How To Buy Treasury Bills & Notes Without Fee at Online Brokers

[Updated and rewritten on April 5, 2022.]

When you’d like to invest for a guaranteed return, I Bonds are no doubt the best deal right now (see How to Buy I Bonds). However, the government imposes an annual purchase limit on I Bonds. After you buy all the I Bonds you can buy, if you still would like to invest a sum of money for a fixed term, buying CDs directly from a bank or credit union used to be the answer but that’s not the case today.

Table of ContentsTreasuries Beat CDs NowOrder WindowYield Determined by AuctionSellingTaxesFidelityVanguardCharles SchwabMerrill EdgeE*TradeTreasuries Beat CDs NowWhen the Fed started raising interest rates, the financial markets responded right away. Banks and credit unions are still slow to raise the rates they pay on savings accounts and CDs because they don’t need more deposits and they rely on people’s inertia and ignorance of the going rates.

I read this headline from DepositAccounts.com — Latino Community Credit Union Unveils Very Competitive Super Jumbo CDs. These super jumbo CDs require a minimum deposit of $200,000 and they pay the top rates of all CDs tracked by DepositAccounts.com. However, those rates were much lower than the yields on Treasuries of comparable maturities on the date the CDs came out.

Super Jumbo CDTreasury Note12-month1.1%1.7%24-month1.8%2.4%36-month2.1%2.6%48-month2.15%2.6%In addition, Treasuries require a minimum investment of only $1,000, the interest is exempt from state and local taxes, and you can buy them in your existing brokerage account. Why in the world would someone buy these CDs from this credit union?

Because people don’t know they can buy Treasuries so easily for a higher yield than CDs at this moment.

When you already have a TreasuryDirect account for I Bonds, you can use the same account to buy regular Treasuries but it’s easier to buy them in a brokerage account. You can buy new-issue Treasuries through the top 3 brokerage firms Fidelity, Vanguard, and Charles Schwab with no fee whatsoever.

Order WindowYou only have to know when the U.S. government will sell a new batch of Treasuries next time. Right now the government sells shorter maturities weekly and longer maturities monthly. You don’t have to wait long for the next sale.

MaturitySale Frequency4-week, 8-week, 13-week, 26-weekweekly52-week, 2-year, 3-year, 5-yearmonthlyThe exact dates are published in the Tentative Auction Schedule from the U.S. Treasury. The schedule lists three dates — the Announcement Date, the Auction Date, and the Settlement Date. You only need to pay attention to the first two dates to know the window for placing your order.

You place your order between the afternoon of the Announcement Date and the night before the Auction Date. For example, if you’d like to invest a sum of money for two years, the schedule shows a 2-year note will be announced on Thursday, April 21 and it will be auctioned on Tuesday, April 26. You will see it offered in your brokerage account on the afternoon of the Announcement Date (April 21). You should have your order in by the night before the Auction Date (April 26).

So check the sale schedule and set a calendar reminder for yourself to place the order within the order window.

Yield Determined by AuctionThe actual yield you’ll receive is determined by an auction but you don’t have to worry about any bidding. You only say how much you’d like to buy in your order. The banks will do the bidding and you are just tagging along. You get the same yield for your tiny $1,000 purchase as a bank buying $100 million. You can get a feel of where the yield might land by checking Daily Treasury Par Yield Curve Rates (click on the first link on the webpage).

Treasury bills (1-year or shorter) are sold at a discount to face value. You pay slightly less than $1,000 for each $1,000 bill. When the bill matures you receive the full $1,000 in your brokerage account. The difference is your interest. Treasury notes (2-year and above) are sold at slightly less than face value. You receive interest payments in your brokerage account every six months.

SellingIf you hold the Treasury to its maturity, you don’t have to do anything extra. The face value will magically appear in your account after it matures.

Some brokers offer an optional “auto roll” feature. If you enable the “auto roll” feature when you buy the Treasury, the broker will automatically use the money from the matured Treasury to buy another new-issue Treasury of the same face value and the same term.

If you decide to sell before the Treasury matures, you can sell it online at any time through the broker. The price will be at the market price at that time, which may be higher or lower than your original purchase price.

TaxesWhen you buy Treasuries in a taxable brokerage account, the brokerage firm will send you the necessary tax form for your taxes after the end of the year. The interest earned on Treasuries is exempt from state and local taxes.

FidelityHere are the steps for placing an order for new-issue Treasuries with Fidelity.

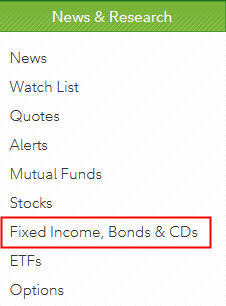

Under News & Research on the top, click on Fixed Income, Bonds & CDs.

Click on the New Issues tab. You pay no extra fee only when you buy a new issue.

You’ll see a list of upcoming issues in the Treasury section. If you don’t see anything for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window.

You’ll see the maturity date of each issue and the expected yield. The expected yield is only an estimate. You’ll know the actual yield only after your order executes but you can be sure you’ll always get the best yield determined by the market. Click on Trade to buy the issue you are interested in.

You may see either the “old” order entry screen or the “new” order entry screen next. Either one works. Only the look and feel are different.

Old order Entry page

Old order Entry page New order entry page

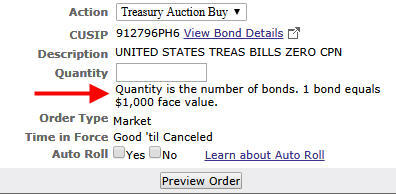

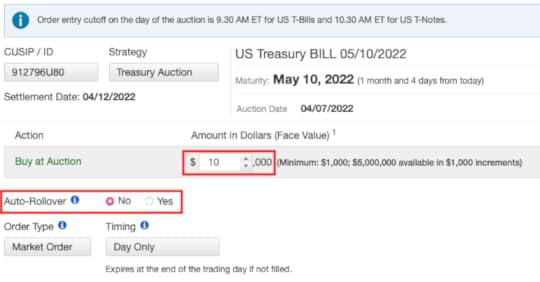

New order entry pageTreasuries are sold in $1,000 increments in a brokerage account. Enter a quantity of 1 if you’d like to buy $1,000 worth. It will cost slightly less than $1,000 when it’s all said and done. Fidelity lets you set up Auto Roll to automatically buy another Treasury of the same term and the same amount when this Treasury matures. It’s convenient when you’re investing in short-term Treasury Bills.

If you turn on Auto Roll, when it’s time to roll to the next one, you may receive an email saying you don’t have enough cash in your account to cover the new purchase. Don’t worry. The matured Treasury will cover the new purchase just in time. See comments from Mapleton Reader.

Again, there is no fee whatsoever from Fidelity when you buy new-issue Treasuries. Have cash ready in your account. You’ll have Treasuries when the auction settles.

VanguardHere are the steps to buy new-issue Treasuries in a Vanguard brokerage account.

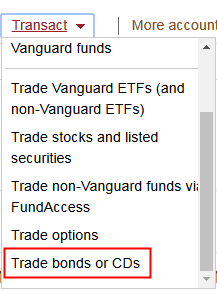

Click on the Transact dropdown next to your account and scroll to the bottom. Click on Trade bonds or CDs.

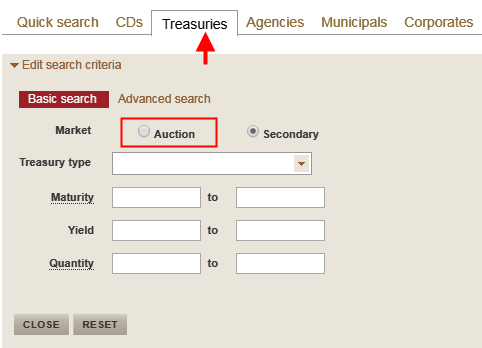

Click on the Treasuries tab and then the Auction radio button. Be sure to select “Auction.” You pay no extra fee only when you buy a new issue.

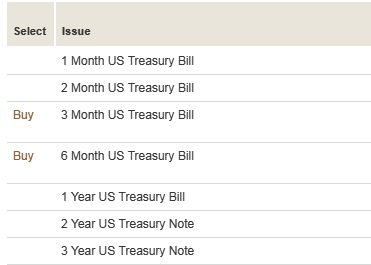

You will see a list. The Treasuries available for accepting orders will have a Buy link. If you don’t see a Buy link for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window.

Vanguard goes by the face amount on the order page. Your order amount must be in $1,000 increments with a minimum of $1,000 and a maximum of $5 million. Vanguard doesn’t offer the Auto Roll feature. Similar to Fidelity, there is no fee whatsoever from Vanguard when you buy new-issue Treasuries.

Charles SchwabYou can buy new-issue Treasuries at Charles Schwab as well. There is also no fee whatsoever from Schwab. I don’t have an account with Schwab but a reader sent me these screenshots from their account.

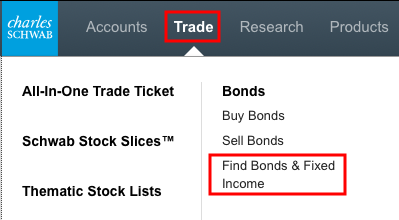

Click on Trade in the top menu and then Find Bonds & Fixed Income.

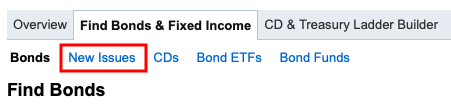

Click on New Issues.

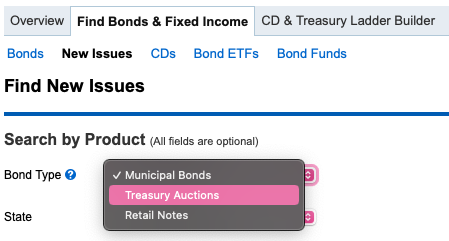

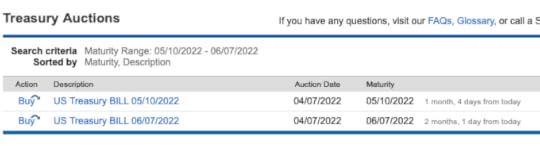

Choose Treasury Auctions in the Bond Type dropdown.

You will see a list of issues available for new orders. If you don’t see anything for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window.

Your order must be in $1,000 increments. If you turn on the Auto-Rollover feature, Schwab will automatically enter a new order for the same term and the same amount when this Treasury matures. If you leave the Auto-Rollover feature off, you’ll just have cash when this Treasury matures.

Merrill EdgeMerrill Edge doesn’t support buying new-issue Treasuries online. Placing an order through a representative by phone costs $30. You can buy Treasuries on the secondary market online but the price quote includes a markup.

E*TradeE*Trade’s commission schedule says their fee is $0 for buying new-issue Treasuries but I don’t have screenshots for how to do it because I don’t have an account with E*Trade.

***

Buying new-issue Treasuries in a brokerage account come down to:

Check the current rates and decide how long you will invest the money.Check the auction schedule to see when the next sale for your desired term will come up.Set a calendar reminder to place your order within the order window.Have cash ready to go in your account.Place your order. Wait for the auction and settlement.Automatically receive interest in your account every six months (only 2-year Treasury Notes and up). Automatically receive the face value when it matures.You can also buy “pre-owned” Treasuries on the secondary market but you’ll have to pay a bid/ask spread there. You’re better off waiting for a new issue unless the term you want to buy isn’t available as a new issue (for example, no 9-month or 4-year terms are offered as a new issue), or for some reason you must buy them today.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Buy Treasury Bills & Notes Without Fee at Online Brokers appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower