Harry Sit's Blog, page 17

January 16, 2023

How to Report 2022 Backdoor Roth In FreeTaxUSA (Updated)

[Updated on January 16, 2023 with screenshots from FreeTaxUSA for 2022 tax filing.]

TurboTax and H&R Block are the two major tax software for filing personal tax returns. A low-cost alternative to TurboTax and H&R Block software is FreeTaxUSA. FreeTaxUSA isn’t only for simple returns. It can still handle more complex transactions, such as the Backdoor Roth.

Just as a refresher, a Backdoor Roth involves making a non-deductible contribution to a Traditional IRA followed by converting from the Traditional IRA to a Roth IRA. Both the contribution and the conversion need to be reported in the tax software. For more information on Backdoor Roth, please read Backdoor Roth: A Complete How-To.

Table of ContentsWhat To ReportConvert From Traditional IRA to RothTraditional IRA ContributionTaxable Income from Backdoor RothTroubleshootingWhat To ReportYou report on the tax return your contribution to a Traditional IRA *for* that year, and you report the conversion to Roth *during* that year.

For example, when you are doing your tax return for year X, you report the contribution you made *for* year X, whether you actually did it during year X or the following year between January 1 and April 15. You also report the conversion to Roth *during* year X, whether the contribution was made for year X, the year before, or any previous years. Therefore a contribution made during the following year for year X goes on the tax return for year X. A conversion done during year Y after you made a contribution for year X goes on the tax return for year Y.

You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finishing your conversion in the same year. I called this a “planned” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for year X in year X and convert it during year X. Contribute for year Y in year Y and convert it during year Y. This way everything is clean and neat.

If you are already off by one year, catch up. Contribute for both the previous year and the current year, then convert the sum during the same year. See Make Backdoor Roth Easy On Your Tax Return.

Here’s the scenario we’ll use as an example:

You contributed $6,000 to a traditional IRA in 2022 for 2022. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2022, the value grew to $6,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments to the screens shown here.

Before we start, suppose this is what FreeTaxUSA shows:

We’ll compare the results after we enter the Backdoor Roth.

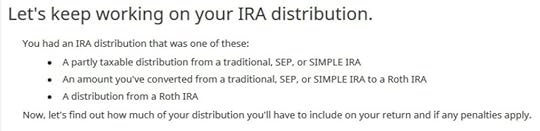

Convert From Traditional IRA to RothThe tax software works on income items first. Even though the conversion happened after the contribution, we enter the conversion first.

When you convert from Traditional IRA to Roth, you will receive a 1099-R. Complete this section only if you converted *during* the year for which you are doing the tax return. If you only converted during the following year and you don’t have a 1099-R yet, skip to the next section: Traditional IRA Contribution. You’ll complete this section next year.

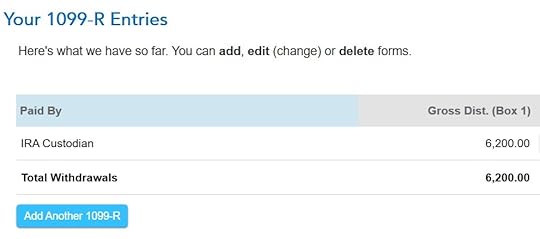

In our example, by the time you converted, the money in the Traditional IRA had grown from $6,000 to $6,200.

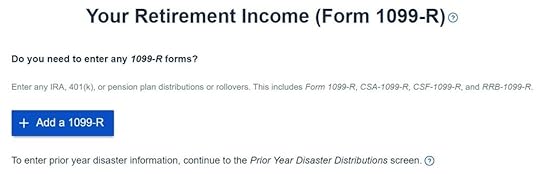

Click on “Add a 1099-R” when it asks you about the 1099-R.

It’s just a regular 1099-R.

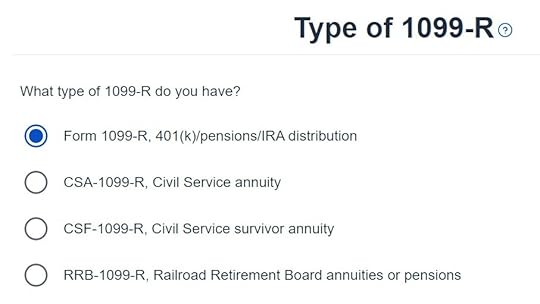

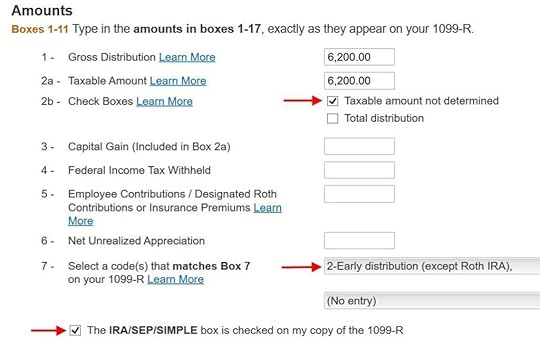

Enter the 1099-R exactly as you have it. Pay attention to the code in Box 7 and the checkboxes. It’s normal to have the same amount as the taxable amount in Box 2a, when Box 2b is checked saying “taxable amount not determined.” Pay attention to the distribution code in Box 7. My 1099-R has code 2, and the IRA/SEP/SIMPLE box is also checked.

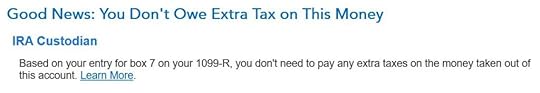

Right after you enter the 1099-R, you will see the refund number drop. Here we went from a $1,540 refund to $264. Don’t panic. It’s normal and temporary. The refund number will come up when we finish everything.

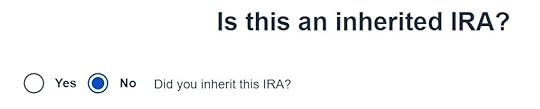

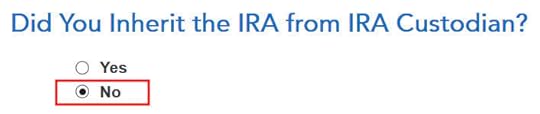

It’s not an inherited IRA.

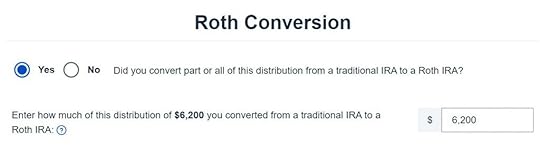

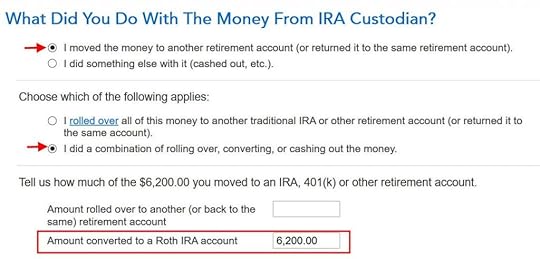

It asks you about Roth conversion. Answer Yes to conversion and enter the converted amount. This whole 1099-R is the result of a Roth conversion.

You are done with this 1099-R. Repeat if you have another 1099-R. If you’re married and both of you did a Backdoor Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse.

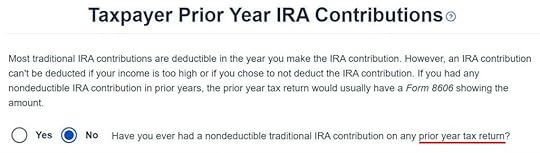

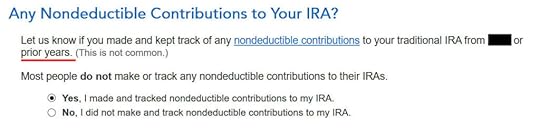

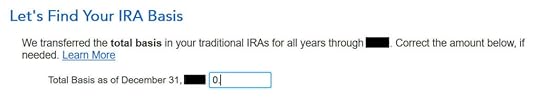

It asks you about the basis carried over from previous years. If you did a clean “planned” backdoor Roth every year, although technically the answer is Yes, you have nothing to carry over from year to year. In our simple example, we don’t have any. If you do, answer Yes and get the number from line 14 of Form 8606 from your previous year’s tax return.

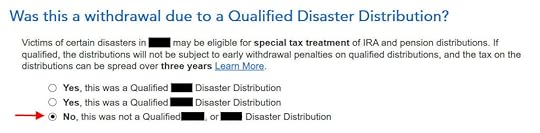

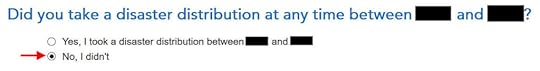

We didn’t take any disaster distribution.

Now continue with all other income items until you are done with income. Your refund meter is still lower than it should be, but it will change soon.

Traditional IRA Contribution

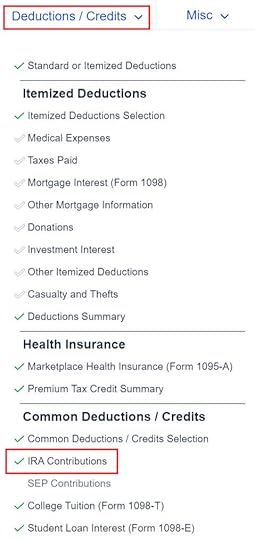

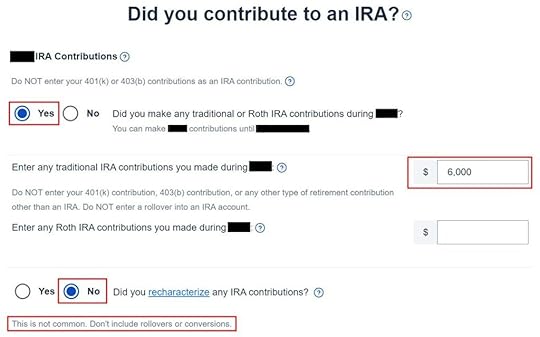

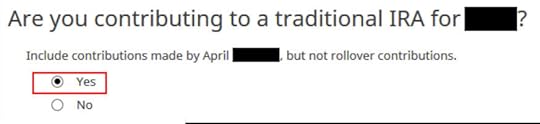

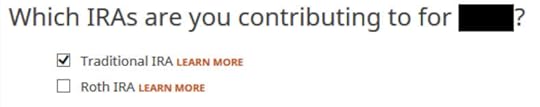

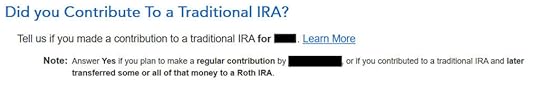

Find the IRA Contributions section under the “Deductions / Credits” menu.

Answer Yes to the first question and enter your contribution. Leave the answer to “Did you recharacterize” at No. In our example, you contributed $6,000 directly to a Traditional IRA. If you originally contributed to a Roth IRA and then you recharacterized the contribution as traditional contributions, enter the amount in the Roth IRA box and choose Yes below when it asks you whether you recharacterized.

Your refund number goes up again! It was a refund of $1,540 before we started. It went down a lot and now it’s back to $1,496. The $44 difference is due to paying tax on the $200 earnings before we converted to Roth.

We didn’t contribute to a SEP, SIMPLE, or solo 401k plan in this example. Answer Yes if you did.

Withdrawal means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer ‘No‘ here.

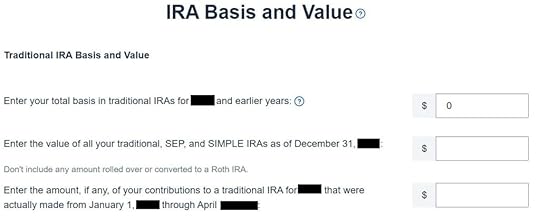

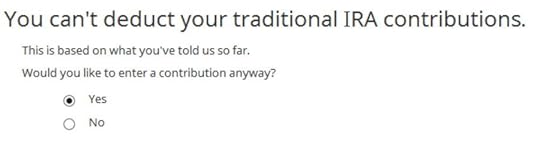

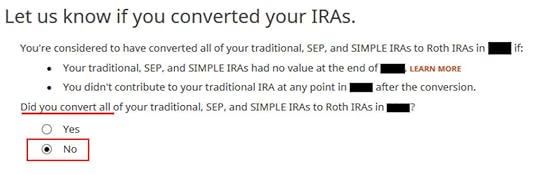

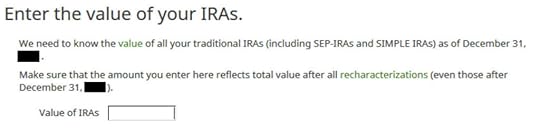

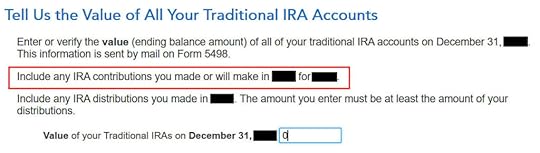

In our example, we don’t have any basis carried over from the previous years. We don’t have any money in traditional, SEP, or SIMPLE IRAs as of the end of the year (we already converted to Roth by then). Our contribution was made during the year in question, not in the following year.

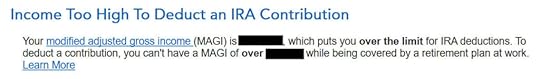

It tells us we don’t get a deduction. We know. It’s because our income was too high. That’s why we did the Backdoor Roth to begin with.

If you only contributed *for* last year but you didn’t convert until the following year, remember to come back next year to finish the conversion part.

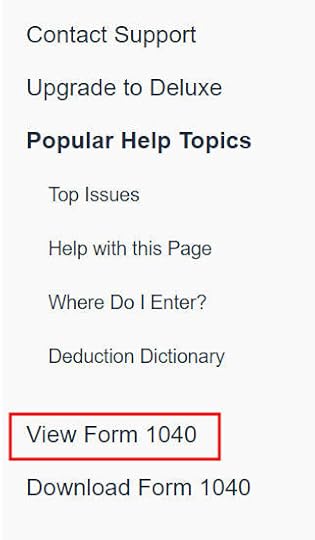

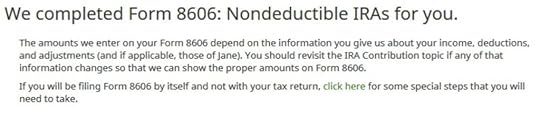

Taxable Income from Backdoor RothAfter going through all these, let’s confirm how you’re taxed on the Backdoor Roth. Click on “View 1040” on the right-hand side.

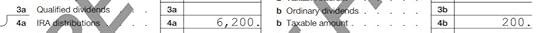

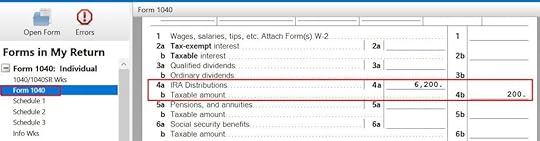

Look for Line 4 in Form 1040.

It shows $6,200 in IRA distributions in line 4a and only $200 is taxable in line 4b. If you are married filing jointly and both of you did a backdoor Roth, the numbers here will show double.

Tah-Dah! You got money into a Roth IRA through the backdoor when you aren’t eligible to contribute to it directly. You will pay tax on a small amount in earnings if you waited between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

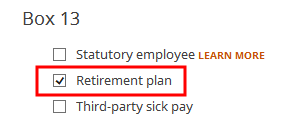

W-2 Box 13Make sure the “Retirement plan” box in Box 13 of the W-2 you entered into the software matches your actual W-2. If you are married and both of you have a W-2, make sure your entries for both W-2’s match the actual forms you received.

When you are not covered by a retirement plan at work, such as a 401k or 403b plan, your Traditional IRA contribution may be deductible, which also makes your Roth conversion taxable.

Self vs SpouseIf you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Report 2022 Backdoor Roth In FreeTaxUSA (Updated) appeared first on The Finance Buff.

How to Report 2022 Backdoor Roth in H&R Block Tax Software

Updated on January 16, 2023, with updated screenshots from H&R Block software for 2022 tax filing. If you use other tax software, see:

How To Report Backdoor Roth In TurboTaxHow to Report Backdoor Roth In FreeTaxUSAIf you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you need to report both the contribution and the conversion in the tax software. For more information on Backdoor Roth, please read Backdoor Roth: A Complete How-To and Make Backdoor Roth Easy On Your Tax Return.

Table of ContentsWhat To ReportUse H&R Block Download SoftwareConvert Traditional IRA to RothEnter 1099-RConverted to RothAdditional QuestionsNon-Deductible Contribution to Traditional IRAIRA ContributionConversion Isn’t RecharacterizationBasis From Previous YearPro-Rata RuleTaxable Income from Backdoor RothTroubleshootingFresh StartCovered by Retirement PlanSelf vs SpouseWhat To ReportYou report on the tax return your contribution to a traditional IRA *for* that year, and you report your conversion to Roth *during* that year.

For example, when you are doing your tax return for year X, you report the contribution you made *for* year X, whether you actually did it in year X or in the following year between January 1 and April 15. You also report your converting to Roth *during* year X, whether the money was contributed for year X, the year before, or any previous years.

Therefore a contribution made during the following year for year X goes on the tax return for year X. A conversion done during year Y after you made a contribution for year X goes on the tax return for year Y.

You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finishing your conversion during the same year. I called this a “planned” Backdoor Roth — you’re doing it deliberately.

Don’t wait until the following year to contribute for the previous year. Contribute for year X in year X and convert it during year X. Contribute for year Y in year Y and convert it during year Y. This way everything is clean and neat.

If you are already off by one year, catch up. Contribute for both the previous year and the current year, then convert the sum during the same year. See Make Backdoor Roth Easy On Your Tax Return.

Use H&R Block Download SoftwareThe screenshots below are taken from H&R Block Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

Here’s the scenario we’ll use as an example:

You contributed $6,000 to a traditional IRA in 2022 for 2022. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2022, the value grew to $6,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you’ll have to make some adjustments to the screens shown here.

Before we start, suppose this is what H&R Block software shows:

We will compare the results after we enter the Backdoor Roth.

Convert Traditional IRA to RothIncome comes before deductions on the tax form. Tax software also organizes this way. Even though you contributed before you converted, the software makes you enter the income first.

Enter 1099-RWhen you convert the Traditional IRA to Roth, you receive a 1099-R for that year. Complete this section only if you converted *during* the year for which you are doing the tax return. If you only contributed for the year in question but didn’t convert until the following year, skip all the way to the next section Non-Deductible Contribution to Traditional IRA.

In this example, we assume by the time you converted, the money in the Traditional IRA had grown from $6,000 to $6,200.

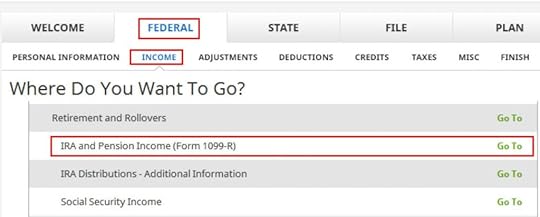

Click on Federal -> Income. Scroll down and find IRA and Pension Income (Form 1099-R). Click on “Go To.”

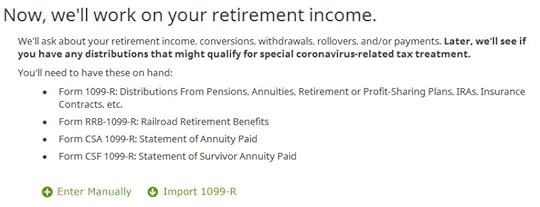

Click on Import 1099-R if you’d like. I show manual entries with “Enter Manually” here.

Just a regular 1099-R.

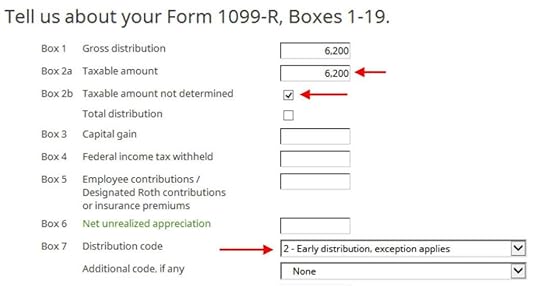

If you imported your 1099-R, double-check to make sure the import exactly matches the copy you received. If you enter your 1099-R manually, be sure to enter everything on the form exactly. Box 1 shows the amount converted to Roth IRA. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” Pay attention to the distribution code in Box 7. My 1099-R has code 2.

My 1099-R had the IRA/SEP/SIMPLE box checked.

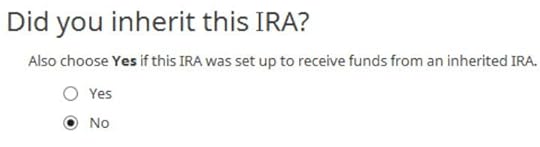

Did not inherit.

Converted to Roth

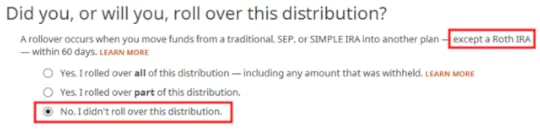

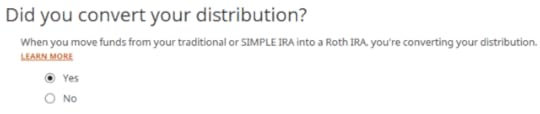

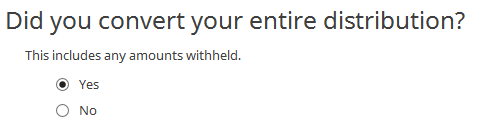

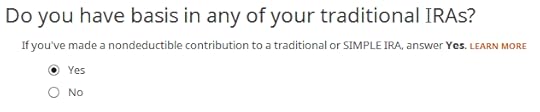

This is a very important question. Read carefully. Answer No, because you converted, not rolled over.

Now answer Yes, you converted.

We converted all of it in our example.

Answer Yes because you made a nondeductible contribution to a traditional IRA.

The refund in progress drops a lot at this point. We went from a $2,434 refund to $946. Don’t panic. It’s normal and only temporary. It will come back up after we complete the section for IRA contributions.

You are done with one 1099-R. Repeat the above if you have another 1099-R. If you’re married and both of you did a Backdoor Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse. Click on Finished when you are done with all the 1099-Rs.

Additional Questions

A few more questions.

Answer Yes because you contributed to a Traditional IRA for the year.

We will wait.

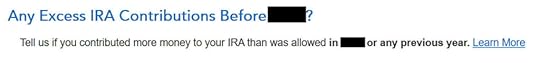

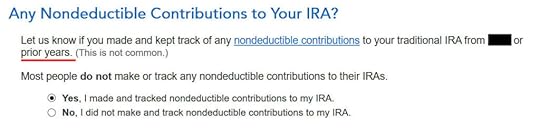

Non-Deductible Contribution to Traditional IRANow we enter the non-deductible contribution to the Traditional IRA *for* the year in question. Complete this part whether you contributed in the same year or you did it or are planning to do it in the following year between January 1 and April 15.

If your contribution during the year in question was for the previous year, make sure you entered it on your previous tax return. If not, fix your previous return first.

IRA Contribution

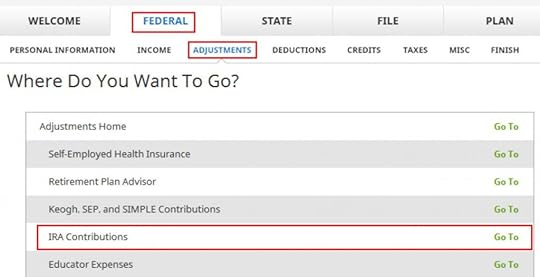

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

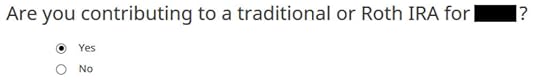

Wrong tense but answer “Yes” because you contributed to an IRA for the year in question.

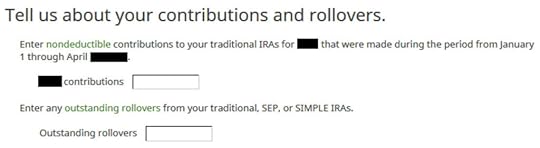

Check the box for Traditional IRA if you contributed directly to a Traditional IRA. If you originally contributed to a Roth IRA and then you recharacterized the contributions as traditional contributions, check the Roth IRA boxes here and then answer yes when it asks you whether you recharacterized.

You know you don’t get a deduction due to income. Enter anyway.

Enter your contribution amount. We contributed $6,000 in our example.

Conversion Isn’t Recharacterization

This is important. Answer No if you contributed to a Traditional IRA and converted to Roth. Answer Yes if you originally contributed to a Roth IRA, recharacterized it to Traditional, and then converted.

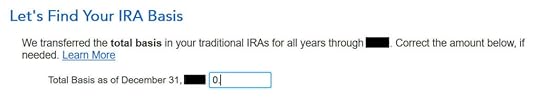

Basis From Previous Year

If you did a clean “planned” backdoor Roth and you started fresh each year, enter zero. If you contributed non-deductible for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

Pro-Rata Rule

This is another important question. If you are doing it the easy way as in our example, technically you can answer Yes and skip some questions. The safer bet is to answer No and go through the follow-up questions. If you’ve been going through these screens back and forth, you may have put in some incorrect answers in a previous round. You will have a chance to review and correct those answers only if you answer No.

In a clean planned backdoor Roth, you contribute for year X during year X. Leave the boxes blank. If you didn’t know better and you contributed for the previous year after January 1, enter the amount in the first box. If you already did it the hard way for the previous year, please, please, please do yourself a big favor and do it the easy way this year. See Make Backdoor Roth Easy On Your Tax Return.

The box should be blank when you do a clean planned backdoor Roth. If you have other Traditional, SEP, or SIMPLE IRAs, add up the balances from your year-end statements and put the value here. The software will apply the pro-rata rule.

That’s great. We’re expecting it.

A summary of your contributions. 0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you did a Backdoor Roth.

We are done entering the non-deductible contribution to the Traditional IRA. Now the refund in progress should go back up. It was a refund of $2,434 when we first started. Now it’s a refund of $2,396. The difference of $38 is due to the tax on the extra $200 earned before the Roth conversion.

If you only contributed *for* last year but you didn’t convert until the following year, remember to come back next year to finish the conversion part.

Taxable Income from Backdoor RothAfter going through all these, let’s confirm how you’re taxed on the Backdoor Roth.

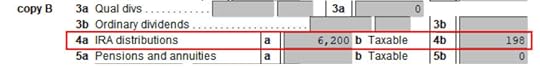

Click on Forms on the top and open Form 1040 and Schedules 1-3. Click on Hide Mini WS. Scroll down to lines 4a and 4b.

It shows $6,200 in IRA distributions, $198 of which is taxable. The taxable income came out to $198, not $200, due to some rounding in the calculation. If you are married filing jointly and both of you did a backdoor Roth, the numbers here will show double.

Tah-Dah! You got money into a Roth IRA through the backdoor when you aren’t eligible to contribute to it directly. You will pay tax on a small amount in earnings if you waited between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

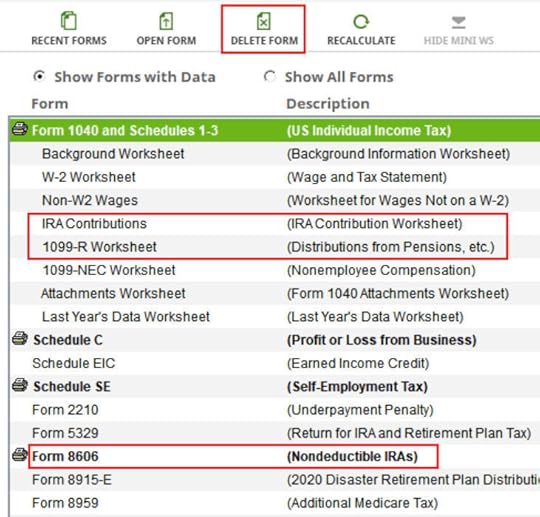

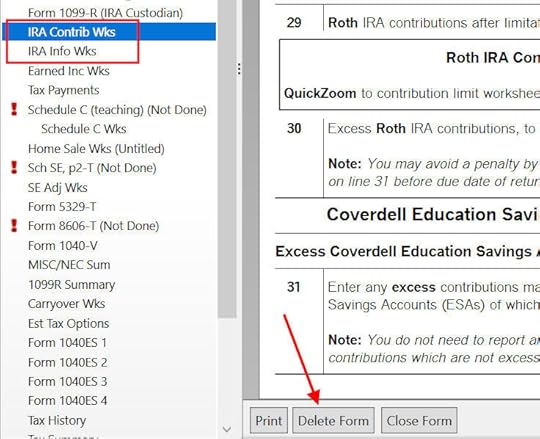

Fresh StartIt’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

Click on Forms and delete IRA Contributions Worksheet, 1099-R Worksheet, and Form 8606. Then start over by following the steps here.

Covered by Retirement PlanMake sure the “Retirement plan” box in Box 13 of the W-2 you entered into the software matches your actual W-2. If you are married and both of you have a W-2, make sure your entries for both W-2’s match the actual forms you received.

When you are not covered by a retirement plan at work, such as a 401k or 403b plan, your Traditional IRA contribution may be deductible, which also makes your Roth conversion taxable.

Self vs SpouseIf you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Report 2022 Backdoor Roth in H&R Block Tax Software appeared first on The Finance Buff.

How To Report 2022 Backdoor Roth In TurboTax (Updated)

Updated on January 16, 2023 with updated screenshots from TurboTax Deluxe downloaded software. If you use other tax software, see:

How To Report Backdoor Roth In H&R Block SoftwareHow to Report Backdoor Roth In FreeTaxUSAIf you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you need to report both the contribution and the conversion in the tax software. For more information on Backdoor Roth, see Backdoor Roth: A Complete How-To.

Table of ContentsWhat To ReportUse TurboTax DownloadConvert Traditional IRA to RothNon-Deductible Contribution to Traditional IRATaxable Income from Backdoor RothTroubleshootingWhat To ReportYou report on the tax return your contribution to a Traditional IRA *for* that year, and you also report your conversion to Roth *during* that year.

For example, when you are doing your tax return for year X, you report the contribution you made *for* year X, whether you actually did it during year X or the following year between January 1 and April 15. You also report your conversion to Roth *during* year X, whether the contribution was made for year X, the year before, or any previous years.

Therefore a contribution made during the following year for year X goes on the tax return for year X. A conversion done during year Y after you made a contribution for year X goes on the tax return for year Y.

You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finishing your conversion in the same year. I called this a “planned” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for year X in year X and convert it during year X. Contribute for year Y in year Y and convert it during year Y. This way everything is clean and neat.

If you are already off by one year, catch up. Contribute for both the previous year and the current year, then convert the sum during the same year. See Make Backdoor Roth Easy On Your Tax Return.

Use TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

Here’s the planned Backdoor Roth scenario we will use as an example:

You contributed $6,000 to a traditional IRA in 2022 for 2022. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2022, the value grew to $6,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments to the screens shown here.

Before we start, suppose this is what TurboTax shows:

We will compare the results after we enter the Backdoor Roth.

Convert Traditional IRA to RothThe tax software works on income items first. Even though the conversion happened after the contribution, we enter the conversion first.

When you convert from Traditional IRA to Roth, you will receive a 1099-R form. Complete this section only if you converted *during* the year for which you are doing the tax return. If you only converted during the following year, you won’t have a 1099-R until next January. Skip all the way to the next section: Non-deductible contribution to Traditional IRA.

In our example, we assume by the time you converted, the money in the Traditional IRA had grown from $6,000 to $6,200.

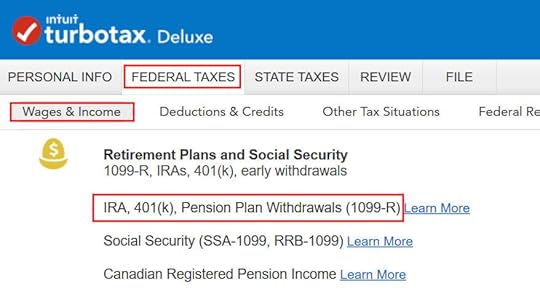

Enter 1099-R

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

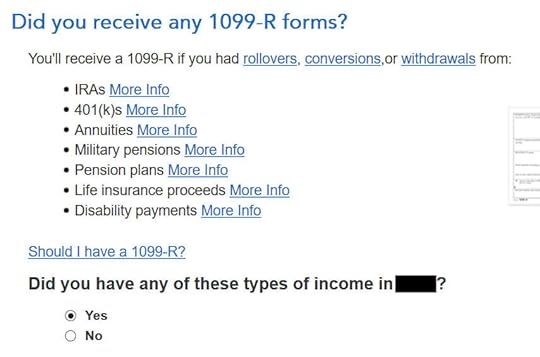

As you work through the interview, you will eventually come to the point to enter the 1099-R. Select Yes, you have this type of income. Import the 1099-R if you’d like. I’m choosing to type it myself.

Just the regular 1099-R.

Box 1 shows the amount converted to Roth IRA. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” Pay attention to the code in Box 7 and the IRA/SEP/SIMPLE box. Make sure your entry matches your 1099-R exactly.

You get this Good News, but …

Your refund in progress drops a lot. We went from $2,384 down to $858. Don’t panic. It’s normal and temporary.

Converted to Roth

Didn’t inherit it.

First click on “I moved …” then click on “I did a combination …” Enter the amount converted in the box. Don’t choose the “I rolled over …” option. A Roth conversion is not a rollover.

No, you didn’t put the money in an HSA.

Not due to a disaster.

You get a summary of your 1099-R’s. Repeat the previous steps to add another if you have more than one. If you’re married and both of you did a Backdoor Roth, enter the 1099-R for both of you, but pay attention to select whose 1099-R it is. Don’t accidentally assign two 1099-R’s to the same person.

Basis and End-of-Year Values

Didn’t take any disaster distribution.

Here it’s asking about the prior year carryover. When you’re doing a clean “planned” Backdoor Roth as in our example — contribute for year X in year X and convert before the end of year X — you can answer No here. If you contributed for the previous year between January 1 and April 15 during year X, answer Yes here.

If you answered Yes to the previous question and you did your previous year’s return correctly also in TurboTax, your basis from the previous year will show up here. If you did your previous year’s tax return wrong, fix your previous return first.

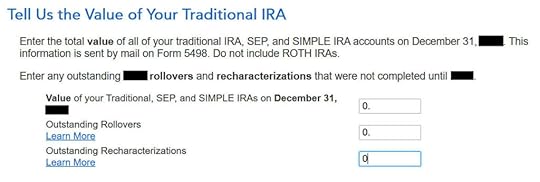

Enter the values at the end of the year. We don’t have anything in traditional, SEP, or SIMPLE IRAs after we converted it all.

That’s it so far on the income side. Continue with other income items. The refund in progress is still temporarily depressed. Don’t worry. It will change.

Non-Deductible Contribution to Traditional IRANow we enter the non-deductible contribution to a Traditional IRA *for* the year we are doing the tax return.

Complete this part whether you contributed before December 31 or you did it or are planning to do it in the following year between January 1 and April 15. If your contribution during the year in question was for the year before, make sure you entered it on the previous tax return. If not, fix your previous return first.

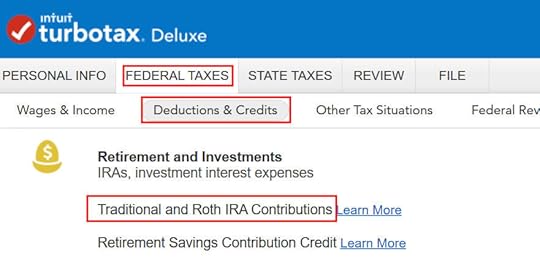

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

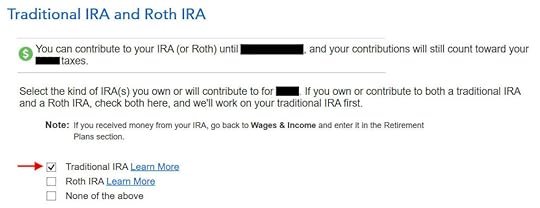

Because we did a clean “planned” Backdoor Roth, we check the box for Traditional IRA. If you did a detour when you first contributed to a Roth IRA before you realized your income is too high and you recharacterized the contribution as to a Traditional IRA, check the box for Roth IRA and answer the questions accordingly.

TurboTax offers an upgrade but we choose to stay in TurboTax Deluxe.

We already checked the box for Traditional but TurboTax just wants to make sure. Answer Yes here.

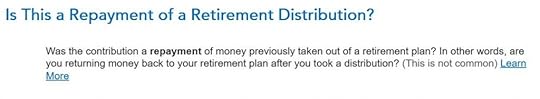

It was NOT a repayment of a retirement distribution.

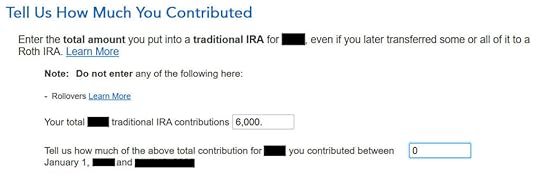

Enter the contribution amount. Because we contributed for year X in year X, we put zero in the second box. If you contributed for the previous year between January 1 and April, enter the contribution in both boxes.

Right away our federal refund in progress goes back up! We started with $2,384. It went down to $858. Now it comes back to $2,335. The $49 difference is because we have to pay tax on the $200 in earnings when we contributed $6,000 and converted $6,200. If you had less earnings, your refund numbers would be closer still.

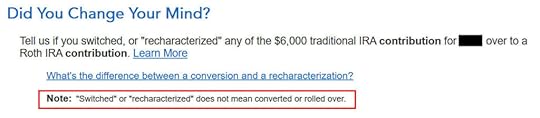

This is a critical question. Answer “No.” You converted the money, not switched or recharacterized.

You may not get this question if you already entered your W-2 and it has Box 13 for the retirement coverage checked. Answer yes if you’re covered by a retirement plan but the box on your W-2 wasn’t checked.

No excess contribution.

Same question we saw before. For a clean “planned” Backdoor Roth, we can answer No. If you made non-deductible contribution for previous years, answer Yes.

Total basis through the previous year. If you did your taxes correctly on TurboTax last year, TurboTax transfers the number here. If you made non-deductible contributions for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

Because we did a clean “planned” Backdoor Roth, we don’t have anything left after we converted everything before the end of the same year.

Income too high, we know. That’s why we did the Backdoor Roth.

The IRA deduction summary shows $0 deduction, which is expected.

Taxable Income from Backdoor RothAfter going through all these, would you like to see how you are taxed on the Backdoor Roth?

Click on Forms on the top right.

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b. They show a $6,200 distribution from the IRA and only $200 of the $6,200 is taxable. That’s the earning between the time you contributed to your Traditional IRA and the time you converted it to Roth.

When you’re done examining the form, click on Step-by-Step on the top right to go back to the interview.

Tah-Dah! You got money into a Roth IRA through the backdoor when you aren’t eligible for contributing to it directly. That’s why it’s called a Backdoor Roth. You will pay tax on a small amount in earnings if you waited between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

Fresh StartIt’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

Click on Forms on the top right.

Find “IRA Contrib Wks” and “IRA Info Wks” in the left navigation pane and click on “Delete Form” to delete them. Then you can start over by following the steps above.

W-2 Box 13

W-2 Box 13Make sure the Retirement Plan box in Box 13 of the W-2 you entered into the software matches your actual W-2. If you are married and both of you have a W-2, make sure your entries for both W-2’s match the actual forms you received.

When you are not covered by a retirement plan at work, such as a 401k or 403b plan, your Traditional IRA contribution may be deductible, which also makes your Roth conversion taxable.

Self vs SpouseIf you are married, make sure you don’t have the 1099-R and IRA contribution mixed up between yourself and your spouse. If you inadvertently entered two 1099-Rs issued to you instead of one for you and one for your spouse, the second 1099-R to you will not match up with a Traditional IRA contribution made by your spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Report 2022 Backdoor Roth In TurboTax (Updated) appeared first on The Finance Buff.

How To Enter 2022 ESPP Sales In TurboTax: Adjust Cost Basis

[Updated on January 16, 2023 with screenshots from TurboTax for 2022 tax filing.]

If your employer offers an Employee Stock Purchase Program (ESPP), you should max it out. You come out ahead even if you sell the shares as soon as you can. See Employee Stock Purchase Plan (ESPP) Is A Fantastic Deal.

After you sell the shares from the ESPP, part of the income will be included on your W-2. However, the 1099-B form you receive from the broker still reflects your discounted purchase price. This post shows you how to make the necessary adjustment on your tax return using TurboTax.

Don’t pay tax twice!

If you use other tax software, please read:

How to Report ESPP Sales in H&R Block SoftwareHow to Report ESPP Sales in FreeTaxUSAIf you’re looking for a guide on doing taxes on RSU sales, please read Restricted Stock Units (RSU) and TurboTax: Net Issuance.

Table of ContentsWhen to Report1099-B From BrokerUse TurboTax DownloadEnter 1099-BCorrect Cost BasisVerify on Schedule DWhen to ReportBefore you begin, be sure to understand when you need to report. You report when you sell the shares you bought under your ESPP. If you only bought shares but you didn’t sell during the tax year, there’s nothing to report yet.

Wait until you sell, but write down the full per-share price (before the discount) when you bought. If you purchased multiple times, write down for each purchase:

The purchase dateThe closing price on the grant dateThe closing price on the purchase dateThe number of shares you boughtThis information is very important when you sell.

Let’s use this example:

You bought 1,000 shares under your ESPP on 9/30/20xx. The closing price on the purchase date was $12 per share. The closing price on the grant date six months before was $10 per share. You bought at $8.50 per share with the discount.

You would write down:

Grant Date4/1/20xxMarket Price on the Grant Date$10 per sharePurchase Date9/30/20xxMarket Price on the Purchase Date$12 per shareShares Purchased1,000Discounted Price$8.50 per shareKeep this information until you sell.

1099-B From BrokerWhen you sell, you will receive a 1099-B form from the broker in the following year. You will report your gain or loss using this 1099-B form and the information you accumulated for each purchase.

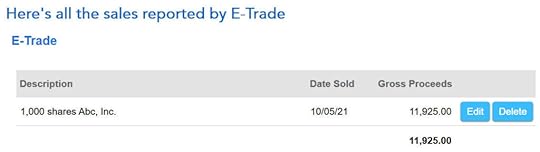

Let’s continue our example:

You sold 1,000 shares from your purchase above on 10/5/20xx at $11.95 per share. After commission and fees, you netted $11,925. You received a 1099-B form from your broker showing a sales proceed of $11,925 in the following year. The 1099-B form shows the cost basis as $8,500, which reflects your discounted purchase price.

Because you didn’t hold it for two years after the grant date and one year after the purchase date, your sale was a “disqualifying disposition.” The discount is added as income to your W-2. This raises your cost basis. If you just accept the 1099-B as-is, you will be double-taxed!

Now let’s account for it in TurboTax.

Use TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax downloaded software from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

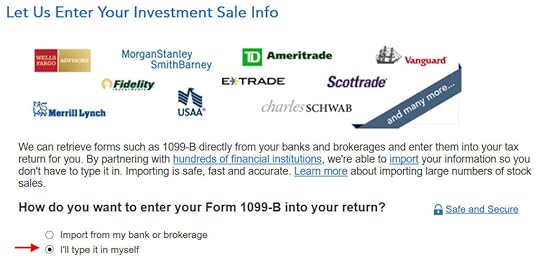

Enter 1099-B

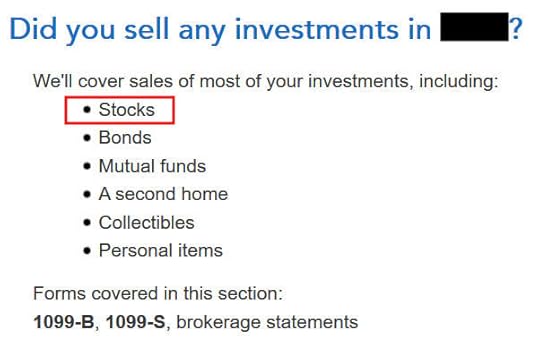

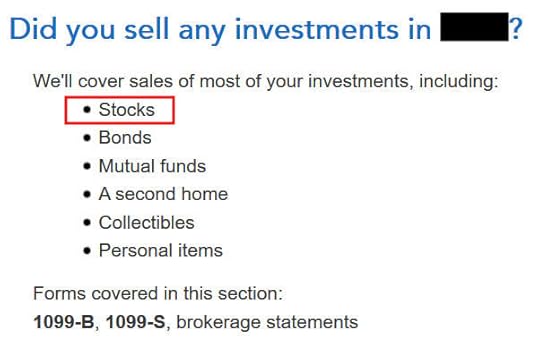

Go to “Federal Taxes” -> “Wages & Income” -> “Investment Income” and find “Stocks, Mutual Funds, Bonds, Other.”

Answer “Yes” because you did sell stocks.

TurboTax offers an upgrade but we don’t need it. TurboTax Deluxe handles ESPP sales just fine.

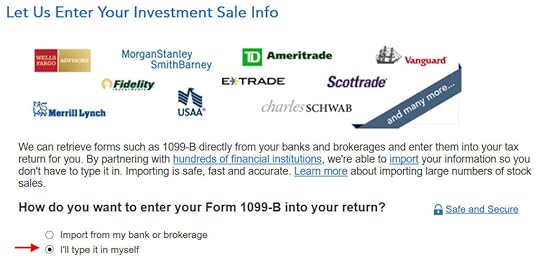

We did receive a 1099-B form.

Import your 1099-B if you’d like. I’ll type it myself here.

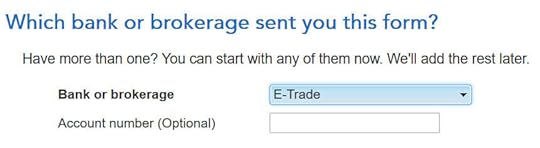

Select or enter the financial institution. Suppose it’s E*Trade.

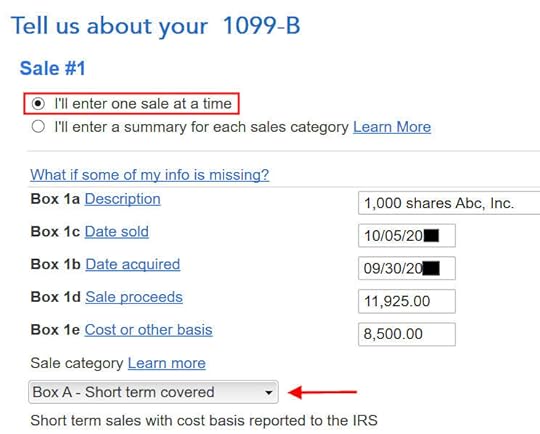

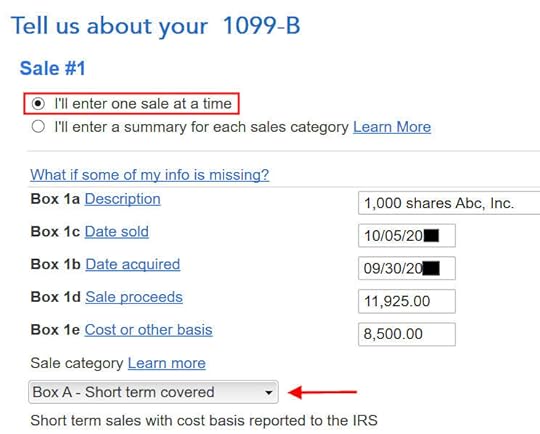

Choose to enter one sale at a time. Fill in the boxes from your 1099-B form. Look carefully at which category the sale belongs to on your 1099-B form. It was Box A on my form. It could be a different one on your form.

The cost basis on your 1099-B was reported to the IRS but it was too low. Don’t change it here directly.

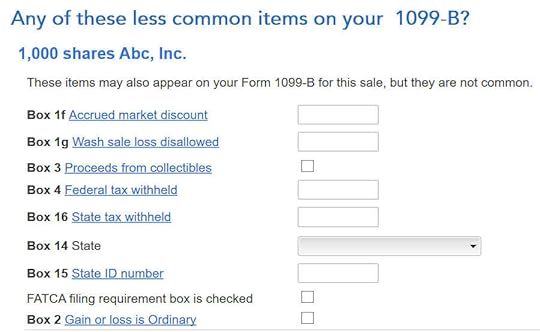

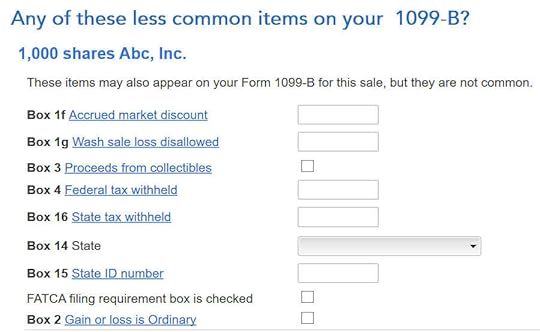

We don’t have any of these fields on our 1099-B form.

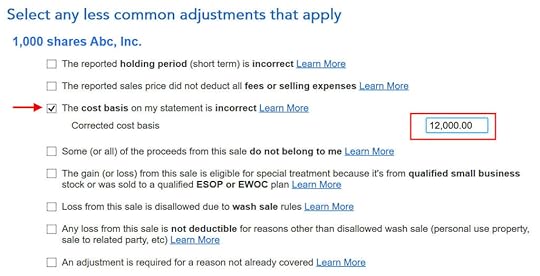

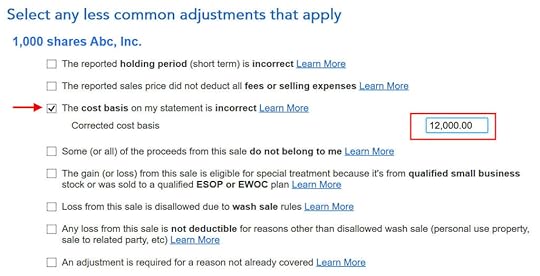

Correct Cost Basis

Check the box for “The cost basis on my statement is incorrect.” Enter your purchase cost plus the amount added to your W-2. When you did a “disqualifying disposition” your cost basis was the full value of the shares on the date of the purchase. The market price was $12 per share when you purchased those 1,000 shares at $8.50 per share. Your employer added the $3,500 discount as income to your W-2. Therefore your true basis is $8,500 + $3,500 = $12,000.

If you didn’t sell all the shares purchased in that batch, multiply the number of shares you sold by the discount price on the date of purchase and add the discount included on your W-2. For example, if you sold only 500 shares and your employer added $1,750 to your W-2, your corrected cost basis is:

$8.50 * 500 + $1,750 = $6,000

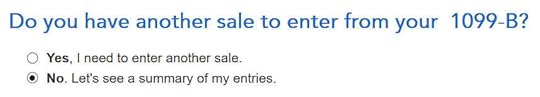

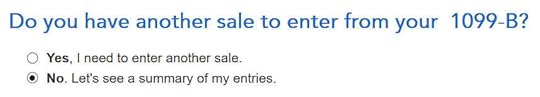

Repeat if you have more sales to enter. We only had one sale in our example.

You get a summary of the sales you entered.

You get a summary of your net gain and loss. We have a net loss because we received less money after selling the shares and paying the commission and fees than our discounted purchase plus the income added to our W-2.

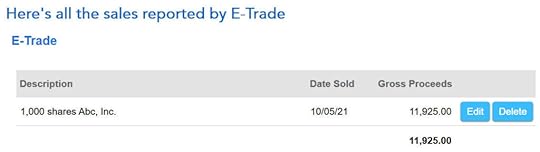

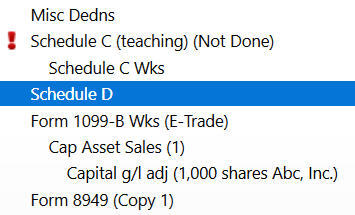

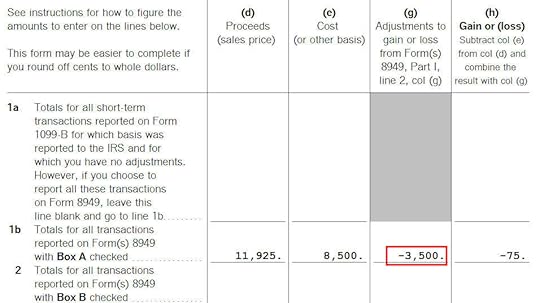

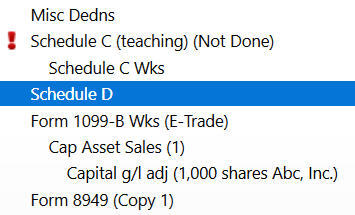

Verify on Schedule DWe can verify that the adjustment makes it all the way to the tax form. Click on “Forms” at the top right.

Find “Schedule D” in the left navigation pane.

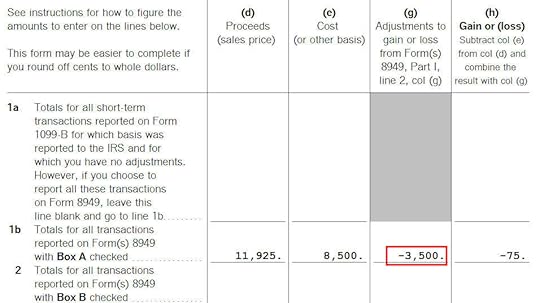

Scroll up or down to find line 1b, 2, 3, 8b, 9, or 10 depending on the sale category on your 1099-B form.

You see the negative adjustment in column (g). If you didn’t make the adjustment and you just accepted the 1099-B as-is, you will pay capital gains tax again on the $3,500 discount you are already paying taxes through your W-2. Remember to make the adjustment!

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Enter 2022 ESPP Sales In TurboTax: Adjust Cost Basis appeared first on The Finance Buff.

How To Enter 2022 ESPP Sales In TurboTax: Don’t Pay Tax Twice!

[Updated on January 16, 2023 with screenshots from TurboTax for 2022 tax filing.]

If your employer offers an Employee Stock Purchase Program (ESPP), you should max it out. You come out ahead even if you sell the shares as soon as you can. See Employee Stock Purchase Plan (ESPP) Is A Fantastic Deal.

After you sell the shares from the ESPP, part of the income will be included on your W-2. However, the 1099-B form you receive from the broker still reflects your discounted purchase price. This post shows you how to make the necessary adjustment on your tax return using TurboTax.

Don’t pay tax twice!

If you use other tax software, please read:

How to Report ESPP Sales in H&R Block SoftwareIf you’re looking for a guide on doing taxes on RSU sales, please read Restricted Stock Units (RSU) and TurboTax: Net Issuance.

Table of ContentsWhen to Report1099-B From BrokerUse TurboTax DownloadEnter 1099-BCorrect Cost BasisVerify on Schedule DWhen to ReportBefore you begin, be sure to understand when you need to report. You report when you sell the shares you bought under your ESPP. If you only bought shares but you didn’t sell during the tax year, there’s nothing to report yet.

Wait until you sell, but write down the full per-share price (before the discount) when you bought. If you purchased multiple times, write down for each purchase:

The purchase dateThe closing price on the grant dateThe closing price on the purchase dateThe number of shares you boughtThis information is very important when you sell.

Let’s use this example:

You bought 1,000 shares under your ESPP on 9/30/20xx. The closing price on the purchase date was $12 per share. The closing price on the grant date six months before was $10 per share. You bought at $8.50 per share with the discount.

You would write down:

Grant Date4/1/20xxMarket Price on the Grant Date$10 per sharePurchase Date9/30/20xxMarket Price on the Purchase Date$12 per shareShares Purchased1,000Discounted Price$8.50 per shareKeep this information until you sell.

1099-B From BrokerWhen you sell, you will receive a 1099-B form from the broker in the following year. You will report your gain or loss using this 1099-B form and the information you accumulated for each purchase.

Let’s continue our example:

You sold 1,000 shares from your purchase above on 10/5/20xx at $11.95 per share. After commission and fees, you netted $11,925. You received a 1099-B form from your broker showing a sales proceed of $11,925 in the following year. The 1099-B form shows the cost basis as $8,500, which reflects your discounted purchase price.

Because you didn’t hold it for two years after the grant date and one year after the purchase date, your sale was a “disqualifying disposition.” The discount is added as income to your W-2. This raises your cost basis. If you just accept the 1099-B as-is, you will be double-taxed!

Now let’s account for it in TurboTax.

Use TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax downloaded software from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

Enter 1099-B

Go to “Federal Taxes” -> “Wages & Income” -> “Investment Income” and find “Stocks, Mutual Funds, Bonds, Other.”

Answer “Yes” because you did sell stocks.

TurboTax offers an upgrade but we don’t need it. TurboTax Deluxe handles ESPP sales just fine.

We did receive a 1099-B form.

Import your 1099-B if you’d like. I’ll type it myself here.

Select or enter the financial institution. Suppose it’s E*Trade.

Choose to enter one sale at a time. Fill in the boxes from your 1099-B form. Look carefully at which category the sale belongs to on your 1099-B form. It was Box A on my form. It could be a different one on your form.

The cost basis on your 1099-B was reported to the IRS but it was too low. Don’t change it here directly.

We don’t have any of these fields on our 1099-B form.

Correct Cost Basis

Check the box for “The cost basis on my statement is incorrect.” Enter your purchase cost plus the amount added to your W-2. When you did a “disqualifying disposition” your cost basis was the full value of the shares on the date of the purchase. The market price was $12 per share when you purchased those 1,000 shares at $8.50 per share. Your employer added the $3,500 discount as income to your W-2. Therefore your true basis is $8,500 + $3,500 = $12,000.

If you didn’t sell all the shares purchased in that batch, multiply the number of shares you sold by the discount price on the date of purchase and add the discount included on your W-2. For example, if you sold only 500 shares and your employer added $1,750 to your W-2, your corrected cost basis is:

$8.50 * 500 + $1,750 = $6,000

Repeat if you have more sales to enter. We only had one sale in our example.

You get a summary of the sales you entered.

You get a summary of your net gain and loss. We have a net loss because we received less money after selling the shares and paying the commission and fees than our discounted purchase plus the income added to our W-2.

Verify on Schedule DWe can verify that the adjustment makes it all the way to the tax form. Click on “Forms” at the top right.

Find “Schedule D” in the left navigation pane.

Scroll up or down to find line 1b, 2, 3, 8b, 9, or 10 depending on the sale category on your 1099-B form.

You see the negative adjustment in column (g). If you didn’t make the adjustment and you just accepted the 1099-B as-is, you will pay capital gains tax again on the $3,500 discount you are already paying taxes through your W-2. Remember to make the adjustment!

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Enter 2022 ESPP Sales In TurboTax: Don’t Pay Tax Twice! appeared first on The Finance Buff.

2022 Self-Employed ACA Health Insurance Subsidy In TurboTax

Updated on January 16, 2023 with screenshots from TurboTax Deluxe downloaded software for 2022 tax filing. If you use H&R Block tax software, please read:

Self-Employed ACA Health Insurance Subsidy In H&R Block SoftwareMany self-employed business owners buy health insurance through the ACA healthcare marketplace (healthcare.gov or a state-specific exchange). If your estimated income qualifies for a subsidy, the marketplace will pay part of the premium directly to the insurance company.

However, the advance subsidy is only an estimate based on the income estimate you provided when you signed up. As self-employed people know full well, the actual income from self-employment can vary greatly from year to year. After the year is over, you have to square up and calculate the actual subsidy you really qualify for. If your business didn’t do as well as you anticipated, you may qualify for a higher subsidy. If you had a great year, you may have to pay back some of it.

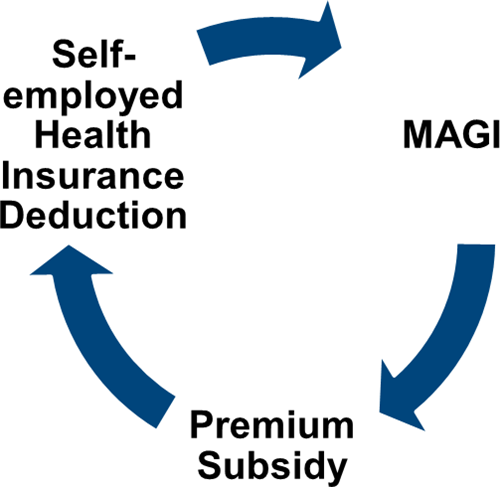

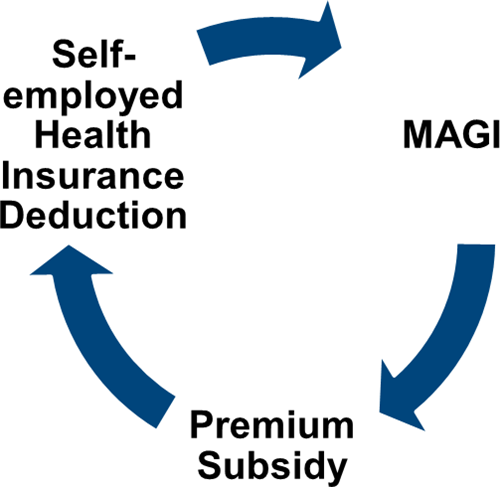

If you’re self-employed, you also qualify for a tax deduction for the health insurance premium. If you qualify for both a subsidy and a deduction, they form a circular relationship.

The IRS prescribed a method to calculate the split between the subsidy and the deduction. It’s difficult to calculate by hand but tax software will take care of it for most people.

Use TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

We will use this scenario as an example:

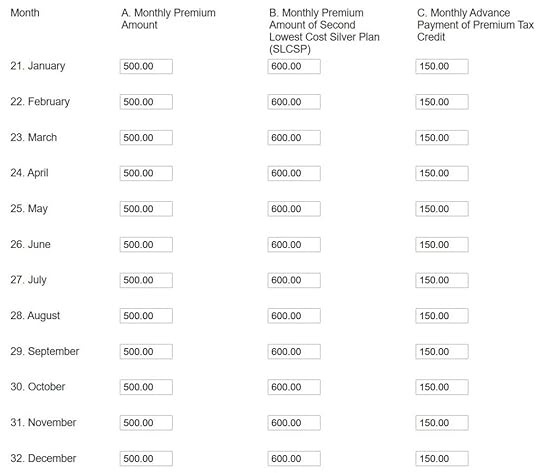

Enter 1095-AYou are single, self-employed, with no dependent. You had health insurance through the ACA healthcare marketplace for all 12 months in the year. The full unsubsidized preimium for the second lowest cost Silver plan was $600/month. The full unsubsidized premium for the plan you chose was $500/month. Based on your estimated income, you got a $150/month advance credit. You paid net $350/month.

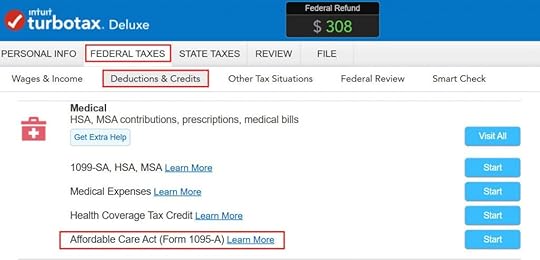

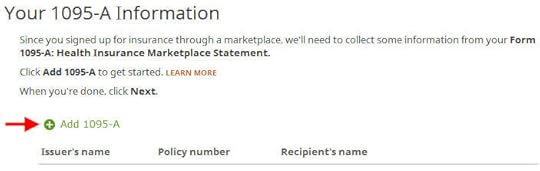

Go to Federal Taxes -> Deductions & Credits. Scroll down and find Affordable Care Act (Form 1095-A) under Medical.

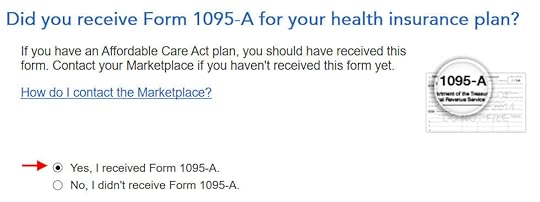

You should have a Form 1095-A from the ACA healthcare marketplace. If you didn’t get it in the mail, log in to your online account and look for a document download.

Enter the month-by-month numbers from your Form 1095-A. It’s tedious to repeat for all 12 months but TurboTax makes you do it. The first column is the full unsubsidized monthly premium for your plan. The middle column is the full unsubsidized premium of the second lowest-cost Silver plan, which is used to calculate your subsidy. The last column is the advance subsidy the ACA marketplace already paid on your behalf to the insurance company.

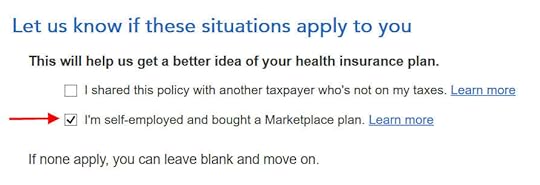

This is important but easy to miss. Even though TurboTax knows you’re self-employed and you have the 1095-A form from the ACA healthcare marketplace, you still must check this box.

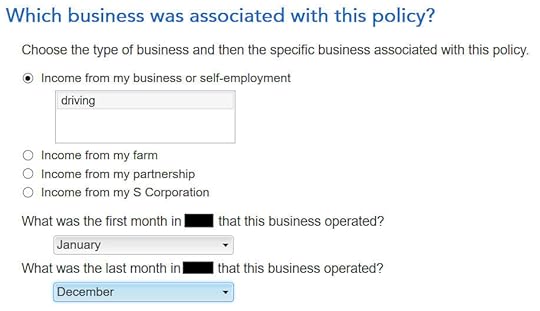

Associate the health insurance with your self-employment and say during which months it applied.

If you have more than one Form 1095-A, repeat and add them all. We only have one in our example.

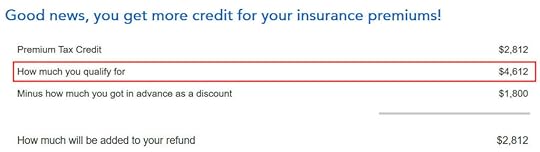

TurboTax crunches the numbers in a split second. It says we’re eligible for more tax credit than the ACA healthcare marketplace already paid directly to the insurance company. We’ll get the difference in our tax refund. If you qualify for less subsidy than the advance already paid, you’ll pay back the difference, subject to a cap (see Cap On Paying Back ACA Health Insurance Subsidy Premium Tax Credit).

Self-Employed Health Insurance DeductionWe’re also eligible for a tax deduction for the portion not covered by the premium tax credit.

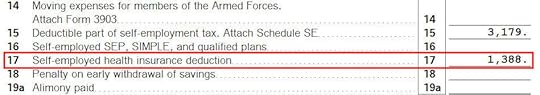

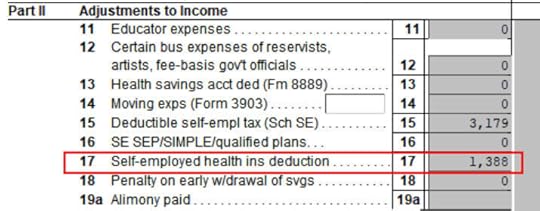

To see your self-employed health insurance deduction, click on Forms on the top right. Find Schedule 1 in the left navigation pane. Look at Line 17. It shows we’re getting a $1,388 tax deduction for self-employed health insurance.

Premium Tax Credit

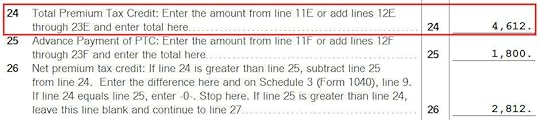

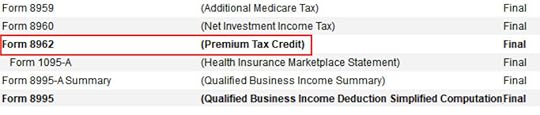

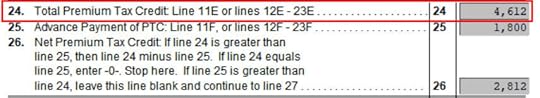

To see the subsidy you qualify for based on your actual income, find Form 8962 in the forms list navigation pane. Scroll down and look at Line 24. When you’re done looking for the form, click on Step-by-Step on the top right to get back to the interview.

$1,388 in self-employed health insurance tax deduction plus $4,612 in premium tax credit equals $6,000 ($500/month), which is the full unsubsidized premium for our health plan (plus any dental and vision insurance premium, which we didn’t have in our example). The numbers add up! TurboTax figured out the split between the tax deduction and the tax credit. It also matched the result from H&R Block software for the same example.

Edge CasesTurboTax works for most cases but it doesn’t work for everyone. You know you’re running into one of the edge cases for which the software doesn’t work when the numbers from the software fail this equation (except for a small difference due to rounding):

Self-Employed Health Insurance Deduction + Premium Tax Credit = Unsubsidized Health Insurance Premium (including any dental and vision premiums)

When this happens, you need a better calculator. See When TurboTax and H&R Block Give Self-Employed Wrong ACA Subsidy.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 Self-Employed ACA Health Insurance Subsidy In TurboTax appeared first on The Finance Buff.

2022 Foreign Tax Credit Form 1116 in TurboTax and H&R Block

[Updated on January 16, 2023 with updated screenshots from TurboTax and H&R Block software for 2022 tax filing.]

When mutual funds and/or ETFs that invest in foreign countries receive dividends or interest, they have to pay taxes to those countries. After the end of the year, these mutual funds and/or ETFs report to your broker how much they paid in foreign taxes on your behalf. When you invest in these mutual funds and/or ETFs outside a tax-advantaged account, your broker will report to you the total foreign taxes you paid through all your funds and/or ETFs. The IRS allows a tax credit for the taxes you paid indirectly to foreign countries.

The foreign taxes paid is reported in Box 7 on the 1099-DIV form you receive from your broker. It’s easy to handle when the total foreign taxes paid from all your 1099-DIV forms is no more than a certain amount — $300 for single, $600 for married filing jointly. You enter the 1099-DIV forms into your tax software and the software will automatically put the total on your tax form (Schedule 3, Line 1).

When your total foreign taxes paid from all your 1099-DIV forms are over the $300/$600 threshold, you’ll need to include Form 1116 in your tax return. I’ll show you how to do this in TurboTax and H&R Block software.

Table of ContentsTurboTaxEnter 1099-DIVForeign-Source IncomeSimplified Limitation for AMTForeign Taxes PaidVerify on Schedule 3Excess Foreign Tax CreditH&R Block SoftwareEnter 1099-DIVForeign Tax CreditAMT Simplified ElectionForeign-Source IncomeAdjustment ExceptionForeign TaxesVerify on Schedule 3Excess Foreign Tax CreditSummaryI start with TurboTax. Please jump to the next section if you use H&R Block software.

TurboTaxThe screenshots below came from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

I’ll use this simple scenario as an example:

Enter 1099-DIVYou received a 1099-DIV from your broker. Box 7 “Foreign Tax Paid” on the 1099-DIV shows $700. 100% of this $700 came from a mutual fund or ETF. You only have this one 1099-DIV that has a number in Box 7.

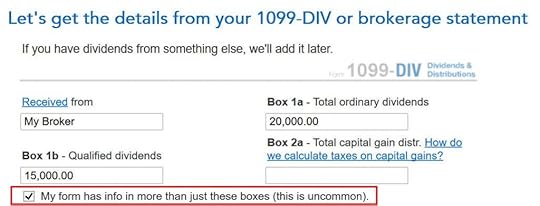

If you’re entering your 1099-DIV manually, you have to check a box on the 1099-DIV entry screen to reveal the additional input fields. Then you put the foreign tax paid number into Box 7. If you imported your 1099’s, double-check that all the numbers from the import match your downloaded copy.

We don’t have any of these uncommon situations.

After you’re done with one 1099-DIV, continue with your other 1099-DIV forms. We only have one 1099-DIV form in our example.

Foreign-Source Income

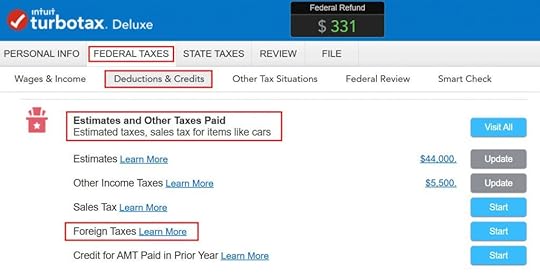

At a much later point, TurboTax will ask you about the foreign tax paid under Deductions & Credits -> Estimates and Other Taxes Paid -> Foreign Taxes.

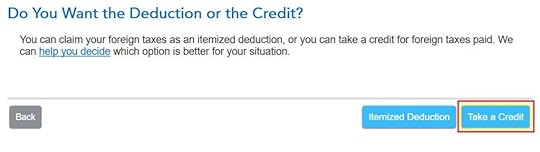

After a brief introduction, the first question is whether you’d like to take a tax deduction or a tax credit. The “help you decide” popup says in general you’re better off taking the credit. So click on “Take a Credit.”

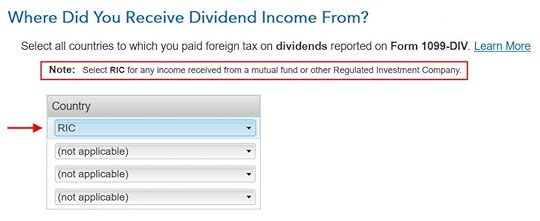

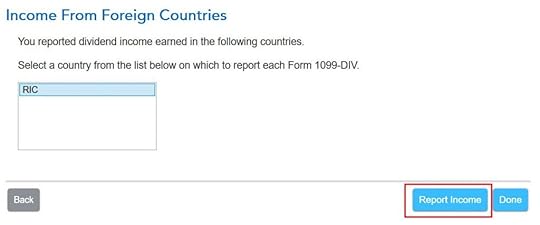

Next, TurboTax asks you which countries you received dividend income from. A small note says select RIC for any income received from a mutual fund or other Regulated Investment Company. U.S.-based mutual funds and ETFs fall into this category. RIC is the first item in the country dropdown.

Then you report income received from country “RIC.” Click on Report Income.

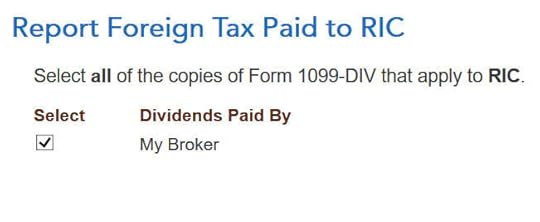

Now you say foreign tax paid from which 1099-DIVs were paid to country RIC. If all your foreign taxes paid were from mutual funds and/or ETFs, select all your 1099-DIV’s that have a number in Box 7.

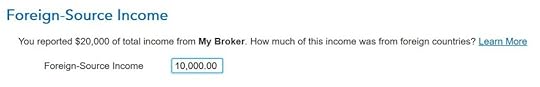

TurboTax asks you how much of the dividend on your 1099-DIV was from foreign countries. This information isn’t on the 1099-DIV itself. Your broker may have included supplemental information with the 1099-DIV. For instance, Fidelity provides the breakdown of total foreign income in its 1099 package.

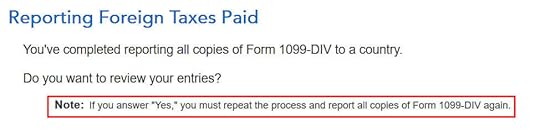

TurboTax asks whether you’d like to review the 1099-DIV forms you entered before. We answer “No” here because we already entered the 1099-DIV forms correctly.

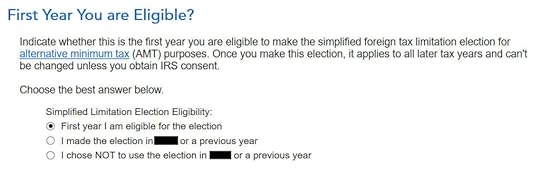

Simplified Limitation for AMT

Now it asks you about a “simplified foreign tax limitation election.” If this is the first year you encounter this, choose the first option.

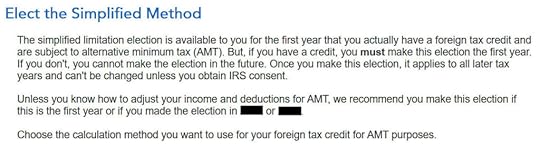

TurboTax suggests you should elect the simplified method. Click on Elect Simplified Calculation.

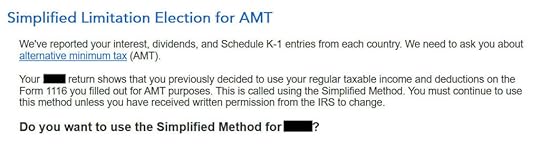

If you used TurboTax last year and you already elected the simplified method, TurboTax reminds you that you should continue with the simplified method. Answer “Yes” here.

Foreign Taxes Paid

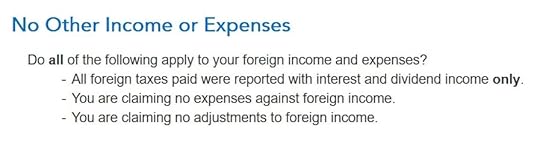

We don’t have any other foreign income, expenses, or adjustments. Click on Yes.

TurboTax auto-filled these. No changes are necessary for us.

We don’t have any carryover from previous years. A carryover is created when you paid more in foreign tax than the tax credit you’re allowed. Your leftover foreign tax paid is first carried back to the previous year and then carried over to the following year.

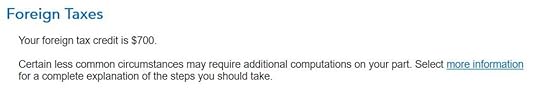

After going through all these, we’re getting 100% credit for the $700 foreign tax paid. Woo-hoo!

Verify on Schedule 3

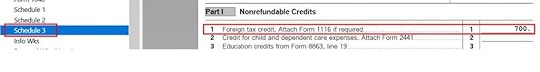

You can verify that you’re getting the foreign tax credit by clicking on Forms at the top right. Find Schedule 3 in the left navigation pane and look at the number on Line 1. You can also look at Form 1116. It looks awfully complicated.

Excess Foreign Tax CreditWe received 100% of the foreign taxes paid as a tax credit in our example. If you paid higher foreign taxes on a lower US income, you may not be able to take 100% of the credit. TurboTax will tell you that you’ll have to wait until next year to take a portion of the credit.

Carrying over part of the credit to the following year requires filing a Form 1116 Schedule B. TurboTax will automatically generate Schedule B when you need it.

H&R Block SoftwareThe following screenshots came from H&R Block downloaded software. The downloaded software is way better than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

I’ll use the same example:

Enter 1099-DIVYou received a 1099-DIV from your broker. Box 7 “Foreign Tax Paid” on the 1099-DIV shows $700. 100% of this $700 came from a mutual fund or ETF. You only have this one 1099-DIV that has a number in Box 7.

If you’re entering the 1099-DIV form manually, type the numbers as shown on your form. If you import, double-check the import to make sure all the numbers match your downloaded copy. H&R Block doesn’t say anything about the foreign tax paid or needing a Form 1116 after you enter the 1099-DIV. Just continue with your other entries.

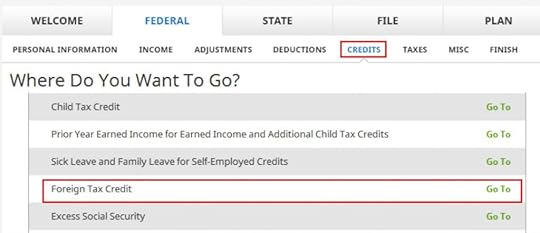

Foreign Tax Credit

It’ll come up much later in the Credits section under Foreign Tax Credit.

Click on Add Form 1116.

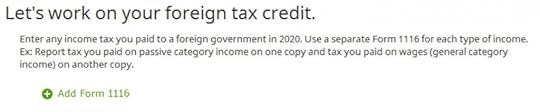

AMT Simplified Election

If this is the first year you’re claiming the Foreign Tax Credit, H&R Block software asks upfront about the simplified election. Select Yes for the simplified election.

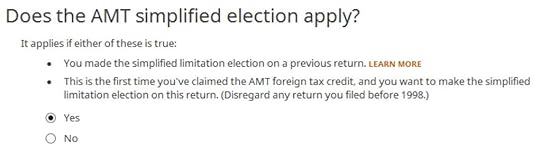

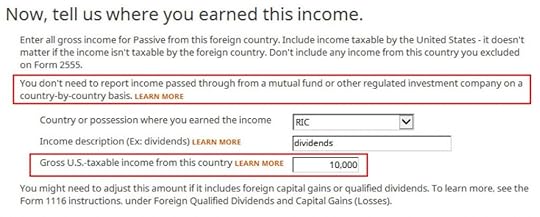

Foreign-Source Income

Dividend income falls under passive income.

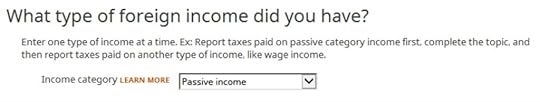

The “learn more” popup says you should choose “RIC” as the country when your foreign income came through mutual funds and/or ETFs. “RIC” is the last item in the country dropdown. You get the foreign income from the supplemental information in your 1099 package from your broker. If you have multiple 1099-DIV’s that reported foreign tax paid in Box 7, you’ll have to add up the foreign income numbers from the respective supplemental information.

Don’t overlook the small note under the gross income input. It says you might need to adjust the amount if it includes foreign capital gains or qualified dividends. When you’re reporting foreign taxes paid from mutual funds and ETFs, the income sure does include qualified dividends. H&R Block doesn’t do the adjustment for you. It asks you to read the IRS instructions, learn how to adjust, and report the adjusted income here. That’s lazy.

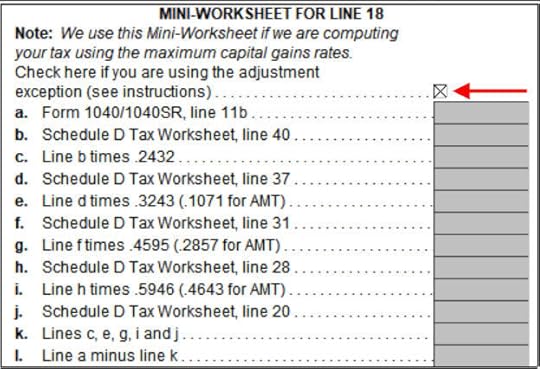

Adjustment ExceptionFortunately, many people qualify for an adjustment exception. From the IRS Form 1116 Instructions:

You qualify for the adjustment exception if you meet both of the following requirements.

1. Line 5 of the Qualified Dividends and Capital Gain Tax Worksheet doesn’t exceed:

a. $340,100 if married filing jointly or qualifying widow(er),

b. $170,050 if married filing separately,

c. $170,050 if single, or

d. $170,050 if head of household.

2. The amount of your foreign source capital gain distributions, plus the amount of your foreign source qualified dividends, is less than $20,000.

The dollar amounts in the first requirement correspond to the top of the 24% bracket. You are spared from figuring out how to adjust if your taxable income minus your qualified dividends and long-term capital gains isn’t in the 32% tax bracket or above, and your foreign source capital gain distributions and qualified dividends aren’t $20,000 or more.

If you’re eligible for the adjustment exception and you decide to take the easy route of not adjusting your foreign-source income, you need to claim a corresponding adjustment exception on your total income. Click on Forms on the top right. Open Form 1116. Scroll down and find Mini-Worksheet for Line 18 just above Line 18. Check the box for using the adjustment exception.

Close the form and return to the interview.

If you don’t qualify for the adjustment exception, good luck learning how to adjust from the Form 1116 instructions. You’re better off switching to TurboTax, which does the adjustment for you when you need it.

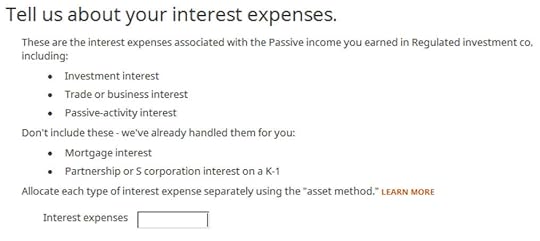

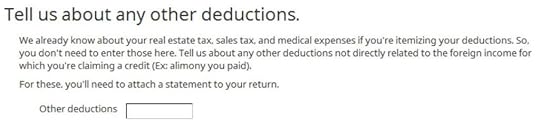

We leave this blank because we don’t have any interest expenses.

We leave this blank because we don’t have any other deductions either.

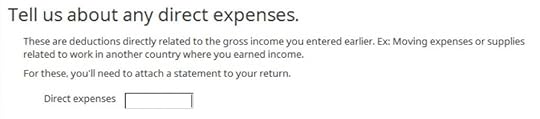

We don’t have any direct expenses either.

We have no losses to adjust.

Yes, our 1099-DIV was reported in U.S. dollars.

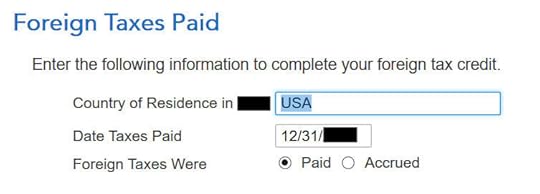

Foreign Taxes

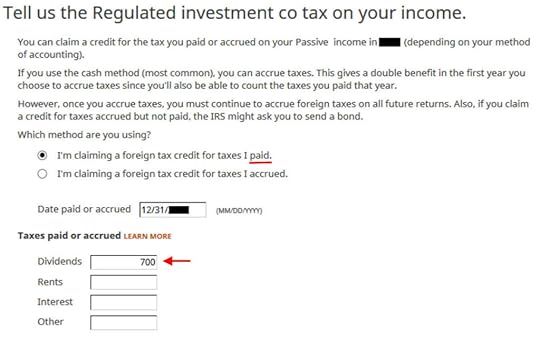

I chose the simpler “paid” method. Enter the end of the year as the date paid. Enter the total foreign tax paid into the Dividends box. If you have multiple 1099-DIV’s that reported foreign tax paid in Box 7, you’ll have to add up those numbers yourself. I wish the software should’ve done the math and auto-populated this field.

All our foreign taxes paid were through mutual funds and ETFs. RIC is the only country to use. We don’t have foreign income from any other countries.

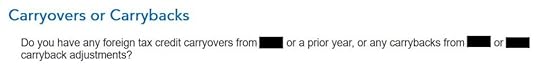

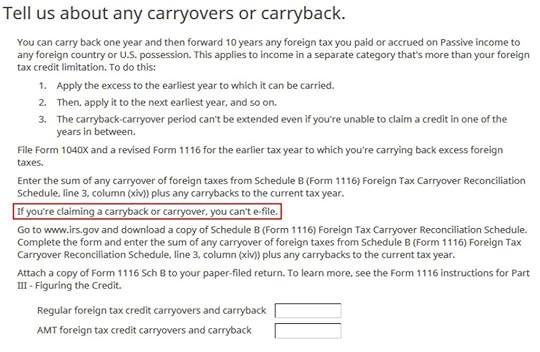

Fortunately, we don’t have any carryover or carryback. If we can’t get 100% credit for the foreign taxes paid this year, we’ll have to create a carryback or carryover, which means we can’t e-file with H&R Block.

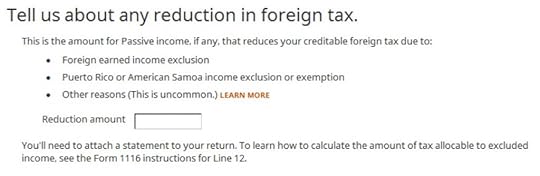

We don’t have any reduction either.

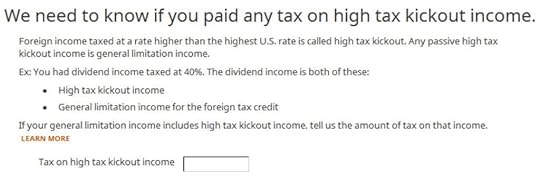

We don’t know what the foreign tax rate was. We’re leaving this blank.

We don’t know how to adjust. We’re leaving it blank again.

This is getting ridiculous. All I want is to get the foreign tax credit!

We’re finally done with one Form 1116. Are we getting the credit?

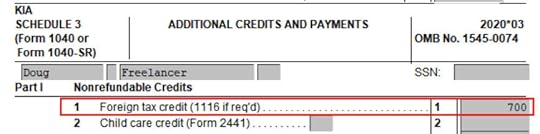

Verify on Schedule 3

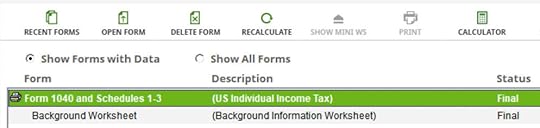

Click on Forms on the top. Double-click on Form 1040 and Schedules 1-3.

Scroll down to Schedule 3. Line 1 shows our foreign tax credit. You can also look at Form 1116. It looks awfully complicated.

Excess Foreign Tax CreditWe received 100% of the foreign taxes paid as a tax credit in our example. If you paid higher foreign taxes on a lower US income, you may not be able to take 100% of the credit. You’ll have to wait until next year to take the rest of it.

Carrying over part of the credit to the following year requires filing a Form 1116 Schedule B. H&R Block doesn’t have this form in their program. H&R Block tells you to download the form from the IRS website, complete it yourself, and attach it to your paper return. That’s ridiculous.

SummaryBoth TurboTax and H&R Block software work when your total foreign taxes paid exceeds the $300/$600 threshold that requires a Form 1116. Either way, you’ll have to gather the foreign income from the 1099 supplemental information from your brokers. After it’s all said and done, you’re getting a tax credit for taxes you paid to foreign countries through your mutual funds and/or ETFs.

TurboTax is more integrated with the 1099-DIV forms you already entered. H&R Block asks you to add up the foreign tax numbers yourself. Because you have to add up the foreign income anyway, you can add up the foreign tax numbers at the same time. H&R Block software asks you to make any necessary adjustments to the foreign-source income, which is quite difficult. The option to activate the adjustment exception is hidden in the Forms mode. You’re on your own when you don’t qualify for the adjustment exception. It also asks you to handle any carryover yourself. TurboTax does a better job of handling the foreign tax credit than the H&R Block software.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 Foreign Tax Credit Form 1116 in TurboTax and H&R Block appeared first on The Finance Buff.

2022 Self-Employed ACA Health Insurance Subsidy In H&R Block

Updated on January 16, 2023, with updated screenshots from H&R Block software for tax year 2022. If you use other tax software, see:

Self-Employed ACA Health Insurance Subsidy and Deduction In TurboTaxMany self-employed business owners buy health insurance from the Affordable Care Act (ACA) healthcare marketplace. Self-employed health insurance premiums are tax-deductible. When your income is low enough, you can also receive a subsidy in the form of a premium tax credit. The tax deduction and the subsidy form a circular relationship. The math is difficult to do by hand but tax software easily handles it for most people.

Use H&R Block Downloaded Software

Use H&R Block Downloaded SoftwareThe screenshots below are taken from H&R Block downloaded software. The downloaded software is way better than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

Self-Employed Health InsuranceI’m using this scenario as an example:

You are single, self-employed, with no dependent. You had health insurance from the ACA healthcare marketplace for all 12 months in the year. The second lowest cost Silver plan was $600/month. The full unsubsidized premium for the plan you chose was $500/month. Based on your estimated income, you got a $150/month advance credit. You paid net $350/month out of pocket.

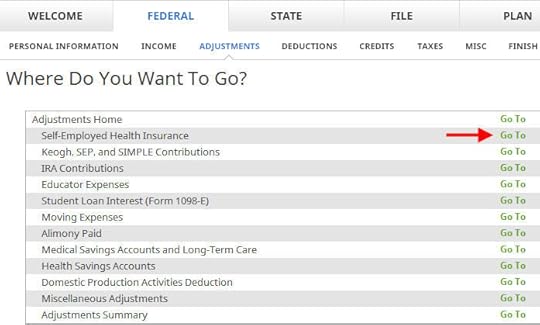

Go to Federal -> Adjustments -> Self-Employed Health Insurance.

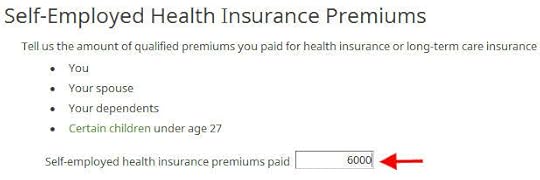

Enter the full unsubsidized premiums for your health insurance in the year. You find this number on the 1095-A form you receive from the ACA healthcare marketplace (line 33, column A). Include both what you paid out of pocket and the advance premium credit paid by the healthcare marketplace. You will reconcile the advance credit later.

If you also paid premiums for dental and vision insurance, add those as well. We don’t have dental and vision premiums in our example.

Right now it says 100% of your premium is deductible. It’ll change after you enter more information from your 1095-A form.

Enter 1095-A

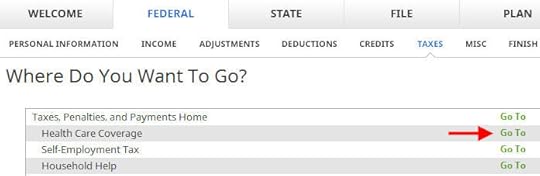

Go to Federal -> Taxes -> Health Care Coverage.

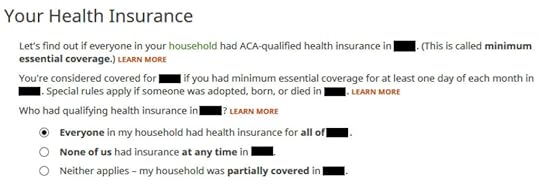

Everyone had insurance in our example.

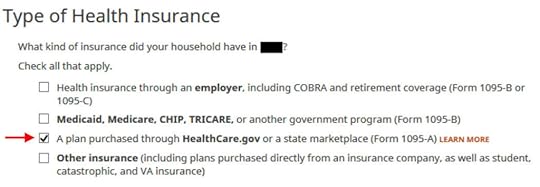

Check the box for a plan from the ACA healthcare marketplace.

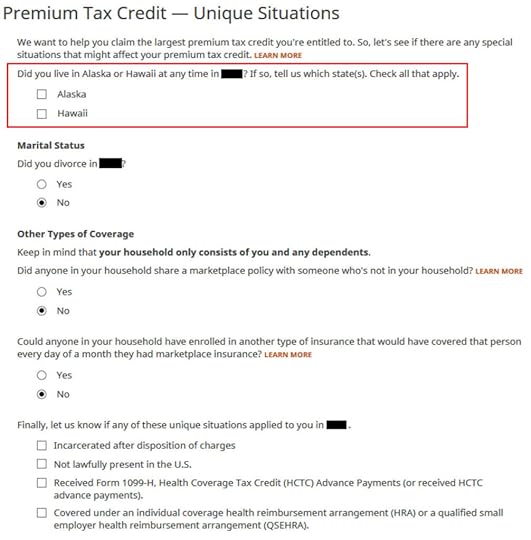

We don’t have any of these unique situations here. Check the box for Alaska or Hawaii if you lived there.

We need to add the 1095-A from the ACA healthcare marketplace.

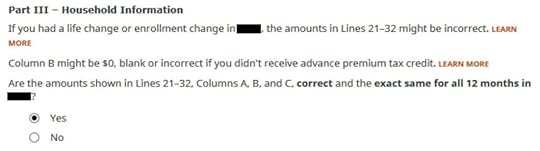

Enter the information as requested. Scroll down to Part III. The numbers on our 1095-A are the same for all 12 months and correct in our example. If you have different numbers for some months, choose ‘No’ and enter the month-by-month numbers from your Form 1095-A.

Enter the monthly amounts from the 1095-A. The full unsubsidized premium was $500/month. The full unsubsidized premium for the second lowest cost Silver plan was $600/month. The ACA healthcare marketplace paid $150/month in advance subsidy to the insurance company on our behalf.

We only have one 1095-A form in our example. If you have more than one, repeat and add them all.

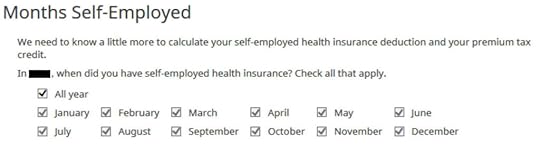

Which months you were self-employed determines how much counts as deductible self-employed health insurance. We were self-employed in all 12 months in our example.

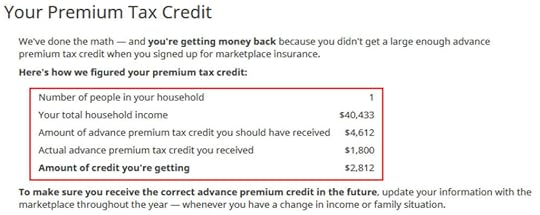

The software crunches the numbers. It says we are eligible for more premium tax credit than the advance subsidy the ACA healthcare marketplace already paid to the insurance company.

Self-Employed Health Insurance DeductionWe’re eligible for a tax deduction on the amount not covered by the re-calculated premium tax credit.

You can verify how much you are receiving a tax deduction. Click on Forms at the top. Double-click on Form 1040 and Schedules 1-3. Scroll down to Schedule 1 and look at line 17. That’s your self-employed health insurance deduction.

Premium Tax Credit

Close Form 1040 and Schedules 1-3 and find Form 8962 in the forms list. Double-click on it.

Scroll down to Line 24 on Form 8962. That’s our premium tax credit based on our actual income. Because we received less in advance subsidy, we’re getting the difference in our tax refund. If you received more in advance subsidy, you’ll have to pay back the difference (subject to a cap, see Cap On Paying Back ACA Health Insurance Subsidy Premium Tax Credit).

$1,388 in self-employed health insurance deduction plus $4,612 in premium tax credit equals $6,000. That’s the total unsubsidized premium for our health insurance (plus any dental and vision insurance premium, which we didn’t have in our example). The numbers add up!

The software figured out the split between the tax deduction and the tax credit. It also matched the result from TurboTax for the same example. This is where software does its best. If you take this to a tax professional, they will have to use their software to calculate the split anyway. I bet they are not able to do it by hand.

Edge CasesTax software works for most cases but it doesn’t work for everyone. You know you’re running into one of the edge cases for which the tax software doesn’t work when the numbers from the software fail this equation (except for a small difference due to rounding):

Self-Employed Health Insurance Deduction + Premium Tax Credit = Unsubsidized Health Insurance Premium (including any dental and vision premiums)

When this happens, you need a better calculator. See When TurboTax and H&R Block Give Self-Employed Wrong ACA Subsidy.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 Self-Employed ACA Health Insurance Subsidy In H&R Block appeared first on The Finance Buff.

January 14, 2023

2022 2023 2024 Federal Poverty Levels (FPL) For ACA Health Insurance

People who don’t have health insurance from work can buy health coverage under the Affordable Care Act (ACA), also known as Obamacare. The premiums are made affordable by a premium subsidy in the form of a tax credit calculated off of your income relative to the Federal Poverty Levels (FPL), also known as the HHS poverty guidelines.

The Maximum IncomeBefore 2021, you qualified for the premium subsidy only if your modified adjusted gross income (MAGI) was at 400% FPL or below. If your MAGI went above 400% FPL even by $1, you lost all the subsidy.

Changes in the law turned the cliff into a gradual slope through 2025. You still qualify for a premium subsidy now if your income is over 400% FPL. You just qualify for a lower amount as your income goes up. See ACA Premium Subsidy Cliff Turns Into a Slope. The cliff is scheduled to return in 2026.

Modified Adjusted Gross Income for the ACA premium subsidy is basically your adjusted gross income (AGI) plus tax-exempt muni bond interest, plus untaxed Social Security benefits. In order to see how much you qualify for the premium subsidy, you have to know where the FPL is.

The Minimum IncomeIn addition to the maximum income to receive the premium subsidy, there’s also a minimum income to get accepted by the ACA marketplace. If your estimated income is too low, the ACA marketplace won’t accept you. They send you to Medicaid instead. The minimum income is 138% FPL in states that expanded Medicaid. In states that didn’t expand Medicaid, the minimum income is 100% FPL. Here’s a map from Kaiser Family Foundation that shows which states expanded Medicaid and which states did not: Current Status of State Medicaid Expansion Decisions.

However, unlike the maximum income, the minimum income is only evaluated at the time of enrollment, not at the time when you file your tax return. If your estimated income at the time of enrollment is below the minimum, the ACA marketplace won’t accept you, and they will refer you to Medicaid. If your estimated income at the time of enrollment is above the minimum and they accepted you, but your income for the year ended up below the minimum due to unforeseen circumstances, as long as you made the original estimate in good faith, you are not required to pay back the premium subsidy you already received.

The FPL NumbersHere are the numbers for coverage in 2022, 2023, and 2024. They increase with inflation every year in January. These are applied with a one-year lag. Your eligibility for a premium subsidy for 2023 is based on the FPL numbers announced in 2022. The new numbers announced in 2023 will be used for coverage in 2024.

There are three sets of numbers. FPLs are higher in Alaska and Hawaii than in the lower 48 states and Washington DC.

48 Contiguous States and Washington DCNumber of persons in household2022 coverage2023 coverage2024 coverage1$12,880$13,880$14,5802$17,420$18,310$19,7203$21,960$23,030$24,8604$26,500$27,750$30,0005$31,040$32,470$35,1406$35,580$37,190$40,2807$40,120$41,910$45,4208$44,660$46,630$50,560moreadd $4,540 eachadd $4,720 eachadd $5,140 eachAlaskaNumber of persons in household2022 coverage2023 coverage2024 coverage1$16,090$16,990$18,2102$21,770$22,890$24,6403$27,450$28,790$31,0704$33,130$34,690$37,5005$38,810$40,590$43,9306$44,490$46,490$50,3607$50,170$52,390$56,7908$55,850$58,290$63,220moreadd $5,680 eachadd $5,900 eachadd $6,430 eachHawaiiNumber of persons in household2022 coverage2023 coverage2024 coverage1$14,820$15,630$16,7702$20,040$21,060$22,6803$25,260$26,490$28,5904$30,480$31,920$34,5005$35,700$37,350$40,4106$40,920$42,780$46,3207$46,140$48,210$52,2308$51,360$53,640$58,140moreadd $5,220 eachadd $5,430 eachadd $5,910 eachSource:

Department of Health and Human Services, notice 2021-01969Department of Health and Human Services, notice 2022-01166The Applicable PercentagesThe FPL numbers determine one aspect of your eligibility for the premium subsidy. How much you are expected to pay when you qualify for the premium subsidy is also determined by a sliding scale called the Applicable Percentages. We cover it in ACA Health Insurance Premium Tax Credit Percentages.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 2023 2024 Federal Poverty Levels (FPL) For ACA Health Insurance appeared first on The Finance Buff.

December 30, 2022

Fidelity Retirement Planning Tool: High-Level Model, Not Tactical

I came across the Fidelity retirement planning calculator three years ago when I met with a Fidelity employee at their branch office. Her title was Vice President, Financial Consultant. She explained to me that, at the VP level, she didn’t have a requirement of having clients use Fidelity’s paid wealth management services. A part of her role was to help clients with financial planning.

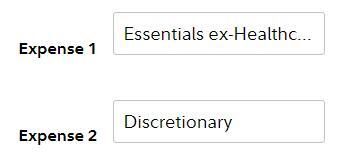

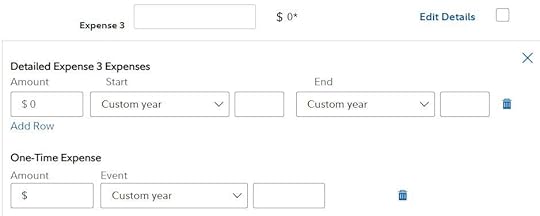

Table of ContentsRetirement Planning ToolIncomeInvestmentsExpensesTaxesProjectionsExplore What-If’sAsset AllocationSoft Sell on AnnuityWhat It Doesn’t DoConclusionRetirement Planning ToolHer primary tool was the retirement planning tool in Fidelity’s Planning and Guidance Center, which is available for free to all Fidelity customers. Non-customers can also register a guest login and use it for free.

You can run the tool on your own without working with someone at a Fidelity branch office. Fidelity employees there help people run the tool and look for up-selling opportunities.

Fidelity’s Planning and Guidance Center also has tools for other goals such as saving for college and buying a home. I only used the retirement planning tool. The basic idea is that you have some income, some investments, and some expenses, and the tool tells you how well your income and investments will cover your planned expenses.

I played with the retirement planning tool three years ago. I used it again recently, and here’s an update on how well it works.

To get started, click on “Planning & Advice” at the top, and then “Retirement.”

Find the “Get started” button in the middle of that page.

If it’s the first time you’re using the tool, it’ll ask you a series of questions: age, gender, when you plan to retire, life expectancy, income, expenses, etc. It jumps into your existing plan after you use it once.

IncomeIf you’re still working, the employment income is assumed to continue until your planned retirement age. If you’re self-employed, reduce your income by 1/2 of the self-employment tax to account for the higher taxes.

You can also add one-time and episodic income sources such as an inheritance, downsizing your home, part-time work, rentals, etc.

If you aren’t receiving Social Security yet, you need to tell the calculator when you’ll claim Social Security and what your benefits will be in today’s dollars. See Retiring Early: Effect On Social Security Benefits for how to get your earnings data from Social Security and feed them into other tools to calculate your benefits.