Harry Sit's Blog, page 26

April 28, 2021

How to Open a Trust Account at Interactive Brokers (IBKR)

Interactive Brokers (IBKR or “IB”) is an online broker used by many active traders. Unlike other typical brokers for retail investors (Fidelity, Schwab, Vanguard, E*Trade, etc.), Interactive Brokers offers more avenues not needed by the typical retail investors, such as trading options, futures, and on international exchanges. However, one of their features appealing to me as a non-trader is the low margin rates. Using margin means borrowing against your portfolio. While traders use margin to add leverage to their trading, which increases both the risk and the potential payoff, long-term investors can use margin only for short-term cash needs.

Under the “IBKR Pro” pricing plan, the interest rate charged for the first $100k in a margin loan is 1.57%. The rate for borrowing the next $900k is only 1.07%. Say you have some investments in a taxable account with large unrealized capital gains. When you need cash, instead of selling your investments and triggering capital gains, you can borrow at these low rates to bridge a short gap. You repay the loan with money from other sources at a later time (delayed financing, real estate sale, matured CDs, etc.). If you only borrow a small amount, say less than 10% of your portfolio, and only for a short period, your risk of getting liquidated when the market goes down is very low.

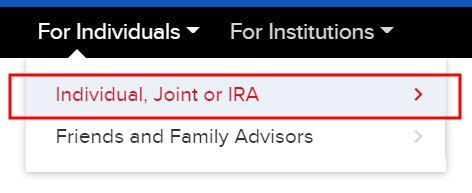

I wanted to move an account to Interactive Brokers to gain access to the low margin rates. Because my source account is under the name of a revocable living trust, I needed to open the new account at Interactive Brokers as a trust account as well. When I tried, I had a hard time figuring out how to open a trust account. I finally found the way. I’m putting it here in case others run into the same difficulties.

When you go to Interactive Brokers’ website, you see a red “Open Account” button on the top right. Don’t go there when you’re trying to open a trust account.

You also see a prominent link on the homepage. Don’t go there either when you’re trying to open a trust account. After you click on either button and create an email and password, the account types in the application are limited to only:

IndividualJointRetirementCustodianThere’s no option to create a trust account.

Instead, use the menu on the top left. Click on “For Individuals” and then “Individual, Joint or IRA.”

You see a bar of icons in the middle of the next page. Click on the last one “Open Account.”

Now, finally, click on the red button at the bottom instead of the one at the top to open a trust account.

The post How to Open a Trust Account at Interactive Brokers (IBKR) appeared first on The Finance Buff.

April 22, 2021

ACA Premium Subsidy Cliff Turns Into a Slope In 2021 and 2022

[Completely rewritten with changes from the American Rescue Plan Act of 2021.]

I have been buying health insurance on an exchange under the Affordable Care Act (ACA) since 2018. Before the ACA, getting health care coverage was one of the biggest challenges for becoming self-employed. Forget about the cost — just getting a policy was a challenge by itself. ACA changed all that. Now self-employed people and others who don’t get health insurance through their jobs can buy health insurance on the exchange.

Not only are you able to buy health insurance, but the coverage is also made affordable by the premium subsidy in the form of a tax credit. How much tax credit you get is calculated off of your modified adjusted gross income (MAGI) relative to the Federal Poverty Level (FPL) for your household size.

Your MAGI for the purpose of ACA is basically:

your gross income;minus pre-tax deductions from paychecks (401k, FSA, …)minus above-the-line deductions, for example: pre-tax traditional IRA contributionsHSA contributions1/2 of self-employment taxpre-tax contribution to SEP-IRA, solo 401k, or other retirement plansself-employed health insurance deductionstudent loan interest deduction plus tax-exempt muni bond interest;plus untaxed Social Security benefitsWages, interest, dividends, capital gains, pension, withdrawals from pre-tax traditional 401k and IRAs, money you convert from Traditional to Roth accounts all go into MAGI. Otherwise-not-taxed muni bond interest and Social Security benefits also count in MAGI.

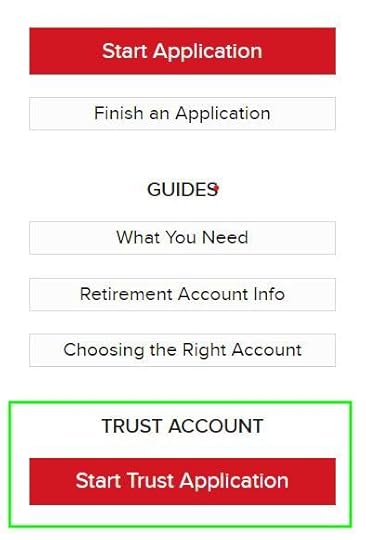

400% FPL Cliff Converted To a SlopeYour tax credit goes down as your income increases. Up through the year 2020, the tax credit drops to zero when your MAGI goes above 400% of FPL. If your MAGI is $1 above 400% FPL, you pay the full premium with zero tax credit. People had to be very careful in tracking their income to make sure it doesn’t go over the cliff.

For a household of a single person in the lower 48 states, that cutoff was just shy of $50,000 in 2020. For a household of two people in the lower 48 states, the cutoff was $67,640 in 2020. See Federal Poverty Levels (FPL) For Affordable Care Act for where 400% of FPL is at for your household size.

Now thanks to the American Rescue Plan Act of 2021 (also known as President Biden’s COVID stimulus package), for two years only — 2021 and 2022 — this cliff becomes a slope. The tax credit will continue to drop as your income increases but it won’t suddenly drop to zero when your income goes $1 over the cliff.

The chart above shows the ACA premium tax credit at different income levels for a household of two people in the lower 48 states where the second lowest cost Silver plan costs $1,000/month. The blue line is for 2020. The orange line is for 2021. The gap between the two lines represents the change between 2020 and 2021. The new law also increased the tax credit before the old cliff but the increase was much more significant after that point. The tax credit was zero at $70,000 income in 2020, but it will be about $500/month in 2021.

Because health insurance premium is higher for older folks and health insurance costs more in some areas of the country, the tax credit is also higher for someone older with the same MAGI and in areas where health insurance is more expensive.

Not having to watch out for the cliff is a huge relief to people closer to the edge of the old cliff, but the new law is only effective for two years in 2021 and 2022. Unless another law extends it, the cliff will come back in 2023.

Re-Enroll for 2021If you didn’t buy an ACA policy on the exchange because you didn’t qualify for a subsidy when you enrolled for 2021, it’s time to move onto the exchange now. You only get the subsidy if you buy your policy on the exchange.

If you already enrolled for 2021 on the exchange, you can edit your application and choose the same plan or a different plan now. That will trigger the recalculation of your subsidies. If you chose a free Bronze plan when you enrolled initially, maybe a Silver plan doesn’t cost much more now with the subsidy increase. Or maybe you’ll decide to convert some money from a Traditional IRA to Roth and use the subsidy increase to partially offset the tax on the Roth conversion.

It’s better if you take the initiative and force the recalculation now. If you don’t, some exchanges will recalculate the subsidy for everyone at a later time. You’ll have to wait longer that way. If your exchange doesn’t automatically recalculate for everyone, you still have another chance to claim the higher subsidy when you file your taxes next year.

Subsidy Repayment Waived in 2020Besides turning a subsidy cliff into a slope, the American Rescue Plan also made some other temporary changes. If you received an Advance Premium Tax Credit in 2020 based on your income estimate at the time of your enrollment and it turned out that your income in 2020 was higher than you originally estimated, you aren’t required to pay back any difference between the subsidy you already received and what the subsidy should’ve been based on your actual income. This repayment waiver applies only to 2020.

There’s no income limit for this waiver of subsidy repayment. If you estimated your income at $30,000 when you enrolled for 2020 and your income turned out to be $300,000 (maybe from trading GameStop or crypto?), you will still keep 100% of the subsidy as if your income was $30,000.

Although there may be some good intentions, the implementation of the repayment waiver is horrible. This helps people who estimated their income really low when they enrolled. You simply lose out if you were more accurate in your estimate.

Unemployment In 2021The American Rescue Plan also said for anyone who receives at least one week of unemployment benefits in 2021, they’re treated as if their income is 133% of FPL, which qualifies them for a free Silver plan, regardless of their actual income in 2021.

There’s no income limit for this special deal. If you receive one week of unemployment in 2021, even if you go on to earn $3 million during the year, you will still receive a free Silver plan as if you’re poor. Again, although there may be some good intentions, the implementation is just horrible. It practically encourages everyone on an ACA plan to get unemployed for a week in 2021.

When the Cliff Comes BackThe ACA subsidy cliff is scheduled to come back in 2023. People will have to manage their income and watch out for the cliff again. The most critical part is to project your income before the end of the year and not realize income willy-nilly before you do the projection. If you find yourself close to the cliff before you realize income, you can still adjust. Many people are caught by surprise only when they do their taxes in the following year. Your options are much more limited after the year is over.

Fortunately, it’s relatively easier to stay under the cliff for those who rely on an investment portfolio for income. When you are before 59-1/2, you are primarily spending money from your taxable accounts. A large part of the money withdrawn is your own savings; the rest is interest, dividends, and capital gains. Spending your own savings isn’t income. If you withdraw $60k to live on, your MAGI isn’t $60k. It’s probably less than $30k.

When you supplement your income with part-time self-employment, you still have the option to contribute to pre-tax traditional 401k, IRA, and HSA. Those pre-tax contributions lower your MAGI, which helps you stay under the 400% FPL cliff when necessary.

100% and 138% FPL CliffThere is another cliff on the low side, although that one is easily overcome if you have retirement accounts.

In order to qualify for a premium subsidy for buying health insurance from the exchange, you must have income above 100% FPL. In states that expanded Medicaid to 138% FPL, you must also not qualify for Medicaid, which means you must have MAGI above 138% FPL.

These are checked only at the time of enrollment. Once you get in, you’re not punished if your income unexpectedly ends up below 100% or 138% of FPL. If you see your income next year is at risk of falling below 100% or 138% FPL when you enroll, tell the exchange you’re planning to convert some money from your Traditional 401k or Traditional IRA to Roth. That’ll raise your income.

The post ACA Premium Subsidy Cliff Turns Into a Slope In 2021 and 2022 appeared first on The Finance Buff.

April 8, 2021

2020 2021 2022 ACA Health Insurance Premium Tax Credit Percentages

If you buy health insurance from healthcare.gov or a state-run ACA exchange, up through the year 2020, whether you qualify for a premium tax credit is determined by your income relative to the Federal Poverty Level (FPL). You didn’t qualify for a premium tax credit if your income was above 400% of FPL. That was a hard cutoff. See Stay Off the ACA Premium Subsidy Cliff.

The American Rescue Plan Act of 2021 (also known as President Biden’s $1.9 trillion stimulus package) removed the hard cutoff at 400% of FPL in 2021 and 2022. Now, how much credit you qualify for is determined by a sliding scale. The government says based on your income, you are supposed to pay this percentage of your income toward a second lowest-cost Silver plan in your area. After you pay that amount, the government will take care of the rest. If you pick a less expensive policy than the second lowest-cost Silver plan, you keep 100% of the savings. If you pick a more expensive policy than the second lowest-cost Silver plan, you pay 100% of the difference.

That sliding scale is called the Applicable Percentage Table. The American Rescue Plan Act of 2021 lowered the numbers significantly in 2021 and 2022 from previous years. For example, in 2020, people with income between 250% and 300% of the Federal Poverty Level were expected to pay between 8.29% and 9.78% of their income toward a second lowest-cost Silver plan in their area. It changed it to a sliding scale between 4% and 6% in 2021 and 2022.

Here are the numbers for different income levels in 2020, 2021, and 2022:

Income20202021 and 2022< 133% FPL2.06%0%< 150% FPL3.09% – 4.12%0%< 200% FPL4.12% – 6.49%0% – 2%< 250% FPL6.49% – 8.29%2% – 4%< 300% FPL8.29% – 9.78%4% – 6%<= 400% FPL9.78%6% – 8.5%> 400% FPLnot eligible8.5%Source: IRS Rev. Proc. 2019-29, American Rescue Plan Act of 2021

As you see from the table above, the changes between 2020 and 2021 are quite substantial. The percentage of income the government expects you to pay toward a second lowest-cost Silver plan depends on your income relative to the Federal Poverty Level. To calculate where your income falls relative to the Federal Poverty Line, please see Federal Poverty Levels (FPL) For Affordable Care Act (ACA).

If your income is low, they expect you to pay a low percentage of your low income. As your income goes higher, they expect you to pay a higher percentage of your higher income. The higher percentage applies not just to the additional income but to your entire income. A higher income times a higher percentage is much more than a lower income times a lower percentage. For example, a household of two in the lower 48 states is expected to pay 3.28% of their income when their 2021 income is $40,000. If they increase their income to $50,000, they are expected to pay 5.60% of their income. The increase of their expected contribution toward ACA health insurance, and the corresponding decrease in their premium tax credit will be:

$50,000 * 5.60% – $40,000 * 3.28% = $1,488

This represents 15% of the $10,000 increase in their income. For a married couple, the effect of paying 15% of the additional income toward ACA health insurance is greater than the effect of paying 12% toward federal income tax. It makes the effective marginal tax rate on the additional $10,000 income 27%, not 12%. Normally it’s a good idea to consider Roth conversion or harvesting tax gains in the 12% tax bracket, but those moves become much less attractive when you receive a premium subsidy for the ACA health insurance. For a helpful tool that can calculate this effect, please see Tax Calculator With ACA Health Insurance Subsidy.

The post 2020 2021 2022 ACA Health Insurance Premium Tax Credit Percentages appeared first on The Finance Buff.

March 29, 2021

Covid Retirement Account Withdrawal in TurboTax and H&R Block

When the COVID pandemic hit and unemployment soared in 2020, Congress passed the CARES Act, which gave special tax treatment for eligible withdrawals from retirement accounts. The usual 10% penalty on early withdrawals before age 59-1/2 is waived. The withdrawals can be treated as spreading over three years, and no income tax will be owed if the withdrawal is repaid in three years. To be eligible, the withdrawals must have taken place between January 1, 2020 and December 30, 2020 (not December 31), and the total withdrawals must not exceed $100,000. An eligible withdrawal is called a coronavirus-related distribution (CRD).

Maybe you took the offer because you had to supplement your income. Maybe you took the opportunity to move $100,000 from the expensive retirement plan through your employer to your IRA. By now you should have received a 1099-R for your retirement account withdrawal. The 1099-R itself doesn’t say anything special about it being a coronavirus-related distribution. You’ll get the special tax treatment only if you do something different on your tax return. Tax software such as TurboTax and H&R Block can do it perfectly fine. Here’s how. We’ll use these two examples:

TurboTax

Example A: You were affected by the COVID-19 pandemic and you withdrew $30,000 from your workplace retirement plan between January 1, 2020 and December 30, 2020. It qualifies as a coronavirus-related distribution. You’d like to spread the withdrawal on your tax return over the next three years.

Example B: Same as Example A except you already repaid the withdrawal in full by putting the money into your IRA. You should owe no tax on it.

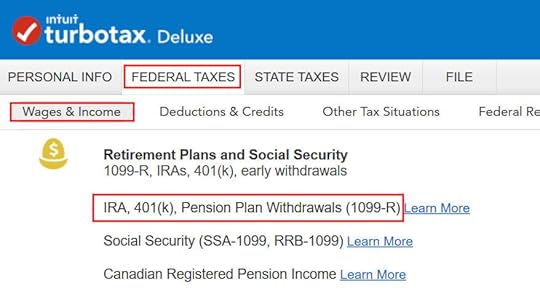

TurboTax has a place for all 1099-R’s. You enter the 1099-R into TurboTax as usual under Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

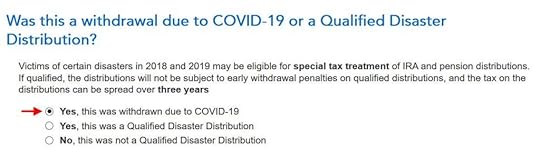

Right after you enter the 1099-R, TurboTax asks you whether it was a coronavirus-related distribution. You answer it was due to COVID-19.

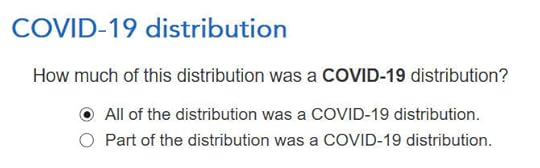

100% of the withdrawal was a COVID-19 distribution in our example. If you had a mix of COVID and non-COVID distribution during the year, you break it down in the software.

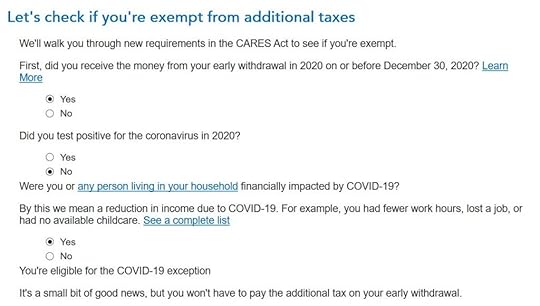

TurboTax checks additional eligibility, including the date of the withdrawal and how you were affected by COVID.

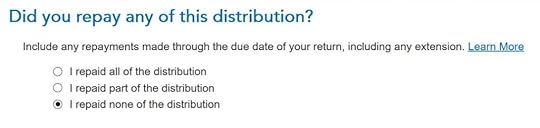

Now it asks you whether you repaid the withdrawal. We didn’t repay in our Example A. We repaid all of it in our Example B. Choose the option that applies to you.

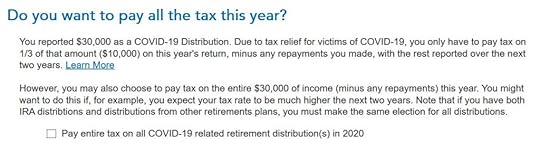

If you didn’t repay, you can spread the distribution on your tax return over three years, which is the default. If you’d like to forego the spreading option and add it all to 2020, check that small box at the bottom.

After you go through the interview, you can check your tax form to see if the software did it correctly. Click on Forms on the top right and then find “Form 1040” in the left navigation pane. Scroll down to find Line 5. The gross amount shows up on Line 5a. If you chose to spread the withdrawal over three years, 1/3 of it shows up on Line 5b. If you already repaid the withdrawal in full, Line 5b should show 0.

You see this is quite straightforward in TurboTax. You don’t need a tax professional for this at all.

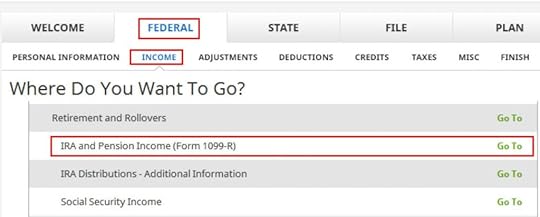

H&R Block SoftwareIt takes more work to do the same in H&R Block software. We’ll use the same examples.

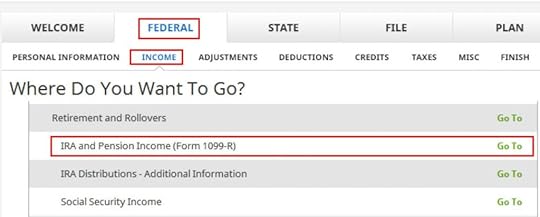

Enter the 1099-R you received for your withdrawal under Federal -> Income -> IRA and Pension Income (Form 1099-R). There’s nothing unusual here.

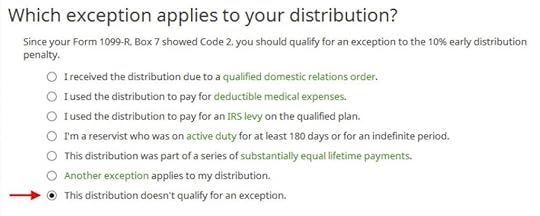

When it asks you which exception applies to your distribution, choose the last option for “no exceptions.” COVID-19 withdrawal is an exception but it’s not one of the exceptions listed here.

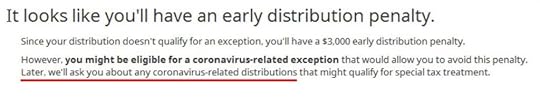

Although it says it looks like you’ll have a penalty, don’t freak out, because it says that coronavirus-related distributions are handled in a different part of the software later.

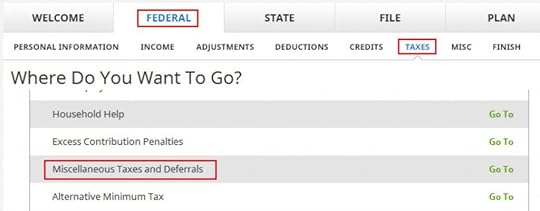

Continue with the rest of your interview in the software until you reach Federal -> Taxes -> Miscellaneous Taxes and Deferrals. Or you can jump ahead to that point now.

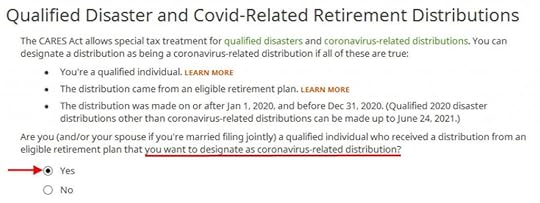

Choose ‘Yes’ when it asks you about COVID withdrawals.

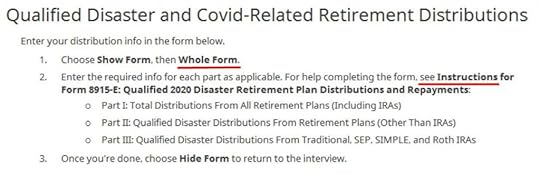

Here H&R Block software asks you to read the instructions and fill out a tax form yourself. That’s lazy. The point of using tax software is that you won’t have to mess with tax forms directly.

The “Show Form” it talks about is under the “Next” button. After you click on that one, there’s another “Whole Form” button, which expands the form.

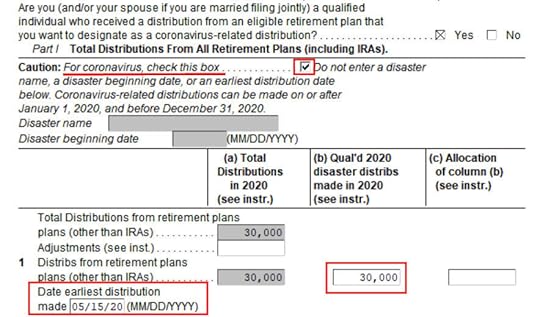

Example A – Withdrawal spread over three years

For our Example A, where you withdrew $30,000 from a workplace retirement plan and you’d like to spread it over three years, you only need to complete the parts called out in the red boxes. Check a box on the top to say it’s related to COVID. Enter the date of the earliest withdrawal and the gross withdrawal amount in Line 1, column b. If you withdrew from a pre-tax IRA, not from a workplace retirement plan, enter the date and the amount on Line 2 instead of Line 1. Click on “Hide Form” when you’re done.

Now you can check how much you’re taxed on this withdrawal. Click on the Forms button in the top menu bar and then open “Form 1040 and Schedule 1-3.” Scroll down the Line 5. Line 5b shows you’re taxed only on $10,000 instead of $30,000.

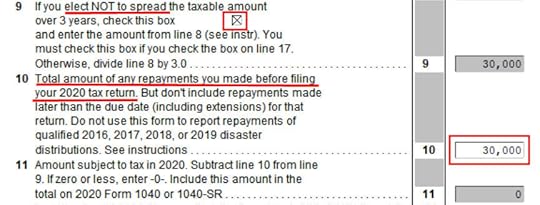

Example B – Full Repayment

For our Example B, where you withdrew $30,000 from a workplace retirement plan and you repaid it in full, in addition to filling out the same fields as in Example A, scroll down to Line 9 and Line 10. Enter the amount of your repayment on Line 10. If that represents 100% of your withdrawal, also check the box on Line 9 and be done with it. If you only made a partial repayment, leave the box in Line 9 unchecked. The difference between 1/3 of your withdrawal and your repayment will be taxable in 2020. If you repaid more than 1/3 of your withdrawal, the taxable amount in 2020 is zero.

Now you can verify you’re not taxed after you repaid all of it. Click on the Forms button in the top menu bar and then open “Form 1040 and Schedule 1-3.” Scroll down the Line 5. Line 5b shows that the taxable amount is $0.

There you have it. It’s a little more complicated in H&R Block software but it’s still not that difficult.

The post Covid Retirement Account Withdrawal in TurboTax and H&R Block appeared first on The Finance Buff.

March 20, 2021

How To Enter Mega Backdoor Roth In H&R Block Tax Software

After writing a walkthrough for how to enter mega backdoor Roth in TurboTax and how to enter mega backdoor Roth in FreeTaxUSA, a reader asked me to do one for H&R Block software as well.

A mega backdoor Roth is different from a regular backdoor Roth. It’s done by making non-Roth after-tax contributions to a 401k-type plan and then moving it to the Roth account within the 401k-type plan or taking the money out (with earnings) to a Roth IRA. It’s a great way to put additional money into a Roth account without having to pay much additional tax. Not all plans allow non-Roth after-tax contributions but some estimated that 40% of people can do it.

H&R Block is in general less expensive than TurboTax. It has a downloaded version and an online version. The downloaded version is both less expensive and more powerful. The downloaded Deluxe + State edition (or the Deluxe Federal-Only edition when you live in a state without an income tax) can handle pretty much everything. It often goes on sale for $20-25 on Amazon, Walmart, or Newegg, sometimes for under $20. Federal e-filing is included. State e-filing costs extra but you can simply print and mail or use the printed forms to file on your state government’s website.

Suppose you did a mega backdoor Roth last year. You’ll receive a 1099-R form from your 401k plan in January. You’ll need to account for it on your tax return. Here’s how to do it in H&R Block downloaded software.

In-Plan RolloverYou can do the mega backdoor Roth in two ways — rollover within the plan or withdraw to a Roth IRA. Rolling over within the plan is much easier, and many plans automate the process. Withdrawing to a Roth IRA also works. See the previous post Mega Backdoor Roth: Convert Within Plan or Out to Roth IRA?

Let’s first look at rolling over to the Roth account within the plan. Here’s the scenario we’ll use as an example:

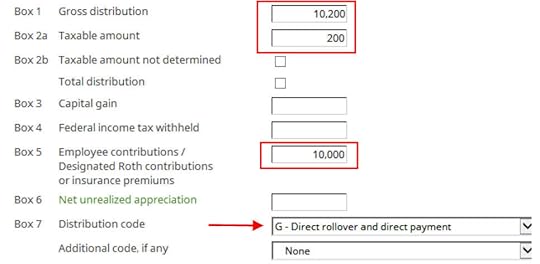

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). By the time the money was rolled over to the Roth account within the plan, your contributions earned $200. You rolled over $10,200 to your Roth 401(k) account.

I’m using 401(k) as a shorthand. It works the same in a 403(b). Now the entries into H&R Block software.

Go to Federal -> Income -> IRA and Pension Income (Form 1099-R).

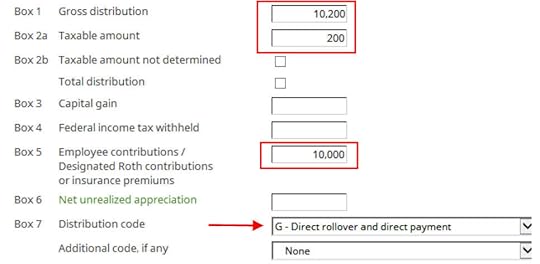

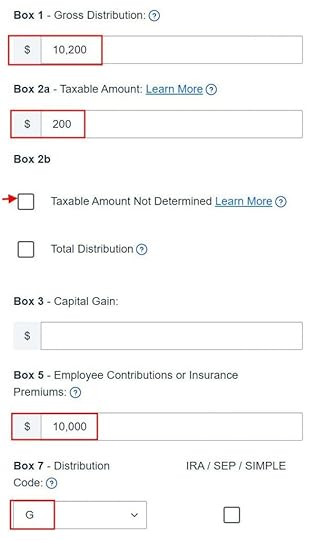

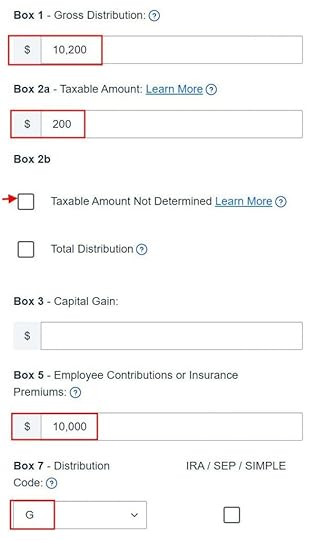

Our 1099-R is a normal 1099-R. Enter the numbers from your 1099-R as-is. Ours looks like this:

The gross amount transferred to the Roth 401k account shows up in Box 1. The earnings are in Box 2a. If you didn’t have earnings in your rollover, Box 2a is zero. “Taxable Amount Not Determined” under Box 2b is left unchecked. The amount of your non-Roth after-tax contributions shows in Box 5. Box 7 has code G.

The IRA/SEP/SIMPLE box in Box 7 on our 1099-R is unchecked.

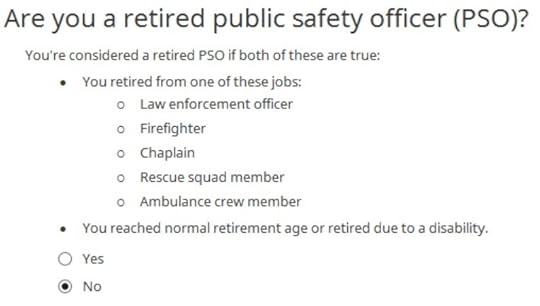

We’re not a retired public safety officer.

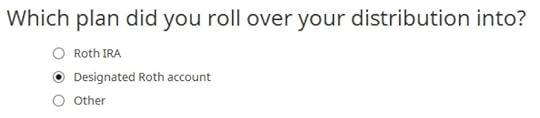

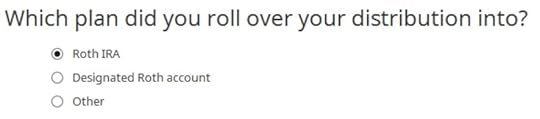

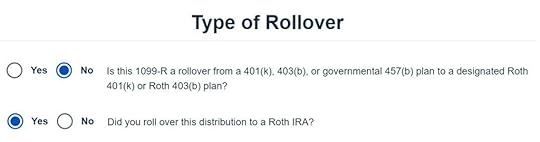

We moved the money within the plan. The Roth 401k account is called a “designated Roth account” in the plan.

That’s it. It’s as simple as that. Now we verify we’re taxed only on the $200 in earnings, and not on the $10,000 non-Roth after-tax contributions.

Click on “Forms” in the top menu bar. Double-click on “Form 1040 and Schedules 1-3” in the forms list. Scroll down to find Line 5. The gross amount transferred to the Roth 401k account shows on Line 5a. Line 5b shows you’re taxed only on the earnings. If you didn’t have earnings, Line 5b will be zero.

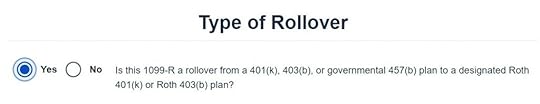

Rollover to Roth IRAIt’s just as easy to report the mega backdoor Roth if you took the money out of the 401k plan and sent it to a Roth IRA. We’ll use the same example as above except you did the rollover to a Roth IRA instead of to the Roth 401k account within the plan.

Enter your 1099-R as-is in the same way as above.

The IRA/SEP/SIMPLE box is still unchecked.

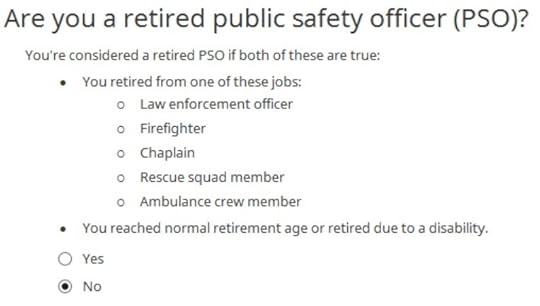

We’re still not a retired public safety officer.

The only difference is we rolled over to a Roth IRA this time.

Now we verify we’re taxed only on the $200 in earnings, and not on the $10,000 non-Roth after-tax contributions.

Click on “Forms” in the top menu bar. Double-click on “Form 1040 and Schedules 1-3” in the forms list. Scroll down to find Line 5. The gross amount transferred to the Roth 401k account shows on Line 5a. Line 5b shows you’re taxed only on the earnings. If you didn’t have earnings, Line 5b will be zero.

The post How To Enter Mega Backdoor Roth In H&R Block Tax Software appeared first on The Finance Buff.

March 15, 2021

How To Enter Mega Backdoor Roth in FreeTaxUSA: A Walkthrough

I did a walkthrough of how to report backdoor Roth in FreeTaxUSA in a previous post. A reader asked me to do another walkthrough for how to report a mega backdoor Roth in FreeTaxUSA.

A mega backdoor Roth is different from a regular backdoor Roth. It’s done by making non-Roth after-tax contributions to a 401k-type plan and then taking the money out (with earnings) to a Roth IRA or moving it to the Roth account within the 401k-type plan. It’s a great way to put additional money into a Roth account without having to pay much additional tax. Not all plans allow non-Roth after-tax contributions but some estimated that 40% of people can do it.

FreeTaxUSA is inexpensive online tax software. It uses the freemium pricing model. Federal tax filing is free regardless of the complexity of the return. After you are done with federal, if you need to file a state return, it costs $12.95. They also offer an optional deluxe upgrade for $6.99, which includes audit assist, priority support, and amended returns. All told, with or without the deluxe upgrade, the total cost is under $20 and it includes e-filing for both federal and state.

Suppose you did a mega backdoor Roth last year. You’ll receive a 1099-R form from your 401k plan in January. You’ll need to account for it on your tax return. FreeTaxUSA makes it quite straightforward. Here’s how to do it in FreeTaxUSA.

In-Plan RolloverYou can do the mega backdoor Roth in two ways — rollover within the plan or withdraw to a Roth IRA. Rolling over within the plan is much easier, and many plans automate the process. Withdrawing to a Roth IRA also works. See the previous post Mega Backdoor Roth: Convert Within Plan or Out to Roth IRA?

Let’s first look at rolling over to the Roth account within the plan. Here’s the scenario we’ll use as an example:

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). By the time the money was rolled over to the Roth account within the plan, your contributions earned $200. You rolled over $10,200 to your Roth 401(k) account.

I’m using 401(k) as a shorthand. It works the same in a 403(b). Now the entries into FreeTaxUSA.

Go to Income -> Common Income -> Retirement Income (1099-R). Enter the numbers from your 1099-R as-is. Ours looks like this:

The gross amount transferred to the Roth 401k account shows up in Box 1. The earnings are in Box 2. Box 2a is left unchecked. The amount of non-Roth after-tax contributions shows in Box 5. Box 7 has code G and the IRA/SEP/SIMPLE box is unchecked. Leave the rest at default unless your 1099-R has values in other boxes.

When it asks whether it was a rollover to a Roth 401(k) account, we say yes.

That’s it. It’s as simple as that. Now we verify we’re taxed only on the $200 in earnings, and not on the $10,000 non-Roth after-tax contributions.

Click on the “View Form 1040” link on the right-hand side.

A draft 1040 form pops up. Look at Line 5. Line 5a shows the gross amount transferred to the Roth 401k. Line 5b shows we’re taxable only on the $200 in earnings. If you didn’t have earnings in your rollover, Line 5b will be zero.

Rollover to Roth IRAIt’s just as easy to report the mega backdoor Roth if you took the money out of the 401k plan and sent it to a Roth IRA. We’ll use the same example as above except you did the rollover to a Roth IRA instead of to the Roth 401k account within the plan.

Enter your 1099-R as-is in the same way as above.

When it asks how we did the rollover, answer ‘No’ to the first question and ‘Yes’ to the second question.

That’s it. Verify that you’re taxed only on the earnings in the same way as above. Look at Line 5 in your draft 1040 form.

The post How To Enter Mega Backdoor Roth in FreeTaxUSA: A Walkthrough appeared first on The Finance Buff.

March 9, 2021

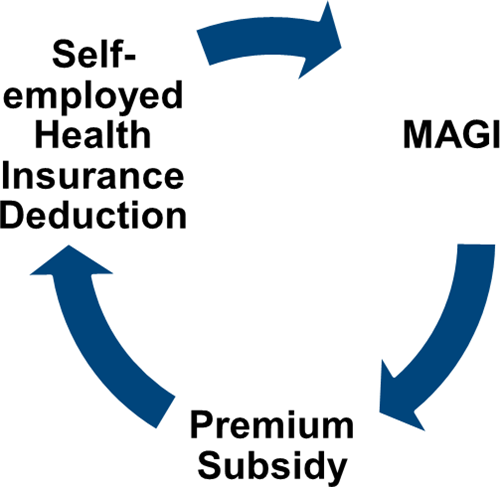

When TurboTax and H&R Block Give Self-Employed Wrong ACA Subsidy

When you’re self-employed, you can deduct your health insurance premium on your tax return. When you buy health insurance through the ACA exchange, you can also get a premium subsidy when your income qualifies. The circular relationship between the self-employed health insurance deduction and the premium tax credit creates an interesting math problem.

Tax Software

Tax SoftwareAfter the IRS provided an iterative method for this math problem in 2014 (see IRS Guidance On Circular Reference in ACA Premium Subsidy and Deduction), tax software vendors such as TurboTax and H&R Block implemented the calculation in their software. It solved the problem for most people. For a step-by-step walkthrough of how to make the software calculate the subsidy and the deduction, please see Self-Employed ACA Health Insurance Subsidy and Deduction In TurboTax and Self-Employed ACA Health Insurance Subsidy In H&R Block Tax Software.

However, the iterative method from the IRS doesn’t work for everyone for 2020. If your income falls close to either end of the spectrum for receiving the premium subsidy, your tax software may give you wrong numbers. Worse yet, the software doesn’t warn you that the numbers are wrong. If you don’t know the numbers are wrong, you may miss out on possibly several thousand dollars worth of tax credits and deductions!

The American Rescue Plan Act of 2021, also known as President Biden’s stimulus package, is expected to become law shortly. It removes the ACA subsidy cliff in 2021 and 2022. This likely will make the IRS method in the tax software work for everyone for 2021 and 2022, but the problem remains for 2020, and it will start again in 2023 unless a new law extends the removal of the ACA subsidy cliff.

Here’s a simple example for which the IRS method as implemented by the tax software doesn’t work for 2020:

Diane, single, earned $60,000 in self-employment income after all business expenses in 2020. She didn’t have any other income or deductions. After subtracting one-half of the self-employment tax, Diane’s MAGI before health insurance was $55,761. As a Texas resident, Diane paid $600/month for a health plan from the ACA exchange ($7,200 total). That plan was also the Second Lowest Cost Silver Plan in her zip code. Diane received no advance subsidy from the ACA exchange.

Both TurboTax and H&R Block tax software calculated $4,749 in self-employed health insurance deduction (Schedule 1, Line 16) and $0 in premium tax credit (Form 8962, Line 24). We know this result makes no sense because if Diane doesn’t get any premium tax credit she should be able to deduct 100% of her health insurance premium ($7,200). In other words, this equation should hold true:

Self-Employed Health Insurance Deduction + Premium Tax Credit = Unsubsidized Health Insurance Premium (including any dental and vision premiums)

You know the tax software is giving you wrong numbers when the numbers fail the equation (except for a small difference due to rounding).

A Better CalculatorMathematician Sam Ferguson heard this problem from a self-employed Uber driver when he was a Ph.D. student at NYU. He studied the math angles and found out why the IRS method didn’t work in all cases. He wrote an alternative method in his paper Obamacare and a Fix for the IRS Iteration. When he spoke to the person in charge at the IRS, the IRS personnel acknowledged the problem but they didn’t treat it as a high priority when the existing method already worked for most people, just not for the edge cases.

Dr. Ferguson developed an online calculator with a software engineer. He authorized me to host it and keep it updated. Here’s the link:

Using this better calculator with our example shows:

Appropriate subsidy amount: 1,398

With this subsidy, your net health insurance cost to be deducted on your tax return is: 7,200 – 1,398 = 5,802

With this net health insurance cost, your modified adjusted gross income is: 55,761 – 5,802 = 49,959

This result makes sense because $5,802 in self-employed health insurance tax deduction plus $1,398 in ACA premium tax credit equals $7,200, which is her unsubsidized health insurance premium (we didn’t have any dental or vision premiums in our simple example).

Also, after deducting $5,802, Diane’s MAGI is $55,761 – $5,802 = $49,959. 400% of the Federal Poverty Line for a household of one person in the lower 48 states for 2020 coverage is $49,960. When Diane’s MAGI is just shy of the 400% FPL cut-off, she’s eligible for the premium tax credit. If Diane’s unsubsidized premium was higher she’d be eligible for more premium tax credit, but because she’s already deducting $5,802, her tax credit is capped to $7,200 – $5,802 = $1,398.

Tax SoftwareCalculatorTax Deduction$4,749$5,802Subsidy$0$1,398If Diane simply goes with the wrong numbers from the tax software, she will miss $1,398 in tax credit plus another $1,053 in tax deduction. That’s a big difference.

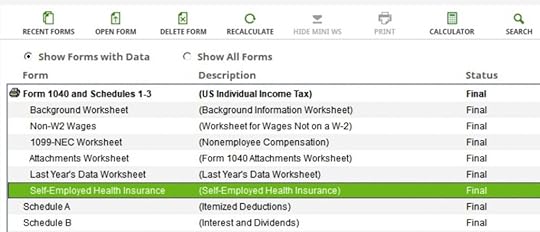

Overriding Tax SoftwareAfter getting the correct numbers from the calculator, you still need to find a way to have your tax software use those numbers. I couldn’t figure out how to override the wrong numbers in TurboTax Deluxe downloaded software. I’m not sure whether a different edition allows manual entries. I was able to override the wrong numbers in H&R Block software. If you use TurboTax and you run into this problem, consider switching to H&R Block software.

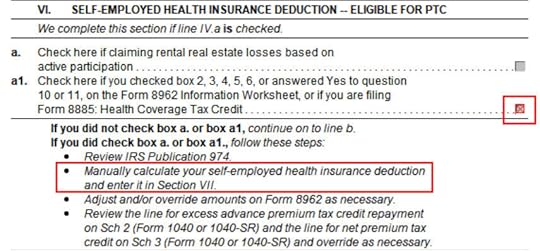

Overriding may prevent you from e-filing, but the inconvenience of having to file your return by mail sure beats missing out on thousands of dollars. In H&R Block downloaded software, click on Forms on the top, and then find “Self-Employed Health Insurance” in the forms list.

Double-click to open that form. Scroll down to Part VI. Right-click on Box a1 and click on Override. This will allow you to enter your manually calculated deduction.

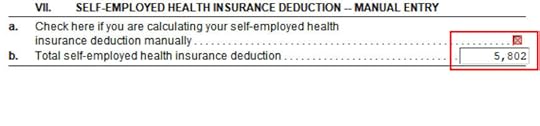

Scroll further down to Part VII. Right-click on Box a and click on Override. Enter the deduction from the online calculator in the box below (in our example, $5,802).

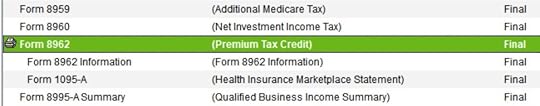

Close this form. Find Form 8962 in the forms list.

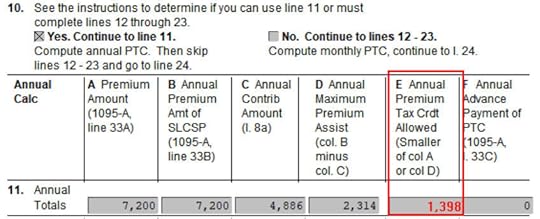

Double-click to open Form 8962. Scroll down to Line 11. If the number in column E is different than the number from the online calculator, right-click on Line 11 column E and click on Override. Enter your manually calculated subsidy (in our example, $1,398). If you must use monthly numbers in Lines 12-23 as opposed to the annual totals in Line 11, do the override in Lines 12-23 column E.

That’ll do it. You should double-check that your Schedule 1 Line 16 shows the correct deduction and your Form 8962 Line 24 shows the correct subsidy.

The post When TurboTax and H&R Block Give Self-Employed Wrong ACA Subsidy appeared first on The Finance Buff.

March 5, 2021

Make Backdoor Roth Easy On Your Tax Return

It’s tax filing time. I’ve been fielding a lot of questions on my articles about the backdoor Roth (if you are not familiar with it please read these first):

Backdoor Roth: A Complete How-ToHow To Report Backdoor Roth In TurboTaxHow To Report Backdoor Roth In H&R Block SoftwareHow to Report Backdoor Roth In FreeTaxUSAOne theme quickly emerged. All those who are confused were contributing to the traditional IRA for the previous year and then converting it to Roth. They made it too hard for themselves.

For example, they contributed to the traditional IRA for the previous year between January 1 and April 15 and then converted it to Roth. They are planning to contribute for the current year, again in the following year before April 15, before converting it to Roth. Although it’s OK to do so, it just gets very confusing at tax time when they do it this way.

The tax law requires that you report your traditional IRA contribution *for* that year and your converting to Roth *during* that year.

In the example above, the contribution made *for* year X in year X+1 goes on the tax return for year X. It has to carry over the tax basis to the return for year X+1. The conversion to Roth *during* year X+1 goes on the tax return for year X+1. The contribution *for* X+1 to be made in X+2 again goes on the tax return for year X+1 but the conversion *during* year X+2 must wait for the tax return for year X+2.

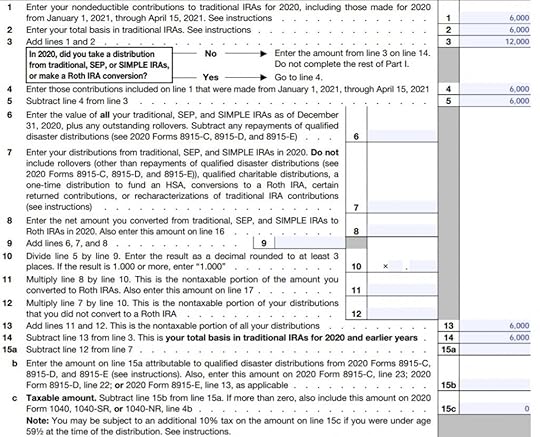

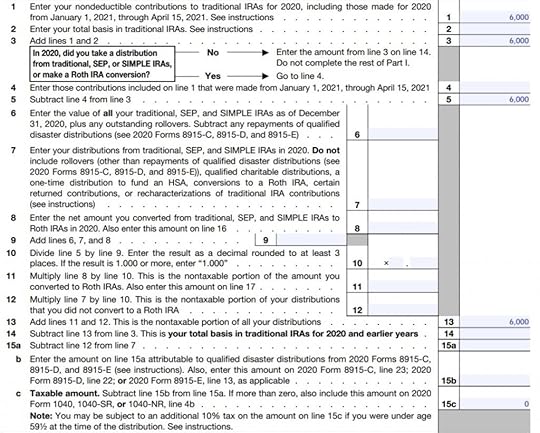

The tax return for the current year ends up having a basis carried over from the previous year, a conversion, a contribution (made in the next year), and a basis carried forward to the next year. The Form 8606 ends up looking like this:

This is very confusing.

The easy way to do it is to contribute for the current year rather than waiting until the following year. Contribute for year X in year X and convert in year X. Contribute for year X+1 in year X+1 and convert in year X+1. This way will be clean and neat. Both the contribution and the conversion go on the same tax return. You don’t carry over anything from one year to the next or wait until the following year to finish it off.

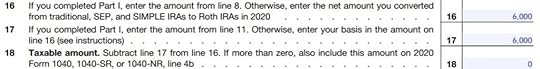

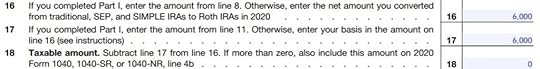

The Form 8606 when you are doing it the easy way looks like this:

That’s very clean.

If you are doing backdoor Roth, please do yourself a big favor and do it the easy way. Contribute for the current year and convert it in the same year. Contribute for year X in year X and convert during year X. Don’t wait until the following year. Otherwise you just confuse yourself at tax time.

If you must get caught up for one year, that’s fine. Contribute for the previous year before April 15, but also contribute for the current year in the current year, and convert both during the current year. You can convert more than once in any year, and there is no limit on the amount you convert. This way you will have a clean slate come next year, which lets you do it the easy way going forward.

Comments are closed because questions are becoming repetitive. Be sure to read existing comments for answers to questions similar to yours.

The post Make Backdoor Roth Easy On Your Tax Return appeared first on The Finance Buff.

March 2, 2021

Make Fewer Things Matter: My Epiphany From Cutting A Pineapple

I don’t do New Year’s Resolutions but I decided to make this my ongoing resolution for the foreseeable future: Make Fewer Things Matter. This dawned on me when I learned how to cut a pineapple.

I grew up in a northern climate. Because transportation wasn’t very good back then, pineapples were a rare treat. Whenever I saw them as a kid, they were cut by the purveyors into this delicate spiral shape. I always had two impressions of pineapples: (a) they were expensive; and (b) they were difficult to cut.

The EpiphanyI saw pineapples around last Christmas in a grocery store with a big sign: $2. I thought I’d spring for a treat for only $2. There goes my first wrong impression from childhood. Pineapples aren’t that expensive.

The next step was to learn how to cut it. Naturally, I went to YouTube and I watched the first video from the search.

To my big surprise, it was amazingly easy to cut a pineapple.

How come I got the impression they’re difficult to cut? YouTube’s autoplay feature served up the next video:

Now a light bulb went off. It’s not difficult to cut a pineapple. It’s only difficult when you want to maximize the amount of flesh. If you don’t care about maximizing the result, you can enjoy pineapples much more easily.

The lesson from cutting the pineapple connected the dots in so many issues in personal finance and investing. I came up with this motto: Make Fewer Things Matter.

The first emphasis in Make Fewer Things Matter is “make.” Things don’t stop mattering on their own. You don’t just ignore them. You do something to make them not matter. The next emphasis is “fewer.” Some things will still matter, but you reduce the number of them. Make a big list of things you think are important. Look at each item and look for ways to make it not matter. After you go through everything and you try to make them not matter, you’re left with a few things that truly matter.

ExamplesWarren Buffett instructed that trustees should invest 90% in S&P 500 and 10% in short-term government bonds for his wife. Is 90% in stocks a good asset allocation for people her age? And the S&P 500 has only large cap U.S. stocks and short-term government bonds pay close to zero? Warren Buffett made it not matter how the money for his wife is invested.

While it’s hotly debated whether the 4% rule still holds in the current environment of high equity valuations and low bond yields, FIRE leaders make it not matter by keeping a positive cash flow.

Over at my post on Medicare IRMAA income brackets, people wanted to know where the income cutoff would be for next year. Because inflation used in the calculation hasn’t happened yet, it’s impossible to make an accurate projection within $2,000. But it’s dead simple to make it within $10,000. If you don’t mind leaving a larger margin of error, precisely what the number will be doesn’t matter.

I stopped updating my post on Social Security Cost of Living Adjustment (COLA) because the story is the same every year. Seniors complain COLA is too low. COLA is low because inflation is low. The most recent COLA was 1.3%. Legislators proposed making it 3% for one year. The average Social Security benefit is $1,500/month. 3% versus 1.3% would increase it by $25/month. Rather than waiting for new legislation, which didn’t pass anyway, you can make it not matter by having your retirement budget not depend on $25/month one way or the other.

A reader asked me about the HSA rollover. Because you can only do one rollover every rolling 12 months, and the rollover takes some time to complete, the question was whether the 12-month clock for the next rollover starts on the day the money comes out of the old account or on the day it goes into the new account. While there’s a technically correct answer, you can make it not matter by spacing your rollovers every 15 months. That way you’re in the clear no matter how the 12 months are counted.

Another reader asked me whether the RMD is required when the surviving spouse takes over an IRA in the year after the owner’s death. Again there’s a technically correct answer but you can make it not matter by simply taking the RMD even if it isn’t strictly necessary. At most, you take the RMD one year too soon. Delaying it by one year doesn’t matter that much anyway.

If you read personal finance and investing articles, it would seem at least half of investing is about taxes: whether you should contribute to Traditional or Roth accounts, which accounts you should put money into first after getting the employer match, which investments should be held in which accounts, which accounts you should withdraw from first after you retire, whether and how much to convert to Roth, and on and on. But if you ask me “How important is tax strategy for building wealth?” I must agree with the Bogleheads it’s not that important. While a good tax strategy is helpful, whether you become wealthy doesn’t depend on it. You can still make it work if all the tax-advantaged accounts go away and dividends and capital gains are taxed as regular income.

If you look for ways to make things not matter, you’ll see a way out in almost everything.

Ward Off FOMO and Sales PitchesMaking fewer things matter helps you zero in on things that really matter. It also helps you ward off FOMO (Fear of Missing Out) and sales pitches. FOMO and sales pitches always try to grab your attention by saying you’re making a mistake. When you don’t mind making a mistake because you made fewer things matter, the sales pitches slide right off. It’s like someone telling me I’m cutting my pineapple wrong.

“You should invest in real estate.” It’s probably a good way to make money but I’ll let others do it.

“You should buy stocks of Tesla, Nikola, NIO, and the electric vehicle industry.” Because they’re in my total stock market index fund, I’ll benefit already if they become successful.

“You should put some money in cryptocurrencies.” Maybe they’re onto something. I’ll let others have at it.

“Look at this. It’s tax-free.” I don’t mind paying more taxes.

You’ve made it when you can afford all the “mistakes.”

The post Make Fewer Things Matter: My Epiphany From Cutting A Pineapple appeared first on The Finance Buff.

February 23, 2021

Foreign Tax Credit With Form 1116 In TurboTax and H&R Block Software

When mutual funds and/or ETFs that invest in other countries receive dividends or interest, they have to pay taxes to those countries. After the end of the year, these mutual funds and/or ETFs report to your broker how much they paid in foreign taxes on your behalf. When you invest in these mutual funds and/or ETFs outside a tax-advantaged account, your broker will report to you the total foreign taxes you paid through all your funds and/or ETFs. The IRS allows a tax credit for the taxes you paid indirectly to foreign countries.

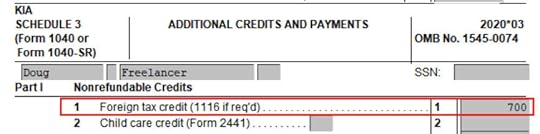

The foreign taxes paid is reported in Box 7 on the 1099-DIV you receive from your broker. When the total foreign taxes paid from all your 1099-DIV’s is no more than a certain amount — $300 for single, $600 for married filing jointly — it’s easy to handle. You enter the 1099-DIV’s as usual into your tax software and the software will automatically put the total on your tax form (Schedule 3, Line 1).

When your total foreign taxes paid from all your 1099-DIV’s is over the $300/$600 threshold, you’ll need to include a Form 1116 in your tax return. I’ll show you how to do this in TurboTax and H&R Block software. I start with TurboTax. Please scroll down to the next section if you use H&R Block software.

TurboTaxI’ll use this example with TurboTax Deluxe downloaded software.

You received a 1099-DIV from your broker. Box 7 “Foreign Tax Paid” on the 1099-DIV shows $700. 100% of this $700 came from a mutual fund or ETF. You only have this one 1099-DIV that has a number in Box 7.

If you’re using TurboTax Online, consider using TurboTax downloaded software next time because it’s both less expensive and more powerful.

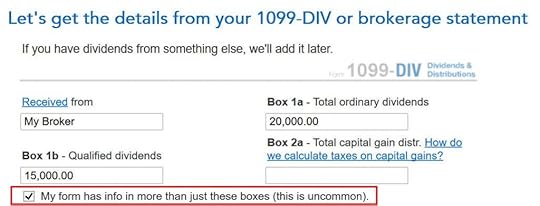

If you’re entering your 1099-DIV manually, you have to check a box on the 1099-DIV entry screen to reveal the additional input fields. Then you put the foreign tax paid number into Box 7. If you imported your 1099’s, double-check that all the numbers from the import match your downloaded copy.

After you enter the 1099-DIV, TurboTax says nothing about exceeding the $300/$600 threshold or needing a Form 1116. You continue with the rest of your entries as usual.

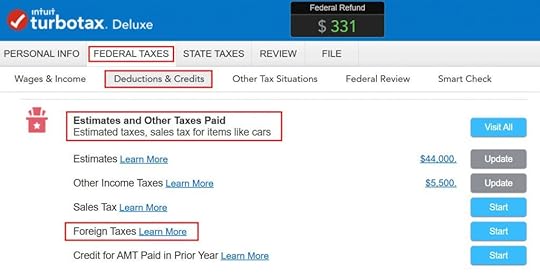

At a much later point, TurboTax will ask you about the foreign tax paid under Deductions & Credits -> Estimates and Other Taxes Paid -> Foreign Taxes.

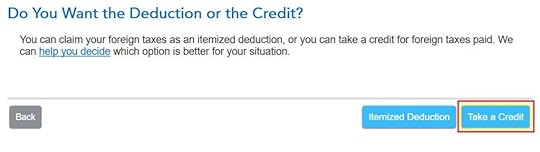

After a brief introduction, the first question is whether you’d like to take a tax deduction or a tax credit. The “help you decide” popup says in general you’re better off taking the credit. So click on “Take a Credit.”

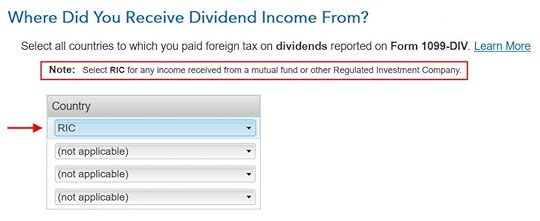

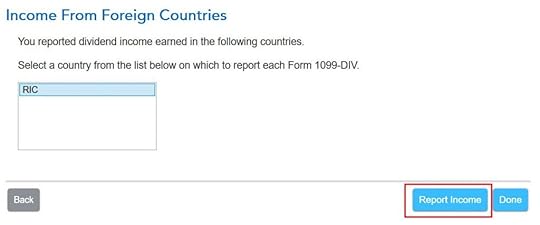

Next, TurboTax asks you which countries you received dividend income from. A small note says select RIC for any income received from a mutual fund or other Regulated Investment Company. U.S.-based mutual funds and ETFs fall into this category. RIC is the first item in the country dropdown.

Then you report income received from country “RIC.” Click on Report Income.

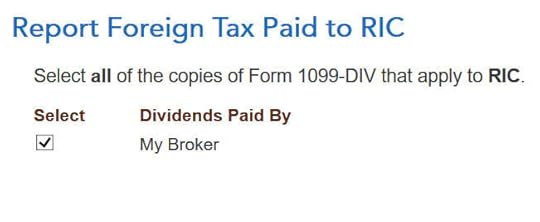

Now you say foreign tax paid from which 1099-DIVs were paid to country RIC. If all your foreign taxes paid were from mutual funds and/or ETFs, select all your 1099-DIV’s that have a number in Box 7.

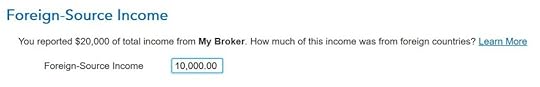

TurboTax asks you how much of the income reported on your 1099-DIV was from foreign countries. This information isn’t on the 1099-DIV itself. Your broker may have included supplemental information with the 1099-DIV. For instance, Fidelity provides the breakdown of total foreign income in its 1099 package.

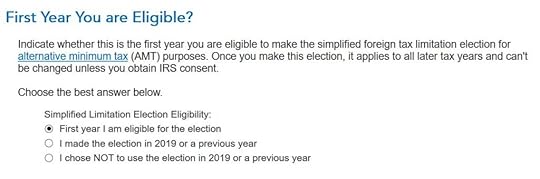

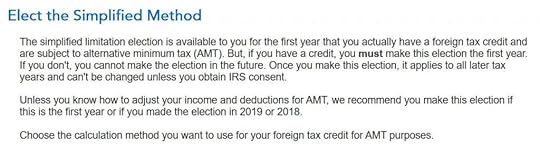

Now it asks you about a “simplified foreign tax limitation election.” If this is the first year you encounter this, choose the first option. If you remember you did this before, choose the second option.

TurboTax suggests you should elect the simplified method. Click on Elect Simplified Calculation.

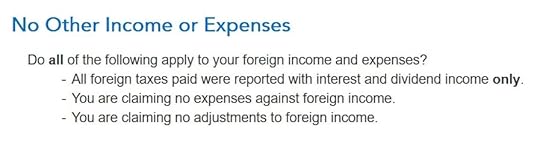

We don’t have any other foreign income or expenses. Click on Yes.

TurboTax auto-filled these. No changes are necessary for us.

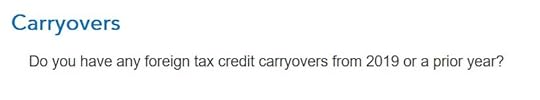

We don’t have any carryover from previous years. A carryover is created when you paid more in foreign tax than the tax credit you’re allowed. Your leftover foreign tax paid is carried over to the following year.

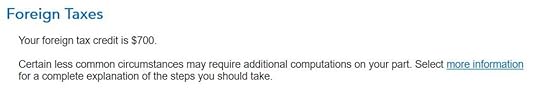

After going through all these, we’re getting 100% credit for the $700 foreign tax paid. Woo-hoo!

You can verify that you’re getting the foreign tax credit by clicking on Forms on the top right. Find Schedule 3 in the left navigation pane and look at the number on Line 1. You can also look at Form 1116. It looks awfully complicated.

H&R Block SoftwareI’ll use the same example in H&R Block downloaded software.

You received a 1099-DIV from your broker. Box 7 “Foreign Tax Paid” on the 1099-DIV shows $700. 100% of this $700 came from a mutual fund or ETF. You only have this one 1099-DIV that has a number in Box 7.

If you’re entering the 1099-DIV manually, type the numbers as shown on your form. If you import, double-check the import to make sure all the numbers match your downloaded copy. H&R Block doesn’t say anything about the foreign tax paid or needing a Form 1116 after you enter the 1099-DIV. Just continue with your other entries.

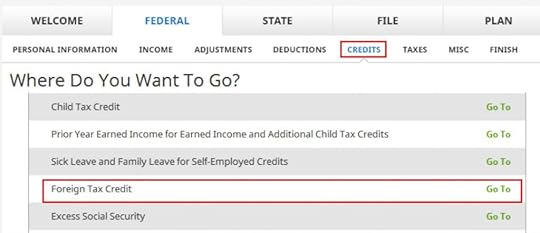

It’ll come up much later in the Credits section under Foreign Tax Credit.

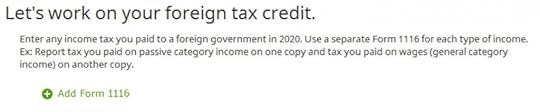

Click on Add Form 1116.

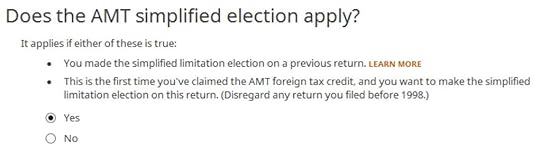

H&R Block software asks upfront about the simplified election. Select Yes if you want the simplified election.

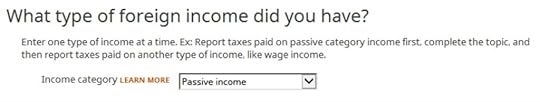

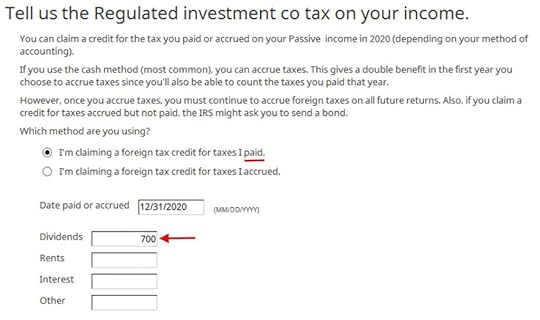

Dividend income falls under passive income.

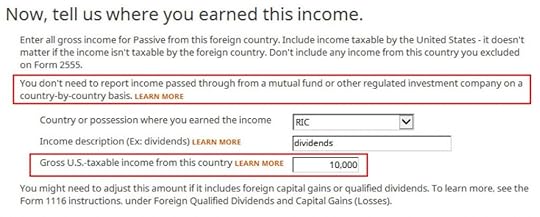

The “learn more” popup says you should choose “RIC” as the country when your foreign income came through mutual funds and/or ETFs. “RIC” is the last item in the country dropdown. You get the foreign income from the supplemental information in your 1099 package from your broker. If you have multiple 1099-DIV’s that reported foreign tax paid in Box 7, you’ll have to add up the foreign income numbers from the respective supplemental information.

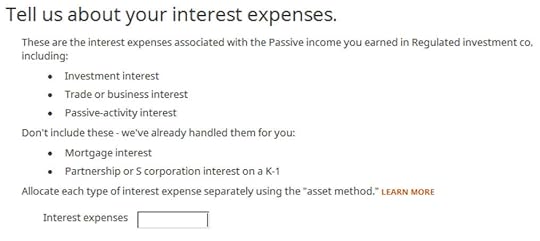

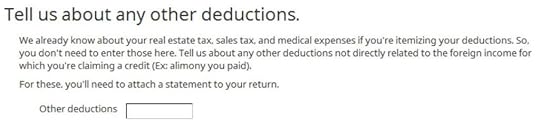

We leave this blank because we don’t have any interest expenses.

We leave this blank because we don’t have any other deductions either.

We don’t have any direct expenses either.

We have no losses to adjust.

Yes, our 1099-DIV reported in U.S. dollars.

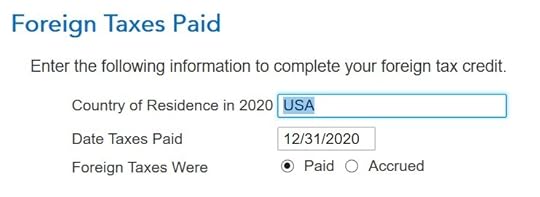

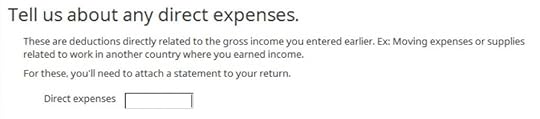

I chose the simpler “paid” method. Enter the end of the year as the date paid. Enter the total foreign tax paid into the Dividends box. If you have multiple 1099-DIV’s that reported foreign tax paid in Box 7, you’ll have to add up those numbers yourself. I wish the software should’ve done the math and auto-populated this field.

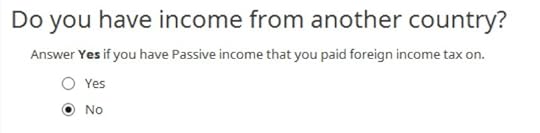

All our foreign taxes paid were through mutual funds and ETFs. RIC is the only country to use. We don’t have foreign income from any other countries.

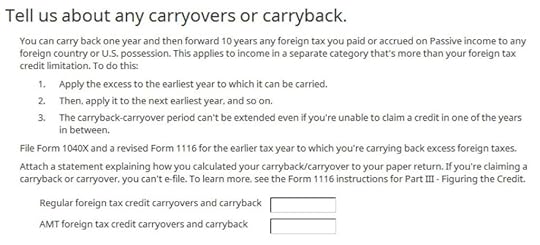

We don’t have any carryover or carryback.

We don’t have any reduction either.

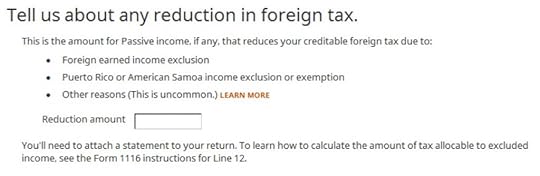

We don’t know what the foreign tax rate was. We’re leaving this blank.

We don’t know how to adjust. We’re leaving it blank again.

This is getting ridiculous. All I want is to get the foreign tax credit!

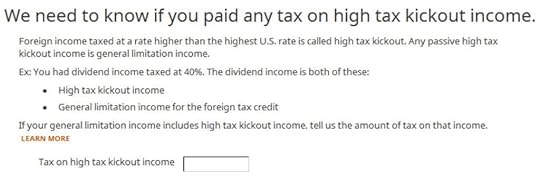

We’re finally done with one Form 1116. Are we getting the credit?

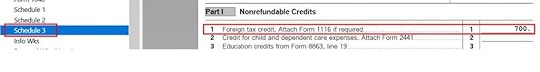

Click on Forms on the top. Double-click on Form 1040 and Schedules 1-3.

Scroll down to Schedule 3. Line 1 shows our foreign tax credit. You can also look at Form 1116. It looks awfully complicated.

SummaryBoth TurboTax and H&R Block software work when your total foreign taxes paid exceeds the $300/$600 threshold that requires a Form 1116. Either way, you’ll have to gather the foreign income from the 1099 supplemental information from your brokers. After it’s all said and done, you’re getting a tax credit for taxes you paid to foreign countries through your mutual funds and/or ETFs.

TurboTax is more integrated with the 1099-DIV’s you already entered. H&R Block asks you to add up the foreign tax numbers yourself. Because you have to add up the foreign income anyway, you can add up the foreign tax numbers at the same time. H&R Block software also asks a number of questions that don’t apply to our simple scenario. It’s easy to click through those once you know they don’t apply.

The post Foreign Tax Credit With Form 1116 In TurboTax and H&R Block Software appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower