Harry Sit's Blog, page 15

April 12, 2023

2023 2024 HSA Contribution Limits and HDHP Qualification

The contribution limits for various tax-advantaged accounts for the following year are usually announced in October, except for the HSA, which come out in April or May. The contribution limits are adjusted for inflation each year, subject to rounding rules.

Table of ContentsHSA Contribution LimitsAge 55 Catch-Up ContributionTwo Plans Or Mid-Year ChangesHDHP QualificationContribute Outside PayrollBest HSA ProvidersHSA Contribution Limits202220232024Individual Coverage$3,650$3,850$4,150Family Coverage$7,300$7,750$8,300HSA Contribution LimitsSource: IRS Rev. Proc. 2021-25, Rev. Proc. 2022-24, Rev. Proc. 2023-23.

Employer contributions are included in these limits.

The family coverage numbers happened to be double the individual coverage numbers in 2022 and 2024 but it isn’t always the case. Because the individual coverage limit and the family coverage limit are both rounded to the nearest $50, the family coverage limit can be slightly more or slightly less than double the individual coverage limit when one number rounds up and the other number rounds down.

Age 55 Catch-Up ContributionAs in 401k and IRA contributions, you are allowed to contribute extra if you are above a certain age. If you are age 55 or older by the end of the year (not age 50 as in 401k and IRA contributions), you can contribute an additional $1,000 to your HSA. If you are married, and both of you are age 55, each of you can contribute an additional $1,000 to your respective HSA.

However, because HSA is in one individual’s name, just like an IRA — there is no joint HSA even when you have family coverage — only the person age 55 or older can contribute the additional $1,000 in his or her own name. If only the husband is 55 or older and the wife contributes the full family contribution limit to the HSA in her name, the husband has to open a separate account in his name for the additional $1,000. If both husband and wife are age 55 or older, they must have two HSA accounts in separate names if they want to contribute the maximum. There’s no way to hit the combined maximum with only one account.

The $1,000 additional contribution limit is fixed by law. It’s not adjusted for inflation.

Two Plans Or Mid-Year ChangesThe limits are more complicated if you are married and the two of you are on different health plans. It’s also more complicated when your health insurance changes mid-year. The insurance change could be due to a job change, marriage or divorce, enrolling in Medicare, the birth of a child, and so on.

For those situations, please read HSA Contribution Limit For Two Plans Or Mid-Year Changes.

HDHP QualificationYou can only contribute to an HSA if you have a High Deductible Health Plan (HDHP). You can use the money already in the HSA for qualified medical expenses regardless of what insurance you currently have.

The IRS also defines what qualifies as an HDHP. For 2023, an HDHP with individual coverage must have at least $1,500 in annual deductible and no more than $7,500 in annual out-of-pocket expenses. For family coverage, the numbers are a minimum of $3,000 in annual deductible and no more than $15,000 in annual out-of-pocket expenses.

For 2024, an HDHP with individual coverage must have at least $1,600 in annual deductible and no more than $8,050 in annual out-of-pocket expenses. For family coverage, the numbers are a minimum of $3,200 in annual deductible and no more than $16,100 in annual out-of-pocket expenses.

Please note the deductible number is a minimum while the out-of-pocket number is a maximum. If the out-of-pocket limit of your insurance policy is too high, it doesn’t qualify as an HSA-eligible policy.

In addition, just having the minimum deductible and the maximum out-of-pocket isn’t sufficient to make a plan qualify as HSA eligible. The plan must also meet other criteria. See Not All High Deductible Plans Are HSA Eligible.

202220232024Individual Coveragemin. deductible$1,400$1,500$1,600max. out-of-pocket$7,050$7,500$8,050Family Coveragemin. deductible$2,800$3,000$3,200max. out-of-pocket$14,100$15,000$16,100HDHP QualificationSource: IRS Rev. Proc. 2021-25, Rev. Proc. 2022-24, Rev. Proc. 2023-23.

Contribute Outside PayrollIf you have a High Deductible Health Plan (HDHP) through your employer, your employer may already set up a linked HSA for you at a selected provider. Your employer may be contributing an amount on your behalf there. Your payroll contributions also go into that account. Your employer may be paying the fees for you on that HSA. You save Social Security and Medicare taxes when you contribute to the HSA through payroll.

When you contribute to an HSA outside an employer, you get the tax deduction on your tax return, similar to when you contribute to a Traditional IRA. If you use tax software, be sure the answer the questions on HSA contributions. The tax deduction shows up on Form 8889 line 13 and Schedule 1 line 13.

If your HDHP also covers your adult children who are not claimed as a dependent on your tax return, they can also contribute to an HSA in their own name if they don’t have other non-HDHP coverage. They get a separate family coverage limit. They will have to open an HSA on their own with an HSA provider.

Best HSA ProvidersIf you get the HSA-eligible high deductible plan through an employer, your employer usually has a designated HSA provider for contributing via payroll deduction. It’s best to use that one because your contributions via payroll deduction are usually exempt from Social Security and Medicare taxes. If you want better investment options, you can transfer or roll over the HSA money from your employer’s designated provider to a provider of your choice afterward. See How To Rollover an HSA On Your Own and Avoid Trustee Transfer Fee.

If you are not going through an employer, or if you’d like to contribute on your own, you can also open an HSA with a provider of your choice. For the best HSA providers with low fees and good investment options, see Best HSA Provider for Investing HSA Money.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2023 2024 HSA Contribution Limits and HDHP Qualification appeared first on The Finance Buff.

2022 2023 2024 HSA Contribution Limits and HDHP Qualification

The contribution limits for various tax-advantaged accounts for the following year are usually announced in October, except for the HSA, which come out in April or May. The contribution limits are adjusted for inflation each year, subject to rounding rules.

Table of ContentsHSA Contribution LimitsAge 55 Catch-Up ContributionTwo Plans Or Mid-Year ChangesHDHP QualificationContribute Outside PayrollBest HSA ProvidersHSA Contribution Limits202220232024Individual Coverage$3,650$3,850$4,150Family Coverage$7,300$7,750$8,300HSA Contribution LimitsSource: IRS Rev. Proc. 2021-25, Rev. Proc. 2022-24, author’s calculation.

Employer contributions are included in these limits.

The family coverage numbers happened to be double the individual coverage numbers in 2022 and 2024 but it isn’t always the case. Because the individual coverage limit and the family coverage limit are both rounded to the nearest $50, the family coverage limit can be slightly more or slightly less than double the individual coverage limit when one number rounds up and the other number rounds down.

Age 55 Catch-Up ContributionAs in 401k and IRA contributions, you are allowed to contribute extra if you are above a certain age. If you are age 55 or older by the end of the year (not age 50 as in 401k and IRA contributions), you can contribute an additional $1,000 to your HSA. If you are married, and both of you are age 55, each of you can contribute an additional $1,000 to your respective HSA.

However, because HSA is in one individual’s name, just like an IRA — there is no joint HSA even when you have family coverage — only the person age 55 or older can contribute the additional $1,000 in his or her own name. If only the husband is 55 or older and the wife contributes the full family contribution limit to the HSA in her name, the husband has to open a separate account in his name for the additional $1,000. If both husband and wife are age 55 or older, they must have two HSA accounts in separate names if they want to contribute the maximum. There’s no way to hit the combined maximum with only one account.

The $1,000 additional contribution limit is fixed by law. It’s not adjusted for inflation.

Two Plans Or Mid-Year ChangesThe limits are more complicated if you are married and the two of you are on different health plans. It’s also more complicated when your health insurance changes mid-year. The insurance change could be due to a job change, marriage or divorce, enrolling in Medicare, the birth of a child, and so on.

For those situations, please read HSA Contribution Limit For Two Plans Or Mid-Year Changes.

HDHP QualificationYou can only contribute to an HSA if you have a High Deductible Health Plan (HDHP). You can use the money already in the HSA for qualified medical expenses regardless of what insurance you currently have.

The IRS also defines what qualifies as an HDHP. For 2023, an HDHP with individual coverage must have at least $1,500 in annual deductible and no more than $7,500 in annual out-of-pocket expenses. For family coverage, the numbers are a minimum of $3,000 in annual deductible and no more than $15,000 in annual out-of-pocket expenses.

For 2024, an HDHP with individual coverage must have at least $1,600 in annual deductible and no more than $8,050 in annual out-of-pocket expenses. For family coverage, the numbers are a minimum of $3,200 in annual deductible and no more than $16,100 in annual out-of-pocket expenses.

Please note the deductible number is a minimum while the out-of-pocket number is a maximum. If the out-of-pocket limit of your insurance policy is too high, it doesn’t qualify as an HSA-eligible policy.

In addition, just having the minimum deductible and the maximum out-of-pocket isn’t sufficient to make a plan qualify as HSA eligible. The plan must also meet other criteria. See Not All High Deductible Plans Are HSA Eligible.

202220232024Individual Coveragemin. deductible$1,400$1,500$1,600max. out-of-pocket$7,050$7,500$8,050Family Coveragemin. deductible$2,800$3,000$3,200max. out-of-pocket$14,100$15,000$16,100HDHP QualificationSource: IRS Rev. Proc. 2021-25, Rev. Proc. 2022-24, author’s calculation.

Contribute Outside PayrollIf you have a High Deductible Health Plan (HDHP) through your employer, your employer may already set up a linked HSA for you at a selected provider. Your employer may be contributing an amount on your behalf there. Your payroll contributions also go into that account. Your employer may be paying the fees for you on that HSA. You save Social Security and Medicare taxes when you contribute to the HSA through payroll.

When you contribute to an HSA outside an employer, you get the tax deduction on your tax return, similar to when you contribute to a Traditional IRA. If you use tax software, be sure the answer the questions on HSA contributions. The tax deduction shows up on Form 8889 line 13 and Schedule 1 line 13.

If your HDHP also covers your adult children who are not claimed as a dependent on your tax return, they can also contribute to an HSA in their own name if they don’t have other non-HDHP coverage. They get a separate family coverage limit. They will have to open an HSA on their own with an HSA provider.

Best HSA ProvidersIf you get the HSA-eligible high deductible plan through an employer, your employer usually has a designated HSA provider for contributing via payroll deduction. It’s best to use that one because your contributions via payroll deduction are usually exempt from Social Security and Medicare taxes. If you want better investment options, you can transfer or roll over the HSA money from your employer’s designated provider to a provider of your choice afterward. See How To Rollover an HSA On Your Own and Avoid Trustee Transfer Fee.

If you are not going through an employer, or if you’d like to contribute on your own, you can also open an HSA with a provider of your choice. For the best HSA providers with low fees and good investment options, see Best HSA Provider for Investing HSA Money.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2022 2023 2024 HSA Contribution Limits and HDHP Qualification appeared first on The Finance Buff.

April 11, 2023

Which Fidelity Money Market Fund Is the Best at Your Tax Rates

The previous post Which Vanguard Money Market Fund Is the Best at Your Tax Rates covered Vanguard money market funds. Vanguard has the best money market funds because they charge the lowest fees in their funds. However, many people — myself included — have a brokerage account at Fidelity Investments. It’s more convenient to keep cash and other investments in one place. If you don’t need absolutely the highest yield, a Fidelity money market fund is still quite good enough.

As I wrote in No FDIC Insurance – Why a Brokerage Account Is Safe, when you keep your cash in a money market fund at a broker, the safety of your money doesn’t depend on the financial health of the broker. The safety comes directly from the safety of the holdings in the money market fund. Your money market fund is safe when the fund’s underlying holdings are safe.

Table of ContentsWhy Money Market FundTaxable Money Market FundsCore-Eligible Money Market FundsPrime Money Market FundsGovernment Money Market FundsSingle State Tax-Exempt Money Market FundsNational Tax-Exempt Money Market FundTaxable or Tax-Exempt?Yield SwingsMM OptimizerYour Tax RatesCompare After-Tax YieldWhy Money Market FundThe reason to keep your cash in a money market fund, as opposed to a high yield savings account, is that you’re not depending on any bank to set their rate competitively. You automatically get the market yield minus the fund manager’s cut, no more, no less, sort of like when you invest in an index fund. You’re not moving to another bank because it’s offering a promotional rate. You’re not moving again when that bank decides to lag behind. See my Guide to Money Market Funds & High Yield Savings Accounts.

Fidelity offers at least 18 money market funds of different types. That’s not counting Institutional funds and funds that are only available in certain account types. These 18 money market funds differ in their underlying holdings and tax treatment at both the federal and the state levels. Which one is slightly better for you than another depends on your preference for convenience and your federal and state tax brackets.

Taxable Money Market FundsSeven of the 18 Fidelity money market funds are taxable money market funds. You pay federal income tax on the income earned from these funds. A portion of the income earned in some funds is exempt from state income tax in most states.

The quoted yield on any money market fund is always a net yield after the expense ratio is already deducted. You don’t need to deduct it again.

Core-Eligible Money Market FundsEvery Fidelity brokerage account has a core position. You don’t have to do anything extra to buy or sell the core position. Any cash you transfer into your Fidelity brokerage account will automatically land in the core position. Any cash you transfer out of your Fidelity brokerage account will come out of the core position.

Your choices in the core position may include these money market funds depending on the account type:

FundExpense Ratio2022 State Tax ExemptionFidelity Government Cash Reserves (FDRXX)0.34%29% (0% in CA, CT, NY)Fidelity Government Money Market Fund (SPAXX)0.42%31% (0% in CA, CT, NY)Fidelity Treasury Money Market Fund (FZFXX)0.42%30% (0% in CA, CT, NY)The income earned in these funds is fully taxable at the federal level. A percentage of the income is exempt from state income tax. That percentage varies from year to year.

There isn’t much difference among these three core-eligible funds. If Fidelity Government Cash Reserves (FDRXX) is an option, I would choose that one as the core position because it has a lower expense ratio.

If you’d like to see what options you have as your core position, click on your core position marked with two asterisks on the Positions page and then click on the Change Core Position button. If you see FCASH as an option in your account, don’t choose that one because FCASH isn’t a money market fund.

All money market funds except the core position require a buy order to get money into them but you don’t have to sell manually. If your core position isn’t sufficient for a debit, Fidelity will automatically sell from your money market fund to cover the difference.

Fidelity Cash Management Account only uses bank sweep as the core position. You can’t change it but you can still buy a money market fund manually in a Cash Management Account.

Prime Money Market FundsFidelity Money Market Fund (SPRXX) and Fidelity Money Market Fund Premium Class (FZDXX) are prime money market funds. They invest in repurchase agreements, CDs, and commercial paper. Prime money market funds pay more but they have a slightly higher risk.

The Premium Class fund (FZDXX) requires a $100,000 minimum investment in a taxable account and a $10,000 minimum investment in an IRA. The minimum is only required to get started. You can drop below the minimum after you have the fund. The regular class fund (SPRXX) doesn’t require a minimum investment but it pays less than the Premium Class fund because it has a higher expense ratio (0.42% versus 0.36%).

The income earned from these prime money funds is fully taxable at the federal level. A small percentage of the income is exempt from state income tax. That percentage varies from year to year. It was 0% in 2022 and 4% in 2021 (0% in CA, CT, and NY).

Government Money Market FundsFidelity Government Money Market Fund Premium Class (FZCXX) and Fidelity Treasury Only Money Market Fund (FDLXX) are government money market funds. They only invest in government securities and repurchase agreements that are collateralized by cash or government securities.

Think of repurchase agreements (“repo”) as a deal with a pawn shop. Entities give collaterals to the money market fund for short-term cash. They’ll come back later to buy back (“repurchase”) their collaterals at a higher price. If they don’t fulfill the repurchase agreement, the money market fund will sell those collaterals. Repurchase agreements aren’t guaranteed by the government. Their safety comes from the collaterals.

A government money market fund is safer than a prime money market fund. Fidelity Treasury Only Money Market Fund (FDLXX) is the safest because it invests more in Treasuries. It pays a little less though.

The income earned from these two funds is fully taxable at the federal level. A percentage of the income is exempt from state income tax. That percentage varies from year to year.

Minimum InvestmentState Tax Exemption in 2022Fidelity Government Money Market Fund Premium Class (FZCXX)$100,000 ($10,000 in IRA)31% (0% in CA, NY, CT)Fidelity Treasury Only Money Market Fund (FDLXX)$094%Among the seven taxable money market funds, if you value the convenience of no extra step to buy, you can leave the money in one of the core-eligible funds. If you want a higher yield and you’re not concerned about the slightly higher risk, you can go with one of the prime money market funds (FZDXX or SPRXX). If you want the most solid peace of mind at the cost of a slightly lower yield, you can choose the Treasury Only fund (FDLXX) for extra safety and the additional state income tax savings. Finally, the Government Money Market Fund Premium Class (FZCXX) is a good middle ground with safer holdings than the prime funds and you’re not giving up too much yield. I have my cash in FZCXX.

Remember to claim the state tax exemption when you do your taxes. See State Tax-Exempt Treasury Interest from Mutual Funds and ETFs.

Single State Tax-Exempt Money Market FundsFidelity offers tax-exempt money market funds specifically for investors in higher tax brackets in California, Massachusetts, New Jersey, and New York. These funds invest in high-quality, short-term municipal securities issued by entities within the state. Income from these funds is tax-exempt from both the federal income tax and the state income tax. They’re sometimes called “double tax-free” funds.

The fund for each state has two share classes — a regular share class and a Premium Class. The Premium Class fund requires a $25,000 minimum investment. The regular class fund has no minimum but it pays a little less because it has a higher expense ratio (0.42% versus 0.30%).

Regular Share Class($0 minimum)Premium Class

($25,000 minimimum)CaliforniaFABXXFSPXXMassachusettsFAUXXFMSXXNew JerseyFAYXXFSJXXNew YorkFAWXXFSNXX

The yield on these single state tax-exempt money market funds is lower than the yield on the seven taxable money market funds but the federal and state tax exemption makes up for it when you’re in a high tax bracket.

Remember to claim the state tax exemption when you do your taxes. See State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs.

National Tax-Exempt Money Market FundFidelity offers three tax-exempt money market funds for investors in higher tax brackets outside of California, Massachusetts, New Jersey, and New York. These funds are more diversified than the eight single-state funds because they invest in short-term, high-quality municipal securities from many states.

Expense RatioMinimum InvestmentFidelity Municipal Money Market Fund (FTEXX)0.41%$0Fidelity Tax-Exempt Money Market Fund (FMOXX)0.47%$0Fidelity Tax-Exempt Money Market Fund Premium Class (FZEXX)0.37%$25,000Income from these funds is tax-exempt from the federal income tax but only a small percentage is exempt from state income tax. The yield is lower than the yield on the seven taxable money market funds but the federal income tax exemption makes up for it when you’re in a high tax bracket. If you live in California, Massachusetts, New Jersey, or New York, you can still invest in these national funds if you don’t mind paying more in state income tax.

Remember to claim the small state tax exemption when you do your taxes. See State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs.

Taxable or Tax-Exempt?A tax-exempt money market fund offers tax savings but it pays less. Choose a tax-exempt fund if you’re in a high tax bracket. Choose a taxable fund if you’re in a low tax bracket. If you’re not sure whether your federal and state tax brackets are considered high or low, you can use a calculator to see which fund offers a better yield after taxes.

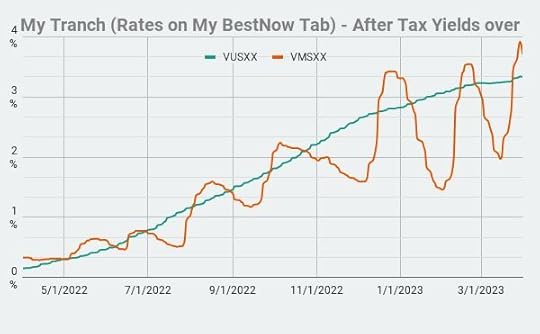

Yield SwingsA wrinkle in comparing taxable and tax-exempt money market funds is that the yield on tax-exempt money market funds swings wildly throughout the year. This chart shows the yield on a taxable money market fund and the yield on a tax-exempt money market fund over a 12-month period:

While the yield on the taxable fund (green line) rose steadily over time as the Fed raised interest rates, the yield on the tax-exempt fund (orange line) swung wildly up and down. If you happen to compare the after-tax yields when the yield on the tax-exempt fund is near a top, it would show that the tax-exempt fund is better even in a low tax bracket. If you happen to compare them when the yield on the tax-exempt fund is near a bottom, it would show that the taxable fund is better even in a high tax bracket.

MM OptimizerSo you can’t just adjust for taxes based on the yields at this moment. You need to look over a longer period to take into account the wild swings in tax-exempt funds.

User retiringwhen on the Bogleheads forum created a Google Sheet that does this. It’s called MM Optimizer. Although the current version of this tool focuses on Vanguard money market funds, it’s also informative when you use a Fidelity money market fund. If the tool shows that a Vanguard taxable money market fund is better than a Vanguard tax-exempt fund at your tax rates, it’s highly likely that a Fidelity taxable money market fund is also better than a Fidelity tax-exempt fund for you at the same tax rates.

The author of MM Optimizer is considering adding support for Fidelity money market funds. It’s possible that a future version of MM Optimizer will include Fidelity money market funds as well.

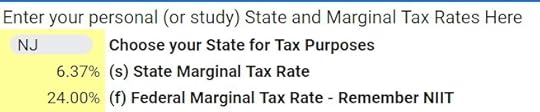

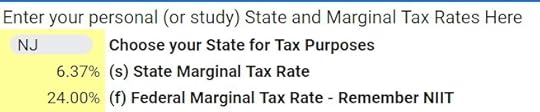

Your Tax RatesMM Optimizer is a shared as View Only. After you make a copy of it to your Google account, you change the tax rates on the My Parameters tab to your tax rates.

My Parameters tabCompare After-Tax Yield

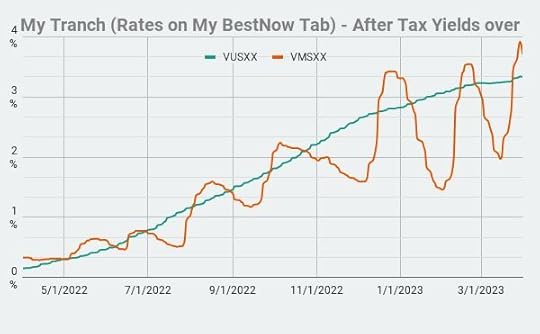

My Parameters tabCompare After-Tax YieldThe My Charts tab shows the after-tax yield of different funds over the last 12 months. You can watch the yields and switch back and forth between a taxable fund and a tax-exempt fund but I wouldn’t bother. The chart shows how many times you would’ve had to switch to catch the temporary swings and how short-lived each switch was.

My Charts tab

My Charts tabI would take a look at this chart and see which line is on top most of the time. Choose a Fidelity taxable money market fund and stay with it if the chart shows that the smoother line is on top most of the time. Choose a Fidelity tax-exempt money market fund if the chart shows that the bouncy line is on top most of the time.

MM Optimizer has a lot more features but you don’t have to get into those. It’s simple to use if you only look at the places I’m showing here. The author is still adding new features. I hope it will include Fidelity money market funds soon. You’ll find the link to the latest version in this post on the Bogleheads forum.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Which Fidelity Money Market Fund Is the Best at Your Tax Rates appeared first on The Finance Buff.

April 5, 2023

Which Vanguard Money Market Fund Is the Best at Your Tax Rates

As I wrote in No FDIC Insurance – Why a Brokerage Account Is Safe, when you keep your cash in a money market fund at a broker, the safety of your money doesn’t depend on the financial health of the broker. The safety comes directly from the safety of the holdings in the money market fund. Your money market fund is safe when the fund’s underlying holdings are safe.

Table of ContentsWhy Money Market FundWhy VanguardTaxable Money Market FundsSingle State Tax-Exempt Money Market FundsNational Tax-Exempt Money Market FundTaxable or Tax-Exempt?Why Money Market FundThe reason to keep your cash in a money market fund, as opposed to a high yield savings account, is that you’re not depending on any bank to set their rate competitively. You automatically get the market yield minus the fund manager’s cut, no more, no less, sort of like when you invest in an index fund. You’re not moving to another bank because it’s offering a promotional rate. You’re not moving again when that bank decides to lag behind. See my Guide to Money Market Funds & High Yield Savings Accounts.

Why VanguardBecause all money market funds of the same type fish in the same pond, how much the fund manager charges to run the fund (the “expense ratio”) directly affects how much yield you’ll receive. Among the major brokers, Vanguard charges the lowest expense ratio on its money market funds. Even if you do your investing elsewhere, you can still open a Vanguard account just to use its money market fund in the same way you use a high yield savings account — transfer money into it when you have excess cash and transfer money out when you need cash.

Vanguard offers six money market funds of three different types. They differ in their underlying holdings and tax treatment at both the federal and the state levels. Which one will be slightly better for you than another depends on your preference for convenience and your federal and state tax brackets.

Taxable Money Market FundsThree of the six Vanguard money market funds are taxable money market funds. You pay federal income tax on the income earned from these funds. A portion of the income earned is exempt from state income tax.

The yield from any of these three funds is very close to each other. The quoted yield on any money market fund is always a net yield after the expense ratio is already deducted. You don’t need to deduct it again.

Vanguard Federal Money Market FundVanguard Federal Money Market Fund (VMFXX) is the settlement fund in a Vanguard brokerage account. You don’t have to do anything extra to buy or sell this fund. It requires no minimum investment. Any cash you transfer into your Vanguard brokerage account will automatically land in this fund. Any cash you transfer out of your Vanguard brokerage account will come out of this fund by default.

The income earned is fully taxable at the federal level. A percentage of the income is exempt from state income tax. That percentage varies from year to year. It was 38% in 2022 (0% for CA, NY, and CT residents).

This fund invests in government securities and repurchase agreements that are collateralized by government securities. Think of repurchase agreements (“repo”) as a deal with a pawn shop. Entities give government securities to the money market fund as collateral for short-term cash. They’ll come back later to buy back (“repurchase”) their government securities at a higher price. If they don’t fulfill the repurchase agreement, the money market fund will sell those government securities. Repurchase agreements themselves aren’t guaranteed by the government but their safety comes from the safe collateral.

Vanguard Treasury Money Market FundVanguard Treasury Money Market Fund (VUSXX) invests primarily in Treasuries. It’s the safest money market fund at Vanguard. You have to enter a buy or sell order to get money into or out of this fund. It has a $3,000 minimum investment. The $3,000 minimum is only required to get started. You can transfer in and out less than $3,000 after you have the fund.

The income earned from the Treasury Money Market Fund is fully taxable at the federal level. A percentage of the income is exempt from state income tax. That percentage varies from year to year. It was 100% in 2022 but it will likely be in the 70% range in 2023.

Vanguard Cash Reserves Federal Money Market FundVanguard Cash Reserves Federal Money Market Fund (VMRXX) is somewhere in between the Federal Money Market Fund and the Treasury Money Market Fund. As in the Treasury Money Market Fund, you have to enter a buy or sell order to get money into or out of this fund. It also has a $3,000 minimum investment.

This fund invests more in Treasuries than the Federal Money Market Fund but less than the Treasury Money Market Fund. The income earned is fully taxable at the federal level. A percentage of the income is exempt from state income tax. That percentage varies from year to year. It was 53% in 2022 (0% for CA, NY, and CT residents).

Must Buy/SellState Tax-Exemption in 2022Federal Money Market (VMFXX)no38% (0% in CA, NY, CT)Treasury Money Market (VUSXX)yes100% (likely ~70% in 2023)Cash Reserves (VMRXX)yes53% (0% in CA, NY, CT)Among these three taxable money market funds, If I value the convenience of no extra step to buy or sell or if I live in a no-tax state, I would choose the Federal Money Market Fund (VMFXX). If I don’t mind the extra step to buy or sell and I live in a high-tax state, I would choose the Treasury Money Market Fund (VUSXX) for extra safety and the additional state income tax savings.

Remember to claim the state tax exemption when you do your taxes. See State Tax-Exempt Treasury Interest from Mutual Funds and ETFs.

Single State Tax-Exempt Money Market FundsVanguard offers a tax-exempt money market fund specifically for California and New York residents in higher tax brackets. These two funds invest exclusively in high-quality, short-term municipal securities issued by entities within the state. Income from these funds is tax-exempt from both the federal income tax and the California and New York state income tax respectively. They’re sometimes called “double tax-free” funds.

Both Vanguard California Municipal Money Market Fund (VCTXX) and Vanguard New York Municipal Money Market Fund (VYFXX) require a buy or sell order to get money into and out of the fund. Both require a $3,000 minimum investment.

The yield on these funds is lower than the yield on the three taxable money market funds but the federal and state tax exemption makes up for it when you’re in a high tax bracket.

Remember to claim the state tax exemption when you do your taxes. See State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs.

National Tax-Exempt Money Market FundVanguard Municipal Money Market Fund (VMSXX) is for investors in higher tax brackets outside of California and New York. This fund is more diversified than the California and New York funds because it invests in short-term, high-quality municipal securities from many states. Income from this fund is tax-exempt from the federal income tax but only a small percentage is exempt from state income tax.

It also requires a $3,000 minimum investment and a buy or sell order to get money into and out of the fund. The yield on this fund is lower than the yield on the three taxable money market funds but the federal income tax exemption makes up for it when you’re in a high tax bracket.

Remember to claim the small state tax exemption when you do your taxes. See State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs.

Taxable or Tax-Exempt?A tax-exempt money market fund offers tax savings but it pays less. Choose a tax-exempt fund if you’re in a high tax bracket. Choose a taxable fund if you’re in a low tax bracket. If you’re not sure whether your federal and state tax brackets are consider high or low, you can use a calculator to see which fund offers a better yield after taxes.

I created such a calculator back in 2007. I was going to update it but I came across a much more elaborate one created by user retiringwhen on the Bogleheads forum. It’s a Google Sheet called MM Optimizer.

Your Tax RatesMM Optimizer is a shared as View Only. After you make a copy of it to your Google account, you change the tax rates on the My Parameters tab to your tax rates.

My Parameters tabBest Right Now

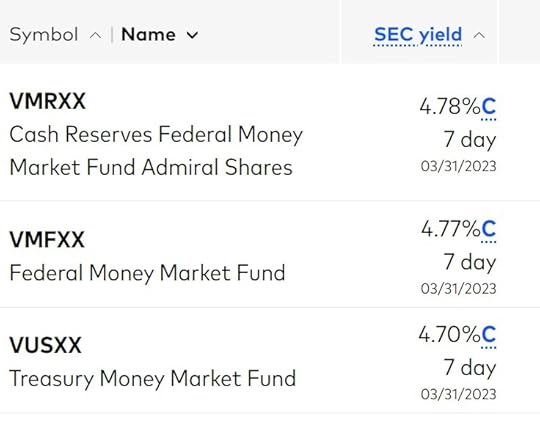

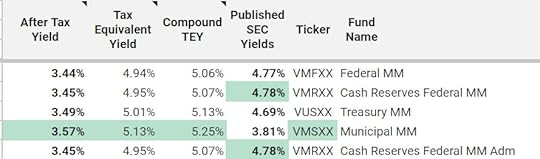

My Parameters tabBest Right NowMM Optimizer automatically pulls in the latest yield numbers. The My Best Now tab shows you which fund has the highest after-tax yield right now for the tax rates you entered.

My Best Now tab, Cells A5 to I12

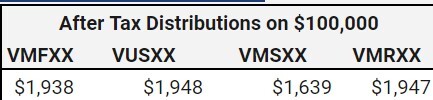

My Best Now tab, Cells A5 to I12In this example, it shows that the national tax-exempt fund has the highest after-tax yield, although not by much over the Treasury money market fund (3.57% versus 3.49%, or 5.25% versus 5.13% in pre-tax terms).

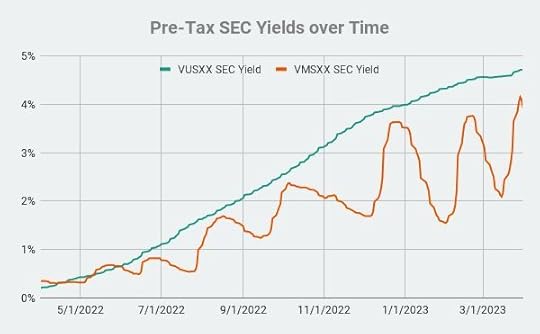

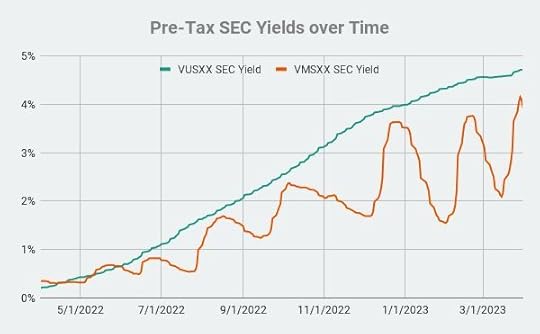

Best Last 12 MonthsA wrinkle in comparing taxable and tax-exempt money market funds is that the yield on tax-exempt money market funds swings wildly throughout the year. This chart shows the yield on a taxable money market fund and the yield on a tax-exempt money market fund over the last 12 months:

Pre-Tax Rate Chart tab

Pre-Tax Rate Chart tabWhile the yield on the taxable fund (green line) rose steadily over time as the Fed raised interest rates, the yield on the tax-exempt fund (orange line) swung wildly up and down. If you happen to compare the after-tax yields when the yield on the tax-exempt fund is near a top, it would show that the tax-exempt fund is better even in a low tax bracket. If you happen to compare them when the yield on the tax-exempt fund is near a bottom, it would show that the taxable fund is better even in a high tax bracket.

MM Optimizer shows which fund was better at your tax rates if you stuck to it over a full year.

My Best Now tab, Cells N15 to Q17

My Best Now tab, Cells N15 to Q17In this case, the Treasury money market fund was better for the full year even though the tax-exempt fund is slightly better at this moment only because the yield on the tax-exempt fund is near a top.

Switching Back and ForthYou can watch the yields and switch back and forth between a taxable fund and a tax-exempt fund but I wouldn’t bother. The My Rate Chart tab shows how many times you would’ve had to switch to catch the temporary swings and how short-lived each switch was.

My Rate Chart tab

My Rate Chart tabI would take a look at this chart and see which line is on top most of the time. Choose that fund and stay with it. In this example, it’s the Treasury money market fund (green line).

MM Optimizer has a lot more features but you don’t have to get into those. It’s simple to use if you only look at the places I’m showing here.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Which Vanguard Money Market Fund Is the Best at Your Tax Rates appeared first on The Finance Buff.

March 21, 2023

Mortgage Interest and Limit in TurboTax, H&R Block, FreeTaxUSA

Many homeowners refinanced to a sub-3% mortgage when interest rates were low a couple of years ago. The mortgage interest most people pay isn’t large enough to make them itemize their deductions. They just take the standard deduction. Those who can still deduct their mortgage interest tend to have a large mortgage.

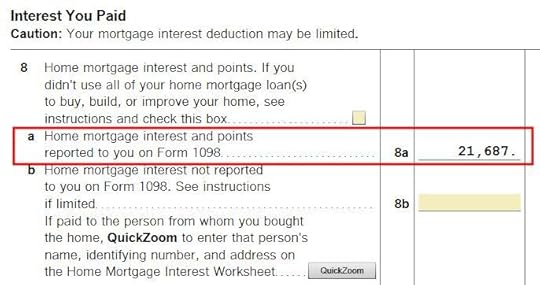

Table of ContentsLimit on DeductionAverage Mortgage BalanceTurboTaxH&R BlockFreeTaxUSALimit on DeductionThe Tax Cuts and Jobs Act of 2017 reduced the limit on the mortgage balance on which you can deduct the mortgage interest from $1 million to $750,000. The lower limit applies to homes acquired after December 15, 2017. The large increase in home prices in recent years makes recently bought homes in high-price areas more likely to exceed the $750,000 limit.

However, lenders still report 100% of the mortgage interest paid on the 1098 form without adjusting for either the old $1 million limit or the new $750,000 limit. If your mortgage balance is over the limit, deducting the mortgage interest is more complicated than just using the number from the 1098 form.

It isn’t simply multiplying $750,000 by your interest rate either when your mortgage balance started above $750,000 and ended below $750,000 or when you took out the loan in the middle of the year.

Average Mortgage BalanceA key concept is your average mortgage balance during the year. When your average mortgage balance exceeds the limit, your deductible mortgage interest is:

Loan Limit / Average Mortgage Balance * Actual Mortage Interest Paid

If you paid $30,000 in mortgage interest on an average mortgage balance of $1,000,000 and you’re subject to the $750,000 limit, your deductible mortgage interest is pro-rated to:

$750,000 / $1,000,000 * $30,000 = $22,500

IRS Publication 936 gives several ways to calculate your average mortgage balance:

Average of first and last balance methodInterest paid divided by interest rate methodMortgage statements methodThe first method is simpler and it gives you a slightly larger deduction but you can use it only if you didn’t prepay more than one month’s principal during the year.

Here’s how it works in TurboTax, H&R Block, and FreeTaxUSA tax software.

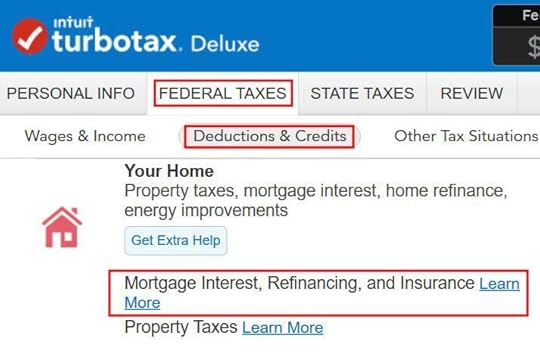

TurboTaxThe screenshots below are taken from TurboTax Deluxe downloaded software. The TurboTax downloaded software is both less expensive and more powerful than TurboTax online software. If you haven’t paid for your TurboTax online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax online to TurboTax download (see instructions for how to make the switch from TurboTax).

Find the mortgage interest topic in the Your Home section under Federal Taxes -> Deduction & Credits.

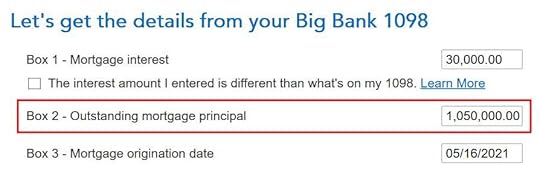

Form 1098

When it asks you to enter information from your 1098 form, enter the numbers as they appear on your form. If Box 2 is blank on your 1098, enter the mortgage balance at the beginning of the year (or your beginning loan balance if you took out the loan during the year).

You get to this summary after you answer a few more questions. Click on Done but you’re not done yet.

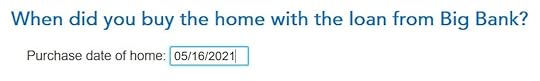

Purchase Date and Ending Balance

The purchase date of the home determines whether you have a $1 million limit or a $750,000 limit for the mortgage interest deduction. If this mortgage was from a refinance, you still enter the date when you originally bought the home.

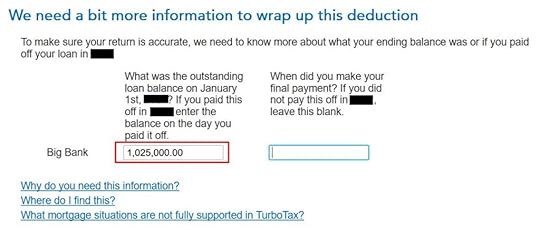

TurboTax asks for the balance as of January 1 of the following year because it uses the “average of first and last balance method” to calculate your average mortgage balance for the year. This works when you didn’t make extra principal payments during the year.

TurboTax calculates a deduction using the “average of first and last balance method” but you can’t legally use that method if you prepaid more than one month’s principal during the year. You must calculate your average mortgage balance in a different way and give the pro-rated deductible mortgage interest to TurboTax.

If You Prepaid PrincipalIf you had the mortgage for all 12 months and your interest rate didn’t change during the year, which is the case for most people with a fixed-rate mortgage, you can use the “interest paid divided by interest rate method” to calculate your average mortgage balance. Suppose you paid $30,000 in mortgage interest and your rate is 2.875%, your average mortgage balance is:

$30,000 / 0.02875 = $1,043,478

Your deductible mortgage interest is:

$750,000 / $1,043,478 * $30,000 = $21,562

If your interest changed during the year, you’re better off using the “mortgage statements method.” Download the monthly statements from your lender. Add up your balance from January to December and divide by 12. That’s your average mortgage balance during the year. Use that number to calculate your pro-rated deductible mortgage interest and give it to TurboTax:

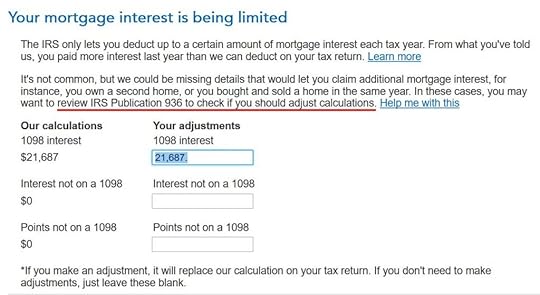

Verify on Schedule ALoan Limit / Average Mortgage Balance * Actual Mortage Interest Paid

To confirm how much mortgage interest deduction you’re getting, click on Forms on the top right and find Schedule A in the list of forms in the left panel.

Scroll down to the middle and find Line 8. You’ll see the mortgage interest deduction.

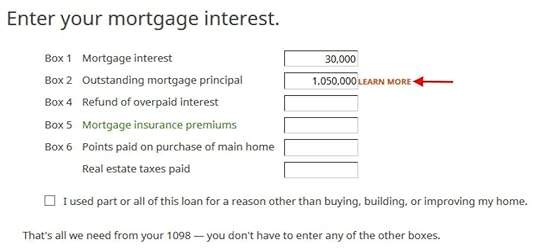

H&R BlockMortgage interest deduction works differently in the H&R Block software.

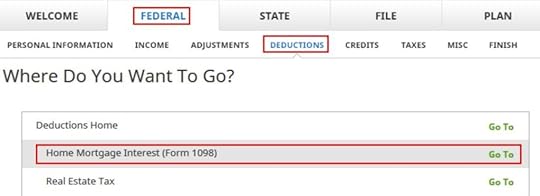

Find “Home Mortgage Interest (Form 1098)” under Federal -> Deductions.

1098 Entries

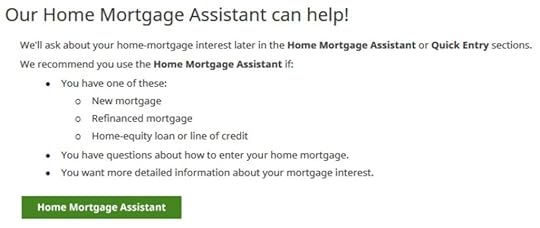

H&R Block offers a Home Mortgage Assistant. Click on that.

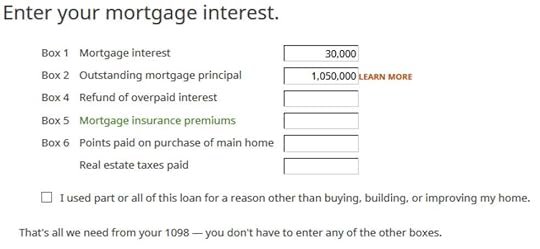

After saying we have a 1098 form and entering the name of the lender, we come to this form to enter the numbers on the 1098 form.

Wrong!

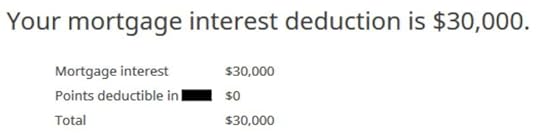

After answering some more questions about points and mortgage insurance premiums, which we don’t have, H&R Block says we can deduct 100% of the mortgage interest paid.

This can’t be right. We entered a beginning balance above $1 million on the 1098 form. H&R Block didn’t ask for the home purchase date to see whether the limit is $1 million or $750,000. It didn’t ask for the ending balance or the interest rate to calculate the average mortgage balance. H&R Block just uses the interest paid number from the 1098 form as if the loan limit doesn’t exist.

Calculate It Yourself

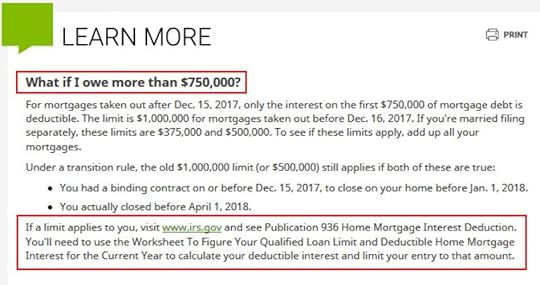

We go back to the 1098 entries to see if we missed anything. See there’s a Learn More link next to Box 2? What’s that?

There’s our answer. It says at the end:

If a limit applies to you, visit www.irs.gov and see Publication 936 Home Mortgage Interest Deduction. You’ll need to use the Worksheet To Figure Your Qualified Loan Limit and Deductible Home Mortgage Interest for the Current Year to calculate your deductible interest and limit your entry to that amount.

Translation: You’re on your own when your mortgage is over $750,000. Calculate it yourself and put the result here.

Granted that TurboTax doesn’t cover all situations but at least it makes an attempt to cover the most common scenario (only regular payments without extra principal payments). H&R Block just washes its hands and puts it all on you when your mortgage is above the limit. That’s lazy. Although only a small percentage of people deduct their mortgage interest now, among those who can still deduct, many have a mortgage above the limit.

It’s bad enough that the software doesn’t do the necessary work to help you calculate, but it’s inexcusable that it doesn’t warn you more conspicuously you’re on your own. Many people won’t notice the information hidden behind a subtle Learn More link.

So what do you do if you’re using the H&R Block software? Do what TurboTax does. First, calculate your average mortgage balance:

If you didn’t prepay more than one month’s principal, get the beginning balance and the ending balance. Take an average.If you made extra principal payments and your interest rate didn’t change, divide the interest paid by your interest rate.Then, calculate your deductible mortgage interest:

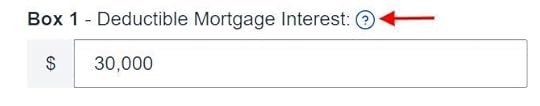

FreeTaxUSALoan Limit / Average Mortgage Balance * Actual Mortage Interest Paid

I also checked how the online tax software FreeTaxUSA does it.

Similar to H&R Block, FreeTaxUSA puts a small question mark link next to the mortgage interest entry. Clicking on the question mark opens a pop-up window, which says toward the end:

If your debt is higher than the limits, use Publication 936 to figure out your deductible home mortgage interest amount and reduce the mortgage interest you enter accordingly.

You’re also on your own when you use FreeTaxUSA. It also doesn’t tell you clearly that you must do some extra work.

***

H&R Block tax software is less expensive than TurboTax but this isn’t the only case where it punts and asks you to read the IRS instructions and come back with the answer yourself. See another example in How to Enter 2022 Foreign Tax Credit Form 1116 in H&R Block. You really have to know where it cuts corners when you use H&R Block software. It works well only when those cut corners don’t affect you. The same also applies to FreeTaxUSA.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Mortgage Interest and Limit in TurboTax, H&R Block, FreeTaxUSA appeared first on The Finance Buff.

March 13, 2023

No FDIC Insurance – Why a Brokerage Account Is Safe

News came last Friday that Silicon Valley Bank was taken over by the FDIC after it had a bank run. Silicon Valley Bank was the 16th largest bank in the country with over $200 billion in assets. Such a big bank failing so suddenly was a shock to the financial system.

Silicon Valley Bank primarily served business customers, not individual retail customers. The FDIC insurance limit of $250,000 isn’t very meaningful to a business. As a result, over 90% of the deposits at Silicon Valley Bank were over the FDIC insurance limit. The government rushed to make an exception and guaranteed all deposits at Silicon Valley Bank to reduce systemic risks.

Most of us don’t have over $250,000 lying around in cash. Even if we need to keep more than $250,000 in cash at times, it’s easy to spread the money over several banks to keep it fully insured. The money is safe as long as you stay under the FDIC insurance limit.

The news of Silicon Valley Bank’s failure also affected Charles Schwab. The stock price of Charles Schwab dropped over 20% at one point today. Charles Schwab has a banking arm — Schwab Bank. Schwab Bank also has uninsured deposits and unrealized losses in long-term bonds on its balance sheet. Many people do have more than $250,000 in Schwab brokerage accounts. Just the other day a reader asked whether it’s safe to buy Treasuries in a brokerage account.

Customer Assets at a BrokerThere’s a big difference between having money at a bank and having money at a broker such as Charles Schwab, Vanguard, or Fidelity. Money at a broker isn’t insured by the FDIC but it isn’t like uninsured deposits at a bank.

When you have money at a bank, you have a lender-borrower relationship with the bank. The bank borrows money from you and lends money to others. As George Bailey explained in It’s a Wonderful Life, the bank doesn’t have your money in a safe. It’s in “Joe’s house, and Kennedy’s house, and a hundred others.” Or in Silicon Valley Bank’s case, it’s in long-term bonds that the bank intended to hold to maturity but lost value after interest rates went up sharply.

When you have money at a broker, the broker is only buying and keeping things for you. There is an exact mapping between what the broker says you have in your account and what the broker keeps for you. Your money is in stocks, bonds, mutual funds, ETFs, etc. The broker doesn’t invest your money in long-term bonds for itself.

Money Market FundWhen you have cash in a money market fund at a broker, the money market fund invests in very short-term bonds. When you’re getting a 4.5% yield in a money market fund, the yield is coming from the underlying holdings of the money market fund. It’s not coming from the broker.

The safety of a money market fund depends on the safety of its underlying holdings. The money market fund isn’t FDIC-insured but its underlying holdings may be issued by government entities. If the broker goes down, you still have shares in the money market fund and the money market fund still has its holdings.

The safest money market fund holds only Treasuries and other government bonds. Vanguard, Fidelity, and Charles Schwab all have a money market fund that invests only in Treasuries and government bonds. See my Guide to Money Market Funds.

Buy TreasuriesIf you can commit to a set term (the equivalent of buying a CD at a bank), you can also buy Treasuries in a brokerage account. You don’t need FDIC insurance when you buy Treasuries because Treasuries are issued by the federal government.

The big-3 brokers Charles Schwab, Vanguard, and Fidelity all make it very easy to buy Treasuries with no fee. See How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy Treasury Bills & Notes on the Secondary Market.

Madoff and MF GlobalPeople lost money at brokers when the broker didn’t maintain the exact mapping between what it said customers had in their accounts and what the broker kept for the customers. Two recent examples are Bernie Madoff and MF Global.

Madoff falsified account records. He said he bought this and that for the customers but he really didn’t. It was a fraudulent scheme.

MF Global breached the legal separation between customer assets and broker assets. It “borrowed” from customer assets to cover failed speculations elsewhere. Customers were eventually made whole after MF Global went bankrupt but it took five years.

SIPC InsuranceBrokerage accounts are insured by SIPC up to $500,000 but the insurance doesn’t cover the payback from your investments. It only covers missing assets if the broker goes down.

If you don’t suspect that Charles Schwab, Vanguard, or Fidelity will act illegally as Madoff or MF Global did, the safety of your money at these brokers doesn’t depend on the financial health of Charles Schwab, Vanguard, or Fidelity.

Most of my money is in brokerage accounts. I don’t worry about whether the account is over the SIPC insurance limit. Money at a broker is safer than uninsured deposits at a bank.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post No FDIC Insurance – Why a Brokerage Account Is Safe appeared first on The Finance Buff.

March 11, 2023

Get Rid of Estimated Tax Payment Vouchers from TurboTax

The previous post Opt Out of Underpayment Penalty in TurboTax covered how TurboTax calculates an underpayment penalty that the IRS may not actually assess. You have to take an extra step to decline the penalty calculated by TurboTax. Here’s another example of TurboTax providing unwanted help that requires work to reverse.

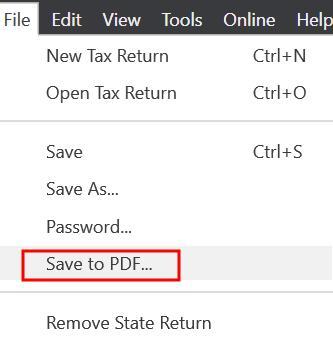

Print or Save to PDFWhen you’re done entering everything into TurboTax, it’s a good idea to print the tax forms or create a PDF file with all the forms as a draft. You should review the forms carefully and compare them with the previous year before you file. After you review everything and e-file, you should save the final filing to a PDF file for your records. TurboTax download software has a handy menu option for that: File -> Save to PDF.

Estimated Tax Payment Vouchers

Estimated Tax Payment VouchersTurboTax automatically includes 4 filled-out estimated tax payment vouchers (Form 1040-ES) when you print or save a PDF. This confuses many people. Most people pay their taxes during the year through withholding. Having the estimated tax payment vouchers printed out or included in the PDF doesn’t mean you must pay estimated taxes now.

The estimated tax payment vouchers are also a relic of the past. Even if you’re required to pay estimated taxes, sending a check with those vouchers by snail mail isn’t the best way to do it anyway. You’re better off paying electronically on the IRS website using either Direct Pay or EFTPS.

Direct Pay doesn’t require setting up an account but you have to verify your identity and enter your bank information every time. EFTPS requires setting up an account but subsequent payments are easier and faster. I use EFTPS.

When you use Direct Pay or ETFPS, you get a confirmation from the IRS of your payment immediately and you know that the payment will be credited to your account accurately. You have more chances of delay and errors if you send a check by mail with one of those estimated tax payment vouchers.

Exclude from Print or PDFHaving estimated tax payment vouchers printed out confuses you. Having them included in your tax filing PDF clutters up your file. If you’d like to avoid confusion, here’s how you can stop TurboTax download software from including them.

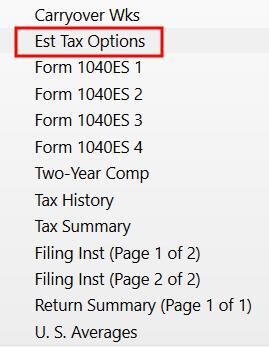

Click on Forms on the top right.

Scroll down and click on “Est Tax Options” near the bottom of the list of forms on the left.

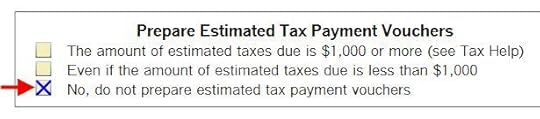

Scroll down on the right to find the heading “Prepare Estimated Tax Payment Vouchers” in the middle of the form. Check the option “No, do not prepare estimated tax payment vouchers.”

Click on Step-by-Step on the top right to get back to where you were.

Now save to PDF or print your forms. It won’t have those useless estimated tax payment vouchers.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Get Rid of Estimated Tax Payment Vouchers from TurboTax appeared first on The Finance Buff.

March 4, 2023

Opt Out of Underpayment Penalty in TurboTax and H&R Block

When you do your taxes in tax software, the software sometimes calculates an underpayment penalty. It thinks you owe the penalty when your tax withholding plus any estimated tax payments were below a certain threshold (the “safe harbor“):

Within $1,000 of your tax obligation; or90% of your current year’s tax obligation; or100% of your previous year’s tax obligation (110% if your AGI in the previous year was $150,000 or more)If your income was uneven throughout the year, you can try to get out of paying the underpayment penalty through a complicated exercise using the “Annualized Income Installment Method.” It basically comes down to doing your taxes four times by separating your income and deductions into four sub-periods within the year and calculating your taxes for each sub-period.

I don’t know about you but I don’t have any appetite for doing my taxes four times.

There’s a much better way. The tax software is only trying to be helpful in calculating the underpayment penalty for you. You can decline its help and let the IRS calculate the penalty and bill you if they decide to assess a penalty.

The IRS actually often doesn’t assess a penalty when the tax software thinks you owe a penalty. You don’t have to volunteer the penalty now.

Here’s how to opt out of calculating the underpayment penalty in TurboTax and H&R Block software.

TurboTaxI’m using TurboTax downloaded software. TurboTax downloaded software is both more powerful and less expensive than TurboTax online software.

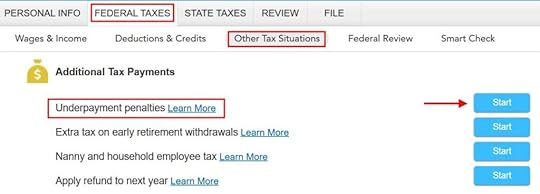

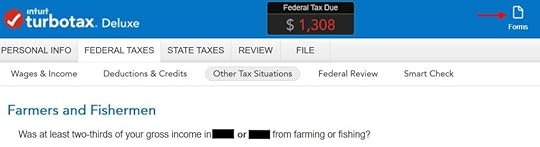

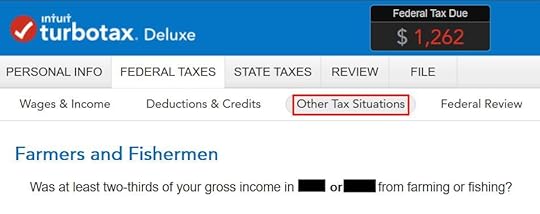

Find “Underpayment penalties” under Federal Taxes -> Other Tax Situations. Click on Start.

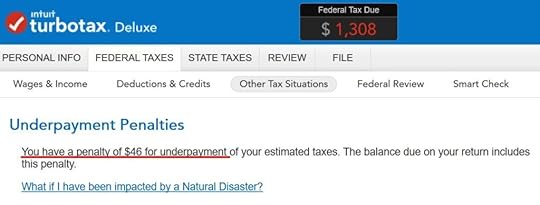

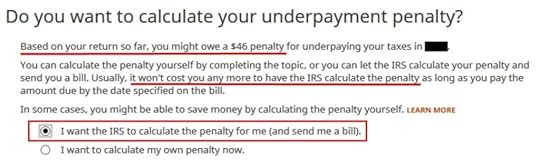

If TurboTax says you have a penalty for underpayment. Click on Continue.

TurboTax asks you about farming or fishing, which doesn’t apply to most people.

You can continue the confusing interview with more hoops to jump through but it’s much quicker if you switch to the Forms mode now by clicking on Forms on the top right.

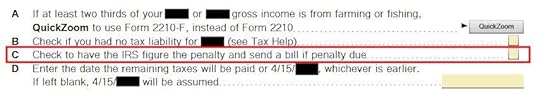

TurboTax opens a form. Check the box next to item C to have the IRS calculate the penalty and send a bill if necessary. Chances are they won’t.

The underpayment penalty calculated by TurboTax is removed immediately after you check that box. Note in our example the tax owed meter dropped from $1,308 to $1,262 after we checked the box.

Click on Step-by-Step to return to the interview.

You’re back to the screen about farming and fishing. Click on “Other Tax Situations” in the sub-menu to exit this section.

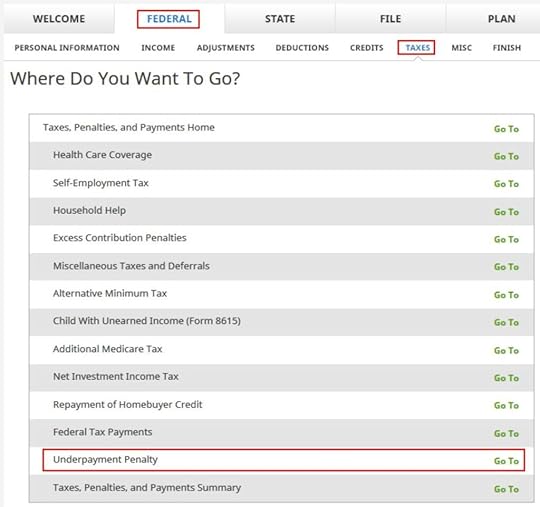

H&R BlockIt’s much more straightforward in the H&R Block downloaded software. H&R Block download is also both more powerful and less expensive than H&R Block online software.

Find “Underpayment Penalty” under Federal -> Taxes. Click on Go To.

H&R Block offers the option to let the IRS calculate the penalty right away. The option is selected by default.

H&R Block explains that it won’t cost you any more to have the IRS calculate the penalty. It actually will cost you less when the IRS doesn’t assess a penalty.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Opt Out of Underpayment Penalty in TurboTax and H&R Block appeared first on The Finance Buff.

February 23, 2023

State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs

The previous post State Tax-Exempt Treasury Interest from Mutual Funds and ETFs covered how to get state income tax exemption on the portion of mutual fund and ETF dividends that are attributed to interest from Treasuries. This post covers how to do the same on the portion of fund dividends attributed to muni bond interest.

Muni Bond Funds and ETFsInvestors in higher tax brackets often invest in muni bonds in their taxable accounts. Although muni bonds typically have a lower yield than Treasuries and corporate bonds, they often still pay more after-tax when the investor is in a high tax bracket.

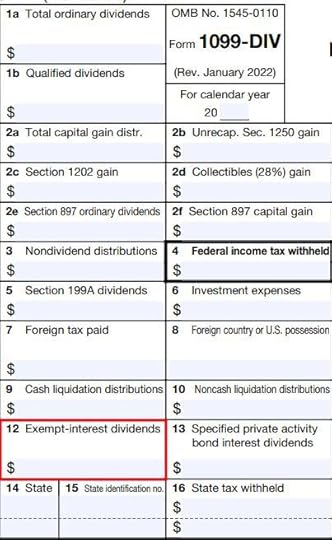

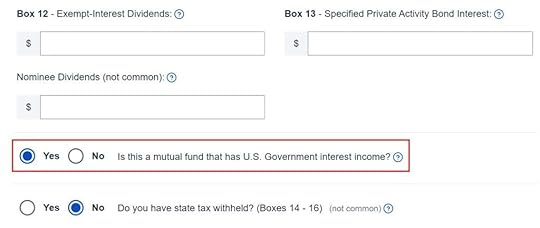

Most people invest in muni bonds through muni bond funds and ETFs. The broker reports fund dividends attributed to muni bond interest separately in Box 12 on a 1099-DIV form.

Your tax software knows about this special box. Whether you import your 1099 forms or enter them manually, the tax software will automatically mark the amount as tax-exempt for federal income tax.

Federal Tax-Exempt vs. State Tax-ExemptIt’s a different story for state income tax.

How a state taxes muni bond interest varies by state. Some jurisdictions such as Washington DC exempt interest from all muni bonds. Most states usually exempt interest only from muni bonds issued by entities within the state or in U.S. territories (Puerto Rico, Guam, Virgin Islands, and American Samoa). Some states have a reciprocal arrangement — “We don’t tax interest from your muni bonds if you don’t tax interest from our muni bonds.”

You need to know how much of the federally tax-exempt dividends on the 1099-DIV form is also state tax-exempt. Your tax software doesn’t know it only by the number on the form.

The broker supplies a breakdown of the tax-exempt dividends by source. It’s up to you to determine how much of the federal tax-exempt dividends from each source came from state tax-exempt muni bonds.

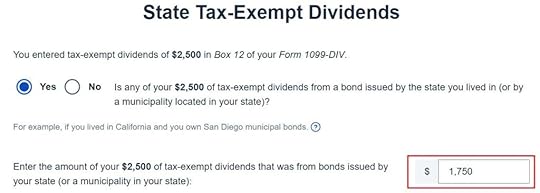

Suppose you own two funds in a taxable brokerage account that paid $2,500 in total tax-exempt dividends as reported in Box 12 of the 1099-DIV form. Your goal is to fill out a table like this with the percentage of state tax-exempt dividends for each fund and calculate your total state tax-exempt dividends:

FundTotal Tax-Exempt Dividend% State Tax-ExemptState Tax-Exempt DividendFund A$1,500100%$1,500Fund B$1,00025%$250Total$2,500$1,750When you give the result to your tax software, it then knows to exempt that portion of the federal tax-exempt dividends from state income tax.

State % from Fund ManagersAlthough the 1099-DIV form and the dividend breakdown by funds are provided by the broker, you’ll have to get the number for the “% State Tax-Exempt” column from the managers of your mutual funds and ETFs.

If you own Vanguard mutual funds or ETFs in a Fidelity brokerage account, you get this information from Vanguard, not from Fidelity. Similarly, if you own iShares ETFs in a Charles Schwab brokerage account, you get the information from iShares, not from Charles Schwab.

Google “[name of fund management company] tax center” to find the information from the fund manager.

For instance, the Vanguard document shows that dividends from Vanguard New York Municipal Money Market Fund are 100% tax-exempt in New York in 2022, and 24.24% of the dividends from the Vanguard Tax-Exempt Bond Index Fund came from New York muni bonds.

VanguardVanguard publishes the information in its Tax Season Calendar. Look for “Tax-exempt interest dividends by state.”

FidelityFidelity publishes the information in Fidelity Mutual Fund Tax Information. Look for “Tax-Exempt Income From Fidelity Funds.”

Charles SchwabCharles Schwab Asset Management publishes the information in its Distributions and Tax Center. Look for “[20xx] Supplementary Tax Information.”

iSharesiShares publishes the information in its Tax Library. Look for “[20xx] Tax Exempt Interest by State.”

State-Specific RequirementsBe sure to read the fine print. Just because a fund lists a percentage for your state doesn’t mean that percentage of dividends from the fund is state tax-exempt. Some states have additional requirements before you can claim the tax exemption.

For instance, the Vanguard tax-exempt income document includes these footnotes:

California and Minnesota require funds to meet in-state minimum threshold to be exempt from state tax. The funds in Table 2 do not meet this criteria [sic].

Illinois does not exempt the portion of dividends from state or local obligations held indirectly through a mutual fund.

This means even though the table shows that 15.23% of the dividends from Vanguard Tax-Exempt Bond Index Fund came from California muni bonds, California exempts none of it because the fund didn’t meet the state’s additional requirements. If you live in Illinois, you can’t claim any Illinois tax exemption on muni fund dividends, period.

Tax SoftwareYou need to give the result to your tax software after you get the “% State Tax-Exempt” for each fund and calculate your State Tax-Exempt dividend with a table like this:

FundTotal Tax-Exempt Dividend% State Tax-ExemptState Tax-Exempt DividendFund A$1,500100%$1,500Fund B$1,00025%$250Total$2,500$1,750TurboTax

If you enter your 1099-DIV form manually, be sure the check the box for additional inputs to enter tax-exempt dividends in Box 12.

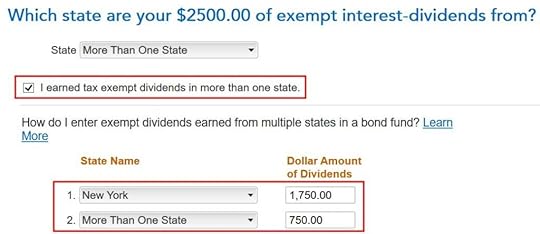

Unless your tax-exempt dividends came from a state-specific fund that’s 100% tax-exempt in your state, check the box “I earned tax exempt dividends in more than one state” and break it down between your state and “More Than One State.” TurboTax will claim the portion for your state as tax-exempt on your state income tax return.

H&R Block

After you enter the tax-exempt dividends in Box 12 of a 1099-DIV form, H&R Block asks you how much of it is also state tax-exempt.

FreeTaxUSA

After you enter the tax-exempt dividends in Box 12 of a 1099-DIV form, FreeTaxUSA asks you how much of it is also state tax-exempt.

***

Most of the work in calculating the amount of fund dividends exempt from state taxes is in hunting down the percentage of state tax-exempt income for each fund and ETF in your taxable brokerage account. Tax software doesn’t know it only from the tax forms.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs appeared first on The Finance Buff.

February 16, 2023

State Tax-Exempt Treasury Interest from Mutual Funds and ETFs

When you earn interest from U.S. Treasuries in a taxable account, the interest is exempt from state and local taxes. How the interest is reported on tax forms depends on whether you hold Treasuries directly or through mutual funds and ETFs.

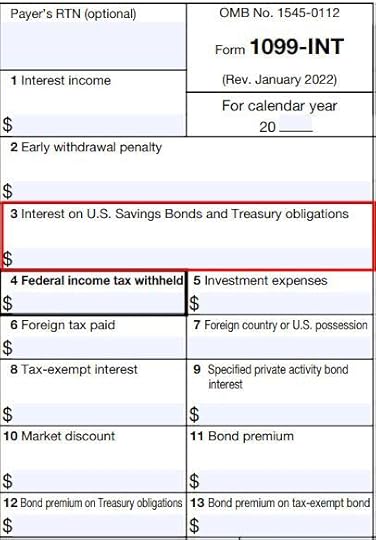

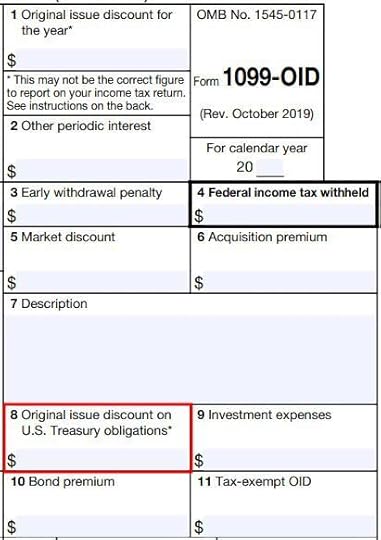

Table of ContentsInterest from Treasury Bills and NotesTreasuries in Mutual Funds and ETFsGovernment % from Fund ManagersVanguardFidelityCharles SchwabiSharesCA, NY, and CT ResidentsTax SoftwareTurboTaxH&R BlockFreeTaxUSAInterest from Treasury Bills and NotesWhen you buy Treasuries in a taxable brokerage account — see How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy Treasury Bills & Notes On the Secondary Market — you’ll see the interest reported on a 1099-INT form and/or a 1099-OID form (for TIPS).

Interest from Treasuries is reported separately in Box 3 on a 1099-INT form.

Inflation adjustment for TIPS is reported separately in Box 8 on a 1099-OID form.

Your tax software knows about these special boxes in the tax forms. Whether you import the tax forms from your broker or enter them manually, the software will automatically mark the interest as exempt from your state income tax.

Treasuries in Mutual Funds and ETFsMany money market funds, bond funds, and bond ETFs hold Treasuries. If you have these funds in a taxable brokerage account, a good part of the funds’ dividends may have come from Treasuries. The portion of fund dividends attributed to interest from Treasuries isn’t qualified dividends. It’s taxed at normal tax rates for federal income tax but it’s still exempt from state and local taxes.

When you have multiple mutual funds or ETFs in a taxable brokerage account, the broker reports dividends received from all sources on one 1099-DIV form. The 1099-DIV form doesn’t have a special box broken out for dividends attributed to Treasuries. Your tax software won’t know how much of the dividends were from Treasuries only by the numbers on the 1099-DIV form.

The broker supplies a breakdown of the dividends by source. It’s up to you to determine how much of the dividends from each source came from Treasuries. Suppose you own four funds in a taxable brokerage account that paid $6,500 in total dividends. Your goal is to fill out a table like this with the percentage of dividends from Treasuries for each fund and calculate your total dividends attributed to Treasuries:

FundTotal Ordinary Dividend% from TreasuriesDividend from TreasuriesFund A$5000%$0Fund B$1,00065%$650Fund C$2,00010%$200Fund D$3,00090%$2,700Total$6,500$3,550When you give the result to your tax software, it then knows to exempt that portion of the dividends from state and local taxes.

Government % from Fund ManagersAlthough the 1099-DIV form and the dividend breakdown by funds are provided by the broker, you’ll have to get the number for the “% from Treasuries” column from the managers of your mutual funds and ETFs.

If you own Vanguard mutual funds or ETFs in a Fidelity brokerage account, you get this information from Vanguard, not from Fidelity. Similarly, if you own iShares ETFs in a Charles Schwab brokerage account, you get the information from iShares, not from Charles Schwab.

Google “[name of fund management company] tax center” to find the information from the fund manager.

VanguardVanguard publishes the information in its Tax Season Calendar. Look for “U.S. government obligations information.”

FidelityFidelity publishes the information in Fidelity Mutual Fund Tax Information. Look for “Percentage of Income From U.S. government securities.”

Charles SchwabCharles Schwab Asset Management publishes the information in its Distributions and Tax Center. Look for “[20xx] Supplementary Tax Information.”

iSharesiShares publishes the information in its Tax Library. Look for “[20xx] U.S. Government Source Income Information.”

CA, NY, and CT ResidentsCalifornia, New York, and Connecticut have additional requirements for exempting fund dividends earned from Treasuries. The fund management company will note in its published information whether a fund met the requirements of CA, NY, and CT. If a fund didn’t meet the requirements, the Treasuries percentage is treated as 0% for CA, NY, and CT residents.

For example, Vanguard Federal Money Market Fund earned 37.79% of its income from U.S. government obligations in 2022. Because it didn’t meet the requirements of CA, NY, and CT, investors in these three states must still pay state income tax on 100% of this fund’s dividends. People in other states pay state income tax on only 62.21% of this fund’s dividends.

Tax SoftwareYou need to give the result to your tax software after you get the “% from Treasuries” for each fund and calculate your dividend from Treasuries with a table like this:

FundTotal Ordinary Dividend% from TreasuriesDividend from TreasuriesFund A$5000%$0Fund B$1,00065%$650Fund C$2,00010%$200Fund D$3,00090%$2,700Total$6,500$3,550It’s easy to miss the entry point for this input unless you really look for it.

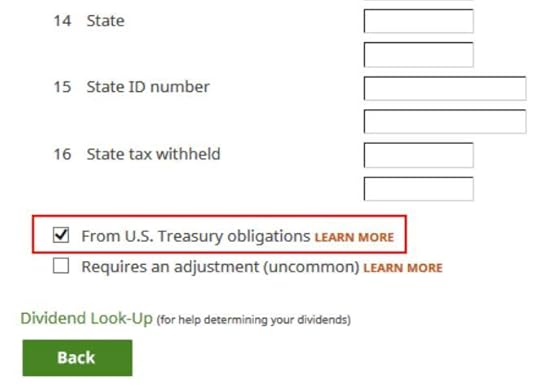

TurboTax

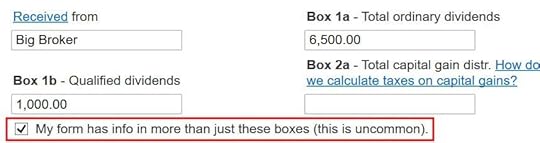

After you import or enter the 1099-DIV form, you need to check a box to say that a portion of the dividends is U.S. Government interest. It’s easy to miss because TurboTax says it’s uncommon, which isn’t true.

Now you enter the amount you calculated in your table.

H&R Block

H&R Block software shows a checkbox at the bottom of the 1099-DIV entries. This field doesn’t come in the import. It’s easy to miss because it’s at the bottom of a long form. You have to really look for it.

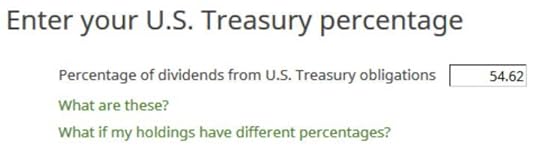

Instead of asking for a dollar amount, H&R Block goes by percentage. It forces you to do a bit of math. In our example, $3,550 from Treasuries divided by $6,500 total ordinary dividends is 54.62%. So we enter 54.62.

FreeTaxUSA

FreeTaxUSA has a radio button at the bottom of the 1099-DIV entries. It’s easy to miss because it’s at the bottom of a long form. You have to really look for it.

Now you give the dollar amount from your table.

***

Most of the work in calculating the amount of fund dividends exempt from state and local taxes is in hunting down the percentage of income from Treasuries for each fund and ETF in your taxable brokerage account. You need to give the calculated amount to your tax software, which doesn’t make it obvious where the number should go.

A similar process also applies to muni bond funds and ETFs. A portion of the fund dividends is exempt from your state income tax (“double tax-free”). I’ll cover that topic in a separate post.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post State Tax-Exempt Treasury Interest from Mutual Funds and ETFs appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower