When TurboTax and H&R Block Give the Wrong ACA Subsidy

[Updated on February 22, 2022 with a different example.]

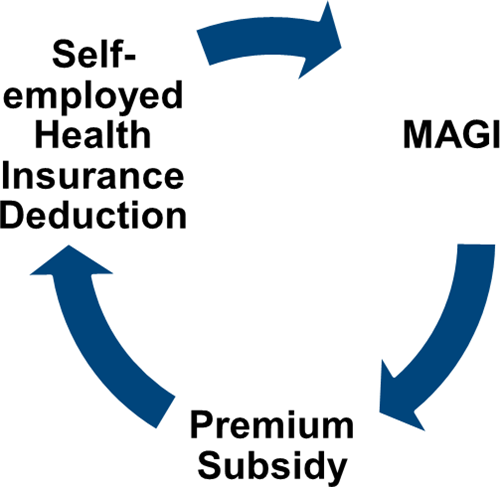

When you’re self-employed, you can deduct your health insurance premium on your tax return. When you buy health insurance through the ACA healthcare marketplace, you can also get a premium subsidy when your income qualifies. The circular relationship between the self-employed health insurance deduction and the premium tax credit creates an interesting math problem.

Tax Software

Tax SoftwareAfter the IRS provided an iterative method for this math problem (see IRS Guidance On Circular Reference in ACA Premium Subsidy and Deduction), tax software vendors such as TurboTax and H&R Block implemented the calculation in their software. It solved the problem for most people. For a step-by-step walkthrough of how to make the software calculate the subsidy and the deduction, please see Self-Employed ACA Health Insurance Subsidy and Deduction In TurboTax and Self-Employed ACA Health Insurance Subsidy and Deduction In H&R Block Tax Software.

However, the calculation in the software still doesn’t work for everyone. Sometimes your specific numbers throw the software out of whack when the same software works perfectly fine with other numbers for other people. Worse yet, the software doesn’t warn you that its calculation is wrong. If you don’t know it’s wrong, you may miss out on large tax credits and deductions!

Here’s a simple example for which TurboTax and H&R Block tax software gives the wrong calculation:

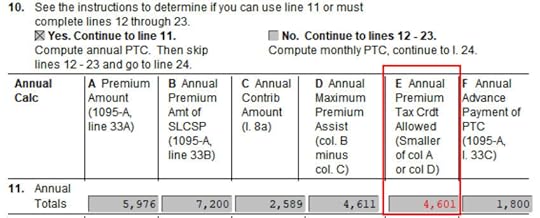

Diane, single, earned $45,000 in self-employment income after all business expenses. She didn’t have any other income or deductions. After subtracting one-half of the self-employment tax, Diane’s MAGI before health insurance was $41,821. As a Texas resident, Diane paid $498/month for a health plan from the ACA healthcare marketplace ($5,976 total). The Second Lowest Cost Silver Plan in her zip code cost $600/month ($7,200 total). Diane received no advance subsidy from the ACA healthcare marketplace.

TurboTax calculated $810 in self-employed health insurance deduction (Schedule 1, Line 17) and $4,522 in premium tax credit (Form 8962, Line 24). We know this result makes no sense because Diane should be able to deduct the full amount not covered by the premium tax credit. Diane paid $5,976. If she receives $4,522 in premium tax credit, she should be able to deduct $5,976 – $4,522 = $1,454, not just $810.

In other words, this equation should hold true:

Self-Employed Health Insurance Deduction + Premium Tax Credit = Unsubsidized Health Insurance Premium (including any dental and vision premiums)

You know the tax software is giving you wrong numbers when the numbers fail the equation (except for a small difference due to rounding).

H&R Block tax software does better than TurboTax in this case. It calculates $1,378 in self-employed health insurance deduction (Schedule 1, Line 17) and $4,612 in premium tax credit (Form 8962, Line 24). This is a little too generous. Diane only paid $5,976 for her health policy but she’s getting $1,378 + $4,612 = $5,990 in tax deduction and tax credit.

A Better CalculatorMathematician Sam Ferguson first heard of this problem from a self-employed Uber driver when he was a Ph.D. student at NYU. He studied the math angles and found out why the calculation didn’t work in all cases. He wrote an alternative method in his paper Obamacare and a Fix for the IRS Iteration. When he spoke to the person in charge at the IRS, the IRS personnel acknowledged the problem but they didn’t treat it as a high priority when the existing method already worked for most people, just not for the edge cases.

Dr. Ferguson developed an online calculator with a software engineer. He authorized me to host it and keep it updated. Here’s the link:

You get these results when you run the same numbers using the better calculator:

CalculatorTurboTaxH&R BlockTax Deduction$1,375$810$1,378Subsidy$4,601$4,522$4,612

Appropriate subsidy amount: 4,601

With this subsidy, your net health insurance cost to be deducted on your tax return is: 5,976 – 4,601 = 1,375

With this net health insurance cost, your modified adjusted gross income is: 41,821 -1,375 = 40,446

If Diane simply goes with the wrong numbers from TurboTax, she will miss $79 in tax credit plus another $565 in tax deduction.

Overriding Tax SoftwareAfter getting the correct numbers from the calculator, you still need to find a way to have your tax software use those numbers. I couldn’t figure out how to override the wrong numbers in TurboTax Deluxe downloaded software. I’m not sure whether a different edition allows manual entries. I was able to figure out how to override in H&R Block software. If you use TurboTax and you run into this problem, consider switching to H&R Block software.

Although the H&R Block software is close enough for our example that it doesn’t need overriding, I’m showing you how to override H&R Block software in case its calculation is off by a larger amount for a different set of numbers. Overriding may prevent you from e-filing, but the inconvenience of having to file your return by mail sure beats missing out on a large deduction or tax credit.

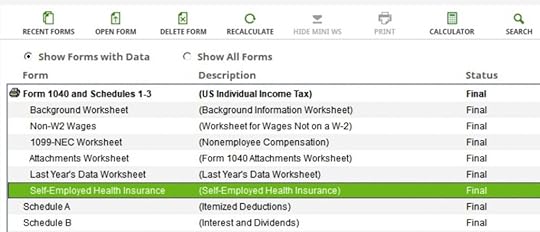

In H&R Block downloaded software, click on Forms on the top, and then find “Self-Employed Health Insurance” in the forms list.

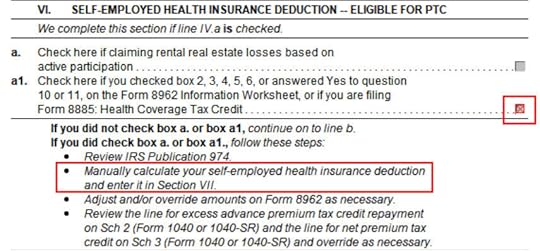

Double-click to open that form. Scroll down to Part VI. Right-click on Box a1 and click on Override. This will allow you to enter your manually calculated deduction.

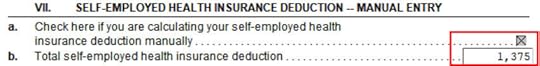

Scroll further down to Part VII. Right-click on Box a and click on Override. Enter the deduction from the online calculator in the box below (in our example, $1,375).

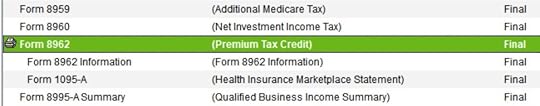

Close this form. Find Form 8962 in the forms list.

Double-click to open Form 8962. Scroll down to Line 11. If the number in column E is different than the number from the online calculator, right-click on Line 11 column E and click on Override. Enter your manually calculated subsidy (in our example, $1,398). If you must use monthly numbers in Lines 12-23 as opposed to the annual totals in Line 11, do the override in Lines 12-23 column E.

That’ll do it. You should double-check that your Schedule 1 Line 17 shows the correct deduction and your Form 8962 Line 24 shows the correct subsidy.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post When TurboTax and H&R Block Give the Wrong ACA Subsidy appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower