How To Deposit Paper I Bonds to TreasuryDirect Online Account

I overpaid my taxes to buy an extra $5,000 worth of I Bonds. I received the paper I Bonds in the mail a week after I received the direct deposit for the remainder of my tax refund.

I can keep these paper bonds in a home safe or a safe deposit box at a bank but I much prefer to keep everything together in the online account at TreasuryDirect. In the usual government fashion, they don’t make it easy. Treat it as a test for how well you’re able to follow instructions. It feels convoluted the first time. It gets better after you get the hang of it.

Deposit = ConversionFirst, the lingo. I think of it as depositing the paper bonds into the online account. The government calls it converting paper savings bonds to electronic form. When you deposit cash into your bank account, no one calls it converting paper currency to electronic form. You won’t find the instructions if you don’t know what it’s called.

You retain the original issue date when you deposit your paper bonds to the online account (“convert to electronic form”). You will earn the same amount of interest whether you keep the paper bonds as paper or add them to your online account.

Conversion Linked AccountNext, you can’t deposit directly into your online account. You have to create a special sub-account within your main account. They call it the “Conversion Linked Account.”

After you log in to TreasuryDirect, click on ManageDirect in the menu.

Then click on “Establish a Conversion Linked Account.”

This will create the sub-account. You only have to do this once. You can re-use this Conversion Linked Account in the future. You will see the linked account on the bottom left of the page when you log in to your main account. You go into the Conversion Linked Account by clicking on “My Converted Bonds.”

You do all the steps below in this Conversion Linked Account.

Registration ListAfter you get into the Conversion Linked Account, go to ManageDirect, and then click on “Create my registration list.”

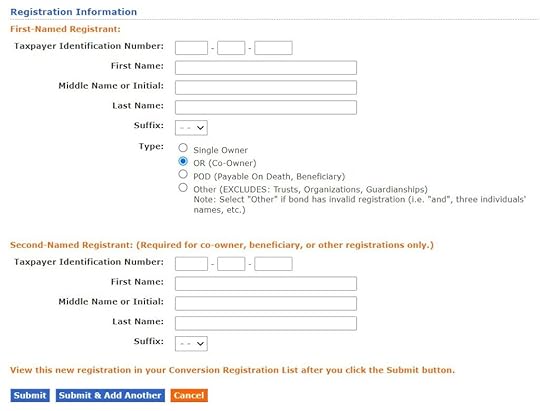

A Registration means how the bonds are owned. You need to create a registration that matches the ownership printed on the paper bonds – just you, you and a second owner, or you with a beneficiary.

Our bonds had both our names. So I chose the “OR (co-owner)” option.

Again, you only have to do this once if your paper bonds from next year’s tax refund will have the same ownership.

Add to CartNow, back to ManageDirect. Click on “Convert my bonds.”

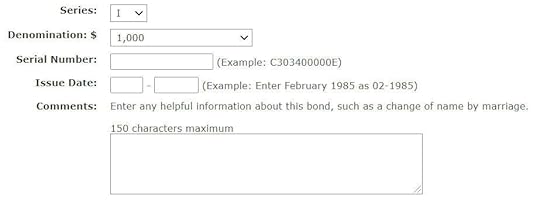

Enter each bond you’d like to deposit/convert. Make sure you enter the correct series, denomination, serial number, and issue date exactly as printed on the paper bonds. Leave the comments blank.

Create Manifest

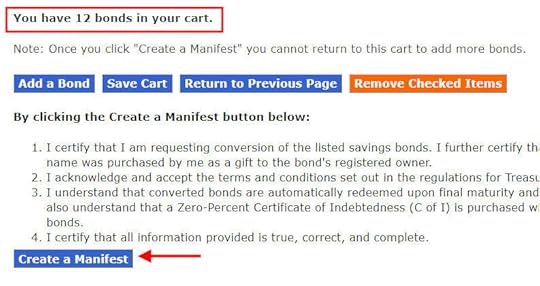

Create ManifestAfter you’re done with entering all the bonds, go back to ManageDirect. Click on “View my cart.”

You will see a list of the bonds you just entered. Double-check to make sure everything is correct. Click on the “Create a Manifest” button at the bottom.

A manifest is like the packing list that comes with your package from online shopping. They want you to print the manifest, sign it, and mail it with your bonds.

Sign and MailThe manifest has the Treasury Department’s mailing address in Minneapolis. Sign the manifest. Take pictures of your bonds before you mail them with the signed manifest.

Because the paper bonds came by regular mail to begin with, I only used plain First Class Mail when I mailed them back. You need two Forever stamps if you put 12 bonds in a regular #10 envelope because the weight is over one ounce. If you’d like to add tracking for your peace of mind, you can pay few dollars extra and mail it by Certified Mail. If you prefer FedEx or UPS, there’s a separate address on the manifest.

Case Number AssignedYou’ll receive an email when they receive your bonds and put the job in their work queue. I received the email seven days after I mailed the bonds. This email includes a case number in case you need to contact them. Just save the email.

Check ManifestTreasuryDirect will work on your deposit/conversion but they won’t send another email when they’re done. Because you’ll retain the original issue date, and you’ll earn the same amount of interest regardless, I don’t worry how long it takes them to complete the process. It doesn’t make any difference whether it’s done in a week, a month, or three months.

If you’d like to check the progress, log in and click on “My Converted Bonds” at the bottom left to go into your Conversion Linked Account. Then go to ManageDirect, and click on “View my manifests.”

It’s close to completion when you see the status changing from blank to “In Progress.” It’s done when the value of your Conversion Linked Account goes up.

You don’t need to check the status every day. You can’t redeem the bonds in the first 12 months anyway. I checked periodically only for the purpose of writing this post. Here’s the complete timeline of my recent submission:

Day 1: Mailed the bonds by First Class Mail.Day 8: Received email with the case number.Day 26: Status of the manifest changed from blank to “In Progress.”Day 27: Conversion completed.Set a reminder to check the status in 30 days. If it’s not done yet, check back in another 30 days.

Transfer to Main Account (Optional)You can leave the converted bonds in the Conversion Linked Account, but I find it easier when the bonds are all together in my main account.

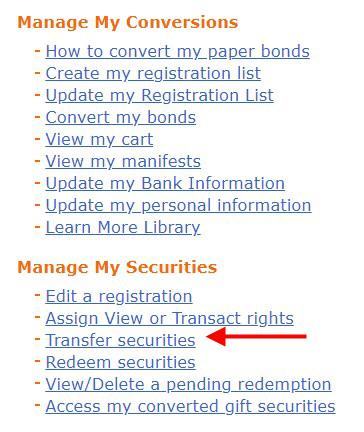

Go into the Conversion Linked Account and then go to ManageDirect. Click on “Transfer securities.”

Go into Series I savings bonds, and check the box for each bond you’d like to transfer. Even though the bonds are in electronic form now, they’re still separate individual bonds, not merged into one large bond.

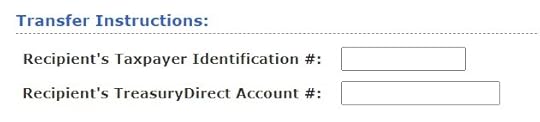

Put in your Social Security Number and the account number of your main account.

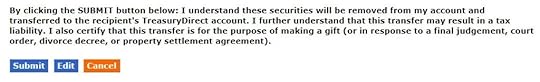

Scroll down to the bottom and submit. It isn’t taxable when you transfer between your Conversion Linked Account and your main account.

Your Conversion Linked Account is empty again after you transfer the converted bonds to your main account. You will use the Conversion Linked Account when you get the paper bonds from your tax refund next year.

***

It feels quite convoluted when you do it the first time. After you get the hang of it, it comes down to:

Enter the serial numbers online. Print and sign a manifest (“packing list”). Mail it with the bonds to Minneapolis.Receive an email with a case number. Check back after 30 days. Check again in another 30 days if necessary.(Optional) Transfer the converted bonds from the special sub-account to the main account.Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Deposit Paper I Bonds to TreasuryDirect Online Account appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower