Harry Sit's Blog, page 20

June 16, 2022

Cash Out I Bonds Tax Free For College Expenses Or 529 Plan

There’s a tradition in this country for parents and grandparents to buy treasury savings bonds for their children or grandchildren as a savings vehicle for college expenses. Before I Bonds came along, it was done primarily using series EE Bonds and primarily in paper form. You can still use I Bonds you buy in the online TreasuryDirect account for college expenses for your children or grandchildren.

Taxpayers naturally assume the interest will be tax-free when they cash out I Bonds for college expenses. The redemptions can be tax-free but it’s not that easy to qualify. Many people intending to use I Bonds for college expenses end up not getting the tax exemption.

Not In Child’s NameTo qualify for the possible tax-free interest, the I Bonds must be in the name of a person age 24 or over at the time of purchase. This means if you put the I Bonds in a child’s name, they won’t qualify for the tax-free treatment (unless the child is already 24 when you buy the bonds for their graduate school or professional school expenses). The child can be a beneficiary on the bonds but not an owner.

Income LimitYour modified adjusted gross income also must be under a set limit in the year you cash out the I Bonds for college expenses to qualify for the tax-free treatment. The income limit is adjusted for inflation each year. These are the limits in 2022 depending on your tax filing status:

Single, Head of HouseholdMarried Filing JointlyFull Exemption$85,800$128,650Partial Exemption$100,800$158,650Income Limits for Savings Bond Interest ExclusionI track these limits for future years in Tax Brackets, Standard Deduction, 0% Capital Gains, etc.

It doesn’t matter what your income is when you purchase the bonds. To qualify for the tax exemption on the interest, your income has to be below the threshold in effect in the year you cash out. You won’t qualify for the tax exemption if your income will always be higher than the income limits.

Qualified Higher Education ExpensesThe college expenses are limited to those for yourself, your spouse, or a dependent on your tax return. This means typically a grandparent or other relatives won’t qualify for the tax-free treatment when they cash out I Bonds to pay for college expenses for a grandchild or a niece or a nephew because the student isn’t a dependent on their tax return.

Only tuition and fees qualify. Room and board don’t qualify. The expenses also can’t be already covered by scholarships or another tax benefit such as 529 plan withdrawals, the American Opportunity tax credit, or the Lifetime Learning tax credit.

If you cash out more than the qualified education expenses, the interest is prorated by the qualified expenses relative to your total cashout. You can’t just assign 100% of the interest to the qualified expenses. For example, if you cash out $20,000 consisting of $15,000 in principal and $5,000 in interest but your qualified higher education expenses in the year are only $12,000, which is 60% of your cashed-out amount, then only 60% of the $5,000 interest is exempt from taxes.

Transfer to 529 PlanIf your income in the year when you expect to pay for college expenses won’t be under the income limit but you have a lower income in a year before that time, you can take advantage of the lower income by cashing out I Bonds and transferring the money to a 529 college savings plan or a Coverdell Education Savings Account.

The amount transferred to a 529 plan or Coverdell ESA for the benefit of yourself, your spouse, or a tax dependent also counts as qualified higher education expenses. When your lower income is below the income limit in effect for that year, you won’t pay tax on the interest.

Many 529 Plans have a separate line item on the contribution form (or a separate form) to indicate that the amount you’re contributing comes from savings bonds.

The amount transferred to a 529 plan for the benefit of a dependent still counts as a gift to the dependent for gift tax purposes in the same way as a cash contribution to the 529 plan.

Form 8815You need to include IRS Form 8815 in your tax return when you claim the tax exemption on cashing out I Bonds for college expenses or transfers to a 529 plan. Tax software TurboTax and H&R Block cover this.

***

The tax exemption on using I Bonds for college is much harder to qualify than a 529 plan. Because the student must be a dependent on the tax return, it only works for the parents for the most part, whereas grandparents or other family members can also use a 529 plan. You also must meet an income limit, whereas there’s no income limit on a 529 plan. The interest will be tax-free only if you’re confident your income will be under the limit at some point.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Cash Out I Bonds Tax Free For College Expenses Or 529 Plan appeared first on The Finance Buff.

April 26, 2022

More Inflation Protection with TIPS After Maxing Out I Bonds

I Bonds are great, but there’s a limit on how much you can buy each year. After you buy all the I Bonds you can buy in your personal account, trust, business, as gifts, from your tax refund, and , then what? A natural answer is TIPS. They are another type of government bond with inflation protection.

I have a lot to say on this topic because I wrote a book about TIPS back in 2010. Amazingly little has changed in all these years. Specific interest rates changed, and some new mutual funds and ETFs came out, but the principles are still the same. I’ll give you the gist of TIPS in this post.

Table of ContentsWhat Are TIPS?No Purchase LimitYield Can Be NegativeInterest Rate RiskLesser of Two EvilsBreakeven Inflation RateWhen to Invest in TIPSHow to Invest in TIPSWhat Are TIPS?TIPS are Treasury Inflation-Protected Securities. They’re a type of bond issued by the U.S. government. Both the principal and the interest are linked to inflation. If inflation goes higher, you get paid more interest and the principal repayment also goes higher.

No Purchase LimitThe biggest advantage of TIPS over I Bonds is that there’s no annual purchase limit in TIPS. You can buy as much as you want, in all types of accounts — including IRAs and HSAs, at an online broker you already use, both as individual bonds and in a mutual fund or ETF. Although you can also buy TIPS through TreasuryDirect, you don’t have to use TreasuryDirect.

Yield Can Be NegativeThe biggest disadvantage of TIPS over I Bonds is that the yield on TIPS can be negative, which means they can be guaranteed to lose to inflation whereas I Bonds are guaranteed to at least match inflation.

5-Year TIPS yIELD: 2010 – April 2022

5-Year TIPS yIELD: 2010 – April 2022The chart above shows the yield on 5-year TIPS from 2010 through April 2022. It turned negative shortly after I published my book in 2010 (great timing, huh?). It stayed consistently positive only between November 2016 and December 2019.

The yield on 5-year TIPS was -0.46% as I wrote this on April 26, 2022. It means you’re guaranteed to lose 0.46% per year to inflation for five years if you bought a 5-year TIPS on that day and you hold it to maturity. No one likes to lose to inflation but there may not be a better choice after you buy all the I Bonds you can buy. Institutional investors invest billions of dollars in TIPS. They settle for a guaranteed loss to inflation to protect against losing an even larger amount to inflation.

You can see the latest yields on TIPS of different maturities at Daily Treasury Par Real Yield Curve Rates (click on the second link on the web page) and on this page from Wall Street Journal. As I wrote this, although the 5-year TIPS yield was still negative, it wasn’t as negative as before. It was -1.6% only 1-1/2 months ago. The 10-year TIPS yield was barely negative at -0.08% at this moment.

If TIPS yields become positive, this disadvantage can turn into an advantage. When TIPS yields were positive in the past, they were higher than the fixed rate on I Bonds.

Interest Rate RiskThe next disadvantage of TIPS over I Bonds is interest rate risk.

I Bonds are guaranteed never to lose money regardless of when you cash out. You forfeit the last three months of interest when you cash out within five years but you’re guaranteed to have your principal back plus the interest you get to keep.

It’s a different story with TIPS. You’re guaranteed to have your principal back only when you hold TIPS to maturity. If you must sell TIPS early, you get the market value, which can be higher or lower than your original investment.

Bond prices go down when market interest rates go up. You can lose money in TIPS over the short term even when inflation is high. For instance, Vanguard Inflation-Protected Securities Fund (VAIPX) invests 100% in TIPS. Its year-to-date return through April 25, 2022 was -4.41%, and that was with the high inflation so far in 2022. The short-term return was negative because market interest rates went up in recent months.

Lesser of Two EvilsAlthough the -4.41% short-term return on the TIPS fund sounds bad, it was actually a lot better than the returns on comparable non-TIPS bond funds. For instance, the year-to-date return on Vanguard Intermediate-Term Treasury Index Fund (VSIGX) was -6.81% in the same period.

TIPS can lose to inflation but other bonds can lose more to inflation. When TIPS yields are negative, after buying all the I Bonds you can buy, your choice isn’t losing to inflation or not losing to inflation. It’s losing a known amount to inflation with TIPS or losing an unknown amount to inflation with other bonds.

Breakeven Inflation RateThe tradeoff comes down to how much inflation there will be in the future. No one knows. The market participants come out with an estimate. That’s the breakeven inflation rate, which is the difference between the yield on TIPS and the yield on nominal Treasury bonds of the same maturity. You’re better off with TIPS if inflation in the future comes out above this breakeven inflation rate. You’re better off with regular Treasuries if inflation in the future comes out below this breakeven inflation rate.

David Enna at TIPS Watch tracked the breakeven inflation rate at the time when TIPS bonds were first issued versus the actual inflation experienced during their lifetime. The data showed the market is always wrong on what future inflation will be. Sometimes the market estimated too high. Sometimes the market estimated too low.

You see the current breakeven inflation rates but you don’t know which way they’re wrong or by how much.

When to Invest in TIPSMost of the questions on TIPS are really on whether it’s a good time to invest in TIPS right now.

Is it the best time to invest in TIPS right now?

Absolutely not. The best time to invest in TIPS was October 2008 when you could lock in a positive 3% yield above inflation for 20 years but we don’t have a time machine.

Should I wait until TIPS yields go higher in the coming months?

No one knows whether the yields on TIPS will go higher or lower. Money waiting in the wings also loses to inflation.

Is it better to switch from other bonds to TIPS now when inflation is high?

No one knows. High inflation isn’t a secret. When everyone expects high inflation, the breakeven inflation rate is also high. This compensates investors in other bonds for their lack of inflation protection.

Market participants collectively come to a conclusion that the current yields on TIPS and other bonds make them no better off or worse off one way or the other. You’re better off in TIPS when the market underestimates future inflation but no one knows whether the market is underestimating or overestimating right now.

Then how do you decide whether to invest in TIPS right now or not?

You decide by whether you want inflation protection or you want to take your chances relative to inflation.

When you invest in TIPS, you know how much you’ll earn or lose over inflation. Invest in TIPS if you’re satisfied by this number no matter what inflation turns out to be in the future. Other fixed-income investments may end up doing better or doing worse than TIPS but you don’t care. Your goal is to protect your investments from inflation.

On the other hand, if you don’t mind losing more to inflation for a chance to lose less, you don’t need to go out of your way to invest in TIPS. No one knows whether TIPS will do better or worse.

Finally, there’s always diversification. You don’t have to go either 100% TIPS or zero TIPS. You can invest in both TIPS and other bonds.

How to Invest in TIPSIf you decide to invest at least some money in TIPS, you can either buy individual TIPS or buy a mutual fund or ETF that holds TIPS. Buying a mutual fund or ETF is the easiest, in the same way as you invest in other bonds. When you’re new to TIPS, start with a mutual fund or ETF.

As in other bonds, short-term TIPS have a lower interest rate risk than longer-term TIPS but, in general, they also have a lower yield.

These mutual fund and ETFs invest in short-term TIPS (maturities up to 5 years):

MinimumExpense RatioiShares 0-5 Year TIPS Bond ETF (STIP)None0.03%Vanguard Short-Term Inflation-Protected Securities ETF (VTIP)None0.04%Vanguard Short-Term Inflation-Protected Securities Index Fund (VTAPX)$3,0000.06%These mutual funds and ETF invest in TIPS of all maturities:

MinimumExpense RatioFidelity Inflation-Protected Bond Index Fund (FIPDX)None0.05%Schwab Treasury Inflation Protected Securities Index Fund (SWRSX)None0.05%Schwab U.S. TIPS ETF (SCHP)None0.05%Vanguard Inflation-Protected Securities Fund Admiral Shares (VAIPX)$50,0000.10%Buying individual TIPS gets more complicated. Please read my book Explore TIPS if you’re interested in buying individual TIPS.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post More Inflation Protection with TIPS After Maxing Out I Bonds appeared first on The Finance Buff.

April 12, 2022

2022 2023 HSA Contribution Limits and HDHP Qualification

The contribution limits for various tax-advantaged accounts for the following year are usually announced in October, except for the HSA, which come out in April or May. The contribution limits are adjusted for inflation each year, subject to rounding rules.

Table of ContentsHSA Contribution LimitsAge 55 Catch Up ContributionTwo Plans Or Mid-Year ChangesHDHP QualificationContribute Outside PayrollBest HSA ProvidersHSA Contribution Limits202120222023Individual Coverage$3,600$3,650$3,850Family Coverage$7,200$7,300$7,750HSA Contribution LimitsSource: IRS Rev. Proc. 2020-32, Rev. Proc. 2021-25, Rev. Proc. 2022-24.

Employer contributions are included in these limits.

The family coverage numbers happened to be twice the individual coverage numbers in 2021 and 2022 but it isn’t always the case. Because the individual coverage limit and the family coverage limit are both rounded to the nearest $50, when one number rounds up and the other number rounds down, the family coverage limit can be slightly more or slightly less than twice the individual coverage limit.

Age 55 Catch Up ContributionAs in 401k and IRA contributions, you are allowed to contribute extra if you are above a certain age. If you are age 55 or older by the end of the year (not age 50 as in 401k and IRA contributions), you can contribute an additional $1,000 to your HSA. If you are married, and both of you are age 55, each of you can contribute additional $1,000 to your respective HSA.

However, because HSA is in one individual’s name, just like an IRA — there is no joint HSA even when you have family coverage — only the person age 55 or older can contribute the additional $1,000 in his or her own name. If only the husband is 55 or older and the wife contributes the full family contribution limit to the HSA in her name, the husband has to open a separate account in his name for the additional $1,000. If both husband and wife are age 55 or older, they must have two HSA accounts in separate names if they want to contribute the maximum. There’s no way to hit the combined maximum with only one account.

The $1,000 additional contribution limit is fixed by law. It’s not adjusted for inflation.

Two Plans Or Mid-Year ChangesThe limits are more complicated if you are married and the two of you are on different health plans. It’s also more complicated when your health insurance changes mid-year. The insurance change could be due to a job change, marriage or divorce, enrolling in Medicare, the birth of a child, and so on.

For those situations, please read HSA Contribution Limit For Two Plans Or Mid-Year Changes.

HDHP QualificationYou can only contribute to an HSA if you have a High Deductible Health Plan (HDHP). You can use the money already in the HSA for qualified medical expenses regardless of what insurance you currently have.

The IRS also defines what qualifies as an HDHP. For 2022, an HDHP with individual coverage must have at least $1,400 in annual deductible and no more than $7,050 in annual out-of-pocket expenses. For family coverage, the numbers are a minimum $2,800 in annual deductible and no more than $14,100 in annual out-of-pocket expenses.

For 2023, an HDHP with individual coverage must have at least $1,500 in annual deductible and no more than $7,500 in annual out-of-pocket expenses. For family coverage, the numbers are a minimum of $3,000 in annual deductible and no more than $15,000 in annual out-of-pocket expenses.

Please note the deductible number is a minimum while the out-of-pocket number is a maximum. If the out-of-pocket limit of your insurance policy is too high, it doesn’t qualify as an HSA-eligible policy.

In addition, just having the minimum deductible and the maximum out-of-pocket isn’t sufficient to make a plan qualify as HSA-eligible. The plan must also meet other criteria. See Not All High Deductible Plans Are HSA Eligible.

202120222023Individual Coveragemin. deductible$1,400$1,400$1,500max. out-of-pocket$7,000$7,050$7,500Family Coveragemin. deductible$2,800$2,800$3,000max. out-of-pocket$14,000$14,100$15,000HDHP QualificationSource: IRS Rev. Proc. 2020-32, Rev. Proc. 2021-25, Rev. Proc. 2022-24.

Contribute Outside PayrollIf you have a High Deductible Health Plan (HDHP) through your employer, your employer may already set up a linked HSA for you at a selected provider. Your employer may be contributing an amount on your behalf there. Your payroll contributions also go into that account. Your employer may be paying the fees for you on that HSA. You save Social Security and Medicare taxes when you contribute to the HSA through payroll.

When you contribute to an HSA outside an employer, you get the tax deduction on your tax return, similar to when you contribute to a Traditional IRA. If you use tax software, be sure the answer the questions on HSA contributions. The tax deduction shows up on Form 8889 line 13 and Schedule 1 line 13.

If your HDHP also covers your adult children who are not claimed as a dependent on your tax return, they can also contribute to an HSA in their own name if they don’t have other non-HDHP coverage. They get a separate family coverage limit. They will have to open an HSA on their own with an HSA provider.

Best HSA ProvidersIf you get the HSA-eligible high deductible plan through an employer, your employer usually has a designated HSA provider for contributing via payroll deduction. It’s best to use that one because your contributions via payroll deduction are usually exempt from Social Security and Medicare taxes. If you want better investment options, you can transfer or roll over the HSA money from your employer’s designated provider to a provider of your choice afterward. See How To Rollover an HSA On Your Own and Avoid Trustee Transfer Fee.

If you are not going through an employer, or if you’d like to contribute on your own, you can also open an HSA with a provider of your choice. For the best HSA providers with low fees and good investment options, see Best HSA Provider for Investing HSA Money.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 2023 HSA Contribution Limits and HDHP Qualification appeared first on The Finance Buff.

2021 2022 2023 HSA Contribution Limits and HDHP Qualification

[Update on April 12, 2022, after the government published March CPI data.]

The contribution limits for various tax-advantaged accounts for the following year are usually announced in October, except for the HSA, which come out in April or May.

The contribution limits are adjusted for inflation each year, subject to rounding rules. I calculated the limits for 2023 with the official inflation data.

Table of ContentsHSA Contribution LimitsAge 55 Catch Up ContributionTwo Plans Or Mid-Year ChangesHDHP QualificationContribute Outside PayrollBest HSA ProvidersHSA Contribution Limits202120222023Individual Coverage$3,600$3,650$3,850Family Coverage$7,200$7,300$7,750HSA Contribution LimitsSource: IRS Rev. Proc. 2020-32, Rev. Proc. 2021-25, author’s calculation.

Employer contributions are included in these limits.

The family coverage numbers happened to be twice the individual coverage numbers in 2021 and 2022 but it isn’t always the case. Because the individual coverage limit and the family coverage limit are both rounded to the nearest $50, when one number rounds up and the other number rounds down, the family coverage limit can be slightly more or slightly less than twice the individual coverage limit.

Age 55 Catch Up ContributionAs in 401k and IRA contributions, you are allowed to contribute extra if you are above a certain age. If you are age 55 or older by the end of the year (not age 50 as in 401k and IRA contributions), you can contribute an additional $1,000 to your HSA. If you are married, and both of you are age 55, each of you can contribute additional $1,000 to your respective HSA.

However, because HSA is in one individual’s name, just like an IRA — there is no joint HSA even when you have family coverage — only the person age 55 or older can contribute the additional $1,000 in his or her own name. If only the husband is 55 or older and the wife contributes the full family contribution limit to the HSA in her name, the husband has to open a separate account in his name for the additional $1,000. If both husband and wife are age 55 or older, they must have two HSA accounts in separate names if they want to contribute the maximum. There’s no way to hit the combined maximum with only one account.

The $1,000 additional contribution limit is fixed by law. It’s not adjusted for inflation.

Two Plans Or Mid-Year ChangesThe limits are more complicated if you are married and the two of you are on different health plans. It’s also more complicated when your health insurance changes mid-year. The insurance change could be due to a job change, marriage or divorce, enrolling in Medicare, the birth of a child, and so on.

For those situations, please read HSA Contribution Limit For Two Plans Or Mid-Year Changes.

HDHP QualificationYou can only contribute to an HSA if you have a High Deductible Health Plan (HDHP). You can use the money already in the HSA for qualified medical expenses regardless of what insurance you currently have.

The IRS also defines what qualifies as an HDHP. For 2022, an HDHP with individual coverage must have at least $1,400 in annual deductible and no more than $7,050 in annual out-of-pocket expenses. For family coverage, the numbers are minimum $2,800 in annual deductible and no more than $14,100 in annual out-of-pocket expenses.

For 2023, an HDHP with individual coverage must have at least $1,500 in annual deductible and no more than $7,500 in annual out-of-pocket expenses. For family coverage, the numbers are a minimum of $3,000 in annual deductible and no more than $15,000 in annual out-of-pocket expenses.

Please note the deductible number is a minimum while the out-of-pocket number is a maximum. If the out-of-pocket limit of your insurance policy is too high, it doesn’t qualify as an HSA-eligible policy.

In addition, just having the minimum deductible and the maximum out-of-pocket isn’t sufficient to make a plan qualify as HSA-eligible. The plan must also meet other criteria. See Not All High Deductible Plans Are HSA Eligible.

202120222023Individual Coveragemin. deductible$1,400$1,400$1,500max. out-of-pocket$7,000$7,050$7,500Family Coveragemin. deductible$2,800$2,800$3,000max. out-of-pocket$14,000$14,100$15,000HDHP QualificationSource: IRS Rev. Proc. 2020-32, Rev. Proc. 2021-25, author’s calculation.

Contribute Outside PayrollIf you have a High Deductible Health Plan (HDHP) through your employer, your employer may already set up a linked HSA for you at a selected provider. Your employer may be contributing an amount on your behalf there. Your payroll contributions also go into that account. Your employer may be paying the fees for you on that HSA. You save Social Security and Medicare taxes when you contribute to the HSA through payroll.

When you contribute to an HSA outside an employer, you get the tax deduction on your tax return, similar to when you contribute to a Traditional IRA. If you use tax software, be sure the answer the questions on HSA contributions. The tax deduction shows up on Form 8889 line 13 and Schedule 1 line 13.

If your HDHP also covers your adult children who are not claimed as a dependent on your tax return, they can also contribute to an HSA in their own name if they don’t have other non-HDHP coverage. They get a separate family coverage limit. They will have to open an HSA on their own with an HSA provider.

Best HSA ProvidersIf you get the HSA-eligible high deductible plan through an employer, your employer usually has a designated HSA provider for contributing via payroll deduction. It’s best to use that one because your contributions via payroll deduction are usually exempt from Social Security and Medicare taxes. If you want better investment options, you can transfer or roll over the HSA money from your employer’s designated provider to a provider of your choice afterward. See How To Rollover an HSA On Your Own and Avoid Trustee Transfer Fee.

If you are not going through an employer, or if you’d like to contribute on your own, you can also open an HSA with a provider of your choice. For the best HSA providers with low fees and good investment options, see Best HSA Provider for Investing HSA Money.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2021 2022 2023 HSA Contribution Limits and HDHP Qualification appeared first on The Finance Buff.

April 5, 2022

How To Buy Treasury Bills & Notes Without Fee at Online Brokers

[Updated and rewritten on April 5, 2022.]

When you’d like to invest for a guaranteed return, I Bonds are no doubt the best deal right now (see How to Buy I Bonds). However, the government imposes an annual purchase limit on I Bonds. After you buy all the I Bonds you can buy, if you still would like to invest a sum of money for a fixed term, buying CDs directly from a bank or credit union used to be the answer but that’s not the case today.

Table of ContentsTreasuries Beat CDs NowOrder WindowYield Determined by AuctionSellingTaxesFidelityVanguardCharles SchwabMerrill EdgeE*TradeTreasuries Beat CDs NowWhen the Fed started raising interest rates, the financial markets responded right away. Banks and credit unions are still slow to raise the rates they pay on savings accounts and CDs because they don’t need more deposits and they rely on people’s inertia and ignorance of the going rates.

I read this headline from DepositAccounts.com — Latino Community Credit Union Unveils Very Competitive Super Jumbo CDs. These super jumbo CDs require a minimum deposit of $200,000 and they pay the top rates of all CDs tracked by DepositAccounts.com. However, those rates were much lower than the yields on Treasuries of comparable maturities on the date the CDs came out.

Super Jumbo CDTreasury Note12-month1.1%1.7%24-month1.8%2.4%36-month2.1%2.6%48-month2.15%2.6%In addition, Treasuries require a minimum investment of only $1,000, the interest is exempt from state and local taxes, and you can buy them in your existing brokerage account. Why in the world would someone buy these CDs from this credit union?

Because people don’t know they can buy Treasuries so easily for a higher yield than CDs at this moment.

When you already have a TreasuryDirect account for I Bonds, you can use the same account to buy regular Treasuries but it’s easier to buy them in a brokerage account. You can buy new-issue Treasuries through the top 3 brokerage firms Fidelity, Vanguard, and Charles Schwab with no fee whatsoever.

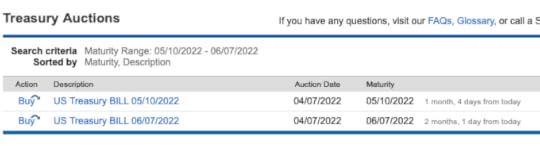

Order WindowYou only have to know when the U.S. government will sell a new batch of Treasuries next time. Right now the government sells shorter maturities weekly and longer maturities monthly. You don’t have to wait long for the next sale.

MaturitySale Frequency4-week, 8-week, 13-week, 26-weekweekly52-week, 2-year, 3-year, 5-yearmonthlyThe exact dates are published in the Tentative Auction Schedule from the U.S. Treasury. The schedule lists three dates — the Announcement Date, the Auction Date, and the Settlement Date. You only need to pay attention to the first two dates to know the window for placing your order.

You place your order between the afternoon of the Announcement Date and the night before the Auction Date. For example, if you’d like to invest a sum of money for two years, the schedule shows a 2-year note will be announced on Thursday, April 21 and it will be auctioned on Tuesday, April 26. You will see it offered in your brokerage account on the afternoon of the Announcement Date (April 21). You should have your order in by the night before the Auction Date (April 26).

So check the sale schedule and set a calendar reminder for yourself to place the order within the order window.

Yield Determined by AuctionThe actual yield you’ll receive is determined by an auction but you don’t have to worry about any bidding. You only say how much you’d like to buy in your order. The banks will do the bidding and you are just tagging along. You get the same yield for your tiny $1,000 purchase as a bank buying $100 million. You can get a feel of where the yield might land by checking Daily Treasury Par Yield Curve Rates (click on the first link on the webpage).

Treasury bills (1-year or shorter) are sold at a discount to face value. You pay slightly less than $1,000 for each $1,000 bill. When the bill matures you receive the full $1,000 in your brokerage account. The difference is your interest. Treasury notes (2-year and above) are sold at slightly less than face value. You receive interest payments in your brokerage account every six months.

SellingIf you hold the Treasury to its maturity, you don’t have to do anything extra. The face value will magically appear in your account after it matures.

Some brokers offer an optional “auto roll” feature. If you enable the “auto roll” feature when you buy the Treasury, the broker will automatically use the money from the matured Treasury to buy another new-issue Treasury of the same face value and the same term.

If you decide to sell before the Treasury matures, you can sell it online at any time through the broker. The price will be at the market price at that time, which may be higher or lower than your original purchase price.

TaxesWhen you buy Treasuries in a taxable brokerage account, the brokerage firm will send you the necessary tax form for your taxes after the end of the year. The interest earned on Treasuries is exempt from state and local taxes.

FidelityHere are the steps for placing an order for new-issue Treasuries with Fidelity.

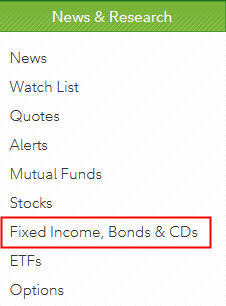

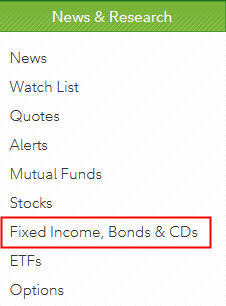

Under News & Research on the top, click on Fixed Income, Bonds & CDs.

Click on the New Issues tab. You pay no extra fee only when you buy a new issue.

You’ll see a list of upcoming issues in the Treasury section. If you don’t see anything for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window.

You’ll see the maturity date of each issue and the expected yield. The expected yield is only an estimate. You’ll know the actual yield only after your order executes but you can be sure you’ll always get the best yield determined by the market. Click on Trade to buy the issue you are interested in.

You may see either the “old” order entry screen or the “new” order entry screen next. Either one works. Only the look and feel are different.

Old order Entry page

Old order Entry page New order entry page

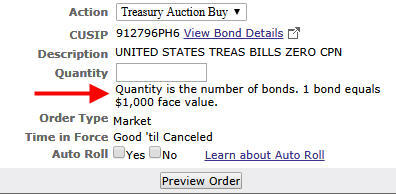

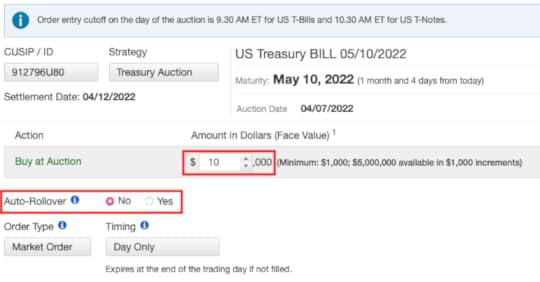

New order entry pageTreasuries are sold in $1,000 increments in a brokerage account. Enter a quantity of 1 if you’d like to buy $1,000 worth. It will cost slightly less than $1,000 when it’s all said and done. Fidelity lets you set up Auto Roll to automatically buy another Treasury of the same term and the same amount when this Treasury matures. It’s convenient when you’re investing in short-term Treasury Bills.

If you turn on Auto Roll, when it’s time to roll to the next one, you may receive an email saying you don’t have enough cash in your account to cover the new purchase. Don’t worry. The matured Treasury will cover the new purchase just in time. See comments from Mapleton Reader.

Again, there is no fee whatsoever from Fidelity when you buy new-issue Treasuries. Have cash ready in your account. You’ll have Treasuries when the auction settles.

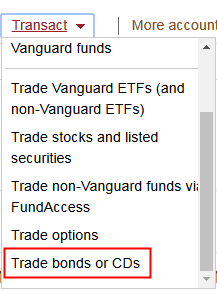

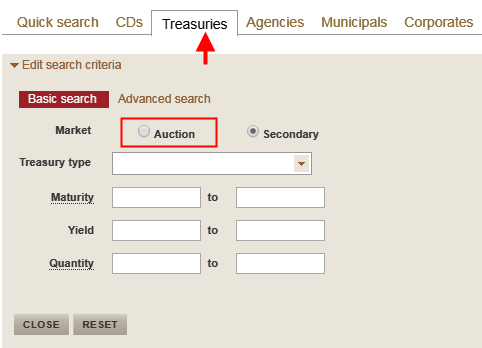

VanguardHere are the steps to buy new-issue Treasuries in a Vanguard brokerage account.

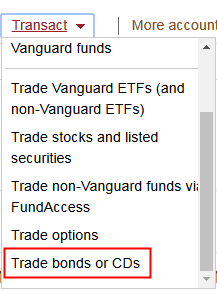

Click on the Transact dropdown next to your account and scroll to the bottom. Click on Trade bonds or CDs.

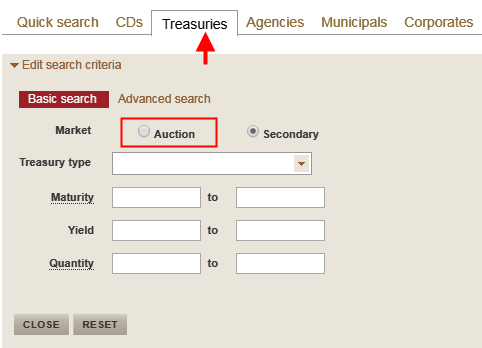

Click on the Treasuries tab and then the Auction radio button. Be sure to select “Auction.” You pay no extra fee only when you buy a new issue.

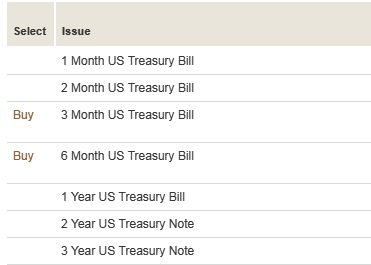

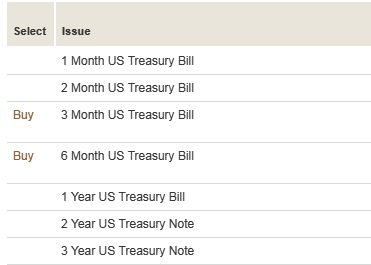

You will see a list. The Treasuries available for accepting orders will have a Buy link. If you don’t see a Buy link for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window.

Vanguard goes by the face amount on the order page. Your order amount must be in $1,000 increments with a minimum of $1,000 and a maximum of $5 million. Vanguard doesn’t offer the Auto Roll feature. Similar to Fidelity, there is no fee whatsoever from Vanguard when you buy new-issue Treasuries.

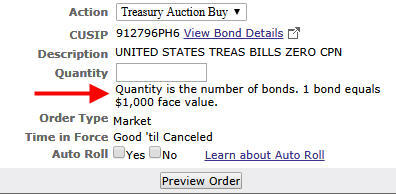

Charles SchwabYou can buy new-issue Treasuries at Charles Schwab as well. There is also no fee whatsoever from Schwab. I don’t have an account with Schwab but a reader sent me these screenshots from their account.

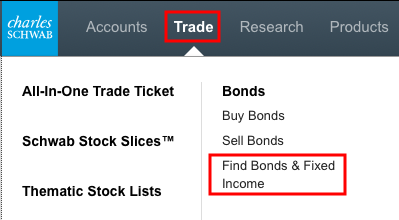

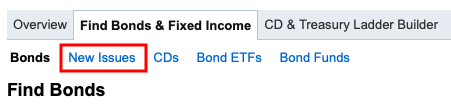

Click on Trade in the top menu and then Find Bonds & Fixed Income.

Click on New Issues.

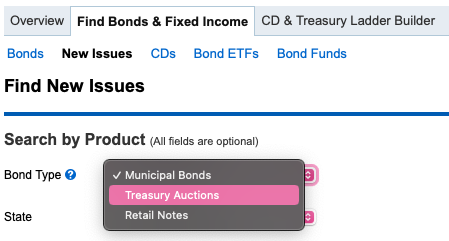

Choose Treasury Auctions in the Bond Type dropdown.

You will see a list of issues available for new orders. If you don’t see anything for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window.

Your order must be in $1,000 increments. If you turn on the Auto-Rollover feature, Schwab will automatically enter a new order for the same term and the same amount when this Treasury matures. If you leave the Auto-Rollover feature off, you’ll just have cash when this Treasury matures.

Merrill EdgeMerrill Edge doesn’t support buying new-issue Treasuries online. Placing an order through a representative by phone costs $30. You can buy Treasuries on the secondary market online but the price quote includes a markup.

E*TradeE*Trade’s commission schedule says their fee is $0 for buying new-issue Treasuries but I don’t have screenshots for how to do it because I don’t have an account with E*Trade.

***

Buying new-issue Treasuries in a brokerage account come down to:

Check the current rates and decide how long you will invest the money.Check the auction schedule to see when the next sale for your desired term will come up.Set a calendar reminder to place your order within the order window.Have cash ready to go in your account.Place your order. Wait for the auction and settlement.Automatically receive interest in your account every six months (only 2-year Treasury Notes and up). Automatically receive the face value when it matures.You can also buy “pre-owned” Treasuries on the secondary market but you’ll have to pay a bid/ask spread there. You’re better off waiting for a new issue unless the term you want to buy isn’t available as a new issue (for example, no 9-month or 4-year terms are offered as a new issue), or for some reason you must buy them today.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Buy Treasury Bills & Notes Without Fee at Online Brokers appeared first on The Finance Buff.

How To Buy Treasury Bills Without Fee at Fidelity or Vanguard

[Updated and rewritten on April 5, 2022.]

When you’d like to invest for a guaranteed return, I Bonds are no doubt the best deal right now (see How to Buy I Bonds). However, the government imposes an annual purchase limit on I Bonds. After you buy all the I Bonds you can buy, if you still would like to invest a sum of money for a fixed term, buying CDs directly from a bank or credit union used to be the answer but that’s not the case today.

When the Fed started raising interest rates, the financial markets responded right away. Banks and credit unions are still slow to raise the rates they pay on savings accounts and CDs because they don’t need more deposits and they rely on people’s inertia and ignorance of the going rates.

Treasuries Beat CDs NowI read this headline from DepositAccounts.com — Latino Community Credit Union Unveils Very Competitive Super Jumbo CDs. These super jumbo CDs require a minimum deposit of $200,000 and they pay the top rates of all CDs tracked by DepositAccounts.com. However, those rates were much lower than the yields on Treasuries of comparable maturities on the date the CDs came out.

Super Jumbo CDTreasury Note12-month1.1%1.7%24-month1.8%2.4%36-month2.1%2.6%48-month2.15%2.6%In addition, Treasuries require a minimum investment of only $1,000, the interest is exempt from state and local taxes, and you can buy them in your existing brokerage account. Why in the world would someone buy these CDs from this credit union?

Because people don’t know they can buy Treasuries so easily for a higher yield than CDs at this moment.

When you already have a TreasuryDirect account for I Bonds, you can use the same account to buy regular Treasuries but it’s easier to buy them in a brokerage account. You can buy new-issue Treasuries through the top 3 brokerage firms Fidelity, Vanguard, and Charles Schwab with no fee whatsoever.

Order WindowYou only have to know when the U.S. government will sell a new batch of Treasuries next time. Right now the government sells shorter maturities weekly and longer maturities monthly. You don’t have to wait long for the next sale.

MaturitySale Frequency4-week, 8-week, 13-week, 26-weekweekly52-week, 2-year, 3-year, 5-yearmonthlyThe exact dates are published in the Tentative Auction Schedule from the U.S. Treasury. The schedule lists three dates — the Announcement Date, the Auction Date, and the Settlement Date. You only need to pay attention to the first two dates to know the window for placing your order.

You place your order between the afternoon of the Announcement Date and the night before the Auction Date. For example, if you’d like to invest a sum of money for two years, the schedule shows a 2-year note will be announced on Thursday, April 21 and it will be auctioned on Tuesday, April 26. You will see it offered in your brokerage account on the afternoon of the Announcement Date (April 21). You should have your order in by the night before the Auction Date (April 26).

So check the sale schedule and set a calendar reminder for yourself to place the order within the order window.

Yield Determined by AuctionThe actual yield you’ll receive is determined by an auction but you don’t have to worry about any bidding. You only say how much you’d like to buy in your order. The banks will do the bidding and you are just tagging along. You get the same yield for your tiny $1,000 purchase as a bank buying $100 million. You can get a feel of where the yield might land by checking Daily Treasury Par Yield Curve Rates (click on the first link on the webpage).

Treasury bills (1-year or shorter) are sold at a discount to face value. You pay slightly less than $1,000 for each $1,000 bill. When the bill matures you receive the full $1,000 in your brokerage account. The difference is your interest. Treasury notes (2-year and above) are sold at slightly less than face value. You receive interest payments in your brokerage account every six months.

When you buy in a taxable brokerage account, the brokerage firm will send you the necessary tax form for your taxes.

FidelityHere are the steps for placing an order for new-issue Treasuries with Fidelity.

Under News & Research on the top, click on Fixed Income, Bonds & CDs.

Click on the New Issues tab. You pay no extra fee only when you buy a new issue.

You’ll see a list of upcoming issues in the Treasury section. You’ll see the maturity date of each issue and the expected yield. The expected yield is only an estimate. You’ll know the actual yield only after your order executes but you can be sure you’ll always get the best yield determined by the market. Click on Trade to buy the issue you are interested in.

Treasuries are sold in $1,000 increments in a brokerage account. Enter a quantity of 1 if you’d like to buy $1,000 worth. It will cost slightly less than $1,000 when it’s all said and done. Fidelity lets you set up Auto Roll to automatically buy another Treasury of the same term when this Treasury matures. It’s convenient when you’re investing in short-term Treasury Bills.

Again, there is no fee whatsoever from Fidelity when you buy new-issue Treasuries. Have cash ready in your account. You’ll have Treasuries when the auction settles.

VanguardHere are the steps to buy new-issue Treasuries in a Vanguard brokerage account.

Click on the Transact dropdown next to your account and scroll to the bottom. Click on Trade bonds or CDs.

Click on the Treasuries tab and then the Auction radio button. Be sure to select “Auction.” You pay no extra fee only when you buy a new issue.

You will see a list. The Treasuries available for accepting orders will have a Buy link. If you don’t see a Buy link for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window.

Vanguard goes by the face amount on the order page. Vanguard doesn’t offer the Auto Roll feature. Similar to Fidelity, there is no fee whatsoever from Vanguard when you buy new-issue Treasuries.

Charles SchwabYou can buy new-issue Treasuries at Charles Schwab as well. There is also no fee whatsoever from Schwab. I don’t have screenshots because I don’t have an account with Schwab.

***

Buying new-issue Treasuries in a brokerage account come down to:

Check the current rates and decide how long you will invest the money.Check the auction schedule to see when the next sale for your desired term will come up.Set a calendar reminder to place your order within the order window.Have cash ready to go in your account.Place your order. Wait for auction and settlement.You can also buy “pre-owned” Treasuries on the secondary market but you’ll have to pay a bid/ask spread there. You’re better off waiting for a new issue unless for some reason you must buy them today.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Buy Treasury Bills Without Fee at Fidelity or Vanguard appeared first on The Finance Buff.

March 19, 2022

Free E-File State Tax Return Directly on the State’s Website

When I was ready to e-file my tax returns through TurboTax downloaded software, it said that federal e-file was free and I could pay another $25 to e-file the state tax return at the same time. Considering that I paid only $30 for the software that includes all the complex logic to prepare both the federal and the state tax returns, $25 for simply transmitting the data and only for the state portion seems outrageous.

It isn’t just TurboTax. H&R Block does the same. Federal e-file is free but you must pay extra if you also want to e-file the state return. Only New York bans tax software vendors from charging extra for e-filing the state return.

No doubt many people relent and just pay the $25. Tax software vendors know it, and they’re counting on this for their revenue. I can afford $25. I would have no problem with it if they included it in the price up front and sold the software for $55 as opposed to $30. I just hate this sneaky tactic.

Printing and mailing the state return isn’t necessarily the only alternative though. Many states accept e-filing directly on the state revenue agency’s website. E-filing a return on the state’s website only takes a few minutes when you already have the completed forms from the tax software.

The web form on my state’s website is just an interactive representation of the same paper form. Besides personal information, I basically entered two numbers from my federal tax return – the AGI and the standard deduction. All the rest were automatically calculated.

Here I collected the available direct e-file links for all 50 states and Washington, DC. If your state offers direct e-file, at least try it once. You can always go back to paying $25 if you don’t like e-filing directly. If your state doesn’t offer direct e-file, printing and mailing isn’t that bad either. I’d done that before for many years and I never had any problems.

You save $25, and more importantly, you feel good about not falling for a big corporation’s pricing game. You get the better product when you use downloaded tax software and you pay nearly half the price than using the software online.

StateFree Direct E-FileAlabamaNo direct e-fileAlaskaNo state income taxArizonaNo direct e-fileArkansasNo direct e-fileCaliforniaCalFileColoradoRevenue OnlineConnecticutTaxpayer Service CenterDelawareDivision of RevenueDistrict Of ColumbiaMyTax DCFloridaNo state income taxGeorgiaNo direct e-fileHawaiiHawaii Tax OnlineIdahoNo direct e-fileIllinoisMyTax IllinoisIndianaNo direct e-fileIowaNo direct e-fileKansasKansas WebFileKentuckyKY FileLouisianaLouisiana File and Pay OnlineMaineMaine I-FileMarylandiFileMassachusettsMassTaxConnectMichiganNo direct e-fileMinnesotaNo direct e-fileMississippiNo direct e-fileMissouriNo direct e-fileMontanaMT QuickFileNebraskaNebFileNevadaNo state income taxNew HampshireNo direct e-fileNew JerseyNew Jersey Online Income Tax FilingNew MexicoTaxpayer Access PointNew YorkSoftware vendors can’t charge for e-fileNorth CarolinaNo direct e-fileNorth DakotaNo direct e-fileOhioI-FileOklahomaOkTAPOregonNo direct e-filePennsylvaniamyPATHRhode IslandNo direct e-fileSouth CarolinaNo direct e-fileSouth DakotaNo state income taxTennesseeNo state income taxTexasNo state income taxUtahTaxpayer Access PointVermontNo direct e-fileVirginiaNo direct e-fileWashingtonNo state income taxWest VirginiaNo direct e-fileWisconsinWI e-fileWyomingNo state income taxLearn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Free E-File State Tax Return Directly on the State’s Website appeared first on The Finance Buff.

March 14, 2022

The Best Tax Software for Foreign Tax Credit (IRS Form 1116)

After reading my previous post Too Much Hassle in Claiming Foreign Tax Credit on IRS Form 1116, several readers said they used tax software OLT this year because OLT had supported Form 1116 and its Schedule B sooner than TurboTax. My gut reaction was:

Project Management TriangleIt’s great that OLT was able to do it fast but does it produce the correct numbers?

In other words, does the project management triangle still hold?

[image error]Mapto, Public domain, via Wikimedia CommonsYou know the saying you can have any two out of the three — good, fast, and cheap — but not all three at the same time. Which two will you pick?

I posited in my previous post that the majority of Form 1116’s filed using the H&R Block software are wrong because users don’t realize that it asks them to calculate adjustments manually outside the software, and they don’t see the option to bypass manual adjustments when it’s hidden in the Forms mode. How well does OLT do?

A Four-Way TestI made up a simple test case:

John, single, earned $50,000 as an independent contractor. He received $5,000 in dividends from an international stock fund, 100% of which was foreign-source income. $4,000 out of the $5,000 was qualified dividends. The fund reported $500 in foreign taxes paid. John had no other income or deductions.

I ran this in four different software packages:

TurboTax Deluxe (download version)H&R Block Premium (download version)FreeTaxUSA (online only)OLT (online only)I took the default path in each software, i.e. how a typical user would use it. Here are the bottom-line results:

Foreign Tax CreditTurboTax$349H&R Block$435FreeTaxUSA$349OLT$381Four software packages, three different answers. Don’t you love it?

AnalysisNow, which answer is correct? Based on my limited understanding of how it should work, I say TurboTax and FreeTaxUSA did it correctly for this simple case, although I don’t see FreeTaxUSA generating the necessary Schedule B to carry the excess credit to next year. H&R Block and OLT calculated the wrong credit amount. FreeTaxUSA calculated the correct credit amount this time because the user qualifies for the adjustment exception. It will do it wrong when the user doesn’t qualify.

H&R Block and OLT won’t always give the wrong answer. You’ll get 100% credit when there’s a wide gap between the foreign taxes paid and the maximum credit allowed. Even if the software calculates the maximum credit wrong, the error may not be large enough to affect your bottom-line number. The thing is, you never know when the faulty logic in the software affects the final number and when it doesn’t. Even if the final number happens to be correct, the Form 1116 you’re filing is still wrong because other numbers on that form are wrong.

Of the four tested, only TurboTax calculates the required adjustment to your foreign-source income when you don’t qualify for the adjustment exception. The other three all ask you to read the instructions and calculate the required adjustment manually outside the software. Because most users don’t realize this, they’ll misrepresent their income when they don’t adjust. Even if they realize they must adjust, it’s quite difficult to calculate the adjustment anyway, which is why H&R Block, FreeTaxUSA, and OLT wash their hands of it in the first place. They turn lazy programming into a user error —

“I said you might need to adjust the income. It’s not my fault that you didn’t.”

When you do qualify for the adjustment exception, as in the test case used here, H&R Block doesn’t make it easy to activate the exception in the interview. You have to know to look for that option in the Forms mode. H&R Block and OLT calculate incorrectly because they omit above-the-line deductions. FreeTaxUSA calculates correctly but it doesn’t include the necessary Schedule B for you to carry the excess credit to the following year.

The WinnerWhen it comes to a complex tax form such as Form 1116, producing the correct numbers should be the top priority. Fast and cheap isn’t the right approach when it’s difficult to verify whether the results are correct. Although TurboTax was late in supporting Form 1116 and the new Schedule B, it was worth the wait.

If you’re stuck with filing Form 1116 for the foreign tax credit, use TurboTax. I’m so glad to get out of this though, for reasons I mentioned in the previous post Too Much Hassle in Claiming Foreign Tax Credit on IRS Form 1116. Even with TurboTax, I have no interest in becoming an expert in Form 1116.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post The Best Tax Software for Foreign Tax Credit (IRS Form 1116) appeared first on The Finance Buff.

March 11, 2022

Too Much Hassle in Claiming Foreign Tax Credit on IRS Form 1116

When a mutual fund or ETF invests in international stocks, some foreign governments tax the fund on its income. The taxes paid to the foreign governments lower the fund’s return. If you have the fund in an IRA, there’s no way to recover those taxes. You just have to live with the lower return.

However, if you have the international stock fund in a regular taxable account, the U.S. government lets you claim a foreign tax credit on the taxes paid to foreign governments. Because this lowers your taxes, it favors keeping the international stock fund in a regular taxable account as opposed to in an IRA.

Dividend Yield and Qualified Dividend RatioThe foreign tax credit isn’t the only factor though. International stock funds tend to pay out a higher dividend. A higher percentage of their dividends also tends to be non-qualified, which are taxed at a higher rate than qualified dividends.

For example, Vanguard Total Stock Index Fund, which invests in U.S. stocks, paid out 1.3% as dividends last year and 95% of its dividends were qualified. Vanguard Total International Stock Index Fund paid out 3.2% last year and only 65% of its dividends were qualified. Both the higher dividend payout and the lower percentage of qualified dividends raise your taxes when you hold an international stock fund in a regular taxable account.

In addition, the higher dividends raise your AGI, which can have ripple effects on ACA health insurance subsidy, Net Investment Income Tax, tax on Social Security, Medicare IRMAA, and many other areas that key off the AGI.

How do you balance the two factors going in opposite directions? If you invest in both a U.S. stocks fund and an international stock fund and you have both IRAs and taxable accounts, which fund should you put in your IRA, and which fund should you put in a taxable account?

A Wash in the Grand SchemeLeif Dahleen at Physician On FIRE calculated with different funds in different tax brackets. Sometimes you’re better off holding international funds in an IRA, and sometimes you’re better off holding them in a taxable account. The absolute differences are close either way. I would call them a wash in the grand scheme.

Other practical considerations play a role when it’s more or less a wash dollar-wise.

Form 1116Claiming the foreign tax credit is as simple as putting a number on your tax return when you paid only a small amount of foreign taxes. The IRS sets that threshold at $300 for single filers and $600 for married filing jointly. When you paid more than $300/$600 in foreign taxes, the IRS doesn’t give the credit as easily. You have to file a Form 1116 with your tax return.

The whole purpose of Form 1116 is to see whether your foreign tax credit should be less than the full amount of the foreign taxes you paid. The two-page form comes with 24 pages of instructions. Receiving dividends from a mutual fund that invests in international stocks gets lumped with having wages, rental real estate, and mortgages in foreign countries.

Schedules K-2 and K-3The IRS is making it more difficult to claim the full foreign tax credit. Even though my small self-employed business has nothing to do with foreign countries, I still had to file 60 pages of nonsense schedules K-2 and K-3 on my business side only on the off chance that it might reduce the foreign tax credit on my personal return.

Adjust Foreign IncomeForm 1116 asks for your foreign-source income to see whether your foreign tax credit should be limited. H&R Block tax software has this seemingly innocent note when you enter the foreign-source income:

You might need to adjust this amount if it includes foreign capital gains or qualified dividends. To learn more, see the Form 1116 instructions, under Foreign Qualified Dividends and Capital Gains (Losses).

Because a portion of the dividend from your international stock fund is qualified dividend, they want you to learn how to adjust the income and give the already adjusted amount. If you actually attempt to read the 24-page Form 1116 instructions, you’ll see confusing adjustment procedures such as dividing your dividends into different buckets and multiplying them by 0, 0.4054, and 0.5405 respectively. Good luck with that!

Then you see in the instructions an adjustment exception that you may qualify for, but it isn’t easy to find how you can choose to use the adjustment exception. I daresay the majority of Form 1116’s filed using H&R Block software are wrong, because users don’t realize what that fine-print note means and they don’t activate the adjustment exception (available only in the Forms mode).

Some other software such as FreeTaxUSA doesn’t adjust the foreign income, period. It produces a wrong tax return when you don’t qualify for the adjustment exception.

Carryover on Schedule BThe IRS added a new Schedule B for Form 1116 to track the portion of foreign tax credit that you can’t claim in full. You carry the residual amount to the following year and try your luck again. TurboTax only started supporting Form 1116 at the beginning of March, and it only started supporting this new Schedule B today, March 11, which is more than halfway toward the tax filing deadline.

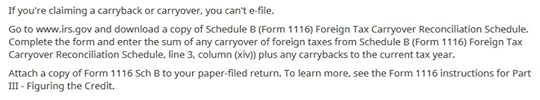

H&R Block tax software says this if you can’t claim 100% of your foreign taxes paid:

They ask you to download the form from the IRS website, complete it yourself, and attach it to your printed tax return. Oh boy. I thought the purpose of using tax software is to avoid having to fill out tax forms by hand.

Quit the GameSubjecting myself to the torture to see whether I can claim only 93% of the foreign taxes paid this year is totally not worth it to me. Even if it turns out you can claim 100%, you still have to go through the exercise.

I decided to quit this game in the spirit of making fewer things matter. I sold the international fund in my taxable account to buy a U.S. stock fund and I did the opposite in my IRA. I won’t have to worry about dealing with the foreign tax credit next year.

If you still want the foreign tax credit, try to limit your foreign taxes paid under the IRS threshold of $300 single, $600 married filing jointly. Or use TurboTax, which does a better job in handling Form 1116. See Foreign Tax Credit Form 1116 in TurboTax and H&R Block for a walkthrough.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Too Much Hassle in Claiming Foreign Tax Credit on IRS Form 1116 appeared first on The Finance Buff.

March 10, 2022

2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets

[Updated on March 10, 2022 after the release of the inflation number for February 2022.]

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors’ services and Medicare Part D that covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

Table of ContentsWhat Is IRMAA?2022 IRMAA Brackets2023 IRMAA Brackets0% Inflation Assumption5% Inflation Assumption2024 IRMAA Brackets0% Inflation Assumption5% Inflation AssumptionNickel and DimeIRMAA AppealNot Penalized For LifeWhat Is IRMAA?Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount.

I haven’t seen any numbers that show how much collecting IRMAA really helps the government in the grand scheme. I’m guessing very little. One report said 7% of all Medicare beneficiaries pay IRMAA. Suppose the 7% pay double the standard premium, it changes the overall split between the beneficiaries and the government from 25:75 to 27:73. Big deal?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits aren’t included in the income for determining IRMAA.

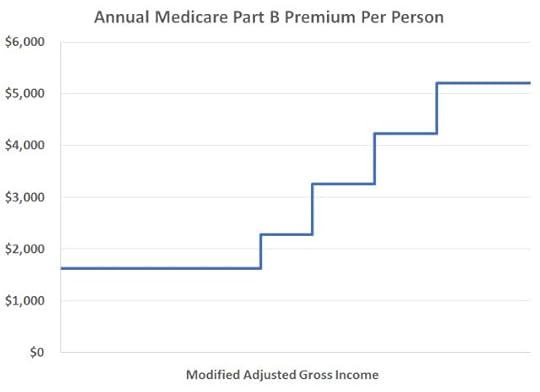

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay. If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

So if your income is near a bracket cutoff, see if you can manage to keep it down and make it stay in a lower bracket. Using the income from two years ago makes it a little harder.

2022 IRMAA BracketsThe IRMAA income brackets (except the very last one) are adjusted for inflation. Here are the IRMAA income brackets for 2022 coverage. Remember the income on your 2020 tax return (AGI plus muni interest) determines the IRMAA you pay in 2022. The income on your 2021 tax return (to be filed in 2022) determines the IRMAA you pay in 2023.

Part B Premium2022 Coverage (2020 Income)StandardSingle: <= $91,000Married Filing Jointly: <= $182,000

Married Filing Separately <= $91,000Standard * 1.4Single: <= $114,000

Married Filing Jointly: <= $228,000Standard * 2.0Single: <= $142,000

Married Filing Jointly: <= $284,000Standard * 2.6Single: <= $170,000

Married Filing Jointly: <= $340,000Standard * 3.2Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $409,000Standard * 3.4Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $409,000IRMAA Brackets for 2022 Coverage

Source: Part B Costs, Medicare.gov

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The income brackets are the same. The surcharges are relatively smaller in dollars.

2023 IRMAA BracketsIt’s too early to know for sure what the 2023 IRMAA brackets will be. Still, you can make reasonable estimates and give yourself some margin to stay clear of the cutoff points. If inflation is 0% from March 2022 through August 2022, these will be the 2023 numbers:

0% Inflation AssumptionPart B Premium2022 Coverage (2020 Income)2023 Coverage (2021 Income)StandardSingle: <= $91,000Married Filing Jointly: <= $182,000

Married Filing Separately <= $91,000Single: <= $96,000

Married Filing Jointly: <= $192,000

Married Filing Separately <= $96,000Standard * 1.4Single: <= $114,000

Married Filing Jointly: <= $228,000Single: <= $121,000

Married Filing Jointly: <= $242,000Standard * 2.0Single: <= $142,000

Married Filing Jointly: <= $284,000Single: <= $151,000

Married Filing Jointly: <= $302,000Standard * 2.6Single: <= $170,000

Married Filing Jointly: <= $340,000Single: <= $181,000

Married Filing Jointly: <= $362,000Standard * 3.2Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $409,000Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $404,000Standard * 3.4Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $409,000Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $404,0002023 IRMAA Brackets with 0% inflation

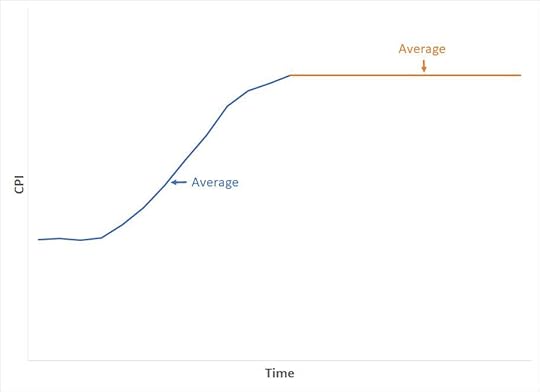

Because the formula compares the average of CPI numbers in a 12-month period over the average of CPI numbers in a base period, even if inflation is 0% in the following months, the average will still be higher than the average in the previous months. If inflation is positive, the IRMAA brackets for 2023 may be higher than these. If inflation is negative, which is rare but still possible, the IRMAA brackets for 2023 may be lower than the numbers above.

5% Inflation Assumption

5% Inflation AssumptionIf inflation is 5% annualized from March 2022 through August 2022, these will be the 2023 numbers:

Part B Premium2022 Coverage (2020 Income)2023 Coverage (2021 Income)StandardSingle: <= $91,000Married Filing Jointly: <= $182,000

Married Filing Separately <= $91,000Single: <= $97,000

Married Filing Jointly: <= $194,000

Married Filing Separately <= $97,000Standard * 1.4Single: <= $114,000

Married Filing Jointly: <= $228,000Single: <= $122,000

Married Filing Jointly: <= $244,000Standard * 2.0Single: <= $142,000

Married Filing Jointly: <= $284,000Single: <= $152,000

Married Filing Jointly: <= $304,000Standard * 2.6Single: <= $170,000

Married Filing Jointly: <= $340,000Single: <= $182,000

Married Filing Jointly: <= $364,000Standard * 3.2Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $409,000Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $403,000Standard * 3.4Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $409,000Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $403,0002023 IRMAA bRACKETS WITH 5% inflation

As you can see from the two tables, there’s very little difference between assuming 0% inflation and 5% inflation from February 2022 through August 2022.

2024 IRMAA BracketsWe have zero data point as of right now for what the 2024 IRMAA brackets will be. If inflation is 0% from March 2022 through August 2023, these will be the 2024 numbers:

0% Inflation AssumptionPart B Premium2022 Coverage (2020 Income)2024 Coverage (2022 Income)StandardSingle: <= $91,000Married Filing Jointly: <= $182,000

Married Filing Separately <= $91,000Single: <= $97,000

Married Filing Jointly: <= $194,000

Married Filing Separately <= $97,000Standard * 1.4Single: <= $114,000

Married Filing Jointly: <= $228,000Single: <= $122,000

Married Filing Jointly: <= $244,000Standard * 2.0Single: <= $142,000

Married Filing Jointly: <= $284,000Single: <= $152,000

Married Filing Jointly: <= $304,000Standard * 2.6Single: <= $170,000

Married Filing Jointly: <= $340,000Single: <= $182,000

Married Filing Jointly: <= $364,000Standard * 3.2Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $409,000Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $403,000Standard * 3.4Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $409,000Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $403,0002024 IRMAA Brackets with 0% inflation5% Inflation Assumption

If inflation is 5% annualized from March 2022 through August 2023, these will be the 2024 numbers:

Part B Premium2022 Coverage (2020 Income)2024 Coverage (2022 Income)StandardSingle: <= $91,000Married Filing Jointly: <= $182,000

Married Filing Separately <= $91,000Single: <= $102,000

Married Filing Jointly: <= $204,000

Married Filing Separately <= $102,000Standard * 1.4Single: <= $114,000

Married Filing Jointly: <= $228,000Single: <= $128,000

Married Filing Jointly: <= $256,000Standard * 2.0Single: <= $142,000

Married Filing Jointly: <= $284,000Single: <= $160,000

Married Filing Jointly: <= $320,000Standard * 2.6Single: <= $170,000

Married Filing Jointly: <= $340,000Single: <= $192,000

Married Filing Jointly: <= $384,000Standard * 3.2Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $409,000Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $398,000Standard * 3.4Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $409,000Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $398,0002024 IRMAA bRACKETS WITH 5% inflationNickel and Dime

The standard Medicare Part B premium is $170.10/month in 2022. A 40% surcharge on the Medicare Part B premium is about $800/year per person or about $1,600/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $182,000 in income, they’re already paying a large amount in taxes. Does making them pay another $1,600 make that much difference? It’s less than 1% of their income but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income and don’t accidentally cross a line for IRMAA.

IRMAA AppealIf your income two years ago was higher because you were working at that time and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA assessment. The “life-changing events” that make you eligible for an appeal include:

Death of spouseMarriageDivorce or annulmentWork reductionWork stoppageLoss of income from income producing propertyLoss or reduction of certain kinds of pension incomeYou file an appeal by filling out the form SSA-44 to show that although your income was higher two years ago, you had a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For LifeIf your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, when your income comes down in the following year, your IRMAA will also come down automatically. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower