2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets

[Updated on March 10, 2022 after the release of the inflation number for February 2022.]

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors’ services and Medicare Part D that covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

Table of ContentsWhat Is IRMAA?2022 IRMAA Brackets2023 IRMAA Brackets0% Inflation Assumption5% Inflation Assumption2024 IRMAA Brackets0% Inflation Assumption5% Inflation AssumptionNickel and DimeIRMAA AppealNot Penalized For LifeWhat Is IRMAA?Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount.

I haven’t seen any numbers that show how much collecting IRMAA really helps the government in the grand scheme. I’m guessing very little. One report said 7% of all Medicare beneficiaries pay IRMAA. Suppose the 7% pay double the standard premium, it changes the overall split between the beneficiaries and the government from 25:75 to 27:73. Big deal?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits aren’t included in the income for determining IRMAA.

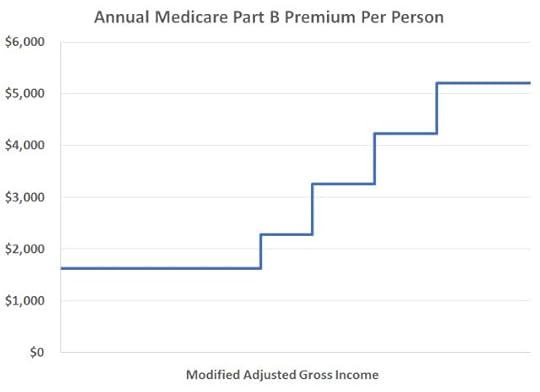

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay. If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

So if your income is near a bracket cutoff, see if you can manage to keep it down and make it stay in a lower bracket. Using the income from two years ago makes it a little harder.

2022 IRMAA BracketsThe IRMAA income brackets (except the very last one) are adjusted for inflation. Here are the IRMAA income brackets for 2022 coverage. Remember the income on your 2020 tax return (AGI plus muni interest) determines the IRMAA you pay in 2022. The income on your 2021 tax return (to be filed in 2022) determines the IRMAA you pay in 2023.

Part B Premium2022 Coverage (2020 Income)StandardSingle: <= $91,000Married Filing Jointly: <= $182,000

Married Filing Separately <= $91,000Standard * 1.4Single: <= $114,000

Married Filing Jointly: <= $228,000Standard * 2.0Single: <= $142,000

Married Filing Jointly: <= $284,000Standard * 2.6Single: <= $170,000

Married Filing Jointly: <= $340,000Standard * 3.2Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $409,000Standard * 3.4Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $409,000IRMAA Brackets for 2022 Coverage

Source: Part B Costs, Medicare.gov

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The income brackets are the same. The surcharges are relatively smaller in dollars.

2023 IRMAA BracketsIt’s too early to know for sure what the 2023 IRMAA brackets will be. Still, you can make reasonable estimates and give yourself some margin to stay clear of the cutoff points. If inflation is 0% from March 2022 through August 2022, these will be the 2023 numbers:

0% Inflation AssumptionPart B Premium2022 Coverage (2020 Income)2023 Coverage (2021 Income)StandardSingle: <= $91,000Married Filing Jointly: <= $182,000

Married Filing Separately <= $91,000Single: <= $96,000

Married Filing Jointly: <= $192,000

Married Filing Separately <= $96,000Standard * 1.4Single: <= $114,000

Married Filing Jointly: <= $228,000Single: <= $121,000

Married Filing Jointly: <= $242,000Standard * 2.0Single: <= $142,000

Married Filing Jointly: <= $284,000Single: <= $151,000

Married Filing Jointly: <= $302,000Standard * 2.6Single: <= $170,000

Married Filing Jointly: <= $340,000Single: <= $181,000

Married Filing Jointly: <= $362,000Standard * 3.2Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $409,000Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $404,000Standard * 3.4Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $409,000Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $404,0002023 IRMAA Brackets with 0% inflation

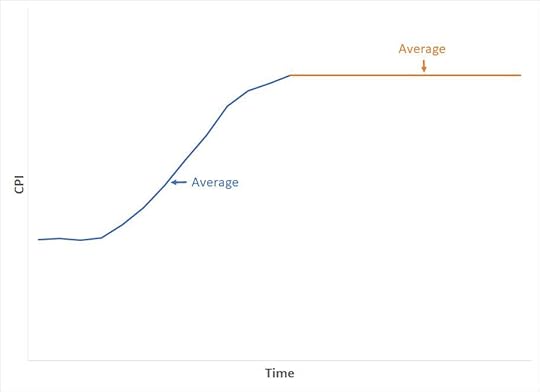

Because the formula compares the average of CPI numbers in a 12-month period over the average of CPI numbers in a base period, even if inflation is 0% in the following months, the average will still be higher than the average in the previous months. If inflation is positive, the IRMAA brackets for 2023 may be higher than these. If inflation is negative, which is rare but still possible, the IRMAA brackets for 2023 may be lower than the numbers above.

5% Inflation Assumption

5% Inflation AssumptionIf inflation is 5% annualized from March 2022 through August 2022, these will be the 2023 numbers:

Part B Premium2022 Coverage (2020 Income)2023 Coverage (2021 Income)StandardSingle: <= $91,000Married Filing Jointly: <= $182,000

Married Filing Separately <= $91,000Single: <= $97,000

Married Filing Jointly: <= $194,000

Married Filing Separately <= $97,000Standard * 1.4Single: <= $114,000

Married Filing Jointly: <= $228,000Single: <= $122,000

Married Filing Jointly: <= $244,000Standard * 2.0Single: <= $142,000

Married Filing Jointly: <= $284,000Single: <= $152,000

Married Filing Jointly: <= $304,000Standard * 2.6Single: <= $170,000

Married Filing Jointly: <= $340,000Single: <= $182,000

Married Filing Jointly: <= $364,000Standard * 3.2Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $409,000Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $403,000Standard * 3.4Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $409,000Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $403,0002023 IRMAA bRACKETS WITH 5% inflation

As you can see from the two tables, there’s very little difference between assuming 0% inflation and 5% inflation from February 2022 through August 2022.

2024 IRMAA BracketsWe have zero data point as of right now for what the 2024 IRMAA brackets will be. If inflation is 0% from March 2022 through August 2023, these will be the 2024 numbers:

0% Inflation AssumptionPart B Premium2022 Coverage (2020 Income)2024 Coverage (2022 Income)StandardSingle: <= $91,000Married Filing Jointly: <= $182,000

Married Filing Separately <= $91,000Single: <= $97,000

Married Filing Jointly: <= $194,000

Married Filing Separately <= $97,000Standard * 1.4Single: <= $114,000

Married Filing Jointly: <= $228,000Single: <= $122,000

Married Filing Jointly: <= $244,000Standard * 2.0Single: <= $142,000

Married Filing Jointly: <= $284,000Single: <= $152,000

Married Filing Jointly: <= $304,000Standard * 2.6Single: <= $170,000

Married Filing Jointly: <= $340,000Single: <= $182,000

Married Filing Jointly: <= $364,000Standard * 3.2Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $409,000Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $403,000Standard * 3.4Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $409,000Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $403,0002024 IRMAA Brackets with 0% inflation5% Inflation Assumption

If inflation is 5% annualized from March 2022 through August 2023, these will be the 2024 numbers:

Part B Premium2022 Coverage (2020 Income)2024 Coverage (2022 Income)StandardSingle: <= $91,000Married Filing Jointly: <= $182,000

Married Filing Separately <= $91,000Single: <= $102,000

Married Filing Jointly: <= $204,000

Married Filing Separately <= $102,000Standard * 1.4Single: <= $114,000

Married Filing Jointly: <= $228,000Single: <= $128,000

Married Filing Jointly: <= $256,000Standard * 2.0Single: <= $142,000

Married Filing Jointly: <= $284,000Single: <= $160,000

Married Filing Jointly: <= $320,000Standard * 2.6Single: <= $170,000

Married Filing Jointly: <= $340,000Single: <= $192,000

Married Filing Jointly: <= $384,000Standard * 3.2Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $409,000Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $398,000Standard * 3.4Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $409,000Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $398,0002024 IRMAA bRACKETS WITH 5% inflationNickel and Dime

The standard Medicare Part B premium is $170.10/month in 2022. A 40% surcharge on the Medicare Part B premium is about $800/year per person or about $1,600/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $182,000 in income, they’re already paying a large amount in taxes. Does making them pay another $1,600 make that much difference? It’s less than 1% of their income but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income and don’t accidentally cross a line for IRMAA.

IRMAA AppealIf your income two years ago was higher because you were working at that time and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA assessment. The “life-changing events” that make you eligible for an appeal include:

Death of spouseMarriageDivorce or annulmentWork reductionWork stoppageLoss of income from income producing propertyLoss or reduction of certain kinds of pension incomeYou file an appeal by filling out the form SSA-44 to show that although your income was higher two years ago, you had a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For LifeIf your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, when your income comes down in the following year, your IRMAA will also come down automatically. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower