Harry Sit's Blog, page 8

April 5, 2024

Split-Year Backdoor Roth in H&R Block, 2nd Year

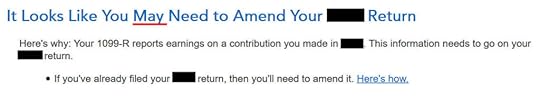

The previous post Split-Year Backdoor Roth in H&R Block, 1st Year dealt with contributing to a Traditional IRA for the previous year and recharacterizing a previous year’s Roth IRA contribution as a Traditional IRA contribution. This post handles the conversion part.

We cover two example scenarios. Here’s the first:

You contributed $6,000 to a Traditional IRA for 2022 in 2023. The value increased to $6,200 when you converted it to Roth in 2023. You received a 1099-R form listing this $6,200 Roth conversion.

You should’ve already reported the contribution part on your 2022 tax return by following Split-Year Backdoor Roth in H&R Block, 1st Year. The IRA custodian sent you a 1099-R form for the conversion in 2023. This post shows you how to put it into H&R Block tax software.

Here’s the second example scenario:

You contributed $6,000 to a Roth IRA for 2022 in 2022. You realized that your income was too high when you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Traditional contribution before April 15, 2023. The IRA custodian moved $6,100 from your Roth IRA to your Traditional IRA because your original $6,000 contribution had some earnings. The value increased again to $6,200 when you converted it to Roth in 2023. You received two 1099-R forms, one for $6,100 and another for $6,200.

You should’ve already reported the recharacterized contribution on your 2022 tax return by following Split-Year Backdoor Roth in H&R Block, 1st Year. The IRA custodian sent you two 1099-R forms, one for the recharacterization, and the other for the conversion. This post shows you how to put both of them into H&R Block tax software.

If you contributed for 2023 in 2024 or if you recharacterized a 2023 contribution in 2024, you’re still in the first year of this journey. Please follow Split-Year Backdoor Roth in H&R Block, 1st Year. If you recharacterized your 2023 contribution in 2023 and converted in 2023, please follow a separate follow-up post.

If neither of these example scenarios fits you, please consult our guide for a normal “clean” backdoor Roth: How to Report Backdoor Roth in H&R Block Tax Software.

If you’re married and both you and your spouse did the same thing, you should follow the steps below once for yourself and once again for your spouse.

Table of ContentsUse H&R Block Download Software1099-R for Recharacterization1099-R for ConversionMore QuestionsClean Backdoor Roth On TopDid Not RecharacterizeBasisTaxable IncomeTroubleshootingFresh StartConversion Is TaxedUse H&R Block Download SoftwareThe screenshots below are taken from H&R Block Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

1099-R for RecharacterizationThis section only applies to the second example scenario. If you didn’t recharacterize (the first example scenario), please skip this section and jump over to the conversion section.

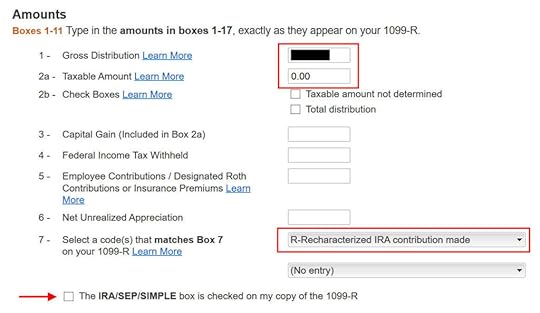

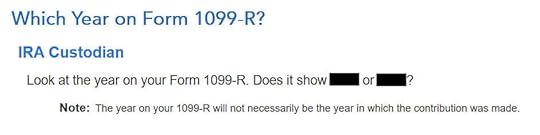

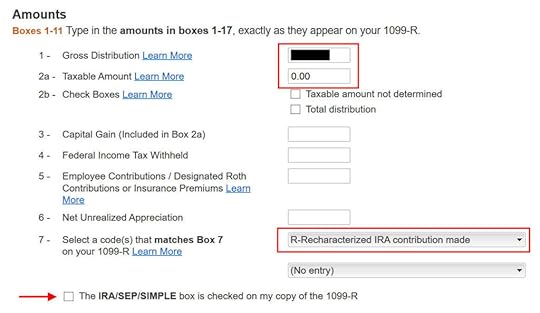

We handle the 1099-R form for recharacterization first. This 1099-R form has a code ‘R’ in Box 7.

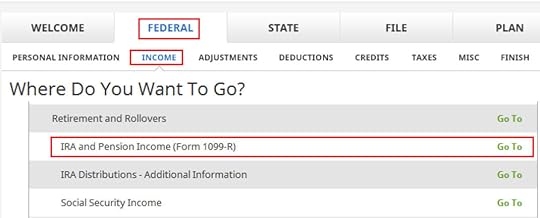

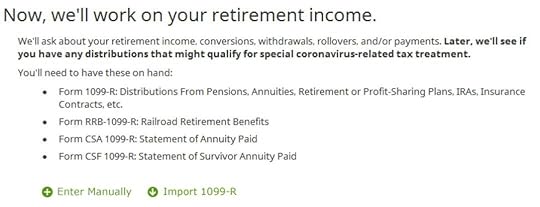

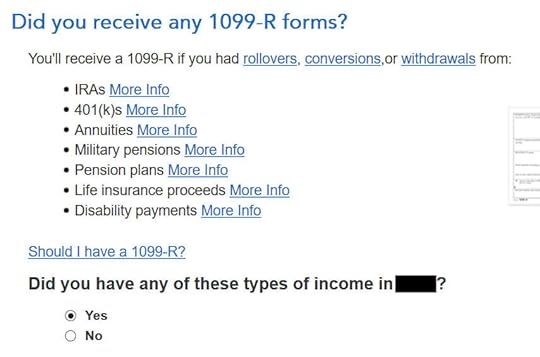

Click on Federal -> Income. Scroll down and find IRA and Pension Income (Form 1099-R). Click on “Go To.”

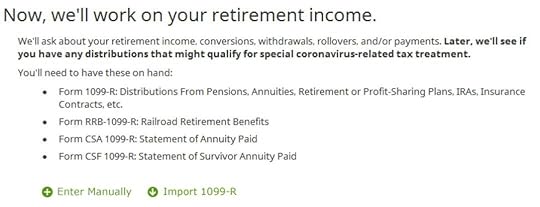

Click on Import 1099-R if you’d like. I show manual entries with “Enter Manually” here.

Just a regular 1099-R.

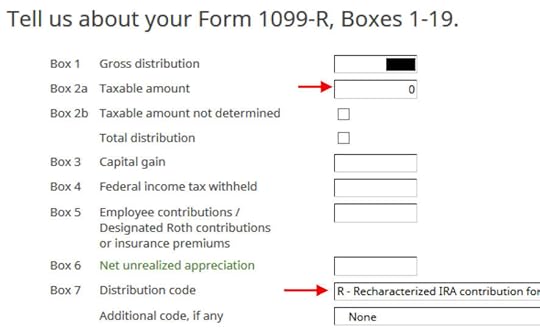

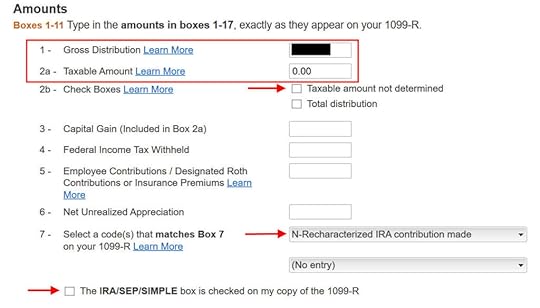

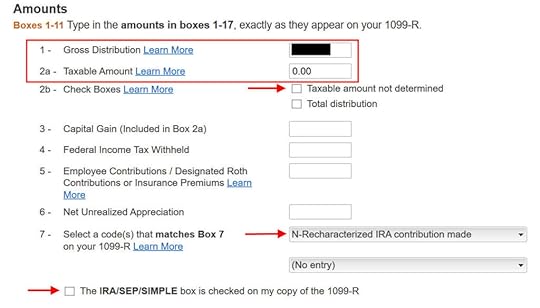

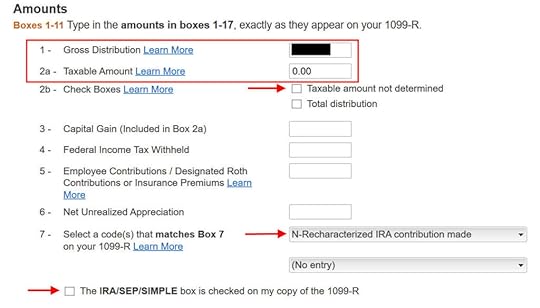

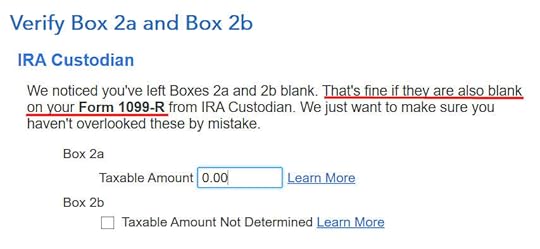

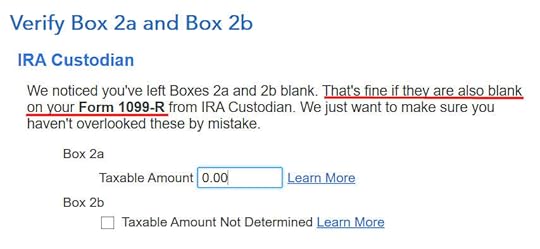

The amount that moved from your Roth IRA to your Traditional IRA is shown in Box 1. The taxable amount in Box 2a is zero. The two checkboxes in Box 2b aren’t checked. The code in Box 7 is “R.”

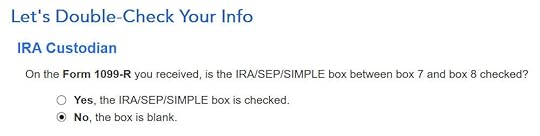

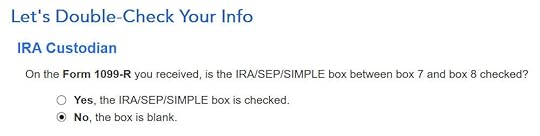

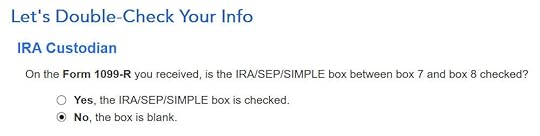

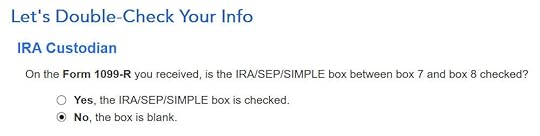

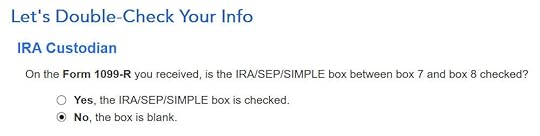

The “IRA/SEP/SIMPLE” box under Box 7 may or may not be checked. It’s not checked in our sample 1099-R.

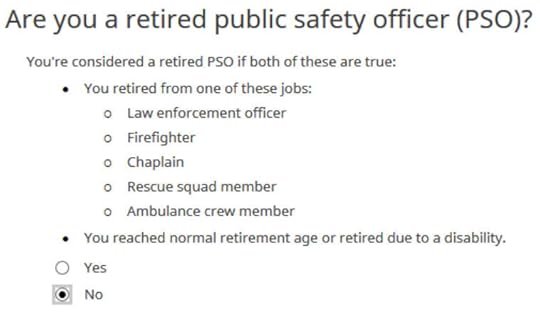

Not a retired public safety officer.

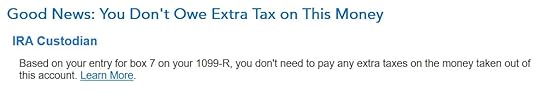

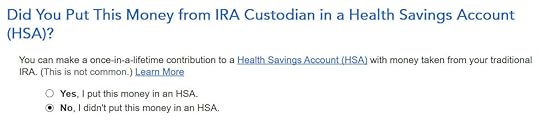

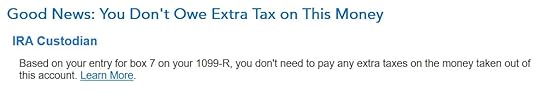

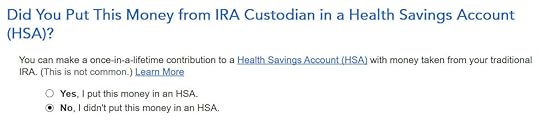

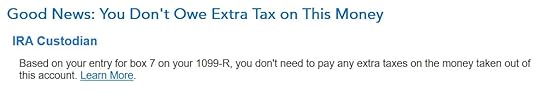

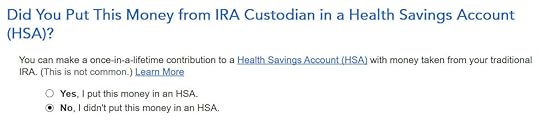

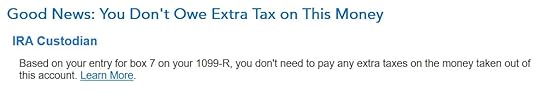

We like to hear that.

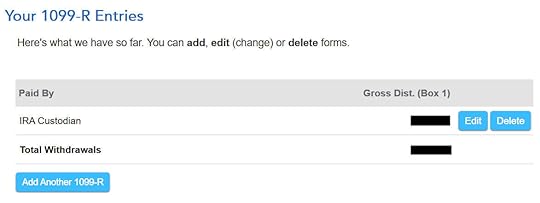

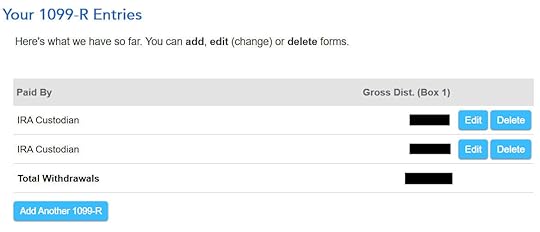

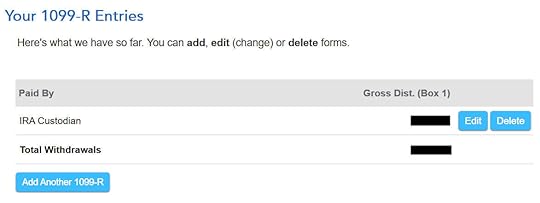

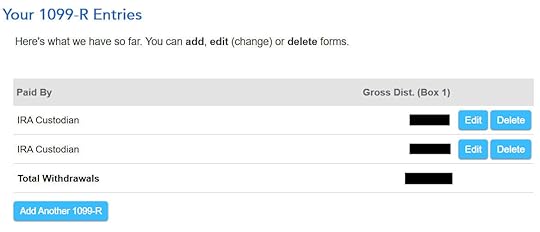

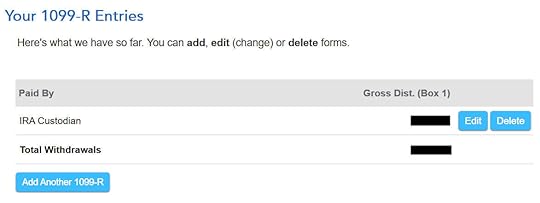

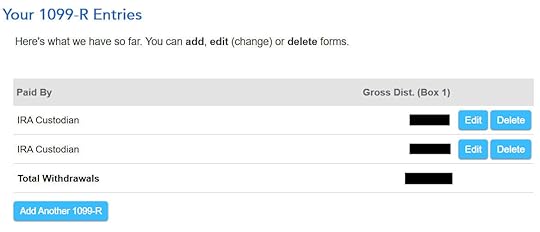

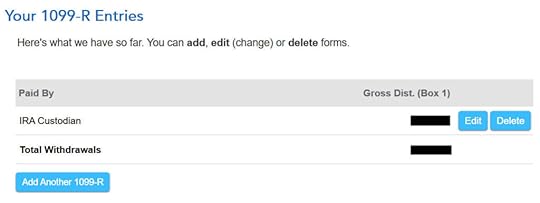

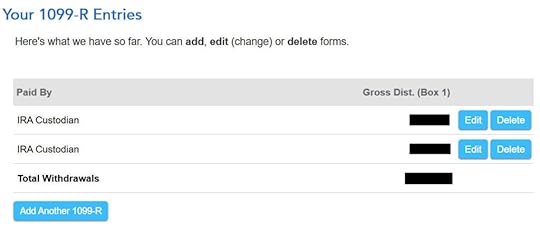

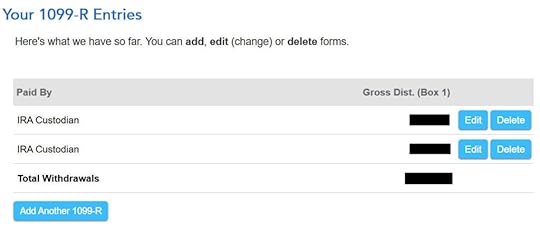

You’re done with the first 1099-R form. Click on “Enter Manually” to add the second one if you don’t already have both 1099-R forms imported.

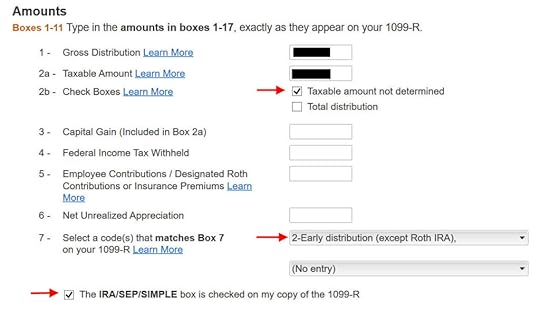

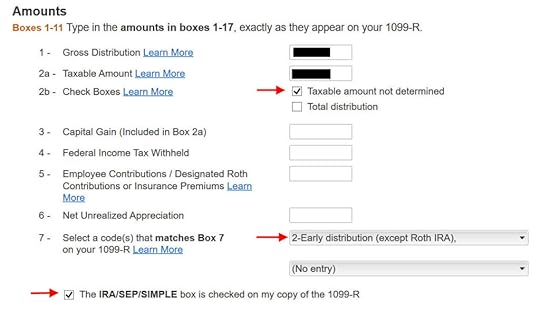

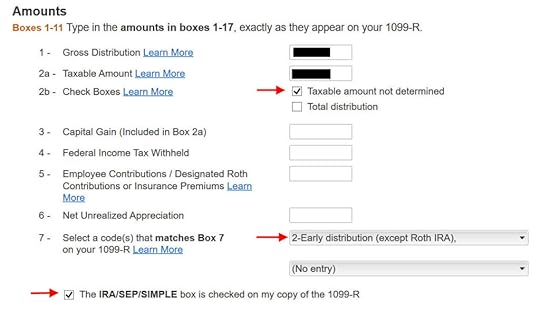

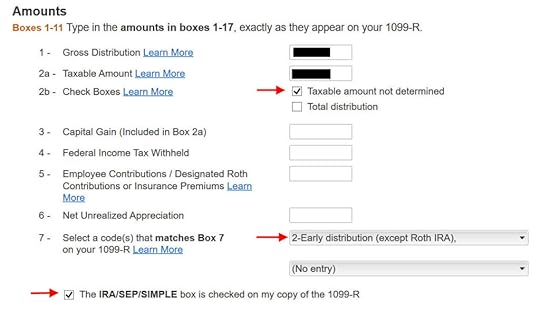

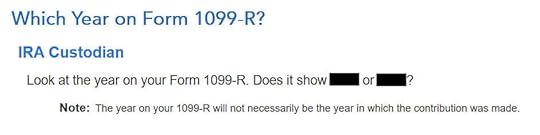

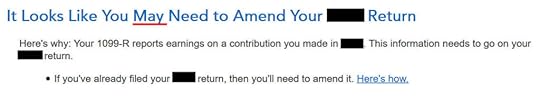

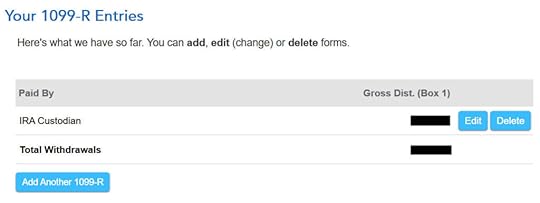

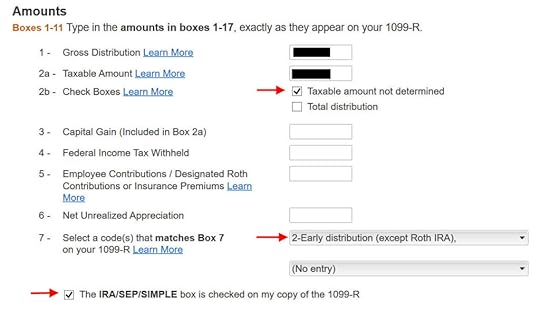

1099-R for ConversionThe 1099-R for conversion has either a code “2” or code “7” in Box 7.

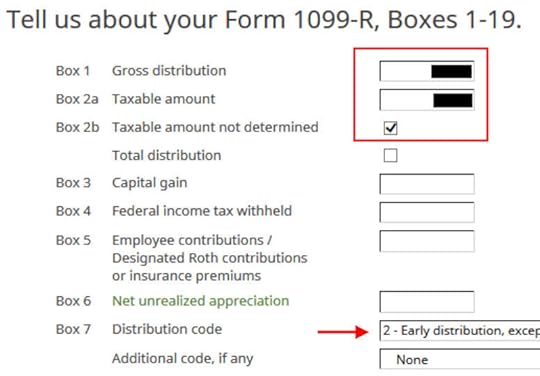

The second 1099-R form is also a regular 1099-R.

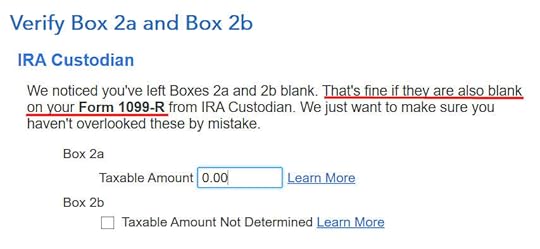

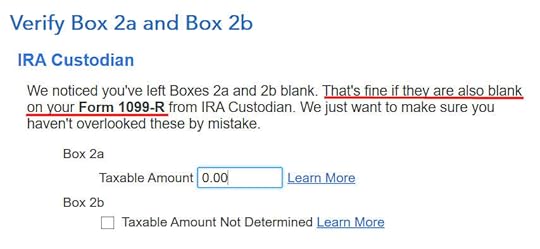

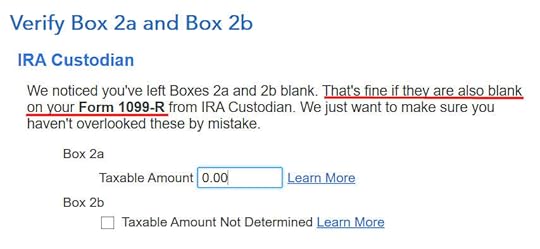

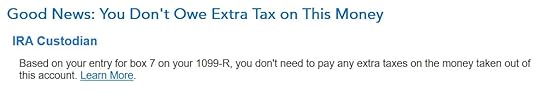

It’s normal to see the conversion reported in Box 2a as the taxable amount when Box 2b is checked to say “Taxable amount not determined.” The code in Box 7 is ‘2‘ when you’re under 59-1/2 or ‘7‘ when you’re over 59-1/2.

The “IRA/SEP/SIMPLE” box is checked on this 1099-R form for the conversion.

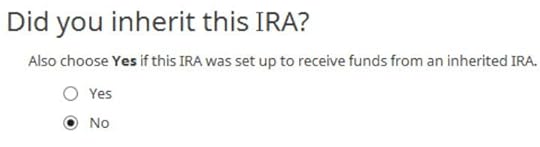

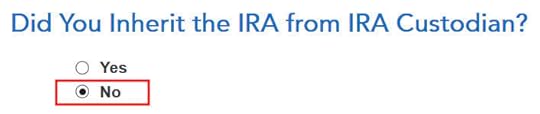

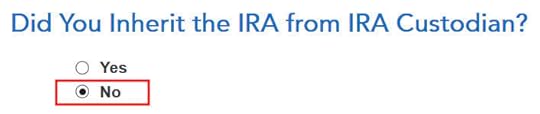

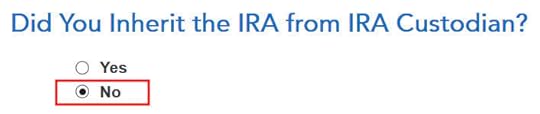

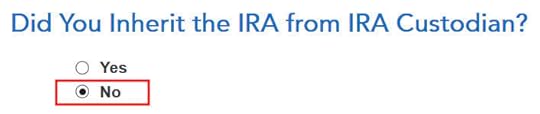

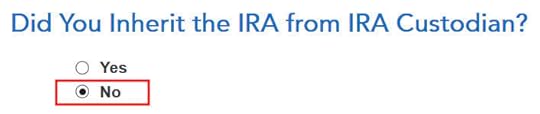

Did not inherit it.

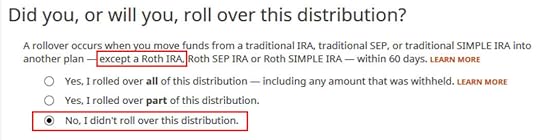

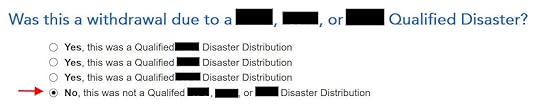

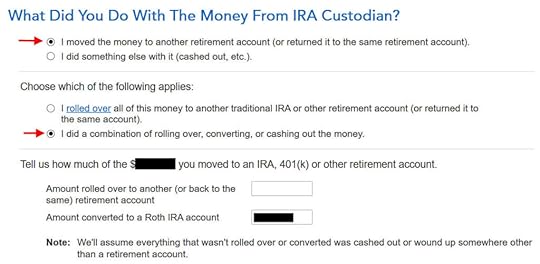

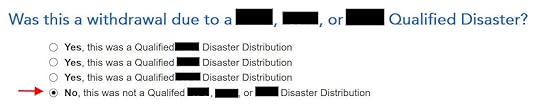

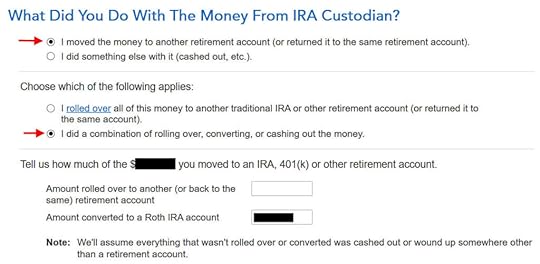

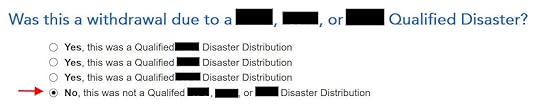

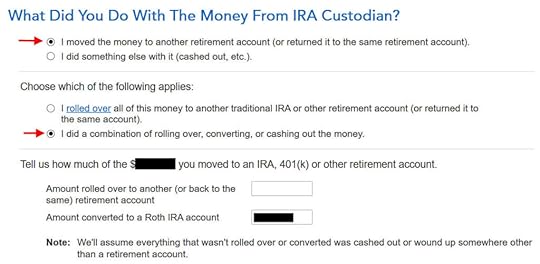

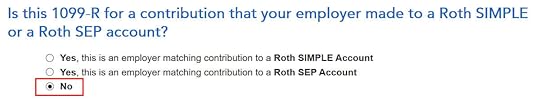

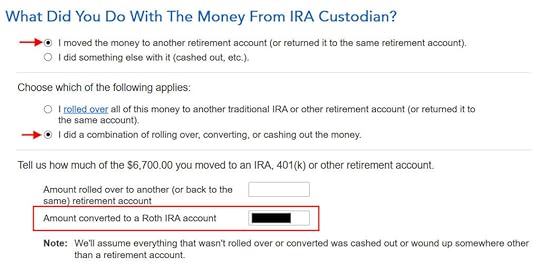

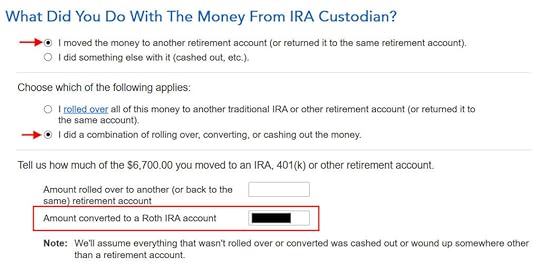

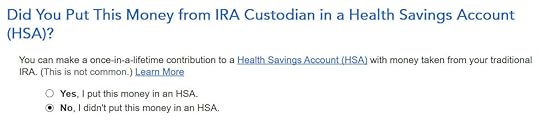

This is a very important question. Read carefully. Answer No, because you converted, not rolled over.

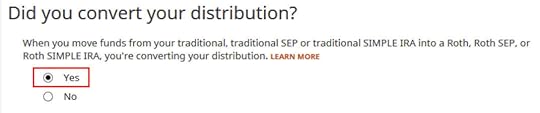

Now answer Yes, you converted.

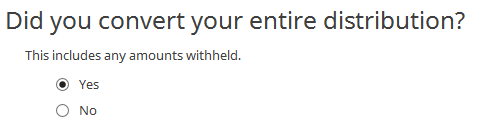

We converted all of it in our example.

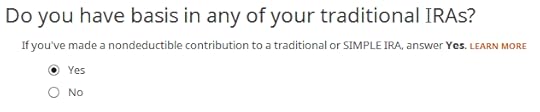

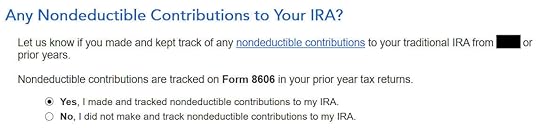

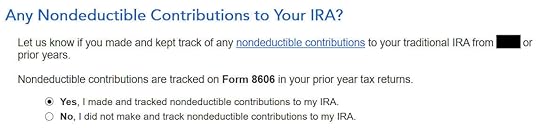

Answer Yes because your contribution for the prior year was your basis.

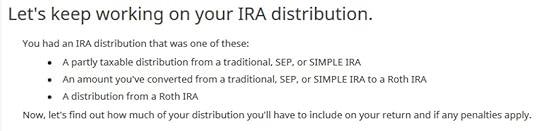

The refund in progress drops a lot at this point. Don’t panic. It’s normal and only temporary. It will come back up after we continue.

You are done with one 1099-R. Repeat the above if you have another 1099-R. If you’re married and both of you converted to Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse. Click on Finished when you are done with all the 1099-Rs.

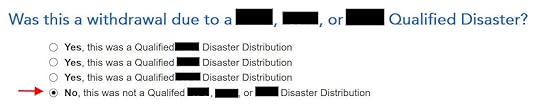

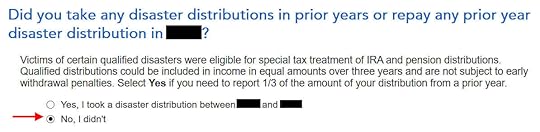

More Questions

H&R Block has a few more questions.

Answer Yes if you did a “clean” backdoor Roth in 2023 on top of converting your 2022 contribution, in other words, you also contributed to a Traditional IRA for 2023 in 2023 and converted both your 2022 contribution and your 2023 contribution in 2023. Your 1099-R includes converting two year’s worth of contributions in a single year.

If you answered “Yes” to the previous question, H&R Block will wait until you also enter your 2023 contribution. Your refund meter is still depressed but don’t worry.

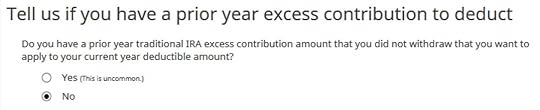

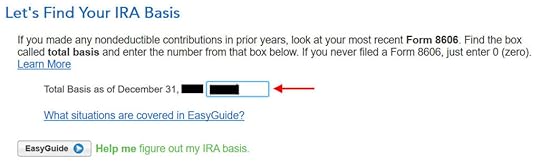

If you answered “No” to the previous question because you didn’t contribute to a Traditional IRA for 2023, the software will ask you for your basis. Get that number from Line 14 of your Form 8606. It’s $6,000 in our example.

Clean Backdoor Roth On TopThe conversion part of the clean backdoor Roth is already included in the 1099-R form we just completed. Now we do the contribution part.

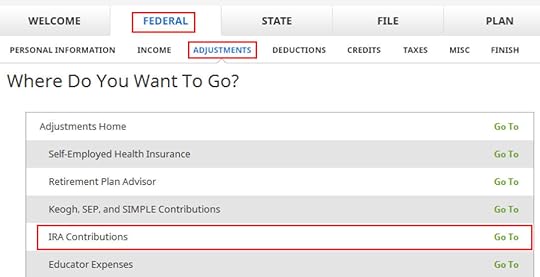

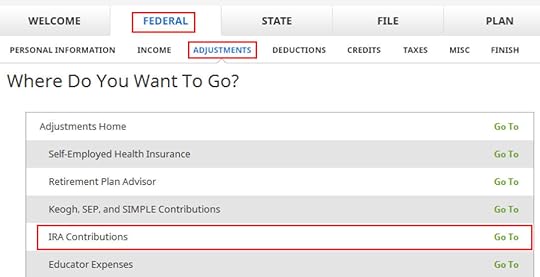

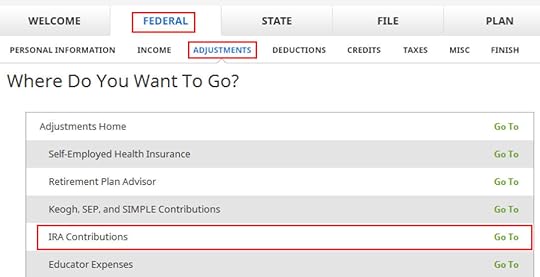

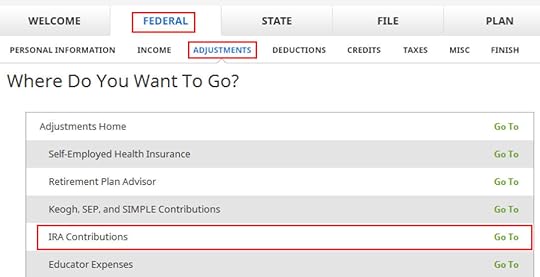

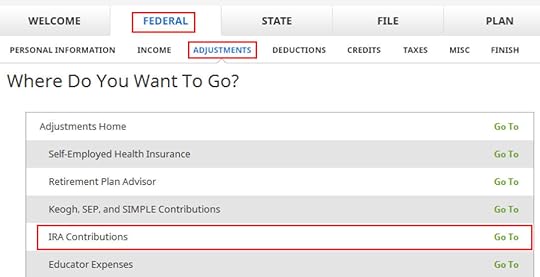

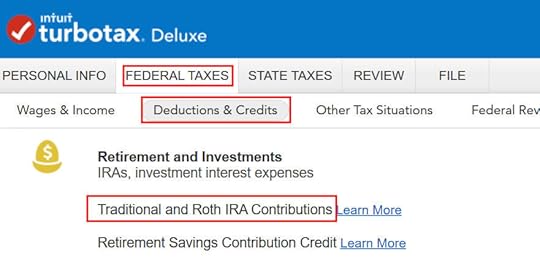

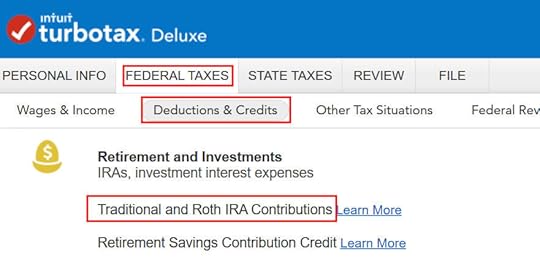

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

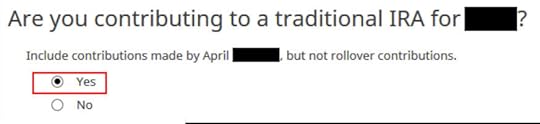

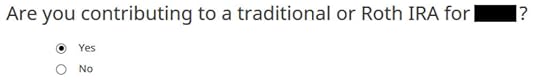

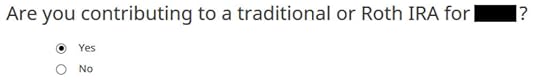

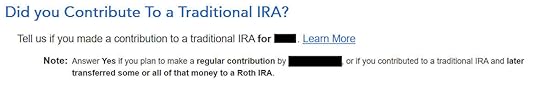

Answer “Yes” because you contributed to a Traditional IRA in 2023 for 2023.

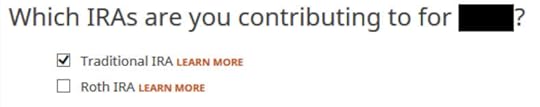

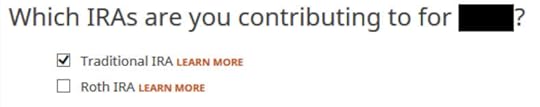

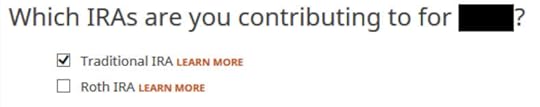

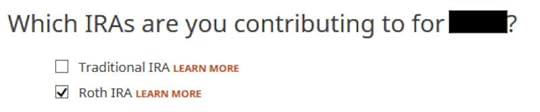

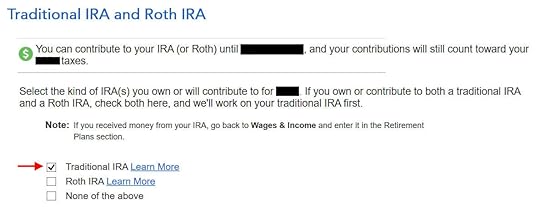

Check the box for Traditional IRA.

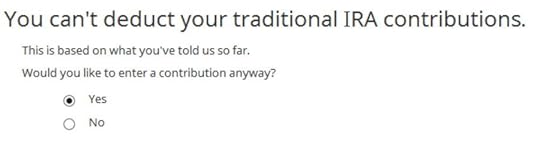

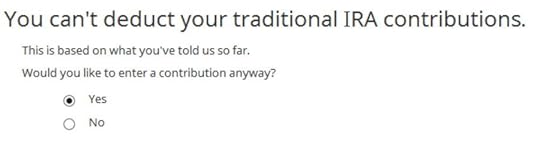

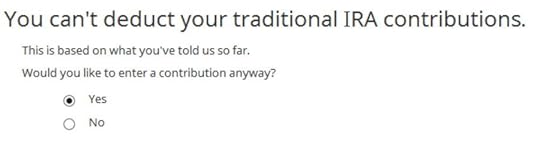

You know you don’t get a deduction due to income. Enter anyway. If you don’t see this question, it means the software thinks you’re eligible for a deduction. You can’t decline the deduction.

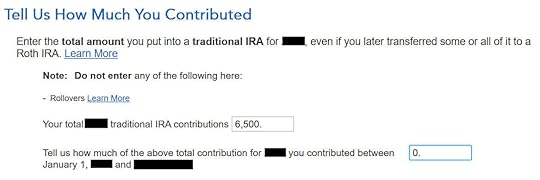

Enter your contribution amount. We contributed $6,500 in our example.

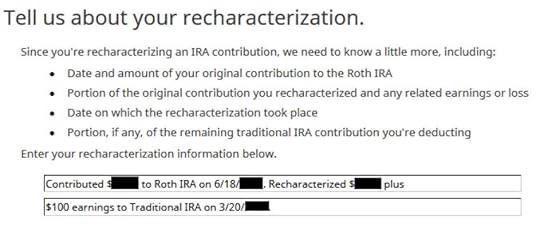

Did Not Recharacterize

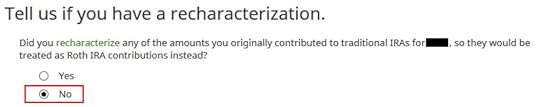

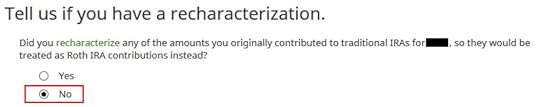

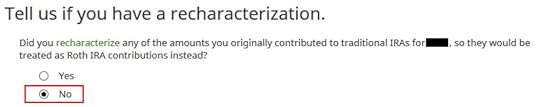

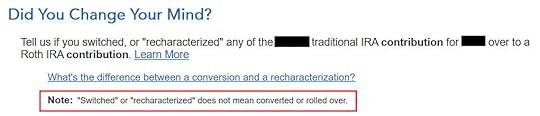

This is important. Answer No because you didn’t recharacterize. You converted to Roth.

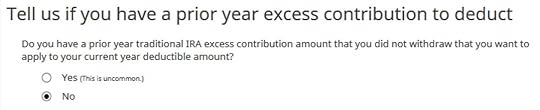

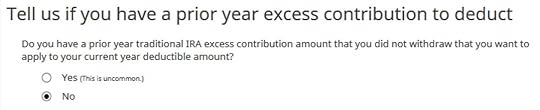

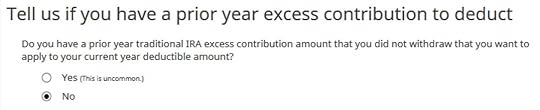

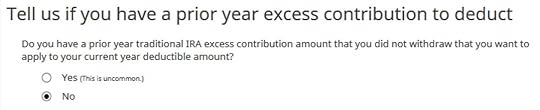

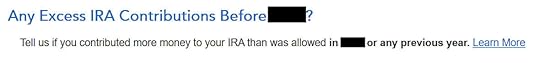

No excess contribution.

Basis

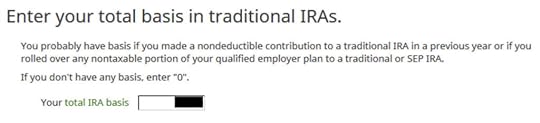

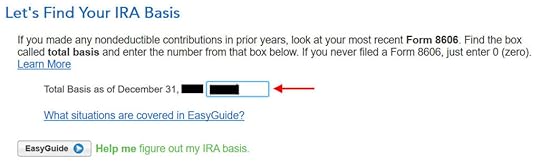

H&R Block should import this from last year’s data but it doesn’t. Get it from last year’s Form 8606 Line 14. If you didn’t have a Form 8606 last year because the software gave you a deduction on Schedule 1 Line 20, your basis is zero. It’s $6,000 in our example.

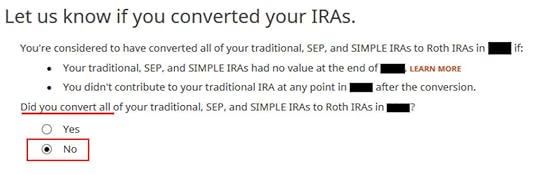

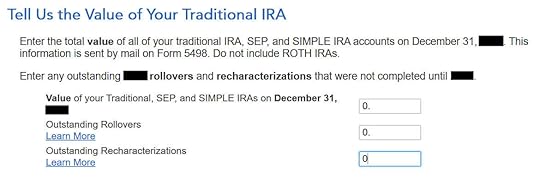

This is another important question. If you emptied out all your Traditional IRA and you don’t have any SEP or SIMPLE IRAs, technically you can answer Yes and skip some questions. The safer bet is to answer No and go through the follow-up questions. If you’ve been going through these screens back and forth, you may have put in some incorrect answers in a previous round. You will have a chance to review and correct those answers only if you answer No.

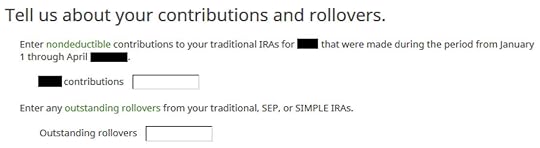

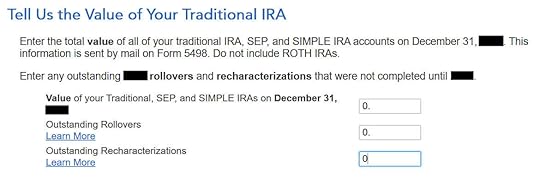

Leave the boxes blank when you contributed for 2023 in 2023.

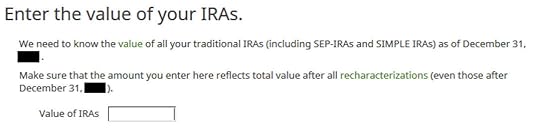

The box should be blank or zero when you emptied all your Traditional IRAs after converting them to Roth. If you had a few dollars of earnings after you converted and you left them in the account, get the value from your year-end statements and put it here. The software will apply the pro-rata rule.

0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you contributed to a Traditional IRA.

Now the refund meter should go back up after you enter the Traditional IRA contributions.

Taxable IncomeYou’re done with the two 1099-R forms. Let’s look at how they show up on your tax return. Click on Forms on the top and open Form 1040 and Schedules 1-3. Click on Hide Mini WS. Scroll down to lines 4a and 4b.

Line 4a shows the amount on your 1099-R for the Roth conversion. Line 4b shows the taxable amount, which is the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth. The taxable amount would be zero if you didn’t have any earnings. The taxable amount can be off by a few dollars due to rounding.

Form 8606 shows these for our example:

Line #Amount16,500 (only if you also did a “clean” backdoor Roth on top, otherwise blank.)26,0003The sum of Line 1 and Line 25The same as Line 313The same as Line 3 (or close to it due to rounding)14016The amount on your 1099-R with a code 2 or 717The same as Line 3 (or close to it due to rounding)18The difference between Line 16 and Line 17Form 8606TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

Fresh StartIt’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

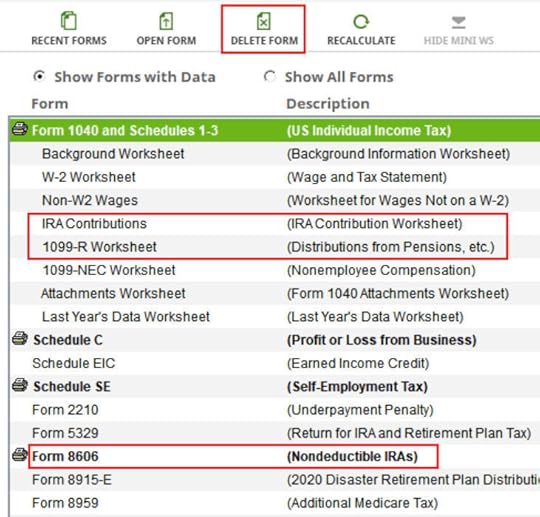

Click on Forms and delete IRA Contributions Worksheet, 1099-R Worksheet, and Form 8606. Then start over by following the steps here.

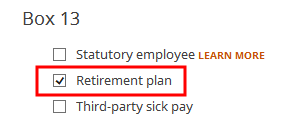

Conversion Is TaxedIf you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. The software gives you the deduction if it sees that your income qualifies. It doesn’t give you the choice of making it non-deductible.

Part of your conversion could be taxed because you took a deduction on the Traditional IRA contribution last year or this year. You see whether you took a deduction by looking at Schedule 1 Line 20 on last year’s and this year’s tax returns.

The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal and it doesn’t cause any problems when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

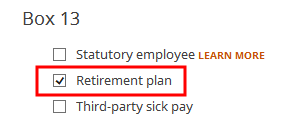

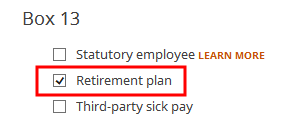

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2. Maybe you forgot the check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries to make sure it matches the W-2.

Learn the Nuts and Bolts

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Split-Year Backdoor Roth in H&R Block, 2nd Year appeared first on The Finance Buff.

Split-Year Backdoor Roth IRA in H&R Block, 1st Year

The best way to do a backdoor Roth is to do it “clean” by contributing for and converting in the same year — contribute for 2023 in 2023 and convert in 2023, contribute for 2024 in 2024 and convert in 2024, and contribute for 2025 in 2025 and convert in 2025. Don’t split them into two years such as contributing for 2022 in 2023 and converting in 2023 or contributing for 2023 in 2024 and converting in 2024. If you did a “clean” backdoor Roth and you’re using H&R Block tax software, please follow How to Report Backdoor Roth in H&R Block Tax Software.

However, many people didn’t know they should’ve done it “clean.” Some people thought it was natural to contribute to an IRA for 2023 between January 1 and April 15 in 2024. Some people contributed directly to a Roth IRA for 2023 in 2023 and only found out their income was too high when they did their taxes in 2024. They had to recharacterize the previous year’s Roth IRA contribution as a Traditional IRA contribution and convert it again to Roth after the fact.

When you contribute for the previous year and convert (or recharacterize and convert in the following year), you have to report them on your tax return in two different years: the contribution in one year and the conversion in the following year. It’s more confusing than a straight “clean” backdoor Roth but that’s the price you pay for not knowing the right way. This post shows you how to do the contribution part in H&R Block for the first year. Split-Year Backdoor Roth in H&R Block, 2nd Year shows you how to do the conversion part for the second year.

If you recharacterized your 2023 contribution in 2023 and converted in 2023, please follow Backdoor Roth in H&R Block: Recharacterized in the Same Year.

I’m showing two examples — (1) a direct contribution to a Traditional IRA for the previous year; and (2) a Roth contribution for the previous year recharacterized as a Traditional contribution. Please see which example matches your scenario and follow along accordingly.

Table of ContentsUse H&R Block Download SoftwareContributed for the Previous YearContributed to Traditional IRADid Not RecharacterizeForm 8606Break the CycleRecharacterized in the Following YearContributed to Roth IRARecharacterized to TraditionalForm 8606Switch to Clean Backdoor RothTroubleshootingNo 1099-RContribution Is DeductibleUse H&R Block Download SoftwareThe screenshots below are taken from H&R Block Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

Contributed for the Previous YearHere’s the example scenario for a direct contribution to the Traditional IRA:

You contributed $6,500 to a Traditional IRA for 2023 between January 1 and April 15, 2024. You then converted it to Roth in 2024.

Because your contribution was *for* 2023, you need to report it on your 2023 tax return by following this guide. Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion when you do your 2024 tax return. Come again next year to use Split-Year Backdoor Roth in H&R Block, 2nd Year.

If you contributed to a Traditional IRA in 2023 for 2022, everything below should’ve happened in your 2022 tax return. In other words,

You contributed $6,000 to a Traditional IRA for 2022 between January 1 and April 15, 2023. You then converted it to Roth in 2023.

Then you should’ve gone through the steps below in your 2022 tax return. If you didn’t, you should fix your 2022 return. The conversion part is covered in Split-Year Backdoor Roth in H&R Block, 2nd Year.

If you’re married and both you and your spouse did the same thing, you must follow the same steps below once for you and once again for your spouse.

If you first contributed to a Roth IRA and then recharacterized it as a Traditional contribution, please jump over to the next example.

Contributed to Traditional IRA

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

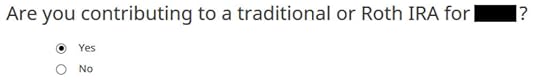

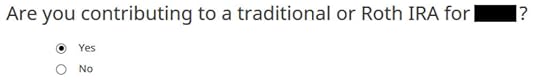

The “Are you contributing to …” wording isn’t exactly accurate when you already contributed but answer “Yes” anyway because you contributed to an IRA for the year in question.

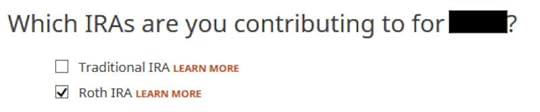

Check the box for Traditional IRA because you contributed directly to a Traditional IRA. See the next example if you contributed to a Roth IRA first and then recharacterized your contribution.

You know you don’t get a deduction due to income. Enter anyway. If you don’t see this question, it means H&R Block thinks you qualify for a deduction. You don’t have the choice to decline the deduction.

Enter your contribution amount. We contributed $6,500 in our example.

Did Not Recharacterize

This is important. Answer No because you didn’t recharacterize. You converted to Roth.

No excess contribution.

Enter zero if this is the first year you contributed to a Traditional IRA. If you contributed non-deductible for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

A summary of your contributions. 0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you contributed to a Traditional IRA for the previous year.

Form 8606Click on Forms on the top and open Form 8606. Click on Hide Mini WS. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2024. It’ll make your conversion in 2024 not taxable.

If you don’t see a Form 8606 or if your Form 8606 doesn’t look right, please check the Troubleshooting section.

Break the CycleWhile you’re at it, you should break the cycle of contributing for the previous year and create a new habit of contributing for the current year. Contribute to a Traditional IRA for 2024 in 2024 and convert in 2024.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

Recharacterized in the Following YearNow let’s look at our second example scenario.

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your income was too high when you did your taxes in 2024. You recharacterized the Roth contribution for 2023 as a Traditional contribution before April 15, 2024. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. Then you converted it to Roth in 2024.

Because your contribution was for 2023, you need to report it on your 2023 tax return by following this guide. Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion when you do your 2024 tax return. Come back again next year to use Split-Year Backdoor Roth in H&R Block, 2nd Year.

Similar to our first example, if you did the same in 2023 for 2022, you should’ve done everything below when you did your taxes for 2022. In other words,

You contributed $6,000 to a Roth IRA for 2022 in 2022. You realized that your income was too high when you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Traditional contribution before April 15, 2023. The IRA custodian moved $6,100 from your Roth IRA to your Traditional IRA because your original $6,000 contribution had some earnings. Then you converted it to Roth in 2023.

Then you should’ve taken all the steps below last year in your 2022 tax return. If you didn’t, you need to fix your 2022 return. The conversion part is covered in Split-Year Backdoor Roth in H&R Block, 2nd Year.

Contributed to Roth IRA

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

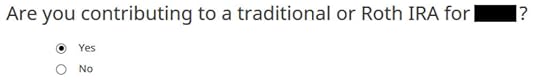

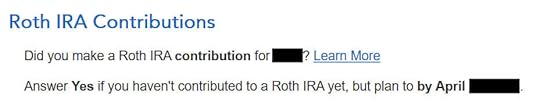

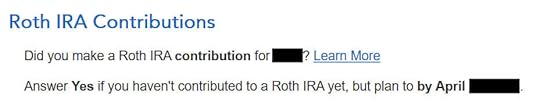

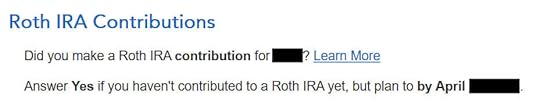

Answer “Yes” because you contributed to an IRA for the year in question.

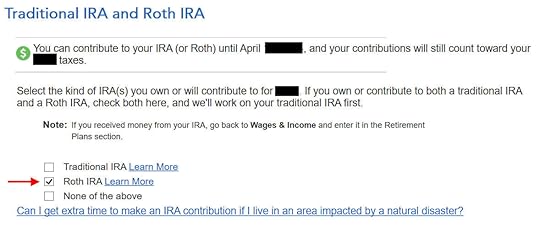

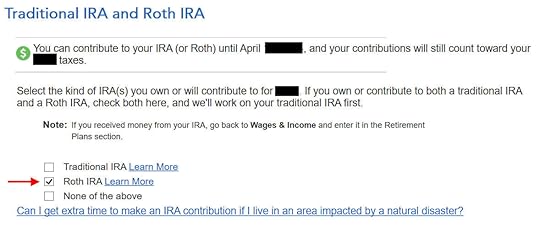

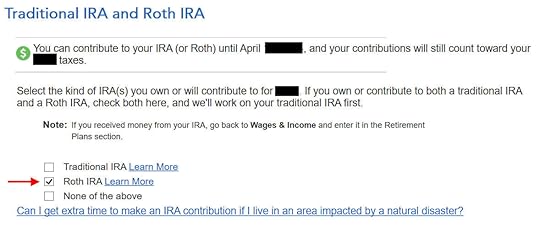

Check the box for Roth IRA because you originally contributed to a Roth IRA before you recharacterized your contribution.

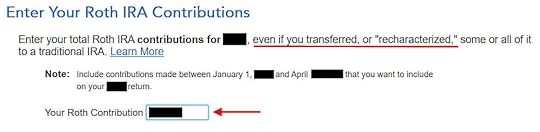

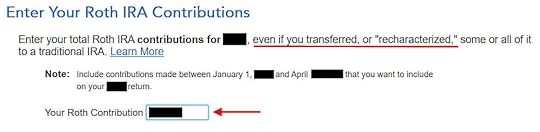

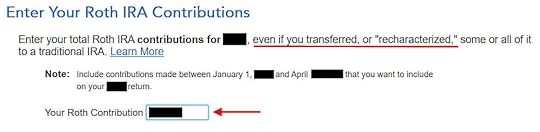

Enter your original contribution amount. It’s $6,500 in our example.

Recharacterized to Traditional

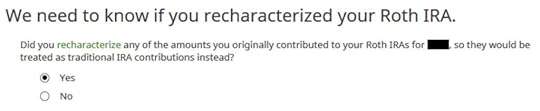

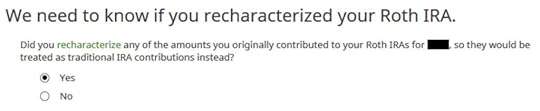

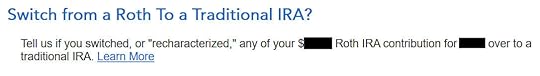

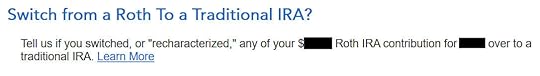

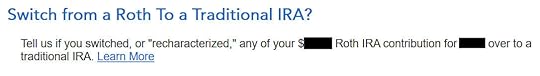

Answer Yes because you recharacterized the contribution.

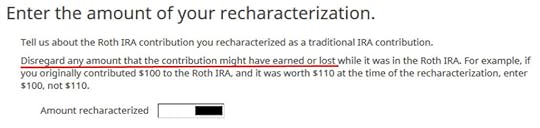

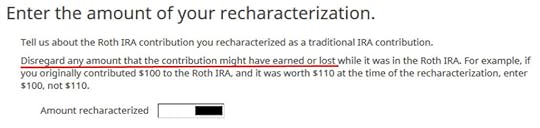

The amount here is relative to the original contribution amount. If you recharacterized the whole thing, enter $6,500 in our example, not $6,600 which was the amount with earnings that the IRA custodian moved into the Traditional IRA.

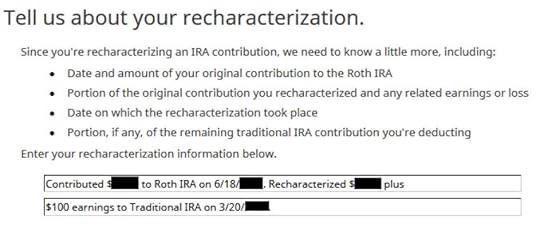

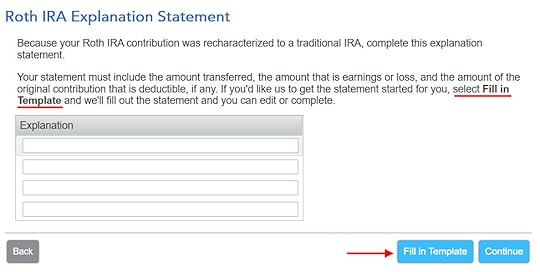

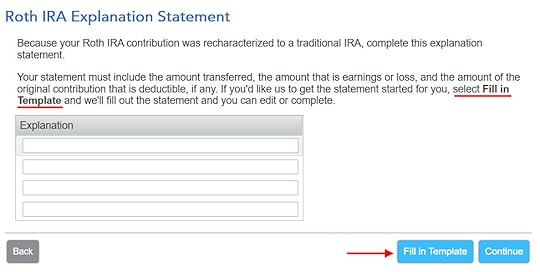

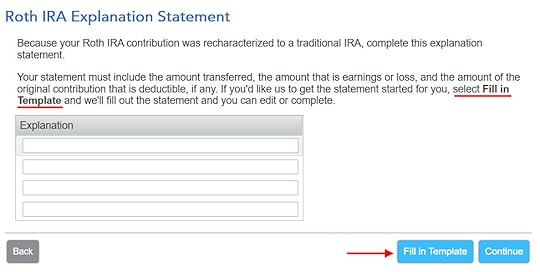

The IRS requires a brief statement to describe your recharacterization.

No excess contribution.

This is as expected. 0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you contributed to a Roth IRA for the previous year and then recharacterized in the following year.

Form 8606Click on Forms on the top and open Form 8606. Click on Hide Mini WS. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2024. It’ll make your conversion in 2024 not taxable.

If you don’t see a Form 8606 or if your Form 8606 doesn’t look right, please check the Troubleshooting section.

Switch to Clean Backdoor RothWhile you are at it, you should switch to a clean backdoor Roth for 2024. Rather than contributing directly to a Roth IRA, seeing that you exceed the income limit, recharacterizing it, and converting it again, you should simply contribute to a Traditional IRA for 2024 in 2024 and convert it to Roth in 2024 if there’s any possibility that your income will be over the limit again.

You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

No 1099-RYou get a 1099-R only if you converted to Roth in 2023. Because you only converted in 2024, you won’t get a 1099-R until 2025. This is normal. You do the conversion part next year by following Split-Year Backdoor Roth IRA in H&R Block, 2nd Year.

Contribution Is DeductibleIf you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. The software will give you the deduction if it sees that your income qualifies. Unlike TurboTax, H&R Block software doesn’t give you the choice of making it non-deductible. You can see this deduction on Schedule 1 Line 20.

You don’t get a Form 8606 when your contribution is fully deductible. The numbers on Lines 1, 3, and 14 of your Form 8606 are less than your full contribution when your contribution is partially deductible.

Taking this deduction will make your Roth IRA conversion taxable next year. You’ll pay less tax this year and more tax next year. In a way, it’s better because you get to use the money for one year. This is normal when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2.

Maybe you forgot the check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries to make sure it matches the W-2.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Split-Year Backdoor Roth IRA in H&R Block, 1st Year appeared first on The Finance Buff.

Split-Year Backdoor Roth in H&R Block, 1st Year

The best way to do a backdoor Roth is to do it “clean” by contributing for and converting in the same year — contribute for 2023 in 2023 and convert in 2023, contribute for 2024 in 2024 and convert in 2024, and contribute for 2025 in 2025 and convert in 2025. Don’t split them into two years such as contributing for 2022 in 2023 and converting in 2023 or contributing for 2023 in 2024 and converting in 2024. If you did a “clean” backdoor Roth and you’re using H&R Block tax software, please follow How to Report Backdoor Roth in H&R Block Tax Software.

However, many people didn’t know they should’ve done it “clean.” Some people thought it was natural to contribute to an IRA for 2023 between January 1 and April 15 in 2024. Some people contributed directly to a Roth IRA for 2023 in 2023 and only found out their income was too high when they did their taxes in 2024. They had to recharacterize the previous year’s Roth IRA contribution as a Traditional IRA contribution and convert it again to Roth after the fact.

When you contribute for the previous year and convert (or recharacterize and convert in the following year), you have to report them on your tax return in two different years: the contribution in one year and the conversion in the following year. It’s more confusing than a straight “clean” backdoor Roth but that’s the price you pay for not knowing the right way. This post shows you how to do the contribution part in H&R Block for the first year. Split-Year Backdoor Roth in H&R Block, 2nd Year shows you how to do the conversion part for the second year.

If you recharacterized your 2023 contribution in 2023 and converted in 2023, it will be in another separate follow-up post.

I’m showing two examples — (1) a direct contribution to a Traditional IRA for the previous year; and (2) a Roth contribution for the previous year recharacterized as a Traditional contribution. Please see which example matches your scenario and follow along accordingly.

Table of ContentsUse H&R Block Download SoftwareContributed for the Previous YearContributed to Traditional IRADid Not RecharacterizeForm 8606Break the CycleRecharacterized in the Following YearContributed to Roth IRARecharacterized to TraditionalForm 8606Switch to Clean Backdoor RothTroubleshootingNo 1099-RContribution Is DeductibleUse H&R Block Download SoftwareThe screenshots below are taken from H&R Block Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

Contributed for the Previous YearHere’s the example scenario for a direct contribution to the Traditional IRA:

You contributed $6,500 to a Traditional IRA for 2023 between January 1 and April 15, 2024. You then converted it to Roth in 2024.

Because your contribution was *for* 2023, you need to report it on your 2023 tax return by following this guide. Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion when you do your 2024 tax return. Come again next year to use Split-Year Backdoor Roth in H&R Block, 2nd Year.

If you contributed to a Traditional IRA in 2023 for 2022, everything below should’ve happened in your 2022 tax return. In other words,

You contributed $6,000 to a Traditional IRA for 2022 between January 1 and April 15, 2023. You then converted it to Roth in 2023.

Then you should’ve gone through the steps below in your 2022 tax return. If you didn’t, you should fix your 2022 return. The conversion part is covered in Split-Year Backdoor Roth in H&R Block, 2nd Year.

If you’re married and both you and your spouse did the same thing, you must follow the same steps below once for you and once again for your spouse.

If you first contributed to a Roth IRA and then recharacterized it as a Traditional contribution, please jump over to the next example.

Contributed to Traditional IRA

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

The “Are you contributing to …” wording isn’t exactly accurate when you already contributed but answer “Yes” anyway because you contributed to an IRA for the year in question.

Check the box for Traditional IRA because you contributed directly to a Traditional IRA. See the next example if you contributed to a Roth IRA first and then recharacterized your contribution.

You know you don’t get a deduction due to income. Enter anyway. If you don’t see this question, it means H&R Block thinks you qualify for a deduction. You don’t have the choice to decline the deduction.

Enter your contribution amount. We contributed $6,500 in our example.

Did Not Recharacterize

This is important. Answer No because you didn’t recharacterize. You converted to Roth.

No excess contribution.

Enter zero if this is the first year you contributed to a Traditional IRA. If you contributed non-deductible for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

A summary of your contributions. 0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you contributed to a Traditional IRA for the previous year.

Form 8606Click on Forms on the top and open Form 8606. Click on Hide Mini WS. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2024. It’ll make your conversion in 2024 not taxable.

Break the CycleWhile you’re at it, you should break the cycle of contributing for the previous year and create a new habit of contributing for the current year. Contribute to a Traditional IRA for 2024 in 2024 and convert in 2024.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

Recharacterized in the Following YearNow let’s look at our second example scenario.

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your income was too high when you did your taxes in 2024. You recharacterized the Roth contribution for 2023 as a Traditional contribution before April 15, 2024. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. Then you converted it to Roth in 2024.

Because your contribution was for 2023, you need to report it on your 2023 tax return by following this guide. Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion when you do your 2024 tax return. Come back again next year to use Split-Year Backdoor Roth in H&R Block, 2nd Year.

Similar to our first example, if you did the same in 2023 for 2022, you should’ve done everything below when you did your taxes for 2022. In other words,

You contributed $6,000 to a Roth IRA for 2022 in 2022. You realized that your income was too high when you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Traditional contribution before April 15, 2023. The IRA custodian moved $6,100 from your Roth IRA to your Traditional IRA because your original $6,000 contribution had some earnings. Then you converted it to Roth in 2023.

Then you should’ve taken all the steps below last year in your 2022 tax return. If you didn’t, you need to fix your 2022 return. The conversion part is covered in Split-Year Backdoor Roth in H&R Block, 2nd Year.

Contributed to Roth IRA

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

Answer “Yes” because you contributed to an IRA for the year in question.

Check the box for Roth IRA because you originally contributed to a Roth IRA before you recharacterized your contribution.

Enter your original contribution amount. It’s $6,500 in our example.

Recharacterized to Traditional

Answer Yes because you recharacterized the contribution.

The amount here is relative to the original contribution amount. If you recharacterized the whole thing, enter $6,500 in our example, not $6,600 which was the amount with earnings that the IRA custodian moved into the Traditional IRA.

The IRS requires a brief statement to describe your recharacterization.

No excess contribution.

This is as expected. 0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you contributed to a Roth IRA for the previous year and then recharacterized in the following year.

Form 8606Click on Forms on the top and open Form 8606. Click on Hide Mini WS. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2024. It’ll make your conversion in 2024 not taxable.

Switch to Clean Backdoor RothWhile you are at it, you should switch to a clean backdoor Roth for 2024. Rather than contributing directly to a Roth IRA, seeing that you exceed the income limit, recharacterizing it, and converting it again, you should simply contribute to a Traditional IRA for 2024 in 2024 and convert it to Roth in 2024 if there’s any possibility that your income will be over the limit again.

You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

No 1099-RYou get a 1099-R only if you converted to Roth during 2023. Because you only converted in 2024, you won’t get a 1099-R until 2025. This is normal. You do the conversion part next year with the 1099-R.

Contribution Is DeductibleIf you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. The software will give you the deduction if it sees that your income qualifies. Unlike TurboTax, H&R Block software doesn’t give you the choice of making it non-deductible. You can see this deduction on Schedule 1 Line 20, which reduces your AGI.

Taking this deduction will make your Roth IRA conversion taxable next year. You’ll pay less tax this year and more tax next year. In a way, it’s better because you get to use the money for one year. This is normal when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2. Maybe you forgot the check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries to make sure it matches the W-2.

Learn the Nuts and Bolts

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Split-Year Backdoor Roth in H&R Block, 1st Year appeared first on The Finance Buff.

March 15, 2024

How to Close Out a Box Spread Early at Fidelity

Selling a short box spread is a way to get a loan at a good rate using your investments as collateral. I sold some short box spreads to get cash for building a home because I didn’t want to sell stocks when stocks were down. Now that stocks recovered, I sold stocks to close out the box spreads before the expiration date.

When you close out a box spread early, you may end up with a gain or loss depending on the interest rate changes. The interest rate happened to have gone up since I originally sold the short box spreads. I ended up with a small gain.

The broker will include the realized gain or loss on a 1099-B form. See Taxes on Box Spread Trades in TurboTax, H&R Block, FreeTaxUSA for how to report it on your tax return.

Here’s how I closed out my short box spreads early.

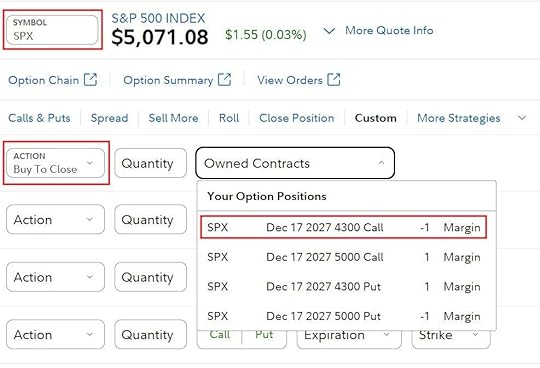

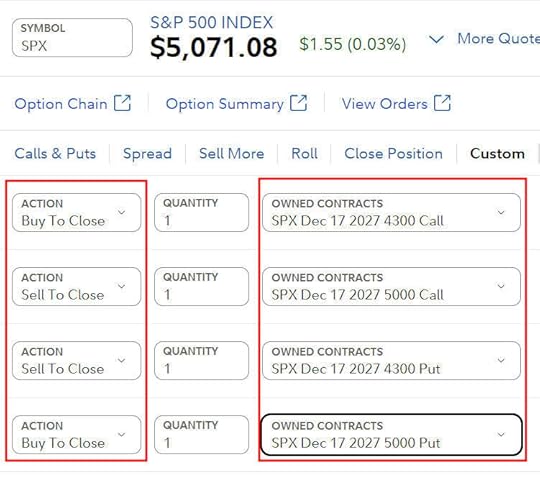

Close Out a Short Box SpreadI executed these trades when I originally sold the box spread:

Sell to Open a call on SPX in December 2027 at 4,300Buy to Open a call on SPX in December 2027 at 5,000Buy to Open a put on SPX in December 2027 at 4,300Sell to Open a put on SPX in December 2027 at 5,000Sell – Buy – Buy – Sell.

To close out this box spread, I needed to execute trades in the opposite direction. “Sell to Open” becomes “Buy to Close” and “Buy to Open” becomes “Sell to Close.” Therefore, these are the closing trades:

Buy to Close a call on SPX in December 2027 at 4,300Sell to Close a call on SPX in December 2027 at 5,000Sell to Close a put on SPX in December 2027 at 4,300Buy to Close a put on SPX in December 2027 at 5,000Buy – Sell – Sell – Buy.

Set Up Four LegsI held the box spreads through Fidelity. Fidelity shows the contracts you hold when you enter the ticker symbol and choose “Buy to Close” in the action dropdown.

Here are all four legs:

Calculate the Limit Price

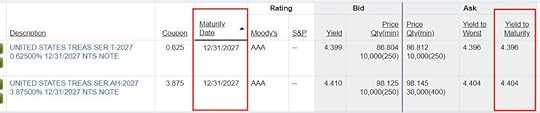

Calculate the Limit PriceI checked the Treasury yields near the expiration date. It was around 4.4%.

Boxspreads.com showed that if I wanted a 4.65% yield (0.25% above Treasury), the target price for a 700-point spread in December 2027 was 594.65.

Use that price for the limit order in Fidelity.

Partial Close

Partial CloseIf you don’t have enough money to close out the full box, you can also execute a partial close. You go up from the bottom of your spread or come down from the top of your spread to shrink the spread to a smaller size.

Suppose I want to shrink my 700-point spread to a 500-point spread, I would close at 4,300 and open at 4,500.

It’s still Buy – Sell – Sell – Buy except you’re going up from 4,300 to only 4,500, not from 4,300 to 5,000. After this trade executes, you’re left with a 4,500 – 5,000 box spread.

Alternatively, you can also come down from the top, to close at 5,000 and open at 4,800. Then you’re left with a 4,300 – 4,800 box spread.

Buy to Open a call on SPX in December 2027 at 4,800Sell to Close a call on SPX in December 2027 at 5,000Sell to Open a put on SPX in December 2027 at 4,800Buy to Close a put on SPX in December 2027 at 5,000Close Out a Long Box SpreadThe same principle applies when you’re closing out a long box spread. These are the original trades for a long box spread:

Buy to Open a call at XSell to Open a call at X + spreadSell to Open a put at XSell to Open a put at X + spreadBuy – Sell – Sell – Buy.

In opposite trades, “Buy to Open” becomes “Sell to Close” and “Sell to Open” becomes “Buy to Close.” These trades will close out a long box spread:

Sell to Close a call at XBuy to Close a call at X + spreadBuy to Close a put at XSell to Close a put at X + spreadSell – Buy – Buy – Sell.

Similarly, you can also partially close out a long box spread by using a smaller spread in your closeout trades.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Close Out a Box Spread Early at Fidelity appeared first on The Finance Buff.

March 10, 2024

Recharacterize & Convert to Roth IRA in TurboTax, Same Year

You may have contributed to a Roth IRA and then realized later in the year that you would exceed the income limit. You recharacterized the Roth IRA contribution as a Traditional IRA contribution and converted it to Roth again before the end of the year. Your IRA custodian sent you two 1099-R forms, one for the recharacterization and one for the conversion. This post shows you how to put them into TurboTax.

If you had done the recharacterizing and converting in the following year, you would have to split the tax reporting into two years by following Backdoor Roth in TurboTax: Recharacterize & Convert, 1st Year and Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year. Now because you caught the problem soon enough before the end of the year, you can handle all of it in the same year by following this guide.

Here’s the example scenario we’ll use in this guide:

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your income would be too high later in 2023. You recharacterized the Roth contribution for 2023 as a Traditional contribution. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. The value increased again to $6,700 when you converted it to Roth before December 31, 2023. You received two 1099-R forms, one for $6,600 and another for $6,700.

If you didn’t do any of these recharacterizing and converting, please follow our guide for a “clean” backdoor Roth in How To Report Backdoor Roth In TurboTax (Updated).

If you’re married and both you and your spouse did the same thing, you should follow the steps below once for yourself and once again for your spouse.

Table of ContentsUse TurboTax Download1099-R for Recharacterization1099-R for ConversionConverted to RothBasisRecharacterized ContributionRecharacterizedRoth BasisMake It NondeductibleTaxable IncomeSwitch to Clean Backdoor RothUse TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

1099-R for RecharacterizationWe handle the 1099-R form for the recharacterization first. This 1099-R form has a code “N” in Box 7.

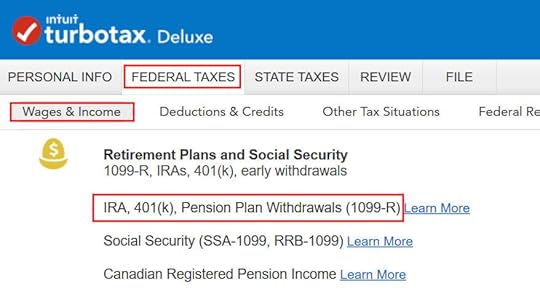

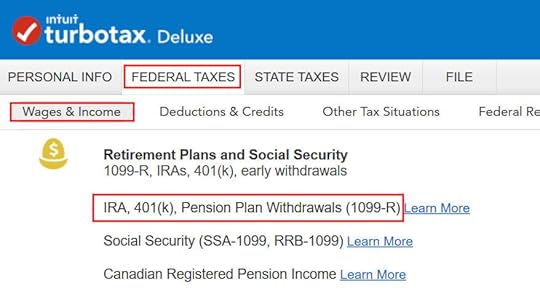

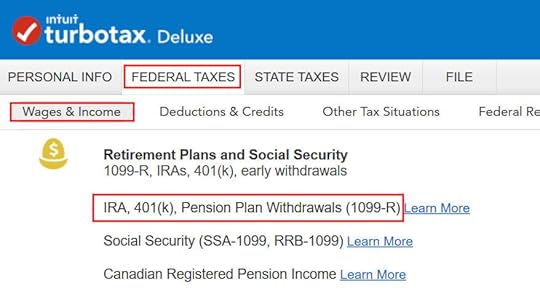

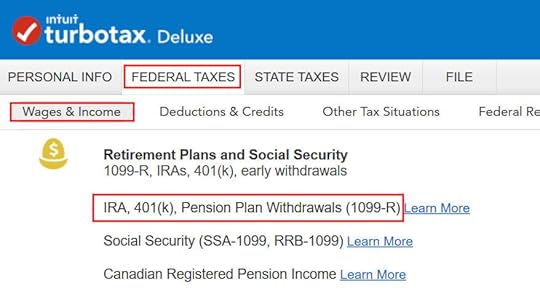

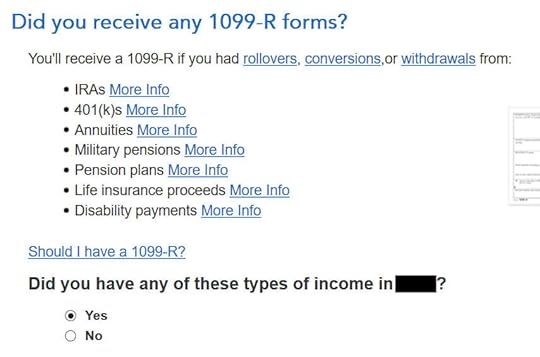

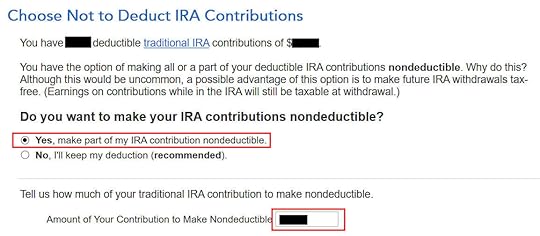

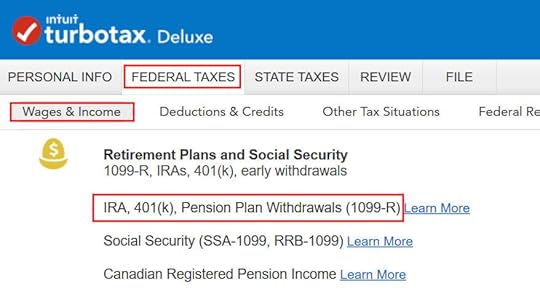

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

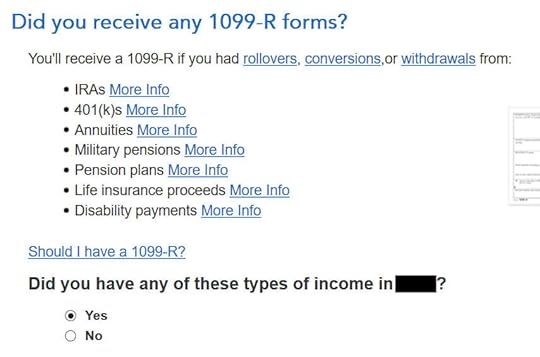

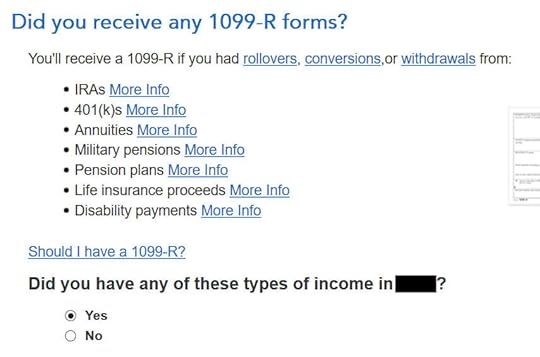

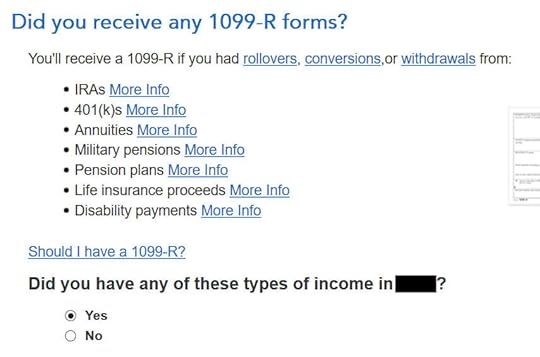

Confirm that you have received a 1099-R form. Import the 1099-R if you’d like. I’m choosing to type it myself.

It’s a regular 1099-R.

The 1099-R form for the recharacterization shows the amount moved from the Roth IRA to the Traditional IRA in Box 1. The taxable amount is 0 in Box 2a and the “Taxable amount not determined” box isn’t checked. The code in Box 7 is “N” and the “IRA/SEP/SIMPLE” box may or may not be checked. It isn’t checked in our sample form.

That box is blank in our 1099-R, and that’s OK.

It’s normal to see zero in Box 2a and blank in Box 2b on this 1099-R form. TurboTax just wants to double-check.

Not a Public Safety Officer.

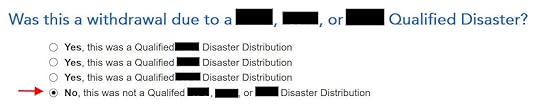

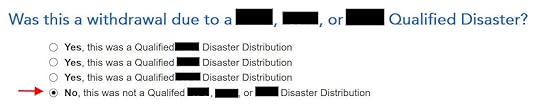

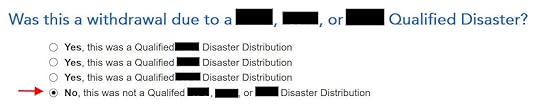

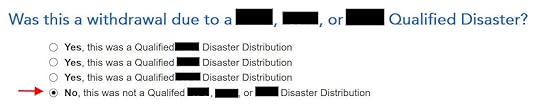

Not due to a disaster.

You’re done with the 1099-R form for the recharacterization. Click on “Add Another 1099-R” to add the one for the conversion if you don’t have both 1099-R forms imported already.

1099-R for Conversion

This 1099-R form is also a regular 1099-R.

It’s normal to see the conversion reported in Box 2a as the taxable amount when Box 2b is checked to say “Taxable amount not determined.” The code in Box 7 is ‘2‘ when you’re under 59-1/2 or ‘7‘ when you’re over 59-1/2. The “IRA/SEP/SIMPLE” box is checked on this 1099-R form for the conversion.

It says that you don’t owe extra tax on this money but your refund meter drops. Don’t panic. It’s normal and only temporary.

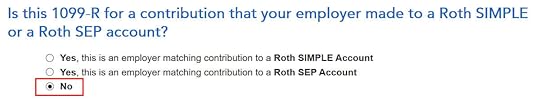

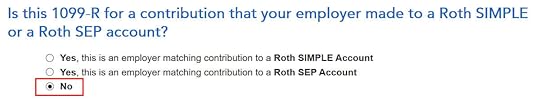

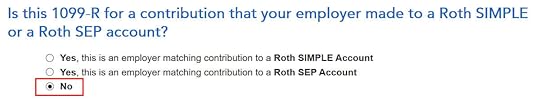

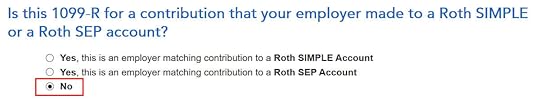

It’s not a Roth SIMPLE or a Roth SEP.

Did not inherit it.

Converted to Roth

First click on “I moved …” then click on “I did a combination …” Enter the amount you converted to Roth in the box. It’s $6,700 in our example. Don’t choose the “I rolled over …” option. A rollover means Traditional-to-Traditional. Converting to Roth isn’t a rollover.

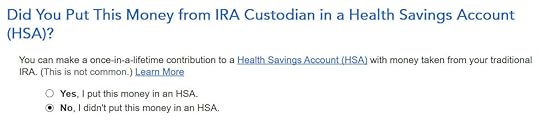

Didn’t put it in an HSA.

Not due to a disaster.

Now the 1099-R summary includes both 1099-R forms. Keep going by clicking on “Continue.”

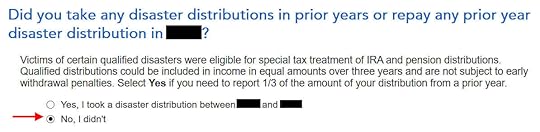

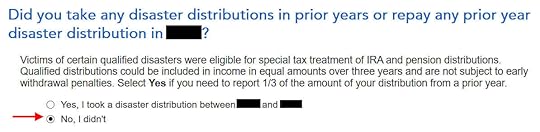

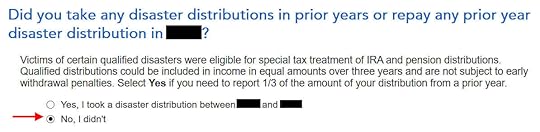

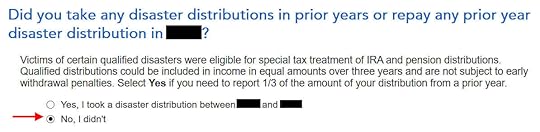

No disaster distributions.

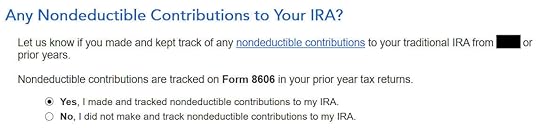

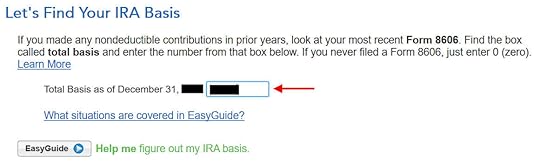

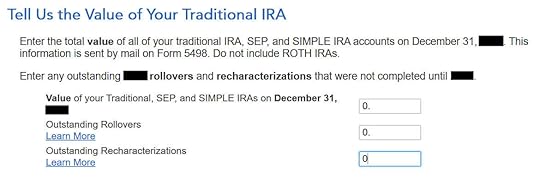

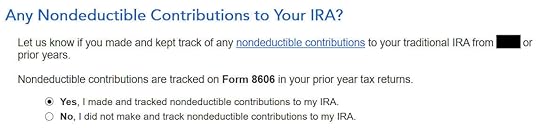

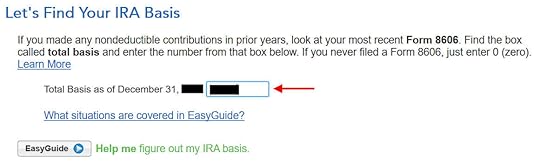

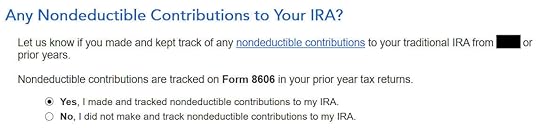

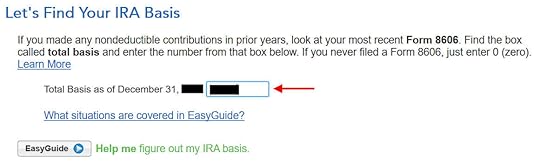

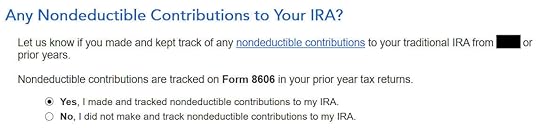

Basis

You can answer “No” here but answering “Yes” with a 0 has the same effect and it allows you to correct previous mistaken entries.

This should be 0 if you hadn’t made any nondeductible contribution to a Traditional IRA before. If you had, get the value from your last year’s Form 8606 Line 14.

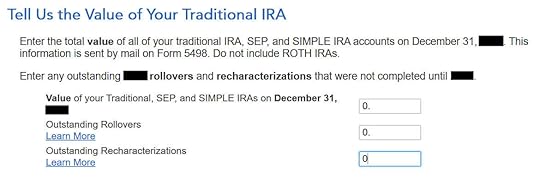

These are normally all zero if you converted everything. If you had a few dollars left in the account from earnings posted after you converted, enter the value from your year-end statement in the first box.

The refund meter is still temporarily depressed. It’ll come back only when we enter the recharacterized Roth IRA contribution.

Recharacterized Contribution

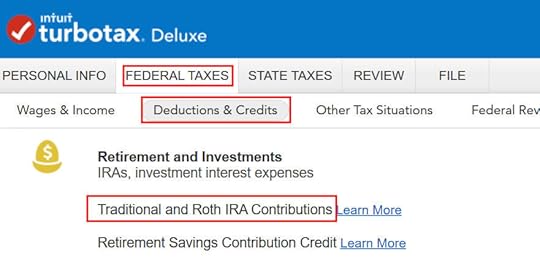

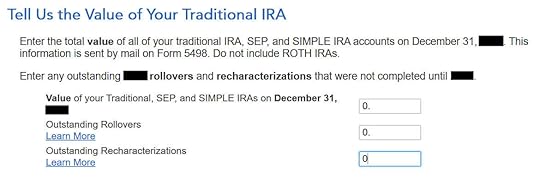

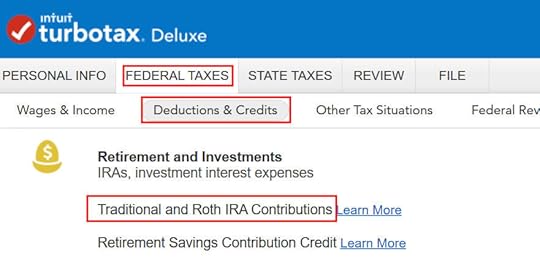

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

Check the box for Roth IRA because you originally contributed to a Roth IRA.

We already checked the box for Roth IRA but TurboTax just wants to make sure.

It was not a repayment of a retirement distribution.

Enter the amount of your original Roth contribution. It was $6,500 in our example.

Recharacterized

Now we confess that we recharacterized the contribution as a Traditional IRA contribution. Answer Yes here.

The amount here is relative to the original contribution amount. If you recharacterized the whole thing, enter $6,500 in our example, not $6,600 which was the amount with earnings that the IRA custodian moved into the Traditional IRA.

The IRS wants a statement to explain the recharacterization. Click on “Fill in Template.”

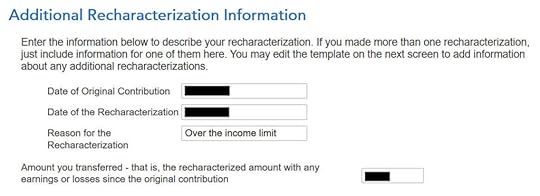

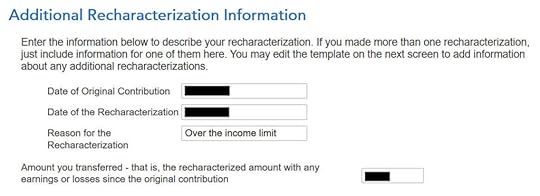

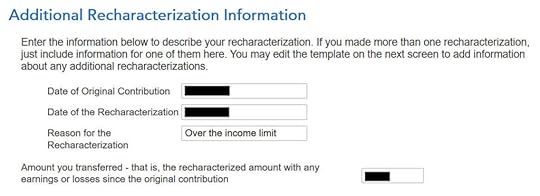

Fill in the dates of your original contribution and your recharacterization. The amount in the last box includes earnings. It’s $6,600 in our example.

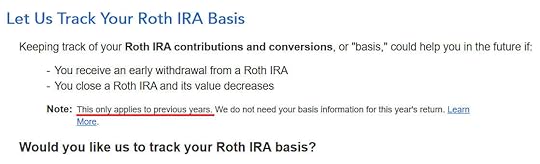

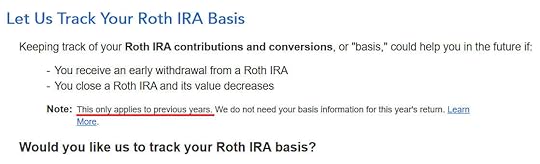

Roth Basis

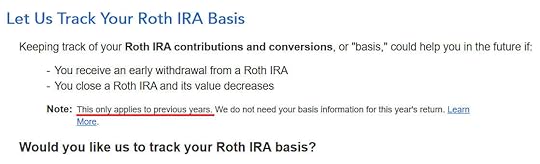

If you take up this offer from TurboTax to track your Roth IRA basis, it’s going to ask you questions about previous years, which is more trouble than it’s worth to me. I answered No.

You don’t need to track your Roth IRA basis if you’re planning to withdraw from your Roth account only after age 59-1/2 and after you’ve had your first Roth IRA for five years. See Roth IRA Withdrawal After 59-1/2 in TurboTax.

No excess contributions.

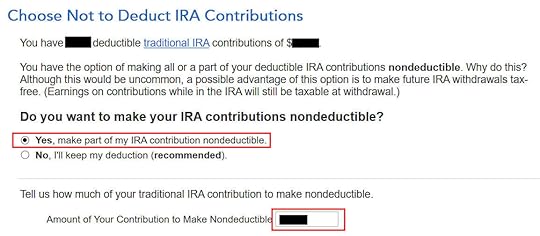

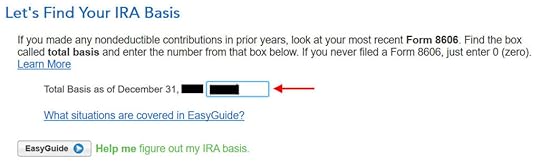

Make It Nondeductible

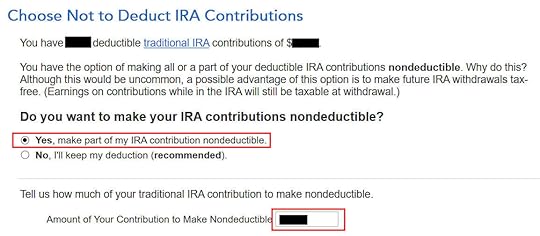

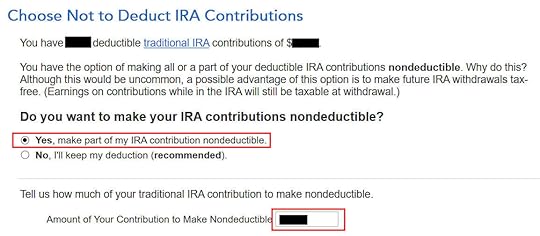

TurboTax shows this only when it sees your income qualifies for a deduction. You have the option to take the deduction or decline the deduction. Taking the deduction will make your conversion taxable, which is also OK because it creates a wash. It’s simpler if you make your full contribution nondeductible and then your Roth conversion isn’t taxable. Enter the amount of your available deductible contribution in the last box. It’s $6,500 in our example.

Your Traditional IRA deduction is zero, which is OK because it makes your Roth conversion not taxable.

Taxable IncomeLet’s look at how all these show up on your tax return. Click on “Forms” on the top right.

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b. Line 4a shows the sum of your two 1099-R forms. It’s $13,300 in our example. This is normal. Line 4b shows that only $200 is taxable. That’s the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth.

When you’re done examining the form, click on Step-by-Step on the top right to go back to the interview.

Switch to Clean Backdoor Roth

Switch to Clean Backdoor RothYou avoided having to split your IRA contribution and Roth conversion in two different tax returns by recharacterizing in the same year and converting before December 31. Still, you had to do the extra work with your IRA custodian and follow all these steps in this guide when you do your taxes.

It’s much better to go with a “clean” backdoor Roth from the get-go. If there’s any possibility that your income will be over the limit again, simply contribute to a Traditional IRA for 2024 in 2024 and convert it to Roth in 2024. You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver. Then you only need to follow our guide for a clean backdoor Roth in How To Report Backdoor Roth In TurboTax.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Recharacterize & Convert to Roth IRA in TurboTax, Same Year appeared first on The Finance Buff.

Recharacterize & Convert in TurboTax, Same Year

You may have contributed to a Roth IRA and then realized later in the year that you would exceed the income limit. You recharacterized the Roth IRA contribution as a Traditional IRA contribution and converted it to Roth again before the end of the year. Your IRA custodian sent you two 1099-R forms, one for the recharacterization and one for the conversion. This post shows you how to put them into TurboTax.

If you had done the recharacterizing and converting in the following year, you would have to split the tax reporting into two years by following Backdoor Roth in TurboTax: Recharacterize & Convert, 1st Year and Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year. Now because you caught the problem soon enough before the end of the year, you can handle all of it in the same year by following this guide.

Here’s the example scenario we’ll use in this guide:

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your income would be too high later in 2023. You recharacterized the Roth contribution for 2023 as a Traditional contribution. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. The value increased again to $6,700 when you converted it to Roth before December 31, 2023. You received two 1099-R forms, one for $6,600 and another for $6,700.

If you didn’t do any of these recharacterizing and converting, please follow our guide for a “clean” backdoor Roth in How To Report Backdoor Roth In TurboTax (Updated).

If you’re married and both you and your spouse did the same thing, you should follow the steps below once for yourself and once again for your spouse.

Table of ContentsUse TurboTax Download1099-R for Recharacterization1099-R for ConversionConverted to RothBasisRecharacterized ContributionRecharacterizedRoth BasisMake It NondeductibleTaxable IncomeSwitch to Clean Backdoor RothUse TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

1099-R for RecharacterizationWe handle the 1099-R form for the recharacterization first. This 1099-R form has a code “N” in Box 7.

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

Confirm that you have received a 1099-R form. Import the 1099-R if you’d like. I’m choosing to type it myself.

It’s a regular 1099-R.

The 1099-R form for the recharacterization shows the amount moved from the Roth IRA to the Traditional IRA in Box 1. The taxable amount is 0 in Box 2a and the “Taxable amount not determined” box isn’t checked. The code in Box 7 is “N” and the “IRA/SEP/SIMPLE” box may or may not be checked. It isn’t checked in our sample form.

That box is blank in our 1099-R, and that’s OK.

It’s normal to see zero in Box 2a and blank in Box 2b on this 1099-R form. TurboTax just wants to double-check.

Not a Public Safety Officer.

Not due to a disaster.

You’re done with the 1099-R form for the recharacterization. Click on “Add Another 1099-R” to add the one for the conversion if you don’t have both 1099-R forms imported already.

1099-R for Conversion

This 1099-R form is also a regular 1099-R.

It’s normal to see the conversion reported in Box 2a as the taxable amount when Box 2b is checked to say “Taxable amount not determined.” The code in Box 7 is ‘2‘ when you’re under 59-1/2 or ‘7‘ when you’re over 59-1/2. The “IRA/SEP/SIMPLE” box is checked on this 1099-R form for the conversion.

It says that you don’t owe extra tax on this money but your refund meter drops. Don’t panic. It’s normal and only temporary.

It’s not a Roth SIMPLE or a Roth SEP.

Did not inherit it.

Converted to Roth

First click on “I moved …” then click on “I did a combination …” Enter the amount you converted to Roth in the box. It’s $6,700 in our example. Don’t choose the “I rolled over …” option. A rollover means Traditional-to-Traditional. Converting to Roth isn’t a rollover.

Didn’t put it in an HSA.

Not due to a disaster.

Now the 1099-R summary includes both 1099-R forms. Keep going by clicking on “Continue.”

No disaster distributions.

Basis

You can answer “No” here but answering “Yes” with a 0 has the same effect and it allows you to correct previous mistaken entries.

This should be 0 if you hadn’t made any nondeductible contribution to a Traditional IRA before. If you had, get the value from your last year’s Form 8606 Line 14.

These are normally all zero if you converted everything. If you had a few dollars left in the account from earnings posted after you converted, enter the value from your year-end statement in the first box.

The refund meter is still temporarily depressed. It’ll come back only when we enter the recharacterized Roth IRA contribution.

Recharacterized Contribution

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

Check the box for Roth IRA because you originally contributed to a Roth IRA.

We already checked the box for Roth IRA but TurboTax just wants to make sure.

It was not a repayment of a retirement distribution.

Enter the amount of your original Roth contribution. It was $6,500 in our example.

Recharacterized

Now we confess that we recharacterized the contribution as a Traditional IRA contribution. Answer Yes here.

The amount here is relative to the original contribution amount. If you recharacterized the whole thing, enter $6,500 in our example, not $6,600 which was the amount with earnings that the IRA custodian moved into the Traditional IRA.

The IRS wants a statement to explain the recharacterization. Click on “Fill in Template.”

Fill in the dates of your original contribution and your recharacterization. The amount in the last box includes earnings. It’s $6,600 in our example.

Roth Basis

If you take up this offer from TurboTax to track your Roth IRA basis, it’s going to ask you questions about previous years, which is more trouble than it’s worth to me. I answered No.

You don’t need to track your Roth IRA basis if you’re planning to withdraw from your Roth account only after age 59-1/2 and after you’ve had your first Roth IRA for five years. See Roth IRA Withdrawal After 59-1/2 in TurboTax.

No excess contributions.

Make It Nondeductible

TurboTax shows this only when it sees your income qualifies for a deduction. You have the option to take the deduction or decline the deduction. Taking the deduction will make your conversion taxable, which is also OK because it creates a wash. It’s simpler if you make your full contribution nondeductible and then your Roth conversion isn’t taxable. Enter the amount of your available deductible contribution in the last box. It’s $6,500 in our example.

Your Traditional IRA deduction is zero, which is OK because it makes your Roth conversion not taxable.

Taxable IncomeLet’s look at how all these show up on your tax return. Click on “Forms” on the top right.

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b. Line 4a shows the sum of your two 1099-R forms. It’s $13,300 in our example. This is normal. Line 4b shows that only $200 is taxable. That’s the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth.

When you’re done examining the form, click on Step-by-Step on the top right to go back to the interview.

Switch to Clean Backdoor Roth

Switch to Clean Backdoor RothYou avoided having to split your IRA contribution and Roth conversion in two different tax returns by recharacterizing in the same year and converting before December 31. Still, you had to do the extra work with your IRA custodian and follow all these steps in this guide when you do your taxes.

It’s much better to go with a “clean” backdoor Roth from the get-go. If there’s any possibility that your income will be over the limit again, simply contribute to a Traditional IRA for 2024 in 2024 and convert it to Roth in 2024. You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver. Then you only need to follow our guide for a clean backdoor Roth in How To Report Backdoor Roth In TurboTax.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Recharacterize & Convert in TurboTax, Same Year appeared first on The Finance Buff.

Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year

You may have contributed to a Roth IRA and then realized later in the year that you would exceed the income limit. You recharacterized the Roth IRA contribution as a Traditional IRA contribution and converted it to Roth again before the end of the year. Your IRA custodian sent you two 1099-R forms, one for the recharacterization and one for the conversion. This post shows you how to put them into TurboTax.

If you had done the recharacterizing and converting in the following year, you would have to split the tax reporting into two years by following Backdoor Roth in TurboTax: Recharacterize & Convert, 1st Year and Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year. Now because you caught the problem soon enough before the end of the year, you can handle all of it in the same year by following this guide.

Here’s the example scenario we’ll use in this guide:

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your income would be too high later in 2023. You recharacterized the Roth contribution for 2023 as a Traditional contribution. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. The value increased again to $6,700 when you converted it to Roth before December 31, 2023. You received two 1099-R forms, one for $6,600 and another for $6,700.

If you didn’t do any of these recharacterizing and converting, please follow our guide for a “clean” backdoor Roth in How To Report Backdoor Roth In TurboTax (Updated).

If you’re married and both you and your spouse did the same thing, you should follow the steps below once for yourself and once again for your spouse.

Table of ContentsUse TurboTax Download1099-R for Recharacterization1099-R for ConversionConverted to RothBasisRecharacterized ContributionRecharacterizedRoth BasisMake It NondeductibleTaxable IncomeSwitch to Clean Backdoor RothUse TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

1099-R for RecharacterizationWe handle the 1099-R form for the recharacterization first. This 1099-R form has a code “N” in Box 7.

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

Confirm that you have received a 1099-R form. Import the 1099-R if you’d like. I’m choosing to type it myself.

It’s a regular 1099-R.

The 1099-R form for the recharacterization shows the amount moved from the Roth IRA to the Traditional IRA in Box 1. The taxable amount is 0 in Box 2a and the “Taxable amount not determined” box isn’t checked. The code in Box 7 is “N” and the “IRA/SEP/SIMPLE” box may or may not be checked. It isn’t checked in our sample form.

That box is blank in our 1099-R, and that’s OK.

It’s normal to see zero in Box 2a and blank in Box 2b on this 1099-R form. TurboTax just wants to double-check.

Not a Public Safety Officer.

Not due to a disaster.

You’re done with the 1099-R form for the recharacterization. Click on “Add Another 1099-R” to add the one for the conversion if you don’t have both 1099-R forms imported already.

1099-R for Conversion

This 1099-R form is also a regular 1099-R.

It’s normal to see the conversion reported in Box 2a as the taxable amount when Box 2b is checked to say “Taxable amount not determined.” The code in Box 7 is ‘2‘ when you’re under 59-1/2 or ‘7‘ when you’re over 59-1/2. The “IRA/SEP/SIMPLE” box is checked on this 1099-R form for the conversion.

It says that you don’t owe extra tax on this money but your refund meter drops. Don’t panic. It’s normal and only temporary.

It’s not a Roth SIMPLE or a Roth SEP.

Did not inherit it.

Converted to Roth

First click on “I moved …” then click on “I did a combination …” Enter the amount you converted to Roth in the box. It’s $6,700 in our example. Don’t choose the “I rolled over …” option. A rollover means Traditional-to-Traditional. Converting to Roth isn’t a rollover.

Didn’t put it in an HSA.

Not due to a disaster.

Now the 1099-R summary includes both 1099-R forms. Keep going by clicking on “Continue.”

No disaster distributions.

Basis

You can answer “No” here but answering “Yes” with a 0 has the same effect and it allows you to correct previous mistaken entries.

This should be 0 if you hadn’t made any nondeductible contribution to a Traditional IRA before. If you had, get the value from your last year’s Form 8606 Line 14.

These are normally all zero if you converted everything. If you had a few dollars left in the account from earnings posted after you converted, enter the value from your year-end statement in the first box.

The refund meter is still temporarily depressed. It’ll come back only when we enter the recharacterized Roth IRA contribution.

Recharacterized Contribution

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

Check the box for Roth IRA because you originally contributed to a Roth IRA.

We already checked the box for Roth IRA but TurboTax just wants to make sure.

It was not a repayment of a retirement distribution.

Enter the amount of your original Roth contribution. It was $6,500 in our example.

Recharacterized

Now we confess that we recharacterized the contribution as a Traditional IRA contribution. Answer Yes here.

The amount here is relative to the original contribution amount. If you recharacterized the whole thing, enter $6,500 in our example, not $6,600 which was the amount with earnings that the IRA custodian moved into the Traditional IRA.

The IRS wants a statement to explain the recharacterization. Click on “Fill in Template.”

Fill in the dates of your original contribution and your recharacterization. The amount in the last box includes earnings. It’s $6,600 in our example.

Roth Basis

If you take up this offer from TurboTax to track your Roth IRA basis, it’s going to ask you questions about previous years, which is more trouble than it’s worth to me. I answered No.

You don’t need to track your Roth IRA basis if you’re planning to withdraw from your Roth account only after age 59-1/2 and after you’ve had your first Roth IRA for five years. See Roth IRA Withdrawal After 59-1/2 in TurboTax.

No excess contributions.

Make It Nondeductible

TurboTax shows this only when it sees your income qualifies for a deduction. You have the option to take the deduction or decline the deduction. Taking the deduction will make your conversion taxable, which is also OK because it creates a wash. It’s simpler if you make your full contribution nondeductible and then your Roth conversion isn’t taxable. Enter the amount of your available deductible contribution in the last box. It’s $6,500 in our example.

Your Traditional IRA deduction is zero, which is OK because it makes your Roth conversion not taxable.

Taxable IncomeLet’s look at how all these show up on your tax return. Click on “Forms” on the top right.

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b. Line 4a shows the sum of your two 1099-R forms. It’s $13,300 in our example. This is normal. Line 4b shows that only $200 is taxable. That’s the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth.

When you’re done examining the form, click on Step-by-Step on the top right to go back to the interview.

Switch to Clean Backdoor Roth

Switch to Clean Backdoor RothYou avoided having to split your IRA contribution and Roth conversion in two different tax returns by recharacterizing in the same year and converting before December 31. Still, you had to do the extra work with your IRA custodian and follow all these steps in this guide when you do your taxes.

It’s much better to go with a “clean” backdoor Roth from the get-go. If there’s any possibility that your income will be over the limit again, simply contribute to a Traditional IRA for 2024 in 2024 and convert it to Roth in 2024. You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver. Then you only need to follow our guide for a clean backdoor Roth in How To Report Backdoor Roth In TurboTax.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year appeared first on The Finance Buff.

March 4, 2024

Use Pascal’s Wager When You’re Not Sure About Tax Rules

17th-century French mathematician and philosopher Blaise Pascal put forward this reasoning on whether one should believe in God (paraphrasing):

You’re not sure whether God exists. If you believe in God and God doesn’t exist, you live with some unnecessary inconvenience. If you don’t believe in God and God does exist, you receive infinite suffering. The cost of being wrong is much higher in the latter case. Therefore you should believe in God whether God exists or not.

This is called Pascal’s wager. It’s a strategy to minimize loss when you’re not sure.

We face many laws and rules in handling our finances. When we’re not sure how the laws and rules work, we can:

A) Spend hours and hours researching the subject and trying to understand the terminologies and how they fit together. We may still come to the wrong conclusion despite our best efforts.

B) Find and hire an expert and rely on the expert’s opinion. We may not find the true expert and the expert can still be wrong.

C) Use Pascal’s wager and weigh the cost of being wrong. Choose the path of the least costly consequence if we’re wrong.

Sometimes it isn’t worth spending the time or money to find out the true answer to some tricky questions. Using Pascal’s wager is an effective way to minimize the damage in case you’re wrong. Let’s look at some real-life examples I came across lately.

Required to File a Tax Form?Besides the regular income tax return, there are some obscure tax forms such as the gift tax return, Form 3520 for receiving foreign gifts, and Form 5500-EZ for a solo 401(k) plan. Rules aren’t always clear on when you’re required to file them and when you’re not.

If you’re required to file a tax form but you think you don’t have to file, you’ll face penalties for failing to file as required. If you’re not required to file a tax form but you file one anyway, you waste a small amount of time doing it. Pascal’s wager says you should file a tax form anyway before the deadline.

Filing a tax return whether required or not has other benefits too. Some people had a harder time receiving stimulus payments from the government during the pandemic because they didn’t file a tax return in a previous year when it wasn’t required. It would’ve been much easier if they had filed a tax return anyway.

There’s no tax to pay if you file a gift tax return, a Form 3520, or a Form 5500-EZ before the deadline. Mistakenly thinking you’re not required to file when it’s actually required incurs large penalties. In the case of Form 5500-EZ, the penalty is $250 per day!

When in doubt, file the tax form.

Take the RMD? Based on Whose Age?The rules on Required Minimum Distributions (RMD) for an inherited IRA are quite complex. It depends on when the original owner died, at what age, whether the IRA had a designated beneficiary, whether the designated beneficiary was a person or a trust, the relationship between the original owner and the beneficiary, the age difference between the original owner and the beneficiary, and so on.

If you’re required to take the RMD from the inherited IRA, the next question is based on whose age. Is it based on the original owner’s age or the beneficiary’s age?

The rules are so complex that Vanguard stopped calculating the RMD for many inherited IRAs for fear of doing it wrong. They punted that responsibility back to the customers and asked them to consult a tax professional.

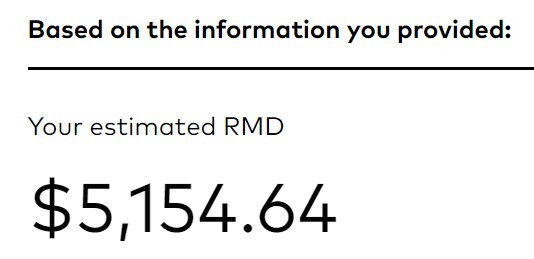

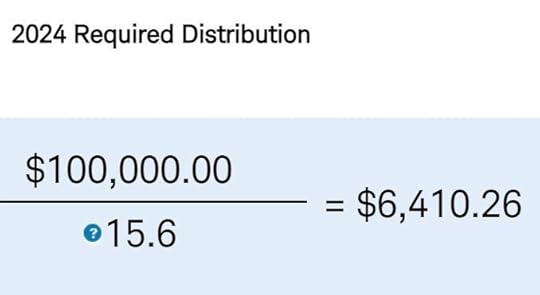

Vanguard still has an online RMD calculator for inherited IRAs. Charles Schwab has one too. The two calculators displayed different results when a reader gave them identical inputs. I tried both of them with this hypothetical case:

IRA Balance on December 31: $100,000Owner’s Date of Birth: May 15, 1955Owner’s Date of Death: May 15, 2023(Non-Spouse) Beneficiary’s Date of Birth: May 15, 1950

The first result was from Vanguard’s calculator. The second result was from Schwab’s calculator. The results varied by almost 25%! Which one is correct? Of course both calculators have disclaimers to say they shouldn’t be relied on as legal or tax advice.

You can study the complex rules again and again and get a degree in RMDs. Or you can pay a CPA and make sure the CPA really understands this subject and you’re not miscommunicating with the CPA. Or you can see which path gives you the least bad consequence when you’re wrong.

If you take the RMD when you aren’t required to take it, the money comes out of the IRA a little sooner. The money eventually has to come out of the IRA anyway. Timing only makes a small difference. If you don’t take the RMD when you are actually required to take it, you face a much higher penalty.

Similarly, when two calculators give two different RMD amounts and you’re not sure which one is the true minimum, it’s perfectly OK to withdraw a higher amount because the RMD is only a minimum. You’ll be in more trouble if you withdraw less than required. Although I think the Vanguard calculator is correct in the hypothetical case, I would take out the larger amount in case I’m wrong.

When in doubt, take the RMD. When in doubt, withdraw a larger amount.

The Last Day to Buy I BondsI Bonds credit interest by the month. It doesn’t matter which exact day in the month you buy I Bonds. You get interest for the entire month as long as you hold I Bonds on the last day of that month. Therefore it’s better to buy I Bonds close to the end of a month.

How close though? When is the last day to buy I Bonds and still get the interest for that month? Is it the last business day of the month? Or is it the second last business day of the month? Or the third last business day of the month?

If you think it’s the last business day of the month but the deadline is actually the second last business day of the month or if you think the deadline is the second last business day of the month but it’s actually the third last business day of the month, your purchase will miss a full month’s worth of interest. If you think the deadline is sooner but it’s actually later, you’re buying a little too soon and you forego earning interest in your savings account or money market fund for a day or two. Not earning interest for a day or two is a lot better than missing a full month’s worth of interest.

I give it a week when I buy I Bonds. The same goes for paying taxes. I set the date of my payment to a week before the due date. If anything goes wrong I still have time to fix it and try again.

When in doubt, do it sooner.

Solo 401k Contribution LimitI have a Solo 401k contribution limit calculator for part-time self-employment. A reader asked me about it because his Third-Party Administrator (TPA) gave him a lower contribution limit. Although I’m confident that my calculator is correct, I said he should go with the lower amount from the TPA.

The calculated contribution limit is only a maximum. No one says you must contribute the maximum. It’s perfectly OK to contribute less than the maximum. If the TPA knows something that I don’t, it’ll be a mess if the reader goes with the higher amount from my calculator and exceeds the legal maximum.

When in doubt, contribute less.

***

You may still be wrong after spending the time and/or money to find the true answers to some tricky questions. You might as well make it easy by evaluating the consequences when you’re wrong. If the consequences are lopsided between two choices, as they often are, use Pascal’s wager and choose the path that costs less when you’re wrong.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Use Pascal’s Wager When You’re Not Sure About Tax Rules appeared first on The Finance Buff.

March 3, 2024

Split-Year Backdoor Roth IRA in TurboTax, 2nd Year

The previous post Split-Year Backdoor Roth IRA in TurboTax, 1st Year dealt with contributing to a Traditional IRA for the previous year and recharacterizing a previous year’s Roth IRA contribution as a Traditional IRA contribution. This post handles the conversion part.

We cover two example scenarios. Here’s the first:

You contributed $6,000 to a Traditional IRA for 2022 in 2023. The value increased to $6,200 when you converted it to Roth in 2023. You received a 1099-R form listing this $6,200 Roth conversion.

You should’ve already reported the contribution part on your 2022 tax return by following Split-Year Backdoor Roth IRA in TurboTax, 1st Year. The IRA custodian sent you a 1099-R form for the conversion in 2023. This post shows you how to put it into TurboTax.

Here’s the second example scenario:

You contributed $6,000 to a Roth IRA for 2022 in 2022. You realized that your income was too high when you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Traditional contribution before April 15, 2023. The IRA custodian moved $6,100 from your Roth IRA to your Traditional IRA because your original $6,000 contribution had some earnings. The value increased again to $6,200 when you converted it to Roth in 2023. You received two 1099-R forms, one for $6,100 and another for $6,200.

You should’ve already reported the recharacterized contribution on your 2022 tax return by following Split-Year Backdoor Roth IRA in TurboTax, 1st Year. The IRA custodian sent you two 1099-R forms, one for the recharacterization, and the other for the conversion. This post shows you how to put both of them into TurboTax.

If you contributed for 2023 in 2024 or if you recharacterized a 2023 contribution in 2024, you’re still in the first year of this journey. Please follow Split-Year Backdoor Roth in TurboTax, 1st Year. If you recharacterized your 2023 contribution in 2023 and converted in 2023, please follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year.

If neither of these example scenarios fits you, please consult our guide for a normal “clean” backdoor Roth: How To Report Backdoor Roth In TurboTax (Updated).