Harry Sit's Blog, page 2

July 29, 2025

Calculator: Effect of Higher SALT Cap in 2025 Trump Tax Law

SALT stands for State And Local Taxes. It’s basically state and local income taxes and property tax. The 2017 Trump tax law capped the tax deduction for SALT at $10,000. If you paid more than $10,000 in state and local taxes, the amount above the $10,000 cap wasn’t deductible.

The SALT cap primarily affected high earners in high-tax states. Legislators from those states had been demanding that the SALT cap be raised or repealed. The 2025 Trump tax law — One Big Beautiful Bill Act — finally raised the SALT cap for the next few years.

Table of ContentsTemporary SALT Cap IncreaseStay In Standard DeductionBunchingSwitch to ItemizingContinue ItemizingIncome-Based PhaseoutMarriage PenaltyHigher Marginal Tax RateCalculatorTemporary SALT Cap IncreaseThe SALT cap goes from $10,000 to $40,000 in 2025 (one-half for married filing separately). The cap will further increase by 1% a year until 2029. Then it returns to $10,000 in 2030.

YearSALT Cap2025$40,0002026$40,4002027$40,8042028$41,2122029$41,6242030$10,000I pay more than $10,000 in state income tax and property tax. With the SALT cap increase, my SALT deduction will be uncapped because it’s less than $40,000. Does this mean my total deductions will increase now?

Stay In Standard DeductionNearly 90% of taxpayers take the standard deduction. That percentage will drop slightly after the SALT cap increase, but it’s expected that over 80% of taxpayers will still take the standard deduction.

I’m in this camp. I took the standard deduction when the SALT cap was $10,000. I will continue to take the standard deduction even though I pay more than the old cap in state and local taxes. This is because when I add my other itemizable deductions (mortgage interest, charity donations, …) to the total state and local taxes I pay, it’s still lower than the standard deduction.

You will get no increase in your deductions from the SALT cap increase if you took the standard deduction under the old cap, and you’ll still take the standard deduction under the new cap (except for the rise in the standard deduction itself, unrelated to the SALT cap).

BunchingBunching means shifting the timing of payments to put two years’ worth of state income tax or property tax into one calendar year. You can do it with charity donations, too.

The tax deduction on the federal tax return goes by the actual date of the SALT payments, not which tax year those payments are for. If you can shift a December payment to January or a January payment to December, you may have enough SALT payments in one calendar year to push you over the hurdle of the standard deduction. Then you will alternate between itemizing in one year and taking the standard deduction next year, as opposed to taking the standard deduction in both years.

Switch to ItemizingYou will get a partial increase if you took the standard deduction before, and you will switch to itemizing after the SALT cap increase.

You get a partial increase because you must pass the hurdle of the standard deduction first. Taking the standard deduction gives you an allowance of free deductions. It’s free because everyone gets the standard deduction; you don’t have to do anything to get it. Switching from the standard deduction to itemized deductions means now you must pay for the allowance that used to be free with a part of your itemized deductions. Your deductions will increase only by what remains after you pay for the free allowance.

For example, suppose you have $5,000 in non-SALT itemizable deductions. You have $15,000 in total itemizable deductions under the old SALT cap, and the standard deduction is $31,500 for married filing jointly. You grab the $16,500 free allowance when you take the standard deduction. Suppose now your total itemized deductions under the new SALT cap are $45,000. Your SALT cap increases by $45,000 – $15,000 = $30,000, but your total deductions only increase by $45,000 – $31,500 = $13,500. You must use $16,500 from your $30,000 increase to pay for the allowance that used to be free.

Continue ItemizingYou will get the full increase if you were already itemizing deductions, and you’ll continue to do so. An increase in the SALT cap increases your SALT deduction to the amount you paid in state and local taxes, up to the new cap. This increase adds to your itemized deductions dollar for dollar.

Income-Based PhaseoutHowever, the new cap isn’t $40,000 for some high earners, because it has an income-based phaseout. The SALT cap drops by 30% of the Modified Adjusted Gross Income (MAGI) above $500,000. When the MAGI reaches $600,000, the SALT cap is back to the old $10,000.

The MAGI for the phaseout is the AGI for most people. It doesn’t add back untaxed Social Security or tax-free muni bond interest. The “modified” part is only for foreign earned income exclusion and residents in Puerto Rico, Guam, American Samoa, and the Northern Mariana Islands.

The table below shows how the SALT cap is phased out with income. Interpolate for an income between two rows in this table.

2025 MAGISALT Cap$500,000 or less$40,000$510,000$37,000$520,000$34,000$530,000$31,000$540,000$28,000$550,000$25,000$560,000$22,000$570,000$19,000$580,000$16,000$590,000$13,000$600,000 or more$10,0002025 SALT Cap Phaseout for Single and Married Filing JointlyThe starting point for the phaseout also increases by 1% a year through 2029. There’s no phaseout in 2030 when the SALT cap goes back to $10,000.

YearPhaseout Starts At2025$500,0002026$505,0002027$510,0502028$515,1512029$520,3022030No phaseoutMarriage PenaltyThe $500,000 income threshold for the phaseout is the same for both single and married filing jointly. It carries a huge marriage penalty. Two single persons, each earning $400,000, can deduct up to $80,000 between the two of them. A married couple earning $800,000 is phased out to a $10,000 cap. Married filing separately doesn’t help because both the phaseout threshold and the cap are cut in half.

Higher Marginal Tax RateThe SALT cap phaseout also increases the marginal tax rate in the phaseout income range. The tax bracket in that income range is normally 32% or 35%. Because a $10,000 increase in the phaseout income range also reduces the SALT cap by $3,000, the marginal tax rate becomes 32% * 1.3 = 41.6% or 35% * 1.3 = 45.5% when the SALT paid is limited by the cap.

High-earners in the phaseout income range should do all-out pre-tax contributions to lower their AGI.

CalculatorI created a calculator to show whether you’ll see no increase, a partial increase, or a full increase from the new SALT cap. The calculator takes into account both the standard deduction and the SALT cap phaseout at higher incomes. It calculates the federal income tax before and after the SALT cap increase to show the tax savings.

Tax Filing Status: SingleHead of Household

Married Filing JointlyI’m 65 by 12/31Spouse (if filing jointly) is 65 by 12/31Adjusted Gross Income (AGI), everything included:Qualified dividends and long-term capital gains included in the AGIUncapped SALT paidOther itemizable deductions (mortgage interest, charity donations, …)

A higher SALT cap increases your standard or itemized deductions by $, from $ to $.

Your federal income tax is approximately $ before the SALT cap increase. It’s approximately $ after.

You save $, which is % of your AGI.

The calculated tax does not include the Net Investment Income Tax (NIIT).

***

Most people will see no benefit from the SALT cap increase because they will continue to take the standard deduction. Some will see a partial increase in their deductions when they start itemizing. Only people who were already itemizing deductions before will see the full increase, unless they get phased out.

You’ll find more deep dives on recent changes from the 2025 Trump tax law in the full OBBBA series.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Calculator: Effect of Higher SALT Cap in 2025 Trump Tax Law appeared first on The Finance Buff.

SALT Cap Calculator: How Much Does It Lower Your Taxes?

SALT stands for State And Local Taxes. It’s basically state and local income taxes and property tax. The 2017 Trump tax law capped the tax deduction for SALT at $10,000. If you paid more than $10,000 in state and local taxes, the amount above the $10,000 cap wasn’t deductible.

Table of ContentsTemporary SALT Cap IncreaseStay In Standard DeductionSwitch to ItemizingContinue ItemizingIncome-Based PhaseoutCalculatorTemporary SALT Cap IncreaseThe 2025 Trump tax law — One Big Beautiful Bill Act — increased the SALT cap from $10,000 to $40,000 in 2025 (one-half for married filing separately). The cap further increases by 1% a year until 2029. Then it goes back to $10,000 in 2030.

YearSALT Cap2025$40,0002026$40,4002027$40,8042028$41,2122029$41,6242030$10,000I pay more than $10,000 in state income tax and property tax. With the SALT cap increase, my SALT deduction will be uncapped because it’s less than $40,000. Does this mean my total deductions will increase now?

Stay In Standard DeductionNearly 90% of taxpayers take the standard deduction. That percentage will drop a little bit after the SALT cap increase, but it’s expected that over 80% of taxpayers will still take the standard deduction.

I’m in this camp. I took the standard deduction when the SALT cap was $10,000. I will continue to take the standard deduction even though I pay more than the old cap in state and local taxes. This is because when I add my other itemizable deductions (mortgage interest, charity donations, …) to the total state and local taxes I pay, it’s still lower than the standard deduction.

You will get no increase in your deductions from the SALT cap increase if you took the standard deduction under the old cap, and you’ll still take the standard deduction under the new cap (except for the increase in the standard deduction itself, unrelated to the SALT cap).

Switch to ItemizingYou will get a partial increase if you took the standard deduction before, and you will switch to itemizing after the SALT cap increase.

You get a partial increase because you must pass the hurdle of the standard deduction first. Taking the standard deduction gives you an allowance of free deductions. It’s free because everyone gets the standard deduction. You don’t have to do anything to get it. Switching from the standard deduction to itemized deductions means now you must pay for the allowance that used to be free with a part of your itemized deductions. Your deductions will increase only by what remains after you pay for the free allowance.

For example, suppose you have $5,000 in non-SALT itemizable deductions. You have $15,000 in total itemizable deductions under the old SALT cap, and the standard deduction is $31,500 for married filing jointly. You grab the $16,500 free allowance and take the standard deduction. Suppose now your total itemized deductions under the new SALT cap are $45,000. Your SALT cap increases by $45,000 – $15,000 = $30,000, but your total deductions only increase by $45,000 – $31,500 = $13,500. You must use $16,500 from your $30,000 increase to pay for the allowance that used to be free.

Continue ItemizingYou will get the full increase if you were already itemizing deductions, and you’ll continue to do so. An increase in the SALT cap increases your SALT deduction to the amount you paid in state and local taxes, up to the new cap. This increase adds to your itemized deductions dollar for dollar.

Income-Based PhaseoutHowever, the new cap isn’t $40,000 for high earners, because it has an income-based phaseout. The SALT cap drops by 30% of the Modified Adjusted Gross Income (MAGI) above $500,000. When the MAGI reaches $600,000, the SALT cap is back to the old $10,000.

The MAGI is the AGI for most people. It doesn’t add back untaxed Social Security or tax-free muni bond interest. The “modified” part is only for foreign earned income exclusion and residents in Puerto Rico, Guam, American Samoa, and the Northern Mariana Islands.

The $500,000 income threshold for the phaseout is the same for both single and married filing jointly. It carries a huge marriage penalty. Two single persons, each earning $400,000, can deduct up to $80,000 in state and local taxes paid. A married couple earning $800,000 is phased out to a $10,000 cap. Married filing separately doesn’t help because both the phaseout threshold and the cap are cut in half.

MAGISALT Cap$500,000 or less$40,000$510,000$37,000$520,000$34,000$530,000$31,000$540,000$28,000$550,000$25,000$560,000$22,000$570,000$19,000$580,000$16,000$590,000$13,000$600,000 or more$10,0002025 SALT Cap Phaseout for Single and Married Filing JointlyThe starting point for the phaseout also increases by 1% a year through 2029.

YearPhaseout Starts At2025$500,0002026$505,0002027$510,0502028$515,1512029$520,3022030No phaseoutCalculatorI created a calculator to show whether you’ll see no increase, a partial increase, or a full increase from the new SALT cap. The calculator takes into account both the standard deduction and the SALT cap phaseout at higher incomes. It calculates the federal income tax before and after the SALT cap increase to show the tax savings.

[Email readers: The calculator doesn’t work in emails. Please go to the website to use the calculator.]

Tax Filing Status: SingleHead of Household

Married Filing JointlyI’m 65 by 12/31Spouse (if filing jointly) is 65 by 12/31Adjusted Gross Income (AGI), everything included:Qualified dividends and long-term capital gains included in the AGIUncapped SALT paidOther itemizable deductions (mortgage interest, charity donations, …)

A higher SALT cap increases your standard or itemized deductions by $, from $ to $.

Your federal income tax is approximately $ before the SALT cap increase. It’s approximately $ after.

You save $, which is % of your AGI.

The calculated tax does not include the Net Investment Income Tax (NIIT).

***

Most people will see no benefit from the SALT cap increase because they will continue to take the standard deduction. Some will see a partial increase in their deductions when they start itemizing. Only people who were already itemizing deductions before will see the full increase, unless they get phased out.

You’ll find more deep dives on recent changes from the 2025 Trump tax law in the full OBBBA series.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post SALT Cap Calculator: How Much Does It Lower Your Taxes? appeared first on The Finance Buff.

July 27, 2025

No Tax on Overtime in 2025 Trump Tax Law. What’s the Catch?

The new 2025 Trump tax law includes provisions for “No Tax on Tips” and “No Tax on Overtime.” I covered “No Tax on Tips” in a different post. Let’s look into “No Tax on Overtime” now. If you earn both tips and overtime pay, you can benefit from both!

Table of ContentsNon-Exempt W-2 EmployeesNot What You ThinkTemporary WindowTax WithholdingTax DeductionDollar CapIncome PhaseoutBoth Overtime and TipsCalculatorNon-Exempt W-2 EmployeesIn general, only W-2 employees are entitled to overtime pay. Independent contractors paid by a 1099 don’t qualify for overtime. Nor do self-employed business owners.

Among W-2 employees, for the most part, only hourly (“non-exempt”) employees are entitled to overtime pay. Most salaried (“exempt”) employees don’t receive overtime pay, regardless of the number of hours they work in a week.

Some salaried employees aren’t paid high enough to qualify as exempt employees. They’re still classified as non-exempt and entitled to overtime pay.

Exempt and non-exempt refer to the requirements mandated by the Fair Labor Standards Act of 1938. Being exempt means that the employer isn’t required to follow those requirements in its employment relationship with you. Your employer will tell you whether you’re exempt or non-exempt if you’re not sure.

If you’re currently a salaried exempt employee, it’s unlikely that your employer is willing to re-classify you as non-exempt and give you the advantage of “No Tax on Overtime.” Having you as a non-exempt employee would subject the employer to many requirements from the Fair Labor Standards Act. An employer wants to find every reason to make an employee exempt from those requirements.

Not What You ThinkThe Fair Labor Standards Act requires that overtime must be paid at least 1-1/2 times the regular hourly wage (“time-and-a-half”). Some state laws and union contracts require double time in some scenarios. Some employers voluntarily pay double time for holidays.

Suppose your regular hourly rate is $30/hour and you’re paid $45/hour for overtime. You receive $450 in gross overtime pay when you work 10 overtime hours in a week. You would think that “No Tax on Overtime” means you don’t pay tax on that $450, but that’s not how it works.

“No Tax on Overtime” covers only the pay premium over and above your regular hourly rate. The “No Tax” part applies to $150 out of the $450 gross overtime pay for 10 hours. You still pay taxes as usual on $300 earned at your regular $30/hour rate for those hours.

As a result, if your overtime hours are paid time-and-a-half, you’ll have no tax on only 1/3 of your gross overtime pay. If you’re paid double time, you’ll have no tax on 1/2 of the gross overtime pay.

Temporary WindowAs is the case with several other provisions in the 2025 Trump tax law affecting individual taxpayers, “No Tax on Overtime” is only effective between 2025 and 2028 (inclusive). It expires at the end of 2028.

Tax Withholding“No Tax” refers only to the federal income tax. It doesn’t change the Social Security and Medicare taxes withheld from your paychecks. It doesn’t reduce your state taxes.

The IRS will make changes to payroll tax withholding to treat overtime pay differently, but the changes won’t start until 2026. You won’t see any change in your paychecks in 2025 unless you change your tax withholding with your employer.

Tax DeductionThe IRS will add a box to the W-2 form for employers to break out the overtime premium. Until then, your employer can report the overtime pay to you outside the W-2. You will have a new tax deduction for your overtime pay premium. You’ll use it to reconcile with your tax withholding. You’ll get a higher tax refund if the tax withholding was too high.

This deduction is available whether you take the standard deduction or itemize your deductions. However, it doesn’t lower your AGI. 100% of your overtime pay will still be included in your AGI. It doesn’t make it easier for you to qualify for other tax benefits, such as the Child Tax Credit.

Dollar CapYou may not be allowed to deduct all your overtime pay premiums. There’s a $12,500 cap ($25,000 for married filing jointly). You don’t get this tax deduction if you’re married filing separately.

Because most people are paid time-and-a-half for overtime, a $12,500 cap for the premium portion of the overtime pay translates into $25,000 at the regular hourly rate for the overtime hours. If your regular hourly rate is $25/hour, it means you can work 1,000 overtime hours in a year before you hit the cap. That’s like working 60 hours per week every week of the year.

If you’re married filing jointly, and only one of you has overtime pay, your cap is twice as high as that for a single person.

Income PhaseoutThe dollar cap drops slowly as your income increases above $150,000 ($300,000 for married filing jointly). It decreases by $100 for every $1,000 of income above the threshold. The cap drops to zero when your income reaches $275,000 ($550,000 for married filing jointly).

Most people won’t be affected by the income phaseout because both the dollar cap and the phaseout threshold are set sufficiently high.

Both Overtime and Tips“No Tax on Overtime” and “No Tax on Tips” are independent of each other. You qualify for both if you receive both overtime pay and tips. If you’re 65 or older, you also qualify for the Senior Deduction. If you take the standard deduction and you donate cash to charities, you’ll qualify for the charity donation deduction starting in 2026.

CalculatorI made a calculator to help you estimate your federal income tax before and after “No Tax on Overtime” and “No Tax on Tips.” Use the calculator to see how much you’ll benefit. Leave the tips field at 0 if you don’t receive tips. [Email readers: The calculator doesn’t work in emails. Please go to the website to try the calculator.]

If you’re married filing jointly, please include income from both of you.

Tax Filing Status: SingleHead of Household

Married Filing JointlyYou:

– Regular Hourly Rate

– Annual Overtime Hours age 65 by 12/31

Spouse:

– Regular Hourly Rate

– Annual Overtime Hours age 65 by 12/31

Your Adjusted Gross Income (AGI), eveything included:Tips included in your AGI:

Your federal income tax before “No Tax on Overtime” and “No Tax on Tips” is approximately $ minus any applicable tax credits. It’s approximately $ after.

You save $, which is % of your total overtime pay plus tips.

The calculator estimates taxes using basic assumptions. It assumes your overtime hours are paid time-and-a-half. Your taxes may be different if you have a more complex scenario.

***

You’ll find more deep dives on recent changes from the 2025 Trump tax law in the full OBBBA series.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post No Tax on Overtime in 2025 Trump Tax Law. What’s the Catch? appeared first on The Finance Buff.

July 26, 2025

No Tax on Tips in 2025 Trump Tax Law. What’s the Catch?

The 2025 Trump tax law — One Big Beautiful Bill Act (OBBBA) — contains a provision for “No tax on tips.” It says if you earn tips, you won’t pay tax on those tips.

As you can expect, not everyone is eligible, and not all tips will have no tax. “No tax” covers only one type of tax, not all taxes. What’s the catch? Let’s take a deep dive.

Table of ContentsOccupationVoluntary Tips OnlyProperly ReportedTemporary WindowTax WithholdingTax DeductionDollar CapIncome PhaseoutCalculatorOccupationFirst of all, you must be in “an occupation which customarily and regularly received tips on or before December 31, 2024.” Don’t think you can run to your boss or your clients and have a part of your pay classified as tips if you’re not in those occupations.

Certain lines of business are automatically excluded. These include health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, and brokerage services. You don’t qualify whether you work as an owner or an employee and receive tips in these businesses.

“Performing arts” stands out in this list. Does that mean a band or a singer won’t qualify if they receive tips?

Voluntary Tips OnlyA tip qualifies only if it “is paid voluntarily without any consequence in the event of nonpayment, is not the subject of negotiation, and is determined by the payor.” I guess this means that a mandatory 20% service fee for a group of six or more won’t count.

The tips can be either cash or card charges. Shared tips count too.

Properly ReportedIf you’re in the right occupation, it doesn’t matter whether you’re a W-2 employee or you’re paid by a 1099. Restaurant and hotel employees paid by a W-2 qualify. Uber and DoorDash drivers paid by a 1099 qualify as well.

The tips must be reported to you and the IRS on the W-2 or 1099. Or you can file Form 4137 with your tax return to report tips in addition to the amount on those W-2 or 1099 forms.

Currently, the W-2 form only has a box for allocated tips. Unallocated tips are mixed with regular pay in other boxes on the W-2. 1099-NEC and 1099-K forms don’t have a separate field for tips right now. The IRS will have to amend those forms with additional boxes to break out tips. Until then, your employer or payor can report the tips to you separately outside the W-2 or 1099.

Temporary Window“No tax on tips” is only effective between 2025 and 2028 (inclusive). It expires at the end of 2028.

Tax WithholdingThis provision only affects your federal income tax. It doesn’t change the Social Security and Medicare taxes withheld from your paychecks, or if you’re paid by a 1099, the self-employment tax you must pay in addition to the regular income tax. It doesn’t reduce your state taxes.

The IRS will make changes to payroll tax withholding to treat tips differently, but the changes won’t start until 2026. You won’t see any change in your paychecks in 2025 unless you change your tax withholding with your employer.

Tax DeductionYou will have a new tax deduction for your income from tips. You’ll use it to reconcile with changes to your tax withholding. You’ll get a higher tax refund if the tax withholding was too high.

This deduction is available whether you take the standard deduction or itemize your deductions. However, it doesn’t lower your AGI. Your income from tips is still included in your AGI. It doesn’t make it easier for you to qualify for other tax benefits, such as the Child Tax Credit.

Dollar CapYou may not be able to deduct all your tips. There’s a $25,000 cap. This cap is the same whether your tax filing status is single, head of household, or married filing jointly.

I guess Congress thinks that a married couple has at most one person earning tips. Therefore, the dollar cap is the same for a single person and a married couple. If you’re married, and both of you earn tips, the dollar cap for your combined tips is the same as that for a single person.

Filing separate returns doesn’t help, because you aren’t allowed this tax deduction if you’re married filing separately.

If you earn tips in a self-employed business (for instance, a sole proprietor hairdresser) and you deduct business expenses, the dollar cap is also limited by the net profit after all business expenses. If you received $20,000 in tips but the business only made $15,000 in net profit, you can only deduct $15,000.

Income PhaseoutThe $25,000 cap goes down slowly as your income increases above $150,000 ($300,000 for married filing jointly). It decreases by $100 for every $1,000 of income above the threshold. The cap drops to zero when your income gets to $400,000 ($550,000 for married filing jointly).

Most people receiving tips don’t have an income that high and won’t be affected by the income phaseout.

CalculatorI made a calculator to help you estimate your federal income tax before and after “no tax on tips.” Use the calculator to see how much you’ll benefit. [Email readers: The calculator doesn’t work in emails. Please go to the website to try the calculator.]

If you’re married filing jointly, please include income and tips from both of you.

Tax Filing Status: SingleHead of Household

Married Filing JointlyI’m 65 by 12/31Spouse (if filing jointly) is 65 by 12/31Your Adjusted Gross Income (AGI) including tips:Tips included in your AGI:

Your federal income tax before “no tax on tips” is approximately $. It’s approximately $ after.

You save $, which is % of your tips income.

The calculator estimates taxes using basic assumptions. Your taxes may be different if you have a more complex scenario.

***

You’ll find more deep dives on recent changes from the 2025 Trump tax law in the full OBBBA series.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post No Tax on Tips in 2025 Trump Tax Law. What’s the Catch? appeared first on The Finance Buff.

July 18, 2025

2025 2026 ACA Health Insurance Premium Tax Credit Percentages

If you buy health insurance from healthcare.gov or a state-run ACA marketplace, a hard cutoff for whether you qualify for a premium tax credit will return in 2026. 2025 is the last year that you may still qualify for a premium tax credit if your income is above 400% of the Federal Poverty Level (FPL). See The ACA Premium Subsidy Cliff After the 2025 Trump Tax Law.

Now, the amount of tax credit you qualify for is determined by a sliding scale. The government says that based on your income, you are supposed to pay this percentage of your income toward a second lowest-cost Silver plan in your area. The government will take care of the rest after you pay that amount.

If you pick a less expensive policy than the second lowest-cost Silver plan, you keep 100% of the savings, up to the point you get the policy for free. If you choose a more expensive policy than the second lowest-cost Silver plan, you pay 100% of the difference.

The Sliding ScaleThat sliding scale is called the Applicable Percentages Table. The applicable percentages were lowered significantly between 2021 and 2025. It reduced the amount that many people pay toward their ACA health insurance. These percentages will go up in 2026.

Here are the applicable percentages for different income levels in 2025 and 2026:

Income20252026< 133% FPL0%2.1%133% – 150% FPL0%3.14% – 4.19%150% – 200% FPL0% – 2%4.19% – 6.6%200% – 250% FPL2% – 4%6.6% – 8.44%250% – 300% FPL4% – 6%8.44% – 9.96%300% – 400% FPL6% – 8.5%9.96%> 400% FPL8.5%UnlimitedACA Applicable PercentagesSource: IRS Rev. Proc. 2024-35, Rev. Proc. 2025-25.

CalculatorI created a calculator that shows how much you can expect to pay toward a Second Lowest Cost Silver Plan in your area in 2025 and 2026. This doesn’t include the relative price changes between the plan you choose and the benchmark plan. You’ll pay extra if the price for your plan increases more than the benchmark plan, or less than the amount shown if the price for your plan goes up less than the benchmark plan.

Your household size:Your state of residence: Lower 48 Alaska HawaiiYour expected income in 2025:Your expected income in 2026:The net premium for a Second Lowest Cost Silver Plan in your area is % of your income in 2025, which comes out to $ per month.

The net premium for a Second Lowest Cost Silver Plan in your area is % of your income in 2026, which comes out to $ per month.

That’s an increase of $ per month or % between 2025 and 2026.

You do not qualify for a premium tax credit in 2026. You’ll pay 100% of the premium when you buy health insurance through an ACA marketplace.

Higher Marginal Tax RateIf your income is low, they expect you to pay a low percentage of your low income. As your income goes higher, they expect you to pay a higher percentage of your higher income. The higher percentage applies not just to the additional income but to your entire income. A higher income times a higher percentage is much more than a lower income times a lower percentage.

For example, a household of two in the lower 48 states earning $50,000 in 2026 is expected to pay 7.94% of their income toward health insurance. If they increase their income to $60,000, they are expected to pay 9.46% of their income. The increase in their expected contribution toward ACA health insurance and the corresponding decrease in their premium tax credit will be:

$60,000 * 9.46% – $50,000 * 7.94% = $1,709

This represents about 17% of the $10,000 increase in their income. For a married couple, the effect of paying 17% of the additional income toward ACA health insurance is greater than the effect of paying 12% toward their federal income tax. It makes the effective marginal tax rate on the additional $10,000 income 29%, not 12%.

Normally it’s a good idea to consider Roth conversion or harvesting tax gains in the 12% tax bracket, but those moves become much less attractive when you receive a premium subsidy for the ACA health insurance. For a helpful tool that can calculate this effect, please see Tax Calculator With ACA Health Insurance Subsidy.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2025 2026 ACA Health Insurance Premium Tax Credit Percentages appeared first on The Finance Buff.

July 14, 2025

Tax Deductions: Above-the-Line, Itemized, and Neither

The new 2025 Trump tax law — One Big Beautiful Bill Act — created several new tax deductions. Some people thought they were above-the-line deductions, but they are all below-the-line. This post explains the difference between the different types of tax deductions.

Not a Tax CreditFirst of all, a tax deduction is not a tax credit.

A tax credit directly reduces your tax dollar-for-dollar. If you’re supposed to pay $5,000 in tax, a $1,000 tax credit reduces your tax to $4,000.

A tax deduction lowers your taxable income, which indirectly reduces your tax. If you’re supposed to pay $5,000 in tax, a $1,000 tax deduction lowers your taxable income by $1,000, which then reduces your tax by a fraction of it, depending on your marginal tax rate.

Therefore, a $1,000 tax deduction is worth a lot less than a $1,000 tax credit.

Within tax deductions, there are above-the-line deductions, standard deduction, itemized deductions, and a set of deductions that are neither above-the-line nor itemized.

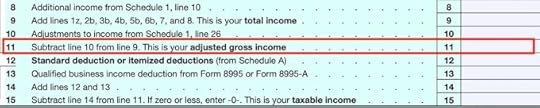

Above-the-Line DeductionsAbove-the-line deductions are officially called adjustments to income. The “line” refers to the line on the tax form for your Adjusted Gross Income (AGI). Your AGI is a key number that determines your eligibility for many tax breaks. It’s the starting point for Modified Adjusted Gross Income (MAGI) for various purposes, for instance, ACA health insurance premiums and IRMAA.

The “Line”

The “Line”A tax deduction is either above-the-line or below-the-line. Above-the-line deductions lower your AGI and help you qualify for other tax breaks. Below-the-line deductions don’t affect your AGI, and they don’t help you qualify for other tax breaks.

Therefore, a $1,000 above-the-line tax deduction is better than a $1,000 below-the-line deduction.

Only specific tax deductions are designated as above-the-line. They are listed on page 2 of Form 1040 Schedule 1. Here are some examples:

HSA contributions made outside of payrollDeductible Traditional IRA contributionsEducator expenses1/2 of the self-employment taxContributions to small business retirement plansSelf-employment health insurance deductionStandard Deduction Or Itemized DeductionsThe standard deduction and itemized deductions come after the AGI. They are below-the-line.

The standard deduction and itemized deductions are mutually exclusive. If you choose to take the standard deduction, you give up itemizing your deductions. If you choose to itemize, you forego the standard deduction.

Typically, you itemize only when the sum of your itemized deductions is greater than your standard deduction. You keep it simple and take the larger standard deduction when you know you don’t have that much in itemized deductions.

Taking the standard deduction is a win because you’re deducting more than your allowable itemized deductions. Over 80% of taxpayers take the standard deduction. So do I.

Itemized deductions are listed on Form 1040 Schedule A. Mortgage interest, state income tax, property tax, and donations to charities are typical itemized deductions (except for the new $1,000/$2,000 charity donations deduction for non-itemizers).

Floors and CapsJust because something is tax-deductible, it doesn’t mean you can deduct 100% of it. This is because some deductions must first clear a floor.

For example, medical expenses are tax-deductible, but you can only deduct the portion that exceeds 7.5% of your AGI. That comes to zero for many people.

Some deductions have a cap. You can deduct only up to the cap, even if you paid more. State and local taxes (SALT) are a well-known example of this.

The new 2025 Trump tax law increased the SALT cap. More people are expected to itemize deductions, but they’re still a minority. Over 80% of people will still take the standard deduction.

Below-the-Line, Available-to-AllIn the old days, separately identified tax deductions were either above-the-line or itemized deductions. Above-the-line deductions were available to both itemizers and non-itemizers. Below-the-line deductions were only the standard deduction or itemized deductions. After taking the above-the-line deductions, you could only take the standard deduction if you don’t itemize.

This dichotomy between above-the-line and must-itemize no longer holds. Congress has created several deductions in recent years that are below-the-line but don’t require itemizing. You can still take these deductions when you take the standard deduction, but they don’t affect your AGI. A deduction available to both itemizers and non-itemizers doesn’t necessarily mean it’s above-the-line.

ItemizersNon-ItemizersAbove-the-Line Deductions

Standard Deduction

Standard Deduction

Itemized Deductions

Itemized Deductions

Below-the-Line, Available-to-All

Below-the-Line, Available-to-All (except when specifically excluded)

(except when specifically excluded)

Both above-the-line deductions and this new category of deductions are available to everyone (except when a deduction is specifically excluded). The difference is in whether it affects your AGI. Only the standard deduction and itemized deductions are still either-or.

Congress created these below-the-line, available-to-all deductions because they wanted to make them more widely available. Giving them to only itemizers (10-20% of taxpayers) would be too limiting. But Congress didn’t want these deductions to lower the AGI and trigger other tax breaks. Some of these deductions themselves have limits based on the AGI. Making them above-the-line would create a circular math problem.

Here are some of the deductions that fall in this category of below-the-line available-to-all deductions:

Qualified Business Income (QBI) Deduction for small businessesSenior Deduction (see Social Security Is Still Taxed Under the New 2025 Trump Tax Law)Car loan interest deduction (see Deductible Car Loan Interest in 2025 Trump Tax Law)Charity donations for non-itemizers (see $1,000 Charity Donation Deduction in the 2025 Trump Tax Law)Overtime pay deductionTips income deductionAll of these deductions are still available if you take the standard deduction, but they don’t lower your AGI.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Tax Deductions: Above-the-Line, Itemized, and Neither appeared first on The Finance Buff.

July 12, 2025

$1,000 Charity Donation Deduction in the 2025 Trump Tax Law

Many charities advertise that donations are tax-deductible, but most people don’t deduct donations on their taxes. That’s because over 80% of taxpayers use the standard deduction, and they don’t get to deduct donations to charities when they don’t itemize. People donate because they support the cause, whether they get a tax deduction or not.

I’m in the 80%. I don’t track my donations because I know I won’t deduct them.

This will change in 2026.

New Deduction for Non-ItemizersSome of you may recall that Congress allowed non-itemizers to deduct a small amount of their charitable donations during COVID. It was originally a one-off $300 deduction in 2020 (see CARES Act 2020 Charity Donation Deduction: $300 or $600 for Married?). Congress re-created it with some tweaks as another one-off for 2021 (see 2021 $300 Charity Deduction For Non-Itemizers $600 Married).

The new 2025 Trump tax law resurrected the 2021 version and raised the allowed amount from $300 to $1,000 ($2,000 for married filing jointly). It’ll be ongoing this time, starting in 2026, with no preset end date.

All the other terms from 2021 are carried over to this new iteration. This deduction is only for people who take the standard deduction. The donations must be in cash, not necessarily physical cash, but not household items, cars, or appreciated securities. Checks, card payments, and bank debits are all OK. The donations must be made directly to charities, not to a donor-advised fund.

There’s no income limit or phaseout.

Some places reported that this deduction is “above-the-line.” It’s not true. This new deduction doesn’t lower your AGI. It doesn’t make it easier for you to qualify for other tax breaks. It doesn’t affect state taxes.

Lower Deduction for ItemizersIf you itemize deductions, this new $1,000/$2,000 deduction isn’t available to you. You’ll continue to include your charity donations as itemized deductions on Schedule A. However, the new 2025 Trump tax law adds a floor for your charitable contributions deduction at 0.5% of your AGI, also starting in 2026, with no preset end date.

This floor is similar to how the medical expenses deduction has a floor at 7.5% of AGI. It reduces the amount you can deduct by 0.5% of your AGI. For example, suppose your AGI is $100,000. 0.5% of $100,000 is $500. After this change goes into effect in 2026, when your total donations to charities add up to $4,000, you can deduct only $3,500 as an itemized deduction.

QCDThe new 2025 Trump tax law didn’t make any changes to Qualified Charitable Distributions (QCDs).

If you’re over 70-1/2, QCDs out of a Traditional IRA are still the best way to donate to charities. QCDs count toward the RMD, but they don’t raise your AGI. You don’t have to itemize to make QCDs. Nor are you required to reduce the amount by 0.5% of AGI. The annual limit for QCDs is 100 times higher than this new $1,000/$2,000 deduction for non-itemizers. The only thing is that QCDs can’t go to a donor-advised fund.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post $1,000 Charity Donation Deduction in the 2025 Trump Tax Law appeared first on The Finance Buff.

July 9, 2025

Deductible Car Loan Interest in the New 2025 Trump Tax Law

When my wife bought a new Subaru Outback in March, the manufacturer offered special financing at 3.9% APR. We didn’t take it because while we could keep our cash in a money market fund earning 4%, the interest is taxable. The interest paid on the loan would be after-tax. It would be net-negative if we financed.

2025 Subaru Outback

2025 Subaru OutbackThe new 2025 Trump tax law — One Big Beautiful Bill Act — made car loan interest deductible (with qualifications and limits). Had we known this was coming, we would’ve financed, but we can’t go back now to get a loan and deduct the interest.

Only New Cars Assembled in the U.S.Not all car loans qualify for the new tax deduction. It must be for a new car, not for a used car. It must be for personal use, not a commercial vehicle.

Both electrical and gasoline-powered vehicles qualify. Cars, minivans, SUVs, pickup trucks, and motorcycles all qualify, but the vehicle must have had its final assembly in the U.S.

Her Subaru Outback would’ve qualified because it was assembled in Indiana. Some brands and models have cars assembled both in the U.S. and outside the U.S. It depends on the specific car you get from the dealership. You can tell by the VIN. It was assembled in the U.S. if the VIN starts with a 1, 4, or 5.

TimingThe loan must be taken out at the time of purchase after December 31, 2024. Refinancing an existing loan taken out before January 1, 2025 doesn’t count. Taking out a new loan now on a car you already own free and clear doesn’t count either.

We’re disqualified because we already paid cash at the time of purchase.

If your loan qualifies, refinancing it continues to qualify, but the new loan must not exceed the outstanding balance of the previous loan. In other words, no cash-out refi.

Income LimitYou’re allowed to deduct up to $10,000 in car loan interest if your modified adjusted gross income (MAGI) is $100,000 or less ($200,000 or less for married filing jointly). Married filing separately still qualifies. The deduction phases out by 20% as your income goes up toward $150,000 (or $250,000 for married filing jointly).

The modified adjusted gross income (MAGI) is the AGI for most people. It doesn’t add back untaxed Social Security or muni bond interest. The income limits aren’t adjusted for inflation.

The $10,000 deduction limit is sufficient for most people. A 5-year loan of $50,000 at 3.9% APR would incur less than $2,000 in interest in the first year and less yet in subsequent years. There’s no limit on the number of cars or any maximum price.

SingleMAGIDeduction Limit$100,000 or less$10,000$110,000$8,000$120,000$6,000$130,000$4,000$140,000$2,000$150,000$0Married Filing JointlyMAGIDeduction Limit$200,000 or less$10,000$210,000$8,000$220,000$6,000$230,000$4,000$240,000$2,000$250,000$0Temporary DeductionIf your car purchase qualifies, your timing qualifies, and your income qualifies, you’re allowed to deduct car loan interest up to the limit each year between 2025 and 2028 (inclusive). If you’re planning to buy a new car in 2026, then you have only three years left.

It’s a tax deduction, not a tax credit. Deducting $2,000 in car loan interest reduces your taxable income by $2,000. It reduces your federal income tax by a few hundred dollars, depending on your tax bracket.

The deduction is available to both itemizers and non-itemizers, but it doesn’t lower your AGI. It doesn’t make it easier for you to qualify for other tax deductions or tax credits.

Higher Prices From TariffsNot everyone qualifies for the tax deduction, but everyone is affected by higher prices from tariffs. Subaru raised prices mid-year shortly after we bought the car. Dealerships also reduced their discount to the MSRP. We would have to pay $4,000 more if we were to buy the same car today.

Paying a higher price costs way more than the tax savings from deducting the interest on a car loan.

***

The headlines say no tax on car loan interest, but this deduction comes with many strings: only new purchases, only new cars and only specific cars, with an income limit, and only in the next few years. We would’ve financed because everything happened to line up, if only we knew. Even though financing and paying cash would be a wash financially, having more cash on hand helps with smoothing out cash flow to stay under the ACA health insurance premium cliff.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Deductible Car Loan Interest in the New 2025 Trump Tax Law appeared first on The Finance Buff.

July 5, 2025

The ACA Premium Subsidy Cliff After the 2025 Trump Tax Law

[Rewritten on July 7, 2025 after the new 2025 Trump tax law was passed.]

As a self-employed individual under 65, I purchase health insurance through the health insurance marketplace established under the Affordable Care Act (ACA). It’s for part-time employees, 1099 contractors, employees of small businesses that don’t offer health insurance, self-employed business owners, early retirees, and others who don’t get health insurance through an employer or a government program.

Nationwide, over 20 million people buy their health insurance this way. It’s still a small percentage relative to the number of people who get health insurance from employers (165 million), Medicare (68 million), or Medicaid and CHIP (78 million).

If you’re among these 20 million people, you qualify for a Premium Tax Credit (PTC) based on your modified adjusted gross income (MAGI) relative to the Federal Poverty Level (FPL) for your household size. In general, the lower your MAGI is, the less you pay for health insurance net of the tax credit.

Table of ContentsMAGI for ACA2021-2025: 400% FPL Cliff Changed to a SlopeThe Cliff Returns in 2026Variable ImpactKnow Your CliffManage Your IncomeShifting IncomeBorrowingIncome Bunching100% and 138% FPL CliffMAGI for ACAYour MAGI for ACA is basically:

Your gross incomeplus tax-exempt muni bond interestplus untaxed Social Security benefitsminus pre-tax deductions from paychecks (401k, FSA, HSA, …)minus above-the-line deductions listed on page 2 of Form 1040 Schedule 1, for example:pre-tax traditional IRA contributionsHSA contributions made outside of payroll1/2 of self-employment taxpre-tax contributions to SEP-IRA, solo 401k, or other retirement plansself-employed health insurance deductionstudent loan interest deductionWages, 1099 income, rental income, interest, dividends, capital gains, pension, withdrawals from pre-tax traditional 401k and IRAs, and Roth conversions all go into the MAGI for ACA. Muni bond interest and untaxed Social Security benefits also count in the MAGI for ACA.

Tax-free withdrawals from Roth accounts don’t increase your MAGI for ACA.

Side note: There are many different definitions of MAGI for various purposes. These different MAGIs include and exclude different components. We’re only talking about the MAGI for ACA here.

2021-2025: 400% FPL Cliff Changed to a SlopeYour premium tax credit goes down as your MAGI increases. Up through the year 2020, the tax credit dropped to zero when your MAGI went above 400% of the Federal Poverty Level (FPL). If your MAGI was $1 above 400% of FPL, you would pay the full premium for your ACA health insurance with zero tax credit.

Laws changed during COVID. This 400% FPL cliff became a downward slope for five years, from 2021 to 2025. The tax credit continued to drop as your MAGI increased, but it didn’t suddenly drop to zero if your income went $1 above 400% of FPL ($81,760 in 2025 for a two-person household in the lower 48 states). The tax credit at income levels below 400% of FPL also became more generous during those five years.

The Cliff Returns in 2026The new 2025 Trump tax law — One Big Beautiful Bill Act — didn’t extend the enhanced tax credit after 2025. The 400% FPL cliff is scheduled to return in 2026. The premium tax credit for incomes below 400% of FPL will also drop back to pre-COVID levels.

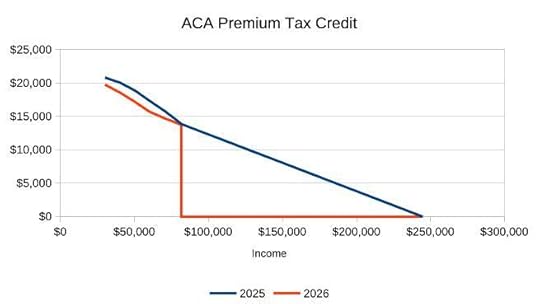

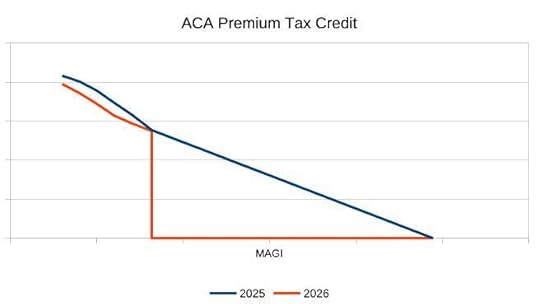

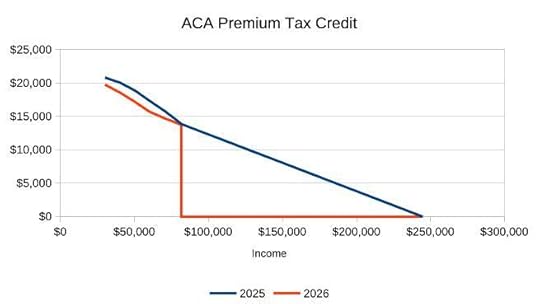

The chart above illustrates the ACA premium tax credit at various income levels for a sample household of two 55-year-olds residing in the lower 48 states. The blue line is for 2025, with the slope and the enhanced tax credit. The orange line is for 2026, without the enhanced tax credit. The sharp vertical drop is the cliff.

Variable ImpactHow your premium tax credit will change in 2026 depends on your position in the chart.

If your MAGI is to the left of the cliff in the chart, your tax credit will drop slightly. It goes down from $18,900 to $17,200 at a $50,000 income in this example. A $1,700 drop in the tax credit translates to an increase of about $140/month for health insurance. Although a $140/month increase sounds manageable, it nearly doubles their net health insurance premium after the credit, going from $160/month to $300/month.

Your tax credit will drop more if your income is to the far right in the chart. At a $200,000 income in this example, the tax credit drops from $3,800 to $0, raising the cost of health insurance by a little over $300/month. No one wants to pay $300 more per month, but at least you have the income to afford it.

The drop is precipitous immediately to the right of the cliff. We’re talking about receiving a $13,000 tax credit in 2025 versus $0 in 2026 at an income of $85k. How do you come up with an extra $13,000 for health insurance when your income is $85k?

I used data from KFF’s premium subsidy calculator for my example. You can enter your specific zip code, household size, and age in this calculator to estimate how much your premium tax credit and your net health insurance premium will change.

Know Your CliffYou must know first and foremost where the cliff is for you. The table below shows the 400% FPL cliff for various household sizes in 2026:

Household SizeLower 48 StatesAlaskaHawaii1$62,600$78,200$71,9602$84,600$105,720$97,2803$106,600$133,240$122,6004$128,600$160,760$147,9205$150,600$188,280$173,2406$172,600$215,800$198,5607$194,600$243,320$223,8808$216,600$270,840$249,200400% FPL Cliff in 2026Source: Federal Poverty Levels (FPL) For Affordable Care Act.

The chart I used as an example is for a two-person household. A chart for your specific situation will have the same shape but different numbers on the axes.

If your MAGI is safely to the left of the cliff and there’s no risk of going over, be prepared for an increase in your health insurance premiums in 2026 due to the decrease in the premium tax credit. If it’s far to the left, watch for a different cliff at the low end, which I’ll explain at the end of this post.

If your MAGI is too far to the right of the cliff and you have no way to bring it to the left, you’ll have to pay 100% of the health insurance premium starting in 2026, which can be well over $20,000 a year.

The tricky part and the opportunities are in the middle. If your MAGI is close to the cliff on each side, you should manage it carefully to keep it from going over the cliff.

Manage Your IncomeThe most critical part is to project your MAGI throughout the year and not to realize income willy-nilly. You can still adjust if you find your income is about to go over the cliff before you realize income. Many people are caught by surprise only when they do their taxes the following year. Your options are much more limited after the year is over.

If income from working will push your MAGI over the cliff, maybe work a little less to keep it under.

Tax-free withdrawals from Roth accounts don’t count as income.

Take a look at the MAGI definition. Minimize items that raise your MAGI, and maximize everything that lowers your MAGI.

When you have W-2 or self-employment income, you have the option to contribute to a pre-tax traditional 401k and IRA. These pre-tax contributions lower your MAGI, which helps you stay under the 400% FPL cliff.

Choose a high-deductible plan and contribute the maximum to an HSA. The new 2025 Trump tax law made all Bronze plans from the ACA marketplace automatically eligible for HSA contributions starting in 2026.

On the other hand, Roth conversions, withdrawals from pre-tax accounts, and realizing capital gains increase your MAGI. You should be careful with doing those when you’re trying to stay under the 400% FPL cliff.

Shifting IncomeIf you’re at risk of going over the cliff in 2026, consider accelerating some income from 2026 to 2025 when the premium tax credit is still on a slope. If pulling income forward to 2025 helps you stay under the cliff in 2026, you lose much less in premium tax credit from your additional income in 2025 than the steep drop in 2026.

On the other hand, if you’re going over the cliff in 2026 no matter what, consider postponing some income from 2025 to 2026. Once you’re over the cliff in 2026, you have nothing more to lose, while less income in 2025 will give you more premium tax credit.

BorrowingIf you have a temporary spike in your need for more cash, consider borrowing instead of withdrawing from pre-tax accounts or realizing large capital gains. Spending borrowed money doesn’t count as income.

When you need cash to buy a new car, instead of realizing large capital gains and pushing yourself over the cliff, take a low-APR car loan to stretch it out. HELOC, security-based lending, and selling short box spreads are also good sources for borrowing.

You can repay the loan when you don’t need as much cash or when you no longer use ACA health insurance.

Income BunchingIf you can’t avoid going over the 400% FPL cliff, consider income bunching. When you’re already over the cliff, you might as well go over big. Withdraw more from pre-tax accounts or realize more capital gains and bank the money for future years.

Spending the banked money doesn’t count as income. Going over the cliff big time in one year may help you avoid going over again for the next several years.

100% and 138% FPL CliffThere is another cliff at the low end, although that one is easily overcome if you have pre-tax retirement accounts.

To qualify for a premium tax credit for buying health insurance from the ACA marketplace, your MAGI must be above 100% of FPL. In states that expanded Medicaid, your MAGI must be above 138% of FPL. This map from KFF shows which states expanded Medicaid and which states did not.

The marketplace sends you to Medicaid if you don’t meet the minimum income requirement. The new 2025 Trump tax law added requirements to Medicaid for reporting work and community engagement. You don’t want to have your income fall below 100% or 138% of FPL and be subject to those new requirements in Medicaid.

If you see your income is at risk of falling below 100% or 138% FPL, convert some money from your Traditional 401k or Traditional IRA to Roth. That’ll raise your income above the minimum income requirement.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post The ACA Premium Subsidy Cliff After the 2025 Trump Tax Law appeared first on The Finance Buff.

ACA Premium Subsidy Cliff After the New 2025 Trump Tax Law

[Rewritten on July 5, 2025 after the new 2025 Trump tax law was passed.]

Because I’m self-employed, I buy health insurance from an exchange established under the Affordable Care Act (ACA). Every state has one. Before the ACA, getting healthcare coverage was one of the biggest challenges for people without employer-provided health insurance. Forget about the cost — just getting a policy was a challenge in itself. ACA changed all that. Now, the self-employed, early retirees, and others who don’t get health insurance through their jobs can buy health insurance from the ACA exchange for their state.

Not only are you able to buy health insurance, but the coverage is also made more affordable by a subsidy in the form of a Premium Tax Credit (PTC). How much tax credit you get is calculated off of your modified adjusted gross income (MAGI) relative to the Federal Poverty Level (FPL) for your household size. The lower your MAGI is, the less you pay for health insurance net of the tax credit.

Table of ContentsMAGI for ACA2021-2025: 400% FPL Cliff Changed to a SlopeThe Cliff Returns in 2026Know Your CliffManage Your IncomeAccelerate Income to 2025BorrowingIncome Bunching100% and 138% FPL CliffMAGI for ACAYour MAGI for ACA is basically:

Your gross income;minus pre-tax deductions from paychecks (401k, FSA, …)minus above-the-line deductions, for example:pre-tax traditional IRA contributionsHSA contributions1/2 of self-employment taxpre-tax contributions to SEP-IRA, solo 401k, or other retirement plansself-employed health insurance deductionstudent loan interest deduction plus tax-exempt muni bond interest;plus untaxed Social Security benefitsWages, 1099 income, rental income, interest, dividends, capital gains, pension, withdrawals from pre-tax traditional 401k and IRAs, and Roth conversions all go into the MAGI for ACA. Muni bond interest and untaxed Social Security benefits also count in the MAGI for ACA.

Tax-free withdrawals from Roth accounts don’t increase your MAGI for ACA.

Side note: There are many different definitions of MAGI for different purposes. These different MAGIs include and exclude different components. We’re only talking about the MAGI for ACA here.

2021-2025: 400% FPL Cliff Changed to a SlopeYour premium tax credit goes down as your MAGI increases. Up through the year 2020, the tax credit dropped to zero when your MAGI went above 400% of the Federal Poverty Level (FPL). If your MAGI was $1 above 400% of FPL, you would pay the full premium with zero tax credit. People had to be very careful in tracking their MAGI to make sure it didn’t go over the cliff.

Laws changed during COVID. This cliff became a slope for only five years, from 2021 through 2025. The tax credit continued to drop as your MAGI increased, but it didn’t suddenly drop to zero when your income went $1 over the cliff.

Removing the cliff was a huge relief to people with an income higher than 400% of FPL ($81,760 in 2025 for a two-person household in the lower 48 states).

The Cliff Returns in 2026The new 2025 Trump tax law — One Big Beautiful Bill Act — didn’t extend the slope treatment to after 2025. The 400% FPL cliff is scheduled to return in 2026.

The chart above shows the ACA premium tax credit at different income levels for a household of two 55-year-olds in the lower 48 states, with the average health insurance costs across all states. The blue line is for 2025 with the slope. The red line is for 2026 with the cliff, assuming that health insurance costs will stay the same as in 2025. The gap between the two lines represents the end of enhanced subsidies in 2026.

The premium tax credit will drop slightly before the 400% FPL cliff. It goes down by about $1,100 for the year at a $70k income, but the drop is precipitous at the cliff. We’re talking about receiving over $13,000 in tax credit in 2025 versus $0 in 2026 for a two-person household with an income of $85k.

The data for the chart came from a calculator created by KFF. You can use this calculator to estimate your premium tax credit and your net health insurance premium by entering your specific zip code, household size, and age.

Know Your CliffHow do you come up with $13,000 extra for health insurance with an income of $85,000?

You must manage your income to keep it under the cliff. The first thing to know is where exactly the cliff is.

For a household of a single person in the lower 48 states, the 400% FPL cutoff is $62,600 in 2026. For a household of two people in the lower 48 states, the cutoff is $84,600 in 2026. See Federal Poverty Levels (FPL) For Affordable Care Act for where the FPL is for your household size. Multiply it by four to get your cliff.

Manage Your IncomeThe next most critical part is to project your income throughout the year and not to realize income willy-nilly before you do the projection. If you find your income is close to the cliff before you realize income, you can still adjust. Many people are caught by surprise only when they do their taxes the following year. Your options are much more limited after the year is over.

If income from working will push your MAGI over the cliff, maybe work a little less to keep it under.

You have some control over staying under the cliff when you rely on an investment portfolio for income. When you are under 59-1/2, you’re primarily spending money from your taxable accounts. A large part of the money withdrawn is your own savings; the rest is interest, dividends, and capital gains. Spending your own savings isn’t income. If you withdraw $60k from a taxable account to live on, your MAGI isn’t $60k. It’s probably less than $30k.

When you’re over 59-1/2, tax-free withdrawals from Roth accounts don’t count as income.

Take a look at the MAGI definition. Minimize anything that raises your MAGI, and maximize everything that lowers your MAGI.

When you have self-employment income, you have the option to contribute to a pre-tax traditional 401k and IRA. Those pre-tax contributions lower your MAGI, which helps you stay under the 400% FPL cliff.

Choose a high-deductible plan and contribute the maximum to an HSA. The new 2025 Trump tax law made all Bronze plans HSA-eligible starting in 2026.

On the other hand, Roth conversions, withdrawals from pre-tax accounts, and realizing capital gains increase your MAGI. You should be careful with doing those when you’re trying to stay under the 400% FPL cliff.

Accelerate Income to 2025If you’re at risk of going over the cliff in 2026, consider accelerating some income to 2025 when the premium tax credit is still a slope. If pulling forward income to 2025 helps you stay under the cliff in 2026, the reduction in the premium tax credit from your additional income in 2025 will be much less than the steep drop in 2026.

BorrowingIf your need for more cash is only temporary, consider borrowing instead of withdrawing from pre-tax accounts or realizing large capital gains. Spending borrowed money doesn’t count as income.

Instead of selling stocks and pushing yourself over the cliff by the realized capital gains when you buy a new car, take a low-APR car loan to stretch it out. HELOC and security-based lending are also good sources for borrowing.

You can repay the loan when you don’t need as much cash or when you no longer use ACA health insurance.

Income BunchingIf you can’t avoid going over the 400% FPL cliff, consider income bunching. When you’re already over the cliff, you might as well go over big. Withdraw more from pre-tax accounts or realize more capital gains and bank the money for future years.

Spending the banked money doesn’t count as income. Going over the cliff big time in one year may help you avoid going over again for multiple years.

100% and 138% FPL CliffThere is another cliff on the low side, although that one is easily overcome if you have pre-tax retirement accounts.

To qualify for a premium subsidy for buying health insurance from the ACA exchange, you must have income above 100% of FPL. In states that expanded Medicaid, you must have your MAGI above 138% of FPL. This map from KFF shows which states expanded Medicaid and which states did not.

The minimum income requirement is checked only at the time of enrollment. Once you get in, you’re not punished if your income unexpectedly ends up below 100% or 138% of FPL. The new 2025 Trump tax law added requirements to Medicaid for reporting work and community engagement. You don’t want to have your income fall below 100% or 138% of FPL and be subject to those reporting requirements.

If you see your income is at risk of falling below 100% or 138% FPL, convert some money from your Traditional 401k or Traditional IRA to Roth. That’ll raise your income above 100% or 138% of FPL.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post ACA Premium Subsidy Cliff After the New 2025 Trump Tax Law appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower