Harry Sit's Blog, page 28

January 14, 2021

Stop Tax Return Fraud: Sign Up for the IRS IP PIN Program

[Updated on January 14, 2021. The online registration is open now.]

Due to many hacks and breaches of personal information, having a tax return filed fraudulently in your name has become a problem in recent years. Criminals gather enough information about you to file a tax return and request a refund from the IRS or the state. By the time you file your tax return, you are told they already have a return in your name. Now you have to show yours is legit and the other one isn’t. If you are due a refund, your refund may be delayed. It’ll be a problem if you’re planning to use your tax refund to buy additional I Bonds. Even if you owe, the fraud still creates more work for you to deal with the headache.

This happens because the whole tax return system wasn’t designed with security in mind. Unlike with any other financial institution, you are not required to have an “account” with the IRS.

When you move, you are not required to notify the IRS. When a tax return next year comes in with a new address, it can be legit. The IRS is expected to trust that address and send a check there if so requested.You are not required to notify the IRS when you marry or divorce. If you always filed a joint return and the next return comes in as single, who knows, maybe you are no longer married.You are not required to link a bank account with the IRS. If a tax return requests the refund to a new bank account or even a prepaid card, it also can be legit. There’s no way to tell whether you just want your refund in a new way or it’s someone else doing it fraudulently.You have multiple channels to file a tax return. You can’t say “I always file on paper. Don’t accept any e-filed returns.” or “I only file through this service. Don’t accept any return on paper or from any other service.”On top of all these, the IRS is expected to process refunds fast. “Don’t ask questions. Just give me my money.”When so much money is at stake, not having a tighter connection between the two parties is just amazing.

Because the lack of a direct relationship with the taxpayers is a root cause, the IRS tries to address it through its Identity Protection PIN (IP PIN) program. When you sign up for the IP PIN program, the IRS will issue you a 6-digit PIN. You put the PIN on your tax return. Any e-filed tax return without the correct PIN will be rejected. Any paper return without the correct PIN will be subject to extra scrutiny.

A specific PIN is valid for only one year. After you sign up once to participate in the program, you log in to the IRS account each year to get a new PIN before the tax season starts. You always use your most current PIN. You don’t need a PIN when you amend your previous tax returns.

This adds an extra step but I think it’s a good measure for security. The IRS IP PIN program is optional. You have to sign up for it. After running it as a pilot for several years, the IRS opened up the program to everyone in 2021. It used to be limited to residents in certain states. Now everyone can sign up. You sign up directly with the IRS online. If you are married, sign up separately for each spouse. The PIN is specific to each person.

My wife and I have used the IP PINs with our tax returns for several years now. They work very well. If you file on paper, there’s a place for them on the signature line.

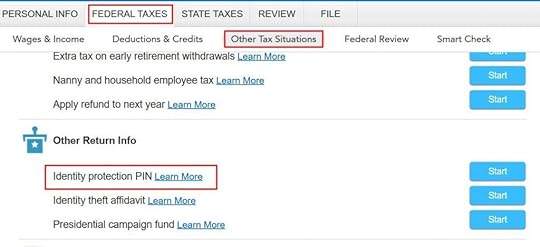

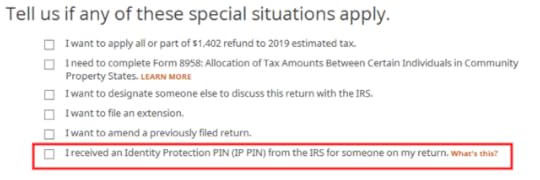

If you use tax software, you tell the software you have a PIN. In TurboTax, it’s under Federal Taxes, Other Tax Situations, Other Return Info, Identity protection PIN.

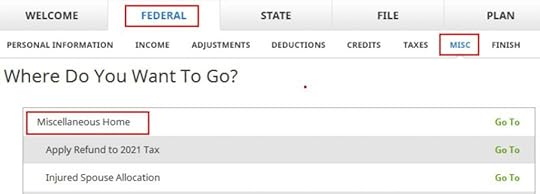

In H&R Block tax software, it’s under Federal, Miscellaneous, Miscellaneous Home.

More info: FAQs about the Identity Protection Personal Identification Number (IP PIN) from the IRS.

The post Stop Tax Return Fraud: Sign Up for the IRS IP PIN Program appeared first on The Finance Buff.

January 10, 2021

Overpay Your Taxes to Buy I Bonds for a Better Yield Than TIPS

The U.S. government sells billions of dollars in Treasury bonds to institutional investors every year. Right now those institutional investors are willing to pay such a high price for good credit quality to end up with a negative return after inflation. The real yield on Treasury Inflation Protected Securities (TIPS) is negative across all maturities.

MaturityReal Yield5-year-1.58%10-year-0.93%20-year-0.46%30-year-0.21%

Source: Daily Treasury Real Yield Curve Rates as of January 8, 2021, Treasury Department

A -0.93% real yield on 10-year TIPS means when this bond matures after 10 years, the purchasing power will be 9% less than today. Investors are willing to lose purchasing power because they’re afraid they’ll lose even more if they buy something else.

The U.S. government also sells savings bonds directly to individual investors in small denominations. Series I Savings Bonds (“I Bonds”) are like a variable-rate flexible term CD. The interest rate goes up and down with inflation, but you’re guaranteed to match the rate of inflation, not lose to it. You can choose to hold I Bonds between one year and 30 years. Matching inflation with a flexible term is a much better deal than losing to inflation after committing to 10 years.

TreasuryDirect

Such a good deal is reserved only for small investors. The government doesn’t let you buy as much as you want. Each person is allowed to buy $10,000 per calendar year. You can only buy it directly on a government website called TreausryDirect, not through a broker such as Vanguard or Fidelity. That means you can’t buy it with money in an IRA or a retirement plan account.

The TreasuryDirect website isn’t the easiest to use, because the government doesn’t have much incentive to make it easier when it’s already offering a much better deal than what institutional investors are willing to pay. However, if you persevere and follow the instructions in this guided tour, you’ll make it work in the end.

If you’re married, the two of you have to open an account with TreasuryDirect separately. TreasuryDirect doesn’t have the concept of a joint account, although you can choose to put a co-owner on the I Bonds you buy. The two accounts can link to the same bank account. The government will debit purchases from your bank account and credit redemptions to your bank account. You pay federal income tax on the accumulated interest only when you sell. The interest is exempt from state income tax.

IRS Direct Pay

After you max out the $10,000 per person per year at TreasuryDirect, you can buy another $5,000 per year indirectly, but only if you’re due at least that much in tax refund and you tell the IRS to use part of your tax refund to buy I Bonds. You can’t send a check with your tax return and ask them to buy I Bonds for you. If you normally don’t have a tax refund that large, you can increase your tax refund by overpaying ahead of time. Because I’m self-employed and I pay quarterly estimated taxes, I just pay extra for the fourth quarter.

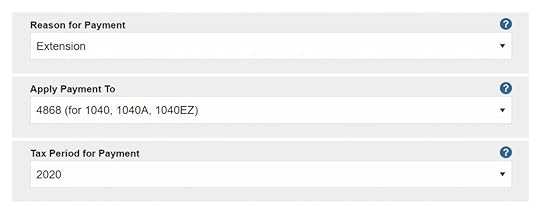

If you don’t pay quarterly estimated taxes, you can make a one-time payment through IRS Direct Pay. After a year is over, you can still pay toward the previous year’s taxes with an automatic extension. When you say your payment is for an extension, the payment automatically files the extension. You don’t need to fill out another form. After you file an extension you get extra time but you don’t have to use it. You can still file your tax return on time before April 15.

IRS Direct Pay

IRS Direct PayTurboTax

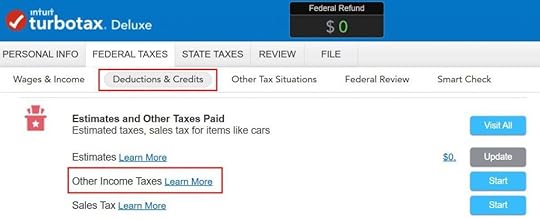

After you pay extra with an automatic extension, make sure to account for it on your tax return. In TurboTax, it’s under Federal Taxes, Deductions & Credits, Estimates and Other Taxes Paid, Other Income Taxes.

Then choose payment with the federal extension for the previous year.

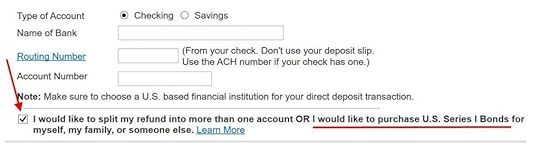

When it comes to buying I Bonds, it’s in the final steps before filing your return when TurboTax asks you whether you’d like to receive your refund by direct deposit or by check. You check a box at the bottom to say you want to split your tax refund and use part of it to buy I Bonds.

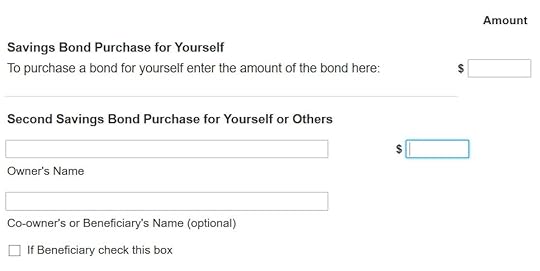

Then you will say how much you’d like to buy and whose name(s) should be on the bonds.

H&R Block Software

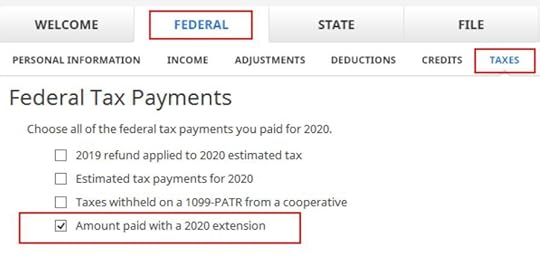

It works similarly in H&R Block tax software. The payment with extension is under Federal, Taxes, Federal Tax Payments.

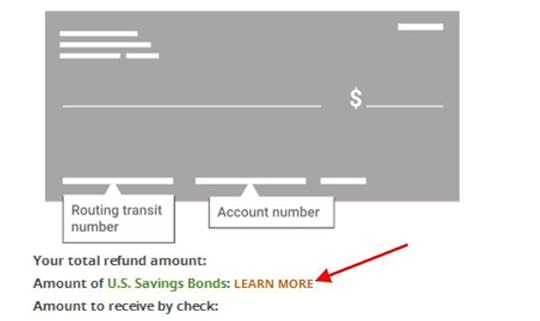

In the final steps before filing the return, when it asks you for the bank information for direct deposit, there’s a small link about U.S. Savings Bonds.

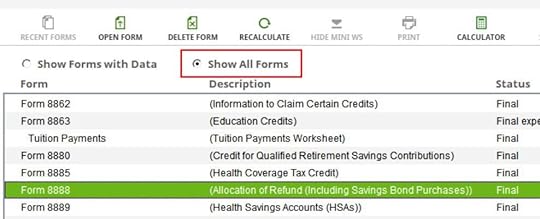

Clicking on the “learn more” link opens a pop-up that tells you how to find the necessary Form 8888.

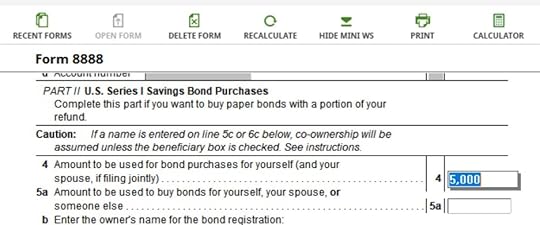

You enter the amount you’d like to buy and the names that should appear on the bonds in Form 8888.

Convert Paper I Bonds to Electronic

After you file your tax return, if everything goes well, the I Bonds will come in paper form by mail in multiple denominations. If you buy $5,000, you will receive four $1,000 bonds, one $500 bonds, two $100 bonds, and six $50 bonds. If you’d like to consolidate these paper bonds with the electronic bonds in your TreasuryDirect account, you can mail them to the Treasury Department and have them converted to electronic bonds. Please read the detailed instructions from TreasuryDirect.

If only they ask for your TreasuryDirect account number on the tax return, they won’t have to print the bonds and you won’t have to mail them back in. Again, the government has no incentive to make it easy. If you want I Bonds, you’ll have to tolerate their process.

The post Overpay Your Taxes to Buy I Bonds for a Better Yield Than TIPS appeared first on The Finance Buff.

December 29, 2020

2021 $300 Charity Deduction For Non-Itemizers $600 Married

Congress passed a new stimulus bill before the Christmas weekend. Although President Trump wanted to raise the second stimulus check from $600 per person to $2,000 per person, he still signed the bill into law. Unlike the previous stimulus law — the CARES Act — this new law doesn’t have a catchy name. The law together with the 2021 government spending is called the Consolidated Appropriations Act, 2021. Some portions of the law have separate names. The part that gives the second stimulus check is called the COVID-related Tax Relief Act of 2020. The part that extended some tax benefits is called the Taxpayer Certainty and Disaster Tax Relief Act of 2020. Because the new laws do some similar things as the CARES Act passed in spring 2020, I’ll refer to them informally as “CARES Act 2.0.”

The original CARES Act introduced a new $300 charity deduction for non-itemizers. It’s only for 2020 and only for those who take the standard deduction. The donation has to be in cash, not in household items, cars, or appreciated securities. It has to be made directly to a charity, not to a donor-advised fund. The maximum deduction is $300 for singles, $300 for married filing jointly, and $150 each for married filing separately. See previous posts CARES Act 2020 Charity Donation Deduction: $300 or $600 for Married? and CARES Act Charity Donation Deduction: Ongoing or Only One Year?

Now “CARES Act 2.0” extended this new charity deduction for non-itemizers to 2021, but with some tweaks for 2021. From the text of the law (bold added by me):

SEC. 212. CERTAIN CHARITABLE CONTRIBUTIONS DEDUCTIBLE BY NON-ITEMIZERS.

(a) In General.–Section 170 is amended by redesignating subsection (p) as subsection (q) and by inserting after subsection (o) the following new subsection:

“(p) Special Rule for Taxpayers Who Do Not Elect to Itemize Deductions.–In the case of any taxable year beginning in 2021, if the individual does not elect to itemize deductions for such taxable year, the deduction under this section shall be equal to the deduction, not in excess of $300 ( $600 in the case of a joint return), which would be determined under this section if the only charitable contributions taken into account in determining such deduction were contributions made in cash during such taxable year (determined without regard to subsections (b)(1)(G)(ii) and (d)(1)) to an organization described in section 170(b)(1)(A) and not–

“(1) to an organization described in section 509(a)(3), or

“(2) for the establishment of a new, or maintenance of an existing, donor advised fund (as defined in section 4966(d)(2)).”.

Consolidated Appropriations Act, 2021, page 1886 in the PDF.

The new deduction is still a one-off, for only 2021, not ongoing. It’s still only for those who take the standard deduction. The donation still has to be in cash, not in household items, cars, or appreciated securities. It still has to be made directly to a charity, not to a donor-advised fund. But, the maximum deduction for married filing jointly is now $600, not $300. The maximum deduction for married filing separately is now $300 each, not $150 each. These tweaks don’t affect 2020.

The 2020 deduction is “above the line,” which reduces one’s Adjusted Gross Income (AGI). Because many tax benefits and limits are keyed off the AGI, having a [slightly] lower AGI helps. The 2021 deduction is “below the line,” which doesn’t reduce the AGI, but it also doesn’t compete with the standard deduction. You can take both the standard deduction and this new charity deduction. It’s more “between the lines” — after the AGI but before the standard deduction. Think of it as increasing your standard deduction for one year by the amount you donate up to the cap and subject to those other requirements.

To summarize:

2020 deduction2021 deductionOnly one yearYesYesOnly for non-itemizersYesYesMust be in cashYesYesDirect to charityYesYesMax – single$300$300Max – married filing jointly$300$600Max – married filing separately$150 each$300 eachLower AGIYesNo

Consistency is never a strength in tax laws.

The post 2021 $300 Charity Deduction For Non-Itemizers $600 Married appeared first on The Finance Buff.

December 22, 2020

See Your Social Security Benefits Estimate In an Interactive Chart

Although I’m many years from being eligible for Social Security, I created a my Social Security online account with the Social Security Administration as a part of the “plant your flag” strategy to preempt identity thieves.

Social Security Administration used to send paper statements once a year to report your earnings history and your estimated benefit. The benefit estimate on the paper statement assumed that you will work until your full retirement age and you will earn the same each year as you did last year. The full retirement age is 67 for anyone born in 1960 and after. When they moved the statement online, the online account showed the same estimate using the same assumptions.

Neither assumption is necessarily true. You may plan to retire early and not work until 67. You may plan to downshift and earn less for some years before you retire. While the paper statement had to show a single static estimate, doing the same in the online account doesn’t take advantage of the interactive computing capabilities.

ssa.tools

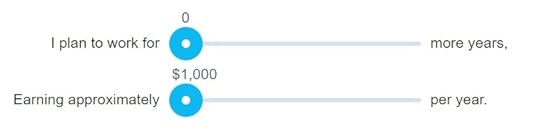

To help address this deficiency, software developer Greg Grothaus created a Social Security calculator at ssa.tools. After you copy and paste your earnings records from the my Social Security online account into ssa.tools, you have two sliders for how many more years you will work and how much you will earn per year.

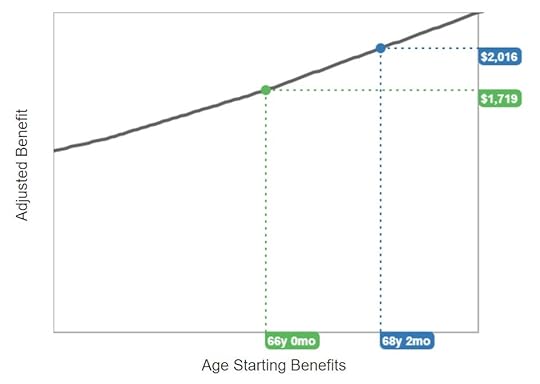

Moving the two sliders produces an interactive chart showing your estimated benefits at different claiming ages.

my Social Security

Social Security Administration apparently liked this idea. Now they built an interactive input in the my Social Security online account. This way people who didn’t know about the calculator at ssa.tools can also see how their estimated benefits will change by how much they will earn in the future.

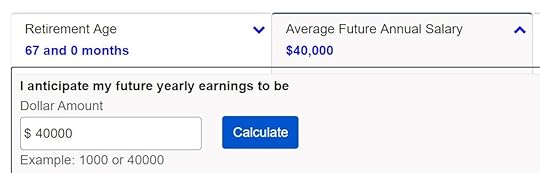

Although the assumed future annual salary still defaults to your earnings from last year, you can change it to a different number.

The chart shows how your Social Security benefit changes by when you will claim your benefit.

Unfortunately, the chart in the my Social Security online account allows only changing the average future annual salary. They still assume you will work and earn that estimated salary each year until your full retirement age. You can’t change how long you will work. The input for “Retirement Age” is only for when you will claim your Social Security benefits. It shows the effect of claiming early for a reduced benefit or claiming late for a higher benefit. When you will stop working and when you will claim your Social Security benefits are two different concepts. They should make it clear and open a separate input for how many more years you will work.

It’s easier to use the my Social Security site because they have all your data, all the rules, and you don’t have to jump out to another tool. It’s a shame the government agency isn’t using that power to the fullest extent. While Social Security Administration also provides a detailed calculator that allows more granular inputs, that detailed calculator is harder to use and not integrated with your earnings history. You’ll have to type in each year’s earnings manually. The Social Security calculator made by Greg Grothaus at ssa.tools does a much better job in showing you how your Social Security benefits will change by how long you will work and how much you will earn.

Why did a government agency with its budget and resources do a poorer job than a side project by an enthusiast software developer and a couple of contributors? That has to be a topic for another day. Until the government agency catches up to the side project, copy your earnings history from the my Social Security online account and use ssa.tools.

You may be surprised to learn that after some years of full-time work, working additional years doesn’t add much to your Social Security benefits. See Retiring Early: Effect On Social Security Benefits.

The post See Your Social Security Benefits Estimate In an Interactive Chart appeared first on The Finance Buff.

December 17, 2020

529 Plan For High School Seniors and Students Already in College

[Updated on December 15, 2020 with the latest rates.]

Selecting investments to match your time horizon is arguably the #1 rule in investing. If you have a long time horizon, you can invest more in risky investments with a better long-term expected return. If you only have a short time horizon, you can only afford to invest in more stable instruments with a lower expected return.

529 plans for college expenses present such a classic case. As each year passes, your investment time horizon shrinks. When the child gets to the senior year in high school, your investment time horizon becomes really short. You know you will need 1/4 of the money in one year, and another 1/4 in two years, three years, and four years. However, Vanguard gives this asset allocation for students age 17-18 in the 529 plan it manages:

21% in stocks52% in bonds27% in short-term reserves

With 21% in stocks and over half in intermediate-term bonds, some investors may think this is too aggressive for money that will be needed soon. When you need 1/4 of your money in one year, another 1/4 in two years, another 1/4 in three years, and the final 1/4 in four years, on average your money is only invested for 2-1/2 years. Some investors prefer to invest money that will be needed in such a short time frame in principal-guaranteed options.

Many 529 plans offer a money market fund option. You can choose the money market fund for the stable principal but sitting in the money market for up to four years feels a bit of a waste. Is there something in between, something that gives you slightly better returns than the money market but has less risk than bond funds?

Only some 529 plans offer CDs and stable value funds. They strike that happy medium between risks and returns for students who are close to going to college or who are already in college.

FDIC-Insured CDs

Ohio’s ColleageAdvantage Direct 529 Plan offers FDIC-insured savings accounts and CDs. As of December 2020, the yields are 0.3% for 1-year to 4-year CDs. The yields are slightly better than the prevailing money market fund yields.

Stable Value Funds

A Stable Value Fund is like a bond portfolio with an insurance contract. It’s guaranteed by the insurance company, not by the government. A stable value fund can offer both a stable principal and a higher yield than a money market fund. However, unlike CDs, their yield isn’t guaranteed for a fixed term. It’s subject to periodic adjustments.

Washington DC’s DC College Savings Plan offers a Principal Protected Portfolio backed by Ameritas Life Insurance Corp. The crediting rate is 2.3% in the fourth quarter of 2020.

Colorado’s CollegeInvest Stable Value Plus plan is backed by Nationwide. The rate for the full year 2021 is 2.09% net after fees.

Utah’s My529 Plan offers PIMCO Interest Income Fund as a choice under its Customized Static option. The yield shown on the fact sheet was 2.41% as of September 30, 2020. The PIMCO fund has the advantage of investing in contracts from multiple financial institutions.

All three plans above are a good option. By comparison, the 30-day SEC yield on the Vanguard Total Bond Market Index Fund was 1.14% as of December 4, 2020.

Moving 529 Plans

Although 529 plans are offered by each state, you are not necessarily limited to using only your own state’s plan. If you like the CDs and stable value fund options offered by one of the plans mentioned above, it’s possible to move your 529 plan account to those plans when your child gets close to going to college.

State tax benefits vary. Based on my own research, if you live in the states colored green and orange below, moving a 529 plan account does not have a negative impact (in Oklahoma and Washington DC, only after satisfying a minimum stay requirement).

In the other states, you’d be better off staying with the state’s own 529 plan. See Using a 529 Plan From Another State Or Your Home State?

Before you choose a 529 plan from another state or move your 529 plan account, find out:

whether your state offers tax benefits on 529 plan contributions;whether it limits the tax benefits to a plan sponsored by itself; and whether it claws back the benefits you previously received if you move the money out to a plan from another state.

The map here is based on my own research to the best I can. It may not be 100% accurate. State laws can and do change. Please always double-check with your state’s tax authorities.

If you decide to move a 529 plan account, the logistics are quite simple, although you are limited to only one move in every rolling 12 months. See Rollover a 529 Account From One Plan To Another.

The post 529 Plan For High School Seniors and Students Already in College appeared first on The Finance Buff.

December 15, 2020

529 Plan For High School Seniors and College Students

[Updated on December 15, 2020 with the latest rates.]

Selecting investments to match your time horizon is arguably the #1 rule in investing. If you have a long time horizon, you can invest more in risky investments with a better long-term expected return. If you only have a short time horizon, you can only afford to invest in more stable instruments with a lower expected return.

529 plans for college expenses present such a classic case. As each year passes, your investment time horizon shrinks. When the child gets to the senior year in high school, your investment time horizon becomes really short. You know you will need 1/4 of the money in one year, and another 1/4 in two years, three years, and four years. However, Vanguard gives this asset allocation for students age 17-18 in the 529 plan it manages:

21% in stocks52% in bonds27% in short-term reserves

With 21% in stocks and over half in intermediate-term bonds, some investors may think this is too aggressive for money that will be needed soon. When you need 1/4 of your money in one year, another 1/4 in two years, another 1/4 in three years, and the final 1/4 in four years, on average your money is only invested for 2-1/2 years. Some investors prefer to invest money that will be needed in such a short time frame in principal-guaranteed options.

Many 529 plans offer a money market fund option. You can choose the money market fund for the stable principal but sitting in the money market for up to four years feels a bit of a waste. Is there something in between, something that gives you slightly better returns than the money market but has less risk than bond funds?

Only some 529 plans offer CDs and stable value funds. They strike that happy medium between risks and returns for students who are close to going to college or who are already in college.

FDIC-Insured CDs

Ohio’s ColleageAdvantage Direct 529 Plan offers FDIC-insured savings accounts and CDs. As of December 2020, the yields are 0.3% for 1-year to 4-year CDs. The yields are slightly better than the prevailing money market fund yields.

Stable Value Funds

A Stable Value Fund is like a bond portfolio with an insurance contract. It’s guaranteed by the insurance company, not by the government. A stable value fund can offer both a stable principal and a higher yield than a money market fund. However, unlike CDs, their yield isn’t guaranteed for a fixed term. It’s subject to periodic adjustments.

Washington DC’s DC College Savings Plan offers a Principal Protected Portfolio backed by Ameritas Life Insurance Corp. The crediting rate is 2.3% in the fourth quarter of 2020.

Colorado’s CollegeInvest Stable Value Plus plan is backed by Nationwide. The rate for the full year 2021 is 2.09% net after fees.

Utah’s My529 Plan offers PIMCO Interest Income Fund as a choice under its Customized Static option. The yield shown on the fact sheet was 2.41% as of September 30, 2020. The PIMCO fund has the advantage of investing in contracts from multiple financial institutions.

All three plans above are a good option. By comparison, the 30-day SEC yield on the Vanguard Total Bond Market Index Fund was 1.14% as of December 4, 2020.

Moving 529 Plans

Although 529 plans are offered by each state, you are not necessarily limited to using only your own state’s plan. If you like the CDs and stable value fund options offered by one of the plans mentioned above, it’s possible to move your 529 plan account to those plans when your child gets close to going to college.

State tax benefits vary. Based on my own research, if you live in the states colored green and orange below, moving a 529 plan account does not have a negative impact (in Oklahoma and Washington DC, only after satisfying a minimum stay requirement).

In the other states, you’d be better off staying with the state’s own 529 plan. See Using a 529 Plan From Another State Or Your Home State?

Before you choose a 529 plan from another state or move your 529 plan account, find out:

whether your state offers tax benefits on 529 plan contributions;whether it limits the tax benefits to a plan sponsored by itself; and whether it claws back the benefits you previously received if you move the money out to a plan from another state.

The map here is based on my own research to the best I can. It may not be 100% accurate. State laws can and do change. Please always double-check with your state’s tax authorities.

If you decide to move a 529 plan account, the logistics are quite simple, although you are limited to only one move in every rolling 12 months. See Rollover a 529 Account From One Plan To Another.

The post 529 Plan For High School Seniors and College Students appeared first on The Finance Buff.

December 8, 2020

Cap On Paying Back ACA Health Insurance Subsidy Premium Tax Credit

For the most part, the ACA health insurance subsidy, aka the premium tax credit, is set up such that it doesn’t matter how much you receive upfront when you enroll. The upfront subsidy is only an estimate. The final subsidy is squared up on your tax return. If you didn’t receive the subsidy when you enrolled but your actual income qualifies, you will get the subsidy as a tax credit when you file your tax return. If the government paid more subsidy than your actual income qualifies for, you will have to pay back the difference on your tax return.

If you aren’t short on cash, there are some advantages in estimating a high income during enrollment and not receiving the subsidy upfront. When you don’t ask for the subsidy, you don’t have to submit any document to prove your income. Your enrollment goes through very easily. You will earn credit card rewards when you pay the full premium to the insurance company. That’s worth much more than receiving the subsidy sooner. I always choose to pay in full and wait for any subsidy until I file my tax return. If I qualify for the subsidy, I’ll get it then. If I don’t qualify, nothing changes. See ACA Health Insurance: Ask For Premium Assistance Or Not.

However, in some cases you’re better off submitting income documentation and trying to qualify for the subsidy upfront.

Cost-Sharing Reductions

If your income is at 250% of the Federal Poverty Level (FPL) or below, you qualify for Cost-Sharing Reductions (CSR) in the form of a lower deductible, lower co-pays, and/or a lower out-of-pocket maximum on your health insurance. For example, a normal Silver plan in my area has a $4,500 deductible and an $8,500 out-of-pocket maximum. If your income is under 200% FPL, the Silver plan with the CSR has a $700 deductible and a $1,800 out-of-pocket maximum. That’s a big difference.

The CSR is only available on Silver plans, and you get into the better Silver plan only when you can justify upfront that your estimated annual income will be at 250% FPL or below. You won’t get your deductible or out-of-pocket maximum adjusted after the fact if you wait until you file your tax return. If your estimated income is at 250% FPL or below, don’t wait.

250% of FPL for a household of two people in the lower 48 states is about $43,000 in 2021. If your income isn’t that low, the CSR doesn’t apply to you.

Minimum Income Threshold

In addition to the maximum income to qualify for the premium tax credit, ACA also has a minimum income threshold. The minimum threshold is 100% of the Federal Poverty Level (FPL) in states that didn’t expand Medicaid and 138% of FPL in states that did. See Status of State Medicaid Expansion Decisions: Interactive Map from Kaiser Family Foundation.

100% FPL for a household of two people in the lower 48 states is $17,240 in 2021. 138% is $23,791. If there’s any chance that your income will fall below the minimum threshold, you should get your subsidy upfront at the time of enrollment. If you received the subsidy upfront and then your income unexpectedly falls below the minimum, you’ll still qualify for the premium tax credit on your tax return. If you didn’t receive the subsidy upfront, you won’t qualify for the premium tax credit on the tax return when your income is below the minimum threshold.

Repayment Cap

If you ask for the subsidy upfront, and your income ends up higher than your estimate, you’ll have to pay back some of the subsidy. There’s a cap on how much you need to pay back. The cap varies depending on your Modified Adjusted Gross Income (MAGI) and your tax filing status. It’s also adjusted for inflation each year. Here are the caps on paying back the subsidy for 2020 and 2021. The caps are the same in both years due to rounding.

MAGI2020 Coverage2021 Coverage< 200% FPLSingle: $325

Other: $650Single: $325

Other: $650 < 300% FPLSingle: $800

Other: $1,600Single: $800

Other: $1,600 < 400% FPLSingle: $1,350

Other: $2,700Single: $1,350

Other: $2,700 >= 400% FPLUnlimited Unlimited

Source: IRS Rev. Proc. 2019-44, Rev. Proc. 2020-45

The repayment cap applies only when your higher income still qualifies you for the premium tax credit. If your actual income exceeds the 400% of FPL cutoff and you don’t qualify for the subsidy anymore, there’s no repayment cap — you will have to pay back 100% of the advance subsidy you received.

The caps are also set sufficiently high such that unless there’s a big difference between your actual income and your estimated income at the time of enrollment, the amount you need to pay back will fall below the cap. For example, suppose you’re married filing jointly and you estimated your income would be $50,000 in 2021 when you enrolled. Suppose by the time you file your tax return, your income turns out to be $60,000. Because your income is $10,000 higher than you originally estimated, you qualify for a lower subsidy now. You will be required to pay back $1,133 as the difference. Because this difference is well under the $2,700 repayment cap, the cap doesn’t really help you.

In addition, because you’re required to notify the healthcare exchange of your income changes during the year in a timely manner so that they can adjust your advance subsidy, normally the difference in the advance subsidy you received and the subsidy you finally qualify for should be well under the cap. The cap helps only when your income increases close to the end of the year to make it too late to adjust your advance subsidy.

Still, a late income change can happen, and the change can be large enough to make the difference in the health insurance subsidy higher than the repayment cap. This is true especially when you’re single with a lower repayment cap. For example, suppose you’re single and you estimated your income would be $30,000 in 2021 when you enrolled. Suppose in December 2021 you decide to convert $20,000 in a Traditional IRA to a Roth IRA. This pushes your income to $50,000. The extra $20,000 income lowers your health insurance subsidy by $2,578, but because your repayment cap is $1,350, you only need to pay back $1,350. You get to keep the other $1,228. In this case, you’re better off asking for the subsidy upfront during enrollment. If you only wait until you file your tax return, you won’t benefit from the repayment cap.

Bottom line: in most cases the repayment cap doesn’t make any difference. However, if you think there’s a chance your income will increase a lot late in the year to make you benefit from the repayment cap, you should try to qualify for the subsidy upfront when you enroll. Maybe it’ll help. Maybe it won’t.

***

If you’re far from qualifying for the Cost-Sharing Reductions, falling below the minimum income threshold, or benefiting from the cap on repaying the subsidy, and your cash flow can afford the full premium upfront. you might as well save yourself some paperwork hassle and wait to claim your premium tax credit at tax time. That’s the case for me. I simply pay the full premium upfront, and I don’t worry about having to pay back any subsidy.

The post Cap On Paying Back ACA Health Insurance Subsidy Premium Tax Credit appeared first on The Finance Buff.

December 1, 2020

Pay Rent Electronically By Zelle: Daily Limit and Scheduling Payments

In many countries, bank account numbers work only one-way: if someone has your bank account number, they can put money into it but they can’t draw money out of it. Under this design, people who want to get paid happily give out their bank account numbers. Here in the U.S., bank account numbers work both ways: if someone has your bank account number, they can both put money into it (direct deposit) and draw money out of it (direct debit). This makes people uneasy in giving out their bank account information, even though the routing number and the account number are printed in plain view on their checks.

Because bank account numbers have no built-in protection for unauthorized debits, banks control who can access the system to do direct deposits and direct debits. Businesses can sign up for access, but in general, individuals can’t. This makes it difficult for individuals to pay another person electronically. Even if someone is willing to give me their bank routing number and account number, I can’t easily pay them with those numbers.

Some third-parties step in and act as a middleman to facilitate person-to-person payments. You pay the third-party and the third-party pays the other person. PayPal, Venmo, Cash App (Square), Apple Pay, Google Pay, and Facebook Pay all work to a degree. It’s free to send and receive when it doesn’t involve a credit card. Both the sender and the recipient must be on the same third-party system. It doesn’t work if you use PayPal and the person you’re paying uses Cash App. Either you also have to sign up for Cash App or they also have to sign up for PayPal. It gets unwieldy if you need to pay multiple people using all different third-parties.

Because these third-parties are private businesses, they have their agenda and they also must protect themselves. When you receive money in the third-party system, if you want to move it to your bank account, you may have to take a manual step to transfer it. The transfer may be subject to scrutiny and restrictions, and it can take several days.

Banks also got into the game. They funded their own middleman and created Zelle. Zelle provides the infrastructure but it leaves the customer-facing parts to the banks. Both the sender and the recipient interact with Zelle primarily through their bank’s online banking or mobile app. When both parties’ banks support Zelle, money leaves the sender’s bank account and it lands directly in the recipient’s bank account in minutes. Banks can choose to charge a fee for Zelle but most banks make it free to both send and receive. It works much better than using those tech companies. All large banks support Zelle (Chase, Bank of America, Wells Fargo, Citi, U.S. Bank, SunTrust, PNC, …). Some smaller banks and credit unions signed up as well. See the full list on Zelle’s website.

This came up when I needed to set up paying rent to my landlord. If I use my bank’s bill pay service, the bank will mail a paper check. My landlord lives in different places at different times of the year. If I pay him electronically, it goes into his bank account no matter where he’s at. Because I have everything else on autopay, I’d like to schedule the rent payments to go out automatically on a set date every month.

To my surprise, finding a bank that can do this was a challenge. Each bank sets its own policy on what it makes available through Zelle. Not all banks chose to support scheduling recurring Zelle payments. Those that support it have a low limit on how much you can send. For example, Navy Federal Credit Union allows sending a maximum of $2,500 every 30 days, and some banks allow sending only $500 per day. Bank of America allows sending up to $3,500 per day and up to $20,000 every 30 days through Zelle, but it doesn’t support scheduling automatic monthly payments. These limits aren’t inherent with Zelle. Different banks chose to impose different restrictions.

If your recipient’s bank supports Zelle, it works well for smaller payments, such as paying friends for shared expenses or paying a gardener. The low limits set by banks and their inconsistent support for scheduled payments make it more difficult to use Zelle for paying rent. Because Bank of America has a higher limit but it doesn’t support scheduling recurring payments, I have to set a calendar reminder and pay manually each month. It’s not the end of the world but I really wish it could be automated.

One important caveat for using Zelle and other third-parties for person-to-person payments is that you have to be absolutely sure you’re paying the right person. If you mistype an email address or phone number, the money can go to the wrong person and it’s difficult or impossible to get the money back. Some banks maintain a list of people you paid before. It helps for repeated payments but you still need to be extra careful when you’re paying someone for the first time. Some banks require typing the email address or phone number of the recipient every time. Doing it right last time doesn’t guarantee you’ll do it right this time. If you have a choice between different banks, use one that maintains a list of payees (Bank of America does).

The post Pay Rent Electronically By Zelle: Daily Limit and Scheduling Payments appeared first on The Finance Buff.

November 19, 2020

401k vs Pension: How To Make Your 401k Pay As Much As a Pension

[Updated with recent numbers from Vanguard.]

For the most part, 401k plans replaced pension as the prevailing vehicle for people’s retirement. Surveys and studies show very bleak numbers. The balances in 401k and IRAs aren’t nearly enough to pay for a comfortable retirement as the previous generation’s good ol’ pension once did.

Most public sector employees still get a pension. This often brings envy. People who don’t get a pension and don’t get enough from their 401k’s are increasingly unwilling to pay those who do.

It also leads to some people saying the 401k system is a failed experiment and that we are better off with a pension. Why can’t 401k and IRAs provide as much retirement income as a pension? There are many reasons such as:

Not all companies offer a 401k (not all companies offered a pension in the past either).Expensive funds and hidden fees in 401k plans (see how to uncover hidden fees in your plan).Volatile investment returns.People don’t understand investing.

These are all true. The biggest reason though, I would say, is that people don’t want 401k and IRAs to provide as much retirement income as a pension once did. In other words, 401k and IRAs don’t succeed because people don’t want them to succeed.

I came to this conclusion from reading Vanguard’s report on the 401k-type plans it manages: How America Saves. It shows in aggregate how much people contributed to their 401k plans, how much people accumulated in their 401k plan accounts, how much they traded in their accounts, etc. Vanguard publishes this report every year.

I highlight these interesting statistics:

24% of employees don’t contribute. 50% of employees younger than 25 don’t contribute.6% of employees with an income of greater than $150,000 don’t contribute.The median employee contribution rate is 6%.21% of employees contribute more than 10%.12% of employees contribute the maximum allowed by law.

Remember the participants covered by the Vanguard report (a) have a 401k plan, and (b) have low-cost funds from Vanguard. The picture is very clear. If people don’t contribute to their 401k’s or if they don’t contribute enough, they aren’t going to have enough in their accounts to cover their retirement.

How were pension plans able to do better? I once worked in the employee benefits department at a large employer with a pension plan. The annual funding to the pension plan came out to about 20% of the total payroll. To the employer, whether it was cash salary or pension contributions, it was all money coming out of the employer’s pocket as the employee compensation costs. For each $100 the employees earned in salary, the employer paid another $20 into the pension plan. The employees actually earned $120. The company was basically automatically putting 20 / 120 = 17% of an employees’ compensation into the pension plan. There wasn’t any choice. That 17% went in no matter what. It was forced savings.

When competition forced the employer to freeze the pension plan, all employees basically got a pay cut. The company no longer paid the $20. With a 3% 401k match, they were now paid 103 instead of 120. That was a 14% pay cut. Instead of taking the pay cut across the board and still saving the same percentage of the new total compensation for retirement, employees took a large part of the pay cut directly from retirement savings. After saving 6% in a 401k and receiving a 3% match, their cash salary was down from 100 to 94, but retirement savings were cut more than half from 20 to 9. When you cut your retirement savings in half, of course your 401k wouldn’t be able to pay as much as the old pension.

Why, when faced with a 14% pay cut, would people take the majority of the cut directly from retirement savings? People’s behavior revealed a preference for more cash today. If the employer didn’t have a pension plan and it just paid $120 to the employees as cash, the employees probably wouldn’t have contributed $20 toward retirement anyway. In other words, the old pension setup forced the employees to save for retirement more than they would’ve done themselves.

Is it bad to prefer cash today over money for retirement in the future? I’m not the one to judge. I subscribe to the philosophy of “live and let live.” If people want to spend more when they are young and spend less when they are old, what’s wrong with that? Why should an employer force them to save for retirement more than they wanted to?

Now, back to the question in the title. How do you make your 401k pay as much as a pension? One word: contribute. It takes about 15-20% of your pay to get to the level a typical pension plan once paid. If you want to achieve the same level of retirement income, you will need to target the contributions at 15-20% of your pay, counting your employer match.

The Vanguard report says that including employer match, employees with an income between $50k and $100k should save at least 12% of income; 15% of income if the income is over $100k. Given the uncertainty over Social Security and salary growth, I would bump these numbers up by a few percentage points.

Next time you hear “people used to have a pension,” think “people used to save 15-20% of their pay.” Nothing stops you from doing so today, unless you don’t want to.

The post 401k vs Pension: How To Make Your 401k Pay As Much As a Pension appeared first on The Finance Buff.

November 12, 2020

CARES Act Charity Donation Deduction: Ongoing or Only 2020?

While trying to solve one mystery in CARES Act Charity Donation Deduction: $300 or $600 for Married? I accidentally introduced another mystery. Is the deduction ongoing until the law changes again or is it a one-off for only 2020?

The text of the CARES Act said (bold added by me):

(22) CHARITABLE CONTRIBUTIONS.—In the case of taxable years beginning in 2020, the amount (not to exceed $300) of qualified charitable contributions made by an eligible individual during the taxable year.

CARES Act (page 65)

Because it said “years” (plural) and it gave no end-date, I thought this was an ongoing deduction. Tax attorneys at White & Case LLP wrote in April on Bloomberg Tax (bold added by me):

For individual taxpayers who do not itemize deductions, the CARES Act creates a new and seemingly permanent above the line deduction of up to $300 (additional to the standard deduction) for cash contributions made to qualifying charities.

Historic CARES Act Will Have Significant Impact on Companies, Individuals, Bloomberg Tax

However, reader MDM pointed out in a comment that the “taxable years” refer to fiscal years that can start on different dates in a year, and all those fiscal years must begin “in” 2020. He said if Congress wanted this to be an ongoing deduction they would’ve said “taxable years beginning after December 31, 2019.”

So what is it? An ongoing deduction or a one-off for only 2020?

The IRS Form 1040 draft instructions that solved our previous mystery doesn’t help. That document is specifically for 2020. It doesn’t say anything about 2021 and beyond. I turned to my trusted source Wolters Kluwer. Wolters Kluwer publishes guides for tax professionals. They wrote in August (bold added by me):

To encourage individuals to give more during the COVID-19 pandemic, Congress provided an incentive to non-itemizers to make charitable contributions. For 2020 only, an individual may claim an “above-the-line” deduction for up to $300 in charitable donations. The legislation is unclear, but most observers assume that the dollar limitation is $600 for married individuals filing jointly.

Charitable Contributions Continue to Rise; Expansion of Above-the-Line Deduction Proposed by John Buchanan at Wolters Kluwer

While it wasn’t clear at that time whether the deduction is $300 or $600 for married filing jointly, it was clear the deduction is a one-off for only 2020.

The Joint Committee on Taxation is a nonpartisan committee of Congress staffed by experienced economists, attorneys, and accountants, who assist Congress on tax legislation. They wrote in their detailed description of the CARES Act (bold added by me):

The provision permits an eligible individual to claim an above-the-line deduction in an amount not to exceed $300 for qualified charitable contributions made during a taxable year that begins in 2020. The above-the-line deduction is not available for contributions made during a taxable year that begins after 2020.

Description of the Tax Provisions of Public Law 116-136, the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act, The Joint Committee on Taxation

Oh well. I should learn how to read. Thank you, MDM, for pointing out the error.

The post CARES Act Charity Donation Deduction: Ongoing or Only 2020? appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower