Harry Sit's Blog, page 16

February 13, 2023

One 1099-R Form for Two Rollovers in TurboTax and H&R Block

When you do a direct rollover from the pre-tax account in a workplace retirement plan to a Traditional IRA, you’ll get a 1099-R form after the end of the year that shows the rollover isn’t taxable. When you do a rollover from the pre-tax account to a Roth account, you’ll get a 1099-R form after the end of the year that shows a taxable amount.

Both of these 1099-R forms are straightforward. It’s either taxable or not taxable. You enter the 1099-R form in your tax software and tell it whether the rollover went to a Traditional account or a Roth account.

Combined 1099-R for Mixed RolloversWhen you do a mix of two or more rollovers in the same year — one to Traditional and one to Roth — your plan administrator may issue a combined 1099-R form for both rollovers. The combined 1099-R form shows that only a portion of your rollovers is taxable.

Example: Suppose you rolled over $30,000 to a Traditional IRA and $20,000 to a Roth account from the pre-tax account in your workplace retirement plan. You may get a 1099-R form that looks like this:

Box 1 Gross Distribution$50,000Box 2a Taxable Amount$20,000Box 2b Taxable amount not determinednot checkedBox 5 Employee contributions/Designated Rothcontributions or insurance premiums$0Box 7 Distribution code(s)GBox 7 IRA/SEP/SIMPLE checkboxnot checkedA combined 1099-R form

This 1099-R form is correct. It shows that a total of $50,000 came out of the plan. $20,000 is taxable because it went into a Roth account and the other $30,000 isn’t taxable because it was rolled over to a Traditional IRA.

Split 1099-R Form for Tax SoftwareTax software such as TurboTax, H&R Block, or FreeTaxUSA sometimes has difficulty in dealing with a combined 1099-R form like this. The software asks you whether the money went to a Roth account. If you answer “Yes” it treats the entire $50,000 as taxable. If you answer “No” it treats the entire $50,000 as not taxable.

The software assumes that a rollover went into either a Traditional IRA or a Roth account but not both on the same 1099-R form. The trick to deal with this deficiency in the tax software is to split the combined 1099-R form into two — one for the rollover to the Traditional IRA and another for the rollover to the Roth account.

If you imported the combined 1099-R form, delete it and enter two 1099-R forms manually. Use the same payer name, address, and tax ID for both 1099-R forms.

You enter this 1099-R form for the rollover to a Traditional IRA:

Box 1 Gross Distribution$30,000Box 2a Taxable Amount$0Box 2b Taxable amount not determinednot checkedBox 5 Employee contributions/Designated Rothcontributions or insurance premiums$0Box 7 Distribution code(s)GBox 7 IRA/SEP/SIMPLE checkboxnot checkedA 1099-R Form for Rollover to Traditional IRA

You tell the software that this rollover went to a Traditional IRA. The software will make it not taxable.

Then you enter another 1099-R form for the rollover to a Roth account:

Box 1 Gross Distribution$20,000Box 2a Taxable Amount$20,000Box 2b Taxable amount not determinednot checkedBox 5 Employee contributions/Designated Rothcontributions or insurance premiums$0Box 7 Distribution code(s)GBox 7 IRA/SEP/SIMPLE checkboxnot checkedA 1099-R Form for Rollover to Roth Account

You tell the software that this rollover went to a Roth account. The software will make it taxable.

If your combined 1099-R form has a positive number in Box 5 because you made non-Roth after-tax contributions (“mega backdoor Roth“), include it on the applicable 1099-R form depending on whether the non-Roth after-tax contributions were rolled over to a Traditional IRA or a Roth account.

The two manually split 1099-R forms added together have the same numbers as the original combined 1099-R form. You’re splitting it only because the tax software isn’t smart enough to handle the combined 1099-R. The numbers are combined again on your 1040 tax form. It will show that you’re paying tax on only the portion that you rolled over from a pre-tax account to a Roth account.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post One 1099-R Form for Two Rollovers in TurboTax and H&R Block appeared first on The Finance Buff.

One 1099-R for Two Rollovers in TurboTax and H&R Block

When you do a direct rollover from the pre-tax account in a workplace retirement plan to a Traditional IRA, you’ll get a 1099-R form after the end of the year that shows the rollover isn’t taxable. When you do a rollover from the pre-tax account to a Roth account, you’ll get a 1099-R form after the end of the year that shows a taxable amount.

Both of these 1099-R forms are straightforward. It’s either taxable or not taxable. You enter the 1099-R form in your tax software and tell it whether the rollover went to a Traditional account or a Roth account.

Combined 1099-R for Mixed RolloversWhen you do a mix of two or more rollovers in the same year — one to Traditional and one to Roth — your plan administrator may issue a combined 1099-R form for both rollovers. The combined 1099-R form shows that only a portion of your rollovers is taxable.

Example: Suppose you rolled over $30,000 to a Traditional IRA and $20,000 to a Roth account from the pre-tax account in your workplace retirement plan. You may get a 1099-R form that looks like this:

Box 1 Gross Distribution$50,000Box 2a Taxable Amount$20,000Box 2b Taxable amount not determinednot checkedBox 7 Distribution code(s)GA combined 1099-R formThis 1099-R form is correct. It shows that a total of $50,000 came out of the plan. $20,000 is taxable because it went into a Roth account and the other $30,000 isn’t taxable because it was rolled over to a Traditional IRA.

Split 1099-R Form for Tax SoftwareTax software such as TurboTax, H&R Block, or FreeTaxUSA has difficulty in dealing with a combined 1099-R form like this. The software assumes that a rollover went into either a Traditional IRA or a Roth account but not both on the same 1099-R form.

The trick to deal with this deficiency in the tax software is to split the combined 1099-R form into two — one for the rollover to the Traditional IRA and another for the rollover to the Roth account. Use the same payer name, address, and tax ID for both 1099-R forms.

You enter this 1099-R form for the rollover to a Traditional IRA:

Box 1 Gross Distribution$30,000Box 2a Taxable Amount$0Box 2b Taxable amount not determinednot checkedBox 7 Distribution code(s)GA 1099-R Form for Rollover to Traditional IRAYou tell the software that this rollover went to a Traditional IRA. The software will make it not taxable.

Then you enter another 1099-R form for the rollover to a Roth account:

Box 1 Gross Distribution$20,000Box 2a Taxable Amount$20,000Box 2b Taxable amount not determinednot checkedBox 7 Distribution code(s)GA 1099-R Form for Rollover to Roth AccountYou tell the software that this rollover went to a Roth account. The software will make it taxable.

If your combined 1099-R form has a number in Box 5 because you made non-Roth after-tax contributions (“mega backdoor Roth“), include it on the applicable 1099-R form depending on whether the non-Roth after-tax contributions were rolled over to a Traditional IRA or a Roth account.

The two split 1099-R forms added together have the same numbers as the original combined 1099-R form. You’re splitting it only because the tax software isn’t smart enough to handle the combined 1099-R. The numbers are combined again on your 1040 tax form. It will show that you’re paying tax on only the portion that you rolled over from a pre-tax account to a Roth account.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post One 1099-R for Two Rollovers in TurboTax and H&R Block appeared first on The Finance Buff.

February 2, 2023

Deliver I Bonds Bought as a Gift in TreasuryDirect

Many people bought I Bonds as a gift and kept them for the future when I Bonds had a good interest rate last year. These bonds started earning the good rate while they were held in a “gift box.” They are eligible for delivery to the registered recipient now.

No Change in TermsDelivering a gift bond moves the bond from one account to another. It doesn’t change the terms of the bond — how much interest the bond earns, when the bond can be cashed out, or when the early withdrawal penalty will stop. Those terms were set on the bond itself at the time it was originally purchased. The bond carries the same terms as it moves from one account to another. It doesn’t matter which account the bond resides in.

Limit Resets by Calendar YearReceiving a gift counts against the recipient’s annual limit in the calendar year of the receipt. Because the annual limit resets on January 1 each year, you can deliver a gift early in the year even though you bought it last October. You don’t have to wait 12 months.

Reason to PostponeIf the gift recipient wants to preserve the annual limit for their own purchase, they may want you to postpone the gift delivery but it doesn’t matter between spouses because you can always buy a new gift and hold it in the gift box again.

When you deliver the current gift and buy a new gift to replace it, the gift recipient has a bond and you have a bond in the gift box. If the gift recipient were to buy directly, the new bond has to wait 12 months before it can be cashed out, whereas the 12-month clock on your gift bond already started last year.

Postponing delivery to preserve the annual limit makes sense only when you’re unwilling to buy a new gift.

Delivering the gift now clears the gift out of your gift box. It closes the loop. You will have one less thing hanging in the air. Unless you have a good reason to postpone, just deliver the gift and move on.

Full DeliveryThe principal value of the received gift counts against the recipient’s annual limit. The interest earned doesn’t count against the limit. You can deliver a $10,000 bond in full to the recipient even though the bond is worth more than $10,000 at the time of delivery because it earned some interest.

To deliver the gift, log in to your TreasuryDirect account and click on Gift Box on the right in the menu at the top.

Go into the bond in the list and click on Deliver. Choose the option “Deliver full amount.”

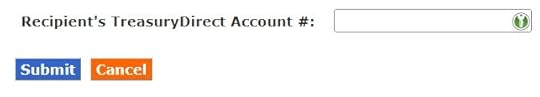

You need the recipient’s TreasuryDirect account number. The name on their TreasuryDirect account and the name on your gift must match exactly including the use of the middle initial versus the full middle name.

Edit RegistrationThe gift bond moves into the recipient’s account as soon as you click on Submit to deliver the gift.

The rightful owner of the gift takes full control of it now. If you made yourself the beneficiary when you bought the gift, the owner can edit the registration to make you the second owner and grant you the transact rights now. Or they can put a different second owner or beneficiary on the bond. See How to Add a Joint Owner or Change Beneficiary on I Bonds and How To Grant Transact or View Right on Your I Bonds.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Deliver I Bonds Bought as a Gift in TreasuryDirect appeared first on The Finance Buff.

January 22, 2023

How to Enter 2022 ESPP Sold in FreeTaxUSA: Adjust Cost Basis

If your employer offers an Employee Stock Purchase Program (ESPP), you should max it out. You come out ahead even if you sell the shares as soon as you can. See Employee Stock Purchase Plan (ESPP) Is A Fantastic Deal.

After you sell the shares from the ESPP, part of the income will be included on your W-2. However, the 1099-B form you receive from the broker still reflects your discounted purchase price. This post shows you how to make the necessary adjustment on your tax return using FreeTaxUSA.

Don’t pay tax twice!

If you use other tax software, please read:

How To Report ESPP Sales In TurboTaxHow to Report ESPP Sales in H&R Block SoftwareTable of ContentsWhen to Report1099-B From BrokerFreeTaxUSAAdjust Cost BasisVerify on Form 8949When to ReportBefore you begin, be sure to understand when you need to report. You report when you sell the shares you bought under your ESPP. If you only bought shares but you didn’t sell during the tax year, there’s nothing to report yet.

Wait until you sell, but write down the full per-share price (before the discount) when you bought. If you purchased multiple times, write down for each purchase:

The purchase dateThe closing price on the grant dateThe closing price on the purchase dateThe number of shares you boughtThis information is very important when you sell.

Let’s use this example:

You bought 1,000 shares under your ESPP on 9/30/20xx. The closing price on the purchase date was $12 per share. The closing price on the grant date six months before was $10 per share. You bought at $8.50 per share with the discount.

You would write down:

Grant Date4/1/20xxMarket Price on the Grant Date$10 per sharePurchase Date9/30/20xxMarket Price on the Purchase Date$12 per shareShares Purchased1,000Discounted Price$8.50 per shareKeep this information until you sell.

1099-B From BrokerWhen you sell, you will receive a 1099-B form from the broker in the following year. You will report your gain or loss using this 1099-B form and the information you accumulated for each purchase. Some brokers will supply supplemental information for your purchases.

Let’s continue our example:

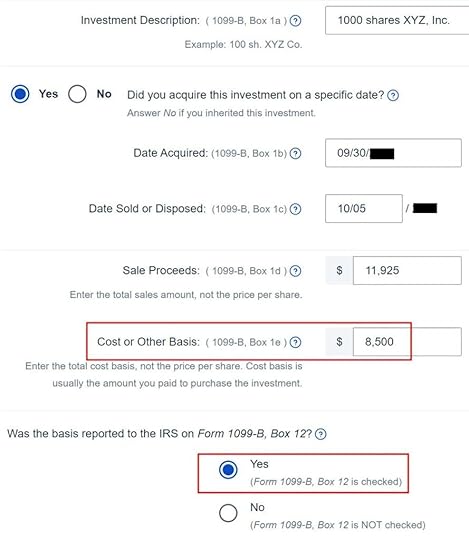

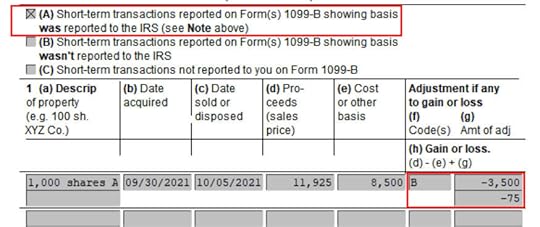

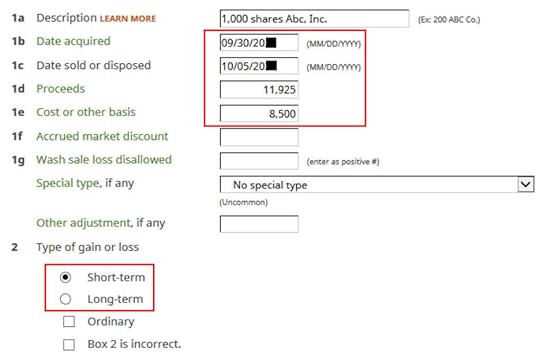

You sold 1,000 shares from your purchase above on 10/5/20xx at $11.95 per share. After commission and fees, you netted $11,925. You received a 1099-B form from your broker showing a sales proceed of $11,925 in the following year. The 1099-B form shows the cost basis as $8,500, which reflects your discounted purchase price.

Because you didn’t hold it for two years after the grant date and one year after the purchase date, your sale was a “disqualifying disposition.” The discount is added as income to your W-2. This raises your cost basis. If you just accept the 1099-B as-is, you will be double-taxed!

FreeTaxUSANow let’s do it in FreeTaxUSA.

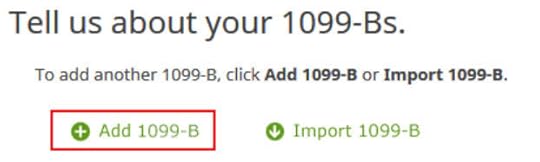

Find “Stocks or Investments Sold (1099-B)” in the “Common Income” section under “Income” in the menu. Click on “Add an Investment Sale.”

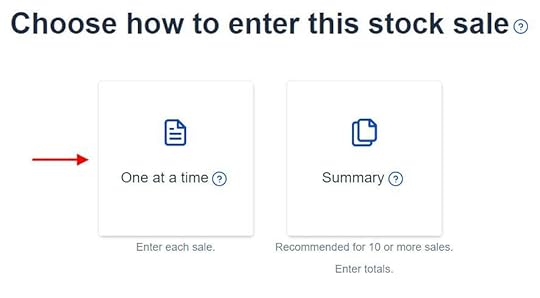

Choose “One at a time.”

Enter the numbers on your 1099-B as they appear. The cost basis on your 1099-B was reported to the IRS but it was too low.

Don’t make any changes here. Your broker sent this information to the IRS. It has to match.

Adjust Cost Basis

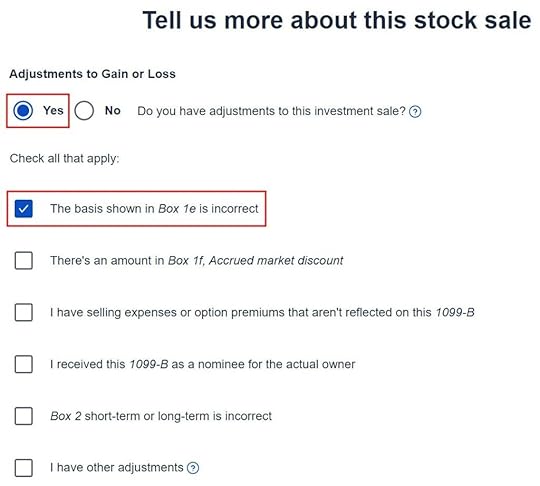

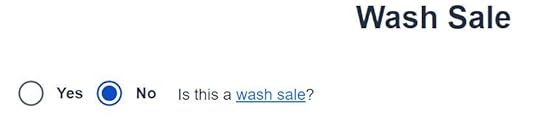

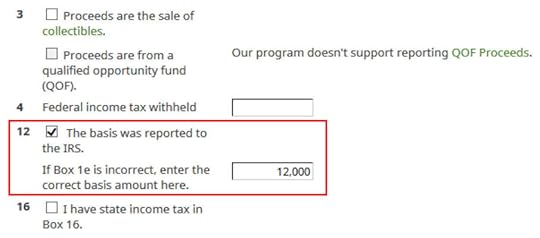

You have this opportunity to make an adjustment. Check the “Yes” radio button and the box for “The basis shown in Box 1e is incorrect.”

Enter your purchase cost plus the amount added to your W-2. When you did a “disqualifying disposition” your cost basis was the full value of the shares on the date of the purchase. The market price was $12 per share when you purchased those 1,000 shares at $8.50 per share. Your employer added the $3,500 discount as income to your W-2. Therefore your true basis is $8,500 + $3,500 = $12,000.

If you didn’t sell all the shares purchased in that batch, multiply the number of shares you sold by the discount price on the date of purchase and add the discount included on your W-2. For example, if you sold only 500 shares and your employer added $1,750 to your W-2, your corrected cost basis is:

$8.50 * 500 + $1,750 = $6,000

If you had a wash sale, your 1099-B form would indicate it as such. We didn’t have a wash sale in our example.

We’re done with one ESPP sale. Repeat if you sold more than once during the year.

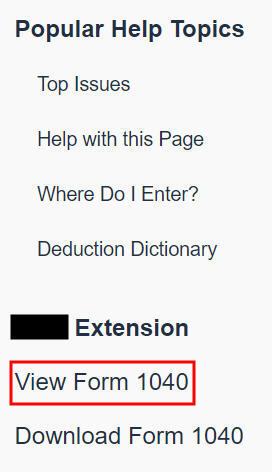

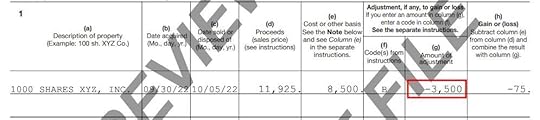

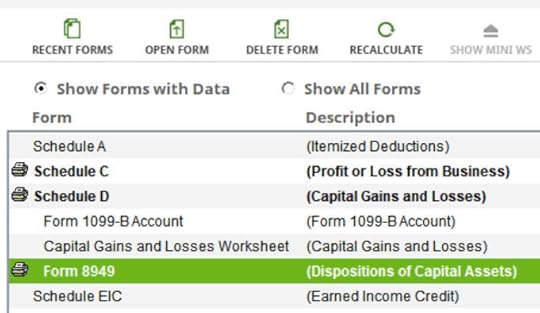

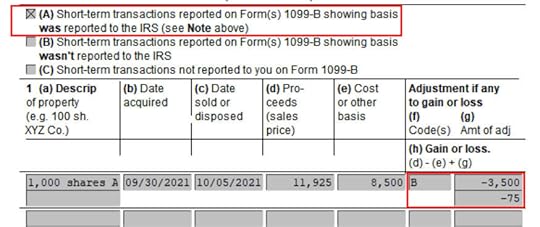

Verify on Form 8949We can verify that the adjustment makes it all the way to the tax form.

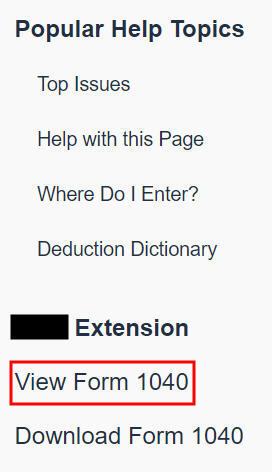

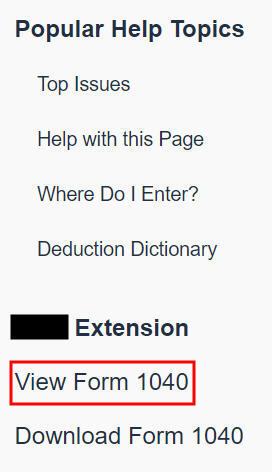

Click on “View Form 1040” on the right.

Scroll down to find Form 8949 in the popup. You see the negative adjustment in column (g).

If you didn’t make the adjustment and you just accepted the 1099-B as-is, you will pay capital gains tax again on the $3,500 discount you are already paying taxes through your W-2. Remember to make the adjustment!

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Enter 2022 ESPP Sold in FreeTaxUSA: Adjust Cost Basis appeared first on The Finance Buff.

January 21, 2023

How to Enter 2022 Foreign Tax Credit Form 1116 in H&R Block

[Updated on January 21, 2023 with updated screenshots from H&R Block software for 2022 tax filing.]

When mutual funds and/or ETFs that invest in foreign countries receive dividends or interest, they have to pay taxes to those countries. These mutual funds and/or ETFs report to your broker after the end of the year how much they paid in foreign taxes on your behalf.

When you invest in these mutual funds and/or ETFs outside a tax-advantaged account, your broker will report to you the total foreign taxes you paid through all your funds and/or ETFs. The IRS allows a tax credit for the taxes you paid indirectly to foreign countries.

Table of ContentsForm 1116Use H&R Block Download1099-DIV EntriesForeign Tax CreditAMT Simplified ElectionForeign-Source IncomeAdjustment ExceptionForeign TaxesVerify on Schedule 3Excess Foreign Tax CreditSummaryForm 1116The foreign taxes paid is reported in Box 7 on the 1099-DIV form you receive from your broker. It’s easy to handle when the total foreign taxes paid from all your 1099-DIV forms is no more than a certain amount — $300 for single and $600 for married filing jointly. You enter the 1099-DIV forms into your tax software and the software will automatically put the total on your tax form (Schedule 3, Line 1).

When your total foreign taxes paid from all your 1099-DIV forms are over the $300/$600 threshold, you’ll need to include Form 1116 in your tax return. I’ll show you how to do this in H&R Block software.

Use H&R Block DownloadThe following screenshots came from H&R Block downloaded software. The downloaded software is both less expensive and more powerful than H&R Block’s online software.

If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

I’ll use the same example:

1099-DIV EntriesYou received a 1099-DIV from your broker. Box 7 “Foreign Tax Paid” on the 1099-DIV shows $700. 100% of this $700 came from a mutual fund or ETF. You only have this one 1099-DIV that has a number in Box 7.

If you import your 1099-DIV forms, double-check the import to make sure all the numbers match your downloaded copies. If you’re entering the 1099-DIV forms manually, type the numbers as shown on your forms.

H&R Block doesn’t say anything about the foreign tax paid or needing a Form 1116 after you enter the 1099-DIV forms. Just continue with your other entries.

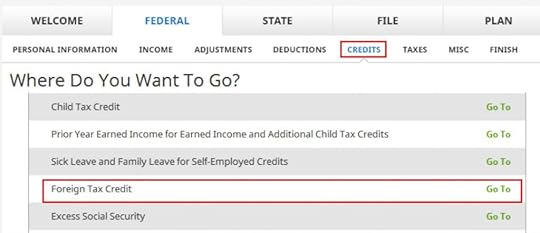

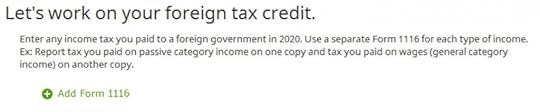

Foreign Tax Credit

Foreign Tax Credit comes up much later in the Credits section under Foreign Tax Credit.

Click on “Add Form 1116.”

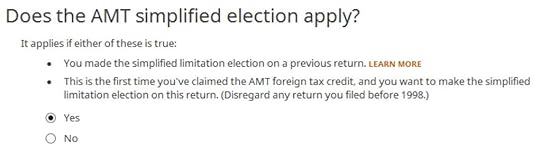

AMT Simplified Election

If this is the first year you’re claiming the Foreign Tax Credit, H&R Block software asks upfront about the simplified election. Select “Yes” for the simplified election.

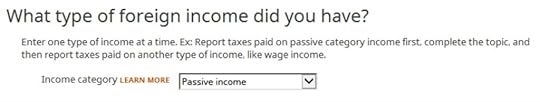

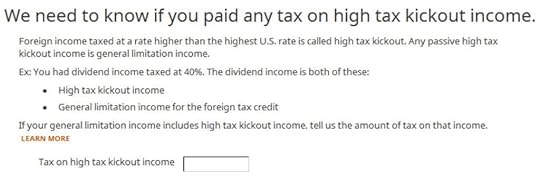

Foreign-Source Income

Dividend income falls under “passive income.”

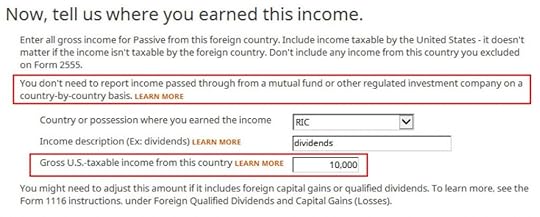

The “learn more” popup says you should choose “RIC” as the country when your foreign income came through mutual funds and/or ETFs. “RIC” is the last item in the country dropdown.

You get the foreign income from the supplemental information in your 1099 package from your broker. If you have multiple 1099-DIV forms that reported foreign tax paid in Box 7, you’ll have to add up the foreign income numbers from the respective supplemental information.

Don’t overlook the small note under the gross income input. It says you might need to adjust the amount if it includes foreign capital gains or qualified dividends. When you’re reporting foreign taxes paid from mutual funds and ETFs, the income sure does include qualified dividends. H&R Block doesn’t do the adjustment for you. It asks you to read the IRS instructions, learn how to adjust, and report the adjusted income here. That’s lazy.

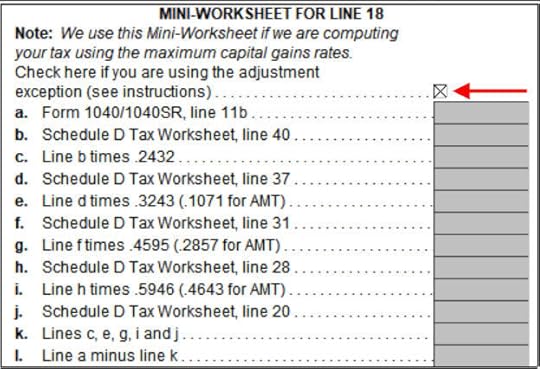

Adjustment ExceptionFortunately, many people qualify for an adjustment exception. From the IRS Form 1116 Instructions:

You qualify for the adjustment exception if you meet both of the following requirements.

1. Line 5 of the Qualified Dividends and Capital Gain Tax Worksheet doesn’t exceed:

a. $340,100 if married filing jointly or qualifying widow(er),

b. $170,050 if married filing separately,

c. $170,050 if single, or

d. $170,050 if head of household.

2. The amount of your foreign source capital gain distributions, plus the amount of your foreign source qualified dividends, is less than $20,000.

The dollar amounts in the first requirement correspond to the top of the 24% bracket. You are spared from figuring out how to adjust if your taxable income minus your qualified dividends and long-term capital gains isn’t in the 32% tax bracket or above, and your foreign source capital gain distributions and qualified dividends aren’t $20,000 or more.

If you’re eligible for the adjustment exception and you decide to take the easy route of not adjusting your foreign-source income, you need to claim a corresponding adjustment exception on your total income.

Click on Forms on the top right. Open Form 1116. Scroll down and find Mini-Worksheet for Line 18 just above Line 18. Check the box for using the adjustment exception.

Close the form and return to the interview.

If you don’t qualify for the adjustment exception, good luck learning how to adjust from the Form 1116 instructions. You’re better off switching to TurboTax, which does the adjustment for you when you need it.

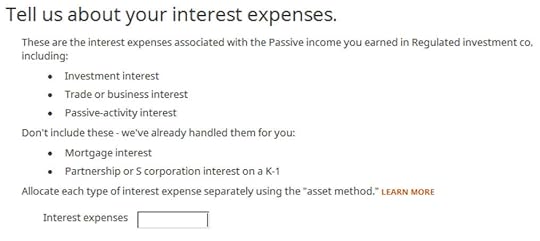

We leave this blank because we don’t have any interest expenses.

We leave this blank because we don’t have any other deductions either.

We don’t have any direct expenses either.

We have no losses to adjust.

Yes, our 1099-DIV was reported in U.S. dollars.

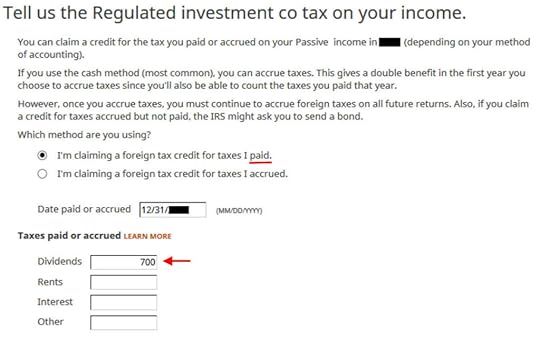

Foreign Taxes

I chose the simpler “paid” method. Enter the end of the year as the date paid. Enter the total foreign tax paid into the Dividends box.

If you have multiple 1099-DIV forms that reported foreign tax paid in Box 7, you’ll have to add up those numbers yourself. I wish the software did the math and auto-populated this field.

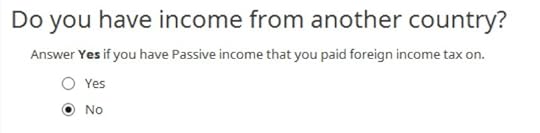

All our foreign taxes paid were through mutual funds and ETFs. RIC is the only country to use. We don’t have foreign income from any other countries.

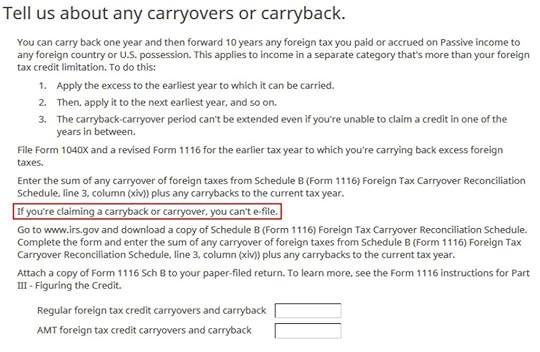

Fortunately, we don’t have any carryover or carryback. If we can’t get 100% credit for the foreign taxes paid this year, we’ll have to create a carryback or carryover, which means we can’t e-file with H&R Block.

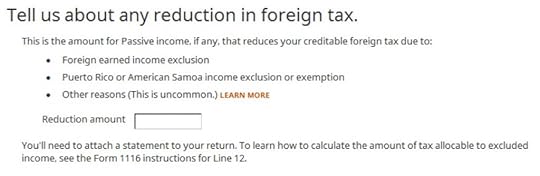

We don’t have any reduction either.

We don’t know what the foreign tax rate was. We’re leaving this blank.

We don’t know how to adjust. We’re leaving it blank again.

This is getting ridiculous. All I want is to get the foreign tax credit!

We’re finally done with Form 1116. Are we getting the credit?

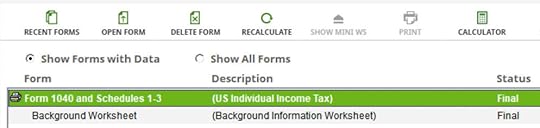

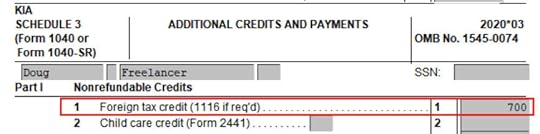

Verify on Schedule 3

Click on Forms on the top. Double-click on Form 1040 and Schedules 1-3.

Scroll down to Schedule 3. Line 1 shows our foreign tax credit. You can also look at Form 1116. It looks awfully complicated.

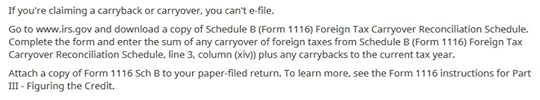

Excess Foreign Tax CreditWe received 100% of the foreign taxes paid as a tax credit in our example. If you paid higher foreign taxes on a lower US income, you may not be able to take 100% of the credit. You’ll have to wait until next year to take the rest of it.

Carrying over part of the credit to the following year requires filing a Form 1116 Schedule B. H&R Block doesn’t have this form in their program. H&R Block tells you to download the form from the IRS website, complete it yourself, and attach it to your paper return. That’s ridiculous.

SummaryH&R Block software works when you paid more in foreign taxes than the $300/$600 threshold that requires a Form 1116. You’ll have to gather the foreign income and the foreign dividends from the 1099 supplemental information from your brokers. After it’s all said and done, you’re getting a tax credit for taxes you paid to foreign countries through your mutual funds and/or ETFs.

H&R Block asks you to add up the foreign tax numbers yourself. It asks you to make any necessary adjustments to the foreign-source income, which is quite difficult. The option to activate the adjustment exception is hidden in the Forms mode. You’re on your own when you don’t qualify for the adjustment exception. It also asks you to handle any carryover yourself.

TurboTax does a better job of handling the foreign tax credit than the H&R Block software. See Foreign Tax Credit Form 1116 in TurboTax.

It’s better to avoid the complicated Form 1116 altogether next year by putting your international mutual funds and ETFs in a tax-advantaged account. See Too Much Hassle in Claiming Foreign Tax Credit on IRS Form 1116.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Enter 2022 Foreign Tax Credit Form 1116 in H&R Block appeared first on The Finance Buff.

January 16, 2023

How to Enter 2022 ESPP Sales in H&R Block: Adjust Cost Basis

[Updated on January 16, 2023 with screenshots from H&R Block tax software for 2022 tax filing.]

If your employer offers an Employee Stock Purchase Program (ESPP), you should max it out. You come out ahead even if you sell the shares as soon as you can. See Employee Stock Purchase Plan (ESPP) Is A Fantastic Deal.

After you sell the shares from the ESPP, part of the income will be included on your W-2. However, the tax form you receive from the broker still reflects your discounted purchase price. This post shows you how to make the necessary adjustment on your tax return using H&R Block tax software.

Don’t pay tax twice!

If you use other software, please read:

How to Report ESPP Sale in TurboTaxHow to Report ESPP Sale in FreeTaxUSATable of ContentsWhen to Report1099-B From BrokerUse H&R Block DownloadEnter 1099-B FormVerify on Form 8949When to ReportBefore you begin, be sure to understand when you need to report. You report when you sell the shares you bought under your ESPP. If you only bought shares but you didn’t sell during the tax year, there’s nothing to report yet.

Wait until you sell, but write down the full per-share price (before the discount) when you bought. If you purchased multiple times, write down for each purchase:

The purchase dateThe closing price on the grant dateThe closing price on the purchase dateThe number of shares you boughtThis information is very important when you sell.

Let’s use this example:

You bought 1,000 shares under your ESPP on 9/30/20xx. The closing price on the purchase date was $12 per share. The closing price on the grant date six months ago was $10 per share. You bought at $8.50 per share with the discount.

You would write down:

Grant Date4/1/20xxMarket Price on the Grant Date$10 per sharePurchase Date9/30/20xxMarket Price on the Purchase Date$12 per shareShares Purchased1,000Discounted Price$8.50 per shareKeep this information until you sell.

1099-B From BrokerWhen you sell, you will receive a 1099-B form from the broker in the following year. You will report your gain or loss using this 1099-B form and the information you accumulated for each purchase.

Let’s continue our example:

You sold 1,000 shares from your purchase above on 10/5/20xx at $11.95 per share. After commission and fees, you netted $11,925. You received a 1099-B form from your broker showing a sales proceed of $11,925 in the following year. The 1099-B form shows the cost basis as $8,500, which reflects your discounted purchase price.

Because you didn’t hold the shares for two years after the grant date and one year after the purchase date, your sale was a “disqualifying disposition.” The discount is added as income to your W-2. This raises your cost basis. If you just accept the 1099-B as-is, you will be double-taxed!

Now let’s account for it in the H&R Block software.

Use H&R Block DownloadThe screenshots below are from H&R Block Deluxe downloaded software. The downloaded software is both less expensive and more powerful than online software. If you haven’t paid for your H&R Block online filing yet, you can buy H&R Block download from Amazon, Walmart, and many other places. If you’re already too far along, make this year your last year of using the online service.

Enter 1099-B Form

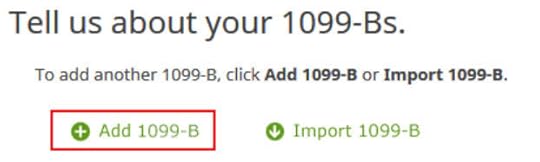

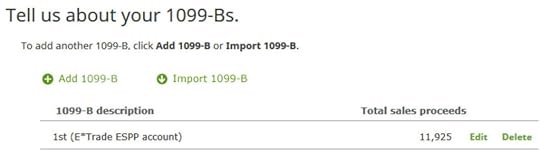

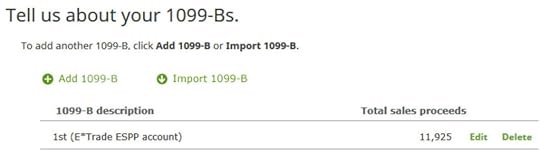

Click on Federal -> Income. Scroll down to find the Investments section. Click on the “Go To” link next to “Sale of Stocks, Bonds, Mutual Funds, and Other Securities (1099-B).”

Import your 1099-B if you’d like. I’m adding it manually.

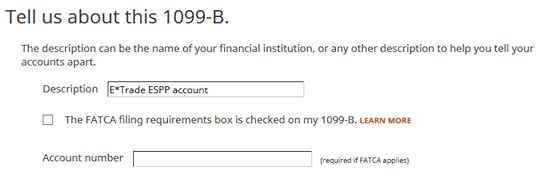

Give your account a description. Suppose this is from the ESPP account at E*Trade.

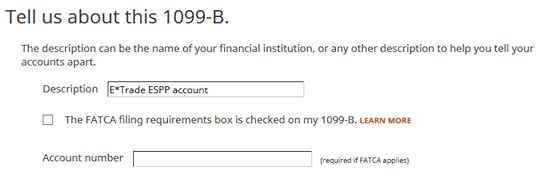

Now we add a sale.

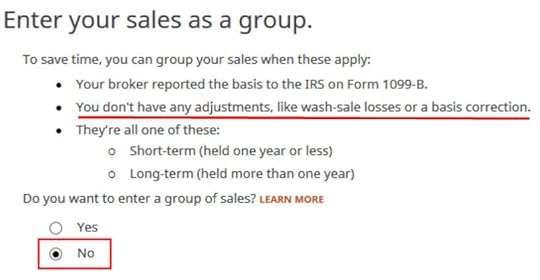

We don’t want to add sales as a group because we need to make an adjustment.

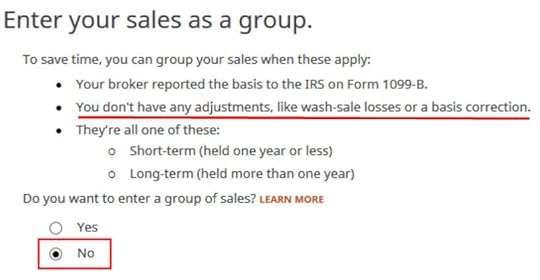

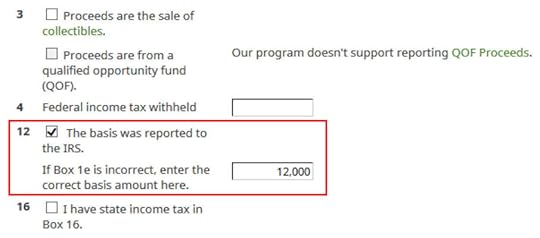

Enter a description. Enter the dates and numbers from the 1099-B form as they appear. Make sure to match the type of gain or loss reported on your 1099-B form. It was short-term on my form.

The cost basis on your 1099-B was reported to the IRS but it was too low. Don’t change it here directly.

Scroll down and check the box for “The basis was reported to the IRS.” Enter your purchase cost plus the amount added to your W-2 as your correct basis amount.

When you did a “disqualifying disposition” your cost basis was the full value of the shares on the date of the purchase. The market price was $12 per share when you purchased those 1,000 shares at $8.50 per share. Your employer added the $3,500 discount as income to your W-2. Therefore your true basis is $8,500 + $3,500 = $12,000.

If you didn’t sell all the shares purchased in that batch, multiply the number of shares you sold by the discount price on the date of purchase and add the discount included on your W-2. For example, if you sold only 500 shares and your employer added $1,750 to your W-2, your corrected cost basis is:

$8.50 * 500 + $1,750 = $6,000

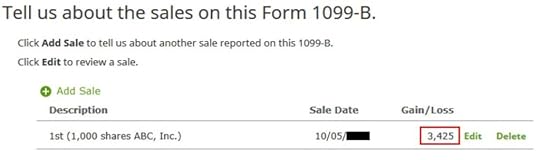

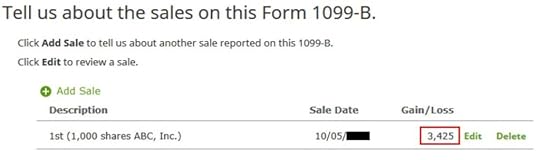

You are done with this entry. The summary gives the impression that you are paying tax again on a large gain, but don’t panic. We’ll verify it’s done correctly in the next section.

This shows a summary of the 1099-B form.

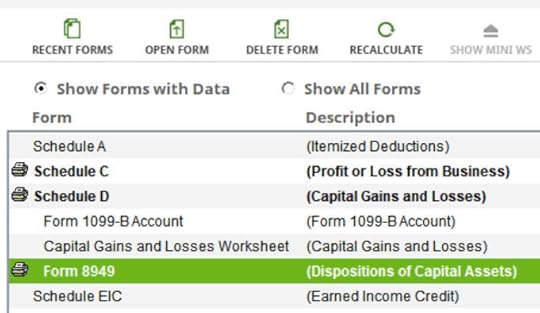

Verify on Form 8949

Click on the “Forms” button in the toolbar. Find Form 8949 and double-click on it.

Find your sale in either Part I or Part II depending on whether it was short-term or long-term on your 1099-B form.

You see the negative adjustment in column (g). If you didn’t make the adjustment and you just accepted the 1099-B as-is, you will pay capital gains tax again on the $3,500 discount you are already paying taxes through your W-2. Remember to make the adjustment!

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Enter 2022 ESPP Sales in H&R Block: Adjust Cost Basis appeared first on The Finance Buff.

How to Do 2022 ESPP Sales In H&R Block: Don’t Pay Tax Twice!

[Updated on January 16, 2023 with screenshots from H&R Block tax software for 2022 tax filing.]

If your employer offers an Employee Stock Purchase Program (ESPP), you should max it out. You come out ahead even if you sell the shares as soon as you can. See Employee Stock Purchase Plan (ESPP) Is A Fantastic Deal.

After you sell the shares from the ESPP, part of the income will be included on your W-2. However, the tax form you receive from the broker still reflects your discounted purchase price. This post shows you how to make the necessary adjustment on your tax return using H&R Block tax software.

Don’t pay tax twice!

If you use other software, please read:

How to Report ESPP Sale In TurboTaxTable of ContentsWhen to Report1099-B From BrokerUse H&R Block DownloadEnter 1099-B FormVerify on Form 8949When to ReportBefore you begin, be sure to understand when you need to report. You report when you sell the shares you bought under your ESPP. If you only bought shares but you didn’t sell during the tax year, there’s nothing to report yet.

Wait until you sell, but write down the full per-share price (before the discount) when you bought. If you purchased multiple times, write down for each purchase:

The purchase dateThe closing price on the grant dateThe closing price on the purchase dateThe number of shares you boughtThis information is very important when you sell.

Let’s use this example:

You bought 1,000 shares under your ESPP on 9/30/20xx. The closing price on the purchase date was $12 per share. The closing price on the grant date six months ago was $10 per share. You bought at $8.50 per share with the discount.

You would write down:

Grant Date4/1/20xxMarket Price on the Grant Date$10 per sharePurchase Date9/30/20xxMarket Price on the Purchase Date$12 per shareShares Purchased1,000Discounted Price$8.50 per shareKeep this information until you sell.

1099-B From BrokerWhen you sell, you will receive a 1099-B form from the broker in the following year. You will report your gain or loss using this 1099-B form and the information you accumulated for each purchase.

Let’s continue our example:

You sold 1,000 shares from your purchase above on 10/5/20xx at $11.95 per share. After commission and fees, you netted $11,925. You received a 1099-B form from your broker showing a sales proceed of $11,925 in the following year. The 1099-B form shows the cost basis as $8,500, which reflects your discounted purchase price.

Because you didn’t hold the shares for two years after the grant date and one year after the purchase date, your sale was a “disqualifying disposition.” The discount is added as income to your W-2. This raises your cost basis. If you just accept the 1099-B as-is, you will be double-taxed!

Now let’s account for it in the H&R Block software.

Use H&R Block DownloadThe screenshots below are from H&R Block Deluxe downloaded software. The downloaded software is both less expensive and more powerful than online software. If you haven’t paid for your H&R Block online filing yet, you can buy H&R Block download from Amazon, Walmart, and many other places. If you’re already too far along, make this year your last year of using the online service.

Enter 1099-B Form

Click on Federal -> Income. Scroll down to find the Investments section. Click on the “Go To” link next to “Sale of Stocks, Bonds, Mutual Funds, and Other Securities (1099-B).”

Import your 1099-B if you’d like. I’m adding it manually.

Give your account a description. Suppose this is from the ESPP account at E*Trade.

Now we add a sale.

We don’t want to add sales as a group because we need to make an adjustment.

Enter a description. Enter the dates and numbers from the 1099-B form as they appear. Make sure to match the type of gain or loss reported on your 1099-B form. It was short-term on my form.

The cost basis on your 1099-B was reported to the IRS but it was too low. Don’t change it here directly.

Scroll down and check the box for “The basis was reported to the IRS.” Enter your purchase cost plus the amount added to your W-2 as your correct basis amount.

When you did a “disqualifying disposition” your cost basis was the full value of the shares on the date of the purchase. The market price was $12 per share when you purchased those 1,000 shares at $8.50 per share. Your employer added the $3,500 discount as income to your W-2. Therefore your true basis is $8,500 + $3,500 = $12,000.

If you didn’t sell all the shares purchased in that batch, multiply the number of shares you sold by the discount price on the date of purchase and add the discount included on your W-2. For example, if you sold only 500 shares and your employer added $1,750 to your W-2, your corrected cost basis is:

$8.50 * 500 + $1,750 = $6,000

You are done with this entry. The summary gives the impression that you are paying tax again on a large gain, but don’t panic. We’ll verify it’s done correctly in the next section.

This shows a summary of the 1099-B form.

Verify on Form 8949

Click on the “Forms” button in the toolbar. Find Form 8949 and double-click on it.

Find your sale in either Part I or Part II depending on whether it was short-term or long-term on your 1099-B form.

You see the negative adjustment in column (g). If you didn’t make the adjustment and you just accepted the 1099-B as-is, you will pay capital gains tax again on the $3,500 discount you are already paying taxes through your W-2. Remember to make the adjustment!

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Do 2022 ESPP Sales In H&R Block: Don’t Pay Tax Twice! appeared first on The Finance Buff.

How To Enter 2022 Mega Backdoor Roth in TurboTax (Updated)

[Updated on January 16, 2023 with screenshots from TurboTax for 2022 tax filing.]

A Mega Backdoor Roth means making non-Roth after-tax contributions to a 401k-type plan and then moving it to the Roth account within the plan or taking the money out (with earnings) to a Roth IRA.

It’s a great way to put additional money into a Roth account without having to pay much additional tax. Not all plans allow non-Roth after-tax contributions but some estimated that 40% of people can do it.

Suppose your plan allows it and you executed a Mega Backdoor Roth. You will receive a 1099-R from the plan in the following year. You will need to account for it on your tax return. Here’s how to do it in TurboTax.

Table of ContentsUse Downloaded SoftwareWithin the Plan Or To Roth IRA1099-R EntriesRollover DestinationAfter-Tax ContributionsVerify on Form 1040Use Downloaded SoftwareYou should do it in TurboTax Deluxe downloaded software. The downloaded software is both less expensive and more powerful than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax from Amazon or Costco and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

If you use other tax software, please see:

How To Enter Mega Backdoor Roth In H&R Block Tax Software or How To Enter Mega Backdoor Roth in FreeTaxUSAWithin the Plan Or To Roth IRAYou can do the Mega Backdoor Roth in two ways — convert within the plan or withdraw to a Roth IRA. Converting within the plan is much easier, and many plans automate this process. Transferring to a Roth IRA also works. See the previous post Mega Backdoor Roth: Convert Within Plan or Out to Roth IRA?

Here’s the scenario we’ll use as an example:

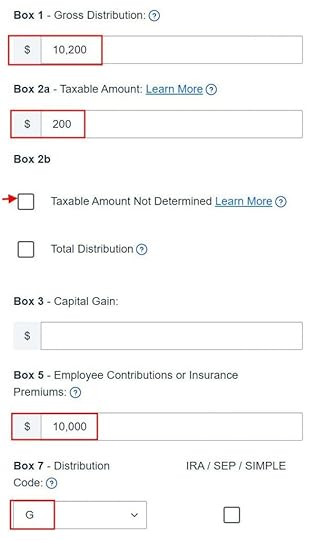

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). By the time the money was converted to the Roth account within the plan or transferred to your Roth IRA, your contributions earned $200. You converted $10,200 to your Roth account.

I’m using 401(k) as a shorthand. It works the same in a 403(b). Now the entries into TurboTax.

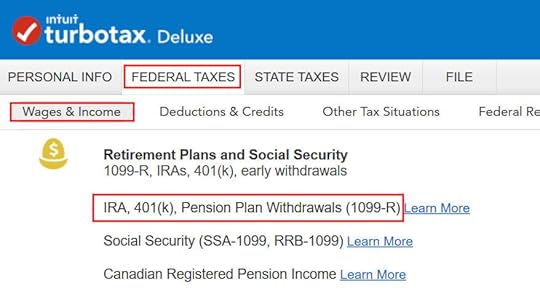

1099-R Entries

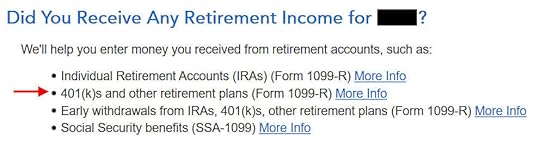

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

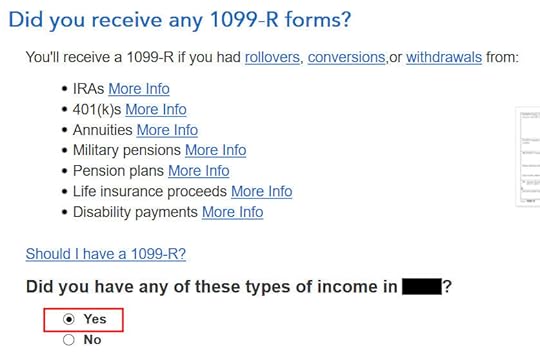

When you come to the Retirement Income section, answer Yes because you received a 1099-R from your 401(k) plan.

Yes, you received a 1099-R form. Import the 1099-R if you’d like. I’m typing it myself here.

You have a normal 1099-R.

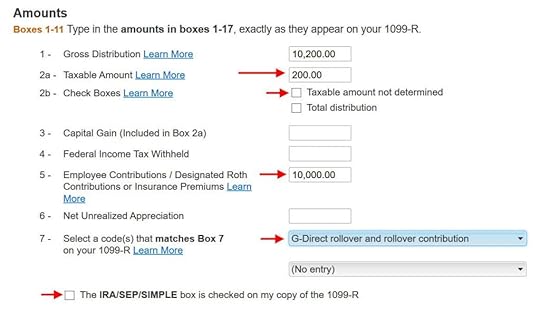

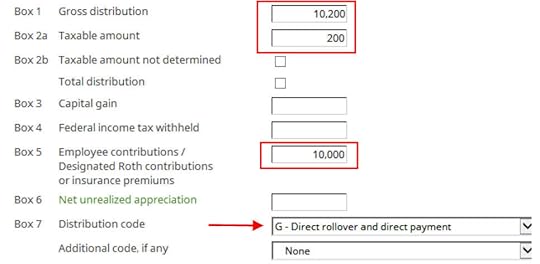

If you import the 1099-R, check the import carefully to make sure it matches your copy exactly. If you type the 1099-R, be sure to type it exactly.

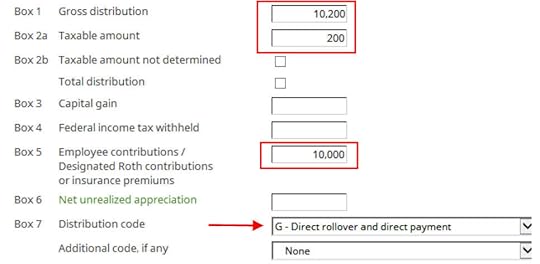

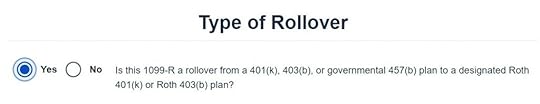

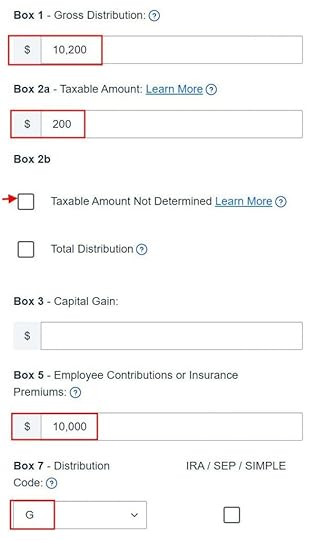

The earnings portion should be in Box 2a. Box 2b “Taxable amount not determined” should NOT be checked. The non-Roth after-tax contributions (the “principal”) should be in Box 5. Box 7 should show a code G. Finally, the box “The IRA/SEP/SIMPLE box is checked on my copy of the 1099-R” should NOT be checked.

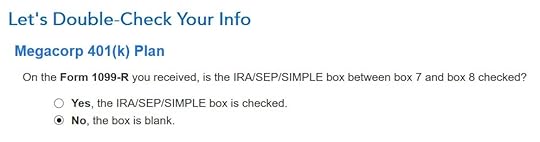

TurboTax wants to make sure the IRA/SEP/SIMPLE checkbox is not checked.

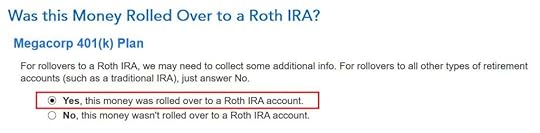

Rollover Destination

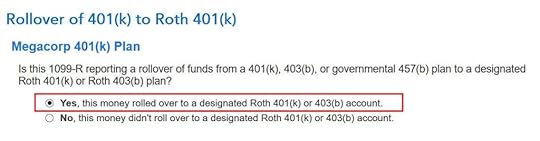

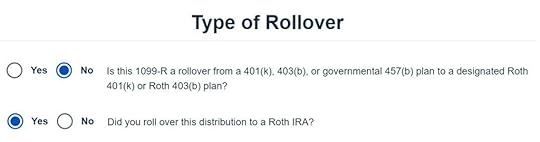

If you converted to Roth within the plan, answer Yes here. If you took the money out of the plan to a Roth IRA, answer No.

If you answered “No” to the previous question, confirm that the money went to a Roth IRA.

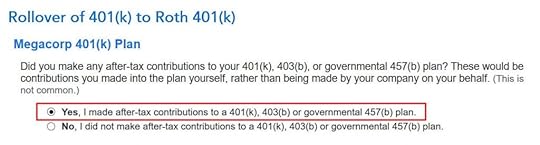

After-Tax Contributions

Answer Yes to confirm that you made non-Roth after-tax contributions to your plan.

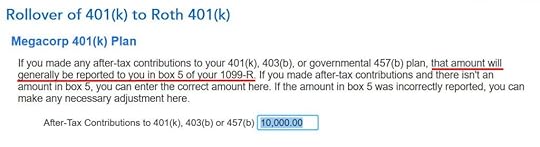

TurboTax pulls up the amount of your non-Roth after-tax contributions from Box 5 of your 1099-R. If your 1099-R isn’t correct, you should work with your 401(k) administrator to have it corrected.

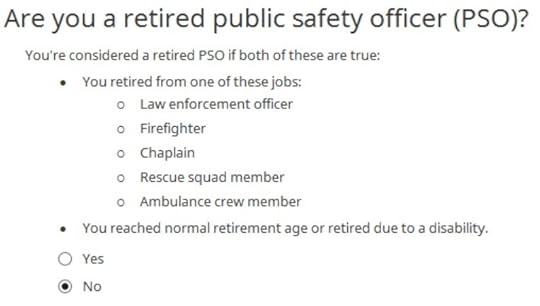

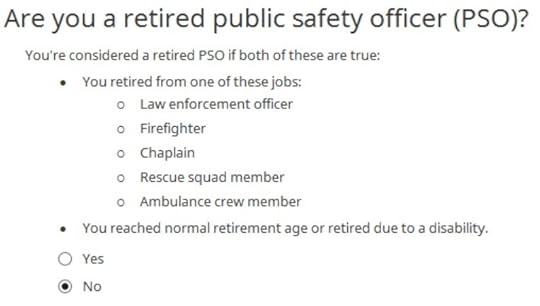

Not a public safety officer, unless you actually are one.

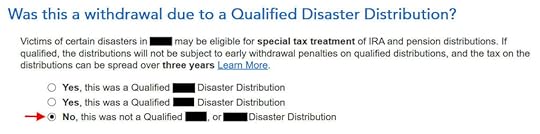

Not due to a disaster.

The summary shows your 1099-R entries. Repeat and add any additional 1099-Rs you may have.

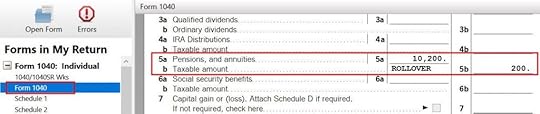

Verify on Form 1040Now let’s confirm you’re only paying tax on the $200 earnings, not on your $10,000 non-Roth after-tax contributions.

Click on Forms on the top right.

Find “Form 1040” in the left navigation pane. Scroll up or down in the right pane to lines 5a and 5b. Line 5a includes the $10,200 gross distribution amount. Line 5b only includes the $200 taxable amount.

With a Mega Backdoor Roth, you got an extra $10k into your Roth account. After paying tax on this $200, the future earnings on the $10,200 will be tax-free.

When you’re done examining the form, click on Step-by-Step on the top right to get back to the interview.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Enter 2022 Mega Backdoor Roth in TurboTax (Updated) appeared first on The Finance Buff.

How To Report 2022 Mega Backdoor Roth In H&R Block (Updated)

[Updated on January 16, 2023 with screenshots from H&R Block tax software for 2022 tax filing.]

A Mega Backdoor Roth is different from a regular Backdoor Roth. It’s done by making non-Roth after-tax contributions to a 401k-type plan and then moving it to the Roth account within the 401k-type plan or taking the money out (with earnings) to a Roth IRA. It’s a great way to put additional money into a Roth account without having to pay much additional tax. Not all plans allow non-Roth after-tax contributions but some estimated that 40% of people can do it.

Suppose you did a Mega Backdoor Roth last year. You should have received a 1099-R form from your 401k plan provider. You’ll need to account for it on your tax return. Here’s how to do it in H&R Block downloaded software. If you use other software, please read:

How to Report Mega Backdoor Roth in TurboTax How to Report Mega Backdoor Roth in FreeTaxUSAUse H&R Block DownloadH&R Block is in general less expensive than TurboTax. It has a downloaded version and an online version. The downloaded version is both less expensive and more powerful.

The downloaded Deluxe + State edition (or the Deluxe Federal-Only edition when you live in a state without an income tax) can handle pretty much everything. It often goes on sale for $20-25 on Amazon, Walmart, or Newegg, sometimes for under $20. It includes five federal e-filing. State e-filing costs extra but you can simply print and mail or file directly with your state on their website (see Free E-File State Tax Return Directly on the State’s Website).

In-Plan RolloverYou can do the mega backdoor Roth in two ways — converting within the plan or withdrawing to a Roth IRA. Converting within the plan is much easier, and many plans automate the process. Withdrawing to a Roth IRA also works. See the previous post Mega Backdoor Roth: Convert Within Plan or Out to Roth IRA?

Let’s first look at converting to the Roth account within the plan. Here’s the scenario we’ll use as an example:

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). By the time you converted the money to the Roth account within the plan, your contributions earned $200. You converted $10,200 to your Roth 401(k) account.

I’m using 401(k) as a shorthand. It works the same in a 403(b). Now here are the entries into H&R Block software.

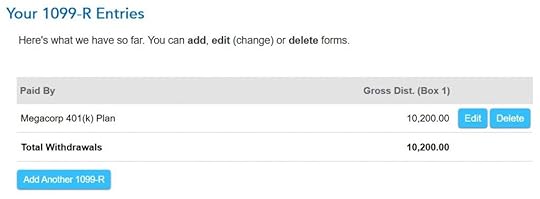

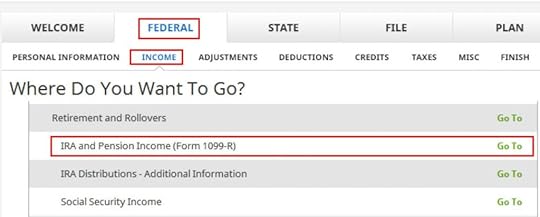

Go to Federal -> Income -> IRA and Pension Income (Form 1099-R). You can import the 1099-R or enter it manually. I’m showing manual entries.

Our 1099-R is a normal 1099-R. Enter the numbers from your 1099-R as-is. Ours looks like this:

The gross amount converted to the Roth 401k account shows up in Box 1. The earnings are in Box 2a. If you didn’t have earnings in your rollover, Box 2a is zero. “Taxable Amount Not Determined” under Box 2b is left unchecked. The amount of your non-Roth after-tax contributions shows in Box 5. Box 7 has code G.

The IRA/SEP/SIMPLE box in Box 7 on your 1099-R should NOT be checked.

We’re not a retired public safety officer.

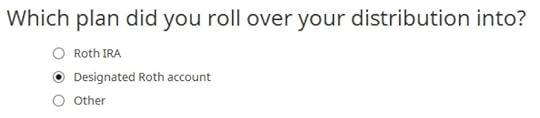

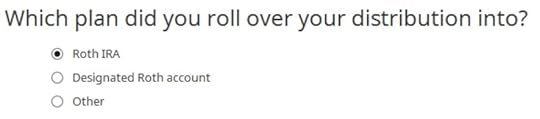

We moved the money within the plan. The Roth 401k account is officially a “designated Roth account” in the plan.

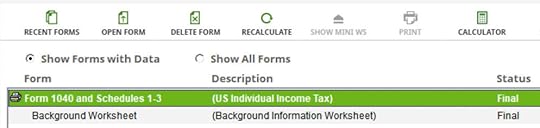

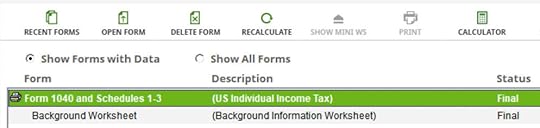

That’s it. It’s as simple as that. Now we verify we’re taxed only on the $200 in earnings, and not on the $10,000 non-Roth after-tax contributions. Click on “Forms” in the top menu bar. Double-click on “Form 1040 and Schedules 1-3” in the forms list.

Scroll down to find Line 5. The gross amount transferred to the Roth 401k account shows on Line 5a. Line 5b shows you’re taxed only on the earnings. If you didn’t have earnings, Line 5b will be zero.

Rollover to Roth IRA

Rollover to Roth IRAIt’s just as easy to report the mega backdoor Roth if you took the money out of the 401k plan and sent it to a Roth IRA. We’ll use the same example as above except you did the rollover to a Roth IRA instead of to the Roth 401k account within the plan.

Enter your 1099-R as-is in the same way as above.

The IRA/SEP/SIMPLE box is still unchecked.

We’re still not a retired public safety officer.

The only difference is we rolled over to a Roth IRA this time.

Now we verify we’re taxed only on the $200 in earnings, and not on the $10,000 non-Roth after-tax contributions. Click on “Forms” in the top menu bar. Double-click on “Form 1040 and Schedules 1-3” in the forms list.

Scroll down to find Line 5. The gross amount transferred to the Roth 401k account shows on Line 5a. Line 5b shows you’re taxed only on the earnings. If you didn’t have earnings, Line 5b will be zero.

Learn the Nuts and Bolts

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Report 2022 Mega Backdoor Roth In H&R Block (Updated) appeared first on The Finance Buff.

How to Enter 2022 Mega Backdoor Roth in FreeTaxUSA (Updated)

[Updated on January 16, 2023 with screenshots from FreeTaxUSA for 2022 tax filing.]

A Mega Backdoor Roth means making non-Roth after-tax contributions to a 401k-type plan and then moving it to the Roth account within the plan or taking the money out (with earnings) to a Roth IRA. It’s a great way to put additional money into a Roth account without having to pay much additional tax. Not all plans allow non-Roth after-tax contributions but some estimated that 40% of people can do it.

Suppose your plan allows it and you did a Mega Backdoor Roth. You’ll receive a 1099-R form from your plan in the following year. You’ll need to account for it on your tax return.

It’s quite straightforward. Here’s how to do it in the inexpensive online tax software FreeTaxUSA. If you use other tax software, please read:

How To Report Mega Backdoor Roth in TurboTax or How To Report Mega Backdoor Roth In H&R Block Tax SoftwareIn-Plan RolloverYou can do the Mega Backdoor Roth in two ways — convert within the plan or withdraw to a Roth IRA. Converting within the plan is much easier, and many plans automate the process. Withdrawing to a Roth IRA also works. See the previous post Mega Backdoor Roth: Convert Within Plan or Out to Roth IRA?

Let’s first look at converting to the Roth account within the plan. Here’s the scenario we’ll use as an example:

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). By the time you converted the money to the Roth account within the plan, your contributions earned $200. You converted $10,200 to your Roth 401(k) account.

I’m using 401(k) as a shorthand. It works the same in a 403(b).

1099-R EntriesNow the entries into FreeTaxUSA. Go to Income -> Common Income -> Retirement Income (1099-R). Enter the numbers from your 1099-R as-is. Ours looks like this:

The gross amount converted to the Roth 401k account shows up in Box 1. The earnings are in Box 2a. If you didn’t have earnings in your conversion, Box 2a is zero. “Taxable Amount Not Determined” under Box 2b is left unchecked. The amount of your non-Roth after-tax contributions (“the principal”) should be in Box 5. Box 7 has code “G” and the IRA/SEP/SIMPLE box is unchecked.

Leave the rest at default unless your 1099-R has values in other boxes.

When it asks whether it was a rollover to a Roth 401(k) account, we say yes.

That’s it. It’s as simple as that.

Verify on Form 1040Now we verify we’re taxed only on the $200 in earnings, and not on the $10,000 non-Roth after-tax contributions.

Click on the “View Form 1040” link on the right-hand side.

A draft 1040 form pops up. Look at Line 5. Line 5a shows the gross amount transferred to the Roth 401k. Line 5b shows we’re taxed only on the $200 in earnings. If you didn’t have earnings in your rollover, Line 5b will be zero.

Rollover to Roth IRAIt’s just as easy to report the Mega Backdoor Roth if you took the money out of the 401k plan and sent it to a Roth IRA. We’ll use the same example as above except you did the rollover to a Roth IRA instead of to the Roth 401k account within the plan.

Enter your 1099-R as-is in the same way as above.

When it asks how we did the rollover, answer “No” to the first question and “Yes” to the second question. That’s it.

Verify that you’re taxed only on the earnings in the same way as above. Click on View Form 1040 on the right.

Look at Line 5 in your draft 1040 form. Line 5a shows the gross amount. Line 5b shows the amount you’re paying tax on.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Enter 2022 Mega Backdoor Roth in FreeTaxUSA (Updated) appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower