Harry Sit's Blog, page 30

July 21, 2020

Life Hack: Donate To Charities Without Getting Junk Mail

Here’s a problem. You’d like to donate some cash to a charity but you’re concerned that the charity will put you on their mailing list and keep asking for more donations. Worse yet, because some charities share their mailing list with other charities, donating to one charity may get you on the mailing list of multiple charities. Your dislike for getting marketing mail may hold you back from making that donation in the first place.

People who have a Donor-Advised Fund (DAF) solve that problem by donating to their Donor-Advised Fund and requesting a grant to the charity from their Donor-Advised Fund. But you need a minimum to open a Donor-Advised Fund account ($5,000 at Fidelity; $25,000 at Vanguard). You also have to pay an administrative fee every year. It’s an overkill if you only want to donate some cash to a charity.

I found a life hack to donate money to charities without worries about getting junk mail. It’s simple and free.

Charity Gift Card

TisBest Philanthropy in Seattle runs a charity gift card program. TisBest itself is a 501(c)(3) nonprofit organization with a mission to encourage people to give gifts of charity, as opposed to gifts of stuff. Other than having used TisBest once as a user, I have no financial relationship with TisBest. This is not a sponsored post.

A gift giver buys a TisBest Charity Gift Card and sends it to the gift recipient, for birthdays, holidays, graduation, wedding, and what not. Instead of using the gift card to buy something, the gift recipient picks a charity and designates the gift to that charity.

100% of the gift card value goes to the charity picked by the gift recipient. The gift giver still gets the full tax deduction. TisBest covers the administration costs with money from its own donors. There is no purchase fee if you get the gift card code by email or print a paper gift card on your own printer. If you want a plastic card, it’s only $1.95 extra to have it mailed either to the purchaser or to the recipient.

Someone sent me a TisBest Charity Gift Card recently. I went to TisBest’s website and picked a charity for the money. It was a simple process.

Privacy Protection

While the TisBest Charity Gift Card works great for its intended purpose, I think it also works well for donating money to a charity yourself while protecting your privacy. You buy a TisBest Charity Gift Card and have the gift card code emailed to yourself. Then you “spend” the gift card on a charity of your choice. TisBest will pool all donations to that charity from all its users and send a lump sum to the charity each quarter. TisBest won’t share your information with the charity. Other than a time delay, the charity you choose still receives 100% of your donation. From TisBest’s FAQs:

Do you give names and contact information to the charities? Whose name is the donation made in?

We understand the problem with unwanted phone and mail solicitations, so we do not share any customer names or contact information with charities unless you ask us to. Donations are made from TisBest Philanthropy. If you want to register with a charity to receive their mailings, we will offer you that opportunity after you have spent your gift card.

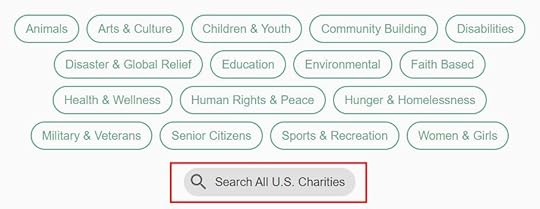

TisBest has a directory of featured charities. The list covers major charities in many different causes. If the one you’d like to support isn’t in the featured list, TisBest also uses a database of all U.S. charities. You can use the search feature to find it.

If you’d like to donate money to more charities but you hesitated because you hate junk mail, now you can use TisBest as a “poor person’s Donor-Advised Fund.” Donate to your heart’s desire with no worries about junk mail. Several other organizations also run similar charity gift card programs. TisBest is the only one I saw that forwards 100% of your donations to the designated charities.

Reference: TisBest FAQs

The post Life Hack: Donate To Charities Without Getting Junk Mail appeared first on The Finance Buff.

July 14, 2020

Can 401k and IRA Contribution Limits Go Down If We Have Deflation?

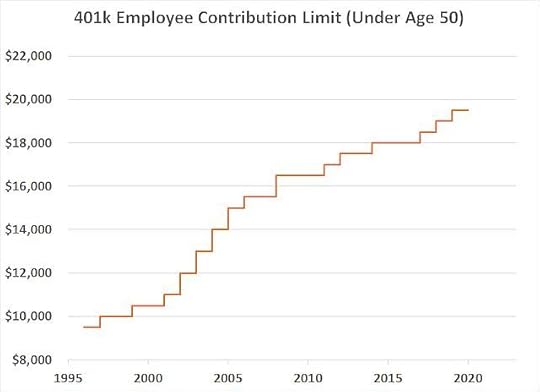

The annual 401k and IRA contribution limits are adjusted for inflation each year. Due to rounding, the limits can stay the same from one year to the next when there isn’t enough inflation. The coronavirus pandemic brought the prospect of deflation. The Consumer Price Index dropped in April. It was flat in May, and it rebounded in June due to a sharp increase in gas prices. A reader asked me whether the 401k and IRA contribution limits in 2021 can go down from their 2020 levels if we have deflation.

The short answer is yes. If we have bad enough deflation, the contribution limits can go down.

The Base Year

The 401k and IRA contribution limits and many other limits in the tax law were set to a round number at a starting point. Then they started adjusting for inflation in subsequent years. You take the inflation number in a later year and compare it to the inflation number at the starting point (the base year). Then you round the calculated results.

Different limits use different specific inflation indexes, different time periods for the comparison, and different rounding methods. Some limits use the CPI-U index, while some others use the Chained CPI-U index. Some limits use a 12-month average as of August of each year, and some other limits use the average in the third quarter. Some limits are rounded down to a nearest threshold, and some other limits are rounded either up or down to a nearest threshold.

For example, suppose a [hypothetical] limit was set to $10,000 in the base year, and the inflation number at that time was 123.456. Then if in year two the inflation number is 125.678, the new limit before rounding is:

$10,000 * 125.678 / 123.456 = $10,180

If this limit is rounded down to the nearest $100, the new limit in year two becomes $10,100.

Now if in year three the inflation number is 128.901, the new limit before rounding is:

$10,000 * 128.901 / 123.456 = $10,441

After rounding down to the nearest $100, the new limit in year three is $10,400.

Notice the calculation in any future year always compares with the inflation number in the base year (123.456 in our hypothetical example). The limit in year three does not depend on the limit in year two. If the inflation number is low enough in year three, it’s possible the limit in year three will be lower than the limit in year two.

Hold Harmless Rule?

Social Security benefits have a “hold harmless” rule. If the Social Security benefits will otherwise go down due to inflation adjustment and/or an increase in the Medicare Part B premium, the benefits are held to the same level in the previous year. This was put in to make sure Social Security recipients don’t receive less from year to year.

There is no “hold harmless” rule in 401k or IRA contribution limits. The inflation adjustment and rounding calculation only compares with the base year. It doesn’t matter what the limit was in the previous year. If the calculation makes the limit lower due to deflation, so be it.

401k and IRA Contribution Limits in 2021

Now, the 401k and IRA contribution limits specifically are rounded down to the nearest $500. It so happened that the 401k contribution limit before rounding only got barely above $19,500 in 2020 (add $6,500 catch-up for age 50 and over). Deflation can push the 401k and its catch-up numbers below the current $19,500 and $6,500 thresholds. If the raw numbers before rounding are $19,497 and $6,496 respectively, then the rounding rule will make the new 401k limits for 2021 go back to $19,000 for under age 50 and extra $6,000 catch-up for age 50 and over.

By my calculation, if inflation in the upcoming months averages to -4.5% annual rate or lower, the 401k contribution limit for 2021 will go back to $19,000 for under age 50 and extra $6,000 catch-up for age 50 and over. That’s not very likely though. If inflation in the upcoming months isn’t that low, the limits for 2021 will stay the same as in 2020. Either way there’s almost no chance for an increase.

The IRA contribution limit has a little more room above the threshold. It first got to $6,000 for under age 50 in 2019. It got up a little more in 2020 before being rounded down to the same $6,000. So it will take larger deflation for the IRA contribution limit for 2021 to go back to $5,500. It can happen theoretically, but I don’t think it’s likely. In all likelihood the IRA contribution limit for 2021 will still be $6,000 for under age 50. The $1,000 catch-up for age 50 and over is hard coded in the law; it doesn’t adjust for inflation.

The post Can 401k and IRA Contribution Limits Go Down If We Have Deflation? appeared first on The Finance Buff.

July 9, 2020

How To Pay Off SBA COVID-19 EIDL Loan Early: A Walkthrough

Back in March, Congress created two loan programs to help small businesses and the self-employed mitigate the economic impact of the COVID-19 pandemic: the Economic Injury Disaster Loan (EIDL) and the Paycheck Protection Program (PPP). Because we were not sure whether we were able to get either loan, we applied for both (see previous post COVID-19 Loans for Self-Employed: Where to Apply). We ended up getting both loans after a long application process — the EIDL loan directly through the SBA, and the PPP loan through a bank.

Our business stabilized somewhat in recent months. Revenue was down 65% in April compared to April of last year. It was down only 47% in June. It’s still bad but the trend is upward. So we decided to pay off the EIDL loan early.

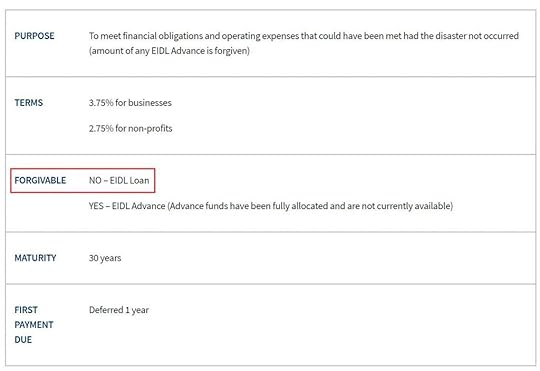

EIDL Loan Is Not Forgivable

The EIDL loan is a 30-year loan at a 3.75% interest rate. No payments are required during the first year but interest still accrues. Except for the EIDL grant ($1,000 per employee up to $10,000), the EIDL loan is not forgivable.

https://www.sba.gov/funding-programs/disaster-assistance/coronavirus-covid-19

https://www.sba.gov/funding-programs/disaster-assistance/coronavirus-covid-19Therefore if you no longer need the cash, it’s better to pay it back early to stop the interest. There’s no prepayment penalty. When no payments are due yet, the SBA isn’t sending any statement or payment stub. If you’d like to pay the loan off, it’s not obvious how much you need to pay or where to send the payment. I’m showing you what to do if you received the EIDL loan and you’d like to pay it off early or pay back a part of the loan to lower your interest charge.

SBA Loan Number

First, you need the SBA loan number for your EIDL loan. This 10-digit number is in the Loan Authorization and Agreement (LA&A) you electronically signed with the SBA. It’s at the beginning of page 2 and also on the upper left of all pages in that document.

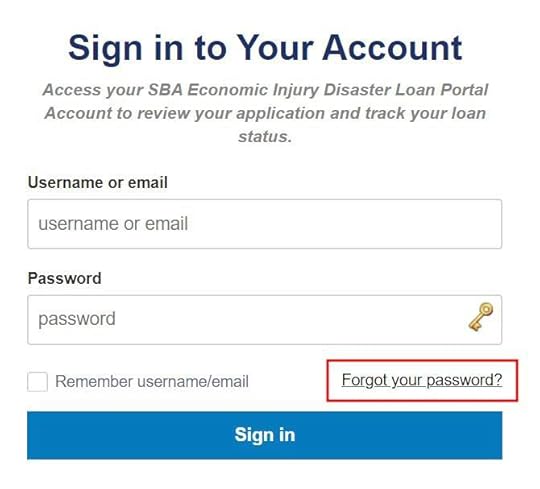

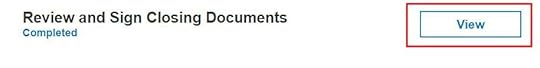

If you didn’t save the document you electronically signed with the SBA, you can go back to the EIDL loan portal at https://covid19relief1.sba.gov and sign in with the email and password you created. If you forgot the password, there’s a “forgot your password” link on the login page.

After you log in, you can re-download the signed loan document.

If you still can’t get into the loan portal, please call the SBA EIDL customer service center at 800-659-2955 or email disastercustomerservice@sba.gov.

SBA CAFS

Next, you need to register with the SBA’s Capital Access Financial System (CAFS). This is similar to the online banking site when you have a loan with a bank. If you have problems registering for online access, please scroll down for how to contact SBA’s Disaster Loan Servicing Center by phone.

Click on the “Not Enrolled?” link above the login fields.

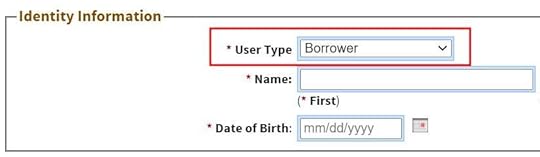

Choose “Borrower” under User Type.

After entering your zip code, click on the Lookup Zip button.

Enter your SBA loan number in the “Financial Commitment ID” field.

Payoff Amount

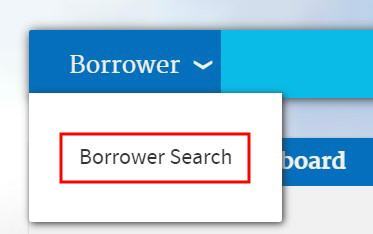

After you successfully register for access, you log in to CAFS with the user ID and password you created. The system will send a one-time PIN to your email address or mobile phone for two-factor authentication. After you get in, at the light blue bar at the top, click on Borrower, and then Borrower Search.

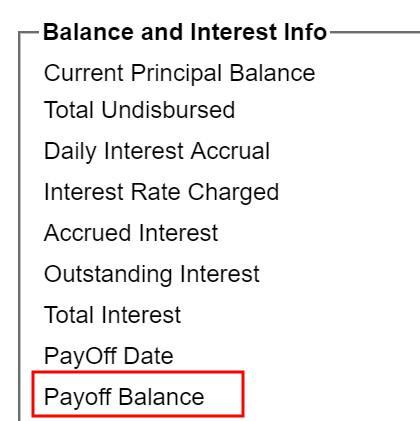

You will see a list of your loans. If you received both the EIDL loan and the PPP loan, you can identify your EIDL loan by the loan number, the loan amount, or the loan type (“DCI”). Click on the EIDL loan. You will see your loan details. If you are trying to pay the loan off, read the Payoff Balance during working hours Monday through Thursday.

Further down the page, you will see a link that says “Go to pay.gov to make a payment.” So you go there next.

Pay.gov

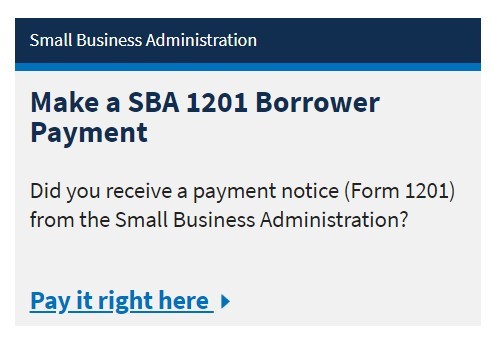

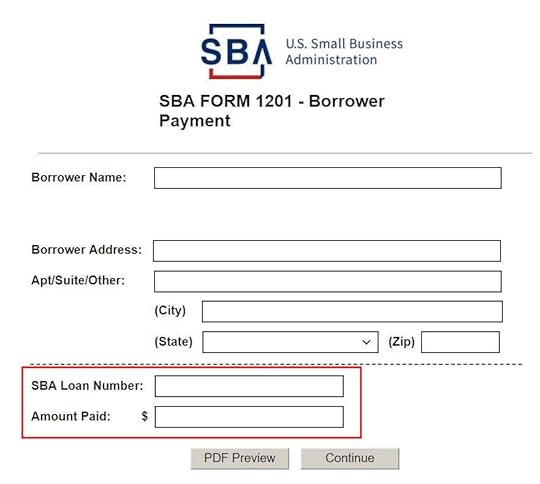

The link just sends you to the home page of pay.gov. This is a multi-purpose website for making many different kinds of payments to the U.S. government. You will see this in the middle of the home page:

You follow that link even though you don’t really have a payment notice (Form 1201) from the SBA. When you follow along, the crucial information you need are your SBA loan number and the payment amount.

If you are trying to pay the loan off, enter the payoff amount you got from SBA CAFS (you can also make a partial payment). The soonest payment date is the next business day. That’s why if you are trying to pay it off, you need the latest payoff amount during the working hours Monday through Thursday. If you get the payoff amount in the evening or on a Friday, by the time the payment arrives, additional interest may have accrued and your payment will be short.

You will give the routing number and account number of a bank account for the payoff. Pay.gov will debit your account and send the payment to the SBA. You can go back to SBA CAFS after a few days to verify the payment and the loan status.

You are done when you see the loan status says “Paid in Full.”

SBA Disaster Loan Servicing Center

If you have problems enrolling in CAFS to view your payoff balance and loan status, you can also try calling SBA’s Disaster Loan Servicing Center. I haven’t called them myself because I was able to get into CAFS. I only found the information on SBA’s website.

SBA has two Disaster Loan Servicing Centers, one in Birmingham, AL, the other in El Paso, TX. Your loan may be assigned to one of the two centers. Or maybe either center will be able to tell you the payoff balance and verify that your loan is paid in full. The Loan Servicing Center also takes payments by phone.

Birmingham Loan Servicing Center

Phone: 800-736-6048

Hours of Operation: Monday – Friday 8:00 a.m. to 4:30 p.m. (CST)

Email: birminghamdlsc at sba dot gov

El Paso Loan Servicing Center

Phone: 800-487-6019

Hours of Operation: Monday – Friday 8:00 a.m. to 4:30 p.m. (MST)

Email: elpasodlsc at sba dot gov

The post How To Pay Off SBA COVID-19 EIDL Loan Early: A Walkthrough appeared first on The Finance Buff.

July 3, 2020

2021 California ACA Health Insurance Premium Subsidy

Update on July 3, 2020: New California state budget for 2021 preserved funding for the state premium assistance. The program design for 2021 carried over the same design from 2020.

Ever since the Affordable Care Act came out, some people who buy health insurance on the ACA exchange have to watch carefully for the premium subsidy cliff. The Premium Tax Credit is cut off at 400% Federal Poverty Level. If your income is $1 higher than the cutoff, you lose all the premium subsidy, which can be well over $10,000 depending on your age and your household size.

If you live in California, you may be able to breathe a sigh of relief in the next few years. California passed a law in 2019 that extends the premium subsidy to 600% Federal Poverty Level (FPL) for three years starting in 2020. California will pick up where the federal government leaves off. News media such as Los Angeles Times reported this in California Gov. Gavin Newsom has signed his first budget. Here’s where the $215 billion will go:

“Based on federal guidelines, subsidies will be available starting in January to individuals earning up to almost $75,000 a year and families of four earning as much as $154,500. The subsidies to purchase health insurance will be highest for those who earn the least, with the lowest earners eligible for enough financial assistance to pay their entire monthly premiums.”

However, in typical treatment by news media, they don’t tell you the details. Subsidies will be available. How much can people expect? If you want to know how the California state subsidies really work, you have to come to my blog.

June 16, 2020

Who’s Leaving 401k Match On the Table?

The standard answer for how to get started in saving for retirement is to get the 401k match. It’s often said to be a 100% return. Although the match isn’t necessarily dollar-for-dollar (50 cents on the dollar is more common), you get the point.

On the other hand, about 1/3 of eligible employees don’t contribute to their 401k. We are not talking about people working for employers that don’t offer a 401k plan, or new employees who aren’t allowed to contribute to their 401k yet. They are already eligible, but they are not contributing. Why are they leaving the 401k match on the table?

Vanguard manages 401k plans for many employers. They publish two detailed reports titled How America Saves every year with data from these plans. One report covers 5 million participants in plans of larger employers and the other report covers 480,000 participants in plans of smaller employers. These reports provide insights in why some employees don’t contribute to their 401k.

Details, Details

First of all, although the vast majority of larger plans offer an employer match, only about half of the smaller plans give a match. When everyone says “get the employer match” it leaves the question what if there’s no match. It can be misinterpreted as you should contribute only when the employer offers a match.

Second, even when the employer offers a match, not all employees get it. Some plans require one year of service before receiving the employer match. 36% of the employees in larger plans and 40% of employees in smaller plans must wait one year before they are eligible for a match. Again when “get the employer match” is drilled in people’s heads, some may choose not to contribute until they are eligible for the match. If they choose not to contribute from the beginning, by the time they are eligible for the match, they don’t necessarily get a reminder from the employer. As a result, some end up not contributing to their 401k even after they are eligible for the match.

Third, after the employees receive the match, they don’t necessarily get to keep it. Some employers require staying with them for up to six years before the match is 100% yours. This is called vesting. Only 41% of employees in larger plans can keep the match as soon as they receive it. For the other 59%, if they change jobs too soon, the employer will take back part of the match or all of it. Employees in half of the smaller plans that do offer a match face less gotcha. 70% of the employees who receive a match can keep the match immediately.

Larger PlansSmaller PlansOffers employer match98%53%Must wait 1 year for match36%40%Immediate vesting41%70%Participation rate74%60%

Anchoring contributing to the 401k on the match can backfire, (a) when there is no match (more likely the case at smaller employers), (b) when there’s a waiting period for the match, or (c) when the match can be forfeited. These all affect the participation rate. However, they may not be the primary driver.

A Matter of Income

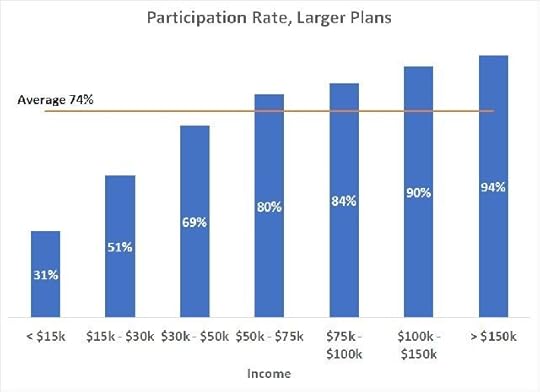

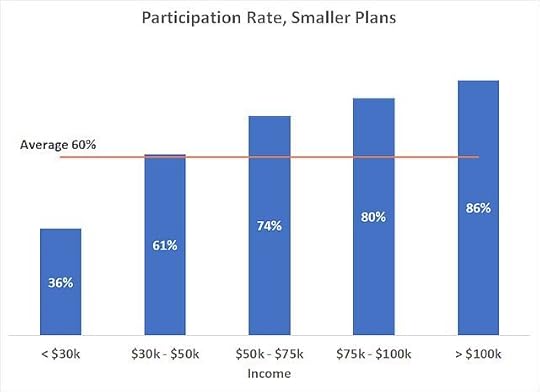

The Vanguard reports also show the participation rates by the employees’ income.

You see the same story in both larger and smaller plans. The participation rate increases with the employees’ annual income. At income above $30,000 a year, the participation rate is close to or above the average. It’s significantly lower at incomes below $30,000.

This should not be a surprise. When someone needs every dollar of their income to live on, they can’t afford to contribute to the 401k. The match ends up discriminating against lower-income employees. Match and after-the-fact tax credit or tax deduction don’t work that well as an incentive for people who need the money today. Under the current system, higher-income employees who will contribute regardless collect the match from the employer, and lower-income employees who can really use some help from the employer end up leaving the match on the table. In addition, by not contributing to their 401k, the lower-income employees may also lose out on tax credits, such as the Saver’s Credit and EITC.

People with lower income face huge economic injustice. Losing out on the 401k match is only a small part of many hurdles in front of them. It’s expensive to be poor everywhere they go.

Reference

How America Saves 2019, The Vanguard GroupHow America Saves 2019, Small Business Edition, The Vanguard Group

The post Who’s Leaving 401k Match On the Table? appeared first on The Finance Buff.

June 13, 2020

2020 2021 Medicare Part B Part D IRMAA Premium Brackets

[Update on August 12, 2020: projections for 2021]

Seniors age 65 or older can sign up for Medicare. Medicare calls people who receive it beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors’ services and Medicare Part D that covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount.

I haven’t seen any numbers that show how much collecting IRMAA really helps the government in the grand scheme. I’m guessing very little. One report said 5% of all Medicare beneficiaries pay IRMAA. Suppose the 5% pay double the standard premium, it changes the overall split between the beneficiaries and the government from 25:75 to 26:74. Big deal?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2019 income determines your IRMAA in 2021. Your 2020 income determines your IRMAA in 2022.

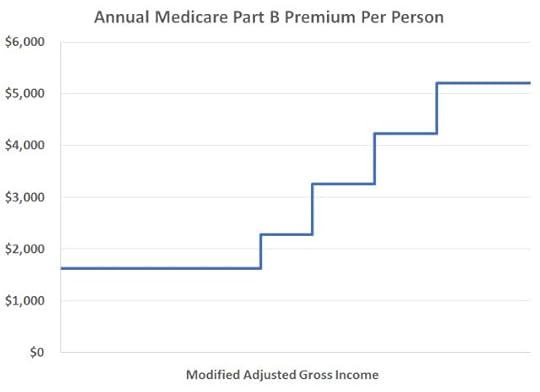

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay. If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

So if your income is near a bracket cutoff, see if you can manage to keep it down and make it stay in a lower bracket. Using the income from two years ago makes a little harder. Now in 2020 you don’t know where exactly the brackets will be for 2022. Still, you can make reasonable estimates and give yourself some margin to stay clear of the cutoff points.

IRMAA Brackets

The IRMAA income brackets (except the very last one) started adjusting for inflation in 2020. Here are the IRMAA income brackets for 2020 and the projected new brackets for 2021. I made these projections for 2021 based on the inflation numbers so far. Rounding rules make it such that inflation numbers for the upcoming months are unlikely to affect the final results. For example, when a number is rounded to the nearest $1,000, it doesn’t matter whether the number is really $87,600 or $87,800 before rounding. Remember the income on your 2019 tax return (AGI plus muni interest) determines the IRMAA you pay in 2021. The income on your 2020 tax return (to be filed in 2021) determines the IRMAA you pay in 2022.

Part B Premium20202021StandardSingle:

Married Filing Jointly: Single:

Married Filing Jointly: Standard * 1.4Single:

Married Filing Jointly: Single:

Married Filing Jointly: Standard * 2.0Single:

Married Filing Jointly: Single:

Married Filing Jointly: Standard * 2.6Single:

Married Filing Jointly: Single:

Married Filing Jointly: Standard * 3.2Single:

Married Filing Jointly: Single:

Married Filing Jointly: Standard * 3.4Single: > $500,000

Married Filing Jointly: > $750,000Single: > $500,000

Married Filing Jointly: > $750,000

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The income brackets are the same. The surcharges are relatively smaller in dollars.

The standard Medicare Part B premium is $144.60/month in 2020. A 40% surcharge on the Medicare Part B premium is about $700/year per person, or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare have over $174k in income, they are probably already paying a large amount in taxes. Does making them pay another $1,400/year make that much difference? Nickel-and-diming just annoys people. People caught by surprise when their income crosses over to a higher bracket by just a small amount get mad at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income and don’t accidentally cross a line for IRMAA.

IRMAA Appeal

If your income two years ago was higher because you were working at that time and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA assessment. The “life-changing events” that make you eligible for an appeal include:

Death of spouseMarriageDivorce or annulmentWork reductionWork stoppageLoss of income from income producing propertyLoss or reduction of certain kinds of pension income

You file an appeal by filling out the form SSA-44 to show that although your income was higher two years ago, you had a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For Life

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, when your income comes down in the following year, your IRMAA will also come down. It’s not the end of the world to pay IRMAA for one year.

The post 2020 2021 Medicare Part B Part D IRMAA Premium Brackets appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower