Harry Sit's Blog, page 24

October 13, 2021

2022 2023 Medicare Part B Part D IRMAA Premium Brackets

[Updated on October 13, 2021, after the September inflation release. All numbers are final. My projections for 2021 matched the official numbers 100%.]

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors’ services and Medicare Part D that covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount.

I haven’t seen any numbers that show how much collecting IRMAA really helps the government in the grand scheme. I’m guessing very little. One report said 7% of all Medicare beneficiaries pay IRMAA. Suppose the 7% pay double the standard premium, it changes the overall split between the beneficiaries and the government from 25:75 to 27:73. Big deal?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits aren’t included in the income for determining IRMAA.

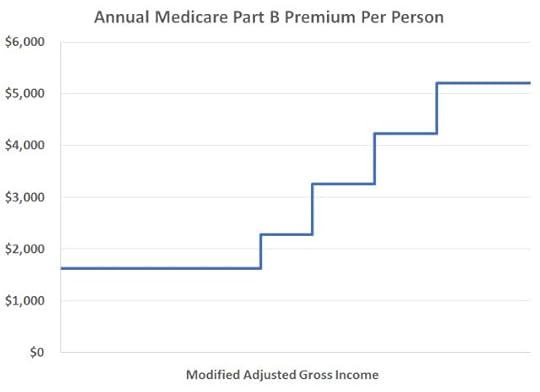

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay. If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

So if your income is near a bracket cutoff, see if you can manage to keep it down and make it stay in a lower bracket. Using the income from two years ago makes it a little harder.

2021 and 2022 IRMAA BracketsThe IRMAA income brackets (except the very last one) started adjusting for inflation in 2020. Here are the IRMAA income brackets for 2021 coverage and 2022 coverage. Before the government publishes the official numbers, I’m able to calculate based on the inflation numbers and the formula set by law. Remember the income on your 2020 tax return (AGI plus muni interest) determines the IRMAA you pay in 2022. The income on your 2021 tax return (to be filed in 2022) determines the IRMAA you pay in 2023.

Part B Premium2021 Coverage (2019 Income)2022 Coverage (2020 Income)StandardSingle: <= $88,000Married Filing Jointly: <= $176,000Single: <= $91,000

Married Filing Jointly: <= $182,000Standard * 1.4Single: <= $111,000

Married Filing Jointly: <= $222,000Single: <= $114,000

Married Filing Jointly: <= $228,000Standard * 2.0Single: <= $138,000

Married Filing Jointly: <= $276,000Single: <= $142,000

Married Filing Jointly: <= $284,000Standard * 2.6Single: <= $165,000

Married Filing Jointly: <= $330,000Single: <= $170,000

Married Filing Jointly: <= $340,000Standard * 3.2Single: <= $500,000

Married Filing Jointly: <= $750,000Single: <= $500,000

Married Filing Jointly: <= $750,000Standard * 3.4Single: > $500,000

Married Filing Jointly: > $750,000Single: > $500,000

Married Filing Jointly: > $750,000

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The income brackets are the same. The surcharges are relatively smaller in dollars.

2023 IRMAA BracketsIt’s too early to know what the 2023 IRMAA brackets will be. Still, you can make reasonable estimates and give yourself some margin to stay clear of the cutoff points. If inflation is 0% through August 2022, these will be the 2023 numbers:

Part B Premium2022 Coverage (2020 Income)2023 Coverage (2021 Income), 0% InflationStandardSingle: <= $91,000Married Filing Jointly: <= $182,000Single: <= $94,000

Married Filing Jointly: <= $188,000Standard * 1.4Single: <= $114,000

Married Filing Jointly: <= $228,000Single: <= $118,000

Married Filing Jointly: <= $236,000Standard * 2.0Single: <= $142,000

Married Filing Jointly: <= $284,000Single: <= $147,000

Married Filing Jointly: <= $294,000Standard * 2.6Single: <= $170,000

Married Filing Jointly: <= $340,000Single: <= $176,000

Married Filing Jointly: <= $352,000Standard * 3.2Single: <= $500,000

Married Filing Jointly: <= $750,000Single: <= $500,000

Married Filing Jointly: <= $750,000Standard * 3.4Single: > $500,000

Married Filing Jointly: > $750,000Single: > $500,000

Married Filing Jointly: > $750,000

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes. Does making them pay another $1,400/year make that much difference? Nickel-and-diming just annoys people. People caught by surprise when their income crosses over to a higher bracket by just a small amount get mad at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income and don’t accidentally cross a line for IRMAA.

IRMAA AppealIf your income two years ago was higher because you were working at that time and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA assessment. The “life-changing events” that make you eligible for an appeal include:

Death of spouseMarriageDivorce or annulmentWork reductionWork stoppageLoss of income from income producing propertyLoss or reduction of certain kinds of pension incomeYou file an appeal by filling out the form SSA-44 to show that although your income was higher two years ago, you had a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For LifeIf your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, when your income comes down in the following year, your IRMAA will also come down automatically. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 2023 Medicare Part B Part D IRMAA Premium Brackets appeared first on The Finance Buff.

September 29, 2021

How To Deposit Paper I Bonds to TreasuryDirect Online Account

I overpaid my taxes to buy an extra $5,000 worth of I Bonds. I received the paper I Bonds in the mail a week after I received the direct deposit for the remainder of my tax refund.

I can keep these paper bonds in a home safe or a safe deposit box at a bank but I much prefer to keep everything together in the online account at TreasuryDirect. In the usual government fashion, they don’t make it easy. Treat it as a test for how well you’re able to follow instructions. It feels convoluted the first time. It gets better after you get the hang of it.

Deposit = ConversionFirst, the lingo. I think of it as depositing the paper bonds into the online account. The government calls it converting paper savings bonds to electronic form. When you deposit cash into your bank account, no one calls it converting paper currency to electronic form. You won’t find the instructions if you don’t know what it’s called.

You retain the original issue date when you deposit your paper bonds to the online account (“convert to electronic form”). You will earn the same amount of interest whether you keep the paper bonds as paper or add them to your online account.

Conversion Linked AccountNext, you can’t deposit directly into your online account. You have to create a special sub-account within your main account. They call it the “Conversion Linked Account.”

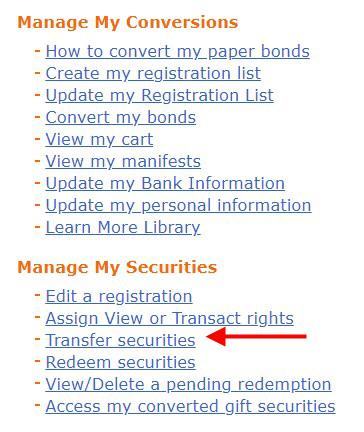

After you log in to TreasuryDirect, click on ManageDirect in the menu.

Then click on “Establish a Conversion Linked Account.”

This will create the sub-account. You only have to do this once. You can re-use this Conversion Linked Account in the future. You will see the linked account on the bottom left of the page when you log in to your main account. You go into the Conversion Linked Account by clicking on “My Converted Bonds.”

You do all the steps below in this Conversion Linked Account.

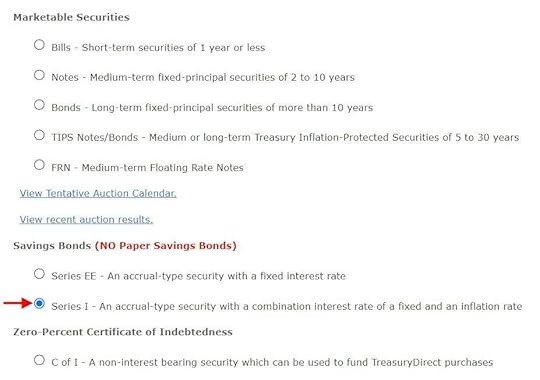

Registration ListAfter you get into the Conversion Linked Account, go to ManageDirect, and then click on “Create my registration list.”

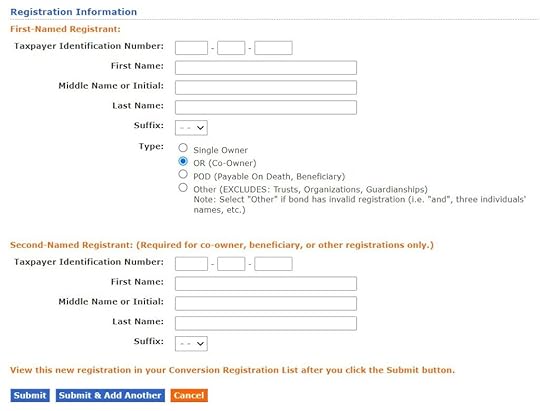

A Registration means how the bonds are owned. You need to create a registration that matches the ownership printed on the paper bonds – just you, you and a second owner, or you with a beneficiary.

Our bonds had both our names. So I chose the “OR (co-owner)” option.

Again, you only have to do this once if your paper bonds from next year’s tax refund will have the same ownership.

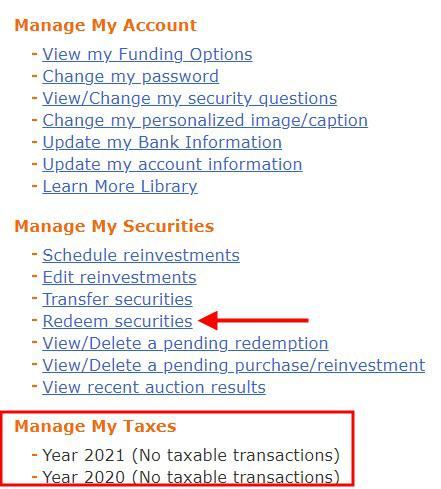

Add to CartNow, back to ManageDirect. Click on “Convert my bonds.”

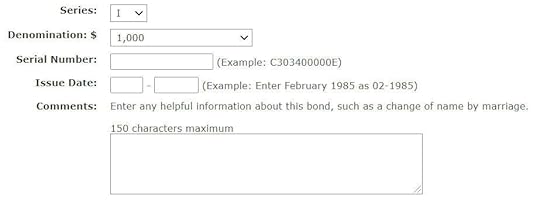

Enter each bond you’d like to deposit/convert. Make sure you enter the correct series, denomination, serial number, and issue date exactly as printed on the paper bonds. Leave the comments blank.

Create Manifest

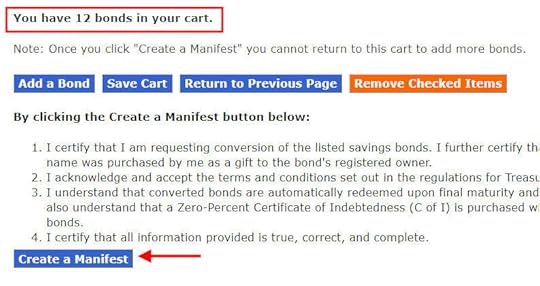

Create ManifestAfter you’re done with entering all the bonds, go back to ManageDirect. Click on “View my cart.”

You will see a list of the bonds you just entered. Double-check to make sure everything is correct. Click on the “Create a Manifest” button at the bottom.

A manifest is like the packing list that comes with your package from online shopping. They want you to print the manifest, sign it, and mail it with your bonds.

Sign and MailThe manifest has the Treasury Department’s mailing address in Minneapolis. Sign the manifest. Take pictures of your bonds before you mail them with the signed manifest.

Because the paper bonds came by regular mail to begin with, I only used plain First Class Mail when I mailed them back. You need two Forever stamps if you put 12 bonds in a regular #10 envelope because the weight is over one ounce. If you’d like to add tracking for your peace of mind, you can pay few dollars extra and mail it by Certified Mail. If you prefer FedEx or UPS, there’s a separate address on the manifest.

Case Number AssignedYou’ll receive an email when they receive your bonds and put the job in their work queue. I received the email seven days after I mailed the bonds. This email includes a case number in case you need to contact them. Just save the email.

Check ManifestTreasuryDirect will work on your deposit/conversion but they won’t send another email when they’re done. Because you’ll retain the original issue date, and you’ll earn the same amount of interest regardless, I don’t worry how long it takes them to complete the process. It doesn’t make any difference whether it’s done in a week, a month, or three months.

If you’d like to check the progress, log in and click on “My Converted Bonds” at the bottom left to go into your Conversion Linked Account. Then go to ManageDirect, and click on “View my manifests.”

It’s close to completion when you see the status changing from blank to “In Progress.” It’s done when the value of your Conversion Linked Account goes up.

You don’t need to check the status every day. You can’t redeem the bonds in the first 12 months anyway. I checked periodically only for the purpose of writing this post. Here’s the complete timeline of my recent submission:

Day 1: Mailed the bonds by First Class Mail.Day 8: Received email with the case number.Day 26: Status of the manifest changed from blank to “In Progress.”Day 27: Conversion completed.Set a reminder to check the status in 30 days. If it’s not done yet, check back in another 30 days.

Transfer to Main Account (Optional)You can leave the converted bonds in the Conversion Linked Account, but I find it easier when the bonds are all together in my main account.

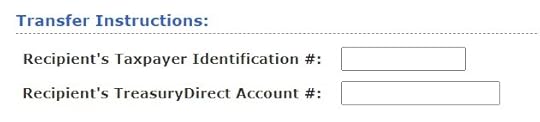

Go into the Conversion Linked Account and then go to ManageDirect. Click on “Transfer securities.”

Go into Series I savings bonds, and check the box for each bond you’d like to transfer. Even though the bonds are in electronic form now, they’re still separate individual bonds, not merged into one large bond.

Put in your Social Security Number and the account number of your main account.

Scroll down to the bottom and submit. It isn’t taxable when you transfer between your Conversion Linked Account and your main account.

Your Conversion Linked Account is empty again after you transfer the converted bonds to your main account. You will use the Conversion Linked Account when you get the paper bonds from your tax refund next year.

***

It feels quite convoluted when you do it the first time. After you get the hang of it, it comes down to:

Enter the serial numbers online. Print and sign a manifest (“packing list”). Mail it with the bonds to Minneapolis.Receive an email with a case number. Check back after 30 days. Check again in another 30 days if necessary.(Optional) Transfer the converted bonds from the special sub-account to the main account.Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Deposit Paper I Bonds to TreasuryDirect Online Account appeared first on The Finance Buff.

September 21, 2021

How To Use Securities-Based Lending to Manage Cash Flow

Earlier this year, ProPublica did an exposé of how the ultra-rich pay relatively little income tax. One of their techniques is that they live on borrowed money. They don’t realize capital gains when they don’t sell their appreciated assets. No realized gains, no taxes. Meanwhile, their assets keep growing, and banks are increasingly comfortable lending them more money for their spending. Wall Street Journal called this strategy “Buy, Borrow, Die” (audio starts at 7:27).

We the small-time investors can do it too through the same mechanism. We can’t live on borrowed money for the rest of our lives but we can use borrowed money for a short while when we use securities-based lending.

What Is Securities-Based Lending?When you use securities-based lending you borrow money using your securities (stocks, bonds, mutual funds, ETFs, …) as the collateral. In principle, it’s not that different than getting a HELOC using your home as the collateral.

Because your securities are much more liquid and easier to value than your home, you can get the loan much faster and at a lower interest rate than from a HELOC. You don’t need to prove your income. The current interest rate can be a little over 1%, whereas the rate on a HELOC is usually close to the prime rate, which is 3.25% today.

When Do You Need Securities-Based Lending?People pride themselves on having no debt, but using borrowed money can be better than using your own money in many scenarios. Here are a few examples:

Make Illiquid Investment with ConfidenceYou have some cash and you’re ready to buy I Bonds for the great interest rate, but you’re concerned about the 12-month lockup. There’s absolutely no way to sell I Bonds in the first 12 months. What if you need the money during that time? Selling other investments triggers capital gains, throws you over income limits, and disqualifies you for this or that.

When you have a standby credit line available, you can go ahead and buy I Bonds with your cash. If nothing comes up in the first 12 months, your I Bonds are liquid now. In case you need the money, you tap the credit line until the lockup is over. You sell I Bonds to repay the loan. Your I Bonds will earn much more interest than the interest you pay on the loan.

Stop Parking CashPeople ask quite often “Where can I park a sum of cash for a year or two?” The answer is usually a savings account or a CD because the timeframe is too short. Both pay about 1% right now if you’re lucky.

When you have a standby credit line available, you can keep the money in your diversified portfolio. Chances are you will earn more than 1% in your portfolio by the time you need the money, but if it has a loss, you can tap the credit line. You pay off the loan when your portfolio recovers.

Bridge a GapYou’re buying a home. Making your purchase offer contingent on selling your current home will make it unattractive to the seller in a competitive market. Selling your current home first and getting a rent-back makes you overbid to buy before the rent-back runs out. Renting after you sell means you have to move twice.

When you have a standby credit line available, you can tap it to buy the new home at your leisure. You move, sell your old home, and repay the loan. It’s worth paying some interest at a low rate to make it all smooth.

Lower Your TaxesYou want to sell some investments to help your daughter buy a home. Selling them all this year will trigger large capital gains but if you split the gains across two calendar years, each half of the gains will fall in the 0% tax bracket.

So you sell half and borrow half. Your daughter gets the home now. You sell the other half next January and repay the loan. The tax savings are much higher than the interest you pay.

Where Do You Get Securities-Based Lending?You get it from the broker that holds your securities. If your current broker doesn’t offer it at an attractive interest rate, you have to be willing to move your account to one that does. Some banks also offer this type of lending through their private banking departments.

You can only borrow against your regular taxable brokerage account. IRAs and other tax-advantaged accounts can’t be pledged for loans but the broker may consider them in the overall relationship when they determine your interest rate.

Charles Schwab, TD Ameritrade (owned by Charles Schwab now), E*Trade, and Merrill Edge do it through their affiliated bank entity. Officially the affiliated bank is making the loan against your taxable brokerage account held at the broker. They all have different names for their programs:

Charles Schwab calls it Pledged Asset Line. TD Ameritrade calls it Collateral Lending Program. E*Trade calls it E*Trade Line of Credit. Merrill Edge calls it Loan Management Account.Fidelity and Interactive Brokers lend directly as a margin loan.

The difference between a line of credit through an affiliated bank and a margin loan through a broker is that the bank loan can’t be used to purchase securities, pay down margin loans, or be deposited into a brokerage account, while the margin loan doesn’t have such restrictions. However, there’s no practical difference when you’re using the loan only for cash flow needs because you aren’t using it for those restricted purposes anyway.

The differences among the brokers come down to the interest rate and how much they let you borrow.

Interest RateSecurities-based lending typically uses a variable rate tied to a short-term market rate plus a fixed markup. There’s usually no setup fee or maintenance fee to keep the credit line open and unused.

Interactive Brokers is known for their low margin rates. They post their rates transparently online. The rate is a blended rate based on how much you borrow. At the time I’m writing this, the rate under the IBKR Pro pricing plan starts at 1.58% on the first $100k and it goes down to 1.08% on the next $900k. Their convenient online calculator shows the blended rate for borrowing $500k is 1.18%.

A fintech startup M1 Finance offers a 2% margin rate in their M1 Plus program ($125 annual fee, free in the first year).

The officially posted interest rates at other brokers — Fidelity, Charles Schwab, TD Ameritrade, E*Trade, and Merrill Edge — are all much higher. However, if you have large accounts at one of these brokers, they’re often willing to offer you a special rate close to the margin rate at Interactive Brokers to keep your business. You should contact the rep assigned to your accounts or someone at their physical branch. I have read multiple reports of people getting offered a rate lower than 1.5% at these brokers.

Vanguard also offers margin loans but I haven’t heard anyone getting a similarly low rate from Vanguard.

If you can get a special rate at your current broker close to the rate offered by Interactive Brokers, you probably should stay. If you’re with Vanguard and you’re willing to move, you can shop among those other brokers and see who offers you the lowest rate.

Interactive Brokers is quite different than other brokers. Because they started from serving institutional customers, even though they also serve retail customers now, they expect you to know what you’re doing. Many things you take for granted at other brokers are either not available or difficult to figure out. It isn’t for the faint of heart. Use Interactive Brokers only when you want a low rate and you can’t get it anywhere else.

How Much Can You Borrow?Each broker sets the rules. The amount you can borrow is only determined by the value of the securities in your account. There’s no debt-to-income requirement. It can be 50% or 70% of the value of your taxable account, but you probably shouldn’t borrow nearly as much anyway.

The RisksThe biggest risk in securities-based lending is that you borrowed too much and a market crash will trigger forced selling at the bottom of the market.

For example, the broker may require that 70% of your account value must be greater than your outstanding loan at all times. Suppose you had $100,000 in your account and you borrowed $50,000, and after the market drops your securities are worth only $70,000 now. 70% of $70,000 is $49,000, which is lower than your $50,000 loan outstanding. Now the broker can sell a part of your securities to pay down the loan, precisely when you don’t want to sell at the bottom of the market. The forced sale may trigger capital gains tax as well.

To guard against a 50% drop in the value of your securities, you probably shouldn’t borrow more than 30% of the account value. It helps if you have a balanced portfolio in your brokerage account that isn’t prone to a 50% drop to begin with. It also helps if you don’t carry the loan for a long period of time.

How Do You Draw From the Credit Line?You may not be able to borrow right away after you sign up for the feature. Set up the account ahead of time and wait until you’re eligible.

Once the credit line is ready to use, you simply make a withdrawal to a linked bank account as needed. Or you can request a wire transfer. You pay interest only on the amount outstanding.

Is the Interest Tax-Deductible?In general, no. Interest on personal loans isn’t tax-deductible. Even if you use the loan to buy a home, the interest is still not tax-deductible when the home isn’t used as collateral for the loan.

If you have a margin loan and you use it to buy additional securities, which isn’t what we’re talking about here, the interest is deductible up to your net investment income but only if you itemize deductions.

Do You Need to Make Payments?You may need to make monthly interest-only payments when you have the loan through a bank affiliated with the broker. When you have a margin loan, the debit balance just compounds within your account. In either case, you can pay down the loan at any time.

***

Excessive borrowing is risky but borrowing prudently at a low rate can make many things a lot easier. If you have a large taxable account, learn from the ultra-rich and put it to good use. You end up saving money in many cases.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Use Securities-Based Lending to Manage Cash Flow appeared first on The Finance Buff.

September 14, 2021

2021 2022 401k 403b 457 IRA FSA HSA Contribution Limits

[Updated on September 14, 2021, after the August inflation release. All IRA-related numbers are final.]

Retirement plan contribution limits are adjusted for inflation each year. Inflation has been at elevated levels in recent months. Most contribution limits and income limits will go up in 2022. Some limits will stay the same as in 2021 due to rounding.

Before the IRS publishes the official numbers in October or November, I’m able to make my own calculations using the published inflation numbers and going by the same rules the IRS uses as stipulated by law.

401k/403b/457/TSP Elective Deferral Limit401k/403b/457/TSP contribution limit will go up by $1,000 from $19,500 in 2021 to $20,500 in 2022. This limit usually goes up by $500 at a time but higher inflation is making it go two steps in one year.

If you are age 50 or over, the catch-up contribution limit will stay the same at $6,500 in 2022 as in 2021.

Employer match or profit-sharing contributions aren’t included in these limits. If you work for multiple employers in the same year or if your employer offers multiple plans, you have one single employee contribution limit for 401k, 403b, and TSP across all plans.

The 457 plan limit is separate from the 401k/403b/TSP limit. You can contribute the maximum to both a 401k/403b/TSP plan and a 457 plan.

Annual Additions LimitThe total employer plus employee contributions to all defined contribution plans by the same employer will increase by $3,000 from $58,000 in 2021 to $61,000 in 2022. This limit usually increases by $1,000 at a time but now it’s jumping three steps in one year.

The age-50-or-over catch-up contribution is separate from this limit. If you work for multiple employers in the same year, you have separate limits for each unrelated employer.

SEP-IRA Contribution LimitThe SEP-IRA contribution limit is always the same as the annual additions limit for a qualified plan. It will also increase by $3,000 from $58,000 in 2021 to $61,000 in 2022.

Because the SEP-IRA doesn’t allow employee contributions, unless your self-employment income is well above $200,000, you have a higher contribution limit if you use a solo 401k. See Solo 401k When You Have Self-Employment Income.

Annual Compensation LimitThe maximum annual compensation that can be considered for making contributions to a retirement plan is always 5x the annual additions limit. Therefore the annual compensation limit will increase by $15,000 from $290,000 in 2021 to $305,000 in 2022.

Highly Compensated Employee ThresholdIf your employer limits your contribution because you are a Highly Compensated Employee (HCE), the minimum compensation will go up from $130,000 in 2021 to $135,000 in 2022.

SIMPLE 401k and SIMPLE IRA Contribution LimitSIMPLE 401k and SIMPLE IRA plans have a lower limit than standard 401k plans. The contribution limit for SIMPLE 401k and SIMPLE IRA plans will go up from $13,500 in 2021 to $14,000 in 2022.

If you are age 50 or over, the catch-up contribution limit will stay the same at $3,000 in 2022 as in 2021.

Employer contributions aren’t included in these limits.

Traditional and Roth IRA Contribution LimitThe Traditional or Roth IRA contribution limit will stay the same at $6,000 in 2022 as in 2021. The age 50 catch-up limit is fixed by law at $1,000 in all years.

The IRA contribution limit and the 401k/403b/TSP or SIMPLE contribution limit are separate. You can contribute the respective maximum to both a 401k/403b/TSP/SIMPLE plan and a traditional or Roth IRA.

Deductible IRA Income LimitThe income limit for taking a full deduction for your contribution to a traditional IRA while participating in a workplace retirement will increase by $2,000 for singles, from $66,000 in 2021 to $68,000 in 2022. It will increase by $4,000 for married filing jointly, from $105,000 in 2021 to $109,000 in 2022. The deduction completely phases out when your income goes above $76,000 in 2021 and $78,000 in 2022 for singles; and for married filing jointly, $125,000 in 2021 and $129,000 in 2022.

The income limit for taking a full deduction for your contribution to a traditional IRA when you are not covered in a workplace retirement but your spouse is will go up by $6,000 for married filing jointly from $198,000 in 2021 to $204,000 in 2022. The deduction completely phases out when your joint income goes above $208,000 in 2021 and $214,000 in 2022.

Roth IRA Income LimitThe income limit for contributing the maximum to a Roth IRA will go up by $4,000 for singles from $125,000 in 2021 to $129,000 in 2022. It will go up by $6,000 for married filing jointly from $198,000 in 2021 to $204,000 in 2022.

You can’t contribute anything directly to a Roth IRA when your income goes above $140,000 in 2021 and $144,000 in 2022 for singles, and $208,000 in 2021 and $214,000 in 2022 for married filing jointly, up by $4,000 and $6,000 respectively in 2022. 2021 may be the last year you can do a backdoor Roth.

Healthcare Flexible Spending Account Contribution LimitThe Healthcare FSA contribution limit will go up by $100 from $2,750 per person in 2021 to $2,850 per person in 2022.

Health Savings Account Contribution LimitThe HSA contribution limit for single coverage will go up by $50 from $3,600 in 2021 to $3,650 in 2022. The HSA contribution limit for family coverage will go up from $7,200 in 2021 to $7,300 in 2022. These were announced previously in the spring. Please see HSA Contribution Limits.

Those who are 55 or older can contribute an additional $1,000. If you are married and both of you are 55 or older, each of you can contribute the additional $1,000, but to separate HSAs in each person’s name.

Saver’s Credit Income LimitThe income limits for receiving a Retirement Savings Contributions Credit (“Saver’s Credit”) will increase in 2022. For married filing jointly, it will be $39,500 in 2021 and $41,000 in 2022 (50% credit), $43,000 in 2021 and $44,000 in 2022 (20% credit), and $66,000 in 2021 and $68,000 in 2022 (10% credit).

The limits for singles will be at half of the limits for married filing jointly, at $19,750 in 2021 and $20,500 in 2022 (50% credit), $21,500 in 2021 and $22,000 in 2022 (20% credit), and $33,000 in 2021 and $34,000 in 2022 (10% credit).

All Together 20212022IncreaseLimit on employee contributions to 401k, 403b, or 457 plan$19,500$20,500$1,000Limit on age 50+ catchup contributions to 401k, 403b, or 457 plan$6,500$6,500NoneSIMPLE 401k or SIMPLE IRA contributions limit$13,500$14,000$500SIMPLE 401k or SIMPLE IRA age 50+ catchup contributions limit$3,000$3,000NoneHighly Compensated Employee definition$130,000$135,000$5,000Maximum annual additions to all defined contribution plans by the same employer$58,000$61,000$3,000SEP-IRA contribution limit$58,000$61,000$3,000Traditional and Roth IRA contribution limit$6,000$6,000NoneTraditional and Roth IRA age 50+ catchup contribution limit$1,000$1,000NoneDeductible IRA income limit, single, active participant in workplace retirement plan$66,000 – $76,000$68,000 – $78,000$2,000Deductible IRA income limit, married, active participant in workplace retirement plan$105,000 – $125,000$109,000 – $129,000$4,000Deductible IRA income limit, married, spouse is active participant in workplace retirement plan$198,000 – $208,000$204,000 – $214,000$6,000Roth IRA income limit, single$125,000 – $140,000$129,000 – $144,000$4,000Roth IRA income limit, married filing jointly$198,000 – $208,000$204,000 – $214,000$6,000Healthcare FSA Contribution Limit$2,750$2,850$100HSA Contribution Limit, single coverage$3,600$3,650$50HSA Contribution Limit, family coverage$7,200$7,300$100HSA, age 55 catch-up$1,000$1,000NoneSaver’s Credit income limit, married filing jointly$39,500 (50%)$43,000 (20%)

$66,000 (10%)$41,000 (50%)

$44,000 (20%)

$68,000 (10%)$1,500 (50%)

$1,000 (50%)

$2,000 (10%)Saver’s Credit income limit, single$19,750 (50%)

$21,500 (20%)

$33,000 (10%)$20,500 (50%)

$22,000 (20%)

$34,000 (10%)$750 (50%)

$500 (50%)

$1,000 (10%)

Source: IRS Notice 2020-79, author’s own calculations

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2021 2022 401k 403b 457 IRA FSA HSA Contribution Limits appeared first on The Finance Buff.

What If Congress Bans Backdoor Roth and Mega Backdoor Roth?

A reader sent me this article on CNBC:

It linked to a summary of the legislation being considered by the House Ways & Means Committee. Among other things, the summary includes these changes with regard to retirement plans and IRAs:

Furthermore, this section prohibits all employee after-tax contributions in qualified plans and prohibits after-tax IRA contributions from being converted to Roth regardless of income level, effective for distributions, transfers, and contributions made after December 31, 2021.

However, this short description doesn’t match 100% the actual text of the bill (page 686 in the PDF). A more accurate description should be:

Furthermore, this section prohibits all employee after-tax contributions in qualified plans and

prohibitsafter-tax IRA contributions from being converted to Roth regardless of income level, effective for distributions, transfers, and contributions made after December 31, 2021.

These changes, if they become law, will effectively ban backdoor Roth and mega backdoor Roth. Specifically, effective January 1, 2022:

Traditional IRAEmployer PlanNon-Roth after-tax contributionAllowedAllowedConvert after-tax contribution to RothNot allowedNot allowedYou can still make non-Roth after-tax contributions, but you can’t convert them to Roth. This ban covers converting from a traditional IRA to a Roth IRA, rolling over after-tax contributions from an employer plan to a Roth IRA, and converting to the Roth account within the employer plan.

What should you do if these proposed changes move forward and become law?

Backdoor Roth – Catch the Last BusIf the proposals become law, you’re still allowed to make nondeductible contributions to a traditional IRA but you won’t be allowed to convert them to Roth after 12/31/2021.

If you’re planning to do the backdoor Roth for 2021 between January 1 and April 15 in 2022, hurry up. Make the contribution for 2021 now and convert it to Roth before December 31, 2021. If you wait until 2022 to make your nondeductible contribution, your contribution will be stuck in the traditional IRA.

If you’re planning to contribute to your Roth IRA directly and there’s any chance that you will exceed the income limit for 2021 ($125,000 single, $198,000 married filing jointly), make it a backdoor Roth now. When you find you exceed the income limit, normally you can recharacterize your Roth IRA contribution to a nondeductible traditional IRA contribution and convert it in the following year but you won’t be able to do that in 2022. So go through the backdoor now.

In either case, you have to do some work to prepare for the backdoor Roth. See Backdoor Roth: A Complete How-To.

For 2022 and beyond, even if you can’t do the backdoor Roth anymore when you exceed the income limit for contributing to a Roth IRA, you can still make nondeductible contributions to a traditional IRA and invest in bonds. Bonds are taxed as ordinary income outside tax-advantaged accounts. You still get tax deferral in the traditional IRA.

Mega Backdoor RothIf your employer’s plan allows non-Roth after-tax contributions, make sure you contribute the maximum allowed in 2021 and converting them before 12/31/2021.

For 2022 and beyond, you can still make non-Roth after-tax contributions to an employer plan but you’re probably better off putting the money in a regular taxable account.

What If the Proposed Changes Don’t Become Law?The proposed changes are only proposals right now. Many proposals don’t become law. However, the moves in anticipation don’t have much of a downside.

Proposals Become LawNo ChangesComplete backdoor Roth before 12/31/2021$$ in Roth$$ in RothPre-emptive backdoor if possibly 2021 income over the limit$$ in Roth$$ in RothComplete mega backdoor Roth before 12/31/2021$$ in Roth$$ in RothIn other words, they are good moves regardless. You’re only doing them a little sooner in case you aren’t allowed to do them if the law changes.

A Big Loss?Is it a big loss if the proposed changes become law and you can’t do backdoor Roth and mega backdoor Roth anymore?

It’s a loss because tax-free beats tax deferral on earnings or the lower tax rates on qualified dividends and long-term capital gains. However, the power of saving and investing comes from making the contributions to begin with, not from how the investment returns are taxed.

A taxable account always works. In the end, even if all the tax-advantaged accounts go away and all the returns are taxed as regular income, those who save and invest more will still succeed. You take advantage of all available tax savings but you can’t stake your success on specific tax breaks.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post What If Congress Bans Backdoor Roth and Mega Backdoor Roth? appeared first on The Finance Buff.

September 8, 2021

Relocating for Retirement: Buy or Rent – Old Rules and New Rules

By now it’s obvious I botched our relocation last year. The decision to relocate was correct but I executed it poorly due to my lack of experience. I also didn’t think through all the options when I only relied on some “rules” that were either outdated or didn’t apply to our situation. In the end, my poor execution cost us $300,000.

Many people may be considering relocation for remote work or retirement. I’m writing down the lessons I learned from my mistakes.

Rent First In a New City?We thought we should rent because we heard the rule that you should rent first when you move to a new city.

The reason behind this rule is that if you jump directly into buying, you may buy in the wrong place when you’re not familiar with the new city. Renting gives you time to figure out where exactly you’d like to settle in.

That’s all good but it introduces two problems.

The first problem is availability. It may be easier if you’re willing to rent an apartment, but if you’d like to live in a single-family home as you’re used to, far fewer single-family homes are available for rent than the number of single-family homes for sale.

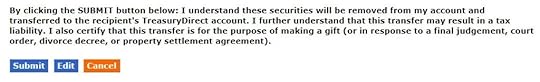

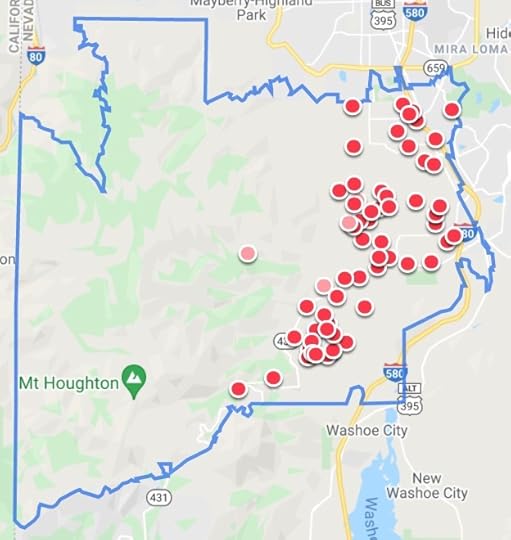

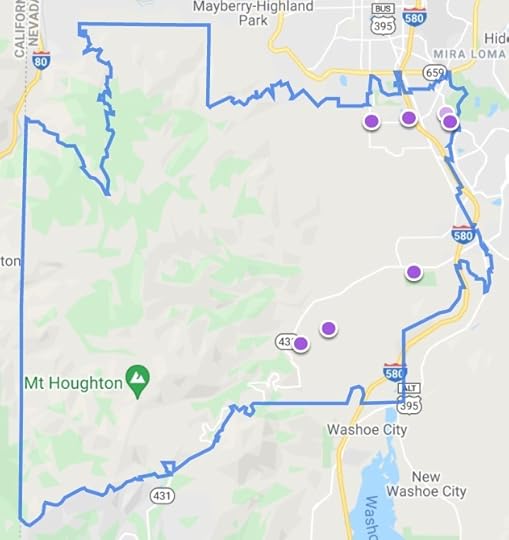

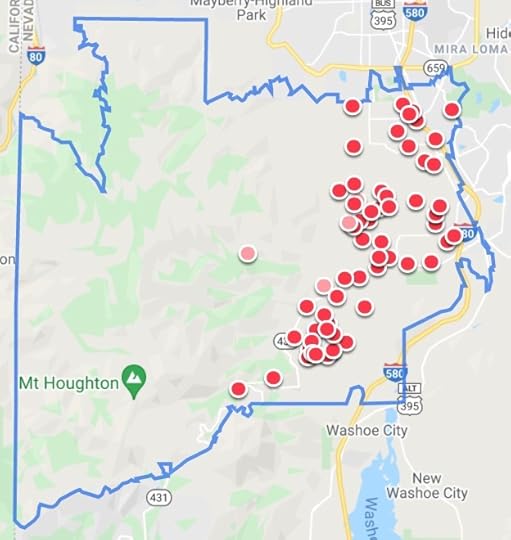

These two maps from Zillow show the single-family homes for rent and for sale in my zip code. You see a big difference in available choices.

For Rent

For Rent For Sale

For SaleThis isn’t a new phenomenon due to the COVID pandemic. It was like this when we were looking for rentals in 2019.

The second problem of insisting on renting first is quality. The average qualify of the homes for rent is a step lower than the average qualify of the homes for sale. If you want to rent a single-family home you actually like, in terms of its location, cleanliness, ages of the appliances, etc., you have even fewer choices.

Because we only looked for rentals, it took us a full year to finally find one we liked. If we also considered buying, we could’ve moved and enjoyed our life in the new area much sooner. So:

Research RemotelyOld Rule: Rent first when you move to a new city.

New Rule: Consider both buying and renting.

What about the worry of buying in the wrong part of the town?

That old rule of renting first probably came out before the Internet era. Now locals get their information online anyway. You can get the same information when you’re remote.

You see where stores and other facilities are on Google Maps. You have satellite view and street view of neighborhoods. You see real-time traffic from DOT cameras. You see voting results, school test scores, air quality indexes, and whatever aspects you care about. You can read the local newspaper and watch the local television stations online. You can join local Facebook groups and see what’s going on there.

We’ve been here for a year and a half. I didn’t learn anything that someone remote can’t find out.

Buy a Rental and Rent It to Youself?Another push toward renting is this other rule that says you should buy only if you’ll stay in the home long-term. Long-term is defined as five years, seven years, 10 years, or longer.

Thinking you must stay in the home long-term makes you pickier. Even though there are more homes for sale than for rent, the abundance of choices quickly disappears when you add all your requirements for staying in the home long-term. This home is a one-story and you want a two-story (or vice versa). This home is too old. That home isn’t in the most desirable neighborhood. This home is on a small lot. This other home requires too much work, etc., etc.

However, when you’re considering renting anyway, you may also consider buying a home of similar quality to a rental. Think of it as renting it to yourself until you find your ideal home. You don’t have to be too picky when it isn’t long-term.

You’re the best landlord in the world when you rent to yourself. You won’t have to worry about breaking a lease or large rent increases. You don’t have to worry about disputes over damages or the security deposit. You can stay however long or however short. When you finally buy your ideal home, you either sell your transition home or keep it as a rental, whichever makes more sense at that time.

Dropping the requirement to stay in the home long-term opens up more choices. So:

What to Do with the Money?Old Rule: Buy only if you’ll stay in the home long-term.

New Rule: Consider buying a rental and rent it to yourself.

If you end up renting or buying a transition home that’s much less expensive than the home you really want, what should you do with the money from the sale of your previous home?

Another rule says you should keep the money safe if you’re planning to use it in the near future, which is usually defined as five years or less.

If you sell a paid-off home, you may intend to buy your next home with all cash from your sale. You should keep the money safe if that’s your only source of funds to buy your next home. What if you can borrow?

You may intend to buy it with all cash, but you don’t have to. You only need the downpayment when you can borrow. The rest of the money can be invested in your normal portfolio allocation. If the market is up when you buy your next home, you sell for a profit. Paying taxes on the gain still beats getting 0.5% in a savings account. If the market is down, you borrow. You pay off the loan when the market recovers.

It’s a myth that you can’t get a mortgage if you don’t have a paycheck. Fannie Mae and Freddie Mac allow banks to qualify you for a mortgage with only assets, including retirement accounts. It’s called an Asset Depletion mortgage or Asset Dissipation Underwriting. You don’t have to actually sell your investments or withdraw from your IRA. The lender only uses the size of your accounts to calculate an equivalent income for the purpose of qualifying you for the mortgage.

We inquired with a lender earlier this year. They easily pre-approved us for a mortgage.

If you have a large taxable account, you can also get a loan using security-based lending. You use your investments as opposed to the home as collateral for the loan. Because the interest rate is variable and investments are more liquid than a home, the interest rate can be in the low 1.x%.

Having options to borrow at low rates allows you to invest the money while you wait to buy your next home. I wish I explored these options after we sold our previous home.

A Better WayOld Rule: Keep the money safe at low returns if you plan to use it in the near future.

New Rule: Set up borrowing options and keep the money invested.

If we relocate again, we will do it this way:

If we see a home that we like for the long-term, buy it.If a suitable home is available for rent, rent it. Set up contigent borrowing options and keep the money invested.Also consider buying a rental home and renting it to ourselves. Keep it as a rental or sell it when we buy the next home.If we stop at (1) and housing prices go up, great. If housing prices go down, we’re in it for the long-term anyway.

If we stop at (2) and housing prices go up, the gains on the investments can keep up or at least offset some of the increase. If the investments have losses, borrow and wait for them to recover. If housing prices go down, great, buy at the lower price.

If we stop at (3) and housing prices go up, the gains on the rental and the residual investments can keep up or at least offset some of the increase. If housing prices go down, great, buy at the lower price and keep the rental as a rental.

This setup is much more robust than the old rules of renting first and keeping the money in cash. The old rules work when:

Desirable rentals are widely available.Home prices more or less track infation.Returns on safe money keep up with inflation.Under these assumptions, you can rent a year and take your sweet time to figure things out. If any one of the assumptions isn’t true, the old rules fail.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Relocating for Retirement: Buy or Rent – Old Rules and New Rules appeared first on The Finance Buff.

Relocating: Buy or Rent – Old Rules and New Rules

By now it’s obvious I botched our relocation last year. The decision to relocate was correct but I executed it poorly due to my lack of experience. I also didn’t think through all the options when I only relied on some “rules” that were either outdated or didn’t apply to our situation. In the end, my poor execution cost us $300,000.

Many people may be considering relocation for remote work or retirement. I’m writing down the lessons I learned from my mistakes.

BackgroundI left my full-time job in spring 2018. We decided to relocate in early 2019. We chose Reno, NV because we had been coming to the Lake Tahoe area for hiking and skiing for many years. Becoming locals beats driving several hours every time.

Rent First In a New City?We thought we should rent because we heard the rule that you should rent first when you move to a new city.

The reason behind this rule is that if you jump directly into buying, you may buy in the wrong place when you’re not familiar with the new city. Renting gives you time to figure out where exactly you’d like to settle in.

That’s all good but it introduces two problems.

The first problem is availability. It may be easier if you’re willing to rent an apartment, but if you’d like to live in a single-family home as you’re used to, far fewer single-family homes are available for rent than the number of single-family homes for sale.

These two maps from Zillow show the single-family homes for rent and for sale in my zip code. You see a big difference in available choices.

For Rent

For Rent For Sale

For SaleThis isn’t a new phenomenon due to the COVID pandemic. It was like this when we were looking for rentals in 2019.

The second problem of insisting on renting first is quality. The average qualify of the homes for rent is a step lower than the average qualify of the homes for sale. If you want to rent a single-family home you actually like, in terms of its location, cleanliness, ages of the appliances, etc., you have even fewer choices.

Because we only looked for rentals, it took us a full year to finally find one we liked. If we also considered buying, we could’ve moved and enjoyed our life in the new area much sooner. So:

Research RemotelyOld Rule: Rent first when you move to a new city.

New Rule: Consider both buying and renting.

What about the worry of buying in the wrong part of the town?

That old rule of renting first probably came out before the Internet era. Now locals get their information online anyway. You can get the same information when you’re remote.

You see where stores and other facilities are on Google Maps. You have satellite view and street view of neighborhoods. You see real-time traffic from DOT cameras. You see voting results, school test scores, air quality indexes, and whatever aspects you care about. You can read the local newspaper and watch the local television stations online. You can join local Facebook groups and see what’s going on there.

We’ve been here for a year and a half. I didn’t learn anything that someone remote can’t find out.

Buy a Rental and Rent It to Youself?Another push toward renting is this other rule that says you should buy only if you’ll stay in the home long-term. Long-term is defined as five years, seven years, 10 years, or longer.

Thinking you must stay in the home long-term makes you pickier. Even though there are more homes for sale than for rent, the abundance of choices quickly disappears when you add all your requirements for staying in the home long-term. This home is a one-story and you want a two-story (or vice versa). This home is too old. That home isn’t in the most desirable neighborhood. This home is on a small lot. This other home requires too much work.

However, when you’re considering renting anyway, you may also consider buying a home of similar quality to a rental. Think of it as renting it to yourself until you find your ideal home. You don’t have to be too picky when it isn’t long-term.

You’re the best landlord in the world when you rent to yourself. You won’t have to worry about the penalty for breaking a lease or large rent increases. You don’t have to worry about disputes over damages or the security deposit. You can stay however long or however short. When you finally buy your ideal home, you either sell your transition home or keep it as a rental, whichever makes more sense at that time.

Dropping the requirement to stay in the home long-term opens up more choices. So:

What to Do with the Money?Old Rule: Buy only if you’ll stay in the home long-term.

New Rule: Consider buying a rental and rent it to yourself.

If you end up renting or buying a transition home that’s much less expensive than the home you really want, what should you do with the money from the sale of your previous home?

Another rule says you should keep the money safe if you’re planning to use it in the near future, which is usually defined as five years or less.

If you sell a paid-off home, you may intend to buy your next home with all cash from your sale. You should keep the money safe if that’s your only source of funds to buy your next home. What if you can borrow?

You may intend to buy it with all cash, but you don’t have to. You only need the downpayment when you can borrow. The rest of the money can be invested in your normal portfolio allocation. If the market is up when you buy your next home, you sell for a profit. Paying taxes on the gain still beats getting 0.5% in a savings account. If the market is down, you borrow. You pay off the loan when the market recovers.

It’s a myth that you can’t get a mortgage if you don’t have a paycheck. Fannie Mae and Freddie Mac allow banks to qualify you for a mortgage with only assets, including retirement accounts. It’s called an Asset Depletion mortgage or Asset Dissipation Underwriting. You don’t have to actually sell your investments or withdraw from your IRA. The lender only uses the size of your accounts to calculate an equivalent income for the purpose of qualifying you for the mortgage.

We inquired with a lender earlier this year. They easily pre-approved us for a mortgage.

If you have a large taxable account, you can also get a loan using security-based lending. You use your investments as opposed to the home as collateral. Because the interest rate is variable and investments are more liquid than a home, the interest rate can be in the low 1.x%.

Having options to borrow at low rates allows you to invest the money while you wait to buy your next home. I wish I explored these options after we sold our previous home.

A Better WayOld Rule: Keep the money safe at low returns if you plan to use it in the near future.

New Rule: Set up borrowing options and keep the money invested.

If we relocate again, we will do it this way:

If we see a home that we like for the long-term, buy it.If a suitable home is available for rent, rent it. Set up contigent borrowing options and keep the money invested.Also consider buying a rental home and renting it to ourselves. Keep it as a rental or sell it when we buy the next home.If we stop at (1) and housing prices go up, great. If housing prices go down, we’re in it for the long-term anyway.

If we stop at (2) and housing prices go up, the gains on the investments can keep up or at least offset some of the increase. If the investments have losses, borrow and wait for them to recover. If housing prices go down, great, buy at the lower price.

If we stop at (3) and housing prices go up, the gains on the rental and residual investments can keep up or at least offset some of the increase. If housing prices go down, great, buy at the lower price and keep the rental as a rental.

This setup is much more robust than the old rules of renting first and keeping the money in cash.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Relocating: Buy or Rent – Old Rules and New Rules appeared first on The Finance Buff.

August 25, 2021

Create a Simple Revocable Living Trust with Software for I Bonds

I mentioned in the previous post How to Buy I Bonds: Soup to Nuts that we were creating a second trust with software to buy another $10,000 worth of I Bonds each year. A reader asked me to share more details on how we were doing it. For more on buying I Bonds in a trust account in general, please read Buy More I Bonds at TreasuryDirect in a Revocable Living Trust.

Please note I’m not a lawyer. I’m only sharing what we did for our own situation. I’m not recommending that you do the same. Please take this as only an anecdote.

Background and PurposeMany married couples have two revocable living trusts — one for each spouse. We have only one joint trust. Both setups are perfectly valid. An attorney prepared the trust for us a few years ago. It has the two of us as both grantors and trustees.

This trust uses my Social Security Number as its tax ID. It already bought $10,000 in I Bonds this year. It also holds other assets elsewhere.

Because a trust can only buy $10,000 in I Bonds each year, we wanted a second trust that uses my wife’s Social Security Number as the tax ID. As a separate trust with a different tax ID, this second trust can buy another $10,000 worth of I Bonds each year. We will only hold I Bonds in this second trust. Our existing trust will still be our main trust.

Quicken Willmaker & TrustNolo (formerly Nolo Press) has been publishing DIY legal books since the 1970s. It publishes a book-and-software kit called Quicken Willmaker & Trust. Amazon sells the 2021 edition for $39.

The 500-page book explains what the documents do and how you should go about them. The included software on a CD uses an interview format that leads you to complete the documents based on your preferences. This approach is similar to how tax software works.

The software in Quicken Willmaker & Trust can create a will, a revocable living trust, a healthcare directive, a durable power of attorney, and some other documents related to estate planning. If we didn’t have an attorney prepare all those for us a few years ago, we would’ve used this software to create them ourselves.

I wanted to get this book-and-software kit from the public library but they didn’t have it. Instead, I found another book at the library that ended up working better for our specific situation.

Make Your Own Living Trust by Dennis CliffordThis other book, Make Your Own Living Trust, now in its 15th edition, is also published by Nolo. The author Dennis Clifford is an estate planning attorney. Amazon sells the book for $39.

As the title suggests, this book only covers living trust, which is fine for our purpose because that was the only thing we needed. Instead of interview-format software, it includes a link at the end to download fill-in-the-blank document templates. The book explains the different choices for the blanks in the templates.

The document templates in Rich Text Format are fully editable by Microsoft Word or compatible applications. This worked better for us because it’s more customizable whereas the software in Quicken Will & Trust only works through interviews.

Simple StructureBecause we wanted to keep this second trust really simple, we went with this structure:

A joint trust with the two of us as both grantors and trustees. Either trustee can act alone on behalf of the trust. We can amend or revoke the trust at any time. This is the same as in our existing trust. It’s also the default in the shared trust document template.The name of the trust mirrors our existing trust, only reversing the order of our names.When one of us dies, the deceased person’s share of the trust assets goes to the survivor. The survivor can amend or revoke the trust at any time.When both of us die, the trust assets dump into our existing (main) trust.The document template has places for trust beneficiaries. We listed each other as the beneficiary when one of us dies and the main trust as the beneficiary when both of us die.

Notary CertificateThe document template says to attach a notary certificate after our signatures. Each state mandates specific language for what the notary certificate should say. I just Googled “[state] notary acknowledgment.” There’s a dedicated website for the notary acknowledgment language in each state but I prefer to get the language from an official state government site.

For example, here’s the link to the language in the Nevada state law, and here’s the one for California. The software in Quicken Will & Trust will probably automatically print the notary acknowledgment based on the state but we had to do this manually with the document template in Make Your Own Living Trust.

Our second trust became official after we signed the trust document and had it notarized. Because I got the book from the public library, our only cost was the notary fee. We can open an account for it at TreasuryDirect now.

***

If we didn’t already have estate planning documents prepared by an attorney, Quicken Willmaker & Trust is probably easier to use because the software uses an interview format. It’s also a better value because it covers more than just the living trust.

The document templates in Make Your Own Living Trust are like the “forms mode” in tax software. You can edit the document directly but you also have to be comfortable doing it. Having to find the correct notary acknowledgment language also adds another step.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Create a Simple Revocable Living Trust with Software for I Bonds appeared first on The Finance Buff.

August 17, 2021

How to Buy I Bonds (Series I Savings Bonds): Soup to Nuts

I’ve been writing about I Bonds for many years. I only realized now I’ve been writing as if everyone already knew what they were and how they worked. The annualized interest rate on I Bonds is currently 3.54% in the first six months. If that’s not high enough to entice you, maybe you’ll be more interested when the rate in the next six months possibly goes higher than 7.5%. If you’re new to I Bonds, this post walks you through from soup to nuts.

What Are I Bonds?I Bonds are short for Series I Savings Bonds. They are bonds issued by the U.S. government directly to retail investors. Currently, I Bonds carry favorable interest rates over other CDs and bonds. This makes I Bonds the best bonds you can buy at the moment.

How I Bonds WorkThink of I Bonds as flexible-term variable-rate CDs.

You’re required to hold them for at least one year. After that, you can cash out at any time you’d like, or you can choose to hold them for up to 30 years from the original time of purchase. If you cash out within five years, you forfeit interest earned in the previous three months, whereas the early withdrawal penalty on a typical commercial CD is often six months or 12 months of interest. The flexibility to cash out after one year with a low early withdrawal penalty or to hang on for as long as 30 years makes I Bonds good for both short-term and long-term investing.

Similar to a CD, the value of I Bonds never goes down. Unlike a typical CD with a fixed interest rate for the entire term, the interest rate on your I Bonds changes in six-month cycles. You stay on the current rate for the full six months and then you go on a new rate for another six months, and the new rate after that for another six months, and so on.

The interest rate is guaranteed to at least match inflation. If inflation goes up, the interest rate on your I Bonds automatically goes up. Some older I Bonds earn a positive rate above inflation. The I Bonds you buy now only match inflation. Even merely matching inflation makes I Bonds attractive when other CDs and bonds don’t keep up with inflation.

Tax TreatmentYou pay tax on the interest from I Bonds only when you decide to cash out, whereas you must pay taxes on the interest from CDs and bond funds every year even if you reinvest the interest. The interest from I Bonds is exempt from state and local income taxes. I Bonds are more appealing than other CDs and bonds because you have the tax deferral and the exemption from state and local income taxes.

Where to Buy I BondsThere are two ways to buy I Bonds:

On a government website TreasuryDirect.govUse money from tax refund when you file your tax return (see details in Overpay Your Taxes to Buy I Bonds)You can only use regular after-tax money to buy I Bonds. They are not available in any tax-advantaged accounts such as 401k-type plans, IRAs, or HSAs. Nor are they available through any brokerage firms such as Fidelity, Charles Schwab, or Vanguard.

Purchase LimitI Bonds are such a great deal that the government puts a limit on how much you can buy each year. At current rates, you should get your full quota before you buy any other CDs or bond funds.

When you buy on the government website TreasuryDirect.gov, the limit is $10,000 each calendar year per Social Security Number as the primary owner in a personal account. When you buy using money from your tax refund, the limit is $5,000 per tax return (not per person when you file jointly).

If you have a trust, you’re allowed to buy another $10,000 each calendar year in a trust account. If you have a business, the business can also buy $10,000 each calendar year.

A married couple each with a revocable living trust and a self-employment business can buy up to $65,000 each calendar year:

$10,000 with Person A as the primary owner and Person B as the second owner$10,000 with Person B as the primary owner and Person A as the second owner$10,000 in the name of Person A’s revocable living trust$10,000 in the name of Person B’s revocable living trust$10,000 in the name of Person A’s business$10,000 in the name of Person B’s business$5,000 using money from their tax refundWe have only one trust now. We’re creating a second trust with software to buy another $10,000. For buying I Bonds in a trust account in general, please read the previous post Buy More I Bonds at TreasuryDirect in a Revocable Living Trust.

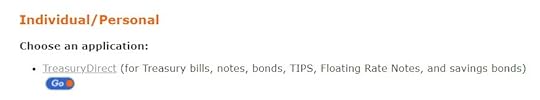

Open AccountIf you never bought I Bonds before, you need to open an account at the government website treasurydirect.gov. You can buy more in the same account in subsequent years. Find the Open Account link on the top right.

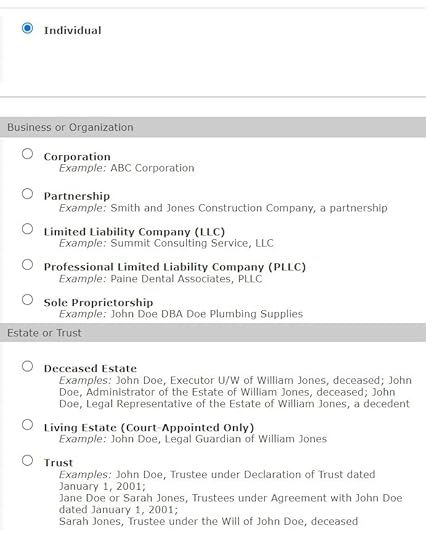

Choose the first option for Individual/Personal. Go here for a trust account or a small business account as well.

Now you can choose an individual, business, or trust account.

Next, fill out the required information and choose a security image, a password (not case sensitive), and security questions. If you’re opening a trust account, see the previous post Buy More I Bonds at TreasuryDirect in a Revocable Living Trust for what to use as the name of your account.

The application also asks you to link a bank account. Important: Please choose a bank account you will keep using forever. Adding the bank account at the time of account application is super easy, but changing the bank account in the future may be quite difficult. Also, make sure you enter the bank routing number and account number correctly. They don’t send any random deposits to verify the bank account. If you enter a wrong number now, it’ll be difficult to change it in the future.

You will receive your account number by email. Important: save your account number. You’ll need it to log in.

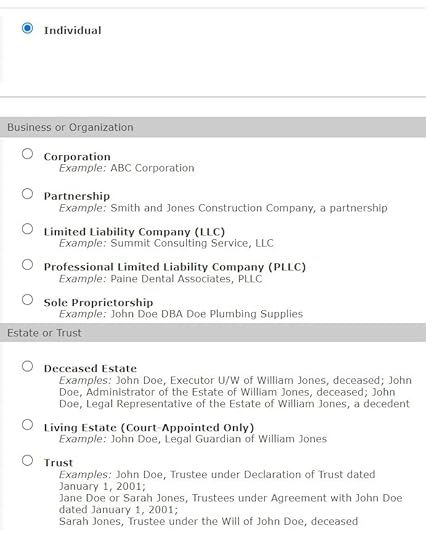

Schedule PurchaseLog in with the account number. The system will email you a one-time password (OTP). Important: Don’t use the back button in the browser when you use the TreasuryDirect.gov website.

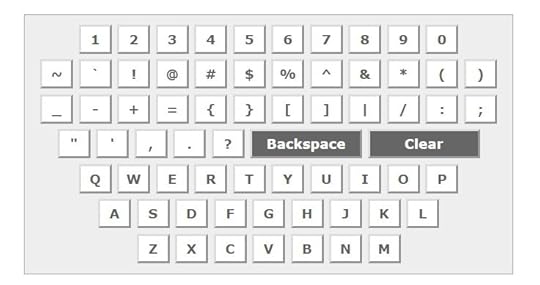

You enter the password you set when you opened the account on this virtual keyboard. It doesn’t have lower case letters. That’s why the password isn’t case-sensitive.

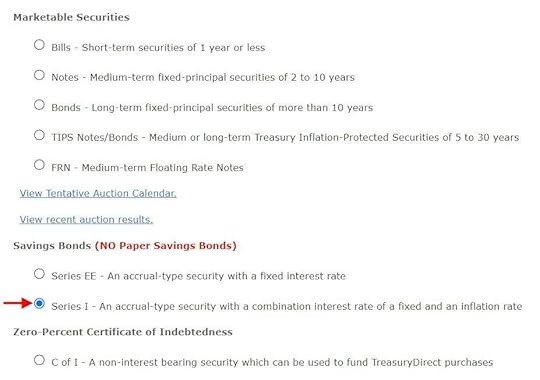

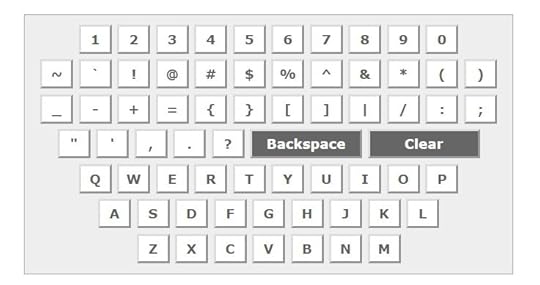

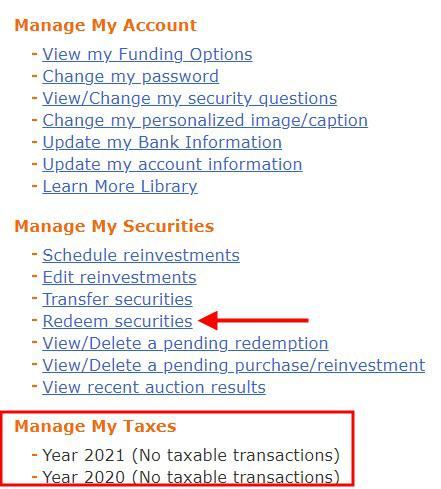

After you log in, go to BuyDirect in the menu.

Although we use TreasuryDirect only to buy I Bonds, the account can be used for other products as well. Choose Series I near the bottom of the list.

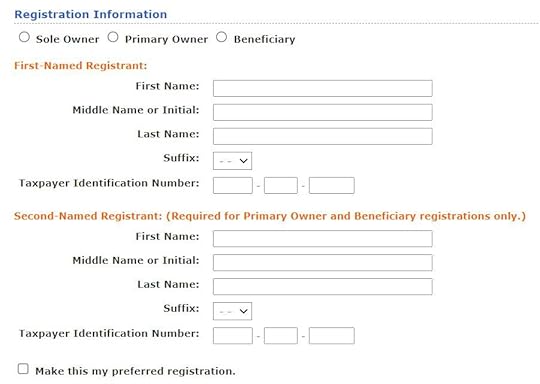

If you’re buying I Bonds for the first time in a personal account, you need to create a Registration, which means whether you want the bonds to have:

Just yourself as the only owner; orYou as the primary owner and another person as the second owner; orYou as the owner and another person as the beneficiary.See the previous post I Bonds Beneficiary vs Second Owner in TreasuryDirect for the difference between a second owner and a beneficiary and How To Grant Transact Right on I Bonds to the Second Owner if you decide to have a second owner. Enter yourself as the “first-named registrant.” Enter the second owner or the beneficiary as the “second-named registrant.” Your second owner or beneficiary has to be a person. It can’t be a trust.

Trust accounts and business accounts can’t have a second owner or a beneficiary. The trust or the business will be the only owner.

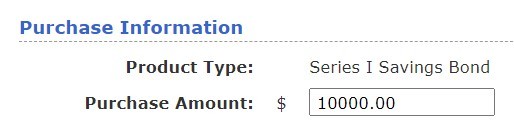

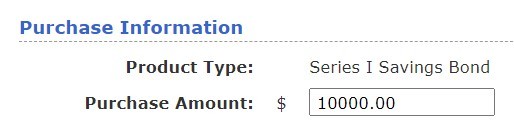

Enter your purchase amount.

Choose the purchase date. Make sure you have money available in the linked bank account. They send out the debit the night before your scheduled purchase date. The debit will hit your bank account on the scheduled date first thing in the morning. They may lock your TreasuryDirect account if the debit bounces. It’ll be difficult to unlock it. Important: Don’t cut it too close to the end of the month, or else you may miss a month worth of interest. I give it a lead time of at least a week before the end of the month.

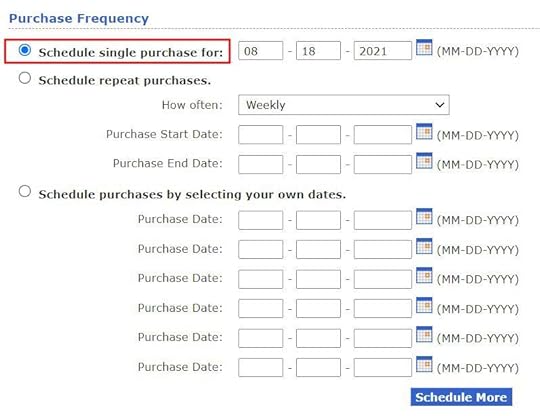

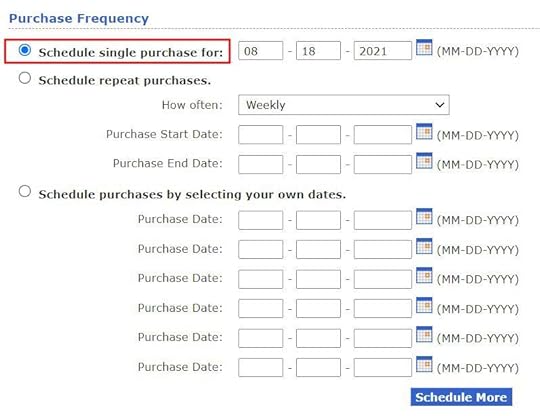

Check Balance

Check BalanceTreasuryDirect doesn’t send any account statements. You check your balance on the website. Your total balance is displayed on the home page after you log in.

You’ll see a list broken down by the Issue Date when you click on the Savings Bonds link.

If your bonds are still within 5 years from the Issue Date, the Current Value automatically excludes interest earned in the last three months. If you cash out today, you’ll receive the Current Value. That’s why the bonds bought three months ago didn’t show any interest in the current value.

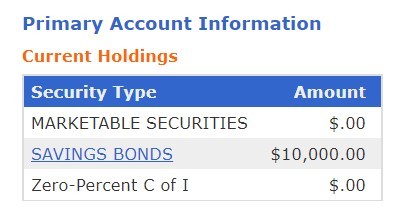

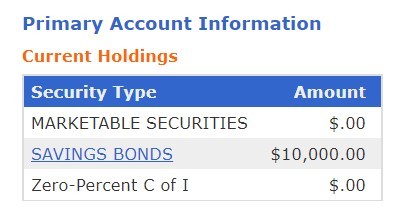

Cash Out (Redeem)Because I Bonds are better than other bonds and there’s a purchase limit, you should hang on to your I Bonds as much as you can until you have better choices. If you need to cash out some of them (called “redeem” in the government lingo), you use the ManageDirect menu.

The option isn’t really obvious unless you know what to look for.

You don’t have to cash out/redeem the full purchase. Redeeming just part of it is just fine. The money will be sent to your linked bank account.

Tax FormsIf you don’t cash out (redeem) any I Bonds in any year, you won’t get a 1099 form for the interest earned. You pay taxes only in the year you cash out.

If you do cash out (redeem) any I Bonds in any year, TreasuryDirect will generate a 1099 tax form for the accumulated interest since your original purchase. They don’t send paper tax forms. You’ll come back to the ManageDirect part of the website at tax time to get the tax form (see the screenshot above).

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Buy I Bonds (Series I Savings Bonds): Soup to Nuts appeared first on The Finance Buff.

How to Buy I Bonds(Series I Savings Bonds): Soup to Nuts

I’ve been writing about I Bonds for many years. I only realized now I’ve been writing as if everyone already knew what they were and how they worked. The annualized interest rate on I Bonds is currently 3.54% in the first six months. If that’s not high enough to entice you, maybe you’ll be more interested when the rate in the next six months possibly goes higher than 7.5%. If you’re new to I Bonds, this post walks you through from soup to nuts.

What Are I Bonds?I Bonds are short for Series I Savings Bonds. They are bonds issued by the U.S. government directly to retail investors. Currently, I Bonds carry favorable interest rates over other CDs and bonds. This makes I Bonds the best bonds you can buy at the moment.

How I Bonds WorkThink of I Bonds as flexible-term variable-rate CDs.

You’re required to hold them for at least one year. After that, you can cash out at any time you’d like, or you can choose to hold them for up to 30 years from the original time of purchase. If you cash out within five years, you forfeit interest earned in the previous three months, whereas the early withdrawal penalty on a typical commercial CD is often six months or 12 months of interest.

Similar to a CD, the value of I Bonds never goes down. Unlike a typical CD with a fixed interest rate for the entire term, the interest rate on your I Bonds changes in six-month cycles. The interest rate is guaranteed to at least match inflation. If inflation goes up, the interest rate on your I Bonds automatically goes up. Some older I Bonds earn a positive rate above inflation. The I Bonds you buy now only match inflation. Even merely matching inflation makes I Bonds attractive when other CDs and bonds don’t keep up with inflation.

Tax TreatmentYou pay tax on the interest from I Bonds only when you decide to cash out, whereas you must pay taxes on the interest from CDs and bond funds every year even if you reinvest the interest. The interest from I Bonds is exempt from state and local income taxes. I Bonds are more appealing than other CDs and bonds because you have the tax deferral and the exemption from state and local income taxes.

Where to Buy I BondsThere are two ways to buy I Bonds:

On a government website TreasuryDirect.govUse money from tax refund when you file your tax return (see details in Overpay Your Taxes to Buy I Bonds)You can only use regular after-tax money to buy I Bonds. They are not available in any tax-advantaged accounts such as 401k-type plans, IRAs, or HSAs. Nor are they available through any brokerage firms such as Fidelity, Charles Schwab, or Vanguard.

Purchase LimitI Bonds are such a great deal that the government puts a limit on how much you can buy each year. At current rates, you should get your full quota before you buy any other CDs or bond funds.

When you buy on the government website TreasuryDirect.gov, the limit is $10,000 each calendar year per Social Security Number as the primary owner in a personal account. When you buy using money from your tax refund, the limit is $5,000 per tax return (not per person when you file jointly).

If you have a trust, you’re allowed to buy another $10,000 each calendar year in a trust account. If you have a business, the business can also buy $10,000 each calendar year.

A married couple each with a revocable living trust and a self-employment business can buy up to $65,000 each calendar year:

$10,000 with Person A as the primary owner and Person B as the second owner$10,000 with Person B as the primary owner and Person A as the second owner$10,000 in the name of Person A’s revocable living trust$10,000 in the name of Person B’s revocable living trust$10,000 in the name of Person A’s business$10,000 in the name of Person B’s business$5,000 using money from their tax refundWe have only one trust now. We’re creating a second trust with software to buy another $10,000.

See previous posts How To Grant Transact Right on I Bonds to the Second Owner and Buy More I Bonds at TreasuryDirect in a Revocable Living Trust.

Open AccountYou open the account at the government website treasurydirect.gov. Find the Open Account link on the top right.

Choose the first option for Individual/Personal. Go here for a trust account or a small business account as well.

Now you can choose an individual, business, or trust account.

Next, fill out the required information and choose a security image, a password (not case sensitive), and security questions.

The application also asks you to link a bank account. Important: Please choose a bank account you will keep using forever. Adding the bank account at the time of account application is super easy, but changing the bank account in the future may be quite difficult. Also, make sure you enter the bank routing number and account number correctly. They don’t send any random deposits to verify the bank account. If you enter a wrong number now, it’ll be difficult to change it in the future.

You will receive your account number by email. Important: save your account number. You’ll need it to log in.

Schedule PurchaseLog in with the account number. The system will email you a one-time password (OTP). Important: Don’t use the back button in the browser when you use the TreasuryDirect.gov website.

You enter the password you set when you opened the account on this virtual keyboard. It doesn’t have lower case letters. That’s why the password isn’t case-sensitive.

After you log in, go to BuyDirect in the menu.

Although we use TreasuryDirect only to buy I Bonds, the account can be used for other products as well. Choose Series I near the bottom of the list.

Enter your purchase amount.

Choose the purchase date. Make sure you have money available in the linked bank account. They may lock your TreasuryDirect account if the debit bounces. It’ll be difficult to unlock it. Important: Don’t cut it too close to the end of the month, or else you may miss a month worth of interest. I give it a lead time of at least a week before the end of the month.

Check Balance

Check BalanceTreasuryDirect doesn’t send any account statements. You check your balance on the website. Your total balance is displayed on the home page after you log in.

You’ll see a list broken down by the Issue Date when you click on the Savings Bonds link.

If your bonds are still within 5 years from the Issue Date, the Current Value automatically excludes interest earned in the last three months. If you cash out today, you’ll receive the Current Value. That’s why the bonds bought three months ago didn’t show any interest in the current value.

Cash Out (Redeem)Because I Bonds are better than other bonds and there’s a purchase limit, you should hang on to your I Bonds as much as you can until you have better choices. If you need to cash out some of them (called “redeem” in the government lingo), you use the ManageDirect menu.

The option isn’t really obvious unless you know what to look for.

You don’t have to cash out/redeem the full purchase. Redeeming just part of it is just fine. The money will be sent to your linked bank account.

Tax FormsIf you don’t cash out (redeem) any I Bonds in any year, you won’t get a 1099 form for the interest earned. You pay taxes only in the year you cash out.