2022 Foreign Tax Credit Form 1116 in TurboTax and H&R Block

[Updated on January 16, 2023 with updated screenshots from TurboTax and H&R Block software for 2022 tax filing.]

When mutual funds and/or ETFs that invest in foreign countries receive dividends or interest, they have to pay taxes to those countries. After the end of the year, these mutual funds and/or ETFs report to your broker how much they paid in foreign taxes on your behalf. When you invest in these mutual funds and/or ETFs outside a tax-advantaged account, your broker will report to you the total foreign taxes you paid through all your funds and/or ETFs. The IRS allows a tax credit for the taxes you paid indirectly to foreign countries.

The foreign taxes paid is reported in Box 7 on the 1099-DIV form you receive from your broker. It’s easy to handle when the total foreign taxes paid from all your 1099-DIV forms is no more than a certain amount — $300 for single, $600 for married filing jointly. You enter the 1099-DIV forms into your tax software and the software will automatically put the total on your tax form (Schedule 3, Line 1).

When your total foreign taxes paid from all your 1099-DIV forms are over the $300/$600 threshold, you’ll need to include Form 1116 in your tax return. I’ll show you how to do this in TurboTax and H&R Block software.

Table of ContentsTurboTaxEnter 1099-DIVForeign-Source IncomeSimplified Limitation for AMTForeign Taxes PaidVerify on Schedule 3Excess Foreign Tax CreditH&R Block SoftwareEnter 1099-DIVForeign Tax CreditAMT Simplified ElectionForeign-Source IncomeAdjustment ExceptionForeign TaxesVerify on Schedule 3Excess Foreign Tax CreditSummaryI start with TurboTax. Please jump to the next section if you use H&R Block software.

TurboTaxThe screenshots below came from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

I’ll use this simple scenario as an example:

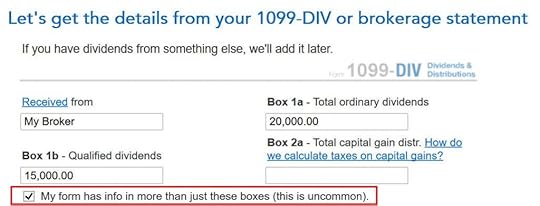

Enter 1099-DIVYou received a 1099-DIV from your broker. Box 7 “Foreign Tax Paid” on the 1099-DIV shows $700. 100% of this $700 came from a mutual fund or ETF. You only have this one 1099-DIV that has a number in Box 7.

If you’re entering your 1099-DIV manually, you have to check a box on the 1099-DIV entry screen to reveal the additional input fields. Then you put the foreign tax paid number into Box 7. If you imported your 1099’s, double-check that all the numbers from the import match your downloaded copy.

We don’t have any of these uncommon situations.

After you’re done with one 1099-DIV, continue with your other 1099-DIV forms. We only have one 1099-DIV form in our example.

Foreign-Source Income

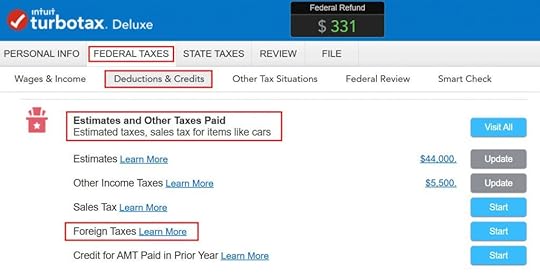

At a much later point, TurboTax will ask you about the foreign tax paid under Deductions & Credits -> Estimates and Other Taxes Paid -> Foreign Taxes.

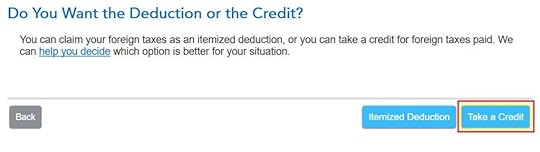

After a brief introduction, the first question is whether you’d like to take a tax deduction or a tax credit. The “help you decide” popup says in general you’re better off taking the credit. So click on “Take a Credit.”

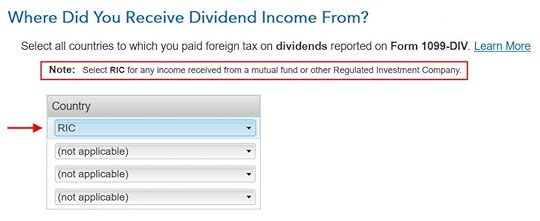

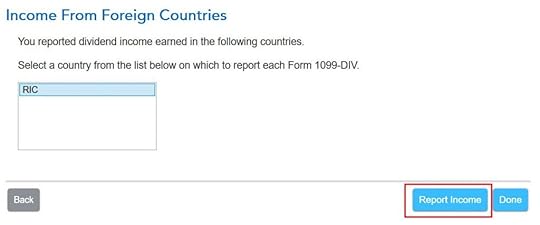

Next, TurboTax asks you which countries you received dividend income from. A small note says select RIC for any income received from a mutual fund or other Regulated Investment Company. U.S.-based mutual funds and ETFs fall into this category. RIC is the first item in the country dropdown.

Then you report income received from country “RIC.” Click on Report Income.

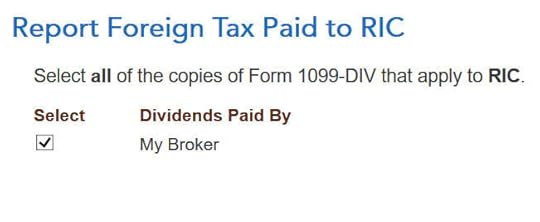

Now you say foreign tax paid from which 1099-DIVs were paid to country RIC. If all your foreign taxes paid were from mutual funds and/or ETFs, select all your 1099-DIV’s that have a number in Box 7.

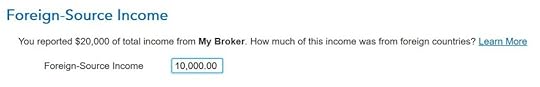

TurboTax asks you how much of the dividend on your 1099-DIV was from foreign countries. This information isn’t on the 1099-DIV itself. Your broker may have included supplemental information with the 1099-DIV. For instance, Fidelity provides the breakdown of total foreign income in its 1099 package.

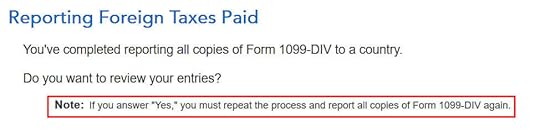

TurboTax asks whether you’d like to review the 1099-DIV forms you entered before. We answer “No” here because we already entered the 1099-DIV forms correctly.

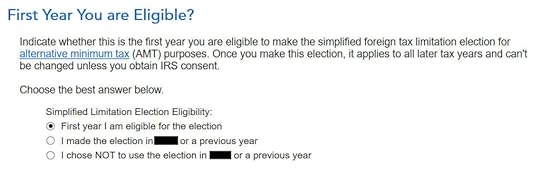

Simplified Limitation for AMT

Now it asks you about a “simplified foreign tax limitation election.” If this is the first year you encounter this, choose the first option.

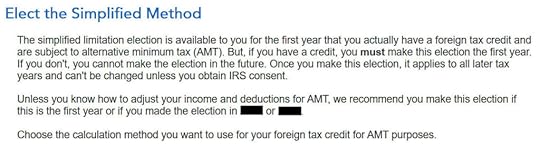

TurboTax suggests you should elect the simplified method. Click on Elect Simplified Calculation.

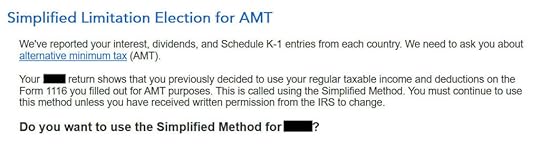

If you used TurboTax last year and you already elected the simplified method, TurboTax reminds you that you should continue with the simplified method. Answer “Yes” here.

Foreign Taxes Paid

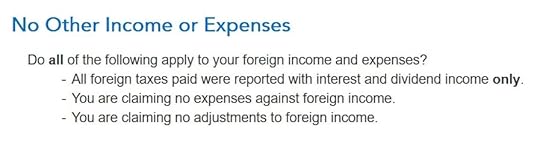

We don’t have any other foreign income, expenses, or adjustments. Click on Yes.

TurboTax auto-filled these. No changes are necessary for us.

We don’t have any carryover from previous years. A carryover is created when you paid more in foreign tax than the tax credit you’re allowed. Your leftover foreign tax paid is first carried back to the previous year and then carried over to the following year.

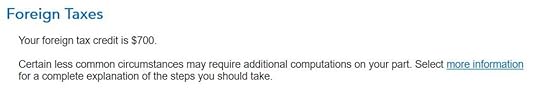

After going through all these, we’re getting 100% credit for the $700 foreign tax paid. Woo-hoo!

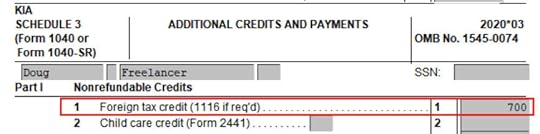

Verify on Schedule 3

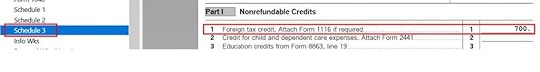

You can verify that you’re getting the foreign tax credit by clicking on Forms at the top right. Find Schedule 3 in the left navigation pane and look at the number on Line 1. You can also look at Form 1116. It looks awfully complicated.

Excess Foreign Tax CreditWe received 100% of the foreign taxes paid as a tax credit in our example. If you paid higher foreign taxes on a lower US income, you may not be able to take 100% of the credit. TurboTax will tell you that you’ll have to wait until next year to take a portion of the credit.

Carrying over part of the credit to the following year requires filing a Form 1116 Schedule B. TurboTax will automatically generate Schedule B when you need it.

H&R Block SoftwareThe following screenshots came from H&R Block downloaded software. The downloaded software is way better than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block download software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block download software next year.

I’ll use the same example:

Enter 1099-DIVYou received a 1099-DIV from your broker. Box 7 “Foreign Tax Paid” on the 1099-DIV shows $700. 100% of this $700 came from a mutual fund or ETF. You only have this one 1099-DIV that has a number in Box 7.

If you’re entering the 1099-DIV form manually, type the numbers as shown on your form. If you import, double-check the import to make sure all the numbers match your downloaded copy. H&R Block doesn’t say anything about the foreign tax paid or needing a Form 1116 after you enter the 1099-DIV. Just continue with your other entries.

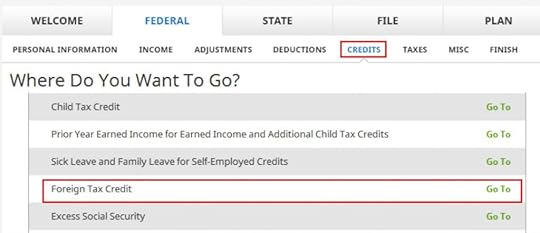

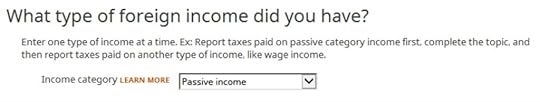

Foreign Tax Credit

It’ll come up much later in the Credits section under Foreign Tax Credit.

Click on Add Form 1116.

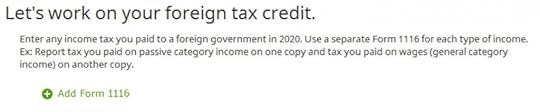

AMT Simplified Election

If this is the first year you’re claiming the Foreign Tax Credit, H&R Block software asks upfront about the simplified election. Select Yes for the simplified election.

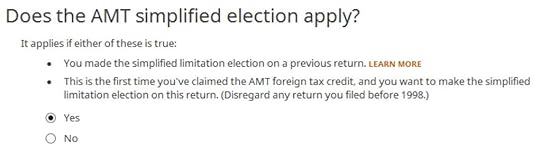

Foreign-Source Income

Dividend income falls under passive income.

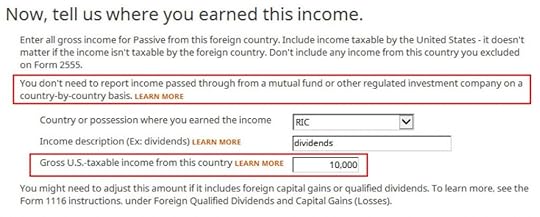

The “learn more” popup says you should choose “RIC” as the country when your foreign income came through mutual funds and/or ETFs. “RIC” is the last item in the country dropdown. You get the foreign income from the supplemental information in your 1099 package from your broker. If you have multiple 1099-DIV’s that reported foreign tax paid in Box 7, you’ll have to add up the foreign income numbers from the respective supplemental information.

Don’t overlook the small note under the gross income input. It says you might need to adjust the amount if it includes foreign capital gains or qualified dividends. When you’re reporting foreign taxes paid from mutual funds and ETFs, the income sure does include qualified dividends. H&R Block doesn’t do the adjustment for you. It asks you to read the IRS instructions, learn how to adjust, and report the adjusted income here. That’s lazy.

Adjustment ExceptionFortunately, many people qualify for an adjustment exception. From the IRS Form 1116 Instructions:

You qualify for the adjustment exception if you meet both of the following requirements.

1. Line 5 of the Qualified Dividends and Capital Gain Tax Worksheet doesn’t exceed:

a. $340,100 if married filing jointly or qualifying widow(er),

b. $170,050 if married filing separately,

c. $170,050 if single, or

d. $170,050 if head of household.

2. The amount of your foreign source capital gain distributions, plus the amount of your foreign source qualified dividends, is less than $20,000.

The dollar amounts in the first requirement correspond to the top of the 24% bracket. You are spared from figuring out how to adjust if your taxable income minus your qualified dividends and long-term capital gains isn’t in the 32% tax bracket or above, and your foreign source capital gain distributions and qualified dividends aren’t $20,000 or more.

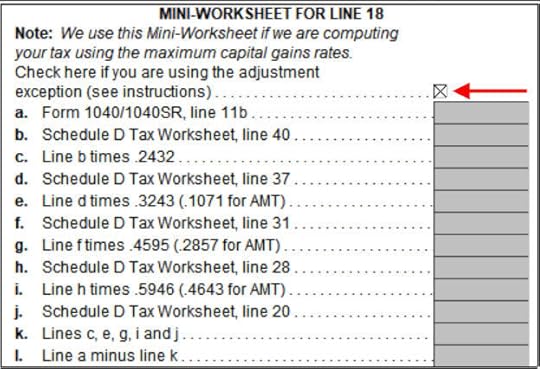

If you’re eligible for the adjustment exception and you decide to take the easy route of not adjusting your foreign-source income, you need to claim a corresponding adjustment exception on your total income. Click on Forms on the top right. Open Form 1116. Scroll down and find Mini-Worksheet for Line 18 just above Line 18. Check the box for using the adjustment exception.

Close the form and return to the interview.

If you don’t qualify for the adjustment exception, good luck learning how to adjust from the Form 1116 instructions. You’re better off switching to TurboTax, which does the adjustment for you when you need it.

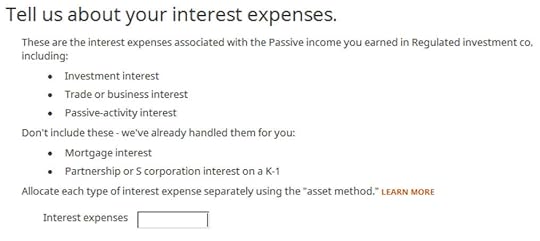

We leave this blank because we don’t have any interest expenses.

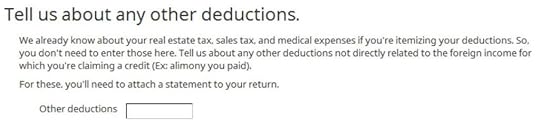

We leave this blank because we don’t have any other deductions either.

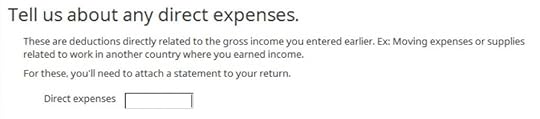

We don’t have any direct expenses either.

We have no losses to adjust.

Yes, our 1099-DIV was reported in U.S. dollars.

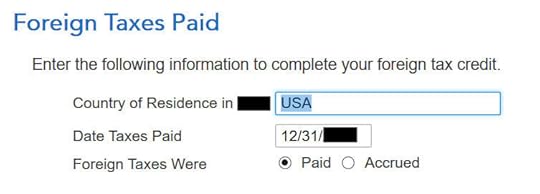

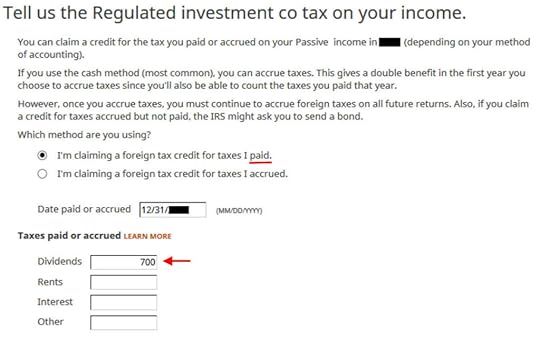

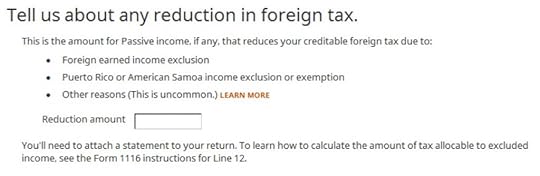

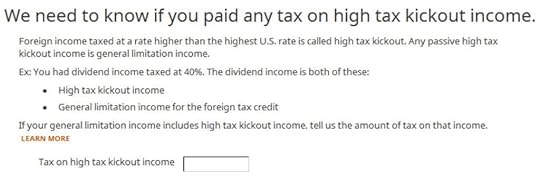

Foreign Taxes

I chose the simpler “paid” method. Enter the end of the year as the date paid. Enter the total foreign tax paid into the Dividends box. If you have multiple 1099-DIV’s that reported foreign tax paid in Box 7, you’ll have to add up those numbers yourself. I wish the software should’ve done the math and auto-populated this field.

All our foreign taxes paid were through mutual funds and ETFs. RIC is the only country to use. We don’t have foreign income from any other countries.

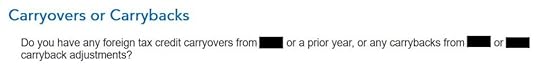

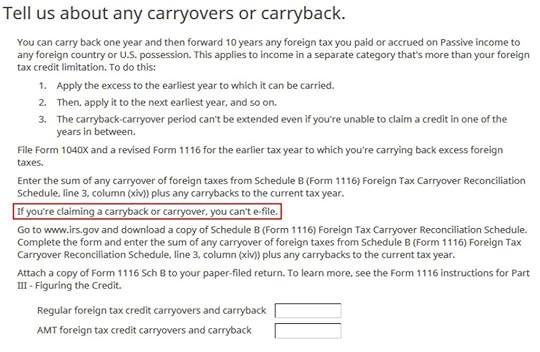

Fortunately, we don’t have any carryover or carryback. If we can’t get 100% credit for the foreign taxes paid this year, we’ll have to create a carryback or carryover, which means we can’t e-file with H&R Block.

We don’t have any reduction either.

We don’t know what the foreign tax rate was. We’re leaving this blank.

We don’t know how to adjust. We’re leaving it blank again.

This is getting ridiculous. All I want is to get the foreign tax credit!

We’re finally done with one Form 1116. Are we getting the credit?

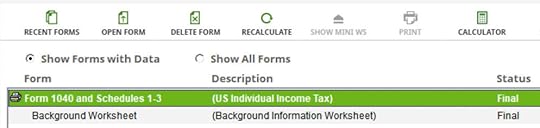

Verify on Schedule 3

Click on Forms on the top. Double-click on Form 1040 and Schedules 1-3.

Scroll down to Schedule 3. Line 1 shows our foreign tax credit. You can also look at Form 1116. It looks awfully complicated.

Excess Foreign Tax CreditWe received 100% of the foreign taxes paid as a tax credit in our example. If you paid higher foreign taxes on a lower US income, you may not be able to take 100% of the credit. You’ll have to wait until next year to take the rest of it.

Carrying over part of the credit to the following year requires filing a Form 1116 Schedule B. H&R Block doesn’t have this form in their program. H&R Block tells you to download the form from the IRS website, complete it yourself, and attach it to your paper return. That’s ridiculous.

SummaryBoth TurboTax and H&R Block software work when your total foreign taxes paid exceeds the $300/$600 threshold that requires a Form 1116. Either way, you’ll have to gather the foreign income from the 1099 supplemental information from your brokers. After it’s all said and done, you’re getting a tax credit for taxes you paid to foreign countries through your mutual funds and/or ETFs.

TurboTax is more integrated with the 1099-DIV forms you already entered. H&R Block asks you to add up the foreign tax numbers yourself. Because you have to add up the foreign income anyway, you can add up the foreign tax numbers at the same time. H&R Block software asks you to make any necessary adjustments to the foreign-source income, which is quite difficult. The option to activate the adjustment exception is hidden in the Forms mode. You’re on your own when you don’t qualify for the adjustment exception. It also asks you to handle any carryover yourself. TurboTax does a better job of handling the foreign tax credit than the H&R Block software.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 Foreign Tax Credit Form 1116 in TurboTax and H&R Block appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower