Harry Sit's Blog, page 25

August 11, 2021

2021 2022 401k 403b 457 TSP IRA FSA HSA Contribution Limits

[Updated in August 2021 after July inflation release.]

Retirement plan contribution limits are adjusted for inflation each year. Inflation has been at elevated levels in recent months. Most contribution limits and income limits will go up in 2022. Some limits will stay the same as in 2021 due to rounding.

Before the IRS publishes the official numbers in October or November, I’m able to make my own calculations using the published inflation numbers and going by the same rules the IRS uses as stipulated by law. Before I have the inflation numbers for all the months used in the formula, due to rounding rules I can project the contribution limit for next year with high confidence.

In most cases, the inflation numbers in the months to come just aren’t able to make the limits cross another rounding threshold. For example when the law says a limit must be rounded down to the nearest $500, and the calculated result comes to $6,200, I know even if it’s off a little, it isn’t going to go below $6,000 or go above $6,500.

I have been able to do early projections with 100% accuracy ever since I started doing them several years ago. Of course, we can always be surprised by the inflation numbers. I’ll update this post if I see a large surprise that changes these projections.

401k/403b/457/TSP Elective Deferral Limit401k/403b/457/TSP contribution limit will go up by $1,000 from $19,500 in 2021 to $20,500 in 2022. This limit usually goes up by $500 at a time but higher inflation is making it go two steps in one year.

If you are age 50 or over, the catch-up contribution limit will stay the same at $6,500 in 2022 as in 2021.

Employer match or profit sharing contributions aren’t included in these limits. If you work for multiple employers in the same year or if your employer offers multiple plans, you have one single employee contribution limit for 401k, 403b, and TSP across all plans. The 457 plan limit is separate. You can contribute the maximum to both a 401k/403b/TSP plan and a 457 plan.

Annual Additions LimitThe total employer plus employee contributions to all defined contribution plans by the same employer will increase by $3,000 from $58,000 in 2021 to $61,000 in 2022. This limit usually increases by $1,000 at a time but now it’s jumping three steps in one year.

The age-50-or-over catch-up contribution is separate from this limit. If you work for multiple unrelated employers in the same year, you have separate limits at each employer.

Annual Compensation LimitThe maximum annual compensation that can be considered for making contributions to a retirement plan is always 5x the annual additions limit. Therefore the annual compensation limit will increase by $15,000 from $290,000 in 2021 to $305,000 in 2022.

Highly Compensated Employee ThresholdIf your employer limits your contribution because you are a Highly Compensated Employee (HCE), the minimum compensation will go up from $130,000 in 2021 to $135,000 in 2022.

SIMPLE 401k and SIMPLE IRA Contribution LimitSIMPLE 401k and SIMPLE IRA plans have a lower limit than standard 401k plans. The contribution limit for SIMPLE 401k and SIMPLE IRA plans will go up from $13,500 in 2021 to $14,000 in 2022.

If you are age 50 or over, the catch-up contribution limit will stay the same at $3,000 in 2022 as in 2021. Employer contributions aren’t included in these limits.

Traditional and Roth IRA Contribution LimitThe Traditional or Roth IRA contribution limit will stay the same at $6,000 in 2022 as in 2021. The age 50 catch-up limit is fixed by law at $1,000 in all years.

The IRA contribution limit and the 401k/403b/TSP or SIMPLE contribution limit are separate. You can contribute the respective maximum to both a 401k/403b/TSP/SIMPLE plan and a traditional or Roth IRA.

Deductible IRA Income LimitThe income limit for taking a full deduction for your contribution to a traditional IRA while participating in a workplace retirement will increase by $2,000 for singles, from $66,000 in 2021 to $68,000 in 2022. It will increase by $4,000 for married filing jointly, from $105,000 in 2021 to $109,000 in 2022. The deduction completely phases out when your income goes above $76,000 in 2021 and $78,000 in 2022 for singles; and $125,000 in 2021 and $129,000 in 2022 for married filing jointly.

The income limit for taking a full deduction for your contribution to a traditional IRA when you are not covered in a workplace retirement but your spouse is will go up by $6,000 for married filing jointly from $198,000 in 2021 to $204,000 in 2022. The deduction completely phases out when your joint income goes above $208,000 in 2021 and $214,000 in 2022.

Roth IRA Income LimitThe income limit for contributing the maximum to a Roth IRA will go up by $4,000 for singles from $125,000 in 2021 to $129,000 in 2022. It will go up by $6,000 for married filing jointly from $198,000 in 2021 to $204,000 in 2022.

You can’t contribute anything directly to a Roth IRA when your income goes above $140,000 in 2021 and $144,000 in 2022 for singles, and $208,000 in 2021 and $214,000 in 2022 for married filing jointly, up by $4,000 and $6,000 respectively in 2022. You can still do a backdoor Roth IRA in such case.

Healthcare Flexible Spending Account Contribution LimitThe Healthcare FSA contribution limit will go up by $100 from $2,750 per person in 2021 to $2,850 per person in 2022.

Health Savings Account Contribution LimitThe HSA contribution limit for single coverage will go up by $50 from $3,600 in 2021 to $3,650 in 2022. The HSA contribution limit for family coverage will go up from $7,200 in 2021 to $7,300 in 2022. These were announced previously in the spring. Please see HSA Contribution Limits.

Those who are 55 or older can contribute additional $1,000. If you are married and both of you are 55 or older, each of you can contribute the additional $1,000, but to separate HSAs in each person’s name.

Saver’s Credit Income LimitThe income limits for receiving a Retirement Savings Contributions Credit (“Saver’s Credit”) will increase in 2022. For married filing jointly, it will be $39,500 in 2021 and $41,000 in 2022 (50% credit), $43,000 in 2021 and $44,000 in 2022 (20% credit), and $66,000 in 2021 and $68,000 in 2022 (10% credit).

The limits for singles will be at half of the limits for married filing jointly, at $19,750 in 2021 and $20,500 in 2022 (50% credit), $21,500 in 2021 and $22,000 in 2022 (20% credit), and $33,000 in 2021 and $34,000 in 2022 (10% credit).

All Together 20212022IncreaseLimit on employee contributions to 401k, 403b, or 457 plan$19,500$20,500$1,000Limit on age 50+ catchup contributions to 401k, 403b, or 457 plan$6,500$6,500NoneSIMPLE 401k or SIMPLE IRA contributions limit$13,500$14,000$500SIMPLE 401k or SIMPLE IRA age 50+ catchup contributions limit$3,000$3,000NoneHighly Compensated Employee definition$130,000$135,000$5,000Maximum annual additions to all defined contribution plans by the same employer$58,000$61,000$3,000Traditional and Roth IRA contribution limit$6,000$6,000NoneTraditional and Roth IRA age 50+ catchup contribution limit$1,000$1,000NoneDeductible IRA income limit, single, active participant in workplace retirement plan$66,000 – $76,000$68,000 – $78,000$2,000Deductible IRA income limit, married, active participant in workplace retirement plan$105,000 – $125,000$109,000 – $129,000$4,000Deductible IRA income limit, married, spouse is active participant in workplace retirement plan$198,000 – $208,000$204,000 – $214,000$6,000Roth IRA income limit, single$125,000 – $140,000$129,000 – $144,000$4,000Roth IRA income limit, married filing jointly$198,000 – $208,000$204,000 – $214,000$6,000Healthcare FSA Contribution Limit$2,750$2,850$100HSA Contribution Limit, single coverage$3,600$3,650$50HSA Contribution Limit, family coverage$7,200$7,300$100HSA, age 55 catch-up$1,000$1,000NoneLearn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2021 2022 401k 403b 457 TSP IRA FSA HSA Contribution Limits appeared first on The Finance Buff.

July 11, 2021

Roth Conversion and Capital Gains On ACA Health Insurance

[Updated with law changes and the new spreadsheet version for 2021.]

Most online tax calculators don’t include the effect on the premium tax credit when you get health insurance under the Affordable Care Act (ACA), also known as Obamacare. This is a major gap for millions of people who get a subsidy for health insurance from the ACA because their income affects the amount of subsidy they will receive. Getting a larger subsidy reduces their tax dollar for dollar; qualifying for less subsidy increases their tax dollar for dollar.

The most accurate way to project taxes is to use the downloaded tax software. However, tax software for the current year won’t be available until November or December. My favorite tool for tax planning is the Case Study Spreadsheet, which is created and updated by MDM on the Mr. Money Mustache forum. MDM releases several updates each year to add new features and keep up with tax law changes.

It’s an actual spreadsheet file, not an online one. You will need Microsoft Excel or compatible software to open it. As with anything downloaded from the Internet, you will have to trust the source. The author MDM puts a lot of work into this spreadsheet. I was invited to test it. As far as I can tell, it’s reasonably accurate.

With 17 tabs, this spreadsheet does a lot of things. It looks overwhelming if you are only looking for one feature out of many. I will show you how this spreadsheet can help calculate the effect of Roth conversion or realizing long-term capital gains when you also receive a subsidy for your ACA health insurance. I used version 21.09 released on July 11, 2021.

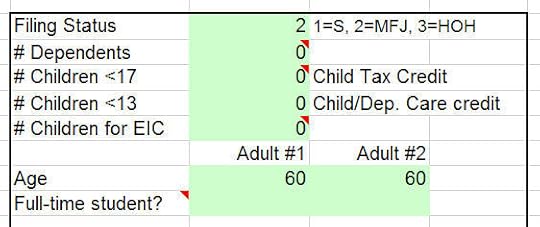

ScenarioA retired couple, both age 60, Nevada residents, married filing jointly, with no dependents. They live on $40k pension income and $5k qualified dividends. They have no other income or deductions. The full price of the second lowest cost Silver plan from the ACA marketplace is $2,000/month. They chose that plan, paying $250/month out of pocket. The government pays $1,750/month to the insurance company as an advance subsidy.

Their questions:

How does it affect their taxes if they convert additional money from their traditional IRA to Roth?How does it affect their taxes if they realize some long-term capital gains?The SpreadsheetAfter you download the spreadsheet, open it in Microsoft Excel or a compatible program. Click on Enable Editing and Enable Content in the yellow ribbon you see in Excel. Go to the Calculations tab. First, you enter your filing status, number of dependents, and your ages starting at cell G2.

You go down to cell H35 to enter your state of residency.

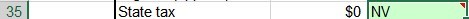

Next, you enter your income. Because the couple in our scenario are retired, we skip the paycheck items and we go down to non-paycheck income starting at cell D23. You only input into cells in green. Use annual numbers here.

Income before Roth Conversion or Capital Gain

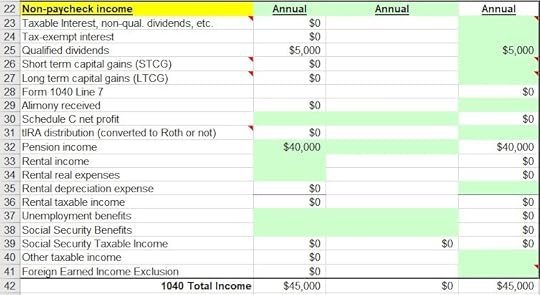

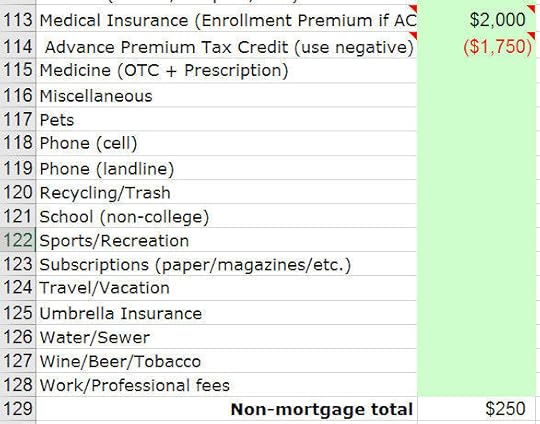

Income before Roth Conversion or Capital GainThen you go down to the monthly average expense section and enter the full price health insurance premium and the advance subsidy in cells B113 and B114. Remember to enter the monthly numbers here. Enter the advance subsidy amount as a negative number. If you mouse over cells B113 and B114, you will see some instructions there.

Now scroll to the far right to cell AC88 or use the find function in your spreadsheet software to locate “Form 8962.” Enter the full price of the second lowest cost Silver plan in cell AE100. Use the annual number here. You may notice it shows “Other 48” in this area. If you live in Alaska or Hawaii, make sure to enter “AK” or “HI” in cell H35.

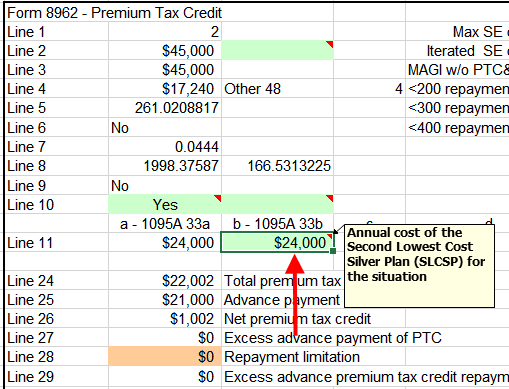

Finally, we go back to the tax calculation area starting at cell F11. This shows their baseline estimated federal income tax.

As you see from above, the spreadsheet estimates that this retired couple will pay $1,490 in federal income tax and receive $1,002 in additional ACA premium tax credit on top of the advance credit already paid directly to the health insurance company. With $45,000 in AGI, that’s average tax rate under 4%. Normally they would be good candidates for converting a part of their traditional IRA to Roth to take advantage of their low tax rate before they start Social Security and before RMDs start.

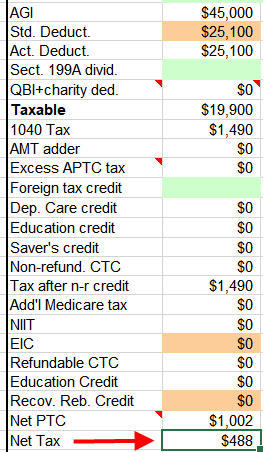

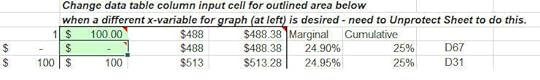

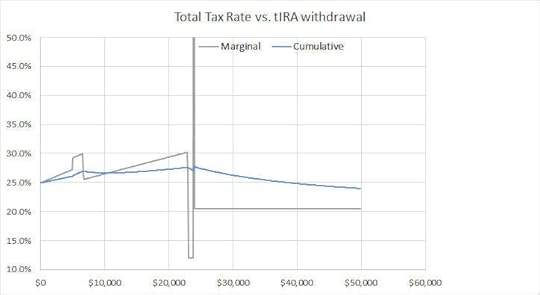

Roth ConversionWhat happens if they do Roth conversions? Now comes the really neat part of this spreadsheet. You see a chart near cell F81.

The X-axis represents different amounts in Traditional IRA withdrawals whether the withdrawals are converted to Roth or not. The Y-axis shows the marginal and cumulative tax rate on such withdrawals. The chart for our example shows this couple pay 25% to 30% tax on their withdrawals/Roth conversions up to about $22,000. Tha marginal tax rate bounces around a little bit and then settles down to about 20%. Then it gets on a small plateau before it flatlines at 30%.

The couple can decide how much they want to convert based on the marginal tax rates in the chart. If 25% to 30% feels too high, they don’t convert. If they want to convert $20,000, they might as well convert some more because the marginal tax rate comes down between $22,000 and $60,000.

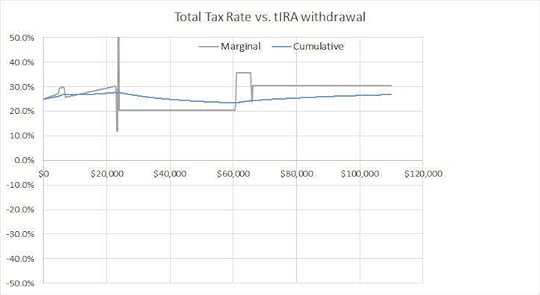

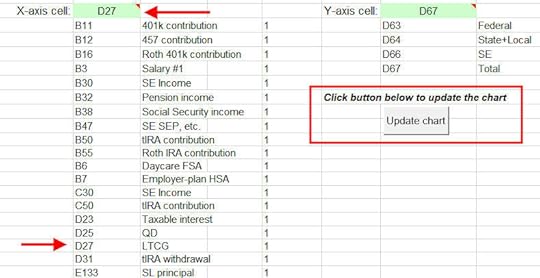

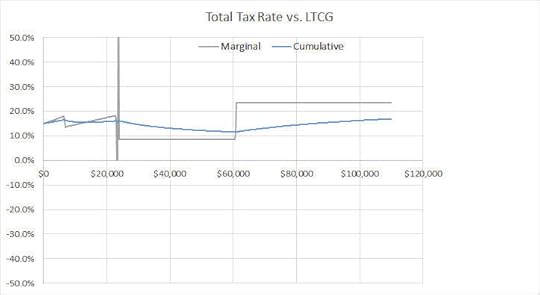

Long-Term Capital GainsWhat happens if instead of Roth conversions they realize some long-term capital gains? We can change the X-axis in the chart from Traditional IRA withdrawals (conversions) to long-term capital gains. The area under the chart tells us how to do that.

The list tells us Long-Term Capital Gains (LTCG) is D27. So we choose D27 in the dropdown for cell G107. Then we click on that button to update the chart.

The shape the chart is similar to the one for Roth conversions but the rates are different. It shows they pay 15% to 18% on realized long-term capital gains up to about $22,000. Then the marginal tax rate goes down to slightly below 10% before a bump to above 20% when they realize more than $60,000 in long-term capital gains.

Again, if 15%-18% feels too high, they shouldn’t realize those gains. If they will already realize $20,000, they might as well realize $40,000 more.

Adjusting Chart ScaleBy default, the Y-axis in the chart goes between -50% and +50%. If we want to use the space in full, we can adjust the Y-axis scale. Select the Y-axis, right-click, and click on Format Axis… Choose a different number for the minimum and the maximum. It will make the chart easier to see.

The range in the X-axis is adjusted by changing the numbers in cells P83 and P84.

Making the first number in green smaller will make the chart show a narrower range. For example, the Roth conversion chart looks like this after changing the number in P83 from the default 220 to 100 together with adjusting the minimum for the Y-axis from -0.5 to 0.1.

It gives us a closer view of what’s happening for conversions up to $50,000 instead of $100,000.

***

This exercise shows that converting to Roth or realizing long-term capital gains while receiving the health insurance subsidy from ACA will incur higher federal income tax than if you are not receiving the health insurance subsidy. The Case Study Spreadsheet does a great job in displaying the effect. It has a learning curve when you go all over the place to find the right spot for your inputs and look at the results, but it works wonders once you know where to enter things and what to look for. The interactive chart shows what-if’s better than any tax software. I thank MDM for the hard work. The more I use it, the more I’m amazed at how neat the spreadsheet it. It’s my go-to tax planning tool.

The same spreadsheet can be used to show the effect of Roth conversions without the complications of ACA health insurance. I’ll do an example with Social Security and Medicare in another post.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Roth Conversion and Capital Gains On ACA Health Insurance appeared first on The Finance Buff.

June 23, 2021

Don’t Choose 2021 Advance Child Tax Credit Opt-Out

The American Rescue Plan Act of 2021 increased the Child Tax Credit in 2021 for taxpayers whose income falls under a qualifying cutoff. The implementation calls for the IRS to send out monthly direct deposits/checks in advance so that you don’t have to adjust your withholding or wait until you file your tax return to get the money.

Because the IRS doesn’t know how much income you’ll have in 2021, they only use your income from the previous year to calculate your monthly payments. When you file your tax return, you re-calculate your child tax credit and you reconcile between what you should receive and what you actually received from the monthly payments.

The IRS already sent letters to people to notify them of the upcoming payments, which are scheduled to start on July 15. If you received the letter but you don’t think you will qualify for the child tax credit in 2021, the IRS provides an opt-out tool for you to tell them not to send the monthly payments. If you fall into this situation because you expect your 2021 income to be higher, you may be tempted to opt-out. Don’t do it.

I made this mistake when I enrolled in ACA health insurance for 2020. The ACA health insurance is set up similarly to the advance child tax credit in that the government can pay a subsidy to the insurance company in advance and you’ll reconcile on your tax return between what they paid during the year and what your income ends up qualifying for.

I refused the advance subsidy in 2020 thinking that I may not qualify for it in the end, and if I did qualify, I would just get it at tax time the following year. That refusal made me miss out on over $8,000 worth of tax credit when a new law enacted in 2021 made everyone keep the advance subsidy received in 2020 whether their income qualified for it or not. I had nothing to keep because I refused the advance subsidy.

Although right now there’s no law that says you’ll get to keep any advance credit that you don’t qualify for, you never know what will happen in the future. If you accept the advance payments, the worst case is that you’ll have to pay it all back, but you aren’t out anything because you already got the money in advance. If you opt-out of the advance payments and the government becomes extra generous, you’ll totally miss out on the generosity.

Most people will simply accept the advance payments. They are the mainstream. There’s safety in the mainstream. When the mainstream wins, you win. The mainstream won’t carry you if you try to be clever and step out of the mainstream. Don’t make the mistake I made in 2020. Go with the mainstream.

Last but not least, it isn’t easy to opt-out anyway. News reports said the opt-out tool requires hoops of ID verification. You have to verify your mobile phone number but that often doesn’t work. You have to upload a photo of your driver’s license but that often doesn’t work either. And if you’re married filing jointly, each of you has to go through the process separately. The easiest thing to do is simply not to go out of your way to opt-out. Do nothing. Accept the money. If it means you have to pay it back next year when you file your tax return, so be it.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Don’t Choose 2021 Advance Child Tax Credit Opt-Out appeared first on The Finance Buff.

June 14, 2021

2021 2022 Medicare Part B Part D IRMAA Premium Brackets

[Update on June 14, 2021: Include projections for 2022. My projections for 2021 matched 100% the official numbers. ]

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors’ services and Medicare Part D that covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount.

I haven’t seen any numbers that show how much collecting IRMAA really helps the government in the grand scheme. I’m guessing very little. One report said 7% of all Medicare beneficiaries pay IRMAA. Suppose the 7% pay double the standard premium, it changes the overall split between the beneficiaries and the government from 25:75 to 27:73. Big deal?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits aren’t included in the income for determining IRMAA.

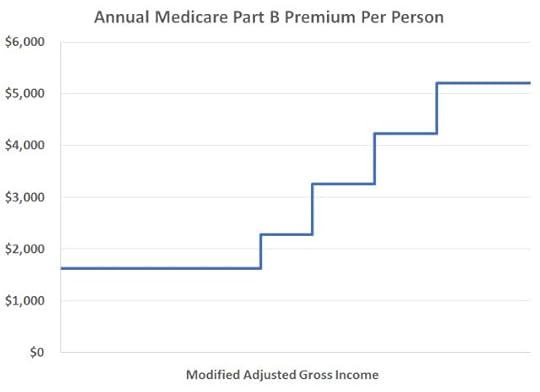

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay. If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

So if your income is near a bracket cutoff, see if you can manage to keep it down and make it stay in a lower bracket. Using the income from two years ago makes it a little harder. Now in 2021, you don’t know where exactly the brackets will be for 2023. Still, you can make reasonable estimates and give yourself some margin to stay clear of the cutoff points.

2021 IRMAA BracketsThe IRMAA income brackets (except the very last one) started adjusting for inflation in 2020. Here are the IRMAA income brackets for 2021 coverage and the projected brackets for 2022 coverage. Before the government publishes the official numbers, I’m able to make projections based on the inflation numbers to date. Rounding rules make it such that the inflation numbers for the upcoming months are unlikely to affect the final results. For example, when a number is rounded to the nearest $1,000, it doesn’t matter whether the number is really $90,200 or $90,300 before rounding. Remember the income on your 2020 tax return (AGI plus muni interest) determines the IRMAA you pay in 2022. The income on your 2021 tax return (to be filed in 2022) determines the IRMAA you pay in 2023.

Part B Premium2021 Coverage (2019 Income)2022 Coverage (2020 Income)StandardSingle: <= $88,000Married Filing Jointly: <= $176,000Single: <= $90,000

Married Filing Jointly: <= $180,000Standard * 1.4Single: <= $111,000

Married Filing Jointly: <= $222,000Single: <= $114,000

Married Filing Jointly: <= $228,000Standard * 2.0Single: <= $138,000

Married Filing Jointly: <= $276,000Single: <= $142,000

Married Filing Jointly: <= $284,000Standard * 2.6Single: <= $165,000

Married Filing Jointly: <= $330,000Single: <= $170,000

Married Filing Jointly: <= $340,000Standard * 3.2Single: <= $500,000

Married Filing Jointly: <= $750,000Single: <= $500,000

Married Filing Jointly: <= $750,000Standard * 3.4Single: > $500,000

Married Filing Jointly: > $750,000Single: > $500,000

Married Filing Jointly: > $750,000

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The income brackets are the same. The surcharges are relatively smaller in dollars.

2022 IRMAA BracketsAs of June 2021, we have 9 out of the 12 required monthly inflation numbers to calculate the income brackets for 2022 coverage. I made the projections above based on a reasonable range of inflation numbers for the remaining three months, but of course we can always be surprised by the actual numbers. I’ll update the projections if I see big surprises that affect the projections.

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes. Does making them pay another $1,400/year make that much difference? Nickel-and-diming just annoys people. People caught by surprise when their income crosses over to a higher bracket by just a small amount get mad at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income and don’t accidentally cross a line for IRMAA.

IRMAA AppealIf your income two years ago was higher because you were working at that time and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA assessment. The “life-changing events” that make you eligible for an appeal include:

Death of spouseMarriageDivorce or annulmentWork reductionWork stoppageLoss of income from income producing propertyLoss or reduction of certain kinds of pension incomeYou file an appeal by filling out the form SSA-44 to show that although your income was higher two years ago, you had a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For LifeIf your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, when your income comes down in the following year, your IRMAA will also come down automatically. It’s not the end of the world to pay IRMAA for one year.

June 8, 2021

Buy More I Bonds at TreasuryDirect in a Revocable Living Trust

One limitation of buying I Bonds is the annual purchase limit. Each person can buy a maximum of $10,000 per calendar year as the primary owner. If you see I Bonds as an investment, it’s true you can’t dump $500,000 into I Bonds in one shot. However, if you see I Bonds as another account, the $10,000/person limit is higher than the annual contribution limit for an IRA. You never hear people say you shouldn’t bother contributing to an IRA because the limit is only $6,000 or $7,000 per year. People go to great lengths to contribute to their IRA with a backdoor Roth.

In addition, if you have a trust, you can buy another $10,000 per year under the name of the trust. A lawyer created a revocable living trust for us back in 2018 (see Will and Trust Through Employer Legal Plan). It was surprisingly easy when I opened an account for the trust at TreasuryDirect last month. It took only 15 minutes to open a new trust account and buy another $10,000 of I Bonds.

Registration NameTreasuryDirect has instructions for opening an entity account. A trust account is one type of entity accounts. The instructions look complicated but it’s not that bad if you read closely. The most tricky part is the name for the trust account. For a revocable living trust, they want the registration to include both the trustee and the grantor even if the names are the same.

My wife and I have a joint trust. We are both trustees and grantors. So the name of our registration becomes:

Person A or Person B, Trustees, [Name of the Trust] U/A with Person A and Person B dated [Month Date, Year]

The instructions include a list of approved abbreviations. “U/A” stands of Under Agreement. They allow 150 characters in the registration. Although the registration looks long and redundant, it fits within 150 characters.

Tax IDA revocable living trust typically uses the grantor’s Social Security Number as its Tax ID. The trust account at TreasuryDirect can still use the grantor’s Social Security Number even though the grantor also has a personal account with TreasuryDirect under the same Social Security Number.

Email AddressThe trustee acts as the manager of the trust account. TreasuryDirect wants an email address for sending one-time passwords and notifications. You can use the same email address if you also have a personal account at TreasuryDirect.

Bank AccountThe new trust account needs a linked bank account. The bank account doesn’t have to be under the name of the trust. It can be the same personal bank account linked to the grantor’s personal account at TreasuryDirect.

Between the personal account and the trust account, the Tax ID, the email address, and the linked bank account can all be the same. The account number and the account type are different.

TreasuryDirect doesn’t do any random deposits to verify the bank account. You can enter an order to buy as soon as you create the trust account. Make sure you give the correct bank account. If the debit bounces, your account will be locked and it’ll take effort to unlock it.

Separate TrustsWe have one joint trust because we live in a community property state. It’s not uncommon for a couple to have separate trusts. If you have two trusts, you can open a separate account for each trust and buy another $10,000 of I Bonds every year in each account.

Create Trust by SoftwareIf you don’t have a trust and you don’t otherwise need one, you can still create a trust just to buy more I Bonds. It may not be worth it if you have to go to a lawyer but if you make it really simple, you can do it with software. Quicken Willmaker & Trust 2021 by Nolo Press sells for only $39 on Amazon. Many public libraries carry this book-and-software combo or a previous edition. You can also find free living trust templates online, although I trust Nolo Press more.

One person isn’t limited to having only one trust either. If you don’t mind the trouble, nothing stops you from creating seven trusts with different names that hold only I Bonds. Once you have the software, you can create one trust or seven trusts.

Transfer from Personal AccountA trust can’t be the second owner or the beneficiary of the I Bonds in a personal account (see I Bonds Beneficiary vs Second Owner in TreasuryDirect). If you’d like to put everything into the trust, it’s possible to transfer bonds in your personal account to the trust account, but it can’t be done online. You will need to fill out FS Form 5511 and sign it before a certifying officer at a financial institution. The certifying officer must sign and apply their signature guarantee stamp or medallion stamp. We did this at Bank of America to replace paper bonds stolen by burglars. It requires extra work but it’s doable.

It isn’t taxable when you transfer personal assets to your own revocable living trust.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Buy More I Bonds at TreasuryDirect in a Revocable Living Trust appeared first on The Finance Buff.

June 2, 2021

I Bonds Beneficiary vs Second Owner in TreasuryDirect

When you have retirement accounts with a private financial institution, you can designate beneficiaries for the account. Some financial institutions also allow Pay On Death (POD) or Transfer On Death (TOD) designations for non-retirement accounts. After reading the previous post How To Grant Transact Right on I Bonds to the Second Owner, someone asked whether it’s easier and better to set up the I Bonds in TreasuryDirect with a beneficiary as opposed to a second owner.

One difference between TreasuryDirect and other financial institutions is that the beneficiaries and the second owners in TreasuryDirect are set at the holdings level, not at the account level. Theoretically, within the same account, you can hold some I Bonds without any second owner or beneficiary, some I Bonds with Person A as the second owner, some I Bonds with Person B as the second owner, some other I Bonds with Person C as the beneficiary, and yet another set of I Bonds with Person D as the beneficiary, and so on. Even though you may not need this much granularity, you can’t simply set a second owner or beneficiary for the entire account.

After you die, your second owners and/or beneficiaries need to contact TreasuryDirect by phone or email, effectively saying:

The owner of this account died. I’m the [second owner or beneficiary] of some bonds in the account. Please give those bonds to me.

If your beneficiary has their own TreasuryDirect account, you can let the beneficiary see which I Bonds they’re a beneficiary of by granting them View rights on those I Bonds. The process to grant View rights to the beneficiary is the same as the process to grant Transact rights to the second owner, as I showed in the previous post. You also have to do it bond by bond.

Whether you should set up your I Bonds with a beneficiary versus a second owner depends on whether you want to let someone transact on those bonds on your behalf when you’re still living. A beneficiary can only be granted View rights. A second owner can be granted either View or Transact rights. In a sense, the second owner with Transact rights is like a beneficiary plus a power of attorney. The second owner with only View rights can’t do anything more than a beneficiary.

BeneficiarySecond OwnerSet on each bondYesYesReceive bonds after your deathYesYesCan be granted View rightsYesYesCan be granted Transact rightsNoYesAs the primary owner of the I Bonds, you can change the arrangement at will. You can add or remove a beneficiary or a second owner at any time. If you started with a beneficiary and now you want a second owner, you can remove the beneficiary and add a second owner. If you started with a second owner and now you want to downgrade to a beneficiary, you can revoke the Transact rights or remove the second owner altogether and add a beneficiary. It’s all up to the primary owner.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post I Bonds Beneficiary vs Second Owner in TreasuryDirect appeared first on The Finance Buff.

May 25, 2021

How To Grant Transact Right on I Bonds to the Second Owner

The recent upticks in inflation made Series I Savings Bonds (“I Bonds”) the best bonds you can buy, if only you can buy more of them. Because they’re indexed to inflation, if inflation goes to 20%, I Bonds will earn 20%. Other than getting I Bonds using your tax refund, the only way to buy them is through the federal government’s website TreasuryDirect.

My wife and I have been buying I Bonds through TreasuryDirect for many years now. When we buy, we always give both our names and our social security numbers: a primary owner WITH a second owner. I’m the primary owner and my wife is the second owner of the bonds I buy in my account. She’s the primary owner and I’m the second owner of the bonds she buys in her account.

I only learned recently that when you’re the second owner of the electronic I Bonds issued through TreasuryDirect, you don’t automatically see those bonds in your account. The bonds have the second owner’s name and Social Security Number in the registration but they’re not automatically matched to the second owner’s TreasuryDirect account. By default, only the primary owner sees the bonds and can redeem the bonds. If the second owner wants to see them or redeem them, the primary owner has to specifically grant View or Transact rights on those bonds to the second owner’s account.

TreasuryDirect describes how to do this in an FAQ: How do I grant View and Transact Rights to securities held in my TreasuryDirect account? Unfortunately, the rights are granted at the level of each bond in the account, not at the account level as a whole. Because we already own multiple bonds, we had to go through the steps one bond at a time in our respective accounts. We also have to remember to go through these steps every time we buy a new bond.

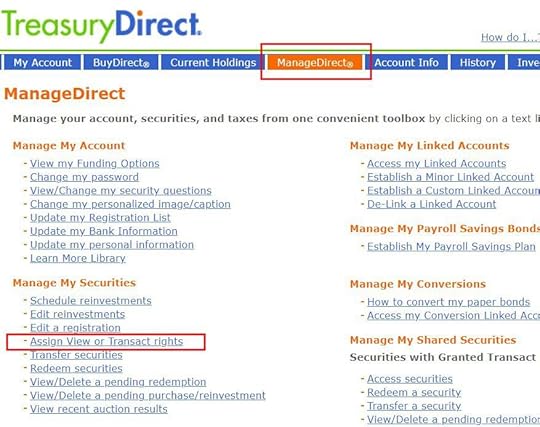

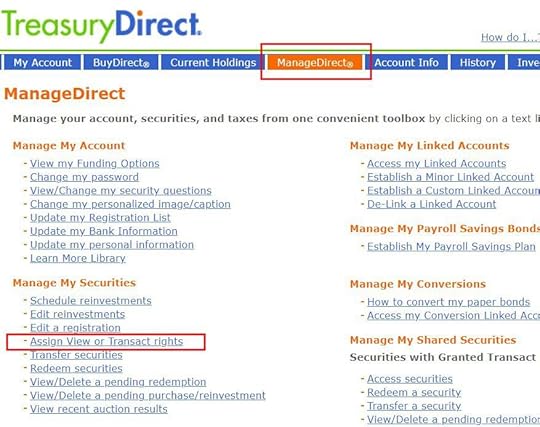

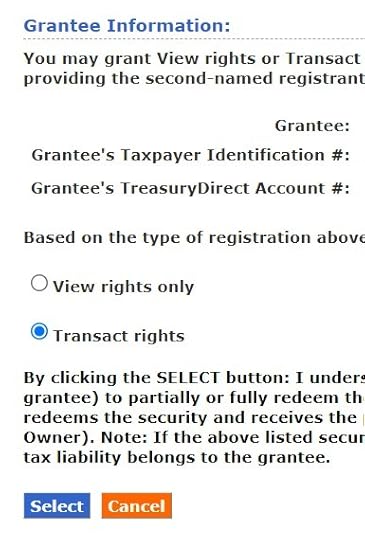

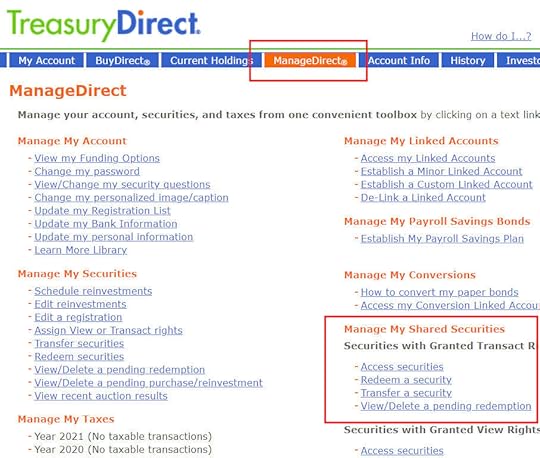

ManageDirectAfter logging into TreasuryDirect, go to ManageDirect, and then click on Assign View or Transact rights under Manage My Securities.

Grant Transact Rights

Grant Transact RightsSelect one of the bonds in your account.

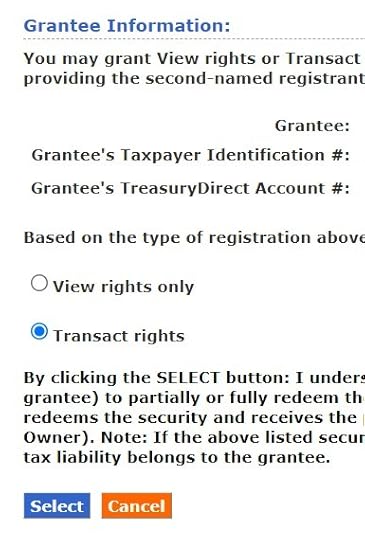

If you put a second owner on the bond at the time of purchase, the second owner’s name and Social Security Number will show up automatically. You need to enter the second owner’s TreasuryDirect account number. If you choose “View rights only” the second owner can only see the bond but can’t redeem it. If you choose “Transact rights” the second owner can both see and redeem the bond.

After you grant the rights for one bond, you go back to the list of your bonds, choose another bond, and repeat. There’s no way to grant rights to multiple bonds in one pass. The list doesn’t show you which bonds you have already granted rights and which bonds you haven’t. You’ll have to remember your progress and pick the next bond.

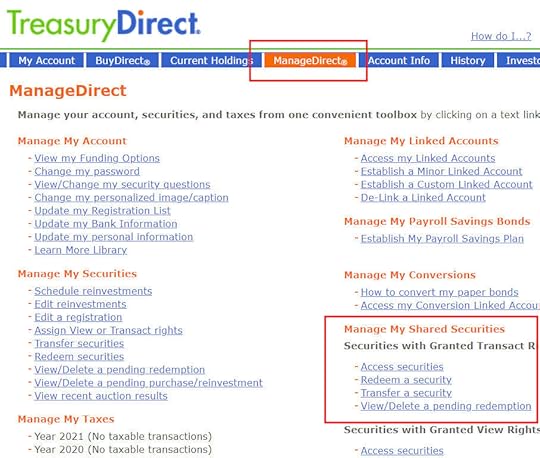

Shared SecuritiesAfter the primary owner grants View or Transact rights to you as the second owner, you still don’t see those bonds in the same view as the bonds of which you’re the primary owner. To see the bonds on which you’ve been granted rights, go to ManageDirect, and then find the links under “Manage My Shared Securities” on the right. The “Access securities” link gives you a list of the bonds you were granted rights to see. If you’d like to redeem a bond, use the “Redeem a security” link.

Another quirk in TreasuryDirect is that the primary owner can revoke the rights or remove the second owner altogether at any time. It’s something to be aware of if your relationship with the other owner changes.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Grant Transact Right on I Bonds to the Second Owner appeared first on The Finance Buff.

How To Grant Transact Right on I Bonds in TreasuryDirect

The recent upticks in inflation made Series I Savings Bonds (“I Bonds”) the best bonds you can buy, if only you can buy more of them. Because they’re indexed to inflation, if inflation goes to 20%, I Bonds will earn 20%. Other than getting I Bonds using your tax refund, the only way to buy them is through the federal government’s website TreasuryDirect.

My wife and I have been buying I Bonds through TreasuryDirect for many years now. When we buy, we always give both our names and our social security numbers: a primary owner WITH a second owner. I’m the primary owner and my wife is the second owner of the bonds I buy in my account. She’s the primary owner and I’m the second owner of the bonds she buys in her account.

I only learned recently that when you’re the second owner of the electronic I Bonds issued through TreasuryDirect, you don’t automatically see those bonds in your account. The bonds have the second owner’s name and Social Security Number in the registration but they’re not automatically matched to the second owner’s TreasuryDirect account. By default, only the primary owner sees the bonds and can redeem the bonds. If the second owner wants to see them or redeem them, the primary owner has to specifically grant View or Transact rights to the second owner’s account.

TreasuryDirect describes how to do this in an FAQ: How do I grant View and Transact Rights to securities held in my TreasuryDirect account? Unfortunately, the rights are granted at the level of each bond in the account, not at the account level as a whole. Because we already own multiple bonds, we had to go through the steps one bond at a time in our respective accounts. We also have to remember to go through these steps every time we buy a new bond.

ManageDirectAfter logging into TreasuryDirect, go to ManageDirect, and then click on Assign View or Transact rights under Manage My Securities.

Grant Transact Rights

Grant Transact RightsSelect one of the bonds in your account.

If you put a second owner on the bond at the time of purchase, the second owner’s name and Social Security Number will show up automatically. You need to enter the second owner’s TreasuryDirect account number. If you choose “View rights only” the second owner can only see the bonds but can’t redeem them. If you choose “Transact rights” the second owner can both see and redeem the bond.

After you grant the rights for one bond, you go back to the list of your bonds, choose another bond, and repeat. There’s no way to grant rights to multiple bonds in one pass. The list doesn’t show you which bonds you have already granted rights and which bonds you haven’t. You’ll have to remember your progress and pick the next bond.

Shared SecuritiesAfter the primary owner grants View or Transact rights to you as the second owner, you still don’t see those bonds in the same view as the bonds on which you’re the primary owner. To see the bonds on which you’ve been granted rights, go to ManageDirect, and then find the links under “Manage My Shared Securities” on the right. The “Access securities” link gives you a list of the bonds you were granted rights to see. If you’d like to redeem a bond, use the “Redeem a security” link.

Another quirk in TreasuryDirect is that the primary owner can revoke the rights or remove the second owner altogether at any time. It’s something to be aware of if your relationship with the other owner changes.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Grant Transact Right on I Bonds in TreasuryDirect appeared first on The Finance Buff.

May 18, 2021

Xfinity Mobile and Spectrum Mobile Bring Your Own Budget Phone

Consumer Reports had a good article on cell phone services through cable companies: Why Cell Phone Service From Your Cable Company May Make Sense. I’ve been getting cell phone service from the cable company for several years now. I can confirm the services work well for my needs at a low cost.

Xfinity MobileWhen I lived in California, the cable company in the area was Comcast. Comcast uses the brand Xfinity for its services. I used Xfinity Internet for home Internet and Xfinity Mobile for mobile.

The underlying services for Xfinity Mobile are carried on the Verizon network, which has good coverage. Xfinity Mobile has two plans: a By-the-Gig plan and an unlimited plan. Both plans include unlimited calls and texts. The difference is only in mobile data.

The By-the-Gig plan is the best when you don’t use much mobile data because you’re on WiFi all the time. You pay $15 per GB of mobile data shared by all lines in your household. If you have five lines and the five lines use 1 GB of mobile data combined when you turn off mobile data and only use WiFi, you pay $15/month, averaging only $3/month per line plus taxes. You don’t have to choose how much data you’ll use beforehand. If you normally use 1 GB but you used 2 GB in a month, you will pay another $15 for the extra GB for that one month before dropping down to $15 again in the following month.

The unlimited plan is the best when you use a lot of mobile data out and about. You pay $45/month for one line, $40/month per line for two lines, $33/month per line for three lines, or $30/month per line for four lines.

If you have a mix of heavy mobile data users and light mobile data users in your household, you can put some lines on the By-the-Gig plan and some lines on the unlimited plan. If you have some months of heavy use mixed with some months of light use, you can switch to the unlimited plan when you expect heavy use and switch back to the By-the-Gig plan when you’re back to light use.

Spectrum MobileAfter I moved to Nevada, the cable company here is Charter. Charter uses the brand Spectrum for its services. I’m using Spectrum Internet and Spectrum Mobile.

Spectrum Mobile is similar to Xfinity Mobile. It also uses Verizon’s network. It also has a By-the-Gig plan and an unlimited plan. The By-the-Gig plan charges $14 per GB of mobile data, taxes included. The unlimited plan charges $45/month per line with no multi-line discount.

Another difference is that the minimum in Xfinity Mobile’s By-the-Gig plan is 1 GB shared among all lines while Spectrum Mobile’s minimum is 1 GB per line. If you have five lines on Xfinity Mobile and the five lines combined only use 1 GB of mobile data, you pay $15/month plus taxes for all five lines. If you have five lines on Spectrum Mobile, you’ll have to pay minimum $14/month per line, which comes to $70/month for all five lines.

Spectrum Mobile isn’t as good as Xfinity Mobile due to its higher minimum in the By-the-Gig plan and the lack of multi-line discount in the unlimited plan. I’m thinking of switching to a different provider.

Bring Your Own Device (BYOD)When I started with Xfinity Mobile, the catch was that you had to buy a phone from them. I bought a cheap phone from them for $1 when they had a sale. I didn’t have to use their cheap phone because once you have it, you can just take the SIM card out and put it in any other unlocked phone that works on the Verizon network.

Both Xfinity Mobile and Spectrum Mobile now let you bring your own devices but they limit them to iPhones, Samsung Galaxy phones, and Google Pixel phones. Before they send you a SIM card, they ask you to provide the IMEI number of your phone, from which they can tell which brand it is. If it’s not an iPhone, a Samsung Galaxy, or a Google Pixel phone, they won’t give you a SIM card unless you buy a phone from them.

This is only a business decision, not a technical limitation. Other unlocked phones that work on the Verizon network will also work once you get the SIM card. So you just need the IMEI number of an iPhone, a Samsung Galaxy, or a Google Pixel phone to request the SIM card. It can be an old phone of those three brands that you no longer use. Or you can ask a friend or a family member who has a phone of those brands. After you pass the initial screening and you get the SIM card, you can put the SIM card in a different phone and it will work as long as your phone is unlocked and it supports the Verizon network. My inexpensive Moto G works just fine.

The post Xfinity Mobile and Spectrum Mobile Bring Your Own Budget Phone appeared first on The Finance Buff.

May 16, 2021

The Best Broker For a Custodial Roth IRA For Your Kid

The age of majority is 18 in most states in the U.S. Kids under 18 are allowed to work for pay but they aren’t allowed to open an account with a financial institution unless an adult is either a joint owner or a custodian. This is because kids under 18 can’t legally sign a contract and agree to the terms.

When a kid works for pay, the kid is eligible to contribute to a Roth IRA based on their earnings, up to the kid’s income from their job or the annual Roth IRA contribution limit, whichever is less.

The money doesn’t have to literally come from the kid. If the kid spent their money on something else, a parent can open a Roth IRA for the kid and fund the Roth IRA with the parent’s money. It’ll be the same as the kid contributed their income to the Roth IRA and the parent gave the kid money to spend on something else.

However, an IRA by definition has only one owner; there’s no joint IRA. Because the kid under 18 can’t open the account themselves, an adult has to do it as the custodian. This type of account is called a custodial Roth IRA. The kid is the owner. The adult is the custodian. When the kid becomes an adult, the account turns into a regular Roth IRA.

A custodial Roth IRA is different from a UGMA/UTMA account. Earnings in a custodial Roth IRA are tax free. Earnings in a UGMA/UTMA account are still taxable. But funding a custodial IRA has an upper limit up to lesser of the kid’s work income or the annual contribution limit. If the kid doesn’t work for pay, you can’t fund a custodial Roth IRA. A UGMA/UTMA account doesn’t have such limit.

Vanguard, Fidelity, and Schwab all offer custodial Roth IRAs.

Vanguard[Hat tip to reader always_gone in comment #14 for how to do it online.]

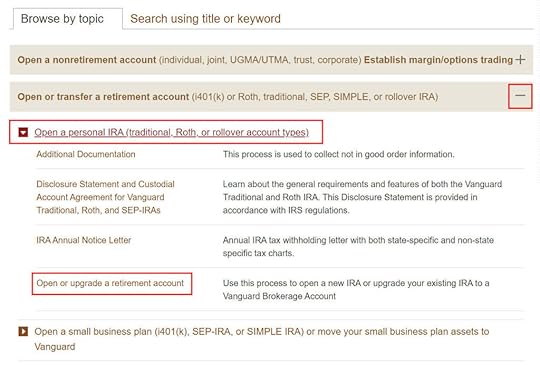

With Vanguard, after you log in, click on Forms in the top menu. The more intuitive “Open an Account” menu item doesn’t work for custodial IRAs.

Expand the second item in the list – “Open or Transfer a Retirement Account.” Click on “Open personal IRA” and then “Open or upgrade a retirement account.”

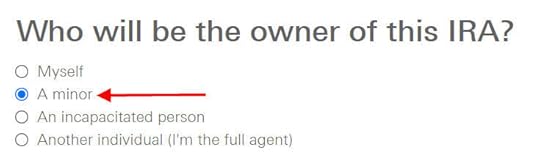

You will answer a series of questions from there. The critical part is in Step 3, where you choose to have a minor as the owner of the new Roth IRA.

You will DocuSign a form after you answer all the questions.

Buying an all-in-one Vanguard Target Retirement Fund requires a $1,000 minimum investment. You can buy ETFs with less money but because you can buy only whole shares, it’s not as easy to invest small amounts. Vanguard charges a $20 annual maintenance fee for small accounts but it can be waived if you sign up for e-delivery of statements and documents.

FidelityYou can open a custodial Roth IRA at Fidelity online with no minimum balance and no annual maintenance fee. A Fidelity Freedom Index Fund would be a good all-in-one option. It doesn’t require any minimum investment. See Fidelity Freedom Index Funds: Hidden Gems For Your IRA and 401k.

Charles SchwabCharles Schwab also offers a custodial Roth IRA with no minimum balance and no annual maintenance fee. They ask you to download a paper application and mail it in. A Schwab Target Index Fund would be a good all-in-one option there. The minimum investment into a Schwab Target Index Fund is only $1. See Schwab Target Index Funds: Hidden Gems For Your IRA and 401k.

***

If your kids work, seize the opportunity to open a custodial Roth IRA for them. Among these three brokers, I would choose Fidelity, because they make it easy to open an account online and you can invest in an all-in-one fund with no minimum investment and no annual maintenance fee.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post The Best Broker For a Custodial Roth IRA For Your Kid appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower