Harry Sit's Blog, page 27

February 21, 2021

Self-Employed ACA Health Insurance Subsidy In H&R Block Tax Software

Many self-employed business owners buy health insurance from the Affordable Care Act (ACA) exchange. Self-employed health insurance premiums are tax-deductible. When your income is low enough, you can also receive a subsidy in the form of a premium tax credit. The tax deduction and the subsidy form a circular relationship. The math is difficult to do by hand but tax software easily handles it for most people.

Here’s how to do it in H&R Block Deluxe downloaded software. I’m using this simple example:

You are single, self-employed, with no dependent. You had health insurance from the ACA exchange for all twelve months in the year. The second lowest cost Silver plan was $600/month. The full unsubsidized premium for the plan you chose was $500/month. Based on your estimated income, you got a $150/month advance credit. You paid net $350/month out of pocket. After deducting your business expenses, your income from self-employment was $45,000 for the year. You don’t have any other income or deductions.

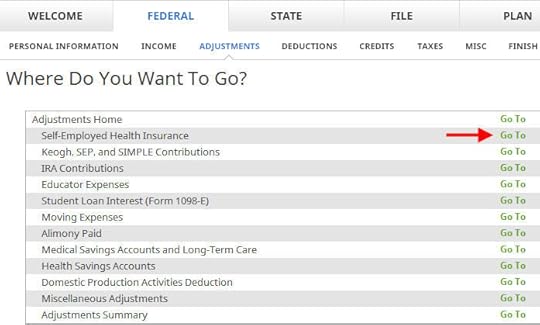

Go to Federal -> Adjustment -> Self-Employed Health Insurance.

Enter the full unsubsidized premiums you paid in the year. You find this number on the 1095-A form you receive from the ACA exchange (line 33, column A). Include both what you paid out of pocket and the advance premium credit. You will reconcile the advance credit later. If you also paid premiums for dental and vision insurance, include those as well. We don’t have dental and vision premiums in our simple example.

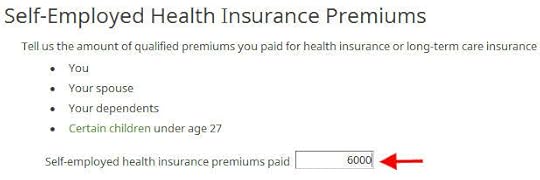

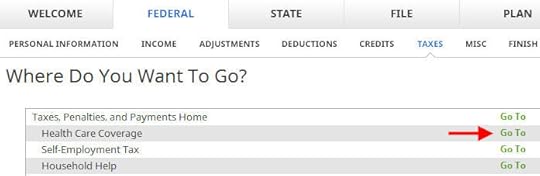

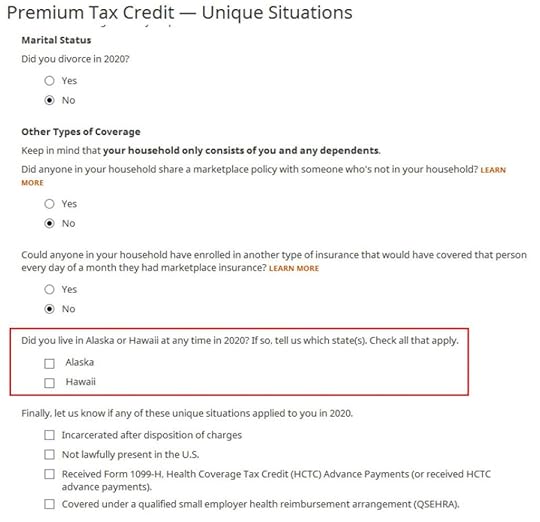

Go to Federal -> Taxes -> Health Care Coverage.

Everyone had insurance in our example.

Check the box for a plan from the ACA marketplace.

We don’t have any of these unique situations here. Check the box for Alaska or Hawaii if you lived there.

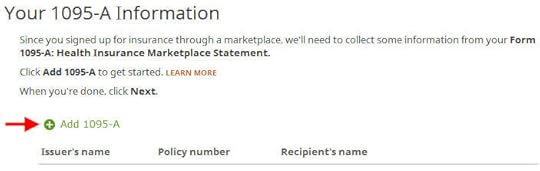

We need to add the 1095-A from the marketplace.

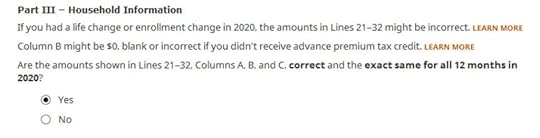

Enter the information as requested. Scroll down to Part III. In our simple example, you had the same plan for all 12 months and the numbers on the 1095-A are all correct. If your plan changed mid-year, choose ‘No’ and enter the month-by-month numbers from your Form 1095-A.

Enter the monthly amounts from the 1095-A. The full unsubsidized premium was $500/month. The full unsubsidized premium for the second lowest cost Silver plan was $600/month. The ACA exchange paid $150/month in advance subsidy to the insurance company on our behalf.

We only have one 1095-A form in our simple example. If you have more than one, repeat and add them all.

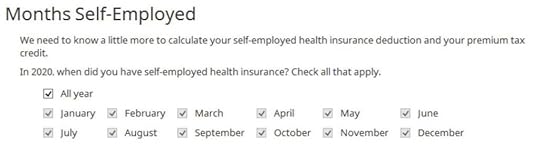

Which months you were self-employed determines how much counts as deductible self-employed health insurance. We were self-employed in all 12 months in our example.

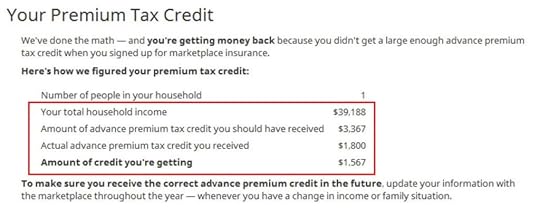

The software crunches the numbers. It says we are eligible for more premium tax credit than the advance subsidy the ACA exchange paid to the insurance company.

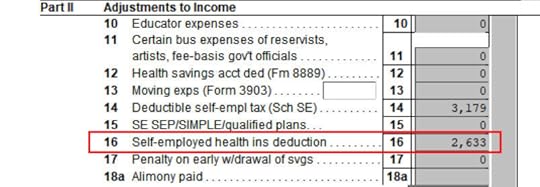

You can verify you are also receiving a tax deduction. Click on Forms at the top. Double-click on Form 1040 and Schedules 1-3. Scroll down to Schedule 1 and look at line 16. That’s your self-employed health insurance deduction.

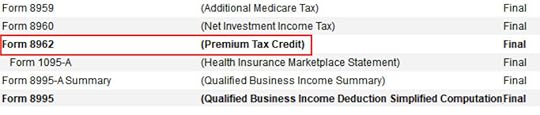

Close Form 1040 and Schedules 1-3 and find Form 8962 in the forms list. Double-click on it.

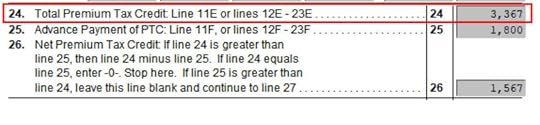

Scroll down to Line 24 on Form 8962. There is our premium tax credit based on our actual income. Because we received less in advance subsidy, we’re getting the difference in our tax refund. If you received more in advance subsidy, you’ll have to pay back the difference (subject to a cap, see Cap On Paying Back ACA Health Insurance Subsidy Premium Tax Credit).

$2,633 in self-employed health insurance deduction plus $3,367 in premium tax credit equals $6,000. That’s the total unsubsidized premium for our health insurance (plus any dental and vision insurance premium, which we didn’t have in our example). The numbers add up! The software figured out the split between the tax deduction and the tax credit. It also matched the result from TurboTax for the same example. This is where software does its best. If you take this to a tax professional, they will have to use their software to calculate the split anyway. I bet they are not able to do it by hand.

The post Self-Employed ACA Health Insurance Subsidy In H&R Block Tax Software appeared first on The Finance Buff.

February 19, 2021

Import W-2 and 1099 Forms Into TurboTax and HR Block: From Where?

After reading my previous post Fake TurboTax Discount Through Vanguard and Fidelity, reader Mike sent me an email:

I have accounts with both Vanguard and Fidelity, having several mutual funds, ETFs, and individual bonds, etc., with each company. I am able to download my tax info into TurboTax from both sites. I don’t think l can do that with HR Block.

I think this is one of the reasons Fidelity and Vanguard offer TurboTax and not H&R Block. A couple of years ago I tried using HR Block and it didn’t download my Fidelity or Vanguard info. If you know anyone who has downloaded their tax forms from HR Block, I’d like to know.

Great question. Both TurboTax and H&R Block advertise that they can import W-2 and 1099 forms. But from where?

TurboTax publishes a list of partners from which you can download W-2 and 1099 Forms. The W-2 partners include the leading payroll provider ADP, some other payroll providers, and a number of large employers. The 1099 partners include most major financial institutions.

I couldn’t find a similar list from H&R Block’s website, but since I have its software, I looked inside the software.

For importing a W-2, H&R Block asks for the employer’s federal Employer Identification Number (EIN). I entered my employer’s EIN found on my W-2. It says it’s eligible for importing because my employer uses ADP for payroll.

For importing 1099’s and 1098’s, H&R Block software lists a number of financial institutions in a scroll box. I can’t copy the complete list out of it and I don’t want to retype them. Because 1099-INT (interest earned) and 1098 (mortgage interest paid) are relatively simple, I’m not too worried about the coverage for banks and credit unions. I just looked at mutual fund companies and brokers, especially discount brokers.

H&R Block’s coverage isn’t as complete as TurboTax’s but there’s a substantial overlap. The table below compares the support for importing W-2 and 1099 forms in TurboTax and H&R Block:

TurboTaxH&R BlockADPyesyesFidelityyesyesVanguardyesyesT. Rowe PriceyesyesCharles SchwabyesyesTD AmeritradeyesyesE*TradeyesyesBettermentyesyesWells Fargo AdvisorsyesnoAmeripriseyesyesEdward JonesyesyesMerrill LynchyesyesUBSyesyesH&R Block doesn’t yet support downloading from Wells Fargo Advisors. It says it supports importing from Vanguard, Fidelity, Charles Schwab, TD Ameritrade, and E*Trade. At a substantial saving off the comparable TurboTax version, I’m not complaining.

The post Import W-2 and 1099 Forms Into TurboTax and HR Block: From Where? appeared first on The Finance Buff.

February 16, 2021

TurboTax 2020 CARES Act $300 Charity Donation Deduction

From the previous posts, we know that in 2020, even if you take the standard deduction you can still deduct up to $300 in cash donations to charities (up to $150 for married filing separately). See CARES Act 2020 Charity Donation Deduction. However, finding the place to get this deduction in TurboTax requires some patience.

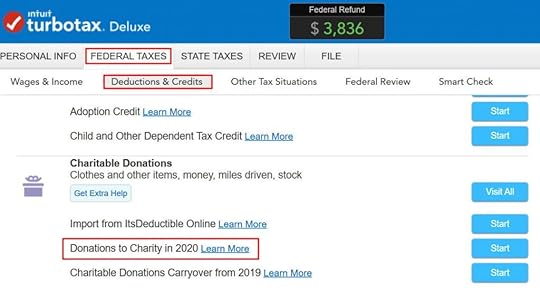

TurboTaxTurboTax has a place to enter charity donations as you would expect. It’s under Federal Taxes -> Deductions & Credits -> Charitable Donations. So far so good.

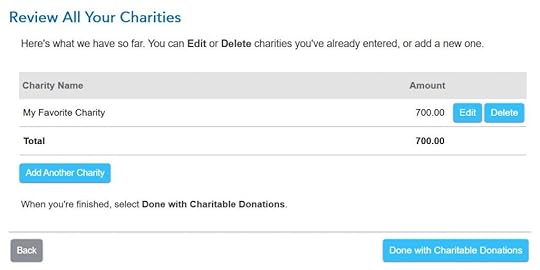

It’s also straightforward to enter the donations. You arrive at this summary after you enter all the details. In our example, the taxpayer donated $700 cash to a favorite charity.

However, your refund number doesn’t change after you click on “Done with Charitable Donations.” It’s as if you’re not getting the deduction for your donations. In our example, the refund was $3,836 before we started, and it was still $3,836 when we were done with charitable donations.

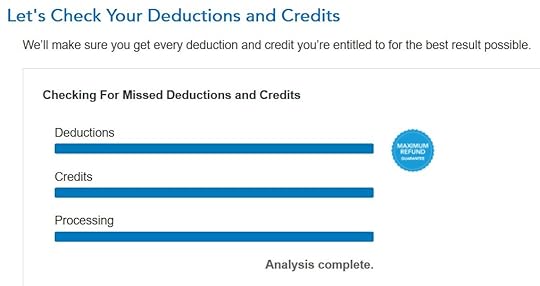

TurboTax continues to ask you about other deductions. After you’re done with all the deductions, TurboTax will do an analysis at that point.

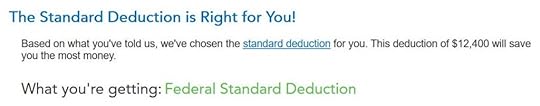

TurboTax double-checks some items until it concludes that you should take the standard deduction.

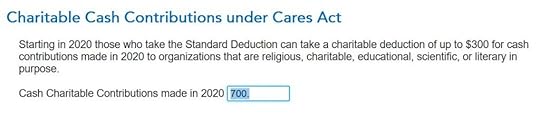

Now, the next screen comes back to the cash donations to charities. It pulls up the cash donations you entered previously.

And now the refund number will change. It was $3,836. Now it’s $3,908. We’re getting $72 for the donations.

So if you don’t see your refund change after you enter your donations, be patient. Keep going, going, and going. Eventually, you will reach the place where TurboTax recognizes that you’re taking the standard deduction and you’re entitled to the $300 deduction for your donations to charity.

H&R Block SoftwareIt’s much more straightforward to do this in the H&R Block software. The H&R Block software assumes you’ll take the standard deduction until it sees enough deductions worth itemizing. It’s a good assumption to make because close to 90% of all taxpayers take the standard deduction. As soon as you enter the charity donations in H&R Block software, the refund number will change.

TurboTax doesn’t assume. It tries to demonstrate it’s thorough and it’s doing the heavy lifting of giving you the maximum deductions. After a song and dance, you end up with the standard deduction anyway. I think the approach in the H&R Block software works better, but TurboTax’s convoluted way creates good materials for blog posts.

The post TurboTax 2020 CARES Act $300 Charity Donation Deduction appeared first on The Finance Buff.

February 11, 2021

2020 2021 2022 HSA Contribution Limits: Individual and Family Coverage

Even though we just got into 2021, it’s time to peek into HSA for 2022. The contribution limits for various tax advantaged accounts for the following year are usually announced in October, except for HSA, which come out in April or May.

The contribution limits are adjusted for inflation each year, subject to rounding rules. Because of the rounding rules, I’m able to calculate the limits based on the inflation numbers available so far. When a number is rounded to the nearest $50, it doesn’t matter whether it’s really $3,643 or $3,661. Since I started doing these calculations, my own calculations always matched 100% to the official numbers from the IRS.

HSA Contribution Limits202020212022Individual Coverage$3,550$3,600$3,650Family Coverage$7,100$7,200$7,250Source: IRS Rev. Proc. 2019-25, Rev. Proc. 2020-32, my own projection.

Employer contributions are included in these limits.

The family coverage numbers happened to be twice the individual coverage numbers in recent years but it isn’t always true. Because the individual coverage limit and the family coverage limit are both rounded to the nearest $50, when one number rounds up and the other number rounds down, the family coverage limit can be slightly more or slightly less than twice the individual coverage limit.

Age 55 Catch Up ContributionAs in 401k and IRA contributions, you are allowed to contribute extra if you are above a certain age. If you are age 55 or older by the end of year (not age 50 as in 401k and IRA contributions), you can contribute additional $1,000 to your HSA. If you are married, and both of you are age 55, each of you can contribute additional $1,000.

However, because HSA is in one individual’s name, just like an IRA — there is no joint HSA even when you have family coverage — only the person age 55 or older can contribute the additional $1,000 in his or her own name. If only the husband is 55 or older and the wife contributes the full family contribution limit to the HSA in her name, the husband has to open a separate account in his name for the additional $1,000. If both husband and wife are age 55 or older, they must have two HSA accounts in separate names if they want to contribute the maximum. There’s no way to hit the combined maximum with only one account.

The $1,000 additional contribution limit is fixed by law. It’s not adjusted for inflation.

Two Plans Or Mid-Year ChangesThe limits are more complicated if you are married and the two of you are on different health plans. It’s also more complicated when your health insurance changes mid-year. The insurance change could be due to a job change, marriage or divorce, enrolling in Medicare, birth of a child, and so on.

For those situations, please read HSA Contribution Limit For Two Plans Or Mid-Year Changes.

HDHP QualificationYou can only contribute to an HSA if you have a High Deductible Health Plan (HDHP). You can use the money already in the HSA for qualified medical expenses regardless what insurance you currently have.

The IRS also defines what qualifies as an HDHP. For 2021, an HDHP with individual coverage must have at least $1,400 in annual deductible and no more than $7,000 in annual out-of-pocket expenses. For family coverage, the numbers are minimum $2,800 in annual deductible and no more than $14,000 in annual out-of-pocket expenses.

For 2022, an HDHP with individual coverage must have at least $1,400 in annual deductible and no more than $7,050 in annual out-of-pocket expenses. For family coverage, the numbers are minimum $2,800 in annual deductible and no more than $14,100 in annual out-of-pocket expenses.

Please note the deductible number is a minimum while the out-of-pocket number is a maximum. If the out-of-pocket limit of your insurance policy is too high, it doesn’t qualify as an HSA-eligible policy.

In addition, just having the minimum deductible and the maximum out-of-pocket isn’t sufficient to make a plan qualify as as HSA-eligible. The plan must also meet other criteria. See Not All High Deductible Plans Are HSA Eligible.

202020212022Individual Coveragemin. deductible$1,400$1,400$1,400max. out-of-pocket$6,900$7,000$7,050Family Coveragemin. deductible$2,800$2,800$2,800max. out-of-pocket$13,800$14,000$14,100Source: IRS Rev. Proc. 2019-25, Rev. Proc. 2020-32, my own projection.

Contribute Outside PayrollIf you have a High Deductible Health Plan (HDHP) through your employer, your employer may already set up a linked HSA for you at a selected provider. Your employer may be contributing an amount on your behalf there. Your payroll contributions also go into that account. Your employer may be paying the fees for you on that HSA. You save Social Security and Medicare taxes when you contribute to the HSA through payroll.

When you contribute to an HSA outside an employer, you get the tax deduction on your tax return, similar to when you contribute to a Traditional IRA. If you use tax software, be sure the answer the questions on HSA contributions. The tax deduction shows up on Form 8889 line 13 and Schedule 1 line 12.

If your HDHP also covers your adult children who are not claimed as a dependent on your tax return, they can also contribute to an HSA in their own name if they don’t have other non-HDHP coverage. They get a separate family coverage limit. They will have to open an HSA on their own with an HSA provider.

Best HSA ProvidersIf you get the HSA-eligible high deductible plan through an employer, your employer usually has a designated HSA provider for contributing via payroll deduction. It’s best to use that one because your contributions via payroll deduction are usually exempt from Social Security and Medicare taxes. If you want better investment options you can transfer or rollover the HSA money from your employer’s designated provider to a provider of your choice afterwards. See How To Rollover an HSA On Your Own and Avoid Trustee Transfer Fee.

If you are not going through an employer, or if you’d like to contribute on your own, you can also open an HSA with a provider of your choice. For the best HSA providers with low fees and good investment options, see Best HSA Provider for Investing HSA Money.

The post 2020 2021 2022 HSA Contribution Limits: Individual and Family Coverage appeared first on The Finance Buff.

January 29, 2021

2020 2021 2022 Federal Poverty Levels (FPL) For ACA Health Insurance

People who don’t have health insurance from work can buy health coverage under the Affordable Care Act, also known as Obamacare. The premiums are made affordable by a premium subsidy in the form of a tax credit calculated off your income relative to the Federal Poverty Levels (FPL), also known as the HHS poverty guidelines.

The Maximum IncomeYou qualify for the premium subsidy only if your modified adjusted gross income (MAGI) is at 400% FPL or below. If your MAGI goes above 400% FPL even by $1, you lose all the subsidy. See Stay Off the ACA Premium Subsidy Cliff.

Modified Adjusted Gross Income for the ACA premium subsidy is basically your adjusted gross income (AGI) plus tax-exempt muni bond interest, plus untaxed Social Security benefits. In order to see whether you qualify for the premium subsidy, you have to know where the FPL is.

The Minimum IncomeIn addition to the maximum income to receive the premium subsidy, there’s also a minimum income to get accepted by the ACA marketplace. If your estimated income is too low, the ACA marketplace won’t accept you. They send you to Medicaid instead. In states that expanded Medicaid, the minimum income is 138% FPL. In states that didn’t expand Medicaid, the minimum income is 100% FPL. Here’s a map from Kaiser Family Foundation that shows which states expanded Medicaid and which states did not: Current Status of State Medicaid Expansion Decisions.

However, unlike the maximum income, the minimum income is only examined at the time of enrollment, not at the time when you file your tax return. If your estimated income at the time of enrollment is below the minimum, the ACA marketplace won’t accept you, and they will refer you to Medicaid. If your estimated income at the time of enrollment is above the minimum and they accepted you, but due to unforeseen circumstances your income for the year ended up below the minimum, as long as you made the original estimate in good faith, you are not required to pay back the premium subsidy you already received.

The FPL NumbersHere are the numbers for coverage in 2020, 2021, and 2022. They increase with inflation every year in January. These are applied with a one-year lag. Your eligibility for a premium subsidy for 2021 is based on the FPL numbers announced in 2020. The new numbers announced in 2021 will be used for coverage in 2022.

There are three sets of numbers. FPLs are higher in Alaska and Hawaii than in the lower 48 states and Washington DC.

48 Contiguous States and Washington DCNumber of persons in household2020 coverage2021 coverage2022 coverage1$12,490$12,760$12,8802$16,910$17,240$17,4203$21,330$21,720$21,9604$25,750$26,200$26,500moreadd $4,420 eachadd $4,480 eachadd $4,540 eachAlaskaNumber of persons in household2020 coverage2021 coverage2022 coverage1$15,600$15,950$16,0902$21,130$21,550$21,7703$26,660$27,150$27,4504$32,190$32,750$33,130moreadd $5,530 eachadd $5,600 eachadd $5,680 eachHawaiiNumber of persons in household2020 coverage2021 coverage2022 coverage1$14,380$14,680$14,8202$19,460$19,830$20,0403$24,540$24,980$25,2604$29,620$30,130$30,480moreadd $5,080 eachadd $5,150 eachadd $5,220 eachSource:

Department of Health and Human Services, notice 2019-00621Department of Health and Human Services, notice 2020-00858 Department of Health and Human Services, notice 2021-01969 The Applicable PercentagesThe FPL numbers determine whether you’re eligible for the premium subsidy. How much you are expected to pay when you qualify for the premium subsidy is determined by a sliding scale called the Applicable Percentages. See ACA Health Insurance Premium Tax Credit Percentages.

The post 2020 2021 2022 Federal Poverty Levels (FPL) For ACA Health Insurance appeared first on The Finance Buff.

January 26, 2021

Vanguard Two-Factor Authentication (2FA): YubiKey + Google Voice

Most financial institutions have some form of two-factor authentication (“2FA”) when you log in online. They ask for something besides your user name and password. Some places do it every time you log in; some places do it only when you log in from an unrecognized device. Some places use a hardware device or a mobile app as the second factor; some places send a code to your email or a text message to your mobile phone number. See the previous post Protect Your Investment Accounts With A Security Token: Fidelity, Schwab, E*Trade, Vanguard.

SIM Swapping RiskI had set up 2FA with Vanguard to have them text the authentication code to my Google Voice number. I gave Vanguard my Google Voice number instead of my regular mobile phone number because a Google Voice number doesn’t have a SIM card, and therefore it’s less susceptible to SIM swapping attacks. In a SIM swapping scam, criminals convince your mobile phone carrier that you lost your phone and you need to put your phone number onto a new SIM card they control. After they take over your phone number, they can go through the “forgot password” process with your online accounts when they’re able to receive authentication codes sent to your mobile number.

Although the risk of getting attacked this way is small, I don’t want this risk. I don’t have my Google Voice number forward any calls or text messages to a cellphone number. All calls and texts to the Google Voice number stay in the Google Voice app on my phone. If criminals SIM swapped my real mobile number, they still can’t receive the authentication codes.

I tried to log in to my Vanguard account last week to see when my tax forms would be available, but this time the authentication code never came. I clicked on the resend link, but the code still didn’t come. Meanwhile, authentication codes from other places came to my Google Voice number just fine. So I knew the problem had to do with Vanguard, not Google Voice or my phone.

Vanguard had an option to resend the authentication code by an automated voice call. When I chose that option, the voice call came, and I was able to get the authentication code from the voice call and log in that way. Phew!

I searched online and I saw others had the same problem. It wasn’t a one-time glitch. Vanguard stopped sending authentication codes to Google Voice numbers for some reason. Without the authentication code, I won’t be able to log in. One obvious option would be to switch the 2FA setup to a regular mobile number. Vanguard still sends authentication codes to regular mobile numbers, just not to Google Voice numbers. I don’t want to do that because I’d like to avoid getting SIM swapped.

Voice CallAt this moment, Vanguard is still making automated voice calls to Google Voice numbers. I can change the setup from receiving a text message to getting a voice call. However, if Vanguard stopped sending text messages to Google Voice numbers because they don’t trust Google Voice numbers, it’s possible they will stop making voice calls to those numbers as well.

For the time being, I switched to receiving voice calls to my Google Voice number. It works in the short term but there’s a risk it will stop working any day.

Security KeyIn addition to sending security codes by text messages or voice calls, Vanguard also supports using a hardware security key. They don’t give or sell security keys to customers. You’d have to buy it on your own.

Vanguard specifically mentions security keys made by a company called Yubico. The least expensive key from Yubico is Yubico Security Key for $20 or Yubico Security Key NFC for $24.50.

The $20 model works only with computers with a rectangular USB port (“USB-A”). The $24.50 model also works with mobile phones that have NFC. Yubico also makes other more expensive models ($45 – $70) that plug into different ports and have more features not required by Vanguard. Vanguard says they don’t support the latest YubiKey 5Ci model ($70).

Less expensive security keys made by other companies that support the same industry standard (“FIDO U2F”) may also work, but for a security device, I would stick to the name brand. If Vanguard stops making voice calls to my Google Voice number, I will buy the Yubico Security Key NFC for $24.50. Although I don’t use the Vanguard mobile app right now, I’m OK with paying an extra $5 to leave that option open.

Security Code as BackupAfter you set up the security key with Vanguard, Vanguard will still use security codes by text message or voice call as a backup in case you don’t have the security key with you when you want to log in. Some security-minded people don’t like that, because it defeats the purpose of having a security key when someone can easily bypass it with a simple click saying they don’t have the security key with them and Vanguard will fall back to sending a text message or making a voice call.

However, if you set the phone number for the security code to a Google Voice number, Vanguard won’t send a text message there. They may not make a voice call there either in the near future. This will make the security key the only 2FA mechanism and it can’t be bypassed. Just make sure not to lose your security key when there’s no fallback. Or register two security keys and keep them in separate places.

The post Vanguard Two-Factor Authentication (2FA): YubiKey + Google Voice appeared first on The Finance Buff.

January 21, 2021

How to Report Backdoor Roth In FreeTaxUSA: A Walkthrough

TaxAct used to be a low-cost alternative to the big two tax prep software TurboTax and H&R Block. However, its pricing strategy changed in recent years. Now TaxAct is just as expensive or sometimes even more expensive than TurboTax and H&R Block. The good news is another low-cost alternative emerged. It’s called FreeTaxUSA.

FreeTaxUSA is purely online; there is no download option. It uses the freemium pricing model. Federal tax filing is free, regardless of the complexity of the return. After you are done with federal, if you need to file a state return, it costs $12.95. They also offer a deluxe upgrade for $6.99, which includes audit assist, priority support, and amended returns. All told, the total cost is under $20 and it includes e-filing for both federal and state.

Low cost is good and all, but how good is the software? I decided to test-drive it with a slightly complicated subject: reporting the Backdoor Roth. Over the years I created guides for how to report Backdoor Roth in TurboTax and how to report Backdoor Roth in H&R Block. A reader asked me to also create a guide for doing the same in FreeTaxUSA.

Just as a refresher, a Backdoor Roth involves making a non-deductible contribution to a Traditional IRA followed by converting from the Traditional IRA to a Roth IRA. Both the contribution and the conversion need to be reported in the tax software. For more information on Backdoor Roth, see Backdoor Roth: A Complete How-To.

What To ReportYou report on the tax return your contribution to a Traditional IRA *for* that year and your converting to Roth *during* that year.

For example, when you are doing your tax return for year X, you report the contribution you made *for* year X, whether you actually did it during year X or between January 1 and April 15 of the following year. You also report your converting to Roth *during* year X, whether the contribution was made for year X, the year before, or any previous years. Therefore a contribution made during the following year for year X goes on the tax return for year X. A conversion done during year Y after you made a contribution for year X goes on the tax return for year Y.

You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finish your conversion in the same year. I called this a “planned” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for year X in year X and convert it during year X. Contribute for year Y in year Y and convert it during year Y. This way everything is clean and neat. If you are already off by one year, catch up. Contribute for both the previous year and the current year, then convert the sum during the same year. See Make Backdoor Roth Easy On Your Tax Return.

FreeTaxUSAHere’s the scenario we’ll use as an example:

You contributed $6,000 to a traditional IRA in 2020 for 2020. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2020, the value grew to $6,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments from the screens shown here.

Before we start, suppose this is what FreeTaxUSA shows:

We’ll compare the results after we enter the Backdoor Roth.

Convert From Traditional IRA to RothThe tax software works on income items first. Even though the conversion happened after the contribution, we enter the conversion first.

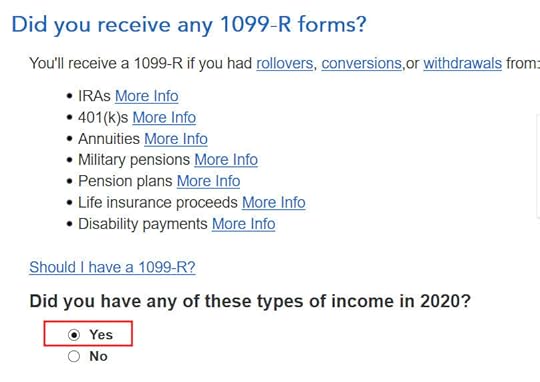

When you convert from Traditional IRA to Roth, you will receive a 1099-R. Complete this section only if you converted *during* the year for which you are doing the tax return. If you only converted during the following year and you don’t have a 1099-R yet, skip to the next section “Traditional IRA Contribution.” You’ll complete this section next year.

In our example, by the time you converted, the money in the Traditional IRA had grown from $6,000 to $6,200.

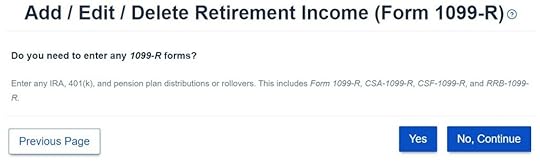

Click on Yes when it asks you about the 1099-R.

It’s just a regular 1099-R.

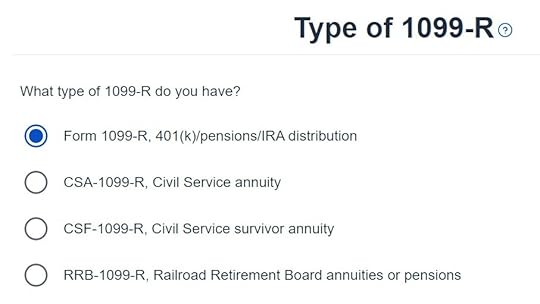

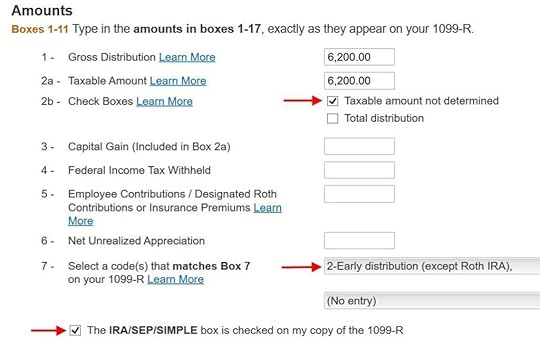

Enter the 1099-R exactly as you have it. Pay attention to the code in Box 7 and the checkboxes. It’s normal to have the same amount as the taxable amount in Box 2a, when Box 2b is checked saying “taxable amount not determined.” Pay attention to the distribution code in Box 7. My 1099-R has code 2, and the IRA/SEP/SIMPLE box is also checked.

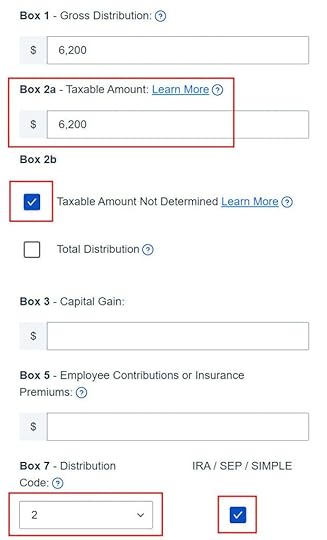

Right after you enter the 1099-R, you will see the refund number drop. Here we went from a $1,540 refund to $264. Don’t panic. It’s normal and temporary. The refund number will come up when we finish everything.

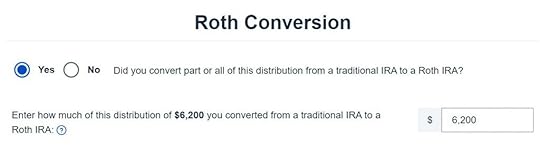

It asks you about Roth conversion. Answer Yes to conversion and enter the converted amount. This whole 1099-R is the result of a Roth conversion.

You are done with this 1099-R. Repeat if you have another 1099-R. If you’re married and both of you did a Backdoor Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse.

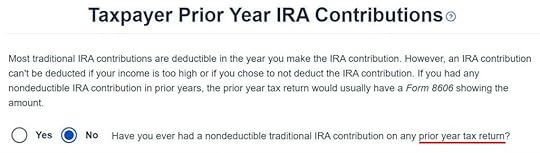

It asks you about basis carried over from previous years. If you did a clean “planned” backdoor Roth every year, although technically the answer is Yes, you have nothing to carry over from year to year. In our simple example we don’t have any. If you do, get the number from line 14 of Form 8606 from your previous year’s tax return.

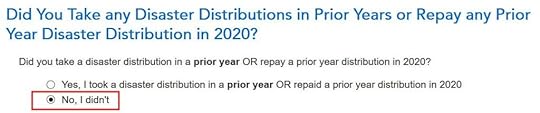

Not impacted by a disaster.

Now continue with all other income items until you are done with income. Your refund meter is still lower than it should be, but it will change soon.

Traditional IRA Contribution

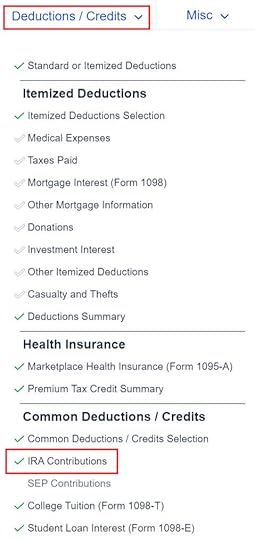

Find the IRA Contributions section under the “Deductions / Credits” menu.

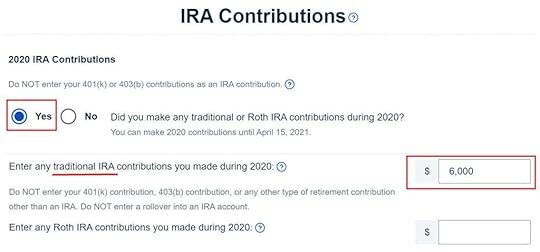

Choose Yes and enter your contribution. In our example you contributed $6,000 directly to a Traditional IRA. If you originally contributed to a Roth IRA and then you recharacterized the contribution as traditional contributions, enter the amount in the Roth IRA box and choose Yes below when it asks you whether you recharacterized.

Your refund number goes up again! It was a refund of $1,540 before we started. It went down a lot and now it’s back to $1,496. The $44 difference is due to paying tax on the $200 earnings before we converted to Roth.

We don’t have a SEP or SIMPLE account.

Withdrawal means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer ‘No’ here.

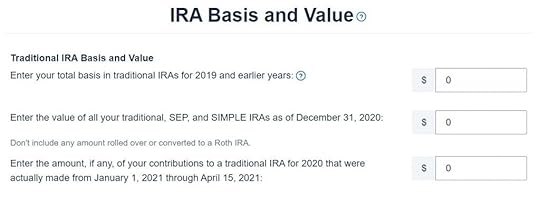

In our example, we don’t have any basis carried over from the previous years. We don’t have any money in traditional, SEP, or SIMPLE IRAs as of the end of the year (we already converted to Roth by then). Our contribution was made during the year in question, not in the following year.

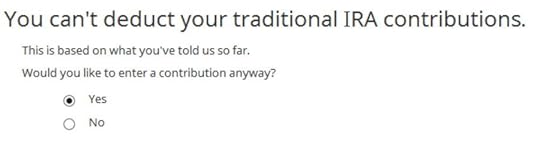

It tells us we don’t get a deduction. We know. It’s because our income was too high. That’s why we did the Backdoor Roth to begin with.

If you only contributed *for* last year but you didn’t convert until the following year, remember to come back next year to finish the conversion part.

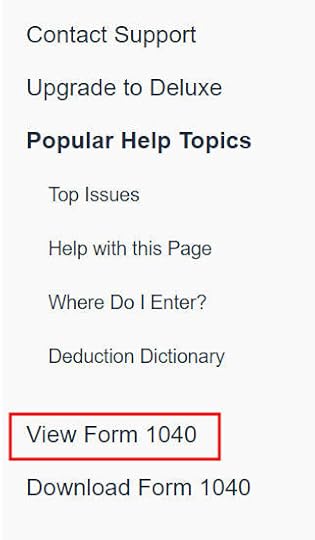

Taxable Income from Backdoor RothAfter going through all these, let’s confirm how you’re taxed on the backdoor Roth. Click on “View 1040” on the right-hand side.

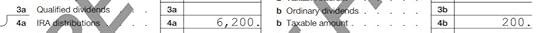

Look for Line 4 in Form 1040.

It shows $6,200 in IRA distributions and only $200 is taxable. If you are married filing jointly and both of you did a backdoor Roth, the numbers here will show double.

Tah-Dah! You got money into a Roth IRA through the backdoor when you aren’t eligible to contribute to it directly. You will pay tax on a small amount in earnings if you waited between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

The post How to Report Backdoor Roth In FreeTaxUSA: A Walkthrough appeared first on The Finance Buff.

January 20, 2021

How To Report Backdoor Roth In H&R Block Tax Software: A Walkthrough

Updated on January 20, 2021 with updated screenshots from H&R Block software for 2020. If you use other tax software, see:

How To Report Backdoor Roth In TurboTaxHow to Report Backdoor Roth In FreeTaxUSAIf you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you need to report both the contribution and the conversion in the tax software. For more information on Backdoor Roth, please read Backdoor Roth: A Complete How-To and Make Backdoor Roth Easy On Your Tax Return.

What To ReportYou report on the tax return your contribution to a traditional IRA *for* that year and your converting to Roth *during* that year.

For example, when you are doing your tax return for year X, you report the contribution you made *for* year X, whether you actually did it in year X or between January 1 and April 15 of the following year. You also report your converting to Roth *during* year X, whether the money was contributed for year X, the year before, or any previous years. Therefore a contribution made during the following year for year X goes on the tax return for year X. A conversion done during year Y after you made a contribution for year X goes on the tax return for year Y.

You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finish your conversion during the same year. I called this a “planned” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for year X in year X and convert it during year X. Contribute for year Y in year Y and convert it during year Y. This way everything is clean and neat. If you are already off by one year, catch up. Contribute for both the previous year and the current year, then convert the sum during the same year. See Make Backdoor Roth Easy On Your Tax Return.

H&R Block SoftwareThe screenshots below are taken from H&R Block Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon or Costco. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

Here’s the scenario we’ll use as an example:

You contributed $6,000 to a traditional IRA in 2020 for 2020. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2020, the value grew to $6,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you’ll have to make some adjustments from the screens shown here.

Before we start, suppose this is what H&R Block software shows:

We will compare the results after we enter the backdoor Roth.

Convert Traditional IRA to RothIncome comes before deductions on the tax form. Tax software also organizes this way. Even though you contributed before you converted, the software makes you enter the income first.

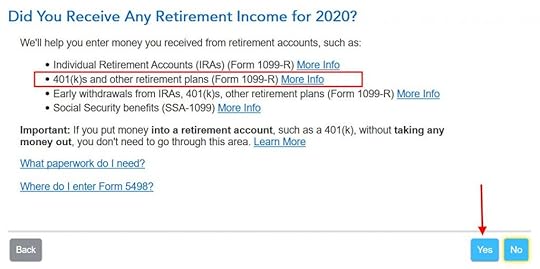

When you convert the Traditional IRA to Roth, you receive a 1099-R for that year. Complete this section only if you converted *during* the year for which you are doing the tax return. If you only contributed for the year in question but didn’t convert until the following year, skip all the way to the next section heading “Non-Deductible Contribution to Traditional IRA.”

In this example, we assume by the time you converted, the money in the Traditional IRA had grown from $6,000 to $6,200.

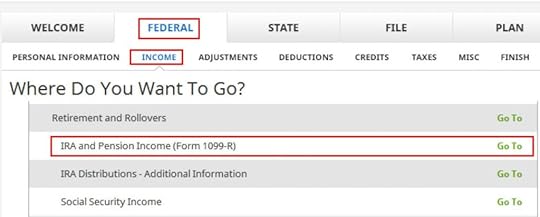

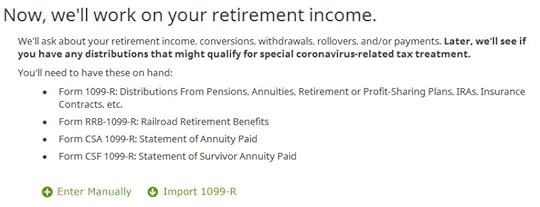

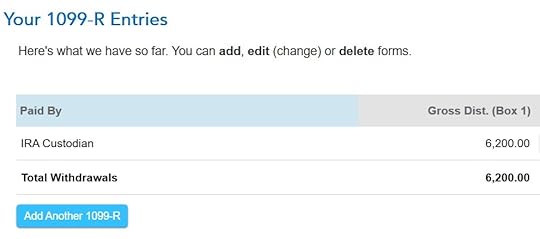

Click on Federal -> Income. Scroll down and find IRA and Pension Income (Form 1099-R). Click on Go To.

Click on Import 1099-R if you’d like. I show manual entries with Enter Manually here.

Just a regular 1099-R.

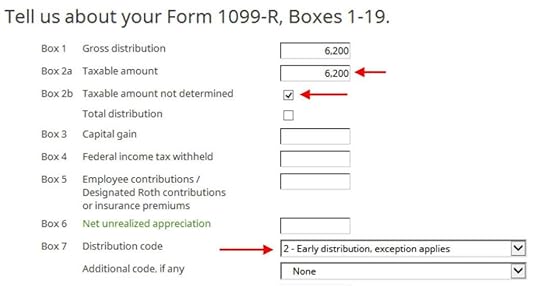

If you imported your 1099-R, double-check to make sure the import exactly matches the copy you received. If you enter your 1099-R manually, be sure to enter everything on the form exactly. Box 1 shows the amount converted to Roth IRA. It’s normal to have the same amount as the taxable amount in Box 2a, when Box 2b is checked saying “taxable amount not determined.” Pay attention to the distribution code in Box 7. My 1099-R has the code 2.

My 1099-R had the IRA/SEP/SIMPLE box checked.

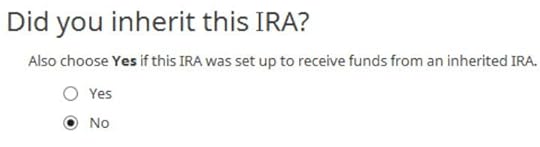

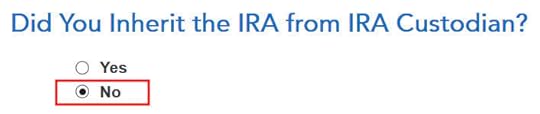

Did not inherit.

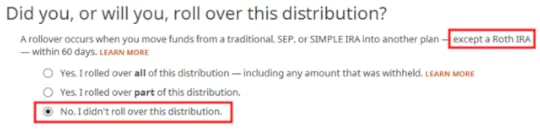

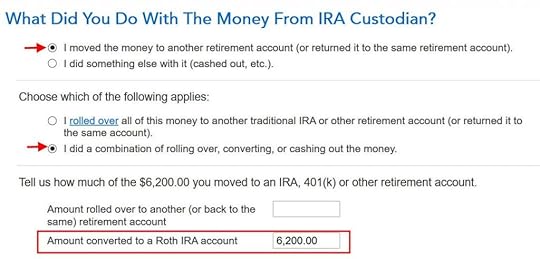

This is a very important question. Read carefully. Answer No, because you converted, not rolled over.

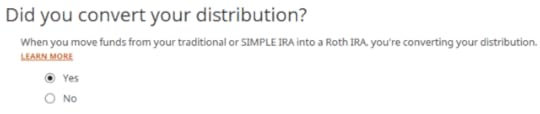

Now answer Yes, you converted.

We converted all of it in our example.

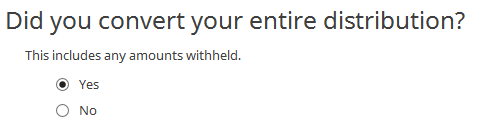

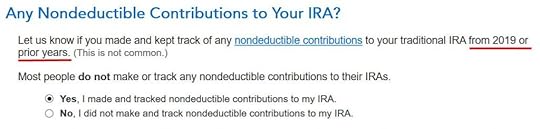

Answer Yes because you made a nondeductible contribution to a traditional IRA.

The refund in progress drops a lot at this point. We went from a $2,434 refund to $946. Don’t panic. It’s normal and only temporary. It will come back up after we complete the section for IRA contributions.

You are done with one 1099-R. Repeat the above if you have another 1099-R. If you’re married and both of you did a Backdoor Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse. Click on Finished when you are done with all the 1099-Rs.

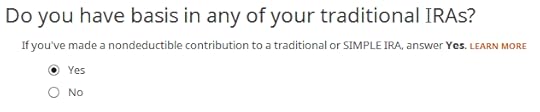

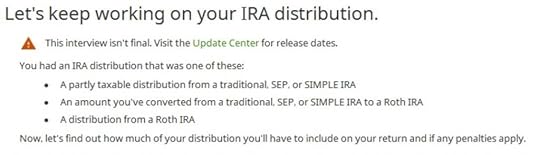

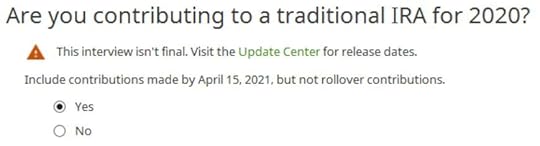

A few more questions. As I’m writing this, the interview isn’t final. The screens may still change after a software update.

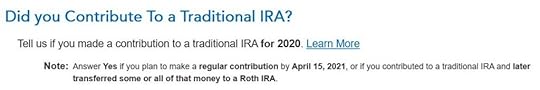

Answer Yes because you contributed to a Traditional IRA for the year.

Will wait.

Non-Deductible Contribution to Traditional IRANow we enter the non-deductible contribution to the Traditional IRA *for* the year in question. Complete this part whether you contributed in the same year or you did it or are planning to do it in the following year between January 1 and April 15. If your contribution during the year in question was for the previous year, make sure you entered it on your previous tax return. If not, fix your previous return first.

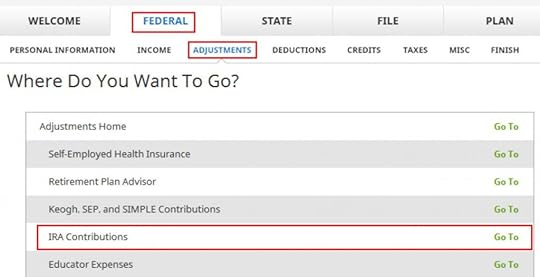

Click on Federal -> Adjustments. Find IRA Contributions. Click on Go To.

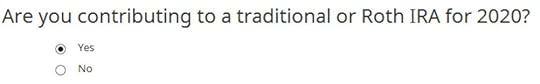

Answer ‘Yes’ because you contributed to an IRA for the year in question.

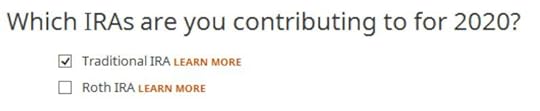

Check the box for Traditional IRA if you contributed directly to a Traditional IRA. If you originally contributed to a Roth IRA and then you recharacterized the contributions as traditional contributions, check the Roth IRA boxes here and then answer yes when it asks you whether you recharacterized.

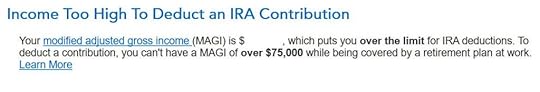

You know you don’t get a deduction due to income. Enter anyway.

Enter your contribution amount. We contributed $6,000 in our example.

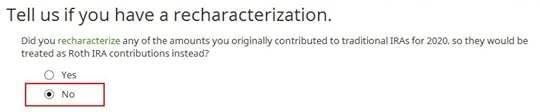

This is important. Answer No if you contributed to a Traditional IRA and converted to Roth. Answer Yes if you originally contributed to a Roth IRA, recharactered it to Traditional, and then converted.

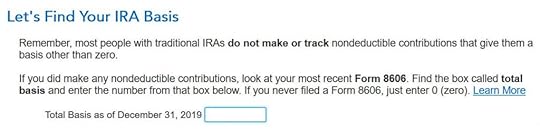

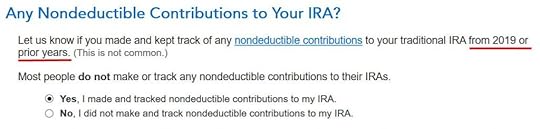

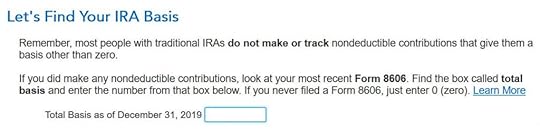

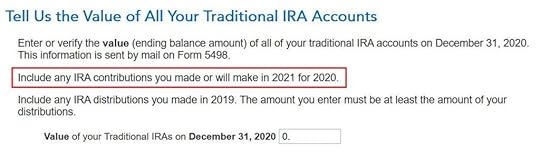

If you did a clean “planned” backdoor Roth and you started fresh each year, enter zero. If you contributed non-deductible for previous years (regardless when), enter the number on line 14 of your Form 8606 from last year.

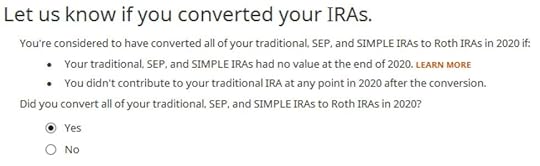

This is another important question. Read carefully. If you are doing it the easy way, as in our example, answer “Yes” — you converted all. If you are doing it the hard way in offset years — contributing for year X in the following year and converting during the following year — answer “No” and you will see some more questions.

If you already did it the hard way, please, please, please do yourself a big favor and do it the easy way next year. See Make Backdoor Roth Easy On Your Tax Return.

A summary of your contributions. 0 in Traditional IRA deduction means it’s nondeductible. Repeat for your spouse if both of you did a backdoor Roth.

We are done entering the nondeductible contribution to the Traditional IRA. Now the refund in progress should go back up. It was a refund of $2,434 when we first started. Now it’s a refund of $2,396. The difference of $38 is due to the tax on the extra $200 earned before the Roth conversion.

If you only contributed *for* last year but you didn’t convert until the following year, remember to come back next year to finish the conversion part.

Taxable Income from Backdoor RothAfter going through all these, let’s confirm how you’re taxed on the backdoor Roth.

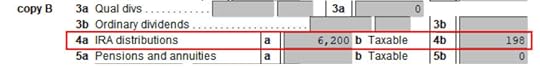

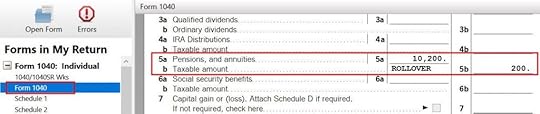

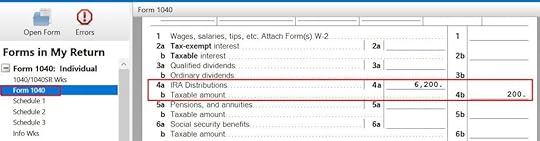

Click on Forms on the top and open Form 1040 and Schedules 1-3. Click on Hide Mini WS. Scroll down to line 4a and 4b.

It shows $6,200 in IRA distributions, $198 of which is taxable. The taxable income came out to $198 not $200 due to some rounding in the calculation. If you are married filing jointly and both of you did a backdoor Roth, the numbers here will show double.

Tah-Dah! You got money into a Roth IRA through the backdoor when you aren’t eligible to contribute to it directly. You will pay tax on a small amount in earnings if you waited between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

Fresh StartIt’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

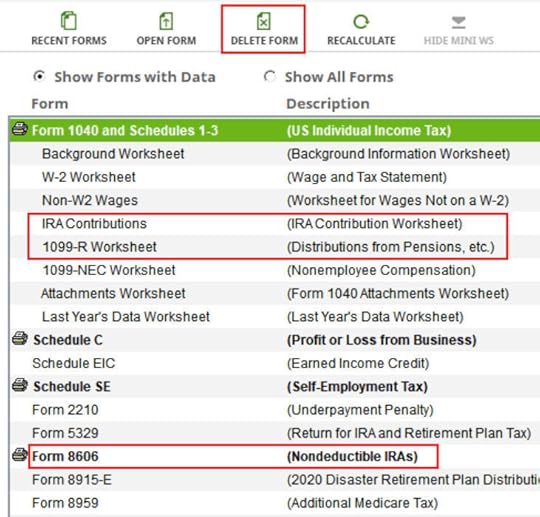

Click on Forms and delete IRA Contributions Worksheet, 1099-R Worksheet and Form 8606. Then start over by following the steps here.

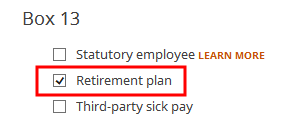

W-2 Box 13Make sure the “Retirement plan” box in Box 13 of the W-2 you entered into the software matches your actual W-2. If you are married and both of you have a W-2, make sure your entries for both W-2’s match the actual forms you received.

When you are not covered by a retirement plan at work, such as a 401k or 403b plan, your Traditional IRA contribution may be deductible, which also makes your Roth conversion taxable.

Self vs SpouseIf you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

The post How To Report Backdoor Roth In H&R Block Tax Software: A Walkthrough appeared first on The Finance Buff.

January 19, 2021

How To Enter Mega Backdoor Roth in TurboTax: A Walkthrough

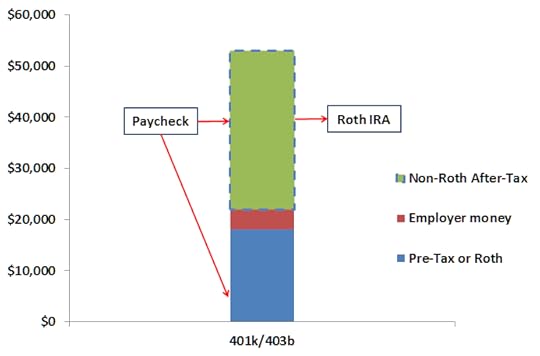

A mega backdoor Roth means making non-Roth after-tax contributions to a 401k-type plan and then taking the money out (with earnings) to a Roth IRA or moving it to the Roth account within the plan. It’s a great way to put additional money into a Roth account without having to pay much additional tax. Not all plans allow non-Roth after-tax contributions but some estimated that 40% of people can do it.

Suppose your plan allows it and you executed a mega backdoor Roth. You will receive a 1099-R from the plan in the following year. You will need to account for it on your tax return. It’s quite straight forward. Here’s how to do it in TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax from Amazon or Costco and switch from TurboTax Online to TurboTax download.

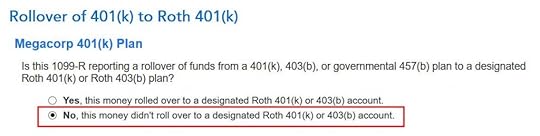

In-Plan RolloverYou can do the mega backdoor Roth in two ways — rollover within the plan or withdraw to a Roth IRA. Rolling over within the plan is much easier, and many plans automate the process. Withdrawing to a Roth IRA also works. See the previous post Mega Backdoor Roth: Convert Within Plan or Out to Roth IRA?

Let’s first look at rolling over to the Roth account within the plan. Here’s the scenario we’ll use as an example:

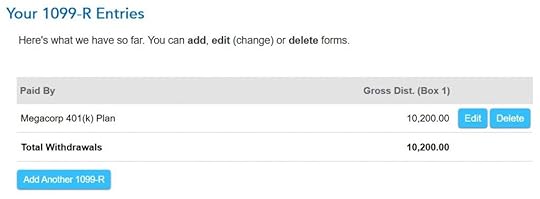

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). By the time the money was rolled over to the Roth account within the plan, your contributions earned $200. You rolled over $10,200 to your Roth 401(k) account.

I’m using 401(k) as a shorthand. It works the same in a 403(b). Now the entries into TurboTax.

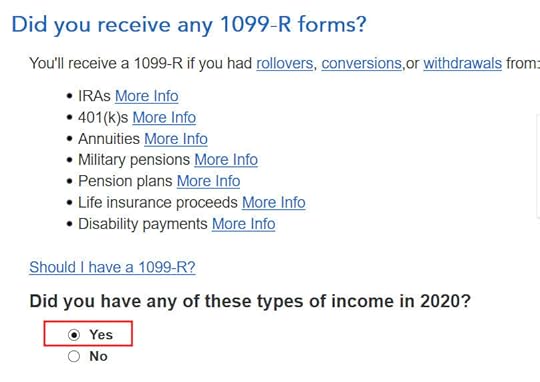

When you come to the Retirement Income section, answer Yes because you received a 1099-R from your 401(k) plan.

Yes, you received a 1099-R form. Import the 1099-R if you’d like. I’m typing it myself here.

You have a normal 1099-R.

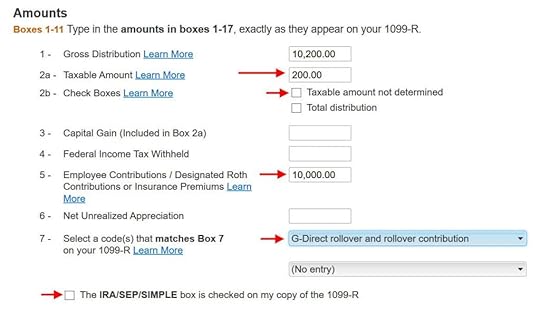

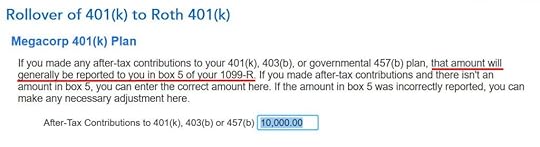

If you import the 1099-R, check the import carefully to make sure it matches your copy exactly. If you type the 1099-R, be sure to type it exactly. The earnings portion should be in box 2a. Box 2b “Taxable amount not determined” should NOT be checked. The after-tax non-Roth contributions (the “principal”) should be in box 5. Box 7 should show a code G. Finally, the box “The IRA/SEP/SIMPLE box is checked on my copy of the 1099-R” should NOT be checked.

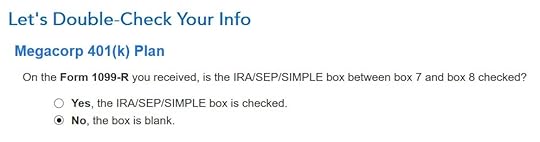

TurboTax wants to make sure the IRA/SEP/SIMPLE checkbox is not checked.

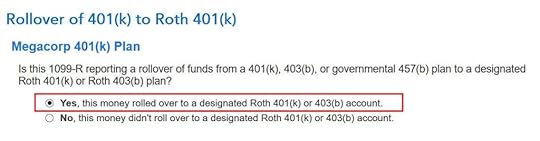

Choose Yes when you rolled over the money within the plan.

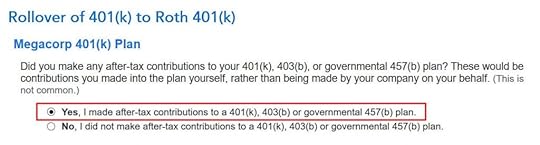

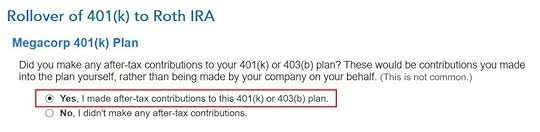

Confirm that you made after-tax non-Roth contributions to your plan.

If your 1099-R is correct, the amount of your after-tax non-Roth contributions shows up in box 5 and TurboTax pulls it up here. If your 1099-R isn’t correct, you should work with your 401(k) administrator to have it corrected.

Not a public safety officer, unless you actually are one.

The summary shows your 1099-R entries.

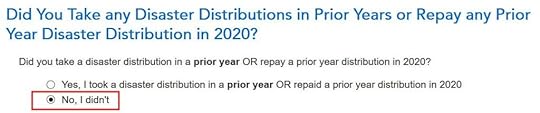

Not affected by a disaster.

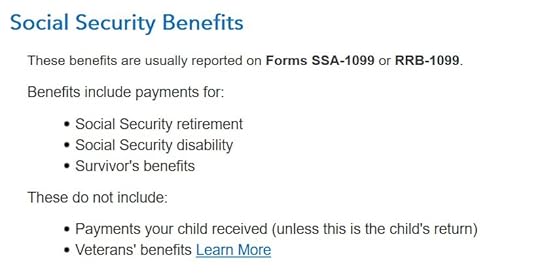

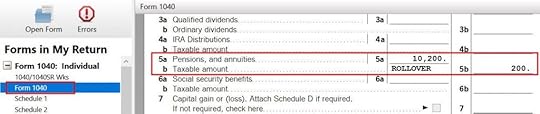

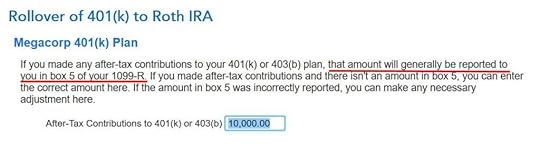

When you see TurboTax moving on to a totally separate topic, in our case Social Security Benefits, you know that’s the end of reporting your mega backdoor Roth. Now let’s confirm you’re only paying tax on the $200 earnings, not on your $10,000 after-tax non-Roth contributions.

Click on Forms on the top right.

Find “Form 1040” in the left navigation pane. Scroll up or down in the right pane to lines 5a and 5b. Line 5a includes the $10,200 gross distribution amount. Line 5b only includes the $200 taxable amount. With a mega backdoor Roth, you got an extra $10k into your Roth account. After paying tax on this $200, the future earnings on the $10,200 going forward will be tax-free.

When you’re done examining the form, click on Step-by-Step on the top right to get back to the interview.

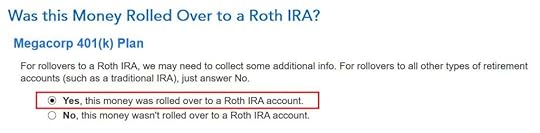

Withdraw to Roth IRANow let’s look at the mega backdoor Roth variation when you withdraw the after-tax non-Roth contributions plus earnings to a Roth IRA. Here’s the scenario we’ll use as an example:

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). By the time the money was rolled over to a Roth IRA, your contributions earned $200. You rolled over $10,200 to your Roth IRA.

The steps in TurboTax are the same as rolling over to the Roth account within the plan until this question:

When you took the money to a Roth IRA, you answer No here.

Confirm that the money went to a Roth IRA.

Confirm that you made after-tax non-Roth contributions.

If your 1099-R is correct, the amount of your after-tax non-Roth contributions shows up in box 5 and TurboTax pulls it up here. If your 1099-R isn’t correct, you should work with your 401(k) administrator to have it corrected.

After this point, the interview follows the same path as rolling over to the Roth account within the plan. Please scroll up and follow there. I’m not repeating them here.

In the end, Form 1040 will show the same as rolling over within the plan. Line 5a includes the $10,200 gross distribution amount. Line 5b only includes the $200 taxable amount. With a mega backdoor Roth, you got an extra $10k into your Roth IRA. After paying tax on this $200, the future earnings on the $10,200 going forward will be tax-free.

The post How To Enter Mega Backdoor Roth in TurboTax: A Walkthrough appeared first on The Finance Buff.

January 18, 2021

How To Report Backdoor Roth In TurboTax: A Walkthrough

Updated on January 17, 2021 with new screenshots from TurboTax Deluxe downloaded software. If you use other tax software, see:

How To Report Backdoor Roth In H&R Block SoftwareHow to Report Backdoor Roth In FreeTaxUSAIf you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you need to report both the contribution and the conversion in the tax software. For more information on Backdoor Roth, see Backdoor Roth: A Complete How-To.

What To ReportYou report on the tax return your contribution to a Traditional IRA *for* that year and your converting to Roth *during* that year.

For example, when you are doing your tax return for year X, you report the contribution you made *for* year X, whether you actually did it during year X or between January 1 and April 15 of the following year. You also report your converting to Roth *during* year X, whether the contribution was made for year X, the year before, or any previous years. Therefore a contribution made during the following year for year X goes on the tax return for year X. A conversion done during year Y after you made a contribution for year X goes on the tax return for year Y.

You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finish your conversion in the same year. I called this a “planned” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for year X in year X and convert it during year X. Contribute for year Y in year Y and convert it during year Y. This way everything is clean and neat. If you are already off by one year, catch up. Contribute for both the previous year and the current year, then convert the sum during the same year. See Make Backdoor Roth Easy On Your Tax Return.

TurboTaxThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download and switch from TurboTax Online to TurboTax download.

Here’s the planned Backdoor Roth scenario we will use as an example:

You contributed $6,000 to a traditional IRA in 2020 for 2020. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2020, the value grew to $6,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments from the screens shown here.

Before we start, suppose this is what TurboTax shows:

We will compare the results after we enter the backdoor Roth.

Convert Traditional IRA to RothThe tax software works on income items first. Even though the conversion happened after the contribution, we enter the conversion first.

When you convert from Traditional IRA to Roth, you will receive a 1099-R form. Complete this section only if you converted *during* the year for which you are doing the tax return. If you only converted during the following year, you won’t have a 1099-R until next January. Skip this section and wait until the next year.

In our example, we assume by the time you converted, the money in the Traditional IRA had grown from $6,000 to $6,200.

As you work through the interview, you will eventually come to the point to enter the 1099-R. Select Yes, you have this type of income. Import the 1099-R if you’d like. I’m choosing to type it myself.

Just the regular 1099-R.

Box 1 shows the amount converted to Roth IRA. It’s normal to have the same amount as the taxable amount in Box 2a, when Box 2b is checked saying “taxable amount not determined.” Pay attention to the code in Box 7 and the IRA/SEP/SIMPLE box. Make sure your entry matches your 1099-R exactly.

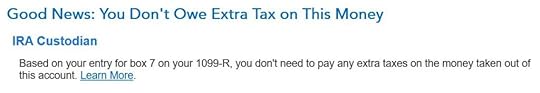

You get this Good News, but …

Your refund in progress drops a lot. We went from $2,384 down to $858. Don’t panic. It’s normal and temporary.

Didn’t inherit it.

First click on “I moved …” then click on “a combination …” Enter the amount converted in the box. There used to be a separate bullet for “converted all” but my current software only shows the two options for “rollover” and “combination.” Don’t choose the rollover option. A Roth conversion is not a rollover.

You get a summary of your 1099-R’s. Repeat the previous steps to add another if you have more than one. If you’re married and both of you did a backdoor Roth, enter the 1099-R for both of you, but pay attention to select whose 1099-R it is. Don’t accidentally assign two 1099-R’s to the same person.

Not impacted by a disaster.

Here it’s asking about the prior year carryover. When you’re doing a clean “planned” backdoor Roth as in our example — contribute for year X in year X and convert before the end of year X — you can answer No here. If you contributed for the previous year between January 1 and April 15, answer Yes here.

If you answered Yes to the previous question and you did your previous year’s return correctly also in TurboTax, your basis from the previous year will show up here. If you did your previous year’s tax return wrong, fix your previous return first.

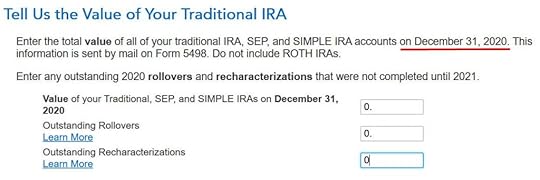

Enter the values at the end of the year. We don’t have anything in traditional, SEP, or SIMPLE IRAs after we converted it all.

That’s it so far on the income side. Continue with other income items. The refund in progress is still temporarily depressed. Don’t worry. It will change.

Non-Deductible Contribution to Traditional IRANow we enter the non-deductible contribution to a Traditional IRA *for* the year we are doing the tax return. Complete this part whether you contributed before December 31 or you did it or are planning to do it in the following year between January 1 and April 15. If your contribution during the year in question was for the year before, make sure you entered it on the previous tax return. If not, fix your previous return first.

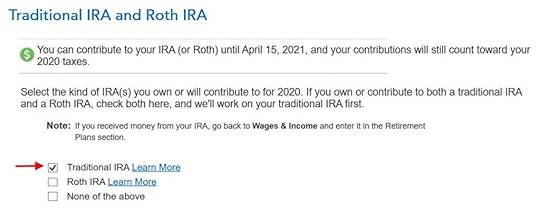

Because we did a clean “planned” backdoor Roth, we check the box for Traditional IRA. If you did a detour when you first contributed to a Roth IRA before you realized your income is too high and you uncharacterized the contribution as to a Traditional IRA, check the box for Roth IRA and answer the questions accordingly.

TurboTax offers an upgrade but we choose to stay in TurboTax Deluxe.

We already checked the box for Traditional but TurboTax just wants to make sure.

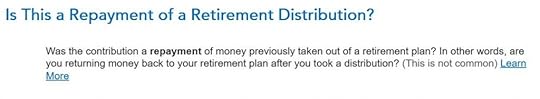

It was NOT a repayment of a retirement distribution.

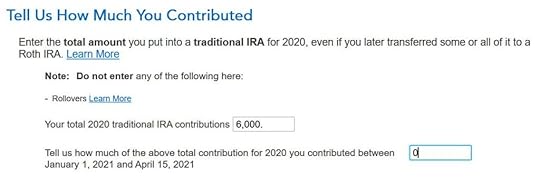

Enter the contribution amount. Because we contributed for year X in year X, we put zero in the second box. If you contributed for the previous year between January 1 and April 15, enter the contribution in both boxes.

Right away our federal refund in progress goes back up! We started with $2,384. It went down to $858. Now it comes back to $1,975. It’s still not as high as we expect, but we are not done yet …

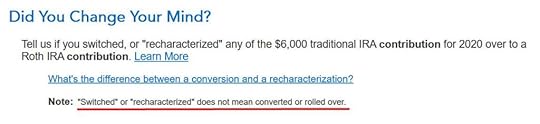

This is a critical question. Answer “No.” You converted the IRA, not recharacterized or switched.

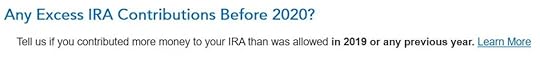

No excess contribution.

Same question we saw before. For a clean “planned” backdoor Roth, we can answer No. If you made non-deductible contribution for previous years, answer Yes.

Total basis through the previous year. If you started fresh, enter zero. If you contributed non-deductible for previous years (regardless when), enter the number on line 14 of your Form 8606 from last year.

Because we did a clean “planned” backdoor Roth, after we converted everything before the end of the same year, we don’t have anything left at the end of the year.

Now the refund in progress comes back to the expected level. We started at $2,384. It’s showing $2,335 now. The $49 difference is because we have to pay tax on the $200 in earnings when we contributed $6,000 and converted $6,200. If you had less in earnings, your refund numbers would be closer still.

Income too high, we know. That’s why we did the backdoor Roth.

The IRA deduction summary shows $0 deduction, which is expected.

Taxable Income from Backdoor RothAfter going through all these, would you like to see how you are taxed on the Backdoor Roth?

Click on Forms on the top right.

Find Form 1040 in the left navigation panel. Scroll down on the right to find lines 4a and 4b. They show a $6,200 distribution from the IRA and only $200 of the $6,200 is taxable. That’s the earning between the time you contributed to your Traditional IRA and the time you converted it to Roth.

When you’re done examining the form, click on Step-by-Step on the top right to go back to the interview.

Tah-Dah! You got money into a Roth IRA through the backdoor when you aren’t eligible for contributing to it directly. That’s why it’s called a Backdoor Roth. You will pay tax on a small amount in earnings if you waited between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

Fresh StartIt’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

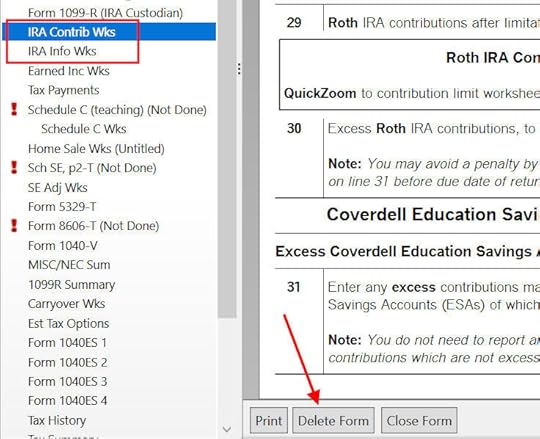

Click on Forms on the top right.

Find “IRA Contrib Wks” and “IRA Info Wks” in the left navigation pane and click on “Delete Form” to delete them. Then you can start over following the steps above.

W-2 Box 13

W-2 Box 13Make sure the Retirement plan box in Box 13 of the W-2 you entered into the software matches your actual W-2. If you are married and both of you have a W-2, make sure your entries for both W-2’s match the actual forms you received.

When you are not covered by a retirement plan at work, such as a 401k or 403b plan, your Traditional IRA contribution may be deductible, which also makes your Roth conversion taxable.

Self vs SpouseIf you are married, make sure you don’t have the 1099-R and IRA contribution mixed up between yourself and your spouse. If you inadvertently entered two 1099-Rs issued to you instead of one for you and one for your spouse, the second 1099-R to you will not match up with a Traditional IRA contribution made by your spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

The post How To Report Backdoor Roth In TurboTax: A Walkthrough appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower