Harry Sit's Blog, page 3

July 5, 2025

2025 2026 Cap on Paying Back ACA Health Insurance Subsidy

[Updated on July 5, 2025, with changes from the 2025 Trump tax law.]

The ACA health insurance subsidy, aka the premium tax credit, is set up such that, for the most part, it doesn’t matter how much subsidy you receive upfront when you enroll. The upfront subsidy is only an estimate. The final subsidy will be squared up when you file your tax return next year.

If you didn’t receive the subsidy when you enrolled but your actual income qualifies, you get the subsidy as a tax credit when you file your tax return. If the government paid more subsidies than your actual income qualifies for, you pay back the difference on your tax return.

Repayment CapThere’s a cap on how much you need to pay back. The cap varies depending on your Modified Adjusted Gross Income (MAGI) relative to the Federal Poverty Level (FPL) and your tax filing status. It’s also adjusted for inflation each year. Here are the caps on paying back the subsidy for 2025 and 2026.

MAGI2025 Coverage2026 Coverage< 200% FPLSingle: $375Other: $750No Cap< 300% FPLSingle: $975

Other: $1,950No Cap< 400% FPLSingle: $1,625

Other: $3,250No Cap>= 400% FPLNo CapNo CapACA APTC Repayment Cap

Source: IRS Rev. Proc. 2024-40.

The new 2025 Trump tax law eliminated the repayment cap, effective in 2026, regardless of income. 2025 is the last year that a repayment cap still applies.

No Cap Above 400% of FPLThe repayment caps in 2025 apply only when your actual income is below 400% of FPL. There’s no repayment cap if your actual income exceeds 400% of FPL — you will have to pay back 100% of the difference between what you received and what your actual income qualifies for.

There is no repayment cap in 2026 or beyond.

Large Change in IncomeThe caps are also set sufficiently high such that the amount you need to pay back will fall below the cap unless there’s a big difference between your actual income and your estimated income at the time of enrollment.

For example, suppose you’re married filing jointly and you estimated your income would be $50,000 in 2025 when you enrolled. Suppose by the time you file your tax return, your income turns out to be $60,000. Because your income is $10,000 higher than you originally estimated, you qualify for a lower subsidy now. You will be required to pay back the $1,554 difference. The cap doesn’t really help you because this $1,554 difference is well under the $3,150 repayment cap.

In addition, because you’re required to notify the healthcare marketplace of your income changes during the year in a timely manner so that they can adjust your advance subsidy, normally the difference between the advance subsidy you received and the subsidy you finally qualify for should be well under the cap. The cap helps only when your income increases close to the end of the year, and it’s too late to adjust your advance subsidy.

Easier for SinglesStill, a late income change can happen, and the change can be large enough to make the difference in the health insurance subsidy higher than the repayment cap. This is true especially when you’re single with a lower repayment cap.

For example, suppose you’re single and you estimated your income would be $30,000 in 2025 when you enrolled. Suppose in December 2025 you decide to convert $20,000 from a Traditional IRA to a Roth IRA. This pushes your income to $50,000. The extra $20,000 income lowers your health insurance subsidy by $2,809, but because your repayment cap is $1,625, you only need to pay back $1,625. You get to keep the other $1,184. In this case, you’re better off asking for the subsidy upfront during enrollment. If you only wait until you file your tax return, you won’t benefit from the repayment cap.

Bottom line: You should try to estimate your income conservatively and qualify for as much subsidy as you can upfront when you enroll for 2025. Maybe it won’t help. Maybe it will. There won’t be any difference starting in 2026, because you’re required to pay back 100% of the difference when you do your taxes.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2025 2026 Cap on Paying Back ACA Health Insurance Subsidy appeared first on The Finance Buff.

July 4, 2025

Social Security Is Still Taxed Under the New 2025 Trump Tax Law

I received an email from Social Security Administration on July 3, applauding the new 2025 Trump tax law — One Big Beautiful Bill Act. The email said,

The new law includes a provision that eliminates federal income taxes on Social Security benefits for most beneficiaries, providing relief to individuals and couples.

I read the One Big Beautiful Bill Act. This part is not true. The new 2025 Trump tax law doesn’t eliminate federal income tax on Social Security benefits. Social Security is still taxable just as before.

Temporary Senior DeductionThe email from Social Security Administration continued to say:

Additionally, it provides an enhanced deduction for taxpayers aged 65 and older, ensuring that retirees can keep more of what they have earned.

This part is true, but the email failed to mention that the enhanced deduction is only temporary, and it has nothing to do with Social Security anyway.

One Big Beautiful Bill Act created a new $6,000 senior deduction, available only from 2025 through 2028, to seniors 65 and older during those years. It doesn’t matter whether you’re receiving Social Security or not. It doesn’t matter whether you’re even eligible for Social Security or not.

Unrelated to Social SecurityIf you’re 62 and receiving Social Security, you don’t qualify for this new senior deduction because you’re not 65 yet. Your Social Security is taxable just as before.

If you and your neighbor are both 65, and you’re receiving Social Security but your neighbor isn’t eligible for Social Security because they didn’t pay into it, both of you qualify for this new senior deduction. If you and your neighbor have the same income outside Social Security (pension, interest, dividends, capital gains, etc.), you’ll pay higher taxes than your neighbor when you add your taxable Social Security benefits on top.

If you’re 65 this year and you’re delaying your Social Security, you still qualify for this new senior deduction. When you claim your Social Security next year at 66, your taxes will increase because Social Security is taxable just as before the 2025 Trump tax law.

No Change to AGIThe new senior deduction goes after the standard deduction or itemized deductions. It doesn’t lower your AGI. It doesn’t make it easier for you to qualify for things keyed off of the AGI, for example, avoiding higher Medicare premiums under IRMAA. It doesn’t lower state taxes.

No Change to Tax on Social SecurityThe new senior deduction is just an extra tax benefit for seniors. It has nothing to do with Social Security. It doesn’t remove taxes on Social Security. The new extra tax benefit may be worth more or less than the tax on your Social Security benefits. You have the new tax benefit on one side and the tax on Social Security on the other side. The two are completely unrelated.

It’s like some people saying they picked up $5 on the street and therefore their coffee is free. The two things have nothing to do with each other. You don’t have to buy coffee after picking up $5. The coffee still costs the same whether you picked up $5 or not. The coffee may be more or less than $5. It isn’t free.

Please use my calculator How Much of Your Social Security Benefits Is Taxable? to find out how much of your Social Security benefits is taxable. The new 2025 Trump tax law didn’t change any of that calculation.

Income PhaseoutNot only is the new senior deduction temporary, but it also phases out as your income goes up. You get the full $6,000 deduction if you’re single and your modified adjusted gross income is $75,000 or less ($150,000 or less for married filing jointly; you get $0 deduction if you’re married filing separately).

As your income goes up, the deduction is reduced by 6% of any additional income above those thresholds. The deduction disappears when your income is $175,000 or more if you’re single, $250,000 or more if you’re married filing jointly and only one of you is 65, or $350,000 if you’re married filing jointly and both of you are 65.

SingleIncomeSenior Deduction$75,000 or less$6,000$85,000$5,400$95,000$4,800$105,000$4,200$115,000$3,600$125,000$3,000$135,000$2,400$145,000$1,800$155,000$1,200$165,000$600$175,000 or above$0Married Filing Jointly, One Person Is 65+IncomeSenior Deduction$150,000 or less$6,000$160,000$5,400$170,000$4,800$180,000$4,200$190,000$3,600$200,000$3,000$210,000$2,400$220,000$1,800$230,000$1,200$240,000$600$250,000 or above$0Married Filing Jointly, Both Are 65+IncomeSenior Deduction$150,000 or less$12,000$160,000$11,400$170,000$10,800$180,000$10,200$190,000$9,600$200,000$9,000$210,000$8,400$220,000$7,800$230,000$7,200$240,000$6,600$250,000$6,000$260,000$5,400$270,000$4,800$280,000$4,200$290,000$3,600$300,000$3,000$310,000$2,400$320,000$1,800$330,000$1,200$340,000$600$350,000 or above$0[Image Credit: Google Gemini]

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Social Security Is Still Taxed Under the New 2025 Trump Tax Law appeared first on The Finance Buff.

June 10, 2025

Use an Independent Agent for Auto and Home Insurance

Auto and homeowners’ insurance have gotten a lot more expensive in recent years. Many people experienced premium increases of 20%, 30%, or more on their renewals, despite having no claims. Inflation in materials and labor, technological advances in vehicles, weather events, and natural disasters are all causes to blame.

A friend asked me which insurance company I used for my homeowners insurance when AAA insurance wanted over $3,000 a year to insure his home. I sent him to the independent insurance agent I use. The agent placed him with the same company I’m with. The premium was a little over $1,000, saving him $2,000 a year.

Sales and Service ChannelHome and auto insurance companies sell and service policies through different channels. Some insurance companies market directly to consumers by heavily advertising on TV and streaming platforms. I’m sure you’ve seen ads from GEICO. You buy their policies online, use their website to renew or make changes, and call a toll-free number for customer service.

Some companies sell policies through a group of captive agents. Both the company and the agents are exclusive to each other. You go through a State Farm agent if you want insurance from State Farm. The State Farm agent only sells policies from State Farm. Allstate and Farmers also operate under this model.

Some other companies sell through independent agents. These agents are small businesses that sell policies from many insurance providers. They serve as a shared outsourced sales and customer service department for the insurance companies they represent.

It doesn’t cost anything to use an independent agent. Insurance companies pay commissions to independent agents, saving money on advertising and staffing their own sales and customer service call centers. The independent agents handle all consumer interaction, including new policy sales, coverage changes, and claims.

Using an independent agent doesn’t guarantee you’ll have the lowest premiums. The agent can shop for you among all the companies they sell for, but they can’t quote policies from companies that don’t sell through them. You can only find out whether GEICO or State Farm offers a better deal by going to GEICO or State Farm. Getting quotes from an independent agent only taps into a pool of insurance carriers that you otherwise don’t think of.

Finding an Independent AgentI found my independent agent when I first moved to a new state. I read the comparison report published by the state insurance department (see State Government Helps You Find Lower Auto & Home Insurance). One company jumped out as offering substantially lower premiums, especially in homeowners insurance.

This insurance company is over 100 years old, but I had never heard of it because it only operates in one state. I saw on their website that they only sold through independent agents. I used the “find an agent” feature on the website to find this local independent agency.

Safeco (owned by Liberty Mutual) is a large national insurer that sells exclusively through independent agents. Using Safeco’s website is an easy way to find an independent agent near you. You are not trying to get insurance from Safeco; you’re only using its website to find an agent. An agent that sells for Safeco also sells for other companies.

Or you can Google “independent insurance agent” plus the name of your city.

Some agents sell both business insurance and personal insurance. I would want an agent who focuses on personal insurance. Some agents represent companies that specialize in insuring expensive cars and high-value homes (structure value, not including the land). If you have only “normal” cars and homes, you may prefer to avoid agents who represent those specialty insurers, such as Chubb and Cincinnati Insurance.

One-Stop Shop with Better ServiceI started working with my agent on a renter’s policy when I was renting. The landlord wanted us to show proof of renter’s insurance that covered sewer backup. Most renter’s policies don’t cover sewer backup because it’s typically covered in a landlord’s policy. The agent put in extra effort to find a renter’s policy that met the landlord’s demand. The premium for the renter’s policy was only $150 a year. The agent’s commission on it couldn’t be that much.

An independent agent is separate from the insurance company. You can tell the agent things that you don’t necessarily want to tell the insurance company yet. When I had a broken windshield, I asked the agent whether it was worth filing a claim and risking raising my premium. The agent told me how that specific insurance company typically treated glass claims on renewals. When I was considering buying a home, I asked the agent for a quote to factor it into the budget, even though I don’t own the property yet. When I needed a home inspector, I asked the agent for a recommendation, which worked out great.

The agent re-shops my auto, home, and umbrella policies among the companies in their universe each year. If another company offers a better deal, the agent asks me if I want to move my policies. This creates competition among insurance companies that sell through independent agents. The business moves away quickly if an insurance company isn’t competitive.

Your insurance policies may move from one company to another but you still interact with the same independent agent with continuity. Consulting an experienced agent for your insurance needs is much better than calling a remote call center. I also feel good about supporting a local small business and smaller insurance companies as opposed to national and international giants. If the bottom-line price to me is the same, I’d much rather see money going to local small businesses than ad spending going to media conglomerates.

Some insurance agencies also sell health insurance. The agency I work with has a person trained and licensed for ACA health insurance. He helps people with annual enrollment. Using an agent for ACA health insurance doesn’t cost anything extra. The agent earns a commission from the insurance company. The insurance company keeps the commission for itself when you enroll without an agent.

***

If you have only bought auto and home insurance from a national brand, a local independent agent gives you another channel to other insurance companies. You may or may not get lower premiums through that channel, but it’s worth a try. If premiums are comparable, you may like the better personal service from an independent agent and feel good about supporting a local small business.

[Image credit: Pixabay.]

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Use an Independent Agent for Auto and Home Insurance appeared first on The Finance Buff.

Using an Independent Agent for Auto and Home Insurance

Auto and homeowners’ insurance have gotten a lot more expensive in recent years. Many people experienced premium increases of 10%, 20%, or more on their renewals. Inflation in materials and labor, technological advances in vehicles, weather events, and natural disasters are all causes to blame.

A friend asked me which insurance company I used for my homeowners insurance when AAA insurance wanted over $3,000 a year to insure his home. I sent him to the independent insurance agent I use. The agent placed him with the same company I’m with. The premium was a little over $1,000, saving him $2,000 a year.

Sales and Service ChannelHome and auto insurance companies sell and service policies through different channels. Some insurance companies market directly to consumers by heavily advertising on TV and streaming platforms. I’m sure you’ve seen ads from GEICO and Progressive. You buy their policies online, use their website to renew or make changes, and call a toll-free number for customer service.

Some companies sell policies through a group of captive agents. Both the company and the agents are exclusive to each other. You go through a State Farm agent if you want insurance from State Farm. The State Farm agent only sells policies from State Farm. Allstate and Farmers also operate under this model.

Some other companies sell through independent agents. These agents are small businesses that sell policies from many insurance providers. They act as a shared outsourced sales and customer service department for the insurance companies they represent. The insurance companies pay commissions to independent agents to save money on advertising or staffing their own sales and customer service call centers. The independent agents handle all consumer interaction, including new policy sales, coverage changes, and claims.

Using an independent agent doesn’t guarantee you’ll have the lowest premiums. The agent can get quotes for you from all the companies they sell for, but they can’t quote policies from companies that don’t sell through them. You can only find out whether GEICO or State Farm offers a better deal by going to GEICO or State Farm. Getting quotes from an independent agent only taps into a pool of insurance carriers that you otherwise don’t think of.

Finding an Independent AgentI found my independent agent when I first moved to a new state. I read the comparison report published by the state insurance department (see State Government Helps You Find Lower Auto & Home Insurance). One company jumped out as offering substantially lower premiums, especially in homeowners insurance.

This insurance company is over 100 years old, but I had never heard of it because it only operates in one state. I saw on their website that they only sold through independent agents. I used the “find an agent” feature on the website to find this local independent agency.

You can also Google “independent insurance agent” plus the name of your city.

One-Stop Shop with Better ServiceI started working with the agent on a renter’s policy when I was renting. The landlord wanted us to show proof of renter’s insurance that covered sewer backup. Most renter’s policies don’t cover sewer backup because it’s typically covered in a landlord’s policy. The agent put in extra effort to find a renter’s policy that met the landlord’s demand. The premium for the renter’s policy was only $150 a year. The agent’s commission on it couldn’t be that much.

An independent agent is separate from the insurance company. You can tell the agent things that you don’t necessarily want to tell the insurance company yet. When I had a broken windshield, I asked the agent whether it was worth it to file a claim and risk raising my premium. The agent told me how that specific insurance company typically treated glass claims on renewals. When I was considering buying a home, I asked the agent for a quote to factor it into the budget, even though I don’t own the property yet. When I needed a home inspector, I asked the agent for a recommendation, which worked out great.

The agent requotes my auto, home, and umbrella policies among the companies in their universe each year. If another company offers a better deal, the agent asks me if I want to move my policies. This creates competition among insurance companies that sell through independent agents. The business moves away quickly if an insurance company isn’t competitive.

Your insurance policies may move from one company to another, but you still interact with the same independent agent with continuity. Consulting an experienced agent for your insurance needs is much better than calling a customer service call center. I also feel good about supporting a local small business and smaller insurance companies as opposed to national and international giants.

Some insurance agencies also sell life insurance and health insurance. The agency I work with has a person trained and licensed for ACA health insurance. He helps people with annual enrollment. Using an agent for ACA health insurance doesn’t cost anything extra. The agent earns a commission from the insurance companies. The insurance company keeps the commission for itself when you enroll without an agent.

***

If you have only bought auto and home insurance from a national brand, a local independent agent gives you another channel to other insurance companies. You may or may not get lower premiums through that channel, but it’s worth a try. If premiums are comparable, you may like the better personal service from an independent agent and feel good about supporting a local small business.

[Image credit: Pixabay.]

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Using an Independent Agent for Auto and Home Insurance appeared first on The Finance Buff.

April 29, 2025

eSIM for International Travel Mobile Data Roaming

One thing that unites the world is the mobile phone. When you travel internationally, everywhere you go, people have their phones. Most hotels and many restaurants have Wi-Fi. Still, it’s much easier if you have mobile data when you’re out and about. You can call an Uber, look for restaurants nearby, or find walking directions to attractions or public transit stations.

U.S. Carriers Are ExpensiveMobile data is expensive in the U.S. According to a website, the United States ranked #219 among 237 countries in the world for the cost of mobile data (from the least expensive to the most expensive). Some say it’s primarily due to limited competition, high infrastructure costs, and a poor market structure.

As expensive as it is in the U.S., the U.S. carriers charge multiple times more when you travel outside the country. Some plans charge as much as $10 per day. If you’re out 30 days, that would be $300. And that’s only if you buy the international travel pass before you travel. If you use international roaming without pre-arrangement, your mobile data bill could be enormous. A plan I used to use charges $100 to $150 per GB of mobile data in some countries. If you use 4 GB of mobile data, that would be $400 to $600.

A reasonable cost should be more like $10 — not $10 per day — $10 for the whole trip.

Buy a Local SIM CardA way to avoid the exorbitant charges from your U.S. carrier is to buy a SIM card locally after you arrive in the foreign country. You find a shop at the airport or on the street to buy a SIM card that covers the length of your stay. You put it into your phone but you have to carefully save your existing SIM card. You’ll need it again when you come back to the U.S.

Image by Tomek from Pixabay

Image by Tomek from PixabayI did this when I traveled to New Zealand in 2016. I bought a SIM card at a store for $5 that covered a whole month.

This works, but it isn’t always easy to find a store that sells SIM cards to international travelers. You may have a language barrier. You have to take precious time out of your vacation to do it. If you lose the tiny SIM card from the U.S., you’ll have to spend time again to replace it after you return.

eSIMTechnology advances since 2016 gave us eSIMs. An eSIM is an electronic equivalent of the tiny physical SIM card. iPhones sold in the U.S. only use eSIMs after iPhone 14 was released in 2022. Other phones released in recent years that still support physical SIM cards also work with eSIMs.

eSIMs don’t have the limitations of physical card trays and card reading contacts. A phone can simultaneously hold two or more eSIMs or one physical SIM plus another eSIM. You can toggle between two SIMs without worrying about losing one.

It also made it much easier to buy a SIM for international travel. You don’t have to find that local store in a foreign country. You can shop online for a wide selection and the best price before you leave.

Chances are that your current phone already supports eSIMs. If you’re not sure, Google your phone’s model plus the word “eSIM” or ask AI.

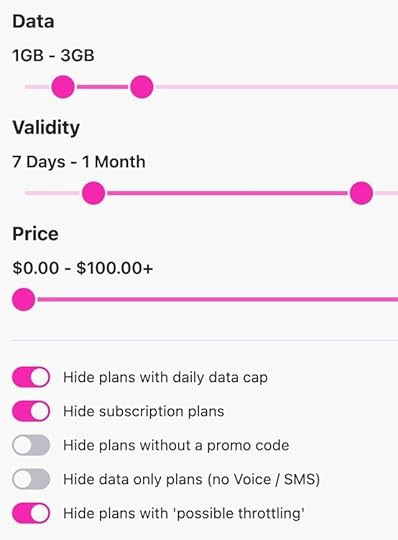

I use the website esimdb.com when I buy an eSIM. It’s like a search engine for online eSIM vendors. It gets paid a commission by the vendors. I’m not affiliated with it. I use it only because it includes a wide selection.

You search by which country you’re traveling to, for how many days, and how much data you need. Some eSIMs cover multiple countries.

esimdb.com filters

esimdb.com filtersFor my typical usage while traveling, 1 GB per week is plenty when hotels have Wi-Fi. I’m going to Quebec, Canada, for a week. esimdb.com shows multiple vendors that sell a 1 GB eSIM for about $2.

Many eSIMs support top-ups. If you need more data than the amount you originally bought, you can go back to the eSIM vendor and pay more to add more data to your eSIM. eSIMs are quite inexpensive anyway. A 1 GB eSIM for Canada costs about $2. A 2 GB eSIM costs about $4. If I don’t want the hassle of possibly running out, paying $4 versus $2 is a rounding error in travel costs.

I look for eSIM vendors that accept Apple Pay, Google Pay, or PayPal because I don’t want to give them my credit card number directly. If a vendor doesn’t accept Apple Pay, Google Pay, or PayPal, I move on to the next one.

It doesn’t matter if you’ve never heard of the vendors listed on esimdb. I have bought eSIMs from several different vendors for different countries, and the eSIMs all worked as advertised.

You get a QR code by email after you buy the eSIM. You add the eSIM to your phone by scanning the QR code with your phone. Adding a new eSIM doesn’t overwrite your existing SIM. You can switch on and off which SIM should be active. Switch off your U.S. line after you board the plane to avoid international roaming charges.

You can add the eSIM before you leave the U.S., but it will drain your battery a little more when the eSIM keeps looking for its carrier and doesn’t find it. If you decide to add the eSIM when you first land in the foreign country, you must be on Wi-Fi when you add it. You also need to display the QR code on a second device, such as a tablet, to scan it, or you can print the QR code on paper and take it with you.

The inexpensive eSIMs are usually data-only eSIMs. You don’t get a local number for calls and texts, but that’s OK. You can use Wi-Fi calling and messaging apps, such as iMessage or WhatsApp. The eSIM uses a local carrier but it doesn’t necessarily come from a carrier in that country. The data roaming setting should still be enabled for it to work.

Unlocked PhoneYou need an unlocked phone whether you buy a local physical SIM or eSIM. A phone locked to a specific carrier doesn’t work with a SIM from a different carrier. If you bought your phone directly from the manufacturer, it’s probably unlocked to begin with. Your phone may be locked if you bought it from your carrier at a discounted price or if it’s still on a device payment plan with the phone company.

You can check whether your phone is unlocked if you’re not sure. On an iPhone, it’s under Settings -> General -> About -> Carrier Lock. The menu option for Android phones varies by model. Google the phone’s model and the phrase “carrier unlock status” or ask AI how to find it.

Some phones are still locked after you already satisfied the requirements from your carrier. You can call the carrier and request unlocking. If your current phone is still locked and you can’t unlock it, you may have an older phone that’s unlocked. Put the eSIM on that one and use it for international travel.

SummaryYou’ll have mobile data for your phone for usually under $10 for your entire trip if you do these:

1. Check whether your phone supports eSIM. Most recent phones already do.

2. Check whether your phone is unlocked. It probably already is. Request unlocking from your carrier if it’s locked.

3. Buy an eSIM online for your destination(s) before you leave.

4. Add the eSIM to your phone and switch off your U.S. line at the airport. Remember to leave the data roaming setting on.

5. Switch your U.S. line back on after you return and delete the travel eSIM.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post eSIM for International Travel Mobile Data Roaming appeared first on The Finance Buff.

April 10, 2025

2025 2026 HSA Contribution Limits and HDHP Qualification

The contribution limits for various tax-advantaged accounts for the following year are usually announced in October, except for the HSA, which comes out in April or May. The contribution limits are adjusted for inflation each year, subject to rounding rules.

You can only contribute to an HSA if you’re covered by a High Deductible Health Plan (HDHP) with no other coverage. You can use the money already in the HSA for qualified medical expenses regardless of what insurance you currently have.

Table of ContentsHSA Contribution LimitsAge 55 Catch-Up ContributionTwo Plans Or Mid-Year ChangesHDHP QualificationContribute From PayrollNon-Dependent Adult ChildrenBest HSA ProvidersHSA Contribution Limits20252026Individual Coverage$4,300$4,400Family Coverage$8,550$8,750HSA Contribution LimitsSource: IRS Rev. Proc. 2024-25, author’s calculation.

Employer contributions are included in these limits.

The family coverage numbers are double the individual coverage numbers in some years but it isn’t always the case every year. Because the individual coverage limit and the family coverage limit are both rounded to the nearest $50, the family coverage limit can be slightly more or slightly less than double the individual coverage limit when one number rounds up and the other number rounds down.

Age 55 Catch-Up ContributionAs in 401k and IRA contributions, you are allowed to contribute extra if you are above a certain age. If you are age 55 or older by the end of the year (not age 50 as in 401k and IRA contributions), you can contribute an additional $1,000 to your HSA. If you are married, and both of you are age 55, each of you can contribute an additional $1,000 to your respective HSA.

However, because an HSA is in one individual’s name, just like an IRA — there is no joint HSA even when you have family coverage — only the person age 55 or older can contribute the additional $1,000 in his or her own name. If only the husband is 55 or older and the wife contributes the full family contribution limit to the HSA in her name, the husband has to open a separate account in his name for the additional $1,000. If both husband and wife are age 55 or older, they must have two HSA accounts in separate names if they want to contribute the maximum. There’s no way to hit the combined maximum with only one account.

The $1,000 additional contribution limit is fixed by law. It’s not adjusted for inflation.

Two Plans Or Mid-Year ChangesThe limits are more complicated if you are married and the two of you are on different health plans. It’s also more complicated when your health insurance changes mid-year. The insurance change could be due to a job change, marriage or divorce, enrolling in Medicare, the birth of a child, and so on.

For those situations, please read HSA Contribution Limit For Two Plans Or Mid-Year Changes.

HDHP QualificationThe IRS also defines what qualifies as an HDHP. For 2025, an HDHP with individual coverage must have at least $1,650 in annual in-network deductible and no more than $8,300 in annual out-of-pocket expenses. For family coverage, the numbers are a minimum of $3,300 in annual deductible and no more than $16,600 in annual out-of-pocket expenses.

For 2026, an HDHP with individual coverage must have at least $1,700 in annual deductible and no more than $8,500 in annual out-of-pocket expenses. For family coverage, the numbers are a minimum of $3,400 in annual deductible and no more than $17,000 in annual out-of-pocket expenses.

Please note the deductible number is a minimum while the out-of-pocket number is a maximum. The maximum out-of-pocket limit only applies to the in-network number. If the in-network out-of-pocket limit of your insurance policy is too high, it doesn’t qualify as an HSA-eligible policy.

In addition, just having the minimum deductible and the maximum out-of-pocket isn’t sufficient to make a plan qualify as HSA eligible. The plan must also meet other criteria. See Not All High Deductible Plans Are HSA Eligible.

20252026Individual Coverageminimum deductible$1,650$1,700maximum out-of-pocket$8,300$8,500Family Coverageminimum deductible$3,300$3,400maximum out-of-pocket$16,600$17,000HDHP QualificationSource: IRS Rev. Proc. 2024-25, author’s calculation.

Contribute From PayrollIf you have a High Deductible Health Plan (HDHP) through your employer, your employer may already set up a linked HSA for you at a selected provider. Your employer may be contributing an amount on your behalf there. You save Social Security and Medicare taxes when you contribute to the HSA through payroll. Your employer may be paying the fees for you on that HSA.

When you contribute to an HSA outside an employer, you claim the tax deduction on your tax return similar to when you contribute to a Traditional IRA. If you use tax software, be sure to answer the questions on HSA contributions. The tax deduction shows up on Form 8889 line 13 and Schedule 1 line 13.

Non-Dependent Adult ChildrenIf your HDHP also covers an adult child who’s not claimed as a dependent on your tax return, each non-dependent adult child covered by the plan can also contribute to a separate HSA in their name at the family coverage level when they don’t have other non-HDHP coverage. This is because they meet the eligibility:

(a) Covered by an HDHP with no other coverage; and

(b) The HDHP policy they have covers more than one person.

Each non-dependent adult child can open a separate HSA on their own with an HSA provider.

Best HSA ProvidersIf you get the HSA-eligible high deductible plan through an employer, your employer usually has a designated HSA provider for contributing via payroll deduction. It’s best to use that one because your contributions via payroll deduction are usually exempt from Social Security and Medicare taxes. If you want better investment options, you can transfer or roll over the HSA money from your employer’s designated provider to a provider of your choice afterward. See How To Rollover an HSA On Your Own and Avoid Trustee Transfer Fee.

If you are not going through an employer, or if you’d like to contribute on your own, you can also open an HSA with a provider of your choice. For the best HSA providers with low fees and good investment options, see Best HSA Provider for Investing HSA Money.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2025 2026 HSA Contribution Limits and HDHP Qualification appeared first on The Finance Buff.

February 20, 2025

Backdoor Roth in FreeTaxUSA: Recharacterize & Convert, Same Year

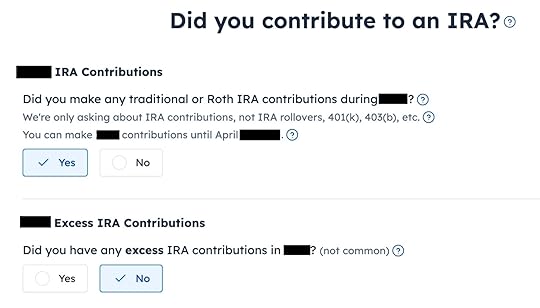

You may have contributed to a Roth IRA and then realized later in the same year that you would exceed the income limit. You recharacterized the Roth IRA contribution as a Traditional IRA contribution and converted it to Roth again before the end of the year. Your IRA custodian sent you two 1099-R forms, one for the recharacterization and one for the conversion. This post shows you how to put them into FreeTaxUSA.

If you had done the recharacterizing and converting in the following year, you would have to split the tax reporting into two years by following Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 1 and Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 2. Now because you caught the problem soon enough before the end of the year, you can handle all of it in the same year by following this guide.

Here’s the example scenario we’ll use in this guide:

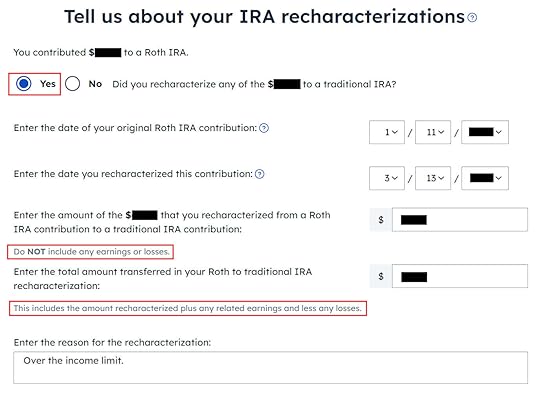

You contributed $7,000 to a Roth IRA for 2024 in 2024. You realized that your income would be too high later in 2024. You recharacterized the Roth contribution for 2024 as a Traditional contribution. The IRA custodian moved $7,100 from your Roth IRA to your Traditional IRA because your original $7,000 contribution had some earnings. The value increased again to $7,200 when you converted it to Roth before December 31, 2024. You received two 1099-R forms, one for $7,100 and another for $7,200.

If you didn’t do any of these recharacterizing and converting, please follow our guide for a “clean” backdoor Roth in How to Report Backdoor Roth In FreeTaxUSA (Updated).

If you’re married and both you and your spouse did the same thing, you should follow the steps below once for yourself and again for your spouse.

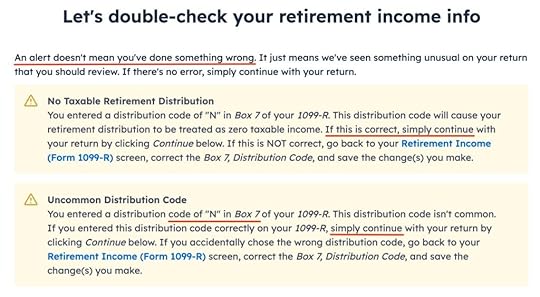

Table of Contents1099-R for Recharacterization1099-R for ConversionRecharacterized ContributionContributed to Roth IRARecharacterized to TraditionalTaxable IncomeForm 8606TroubleshootingThe Entire Conversion Is TaxedSelf vs Spouse1099-R for RecharacterizationWe handle the 1099-R form for the recharacterization first. This 1099-R form has a code “N” in Box 7.

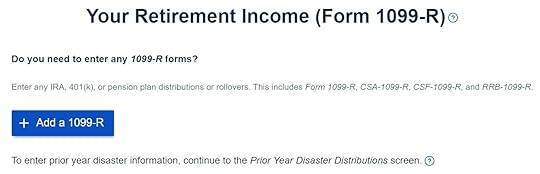

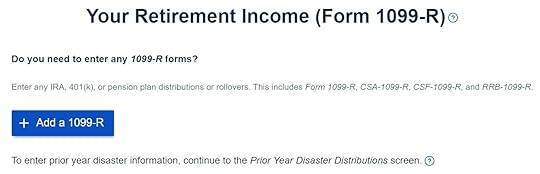

Find “Retirement Income (1099-R)” under the Income menu.

Click on the “Add a 1099-R” button.

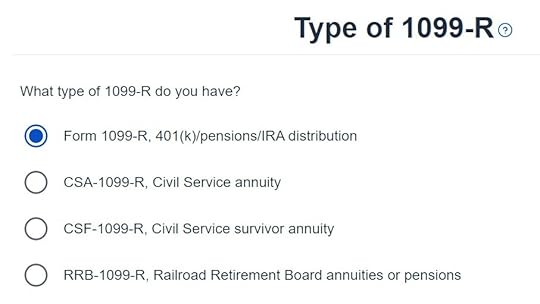

It’s just a regular 1099-R.

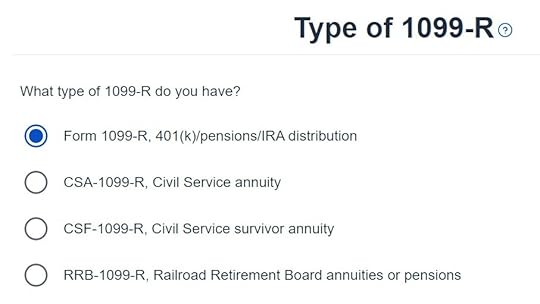

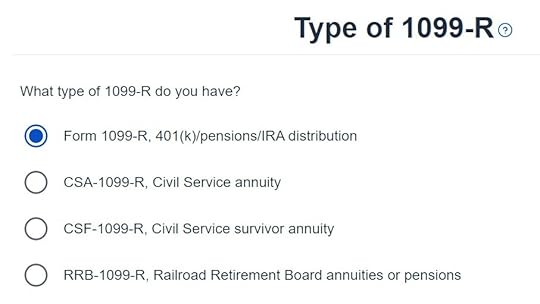

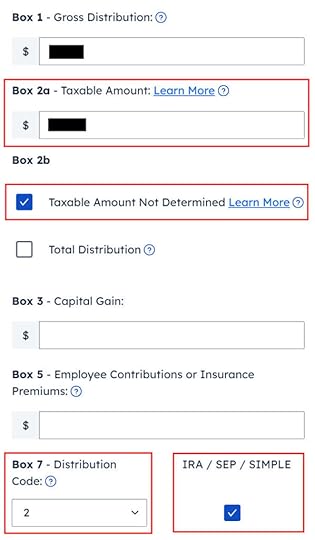

The 1099-R form for the recharacterization shows the amount moved from the Roth IRA to the Traditional IRA in Box 1. It’s $7,100 in our example. The taxable amount is 0 in Box 2a and the “Taxable amount not determined” box isn’t checked. The code in Box 7 is “N” and the “IRA/SEP/SIMPLE” box may or may not be checked. It isn’t checked in our sample form.

The recharacterization wasn’t a rollover.

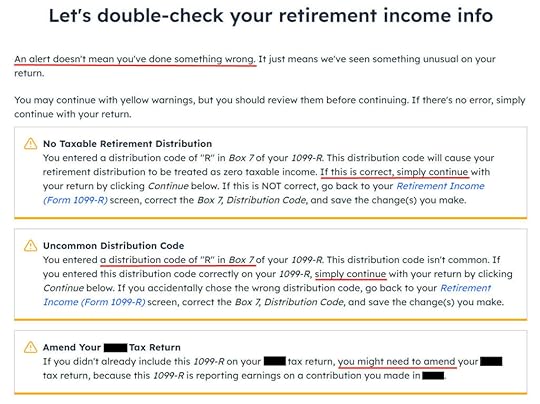

FreeTaxUSA shows some alerts just to double-check. The zero taxable income on the 1099-R is correct. Code “N” in Box 7 is also correct.

You’re done with the 1099-R form for the recharacterization. Click on the “Add a 1099-R” button to add the other 1099-R for the conversion.

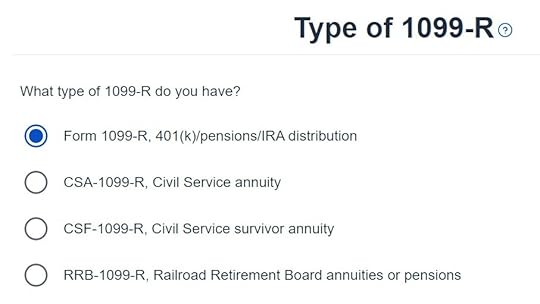

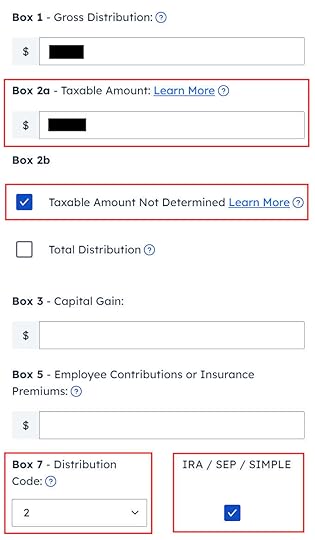

1099-R for ConversionThe 1099-R for the conversion has a code “2” in Box 7 if you’re under age 59-1/2 or a code “7” if you’re 59-1/2 or older.

It’s also a regular 1099-R.

Box 1 shows the amount converted to Roth. It’s $7,200 in our example. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” Make sure to choose the correct code in Box 7 to match your 1099-R. The “IRA / SEP / SIMPLE” box is checked.

Your refund number drops after you enter this 1099-R. Don’t panic. It’s normal and temporary. The refund number will come up when we finish everything.

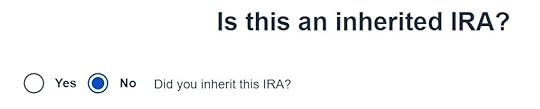

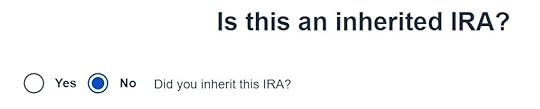

It’s not an inherited IRA.

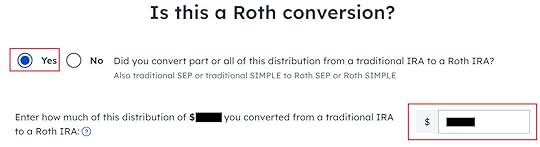

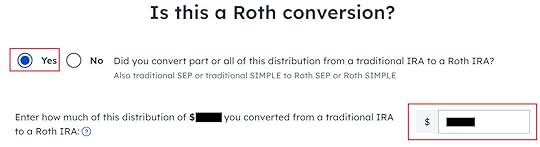

It’s a Roth conversion. 100% of the amount on the 1099-R was converted from a Traditional IRA to a Roth IRA.

You are done with this 1099-R for the conversion. Repeat if you have another 1099-R. If you’re married and both of you converted to Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R forms to the same person when they belong to each spouse. Click on “Continue” when you have entered all the 1099-R forms.

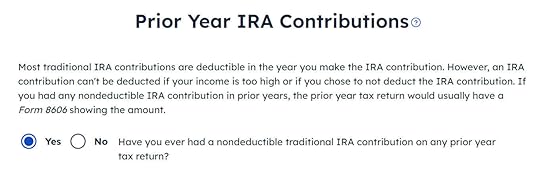

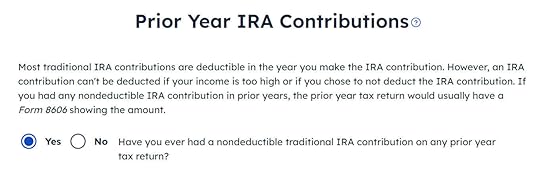

It asks you about the basis carried over from previous years. If you never contributed to a Traditional IRA in previous years, you can answer “No.” Answering “Yes” and entering a zero on the next page has the same effect as answering “No.” If you have gone back and forth before you found this guide, some of your previous answers may be stuck. Answering “Yes” here will give you a chance to review and correct them. If you have a basis carryover on line 14 of Form 8606 from your previous year’s tax return, answer Yes here and enter it on the next page.

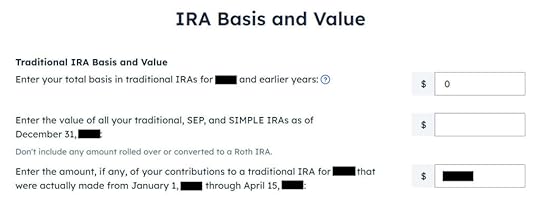

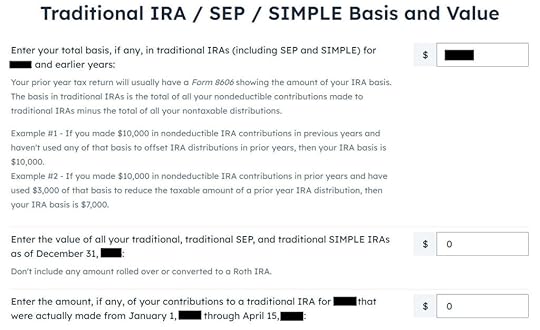

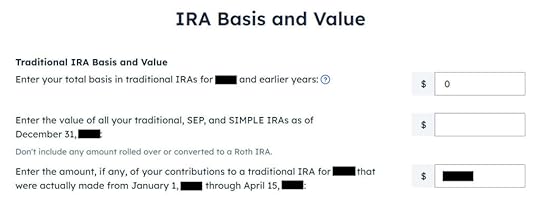

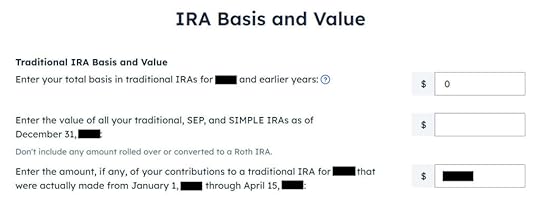

The value in the first box should be zero if you never contributed to a Traditional IRA in previous years. If you had a small amount of earnings posted to your Traditional IRA after the conversion and you didn’t convert the earnings, enter the account’s value from your year-end statement in the second box. The third box should be zero because you recharacterized before the end of the year.

We didn’t take any disaster distribution.

Now continue with all other income items until you are done with income. Your refund meter is still lower than it should be but it will change soon.

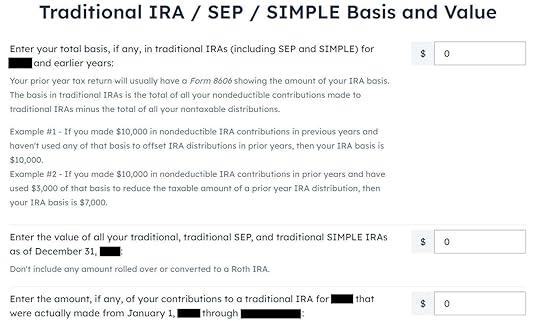

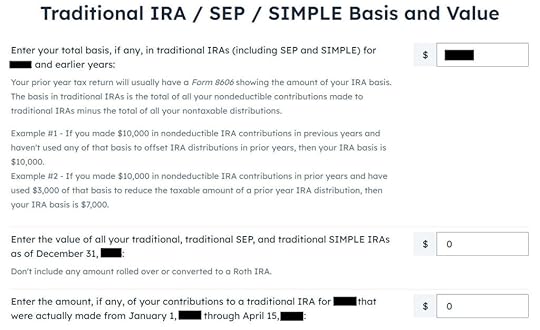

Recharacterized ContributionNow we tell FreeTaxUSA that we contributed to a Roth IRA before we recharacterized the contribution to a Traditional IRA.

Contributed to Roth IRA

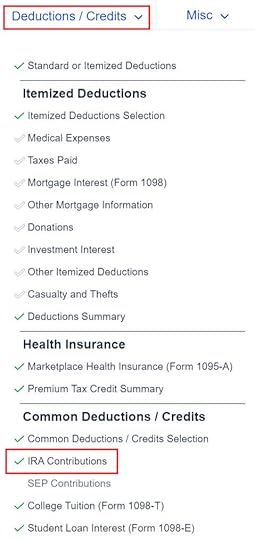

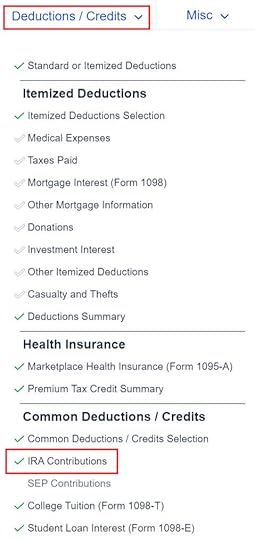

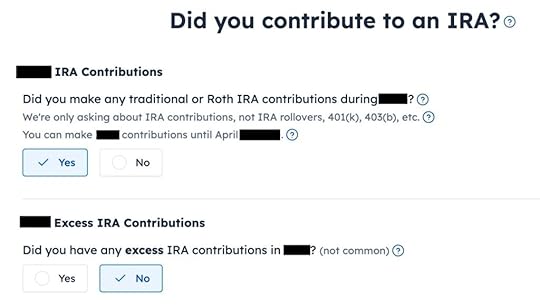

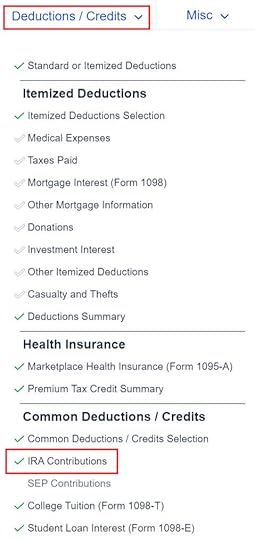

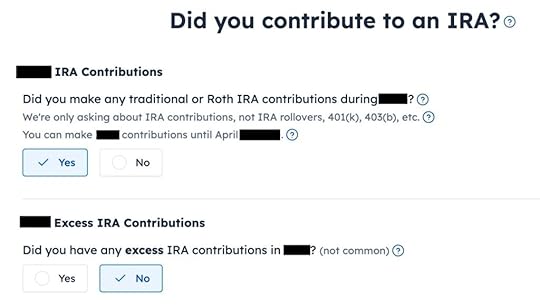

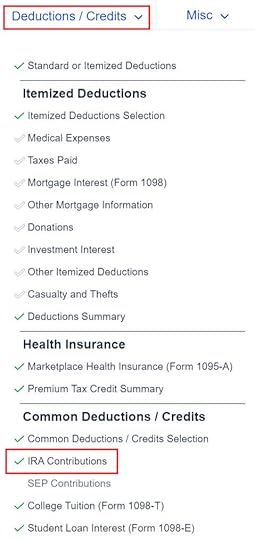

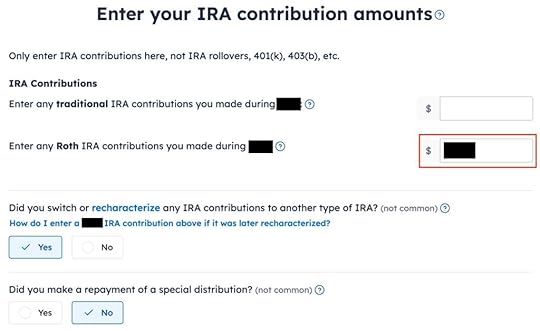

Find the IRA Contributions section under the “Deductions / Credits” menu.

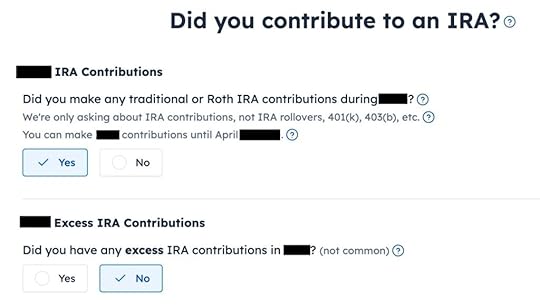

Answer “Yes” to the first question. An excess contribution means contributing more than you’re allowed to contribute. We didn’t have that.

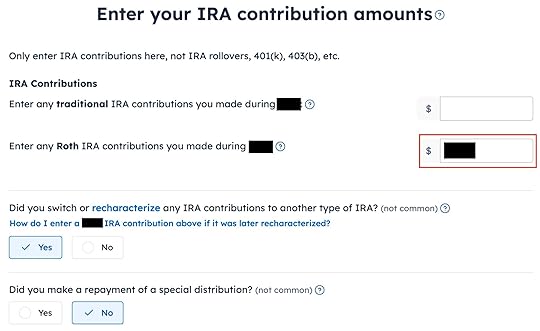

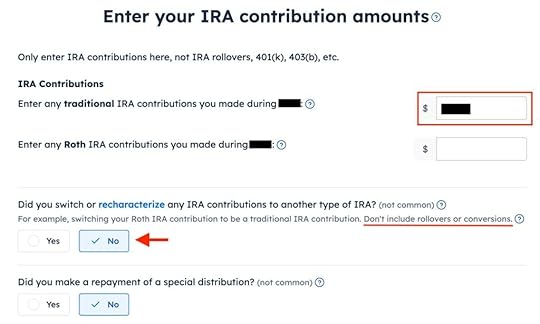

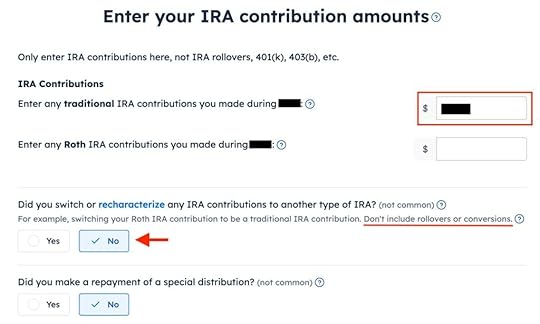

Enter your contribution in the second box because you originally contributed to a Roth IRA. Answer “Yes” to “Did you switch or recharacterize.” We didn’t repay any special distribution.

Recharacterized to Traditional

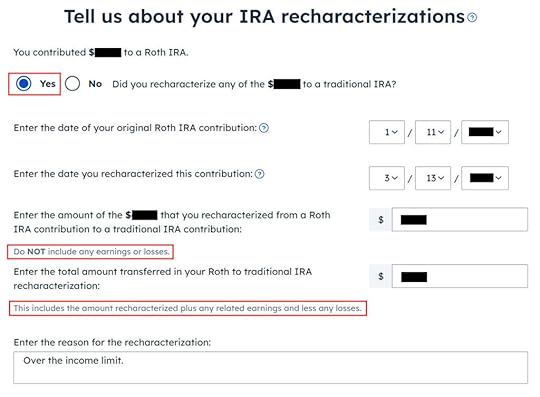

Select “Yes” to confirm you recharacterized a contribution. It opens up additional inputs for an explanation. If you recharacterized 100% of your original contribution, enter it in the first box. It’s $7,000 in our example. We enter $7,100 from our example in the second box, which is the amount that the IRA custodian moved from the Roth IRA to the Traditional IRA when we recharacterized.

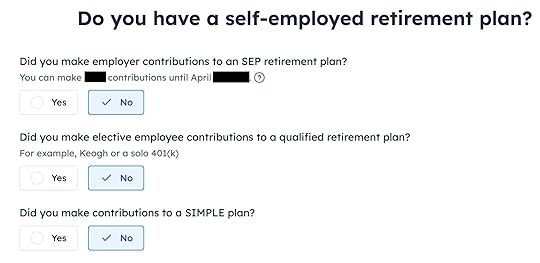

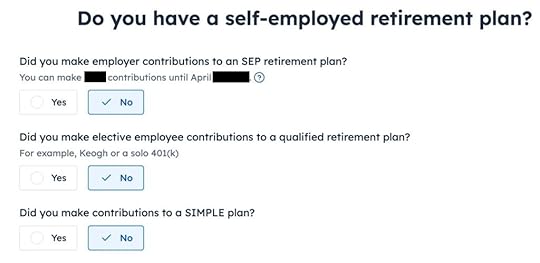

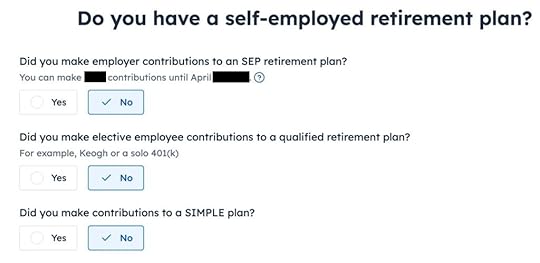

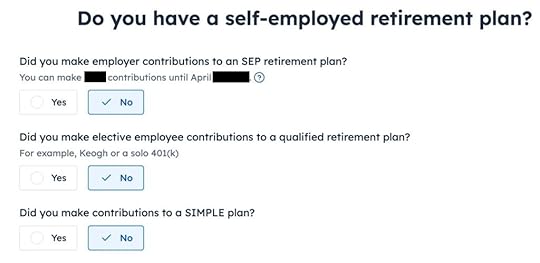

We didn’t contribute to a SEP, solo 401k, or SIMPLE plan. Answer “Yes” if you did.

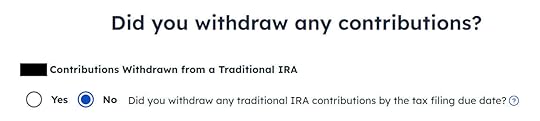

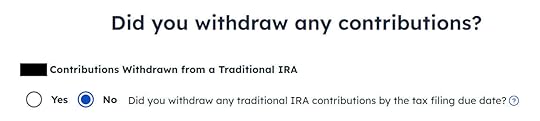

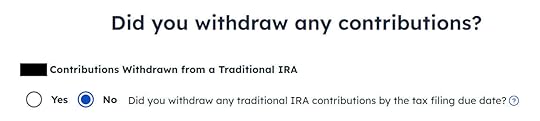

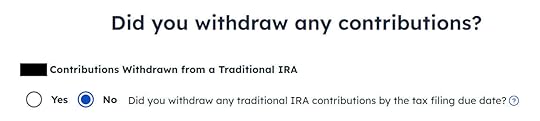

Withdraw means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer “No” here.

The value in the first box should be zero if you never contributed to a Traditional IRA in previous years. The value in the second box should also be zero if you converted everything. If you had a small amount of earnings posted to your Traditional IRA after the conversion and you didn’t convert the earnings, enter the account’s value from your year-end statement in the second box. The third box should be zero because you recharacterized before the end of the year.

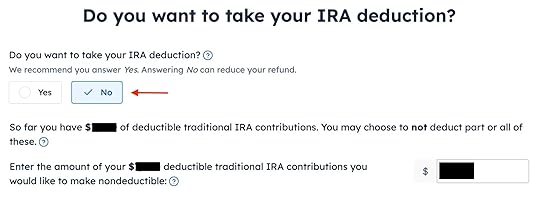

You see this screen only if your income falls below the income limit that allows a deduction for a Traditional IRA contribution. You don’t see this if your income is above the income limit. Answering Yes will make your contribution deductible but it will also make your Roth conversion taxable, which comes to a wash. It’s less confusing if you answer “No” here and make the entire amount that could be deducted nondeductible.

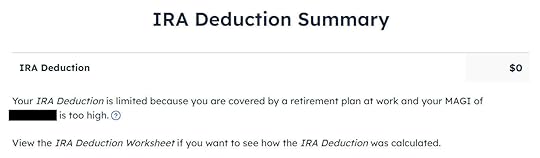

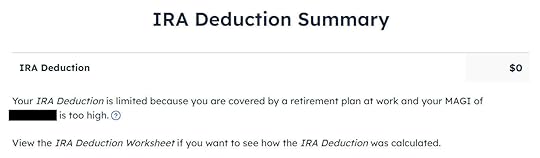

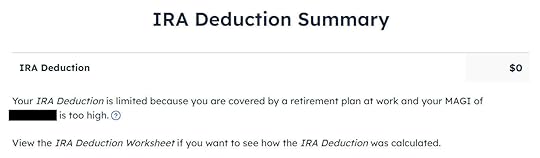

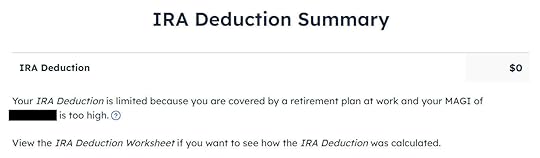

It tells us we don’t get a deduction because our income was too high or because we chose to make our contribution nondeductible. We know. That’s why we did the Backdoor Roth.

The refund meter should go back up now.

Taxable IncomeLet’s look at how these entries show up on our tax return. Click on the three dots on the top right above the IRA Deduction Summary and then click on “Preview Return.”

Look for Lines 4a and 4b in your Form 1040.

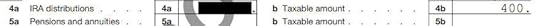

It shows the sum of your two 1099-R forms on line 4a and only $200 is taxable on line 4b. The taxable amount is the difference between the amount you converted to Roth and your original contribution.

Form 8606Go toward the end of the pop-up to find Form 8606. It shows these for our example:

Line #Amount17,00037,00057,000137,000 *167,200177,00018200 *footnote* From Worksheet-1-1 in Publication 590 BForm 8606There’s also a statement to describe your recharacterization at the end.

TroubleshootingIf you followed the steps in this guide and you are not getting the expected results, here are a few things to check.

The Entire Conversion Is TaxedIf you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your IRA contribution. If you have a retirement plan at work but your income is low enough, you are also eligible for a deduction on your IRA contribution. FreeTaxUSA gives you the option to take a deduction if it sees that your income qualifies.

Taking the deduction makes a corresponding amount of the Roth conversion taxable. Answering “No” in the “Do you want to take your IRA deduction?” page will have you taxed only on the earnings in your Roth conversion.

Self vs SpouseIf you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with an IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Backdoor Roth in FreeTaxUSA: Recharacterize & Convert, Same Year appeared first on The Finance Buff.

February 12, 2025

Protect Your Brokerage Accounts From ACATS Transfer Fraud

When you transfer investments in a brokerage account from one broker to another, it goes by a system called ACATS, which stands for Automated Customer Account Transfer Service. Some people call it ACAT. I’m going with the official name ACATS.

ACATS transfers keep the holdings intact and don’t trigger taxes. I used ACATS when I transferred a part of my account from Fidelity to US Bancorp Investments recently for the 4% rewards card.

With all the hacks and data leaks in recent years, fraudulent ACATS transfers have also become a problem. I read a report of this type of fraud from a poster ww340 on the Bogleheads forum.

I discovered that our taxable account at Vanguard had been slowly pilfered of approximately $100,000 in stocks transferred by ACATS to 2 different brokerage accounts that were not mine over a period of time.

These stock transfers were taken out of our account each time we received a dividend. … … Every few months 750 shares of that fund were transferred. Transfers were made 3 times before I realized it was happening.

Source: ACAT fraud with a twist – Vanguard, Bogleheads Forum.

We don’t want our investments stolen from us. How do we protect our accounts from ACATS fraud?

Fraudulent Account In Your NameACATS is a pull-only system. All transfer requests start at the receiving firm. A transfer requires a medallion signature guarantee if names don’t match between the receiving and the sending accounts. Therefore thieves usually start with creating a fraudulent account in your name at another broker. They don’t have to hack into your account when they could just pull from an account they control.

Opening a brokerage account doesn’t require a credit check. Freezing your credit doesn’t stop it. Freezing your ChexSystems report doesn’t stop it either because that’s only for banks and credit unions. If someone has your name, Social Security Number, address, and phone number, they have all the information to open a brokerage account in your name. All those pieces of information have been leaked in repeated hacks.

Because thieves can choose paperless delivery at many financial institutions, you may have no clue when a fraudulent account is opened in your name somewhere out there. Some brokers still send mail. You should be on alert if you receive mail from a financial institution you don’t use.

Account Number and StatementAn ACATS transfer request requires the account number of the source account. Some brokers ask for a recent account statement from the source account but it’s often optional. My recent transfer went through without a statement.

An ACATS transfer doesn’t require confirmation by the customer at the sending firm either. A transfer would go through if someone had your account number and the names matched on both accounts. Therefore you should safeguard your account number from falling into the wrong hands. That’s the critical piece of information for a successful ACATS transfer.

A partial transfer also requires knowing your holdings, which are listed in your online account or statements. Therefore you should protect your account statements.

Choose paperless statements and tax forms. They are more secure than hard copies sent by mail. Store those documents securely.

Your brokerage account should have the strongest 2-factor authentication. Don’t let thieves reset your password to get your account number or holdings. See Security Hardware for Vanguard, Fidelity, and Schwab Accounts. If you submit your statement to someone to qualify for a loan, black out the account number.

Your email should also have the strongest 2-factor authentication. Don’t let thieves find your account number or holdings in some emails. See Secure Your Email Account to Prevent Wire Fraud.

Enable LockdownFidelity is the only broker I know that offers an optional Money Transfer Lockdown feature. It doesn’t stop all the ways money can go out of an account but a partial lockdown is better than no lockdown. Fidelity will reject all ACATS transfers when you turn on this setting on an account.

Enabling the lockdown also stops some legit transfers you initiate. You’ll have to disable the lockdown, do your transfer, and re-enable the lockdown. It’s a tradeoff between convenience and protection.

Transfer AlertsAn ACATS transfer doesn’t require an approval from you before it goes through but it’s helpful if your broker at least sends you an alert when it receives a transfer request or immediately after it processes a transfer. Some brokers don’t do any of that.

Fidelity sent me an alert when they received my legit transfer request through US Bancorp Investments. When I transferred from Vanguard last year, Vanguard didn’t send me anything either before or after they processed the transfer. A fraudulent transfer could’ve gone through without my knowledge. Vanguard only sent me a letter after a few weeks saying the account was closed. I would’ve received nothing if it had been a partial transfer and the account was still open, as was the fraudulent transfer against ww340.

If your broker notifies you by mail, it’s helpful if you open it. The poster ww340 said,

I had everything online and usually only get proxy votes or fund information sheets, so I do not always open Vanguard mail.

That was a mistake. Use a broker that sends you alerts about these transfers either before or after the transfer is processed. The sooner you know, the better chances you have to stop the transfer or reverse it. Make a habit of reading everything that comes from your broker.

A Flood of SpamBeware when you receive a sudden flood of spam emails and texts. It’s a telltale sign you’re under attack somewhere. Thieves flood you with spam to bury the notification emails and texts from your financial institution. This happened to ww340:

My email got hundreds or thousands of spam emails every time a fraudelent order was placed. My email had 73,000 emails with 99% of those were spam and spam subscriptions. So that hid the fraud when the notices were hidden among the spam.

Call your banks and brokers immediately and tell them to stop all transactions if you see a surge of spam emails or texts.

Check Your AccountsSome people suggest not checking your investment accounts often. This helps you avoid trading on fear or greed. That’s good if your broker will notify you of outgoing activities and you’re on top of the notifications. Otherwise your account or shares could be long gone before you notice.

Brokers send you account statements monthly or quarterly for a reason. You don’t need to check your accounts daily. I suggest checking monthly for unusual activities.

Keep Independent RecordsAn ACATS transfer can be a full transfer of the entire account or a partial transfer of select holdings. A full account transfer is easier to detect when you see your entire account is gone. A partial transfer such as leeching 750 shares at a time is more difficult to see.

Portfolio values fluctuate with the market prices but you should match the number of shares in your account with your independent records. Don’t just look at the total value of your account. Look at the number of shares in each holding. Thieves that stole from ww340 tried to hide their theft by transferring out shares shortly after a dividend was paid. You may not detect it easily if you only look at the total value.

Many old-timers use Quicken to track their accounts. I use Microsoft Money, which was discontinued 10+ years ago but you can still find the last free release on archive.org. It still works on Windows 11. What system you use doesn’t matter as long as it helps you track your shares independently. An online aggregator such as Empower or Fidelity’s Full View isn’t the best tool for this purpose because they don’t maintain an independent source of truth. An online aggregator only reports what’s currently in your accounts.

You should know how many shares you should have in each holding at any time. Compare them with how many shares you see in your account. You’ll know when you see a difference. Having fewer accounts, fewer holdings, and fewer transactions will make this task easier.

***

ACATS was designed before all the hacks and data leaks. Now the account number is the only secret that prevents a fraudulent transfer. We must do everything we can to protect this secret. It helps to turn on the lockdown setting if your broker offers it. It also helps to use a broker that notifies you of pending and completed transfers.

Fraudulent ACATS transfers can be reversed. We want to detect them sooner rather than later. Check your account activities monthly and keep independent records.

[Image Credit: Gerd Altmann from Pixabay.]

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Protect Your Brokerage Accounts From ACATS Transfer Fraud appeared first on The Finance Buff.

January 30, 2025

Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 2

[Updated on January 30, 2025 with screenshots from FreeTaxUSA for the 2024 tax year.]

The previous post Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 1 dealt with contributing to a Traditional IRA for the previous year and recharacterizing a previous year’s Roth IRA contribution as a Traditional IRA contribution. This post handles the conversion part in FreeTaxUSA. If you use TurboTax or H&R Block tax software, see:

Split-Year Backdoor Roth IRA in TurboTax, Year 2Split-Year Backdoor Roth IRA in H&R Block, Year 2We cover two example scenarios in this post. Here’s the first:

You contributed $6,500 to a Traditional IRA for 2023 in 2024. The value increased to $6,700 when you converted it to Roth in 2024. You received a 1099-R form listing this $6,700 Roth conversion.

You should’ve already reported the contribution part on your 2023 tax return by following Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 1 last year. The IRA custodian sent you a 1099-R form for the conversion in 2024. This post shows you how to put it into FreeTaxUSA.

Here’s the second example scenario:

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your income was too high when you did your 2023 taxes in 2024. You recharacterized the Roth contribution for 2023 as a Traditional contribution before April 15, 2024. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. The value increased again to $6,700 when you converted it to Roth in 2024. You received two 1099-R forms, one for $6,600 and another for $6,700.

You should’ve already reported the recharacterized contribution on your 2023 tax return by following Split-Year Backdoor Roth IRA in FreeTaxUSA, 1st Year last year. The IRA custodian sent you two 1099-R forms, one for the recharacterization, and the other for the conversion. This post shows you how to put both of them into FreeTaxUSA.

If you contributed for 2024 in 2025 or if you recharacterized a 2024 contribution in 2025, you’re still in year 1 of this journey. Please follow Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 1.

If neither of these example scenarios fits you, please consult our guide for a normal “clean” backdoor Roth: How to Report Backdoor Roth In FreeTaxUSA (Updated).

If you’re married and both you and your spouse did the same thing, you should follow the steps below for both yourself and your spouse.

Table of Contents1099-R for Recharacterization1099-R for ConversionClean Backdoor Roth On TopTaxable IncomeForm 8606TroubleshootingConversion Is TaxedSelf vs Spouse1099-R for RecharacterizationThis section only applies to the second example scenario. If you contributed directly to a Traditional IRA for 2023 in 2024 and didn’t recharacterize (the first example scenario), please skip this section and jump over to the conversion section.

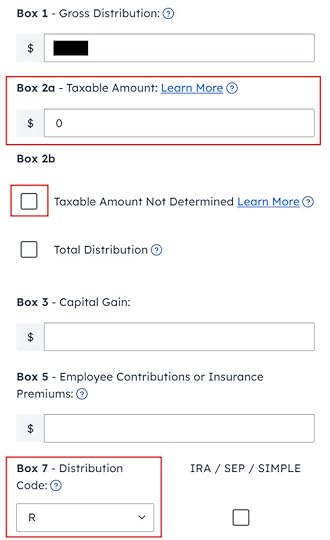

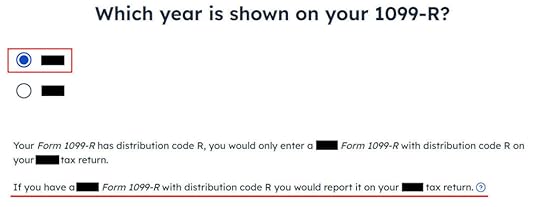

We handle the 1099-R form for recharacterization first. This 1099-R form has a code “R” in Box 7.

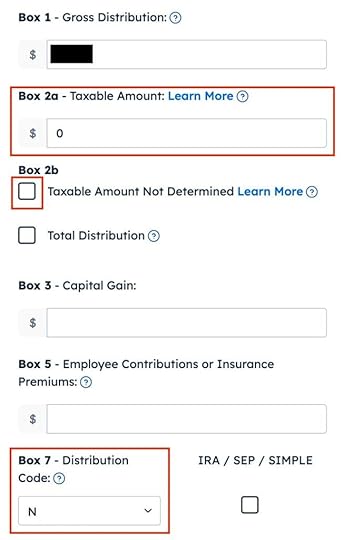

Find “Retirement Income (1099-R)” under the Income menu.

Click on the “Add a 1099-R” button.

It’s just a regular 1099-R.

Enter the 1099-R for the recharacterization exactly as you have it. Box 1 shows the amount transferred from the Roth IRA to the Traditional IRA when you recharacterized your 2023 contribution in 2024. Box 2a shows that the recharacterization isn’t taxable. Box 2b “taxable amount not determined” isn’t checked. The code in Box 7 is “R.” The “IRA / SEP / SIMPLE” box isn’t checked.

Your 1099-R shows 2024 but FreeTaxUSA says you should’ve reported it on your 2023 tax return. The problem is you didn’t have it back then. You couldn’t have reported something you didn’t have. Select the correct year and continue anyway.

The recharacterization wasn’t a rollover.

FreeTaxUSA shows some alerts. The zero taxable income on the 1099-R is correct. Code “R” in Box 7 is also correct. Although you didn’t include this 1099-R last year because you didn’t have it at that time, you don’t need to amend last year’s tax return if you reported the recharacterization in a different way when you followed Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 1 last year. You may need to amend last year’s return only if you didn’t report the recharacterization last year at all.

You’re done with the 1099-R form for the recharacterization. Click on the “Add a 1099-R” button to add the other 1099-R for the conversion.

1099-R for ConversionThe 1099-R for the conversion has a code “2” in Box 7 if you’re under age 59-1/2 or a code “7” if you’re 59-1/2 or older.

It’s also a regular 1099-R.

Box 1 shows the amount converted to Roth. If you contributed to a Traditional IRA for 2024 in 2024 and converted in 2024 (a “clean” backdoor Roth) on top of converting the 2023 contribution in 2024, the amount on the 1099-R includes two years’ worth of contributions. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” Make sure to choose the correct code in Box 7 to match your 1099-R. The “IRA / SEP / SIMPLE” box is checked.

Your refund number drops after you enter the 1099-R. Don’t panic. It’s normal and temporary. The refund number will come up when we finish everything.

It’s not an inherited IRA.

It’s a Roth conversion. 100% of the amount on the 1099-R was converted from a Traditional IRA to a Roth IRA.

You are done with this 1099-R for the conversion. Repeat if you have another 1099-R. If you’re married and both of you converted to Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R forms to the same person when they belong to each spouse. Click on “Continue” when you have entered all the 1099-R forms.

Answer “Yes” here because you had a Traditional IRA contribution from last year.

Get the value for the first box from last year’s Form 8606 Line 14 (assuming that you did last year correctly). If you didn’t have a Form 8606 last year because you didn’t do it correctly, your basis is the amount of your 2023 Traditional IRA contribution minus any deduction you took on last year’s Schedule 1 Line 20. The total basis is $6,500 in our example.

The second box should be zero when you emptied all your Traditional IRAs after converting them to Roth and you don’t have any SEP or SIMPLE IRAs. If you had a few dollars of earnings posted in the Traditional IRA after you converted and you left them in the account, get the value from your year-end statement and put it in the second box. The software will apply the pro-rata rule.

The third box should also be zero when you made your 2024 contribution in 2024.

We didn’t take any disaster distribution.

Now continue with all other income items until you are done with income.

Clean Backdoor Roth On TopIf you did a “clean” backdoor Roth on top of converting the 2023 contribution in 2024 (contributed to a Traditional IRA for 2024 in 2024 and converted in 2024), the conversion part of the clean backdoor Roth is already included in the 1099-R form we just completed. Now we do the contribution part.

Find the “IRA Contributions” section under the “Deductions / Credits” menu.

Answer “Yes” to the first question. An excess contribution means contributing more than you’re allowed to contribute. We didn’t have that.

Enter the amount you contributed to the Traditional IRA for 2024 in the first box. Leave the answer to “Did you switch or recharacterize” at No. We converted. We didn’t switch or recharacterize. We didn’t repay any distribution either.

Your refund number goes up again after you enter the contribution.

We didn’t contribute to a SEP, solo 401k, or SIMPLE plan. Answer Yes if you did.

“Withdraw” means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer “No” here.

FreeTaxUSA shows the same page we saw before in the conversion section. Confirm and continue.

It tells us we don’t get a deduction because our income is too high. If you see a deduction here it means the software thinks your income qualifies for a deduction, which may or may not be correct. Please see the Troubleshooting section.

Taxable IncomeYou’re done with the 1099-R forms. Let’s look at how they show up on your tax return. Click on the three dots on the top right above the IRA Deduction Summary and then click on “Preview Return.”

Look for Lines 4a and 4b in your Form 1040.

Line 4a shows the amount on your 1099-R for the Roth conversion. Line 4b shows the taxable amount, which is the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth. The taxable amount on Line 4b would be zero if you didn’t have any earnings.

Form 8606Go toward the end of the pop-up to find Form 8606. It shows these for our example:

Line #Amount17,000 (only if you also did a “clean” backdoor Roth on top, otherwise blank.)26,5003The sum of Line 1 and Line 25The same as Line 38The amount on your 1099-R with a code 2 or 713The same as Line 314blank (or a small amount if your Traditional IRA had a small balance at the end of 2024)16The same as Line 817Line 3 minus Line 1418The difference between Line 16 and Line 17Form 8606TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

Conversion Is TaxedIf you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. FreeTaxUSA gives you the deduction if it sees that your income qualifies. It doesn’t give you the choice of making it non-deductible.

Part of your conversion could be taxed because you took a deduction on the Traditional IRA contribution last year or this year. You see whether you took a deduction by looking at Schedule 1 Line 20 on last year’s and this year’s tax returns.

The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal and it doesn’t cause any problems when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2.

Maybe you forgot the check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries in FreeTaxUSA to make sure they match the W-2.

Self vs SpouseIf you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 2 appeared first on The Finance Buff.

Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 1

[Updated on January 30, 2025 with updated screenshots from FreeTaxUSA for the 2024 tax year.]

The best way to do a backdoor Roth is to do it “clean” by contributing *for* and converting in the same year — contribute for 2024 in 2024 and convert in 2024, and contribute for 2025 in 2025 and convert in 2025. Don’t split them into two years: contributing for 2023 in 2024 and converting in 2024 or contributing for 2024 in 2025 and converting in 2025. If you did a “clean” backdoor Roth and you’re using FreeTaxUSA, please follow How to Report Backdoor Roth In FreeTaxUSA (Updated).

However, many people didn’t know they should’ve done it “clean.” Some people thought it was natural to contribute to an IRA for 2024 between January 1 and April 15, 2025. Some people contributed directly to a Roth IRA for 2024 in 2024 and only found out their income was too high when they did their 2024 taxes in 2025. They had to recharacterize the previous year’s Roth IRA contribution as a Traditional IRA contribution and convert it again to Roth after the fact.

When you contribute for the previous year and convert (or recharacterize and convert in the following year), you have to report them on your tax return in two different years: the contribution in one year and the conversion in the following year. It’s more confusing than a straight “clean” backdoor Roth but that’s the price you pay for not knowing the right way. This post shows you how to enter the contribution part in FreeTaxUSA for the first year. Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 2 shows you how to do the conversion part for the second year.

I’m showing two examples — (1) a direct contribution to a Traditional IRA for the previous year; and (2) recharacterizing a Roth contribution for the previous year as a Traditional contribution. Please see which example matches your scenario and follow along accordingly.

Table of ContentsContributed for the Previous YearContributed to Traditional IRAForm 8606Break the CycleRecharacterized Roth ContributionContributed to Roth IRARecharacterized to TraditionalForm 8606Switch to Clean Backdoor RothTroubleshootingNo 1099-RContribution Is DeductibleContributed for the Previous YearHere’s the example scenario for a direct contribution to the Traditional IRA:

You contributed $7,000 to a Traditional IRA for 2024 between January 1 and April 15, 2025. You then converted it to Roth in 2025.

Because your contribution was *for* 2024, you need to report it on your 2024 tax return by following this guide. Because you converted in 2025, you won’t get a 1099-R for your conversion until January 2026. You will report the conversion when you do your 2025 tax return. Come again next year to follow Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 2.

If you contributed to a Traditional IRA in 2024 for 2023, everything below should’ve happened in your 2023 tax return. In other words, if this fits you:

You contributed $6,500 to a Traditional IRA for 2023 between January 1 and April 15, 2024. You then converted it to Roth in 2024.

Then you should’ve gone through the steps below in your 2023 tax return. If you didn’t, you should fix your 2023 return. The conversion part is covered in Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 2.

If you’re married and both you and your spouse did the same thing, you must follow the same steps below for both you and your spouse.

If you first contributed to a Roth IRA in 2024 and then recharacterized it as a Traditional contribution in 2025, please jump over to the next example.

Contributed to Traditional IRA

Find the “IRA Contributions” section under the “Deductions / Credits” menu.

Answer Yes to the first question even though it says “during” 2024 when you contributed “for” 2024 in 2025. An excess contribution means contributing more than you’re allowed to contribute. We didn’t have that.

Enter the amount you contributed to the Traditional IRA in the first box. Leave the answer to “Did you recharacterize” at No. We converted. We didn’t switch or recharacterize. We didn’t repay any distribution either.

We didn’t contribute to a SEP, solo 401k, or SIMPLE plan. Answer Yes if you did.

Withdraw means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer “No” here.

The first box is normally zero if this is the first time you contributed to a Traditional IRA. If you made nondeductible contributions to a Traditional IRA in previous years, get the value from your last year’s Form 8606 Line 14 (assuming you did your tax return correctly). If you entered a number in the first box because you didn’t understand what it was asking, now is the chance to correct it.

The second box is also blank or zero when you had no Traditional, SEP, or SIMPLE IRA as of December 31, 2024.

Enter your contribution in the third box because you did it between January 1 and April 15, 2025.

It tells us we don’t get a deduction because our income was too high. We know. That’s why we did the Backdoor Roth. If the number isn’t zero here, it means the software thinks you qualify for a deduction with your income. You don’t have a choice to decline the deduction.

Form 8606Let’s look at Form 8606 to confirm that it did everything correctly. Click on the three dots on the top right above the IRA Deduction Summary page and then click on “Preview Return.”

Scroll toward the end of the tax forms to find Form 8606. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number on Line 14. This number will carry over to 2025. It’ll make your conversion in 2025 not taxable.

If you don’t see a Form 8606 or if your Form 8606 doesn’t look right, please check the Troubleshooting section.

Break the CycleWhile you’re at it, you should break the cycle of contributing for the previous year and create a new habit of contributing for the current year. Contribute to a Traditional IRA for 2025 in 2025 and convert in 2025.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2024 contribution and your 2025 contribution in 2025. Then you will start 2026 fresh. Contribute for 2026 in 2026 and convert in 2026.

Recharacterized Roth ContributionNow let’s look at our second example scenario.

You contributed $7,000 to a Roth IRA for 2024 in 2024. You realized that your income was too high when you did your 2024 taxes in 2025. You recharacterized the Roth contribution for 2024 as a Traditional contribution before April 15, 2025. The IRA custodian moved $7,100 from your Roth IRA to your Traditional IRA because your original $7,000 contribution had some earnings. Then you converted it to Roth in 2024.

Because your contribution was for 2024, you need to report it on your 2024 tax return by following this guide. Because you converted in 2025, you won’t get a 1099-R for your conversion until January 2026. You will report the conversion when you do your 2025 tax return. Come back again next year to follow Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 2.

Similar to our first example, if you did the same in 2024 for 2023, you should’ve done everything below when you did your 2023 taxes. In other words, if this fit you:

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your income was too high when you did your 2023 taxes in 2024. You recharacterized the Roth contribution for 2023 as a Traditional contribution before April 15, 2024. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. Then you converted it to Roth in 2024.

Then you should’ve taken all the steps below last year in your 2023 tax return. If you didn’t, you need to fix your 2023 return. The conversion part is covered in Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 2.

Contributed to Roth IRA

Find the IRA Contributions section under the “Deductions / Credits” menu.

Answer “Yes” to the first question. An excess contribution means contributing more than you’re allowed to contribute. We didn’t have that.

Enter your contribution in the second box because you originally contributed to a Roth IRA. Answer “Yes” to “Did you switch or recharacterize.” We didn’t repay any special distribution.

Recharacterized to Traditional

Select “Yes” to confirm you recharacterized a contribution. It opens up additional inputs for a statement required by the IRS. If you recharacterized 100% of your original contribution, enter it in the first box. It’s $7,000 in our example. We enter $7,100 from our example in the second box, which is the amount that the IRA custodian moved from the Roth IRA to the Traditional IRA when we recharacterized.

We didn’t contribute to a SEP, solo 401k, or SIMPLE plan. Answer Yes if you did.

Withdraw means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer “No” here.

All three boxes should normally be blank or zero.

The first box is normally zero when you didn’t make any nondeductible contributions to a Traditional IRA in previous years. If you did, get the value from your last year’s Form 8606 Line 14 (assuming you did your tax return correctly). If you entered a number in the first box because you didn’t understand what it was asking, now is the chance to correct it.

The second box is also blank or zero when you had no Traditional, SEP, or SIMPLE IRA as of December 31, 2024.

The third box is also blank or zero because you made the original contribution in 2024. Recharacterizing makes it as if you contributed to a Traditional IRA to begin with.

It tells us we don’t get a deduction because our income was too high. We know. That’s why we did the Backdoor Roth. If the number isn’t zero here, it means the software thinks you qualify for a deduction with your income. You don’t have a choice to decline the deduction.

Form 8606Let’s look at the Form 8606 to confirm that it did everything correctly. Click on the three dots on the top right above the IRA Deduction Summary and then click on “Preview Return.”