Harry Sit's Blog, page 19

September 22, 2022

Guide to Money Market Fund & High Yield Savings Account (2022)

Both money market funds and savings accounts are good places for temporary savings that you may deposit and withdraw at any moment. If you can afford to lock up your money for a set period of time — for as short as four weeks — you’ll earn more interest in Treasury Bills. See How To Buy Treasury Bills & Notes Without Fee at Online Brokers. If you can afford to lock up the money for at least a year, consider I Bonds. See How to Buy I Bonds.

When the Federal Reserve kept the short-term interest rate close to zero in 2020 and 2021, pretty much all the money market funds paid an annualized yield of only 0.01%. Some online banks and credit unions were more generous at that time. They paid something like 0.65% annual percentage yield (APY), which wasn’t really “high yield” but it was certainly better than 0.01%. Now that the Fed has been raising rates, money market funds have become competitive again.

Table of ContentsWho Sets the Interest RateComparing YieldFDIC InsuranceFees and MinimumsWithdrawal and Transfer LimitsSweep Funds and Purchased FundsTax TreatmentThe Best Money Market FundsVanguardFidelityCharles SchwabMerrill EdgeWho Sets the Interest RateMoney market funds are an investment product. They’re offered by brokers such as Vanguard, Fidelity, or Charles Schwab. Savings accounts are offered by banks and credit unions. A big difference between how much interest a money market fund pays and how much a savings account pays is in who sets the interest rate.

A side note: Some banks and credit unions also offer money market accounts. They’re just a savings account by a different name, perhaps with slightly different features such as check-writing privileges or a debit card for ATM withdrawals. They’re not the same as a money market fund. For the purpose of this post, I treat money market accounts from banks and credit unions the same as savings accounts.

Money market funds invest in very short-term debt securities in the financial market. The fund manager takes a fixed cut (the “expense ratio”) from what they earn in the market before paying the rest to you. If the market yield goes up, the yield you receive automatically goes up. If the market yield goes down, the yield you receive automatically goes down. You’re at the mercy of the market conditions. That’s why they could only pay 0.01% in 2020 and 2021.

The interest rate on a savings account is set by the bank or credit union. Banks and credit unions want deposits as reserves to make loans. They’ll set a high interest rate if they need to attract more deposits. They’ll set it low if they don’t have a strong loan demand. You’re at the mercy of the bank or credit union. If they decide to stay behind, there’s nothing you can do except jump ship to a different bank, which requires giving your Social Security number, creating new login credentials, opening a new account, linking your checking account, downloading a new mobile app, etc.

Therefore, when you put your money in a savings account, sometimes you get an above-market interest rate, and sometimes you get a below-market interest rate. If you go with a bank that offers a higher interest rate, be prepared to move when they lag behind. You can see the current rates offered by banks and credit unions at depositaccounts.com. When you put your money in a money market fund, you’ll get the market yield minus the fund manager’s cut at all times, no more, no less.

Comparing YieldThe yield on a money market fund changes with the market daily. A money market fund quotes a 7-day average yield. That’s the average yield investors actually received in the past seven days. When the market yield is rising fast, the yield you’ll get when you invest in the money market fund now may be higher than the average yield in the past seven days.

The yield quoted for a money market fund is after subtracting the expense ratio taken by the fund manager. It’s directly comparable with the yield on a high yield savings account. You don’t need to subtract the fund’s expense ratio again from the quoted yield.

The yield on a savings account is fixed until the bank or the credit union decides to change it. It’s completely up to the bank or the credit union as to when they’ll change it and how much they’ll change it.

FDIC InsuranceMoney market funds aren’t insured by the Federal Deposit Insurance Corporation (FDIC), National Credit Union Administration (NCUA), or any other government agency. However, if you stick with money market funds offered by large brokers such as Vanguard, Fidelity, or Charles Schwab, they’re generally safe.

A money market fund that wasn’t offered by a top-3 broker did fail during the financial crisis in 2008. If you’re really concerned about safety, you can also use a money market fund that invests only in Treasuries or government debt. The money market fund itself isn’t insured but the underlying investments in the fund are backed by the government.

Savings accounts are insured by the FDIC (or NCUA for credit unions) for up to $250,000. The insurance goes up to $500,000 for a joint account.

Having FDIC or NCUA insurance is nice but I don’t lose sleep over not having it when I use a money market fund from a large broker. When there’s only a small difference in the yields between different types of money market funds, choose one that invests only in Treasuries or government debt for extra safety.

Fees and MinimumsA savings account can have a minimum deposit or monthly fees but the typical good high yield savings accounts don’t have any minimum balance requirement or monthly fees.

A money market fund can also have a minimum investment but many don’t. Many funds that have a minimum investment also have it only as the initial minimum. You need to put that much into the fund to get started but you don’t necessarily need to keep that much in the fund at all times. They don’t kick you out when your balance goes below the initial minimum.

Withdrawal and Transfer LimitsWhen you need to withdraw from a savings account or a money market fund, you usually just transfer the money to your checking account.

Savings accounts used to allow a maximum of six transfers per month by Regulation D of the Federal Reserve. The Fed removed that requirement from the banks but some banks are still imposing the old limit on their own. Avoid those banks.

Each bank or credit union sets the limit on the amount of the transfer on a per-transfer, per-day, or per-month basis. For example, Alliant Credit Union has an outbound transfer limit of $25,000 per day.

Brokers typically have a higher transfer limit than banks and credit unions. If you often transfer large amounts, use a money market fund.

Sweep Funds and Purchased FundsA broker usually offers several different money market funds. They make some of them available as the default “sweep” fund in a brokerage account, while other money market funds stay as “purchased” funds.

A sweep fund (sometimes called a “core” or “settlement” fund) serves as the default cash position in your brokerage account. The cash you deposit into the account, dividends not automatically reinvested, or any proceeds from selling your investments “sweep” into this fund daily. Withdrawals and cash for new purchases come out of this fund. The broker may designate one money market fund as the default but they may also let you choose among a handful of funds to serve as the sweep/core/settlement fund.

Your choice for a sweep fund is limited. They don’t make all of their money market funds available as a sweep/core/settlement fund. The ones made available as a sweep fund don’t have the best yield because they have higher costs. The higher-yielding money market funds are only available as a “purchased” fund which requires an extra step to buy or sell just like other mutual funds.

A purchased money market fund isn’t as automatic but you get a higher yield to compensate. If you keep a large balance in a money market fund, it’s worth the extra step to buy and sell manually.

Tax TreatmentYou pay both federal income tax and state income tax on the interest earned in a savings account. The tax treatment on the interest earned in a money market fund depends on the underlying investments in the fund.

There are five types of money market funds:

PrimeGovernmentTreasuryNational Tax-ExemptState-Specific Tax-ExemptThe last two types pay a lower yield but are tax-free at the federal level, which can be a good choice if you’re in a high tax bracket depending on the yield difference between tax-exempt funds and taxable funds. The state-specific tax-exempt funds are tax-free at both the federal and the state levels for residents in that state.

Federal Income TaxState Income TaxPrimeYesYesGovernmentYesPartialTreasuryYesNoNational Tax-ExemptNoPartialState-Specific Tax-ExemptNoNoTax TreatmentStates don’t tax interest from Treasuries and bonds from their own state. Some states prorate. If 30% of the interest earned by a fund is from Treasuries and in-state bonds, 30% is tax-free for state income tax. Some states require a minimum percentage of interest or a minimum percentage of assets from these tax-free sources to qualify. If the minimum is 50% but the fund only earned 30% from Treasuries and in-state bonds, 100% of the interest is still taxable by that state.

The Best Money Market FundsThe same type of money market funds fish in the same pond, so to speak. The yield you receive from a money market fund depends heavily on the expense ratio the fund charges before paying you.

Among the top-3 retail brokers, Vanguard charges the lowest expense ratios in its money market funds. Even if you use another broker for your investments, you can still use Vanguard just for its money market funds as you do with a bank or a credit union for a high yield savings account.

VanguardThe default settlement fund in a Vanguard brokerage account is Vanguard Federal Money Market Fund (VMFXX). This fund invests in U.S. government securities. It has an expense ratio of 0.11%. Any cash you add to the brokerage account automatically goes into this fund. There’s no minimum, and you don’t have to do anything extra to buy it.

Vanguard also offers some other money market funds for buying and selling manually. All require a minimum initial purchase of $3,000. Please click here to see the list (click on the Performance tab to see the current yield).

For maximum safety, Vanguard Treasury Money Market Fund (VUSXX, expense ratio 0.09%) invests exclusively in Treasuries. Interest from this fund is exempt from state and local taxes.

FidelityThe default sweep/core fund in a Fidelity account depends on the account type. You can also change the core fund among a few available choices (except in the Cash Management Account).

The funds available as the sweep/core position include:

FundTypeExpense RatioFidelity Government Cash Reserves (FDRXX)Government0.33%Fidelity Government Money Market Fund (SPAXX)Government0.42%Fidelity Treasury Money Market Fund (FZFXX)Government0.42%Fidelity Core-Eligible Money Market FundsThese core funds don’t require any minimum. As you can see, the expense ratios of these Fidelity money market funds are higher than the expense ratios of Vanguard money market funds, resulting in a lower yield in general.

Fidelity offers additional money market funds for manual purchases. These other money market funds are “semi-automatic” at Fidelity. You must buy them manually but Fidelity will automatically sell them when your core fund is insufficient to cover your withdrawals and trades. This is unique to Fidelity. Both Vanguard and Charles Schwab require manual selling for “purchased” money market funds.

Here are some Fidelity money market funds with a higher yield:

FundMinimumTypeNet Expense RatioFidelity Money Market Fund Premium Class (FZDXX)$100kPrime0.30%Fidelity Money Market Fund (SPRXX)$0Prime0.42%Fidelity Treasury Only Money Market Fund (FDLXX)$0Treasury0.42%Fidelity Non-Core Money Market FundsPrime money market funds have a higher yield because they invest in corporate debt in addition to government debt. You can earn slightly more by manually buying FZDXX ($100k initial minimum) or SPRXX (no minimum). For extra safety, buy FDLXX because it only invests in Treasuries.

When you buy FZDXX or SPRXX manually, you can receive a yield close to the yield on a Vanguard money market fund while staying in the same account at Fidelity. Fidelity will automatically sell FZDXX or SPRXX when you don’t have enough money in the core fund to cover withdrawals and trades.

Charles SchwabCharles Schwab doesn’t offer a money market fund as the default sweep in its brokerage accounts. It uses a “bank sweep” as the default, which pays a much lower interest rate.

Schwab offers money market funds only as “purchased” money market funds. You’ll have to buy and sell these funds manually. Here are some of the available funds:

FundTypeNet Expense RatioSchwab Value Advantage Money Fund (SWVXX)Prime0.34%Schwab Government Money Fund (SNVXX)Government0.34%Schwab U.S. Treasury Money Fund (SNSXX)Treasury0.34%Schwab Purchased Money Market FundsYou can receive a yield close to the yield on a Vanguard money market fund while staying in the same account at Charles Schwab but you will have to buy and sell a money market fund manually. For extra safety, buy SNSXX because it only invests in Treasuries.

Merrill EdgeSimilar to Charles Schwab, Merrill Edge also only offers a “bank sweep” as the default cash option, which pays a low interest rate.

However, you can buy and sell a number of money market funds manually. See the full list on Merrill Edge’s website. Here are some higher yielding funds:

FundTypeNet Expense RatioBlackRock Liquidity Funds: Treasury Trust (TTTXX)Treasury0.17%Federated Hermes Treasury Obligations Fund (TOIXX)Government0.20%Fidelity Investments Money Market Treasury Only Class I (FSIXX)Treasury0.18%Select Money Market Funds at Merrill EdgeAlthough these institution-class funds normally require a very large minimum investment, you can buy them at Merrill Edge with only a minimum of $1,000.

***

Both a high yield savings account and a money market fund work for temporary savings. A money market fund has the benefit of automatically adjusting to the current market yield (minus the fund’s expense ratio). You aren’t at the mercy of a bank’s decision to catch up or stay behind. If you’re in a high-tax state, using a Treasury money market fund gives you the highest safety, and the interest is exempt from state and local taxes.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Guide to Money Market Fund & High Yield Savings Account (2022) appeared first on The Finance Buff.

September 15, 2022

Calculator: How Much of My Social Security Benefits Is Taxable?

Social Security benefits are 100% tax-free when your income is low. As your total income goes up, you’ll pay federal income tax on a portion of the benefits while the rest of your Social Security benefits remain tax-free. This taxable portion goes up as your income rises but it will never exceed 85%. Even if your annual income is $1 million, at least 15% of your Social Security benefits will still be tax-free.

The amount of the taxable Social Security benefits becomes part of your gross income on your tax return. It’s still subject to your normal deductions to arrive at your taxable income. You still pay at your normal tax rates on the taxable amount. 50% or 85% of your benefits being taxable doesn’t mean you’ll pay a 50% or 85% tax on your benefits. The actual taxation on your benefits is much less.

The IRS has a somewhat complex formula to determine how much of your Social Security benefits is taxable and how much is tax-free. It first calculates a combined income that consists of half of your Social Security benefits plus your other income such as withdrawals from your retirement accounts, interest, dividends, and short-term and long-term capital gains. It also adds any tax-exempt interest from muni bonds. This income is then reduced by a number of above-the-line deductions such as deductible contributions to Traditional IRAs, SEP-IRAs, SIMPLE IRAs, HSAs, deductible self-employment tax, and self-employment health insurance. Finally, this provisional income goes through some thresholds based on your tax filing status (Married Filing Jointly or Single/Head of Household). All of these are in Worksheet 1 in IRS Publication 915.

You can go through the steps in the worksheet to calculate the amount of social security benefits that will be taxable but the worksheet isn’t the easiest to use. I made an online calculator that helps you calculate much more quickly. You only give three numbers plus your tax filing status. You’ll have your answer by clicking on a button.

The calculator works for all types of Social Security benefits. It doesn’t matter whether you’re receiving retirement income benefits, disability benefits, spousal benefits, or survivor benefits as a widow or widower. It only applies to federal taxes though. Different states have different rules on taxing Social Security benefits. State taxes don’t necessarily follow the same rules as the federal government.

Note to email subscribers: The embedded calculator below doesn’t work directly in the email. Please click here to use it online.

function calc() { status = document.forms["SSTaxableCalc"]["filing-status"].value; ss = Number(document.forms["SSTaxableCalc"]["ss"].value); other = Number(document.forms["SSTaxableCalc"]["other"].value); adj = Number(document.forms["SSTaxableCalc"]["adjustment"].value); if (status == "MFJ") { floor = 32000; gap = 12000; } else { floor = 25000; gap = 9000; } income = Math.max(other ss / 2 - adj - floor, 0); above_gap = Math.max(income - gap, 0); half_gap = Math.min(income, gap) / 2; fifty_pct_tier = Math.min(ss, half_gap); eighty_five_pct_tier = above_gap * 0.85; taxable = Math.min(fifty_pct_tier eighty_five_pct_tier, ss * 0.85); tax_free_pct = 100 - taxable / ss * 100; document.getElementById("taxable").innerHTML = Math.round(taxable).toLocaleString(); document.getElementById("percentage").innerHTML = Math.round(tax_free_pct); document.getElementById("results").style.display = "block";}Tax Filing Status:Married Filing JointlySingle or Head of HouseholdSocial Security benefits:Other income (including tax-exempt muni bond interest):Above-the-line deductions. These include deductible contributions to HSA, traditional IRA, SEP-IRA, and SIMPLE IRA, and deductible self-employment tax and self-employment health insurance.

$ of your Social Security benefits is taxable, which means % of your benefits is tax-free.

When more than 15% of your Social Security benefits is tax-free, additional income outside Social Security will make more of your Social Security benefits taxable, reducing that number toward 15%. Some people call this the tax torpedo, but it’s a misleading term. You actually still pay lower taxes than other people with the same income. See why that’s the case in An Unusually High Marginal Tax Rate Means Paying Lower Taxes.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Calculator: How Much of My Social Security Benefits Is Taxable? appeared first on The Finance Buff.

September 12, 2022

Random Thoughts From a Month-Long Trip to Switzerland

I learn something every time I take a long trip to another country. When I went to Peru, it was “Choose what you do.” When I went to Kenya, it was “Take it slow.” When I went to Bolivia, it was “Experience early.”

I took a month-long trip to Switzerland recently. If I sum up the learning from this trip, it’s this — Our way isn’t the only way.

CoffeeMost people drink coffee in a cup or mug here in the U.S. When I was at a mountain hut in Switzerland, I saw people pouring coffee into a bowl, putting butter or jam on their bread, and then dipping the bread into the coffee bowl.

That’s weird to me but they must have their good reasons. Maybe I should try it. Our way isn’t the only way.

TransportationI drive everywhere here in the U.S. but I didn’t need a car for a whole month while I was in Switzerland. I took trains and buses everywhere. This wasn’t limited to only large cities like Zurich or Geneva. Some small villages I went to had a population of no more than 1,000 people.

Trains go into the airport. You come out of the airport terminal and go directly into the train station. Regional buses wait at the train station. You come off the train and hop on a bus. They have a mobile phone app that tells you which trains and buses to take and you can buy one through-ticket that covers all the connections directly in the app even though the underlying trains and buses are operated by different companies.

The trains and buses aren’t necessarily fast but they are reliable. If the schedule in the mobile app says the train will arrive at 9:37, it shows up at 9:37. If you have only four minutes to switch from one train to another, you won’t miss the connection.

Going by train and bus is so much more convenient and less stressful. Swiss people of course also have cars. They just drive less frequently. Having fewer cars on the road means less pollution, less congestion, less road rage, and fewer traffic deaths and injuries.

As soon as I got back to the U.S., I needed a Uber to get home from the airport. It was such a big contrast.

Having good public transportation isn’t just a matter of population density. The state of New Jersey has more population in a land area about half the size of Switzerland. I definitely needed a car when I visited New Jersey. Our way of everybody driving everywhere isn’t the only way to organize transportation.

Free Enterprise + Public InfrastructureI watched the movie Heidi before I left for Switzerland. It showed that Switzerland used to be a poor country. The Swiss people raised cattle and sheep in the mountains (famous for Swiss cheese). A poor girl was sent to Germany as the companion to a wealthy family’s daughter. She was laughed at for not being able to read.

Switzerland’s per-capita GDP is higher than that of the U.S. now. It’s as hands-off to capital as it gets. As a small country of only eight million people with a tiny domestic market, it has the largest food company in the world. As a land-locked mountainous country, it has the world’s largest ocean container shipping company. Without large mining resources of its own, it has the world’s largest commodity trading and mining company. Russian oligarchs have their operations there. Two Swiss pharmaceutical companies are in the global top five. Such a small country has a vastly disproportional economic power in the world.

The commitment to free enterprise didn’t stop the country from providing public infrastructure though. Their trains are run by a company 100% owned by the government. The inter-region buses are operated by a subsidiary of the country’s postal system. I saw the bus driver picking up mail from drop boxes along the way.

Tuition at many public universities in Switzerland is under $1,000 per semester. Albert Einstein got his college and Ph.D. degrees at a public university in Switzerland.

Funding public infrastructure obviously requires taxes. Swiss citizens see the long-term benefits to its economy from good public transportation and good public education. Our way of lower taxes isn’t the only way to have a thriving economy.

Direct DemocracyLike the United States, Switzerland also has a federal form of government. Citizens in its 26 states (“cantons”) literally don’t speak the same language. As I traveled from one canton to another and sometimes from the eastern part of the same canton to the western part, all the signs in the streets changed from German to French (I didn’t go to the Italian-speaking part of the country).

Rather than having two political parties dueling with each other and resulting in oscillating policies when one party comes to power versus the other, the Swiss legislature is made up of 11 different parties. With proportional representation as opposed to a winner-take-all system, gerrymandering isn’t a thing. All political leanings are represented. It doesn’t matter if you’re a conservative in a blue state or if you’re a liberal in a red state.

Seven members from 4 different parties form a Federal Council that governs the country. The 7 members rotate to serve a one-year term as the President. The President doesn’t have any more power than any other member of the council. A stable government built on consensus creates a good environment for the economy.

Rather than going through years of litigation and having a judge or a handful of judges overturn laws, Swiss citizens can overturn laws directly in referendums held 3 or 4 times every year. Citizens can also amend the constitution directly in a referendum. The number of signatures needed to put an issue on the referendum is relatively low. The government and the legislature won’t make unpopular moves when they know citizens can easily veto them in a few months. The will of the people prevails.

Here in the U.S., we hold our constitution and the founding fathers in high regard as if they had the best design. I realized it isn’t the only way when I saw how well the Swiss constitution was designed. The American founding fathers had to deal with the problems they were facing at the time. They couldn’t foresee the structural problems they created.

Direct democracy of course also has its problems. The county I live in now needed a new high school due to population growth resulting in overcrowding at the existing high school. When the county school district put a bond issue on the ballot in 2019, citizens in the county voted it down because they didn’t want to pay higher property taxes. Now, three years later, the population grew some more and the overcrowding got worse. The county still needed a new high school but construction costs have gone up a lot and the interest rate for issuing a bond has gone up a lot as well. Citizens have to pay higher property taxes now because they waited. People sometimes make mistakes but on balance I think it’s better to give the power to the people.

***

Back to our usual money and finance topics, sometimes we think our way is the only way, and any other way will result in a disaster. It’s not true. We should always keep an open mind. Living in a low-cost-of-living area works. So does living in a high-cost-of-living area. Entrepreneurship works. So does working a W-2 job. Investing in index funds works. So does investing in real estate. What made us successful isn’t the only way.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Random Thoughts From a Month-Long Trip to Switzerland appeared first on The Finance Buff.

August 22, 2022

ACA Premium Subsidy Cliff Turns Into a Slope Through 2025

[Updated after the passing of the Inflation Reduction Act of 2022.]

I have been buying health insurance on an exchange under the Affordable Care Act (ACA) since 2018. Before the ACA, getting health care coverage was one of the biggest challenges for becoming self-employed. Forget about the cost — just getting a policy was a challenge by itself. ACA changed all that. Now self-employed people and others who don’t get health insurance through their jobs can buy health insurance on the exchange.

Not only are you able to buy health insurance, but the coverage is also made affordable by the premium subsidy in the form of a tax credit. How much tax credit you get is calculated off of your modified adjusted gross income (MAGI) relative to the Federal Poverty Level (FPL) for your household size.

Your MAGI for the purpose of ACA is basically:

your gross income;minus pre-tax deductions from paychecks (401k, FSA, …)minus above-the-line deductions, for example: pre-tax traditional IRA contributionsHSA contributions1/2 of self-employment taxpre-tax contribution to SEP-IRA, solo 401k, or other retirement plansself-employed health insurance deductionstudent loan interest deduction plus tax-exempt muni bond interest;plus untaxed Social Security benefitsWages, interest, dividends, capital gains, pension, withdrawals from pre-tax traditional 401k and IRAs, and money you convert from Traditional to Roth accounts all go into MAGI for ACA. Otherwise-not-taxed muni bond interest and Social Security benefits also count in MAGI for ACA.

Side note: There are many different definitions of MAGI for different purposes. These different MAGIs include and exclude different components. We’re only talking about MAGI for ACA here.

400% FPL Cliff Converted To a SlopeYour tax credit goes down as your income increases. Up through the year 2020, the tax credit drops to zero when your MAGI goes above 400% of FPL. If your MAGI is $1 above 400% FPL, you pay the full premium with zero tax credit. People had to be very careful in tracking their income to make sure it doesn’t go over the cliff.

For a household of a single person in the lower 48 states, that cutoff was just shy of $50,000 in 2020. For a household of two people in the lower 48 states, the cutoff was $67,640 in 2020. See Federal Poverty Levels (FPL) For Affordable Care Act for where 400% of FPL is at for your household size.

Now thanks to the American Rescue Plan Act of 2021 and the Inflation Reduction Act of 2022, for five years only — 2021 through 2025 — this cliff becomes a slope. The tax credit will continue to drop as your income increases but it won’t suddenly drop to zero when your income goes $1 over the cliff.

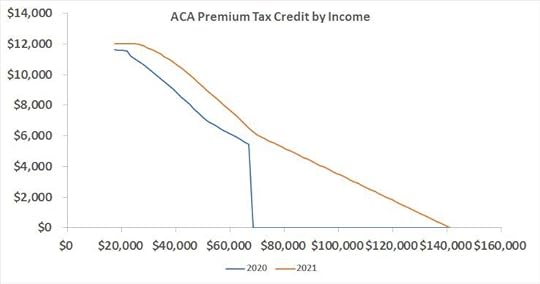

The chart above shows the ACA premium tax credit at different income levels for a household of two people in the lower 48 states where the second lowest cost Silver plan costs $1,000/month. The blue line is for 2020. The orange line is for 2021. The gap between the two lines represents the change between 2020 and 2021. The new law also increased the tax credit before the old cliff but the increase was much more significant after that point. The tax credit was zero at $70,000 income in 2020, but it will be about $500/month in 2021.

Because health insurance premium is higher for older folks and health insurance costs more in some areas of the country, the tax credit is also higher for someone older with the same MAGI and in areas where health insurance is more expensive.

Not having to watch out for the cliff is a huge relief to people closer to the edge of the old cliff, but the new laws are only effective for five years from 2021 through 2025. Unless another law extends it, the cliff will come back in 2026.

When the Cliff Comes BackThe ACA subsidy cliff is scheduled to come back in 2026. People will have to manage their income and watch out for the cliff again. The most critical part is to project your income before the end of the year and not realize income willy-nilly before you do the projection. If you find yourself close to the cliff before you realize income, you can still adjust. Many people are caught by surprise only when they do their taxes in the following year. Your options are much more limited after the year is over.

Fortunately, it’s relatively easier to stay under the cliff for those who rely on an investment portfolio for income. When you are before 59-1/2, you’re primarily spending money from your taxable accounts. A large part of the money withdrawn is your own savings; the rest is interest, dividends, and capital gains. Spending your own savings isn’t income. If you withdraw $60k to live on, your MAGI isn’t $60k. It’s probably less than $30k.

When you supplement your income with part-time self-employment, you still have the option to contribute to pre-tax traditional 401k, IRA, and HSA. Those pre-tax contributions lower your MAGI, which helps you stay under the 400% FPL cliff when necessary.

100% and 138% FPL CliffThere is another cliff on the low side, although that one is easily overcome if you have retirement accounts.

In order to qualify for a premium subsidy for buying health insurance from the exchange, you must have income above 100% FPL. In states that expanded Medicaid to 138% FPL, you must also not qualify for Medicaid, which means you must have MAGI above 138% FPL.

These are checked only at the time of enrollment. Once you get in, you’re not punished if your income unexpectedly ends up below 100% or 138% of FPL. If you see your income next year is at risk of falling below 100% or 138% FPL when you enroll, tell the exchange you’re planning to convert some money from your Traditional 401k or Traditional IRA to Roth. That’ll raise your income.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post ACA Premium Subsidy Cliff Turns Into a Slope Through 2025 appeared first on The Finance Buff.

July 29, 2022

2022 2023 ACA Health Insurance Premium Tax Credit Percentages

If you buy health insurance from healthcare.gov or a state-run ACA exchange, up through the year 2020, there was a hard cutoff for whether you qualify for a premium tax credit. You didn’t qualify for a premium tax credit if your income was above 400% of the Federal Poverty Level (FPL). The American Rescue Plan removed the hard cutoff at 400% of FPL in 2021 and 2022. See ACA Premium Subsidy Cliff Turns Into a Slope.

Now, how much credit you qualify for is determined by a sliding scale. The government says that based on your income, you are supposed to pay this percentage of your income toward a second lowest-cost Silver plan in your area. After you pay that amount, the government will take care of the rest. If you pick a less expensive policy than the second lowest-cost Silver plan, you keep 100% of the savings, up to the point you get the policy for free. If you pick a more expensive policy than the second lowest-cost Silver plan, you pay 100% of the difference.

That sliding scale is called the Applicable Percentages Table. The American Rescue Plan also lowered the applicable percentages significantly in 2021 and 2022 from previous years. Unless these provisions are extended, the 400% FPL subsidy cliff and the higher applicable percentages will return in 2023.

Here are the applicable percentages for different income levels in 2022 and 2023:

Income20222023< 133% FPL0%1.92%< 150% FPL0%2.88% – 3.84%< 200% FPL0% – 2%3.84% – 6.05%< 250% FPL2% – 4%6.05% – 7.73%< 300% FPL4% – 6%7.73% – 9.12%<= 400% FPL6% – 8.5%9.12%> 400% FPL8.5%not eligibleACA Applicable PercentagesSource: IRS Rev. Proc. 2021-23, Rev. Proc. 2022-34

As you see from the table above, the changes between 2022 and 2023 are quite substantial. The percentage of income the government expects you to pay toward a second lowest-cost Silver plan depends on your income relative to the Federal Poverty Level. To calculate where your income falls relative to the Federal Poverty Line, please see Federal Poverty Levels (FPL) For Affordable Care Act (ACA).

For example, people with income between 250% and 300% of the Federal Poverty Level are expected to pay between 7.73% and 9.12% of their income toward a second lowest-cost Silver plan in their area in 2023. That’s much higher than the sliding scale between 4% and 6% of income in 2022.

Congress is considering a new bill — the Inflation Reduction Act of 2022 — that will extend the 2022 applicable percentages for another three years through 2025. If this bill passes, it will reduce the amount many people pay toward their ACA health insurance.

If your income is low, they expect you to pay a low percentage of your low income. As your income goes higher, they expect you to pay a higher percentage of your higher income. The higher percentage applies not just to the additional income but to your entire income. A higher income times a higher percentage is much more than a lower income times a lower percentage.

For example, a household of two in the lower 48 states is expected to pay 3.18% of their income when their 2022 income is $40,000. If they increase their income to $50,000, they are expected to pay 5.48% of their income. The increase of their expected contribution toward ACA health insurance, and the corresponding decrease in their premium tax credit will be:

$50,000 * 5.48% – $40,000 * 3.18% = $1,468

This represents about 15% of the $10,000 increase in their income. For a married couple, the effect of paying 15% of the additional income toward ACA health insurance is greater than the effect of paying 12% toward their federal income tax. It makes the effective marginal tax rate on the additional $10,000 income 27%, not 12%.

Normally it’s a good idea to consider Roth conversion or harvesting tax gains in the 12% tax bracket, but those moves become much less attractive when you receive a premium subsidy for the ACA health insurance. For a helpful tool that can calculate this effect, please see Tax Calculator With ACA Health Insurance Subsidy.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 2023 ACA Health Insurance Premium Tax Credit Percentages appeared first on The Finance Buff.

July 25, 2022

An Unusually High Marginal Tax Rate Means Paying Lower Taxes

Most people are familiar with the concept of the progressive income tax system in the U.S. As your income goes higher, you pay a higher tax rate on your additional income.

Some people mistakenly think that getting a bonus that pushes them into a higher tax bracket will make them worse off than not getting the bonus. That’s not true because a higher tax rate isn’t imposed on the entire income. It only applies to the portion of the income that crosses the line and lands in the higher tax bracket. That’s why the phrase “tax bracket” in common parlance is really the marginal tax bracket. It applies to the income on the margin.

Table of ContentsMarginal Tax Rate > Tax BracketThe Root CauseGlass Half FullExamplesTax Credit PhaseoutDividends and Capital Gains Bump Zone“Tax Torpedo” on Social Security BenefitsConclusionMarginal Tax Rate > Tax BracketIf you paid more attention to taxes, you would also know that your marginal tax rate isn’t necessarily those in the published tax brackets — 12%, 22%, 24%, 32%, etc. Other parts of the tax laws can give you a high marginal tax rate even when you don’t have a high income.

I showed this effect in Receive EITC, Contribute to Traditional 401k Not Roth 401k. People with a low enough income to qualify for the Earned Income Tax Credit (EITC) face a marginal tax rate as high as 41%. Mike Piper also explained this phenomenon well with more examples in his blog post Marginal Tax Rate: Not (Necessarily) The Same As Your Tax Bracket.

Some authors (not Mike Piper) use incendiary language and call it the tax torpedo, tax time bomb, etc., especially when it relates to taxes on retirement income.

The Root CauseAn unusually high marginal tax rate at a modest income almost always results from losing some tax benefits as your income goes up. The additional income gets taxed at the normal rate but losing some other tax benefits at the same time compounds the effect.

For instance, if an additional $1,000 of income normally gets taxed at 12% but you also lose $300 in other tax benefits due to this higher income, your taxes will go up by $120 + $300 = $420. That’s a 42% marginal tax rate, not 12%. People caught by this are naturally upset. They say they’re paying a higher tax rate than the rich.

The thing is, when you have an unusually high marginal tax rate, you’re actually paying lower taxes than other people with the same income. In other words, the unusually high marginal tax rate is a blessing, not a curse.

Glass Half FullYou pay lower taxes than other people with the same income because when you’re losing some tax benefits, you have something to lose to begin with. As you lose some of those tax benefits, you still get to keep a part of them. Income isn’t the only qualification criterion for tax benefits. Keeping some tax benefits makes you pay lower taxes than other people with the same income who aren’t eligible for those tax benefits for other reasons.

It’s a classic story of a glass half full or half empty. Losing some tax benefits gives you an unusually high marginal tax rate, bad! Keeping some tax benefits lowers your taxes, good! Should you lament at the loss or savor the part that you keep?

ExamplesLet’s look at some real-world examples.

Tax Credit PhaseoutThe American Opportunity Credit is a tax credit for people paying college expenses. The maximum credit is $2,500 per student. For a married couple in a specific range of income, they lose $125 per student for every additional $1,000 of income. People with income below the phaseout range get the maximum credit. People with income above the phaseout range get nothing.

Let’s say a married couple has two kids going to college in the same year. They would normally qualify for a $5,000 tax credit but they lose $3,000 of it because their income is in the phaseout range. Their marginal tax rate is the normal rate from their tax bracket plus 25%, but they still receive a $2,000 tax credit after losing $3,000. They pay $2,000 less in taxes than another couple with the same income whose kids don’t go to college. Higher marginal tax rate, yes, but lower total taxes in dollars. Getting a tax credit when your kids go to college (and presumably will have a better future) is great.

A similar effect exists in many other tax credits and deductions with an income phaseout, such as child tax credit, child and dependent care credit, earned income credit, saver’s credit, student loan interest deduction, and so on. In each case, a higher marginal tax rate from losing some tax credits and deductions means lower taxes compared to others with the same income but don’t qualify for those credits or deductions due to other reasons.

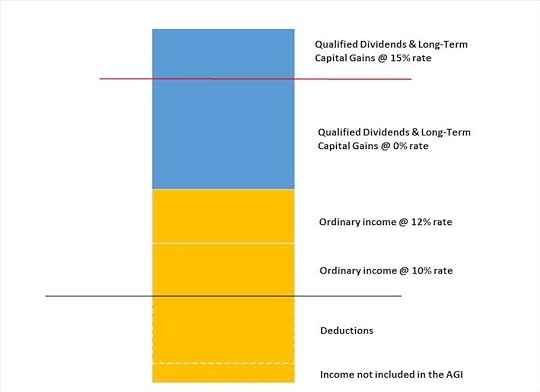

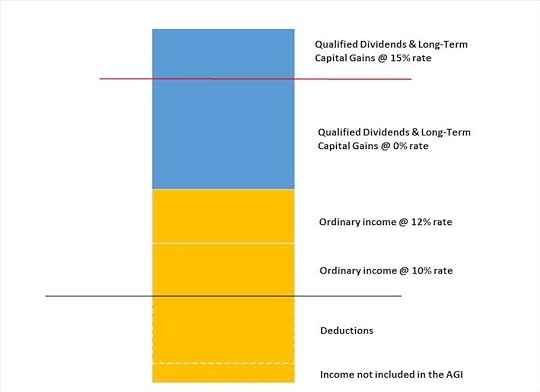

Dividends and Capital Gains Bump ZoneA “bump zone” exists when a part of your qualified dividends and long-term capital gains is taxed at 0% and the remaining part is taxed at 15%. Any additional ordinary income will be taxed at the normal tax rate in addition to bumping an equal amount of the qualified dividends and long-term capital gains from the 0% rate to the 15% rate. The net effect is that the additional ordinary income is taxed at 25% or 27% instead of 10% or 12%.

Suppose a married couple has $40,000 of income taxed at ordinary rates plus $60,000 in qualified dividends and long-term capital gains. If they receive an additional $1,000 in ordinary income, it’s taxed at 12% but it also bumps $1,000 of their qualified dividends and long-term capital gains out of the 0% rate to the 15% rate. Their marginal tax rate on this $1,000 of additional income is 12% + 15% = 27%.

Compare that to another couple with $90,000 of income taxed at ordinary rates and $10,000 in qualified dividends and long-term capital gains. If they receive an additional $1,000 in ordinary income, it’s taxed at 22% with no bumping effect because all of their qualified dividends and long-term capital gains are already taxed at 15%.

Both couples have the same total taxable income of $100,000. Although the first couple’s 27% marginal tax rate is higher than the second couple’s 22%, the first couple pays a much lower amount of total taxes in dollars because a big part of their income is still taxed at 0% after a small part is bumped out to 15%.

Again, a higher marginal tax rate means lower total taxes at the same income.

“Tax Torpedo” on Social Security BenefitsRetirees don’t pay federal income tax on their Social Security benefits when their income is low. As their income goes up and crosses a threshold, they start paying taxes on a part of their Social Security benefits. This works similarly to the bumping effect in the previous section on qualified dividends and long-term capital gains. Additional income is taxed at the normal rate plus it bumps another amount of the Social Security benefits out of the 0% rate.

It’s a little different than the dividends and capital gains bump zone in two ways:

1. The bump isn’t dollar-for-dollar. Each dollar of additional income only bumps 50 cents or 85 cents of Social Security benefits out of the 0% rate.

2. Social Security benefits can never be completely bumped out of the 0% rate. The bumping stops when 85% of the Social Security benefits are taxable. At least 15% of the benefits will stay tax-free even if your income is $1 million.

The effect of this bumping is that for some Social Security recipients in a range of income, their marginal tax rate on additional income is 1.5x or 1.85x of the normal rate. Some people call this the tax torpedo.

Suppose a married couple has $30,000 of income taxed at ordinary rates plus $50,000 in Social Security benefits. If they get another $1,000 from interest on their savings account, this $1,000 is taxed at 12% but it also makes another $850 of their Social Security benefits taxable. Their marginal tax rate on this $1,000 is 12% * 1.85 = 22.2% because they’re being “tax-torpedoed.”

Compare that to another couple with $80,000 of income taxed at ordinary rates who are not receiving Social Security benefits. If they get the same additional $1,000 from interest on their savings account, it’s taxed at 12% with no torpedoes.

Both couples have the same total income. Although the first couple’s 22.2% marginal tax rate is higher than the second couple’s 12%, the first couple pays a lower amount of total taxes in dollars. After taking on all the torpedoes, a good part of their income stays tax-free.

ConclusionKnowing your marginal tax rate is important for tax planning on things to do on the margin — making Traditional vs. Roth contributions, realizing capital gains, Roth conversions, etc. — but having an unusually high marginal tax rate isn’t a problem. You’re not being penalized. You’re actually rewarded with paying lower taxes.

If you see people trying to rile you up by pointing to an unusually high marginal tax rate, they’re either misinformed or trying to mislead. What matters to your bottom line is the total amount of taxes you pay in dollars. You live on total after-tax dollars, not on marginal tax rates. An unusually high marginal tax rate coupled with low total taxes in dollars sure beats the other way around.

If you find yourself with an unusually high marginal tax rate, don’t dread it. Celebrate. It means you’re paying lower taxes than other people with the same income. It also gives you bigger incentives to lower your income and lower your taxes even further. You get much higher tax savings from your pre-tax contributions. Doing less work for a better work-life balance costs you less in after-tax income. It’s a great position to be in.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post An Unusually High Marginal Tax Rate Means Paying Lower Taxes appeared first on The Finance Buff.

July 13, 2022

2022 2023 Tax Brackets, Standard Deduction, 0% Capital Gains, etc.

[Updated on July 13, 2022 after the release of the inflation numbers for June 2022.]

My other post listed the 2022 2023 retirement account contribution and income limits. I also calculated the inflation-adjusted tax brackets and some of the most commonly used numbers in tax planning for 2023 using the published inflation numbers and the same formula prescribed in the tax law. I’m calling these projections “preliminary” but they should be fairly close. I’ll keep them updated in the coming months.

Table of Contents2022 2023 Standard Deduction2022 2023 Tax Brackets2022 2023 0% Capital Gains Tax2022 2023 Gift Tax Exclusion2022 Savings Bonds Tax-Free Redemption for College Expenses2022 2023 Standard DeductionYou don’t pay federal income tax on every dollar of your income. You deduct an amount from your income before you calculate taxes. About 90% of all taxpayers take the standard deduction. The other ~10% itemize deductions when their total deductions exceed the standard deduction. In other words, you’re deducting a larger amount than your allowed deductions when you take the standard deduction. Don’t feel bad about taking the standard deduction!

The basic standard deduction in 2022 and 2023 are:

20222023 (Preliminary)Single or Married Filing Separately$12,950$13,850Head of Household$19,400$20,800Married Filing Jointly$25,900$27,700Basic Standard DeductionSource: IRS Rev. Proc. 2021-45, author’s own calculations.

People who are age 65 and over have a higher standard deduction than the basic standard deduction.

20222023 (Preliminary)Single, age 65 and over$14,700$15,700Head of Household, age 65 and over$21,150$22,650Married Filing Jointly, one person age 65 and over$27,300$29,200Married Filing Jointly, both age 65 and over$28,700$30,700Standard Deduction for age 65 and overSource: IRS Rev. Proc. 2021-45, author’s own calculations.

People who are blind have an additional standard deduction.

20222023 (Preliminary)Single or Head of Household, blind+$1,750+$1,850Married Filing Jointly, one person is blind+$1,400+$1,500Married Filing Jointly, both are blind+$2,800+$3,000Additional Standard Deduction for BlindnessSource: IRS Rev. Proc. 2021-45, author’s own calculations.

2022 2023 Tax BracketsThe tax brackets are based on taxable income, which is AGI minus various deductions. The tax brackets in 2022 are:

SingleHead of HouseholdMarried Filing Jointly10%$0 – $10,275$0 – $14,650$0 – $20,55012%$10,275- $41,775$14,650 – $55,900$20,550 – $83,55022%$41,775 – $89,075$55,900 – $89,050$83,550 – $178,15024%$89,075 – $170,050$89,050 – $170,050$178,150 – $340,10032%$170,050 – $215,950$170,050 – $215,950$340,100 – $431,90035%$215,950 – $539,900$215,950 – $539,900$431,900 – $647,85037%Over $539,900Over $539,900Over $647,850Tax BracketsSource: IRS Rev. Proc. 2021-45.

The preliminary 2023 tax brackets are:

SingleHead of HouseholdMarried Filing Jointly10%$0 – $11,000$0 – $15,700$0 – $22,00012%$11,000 – $44,775$15,700 – $59,900$22,000 – $89,55022%$44,775 – $95,475$59,900 – $95,450$89,550 – $190,95024%$95,475 – $182,275$95,450 – $182,250$190,950 – $364,55032%$182,275 – $231,450$182,250 – $231,450$364,550 – $462,90035%$231,450 – $578,650$231,450 – $578,650$462,900 – $694,35037%Over $578,650Over $578,650Over $694,350Tax BracketsSource: author’s own calculations.

A common misconception is that when you get into a higher tax bracket, all your income is taxed at the higher rate, and you’re better off not having the extra income. That’s not true. Tax brackets work incrementally. If you’re $1,000 into the next tax bracket, only $1,000 is taxed at the higher rate. It doesn’t affect the income in the previous brackets.

For example, someone single with a $60,000 AGI in 2022 will pay:

First 12,950 (the standard deduction)0%Next $10,27510%Next $31,500 ($41,775 – $10,275)12%Final $5,27522%Progressive Tax RatesThis person is in the 22% tax bracket but only $5,275 out of the $60,000 AGI is really taxed at 22%. The bulk of the income is taxed at 0%, 10%, and 12%. The blended tax rate is only 9.9%. If this person doesn’t earn the final $5,275, he or she is in the 12% bracket instead of the 22% bracket, but the blended tax rate only goes down slightly from 9.9% to 8.8%. Making the extra $5,275 income doesn’t cost this person more in taxes than the extra income.

Don’t be afraid of going into the next tax bracket.

2022 2023 0% Capital Gains TaxWhen your other taxable income (after deductions) plus your qualified dividends and long-term capital gains are below a cutoff, you will pay no federal income tax on your qualified dividends and long-term capital gains under this cutoff.

This is illustrated by the chart below. Taxable income is the part above the black line, after subtracting deductions. A portion of the qualified dividends and long-term capital gains is taxed at 0% when the other taxable income plus these qualified dividends and long-term capital gains are under the red line.

The red line is close to the top of the 12% tax bracket but they don’t line up exactly.

20222023 (Preliminary)Single or Married Filing Separately$41,675$44,650Head of Household$55,800$59,800Married Filing Jointly$83,350$89,300Maximum Zero Rate Amount for Qualified Dividends and Long-term Capital GainsSource: IRS Rev. Proc. 2021-45, author’s own calculations.

For example, suppose a married couple filing jointly has $70,000 in other taxable income (after deductions) and $20,000 in qualified dividends and long-term capital gains in 2022. The maximum zero rate amount cutoff is $83,350. $13,350 of the qualified dividends and long-term capital gains ($83,350 – $70,000) is taxed at 0%. The remaining $20,000 – $13,350 = $6,650 is taxed at 15%.

2022 2023 Gift Tax ExclusionEach person can give another person up to a set amount in a calendar year without having to file a gift tax form. Not that filing a gift tax form is onerous, but many people avoid it if they can. In 2023, this gift tax exclusion amount will likely increase from $16,000 to $17,000.

20222023 (Preliminary)Gift Tax Exclusion$16,000$17,000Source: IRS Rev. Proc. 2021-45, author’s own calculations.

The gift tax exclusion is counted by each giver to each recipient. As a giver, you can give up to $16,000 each to an unlimited number of people without having to file a gift tax form. If you give $16,000 to each of your 10 grandkids in 2022 for a total of $160,000, you still won’t be required to file a gift tax form. Any recipient can also receive a gift from an unlimited number of people. If a grandchild receives $16,000 from each of his or her four grandparents in 2022, no taxes or tax forms will be required.

2022 Savings Bonds Tax-Free Redemption for College ExpensesIf you cash out U.S. Savings Bonds (Series I or Series EE) for college expenses or transfer to a 529 plan, your modified adjusted gross income must be under certain limits to get a tax exemption on the interest. Here are the income limits depending on your filing status in 2022:

Single, Head of HouseholdMarried Filing JointlyFull Exemption$85,800$128,650Partial Exemption$100,800$158,650Income Limit for Tax-Free Savings Bond Redemption for Higher EducationSource: IRS Rev. Proc. 2021-45.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 2023 Tax Brackets, Standard Deduction, 0% Capital Gains, etc. appeared first on The Finance Buff.

2022 2023 401k 403b 457 IRA FSA HSA Contribution Limits

[Updated on July 13, 2022 with preliminary projections for 2023.]

Retirement plan contribution limits are adjusted for inflation each year. Inflation has been at elevated levels in recent months. Most contribution limits and income limits will go up in 2023.

Before the IRS publishes the official numbers in late October or early November, I’m able to make my own calculations using the published inflation numbers and going by the same rules the IRS uses as stipulated by law. I’ve maintained a record of 100% accuracy ever since I started doing these calculations. However, higher inflation makes it more difficult to hit 100% accuracy. I’m calling my 2023 projections “preliminary” at this point, but they should be fairly close. I’ll keep these updated in the coming months.

Table of Contents2023 401k/403b/457/TSP Elective Deferral Limit2023 Annual Additions Limit2023 SEP-IRA Contribution Limit2023 Annual Compensation Limit2023 Highly Compensated Employee Threshold2023 SIMPLE 401k and SIMPLE IRA Contribution Limit2023 Traditional and Roth IRA Contribution Limit2023 Deductible IRA Income Limit2023 Roth IRA Income Limit2023 Healthcare FSA Contribution Limit2023 HSA Contribution Limit2023 Saver’s Credit Income LimitAll Together2023 401k/403b/457/TSP Elective Deferral Limit401k/403b/457/TSP contribution limit will go up by $2,000 from $20,500 in 2022 to $22,500 in 2023. This limit usually goes up by $500 at a time but higher inflation is making it go four steps in one year.

If you are age 50 or over, the catch-up contribution limit will go up by $1,000 from $6,500 in 2022 to $7,500 in 2023.

Employer match or profit-sharing contributions aren’t included in these limits. If you work for multiple employers in the same year or if your employer offers multiple plans, you have one single employee contribution limit for 401k, 403b, and TSP across all plans.

The 457 plan limit is separate from the 401k/403b/TSP limit. You can contribute the maximum to both a 401k/403b/TSP plan and a 457 plan.

2023 Annual Additions LimitThe total employer plus employee contributions to all defined contribution plans by the same employer will increase by $6,000 from $61,000 in 2022 to $67,000 in 2023. This limit usually increases by $1,000 at a time but now it’s jumping six steps in one year.

The age-50-or-over catch-up contribution is separate from this limit. If you work for multiple employers in the same year, you have a separate annual additions limit for each unrelated employer.

2023 SEP-IRA Contribution LimitThe SEP-IRA contribution limit is always the same as the annual additions limit for a 401k plan. It will also increase by $6,000 from $61,000 in 2022 to $67,000 in 2023.

Because the SEP-IRA doesn’t allow employee contributions, unless your self-employment income is well above $200,000, you have a higher contribution limit if you use a solo 401k. See Solo 401k When You Have Self-Employment Income.

2023 Annual Compensation LimitThe maximum annual compensation that can be considered for making contributions to a retirement plan is always 5x the annual additions limit. Therefore the annual compensation limit will increase by $30,000 from $305,000 in 2022 to $335,000 in 2023.

2023 Highly Compensated Employee ThresholdIf your employer limits your contribution because you are a Highly Compensated Employee (HCE), the minimum compensation will go up by $15,000 from $135,000 in 2022 to $150,000 in 2023.

2023 SIMPLE 401k and SIMPLE IRA Contribution LimitSIMPLE 401k and SIMPLE IRA plans have a lower limit than standard 401k plans. The contribution limit for SIMPLE 401k and SIMPLE IRA plans will go up by $1,500 from $14,000 in 2022 to $15,500 in 2023.

If you are age 50 or over, the catch-up contribution limit in a SIMPLE 401k or SIMPLE IRA plan will increase by $500 from $3,000 in 2022 to $3,500 in 2023.

Employer contributions to a SIMPLE 401k or SIMPLE IRA plan aren’t included in these limits.

2023 Traditional and Roth IRA Contribution LimitThe Traditional or Roth IRA contribution limit will go up by $500 from $6,000 in 2022 to $6,500 in 2023. The age 50 catch-up limit is fixed by law at $1,000 in all years.

The IRA contribution limit and the 401k/403b/TSP or SIMPLE contribution limit are separate. You can contribute the respective maximum to both a 401k/403b/TSP/SIMPLE plan and a traditional or Roth IRA.

2023 Deductible IRA Income LimitThe income limit for taking a full deduction for your contribution to a traditional IRA while participating in a workplace retirement will increase by $5,000 for singles, from $68,000 in 2022 to $73,000 in 2023. It will increase by $8,000 for married filing jointly, from $109,000 in 2022 to $117,000 in 2023. The deduction completely phases out when your income goes above $78,000 in 2022 and $83,000 in 2023 for singles; and for married filing jointly, $129,000 in 2022 and $137,000 in 2023.

The income limit for taking a full deduction for your contribution to a traditional IRA when you are not covered in a workplace retirement but your spouse is will go up by $15,000 for married filing jointly from $204,000 in 2022 to $219,000 in 2023. The deduction completely phases out when your joint income goes above $214,000 in 2022 and $229,000 in 2023.

2023 Roth IRA Income LimitThe income limit for contributing the maximum to a Roth IRA will go up by $9,000 for singles from $129,000 in 2022 to $138,000 in 2023. It will go up by $15,000 for married filing jointly from $204,000 in 2022 to $219,000 in 2023.

You can’t contribute anything directly to a Roth IRA when your income goes above $144,000 in 2022 and $153,000 in 2023 for singles, and $214,000 in 2022 and $229,000 in 2023 for married filing jointly, up by $9,000 and $15,000 respectively in 2023. 2022 may be the last year you can do a backdoor Roth.

2023 Healthcare FSA Contribution LimitThe Healthcare FSA contribution limit will go up by $200 from $2,850 per person in 2022 to $3,050 per person in 2023.

Some employers allow carrying over some unused amount to the following year. The maximum amount that can be carried over to the following year is set to 20% of the annual contribution limit. As a result, the carryover limit will go up by $40 from $570 per person in 2022 to $610 per person in 2023.

2023 HSA Contribution LimitThe HSA contribution limit for single coverage will go up by $200 from $3,650 in 2022 to $3,850 in 2023. The HSA contribution limit for family coverage will go up from $7,300 in 2022 to $7,750 in 2023. These were announced previously in the spring. Please see HSA Contribution Limits.

Those who are 55 or older can contribute an additional $1,000. If you are married and both of you are 55 or older, each of you can contribute the additional $1,000, but they must go into separate HSAs in each person’s name.

2023 Saver’s Credit Income LimitThe income limits for receiving a Retirement Savings Contributions Credit (“Saver’s Credit”) will increase in 2023. For married filing jointly, it will be $41,000 in 2022 and $43,500 in 2023 (50% credit), $44,000 in 2022 and $47,500 in 2023 (20% credit), and $68,000 in 2022 and $73,000 in 2023 (10% credit).

The limits for singles will be at half of the limits for married filing jointly, at $20,050 in 2022 and $21,750 in 2023 (50% credit), $22,000 in 2022 and $23,750 in 2023 (20% credit), and $34,000 in 2022 and $36,500 in 2023 (10% credit).

All Together 20222023IncreaseLimit on employee contributions to 401k, 403b, or 457 plan$20,500$22,500$2,000Limit on age 50+ catchup contributions to 401k, 403b, or 457 plan$6,500$7,500$1,000SIMPLE 401k or SIMPLE IRA contributions limit$14,000$15,500$1,500SIMPLE 401k or SIMPLE IRA age 50+ catchup contributions limit$3,000$3,500$500Highly Compensated Employee definition$135,000$150,000$15,000Maximum annual additions to all defined contribution plans by the same employer$61,000$67,000$6,000SEP-IRA contribution limit$61,000$67,000$6,000Traditional and Roth IRA contribution limit$6,000$6,500$500Traditional and Roth IRA age 50+ catchup contribution limit$1,000$1,000NoneDeductible IRA income limit, single, active participant in workplace retirement plan$68,000 – $78,000$73,000 – $83,000$5,000Deductible IRA income limit, married, active participant in workplace retirement plan$109,000 – $129,000$117,000 – $137,000$8,000Deductible IRA income limit, married, spouse is active participant in workplace retirement plan$204,000 – $214,000$219,000 – $229,000$15,000Roth IRA income limit, single$129,000 – $144,000$138,000 – $153,000$9,000Roth IRA income limit, married filing jointly$204,000 – $214,000$219,000 – $229,000$15,000Healthcare FSA Contribution Limit$2,850$3,050$200HSA Contribution Limit, single coverage$3,650$3,850$200HSA Contribution Limit, family coverage$7,300$7,750$450HSA, age 55 catch-up$1,000$1,000NoneSaver’s Credit income limit, married filing jointly$41,000 (50%)$44,000 (20%)

$68,000 (10%)$43,500 (50%)

$47,500 (20%)

$73,000 (10%)$2,500 (50%)

$3,500 (20%)

$5,000 (10%)Saver’s Credit income limit, single$20,500 (50%)

$22,000 (20%)

$34,000 (10%)$21,750

(50%)

$23,750 (20%)

$36,500 (10%)$1,250 (50%)

$1,750 (20%)

$2,500 (10%)

Source: IRS Notice 2021-61, author’s own calculations.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 2023 401k 403b 457 IRA FSA HSA Contribution Limits appeared first on The Finance Buff.

July 8, 2022

How to Split an Existing I Bond for Multiple Beneficiaries

When savings bonds were only on paper, there was no account. The co-owner or the beneficiary had to be printed on the paper bond itself. The paper bond had room for only one co-owner or beneficiary.

After Treasury started issuing savings bonds in the online TreasuryDirect account, they continued with this setup. You have an online account but you can’t set your second owner or beneficiary at the account level as you normally do in your other investment accounts. You set it at the holdings level — bond by bond — and each bond can have only one person as the second owner or the beneficiary. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

Table of ContentsSplit for Multiple BeneficiariesCustom Linked AccountOpen Custom Linked AccountPartial Transfer(Optional) Wait a Few DaysTransfer BackSplit for Multiple BeneficiariesIf you have two children, you can’t name both of them as 50/50 beneficiaries on the same bond. You’ll have to buy two bonds, one with each child as the beneficiary. See How to Buy I Bonds.

What if you didn’t realize this and you only placed one order for $10,000? How do you split your existing $10,000 bond into two $5,000 bonds and name a different child for each half?

There’s no direct way to do this in TreasuryDirect, but I figured out an indirect way.

Custom Linked AccountTreasuryDirect lets you open a Custom Linked Account linked to your main account. It’s like a sub-account or a goal savings account. In their words:

This is a flexible account you can establish to meet specific financial goals. You can even create a customized name, such as “Vacation Fund,” for the account. We offer the same convenient capabilities as in your Primary TreasuryDirect account.

The Custom Linked Account can only be accessed through your main account. Having a Custom Linked Account doesn’t increase your annual purchase limit. It only lets you separate your holdings for organization purposes. Most people don’t need a Custom Linked Account. We will use it to split your existing bond.

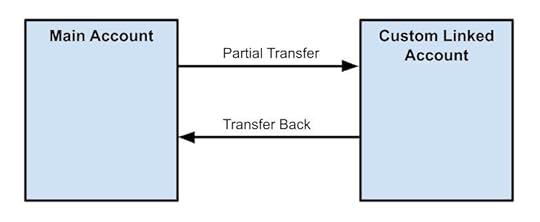

The idea is that you do a partial transfer of your existing bond to this Custom Linked Account. This will split your existing bond into two places — one part is in the Custom Linked Account and the other part stays in the main account. If you need to split an existing bond into more than two parts, repeat the partial transfer. After you’re done with splitting, you transfer the split parts back to your main account.

Transferring parts of an existing bond back and forth between your main account and your Custom Linked Account doesn’t trigger taxes. Nor does it eat into your annual purchase limit.

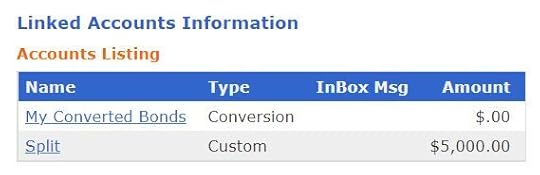

If you already have a Conversion Linked Account from depositing paper bonds to your TreasuryDirect account, you can also use that one to hold the splits. You don’t need to open a Custom Linked Account.

Open Custom Linked AccountI’m showing how to split using a Custom Linked Account even though I already have a Conversion Linked Account.

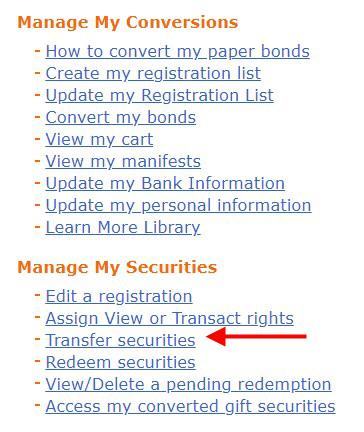

To open a Custom Linked Account, go to ManageDirect and then click on “Establish a Custom Linked Account.”

You’ll be prompted to answer a security question. Then it will ask you to give a personalized name for this new account and whether to use the same email address or a new email address. I just called this new account “Split” because I’ll use it to split an existing bond.

Your existing personal information and bank account information will copy over to the Custom Linked Account but we’re not going to buy new bonds in this account. After you submit the information, you will see an account number for the Custom Linked Account on the top right. Copy the account number. You’ll need it when you do the partial transfer.

Partial Transfer

Click on the link to your main account on the top right to go back to your main account. Go to ManageDirect and then click on “Transfer securities.”

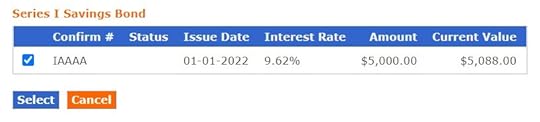

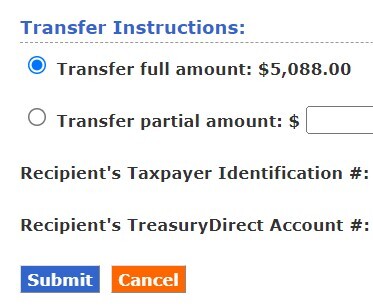

Select one of your existing bonds. You can only split one bond at a time.

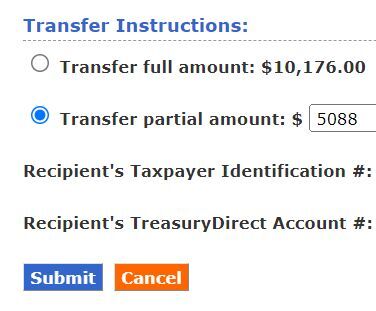

Choose “Transfer partial amount.” I divided the current value by two because I’m splitting this bond 50/50. If you’d like to split it three-way or in different percentages, adjust your partial amount off of the full amount including interest. Give your own Social Security Number as the “Recipient’s Taxpayer Identification #” because you’re transferring to a Custom Linked Account owned by yourself. You give the account number of the Custom Linked Account as the “Recipient’s TreasuryDirect Account #“.

The transfer happens immediately. If you’d like to split your bond into more than two parts, just repeat this process.

(Optional) Wait a Few DaysYou may be able to transfer the split part from your Custom Linked Account back to your main account right away, but I waited a few days just in case it needed to age a little bit and get settled in the new home. I wasn’t in any hurry anyway. This may not be necessary but I figured it couldn’t hurt.

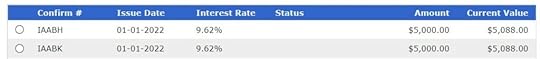

Transfer BackThe process to transfer the split-off bond from the Custom Linked Account back to the main account is just the reverse of the previous move.

Log in to your main account. Scroll to the bottom to find your list of linked accounts. Click on the link for the Custom Linked Account.

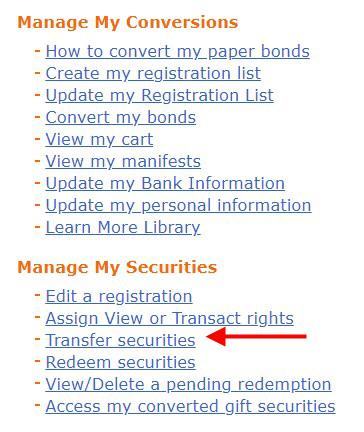

Go to ManageDirect, and then click on “Transfer securities.”

Answer the security question. If you split your bond into more than two parts, you can select all the bonds in the Custom Linked Account. If you only have one bond in the Custom Linked Account, select it and choose “Transfer full amount” this time.

Give your own Social Security Number as the “Recipient’s Taxpayer Identification #” and give the account number of your main account as the “Recipient’s TreasuryDirect Account #“.

Click on the link to your main account on the top right to go back to your main account. Click on Current Holdings. You’ll see all the parts of your original bond.

Now you can assign a different second owner or beneficiary for each part. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Split an Existing I Bond for Multiple Beneficiaries appeared first on The Finance Buff.

June 29, 2022

A Large Margin of Safety Reduces Stress and Need for Precision

I eat oatmeal for breakfast. Because I’m lazy, I cook it in the microwave. When I first started doing it, the oatmeal overflowed and made a mess in the microwave.

I found a discussion online on this same problem. People had many different suggestions. Someone said to use water instead of milk. Someone said to cook it at 50% power for a longer time. Someone said to interrupt it in the middle, stir, and continue. Someone said to add a pinch of salt. Finally, someone said,

Just use a bigger bowl.

I bought this bowl from Target for $2. Problem solved.

You don’t have to be precise when the bowl is big enough. It doesn’t matter whether you use milk or water. You can cook at full power. You don’t need to stir and reheat. The big bowl gives you more leeway.

Benjamin Graham talked about the concept of “margin of safety” in the context of investing. When you buy at a wide margin of safety between a stock’s price and its intrinsic value, you’ll still get a good return even when your estimate of the intrinsic value is off a little.

Translating to personal finance, using a bigger bowl means saving and investing more such that you’ll always meet your goal even if you run into unfavorable market conditions. You don’t have to be precise in how much of your savings should go into traditional or Roth accounts. You’ll still be OK if you invested a good chunk in international stocks when international stocks did poorly relative to U.S. stocks.

At retirement, it means having a large portfolio such that you won’t worry about bear markets or high inflation. You spend your time on activities you enjoy, not watching what the Fed will do next. Your retirement success won’t depend on knowing when to harvest tax losses, how much you should convert to Roth, or whether you’ll pay IRMAA.

Big Bowls In ActionI read an interesting discussion on the Bogleheads forum. The poster retired in October 2021 but he had over 80% of his investment portfolio in one stock. As of early June when he posted an update, the value of his investment portfolio dropped 22% in five months. He had plans to reduce exposure to this single stock, but overall he hadn’t felt any undue stress. He was comfortable waiting for his investment thesis to play out.

Besides his confidence in this company as a leader in its field, he didn’t feel stressed because he had a big bowl. His portfolio value was $9 million after the drop and he planned to spend $250k a year in retirement. The planned expenses were less than 3% of the value of his portfolio and I imagine that a large portion is discretionary. It would be quite a different story if his portfolio value was $900k and the planned expenses were basic needs. The bigger bowl allowed him to take risks that are otherwise considered reckless.

I won’t put 80% of my portfolio in one single stock if I have $9 million but I’m not too worried about this person. The bowl is big enough. He can do whatever he wants.

I also read this interview of a retiree on ESI Money blog. He retired 14 months ago. His wife has been a stay-at-home mom for 15 years. Their investment portfolio is 89% in hedge funds plus some small percentages in real estate and other assets. That’s certainly unconventional but he’s not too concerned with not having enough safe assets such as bonds or annuities because they have $13 million in investments while spending $186k a year.

I won’t put 89% of my investments in hedge funds if I have $13 million but I’m not worried about them either. They have a big enough bowl.

If You’ve Won the Game, Stop PlayingInvestment advisor and author Dr. William Bernstein famously said:

If you’ve won the game, stop playing.

This suggests reducing risk when you have enough assets to provide an adequate lifetime income stream.

You’ll have to decide whether you truly won the game. If your investments teeter on the edge between enough and not enough, you’ll naturally worry while going through rough patches. This creates great demand for retirement calculators and optimizing orders of withdrawals, Social Security benefits, and Roth conversions. Everyone wants to know whether they have enough to retire.

Ironically, when it’s abundantly clear they’ve won the game (“a big bowl”), as in the two examples above, it doesn’t really matter that much whether they stop playing or not. They can stop playing and convert everything into safe assets. Or they can keep playing and take unnecessary risks as they prefer. They’ll make it either way.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post A Large Margin of Safety Reduces Stress and Need for Precision appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower