Harry Sit's Blog, page 23

December 23, 2021

Buy I Bonds as a Gift: What Works and What Doesn’t

My previous posts covered buying I Bonds in a trust, , and buying I Bonds for your business. Let’s look at another way to buy I Bonds this time: buying them as a gift. For background on I Bonds in general, please read How To Buy I Bonds.

Table of ContentsGift Box and DeliveryPurchase LimitInterest and Holding PeriodGift to KidsWhen Gifts Are Useful and When They Are NotOfficial Walkthrough VideosGift Box and DeliveryYou buy I Bonds as a gift in two stages: buying and delivering.

You must give the recipient’s name and Social Security Number in the buying stage. Only a personal account can buy or receive gifts. A trust or a business can neither buy a gift nor receive a gift.

The bonds you buy as a gift go into a “gift box.” You can’t cash out the bonds stored in your gift box. This is analogous to you going to a store and bringing back the gift to your closet. The gift already has the recipient’s name on it. You can’t steal the gift for yourself.

The recipient doesn’t know you bought a gift for them until you deliver the gift to them. This is analogous to bringing the gift from your closet when you visit family. You’ll need the recipient’s account number to deliver a gift.

I Bonds stored in your gift box are in limbo. You can’t cash them out because they’re not yours. The recipient can’t cash them out either because they don’t have them yet.

There’s a minimum wait of five business days between buying and delivering to make sure your bank debit clears. There’s no maximum stay in the gift box. You can pre-purchase gifts and wait to deliver them at a much later time. You can also choose to deliver gifts in bits and pieces as opposed to in one lump sum.

Purchase LimitDelivered gifts count toward the $10,000 annual purchase limit of the recipient in the year of delivery. You can still buy gifts for others even if you already bought the maximum for yourself.

You can buy a maximum of $10,000 for any recipient in one purchase but there’s no limit in how many recipients you buy for or how many times you can buy for the same recipient in any calendar year. If you’d like, you can buy $10,000 worth of I Bonds for each of your 20 family members or you can make 5 separate purchases of $10,000 each for the same family member, all in the same calendar year. The limit is in how much you can deliver to the same recipient in the same calendar year.

If the recipient also bought the maximum for themselves this year, delivering additional I Bonds to them will put them over their annual purchase limit. You’ll have to wait to deliver in a year they’re not buying the maximum themselves. If you bought more than $10,000 as gifts for the same recipient, you’ll have to wait to deliver the gifts across multiple years.

Interest and Holding PeriodInterest and the holding period start in the month of your purchase. If you pre-purchase gifts and wait to deliver them to the recipient at a later time, bonds in the gift box still earn interest before delivery. The holding period for cashing out also starts right away. If five months have passed between the time of purchase and the time of delivery, the recipient only has to wait another seven months before they can cash out as opposed to the full 12 months for freshly purchased bonds.

Gift to KidsIt’s not necessary to buy as gifts for your own kids. As the parent, you can open a minor linked account in your account and buy directly in your kid’s name. See previous post .

Buying I Bonds as a gift works for a grandchild or a niece or a nephew. The child’s parent needs to open a minor linked account under the parent’s account and give you the child’s Social Security Number and account number.

When Gifts Are Useful and When They Are NotIf you’re thinking of “borrowing” other people’s names and Social Security Numbers to buy more I Bonds as gifts but keep the bonds for yourself, it doesn’t work. Only the named recipient can cash out the bonds. If you don’t deliver them, the bonds stay in your gift box, and neither you nor the specified recipient can cash them out. After you deliver the gift bonds, it’s the recipient’s money, and they can do whatever they want with the bonds.

If you’re thinking of letting others buy I Bonds as gifts for you to work around the $10,000 annual purchase limit, it doesn’t quite work either. Gifts delivered to you count toward your annual purchase limit. If you already bought your maximum for the year, having additional gift bonds delivered to you in the same calendar year will put you over the limit.

Buying I Bonds as a gift works when you want a family member to have some I Bonds but they don’t have spare cash. It works the same as giving them money and letting them buy themselves.

It also works to a limited extent if you think the high interest rates on I Bonds are only temporary. You can buy a gift for your spouse and hold it in your gift box. Have your spouse do the same for you. When interest rates drop and the two of you don’t buy I Bonds anymore, you can deliver the gift to each other. The older gift bonds earned the high interest rates in the years past and they have aged enough for immediate cashout. Because there’s a limit in how much you can deliver to the same person each year, don’t go overboard with this. If you hold $100,000 in the gift box and the interest rates are no longer competitive, those bonds will be in limbo for a long time while earning uncompetitive interest rates.

Official Walkthrough VideosIf you’re ready to buy I Bonds as a gift, please watch these walkthrough videos on the TreasuryDirect website:

Purchasing a Gift Bond – The video shows buying a Series EE bond. Make sure to select Series I when you’d like to buy I Bonds.

Delivering a Gift Bond – Remember to check with the recipient how much they bought or are planning to buy this year themselves.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Buy I Bonds as a Gift: What Works and What Doesn’t appeared first on The Finance Buff.

December 19, 2021

2022 New IRS Required Minimum Distribution (RMD) Tables

People age 72 and above are required to withdraw a minimum amount from their pre-tax retirement accounts each year. This makes sure taxes aren’t deferred forever. It’s called Required Minimum Distributions (RMD). The required amount is a percentage of the account’s balance as of December 31 of the previous year. The required percentage goes up with age, reflecting the reduced life expectancy.

Back in 2018, President Trump signed an executive order directing the IRS to study the life expectancy tables used to determine RMDs and see whether they should be updated to reflect longevity improvements over the years. They did that and published a new set of RMD tables for years starting on or after January 1, 2022. These new tables will lower RMDs slightly for most ages.

However, maybe because it’s still early, the IRS hasn’t yet updated its Publication 590-B to show the new tables. Meanwhile, people planning to take the required minimum distributions in 2022 need to know how much they must take from their retirement accounts to comply with the new regulations.

The new tables are out there. They’re just not in the IRS publication yet. The IRS published them in the Federal Register in November 2020. The Federal Register is the place for official records of the federal government. It’s like the books in the county recorder’s office where all the land deeds are recorded.

Here are the links in the Federal Register for the three new RMD tables. The Uniform Life Table is the most commonly used table. Use this table when you are:

unmarried; ormarried and your spouse isn’t more than 10 years younger than you; ormarried and your spouse isn’t the sole beneficiary of your accountUse the Joint and Last Survivor Table when your spouse is more than 10 years younger and is the sole beneficiary. Use the Single Life Table when you’re a beneficiary of an inherited retirement account.

Uniform Life TableI’m reproducing the most commonly used Uniform Life Table here for your convenience.

A factor of 27.4 at age 72 means that out of a $1 million total balance in the pre-tax retirement accounts as of December 31 of the previous year, someone who reaches age 72 in the current year must withdraw a minimum of:

$1,000,000 / 27.4 = $36,496.35

The factor for age 72 in the previous table was 25.6, which means the required minimum distribution would’ve been:

$1,000,000 / 25.6 = $39,062.50

The new table reduces the RMD by $2,556.15, which saves a few hundred dollars in taxes.

AgeDistribution Period7227.47326.57425.57524.67623.77722.97822.07921.18020.28119.48218.58317.78416.88516.08615.28714.48813.78912.99012.29111.59210.89310.1949.5958.9968.4977.8987.3996.81006.41016.01025.61035.21044.91054.61064.31074.11083.91093.71103.51113.41123.31133.11143.01152.91162.81172.71182.51192.3120+2.0Uniform Life Table Effective 1/1/2022One-Time Reset for Inherited AccountsWhen you’re taking RMDs from your own accounts, you look up your age each year in the applicable table and use the associated factor to calculate your RMD. It works differently when you’re taking RMDs from an inherited account.

When you take the RMD from an inherited account in the first year, you look up the factor in the Single Life Table by your age. For the second year and beyond, you don’t go back to the table again. You remember the factor used in the previous year and you reduce it by 1.

Now, if you already started taking RMDs from an inherited account and the tables changed, the IRS allows you a one-time reset. You look up the factor in the new Single Life Table by your age in the year when you first started taking RMD from the inherited account. Then you reduce the factor by the number of years since then. This makes as if the new tables were in effect back when you started.

Source: Updated Life Expectancy and Distribution Period Tables Used for Purposes of Determining Minimum Required Distributions, Internal Revenue Service, T.D. 9930

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 New IRS Required Minimum Distribution (RMD) Tables appeared first on The Finance Buff.

2022 New Required Minimum Distribution (RMD) Tables

People age 72 and above are required to withdraw a minimum amount from their pre-tax retirement accounts each year. This makes sure taxes aren’t deferred forever. It’s called Required Minimum Distributions (RMD). The required amount is a percentage of the account’s balance as of December 31 of the previous year. The required percentage goes up with age, reflecting the reduced life expectancy.

Back in 2018, President Trump signed an executive order directing the IRS to study the life expectancy tables used to determine RMDs and see whether they should be updated to reflect longevity improvements over the years. They did that and published a new set of RMD tables to be used effective January 1, 2022. These new tables will lower RMDs slightly across all ages.

However, maybe because it’s still early, the IRS hasn’t yet updated its Publication 590-B to show the new tables. Meanwhile, people planning to take the required minimum distributions in 2022 need to know how much they must take from their retirement accounts to comply with the new regulations.

The new tables are out there. They’re just not in the IRS publication yet. The IRS published them in the Federal Register in November 2020. The Federal Register is the place for official records of the federal government. It’s like the books in the county recorder’s office where all the land deeds are recorded.

Here are the links in the Federal Register for the three RMD tables. The Uniform Life Table is the most commonly used table. Use this table when you are:

unmarried; ormarried and your spouse isn’t more than 10 years younger than you; ormarried and your spouse isn’t the sole beneficiary of your accountUse the Joint and Last Survivor Table when your spouse is more than 10 years younger and is the sole beneficiary. Use the Single Life Table when you’re a beneficiary of an inherited retirement account.

Uniform Life TableI’m reproducing the most commonly used Uniform Life Table here for your convenience.

A factor of 27.4 at age 72 means that out of a $1 million total balance in the pre-tax retirement accounts as of December 31 of the previous year, someone who reaches age 72 in the current year must withdraw a minimum of:

$1,000,000 / 27.4 = $36,496.35

The factor for age 72 in the previous table was 25.6, which means the required minimum distribution would’ve been:

$1,000,000 / 25.6 = $39,062.50

The new table reduces the RMD by $2,556.15, which saves a few hundred dollars in taxes.

AgeDistribution Period7227.47326.57425.57524.67623.77722.97822.07921.18020.28119.48218.58317.78416.88516.08615.28714.48813.78912.99012.29111.59210.89310.1949.5958.9968.4977.8987.3996.81006.41016.01025.61035.21044.91054.61064.31074.11083.91093.71103.51113.41123.31133.11143.01152.91162.81172.71182.51192.3120+2.0Uniform Life Table Effective 1/1/2022Source: Updated Life Expectancy and Distribution Period Tables Used for Purposes of Determining Minimum Required Distributions, Internal Revenue Service, T.D. 9930

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 New Required Minimum Distribution (RMD) Tables appeared first on The Finance Buff.

What If Congress Bans Backdoor Roth in 2022?

[Updated and rewritten on December 19, 2021 after Congress decided to postpone the Build Back Better legislation to 2022.]

President Biden and Congress have been working on the Build Back Better legislation for some time. The House already passed a bill. The Senate has come up with a draft bill. There are some differences between the two versions and there are still some disagreements in what exactly should go into the Senate bill. However, one thing not in disagreement is that Congress wants to ban the backdoor Roth and the mega backdoor Roth. Both the House and the Senate agree this will be part of the Build Back Better package if and when it passes.

These changes, if they become law, will have these effects:

IRAEmployer PlanMake non-Roth after-tax contributionAllowedAllowedConvert pre-tax money to RothAllowed*Allowed*Convert after-tax money to RothNot allowedNot allowed* Allowed for everyone through 2031. Still allowed after 12/31/2031 unless your income is above $400k (single) or $450k (married filing jointly).

You can still make non-Roth after-tax contributions, but you can’t convert those non-Roth after-tax contributions to Roth. This ban covers converting after-tax money from a traditional IRA to a Roth IRA, rolling over after-tax contributions from an employer plan to a Roth IRA, and converting after-tax money in an employer plan to the Roth account within the plan.

Due to the disagreements in other parts of the bill unrelated to backdoor Roth and mega backdoor Roth, Congress decided to continue their discussion in 2022. If and when they finally reach an agreement, the effective date will be sometime in 2022 or later.

What should you do if these proposed changes move forward and become law in 2022?

Roth Conversion Isn’t Backdoor RothFirst of all, many people confuse backdoor Roth with a plain vanilla Roth conversion. Although backdoor Roth uses Roth conversion as its second step, a straight-up Roth conversion of pre-tax money isn’t backdoor Roth.

The bills in the House and the Senate allow converting pre-tax money to Roth by anyone for at least 10 years through the end of 2031. Starting in 2032, only those with a high income won’t be allowed to convert pre-tax money. That’s 10 years from now. Who knows what will change by then. If you’re only worried about a plain vanilla Roth conversion, please understand it isn’t affected for at least 10 years.

Backdoor Roth – 2021If the proposals become law in 2022, you’re still allowed to make nondeductible contributions to a traditional IRA but you won’t be allowed to convert them to Roth after an effective date to be determined but it doesn’t affect converting to Roth on or before 12/31/2021.

If you’re planning to make the nondeductible traditional IRA contribution for 2021 between January 1 and April 15 in 2022, hurry up. Make the contribution for 2021 now and convert it to Roth before December 31, 2021. If you wait until 2022 to make your nondeductible contribution, it’s possible you won’t be able to convert to Roth and your contribution will be stuck in the traditional IRA.

If you’re planning to contribute or if you already contributed to your Roth IRA directly and there’s any chance that you will exceed the income limit for 2021 ($125,000 single, $198,000 married filing jointly), make it a backdoor Roth now. When you find you exceed the income limit, normally you can recharacterize your Roth IRA contribution to a nondeductible traditional IRA contribution and convert it in the following year but it’s possible you won’t be able to do that in 2022. So go through the backdoor now. Make a nondeductible contribution to a traditional IRA and convert before 12/31/2021.

In either case, you have to do some work to prepare for the backdoor Roth. See Backdoor Roth: A Complete How-To.

Mega Backdoor Roth – 2021If your employer’s plan allows non-Roth after-tax contributions, make sure you contribute the maximum allowed in 2021 and convert them before 12/31/2021.

Some plans do an automatic conversion on the same day. You’re covered if you signed up for the automatic conversions. If your plan doesn’t offer automatic conversion and you forget to convert manually, it’s possible your non-Roth after-tax contributions will be stuck.

What About 2022?As the President and Congress continue their discussion into 2022, we don’t know what the final outcome will be. If you normally do the backdoor Roth in January, should you proceed as usual or should you wait until it’s clear which way it will go? If you’re currently making non-Roth after-tax contributions to an employer plan, should you continue or pause those after-tax contributions?

I see these four possible scenarios:

1. Law Doesn’t ChangeIt’s possible the discussion reaches an impasse and the bill doesn’t pass in the Senate. If you proceed as usual, you’ll get your backdoor Roth in January. If you wait until say May to learn that the legislation died, you still have time to complete your backdoor Roth and mega backdoor Roth. The difference is only in when, not whether, you complete your backdoor Roth and mega backdoor Roth.

2. Law Changes, Effective 1/1/2023It’s also possible that the bill passes in the Senate in 2022 with a ban of backdoor Roth and mega backdoor Roth effective 1/1/2023. As far as 2022 is concerned, this is the same as the previous scenario. Either way you’ll get it done in 2022 and the only difference is in which month.

3. Law Changes, Effective Mid-Year with No Advance WarningAnother possibility is the bill passes with no advance warning. Say the bill passes on March 10 with an effective date of March 11. They often do that to avoid a last-minute mad dash to beat the clock. By the time the law changes, it’s already too late to make any changes. Meanwhile, those who performed backdoor Roth and mega backdoor Roth before the effective date won’t be affected.

In this scenario, you’re better off doing the backdoor Roth and mega backdoor Roth before the law changes. You snooze, you lose.

4. Law Changes, Effective 1/1/2022It’s also possible that the tax law changes will be made retroactive to January 1, 2022. It’s legal and it happened before.

Currently, a Roth conversion or an in-plan Roth rollover can’t be reversed (“recharacterized”). If you already completed the conversion before it’s made illegal retroactively, I imagine they will also give you a one-time exemption to undo it. If you go ahead under the current law, you’ll have the hassle of unwinding your conversion.

In summary,

Proceed ASAPWaitBill fails$$ in Roth$$ in RothLaw changes, effective 1/1/2023$$ in Roth$$ in RothLaw changes mid-year$$ in Rothmiss opportunityLaw changes retroactively to 1/1/2022unwind conversionno extra workWhether you should go ahead as soon as you can or wait until it’s clear on how the law will change depends on how badly you don’t want to miss an opportunity versus how much you hate the possible hassle of having to undo a conversion. I will proceed ASAP in my personal accounts, but only you can make the decision for yourself.

A Big Loss?Is it a big loss if the proposed changes become law and you can’t do backdoor Roth and mega backdoor Roth anymore?

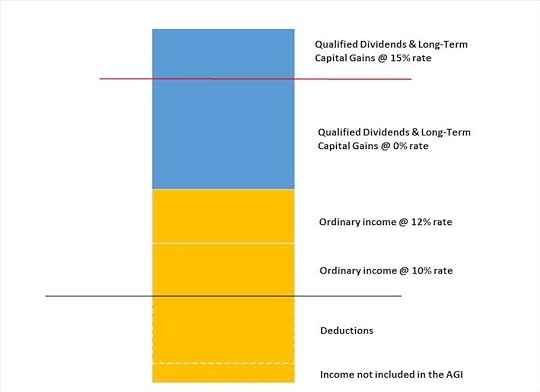

It’s a loss because tax-free growth beats tax deferral on the earnings or the lower tax rates on qualified dividends and long-term capital gains. However, the power of saving and investing comes from making the contributions to begin with, not from how the investment returns are taxed.

A taxable account always works. In the end, even if all the tax-advantaged accounts go away and all the returns are taxed as regular income, those who save and invest more will still succeed. You take advantage of all available tax savings but you can’t stake your success on specific tax breaks.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post What If Congress Bans Backdoor Roth in 2022? appeared first on The Finance Buff.

What If Backdoor Roth and Mega Backdoor Roth Die in 2022?

[Updated and rewritten on December 19, 2021 after Congress decided to postpone the legislation to 2022.]

President Biden and Congress have been working on the Build Back Better legislation for some time. The House already passed a bill. The Senate has come up with a draft bill. There are some differences between the two versions and there are still some disagreements in what exactly should go into the Senate bill. However, one thing not in disagreement is that Congress wants to ban the backdoor Roth and the mega backdoor Roth. Both the House and the Senate agree this will be part of the Build Back Better package if and when it passes.

These changes, if they become law, will have these effects:

IRAEmployer PlanMake non-Roth after-tax contributionAllowedAllowedConvert pre-tax money to RothAllowed*Allowed*Convert after-tax money to RothNot allowedNot allowed* Allowed for everyone through 2031. Still allowed after 12/31/2031 unless your income is above $400k (single) or $450k (married filing jointly).

You can still make non-Roth after-tax contributions, but you can’t convert those non-Roth after-tax contributions to Roth. This ban covers converting after-tax money from a traditional IRA to a Roth IRA, rolling over after-tax contributions from an employer plan to a Roth IRA, and converting after-tax money in an employer plan to the Roth account within the plan.

Due to the disagreements in other parts of the bill unrelated to backdoor Roth and mega backdoor Roth, Congress decided to continue their discussion in 2022. If and when they finally reach an agreement, the effective date will be sometime in 2022 or later.

What should you do if these proposed changes move forward and become law in 2022?

Roth Conversion Isn’t Backdoor RothFirst of all, many people confuse backdoor Roth with a plain vanilla Roth conversion. Although backdoor Roth uses Roth conversion as its second step, a straight-up Roth conversion of pre-tax money isn’t backdoor Roth.

The bills in the House and the Senate allow converting pre-tax money to Roth by anyone for at least 10 years through the end of 2031. Starting in 2032, only those with a high income won’t be allowed to convert pre-tax money. That’s 10 years from now. Who knows what will change by then. If you’re only worried about a plain vanilla Roth conversion, please understand it isn’t affected for at least 10 years.

Backdoor Roth – 2021If the proposals become law in 2022, you’re still allowed to make nondeductible contributions to a traditional IRA but you won’t be allowed to convert them to Roth after an effective date to be determined but it doesn’t affect converting to Roth on or before 12/31/2021.

If you’re planning to make the nondeductible traditional IRA contribution for 2021 between January 1 and April 15 in 2022, hurry up. Make the contribution for 2021 now and convert it to Roth before December 31, 2021. If you wait until 2022 to make your nondeductible contribution, it’s possible you won’t be able to convert to Roth and your contribution will be stuck in the traditional IRA.

If you’re planning to contribute or if you already contributed to your Roth IRA directly and there’s any chance that you will exceed the income limit for 2021 ($125,000 single, $198,000 married filing jointly), make it a backdoor Roth now. When you find you exceed the income limit, normally you can recharacterize your Roth IRA contribution to a nondeductible traditional IRA contribution and convert it in the following year but it’s possible you won’t be able to do that in 2022. So go through the backdoor now. Make a nondeductible contribution to a traditional IRA and convert before 12/31/2021.

In either case, you have to do some work to prepare for the backdoor Roth. See Backdoor Roth: A Complete How-To.

Mega Backdoor Roth – 2021If your employer’s plan allows non-Roth after-tax contributions, make sure you contribute the maximum allowed in 2021 and convert them before 12/31/2021.

Some plans do an automatic conversion on the same day. You’re covered if you signed up for the automatic conversions. If your plan doesn’t offer automatic conversion and you forget to convert manually, it’s possible your non-Roth after-tax contributions will be stuck.

What About 2022?As the President and Congress continue their discussion into 2022, we don’t know what the final outcome will be. If you normally do the backdoor Roth in January, should you proceed as usual or should you wait until it’s clear which way it will go? If you’re currently making non-Roth after-tax contributions to an employer plan, should you continue or pause those after-tax contributions?

I see these four possible scenarios:

1. Law Doesn’t ChangeIt’s possible the discussion reaches an impasse and the bill doesn’t pass in the Senate. If you proceed as usual, you’ll get your backdoor Roth in January. If you wait until say May to learn that the legislation died, you still have time to complete your backdoor Roth and mega backdoor Roth. The difference is only in when, not whether, you complete your backdoor Roth and mega backdoor Roth.

2. Law Changes, Effective 1/1/2023It’s also possible that the bill passes in the Senate in 2022 with a ban of backdoor Roth and mega backdoor Roth effective 1/1/2023. As far as 2022 is concerned, this is the same as the previous scenario. Either way you’ll get it done in 2022 and the only difference is in which month.

3. Law Changes, Effective Mid-Year with No Advance WarningAnother possibility is the bill passes with no advance warning. Say the bill passes on March 10 with an effective date of March 11. They often do that to avoid a last-minute mad dash to beat the clock. By the time the law changes, it’s already too late to make any changes. Meanwhile, those who performed backdoor Roth and mega backdoor Roth before the effective date won’t be affected.

In this scenario, you’re better off doing the backdoor Roth and mega backdoor Roth before the law changes. You snooze, you lose.

4. Law Changes, Effective 1/1/2022It’s also possible that the tax law changes will be made retroactive to January 1. It’s legal and it happened before.

Currently, a Roth conversion or an in-plan Roth rollover can’t be reversed. If you already completed the conversion before it’s made illegal retroactively, I imagine they will also give you a one-time exemption to undo it. If you go ahead under the current law, you’ll have the hassle of unwinding your conversion.

In summary,

Proceed as UsualWaitBill fails$$ in Roth$$ in RothLaw changes, effective 1/1/2023$$ in Roth$$ in RothLaw changes mid-year$$ in Rothmiss opportunityLaw changes retroactively to 1/1/2022unwind conversionno extra workWhether you should go ahead as soon as you can or wait until it’s clear on how the law will change depends on how badly you don’t want to miss an opportunity versus how much you hate the possible hassle of having to undo a conversion. To me personally, I will proceed as usual, but only you can make the decision for yourself.

A Big Loss?Is it a big loss if the proposed changes become law and you can’t do backdoor Roth and mega backdoor Roth anymore?

It’s a loss because tax-free growth beats tax deferral on the earnings or the lower tax rates on qualified dividends and long-term capital gains. However, the power of saving and investing comes from making the contributions to begin with, not from how the investment returns are taxed.

A taxable account always works. In the end, even if all the tax-advantaged accounts go away and all the returns are taxed as regular income, those who save and invest more will still succeed. You take advantage of all available tax savings but you can’t stake your success on specific tax breaks.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post What If Backdoor Roth and Mega Backdoor Roth Die in 2022? appeared first on The Finance Buff.

December 13, 2021

Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp

I covered buying I Bonds in a trust and in previous posts. This time we look at buying I Bonds in the name of a business. For background on I Bonds in general, please read How To Buy I Bonds.

Table of ContentsA Business Is Separate From the OwnerA Business’s Investments Belong to the BusinessEntity Accounts at TreasuryDirectBuying and Cashing OutKeep Them SeparateWhen the Business EndsAfter You DieA Business Is Separate From the OwnerMany people have a business when they sell products or provide services. Some people have a separate LLC for each of their rental properties. A key principle in business is that a business is separate from its owner. When you buy flowers from Carol’s Flowers you’re buying from Carol’s business, not from Carol herself.

A business may be organized as a sole proprietorship, a partnership, an LLC, an S-Corp, or a C-Corp. An LLC, S-Corp, or C-Corp usually requires registering with the state. A sole proprietorship or a partnership may have a fictitious name filing (“DBA”) with the state or the county. Some counties and cities also require business licenses. Having any of these shows it’s a business. The business exists separately from the owner as a person.

An S-Corp or a C-Corp has a separate tax ID (“EIN”). An LLC or a sole proprietorship can have an EIN or it can use the owner’s Social Security Number as its tax ID. Which tax ID a business uses and how the business is taxed don’t change the fact the business is still a separate entity from the owner as a person.

A Business’s Investments Belong to the BusinessA business as a separate entity can (and should) have its own bank account to keep the business’s financial affairs separate from the owner’s personal financial affairs. In addition to receiving revenue, paying business expenses, and paying the owner, the business can invest its excess cash in stocks, bonds, mutual funds, ETFs, real estate, and what have you. And that includes I Bonds as well.

All the business’s assets, including cash in the bank, vehicle, equipment, inventory, and all its investments still belong to the business. If the business changes ownership, the new owners get everything the business owns. If the business gets a judgment against it, all the assets the business owns are subject to the judgment. This creates a risk in keeping financial assets in the business’s name.

Entity Accounts at TreasuryDirectIf you’re OK with the risk of buying I Bonds in the name of your business, you can open an entity account for your business at TreasuryDirect. A business can buy up to $10,000 per calendar year. If you own multiple business entities, each separate business entity can buy up to $10,000 per calendar year in its own separate account.

Choose the correct business type that corresponds to your business and go from there.

You’ll be the Account Manager of the business account. You can give the same email address that you use on a personal account with TreasuryDirect. The business account at TreasuryDirect should link to the business’s bank account, not your personal bank account. Write down the account number you receive by email after you open the account. You’ll need it to log in.

Repeat the process if you have multiple business entities.

Buying and Cashing OutYou use the excess cash in the business to buy I Bonds. If you normally pay out the cash as an owner’s draw, that money has to stay in the business now, which reduces your owner’s draw. If your business is a pass-through entity (sole proprietorship, LLC, or S-Corp), you’re still taxed on the money even if you don’t actually pay out the draw.

When you cash out I Bonds in the business account, the money goes to the business’s bank account. You can do whatever you normally do with any cash in the business’s bank account, including paying out to the owner. TreasuryDirect will generate a 1099-INT form with the business’s tax ID. They don’t mail a paper 1099 form. You’ll have to remember to log in next year and download or print the 1099 form.

If the business files a separate tax return (C-Corp, S-Corp, partnership, or LLC taxed as an S-Corp or a partnership), the business has to include the interest income on its tax return. If the business issues a K-1 form to the owner, the interest income also goes on the K-1 form, which the owner uses to include on their personal tax return.

Keep Them SeparateSimilar to a trust account, when the business is ongoing, you should keep the business account and the personal account separate and avoid transferring from one to another when you’re buying the maximum in both accounts in the same year. You’ll get a stern warning if you buy the maximum in both accounts and transfer from one account to the other in the same year.

When you’re done buying all the I Bonds you want and you’d like to consolidate your holdings into one account, transfer in a year when you’re not buying I Bonds. Use FS Form 5511.

When the Business EndsBefore you wind down the business, you should dispose of the business’s assets and liabilities. Your authority to transact on behalf of the business ends when the business ceases to exist. So either sell or transfer the business’s assets to the owner(s) before you shut down the business.

If you’d like to keep the I Bonds as I Bonds as opposed to cashing out, you can transfer the bonds in the business account to the owner’s personal account.

After You DieA business account in TreasuryDirect can’t designate a second owner or a beneficiary. If you die, whoever takes over the ownership of the business also takes over the I Bonds the business owns. The new owner needs to change the business account’s Account Manager with FS Form 5446.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp appeared first on The Finance Buff.

December 8, 2021

Buy I Bonds in Your Kid’s Name: You Can, But Should You?

As news on I Bonds spreads, some people are looking for ways to buy more I Bonds beyond the limit of $10,000 per person per calendar year. Buying in a trust account is one way. Buying in your kid’s name, buying for your business, and buying as a gift are some other ways. We’ll start with buying in a kid’s name in this post. For background on I Bonds in general, please read How To Buy I Bonds.

Table of ContentsKids Can Invest Too529 Plan Is Better for CollegeKiddie TaxMinor Linked AccountCashing OutReaching AdulthoodKids Can Invest TooFirst of all, we’re talking about kids under 18 here. Adult children are adults. They can buy I Bonds in the same way as any other adult. If your adult children don’t have spare cash you can give them money and they can use the money to buy I Bonds (or anything else). If you’d like to buy I Bonds and then give the bonds to them as a gift, that’s buying as a gift. We’ll cover buying I Bonds as a gift in a different post.

Kids can invest too, not only in I Bonds but also in other investments such as mutual funds, ETFs, etc. Because kids can’t legally agree to terms and conditions when they’re a minor, an adult has to open an account for them and act as a custodian. These accounts are typically called UTMA accounts, which are named after the law that governs custodial accounts: Uniform Transfer to Minors Act.

If you already have UTMA accounts for your kids and you’re just diversifying part of their investments into I Bonds, you can skip some of the discussion on whether you should open an account in your kid’s name in the first place.

Money In a Kid’s NameMoney in your kid’s name belongs to your kid. You’re only holding the money and investing on their behalf until your kid becomes an adult. Even if you gave the money to your kid to begin with, you can’t take the money back or spend it willy-nilly. You can spend money from the kid’s account but it has to be on something that specifically benefits the kid. Spending the money on their sports uniforms and equipment may be OK but not for general household expenses.

As the custodian, you can decide to invest your kid’s money in mutual funds, ETFs, or I Bonds. Once your kid becomes an adult, your duty as the custodian is over and you must turn over the investments to the kid. If they decide to blow the money on a Tesla or travel to Antarctica, that’s their prerogative.

529 Plan Is Better for CollegeIf you intend to use the money for your kid’s college expenses, it’s probably better to put the money in a 529 plan than a custodial account. Depending on where you live, you may get a state tax deduction or credit for contributing to a 529 plan. Earnings in a 529 plan are tax-free when the money is distributed for qualified college expenses whereas earnings in a custodial account are taxable.

When the I Bonds are in the kid’s name, the interest is still taxable even if the bonds are cashed out for their college expenses. When the I Bonds are in a parent’s name, it’s possible that the interest is tax-free when they’re used for a child’s qualified college expenses. However, many high-income parents don’t meet the qualifying income limit to make it tax-free.

If your kid is still young, money in a 529 plan can be invested in stocks for possibly better returns whereas I Bonds at current rates only match inflation. When your kid is ready to go to college, money in a 529 plan is also treated more favorably in financial aid considerations than money in a custodial account.

Kiddie TaxIf the money isn’t for college expenses but for some other expenses specifically for the kid, there are some limited tax benefits to put the money under your kid’s name as opposed to keeping it in your own name.

When you redeem I Bonds under your kid’s name (either to transfer to a custodial account elsewhere or to spend specifically for their benefit), the accumulated interest is taxable. The first $1,100 in interest income covered by the kid’s standard deduction is tax-free. The tax on the next $1,100 is at the kid’s tax rate, which starts at 10% when they have no other income. The tax on interest income above $2,200 is at your tax rate, which would be the same had you kept the money in your own name.

So the tax benefit of putting money in your kid’s name is limited to the first $2,200 in investment income. Your kid pays a blended 5% on $2,200 versus you pay at your marginal tax rate. You need to file a tax return on behalf of your kid to realize the tax savings. The kid’s tax return is relatively simple when they don’t have other income. Downloaded tax software offers five federal e-files for this purpose.

Minor Linked AccountAfter considering the limitations of holding money in your kid’s name, the possibly better alternative of simply adding to their 529 plan, the limited tax benefits, and having to file a tax return for your kid, if you still want to buy I Bonds in your kid’s name, here’s how.

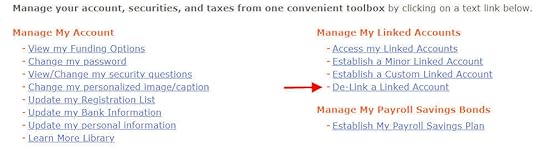

First, log in to your own TreasuryDirect account. Then to go ManageDirect. Find the link for “Establish a Minor Linked Account” on the right.

The fill out the required information (name, Social Security Number, date of birth, etc.). The primary bank account linked to your account is automatically linked to this Minor Linked Account for your kid.

Repeat the above if you’d like to create a Minor Linked Account for another kid.

After the Minor Linked Account is created, you go into it by clicking on the “Access my Linked Accounts” link under ManageDirect.

Then you buy I Bonds as usual in each Minor Linked Account. The purchase limit is also $10,000 per kid per calendar year.

Cashing OutWhen you cash out I Bonds from a Minor Linked Account for your kid, the money goes to the linked bank account. After that, you can transfer the money to a custodial account elsewhere for some other investments for your kid or spend the money on expenses that specifically benefit the kid.

Just like cashing out I Bonds in any other account, the accumulated interest is taxable to the kid in the year you cash out. TreasuryDirect will generate a 1099-INT form but it won’t send it by mail. You’ll have to remember to come into the Minor Linked Account and download or print the 1099 form. You use the 1099 form to file the tax return for your kid.

Reaching AdulthoodWhen your kid reaches 18, they can set up their own TreasuryDirect account as an adult. You “de-link” in ManageDirect and transfer the bonds in the Minor Linked Account to their adult account. They’ll take over from there.

Only moving the bonds from the Minor Linked Account to their adult account in TreasuryDirect doesn’t trigger taxes. Cashing out does.

***

Buying I Bonds in your kid’s name is relatively simple. The more important questions are:

Do you want to give money to your kid in the first place, as opposed to adding to their 529 plan or keeping full control of the money in your own name?How much of your kid’s money should you invest in I Bonds that match inflation as opposed to in mutual funds and ETFs for long-term growth?Remember money in your kid’s name belongs to the kid.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post appeared first on The Finance Buff.

November 30, 2021

How To Harvest Tax Loss Between an ETF and a Mutual Fund

Mutual funds are priced once a day after the markets close. The fund tallies up the value of all its holdings and calculates a Net Asset Value (NAV) per share. All the buy orders and sell orders the fund received before the markets closed on this day transact at this NAV. Everyone pays the same price on the same day but you don’t know what the price will be at the end of the day when you place your order.

ETFs are priced in the market throughout the day. Their prices change by the second. You see the price when you place your order but you don’t know whether this price is high or low relative to prices at a later time in the day or when the markets close.

In some ways, ETFs’ up-to-the-second pricing is an advantage. If the market is going up, there’s an opportunity to buy earlier in the day at a lower price. If the market is going down, there’s an opportunity to sell before it goes further down by the end of the day. You can also use limit orders to have your order execute only when the price meets a preset point, whereas mutual funds only accept market orders at the to-be-determined NAV.

However, the ever-changing prices can also be a hindrance. In general, you have to place your ETF orders when the market is open. Because you may be busy with work or other activities during those hours, you may prefer to put in your orders in the evening or on weekends. If you enter a market order for an ETF when the market is closed, your order will execute when the market first opens. Prices are sometimes volatile in the opening minutes and you may not get a fair price. If you enter a limit order for an ETF when the market is closed, your order may not be executed when the market moves away from the price you set in the limit order.

When you find time during trading hours to place an ETF order, you still can’t be sure how the price you see at that moment compares with the price of a mutual fund set after the end of the day. This comes into play when you harvest tax losses between an ETF and a mutual fund.

When you harvest tax losses, you sell one investment and you buy something similar. If you’re selling an ETF and buying a mutual fund, a big rally at the close will raise the price of the mutual fund, which makes you buy high and sell low. If you’re buying an ETF and selling a mutual fund, a large selloff at the close can also make you buy high and sell low.

Ideally you want to make your ETF order execute as close to 4:00 pm Eastern Time as possible in order to match the price movement in the mutual fund. It’s difficult when your schedule doesn’t allow it.

Market On Close OrdersThe Market On Close (MOC) order type comes to the rescue.

A Market On Close order is a market order that’s executed at the closing price. It makes an ETF order behave like a mutual fund order. Instead of your order executing immediately (market order) or at a preset price (limit order), your Market On Close order will execute at the closing price, whatever it happens to be.

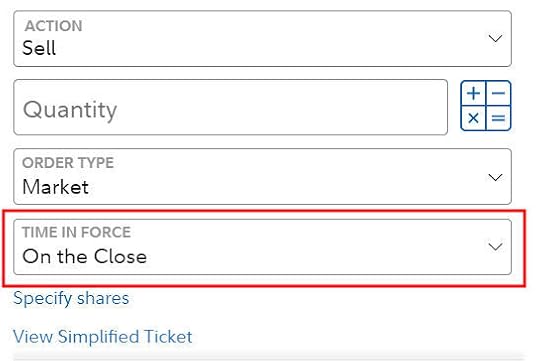

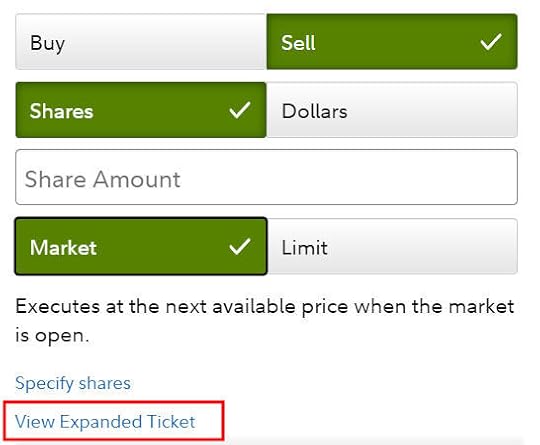

Most of the mainstream brokers for retail investors except Vanguard support Market On Close orders for ETFs. Here’s how to enter a Market On Close order with Fidelity:

Choose “Market” in the Order Type field and “On the Close” in the “Time in Force” field.

If your order entry screen looks like this, you’re on the Simplified Ticket. Click on the “View Expanded Ticket” link to open up more options.

Here are a few other things to keep in mind about Market On Close orders:

1. You can enter a Market On Close order only in whole shares. Fidelity supports trading fractional shares and trading in dollars but not for the Market On Close order type.

2. You can enter a Market On Close order only after the market opens and before a cutoff time prior to the close. Fidelity sets the cutoff at 3:40 pm Eastern Time, 20 minutes before the close. Charles Schwab has the cutoff at 3:45 pm Eastern Time.

3. A Market On Close order can’t be canceled after 3:58 pm Eastern Time.

If you prefer the simplicity of mutual funds, using Market On Close orders makes buying and selling ETFs close to the experience in buying and selling mutual funds. More importantly, when you harvest tax losses between an ETF and a mutual fund, using a Market On Close order makes both your ETF order and your mutual fund order execute at the closing price. This minimizes the price fluctuation between your orders.

It’s too bad Vanguard doesn’t support Market On Close orders. Consider using a different broker if you’d like to use Market On Close orders.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Harvest Tax Loss Between an ETF and a Mutual Fund appeared first on The Finance Buff.

November 7, 2021

2022 Tax Brackets, Standard Deduction, and 0% Capital Gains

My previous post listed the 2022 retirement account contribution and income limits. The IRS will publish a separate notice shortly with the inflation-adjusted tax brackets and other income limits for 2022. I calculated some of the most commonly used numbers using the published inflation numbers and the same formula prescribed in the tax law. In general, the 2022 numbers will increase by 3.1% from 2021 before rounding.

These numbers don’t take into account the draft legislation currently being considered by Congress. Some of the numbers may change if laws change.

2022 Standard DeductionAbout 90% of all taxpayers take the standard deduction. The standard deduction in 2022 is:

20212022Single or Married Filing Separately$12,550$12,950Head of Household$18,800$19,400Married Filing Jointly$25,100$25,900Standard DeductionSource: IRS Rev. Proc. 2020-45, author’s own calculation.

People who are age 65+ or blind have a higher standard deduction than these.

2022 Tax BracketsThe tax brackets are based on taxable income, which is AGI minus various deductions.

SingleMarried Filing Jointly10%$0 – $10,275$0 – $20,55012%$10,275- $41,775$20,550 – $83,55022%$41,775 – $89,075$83,550 – $178,15024%$89,075 – $170,050$178,150 – $340,10032%$170,050 – $215,950$340,100 – $431,90035%$215,950 – $539,900$431,900 – $647,85037%> $539,900> $647,850Tax BracketsSource: author’s own calculation.

2022 0% Capital Gains TaxWhen your other taxable income plus your qualified dividends and long-term capital gains are below a cutoff, you will pay no federal income tax on your qualified dividends and long-term capital gains under this cutoff.

The cutoff is close to the top of the 12% tax bracket but they don’t line up exactly.

20212022Single$40,400$41,675Head of Household$54,100$55,800Married Filing Jointly$80,800$83,350Maximum Zero Rate AmountSource: IRS Rev. Proc. 2020-45, author’s own calculation.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 Tax Brackets, Standard Deduction, and 0% Capital Gains appeared first on The Finance Buff.

October 13, 2021

2022 2023 Medicare Part B IRMAA Premium Brackets

[Updated on October 13, 2021, after the September inflation release. All numbers are final. My projections for 2021 matched the official numbers 100%.]

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors’ services and Medicare Part D that covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount.

I haven’t seen any numbers that show how much collecting IRMAA really helps the government in the grand scheme. I’m guessing very little. One report said 7% of all Medicare beneficiaries pay IRMAA. Suppose the 7% pay double the standard premium, it changes the overall split between the beneficiaries and the government from 25:75 to 27:73. Big deal?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits aren’t included in the income for determining IRMAA.

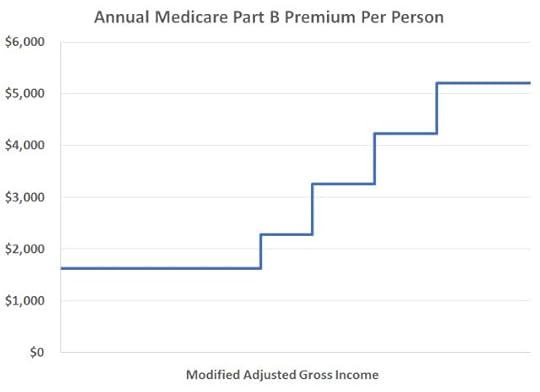

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay. If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

So if your income is near a bracket cutoff, see if you can manage to keep it down and make it stay in a lower bracket. Using the income from two years ago makes it a little harder.

2021 and 2022 IRMAA BracketsThe IRMAA income brackets (except the very last one) started adjusting for inflation in 2020. Here are the IRMAA income brackets for 2021 coverage and 2022 coverage. Before the government publishes the official numbers, I’m able to calculate based on the inflation numbers and the formula set by law. Remember the income on your 2020 tax return (AGI plus muni interest) determines the IRMAA you pay in 2022. The income on your 2021 tax return (to be filed in 2022) determines the IRMAA you pay in 2023.

Part B Premium2021 Coverage (2019 Income)2022 Coverage (2020 Income)StandardSingle: <= $88,000Married Filing Jointly: <= $176,000Single: <= $91,000

Married Filing Jointly: <= $182,000Standard * 1.4Single: <= $111,000

Married Filing Jointly: <= $222,000Single: <= $114,000

Married Filing Jointly: <= $228,000Standard * 2.0Single: <= $138,000

Married Filing Jointly: <= $276,000Single: <= $142,000

Married Filing Jointly: <= $284,000Standard * 2.6Single: <= $165,000

Married Filing Jointly: <= $330,000Single: <= $170,000

Married Filing Jointly: <= $340,000Standard * 3.2Single: <= $500,000

Married Filing Jointly: <= $750,000Single: <= $500,000

Married Filing Jointly: <= $750,000Standard * 3.4Single: > $500,000

Married Filing Jointly: > $750,000Single: > $500,000

Married Filing Jointly: > $750,000

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The income brackets are the same. The surcharges are relatively smaller in dollars.

2023 IRMAA BracketsIt’s too early to know what the 2023 IRMAA brackets will be. Still, you can make reasonable estimates and give yourself some margin to stay clear of the cutoff points. If inflation is 0% through August 2022, these will be the 2023 numbers:

Part B Premium2022 Coverage (2020 Income)2023 Coverage (2021 Income), 0% InflationStandardSingle: <= $91,000Married Filing Jointly: <= $182,000Single: <= $94,000

Married Filing Jointly: <= $188,000Standard * 1.4Single: <= $114,000

Married Filing Jointly: <= $228,000Single: <= $118,000

Married Filing Jointly: <= $236,000Standard * 2.0Single: <= $142,000

Married Filing Jointly: <= $284,000Single: <= $147,000

Married Filing Jointly: <= $294,000Standard * 2.6Single: <= $170,000

Married Filing Jointly: <= $340,000Single: <= $176,000

Married Filing Jointly: <= $352,000Standard * 3.2Single: <= $500,000

Married Filing Jointly: <= $750,000Single: <= $500,000

Married Filing Jointly: <= $750,000Standard * 3.4Single: > $500,000

Married Filing Jointly: > $750,000Single: > $500,000

Married Filing Jointly: > $750,000

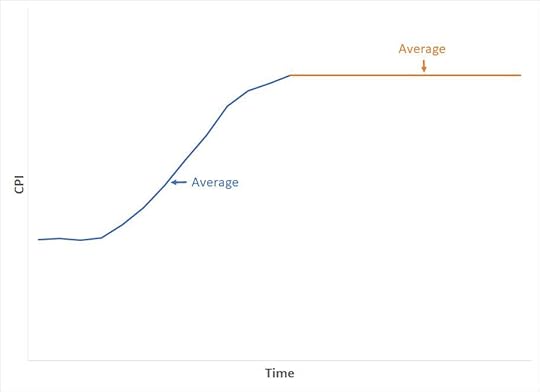

Because the formula compares the average of CPI numbers in a 12-month period over the average of CPI numbers in the previous 12-month period, even if inflation is 0% in the following months, the average will still be higher than the average in the previous months. If inflation is positive, the IRMAA brackets for 2023 may be higher than these. If inflation is negative, which is rare but still possible, the IRMAA brackets for 2023 may be lower than these.

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes. Does making them pay another $1,400/year make that much difference? Nickel-and-diming just annoys people. People caught by surprise when their income crosses over to a higher bracket by just a small amount get mad at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income and don’t accidentally cross a line for IRMAA.

IRMAA AppealIf your income two years ago was higher because you were working at that time and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA assessment. The “life-changing events” that make you eligible for an appeal include:

Death of spouseMarriageDivorce or annulmentWork reductionWork stoppageLoss of income from income producing propertyLoss or reduction of certain kinds of pension incomeYou file an appeal by filling out the form SSA-44 to show that although your income was higher two years ago, you had a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For LifeIf your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, when your income comes down in the following year, your IRMAA will also come down automatically. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 2023 Medicare Part B IRMAA Premium Brackets appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower