Harry Sit's Blog, page 4

January 30, 2025

2024 2025 ACA Health Insurance Premium Tax Credit Percentages

If you buy health insurance from healthcare.gov or a state-run ACA exchange, there used to be a hard cutoff for whether you qualify for a premium tax credit. You didn’t qualify for a premium tax credit if your income was above 400% of the Federal Poverty Level (FPL). New laws removed the hard cutoff at 400% of FPL through 2025. See ACA Premium Subsidy Cliff Turns Into a Slope.

Now, how much credit you qualify for is determined by a sliding scale. The government says that based on your income, you are supposed to pay this percentage of your income toward a second lowest-cost Silver plan in your area. After you pay that amount, the government will take care of the rest.

If you pick a less expensive policy than the second lowest-cost Silver plan, you keep 100% of the savings, up to the point you get the policy for free. If you pick a more expensive policy than the second lowest-cost Silver plan, you pay 100% of the difference.

That sliding scale is called the Applicable Percentages Table. The applicable percentages have been lowered significantly through the end of 2025. It reduced the amount many people would otherwise pay toward their ACA health insurance.

Here are the applicable percentages for different income levels through 2025:

Income2024 – 2025< 133% FPL0%< 150% FPL0%< 200% FPL0% – 2%< 250% FPL2% – 4%< 300% FPL4% – 6%<= 400% FPL6% – 8.5%> 400% FPL8.5%ACA Applicable PercentagesSource: IRS Rev. Proc. 2024-35.

The percentage of income the government expects you to pay toward a second lowest-cost Silver plan depends on your income relative to the Federal Poverty Level. To calculate where your income falls relative to the Federal Poverty Level, please see Federal Poverty Levels (FPL) For Affordable Care Act (ACA).

If your income is low, they expect you to pay a low percentage of your low income. As your income goes higher, they expect you to pay a higher percentage of your higher income. The higher percentage applies not just to the additional income but to your entire income. A higher income times a higher percentage is much more than a lower income times a lower percentage.

For example, a household of two in the lower 48 states is expected to pay 7.06% of their income when their 2025 income is $70,000. If they increase their income to $80,000, they are expected to pay 8.28% of their income. The increase in their expected contribution toward ACA health insurance, and the corresponding decrease in their premium tax credit will be:

$80,000 * 8.28% – $70,000 * 7.06% = $1,682

This represents about 17% of the $10,000 increase in their income. For a married couple, the effect of paying 17% of the additional income toward ACA health insurance is greater than the effect of paying 12% toward their federal income tax. It makes the effective marginal tax rate on the additional $10,000 income 29%, not 12%.

Normally it’s a good idea to consider Roth conversion or harvesting tax gains in the 12% tax bracket, but those moves become much less attractive when you receive a premium subsidy for the ACA health insurance. For a helpful tool that can calculate this effect, please see Tax Calculator With ACA Health Insurance Subsidy.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2024 2025 ACA Health Insurance Premium Tax Credit Percentages appeared first on The Finance Buff.

How to Report 2024 Backdoor Roth In FreeTaxUSA (Updated)

[Updated on January 30, 2025 with screenshots from FreeTaxUSA for the 2024 tax year.]

TurboTax and H&R Block are the two major tax software for filing personal tax returns. A low-cost alternative to TurboTax and H&R Block software is FreeTaxUSA. FreeTaxUSA isn’t only for simple returns. It can still handle more complex transactions, such as the Backdoor Roth.

Just as a refresher, a Backdoor Roth involves making a non-deductible contribution to a Traditional IRA followed by converting from the Traditional IRA to a Roth IRA. Both the contribution and the conversion need to be reported in the tax software. For more information on Backdoor Roth, please read Backdoor Roth: A Complete How-To.

Table of ContentsWhat To ReportConvert From Traditional IRA to RothTraditional IRA ContributionTaxable Income from Backdoor RothTroubleshootingWhat To ReportYou report on the tax return your contribution to a Traditional IRA *for* that year, and you report the conversion to Roth *during* that year.

For example, when you are doing your tax return for year 2024, you report the contribution you made *for* 2024, whether you actually did it in 2024 or between January 1 and April 15, 2025. You also report the conversion to Roth *during* 2024, whether the contribution was made for 2024, 2023, or any previous years. Therefore a contribution made in 2025 for 2024 goes on the tax return for 2024. A conversion done during 2025 after you made a contribution for 2024 goes on the tax return for 2025.

You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finishing your conversion in the same year. I call this a “planned” Backdoor Roth or a “clean” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for 2025 in 2025 and convert it in 2025. Contribute for 2026 in 2026 and convert it in 2026. This way everything is clean and neat.

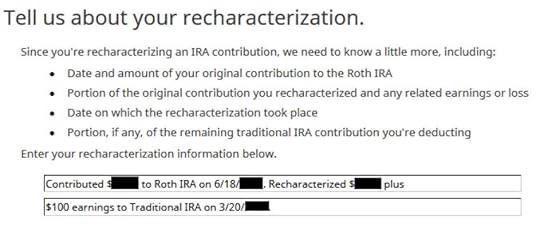

If you are already off by one year, it depends on whether you’re handling the contribution part or the conversion part right now. If you contributed to a Traditional IRA for 2024 in 2025 or if you recharacterized a 2024 Roth contribution to Traditional in 2025, please follow Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 1. If you contributed to a Traditional IRA for 2023 in 2024 or if you recharacterized a 2023 Roth contribution to Traditional in 2024 and converted in 2024, please follow Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 2.

Here’s the scenario we’ll use as an example:

You contributed $7,000 to a traditional IRA in 2024 for 2024. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2024, the value grew to $7,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments to the screens shown here.

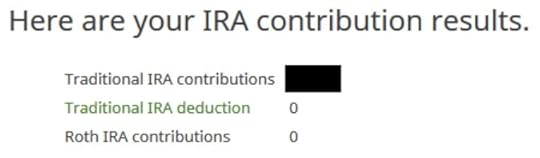

Before we start, suppose this is what FreeTaxUSA shows:

We’ll compare the results after we enter the Backdoor Roth.

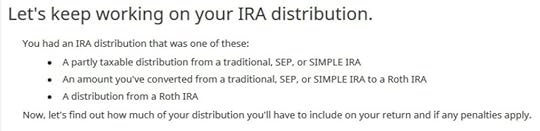

Convert From Traditional IRA to RothThe tax software works on income items first. We enter the conversion first even though the conversion happened after the contribution.

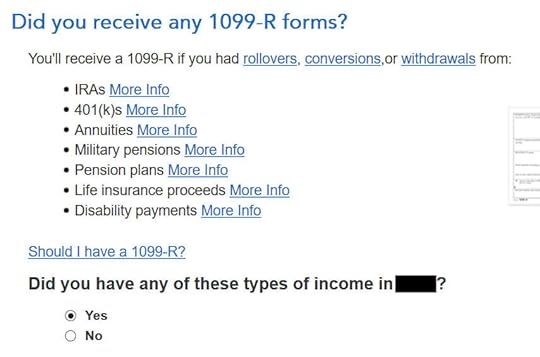

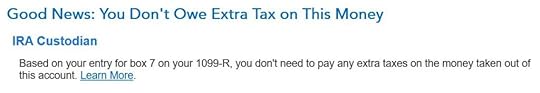

When you convert from a Traditional IRA to a Roth IRA, you will receive a 1099-R form. Complete this section only if you converted *during* 2024. If you only converted in 2025, you won’t have a 1099-R until next January. Please follow Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 1 now and come back next year to follow Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 2. If your conversion during 2024 was against a contribution you made for 2023 or a 2023 contribution you recharacterized in 2024, please follow Split-Year Backdoor Roth IRA in FreeTaxUSA, 2nd Year.

In our example, by the time you converted, the money in the Traditional IRA had grown from $7,000 to $7,200.

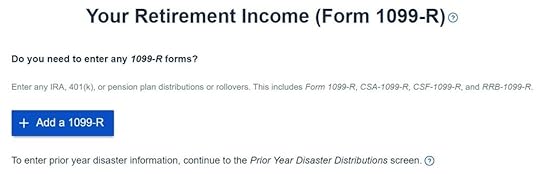

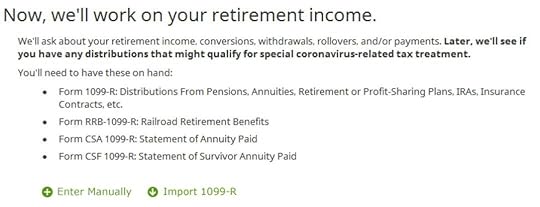

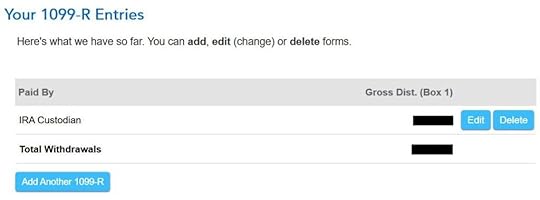

Click on “Add a 1099-R” when it asks you about the 1099-R.

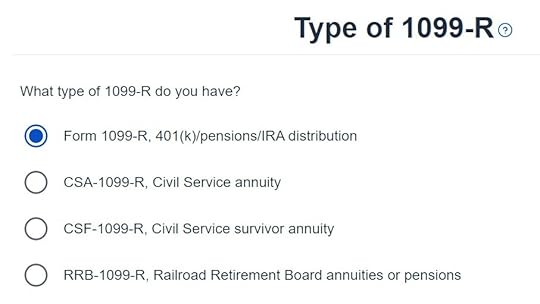

It’s just a regular 1099-R.

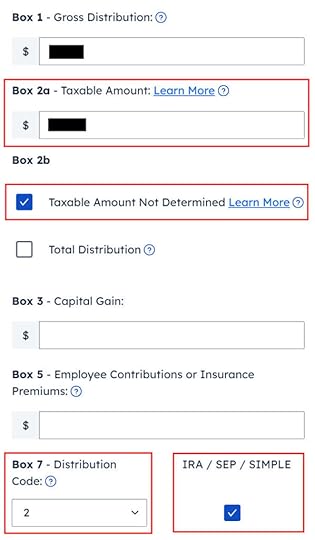

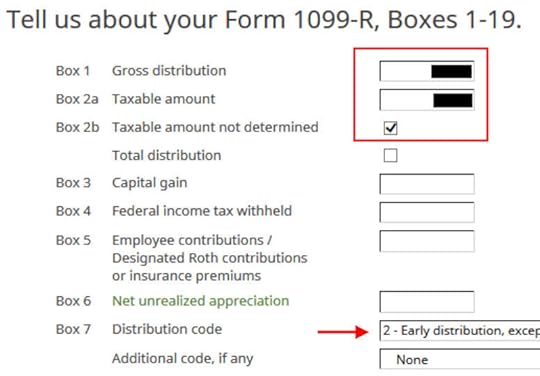

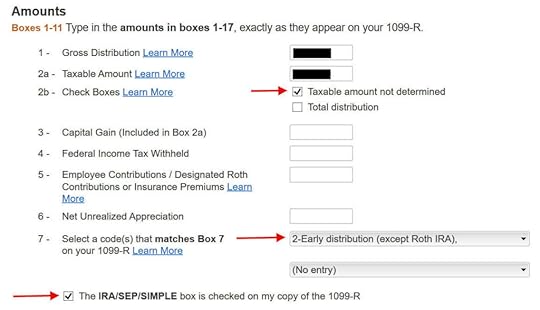

Enter the 1099-R exactly as you have it. Pay attention to the code in Box 7 and the checkboxes. It’s normal to have the same amount as the taxable amount in Box 2a, when Box 2b is checked saying “taxable amount not determined.” Pay attention to the distribution code in Box 7. It’s code 2 if you’re under 59-1/2 and code 7 if you’re over 59-1/2. The IRA/SEP/SIMPLE box is also checked.

Right after you enter the 1099-R, you will see the refund number drop. Here we went from a $1,540 refund to $264. Don’t panic. It’s normal and temporary. The refund number will come up when we finish everything.

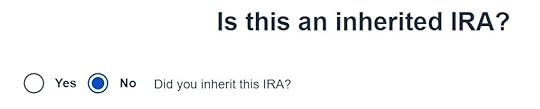

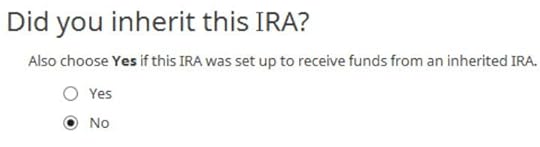

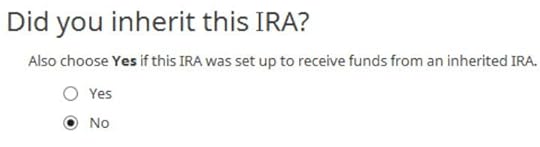

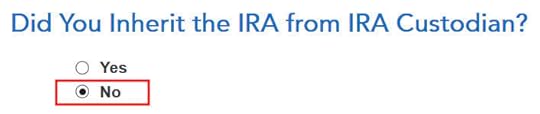

We did not inherit this IRA.

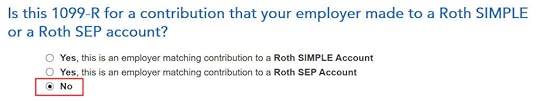

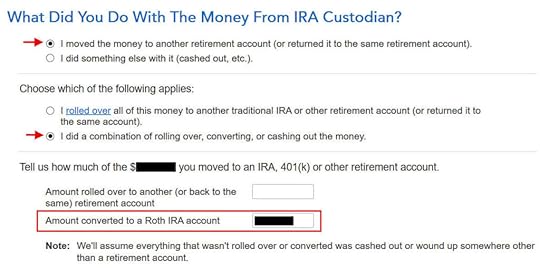

It asks you about Roth conversion. Answer Yes to conversion and enter the converted amount.

You are done with this 1099-R. Repeat if you have another 1099-R. If you’re married and both of you did a Backdoor Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse.

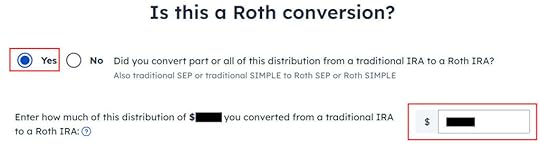

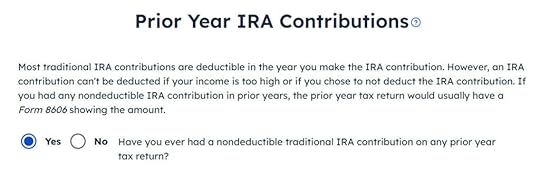

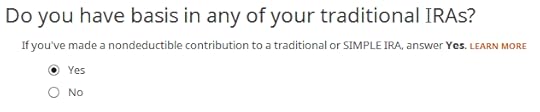

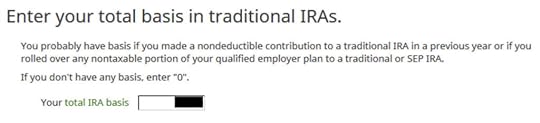

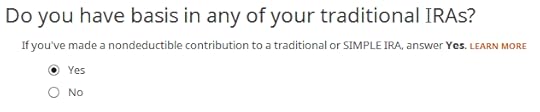

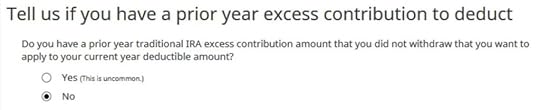

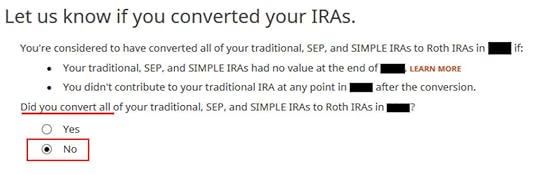

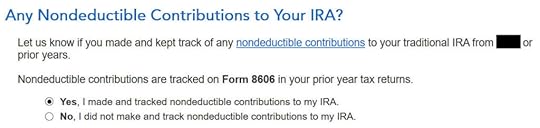

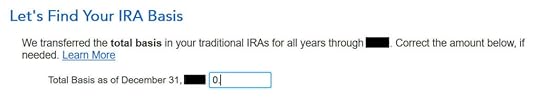

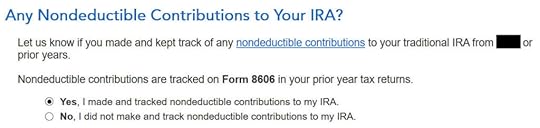

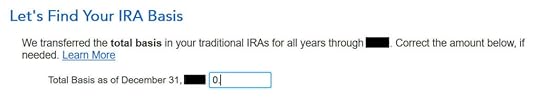

It asks you about the basis carried over from previous years. If you did a clean “planned” backdoor Roth every year, you can answer “No.” Answering “Yes” and entering all 0’s on the next page has the same effect as answering “No.” If you have gone back and forth before you found this guide, some of your previous answers may be stuck. Answering “Yes” here will give you a chance to review and correct them. If you have a basis carryover on line 14 of Form 8606 from your previous year’s tax return, answer Yes here and enter it on the next page.

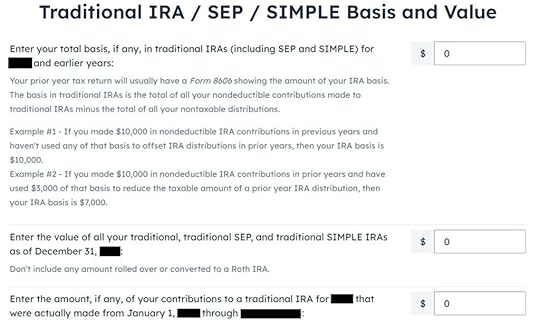

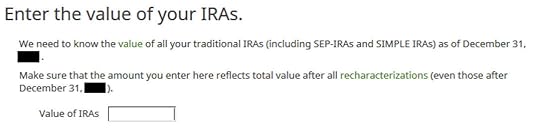

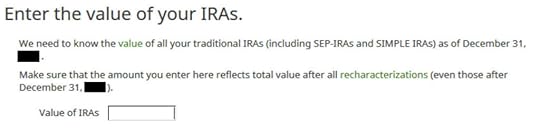

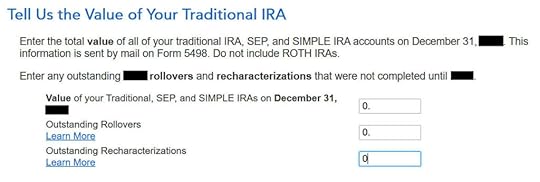

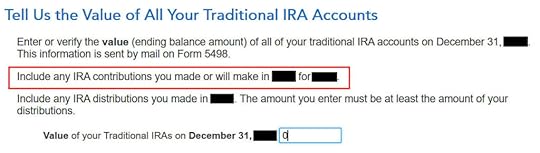

The values should be all 0 if you did a “clean” planned backdoor Roth. If you had a small amount of earnings posted to your Traditional IRA after the conversion and you didn’t convert the earnings, enter the account’s value in the second box from your year-end statement.

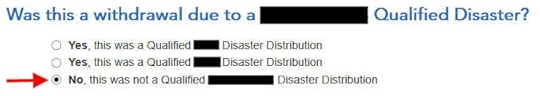

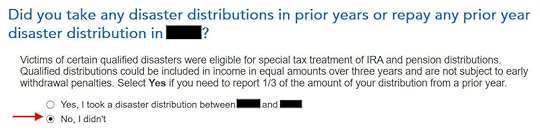

We didn’t take any disaster distribution.

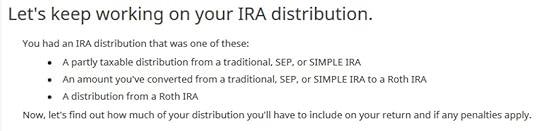

Now continue with all other income items until you are done with income. Your refund meter is still lower than it should be but it will change soon.

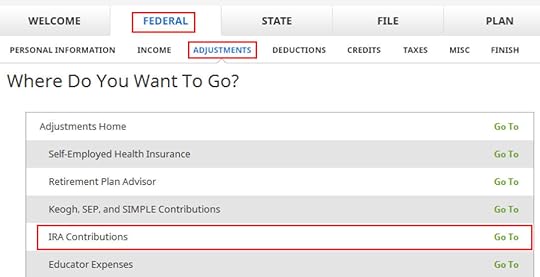

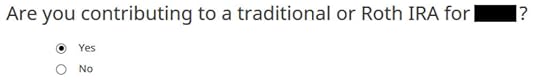

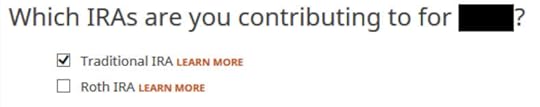

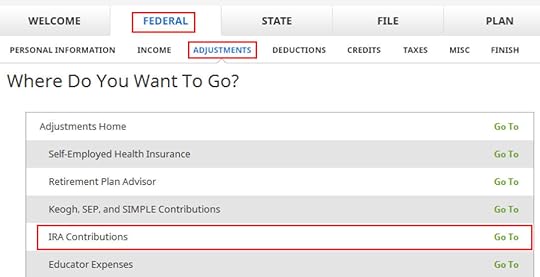

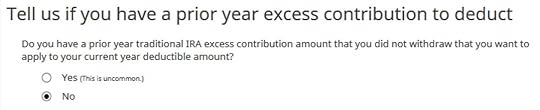

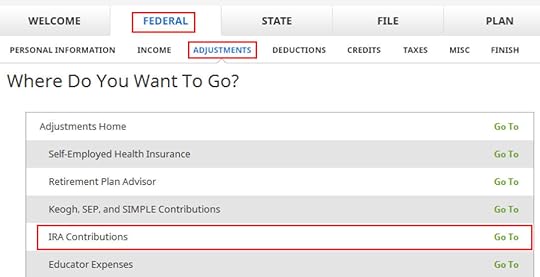

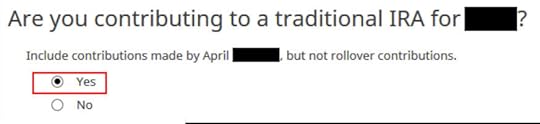

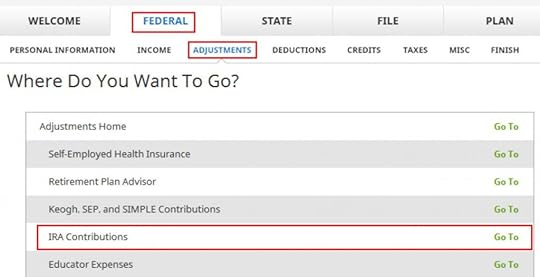

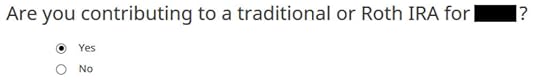

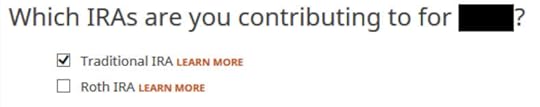

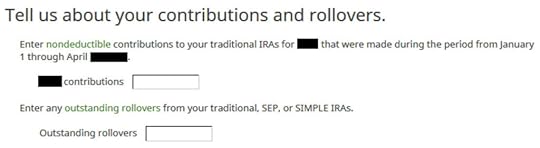

Traditional IRA Contribution

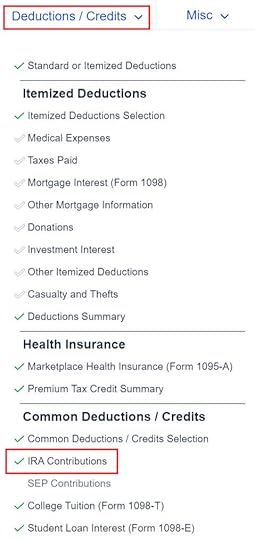

Find the IRA Contributions section under the “Deductions / Credits” menu.

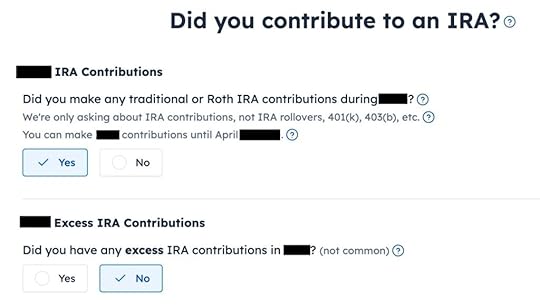

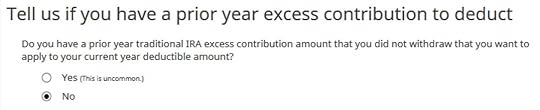

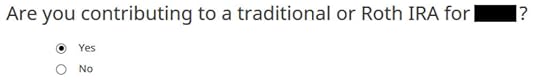

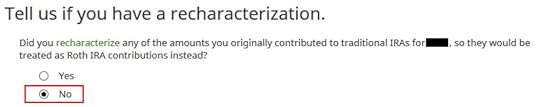

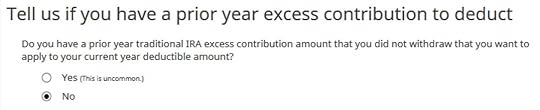

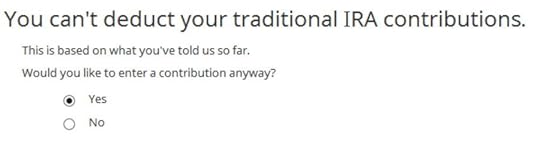

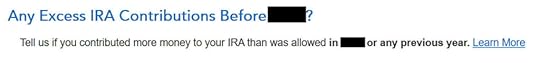

Answer Yes to the first question. An excess contribution means contributing more than you’re allowed to contribute. We didn’t have that.

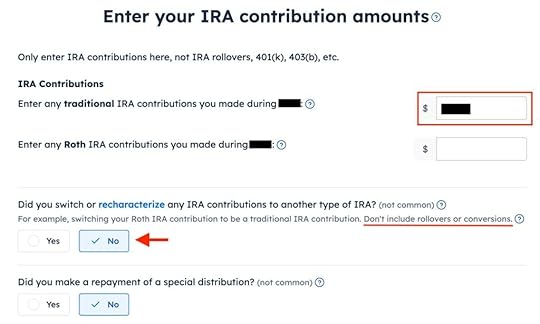

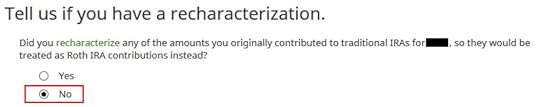

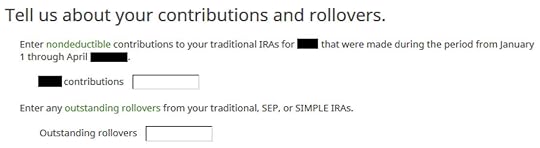

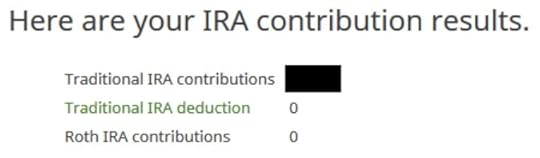

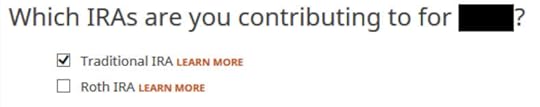

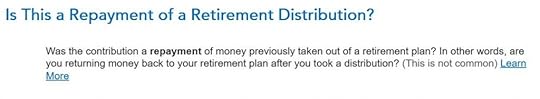

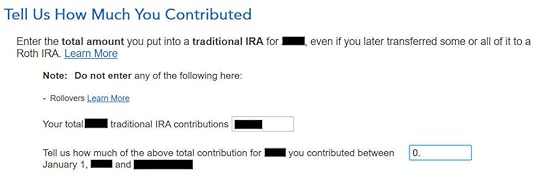

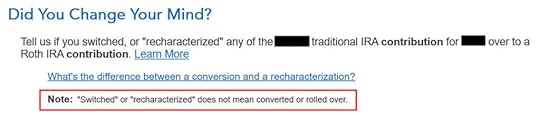

Enter the amount you contributed to the Traditional IRA in the first box. Leave the answer to “Did you switch or recharacterize” at No. We converted. We didn’t recharacterize. We didn’t repay any distribution either.

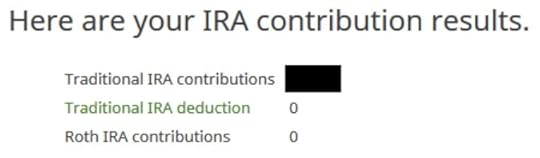

Your refund number goes up again! It was a refund of $1,540 before we started. It went down a lot and now it’s back to $1,496. The $44 difference is due to paying tax on the $200 earnings before we converted to Roth.

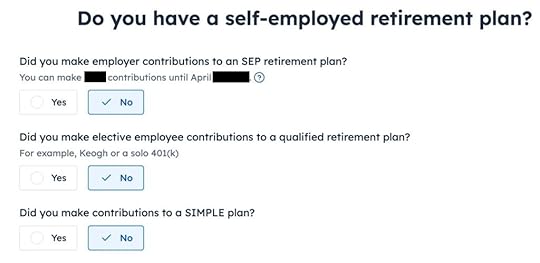

We didn’t contribute to a SEP, solo 401k, or SIMPLE plan. Answer Yes if you did.

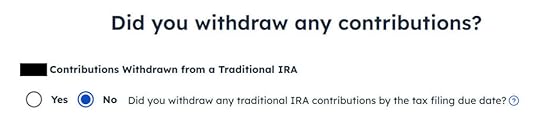

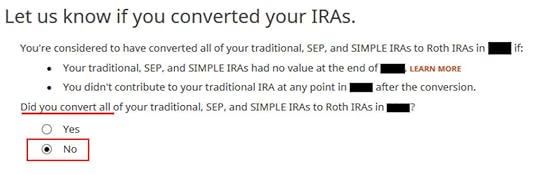

Withdraw means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer ‘No‘ here.

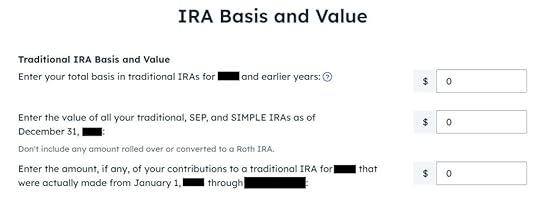

All values are zero when you did a “clean” planned Backdoor Roth. If you had a small amount of earnings posted to your Traditional IRA after you converted and you didn’t convert the earnings, enter the balance of your Traditional IRA from your year-end statement in the second box.

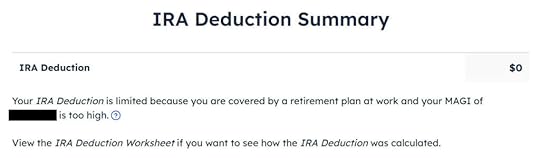

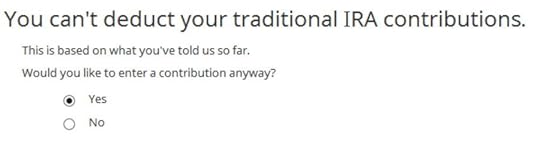

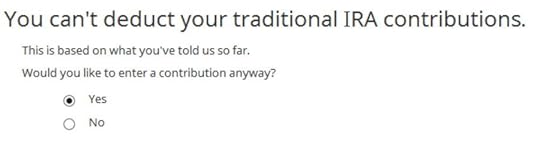

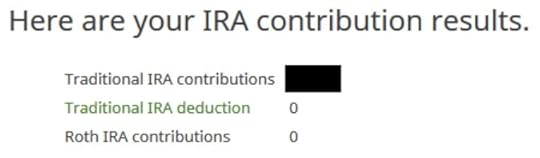

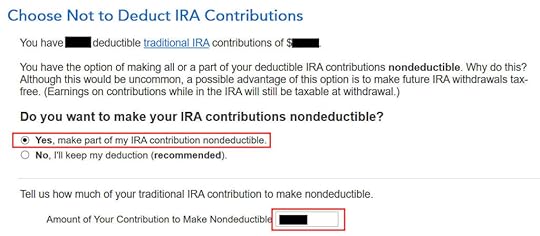

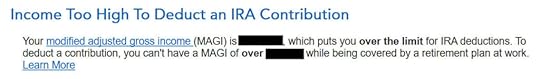

It tells us we don’t get a deduction because our income was too high. We know. That’s why we did the Backdoor Roth.

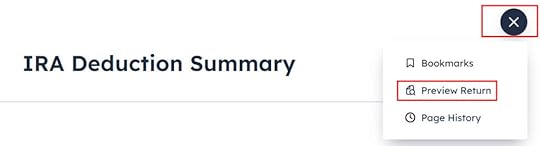

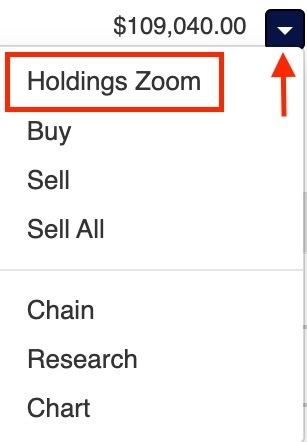

Taxable Income from Backdoor RothAfter going through all these, let’s confirm how you’re taxed on the Backdoor Roth. Click on the three dots on the top right above the IRA Deduction Summary and then click on “Preview Return.”

Look for Line 4 in Form 1040.

It shows $7,200 in IRA distributions in line 4a and only $200 is taxable in line 4b. If you are married filing jointly and both of you did a backdoor Roth, the numbers here will show double.

Tah-Dah! You put money into a Roth IRA through the backdoor when you aren’t eligible to contribute to it directly. You pay tax on a small amount of earnings if you waited between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

Conversion Is TaxedIf you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. FreeTaxUSA will give you the deduction if it sees that you qualify. It doesn’t give you the choice of making it non-deductible. You see this deduction on Schedule 1, Line 20.

Taking this deduction also makes your Roth IRA conversion taxable. The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal and it doesn’t cause any problems when you (or your spouse) indeed don’t have a retirement plan at work.

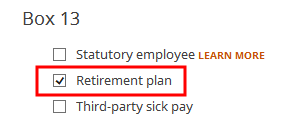

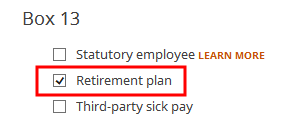

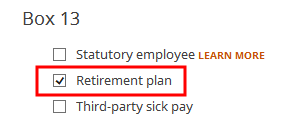

If you actually have a retirement plan at work, the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2.

Maybe you forgot the check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries in FreeTaxUSA to make sure they match the W-2.

Self vs SpouseIf you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Report 2024 Backdoor Roth In FreeTaxUSA (Updated) appeared first on The Finance Buff.

January 29, 2025

How To Report 2024 Mega Backdoor Roth In H&R Block (Updated)

[Updated on January 29, 2025 with screenshots from H&R Block Deluxe downloaded software for the 2024 tax year.]

A Mega Backdoor Roth is different from a regular Backdoor Roth. It’s done by making non-Roth after-tax contributions to a 401k-type plan before moving it to the Roth account within the 401k-type plan or taking the money out (with earnings) to a Roth IRA.

It’s a great way to put additional money into a Roth account without having to pay much additional tax. Not all plans allow non-Roth after-tax contributions but some estimated that 40% of people can do it.

Suppose you did a Mega Backdoor Roth last year. You should have received a 1099-R form from your 401k plan provider. You’ll need to account for it on your tax return. Here’s how to do it in H&R Block tax software. If you use TurboTax or FreeTaxUSA, please see:

How To Enter Mega Backdoor Roth in TurboTax (Updated)How to Enter Mega Backdoor Roth in FreeTaxUSA (Updated)Table of ContentsUse H&R Block DownloadWithin the Plan Or To Roth IRA1099-R EntriesRollover DestinationVerify on Form 1040Use H&R Block DownloadThe screenshots in this post are from H&R Block Deluxe downloaded software. The downloaded software is both less expensive and more powerful than the online version. A user reported getting an error from the online version of H&R Block in comment #8. The H&R Block downloaded software didn’t give that error.

If you haven’t paid for your H&R Block online filing yet, you can buy H&R Block downloaded software from Amazon, Walmart, Newegg, or Office Depot and switch to the downloaded software. If you’re already too far along with your entries, make this your last year of using the online version and switch to the downloaded version next year.

Within the Plan Or To Roth IRAYou can do the mega backdoor Roth in two ways — convert within the plan or withdraw to a Roth IRA. Converting within the plan is much easier, and many plans automate the process. Transferring to a Roth IRA also works. See the previous post Mega Backdoor Roth: Convert Within Plan or Out to Roth IRA?

Here’s the scenario we’ll use as an example:

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). By the time you converted the money to the Roth account within the plan or transferred it to your Roth IRA, your contributions earned $200. You converted $10,200 to your Roth account.

I’m using 401(k) as a shorthand. It works the same in a 403(b). If you did a split rollover — after-tax contributions to a Roth IRA and the earnings to a Traditional IRA — and the plan administrator issued one 1099-R for your two rollovers, you’ll need to split your 1099-R into two. See One 1099-R Form for Two Rollovers in TurboTax and H&R Block.

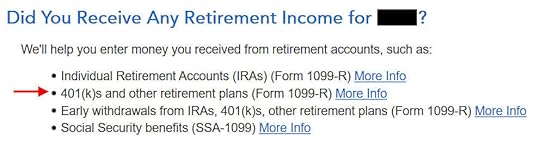

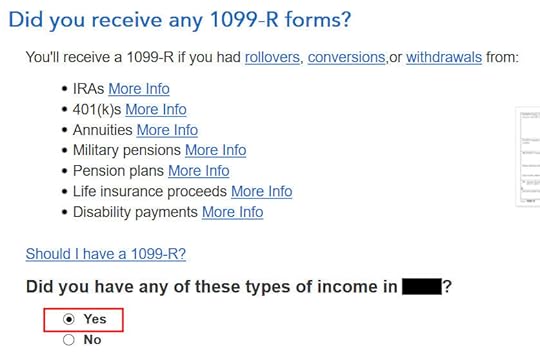

1099-R Entries

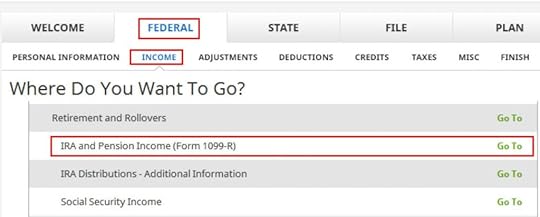

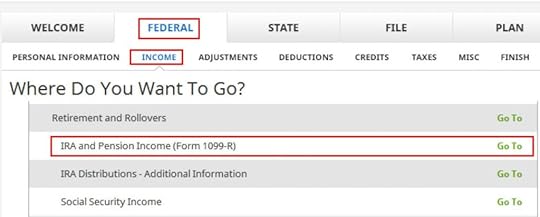

Go to Federal -> Income -> IRA and Pension Income (Form 1099-R). You can import the 1099-R or enter it manually. I’m showing manual entries.

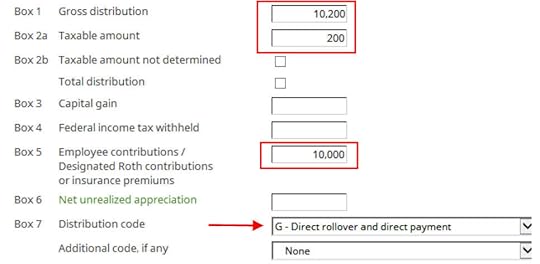

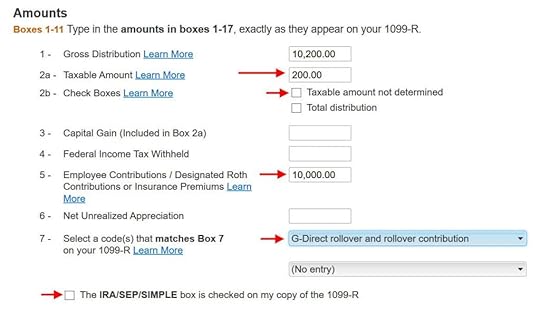

Our 1099-R is a normal 1099-R. Enter the numbers from your 1099-R as-is. Ours looks like this:

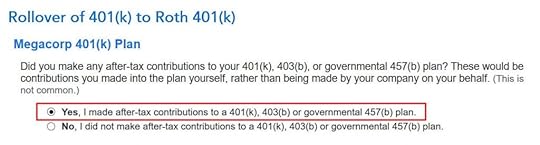

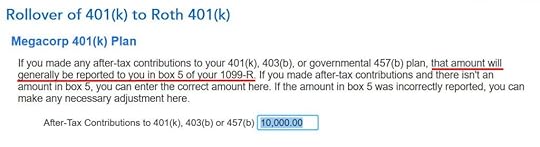

The gross amount converted to the Roth account shows up in Box 1. The earnings are in Box 2a. If you didn’t have earnings in your rollover, Box 2a is zero. “Taxable Amount Not Determined” under Box 2b is left unchecked. The amount of your non-Roth after-tax contributions shows in Box 5. Box 7 has code G.

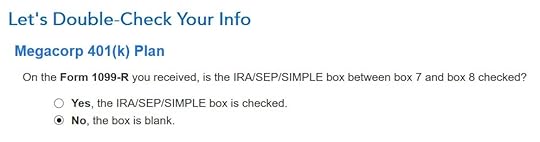

The IRA/SEP/SIMPLE box in Box 7 on your 1099-R should NOT be checked.

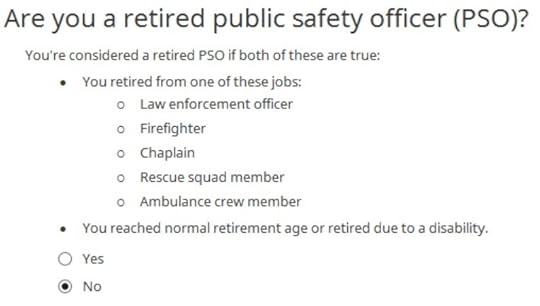

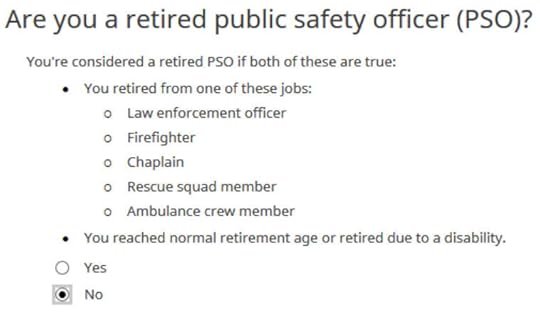

We’re not a retired public safety officer.

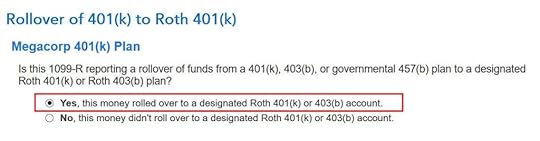

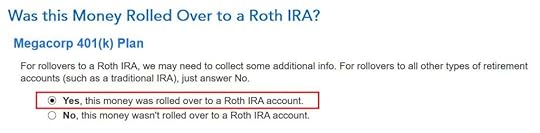

Rollover Destination

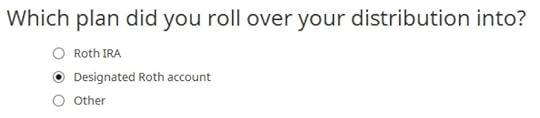

The Roth 401k account is officially a “designated Roth account” in the plan. Choose “Designated Roth account” if you converted within the plan. Choose “Roth IRA” if you took the money out of the plan to your Roth IRA.

That’s it. It’s as simple as that.

Verify on Form 1040Now we verify we’re taxed only on the $200 in earnings, and not on the $10,000 non-Roth after-tax contributions.

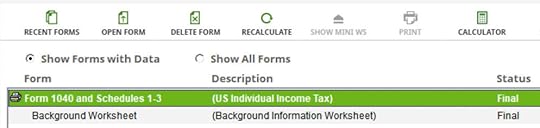

Click on “Forms” in the top menu bar. Double-click on “Form 1040 and Schedules 1-3” in the forms list and click on “Hide Mini WS.”

Scroll down to find Line 5. The gross amount transferred to the Roth account shows on Line 5a. Line 5b shows you’re taxed only on the earnings. If you didn’t have earnings, Line 5b will be zero.

When you’re done looking at the form, close the forms window to get back to the interview.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Report 2024 Mega Backdoor Roth In H&R Block (Updated) appeared first on The Finance Buff.

January 28, 2025

Split-Year Backdoor Roth IRA in H&R Block, Year 2

Updated on January 28, 2025, with updated screenshots from H&R Block Deluxe download software for the 2024 tax year. If you use TurboTax or FreeTaxUSA, see:

Split-Year Backdoor Roth IRA in TurboTax, 2nd YearSplit-Year Backdoor Roth IRA in FreeTaxUSA, 2nd YearThe previous post Split-Year Backdoor Roth in H&R Block, 1st Year dealt with contributing to a Traditional IRA for the previous year or recharacterizing a previous year’s Roth IRA contribution as a Traditional IRA contribution. This post handles the conversion part.

We cover two example scenarios. Here’s the first scenario:

You contributed $6,500 to a Traditional IRA for 2023 in 2024. The value increased to $6,700 when you converted it to Roth in 2024. You received a 1099-R form listing this $6,700 Roth conversion.

You should’ve already reported the contribution part on your 2023 tax return by following Split-Year Backdoor Roth in H&R Block, 1st Year. The IRA custodian sent you a 1099-R form for the conversion in 2024. This post shows you how to put it into H&R Block tax software.

Here’s the second example scenario:

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your income was too high when you did your 2023 taxes in 2024. You recharacterized the Roth contribution for 2023 as a Traditional contribution before April 15, 2024. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. The value increased again to $6,700 when you converted it to Roth in 2024. You received two 1099-R forms, one for $6,600 and another for $6,700.

You should’ve already reported the recharacterized contribution on your 2023 tax return by following Split-Year Backdoor Roth in H&R Block, 1st Year. The IRA custodian sent you two 1099-R forms, one for the recharacterization, and the other for the conversion. This post shows you how to put both of them into H&R Block tax software.

If you contributed for 2024 in 2025 or if you recharacterized a 2024 contribution in 2025, you’re still in the first year of this journey. Please follow Split-Year Backdoor Roth in H&R Block, 1st Year. If you recharacterized your 2024 contribution in 2024 and converted in 2024, please follow Backdoor Roth in H&R Block: Recharacterized in the Same Year.

If neither of these example scenarios fits you, please consult our guide for a normal “clean” backdoor Roth: How to Report Backdoor Roth in H&R Block Tax Software.

If you’re married and both you and your spouse did the same thing, you should follow the steps below once for yourself and once again for your spouse.

Table of ContentsUse H&R Block Download Software1099-R for Recharacterization1099-R for ConversionMore QuestionsClean Backdoor Roth On TopDid Not RecharacterizeBasisTaxable IncomeTroubleshootingFresh StartConversion Is TaxedUse H&R Block Download SoftwareThe screenshots below are taken from H&R Block Deluxe downloaded software. The downloaded software is more powerful and less expensive than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

1099-R for RecharacterizationThis section only applies to the second example scenario. If you didn’t recharacterize (the first example scenario), please skip this section and jump over to the conversion section.

We handle the 1099-R form for recharacterization first. This 1099-R form has a code ‘R’ in Box 7.

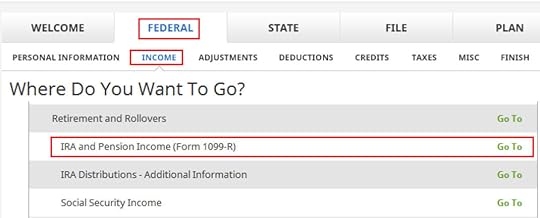

Click on Federal -> Income. Scroll down and find IRA and Pension Income (Form 1099-R). Click on “Go To.”

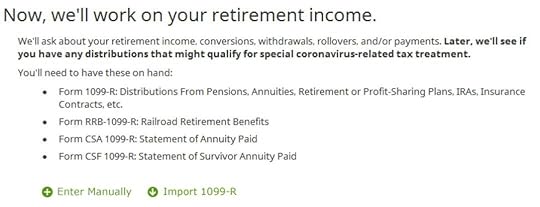

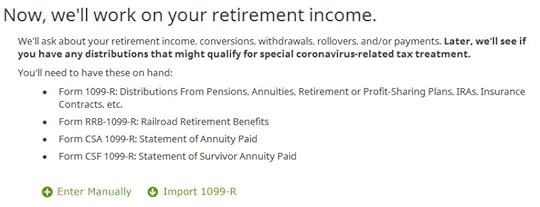

Click on Import 1099-R if you’d like. I show manual entries with “Enter Manually” here.

Just a regular 1099-R.

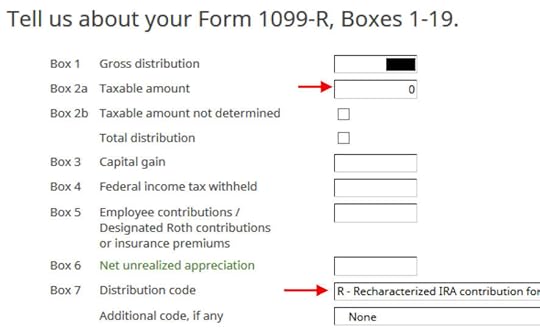

The amount that moved from your Roth IRA to your Traditional IRA is shown in Box 1. It’s $6,600 in our example. The taxable amount in Box 2a is zero. The two checkboxes in Box 2b aren’t checked. The code in Box 7 is “R.”

The “IRA/SEP/SIMPLE” box under Box 7 may or may not be checked. It’s not checked in our sample 1099-R.

Not a retired public safety officer.

We like to hear that.

You’re done with the first 1099-R form. Click on “Enter Manually” to add the second one if you don’t already have both 1099-R forms imported.

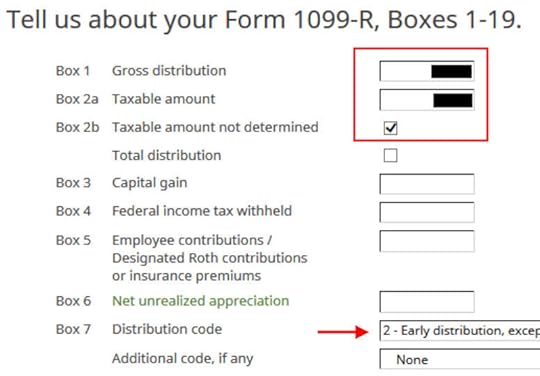

1099-R for ConversionThe 1099-R for conversion has either a code “2” or code “7” in Box 7.

The second 1099-R form is also a regular 1099-R.

It’s normal to see the conversion reported in Box 2a as the taxable amount when Box 2b is checked to say “Taxable amount not determined.” The code in Box 7 is ‘2‘ when you’re under 59-1/2 or ‘7‘ when you’re over 59-1/2.

The “IRA/SEP/SIMPLE” box is checked on this 1099-R form for the conversion.

Did not inherit it.

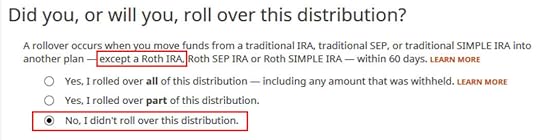

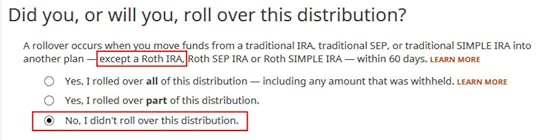

This is a very important question. Read carefully. Answer No, because you converted, not rolled over.

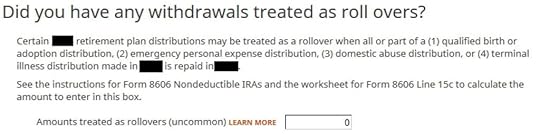

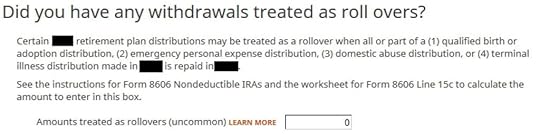

We don’t have these repaid withdrawals treated as rollovers.

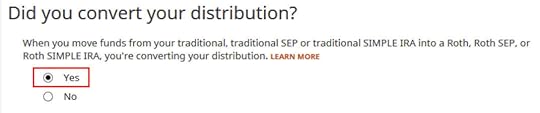

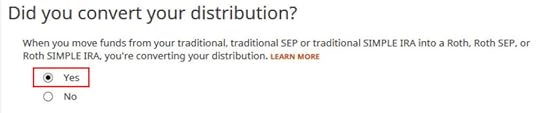

Now answer Yes, you converted.

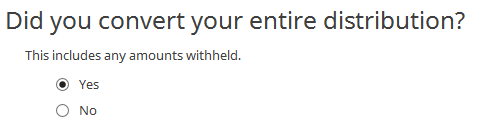

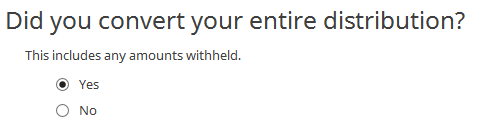

We converted all of it in our example.

Answer Yes because your contribution for the prior year was your basis.

The refund in progress drops a lot at this point. Don’t panic. It’s normal and only temporary. It will come back up after we continue.

You are done with this 1099-R. Repeat the above if you have another 1099-R. If you’re married and both of you converted to Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-Rs to the same person when they belong to each spouse. Click on Finished when you are done with all the 1099-Rs.

More Questions

H&R Block has a few more questions.

Answer Yes if you did a “clean” backdoor Roth in 2024 on top of converting your 2023 contribution, in other words, you also contributed to a Traditional IRA for 2024 in 2024 and converted both your 2023 contribution and your 2024 contribution in 2024. Your 1099-R includes converting two year’s worth of contributions in a single year.

If you answered “Yes” to the previous question, H&R Block will wait until you also enter your 2024 contribution. Your refund meter is still depressed but don’t worry.

If you answered “No” to the previous question because you didn’t contribute to a Traditional IRA for 2024, the software will ask you for your basis. Get that number from Line 14 of your Form 8606. It’s $6,500 in our example.

Clean Backdoor Roth On TopThe conversion part of the clean backdoor Roth is already included in the 1099-R form we just completed. Now we do the contribution part.

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

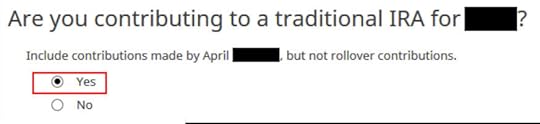

Answer “Yes” because you contributed to a Traditional IRA in 2024 for 2024.

Check the box for Traditional IRA.

You know you don’t get a deduction due to income. Enter anyway. If you don’t see this question, it means the software thinks you’re eligible for a deduction. You can’t decline the deduction.

Enter your contribution amount. We contributed $7,000 in our example.

Did Not Recharacterize

This is important. Answer No because you didn’t recharacterize. You converted to Roth.

No excess contribution.

Basis

H&R Block should import this from last year’s data but it doesn’t. Get it from last year’s Form 8606 Line 14. If you didn’t have a Form 8606 last year because the software gave you a deduction on Schedule 1 Line 20, your basis is zero. It’s $6,500 in our example.

This is another important question. If you emptied all your Traditional IRA and you don’t have any SEP or SIMPLE IRAs, technically you can answer Yes and skip some questions. The safer bet is to answer No and go through the follow-up questions. If you’ve been going through these screens back and forth, you may have put in some incorrect answers in a previous round. You will have a chance to review and correct those answers only if you answer No.

Leave the boxes blank when you contributed for 2024 in 2024.

The box should be blank or zero when you emptied all your Traditional IRAs after converting them to Roth. If you had a few dollars of earnings after you converted and you left them in the account, get the value from your year-end statements and put it here. The software will apply the pro-rata rule.

0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you contributed to a Traditional IRA.

Now the refund meter should go back up after you enter the Traditional IRA contributions.

Taxable IncomeYou’re done with the 1099-R forms. Let’s look at how they show up on your tax return. Click on Forms on the top and open Form 1040 and Schedules 1-3. Click on Hide Mini WS. Scroll down to lines 4a and 4b.

Line 4a shows the amount on your 1099-R for the Roth conversion. Line 4b shows the taxable amount, which is the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth. The taxable amount would be zero if you didn’t have any earnings. The taxable amount can be off by a few dollars due to rounding.

Form 8606 shows these for our example:

Line #Amount17,000 (only if you also did a “clean” backdoor Roth on top, otherwise blank.)26,5003The sum of Line 1 and Line 25The same as Line 313The same as Line 3 (or close to it due to rounding)14016The amount on your 1099-R with a code 2 or 717The same as Line 3 (or close to it due to rounding)18The difference between Line 16 and Line 17Form 8606TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

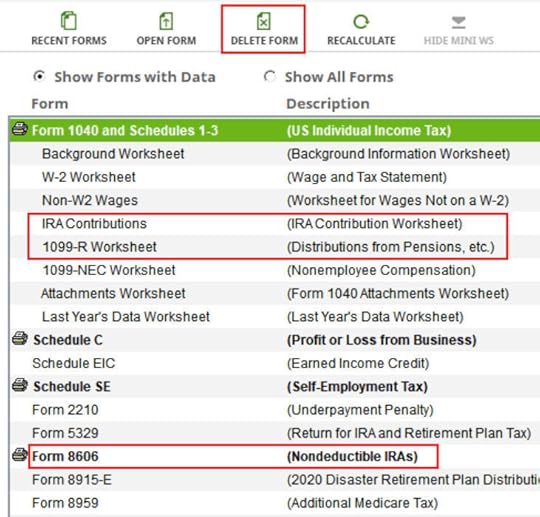

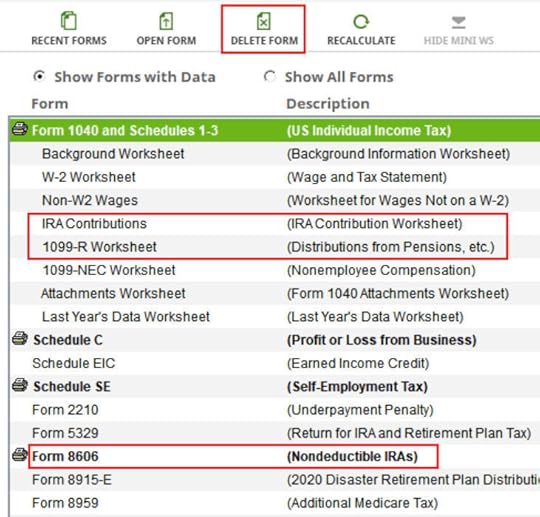

Fresh StartIt’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

Click on Forms and delete IRA Contributions Worksheet, 1099-R Worksheet, and Form 8606. Then start over by following the steps here.

Conversion Is TaxedIf you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. The software gives you the deduction if it sees that your income qualifies. It doesn’t give you the choice of making it non-deductible.

Part of your conversion could be taxed because you took a deduction on the Traditional IRA contribution last year or this year. You see whether you took a deduction by looking at Schedule 1 Line 20 on last year’s and this year’s tax returns.

The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal and it doesn’t cause any problems when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2.

Maybe you forgot to check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries to make sure it matches the W-2.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Split-Year Backdoor Roth IRA in H&R Block, Year 2 appeared first on The Finance Buff.

Split-Year Backdoor Roth IRA in H&R Block, Year 1

Updated on January 28, 2025, with updated screenshots from H&R Block Deluxe download software for the 2024 tax year. If you use TurboTax or FreeTaxUSA, see:

Split-Year Backdoor Roth IRA in TurboTax, 1st YearSplit-Year Backdoor Roth IRA in FreeTaxUSA, 1st YearThe best way to do a backdoor Roth is to do it “clean” by contributing for and converting in the same year — contribute for 2024 in 2024 and convert in 2024, contribute for 2025 in 2025 and convert in 2025, and contribute for 2026 in 2026 and convert in 2026. Don’t split them into two years: contributing for 2023 in 2024 and converting in 2024 or contributing for 2024 in 2025 and converting in 2025. If you did a “clean” backdoor Roth and you’re using H&R Block tax software, please follow How to Report Backdoor Roth in H&R Block Tax Software.

However, many people didn’t know they should’ve done it “clean.” Some people thought it was natural to contribute to an IRA for 2024 between January 1 and April 15 in 2025. Some people contributed directly to a Roth IRA for 2024 in 2024 and only found out their income was too high when they did their 2024 taxes in 2025. They had to recharacterize the previous year’s Roth IRA contribution as a Traditional IRA contribution and convert it again to Roth after the fact.

When you contribute for the previous year and convert (or recharacterize and convert in the following year), you have to report them on your tax return in two different years: the contribution in one year and the conversion in the following year. It’s more confusing than a straight “clean” backdoor Roth but that’s the price you pay for not knowing the right way. This post shows you how to report the contribution part in H&R Block for the first year. Split-Year Backdoor Roth in H&R Block, 2nd Year shows you how to do the conversion part for the second year.

If you recharacterized your 2024 contribution in 2024 and converted in 2024, please follow Backdoor Roth in H&R Block: Recharacterized in the Same Year.

I’m showing two examples — (1) a direct contribution to a Traditional IRA for the previous year; and (2) a Roth contribution for the previous year recharacterized as a Traditional contribution. Please see which example matches your scenario and follow along accordingly.

Table of ContentsUse H&R Block Download SoftwareContributed for the Previous YearContributed to Traditional IRADid Not RecharacterizeForm 8606Break the CycleRecharacterized in the Following YearContributed to Roth IRARecharacterized to TraditionalForm 8606Switch to Clean Backdoor RothTroubleshootingNo 1099-RContribution Is DeductibleUse H&R Block Download SoftwareThe screenshots below are taken from H&R Block Deluxe downloaded software. The downloaded software is more powerful and less expensive than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

Contributed for the Previous YearHere’s the example scenario for a direct contribution to the Traditional IRA:

You contributed $7,000 to a Traditional IRA for 2024 between January 1 and April 15, 2025. You then converted it to Roth in 2025.

Because your contribution was *for* 2024, you need to report it on your 2024 tax return by following this guide. Because you converted in 2025, you won’t get a 1099-R for your conversion until January 2026. You will report the conversion when you do your 2025 tax return. Come again next year to use Split-Year Backdoor Roth in H&R Block, 2nd Year.

If you contributed to a Traditional IRA in 2024 for 2023, everything below should’ve happened in your 2023 tax return. In other words,

You contributed $6,500 to a Traditional IRA for 2023 between January 1 and April 15, 2024. You then converted it to Roth in 2024.

Then you should’ve gone through the steps below in your 2023 tax return. If you didn’t, you should fix your 2023 return. The conversion part is covered in Split-Year Backdoor Roth in H&R Block, 2nd Year.

If you’re married and both you and your spouse did the same thing, you must follow the same steps below once for you and once again for your spouse.

If you first contributed to a Roth IRA and then recharacterized it as a Traditional contribution, please jump over to the next example.

Contributed to Traditional IRA

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

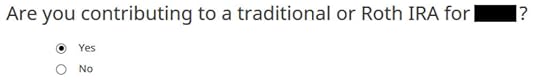

The “Are you contributing to …” wording isn’t exactly accurate when you already contributed but answer “Yes” anyway because you contributed to an IRA for the year in question.

Check the box for Traditional IRA because you contributed directly to a Traditional IRA. See the next example if you contributed to a Roth IRA first and then recharacterized your contribution.

You know you don’t get a deduction due to income. Enter anyway. If you don’t see this question, it means H&R Block thinks you qualify for a deduction. You don’t have the choice to decline the deduction.

Enter your contribution amount. We contributed $7,000 in our example.

Did Not Recharacterize

This is important. Answer No because you didn’t recharacterize. You converted to Roth.

No excess contribution.

Enter zero if this is the first year you contributed to a Traditional IRA. If you contributed non-deductible for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

A summary of your contributions. 0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you contributed to a Traditional IRA for the previous year.

Form 8606Click on Forms on the top and open Form 8606. Click on Hide Mini WS. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2025. It’ll make your conversion in 2025 not taxable.

If you don’t see a Form 8606 or if your Form 8606 doesn’t look right, please check the Troubleshooting section.

Break the CycleWhile you’re at it, you should break the cycle of contributing for the previous year and create a new habit of contributing for the current year. Contribute to a Traditional IRA for 2025 in 2025 and convert in 2025.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2024 contribution and your 2025 contribution in 2025. Then you will start 2026 fresh. Contribute for 2026 in 2026 and convert in 2026.

Recharacterized in the Following YearNow let’s look at our second example scenario.

You contributed $7,000 to a Roth IRA for 2024 in 2024. You realized that your income was too high when you did your 2024 taxes in 2025. You recharacterized the Roth contribution for 2024 as a Traditional contribution before April 15, 2025. The IRA custodian moved $7,100 from your Roth IRA to your Traditional IRA because your original $7,000 contribution had some earnings. Then you converted it to Roth in 2025.

Because your contribution was for 2024, you need to report it on your 2024 tax return by following this guide. Because you converted in 2025, you won’t get a 1099-R for your conversion until January 2026. You will report the conversion when you do your 2025 tax return. Come back again next year to use Split-Year Backdoor Roth in H&R Block, 2nd Year.

Similar to our first example, if you did the same in 2024 for 2023, you should’ve done everything below when you did your taxes for 2023. In other words,

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your income was too high when you did your 2023 taxes in 2024. You recharacterized the Roth contribution for 2023 as a Traditional contribution before April 15, 2024. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. Then you converted it to Roth in 2024.

Then you should’ve taken all the steps below last year on your 2023 tax return. If you didn’t, you need to fix your 2023 return. The conversion part is covered in Split-Year Backdoor Roth in H&R Block, 2nd Year.

Contributed to Roth IRA

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

Answer “Yes” because you contributed to an IRA for the year in question.

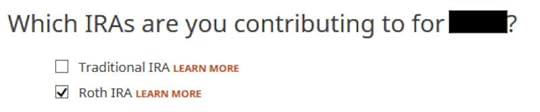

Check the box for Roth IRA because you originally contributed to a Roth IRA before you recharacterized your contribution.

Enter your original contribution amount. It’s $7,000 in our example.

Recharacterized to Traditional

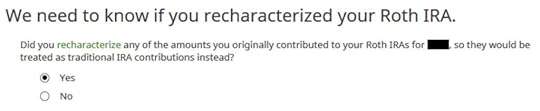

Answer Yes because you recharacterized the contribution.

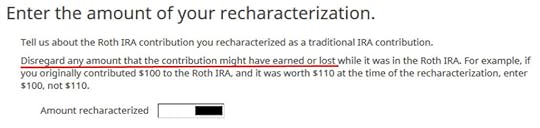

The amount here is relative to the original contribution amount. If you recharacterized the whole thing, enter $7,000 in our example, not $7,100 which was the amount with earnings that the IRA custodian moved into the Traditional IRA.

The IRS requires a brief statement to describe your recharacterization.

No excess contribution.

This is as expected. 0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you contributed to a Roth IRA for the previous year and then recharacterized in the following year.

Form 8606Click on Forms on the top and open Form 8606. Click on Hide Mini WS. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2025. It’ll make your conversion in 2025 not taxable.

If you don’t see a Form 8606 or if your Form 8606 doesn’t look right, please check the Troubleshooting section.

Switch to Clean Backdoor RothWhile you are at it, you should switch to a clean backdoor Roth for 2025. Rather than contributing directly to a Roth IRA, seeing that you exceed the income limit, recharacterizing it, and converting it again, you should simply contribute to a Traditional IRA for 2025 in 2025 and convert it to Roth in 2025 if there’s any possibility that your income will be over the limit again.

You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2024 contribution and your 2025 contribution in 2025. Then you will start 2026 fresh. Contribute for 2026 in 2026 and convert in 2026.

TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

No 1099-RYou get a 1099-R only if you converted to Roth in 2024. Because you only converted in 2025, you won’t get a 1099-R until 2026. This is normal. You do the conversion part next year by following Split-Year Backdoor Roth IRA in H&R Block, 2nd Year.

Contribution Is DeductibleIf you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. The software will give you the deduction if it sees that your income qualifies. Unlike TurboTax, H&R Block software doesn’t give you the choice of making it non-deductible. You can see this deduction on Schedule 1 Line 20.

You don’t get a Form 8606 when your contribution is fully deductible. The numbers on Lines 1, 3, and 14 of your Form 8606 are less than your full contribution when your contribution is partially deductible. This is normal when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

Taking this deduction will make your Roth IRA conversion taxable next year. You’ll pay less tax this year and more tax next year.

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2.

Maybe you forgot to check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries to make sure it matches the W-2.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Split-Year Backdoor Roth IRA in H&R Block, Year 1 appeared first on The Finance Buff.

How to Report 2024 Backdoor Roth in H&R Block Tax Software

Updated on January 28, 2025, with updated screenshots from H&R Block Deluxe download software for the 2024 tax year. If you use other tax software, see:

How To Report Backdoor Roth In TurboTaxHow to Report Backdoor Roth In FreeTaxUSAIf you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you need to report both the contribution and the conversion in the tax software. For more information on Backdoor Roth, please read Backdoor Roth: A Complete How-To and Make Backdoor Roth Easy On Your Tax Return.

Table of ContentsWhat To ReportUse H&R Block Download SoftwareConvert Traditional IRA to RothEnter 1099-RConverted to RothAdditional QuestionsNon-Deductible Contribution to Traditional IRAIRA ContributionConversion Isn’t RecharacterizationBasis From Previous YearPro-Rata RuleTaxable Income from Backdoor RothTroubleshootingFresh StartConversion Is TaxedSelf vs SpouseWhat To ReportYou report on the tax return your contribution to a traditional IRA *for* that year, and you report your conversion to Roth *during* that year.

For example, when you are doing your tax return for 2024, you report the contribution you made *for* 2024, whether you actually did it in 2024 or between January 1 and April 15, 2025. You also report your converting to Roth *during* 2024, whether the money was contributed for 2024, 2023, or any previous years.

Therefore a contribution made in 2025 for 2024 goes on the tax return for 2024. A conversion done during 2025 after you made a contribution for 2024 goes on the tax return for 2025.

You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finishing your conversion during the same year. I call this a “planned” Backdoor Roth or a “clean” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for 2024 in 2024 and convert it during 2024. Contribute for 2025 in 2025 and convert it during 2025. This way everything is clean and neat.

If you are already off by one year, it depends on whether you’re handling the contribution part or the conversion part right now. If you contributed to a Traditional IRA for 2024 in 2025 or if you recharacterized a 2024 Roth contribution to Traditional in 2025, please follow Split-Year Backdoor Roth in H&R Block, 1st Year. If you contributed to a Traditional IRA for 2023 in 2024 and converted in 2024, please follow Split-Year Backdoor Roth in H&R Block, 2nd Year. If you recharacterized a 2024 Roth contribution to Traditional in 2024 and converted in 2024, please follow Backdoor Roth in H&R Block: Recharacterized in the Same Year.

Use H&R Block Download SoftwareThe screenshots below are taken from H&R Block Deluxe downloaded software. The downloaded software is more powerful and less expensive than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

Here’s the scenario we’ll use as an example:

You contributed $7,000 to a Traditional IRA in 2024 for 2024. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2024, the value grew to $7,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you’ll have to make some adjustments to the screens shown here.

Before we start, suppose this is what H&R Block software shows:

We will compare the results after we enter the Backdoor Roth.

Convert Traditional IRA to RothIncome comes before deductions on the tax form. Tax software is also organized this way. Even though you contributed before you converted, the software makes you enter the income first.

Enter 1099-RWhen you convert the Traditional IRA to Roth, you receive a 1099-R form. Complete this section only if you converted *during* 2024. If you only converted in 2025, you won’t have a 1099-R until next January. Please follow Split-Year Backdoor Roth in H&R Block, 1st Year now and come back next year to follow Split-Year Backdoor Roth in H&R Block, 2nd Year. If your conversion during 2024 was against a contribution you made for 2023 or a 2023 contribution you recharacterized in 2024, please follow Split-Year Backdoor Roth in H&R Block, 2nd Year.

In this example, we assume by the time you converted, the money in the Traditional IRA had grown from $7,000 to $7,200.

Click on Federal -> Income. Scroll down and find IRA and Pension Income (Form 1099-R). Click on “Go To.”

Click on Import 1099-R if you’d like. I show manual entries with “Enter Manually” here.

Just a regular 1099-R.

If you imported your 1099-R, double-check to make sure the import exactly matches the copy you received. If you enter your 1099-R manually, be sure to enter everything on the form exactly. Box 1 shows the amount converted to the Roth IRA. It’s $7,200 in our example. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” Pay attention to the distribution code in Box 7. It should be code 2 when you’re under 59-1/2 and code 7 when you’re over 59-1/2.

My 1099-R had the IRA/SEP/SIMPLE box checked.

We didn’t inherit it.

Converted to Roth

This is a very important question. Read carefully. Answer No, because you converted, not rolled over.

We didn’t have any of these withdrawals treated as rollovers.

Now answer Yes, you converted.

We converted all of it in our example.

Answer Yes because you made a nondeductible contribution to a traditional IRA.

The refund in progress drops a lot at this point. We went from a $2,434 refund to $946. Don’t panic. It’s normal and only temporary. It will come back up after we complete the section for IRA contributions.

You are done with one 1099-R. Repeat the above if you have another 1099-R. If you’re married and both of you did a Backdoor Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse. Click on Finished when you are done with all the 1099-Rs.

Additional Questions

A few more questions.

Answer Yes because you contributed to a Traditional IRA for the year.

We will wait.

Non-Deductible Contribution to Traditional IRANow we enter the non-deductible contribution to the Traditional IRA *for* 2024 in 2024.

If you contributed for 2024 between January 1 and April 15, 2025 or if you recharacterized a 2024 contribution in 2025, please follow Split-Year Backdoor Roth in H&R Block, 1st Year. If your contribution during 2024 was for 2023, make sure you entered it on the 2023 tax return. If not, fix your 2023 return first by following the steps in Split-Year Backdoor Roth in H&R Block, 1st Year.

IRA Contribution

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

Wrong tense but answer “Yes” because you contributed to an IRA for the year in question.

Because we did a clean “planned” Backdoor Roth, we check the box for Traditional IRA.

You know you don’t get a deduction due to income. Choose “Yes” and enter it anyway.

Enter your contribution amount. We contributed $7,000 in our example.

Conversion Isn’t Recharacterization

This is important. Answer No because you didn’t recharacterize. You converted to Roth.

We don’t have any excess contribution.

Basis From Previous Year

If you did a clean “planned” backdoor Roth and you started fresh each year, enter zero. If you contributed non-deductible for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

Pro-Rata Rule

This is another important question. If you are doing it the easy way as in our example, technically you can answer Yes and skip some questions. The safer bet is to answer No and go through the follow-up questions. If you’ve been going through these screens back and forth, you may have put in some incorrect answers in a previous round. You will have a chance to review and correct those answers only if you answer No.

In a clean planned backdoor Roth, you contribute for 2024 during 2024. Leave the boxes blank.

The box should be blank after you converted everything in your Traditional IRA to Roth before the end of the same year. If you have a small balance left because of interest, enter the value from your year-end statement here.

That’s great. We’re expecting it.

A summary of your contributions. 0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you did a Backdoor Roth.

We are done entering the non-deductible contribution to the Traditional IRA. Now the refund meter should go back up. It was a refund of $2,434 when we first started. Now it’s a refund of $2,396. The difference of $38 is due to the tax on the extra $200 earned before the Roth conversion.

Taxable Income from Backdoor RothAfter going through all these, let’s confirm how you’re taxed on the Backdoor Roth.

Click on Forms on the top and open Form 1040 and Schedules 1-3. Click on Hide Mini WS. Scroll down to lines 4a and 4b.

It shows $7,200 in IRA distributions, $201 of which is taxable. The taxable income isn’t exactly $200 due to some rounding in the calculation. If you are married filing jointly and both of you did a backdoor Roth, the numbers here will show double.

Tah-Dah! You put money into a Roth IRA through the backdoor when you aren’t eligible to contribute to it directly. You will pay tax on a small amount in earnings between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

Fresh StartIt’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

Click on Forms and delete IRA Contributions Worksheet, 1099-R Worksheet, and Form 8606. Then start over by following the steps here.

Conversion Is TaxedIf you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. The software will give you the deduction if it sees that your income qualifies. It doesn’t give you the choice of making it non-deductible. You can see this deduction on Schedule 1 Line 20, which reduces your AGI.

Taking this deduction also makes your Roth IRA conversion taxable. The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal and it doesn’t cause any problems when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2. Maybe you forgot the check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries to make sure it matches the W-2.

Self vs Spouse

Self vs SpouseIf you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Report 2024 Backdoor Roth in H&R Block Tax Software appeared first on The Finance Buff.

How To Enter 2024 Mega Backdoor Roth in TurboTax (Updated)

[Updated on January 28, 2025 with screenshots from TurboTax Deluxe download software for the 2024 tax year.]

A Mega Backdoor Roth means making non-Roth after-tax contributions to a 401k-type plan and then moving it to the Roth account within the plan or taking the money out (with earnings) to a Roth IRA. If you’re looking for the regular backdoor Roth, where you contribute to a Traditional IRA (not a 401k-type plan) before converting it to Roth, please see How To Report Backdoor Roth In TurboTax (Updated).

A mega backdoor Roth is a great way to put additional money into a Roth account without having to pay much additional tax. Not all employer plans allow non-Roth after-tax contributions but some estimated that 40% of people can do it.

Suppose your employer plan allows it and you executed a Mega Backdoor Roth. You will receive a 1099-R from the plan in the following year. You will need to account for it on your tax return. Here’s how to do it in TurboTax.

Table of ContentsUse Downloaded SoftwareWithin the Plan Or To Roth IRASplit Rollover1099-R EntriesRollover DestinationAfter-Tax ContributionsVerify on Form 1040Use Downloaded SoftwareYou should do it in TurboTax Deluxe downloaded software. The downloaded software is both less expensive and more powerful than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax from Amazon or Costco and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

If you use other tax software, please see:

How To Enter Mega Backdoor Roth In H&R Block Tax Software or How To Enter Mega Backdoor Roth in FreeTaxUSAWithin the Plan Or To Roth IRAYou can do the Mega Backdoor Roth in two ways — convert within the plan or withdraw to a Roth IRA. Converting within the plan is much easier, and many plans automate this process. Transferring to a Roth IRA also works. See the previous post Mega Backdoor Roth: Convert Within Plan or Out to Roth IRA?

Here’s the scenario we’ll use as an example:

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). By the time the money was converted to the Roth account within the plan or transferred to your Roth IRA, your contributions earned $200. You converted $10,200 to your Roth account.

I’m using 401(k) as a shorthand. It works the same in a 403(b).

Split RolloverIf you did a split rollover — after-tax contributions to a Roth IRA and the earnings to a Traditional IRA — and the plan administrator issued one 1099-R for your two rollovers, you’ll need to split your 1099-R and enter two 1099-R forms in TurboTax. See One 1099-R Form for Two Rollovers in TurboTax and H&R Block.

If you imported the single 1099-R that covers both rollovers, delete it and manually enter two 1099-R forms. The first 1099-R shows rolling over the after-tax contributions to a Roth IRA, for example:

Box 1 Gross Distribution$10,000Box 2a Taxable Amount$0Box 2b Taxable amount not determinednot checkedBox 5 Employee contributions/Designated Rothcontributions or insurance premiums$10,000Box 7 Distribution code(s)GBox 7 IRA/SEP/SIMPLE checkboxnot checked

The second 1099-R shows rolling over the earnings to a Traditional IRA, for example:

Box 1 Gross Distribution$200Box 2a Taxable Amount$0Box 2b Taxable amount not determinednot checkedBox 5 Employee contributions/Designated Rothcontributions or insurance premiums$0Box 7 Distribution code(s)GBox 7 IRA/SEP/SIMPLE checkboxnot checked

The rest of this post shows what to do with the first 1099-R (after-tax to Roth IRA). The second 1099-R (earnings to Traditional IRA) is a straight Traditional-to-Traditional rollover.

1099-R Entries

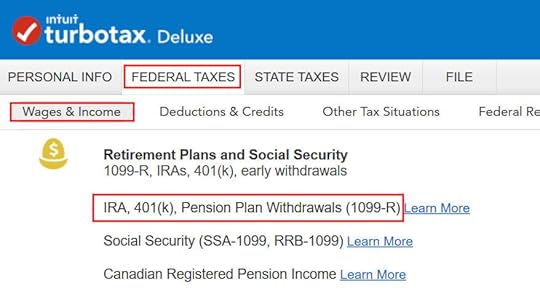

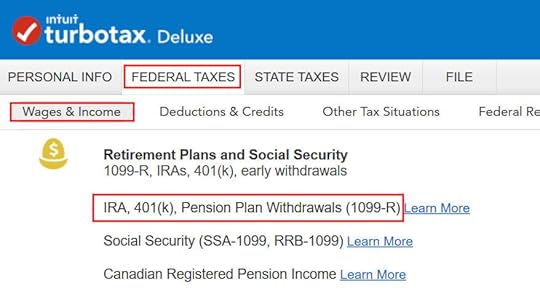

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

When you come to the Retirement Income section, answer Yes because you received a 1099-R from your 401(k) plan.

Yes, you received a 1099-R form. Import the 1099-R if you’d like. I’m typing it myself here.

You have a normal 1099-R.

If you import the 1099-R, check the import carefully to make sure it matches your copy exactly. If you type the 1099-R, be sure to type it exactly.

The earnings portion should be in Box 2a. Box 2b “Taxable amount not determined” should NOT be checked. The non-Roth after-tax contributions (the “principal”) should be in Box 5. Box 7 should show a code G. Finally, the box “The IRA/SEP/SIMPLE box is checked on my copy of the 1099-R” should NOT be checked.

TurboTax wants to make sure the IRA/SEP/SIMPLE checkbox is not checked.

Rollover Destination

If you converted to Roth within the plan, answer Yes here. If you took the money out of the plan to a Roth IRA, answer No.

If you answered “No” to the previous question, confirm that the money went to a Roth IRA.

After-Tax Contributions

Answer Yes to confirm that you made non-Roth after-tax contributions to your plan.

TurboTax pulls up the amount of your non-Roth after-tax contributions from Box 5 of your 1099-R. If your 1099-R isn’t correct, you should work with your 401(k) administrator to have it corrected.

Not a public safety officer, unless you actually are.

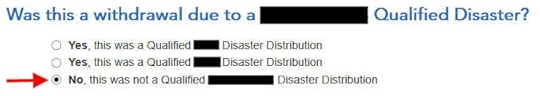

It wasn’t due to a disaster.

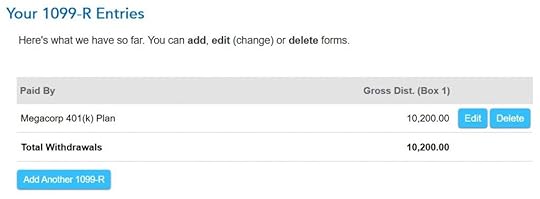

The summary shows your 1099-R entries. Repeat and add any additional 1099-Rs you may have.

Verify on Form 1040Now let’s confirm you’re only paying tax on the $200 earnings, not on your $10,000 non-Roth after-tax contributions.

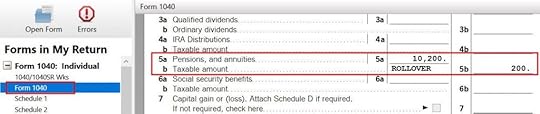

Click on Forms on the top right.

Find “Form 1040” in the left navigation pane. Scroll up or down in the right pane to lines 5a and 5b. Line 5a includes the $10,200 gross distribution amount. Line 5b only includes the $200 taxable amount.

With a Mega Backdoor Roth, you put an extra $10k into your Roth account. After paying tax on this $200, the future earnings on the $10,200 will be tax-free.

When you’re done examining the form, click on Step-by-Step on the top right to get back to the interview.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Enter 2024 Mega Backdoor Roth in TurboTax (Updated) appeared first on The Finance Buff.

January 26, 2025

How To Report 2024 Backdoor Roth In TurboTax (Updated)

Updated on January 26, 2025 with updated screenshots from TurboTax Deluxe downloaded software for the 2024 tax year. If you use other tax software, see:

How To Report Backdoor Roth In H&R Block SoftwareHow to Report Backdoor Roth In FreeTaxUSAIf you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you must report both the contribution and the conversion in the tax software. For more information on Backdoor Roth in general, see Backdoor Roth: A Complete How-To.

Table of ContentsWhat To ReportUse TurboTax DownloadConvert Traditional IRA to RothEnter 1099-RConverted to RothBasisNon-Deductible Contribution to Traditional IRAConverted, Did Not RecharacterizeBasisMake It NondeductibleTaxable Income from Backdoor RothTroubleshootingFresh StartConversion Is TaxedSelf vs SpouseWhat To ReportYou report on the tax return your contribution to a Traditional IRA *for* that year, and you also report your conversion to Roth *during* that year.

For example, when you are doing your tax return for 2024, you report the contribution you made *for* 2024, whether you actually did it during 2024 or between January 1 and April 15, 2025. You also report your conversion to Roth *during* 2024, whether the contribution was made for 2024, 2023, or any previous years.

Therefore a contribution made during 2025 for year 2024 goes on the tax return for year 2024. A conversion done during 2025 after you contributed for 2024 goes on the tax return for 2025.

You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finishing your conversion in the same year. I call this a “planned” Backdoor Roth or a “clean” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for 2024 in 2024 and convert it during 2024. Contribute for 2025 in 2025 and convert it during 2025. This way everything is clean and neat.

If you are already off by one year, it depends on whether you’re handling the contribution part or the conversion part right now. If you contributed to a Traditional IRA for 2024 in 2025 and converted in 2025 or if you recharacterized a 2024 Roth contribution in 2025 and converted in 2025, please follow Split-Year Backdoor Roth IRA in TurboTax, 1st Year. If you contributed to a Traditional IRA for 2023 in 2024 and converted in 2024 or if you recharacterized a 2023 Roth contribution in 2024 and converted in 2024, please follow Split-Year Backdoor Roth IRA in TurboTax, 2nd Year. If you recharacterized your 2024 Roth contribution in 2024 and converted in 2024, please follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year.

Use TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

Here’s the planned “clean” Backdoor Roth scenario we will use as an example:

You contributed $7,000 to a traditional IRA in 2024 for 2024. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2024, the value grew to $7,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments to the screens shown here.

Before we start, suppose this is what TurboTax shows:

We will compare the results after we enter the Backdoor Roth.

Convert Traditional IRA to RothThe tax software works on income items first. Even though the conversion happened after the contribution, we enter the conversion first.

When you convert from a Traditional IRA to a Roth IRA, you will receive a 1099-R form. Complete this section only if you converted *during* 2024. If you only converted during 2025, you won’t have a 1099-R until next January. Please follow Split-Year Backdoor Roth IRA in TurboTax, 1st Year. If your conversion during 2024 was against a contribution you made for 2023 or a 2023 contribution you recharacterized in 2024, please follow Split-Year Backdoor Roth IRA in TurboTax, 2nd Year.

In our example, we assume by the time you converted, the money in the Traditional IRA had grown from $7,000 to $7,200.

Enter 1099-R

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

As you work through the interview, you will eventually come to the point of entering the 1099-R. Select Yes, you have this type of income. Import the 1099-R if you’d like. I’m choosing to type it myself.

Just the regular 1099-R.

Box 1 shows the amount converted to the Roth IRA. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” Pay attention to the code in Box 7 and the IRA/SEP/SIMPLE box. Make sure your entry matches your 1099-R exactly.

You get this Good News, but …

Your refund in progress drops a lot. We went from $2,384 down to $858. Don’t panic. It’s normal and temporary.

It has nothing to do with an employer.

Didn’t inherit it.

Converted to Roth

First click on “I moved …” then click on “I did a combination …” Enter the amount you converted in the box. It’s $7,200 in our example. Don’t choose the “I rolled over …” option. A Roth conversion is not a rollover.

No, you didn’t put the money in an HSA.

It wasn’t due to a disaster.

You get a summary of your 1099-R’s. Repeat the previous steps to add another if you have more than one. If you’re married and both of you did a Backdoor Roth, enter the 1099-R for both of you, but pay attention to select whose 1099-R it is. Don’t accidentally assign two 1099-R forms to the same person.

Basis

Didn’t take or repay any disaster distribution.

Here it’s asking about the carryover from the prior year. When you did a clean “planned” Backdoor Roth as in our example — contributed for 2024 in 2024 and converted before the end of 2024 — you can answer No here but answering Yes with a 0 has the same effect as answering No and it allows you to correct errors.

If you answered Yes to the previous question and you did your previous year’s return correctly also in TurboTax, your basis from the previous year will show up here. If you did your previous year’s tax return wrong, fix your previous return first.

Enter the values of ALL your Traditional, SEP, and SIMPLE IRAs at the end of the year. We don’t have anything in traditional, SEP, or SIMPLE IRAs after we converted it all. If your account posted earnings after you converted and you left the earnings in the account, get the value from your year-end statement and put it in the first box.

That’s it so far on the income side. Continue with other income items. The refund in progress is still temporarily depressed. Don’t worry. It will change.

Non-Deductible Contribution to Traditional IRANow we enter the non-deductible contribution to a Traditional IRA *for* 2024.

If you contributed for 2024 between January 1 and April 15, 2025 or if you recharacterized a 2024 contribution in 2025, please follow Backdoor Roth in TurboTax: Recharacterize and Convert, 1st Year. If your contribution during 2024 was for 2023, make sure you entered it on the 2023 tax return. If not, fix your 2023 return first by following the steps in Backdoor Roth in TurboTax: Recharacterize and Convert, 1st Year.

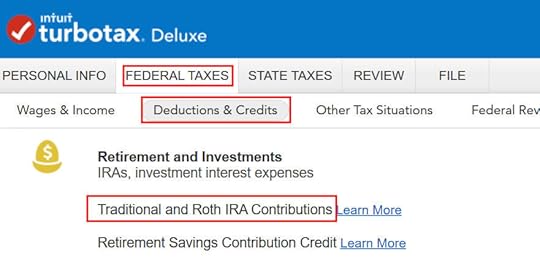

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

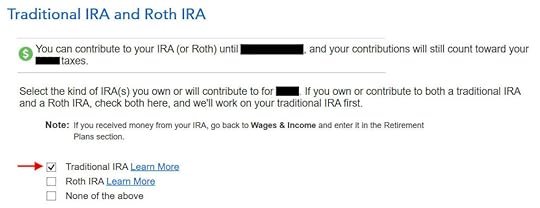

Because we did a clean “planned” Backdoor Roth, we check the box for Traditional IRA.

TurboTax offers an upgrade but we don’t need it. Choose to continue in TurboTax Deluxe.

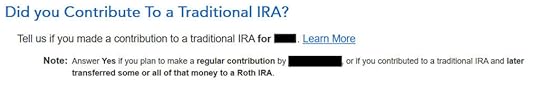

We already checked the box for Traditional but TurboTax just wants to make sure. Answer Yes here.

It was not a repayment of a retirement distribution.

Enter the contribution amount. It’s $7,000 in our example. Because we contributed for year 2024 in 2024, we put zero in the second box. If you contributed for 2024 between January 1 and April 15, 2025, enter the contribution in both boxes.

Right away our federal refund in progress goes back up! We started with $2,384. It went down to $858. Now it comes back to $2,335. The $49 difference is because we have to pay tax on the $200 in earnings when we contributed $7,000 and converted $7,200. If you had less earnings, your refund numbers would be closer still.

Converted, Did Not Recharacterize

This is a critical question. Answer “No.” You converted the money, not switched or recharacterized.

You may not get this question if you already entered your W-2 and it has Box 13 for the retirement coverage checked. Answer yes if you’re covered by a retirement plan but the box on your W-2 wasn’t checked.

No excess contribution.

Basis

TurboTax asks the same question we saw before. For a clean “planned” Backdoor Roth, we can answer No but answering Yes with a 0 has the same effect and it allows you to correct errors.

If you did your taxes correctly on TurboTax last year, TurboTax transfers the number here. If you made non-deductible contributions for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

Make It Nondeductible

TurboTax shows this screen if it sees that you qualify for a deduction for the Traditional IRA contribution. If you take the deduction it’ll make your Roth conversion taxable, which creates a wash. It’s simpler if you make your full IRA contribution nondeductible, and then your Roth conversion won’t be taxable. Enter the amount that TurboTax says is deductible.

Because we did a clean “planned” Backdoor Roth, we don’t have anything left after we converted everything before the end of the same year. If you have a small balance left because of interest, enter the value from your year-end statement here.

We know our income was too high. That’s why we did the Backdoor Roth.

The IRA deduction summary shows a $0 deduction, which is expected.

Taxable Income from Backdoor RothAfter going through all these, would you like to see how you are taxed on the Backdoor Roth?

Click on Forms on the top right.

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b. They show a $7,200 distribution from the IRA and only $200 of the $7,200 is taxable in our example. That’s the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth.

When you’re done examining the form, click on Step-by-Step on the top right to go back to the interview.

Tah-Dah! You put money into a Roth IRA through the backdoor when you aren’t eligible to contribute to it directly. That’s why it’s called a Backdoor Roth. You pay tax on a small amount of earnings between contribution and conversion. That’s negligible relative to the benefit of having tax-free growth on your contribution for many years.

TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

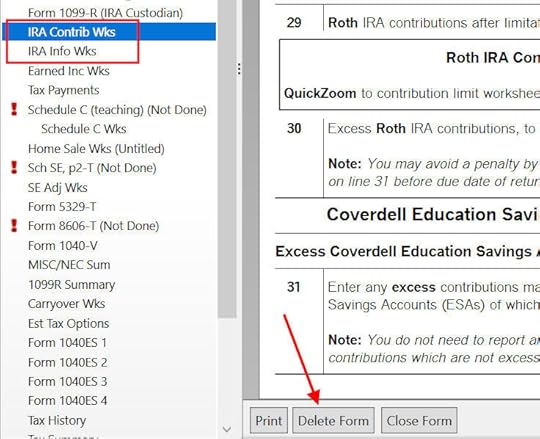

Fresh StartIt’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

Click on Forms on the top right.

Find “IRA Contrib Wks” and “IRA Info Wks” in the left navigation pane and click on “Delete Form” to delete them. Then you can start over by following the steps above.

Conversion Is Taxed

Conversion Is TaxedIf you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. Taking this deduction also makes your Roth IRA conversion taxable. You can see this deduction on Schedule 1 Line 20, which reduces your AGI.

The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal and it doesn’t cause any problems when you indeed don’t have a retirement plan at work.

It’s less confusing if you decline the tax deduction, which also makes your conversion non-taxable. See the Make It Nondeductible section.

Self vs SpouseIf you are married, make sure you don’t have the 1099-R and IRA contribution mixed up between yourself and your spouse. If you inadvertently entered two 1099-Rs issued to you instead of one for you and one for your spouse, the second 1099-R to you will not match up with a Traditional IRA contribution made by your spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Report 2024 Backdoor Roth In TurboTax (Updated) appeared first on The Finance Buff.

January 16, 2025

2024 2025 2026 Federal Poverty Levels (FPL) for ACA Health Insurance

People who don’t have health insurance from an employer plan can buy health insurance from a marketplace under the Affordable Care Act (ACA), also known as Obamacare. The monthly premiums are made affordable by a premium subsidy in the form of a tax credit calculated off of your household income relative to the Federal Poverty Level (FPL), also known as the federal poverty line, federal poverty guidelines, or HHS poverty guidelines.

The premium subsidy goes by a sliding scale. The higher your income relative to the FPL for your household size, the lower your premium subsidy is.

Modified Adjusted Gross Income (MAGI)The income to compare against the FPL is the Modified Adjusted Gross Income (MAGI) for your household. It doesn’t matter how many family members in your household need coverage from the ACA health insurance.

There are many different definitions of MAGI in the tax code. MAGI for ACA health insurance is basically your Adjusted Gross Income (AGI) plus tax-exempt muni bond interest and untaxed Social Security benefits.

These incomes are included in your AGI, and therefore increase your MAGI for ACA health insurance:

Wages, salaries, tips, and other employment incomeBusiness incomeIncome from real estate rentalsUnemployment benefitsPension and withdrawals from pre-tax IRAs or annuitiesSocial Security benefitsInterest, dividends, and capital gainsThese above-the-line deductions are removed from your AGI and therefore reduce your MAGI for ACA health insurance: