaxACT blog:

Thanks to federal coronavirus relief legislation, taxpayers are now able to take advantage of a new deduction for donating to qualifying charities — up to $300 for individual filers and up to $600 for married couples.

However, some sources said it’s still $300 for married filing jointly. From Kiplinger:

The CARES Act, among other coronavirus relief efforts, has instituted a provision allowing people to deduct $300 for charitable contributions. If you are married and filing jointly, your deduction is still limited to $300.

So what is it when you’re married filing jointly? $300 or $600? The IRS released the Form 1040 draft instructions last week. Now we have the definitive answer on page 29 (bold added by me):

If you don’t itemize deductions on Schedule A (Form 1040), you (or you and your spouse if filing jointly) may be able to take a charitable deduction for cash contributions made in 2020.

Enter the total amount of your contributions on line 10b. Don’t enter more than:

• $300 if single, head of household, or qualifying widow(er);

• $300 if married filing jointly; or

• $150 if married filing separately

That resolves it. The above-the-line deduction for 2020 is capped at $300 per tax return whether you’re single or married filing jointly. It’s capped at $150 each if you’re married filing separately.

[Update] Just to make it more confusing, Congress passed a new law that extended this deduction to 2021, and the cap in 2021 for married filing jointly is increased to $600. The cap in 2020 for married filing jointly is still left at $300. See 2021 $300 Charity Deduction For Non-Itemizers $600 Married.

The post CARES Act 2020 Charity Donation Deduction: $300 or $600 for Married? appeared first on The Finance Buff.

CARES Act Charity Donation Deduction: $300 or $600 for Married?

Since the Trump tax law in 2017 increased the standard deduction and capped the deduction for state and local taxes, the number of people who take the standard deduction increased from 70% of all taxpayers to 88%. I was part of the change. I switched to taking the much simpler standard deduction in the last two years. It also means I didn’t get an extra tax deduction for donating to charities. It was all included in the standard deduction.

The CARES Act passed earlier this year created a new above-the-line charitable contributions deduction for the 88% of all taxpayers who don’t itemize deductions. To qualify for this new deduction, the donations have to be in cash, and they have to be donated directly to charities. Donating household items to Goodwill doesn’t count. Donating appreciated stocks doesn’t count. Giving to a donor-advised fund doesn’t count. Because TisBest is officially a donor-advised fund, buying a charity gift card there probably doesn’t count either.

It isn’t a one-off for only 2020. This deduction is available every year until Congress changes the law again. The deduction is capped at $300. While it’s clear when you’re single, it’s a little ambiguous whether it’s $600 per married couple filing jointly or still $300. Here’s the relevant part from the text of the CARES Act (bold added by me):

SEC. 2204. ALLOWANCE OF PARTIAL ABOVE THE LINE DEDUCTION FOR CHARITABLE CONTRIBUTIONS.

CARES Act (page 65)

(a) IN GENERAL.—Section 62(a) of the Internal Revenue Code of 1986 is amended by inserting after paragraph (21) the following new paragraph:

‘‘(22) CHARITABLE CONTRIBUTIONS.—In the case of taxable years beginning in 2020, the amount (not to exceed $300) of qualified charitable contributions made by an eligible individual during the taxable year.’’.

Because it said “individual,” a literal reading may interpret it as $600 per married couple filing jointly. From the TaxACT blog:

Thanks to federal coronavirus relief legislation, taxpayers are now able to take advantage of a new deduction for donating to qualifying charities — up to $300 for individual filers and up to $600 for married couples.

However, some sources said it’s still $300 for married filing jointly. From Kiplinger:

The CARES Act, among other coronavirus relief efforts, has instituted a provision allowing people to deduct $300 for charitable contributions. If you are married and filing jointly, your deduction is still limited to $300.

So what is it when you’re married filing jointly? $300 or $600? The IRS released the Form 1040 draft instructions last week. Now we have the definitive answer on page 29 (bold added by me):

If you don’t itemize deductions on Schedule A (Form 1040), you (or you and your spouse if filing jointly) can take a charitable deduction of up to $300 for cash contributions made in 2020 to organizations that are religious, charitable, educational, scientific, or literary in purpose. See Pub. 526 for more information on the types of organizations that qualify. A deduction can’t be taken for a contribution to an organization described in IRC 509(a)(3) or for the establishment of a new, or maintenance of an existing, donor advised fund. Also, contributions of noncash property and contributions carried forward from prior years don’t qualify for this deduction. See the Instructions for Schedule A and Pub. 526 for more information on those types of contributions. Enter the total amount of your contributions on line 10b. Don’t enter more than $300.

That resolves it. The above-the-line deduction is capped at $300 per tax return whether you’re single or married.

The post CARES Act Charity Donation Deduction: $300 or $600 for Married? appeared first on The Finance Buff.

October 27, 2020

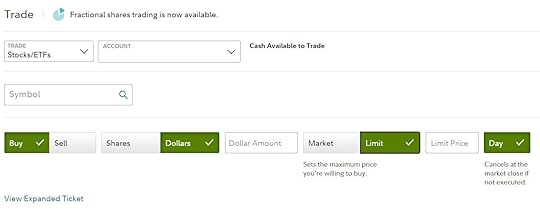

Fidelity Extended ETF Orders in Dollars with Fractional Shares to Website

Fidelity started accepting ETF orders in dollars with fractional shares back in February but it was available only in their mobile app (see Fidelity Accepts ETF Orders in Dollars with Fractional Shares). Now Fidelity extended the same functionality to online trading on their website.

When you buy or sell an ETF at most other brokers, you have to do it in whole shares. If you’d like to invest $3,000 in an ETF and the price of the ETF is $53.69 per share, you have to calculate first how many shares it is. Then you place an order for either 55 shares or 56 shares, which will cost you either $2,952.95 or $3,006.64, but not $3,000 exactly. When you place an order in dollars to buy $3,000 worth of this ETF at Fidelity, you don’t have to care what the price is per share. Fidelity will do the math and give you 55.876 shares. You will pay $2,999.98, with two cents left from your $3,000. Buying or selling in dollars is more natural than in shares.

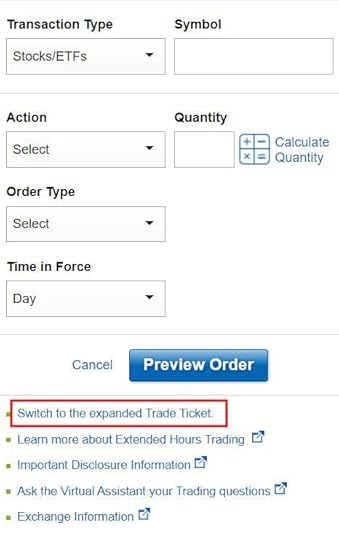

There are two paths to access the screen for placing an order in dollars.

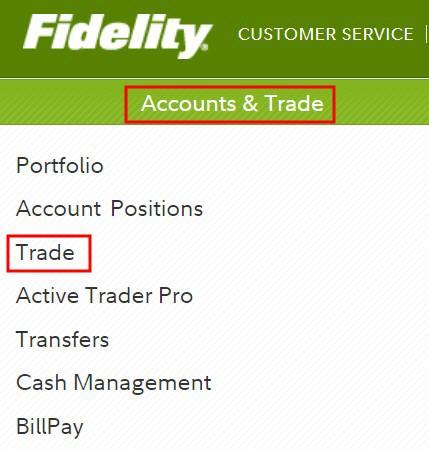

Pull-Down Menu

If you use the pull-down menu, click on Accounts & Trade, and then Trade.

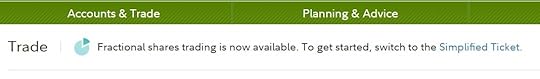

If you haven’t seen the Simplified Ticket before, you will see a banner message saying fractional shares trading is available on the Simplified Ticket. After you click on the link for the Simplified Ticket once, it will default to the Simplified Ticket next time.

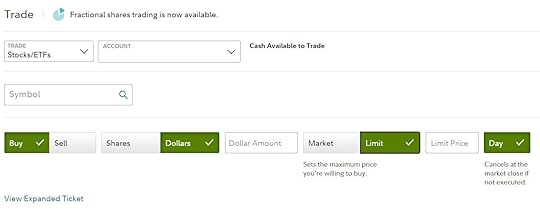

On the Simplified Ticket, you can choose to place orders either in shares or in dollars, as a market order or a limit order. If you choose to place the order in dollars as a limit order, the limit order is only valid for one day. The order will expire if it can’t be filled before the end of the day. Other order types such as Good ‘Til Canceled (GTC), On the Open, On the Close, etc. aren’t available for an order in dollars.

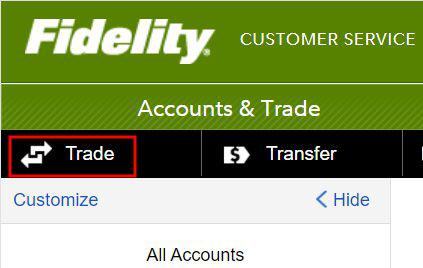

Trade Pop-up

If you use the Trade quick action link below the Accounts & Trade menu, you get a small pop-up for entering trades.

This pop-up only accepts orders in shares. Click on the “Switch to the expanded Trade Ticket” link at the bottom. It actually sends you to the Simplified Ticket, where you can place orders in dollars.

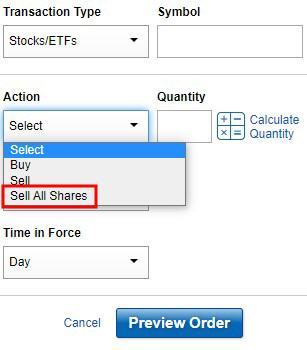

Sell All Shares

Before you can buy and hold fractional shares, it used to be that when you’d like to sell all shares in a holding, you enter an order to sell all the whole shares, and the remaining fractional share will be sold automatically. For example, if you have 55.876 shares in an ETF and you’d like to sell all your shares, you enter an order to sell 55 shares. When this order settles, your 0.876 shares will also be sold at the same price. There’s no way to hold less than one share. This is still the case at some other brokers.

Now that Fidelity lets you buy and sell in dollars, which can leave you with less than one share, they don’t automatically sell your fractional share anymore. If you have 55.876 shares and you enter an order to sell 55 shares, you will still hold the remaining 0.876 shares. If you’d like to sell all your shares in a holding, you can explicitly choose the “Sell All Shares” option.

The post Fidelity Extended ETF Orders in Dollars with Fractional Shares to Website appeared first on The Finance Buff.

October 20, 2020

Ally Bank Removed Online Early Withdrawal From No-Penalty CDs

I have some money in a no-penalty CD at Ally Bank. A no-penalty CD offers the best of both worlds: The interest rate is guaranteed not to go down during the term, and the money stays liquid at all times. If you need money before the CD matures, there is no early withdrawal penalty.

It used to be very easy to break a CD at Ally Bank. You go through an online interface and choose to transfer the money to an Ally savings account or a linked external account. Now Ally Bank quietly removed the simple online process. They replaced it with this message:

We’re only processing early withdrawals by phone right now.

Call us at 1-877-247-2559. We’re here 24/7.

The message makes it sound like it’s only temporary, maybe during system maintenance, but it’s not. The change is permanent. The online process is gone. If you need to withdraw early from your CD, you must call customer service.

Calling sounds simple but it’s not. If you don’t remember your favorite movie or whatever answer you gave to the security question, you won’t pass authentication. If you gave your Google Voice number as your mobile phone number, which they happily supported when you set up your account back then but now they don’t, you won’t be able to receive any security code they text you. If you fail authentication when you call, they will lock your online account. Now you’ll have to wait for someone from the Loss Prevention department to contact you in two to five business days. If you need the money from your CD, which is why you were forced to call to begin with, they don’t care. No way to contact Loss Prevention. No way to expedite. Just wait until they find time to call you. Please don’t ask me how I know.

Before you call any financial institution, while you still have online access to your account, go through all the security setups and make sure you have all the information you gave them when you first set up your account a long time ago. Reconsider using any online-only bank that forces you to call to transact business.

An online bank not allowing routine transactions online isn’t acceptable to me. I will close my account with Ally when my CDs mature.

When rates are so low anyway, it favors banks and credit unions with a physical presence. At least you have an option to go in and talk to someone to resolve any issues, whereas you are helpless when an online bank cuts off your access. If you can’t find good rates from a local bank or credit union, consider Marcus. Marcus also offers no-penalty CDs. Rates on savings accounts and CDs at Marcus are competitive with the rates at Ally Bank.

The post Ally Bank Removed Online Early Withdrawal From No-Penalty CDs appeared first on The Finance Buff.

October 6, 2020

Relocate Out of California to Escape High Taxes After Retirement?

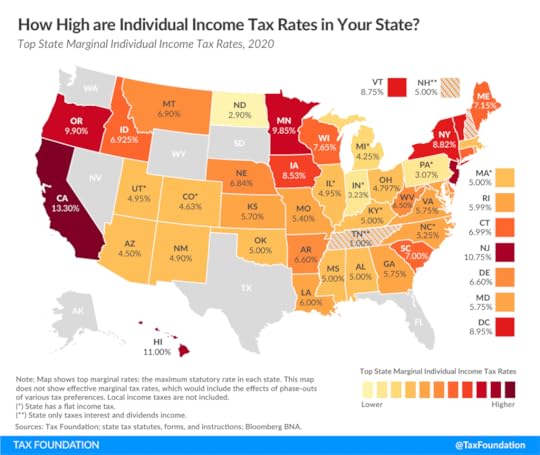

Whenever we mention to people that we moved from California, they all say it makes sense because we get to avoid the high state income tax in California. I don’t blame them. California has a reputation for high taxes. When you Google state income taxes, you get a map like this:

Source: State Individual Income Tax Rates and Brackets for 2020, Tax Foundation

Source: State Individual Income Tax Rates and Brackets for 2020, Tax FoundationCalifornia is shown in the darkest color. Its 13.3% top marginal tax rate is the highest in the country. On the other hand, even when we worked full-time in California, we never paid 13.3%. The 13.3% rate is only for people making over $1 million. Our marginal state income tax rate was 9.3%, which is still high, but it’s at least lower than the 9.9% rate in the neighbor state Oregon, or the 9.85% rate in Minnesota.

When you’re working, a 9.3% marginal state income tax rate isn’t ideal but you accept it for the job opportunities. When you’re no longer tied to a job, you think you finally get to escape it by moving to a place with no or low state taxes. That’s the motivation behind many searches for relocating to a retiree-friendly low-tax state. However, I like this tweet from Christine Benz of Morningstar on this topic:

When I think about factors influencing where to live in retirement, my list would be:

— Christine Benz (@christine_benz) June 12, 2020

1. Proximity to family/friends

2. Culture/activities/"fit"

3. Weather

4.

5.

6. Cost of housing

7.

8.

9.

10. Taxes

But not everyone thinks that way. My latest. https://t.co/xkbcHjHl7p

Taxes were very low on our list of considerations as well when we decided to relocate. We moved primarily to be closer to the destinations for the activities we enjoy. Besides, the state income tax can be completely different when you no longer have a high income. Our California state income tax last year was under $1,000, whereas we paid five figures when we were working full-time. It’s counter-productive to relocate out of a state only to escape a tax under $1,000.

Our California state income tax was low because the tax rates are progressive. A married couple first gets $9,074 as the standard deduction. Then it goes by this tax schedule:

Over –But not over –Tax$017,618$0.00 + 1.00% of the amount over $017,61841,766176.18 + 2.00% of the amount over 17,61841,76665,920659.14 + 4.00% of the amount over 41,76665,92091,5061,625.30 + 6.00% of the amount over 65,92091,506115,6483,160.46 + 8.00% of the amount over 91,506115,648590,7465,091.82 + 9.30% of the amount over 115,648

Finally, a married couple gets an exemption credit of $244. When a couple has $60k in gross income, their California state income tax is:

$659 + ($60,000 – $9,074 – $41,766) * 4% – $244 = $781

When you don’t have a big income, most of the income is taxed at 0%, 1%, and 2%. It’s a lot different than paying 9.3% on the bulk of your income when you’re working.

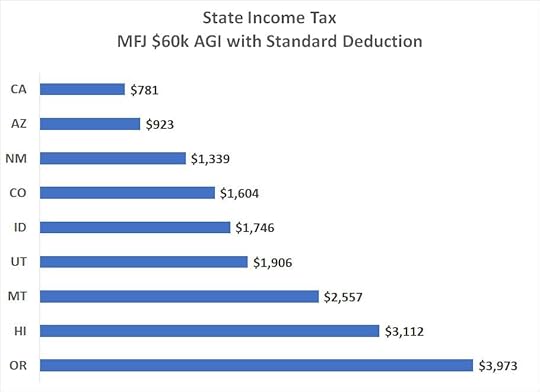

Out of curiosity, I did a mock tax return for all the states west of Rocky Mountains for a married couple with $60k in gross income. Besides states with no income tax (Alaska, Washington, Nevada, and Wyoming), California has the lowest income tax. That was a big surprise to me.

Some states (such as Hawaii) give special treatment to certain sources of income. Here I only did normal income without distinguishing the income types. I also only took the standard deduction in each state.

Property Tax

What about property tax? California has the famous Prop 13. The property tax increase is capped to 2% a year from the time of purchase. If you bought your home a long time ago, your property tax can be very low. Prop 60 and Prop 90 also allow someone 55 or older to sell their principal residence and transfer their low capped value to another property of equal or lesser value within the same county or in a welcoming county. Many retirees’ property tax will increase if they move to another state.

ACA Tax Credit

In addition, if you’re retired and you need ACA health insurance before you’re eligible for Medicare but your income is over the cliff for the federal premium tax credit, California kicks in with its version of the premium tax credit. With the tax credit from the state, your effective California state income tax rate can be negative 10%!

***

My takeaway from this exercise: Don’t assume. Even if you consider state taxes as an important factor for relocating after retirement, high taxes when you’re working doesn’t mean high taxes when you stop. Contrary to the perception of many people, California may very well be a retiree-friendly low-tax state.

The post Relocate Out of California to Escape High Taxes After Retirement? appeared first on The Finance Buff.

September 24, 2020

Positive Cash Flow: An Open Secret In Early Retirement

It’s been six months since the stock market touched a bottom in the coronavirus crash. It recovered nicely and fast. When the 2008 financial crisis started, I followed a path of overbalancing. After the stock market dropped 20%, I increased my allocation to stocks by five percentage points, and I increased it again by another five percentage points for each additional 10% drop. Whether the moves were right or wrong in theory, they were successful in the end. I was able to buy more stocks at low prices. Even at the bottom of the market in March 2020, the prices were still so much higher than the prices I paid in 2008 and 2009.

I didn’t overbalance again in March 2020. It wasn’t because I thought the market would never recover this time around. Overbalancing would’ve worked equally well in 2020, perhaps even better than in 2008. I didn’t do it because I’m different than I was in 2008.

I had a good-paying job in 2008. Although some people lost their jobs in the great recession, the industry I was in wasn’t hit hard. The company I worked for had a layoff, which affected 5% of the employees. The laid-off employees were able to find other jobs in short order. My salary was more than enough to cover our expenses. In other words, I had a positive cash flow outside my portfolio. My portfolio was also smaller back then. Although the percentage loss in 2008-2009 was larger than in March 2020, my loss-to-income ratio was much lower last time. Because I wasn’t relying on my investment portfolio and I could make up the loss relatively quickly with my income, I had no problem being greedy when others were fearful.

I don’t have that luxury anymore in 2020. While I still have some income from my blog and my advisor search and screening service, my income is far less than my previous salary. It doesn’t cover our expenses. While our withdrawal rate is still low, it feels a lot different than having a positive cashflow outside your portfolio and covering all your expenses with it.

Having a positive cash flow outside the portfolio is an open secret in the Financial Independence Retire Early (FIRE) circles. Despite all the headlines talking about saving 25x or 30x of annual expenses, it’s more for confidence than actually using the savings to cover expenses post-FIRE. The smart FIRE leaders don’t rely on their investment portfolio for their day-to-day spending. In theory, they can cover their expenses by withdrawing from their investment portfolio, but in reality, they don’t. They cover their expenses by their current income while leaving their portfolio untouched. Those who questioned whether FIRE will survive when the stock market crashed in March simply didn’t know how the game is played. The 4% rule doesn’t matter when you don’t withdraw at all.

This isn’t to argue whether the FIRE leaders really retired or not. It’s a lesson on how to insulate yourself from bear markets. If you have a positive cash flow outside your portfolio, you don’t worry much about bear markets. So how do you keep a positive cash flow after FIRE? Multiple ways.

Spouse’s Employment

Some couples keep one person working after FIRE. The working spouse’s employment covers the expenses and provides health insurance. Government statistics show that among working couples, 1/3 of them only have one spouse employed. When my wife quit her job in 2015, I was still working. If a bear market came but I kept my job, we wouldn’t have to worry.

Pension

Some had a pension when they retired. Doug Nordman at The Military Guide had it from the military. Fritz at The Retirement Manifesto had it from a private employer. Some employers also provide health insurance to retirees receiving a pension. Even if the pension doesn’t cover all the expenses, it still provides a nice cushion. Living lean in a bear market is also an option.

Part-Time Job

Some keep their job and only drop down to part-time. The part-time job can provide income and health insurance. Bianca planned to do that in her flight attendant job (This flight attendant has enough money saved to retire at 44, but she wants to keep working, MarketWatch).

Rental Properties

Living on income from rental properties is another popular option. Chad Carson has a book and a course teaching people how to retire early on rental properties.

Self-Employment

The most famous early retiree Mr Money Mustache arguably never withdrew from his investment portfolio after he retired at 30. He used self-employment income, first from fixing and flipping houses, then from blogging. Leif at Physician On FIRE just posted his 2019 tax return. He had a negative withdrawal rate because his self-employment income covered his expenses. He didn’t worry when the value of his investment portfolio dropped by $1 million in March. That’s the power of having a positive cash flow outside the portfolio.

If you only have a job, you’re vulnerable to recessions and unemployment, as many have experienced in the COVID-19 pandemic. If you only have an investment portfolio, you’re vulnerable to prolonged bear markets. When you have both an investment portfolio and a positive cash flow outside the portfolio, you’re financially more secure. That’s the smart way to do FIRE.

***

[Update] Long-time blogger J.D. Roth wrote this note when he shared this post on Apex Money:

As a FIRE insider, I can say that this is generally 100% true. Except for me and Doug Nordman, most FIRE folks support themselves with actual income.

The post Positive Cash Flow: An Open Secret In Early Retirement appeared first on The Finance Buff.

Positive Cash Flow: Open Secret In Early Retirement

It’s been six months since the stock market touched a bottom in the coronavirus crash. It recovered nicely and fast. When the 2008 financial crisis started, I followed a path of overbalancing. After the stock market dropped 20%, I increased my allocation to stocks by five percentage points, and I increased it again by another five percentage points for each additional 10% drop. Whether the moves were right or wrong in theory, they were successful in the end. I was able to buy more stocks at low prices. Even at the bottom of the market in March 2020, the prices were still so much higher than the prices I paid in 2008 and 2009.

I didn’t overbalance again in March 2020. It wasn’t because I thought the market would never recover this time around. Overbalancing would’ve worked equally well in 2020, perhaps even better than in 2008. I didn’t do it because I’m different than I was in 2008.

I had a good-paying job in 2008. Although some people lost their jobs in the great recession, the industry I was in wasn’t hit hard. The company I worked for had a layoff, which affected 5% of the employees. The laid-off employees were able to find other jobs in short order. My salary was more than enough to cover our expenses. In other words, I had a positive cash flow outside my portfolio. My portfolio was also smaller back then. Although the percentage loss in 2008-2009 was larger than in March 2020, my loss-to-income ratio was much lower last time. Because I wasn’t relying on my investment portfolio and I could make up the loss relatively quickly with my income, I had no problem being greedy when others were fearful.

I don’t have that luxury anymore in 2020. While I still have some income from my blog and my advisor search and screening service, my income is far less than my previous salary. It doesn’t cover our expenses. While our withdrawal rate is still low, it feels a lot different than having a positive cashflow externally and covering all your expenses with it.

Having a positive cash flow outside the portfolio is an open secret in the Financial Independence Retire Early (FIRE) circles. Despite all the headlines talking about saving 25x or 30x of annual expenses, it’s more for confidence than actually using the savings. The smart FIRE leaders don’t rely on their investment portfolio for their day-to-day spending. In theory, they can cover their expenses by withdrawing from their investment portfolio, but in reality, they don’t. They cover their expenses by their current income while leaving their portfolio untouched. Those who questioned whether FIRE will survive when the stock market crashed in March simply didn’t know how the game is played. The 4% rule doesn’t matter when you don’t withdraw at all.

This isn’t to argue whether the FIRE leaders really retired or not. It’s a lesson on how to insulate yourself from bear markets. If you have a positive cash flow outside your portfolio, you don’t worry much about bear markets. So how do you keep a positive cash flow after FIRE? Multiple ways.

Spouse’s Employment

Some couples keep one person working after FIRE. The working spouse’s employment covers the expenses and provides health insurance. Government statistics show that among working couples, 1/3 of them only have one spouse employed. When my wife quit her job in 2015, I was still working. If a bear market came but I kept my job, we wouldn’t have to worry.

Pension

Some had a pension when they retired. Doug Nordman at The Military Guide had it from the military. Fritz at The Retirement Manifesto had it from a private employer. Some employers also provide health insurance to retirees receiving a pension. Even if the pension doesn’t cover all the expenses, it still provides a nice cushion. Living lean in a bear market is also an option.

Part-Time Job

Some keep their job and only drop down to part-time. The part-time job can provide income and health insurance. Bianca planned to do that in her flight attendant job (This flight attendant has enough money saved to retire at 44, but she wants to keep working, MarketWatch).

Rental Properties

Living on income from rental properties is another popular option. Chad Carson has a book and a course teaching people how to retire early on rental properties.

Self-Employment

The most famous early retiree Mr Money Mustache arguably never withdrew from his investment portfolio after he retired at 30. He used self-employment income, first from fixing and flipping houses, then from blogging. Leif at Physician On FIRE just posted his 2019 tax return. He had a negative withdrawal rate because his self-employment income covered his expenses. He didn’t worry when the value of his investment portfolio dropped by $1 million in March. That’s the power of having a positive cash flow outside the portfolio.

If you only have a job, you’re vulnerable to recessions and unemployment, as many have experienced in the COVID-19 pandemic. If you only have an investment portfolio, you’re vulnerable to prolonged bear markets. When you have both an investment portfolio and a positive cash flow outside the portfolio, you’re financially more secure. That’s the smart way to do FIRE.

The post Positive Cash Flow: Open Secret In Early Retirement appeared first on The Finance Buff.

August 12, 2020

2020 2021 401k 403b 457 TSP IRA FSA HSA Contribution Limits

[Updated in August 2020 after July inflation release.]

Retirement plan contribution limits are adjusted for inflation each year. While inflation dipped in April due to the COVID-19 pandemic, it has rebounded in recent months. The contribution limits for 2021 are no longer at risk of going down. Most of the limits will stay the same as in 2020. Some income limits will go up slightly.

Before the IRS publishes the official numbers in October or November, I’m able to make my own calculations using the published inflation numbers and going by the same rules the IRS uses as stipulated by law. Before I have the inflation numbers for all the months used in the formula, due to rounding rules I can project the contribution limit for next year with high confidence. The inflation numbers in the months to come just aren’t able to make the limits cross another rounding threshold. For example when the law says a limit must be rounded down to the nearest $500, and the calculated result comes to $6,200, I know even if it’s off a little, it isn’t going to go below $6,000 or go above $6,500.

I have been able to do early projections with 100% accuracy ever since I started doing them several years ago.

401k/403b/457/TSP Elective Deferral Limit

401k/403b/457/TSP contribution limit will stay the same at $19,500 in 2021 as in 2020. If you are age 50 or over, the catch-up contribution limit will also stay the same at $6,500 in 2021 as in 2020.

Employer match or profit sharing contributions aren’t included in these limits. If you work for multiple employers in the same year or if your employer offers multiple plans, you have one single limit for 401k, 403b, and TSP across all plans. The 457 plan limit is separate. You can contribute the maximum to both a 401k/403b/TSP plan and a 457 plan.

Annual Additions Limit

The total employer plus employee contributions to all defined contribution plans by the same employer will increase by $1,000 from $57,000 in 2020 to $58,000 in 2021. The age-50-or-over catch-up contribution is on top of this limit. If you work for multiple unrelated employers in the same year, you have separate limits at each employer.

Annual Compensation Limit

The maximum annual compensation that can be considered for making contributions to a retirement plan is always 5x the annual additions limit. Therefore the annual compensation limit will increase by $5,000 from $285,000 in 2020 to $290,000 in 2021.

Highly Compensated Employee Threshold

If your employer limits your contribution because you are a Highly Compensated Employee (HCE), the minimum compensation will stay the same at $130,000 in 2021 as in 2020.

SIMPLE 401k and SIMPLE IRA Contribution Limit

SIMPLE 401k and SIMPLE IRA plans have a lower limit than standard 401k plans. The contribution limit for SIMPLE 401k and SIMPLE IRA plans will stay the same at $13,500 in 2021 as in 2020. If you are age 50 or over, the catch-up contribution limit will also stay the same at $3,000 in 2021 as in 2020. Employer contributions aren’t included in these limits.

Traditional and Roth IRA Contribution Limit

Traditional and Roth IRA contribution limit will stay the same at $6,000 in 2021 as in 2020. The age 50 catch-up limit is fixed by law at $1,000 in all years. The IRA contribution limit and the 401k/403b/TSP or SIMPLE contribution limit are separate. You can contribute the respective maximum to both a 401k/403b/TSP/SIMPLE plan and a traditional or Roth IRA.

Deductible IRA Income Limit

The income limit for taking a full deduction for your contribution to a traditional IRA while participating in a workplace retirement will increase by $1,000 for singles, from $65,000 in 2020 to $66,000 in 2021, and it will also increase by $1,000 for married filing jointly, from $104,000 in 2020 to $105,000 in 2021. The deduction completely phases out when your income goes above $75,000 in 2020 and $76,000 in 2021 for singles; and $124,000 in 2020 and $125,000 in 2021 for married filing jointly.

The income limit for taking a full deduction for your contribution to a traditional IRA when you are not covered in a workplace retirement but your spouse is will go up by $2,000 for married filing jointly from $196,000 in 2020 to $198,000 in 2021. The deduction completely phases out when your joint income goes above $206,000 in 2020 and $208,000 in 2021.

Roth IRA Income Limit

The income limit for contributing the maximum to a Roth IRA will go up by $1,000 for singles from $124,000 in 2020 to $125,000 in 2021. It will go up by $2,000 for married filing jointly from $196,000 in 2020 to $198,000 in 2021. You can’t contribute anything directly to a Roth IRA when your income goes above $139,000 in 2020 and $140,000 in 2021 for singles, and $206,000 in 2020 and $208,000 in 2021 for married filing jointly, up by $1,000 and $2,000 respectively in 2021. You can still do a backdoor Roth IRA in such case.

Healthcare Flexible Spending Account Contribution Limit

The Healthcare FSA contribution limit will stay the same at $2,750 per person in 2021 as in 2020.

Health Savings Account Contribution Limit

The HSA contribution limit for single coverage will go up by $50 from $3,550 in 2020 to $3,600 in 2021. The HSA contribution limit for family coverage will go up from $7,100 in 2020 to $7,200 in 2021. These were announced previously in the spring. Please see 2019 2020 2021 HSA Contribution Limits.

Those who are 55 or older can contribute additional $1,000. If you are married and both of you are 55 or older, each of you can contribute the additional $1,000, but to separate HSAs in each person’s name.

Saver’s Credit Income Limit

The income limits for receiving a Retirement Savings Contributions Credit (“Saver’s Credit”) will increase in 2021. For married filing jointly, it will be $39,000 in 2020 and $39,500 in 2021 (50% credit), $42,500 in 2020 and $43,000 in 2021 (20% credit), and $65,000 in 2020 and $66,000 in 2021 (10% credit). The limits for singles will be at half of the limits for married filing jointly, at $19,500 in 2020 and $19,750 in 2021 (50% credit), $21,250 in 2020 and $21,500 in 2021 (20% credit), and $32,500 in 2020 and $33,000 in 2021 (10% credit).

All Together

20202021IncreaseLimit on employee contributions to 401k, 403b, or 457 plan$19,500$19,500NoneLimit on age 50+ catchup contributions to 401k, 403b, or 457 plan$6,500$6,500NoneSIMPLE 401k or SIMPLE IRA contributions limit$13,500$13,500NoneSIMPLE 401k or SIMPLE IRA age 50+ catchup contributions limit$3,000$3,000NoneHighly Compensated Employee definition$130,000$130,000NoneMaximum annual additions to all defined contribution plans by the same employer$57,000$58,000$1,000Traditional and Roth IRA contribution limit$6,000$6,000NoneTraditional and Roth IRA age 50+ catchup contribution limit$1,000$1,000NoneDeductible IRA income limit, single, active participant in workplace retirement plan$65,000 – $75,000$66,000 – $76,000$1,000Deductible IRA income limit, married, active participant in workplace retirement plan$104,000 – $124,000$105,000 – $125,000$1,000Deductible IRA income limit, married, spouse is active participant in workplace retirement plan$196,000 – $206,000$198,000 – $208,000$2,000Roth IRA income limit, single$124,000 – $139,000$125,000 – $140,000$1,000Roth IRA income limit, married filing jointly$196,000 – $206,000$198,000 – $208,000$2,000Healthcare FSA Contribution Limit$2,750$2,750NoneHSA Contribution Limit, single coverage$3,550$3,600$50HSA Contribution Limit, family coverage$7,100$7,200$100HSA, age 55 catch-up$1,000$1,000None

The post 2020 2021 401k 403b 457 TSP IRA FSA HSA Contribution Limits appeared first on The Finance Buff.

August 4, 2020

2020 2021 ACA Health Insurance Premium Tax Credit Percentages

If you buy health insurance from healthcare.gov or a state-run ACA exchange, whether you qualify for a premium tax credit is determined by your income relative to the Federal Poverty Level (FPL). You don’t qualify for a premium tax credit if your income is above 400% of FPL. That’s a hard cutoff. See Stay Off the ACA Premium Subsidy Cliff.

If you do qualify for a premium tax credit, how much credit you qualify is determined by a sliding scale set each year by the government. The government says based on your income, you are supposed to pay this percentage of your income toward a second lowest-cost Silver plan in your area. After you pay that amount, the government will take care of the rest. If you pick a less expensive policy than the second lowest-cost Silver plan, you keep 100% of the savings. If you pick a more expensive policy than the second lowest-cost Silver plan, you pay 100% of the difference.

That sliding scale is called the Applicable Percentage Table. The numbers are adjusted each year. In 2020, people with income between 300% and 400% of Federal Poverty Level are expected to pay 9.78% of their income toward a second lowest-cost Silver plan in their area. That number is going to change to 9.83% for 2021.

Here are the numbers for different income levels in 2020 and 2021:

Income20202021< 133% FPL2.06%2.07%< 150% FPL3.09% – 4.12%3.10% – 4.14%< 200% FPL4.12% – 6.49%4.14% – 6.52%< 250% FPL6.49% – 8.29%6.52% – 8.33%< 300% FPL8.29% – 9.78%8.33% – 9.83%9.78%9.83%

Source: IRS Rev. Proc. 2019-29, Rev. Proc. 2020-36

As you see from the table above, the changes between 2020 and 2021 are quite minimal. The percentage of income the government expects you to pay toward a second lowest-cost Silver plan depends on your income relative to the Federal Poverty Level. To calculate where your income falls relative to the Federal Poverty Line, please see Federal Poverty Levels (FPL) For Affordable Care Act (ACA).

If your income is low, they expect you to pay a low percentage of your low income. As your income goes higher, they expect you to pay a higher percentage of your higher income. The higher percentage applies not just to the additional income but to your entire income. A higher income times a higher percentage is much more than a lower income times a lower percentage. For example, a household of two in the lower 48 states is expected to pay 7.82% of their income when their 2020 income is $40,000. If they increase their income to $50,000, they are expected to pay 9.66% of their income. The increase of their expected contribution toward ACA health insurance, and the corresponding decrease in their premium tax credit will be:

$50,000 * 9.66% – $40,000 * 7.82% = $1,702

This represents 17% of the $10,000 increase in their income. For a married couple, the effect of paying 17% of the additional income toward ACA health insurance is greater than the effect of paying 12% toward federal income tax. Normally it’s a good idea to consider Roth conversion or harvesting tax gains in the 12% tax bracket, but those moves become much less attractive when you receive a premium subsidy for ACA health insurance. For a helpful tool that can calculate this effect, please see Tax Calculator With ACA Health Insurance Subsidy.

The post 2020 2021 ACA Health Insurance Premium Tax Credit Percentages appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower