Who’s Leaving 401k Match On the Table?

The standard answer for how to get started in saving for retirement is to get the 401k match. It’s often said to be a 100% return. Although the match isn’t necessarily dollar-for-dollar (50 cents on the dollar is more common), you get the point.

On the other hand, about 1/3 of eligible employees don’t contribute to their 401k. We are not talking about people working for employers that don’t offer a 401k plan, or new employees who aren’t allowed to contribute to their 401k yet. They are already eligible, but they are not contributing. Why are they leaving the 401k match on the table?

Vanguard manages 401k plans for many employers. They publish two detailed reports titled How America Saves every year with data from these plans. One report covers 5 million participants in plans of larger employers and the other report covers 480,000 participants in plans of smaller employers. These reports provide insights in why some employees don’t contribute to their 401k.

Details, Details

First of all, although the vast majority of larger plans offer an employer match, only about half of the smaller plans give a match. When everyone says “get the employer match” it leaves the question what if there’s no match. It can be misinterpreted as you should contribute only when the employer offers a match.

Second, even when the employer offers a match, not all employees get it. Some plans require one year of service before receiving the employer match. 36% of the employees in larger plans and 40% of employees in smaller plans must wait one year before they are eligible for a match. Again when “get the employer match” is drilled in people’s heads, some may choose not to contribute until they are eligible for the match. If they choose not to contribute from the beginning, by the time they are eligible for the match, they don’t necessarily get a reminder from the employer. As a result, some end up not contributing to their 401k even after they are eligible for the match.

Third, after the employees receive the match, they don’t necessarily get to keep it. Some employers require staying with them for up to six years before the match is 100% yours. This is called vesting. Only 41% of employees in larger plans can keep the match as soon as they receive it. For the other 59%, if they change jobs too soon, the employer will take back part of the match or all of it. Employees in half of the smaller plans that do offer a match face less gotcha. 70% of the employees who receive a match can keep the match immediately.

Larger PlansSmaller PlansOffers employer match98%53%Must wait 1 year for match36%40%Immediate vesting41%70%Participation rate74%60%

Anchoring contributing to the 401k on the match can backfire, (a) when there is no match (more likely the case at smaller employers), (b) when there’s a waiting period for the match, or (c) when the match can be forfeited. These all affect the participation rate. However, they may not be the primary driver.

A Matter of Income

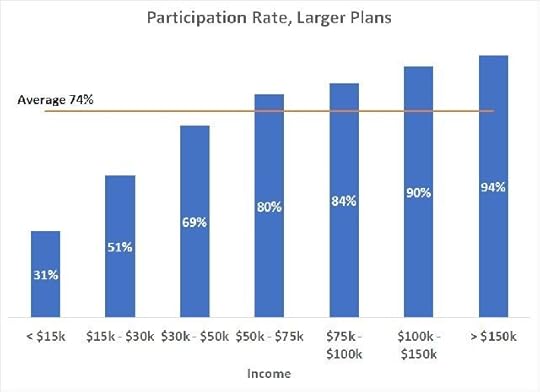

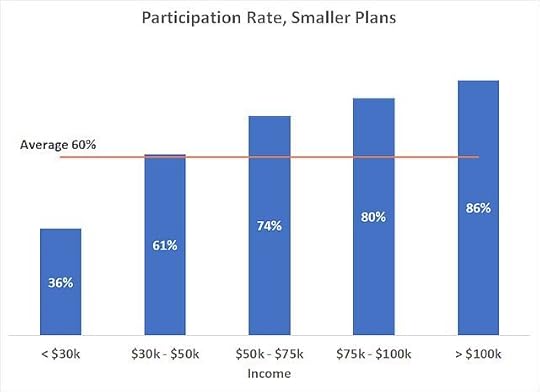

The Vanguard reports also show the participation rates by the employees’ income.

You see the same story in both larger and smaller plans. The participation rate increases with the employees’ annual income. At income above $30,000 a year, the participation rate is close to or above the average. It’s significantly lower at incomes below $30,000.

This should not be a surprise. When someone needs every dollar of their income to live on, they can’t afford to contribute to the 401k. The match ends up discriminating against lower-income employees. Match and after-the-fact tax credit or tax deduction don’t work that well as an incentive for people who need the money today. Under the current system, higher-income employees who will contribute regardless collect the match from the employer, and lower-income employees who can really use some help from the employer end up leaving the match on the table. In addition, by not contributing to their 401k, the lower-income employees may also lose out on tax credits, such as the Saver’s Credit and EITC.

People with lower income face huge economic injustice. Losing out on the 401k match is only a small part of many hurdles in front of them. It’s expensive to be poor everywhere they go.

Reference

How America Saves 2019, The Vanguard GroupHow America Saves 2019, Small Business Edition, The Vanguard Group

The post Who’s Leaving 401k Match On the Table? appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower