Harry Sit's Blog, page 7

June 20, 2024

2 Ways to Use Fidelity as a Bank Account

[Rewritten on June 20, 2024 after Fidelity made a money market fund available as the default option in the Cash Management Account. Also added a section on debit card security.]

Fidelity Investments is best known as an administrator for workplace retirement plans and an online broker for retail investors. In addition to 401k/403b accounts, Traditional and Roth IRAs, HSAs, and taxable brokerage accounts, Fidelity also offers accounts that can be used for the same purpose as a checking account and a savings account.

Because Fidelity is interested in having a full relationship with its customers for both banking and investing and its primary focus is on the investing part, it’s in a good position to offer better rates and features than banks in the banking part.

This is not a sponsored post. Fidelity isn’t paying me to promote it. I’m only writing as a satisfied customer of over 20 years. Here are two ways to use a Fidelity account to manage day-to-day spending and savings.

Table of Contents1. CMA as CheckingIncluded FeaturesChoose Core PositionRouting Number and Account NumberLimitationsSecure Your Debit CardLink to External Account2. CMA as Checking/Savings ComboBuy Another Money Market FundCash Manager Not NeededAdd Treasury Bills or Brokered CDs1. CMA as CheckingFidelity Cash Management Account (CMA) is a separate account type from Fidelity’s regular taxable brokerage account officially called “The Fidelity Account.” You have to choose the account type when you open the account. A Cash Management Account can’t be changed to a regular taxable brokerage account after you open the account. Nor can an existing regular taxable brokerage account be changed to a CMA.

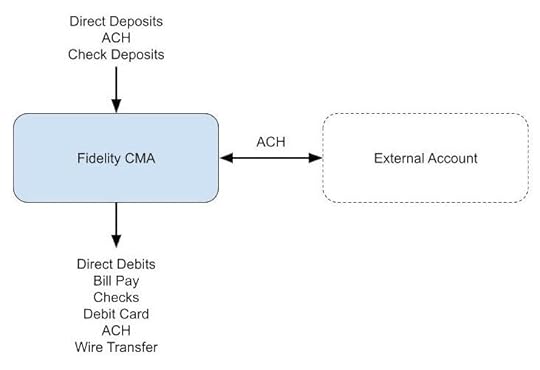

Included FeaturesThe Cash Management Account is specifically designed to meet banking needs. It has pretty much everything people need for a checking account and nearly everything is free.

– FDIC-insured balance (2.72% APY as of June 19, 2024) or a money market fund (4.95% 7-day yield as of June 19, 2024).

– No minimum balance. No maintenance fee. Does not require direct deposit.

– Provides a routing number and an account number for direct deposits and direct debits.

– Accepts check deposits by mobile app or in person at a Fidelity branch.

– Free checkbook. No minimum amount for writing a check.

– Free Visa debit card for purchase, ATM withdrawal, and teller cash advance. It does not require using the debit card a minimum number of times per month.

– No fee to use any ATM worldwide. Reimburses the ATM fee charged by the machine.

– Free Bill Pay service with eBill.

– Free same-day ACH. Push $100,000 per business day out of Fidelity and pull $250,000 per business day into Fidelity by online self-service. Call customer service to transfer a higher amount.

– Free wire transfers. Same $100,000 per business day by online self-service. Call customer service to wire a higher amount.

Choose Core PositionThe “core position” in a Fidelity account is the default holding. Money coming into the account lands in the core position and money going out of the account is withdrawn from the core position first.

You have a choice to keep your core position either in FDIC-insured banks or in a money market fund. The money market fund isn’t FDIC-insured but its underlying holdings are short-term government securities. I’m comfortable keeping my money in the money market fund for a higher yield. See No FDIC Insurance – Why a Brokerage Account Is Safe.

To switch from the FDIC-Insured Deposit Sweep Program to the Fidelity Government Money Market Fund (SPAXX), click on the “Positions” tab and select your cash balance. You will see a “Change Core Position” button.

Your chosen core position stays effective until you change it again. If you make Fidelity Government Money Market Fund (SPAXX) your core position, your existing core balance and all future deposits will automatically go into the money market fund.

The 4.95% yield from the money market fund is higher than the yield on many high-yield savings accounts as of June 19, 2024. For example, Ally Bank pays only 4.2% on its high-yield savings account, which doesn’t have all the checking features such as Bill Pay.

Routing Number and Account NumberYou see the routing number and the account number for direct deposits and direct debits when you click on the routing number link below the account name.

Choose “checking” as the account type if you’re asked to select one.

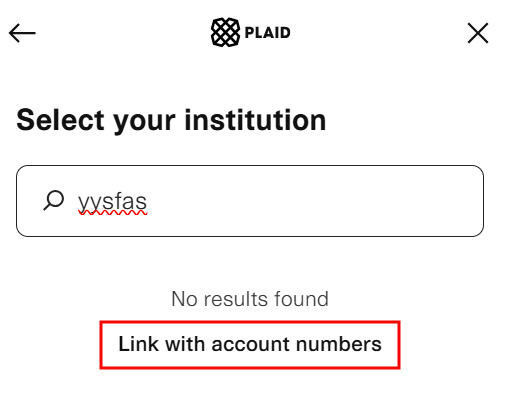

If your bank uses Plaid to add a Fidelity account as a linked bank account, search for a non-existent bank and then click on “Link with account numbers.” It will make Plaid use a micro-deposit to verify your Fidelity account.

You go back to verify the link after you receive the micro-deposit in your Fidelity account.

LimitationsFidelity Cash Management Account has some limitations that aren’t a deal-breaker to me.

– Does not accept deposits of physical cash or money orders.

– Does not support Zelle in the account. You can link the debit card in the Zelle mobile app.

– Does not link instantly through Plaid (must go through micro-deposits).

– Does not offer sub-accounts for tracking different goals.

– Does not provide cashier’s checks.

– Recurring ACH pushes out of Fidelity only support monthly and annual frequencies. Recurring ACH pulls into Fidelity only support weekly, biweekly, and monthly frequencies.

– 1% transaction fee on debit card purchases in foreign countries. This fee doesn’t apply to international ATM withdrawals.

– ACH pulls and check deposits are held for up to five business days. The money still earns interest. It’s just not available for withdrawal while it’s on hold. You won’t be subject to the hold if you know the right way to transfer money.

I use my otherwise dormant Bank of America checking account on those rare occasions when I need to deposit physical cash, get a cashier’s check, or set up recurring transfers on an odd schedule. I don’t use a debit card for purchases or track my savings by separate goals.

The hold time on ACH pulls and check deposits will shrink over time for established accounts on smaller amounts. My ACH pulls and check deposits are usually available for withdrawal in two business days. I do an ACH push from the other side when I need it to be available immediately.

Secure Your Debit CardThe account automatically comes with a Visa debit card. The debit card can be used for purchases without a PIN when it’s run as a credit card. This creates a problem in case your debit card is lost or stolen. A user posted on Reddit that he or she was having a hard time getting the money back after thieves bought $6,000 worth of gift cards with the stolen debit card.

It’s better not to carry the debit card with you in your wallet. If you prefer to use a debit card for purchases, put the debit card in Apple Pay or Google Pay and tap your phone to pay. It’s more difficult for criminals to crack a phone than to tap your lost or stolen debit card everywhere. If you normally don’t use a debit card for purchases, keep it at home and only take it with you when you anticipate needing to withdraw cash at an ATM.

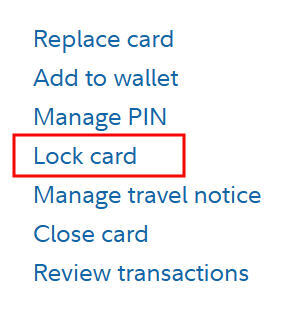

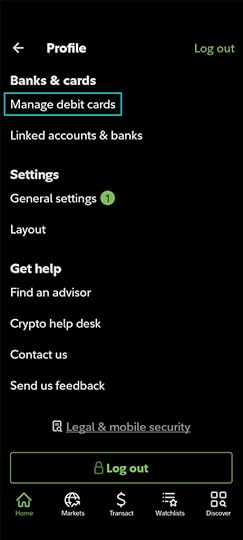

You can also lock your debit card on Fidelity’s website or in the Fidelity mobile app. Locking the card makes it decline all transactions. I previously used the debit card in Venmo to pay friends for shared expenses. Venmo also works with a bank account. I added the Fidelity account as a bank account and removed the debit card from Venmo. Now my debit card is securely locked at all times. I’ll only unlock it when I need to use it to withdraw cash.

To lock the debit card online, open a new tab in your browser after you log in to Fidelity and go to fidelitydebitcard.com. Find your debit card and click on “Lock card.”

If you install the Fidelity mobile app on your phone, you can unlock the debit card right before you need to use the card to withdraw cash and lock it again when you’re done. Tap the head icon on the top right to find “Manage debit cards” in your profile in the Fidelity app. Tap “Lock or unlock card” on the next screen to lock or unlock the card.

Link to External Account

Link to External AccountWhen you use a Fidelity CMA as your checking account, you can link it to an external account as you normally do with a checking account. For example, the settlement fund in a Vanguard brokerage account pays 5.27% as of June 19, 2024. You can use Vanguard as your savings account to earn a slightly higher yield while using the Fidelity CMA as your checking account. The bulk of your cash earns 5.27% at Vanguard while the amount you need for spending earns 4.95% in the Fidelity CMA.

2. CMA as Checking/Savings Combo

2. CMA as Checking/Savings ComboInstead of linking to an external savings account, you can put the money in a different money market fund in the Cash Management Account and keep both checking and savings in the same account.

Buy Another Money Market FundAlthough the CMA is designed for banking needs, it’s still a brokerage account. With some exceptions (no margin or options), you can buy in the CMA pretty much everything available in a regular brokerage account. This includes stocks, bonds, brokered CDs, mutual funds, and ETFs.

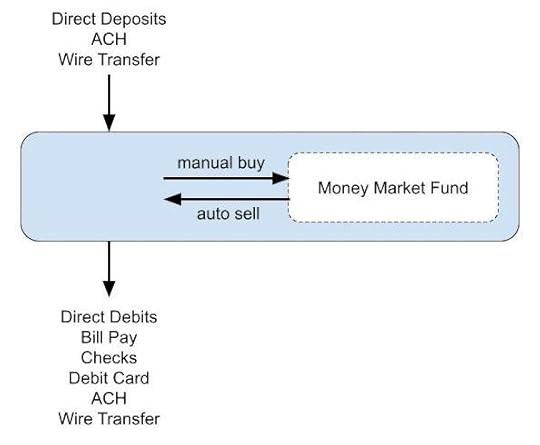

The CMA becomes a checking/savings combo when you buy a different money market fund in it. The core balance in the CMA serves as the checking part and the manually purchased non-core money market fund serves as the savings part. Fidelity will automatically sell from the non-core money market fund when your core balance in the CMA is insufficient to cover a debit. This is like having free automatic overdraft transfers from savings to checking.

Some people prefer to buy Fidelity Money Market Fund (SPRXX) or Fidelity Money Market Fund Premium Class (FZDXX). Their yields were 5.02% and 5.14% respectively as of June 19, 2024, which were slightly higher than the 4.95% yield on Fidelity Government Money Market Fund (SPAXX) in the core position. Some people prefer to buy Fidelity Treasury Only Money Market Fund (FDLXX), which had a 4.93% 7-day yield as of June 19, 2024 but more of the income is exempt from state income taxes. None of the these funds can be set as the default core position but you can buy them manually. See Which Fidelity Money Market Fund Is the Best at Your Tax Rates.

Because Fidelity will automatically sell from the non-core money market fund to cover debits, if you’re so inclined, you can be aggressive in keeping the core balance in the CMA close to zero while keeping the bulk of your account in a different money market fund earning a slightly higher yield. Or you can set a maximum target balance alert with the Cash Manager to buy more shares of the non-core money market fund when you have excess cash in the “checking” part.

Some people prefer to just keep everything in the default Fidelity Government Money Market Fund (SPAXX) because the extra yield from a non-core money market fund is quite small.

Cash Manager Not NeededYou may have seen some convoluted setups using the Cash Manager overdraft feature in the Fidelity CMA. It’s unnecessary and undesirable.

The only thing remotely useful in the Cash Manager is the maximum balance alerts. An alert only tells you that your CMA core balance exceeded the maximum target balance. It doesn’t automatically buy a non-core money market fund in the CMA for you. You still have to buy it manually if you want.

You don’t need an alert for the CMA core balance dropping below a minimum balance when you have enough savings in a non-core money market fund held in the CMA. Selling from the non-core money market fund held within the CMA to cover debits works out of the box. It happens automatically anyway even if you don’t set up anything in the Cash Manager.

The Cash Manager has a “self-funded overdraft protection” feature to link the CMA to another Fidelity account or an external bank account. This is unnecessary and undesirable when you want the CMA to stand by itself. You don’t want unauthorized debits to affect your other accounts.

Add Treasury Bills or Brokered CDsIf you’d like to take it one step further, you can also buy Treasury Bills or brokered CDs in the CMA when you have money that you know you won’t need for some time. The CMA then becomes a checking/savings/CD combo. The money automatically goes into the “checking” part when the Treasury Bill or brokered CD matures. For example, the amount set aside for the next property tax bill can go into a Treasury Bill or a brokered CD. See How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy CDs in a Fidelity Brokerage Account.

Please note if you enable the “auto roll” feature when you buy new-issue Treasury Bills or brokered CDs in the CMA, the amount for the next roll reduces your “available to withdraw” number for a few days during the roll. A debit may fail if you don’t have enough available to withdraw. It’s not a problem if you don’t use auto roll or if you keep a substantially higher amount in a money market fund than the amount for the next roll.

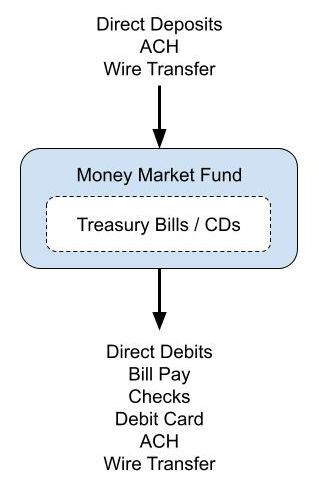

Using a Fidelity CMA for spending and savings becomes truly set-and-forget. All deposits automatically earn about a 5% yield as of June 19, 2024. All debits come out of this money market fund. It’s like using a savings account as a checking account. You can manually buy a non-core money market fund but you don’t have to. The yield on the default Fidelity Government Money Market Fund (SPAXX) is close enough to the yield on another Fidelity money market fund.

You can still buy Treasury Bills or brokered CDs to set aside money for specific bills in the future. Please note the caveat on “auto roll” and “available to withdraw” mentioned above. It’s better to do it in a different brokerage account if you prefer to use “auto roll.”

***

The biggest draw of using the Fidelity CMA for spending and short-term reserves is the checking features. You effectively use a savings account as a checking account and earn a good yield from the first dollar. Everything is seamlessly together.

A Vanguard money market fund and some less well-known high-yield savings accounts pay more but they don’t offer checking features. When you pair it with a checking account that pays close to zero, the blended yield on all your cash goes down. For example, if you have $5,000 in a checking account that pays 0.1% and you have $50,000 in a Vanguard money market fund that pays 5.27%, your blended yield on $55,000 is 4.8%. You might as well put the whole $55,000 in a Fidelity CMA earning 4.95% and eliminate the need to watch your checking account balance and transfer back and forth between two accounts.

Transitioning a checking account takes some time and effort. Banks know it. That’s why they pay you close to zero in checking accounts. They bet that you think it takes too much work to switch. Don’t fall for it. It’s easier than you think when you take your time to make the move.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2 Ways to Use Fidelity as a Bank Account appeared first on The Finance Buff.

May 5, 2024

Model Big Financial Decisions with MaxiFi Software

I use the free Fidelity retirement planning tool to keep an eye on our current investments relative to our spending. Using that tool revealed two fundamental drivers of financial success in retirement.

Good ReturnsBad ReturnsLow SpendingOKOKHigh SpendingOKNot OKAlthough my wife said the two fundamental drivers were only too obvious, the planning tool gives us an idea of how low is low and how high is high.

Table of ContentsConventional Retirement CalculatorMaxiFiBase Plan and Maximized PlanDiscretionary Spending as a MetricSocial Security Claiming StrategyAssumptions, Assumptions, AssumptionsAlternative ProfilesRoth ConversionsIgnore the PrecisionMonte CarloSupportOther SoftwareConventional Retirement CalculatorThe Fidelity retirement planning tool uses a conventional approach. It gathers your investments and asks you how much you plan to spend. Then it simulates future returns to see how well your investments will cover your planned spending. It’s a success if your projected balance is above zero at the end of your planning horizon. Many retirement planning tools work like this. I just happen to use the one from Fidelity because it’s available and free.

It isn’t easy to use the tool to model big financial decisions such as staying in a high-cost-of-living area after retirement versus relocating as we did last time in Moving to Lower Cost of Living After You Retire. You can run the projections and save the report as a PDF, change the assumptions, run it again, save the new report as a PDF, and compare the two PDFs. If you’d like to go back to your original assumptions, you must remember where you made changes and back out all your changes.

When I compare the effects of different levels of spending, I use my login to run one level of spending and my wife uses her login to run a different level of spending. Then we compare the two PDFs. It works for a simple A-B comparison but it’s difficult to do more than that.

MaxiFiOther financial planning applications are better equipped for tactical planning. MaxiFi is one of them.

MaxiFi is online financial planning software from a company led by Boston University economics professor Larry Kotlikoff. The Standard version costs $109 for the first year ($89/year for renewal) and the Premium version costs $149 for the first year ($109/year for renewal). I bought the Premium version last year to see how it worked.

I played with the software but I’m far from an expert user. Reader Dennis Hurley is more experienced with MaxiFi. He helped me get up to speed. I’m only describing how I used MaxiFi. It may not be the officially correct way as intended by the software maker.

MaxiFi takes an unconventional approach. It doesn’t link your accounts. It only asks for the total amount in your pre-tax, Roth, and taxable buckets respectively. It doesn’t ask what investments you have in your accounts. You enter your expected safe return for each bucket in the settings. It doesn’t ask how much you plan to spend unless it’s one-time or episodic (“special expenses”). The software calculates your available discretionary spending based on the principle of consumption smoothing.

Discretionary spending in MaxiFi is in economic terms. It isn’t what we normally think of as discretionary in everyday life. MaxiFi treats housing, taxes, Medicare Part B premiums, life insurance, and special expenses as fixed spending. Everything else is discretionary spending. You would think food isn’t discretionary but that’s just how MaxiFi categorizes things. If the term “discretionary” bothers you, just give it a different name or simply call it “other.”

Base Plan and Maximized PlanMaxiFi starts by asking about your current financial situation and your assumptions for inflation, expected returns, your desired retirement age, when you will start withdrawing from your retirement accounts, and when you’re thinking of claiming Social Security. This generates a Base Plan.

Then it offers to improve the Base Plan by automatically testing changes to when you will claim Social Security, when you will start smooth withdrawals from your retirement accounts, whether you’ll withdraw from pre-tax accounts first or Roth accounts first, and whether you’ll consider buying an annuity.

You can say yes or no to which item you want the software to change. MaxiFi will generate a Maximized Plan by testing different combinations of those items and picking a plan that has the highest lifetime discretionary spending. If you’re happy with the changes, you can apply them to the Base Plan in one click.

Discretionary Spending as a MetricMaxiFi sees a change as an improvement when it increases the calculated discretionary spending. I treat the annual discretionary spending from MaxiFi only as a metric. I don’t see it as the software mandating that I must spend that amount every year. I only use the amount of discretionary spending to compare different situations. I know that a move is a good one if it increases my available discretionary spending.

Social Security Claiming StrategyIf you’re married and you set the maximum age to 98 or 100 for both of you, MaxiFi will most likely suggest that you both delay claiming Social Security to age 70. Don’t be surprised this differs from the output of other tools such as Open Social Security.

Open Social Security uses mortality tables with weighted probabilities of living to different ages. MaxiFi uses fixed ages from your inputs. If you say both of you will live to 100 for sure, the best strategy naturally is to delay to age 70 for both. You’ll see different strategies when you create different profiles with both spouses living to 85 or one spouse living to 95 and the other living to 83, etc. I like Open Social Security’s approach better in this regard.

The maximum age inputs also affect annuity suggestions in the Maximized Plan. If you say both of you will live to 100 in the profile, buying an annuity will naturally be helpful if you turn on optimizing annuities. I set the annuity options to “no” when I run a Maximized Plan.

Assumptions, Assumptions, AssumptionsMaxiFi is a modeling tool. It can’t predict the future. No software can. All outputs are based on a specific set of assumptions. I automatically add “based on this set of assumptions” to every output I read from MaxiFi.

The Maximized Plan is optimal only based on one set of assumptions. The optimal plan will be different under a different set of assumptions. I see the value of MaxiFi not as much in generating a withdrawal and spending plan based on a set of assumptions but more in testing different assumptions.

Alternative ProfilesMaxiFi makes it easy to compare different scenarios. You duplicate the Base Profile into an Alternative Profile, make changes in the Alternative Profile, and compare it with the Base Profile. You can have up to 25 alternative profiles and compare between different profiles. This helps answer all sorts of “Can I afford it?” and “Should I do A or B?” questions:

Can I retire now versus 5 years from now?

Can I afford to buy a more expensive house?

Will sending my kids to private school derail my retirement?

Should I pay cash for a home or get a mortgage?

Should I stay in my current home or downsize or relocate?

Should I sell my house or rent it out?

These big financial decisions require more attention because they tend to be one-time, all-or-nothing, and costly to switch.

You’ll see the impact on your available discretionary spending when you compare outputs between alternative profiles. You know you’ll have more money to spend if you work another 5 years, but by how much? You create one profile with retiring now, duplicate it, change the retirement date, and compare. You know you’ll have less money for retirement if you send your kids to private school, but by how much? You duplicate your current profile into an alternative profile, add the extra expenses, and compare it with your current profile.

A reader said he was interested in moving from a high cost-of-living area but selling his home will trigger taxes on a large capital gain well beyond the $500k tax exemption. The NYT buy-or-rent calculator I used in the previous post doesn’t take into account the built-in capital gain. MaxiFi does.

I created one hypothetical profile in MaxiFi with a home in California worth $2.5 million and a cost basis of $500k ($2 million unrealized capital gain before the tax exemption). I duplicated it into another profile and made changes to sell the home in California, pay federal and state taxes on the capital gains, and buy a $1 million home in Georgia. MaxiFi shows this when I compared the two profiles:

It shows how much the lifetime discretionary spending would increase based on a set of assumptions by selling the California home and moving to Georgia despite having to pay capital gains taxes on $2 million. I can create additional profiles and compare again with the home value growing faster in California than in Georgia or different inflation rates and different investment returns.

MaxiFi can’t predict the future but it can help you model different scenarios.

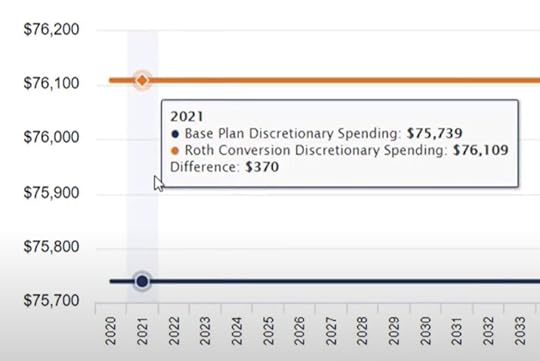

Roth ConversionsYou can also use alternative profiles to model Roth conversions. MaxiFi doesn’t suggest how much you should convert but you can test converting different amounts between ages X and Y in alternative profiles. Here’s a video from MaxiFi on how to model a Roth conversion:

Ignore the PrecisionAny modeling software will calculate to the exact dollar but I ignore the precision. Because projections are based on assumptions, it will be a miracle if a projection gets the first two digits correct in real life. It’s difficult to even get the first one digit right.

In the previous example, if a retired couple sells a $2.5 million home in California and moves to Georgia, will they really increase their lifetime discretionary spending by $500,817? It could turn out to be $300k, $400k, $600k, or $700k. I don’t think you can have high confidence it’ll be $500k in real life. All you can say is that selling and moving is directionally beneficial if the assumptions aren’t too far off.

The Roth conversion video from MaxiFi shows that the conversion amount being considered would raise the annual discretionary spending from $75,739 to $76,109 based on a set of assumptions. I would call it a toss-up. The $370 difference is too small because it’s less than 0.5% of the annual discretionary spending. Converting that amount in real life could be better or it could be worse. I can’t even say it’s directionally beneficial. I would look for moves that make a bigger difference.

Monte CarloThe Premium version of MaxiFi includes Living Standard Monte Carlo®, which simulates how different investment strategies and spending behaviors impact your living standard. The $40 price difference between the Stand version and the Premium version in the first year isn’t much. You might as well try the Monte Carlo reports to see if they’re helpful but I find the standard reports more useful than the Monte Carlo reports.

A problem with Monte Carlo is that it always shows a wide range of outcomes. My available spending can be $50k a year if returns are poor or it can be $200k a year if returns are good. So do I spend $50k or $200k? If I spend $50k a year, I’ll have a ton of money left that I could’ve enjoyed when returns aren’t that bad. If I spend $200k a year, it won’t be sustainable when returns are poor. This isn’t unique to MaxiFi. That’s just the nature of the beast. No software can remove this uncertainty.

I find more value in the reports in the Standard version of MaxiFi because I only use the annual spending from the software as a metric to compare different scenarios. I don’t go by the spending output from the software for my actual spending. If you want to save a little bit of money, maybe start with the Standard version and upgrade to Premium when you decide to use MaxiFi long term.

SupportMaxiFi has a user’s manual on its support website and how-to videos and webinars on YouTube. The company also offers online office hours twice a month to answer questions. If you can’t figure out how to model something, you can send an email to MaxiFi customer service and they’ll tell you. If you want a MaxiFi expert to review your plan and help you interpret the results, it’s $250 for a one-hour video session. I get the sense that they really want to help you make good financial decisions with the software.

Other SoftwareI’m satisfied with MaxiFi overall. It’s inexpensive and useful to model big financial decisions. No software can predict the future but you don’t have to throw up your hands and leave big financial decisions to gut feelings.

I don’t expect any software to tell me how much I can spend that won’t lead to having a big pile of money in the end when returns are good or having to adjust the spending down when returns are poor. That’s not how I use MaxiFi.

Set a wide range of assumptions and evaluate the wide range of outcomes. You still won’t know how exactly a big financial decision will turn out in real life but you’ll have some idea of a range and understand what will influence the outcomes. It’s a steal to pay only $109 or $149 for a tool to help you make big financial decisions.

MaxiFi isn’t the only financial planning software. I can’t say it’s the best because I haven’t used many other software to compare. I only know it’s more powerful than the free Fidelity retirement calculator. NewRetirement and Pralana are in the same $100 – $150 price range. If you have big financial decisions coming up and you’re not sure which software to use, try them all and pick your favorite. I’m going to buy Pralana to try it when my MaxiFi license expires.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Model Big Financial Decisions with MaxiFi Software appeared first on The Finance Buff.

May 1, 2024

Check These Before You Transfer an Account From Vanguard

I received an email from Vanguard notifying me of upcoming changes to its fee schedule. The one change that stands out for me is that Vanguard may charge $100 effective July 1 if I transfer an account to another broker unless I have $5 million with Vanguard.

I’ve been investing with Vanguard for over 25 years. I have had the feeling from some changes by Vanguard in recent years that I’m not as valued as before. This latest announcement finally pushed me to the inevitable. I submitted a request to transfer my account to Fidelity before the new fee takes effect.

If you’re thinking along the same lines, you should check a few things before you transfer your accounts out of Vanguard.

Table of Contents1. Do you have a taxable account at Vanguard?2. Cost Basis Method Election in Taxable Account3. Do you have Vanguard mutual funds?4. Do your Vanguard mutual funds have ETF shares?5. Wait for Everything to Settle6. Save Cost Basis Details of Taxable Accounts7. Save Account Number and Recent Statement8. Request Transfer of Assets at the Receiving Firm9. Verify Cost Basis in Taxable Account10. Residual Sweep11. Dividend Reinvestment and Cost Basis Settings in the New Account1. Do you have a taxable account at Vanguard?Tax-advantaged accounts such as Traditional and Roth IRAs can be transferred to another broker without tax consequences. The transfer doesn’t generate a 1099 form. It doesn’t count toward your annual contribution limit. Please skip to Step 3 if you only have tax-advantaged accounts at Vanguard.

Transferring a regular taxable brokerage account needs more careful attention.

2. Cost Basis Method Election in Taxable AccountIf you have mutual funds (not stocks, ETFs, bonds, or brokered CDs) in a regular taxable brokerage account, you should first make sure the cost basis method of your holdings is set to Specific Identification (“SpecId”). The default cost basis method for mutual funds is Average Cost. Setting it to SpecId will transfer the cost basis of each tax lot when you transfer your account. It’ll help you minimize taxes when you sell in the future.

This only applies to taxable accounts. You don’t need to do anything with the cost basis method in tax-advantaged accounts.

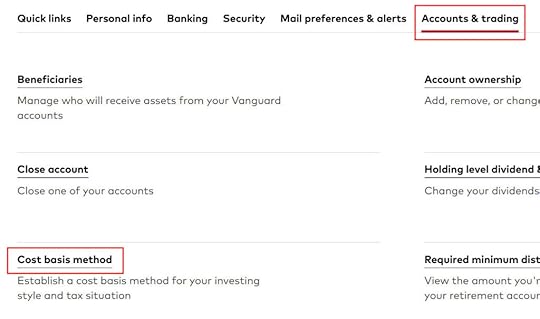

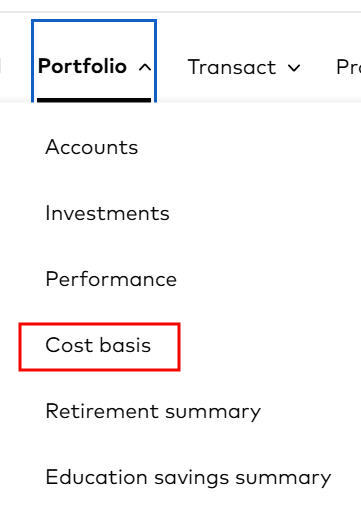

You can see or change your current setting in Profile & settings (the head icon) -> Accounts & trading tab -> Cost basis method.

The change may take a day or two to complete. Wait until it’s done before you continue.

3. Do you have Vanguard mutual funds?Individual stocks, ETFs, bonds, and brokered CDs are all equally available at another broker. You can transfer these easily to another broker and hold, buy, or sell them at the new broker. Please skip to Step 5 if you only have individual stocks, ETFs, bonds, and brokered CDs in your Vanguard account.

If you have Vanguard mutual funds, there’s usually no charge for holding existing shares or automatically reinvesting dividends at another broker but you may have to pay a commission when you buy more shares of those funds. Fidelity and Charles Schwab don’t charge a commission for selling shares of Vanguard mutual funds you already own but they do charge for buying additional shares outside of automatic dividend reinvestments. Some other brokers charge for both buying and selling.

I have Vanguard mutual funds but I’m not buying new shares in those funds. I will only hold, automatically reinvest dividends, and sell my existing shares over time. I won’t incur any fees when I hold my Vanguard mutual funds at Fidelity.

4. Do your Vanguard mutual funds have ETF shares?If you have Vanguard mutual funds and you want to buy more shares in the future besides automatically reinvesting dividends, see if your funds are also available as an ETF. Look up the fund on Vanguard’s website. If the fund is also available as an ETF, it will say so under the name of the fund.

Vanguard can convert these mutual funds to the equivalent ETF tax-free without a fee. You’ll need to call Vanguard to convert them to ETF. After your funds are converted to ETFs, you can transfer the resulting ETFs to another broker and buy more shares of the ETFs at the new broker.

Be sure to complete Step 2 before you call Vanguard to convert your mutual fund to ETF in a taxable account. If the mutual fund is still on the Average Cost method when it gets converted, the converted ETF will only have the average cost.

There’s a small risk that Vanguard will mess up the cost basis when you convert your mutual funds to ETFs in a taxable account. I didn’t want to take that chance when I transferred a taxable account from Vanguard. I’m OK with only holding the Vanguard mutual funds, automatically reinvesting dividends, and selling without a commission at Fidelity. I just won’t buy new shares.

Some Vanguard funds aren’t available as an ETF. If you transfer your account, buying new shares of those funds will likely incur a commission at the new broker. You’ll have to find an alternative. Some Vanguard funds not available as an ETF are still the best-in-class. Maybe you should keep your account at Vanguard if you will buy more shares of those funds.

5. Wait for Everything to SettleIf you decide to transfer and you have recent transactions in your Vanguard account (money in, money out, trades, converting mutual funds to ETFs), you should wait for everything to settle before you transfer your account. It’s easier for everyone if you transfer when nothing is in the air.

6. Save Cost Basis Details of Taxable AccountsIt’s important to keep the cost basis records accurate when you transfer a taxable account. You should save or print your cost basis details before you transfer. This doesn’t apply to tax-advantaged accounts.

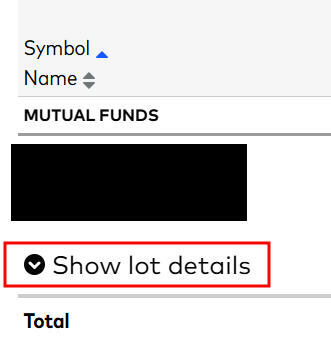

You see these details under Portfolio -> Cost basis.

Expand “Show lot details” under each holding. Save the page to a PDF or print it.

7. Save Account Number and Recent StatementYou’ll need to give your Vanguard account number and a recent statement when you transfer your account. The statements are under Activity -> Statements.

The statement doesn’t show your full account number. You need to copy your account number and save it separately.

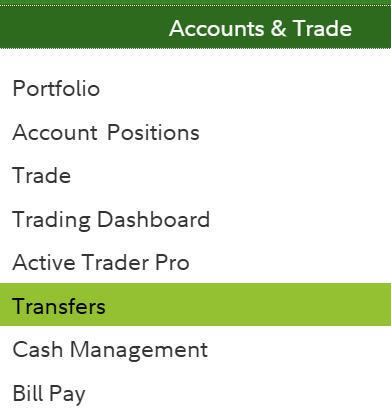

8. Request Transfer of Assets at the Receiving FirmYou should initiate the transfer at the receiving firm. The process is usually online. It’s under Accounts & Trade -> Transfers and then “Move an account to Fidelity” in Fidelity. Look for something similar at other brokers.

You’ll be asked where you’re transferring from, the account number at the sending firm, what type of account it is, whether you’d like to transfer everything in the account or only part of it, whether you’re transferring into an existing account or a new account (and create this new account when applicable), and finally to attach a recent account statement of the source account.

The account type should match (Traditional-to-Traditional, Roth-to-Roth, taxable-to-taxable, trust-to-trust). The account name should also match (individual-to-individual, joint-to-joint). If they don’t match, please fix them on either side first.

If you’re asked whether you’d like to transfer in-kind or sell and transfer cash, make sure to choose in-kind. In-kind means transferring each holding as-is without any change. Only transferring in-kind won’t trigger taxes in a taxable account.

The transfer usually takes a week or sooner to complete.

9. Verify Cost Basis in Taxable AccountIf the transfer is successful, the holdings will come over first without the cost basis details. That’s normal. The cost basis details will come in another week or two. You should verify the cost basis details against the records you saved in Step 6.

10. Residual SweepIf you do a full account transfer and any of your investments paid dividends during the transfer, the dividends may still go into your old account. There will be another automatic sweep to transfer any residual amounts. You don’t have to initiate it. It will come over in a few weeks.

11. Dividend Reinvestment and Cost Basis Settings in the New AccountDividend reinvestment and cost basis tracking method for your newly transferred holdings will follow the settings in the receiving account. Take a look and set them to your preference.

I automatically reinvest dividends and use the default cost basis method in tax-advantaged accounts. In a taxable account, I automatically send the dividends to the spending account and use Actual Cost for cost basis and Fidelity’s Tax-Sensitive default disposal method.

***

Transferring a Vanguard account isn’t difficult but it requires some planning, especially when you’re transferring a taxable account with mutual funds. Sometimes it’s better not to transfer. The most important parts are not to sell anything and trigger taxes and to preserve the cost basis records for individual lots in taxable accounts.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Check These Before You Transfer an Account From Vanguard appeared first on The Finance Buff.

April 22, 2024

Is It Worth Moving to Lower Cost of Living After You Retire?

I wrote in a previous post Our Experience in Building a Home Over Buying an Existing Home that I built a new home. By coincidence, the final all-in cost of this new home came to about the same as the net proceeds from selling my previous home in California four years ago. That previous home is worth a lot more now. If I take an average of the estimated value from Zillow and Redfin, it’s worth 50% more than my new home.

As a house though, the previous home has nothing to compare to the new home. It was a tract house built in the 1960s with 1/3 of the living space of my new home. Successive owners updated it here and there over 60 years but the structure was still the original.

How come a 60-year-old home is worth 50% more than a brand-new home three times its size? The value is obviously in the land. The land under that previous home is worth at least five times the land under my new home although the two pieces of land are of similar size.

When people talk about low-cost-of-living (LCOL) areas, high-cost-of-living (HCOL) areas, and very-high-cost-of-living (VHCOL) areas, the difference in cost of living is mostly driven by the cost of housing. After all, prices are the same when you order stuff from Amazon. Groceries and gas may cost a little more in some places but they don’t make up a large part of spending. Why is housing so much more expensive in some places than others?

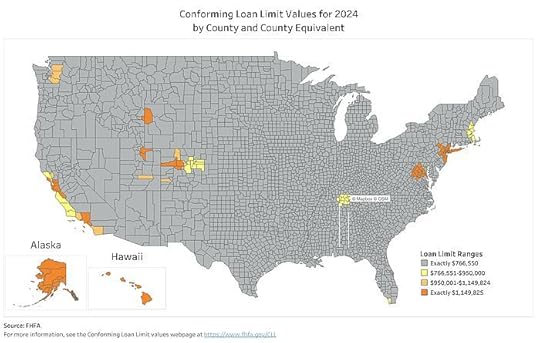

We get some clues by looking at where home prices are most expensive in the country.

Conforming Loan Limit MapThe Federal Housing Finance Agency (FHFA) sets a dollar limit on “conforming loans.” Mortgages under the conforming loan limit can be sold to Fannie Mae and Freddie Mac. The loan limit is the same in most places across the country. It’s 50% higher in some pockets with high home prices. The conforming loan limit map shows where these high-cost areas are.

Source: Conforming Loan Limit Map, Federal Housing Finance Agency

This map goes by counties. The dark orange counties on the map have the highest conforming loan limit in the country, which is a sign of the highest home prices.

AlaskaHawaiiNorthern California near San FranciscoSouthern California near Los AngelesTwo counties in Wyoming and Idaho near Jackson, WYTwo counties in Utah near Park City, UTThree counties in Colorado near Aspen, COWashington D.C. and nearby areas in Maryland, Virginia, and West VirginiaNew York City and nearby areas in New York, New Jersey, and PennsylvaniaTwo counties in Massachusetts near Martha’s VineyardWe see two themes from this list: major economic centers and vacation spots.

Homes are more expensive in major economic centers but so are incomes. I couldn’t have made it this far if I didn’t live in a VHCOL area with abundant good-paying jobs.

Homes are more expensive in vacation spots because people buy second homes there for their vacations and to rent to vacationers.

If you’re working, is it worth moving to a VHCOL area for a higher salary? If you’re retired, is it better to move away from a VHCOL area when jobs are no longer a factor?

Cost of OwnershipAlthough I said a buy-or-rent calculator should be the last step you take when you explore whether you should buy or rent, it’s a useful tool to compare the cost of owning a home in different places because the calculator converts the various costs of owning a home to a single rent-equivalent number. If owning a home in one place is equivalent to $4,000/month in rent and owning a home in a different place is equivalent to $3,000/month in rent, we know that housing in the first area costs $1,000/month more.

I ran the New York Times buy-or-rent calculator with these assumptions for three homes in different places costing $500k, $1 million, and $2 million:

Plan to stay in home: 20 yearsDown payment: 100% (no mortgage)Home price growth rate: 3%Rent growth rate: 3%Investment return rate: 7%Inflation rate: 3%Property tax rate: 1% of home valueMarginal tax rate: 25% (federal and state)Closing cost to buy: 0%Closing cost to sell: 6%Maintenance: $5,000 a yearHomeowner’s insurance: $2,000 a yearUtility covered by landlord if renting: $0Monthly common fees: $0Common fees deduction: 0%Security deposit if renting: 1 monthBroker’s fee if renting: $0Renter’s insurance if renting: $150/yearI set the maintenance cost and homeowner’s insurance to a fixed amount because the difference in the home values in different places is primarily in the land. A home in a VHCOL area doesn’t necessarily cost more to maintain or insure.

These are the rent-equivalent numbers for homes in three different places under my assumptions above. Please re-run the numbers if you prefer a different set of assumptions.

$500k Home$1 million Home$2 million HomeCost of Ownership$2,215/month$3,939/month$7,439/monthUnder these assumptions, a job seeker moving from an area where a home costs $500k to an area where a home costs $1 million will need to make $1,700/month or $20k per year more after taxes to cover the higher cost of housing. A retiree moving from where a home costs $2 million to where a home costs $1 million will save $3,500/month or $42k per year from the lower cost of housing under the same assumptions.

The difference in housing costs is sensitive to the assumed home price growth rate. If home prices in a VHCOL area grow faster because the area is a major economic center or a popular vacation spot, it lowers the cost of ownership. Here are the costs of ownership with different home price growth rates:

$500k Home$1 million Home$2 million HomeHome Price Growth3%/year4%/year4%/yearCost of Ownership$2,215/month$3,476/month$6,492/monthIf home prices in a VHCOL area grow only 1%/year faster, a $2 million home in the VHCOL area is still more expensive to own than a $500k home in the LCOL area, but it’s only 2.9 times as expensive, not 4 times. A 1% faster growth rate reduces the gap in costs of ownership between a $1 million home and a $2 million home from $42k a year to $31k a year. 1% faster growth lowers the gap between a $500k home and a $1 million home from $20k a year to $15k a year.

When you’re working, it’s worth moving to a VHCOL area when higher incomes and better career opportunities cover the higher cost of housing. That’s why housing costs more in those places.

For retirees, whether to move out of a VHCOL area is ultimately a lifestyle choice. Yes, it may cost $30k or $40k more per year but if you have family there and you can afford it, it may be worth it for you to stay put. On the other hand, if you aren’t too attached to a VHCOL area and you were there only for jobs, moving to a different place may free up $30k or $40k per year to spend on other things.

I still like this tweet on where to live in retirement from Christine Benz, Director of Personal Finance at Morningstar:

When I think about factors influencing where to live in retirement, my list would be:

— Christine Benz (@christine_benz) June 12, 2020

1. Proximity to family/friends

2. Culture/activities/"fit"

3. Weather

4.

5.

6. Cost of housing

7.

8.

9.

10. Taxes

But not everyone thinks that way. My latest. https://t.co/xkbcHjHl7p

You hear a lot about the difference in state taxes but I think the tax aspect is way overblown. We saved less than $1,000/year in state income tax when we moved from high-tax California to no-tax Nevada. It’s not worth moving to save only $1,000 a year. The difference in the cost of housing is more substantial. Running the numbers helps you quantify it. You may choose to stay put or move to a place closer to family, friends, activities, or a place with the weather you prefer. Quantifying the difference in housing costs helps you make an informed decision.

In our case, we didn’t save much money by moving but we improved our lifestyle. We could’ve chosen a different place with a lower cost of living but we like it here. That makes it worth it. Lifestyle comes first when you can afford it.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Is It Worth Moving to Lower Cost of Living After You Retire? appeared first on The Finance Buff.

April 12, 2024

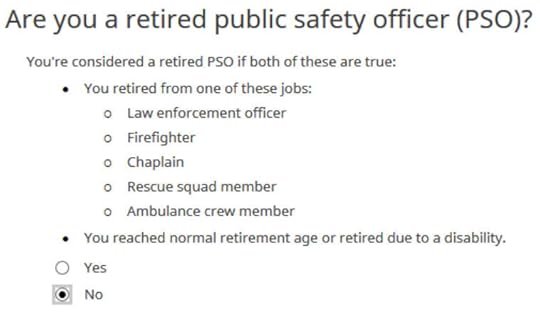

Split-Year Backdoor Roth IRA in FreeTaxUSA, 2nd Year

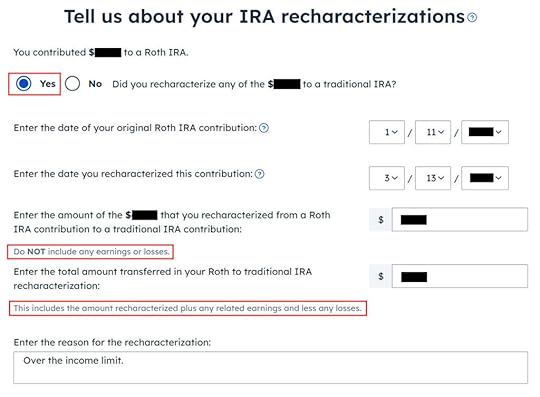

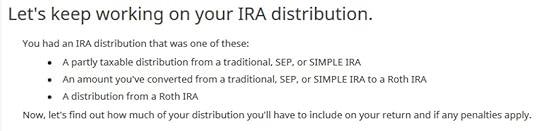

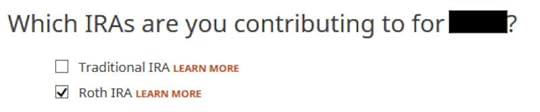

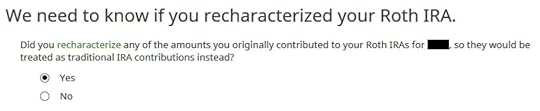

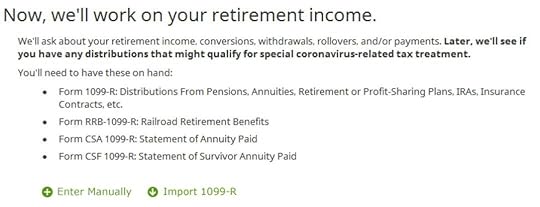

The previous post Split-Year Backdoor Roth IRA in FreeTaxUSA, 1st Year dealt with contributing to a Traditional IRA for the previous year and recharacterizing a previous year’s Roth IRA contribution as a Traditional IRA contribution. This post handles the conversion part in FreeTaxUSA.

We cover two example scenarios in this post. Here’s the first:

You contributed $6,000 to a Traditional IRA for 2022 in 2023. The value increased to $6,200 when you converted it to Roth in 2023. You received a 1099-R form listing this $6,200 Roth conversion.

You should’ve already reported the contribution part on your 2022 tax return by following Split-Year Backdoor Roth IRA in FreeTaxUSA, 1st Year. The IRA custodian sent you a 1099-R form for the conversion in 2023. This post shows you how to put it into FreeTaxUSA.

Here’s the second example scenario:

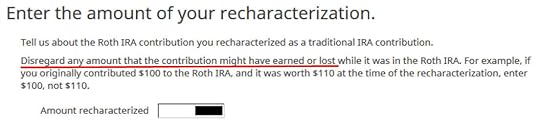

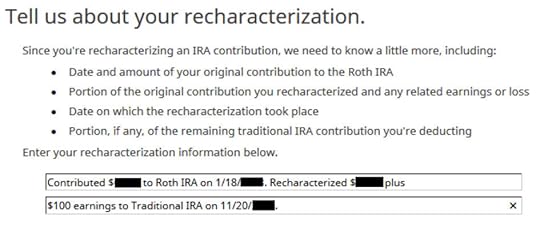

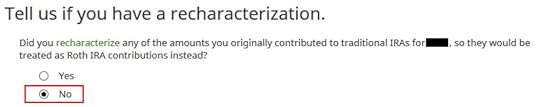

You contributed $6,000 to a Roth IRA for 2022 in 2022. You realized that your income was too high when you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Traditional contribution before April 15, 2023. The IRA custodian moved $6,100 from your Roth IRA to your Traditional IRA because your original $6,000 contribution had some earnings. The value increased again to $6,200 when you converted it to Roth in 2023. You received two 1099-R forms, one for $6,100 and another for $6,200.

You should’ve already reported the recharacterized contribution on your 2022 tax return by following Split-Year Backdoor Roth IRA in FreeTaxUSA, 1st Year. The IRA custodian sent you two 1099-R forms, one for the recharacterization, and the other for the conversion. This post shows you how to put both of them into FreeTaxUSA.

If you contributed for 2023 in 2024 or if you recharacterized a 2023 contribution in 2024, you’re still in the first year of this journey. Please follow Split-Year Backdoor Roth IRA in FreeTaxUSA, 1st Year. If you recharacterized your 2023 contribution in 2023 and converted in 2023, please use a different follow-up post.

If neither of these example scenarios fits you, please consult our guide for a normal “clean” backdoor Roth: How to Report Backdoor Roth In FreeTaxUSA (Updated).

If you’re married and both you and your spouse did the same thing, you should follow the steps below for both yourself and your spouse.

Table of Contents1099-R for Recharacterization1099-R for ConversionClean Backdoor Roth On TopTaxable IncomeTroubleshootingConversion Is TaxedSelf vs Spouse1099-R for RecharacterizationThis section only applies to the second example scenario. If you contributed directly to a Traditional IRA for the previous year and didn’t recharacterize (the first example scenario), please skip this section and jump over to the conversion section.

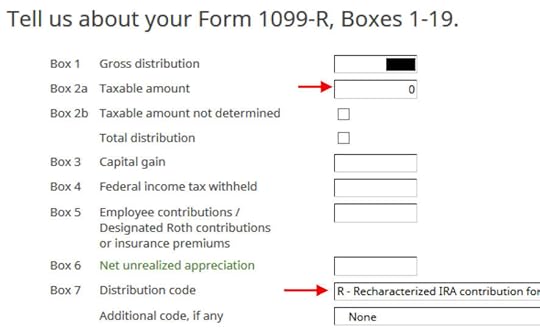

We handle the 1099-R form for recharacterization first. This 1099-R form has a code “R” in Box 7.

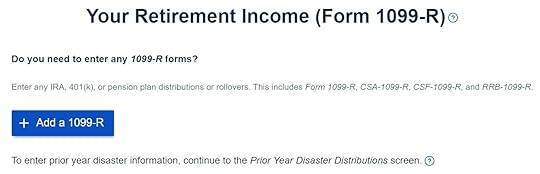

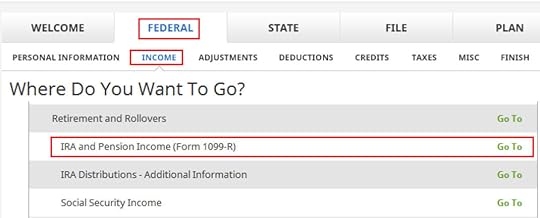

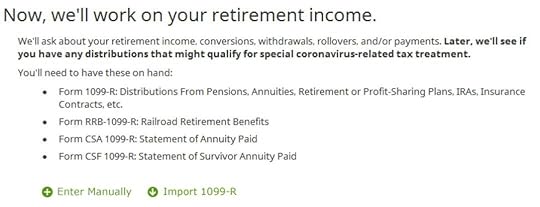

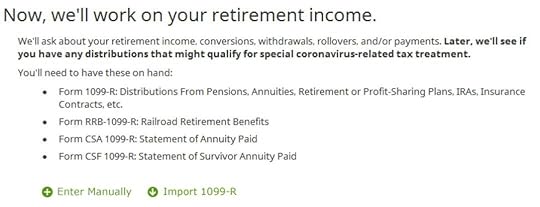

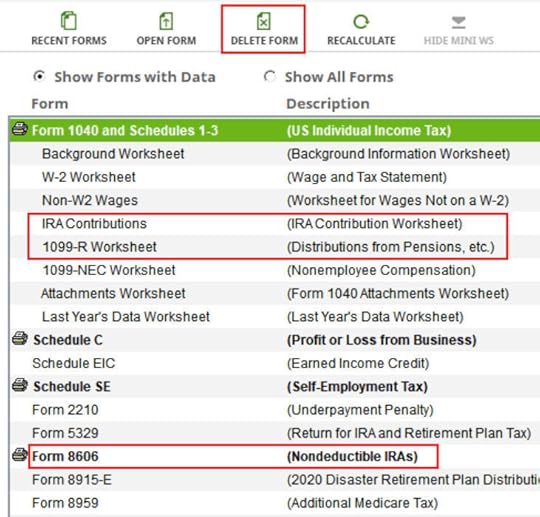

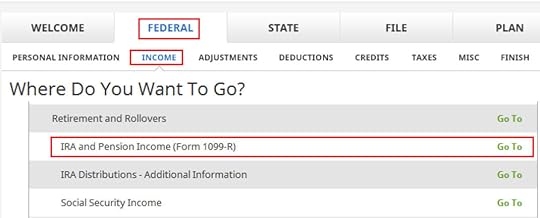

Find “Retirement Income (1099-R)” under the Income menu.

Click on the “Add a 1099-R” button.

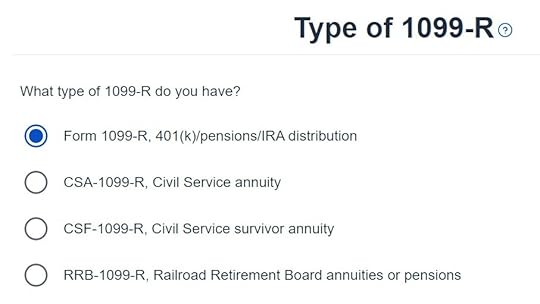

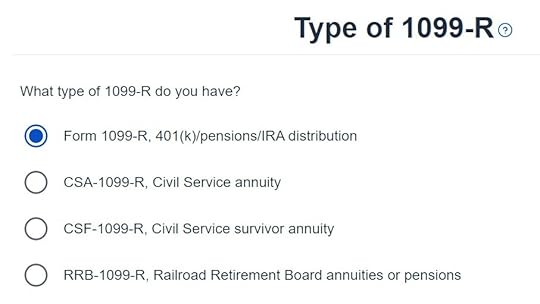

It’s just a regular 1099-R.

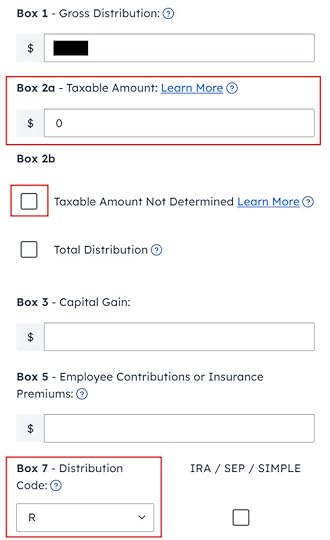

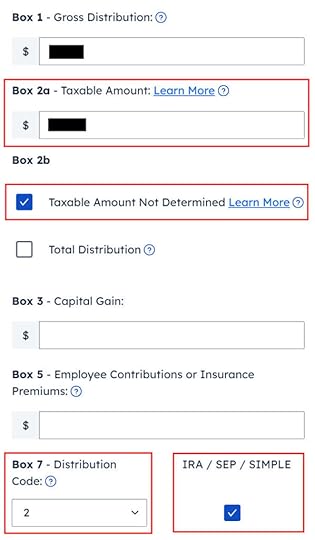

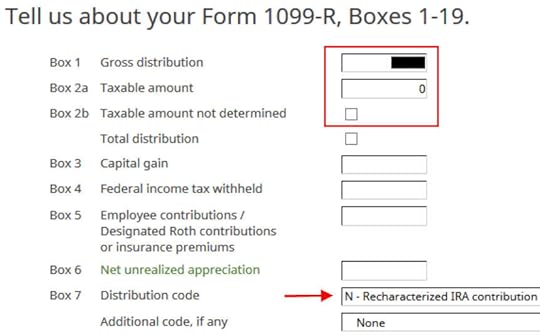

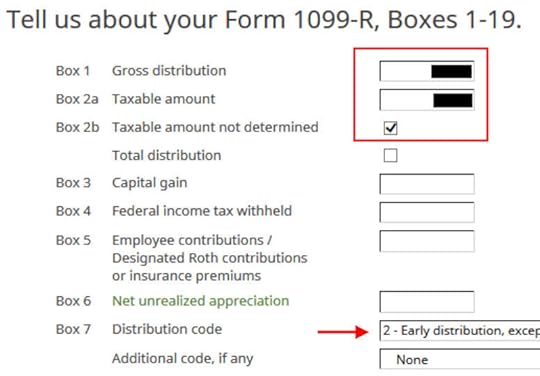

Enter the 1099-R for the recharacterization exactly as you have it. Box 1 shows the amount that was transferred from the Roth IRA to the Traditional IRA when you recharacterized your 2022 contribution. Box 2a shows that the recharacterization isn’t taxable. Box 2b “taxable amount not determined” isn’t checked. The code in Box 7 is “R.” The “IRA / SEP / SIMPLE” box isn’t checked.

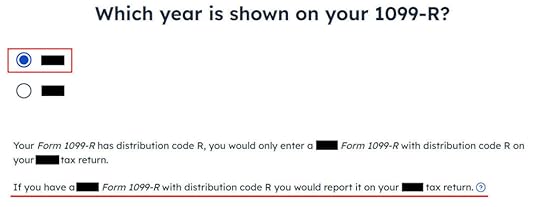

Your 1099-R shows 2023 but FreeTaxUSA says you should’ve reported it on your 2022 tax return. The problem is you didn’t have it back then. You couldn’t have reported something you didn’t have. Select the correct year and continue anyway.

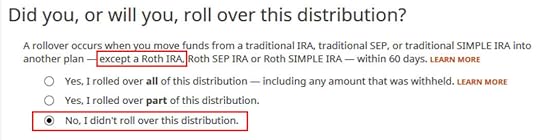

The recharacterization wasn’t a rollover.

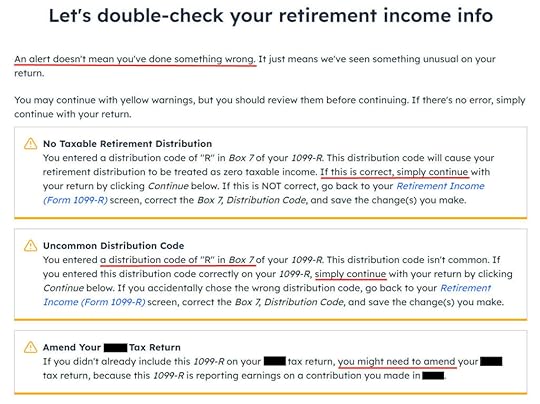

FreeTaxUSA shows some alerts. The zero taxable income on the 1099-R is correct. Code “R” in Box 7 is also correct. Although you didn’t include this 1099-R last year because you didn’t have it at that time, you don’t need to amend last year’s tax return if you reported the recharacterization in a different way when you followed Split-Year Backdoor Roth IRA in FreeTaxUSA, 1st Year. You may need to amend last year’s return only if you didn’t report the recharacterization last year at all.

You’re done with the 1099-R form for the recharacterization. Click on the “Add a 1099-R” button to add the other 1099-R for the conversion.

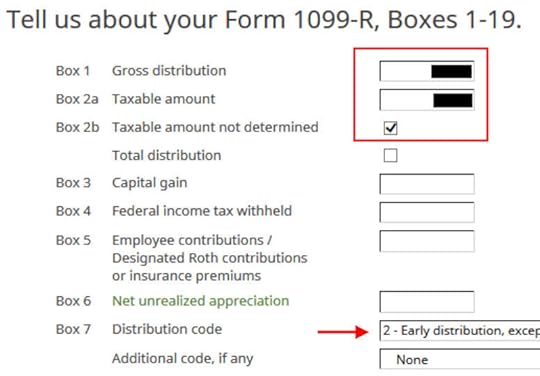

1099-R for ConversionThe 1099-R for conversion has a code “2” in Box 7 if you’re under age 59-1/2 or a code “7” if you’re 59-1/2 or older.

It’s also a regular 1099-R.

Box 1 shows the amount converted to Roth. If you contributed to a Traditional IRA for 2023 in 2023 and converted in 2023 (a “clean” backdoor Roth) on top of converting the 2022 contribution in 2023, the amount on the 1099-R includes two years’ worth of contributions. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” Make sure to choose the correct code in Box 7 to match your 1099-R. The “IRA / SEP / SIMPLE” box is checked.

Your refund number drops after you enter the 1099-R. Don’t panic. It’s normal and temporary. The refund number will come up when we finish everything.

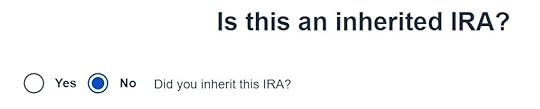

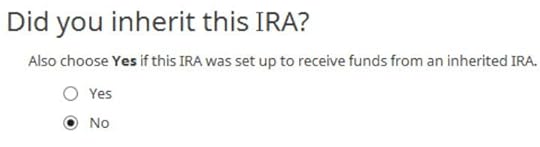

It’s not an inherited IRA.

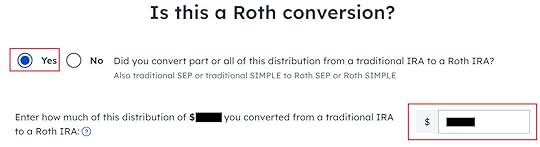

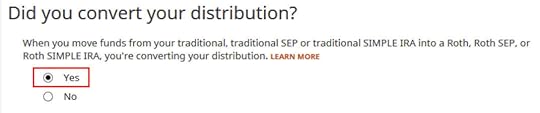

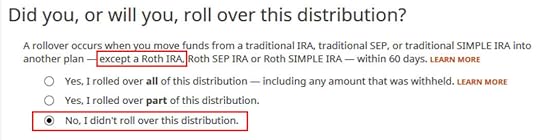

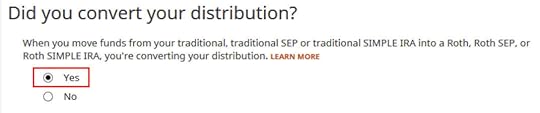

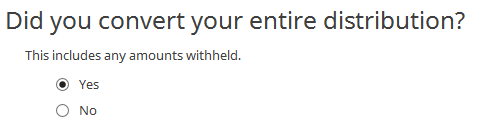

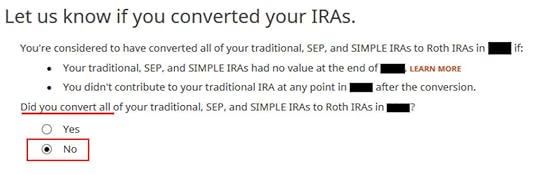

It’s a Roth conversion. 100% of the amount on the 1099-R was converted from a Traditional IRA to a Roth IRA.

You are done with this 1099-R for the conversion. Repeat if you have another 1099-R. If you’re married and both of you converted to Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R forms to the same person when they belong to each spouse. Click on “No, Continue” when you have entered all the 1099-R forms.

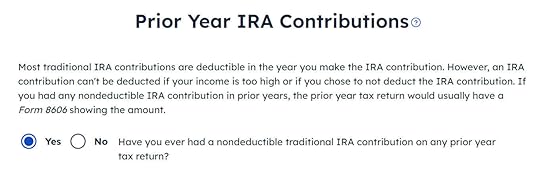

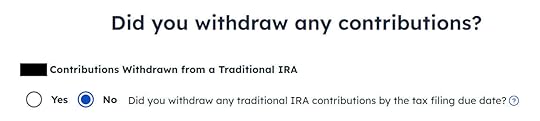

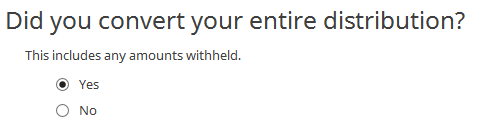

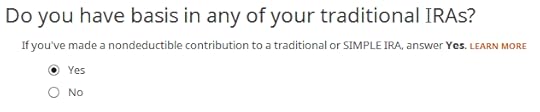

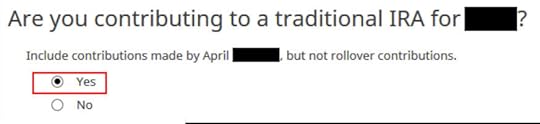

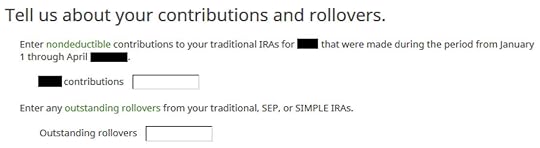

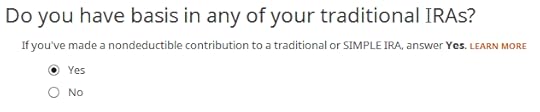

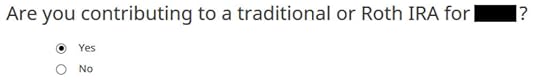

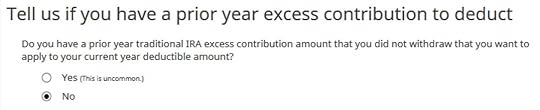

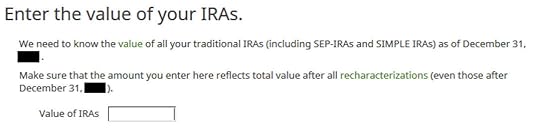

Answer “Yes” here because you had a Traditional IRA contribution from last year.

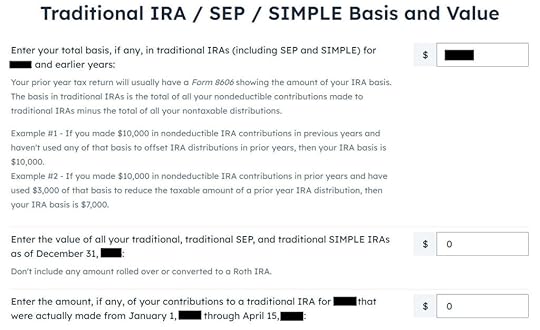

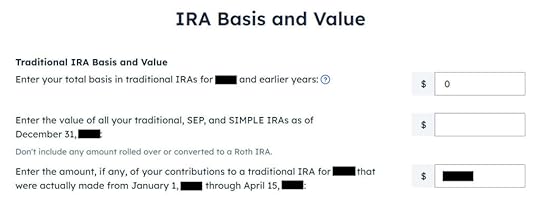

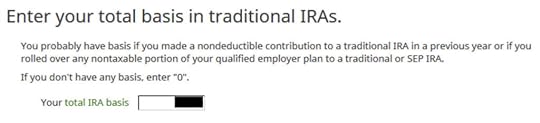

Get the value for the first box from last year’s Form 8606 Line 14 (assuming that you did last year correctly). If you didn’t have a Form 8606 last year because you didn’t do it correctly, your basis is the amount of your 2022 Traditional IRA contribution minus any deduction you took on last year’s Schedule 1 Line 20. The total basis is $6,000 in our example.

The second box should be zero when you emptied all your Traditional IRAs after converting them to Roth and you don’t have any SEP or SIMPLE IRAs. If you had a few dollars of earnings posted in the Traditional IRA after you converted and you left them in the account, get the value from your year-end statement and put it in the second box. The software will apply the pro-rata rule.

The third box should also be zero when you made your 2023 contribution in 2023.

We didn’t take any disaster distribution.

Now continue with all other income items until you are done with income.

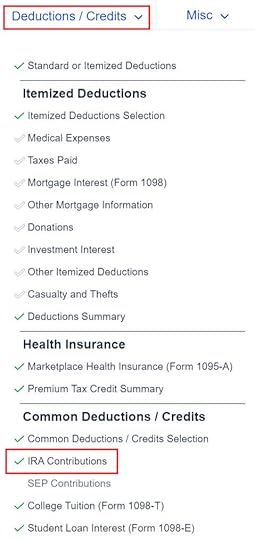

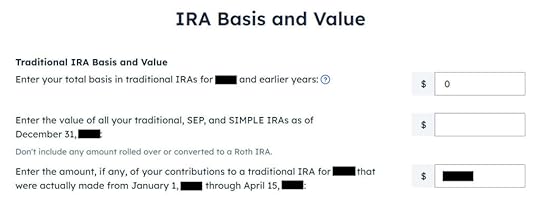

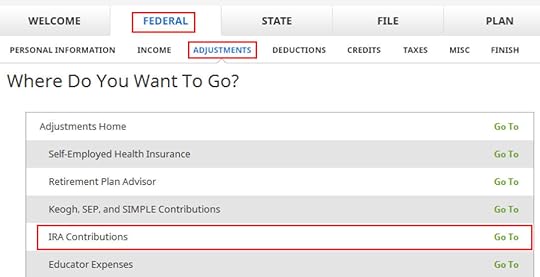

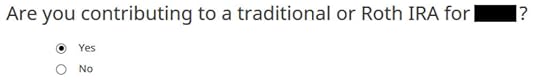

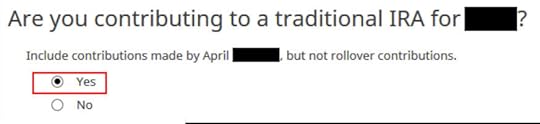

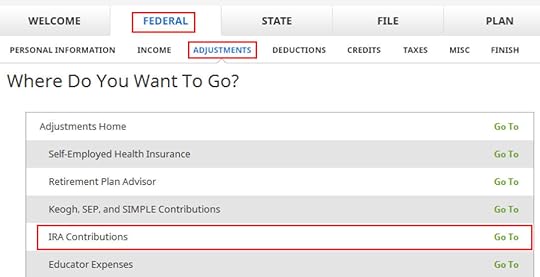

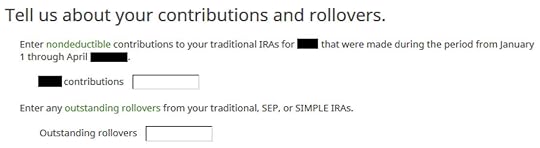

Clean Backdoor Roth On TopIf you did a “clean” backdoor Roth on top of converting the 2022 contribution in 2023 (contributed to a Traditional IRA for 2023 in 2023 and converted in 2023), the conversion part of the clean backdoor Roth is already included in the 1099-R form we just completed. Now we do the contribution part.

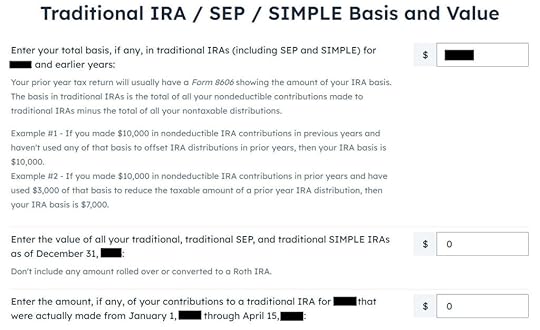

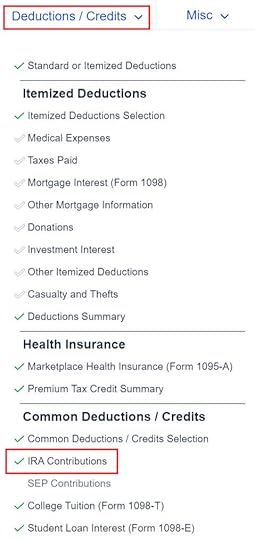

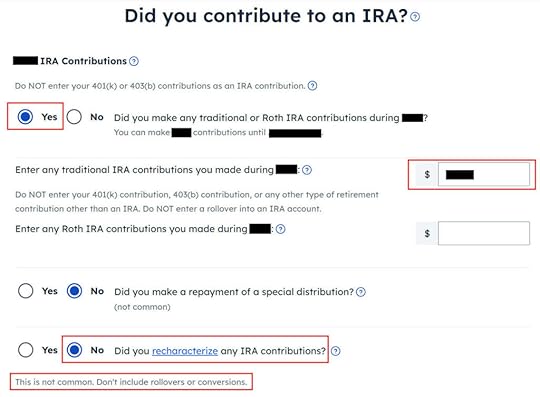

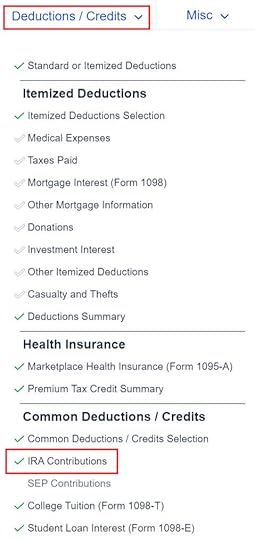

Find the “IRA Contributions” section under the “Deductions / Credits” menu.

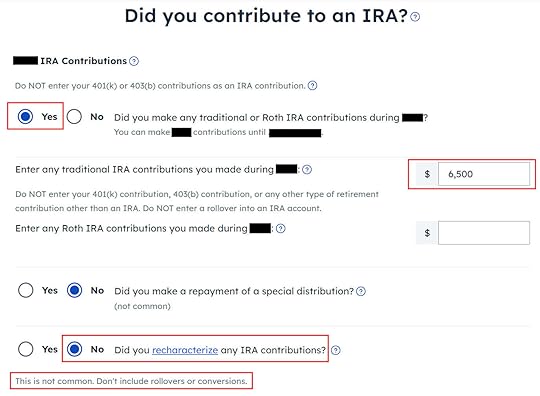

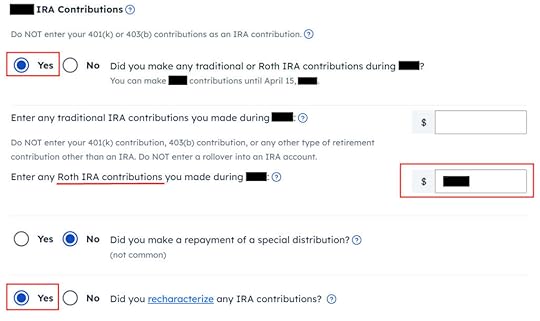

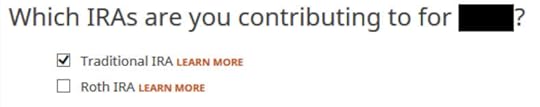

Answer “Yes” to the first question and enter your contribution to your Traditional IRA. Leave the answer to “Did you recharacterize” at No. We contributed $6,500 in our example.

Your refund number goes up again after you enter the contribution.

We didn’t contribute to a SEP, SIMPLE, or solo 401k plan in this example. Answer Yes if you did.

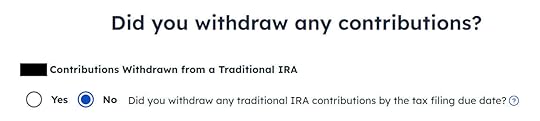

“Withdraw” means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer “No” here.

FreeTaxUSA shows the same page we saw before in the conversion section. Confirm and continue.

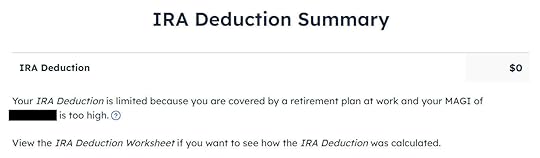

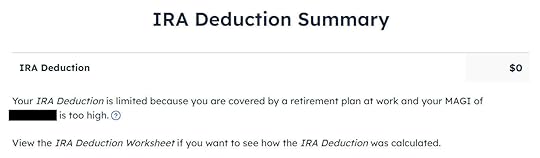

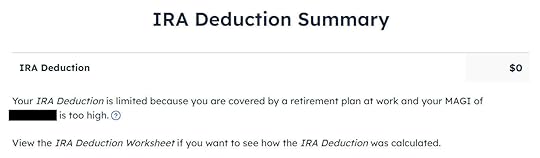

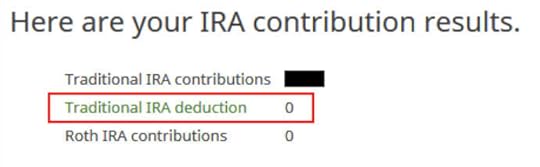

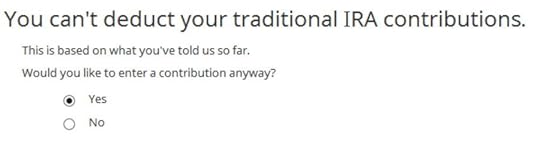

It tells us we don’t get a deduction because our income is too high. If you see a deduction here it means the software thinks your income qualifies for a deduction, which may or may not be correct. Please see the Troubleshooting section.

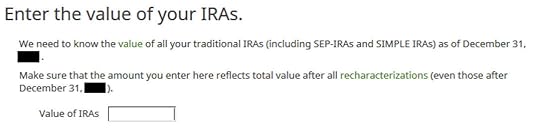

Taxable IncomeYou’re done with the 1099-R forms. Let’s look at how they show up on your tax return. Click on the three dots on the top right above the IRA Deduction Summary and then click on “Preview Return.”

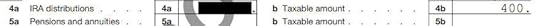

Look for Lines 4a and 4b in your Form 1040.

Line 4a shows the amount on your 1099-R for the Roth conversion. Line 4b shows the taxable amount, which is the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth. The taxable amount on Line 4b would be zero if you didn’t have any earnings.

Go toward the end in the pop-up to find Form 8606. It shows these for our example:

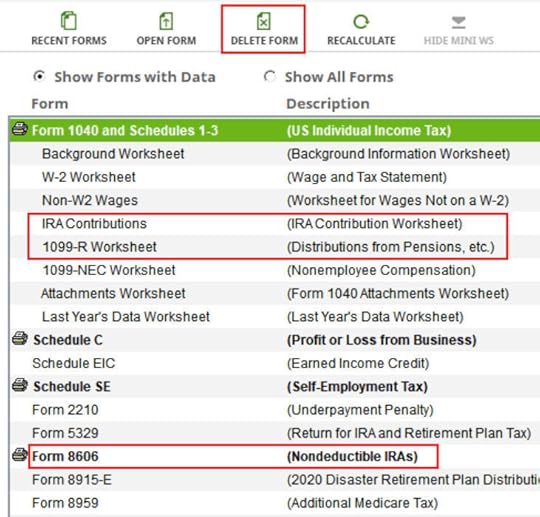

Line #Amount16,500 (only if you also did a “clean” backdoor Roth on top, otherwise blank.)26,0003The sum of Line 1 and Line 25The same as Line 38The amount on your 1099-R with a code 2 or 713The same as Line 314blank (or a small amount if your Traditional IRA had a small balance at the end of 2023)16The same as Line 817Line 3 minus Line 1418The difference between Line 16 and Line 17Form 8606TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

Conversion Is TaxedIf you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. FreeTaxUSA gives you the deduction if it sees that your income qualifies. It doesn’t give you the choice of making it non-deductible.

Part of your conversion could be taxed because you took a deduction on the Traditional IRA contribution last year or this year. You see whether you took a deduction by looking at Schedule 1 Line 20 on last year’s and this year’s tax returns.

The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal and it doesn’t cause any problems when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

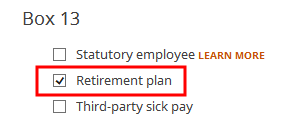

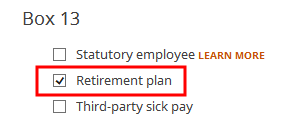

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2.

Maybe you forgot the check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries in FreeTaxUSA to make sure they match the W-2.

Self vs SpouseIf you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Split-Year Backdoor Roth IRA in FreeTaxUSA, 2nd Year appeared first on The Finance Buff.

April 10, 2024

2024 2025 HSA Contribution Limits and HDHP Qualification

The contribution limits for various tax-advantaged accounts for the following year are usually announced in October, except for the HSA, which comes out in April or May. The contribution limits are adjusted for inflation each year, subject to rounding rules.

You can only contribute to an HSA if you’re covered by a High Deductible Health Plan (HDHP) with no other coverage. You can use the money already in the HSA for qualified medical expenses regardless of what insurance you currently have.

Table of ContentsHSA Contribution LimitsAge 55 Catch-Up ContributionTwo Plans Or Mid-Year ChangesHDHP QualificationContribute Outside PayrollNon-Dependent Adult ChildrenBest HSA ProvidersHSA Contribution Limits20242025Individual Coverage$4,150$4,300Family Coverage$8,300$8,550HSA Contribution LimitsSource: IRS Rev. Proc. 2023-23, author’s calculation.

Employer contributions are included in these limits.

The family coverage numbers happened to be double the individual coverage numbers in 2024 but it isn’t always the case every year. Because the individual coverage limit and the family coverage limit are both rounded to the nearest $50, the family coverage limit can be slightly more or slightly less than double the individual coverage limit when one number rounds up and the other number rounds down.

Age 55 Catch-Up ContributionAs in 401k and IRA contributions, you are allowed to contribute extra if you are above a certain age. If you are age 55 or older by the end of the year (not age 50 as in 401k and IRA contributions), you can contribute an additional $1,000 to your HSA. If you are married, and both of you are age 55, each of you can contribute an additional $1,000 to your respective HSA.

However, because an HSA is in one individual’s name, just like an IRA — there is no joint HSA even when you have family coverage — only the person age 55 or older can contribute the additional $1,000 in his or her own name. If only the husband is 55 or older and the wife contributes the full family contribution limit to the HSA in her name, the husband has to open a separate account in his name for the additional $1,000. If both husband and wife are age 55 or older, they must have two HSA accounts in separate names if they want to contribute the maximum. There’s no way to hit the combined maximum with only one account.

The $1,000 additional contribution limit is fixed by law. It’s not adjusted for inflation.

Two Plans Or Mid-Year ChangesThe limits are more complicated if you are married and the two of you are on different health plans. It’s also more complicated when your health insurance changes mid-year. The insurance change could be due to a job change, marriage or divorce, enrolling in Medicare, the birth of a child, and so on.

For those situations, please read HSA Contribution Limit For Two Plans Or Mid-Year Changes.

HDHP QualificationThe IRS also defines what qualifies as an HDHP. For 2024, an HDHP with individual coverage must have at least $1,600 in annual in-network deductible and no more than $8,050 in annual out-of-pocket expenses. For family coverage, the numbers are a minimum of $3,200 in annual deductible and no more than $16,100 in annual out-of-pocket expenses.

For 2025, an HDHP with individual coverage must have at least $1,650 in annual deductible and no more than $8,300 in annual out-of-pocket expenses. For family coverage, the numbers are a minimum of $3,300 in annual deductible and no more than $16,600 in annual out-of-pocket expenses.

Please note the deductible number is a minimum while the out-of-pocket number is a maximum. The maximum out-of-pocket limit only applies to the in-network number. If the in-network out-of-pocket limit of your insurance policy is too high, it doesn’t qualify as an HSA-eligible policy.

In addition, just having the minimum deductible and the maximum out-of-pocket isn’t sufficient to make a plan qualify as HSA eligible. The plan must also meet other criteria. See Not All High Deductible Plans Are HSA Eligible.

20242025Individual Coverageminimum deductible$1,600$1,650maximum out-of-pocket$8,050$8,300Family Coverageminimum deductible$3,200$3,300maximum out-of-pocket$16,100$16,600HDHP QualificationSource: IRS Rev. Proc. 2023-23, author’s calculation.

Contribute Outside PayrollIf you have a High Deductible Health Plan (HDHP) through your employer, your employer may already set up a linked HSA for you at a selected provider. Your employer may be contributing an amount on your behalf there. Your payroll contributions also go into that account. Your employer may be paying the fees for you on that HSA. You save Social Security and Medicare taxes when you contribute to the HSA through payroll.

When you contribute to an HSA outside an employer, you claim the tax deduction on your tax return similar to when you contribute to a Traditional IRA. If you use tax software, be sure to answer the questions on HSA contributions. The tax deduction shows up on Form 8889 line 13 and Schedule 1 line 13.

Non-Dependent Adult ChildrenIf your HDHP also covers your adult children who are not claimed as a dependent on your tax return, each non-dependent adult child can also contribute to a separate HSA in their name at the family coverage level when they don’t have other non-HDHP coverage. This is because they meet the eligibility:

(a) Covered by an HDHP with no other coverage; and

(b) The HDHP policy they have covers more than one person.

Each non-dependent adult child can open a separate HSA on their own with an HSA provider.

Best HSA ProvidersIf you get the HSA-eligible high deductible plan through an employer, your employer usually has a designated HSA provider for contributing via payroll deduction. It’s best to use that one because your contributions via payroll deduction are usually exempt from Social Security and Medicare taxes. If you want better investment options, you can transfer or roll over the HSA money from your employer’s designated provider to a provider of your choice afterward. See How To Rollover an HSA On Your Own and Avoid Trustee Transfer Fee.

If you are not going through an employer, or if you’d like to contribute on your own, you can also open an HSA with a provider of your choice. For the best HSA providers with low fees and good investment options, see Best HSA Provider for Investing HSA Money.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2024 2025 HSA Contribution Limits and HDHP Qualification appeared first on The Finance Buff.

2023 2024 2025 HSA Contribution Limits and HDHP Qualification

The contribution limits for various tax-advantaged accounts for the following year are usually announced in October, except for the HSA, which comes out in April or May. The contribution limits are adjusted for inflation each year, subject to rounding rules.

Table of ContentsHSA Contribution LimitsAge 55 Catch-Up ContributionTwo Plans Or Mid-Year ChangesHDHP QualificationContribute Outside PayrollBest HSA ProvidersHSA Contribution Limits202420242025Individual Coverage$3,850$4,150$4,300Family Coverage$7,750$8,300$8,550HSA Contribution LimitsSource: IRS Rev. Proc. 2022-24, Rev. Proc. 2023-23, author’s calculation.

Employer contributions are included in these limits.

The family coverage numbers happened to be double the individual coverage numbers in 2024 but it isn’t always the case every year. Because the individual coverage limit and the family coverage limit are both rounded to the nearest $50, the family coverage limit can be slightly more or slightly less than double the individual coverage limit when one number rounds up and the other number rounds down.

Age 55 Catch-Up ContributionAs in 401k and IRA contributions, you are allowed to contribute extra if you are above a certain age. If you are age 55 or older by the end of the year (not age 50 as in 401k and IRA contributions), you can contribute an additional $1,000 to your HSA. If you are married, and both of you are age 55, each of you can contribute an additional $1,000 to your respective HSA.

However, because an HSA is in one individual’s name, just like an IRA — there is no joint HSA even when you have family coverage — only the person age 55 or older can contribute the additional $1,000 in his or her own name. If only the husband is 55 or older and the wife contributes the full family contribution limit to the HSA in her name, the husband has to open a separate account in his name for the additional $1,000. If both husband and wife are age 55 or older, they must have two HSA accounts in separate names if they want to contribute the maximum. There’s no way to hit the combined maximum with only one account.

The $1,000 additional contribution limit is fixed by law. It’s not adjusted for inflation.

Two Plans Or Mid-Year ChangesThe limits are more complicated if you are married and the two of you are on different health plans. It’s also more complicated when your health insurance changes mid-year. The insurance change could be due to a job change, marriage or divorce, enrolling in Medicare, the birth of a child, and so on.

For those situations, please read HSA Contribution Limit For Two Plans Or Mid-Year Changes.

HDHP QualificationYou can only contribute to an HSA if you have a High Deductible Health Plan (HDHP). You can use the money already in the HSA for qualified medical expenses regardless of what insurance you currently have.

The IRS also defines what qualifies as an HDHP. For 2023, an HDHP with individual coverage must have at least $1,500 in annual deductible and no more than $7,500 in annual out-of-pocket expenses. For family coverage, the numbers are a minimum of $3,000 in annual deductible and no more than $15,000 in annual out-of-pocket expenses.

For 2024, an HDHP with individual coverage must have at least $1,600 in annual deductible and no more than $8,050 in annual out-of-pocket expenses. For family coverage, the numbers are a minimum of $3,200 in annual deductible and no more than $16,100 in annual out-of-pocket expenses.

For 2025, an HDHP with individual coverage must have at least $1,650 in annual deductible and no more than $8,300 in annual out-of-pocket expenses. For family coverage, the numbers are a minimum of $3,300 in annual deductible and no more than $16,600 in annual out-of-pocket expenses.

Please note the deductible number is a minimum while the out-of-pocket number is a maximum. If the out-of-pocket limit of your insurance policy is too high, it doesn’t qualify as an HSA-eligible policy.

In addition, just having the minimum deductible and the maximum out-of-pocket isn’t sufficient to make a plan qualify as HSA eligible. The plan must also meet other criteria. See Not All High Deductible Plans Are HSA Eligible.

202320242025Individual Coverageminimum deductible$1,500$1,600$1,650maximum out-of-pocket$7,500$8,050$8,300Family Coverageminimum deductible$3,000$3,200$3,300maximum out-of-pocket$15,000$16,100$16,600HDHP QualificationSource: IRS Rev. Proc. 2022-24, Rev. Proc. 2023-23, author’s calculation.

Contribute Outside PayrollIf you have a High Deductible Health Plan (HDHP) through your employer, your employer may already set up a linked HSA for you at a selected provider. Your employer may be contributing an amount on your behalf there. Your payroll contributions also go into that account. Your employer may be paying the fees for you on that HSA. You save Social Security and Medicare taxes when you contribute to the HSA through payroll.

When you contribute to an HSA outside an employer, you get the tax deduction on your tax return, similar to when you contribute to a Traditional IRA. If you use tax software, be sure to answer the questions on HSA contributions. The tax deduction shows up on Form 8889 line 13 and Schedule 1 line 13.

If your HDHP also covers your adult child who’s not claimed as a dependent on your tax return, they can also contribute to an HSA in their own name if they don’t have other non-HDHP coverage. They get a separate family coverage limit. They will have to open an HSA on their own with an HSA provider.

Best HSA ProvidersIf you get the HSA-eligible high deductible plan through an employer, your employer usually has a designated HSA provider for contributing via payroll deduction. It’s best to use that one because your contributions via payroll deduction are usually exempt from Social Security and Medicare taxes. If you want better investment options, you can transfer or roll over the HSA money from your employer’s designated provider to a provider of your choice afterward. See How To Rollover an HSA On Your Own and Avoid Trustee Transfer Fee.

If you are not going through an employer, or if you’d like to contribute on your own, you can also open an HSA with a provider of your choice. For the best HSA providers with low fees and good investment options, see Best HSA Provider for Investing HSA Money.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2023 2024 2025 HSA Contribution Limits and HDHP Qualification appeared first on The Finance Buff.

April 8, 2024

Split-Year Backdoor Roth IRA in FreeTaxUSA, 1st Year

The best way to do a backdoor Roth is to do it “clean” by contributing *for* and converting in the same year — contribute for 2023 in 2023 and convert in 2023, contribute for 2024 in 2024 and convert in 2024, and contribute for 2025 in 2025 and convert in 2025. Don’t split them into two years such as contributing for 2022 in 2023 and converting in 2023 or contributing for 2023 in 2024 and converting in 2024. If you did a “clean” backdoor Roth and you’re using FreeTaxUSA, please follow How to Report Backdoor Roth In FreeTaxUSA (Updated).

However, many people didn’t know they should’ve done it “clean.” Some people thought it was natural to contribute to an IRA for 2023 between January 1 and April 15, 2024. Some people contributed directly to a Roth IRA for 2023 in 2023 and only found out their income was too high when they did their taxes in 2024. They had to recharacterize the previous year’s Roth IRA contribution as a Traditional IRA contribution and convert it again to Roth after the fact.

When you contribute for the previous year and convert (or recharacterize and convert in the following year), you have to report them on your tax return in two different years: the contribution in one year and the conversion in the following year. It’s more confusing than a straight “clean” backdoor Roth but that’s the price you pay for not knowing the right way. This post shows you how to do the contribution part in FreeTaxUSA for the first year. A follow-up post shows you how to do the conversion part for the second year.

If you recharacterized your 2023 Roth IRA contribution to Traditional in 2023 and converted to Roth again in 2023, please use another follow-up post.

I’m showing two examples — (1) a direct contribution to a Traditional IRA for the previous year; and (2) recharacterizing a Roth contribution for the previous year as a Traditional contribution. Please see which example matches your scenario and follow along accordingly.

Table of ContentsContributed for the Previous YearContributed to Traditional IRAForm 8606Break the CycleRecharacterized Roth ContributionContributed to Roth IRARecharacterized to TraditionalForm 8606Switch to Clean Backdoor RothTroubleshootingNo 1099-RContribution Is DeductibleContributed for the Previous YearHere’s the example scenario for a direct contribution to the Traditional IRA:

You contributed $6,500 to a Traditional IRA for 2023 between January 1 and April 15, 2024. You then converted it to Roth in 2024.

Because your contribution was *for* 2023, you need to report it on your 2023 tax return by following this guide. Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion when you do your 2024 tax return. Come again next year to follow the follow-up post.

If you contributed to a Traditional IRA in 2023 for 2022, everything below should’ve happened in your 2022 tax return. In other words,

You contributed $6,000 to a Traditional IRA for 2022 between January 1 and April 15, 2023. You then converted it to Roth in 2023.

Then you should’ve gone through the steps below in your 2022 tax return. If you didn’t, you should fix your 2022 return. The conversion part is covered in a follow-up post.

If you’re married and both you and your spouse did the same thing, you must follow the same steps below for both you and your spouse.

If you first contributed to a Roth IRA and then recharacterized it as a Traditional contribution in the following year, please jump over to the next example.

Contributed to Traditional IRA

Find the “IRA Contributions” section under the “Deductions / Credits” menu.

Answer Yes to the first question and enter your contribution in the first box even though the question says “made during 2023″ and you actually contributed in the following year. Leave the answer to “Did you recharacterize” at No.

We didn’t contribute to a SEP, SIMPLE, or solo 401k plan in this example. Answer Yes if you did.

Withdraw means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer “No” here.

The first box is normally zero if this is the first time you contributed to a Traditional IRA. If you made nondeductible contributions to a Traditional IRA in previous years, get the value from your last year’s Form 8606 Line 14 (assuming you did your tax return correctly). If you entered a number in the first box because you didn’t understand what it was asking, now is the chance to correct it.

The second box is also blank or zero when you had no Traditional, SEP, or SIMPLE IRA as of December 31, 2023.

Enter your contribution in the third box because you did it between January 1 and April 15, 2024.

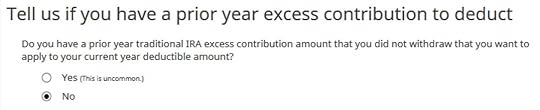

It tells us we don’t get a deduction because our income was too high. We know. That’s why we did the Backdoor Roth. If the number isn’t zero here, it means the software thinks you qualify for a deduction with your income. You don’t have a choice to decline the deduction.

Form 8606Let’s look at the Form 8606 to confirm that it did everything correctly. Click on the three dots on the top right above the IRA Deduction Summary and then click on “Preview Return.”

Scroll toward the end of the tax forms to find Form 8606. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2024. It’ll make your conversion in 2024 not taxable.

If you don’t see a Form 8606 or if your Form 8606 doesn’t look right, please check the Troubleshooting section.

Break the CycleWhile you’re at it, you should break the cycle of contributing for the previous year and create a new habit of contributing for the current year. Contribute to a Traditional IRA for 2024 in 2024 and convert in 2024.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.