How To Enter 2022 ESPP Sales In TurboTax: Adjust Cost Basis

[Updated on January 16, 2023 with screenshots from TurboTax for 2022 tax filing.]

If your employer offers an Employee Stock Purchase Program (ESPP), you should max it out. You come out ahead even if you sell the shares as soon as you can. See Employee Stock Purchase Plan (ESPP) Is A Fantastic Deal.

After you sell the shares from the ESPP, part of the income will be included on your W-2. However, the 1099-B form you receive from the broker still reflects your discounted purchase price. This post shows you how to make the necessary adjustment on your tax return using TurboTax.

Don’t pay tax twice!

If you use other tax software, please read:

How to Report ESPP Sales in H&R Block SoftwareHow to Report ESPP Sales in FreeTaxUSAIf you’re looking for a guide on doing taxes on RSU sales, please read Restricted Stock Units (RSU) and TurboTax: Net Issuance.

Table of ContentsWhen to Report1099-B From BrokerUse TurboTax DownloadEnter 1099-BCorrect Cost BasisVerify on Schedule DWhen to ReportBefore you begin, be sure to understand when you need to report. You report when you sell the shares you bought under your ESPP. If you only bought shares but you didn’t sell during the tax year, there’s nothing to report yet.

Wait until you sell, but write down the full per-share price (before the discount) when you bought. If you purchased multiple times, write down for each purchase:

The purchase dateThe closing price on the grant dateThe closing price on the purchase dateThe number of shares you boughtThis information is very important when you sell.

Let’s use this example:

You bought 1,000 shares under your ESPP on 9/30/20xx. The closing price on the purchase date was $12 per share. The closing price on the grant date six months before was $10 per share. You bought at $8.50 per share with the discount.

You would write down:

Grant Date4/1/20xxMarket Price on the Grant Date$10 per sharePurchase Date9/30/20xxMarket Price on the Purchase Date$12 per shareShares Purchased1,000Discounted Price$8.50 per shareKeep this information until you sell.

1099-B From BrokerWhen you sell, you will receive a 1099-B form from the broker in the following year. You will report your gain or loss using this 1099-B form and the information you accumulated for each purchase.

Let’s continue our example:

You sold 1,000 shares from your purchase above on 10/5/20xx at $11.95 per share. After commission and fees, you netted $11,925. You received a 1099-B form from your broker showing a sales proceed of $11,925 in the following year. The 1099-B form shows the cost basis as $8,500, which reflects your discounted purchase price.

Because you didn’t hold it for two years after the grant date and one year after the purchase date, your sale was a “disqualifying disposition.” The discount is added as income to your W-2. This raises your cost basis. If you just accept the 1099-B as-is, you will be double-taxed!

Now let’s account for it in TurboTax.

Use TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax downloaded software from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

Enter 1099-B

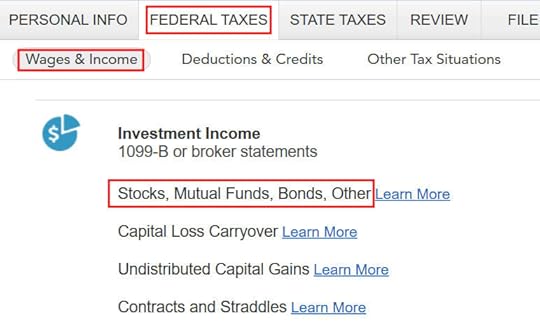

Go to “Federal Taxes” -> “Wages & Income” -> “Investment Income” and find “Stocks, Mutual Funds, Bonds, Other.”

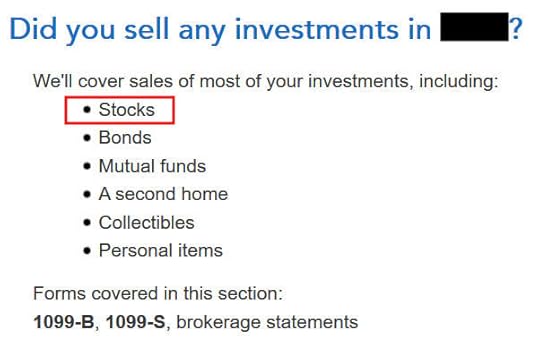

Answer “Yes” because you did sell stocks.

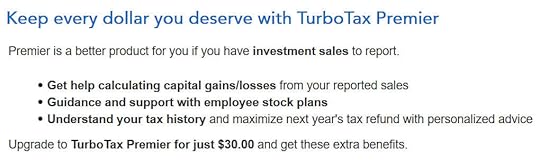

TurboTax offers an upgrade but we don’t need it. TurboTax Deluxe handles ESPP sales just fine.

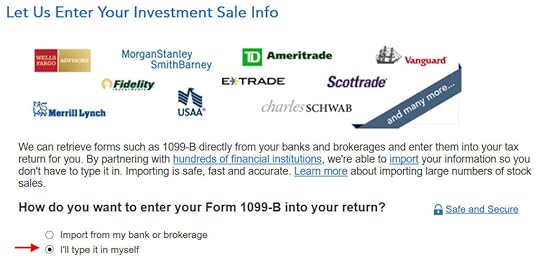

We did receive a 1099-B form.

Import your 1099-B if you’d like. I’ll type it myself here.

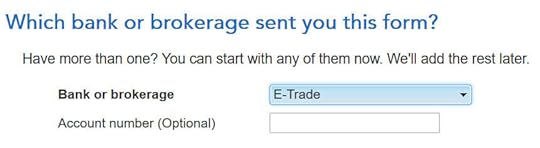

Select or enter the financial institution. Suppose it’s E*Trade.

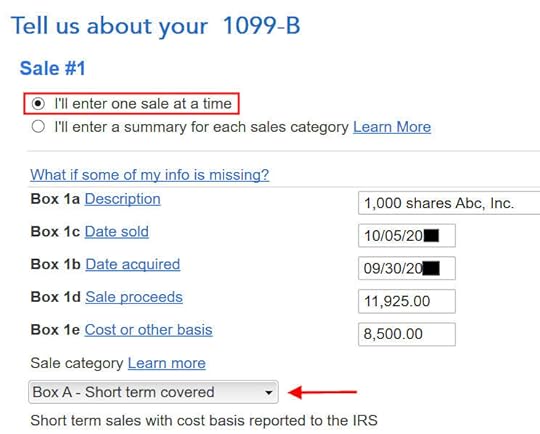

Choose to enter one sale at a time. Fill in the boxes from your 1099-B form. Look carefully at which category the sale belongs to on your 1099-B form. It was Box A on my form. It could be a different one on your form.

The cost basis on your 1099-B was reported to the IRS but it was too low. Don’t change it here directly.

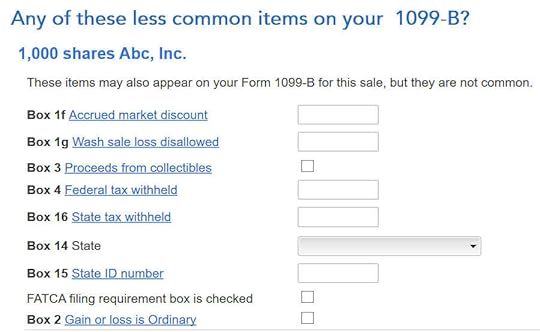

We don’t have any of these fields on our 1099-B form.

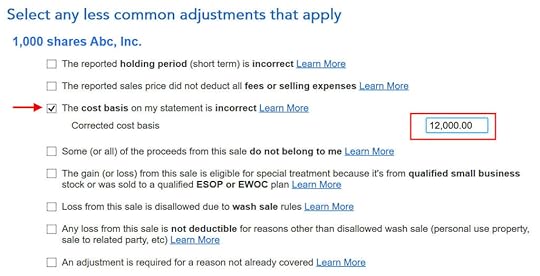

Correct Cost Basis

Check the box for “The cost basis on my statement is incorrect.” Enter your purchase cost plus the amount added to your W-2. When you did a “disqualifying disposition” your cost basis was the full value of the shares on the date of the purchase. The market price was $12 per share when you purchased those 1,000 shares at $8.50 per share. Your employer added the $3,500 discount as income to your W-2. Therefore your true basis is $8,500 + $3,500 = $12,000.

If you didn’t sell all the shares purchased in that batch, multiply the number of shares you sold by the discount price on the date of purchase and add the discount included on your W-2. For example, if you sold only 500 shares and your employer added $1,750 to your W-2, your corrected cost basis is:

$8.50 * 500 + $1,750 = $6,000

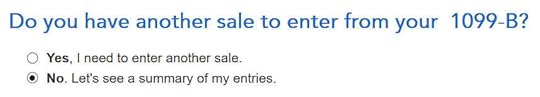

Repeat if you have more sales to enter. We only had one sale in our example.

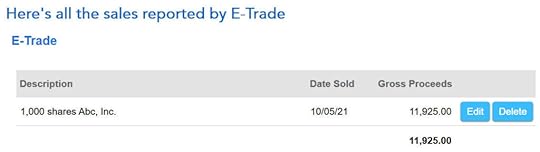

You get a summary of the sales you entered.

You get a summary of your net gain and loss. We have a net loss because we received less money after selling the shares and paying the commission and fees than our discounted purchase plus the income added to our W-2.

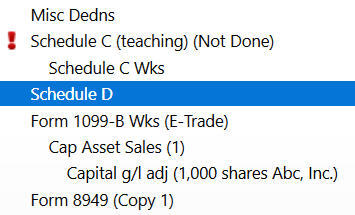

Verify on Schedule DWe can verify that the adjustment makes it all the way to the tax form. Click on “Forms” at the top right.

Find “Schedule D” in the left navigation pane.

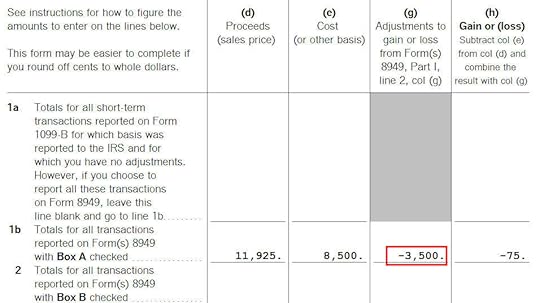

Scroll up or down to find line 1b, 2, 3, 8b, 9, or 10 depending on the sale category on your 1099-B form.

You see the negative adjustment in column (g). If you didn’t make the adjustment and you just accepted the 1099-B as-is, you will pay capital gains tax again on the $3,500 discount you are already paying taxes through your W-2. Remember to make the adjustment!

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Enter 2022 ESPP Sales In TurboTax: Adjust Cost Basis appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower