Harry Sit's Blog, page 22

January 30, 2022

How To Use a Password Manager with TreasuryDirect for I Bonds

When you buy I Bonds in multiple accounts for yourself, spouse, , trust, and business, logging in to the TreasuryDirect website can be a pain.

You have to log in separately using each assigned account number. It’s difficult to remember the account numbers. You’d have to save them somewhere, ideally in a password manager such as KeePass, Bitwarden, or LastPass. You copy the account number from the password manager and paste it on the login page. You’ll receive a one-time passcode by email. You paste it on the next page. So far so good.

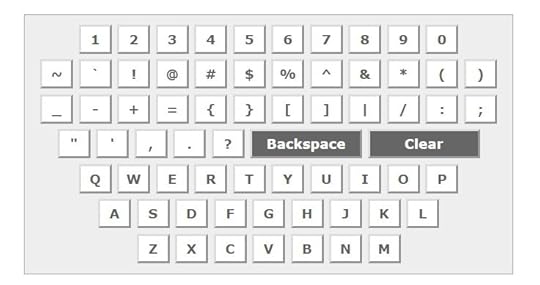

Virtual KeyboardNow comes the password part. You can’t paste directly into the password field. The TreasuryDirect website uses this virtual keyboard:

You click on the buttons with your mouse or finger to enter your password. If you follow the recommended practice and use a long password with a mix of letters, numbers, and symbols, it’s painful to click in your long password.

Some password managers can fill in the password automatically. If your password manager doesn’t, you may be tempted to reset your password to a simpler one just to avoid this pain. Don’t. There’s a workaround.

Remove HTML AttributeThe reason you can’t paste into the password field is that the TreasuryDirect web page instructs your browser to set that field to read-only. If you right-click on the password field and choose “Inspect” in the context menu (it works at least in Chrome and Firefox), you will see this:

readonly="readonly" name="password" size="20" maxlength="16" class="pwordinput" value="" data-cip-id="blah blah">When you double-click in that area and simply remove the part in red, the password field won’t be read-only anymore. Now you can paste your password!

Whether the password field is read-only or not only affects the behavior of your browser. Whether you click on the virtual keyboard or paste your password, the password will be transmitted to TreasuryDirect in the same way.

Browser BookmarkIf you’d like to eliminate the extra steps to right-click and remove the HTML attribute every time you log in, you can use a browser bookmark to automate the task. Create a bookmark in your browser and use this as the URL:

javascript:(function(){document.querySelector(".pwordinput").removeAttribute("readonly")})();Next time when you’re on the password page in TreasuryDirect, click on that bookmark. Nothing visible happens but it removes the read-only attribute from the password field. You can paste your password from the password manager now.

It works the same way as manually removing the HTML attribute. It just happens in one click instead of multiple steps.

Browser ExtensionIf you’re more technical and you already use a browser extension (add-on) such as Greasemonkey for Firefox or Tampermonkey for Chrome, you can put a script in the browser extension and eliminate that one click of a bookmark.

This is beyond the scope of this post. Here’s a solution I found on the Internet:

I haven’t tested either script. It may not be the only solution or the best one. Inspect and use it at your own risk. Because I don’t log in frequently, clicking on a bookmark once per session is easy enough for me.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Use a Password Manager with TreasuryDirect for I Bonds appeared first on The Finance Buff.

January 28, 2022

How To Report 2021 ESPP Sale In TurboTax: Don’t Pay Tax Twice!

[Updated in 2022 with new screenshots from TurboTax.]

If your employer offers an Employee Stock Purchase Program (ESPP), you should max it out. You come out ahead even if you sell the shares as soon as you can. See Employee Stock Purchase Plan (ESPP) Is A Fantastic Deal.

After you sell the shares from the ESPP, part of the income will be included on your W-2. However, the 1099-B form you receive from the broker still reflects your discounted purchase price. This post shows you how to make the necessary adjustment on your tax return using TurboTax.

Don’t pay tax twice!

If you use other tax software, please read:

How to Report ESPP Sale in H&R Block SoftwareIf you’re looking for a guide on doing taxes on RSU sales, please read Restricted Stock Units (RSU) and TurboTax: Net Issuance.

Table of ContentsWhen to Report1099-B From BrokerUse TurboTax DownloadEnter 1099-BCorrect Cost BasisVerify on Schedule DWhen to ReportBefore you begin, be sure to understand when you need to report. You report when you sell the shares you bought under your ESPP. If you only bought shares but you didn’t sell during the tax year, there’s nothing to report yet.

Wait until you sell, but write down the full per-share price (before the discount) when you bought. If you purchased multiple times, write down for each purchase:

The purchase dateThe closing price on the grant dateThe closing price on the purchase dateThe number of shares you boughtThis information is very important when you sell.

Let’s use this example:

You bought 1,000 shares under your ESPP on 9/30/20xx. The closing price on the purchase date was $12 per share. The closing price on the grant date six month before was $10 per share. You bought at $8.50 per share with the discount.

You would write down:

Grant Date4/1/20xxMarket Price on the Grant Date$10 per sharePurchase Date9/30/20xxMarket Price on the Purchase Date$12 per shareShares Purchased1,000Discounted Price$8.50 per shareKeep this information until you sell.

1099-B From BrokerWhen you sell, you will receive a 1099-B form from the broker in the following year. You will report your gain or loss using this 1099-B form and the information you accumulated for each purchase.

Let’s continue our example:

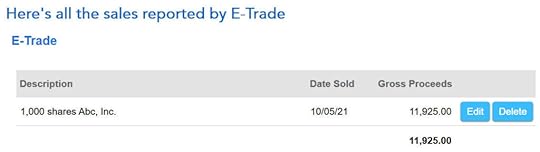

You sold 1,000 shares from your purchase above on 10/5/20xx at $11.95 per share. After commission and fees, you netted $11,925. You received a 1099-B form from your broker showing a sales proceed of $11,925 in the following year. The 1099-B form shows the cost basis as $8,500, which reflects your discounted purchase price.

Because you didn’t hold it for two years after the grant date and one year after the purchase date, your sale was a “disqualifying disposition.” The discount is added as income to your W-2. This raises your cost basis. If you just accept the 1099-B as-is, you will be double-taxed!

Now let’s account for it in TurboTax.

Use TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download.

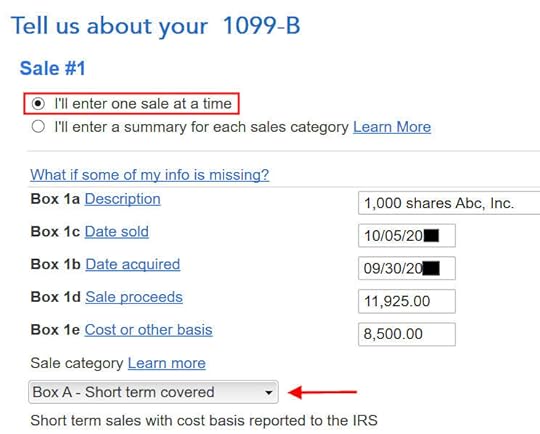

Enter 1099-B

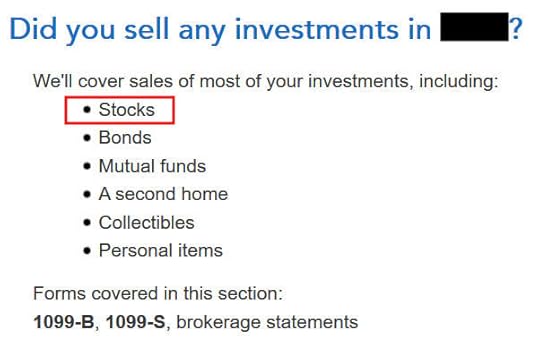

Go to “Federal Taxes” -> “Wages & Income” -> “Investment Income” and find “Stocks, Mutual Funds, Bonds, Other.”

Answer “Yes” because you did sell stocks.

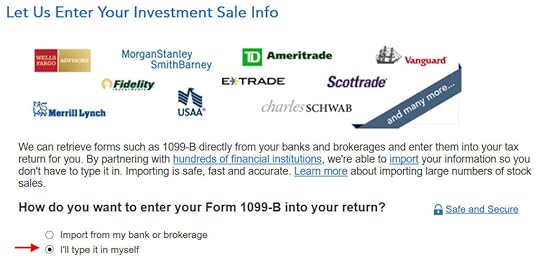

TurboTax offers an upgrade but we don’t need it. TurboTax Deluxe handles ESPP sale just fine.

We did receive a 1099-B form.

Import your 1099-B if you’d like. I’ll type it myself here.

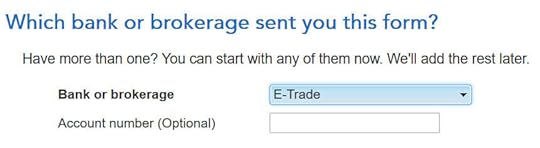

Select or enter the financial institution. Suppose it’s E*Trade.

Choose to enter one sale at a time. Fill in the boxes from your 1099-B form. Look carefully which category the sale belongs to on your 1099-B form. It was Box A on my form. It could be a different one on your form.

The cost basis on your 1099-B was reported to the IRS but it was too low. Don’t change it here directly.

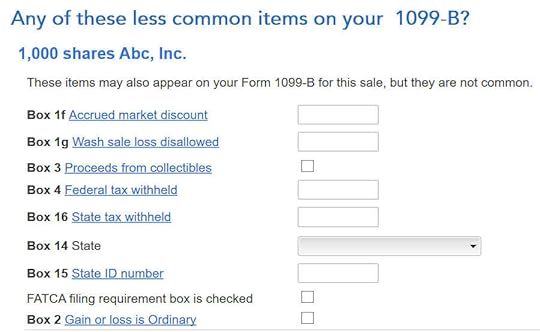

We don’t have any of these fields on our 1099-B form.

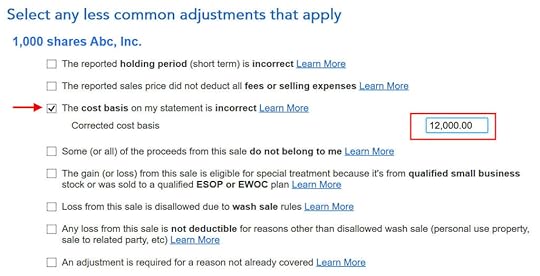

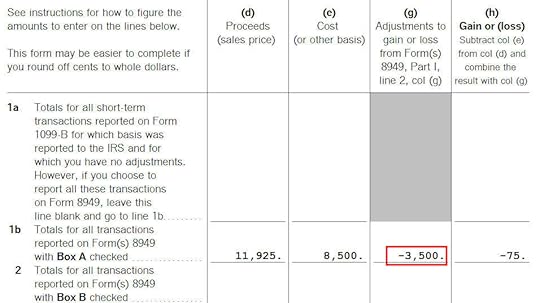

Correct Cost Basis

Check the box for “The cost basis on my statement is incorrect.” Enter your purchase cost plus the amount added to your W-2. When you did a “disqualifying disposition” your cost basis was the full value of the shares on the date of the purchase. The market price was $12 per share when you purchased those 1,000 shares at $8.50 per share. Your employer added the $3,500 discount as income to your W-2. Therefore your true basis is $8,500 + $3,500 = $12,000.

If you didn’t sell all the shares purchased in that batch, multiply the number of shares you sold by the discount price on the date of purchase and add the discount included on your W-2. For example, if you sold only 500 shares and your employer added $1,750 to your W-2, your corrected cost basis is:

$8.50 * 500 + $1,750 = $6,000

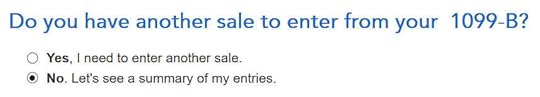

Repeat if you have more sales to enter. We only had one sale in our example.

You get a summary of the sales you entered.

You get a summary of your net gain and loss. We have a net loss because we received less money after selling the shares and paying the commission and fees than our discounted purchase plus the income added to our W-2.

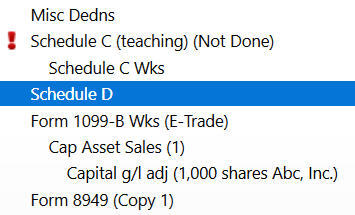

Verify on Schedule DWe can verify that the adjustment makes it all the way to the tax form. Click on “Forms” on the top right.

Find “Schedule D” in the left navigation pane.

Scroll up or down to find lind 1b, 2, 3, 8b, 9, or 10 depending on the sale category on your 1099-B form.

You see the negative adjustment in column (g). If you didn’t make the adjustment and you just accepted the 1099-B as-is, you will pay capital gains tax again on the $3,500 discount you are already paying taxes through your W-2. Remember to make the adjustment!

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Report 2021 ESPP Sale In TurboTax: Don’t Pay Tax Twice! appeared first on The Finance Buff.

January 25, 2022

The Forgotten Deductible Traditional IRA

This article was inspired by a post made by Kevin M on the Bogleheads forum. You may have heard of this rule of thumb about retirement savings priorities:

Contribute to 401k (or 403b) to get the full employer matchMaximize Roth IRAMaximize 401k (or 403b)Invest in taxable accountKevin asked why a Roth IRA as opposed to a deductible Traditional IRA is used in Step 2. It’s a very good question. In the financial media and blogs, everybody talks about the Roth IRA. The deductible Traditional IRA is hardly mentioned.

There are reasons Roth IRAs have better publicity. Some are good reasons; some aren’t. Today’s article is about the forgotten deductible Traditional IRA and how it shouldn’t be neglected.

Available to Most PeopleOne reason a Roth IRA is recommended more often than a deductible Traditional IRA is probably that some people can’t contribute to a deductible Traditional IRA but they can contribute to a Roth IRA. For people covered by a retirement plan at work, the AGI cutoff for contributing to a deductible Traditional IRA in 2022 is $78k single, $129k married filing jointly whereas the cutoff for contributing to a Roth IRA is $144k single, $214k married filing jointly.

Therefore for people with an AGI between $78k and $144k (single) or between $129k and $214k (married filing jointly), if they are covered by a retirement plan at work, the Roth IRA is an option but the deductible Traditional IRA isn’t.

But that’s only a narrow band. The vast majority of people have an AGI below $78k single, $129k married. The deductible Traditional IRA is also an available option to these vast majority of people but they probably don’t hear about it as often as they do about the Roth IRA.

Also remember the AGI is after all pre-tax deductions from the paycheck such as 401k contributions and health insurance. The actual cutoff for gross income is probably another $10,000 higher.

It could be because people who consume financial media tend to have a higher income. Therefore the financial media write for the higher-income people. If your AGI is below $78k single/$129k married but you are reading articles written for people with income above that, you are not getting the full picture if the articles don’t state that assumption.

Higher Income Limit Without a Workplace Retirement PlanMoreover, according to data from EBRI, only 60% of all workers have a retirement plan at work to begin with. For the other 40% of the population who don’t have a retirement plan at work, there’s either no income limit at all for contributing to a deductible Traditional IRA or the income limit is the same as that for contributing to a Roth IRA.

I would say most people are eligible for a deductible Traditional IRA but they don’t know it.

Traditional WinsWhen both options are available, should you automatically choose a Roth IRA over a deductible Traditional IRA, as the coverage in the financial media would suggest? Of course not.

I wrote The Case Against Roth 401k. It’s still true today. Everything I mentioned in that article against a Roth 401k applies to Roth IRA as well if you have the option to use a deductible Traditional IRA. To summarize, a deductible Traditional IRA helps:

Fill in lower tax brackets in retirementAvoid high state income taxLeave the option open for future Roth conversionsAvoid triggering phaseoutsYou still have to evaluate today’s tax bracket versus the possible tax brackets when you retire. If today’s tax bracket is 22% plus state income tax rate, it’s far from a forgone conclusion that tax rates will be higher when you retire than when you are working.

Don’t Worry About the RMDRoth proponents often cite the lack of Required Minimum Distributions (RMD) as an advantage of Roth accounts. It’s true but I’m afraid that’s another artifact of today’s retirees having pensions.

When you have a pension and you live comfortably on the pension and Social Security, RMD from your 401k and IRAs starting at age 72 adds to your taxable income, which is taxed at the marginal income tax rate and probably triggers some other taxes and phaseouts.

However, most of today’s workers don’t have a pension. They will need to withdraw from their 401k and IRAs anyway for retirement income. RMD won’t be a big problem if you don’t have a pension or you don’t have a large account balance. For the vast majority, the problem will be not having enough balance in the 401k and IRAs. Their problem won’t be being forced to withdraw more than they need.

Irrational ReasoningSo why are Roth IRAs and Roth 401k’s so popular that the deductible Traditional IRAs are almost forgotten? I can think of two reasons.

First, many people think they have a zero marginal income tax rate because they have low income. It’s been reported nearly 50% of taxpayers don’t actually pay federal income tax after all deductions and credits. However, their marginal tax rate isn’t necessarily zero. If they take a deduction they will receive more refundable tax credit.

The second reason is certainty. Paying a known rate today versus an unknown rate in the future is appealing, but I don’t think it’s rational, at least not for everyone. If the rate is low enough (10%?), paying it to remove uncertainty can be worth it. If it’s 22% plus the state income tax rate, it’s not clear at all. Going for certainty can cost you in retirement income.

Don’t forget the deductible Traditional IRA.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post The Forgotten Deductible Traditional IRA appeared first on The Finance Buff.

The Case Against Roth 401(k): Still True After All These Years

[Originally written in 2008. Updated in 2022. The case is still valid after all these years.]

To Roth or not to Roth, that is the question.

Many employers offer both a Traditional and a Roth contribution option in their 401(k) plan. If you choose the Traditional option, your contributions go in pre-tax but you pay tax when you withdraw after you retire. If you choose the Roth option, you pay tax first before you contribute but your withdrawals are tax-free after you retire. You can mix and match between Traditional and Roth but your total contributions between the two can’t exceed the annual limit.

TraditionalRothContributionspre-taxpost-taxEarningstax-deferredtax-freeWithdrawalstaxabletax-freeThis question of whether one is better off with contributing to the Traditional 401k or contributing to the Roth 401k has been the subject of a lot of debate. Although there is no one-size-fits-all answer, I think for most people the majority, if not 100%, of the contribution should go to a Traditional 401(k). I will state my case against the Roth 401(k) in this article.

Table of ContentsFill In Lower Tax Brackets In RetirementAvoid High State Income TaxLeave the Option Open for Future Roth ConversionsAvoid Triggering Phase-outsEasier to Get the Full Employer MatchWho Should Use a Roth 401(k)?Tax Diversification?Higher Effective ContributionsWhat About Roth IRA?The basic premise of a Roth 401(k), and to some extent a Roth IRA, is that of prepayment. You are prepaying taxes now so you don’t have to pay tax later. This prepayment concept is not uncommon. For example, buying a season ticket is prepaying for the individual events. Buying a timeshare is prepaying for vacation accommodation.

Whenever we deal with a prepayment scheme, we have to assess whether prepaying is “worth it.” The same paradigm also applies to Traditional versus Roth 401(k). There are several factors that make prepaying the taxes now not worth it.

Fill In Lower Tax Brackets In RetirementI showed in a previous post Commutative Law of Multiplication that if the marginal tax rate at retirement is the same as it is now, the Traditional and Roth 401(k)’s are equivalent. If the marginal tax rate is higher now than in retirement, one is better off contributing to a Traditional 401k. If the current marginal tax rate is lower, one is better off contributing to a Roth 401k.

But that applies only to the marginal dollar, which is the last dollar you can shift between Traditional and Roth 401(k). It is not necessarily the case for the entire contribution or the average dollar.

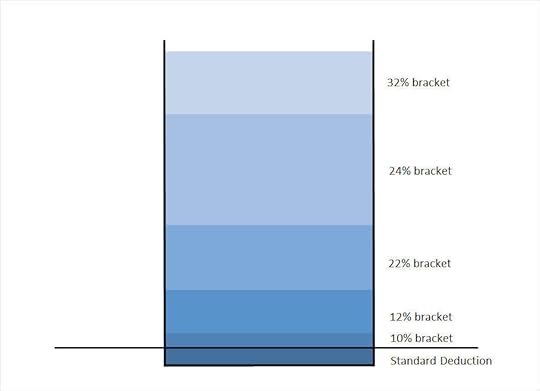

The tax system in the United States is progressive and it will probably stay that way. It means that income is taxed at increasing rates as it goes higher. Even if you think the marginal tax rate in the future will be higher, there will still be lower brackets and these lower brackets should be filled with money from a Traditional 401(k).

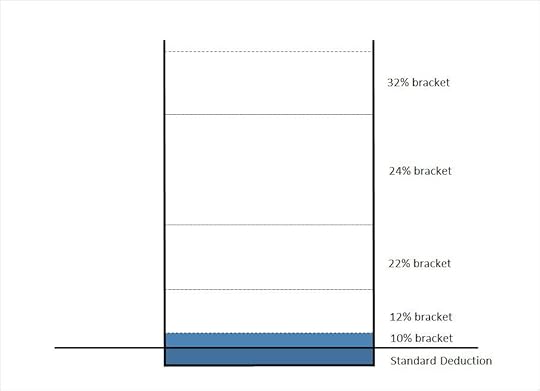

The chart below illustrates how the tax brackets work:

Picture a bucket with markings on the side. As you pour water into the bucket, the water goes up and crosses the marked lines. This represents how your income is taxed. The first chunk of your income absorbed by your tax deduction isn’t taxable. The next chunk of your income is taxed at 10%. The next chunks after that are taxed at 12%, 22%, etc.

When you contribute to a Traditional 401(k), you are scooping up income from the top of this bucket. The dollars you contribute come from the highest tax bracket for your income.

After you retire, you’re staring at an empty or shallow bucket before you pour in money from your 401(k). The money first goes through the lower brackets before it reaches the top.

Even if you assume your marginal tax bracket in retirement will be higher due to tax increases, a large portion of the 401(k) withdrawal may still be taxed at a lower rate than what it was when you contributed the money.

Until you know you can generate from your Traditional 401(k) enough income to fill the lower brackets, it doesn’t make sense to contribute to a Roth 401(k). For people without a pension, it means the majority of the retirement savings should go to a Traditional 401(k), not Roth.

If you have a pension and/or you expect to have a huge balance in Traditional 401(k)/IRA, large enough to fill the lower brackets every year, then contributing some money to Roth makes sense.

Avoid High State Income TaxMany people work in high-tax states like California and New York today. They work there because there are a lot of good-paying jobs in those states. They won’t necessarily retire there because taxes and the cost of living are high in those states.

States popular with retirees like Florida and Texas have no state income tax. If you’re working in a high-tax state today but there’s a good chance you will retire in a no-tax or low-tax state, contributing to a Traditional 401(k) lets you avoid paying the high state income tax on the contributions. Prepaying the high state income tax now is a dead loss.

Leave the Option Open for Future Roth ConversionsWhen you leave your employer, you can roll over the Traditional 401(k) to a Traditional IRA, which then can be converted to a Roth IRA at a later time when it is advantageous to you. A Roth 401k or IRA on the other hand can never be converted back to Traditional.

With a Traditional 401k, you hold the option, which has value. If you contribute to a Roth, you give up that valuable option. You can decide to convert and pay the tax whenever you are in a lower tax bracket than where you are now. Good times for conversion include:

Going back to school for a career change.Becoming unemployed due to layoffs or burn-out.Starting a business (not as much income in the first few years).A two-income couple having one parent stay at home or work part-time for a few years after they have kids.A high-income single person marrying a lower-income spouse.Taking early retirement.Moving from a high-tax state to a no-tax or low-tax state.Unless you’re sure that your marginal tax bracket will never be lower throughout your lifetime, you should leave the option open by putting money in a Traditional 401(k) and waiting to convert to Roth when an opportunity comes.

Avoid Triggering Phase-outsBecause contributing to a Roth 401k does not reduce your gross income, you appear to have a higher income than if you contributed to a Traditional 401k.

There are all kinds of income-based eligibility cutoffs and phase-outs in the tax code. When you exceed the income threshold, your tax benefits from those programs are either reduced or eliminated. Some of these tax breaks include:

Child Tax CreditChild and Dependent Care CreditAmerican Opportunity tax creditLifetime Learning creditEligibility to contribute to a Roth IRAStudent loan interest tax deductionThink of the stimulus payments during the COVID pandemic. If a single person earned $80,000 but contributed $10,000 to a Roth 401k, he/she wasn’t eligible for the payment. If he/she contributed $12,000 to a Traditional 401(k) instead, he/she was eligible.

Easier to Get the Full Employer MatchSome people think if you contribute to Roth 401k, the employer’s match will also go there, which will effectively increase your employer match. That’s not true. The employer match always goes to the pre-tax account whether you contribute to the Traditional 401k or the Roth 401k.

When money is tight, it’s easier to qualify for the full employer match when you contribute to the Traditional 401k with pre-tax dollars.

Who Should Use a Roth 401(k)?With so many disadvantages, then, for whom does a Roth 401(k) make sense?

A Roth 401(k) is good for people in low-paying jobs now but expect to have high-paying jobs later. Doctors in resident programs fit that description very well. They are paid very little while they are in residency but their income is expected to rise substantially higher when they finish the program. Their income will stay high in their career and they will receive a high income after they retire. Prepaying tax now makes sense because they are prepaying at a low rate and they will avoid paying a higher rate later.

College students working part-time jobs or recent graduates working in entry-level jobs are also good examples for taking advantage of a Roth 401(k) while their income (and their tax rate) is low.

A Roth 401(k) is also good for people who are already in the top tax bracket and expect to be there forever. If they don’t see any chance of being in a lower tax bracket, prepaying tax now will lock in the tax rate so they won’t have to worry about future tax increases. On the other hand, people who are in the top tax bracket are in a good position to retire early, with many years of lower tax brackets to fill. So don’t be too sure of staying in the top tax bracket forever.

Tax Diversification?What about the idea of tax diversification? Some advocate both a Roth 401k and a Traditional 401k because the tax rates in the future are uncertain.

Diversification is good in general but it doesn’t mean automatic 50:50. Just like investing in emerging markets provides diversification, it doesn’t mean you should invest 50% of your money in emerging markets. You still have to decide how much you should allocate your retirement savings between Traditional and Roth just like you allocate a portfolio between developed markets and emerging markets.

Tax diversification also doesn’t mean you have to do it right now if you are in your peak earning years. There might be better times coming up in the future.

As for me, I had contributed 100% to a Traditional 401(k) every year when I worked full-time. Prepaying taxes just wasn’t worth it.

Higher Effective ContributionsSome say the Roth 401(k) is better because you can fool yourself into contributing more when you’re using after-tax money. Contributing 10% of your salary post-tax effectively puts more money into your 401k than contributing 10% of your salary pre-tax. It’s true but you should adjust your contribution to 12% or 15% to equalize the net paycheck when you contribute to a Traditional 401k.

A Roth 401k has a higher effective contribution limit because the annual contribution limit is the same when you max out your 401k. There is some truth to it. See follow-up post, Roth 401(k) for People Who Contribute the Max, which includes an online spreadsheet that calculates the value of having a higher effective contribution limit in a Roth 401k.

What About Roth IRA?All arguments for and against the Roth 401k also apply to the Roth IRA when you are not yet contributing the maximum to your Traditional 401k. Instead of contributing to the Roth IRA, you can just increase the contribution to your Traditional 401k.

An additional argument in favor of the Roth IRA is that some 401k plans have higher fees. Even then the Traditional 401k can still be better when you don’t expect to work there for many years. You can roll over to your own IRA for lower fees when you change jobs. See Alternatives to a High Cost 401k Or 403b Plan.

If you are already contributing the maximum to your Traditional 401k, you may still be able to take a deduction for contributing to a Traditional IRA. See The Forgotten Deductible Traditional IRA. A Roth IRA is better when you already contribute the maximum to your Traditional 401k and you don’t get a deduction for contributing to a Traditional IRA anyway.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post The Case Against Roth 401(k): Still True After All These Years appeared first on The Finance Buff.

January 20, 2022

2021 2022 2023 Federal Poverty Levels (FPL) For ACA Health Insurance

People who don’t have health insurance from work can buy health coverage under the Affordable Care Act (ACA), also known as Obamacare. The premiums are made affordable by a premium subsidy in the form of a tax credit calculated off of your income relative to the Federal Poverty Levels (FPL), also known as the HHS poverty guidelines.

The Maximum IncomeExcept for 2021 and 2022, you qualify for the premium subsidy only if your modified adjusted gross income (MAGI) is at 400% FPL or below. If your MAGI goes above 400% FPL even by $1, you lose all the subsidy. See Stay Off the ACA Premium Subsidy Cliff.

The American Rescue Act made a temporary change for 2021 and 2022. It turned the cliff into a gradual slope. You still qualify for a premium subsidy in 2021 and 2022 even if your income is over 400% FPL. You just qualify for a lower amount as your income goes up. See ACA Premium Subsidy Cliff Turns Into a Slope In 2021 and 2022. The cliff is scheduled to return in 2023.

Modified Adjusted Gross Income for the ACA premium subsidy is basically your adjusted gross income (AGI) plus tax-exempt muni bond interest, plus untaxed Social Security benefits. In order to see how much you qualify for the premium subsidy, you have to know where the FPL is.

The Minimum IncomeIn addition to the maximum income to receive the premium subsidy, there’s also a minimum income to get accepted by the ACA marketplace. If your estimated income is too low, the ACA marketplace won’t accept you. They send you to Medicaid instead. In states that expanded Medicaid, the minimum income is 138% FPL. In states that didn’t expand Medicaid, the minimum income is 100% FPL. Here’s a map from Kaiser Family Foundation that shows which states expanded Medicaid and which states did not: Current Status of State Medicaid Expansion Decisions.

However, unlike the maximum income, the minimum income is only examined at the time of enrollment, not at the time when you file your tax return. If your estimated income at the time of enrollment is below the minimum, the ACA marketplace won’t accept you, and they will refer you to Medicaid. If your estimated income at the time of enrollment is above the minimum and they accepted you, but due to unforeseen circumstances your income for the year ended up below the minimum, as long as you made the original estimate in good faith, you are not required to pay back the premium subsidy you already received.

The FPL NumbersHere are the numbers for coverage in 2021, 2022, and 2023. They increase with inflation every year in January. These are applied with a one-year lag. Your eligibility for a premium subsidy for 2022 is based on the FPL numbers announced in 2021. The new numbers announced in 2022 will be used for coverage in 2023.

There are three sets of numbers. FPLs are higher in Alaska and Hawaii than in the lower 48 states and Washington DC.

48 Contiguous States and Washington DCNumber of persons in household2021 coverage2022 coverage2023 coverage1$12,760$12,880$13,5902$17,240$17,420$18,3103$21,720$21,960$23,0304$26,200$26,500$27,7505$30,680$31,040$32,4706$35,160$35,580$37,1907$39,640$40,120$41,9108$44,120$44,660$46,630moreadd $4,480 eachadd $4,540 eachadd $4,720 eachAlaskaNumber of persons in household2021 coverage2022 coverage2023 coverage1$15,950$16,090$16,9902$21,550$21,770$22,8903$27,150$27,450$28,7904$32,750$33,130$34,6905$38,350$38,810$40,5906$43,950$44,490$46,4907$49,550$50,170$52,3908$55,150$55,850$58,290moreadd $5,600 eachadd $5,680 eachadd $5,900 eachHawaiiNumber of persons in household2021 coverage2022 coverage2023 coverage1$14,680$14,820$15,6302$19,830$20,040$21,0603$24,980$25,260$26,4904$30,130$30,480$31,9205$35,280$35,700$37,3506$40,430$40,920$42,7807$45,580$46,140$48,2108$50,730$51,360$53,640moreadd $5,150 eachadd $5,220 eachadd $5,430 eachSource:

Department of Health and Human Services, notice 2020-00858Department of Health and Human Services, notice 2021-01969Department of Health and Human Services, notice 2022-01166The Applicable PercentagesThe FPL numbers determine one aspect of your eligibility for the premium subsidy. How much you are expected to pay when you qualify for the premium subsidy is also determined by a sliding scale called the Applicable Percentages. We cover it in ACA Health Insurance Premium Tax Credit Percentages.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2021 2022 2023 Federal Poverty Levels (FPL) For ACA Health Insurance appeared first on The Finance Buff.

How to Report 2021 Backdoor Roth In FreeTaxUSA (Updated)

TaxAct used to be a low-cost alternative to the big two tax prep software TurboTax and H&R Block. However, its pricing strategy changed in recent years. Now TaxAct is just as expensive or sometimes even more expensive than TurboTax and H&R Block. The good news is another low-cost alternative emerged. It’s called FreeTaxUSA.

FreeTaxUSA is purely online; there is no download option. It uses the freemium pricing model. Federal tax filing is free, regardless of the complexity of the return. After you are done with federal, if you need to file a state return, it costs $12.95. They also offer a deluxe upgrade for $6.99, which includes audit assist, priority support, and amended returns. All told, the total cost is under $20 and it includes e-filing for both federal and state.

Low cost is good and all, but how good is the software? I decided to test-drive it with a slightly complicated subject: reporting the Backdoor Roth. Over the years I created guides for how to report Backdoor Roth in TurboTax and how to report Backdoor Roth in H&R Block. A reader asked me to also create a guide for doing the same in FreeTaxUSA.

Just as a refresher, a Backdoor Roth involves making a non-deductible contribution to a Traditional IRA followed by converting from the Traditional IRA to a Roth IRA. Both the contribution and the conversion need to be reported in the tax software. For more information on Backdoor Roth, see Backdoor Roth: A Complete How-To.

Table of ContentsWhat To ReportConvert From Traditional IRA to RothTraditional IRA ContributionTaxable Income from Backdoor RothTroubleshootingWhat To ReportYou report on the tax return your contribution to a Traditional IRA *for* that year and your converting to Roth *during* that year.

For example, when you are doing your tax return for year X, you report the contribution you made *for* year X, whether you actually did it during year X or between January 1 and April 15 of the following year. You also report your converting to Roth *during* year X, whether the contribution was made for year X, the year before, or any previous years. Therefore a contribution made during the following year for year X goes on the tax return for year X. A conversion done during year Y after you made a contribution for year X goes on the tax return for year Y.

You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finish your conversion in the same year. I called this a “planned” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for year X in year X and convert it during year X. Contribute for year Y in year Y and convert it during year Y. This way everything is clean and neat.

If you are already off by one year, catch up. Contribute for both the previous year and the current year, then convert the sum during the same year. See Make Backdoor Roth Easy On Your Tax Return.

Here’s the scenario we’ll use as an example:

You contributed $6,000 to a traditional IRA in 2021 for 2021. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2021, the value grew to $6,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments to the screens shown here. Some of the screenshots were from the previous year. The screens are still the same in the 2021 edition.

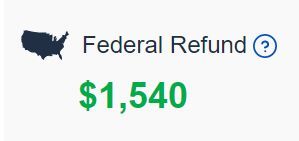

Before we start, suppose this is what FreeTaxUSA shows:

We’ll compare the results after we enter the Backdoor Roth.

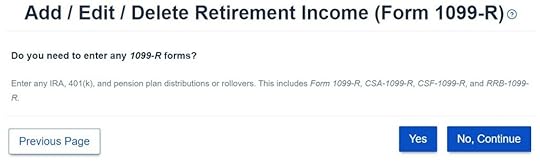

Convert From Traditional IRA to RothThe tax software works on income items first. Even though the conversion happened after the contribution, we enter the conversion first.

When you convert from Traditional IRA to Roth, you will receive a 1099-R. Complete this section only if you converted *during* the year for which you are doing the tax return. If you only converted during the following year and you don’t have a 1099-R yet, skip to the next section “Traditional IRA Contribution.” You’ll complete this section next year.

In our example, by the time you converted, the money in the Traditional IRA had grown from $6,000 to $6,200.

Click on Yes when it asks you about the 1099-R.

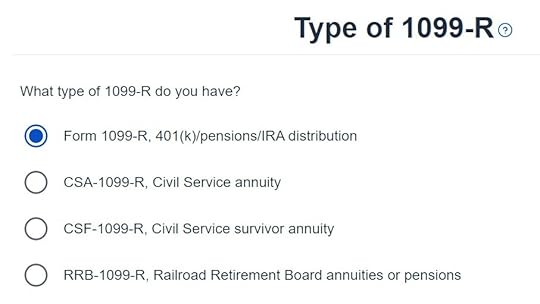

It’s just a regular 1099-R.

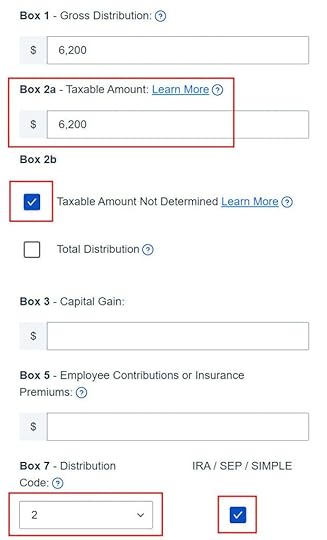

Enter the 1099-R exactly as you have it. Pay attention to the code in Box 7 and the checkboxes. It’s normal to have the same amount as the taxable amount in Box 2a, when Box 2b is checked saying “taxable amount not determined.” Pay attention to the distribution code in Box 7. My 1099-R has code 2, and the IRA/SEP/SIMPLE box is also checked.

Right after you enter the 1099-R, you will see the refund number drop. Here we went from a $1,540 refund to $264. Don’t panic. It’s normal and temporary. The refund number will come up when we finish everything.

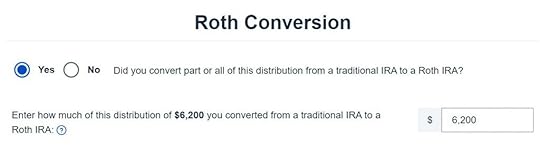

It asks you about Roth conversion. Answer Yes to conversion and enter the converted amount. This whole 1099-R is the result of a Roth conversion.

You are done with this 1099-R. Repeat if you have another 1099-R. If you’re married and both of you did a Backdoor Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse.

It asks you about the basis carried over from previous years. If you did a clean “planned” backdoor Roth every year, although technically the answer is Yes, you have nothing to carry over from year to year. In our simple example, we don’t have any. If you do, get the number from line 14 of Form 8606 from your previous year’s tax return.

Not impacted by a disaster.

Now continue with all other income items until you are done with income. Your refund meter is still lower than it should be, but it will change soon.

Traditional IRA Contribution

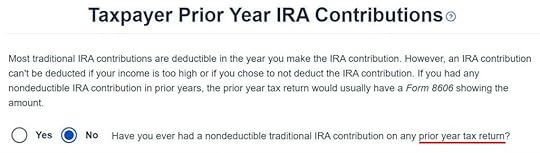

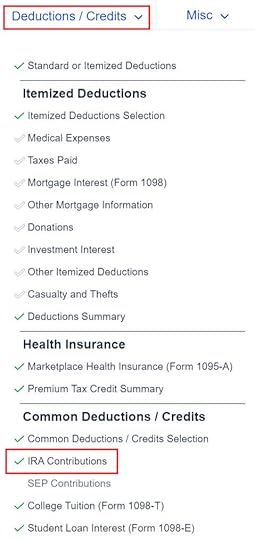

Find the IRA Contributions section under the “Deductions / Credits” menu.

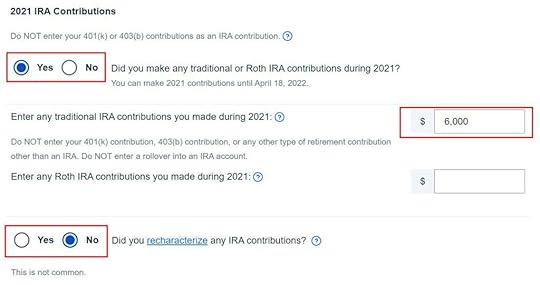

Answer Yes to the first question and enter your contribution. Leave the answer to “Did you recharacterize” at No. In our example, you contributed $6,000 directly to a Traditional IRA. If you originally contributed to a Roth IRA and then you recharacterized the contribution as traditional contributions, enter the amount in the Roth IRA box and choose Yes below when it asks you whether you recharacterized.

Your refund number goes up again! It was a refund of $1,540 before we started. It went down a lot and now it’s back to $1,496. The $44 difference is due to paying tax on the $200 earnings before we converted to Roth.

We don’t have a SEP or SIMPLE account.

Withdrawal means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer ‘No’ here.

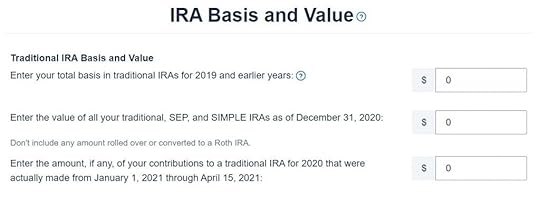

In our example, we don’t have any basis carried over from the previous years. We don’t have any money in traditional, SEP, or SIMPLE IRAs as of the end of the year (we already converted to Roth by then). Our contribution was made during the year in question, not in the following year.

It tells us we don’t get a deduction. We know. It’s because our income was too high. That’s why we did the Backdoor Roth to begin with.

If you only contributed *for* last year but you didn’t convert until the following year, remember to come back next year to finish the conversion part.

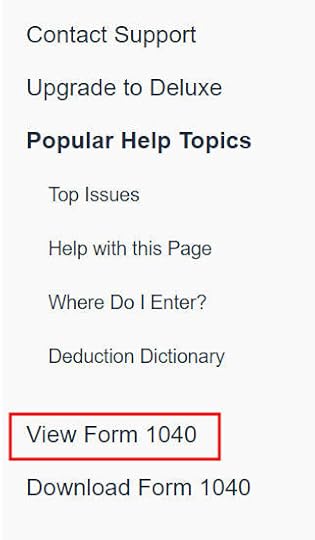

Taxable Income from Backdoor RothAfter going through all these, let’s confirm how you’re taxed on the Backdoor Roth. Click on “View 1040” on the right-hand side.

Look for Line 4 in Form 1040.

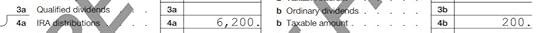

It shows $6,200 in IRA distributions and only $200 is taxable. If you are married filing jointly and both of you did a backdoor Roth, the numbers here will show double.

Tah-Dah! You got money into a Roth IRA through the backdoor when you aren’t eligible to contribute to it directly. You will pay tax on a small amount in earnings if you waited between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

W-2 Box 13Make sure the “Retirement plan” box in Box 13 of the W-2 you entered into the software matches your actual W-2. If you are married and both of you have a W-2, make sure your entries for both W-2’s match the actual forms you received.

When you are not covered by a retirement plan at work, such as a 401k or 403b plan, your Traditional IRA contribution may be deductible, which also makes your Roth conversion taxable.

Self vs SpouseIf you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Report 2021 Backdoor Roth In FreeTaxUSA (Updated) appeared first on The Finance Buff.

January 17, 2022

Taxes on I Bonds Get Complicated If You Go Against the Default

Taxes on I Bonds are dead simple if you don’t do anything extra. You make it a lot more complicated when you go against the default.

Table of ContentsThe Default – During Your LifetimeThe Default – After You DieOptional – Pay Up In the Year of DeathOptional – Report Interest Every YearNo Annual 1099 No Periodic StatementsValue on December 31 or January 1?Unrealized Early Withdrawal PenaltyBond-by-Bond Tracking RequiredRisk of Paying Tax TwiceSavings Bond CalculatorThe Default – During Your LifetimeBy default, you don’t pay any taxes while you’re holding I Bonds during your lifetime. You pay federal income tax on the interest accumulated over the years only when you cash out or when the bonds mature after 30 years. It’ll be taxed as ordinary income, not long-term capital gains. The interest is exempt from state and local taxes. There’s no RMD in I Bonds.

If you do a partial cashout from a purchase, TreasuryDirect will split the cashed-out amount proportionately into principal and interest. Suppose you originally bought $10,000 and the $10,000 grew to $15,000 with interest. When you cash out $3,000 from this purchase, which is 20% of the total value, TreasuryDirect will split it into $2,000 principal and $1,000 interest. You’ll pay tax on $1,000.

TreasuryDirect will track and calculate the interest for you. They’ll generate a 1099-INT form for the year when you cash out any I Bonds or when any I Bonds mature. You log in to your account and download the 1099 form.

The Default – After You DieThe second owner or beneficiary on your I Bonds inherits those bonds after you die. Be sure to keep your second owner or beneficiary designations up to date. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

By default, your second owner or beneficiary doesn’t pay any taxes when they continue to hold those I Bonds they inherit from you. I Bonds aren’t eligible for a step-up in basis. They’ll pay federal income tax on the accumulated interest since your original purchase when they cash out or when the bonds mature. It’ll be taxed as ordinary income, not long-term capital gains. The interest is exempt from state and local taxes. TreasuryDirect will track and calculate the interest and generate the 1099-INT form for the new owner.

This is the easiest.

Optional – Pay Up In the Year of DeathAfter you die, your surviving spouse or whoever files your final year’s tax return can choose to include all the accumulated interest earned through your date of death on your final tax return. Then the second owner or the beneficiary will pay tax only on the interest earned going forward.

Your surviving spouse or the executor of your estate will need to do the calculation themselves if they choose this option. TreasuryDirect won’t generate any 1099 form unless they cash out your I Bonds.

Your second owner or beneficiary needs to keep the documentation to show how much interest was already added to your final tax return for the bonds they inherited. When they cash out the bonds or when the bonds mature, the 1099 form from TreasuryDirect will still show all the interest since your original purchase. They’ll have to remember to back out the interest that was already included on your final tax return. See IRS Publication 559 (page 11).

Because it can be many years until they cash out the bonds or when the bonds mature, it’s quite possible they’ll forget and they’ll pay tax again on the whole thing when they have a 1099 form in front of them. I think it’s better to just go with the default and not go out of the way to pay up in the year of your death.

Optional – Report Interest Every YearReader Jeff left this comment on my How to Buy I Bonds post:

Your comment on taxation is a bit misleading. Yes, you can wait until maturity to declare the interest in you income. However, you do have the option of declaring the interest annually on your tax return. In some cases that can be better, especially for younger buyers who don’t have much (or any) taxable income to report.

I admit I left that part out of the scope of the introduction to I Bonds because it’s more of an advanced tactic. Let’s go into it now.

IRS Publication 550 says this on page 7:

Method 2. Choose to report the increase in redemption value as interest each year.

You must use the same method for all Series EE, Series E, and Series I bonds you own. If you do not choose method 2 by reporting the increase in redemption value as interest each year, you must use method 1.

Method 1 is the default we talked about already — you wait until you cash out or until the bonds mature. Method 2 is appealing when you’re in a low tax bracket. You avoid having all the accumulated interest come as income in one year when you cash out or when the bonds mature. As Jeff mentioned, this is especially true when I Bonds are owned by a child, whose standard deduction and low tax brackets may otherwise go unused each year.

This optional Method 2 is doable in theory but it brings a lot of complications in real life.

No Annual 1099You don’t get much help if you choose Method 2. It’s not like you can change a setting in your TreasuryDirect account and you’ll start receiving 1099 forms each year. TreasuryDirect will always assume you’re going with the default. You’ll have to figure out on your own how much interest to report each year.

No Periodic StatementsYou see the current values of your I Bonds when you log in to your TreasuryDirect account. TreasuryDirect doesn’t produce any monthly or annual statements showing you the historical values and how much interest you earned during any month or year. When you’re doing taxes in March, it’s a small challenge just to figure out what the values were as of the beginning of this year or the end of last year.

Value on December 31 or January 1?The IRS publication only says to report “the increase in redemption value” but it doesn’t say between which dates. Is it from January 1 to December 31? Or is it from December 31 of the prior year to December 31? Or is it from January 1 to January 1 of the following year?

The values on December 31 and January 1 are the same in most other financial instruments because January 1 is always a holiday. That’s not the case for I Bonds. I Bonds get the interest from the previous month on the first of each month. The redemption value on January 1 includes interest from December whereas the redemption value on December 31 does not.

If you count the increase using the values from January 1 to December 31 each year, you only include interest from 11 months. That can’t be right.

When it comes to taxes, the cutoff is usually December 31. If you use December 31 to December 31, you include interest from December of the prior year through November. That’s odd, but maybe that’s how they want it?

If you use January 1 to January 1, you include interest from January to December, but are you supposed to use January 1 of the following year as the valuation date?

After further research, reader Steven figured out that you should calculate “the increase in redemption value” using values on December 31 each year to report as interest on your tax return. See comment #7 under this post.

Unrealized Early Withdrawal PenaltyThe redemption values you see in TreasuryDirect automatically exclude the potential three-month early withdrawal penalty when the bonds are within their first five years. It’s not clear whether “the increase in redemption value” is before this unrealized early withdrawal penalty or after.

When you have a bank CD, the interest is first paid, which you pay tax on, and you deduct the early withdrawal penalty if you withdraw early. If you use the redemption values of your I Bonds as shown by TreasuryDirect, you will have the early withdrawal penalty pre-deducted whether you actually withdraw early or not. You will have three fewer months of interest in the first year and 15 months of interest in the sixth year (instead of the normal 12 months). Again, that’s odd but maybe that’s how they want it?

Further research from Steven showed you should use the values on December 31 each year as reported by TreasuryDirect, with any early withdrawal penalty pre-deducted.

Bond-by-Bond Tracking RequiredWhen you report interest annually, you make one entry on your tax return for all the I Bonds you own. When you finally cash out one of them, TreasuryDirect still assumes you’re going with the default and the 1099 form will include all the accumulated interest. You’ll need to back out all the interest you reported in previous years for that one bond you cashed out.

If you only rely on previous tax returns, (a) you’ll need to go back many years; and (b) getting the total for all bonds from previous tax returns isn’t enough. You’ll need the details bond by bond. If you only cash out part of a bond, you need to make further adjustments and also account for previous partial cashouts of the same bond.

If you use a tax preparer and you want them to track and report the interest every year, the extra cost required for this bond-by-bond tracking can easily overwhelm any tax savings from using the optional reporting method.

Risk of Paying Tax TwiceIf you have been reporting interest every year and now someone else has to do your taxes for whatever reason, they may not know what was done before. It’s very easy to pay tax again when they have a 1099 form in front of them because that’s the default.

Savings Bond CalculatorIf you really really want to take on reporting interest annually, it’s helpful to use the Savings Bond Calculator from TreasuryDirect. The calculator shows you the redemption value of an I Bond as of a given date.

The stand-alone calculator isn’t integrated into your TreasuryDirect account. Please read the instructions for how to save a list of bonds you own. Use Firefox or Safari when you save your list. It doesn’t work with Chrome or Microsoft Edge. You’ll have to update the list manually as you acquire new bonds and cash out old bonds.

Build and maintain a spreadsheet. Calculate the increase in redemption values using December-to-December values without any adjustment for the unrealized early withdrawal penalty during the first five years. Update the values in your spreadsheet with the values from the Savings Bond Calculator. Save screenshots of the Savings Bond Calculator as your documentation if necessary.

***

Now you know why I left out the optional tax reporting method from the How to Buy I Bonds post. It’s much more complicated in real life than just that one sentence in the IRS publication. I’m not sure the juice is worth the squeeze. I happily go along with the default for my I Bonds.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Taxes on I Bonds Get Complicated If You Go Against the Default appeared first on The Finance Buff.

Taxes on I Bonds Are Complicated If You Go Against the Default

Taxes on I Bonds are dead simple if you don’t do anything extra. You make it a lot more complicated when you go against the default.

Table of ContentsThe Default – During Your LifetimeThe Default – After You DieOptional – Pay Up In the Year of DeathOptional – Report Interest Every YearNo Annual 1099 No Periodic StatementsValue on December 31 or January 1?Unrealized Early Withdrawal PenaltyBond-by-Bond Tracking RequiredRisk of Paying Tax TwiceSavings Bond CalculatorThe Default – During Your LifetimeBy default, you don’t pay any taxes while you’re holding I Bonds during your lifetime. You pay federal income tax on the interest accumulated over the years only when you cash out or when the bonds mature after 30 years. The interest is exempt from state and local taxes. There’s no RMD in I Bonds.

If you do a partial cashout from a purchase, the cashed-out amount will be split proportionately into principal and interest. Suppose you originally bought $10,000 and the $10,000 grew to $15,000 with interest. When you cash out $3,000 from this purchase, which is 20% of the total value, it will be split into $2,000 principal and $1,000 interest. You’ll pay tax on $1,000.

TreasuryDirect will track and calculate the interest for you. They’ll generate a 1099-INT form for the year when you cash out any I Bonds or when any I Bonds mature. You log in to your account and download the 1099 form.

The Default – After You DieThe second owner or beneficiary on your I Bonds inherits those bonds after you die. Be sure to keep your second owner or beneficiary designations up to date. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

By default, your second owner or beneficiary doesn’t pay any taxes when they continue to hold those I Bonds they inherit from you. I Bonds aren’t eligible for a step-up in basis. They’ll pay federal income tax on the accumulated interest since your original purchase when they cash out or when the bonds mature. The interest is exempt from state and local taxes. TreasuryDirect will track and calculate the interest and generate the 1099 form for the new owner.

This is the easiest.

Optional – Pay Up In the Year of DeathAfter you die, your surviving spouse or whoever files your final year’s tax return can choose to include all the accumulated interest earned until your date of death on your final tax return. Then the second owner or the beneficiary will pay tax only on the interest earned going forward.

Your surviving spouse or the executor of your estate will need to do the calculation themselves if they choose this option. TreasuryDirect won’t generate any 1099 form unless they cash out your I Bonds.

Your second owner or beneficiary needs to keep documentation to show how much interest was already added to your final tax return for the bonds they inherited. When they cash out the bonds or when the bonds mature, the 1099 form will still show all the interest since the beginning. They’ll have to remember to back out the interest that was already included on your final tax return. See IRS Publication 559 (page 11).

Because it can be many years until they cash out the bonds or when the bonds mature, it’s quite possible they’ll forget and they’ll pay tax again on the whole thing when they have a 1099 form in front of them. I think it’s better to just go with the default and not go out of the way to pay up in the year of your death.

Optional – Report Interest Every YearReader Jeff left this comment on my How to Buy I Bonds post:

Your comment on taxation is a bit misleading. Yes, you can wait until maturity to declare the interest in you income. However, you do have the option of declaring the interest annually on your tax return. In some cases that can be better, especially for younger buyers who don’t have much (or any) taxable income to report.

I admit I left that part out of the scope of the introduction to I Bonds because it’s more of an advanced tactic. Let’s go into it now.

IRS Publication 550 says this on page 7:

Method 2. Choose to report the increase in redemption value as interest each year.

You must use the same method for all Series EE, Series E, and Series I bonds you own. If you do not choose method 2 by reporting the increase in redemption value as interest each year, you must use method 1.

Method 1 is the default we talked about already — you wait until you cash out or the bonds mature. Method 2 is appealing when you’re in a low tax bracket. You avoid having all the accumulated interest come as income in one year when you cash out or when the bonds mature. As Jeff mentioned, this is especially true when I Bonds are owned by a child, whose standard deduction and low tax brackets may otherwise go unused each year.

This optional Method 2 is doable in theory but it brings a lot of complications in real life.

No Annual 1099You don’t get much help if you choose Method 2. It’s not like you can change a setting in your TreasuryDirect account and you’ll start receiving 1099 forms each year. TreasuryDirect will always assume you’re going with the default. You’ll have to figure out on your own how much interest to report each year.

No Periodic StatementsYou see the current values of your I Bonds when you log in to your TreasuryDirect account. TreasuryDirect doesn’t produce any monthly or annual statements showing you the historical values and how much interest you earned during any month or year. When you’re doing taxes in March, it’s a small challenge just to figure out what the values were as of the beginning of this year or the end of last year.

Value on December 31 or January 1?The IRS publication only says to report “the increase in redemption value” but it doesn’t say between which dates. Is it from January 1 to December 31? Or is it from December 31 of the prior year to December 31? Or is it from January 1 to January 1 of the following year?

The values on December 31 and January 1 are the same in most other financial instruments because January 1 is always a holiday. That’s not the case for I Bonds. I Bonds get the interest from the previous month on the first of each month. The redemption value on January 1 includes interest from December whereas the redemption value on December 31 does not.

If you count the increase using the values from January 1 to December 31 each year, you only include interest from 11 months. That can’t be right.

When it comes to taxes, the cutoff is usually December 31. If you use December 31 to December 31, you include interest from December of the prior year through November. That’s odd, but maybe that’s how they want it?

If you use January 1 to January 1, you include interest from January to December, but are you supposed to use January 1 of the following year as the valuation date?

It’s not clear how you should calculate “the increase in redemption value” to report as interest on your tax return.

Unrealized Early Withdrawal PenaltyThe redemption values you see in TreasuryDirect automatically exclude the potential three-month early withdrawal penalty when the bonds are within their first five years. It’s not clear whether “the increase in redemption value” should adjust for this unrealized early withdrawal penalty or not.

When you have a bank CD, the interest is first paid, which you pay tax on, and you deduct the early withdrawal penalty if you withdraw early. If you use the redemption values of your I Bonds as shown by TreasuryDirect, you will have the early withdrawal penalty pre-deducted whether you actually withdraw early or not. You will have three fewer months of interest in the first year and 15 months of interest in the sixth year (instead of the normal 12 months). Again, that’s odd but maybe that’s how they want it?

Bond-by-Bond Tracking RequiredWhen you report interest annually, you make one entry on your tax return for all the I Bonds you own. When you finally cash out one of them, TreasuryDirect still assumes you’re going with the default and the 1099 form will include all the accumulated interest. You’ll need to back out all the interest you reported in previous years for that one bond you cashed out.

If you only rely on previous tax returns, (a) you’ll need to go back many years; and (b) getting the total for all bonds from previous tax returns isn’t enough. You’ll need the details bond by bond. If you only cash out part of a bond, you need to make further adjustments and also account for previous partial cashouts of the same bond.

If you use a tax preparer and you want them to track and report the interest every year, the extra cost required for this bond-by-bond tracking can easily overwhelm any tax savings from using the optional reporting method.

Risk of Paying Tax TwiceIf you have been reporting interest every year and now someone else has to do your taxes for whatever reason, they may not know what was done before. It’s very easy to pay tax again when they have a 1099 form in front of them because that’s the default.

Savings Bond CalculatorIf you really really want to take on reporting interest annually, it’s helpful to use the Savings Bond Calculator from TreasuryDirect. The calculator shows you the redemption value of an I Bond as of a given date.

The stand-alone calculator isn’t integrated into your TreasuryDirect account. Please read the instructions for how to save a list of bonds you own. Use Firefox or Safari when you save your list. It doesn’t work with Chrome or Microsoft Edge. You’ll have to update the list manually as you acquire new bonds and cash out old bonds.

Build and maintain a spreadsheet. Decide on whether you should calculate the increase in redemption values using December-to-December values or January-to-January values and whether you should make any adjustments for the unrealized early withdrawal penalty during the first five years. Update the values in your spreadsheet with the values from the Savings Bond Calculator. Save screenshots of the Savings Bond Calculator as your documentation if necessary.

***

Now you know why I left out the optional tax reporting method. It’s much more complicated in real life than just that one sentence in the IRS publication. I’m not sure the juice is worth the squeeze. I happily go along with the default for my I Bonds.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Taxes on I Bonds Are Complicated If You Go Against the Default appeared first on The Finance Buff.

January 9, 2022

Where to Get a Signature Guarantee for I Bonds at TreasuryDirect

Opening an account at TreasuryDirect to buy I Bonds is an easy process for most people. It takes less than 15 minutes (see How to Buy I Bonds). However, a small percentage of people run into an issue with ID verification. They are asked by TreasuryDirect to get a signature guarantee on a paper form FS 5444.

TreasuryDirect uses an automated third-party service to run ID verification. Many other financial institutions do the same for opening accounts online. Your account is kicked off to an exception process when the automated service says they can’t verify your identity based on the given information. When this happens at other financial institutions, they may ask you to upload pictures of your driver’s license or show up with your ID at a physical branch. Because TreasuryDirect doesn’t have any physical branch, they ask you to get a signature guarantee on a paper form and mail it to them.

Unrelated to Credit FreezeFailing ID verification isn’t caused by having a credit freeze. You can still pass with a credit freeze in place. You don’t need to unfreeze your credit before you open an account with TreasuryDirect.

It has more to do with matching your name, date of birth, Social Security Number, driver’s license number, address, and phone number. If you moved recently, the ID verification service may fail you because they don’t have the updated information yet. Or perhaps the ID verification service simply doesn’t have all the information for everyone. It’ll return a failure when it can’t match the information.

It’s not your fault. The automated ID verification service just isn’t 100% reliable. You’ll have some extra work if you’re unlucky.

Required for Changing Bank AccountTreasuryDirect also requires a signature guarantee on Form FS 5512 when you want to change the bank account linked to your account. This is why you should choose a bank account that you intend to use for a long time when you open your TreasuryDirect account. Changing it down the road will require more work.

Once you have the bank account linked, cashing out bonds won’t require a signature guarantee again.

Certifying OfficerYou need the signature guarantee from a “certifying officer.” This officer can be someone at a bank, a credit union, or a brokerage firm. You sign in front of the officer. The officer signs the form after verifying your ID.

If you need a signature guarantee because you’re changing the linked bank account, the certifying officer doesn’t have to be from the same bank. The form from TreasuryDirect says a notary public isn’t an acceptable certifying officer.

You don’t need to go to a place where you have an account, although being a customer certainly helps. They’re only doing you a favor because TreasuryDirect isn’t paying them and they have no obligation to do it. It’s easy for them to say no for fear of liability or simply because they haven’t seen it before.

If you go to a bank or a credit union, talk to someone working at a desk, not a teller. The teller may not be familiar with it. Try to catch someone more experienced who may have done it before. Ask nicely. If you get a “no” from someone, try a different branch or go to a different bank. Try a credit union or a small community bank, which may be more community-minded and willing to go the extra mile.

When I needed it, I made an appointment at a Bank of America branch and they did it for me.

Not a Medallion Signature GuaranteeTreasuryDirect asks for a signature guarantee, not necessarily a medallion signature guarantee. A medallion signature guarantee is one form of acceptable signature guarantee but it’s not the only one.

A medallion signature guarantee is a program of the securities industry. It’s used more for transferring brokerage accounts. If your broker has a physical branch near you, you can try there but many brokers only give medallion signature guarantees when it involves their own accounts. They don’t do it for outside accounts. If you have large accounts at the broker, they may agree to make an exception.

Many banks and credit unions don’t give medallion signature guarantees but the [normal] signature guarantees they give for signing checks will work for TreasuryDirect. So don’t start your conversation at a bank or a credit union by asking for a medallion signature guarantee. Simply say you need a signature guarantee.

Notarize with a NoteIf you have a really hard time finding someone at a bank, a credit union, or a broker to give you the signature guarantee, some people reported that TreasuryDirect accepted the form with a notary stamp when they attached a note saying they couldn’t get any certifying officer to sign the form.

It’s not guaranteed this will always work but it’s worth trying as a last resort when you’re denied by the local institutions.

Mail and WaitIf you succeed in getting a signature guarantee from someone willing to accommodate, now you mail it to the address on the form and wait. It may take 2-3 weeks for TreasuryDirect to complete the process. You’ll receive an email when it’s done.

I had to do this recently for changing the linked bank account. I mailed the form on December 20th. It was processed on January 4th. The turnaround time isn’t too bad, considering the mailing time, the holidays, and the flurries of activities at the end of the year. Just have some patience and let the process run its course.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Where to Get a Signature Guarantee for I Bonds at TreasuryDirect appeared first on The Finance Buff.

December 30, 2021

How to Add a Joint Owner or Change Beneficiary on I Bonds

When you have an account with a bank or a brokerage account, usually you can designate a beneficiary (or multiple beneficiaries with split percentages) for your account. The beneficiary gets everything in your account in case you die. It works differently when you have I Bonds in a personal account at TreasuryDirect, where your second owner and beneficiary are set separately for each holding, not for the whole account.

In This ArticleRegistration at Time of PurchaseReview Current RegistrationsCreate Your Desired RegistrationAssociate New Registration to Existing BondsGrant Transact or View RightsDeposited Paper Bonds with Joint OwnershipRegistration at Time of PurchaseWithin the same TreasuryDirect account, you can own some bonds by yourself without any second owner or beneficiary, some bonds with Person A as the second owner (“you WITH A”), some bonds with Person B as the second owner (“you WITH B”), some bonds with Person C as the beneficiary (“you POD C”), and some bonds with Person D as the beneficiary (“you POD D”). POD stands for Pay On Death. Most people probably don’t need this level of granularity but it’s an option. For more on the difference between a second owner and a beneficiary, please read I Bonds Beneficiary vs Second Owner in TreasuryDirect.

These options are only available in a personal account. An entity account for a trust or a business can’t have bonds with a second owner or a beneficiary. A trust or a business also can’t be designated as a second owner or a beneficiary. The second owner or beneficiary must be a person.

You designate the second owner or the beneficiary at the time of each purchase. The granularity compensates for the lack of designating multiple beneficiaries by percentages at the account level. While you can’t designate 50:50 between your two children as beneficiaries for the whole account, you can enter two orders every time you buy $10,000 worth of I Bonds: one order for $5,000 with Child A as the beneficiary and another order for $5,000 with Child B as the beneficiary.

Each ownership combination — you alone, you WITH person X as the second owner, or you POD person Y as the beneficiary — is called a registration. You can have as many registrations as you’d like and you can associate any one of your registrations to any bond in your account.

The registration for a bond you set at the time of purchase can be changed post-purchase. If you didn’t set a second owner or a beneficiary when you first bought the bonds or if you change your mind at a later time, you can add, remove, or change the second owner or the beneficiary at any time.

Review Current RegistrationsBefore you make any changes to the registration on any of your bonds in the account, you should review how they’re currently set and see which ones need to be changed. After you login to the account, click on “Current Holdings” at the top.

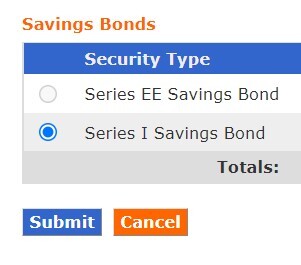

Then scroll down to the bottom and select Series I Saving Bond.

You will see a list of your bonds grouped by your existing registrations. Take notes for which bonds you’d like to make a change.

Create Your Desired RegistrationNow, you need to create a registration with the ownership combination you’d like to have. Say you originally bought the bond with your name alone and now you’d like to add a second owner, or you’d like to elevate your beneficiary to a second owner, you should create a registration for you with this person as the second owner (“you WITH X”). Or if you’d like to change your beneficiary to a different person, you should create a registration for you with this new person as the beneficiary (“you POD Y”).

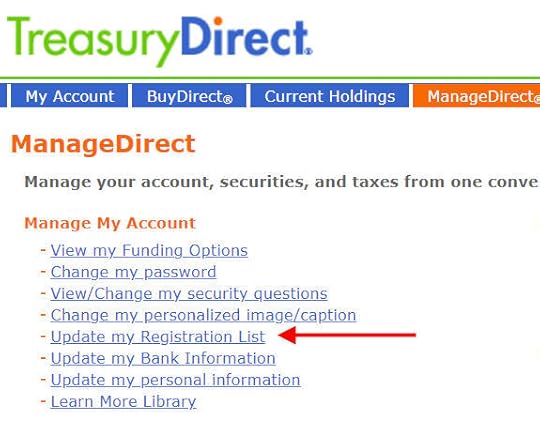

Click on “Update my Registration List” under ManageDirect.

You’ll see a list of existing registrations in your account. Click on “Add Registration” to create a new one.

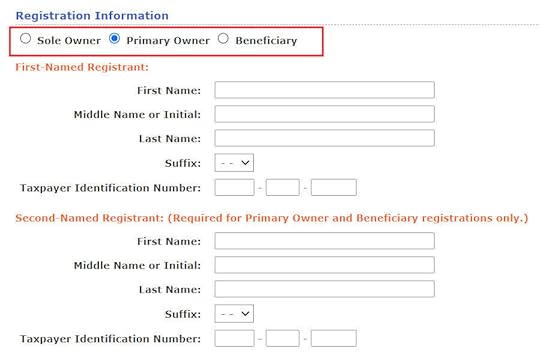

The radio buttons at the top shows the registration types. Sole Owner means you alone, without a second owner or a beneficiary. Primary Owner means you with a second owner. Beneficiary means you with a beneficiary. If you chooses Primary Owner or Beneficiary, enter yourself as the First-Named Registrant and the second owner or the beneficiary as the Second-Named Registrant.

The new combination will be added to your list of registrations. It’s not associated with any bonds yet. If you’d like to use this new registration for all new bonds you buy in the future, select it in the list and click on the “Preferred Registration” button.

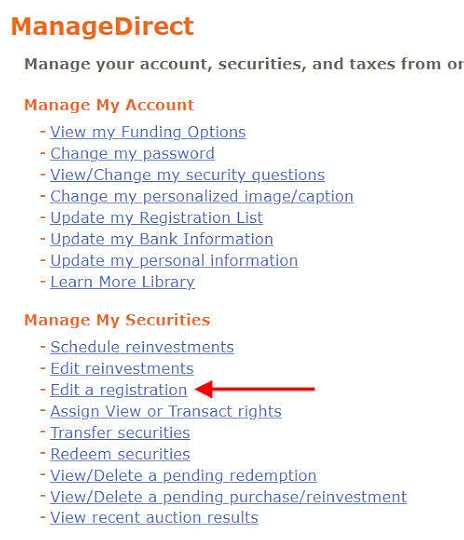

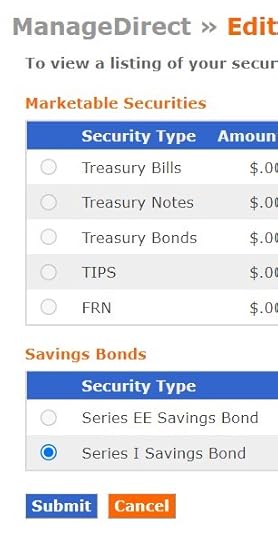

Associate New Registration to Existing BondsMaking a new registration your preferred registration only affects the default for new bonds you buy in the future. To change the registration on your existing bonds, click on “Edit a registration” under ManageDirect.

Scroll down to the bottom and select Series I Savings Bond.

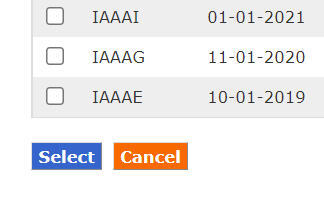

You will see a list of your I Bonds. Check the box for the ones you’d like to change. Or check all of them if you’d like to change the registration for all existing bonds.

Choose your desired registration in the dropdown. The bonds you selected will change to this new registration after you click on Submit. As long as you’re still the primary owner, changing the registration doesn’t trigger taxes.

Grant Transact or View Rights

Grant Transact or View RightsIf you granted Transact or View rights to the previous second owner or beneficiary, those rights will be automatically canceled after you change the Registration. You’ll need to grant Transact or View rights to your new second owner or beneficiary if you’d like. For more on why you may want to grant Transact or View rights and a walkthrough of how to do it, please read How To Grant Transact or View Right on Your I Bonds.

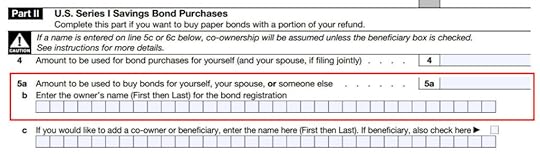

Deposited Paper Bonds with Joint OwnershipIf you have bonds in your account that originated from paper bonds you bought with your tax refund (see Overpay Your Taxes to Buy I Bonds and How To Deposit Paper I Bonds to TreasuryDirect Online Account), those bonds may have been issued to you and your spouse jointly (“you OR spouse”) when you filed a joint tax return.

This “OR” type of ownership is different than the “you WITH X” type of ownership in that the two owners are equal. There’s no primary owner or second owner in the “OR” type of ownership. One owner can’t kick out the other owner without the other owner’s consent. The “OR” ownership is preserved when paper bonds are deposited into the TreasuryDirect account. These bonds become “restricted securities” and you can’t change the registration on them.

If you don’t like this restriction, don’t use Box 4 on IRS Form 8888 when you buy I Bonds with your joint tax return. Use Line 5a and enter only one name. Alternate the owner between you and spouse in different years.

You can change the registration and grant rights after you deposit the paper bonds with only one name. This way you can have the same registration for all the bonds in your account.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Add a Joint Owner or Change Beneficiary on I Bonds appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower