Harry Sit's Blog, page 12

November 25, 2023

Which Financial Decisions Require Extra Attention and Which Don’t

Karsten Jeske at the Early Retirement Now blog wrote When to Worry, When to Wing It: Withdrawal Rate Case Studies back in 2021. It looked into what really makes a difference in safe withdrawals in retirement. Does the withdrawal frequency matter? What if withdrawals fluctuate? What if you need long-term care? It’s a great post worth reading or re-reading.

I’ve been thinking along this line more broadly. We face all types of choices and decisions in personal finance. Which decisions should we be more careful of and which decisions can we “wing it”?

This distinction is important because if you give equal attention to every decision, either you’ll get bogged down by months of research on something that doesn’t make much difference or you’ll make a casual decision that sets you back a huge sum. You should prioritize your mental energy for things that really require it.

Is It One-Time or Recurring?A big category in the blogging world is food. People share how to make all types of dishes and pastries. These are good candidates for winging it because you don’t make something just one time. You’ll have plenty of opportunities to fine-tune and improve.

You need a good recipe, not necessarily the best one, although everyone says their recipe is the best, which is subjective anyway. This good recipe works. That good recipe works too. If you start using one recipe, you’re not bound to use it forever. Even if a recipe totally doesn’t work for you, you ruin only one attempt. You have hundreds of attempts ahead of you. You just use a different recipe next time.

You don’t have to do it “right” the first time if it’s a recurring task. It’s not a big deal to wing it.

Can You Do Both?Many choices aren’t all-or-nothing. You can split and do both.

I browsed some pages of the book The Food Lab by Kenji López-Alt at Costco one day. The author experimented with different ways to boil eggs. He tried starting in cold water in one pot and starting in boiling water in another pot. He boiled eggs for one minute, two minutes, three minutes, … He cut each egg open to see which way he liked better.

The author’s point wasn’t that you should just go with his recommendation on how you should boil eggs. You may prefer a different degree of softness, you live at a different elevation, the power from your stove is different, and you have different cookware. You can experiment with multiple ways simultaneously to find what works best for you.

If the choice isn’t either-or, you can split and do both. This is especially helpful when results are uncertain. You reduce your risk by having several irons in the fire.

What If You Decide to Switch?If it’s one-time and you can’t do both, what does it take if you decide to switch when you realize you should’ve done it differently?

Many financial decisions can be reversed easily. If you decide to go with Bank A and you realize later you should’ve used Bank B, you can open a new account with Bank B and transfer everything from Bank A. Maybe you could’ve earned a little more interest if you went with Bank B in the beginning but you don’t lose any principal by switching.

You can wing it if you see that it won’t cost much to switch when you know better.

When to Be CarefulYou should be careful when a choice is one-time, all-or-nothing, and it’s impossible or costly to switch.

I’ve been working on a home construction project this year. Most decisions I had to make for this project were of this type: one-time, all-or-nothing, and it’s costly to switch.

Should I add insulation between the interior walls for sound-dampening purposes? This is the only time I’m doing it because I don’t have another home to build in the foreseeable future. It’ll be difficult to add insulation later if I don’t do it now. Doing it half-and-half doesn’t really help. Does it really work to reduce noise? The contractor doing it says it works but is that asking a barber whether I need a haircut? I’ll lose 100% of what I spend on materials and labor if I can’t tell the difference with or without insulation in the interior walls.

Things that require a physical change are more difficult because they’re often one-time, all-or-nothing, and costly to switch.

So, when you face a choice or decision, ask whether it’s like cooking or construction. Is it one-time or recurring? Can you split and do both? What if you decide to switch? These answers tell you whether you can wing it or you must be careful in making that decision.

Personal Finance DecisionsLet’s look at some frequently asked questions in personal finance from this angle.

Should I use a high-yield savings account or a money market fund for my short-term savings?

Wing it. It isn’t either-or. If you’re using a high-yield savings account now, you can put a small amount in a money market fund and see how it works. If you move from one to another and you don’t like it, you can always move back.

Should I use Vanguard, Fidelity, or Schwab for my IRA?

Wing it. Pick one as a start. Have a second account elsewhere if you’re curious. Let your own experience guide you.

Which tax software should I use? Online or download? Is Deluxe enough or do I need Premier?

Wing it. You’ll use something every year. It isn’t difficult to switch. Use one this year and a different one next year. It’s not that expensive to buy two in the same year. You’ll see which one you like better.

Should I buy whole life, variable universal life, or term life insurance?

Be careful. You’ll lose a large sum if you buy into whole life or variable universal life insurance and you realize you don’t want it.

Should I contribute to a pre-tax Traditional account or a Roth account?

Wing it. I chuckled when I read in a book written by a financial advisor that one should seek the expert counsel of a financial advisor on this question. It’s complex if you must choose one and stick to that choice for the rest of your life but that’s not the case. Nothing stops you from splitting and doing both. If you start with Traditional and you realize you should go with Roth (or vice versa), you can change it next month. Money in a Traditional account can be converted to a Roth account. So choose one or both and adapt as you go.

Should I invest in a mutual fund like VTSAX or an ETF like VTI? What about Fidelity’s zero-expense-ratio funds?

Wing it. Try both if you’d like to see how they work. You can switch if you prefer one over another.

Which job offer should I take?

Be careful. You can’t take both jobs at the same time. If you go with one, by the time you realize it’s the wrong one, the other opportunity may not be waiting for you anymore. Being in the right place at the right time can make a huge difference in one’s career and financial success.

I’m retired. How much can I withdraw from my portfolio, 3%, 3.5%, or 4%?

Wing it but not too wildly. Spending is a fundamental driver of financial success in retirement. It’s difficult to determine what will work if you must follow the same path for the rest of your life, but you don’t have to. You’re allowed to adjust and adapt. Just don’t start at 8% unless you’re Dave Ramsey.

When should I claim Social Security?

Be careful. You only have one year to change your mind once you claim. If you claimed early, you must wait until your Full Retirement Age to suspend. If you claim late, you can only go back six months. Use the Open Social Security calculator. Use another calculator for a second opinion.

Should I buy a home or rent?

Be careful. You can’t buy half and rent half. You can’t buy 10% of a home this year and another 10% next year. It’s costly to switch between owning and renting. Not buying at the right time or buying at the wrong time can cost you hundreds of thousands of dollars.

Should I invest or pay extra toward my mortgage?

Wing it. You can do both. You can start or stop at any time.

Should I convert from my Traditional account to Roth? How much?

Be careful if you’re thinking of converting a substantial amount because you can’t undo a Roth conversion. Wing it if you’ll convert every year. You don’t need to map out your conversions for the next 30 years and follow a table rigidly. Start low and adjust as you see fit.

Can I retire?

Some people have an option for going part-time or regaining employment after a break. Be careful if you don’t have that option.

***

Not all financial decisions require equal attention from us. Spend more energy on decisions that are one-time, all-or-nothing, and difficult to switch. Ongoing decisions don’t need to be optimized upfront. Start with something, split, experiment, and adapt as you go.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Which Financial Decisions Require Extra Attention and Which Don’t appeared first on The Finance Buff.

November 5, 2023

Downsides of HSA: When It’s Not Worth It to Contribute

You may have heard that the Health Savings Account (HSA) is the ultimate retirement account because it’s triple tax-free. Contributions go in tax-free. The balance grows tax-free. Withdrawals are again tax-free to pay for accumulated out-of-pocket medical expenses.

I have an HSA but it’s my least favorite retirement account. My HSA has the lowest balance among all my accounts. It’s not always worth it to contribute to an HSA.

Low Contribution LimitThe first problem with the HSA is that it has a low contribution limit. Here are the contribution limits of different account types in 2024 (double these for a married couple):

Before Catch-upWith Catch-up401k/403b/457$23,000$30,500 (age 50+)IRA/Roth IRA$7,000$8,000 (age 50+)HSA$4,150$5,150 (age 55+)The HSA contribution limit is only slightly more than half of the IRA contribution limit. It’s less than 20% of the 401k/403b/457 contribution limit. The catch-up contribution for HSA starts at age 55, not age 50 as in a 401k or an IRA.

Triple tax-free is good but you just can’t put as much into the HSA. The 401k/403b/457 plan and the Traditional or Roth IRA should still be your primary retirement accounts.

Requires High Deductible Health InsuranceYou also can’t contribute to an HSA just because you want to. You must be covered under a High Deductible Health Plan (HDHP) without any other coverage. Because most people get health insurance through their employer, this depends on the employer offering an HSA-eligible health insurance plan. If you get health insurance from the ACA marketplace, this depends on insurance companies offering HSA-eligible plans in your area. If you’re on Medicare, you can’t contribute to an HSA.

You don’t have the option to contribute to an HSA if you don’t have the right health insurance.

This requirement to be covered under only a High Deductible Health Plan gets complicated when a married couple has different health insurance or when health insurance changes mid-year due to job change, marriage, divorce, childbirth, enrolling in Medicare (sometimes retroactively), etc., etc. See HSA Contribution Limit For Two Plans Or Mid-Year Changes. Don’t get me started on some employers having a “plan year” that doesn’t start on January 1. That brings extra wrinkles too.

High Deductible Health Insurance Pays LessHaving a high deductible means your health insurance pays less. It works if you’re healthy with low healthcare expenses. It can also work if you have high healthcare expenses but the premiums on the high-deductible plan are much lower. You use the money saved from the premiums to pay for the higher out-of-pocket expenses.

This tradeoff between lower premiums and higher out-of-pocket costs may not always work out in favor of a high-deductible plan. You have to do the math. I have a spreadsheet in Do The Math: HMO/PPO vs High Deductible Plan With HSA. If a low-deductible plan makes more sense for your expected healthcare expenses, you may be better off foregoing the HSA.

Even if your employer or the ACA marketplace offers an HSA-eligible plan and you have low healthcare expenses, the HSA-eligible plan may not have your doctors in the network. Then you face the dilemma of switching doctors for the whole family just to contribute to the HSA or continuing with the same providers out of network and not getting discounts from negotiated rates.

High Deductible ≠ HSA-EligibleAn HSA-eligible high-deductible plan has specific definitions. Just because the deductible is high doesn’t mean the plan is automatically HSA-eligible.

Insurance companies sometimes “enhance” their high-deductible plans to make them not HSA-eligible. The small “enhancements” ruin your opportunity to contribute to an HSA.

I’m facing this situation next year. Here are the high-deductible plans I see from the ACA marketplace for the two of us:

Current PlanNew PlanNew HSA PlanDeductible$15,000$18,300$16,100Out-of-Pocket Maximum$15,000$18,900$16,100Office VisitMust meet deductible first$45 primary care$95 specialistMust meet deductible firstHSA-eligible

Monthly Premium$1,117$1,282 (+15%)$1,612 (+44%)

Monthly Premium$1,117$1,282 (+15%)$1,612 (+44%)Our current plan is HSA-eligible. We pay everything except preventive care out of pocket because we have little chance of meeting the $15,000 deductible.

The new plan for next year raises the deductible and the out-of-pocket maximum by another 20%, which we don’t expect to come even close. It throws in some Day 1 coverage for office visits. We’ll pay a $45 co-pay to see a primary care doctor or a $95 co-pay to see a specialist before meeting the deductible. This is worth something but it makes the plan not HSA-eligible (the out-of-pocket maximum is also too high to qualify).

If we still want to contribute to the HSA, the premium for an HSA-eligible plan is $495/month higher than this year, and it’s $330/month higher than the premium for the non-HSA plan. Paying almost $4,000 more for the HSA-eligible plan takes away the tax benefits from contributing to an HSA.

***

Triple tax-free is great but a lot of things must line up to obtain HSA’s tax benefits. You must have an HSA-eligible health insurance plan as a choice from your employer or the ACA marketplace. The HSA-eligible plan has to cover the right doctors and facilities. The higher deductible has to make sense for your expected healthcare expenses. The premium has to be not so much higher than a non-HSA plan as to blow out all the tax benefits. These practical considerations are often glossed over when people are excited about HSA’s tax benefits.

When the stars line up, go ahead and contribute the maximum to the HSA. The HSA contribution limit is still low but it’s better than nothing.

The HSA is my least favorite retirement account because things don’t always line up. The tax benefits are easily negated by other factors. I’m not going to pay $4,000 more for health insurance only for the sake of putting $8,300 into the HSA.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Downsides of HSA: When It’s Not Worth It to Contribute appeared first on The Finance Buff.

Why the HSA Is My Least Favorite Retirement Account

You may have heard that the Health Savings Account (HSA) is the ultimate retirement account because it’s triple tax-free. Contributions go in tax-free. The balance grows tax-free. Withdrawals are again tax-free to pay for accumulated out-of-pocket medical expenses.

I have an HSA but it’s my least favorite retirement account. My HSA has the lowest balance among all my accounts.

Low Contribution LimitThe first problem with the HSA is that it has a low contribution limit. Here are the contribution limits of different account types in 2024 (double these for a married couple):

Before Catch-upWith Catch-up401k/403b/457$23,000$30,500 (age 50+)IRA/Roth IRA$7,000$8,000 (age 50+)HSA$4,150$5,150 (age 55+)The HSA contribution limit is only slightly more than half of the IRA contribution limit and it’s less than 20% of the 401k/403b/457 contribution limit. The catch-up contribution for HSA starts at age 55, not age 50 as in a 401k or an IRA.

Triple tax-free is good but you just can’t put as much into the HSA. The 401k/403b/457 plan and the Traditional or Roth IRA should still be your primary retirement accounts.

Requires High Deductible Health InsuranceYou also can’t contribute to an HSA just because you want one. You must be covered under a High Deductible Health Plan (HDHP) without any other coverage. Because most people get health insurance through their employer, this depends on the employer offering an HSA-eligible health insurance plan. If you get health insurance from the ACA marketplace, this depends on insurance companies offering HSA-eligible plans in your area. If you’re on Medicare, you can’t contribute to an HSA.

This requirement to be covered under only a High Deductible Health Plan gets complicated when a married couple has different health insurance or when health insurance changes mid-year due to job change, marriage, divorce, childbirth, becoming eligible for Medicare, etc., etc. See HSA Contribution Limit For Two Plans Or Mid-Year Changes. Don’t get me started on some employers having a “plan year” that doesn’t start on January 1. That brings extra wrinkles too.

Having a high deductible means your health insurance pays less. It works if you’re healthy with low healthcare expenses but if a low-deductible plan makes more sense for your expected healthcare expenses, you may be better off foregoing the HSA.

Even if your employer or the ACA marketplace offers an HSA-eligible plan and you have low healthcare expenses, the HSA-eligible plan may not have your doctors in the network. Then you face the dilemma of switching doctors for the whole family just to contribute to the HSA or continuing with the same providers out of network and not getting discounts from negotiated rates.

High Deductible ≠ HSA-EligibleAn HSA-eligible high-deductible plan has specific definitions. Just because the deductible is high doesn’t mean the plan is automatically HSA-eligible.

Insurance companies sometimes “enhance” their high-deductible plans to make them not HSA-eligible. The small “enhancements” ruin your opportunity to contribute to an HSA.

I’m facing this situation for next year. Here are the high-deductible plans I see from the ACA marketplace for the two of us:

Current PlanNew PlanNew HSA PlanDeductible$15,000$18,300$16,100Out-of-Pocket Maximum$15,000$18,900$16,100Office VisitMust meet deductible first$45 primary care$95 specialistMust meet deductible firstHSA-eligible

Monthly Premium$1,117$1,282 (+15%)$1,612 (+44%)

Monthly Premium$1,117$1,282 (+15%)$1,612 (+44%)Our current plan is HSA-eligible. We pay everything except preventive care out of pocket because we have little chance of meeting the $15,000 deductible.

The new plan for next year raises the deductible and the out-of-pocket maximum by another 20%, which we don’t expect to come even close. It throws in some Day 1 coverage for office visits. We’ll pay a $45 co-pay to see a primary care doctor or a $95 co-pay to see a specialist before meeting the deductible. This is worth something but it makes the plan not HSA-eligible (the out-of-pocket maximum is also too high to qualify).

If we still want to contribute to the HSA, the premium for an HSA-eligible plan is $495/month higher than last year, and it’s $330/month higher than the premium for the non-HSA plan. Paying almost $4,000 more for the HSA-eligible plan takes away the tax benefits from contributing to an HSA.

***

Triple tax-free is great but a lot of things must line up to obtain HSA’s tax benefits. You must have an HSA-eligible health insurance plan as a choice from your employer or the ACA marketplace. The HSA-eligible plan has to cover the right doctors and facilities. The higher deductible has to make sense for your expected healthcare expenses. The premium has to be not so much higher than a non-HSA plan as to blow out all the tax benefits. These practical considerations are often glossed over when people are excited about HSA’s tax benefits.

If everything lines up, go ahead and contribute the maximum to the HSA. The HSA contribution limit is still low but it’s better than nothing.

The HSA is my least favorite retirement account because things don’t always line up. The tax benefits are easily negated by other factors. I’m not going to pay $4,000 more for health insurance only for the sake of contributing $8,300 to the HSA.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Why the HSA Is My Least Favorite Retirement Account appeared first on The Finance Buff.

October 12, 2023

2024 Social Security Cost of Living Adjustment (COLA)

Retirees on Social Security receive an increase of their Social Security benefits each year known as the Cost of Living Adjustment or COLA. The COLA was 8.7% in 2023, which was the largest in 40 years. Retirees on Social Security will once again receive a COLA in 2024 but it won’t be as big as the one in 2023.

Table of ContentsAutomatic Link to InflationCPI-WQ3 Average2024 Social Security COLAMedicare PremiumsRoot for a Lower COLAAutomatic Link to InflationSome retirees think the COLA is given at the discretion of the President or Congress and they want their elected officials to take care of seniors by declaring a higher COLA. They blame the President or Congress when they think the increase is too small.

It was done that way before 1975 but the COLA has been automatically linked to inflation for nearly 50 years. How much the COLA will be is determined strictly by the inflation numbers. The COLA is high when inflation is high. It’s low when inflation is low. There’s no COLA when inflation is zero or negative, which happened in 2010, 2011, and 2016.

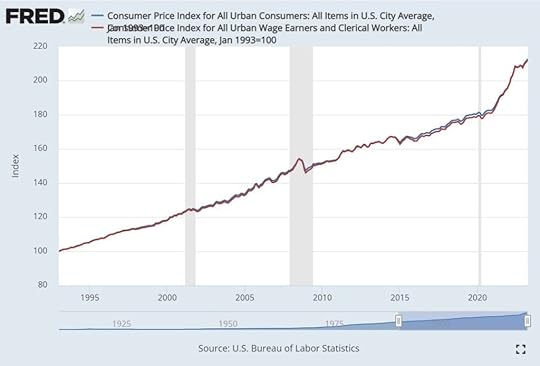

CPI-WSpecifically, the Social Security COLA is determined by the increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). CPI-W is a separate index from the Consumer Price Index for All Urban Consumers (CPI-U), which is more often referenced by the media when they talk about inflation.

CPI-W tracks inflation experienced by workers. CPI-U tracks inflation experienced by consumers. There are some minor differences in how much weight different goods and services have in each index but CPI-W and CPI-U look practically identical when you put them in a chart.

CPI-W and CPI-U 1993-2023

CPI-W and CPI-U 1993-2023The red line is CPI-W and the blue line is CPI-U. They differed by only smidges in 30 years.

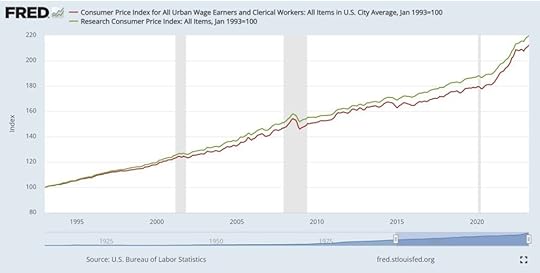

There’s also a research CPI index called the Consumer Price Index for Americans 62 years of age and older, or R-CPI-E. This index weighs more by the spending patterns of older Americans. Some researchers argue that the Social Security COLA should use R-CPI-E, which has increased more than CPI-W in the last 30 years.

CPI-W and R-CPI-E 1993-2023

CPI-W and R-CPI-E 1993-2023The green line is R-CPI-E. The red line is CPI-W. R-CPI-E outpaced CPI-W in 30 years between 1993 and 2023 but not by much. Had the Social Security COLA used R-CPI-E instead of CPI-W, Social Security benefits would’ve been higher by 0.1% per year, or a little over 3% after 30 years. That’s still not much difference.

Regardless of which exact CPI index is used to calculate the Social Security COLA, it’s subject to the same overall price environment. Congress chose CPI-W 50 years ago. That’s the one we’re going with.

Q3 AverageMore specifically, Social Security COLA for next year is calculated by the increase in the average of CPI-W from the third quarter of last year to the third quarter of this year. You get the CPI-W numbers in July, August, and September. Add them up and divide by three. You do the same for July, August, and September last year. Compare the two numbers and round the change to the nearest 0.1%. That’ll be the Social Security COLA for next year.

The government released the CPI-W for September on October 12. The Social Security Administration made the calculation and announced the Social Security COLA for 2024.

2024 Social Security COLABecause the Q3 average CPI-W in 2023 increased by 3.2% over the Q3 average CPI-W in 2022, the 2024 Social Security COLA will be 3.2%. This is in line with my previous projection.

Medicare PremiumsIf you’re on Medicare, the Social Security Administration automatically deducts the Medicare premium from your Social Security benefits. The Social Security COLA is given on the “gross” Social Security benefits before deducting the Medicare premium and any tax withholding.

Medicare announces the premium for next year around the same time Social Security announces the COLA but not necessarily on the same date. The increase in healthcare costs is part of the cost of living that the COLA is intended to cover. You’re still getting the full COLA even though a part of the COLA will be used toward the increase in Medicare premiums.

Retirees with a higher income pay more than the standard Medicare premiums. This is called Income-Related Monthly Adjustment Amount (IRMAA). I cover IRMAA in 2024 2025 Medicare IRMAA Premium MAGI Brackets.

Root for a Lower COLAPeople intuitively want a higher COLA but a higher COLA can only be caused by higher inflation. Higher inflation is bad for retirees.

Whether inflation is high or low, your Social Security benefits will have the same purchasing power. It’s the purchasing power of your savings and investments outside Social Security that you should worry about. When inflation is high, even though your Social Security benefits get a bump, your other money loses more value to inflation. Your savings and investments outside Social Security will last longer when inflation is low.

You want a lower Social Security COLA, which means lower inflation and lower expenses.

Some people say that the government deliberately under-reports inflation. Even if that’s the case, you still want a lower COLA.

Suppose the true inflation for seniors is 3% higher than the reported inflation. If you get a 1% COLA when the true inflation is 4% and you get a 5% COLA when the true inflation is 8%, you are much better off with a lower 1% COLA together with 4% inflation than getting a 5% COLA together with 8% inflation. Your Social Security benefits lag inflation by the same amount either way, but you’d rather your other money outside Social Security loses to 4% inflation than to 8% inflation.

Root for lower inflation and lower Social Security COLA when you are retired.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2024 Social Security Cost of Living Adjustment (COLA) appeared first on The Finance Buff.

September 18, 2023

Stay Away from Zero-Percent C of I in TreasuryDirect

There’s a saying — “A little knowledge is a dangerous thing.” When you don’t know much about a subject, you stay with the tried-and-true because there’s safety in the mainstream. As you learn more about the subject, you start to explore off the beaten path. That’s when the danger starts. You think you know what to do but you don’t know what to avoid. If you only know enough to get into trouble, you’re better off not knowing it.

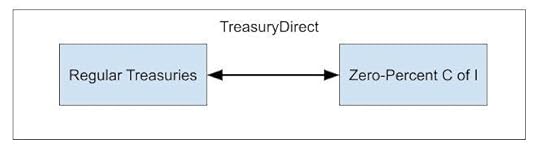

We have an example of this in using TreasuryDirect.

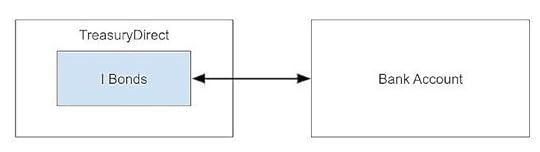

Many people bought I Bonds last year at TreasuryDirect. You link a bank account and put in an order to buy. TreasuryDirect debits the bank account and gives you I Bonds in the account. Many readers of this blog have done that. It works in reverse when you sell. TreasuryDirect credits the linked bank account. These are all routine transactions.

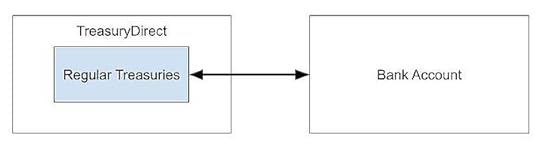

Some people discover that you can also buy regular Treasuries in the TreasuryDirect account. You can buy in $100 increments as opposed to in $1,000 increments in a brokerage account. You can place the order more days in advance versus having to wait for the official announcement. TreasuryDirect supports “auto roll” whereas not all brokers support it. TreasuryDirect debits the same linked bank account for purchases and credits it when the Treasuries mature. These are all routine too.

Then some people notice this peculiar thing called a “Zero-Percent Certificate of Indebtedness” or in short “Zero-Percent C of I” or simply “C of I.” It’s basically TreasuryDirect’s version of uninvested cash in a brokerage account. It doesn’t pay any interest, hence “Zero-Percent.” Zero-Percent C of I can be designated as the destination of the credits from matured Treasuries, to be used as the source of your debits for the next purchase.

You would think this Zero-Percent C of I is useless because drawing from and sending to the bank account works just fine and you can at least earn some interest while the money is in your bank account, but some people decide to use Zero-Percent C of I to hold cash in TreasuryDirect.

That’s when the trouble starts. I read this report on the Bogleheads investment forum (I edited it slightly for brevity):

Well, I moved all of my savings into the US Treasury, in the form of four-week T-Bills that redeeem to C of I.

Normally, that’s not an issue, works every time.

Until two days ago when I got an email saying my account was flagged as having some concerns and Risk Management had placed a hard lock on the account as a precautionary measure.

I was asked to fill out a FS Form 5444. I mailed the notarized form but the processing time for this form is “20 weeks minimum.”

I called the Treasury and got transferred to the hardlock department. They said they received my form but couldn’t act on it.

They also said, the reason for the hard lock was because I bought a $1,000 C of I with my bank account, intending to use it to buy a T-Bill, and this was a fraud risk.

So I will not be able to log into my account to recover any of my money, nor will I be able to reinvest it.

Over the next 20 weeks I’m going to lose out on perhaps about $5,000 worth of interest, yikes.

False positives in risk management and account restrictions happen sometimes. Normally it wouldn’t be a big problem because at worst you can’t place new orders and money from matured T-Bills will still come back to your bank account. In this case, the money goes to Zero-Percent C of I, which earns no interest while it takes 20 weeks to resolve the account restriction.

This investor is clearly better off not knowing that Zero-Percent C of I exists.

He or she is also better off not knowing that you can use TreasuryDirect to buy T-Bills. If he or she bought T-Bills in a commercial brokerage account, at least the settlement fund or core position earns interest and it should be much quicker to resolve the risk management issue than 20 weeks.

To be clear, I don’t blame this investor for using Zero-Percent C of I or using TreasuryDirect to buy T-Bills. It still wouldn’t be a big problem if TreasuryDirect could review the notarized form and remove the restriction in two days as opposed to 20 weeks, but the reality is that TreasuryDirect is understaffed. The computer system runs routine transactions efficiently but things requiring human intervention can take a long time.

Lessons learned: Treat TreasuryDirect as a delicate object. Do as little as possible with it. Stay on the beaten path. Buy your I Bonds. Sell your I Bonds. Use your linked bank account to transact. Don’t use the browser’s back button. Remember your password and your answers to the security questions. Be extra careful not to get your account locked. Use your brokerage account when you buy regular Treasuries. Stay away from Zero-Percent C of I in TreasuryDirect.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Stay Away from Zero-Percent C of I in TreasuryDirect appeared first on The Finance Buff.

September 13, 2023

2024 2025 2026 Medicare Part B IRMAA Premium MAGI Brackets

[Updated on January 11, 2024 after the release of the inflation number for December 2023.]

Seniors 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B which covers doctors’ services and Medicare Part D which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

Table of ContentsWhat Is IRMAA?MAGI2024 IRMAA Brackets2025 IRMAA Brackets2026 IRMAA BracketsRoth Conversion ToolsNickel and DimeIRMAA AppealNot Penalized For LifeWhat Is IRMAA?Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to the Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

MAGIThe income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2022 MAGI determines your IRMAA in 2024. Your 2023 MAGI determines your IRMAA in 2025. Your 2024 MAGI determines your IRMAA in 2026.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes untaxed Social Security benefits. The MAGI for IRMAA doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits.

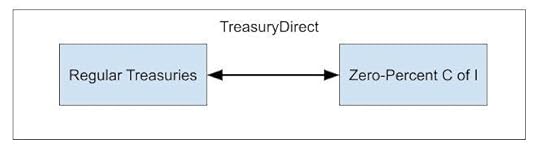

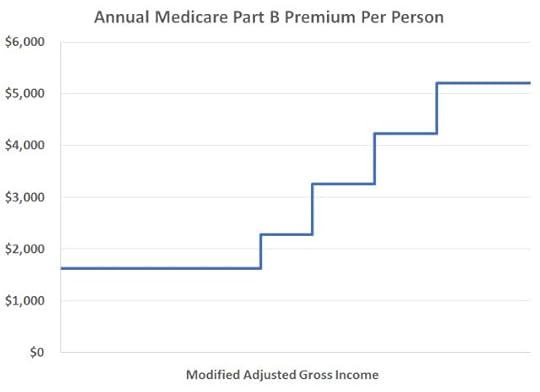

As if it’s not complicated enough while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can cause a sudden jump in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married filing a joint tax return and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

So if your income is near a bracket cutoff, see if you can manage to keep it down and make it stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2024 IRMAA BracketsThe income on your 2022 IRS tax return (filed in 2023) determines the IRMAA you pay in 2024.

Part B Premium2024 Coverage (2022 Income)StandardSingle: <= $103,000Married Filing Jointly: <= $206,000

Married Filing Separately <= $103,0001.4x StandardSingle: <= $129,000

Married Filing Jointly: <= $258,0002.0x StandardSingle: <= $161,000

Married Filing Jointly: <= $322,0002.6x StandardSingle: <= $193,000

Married Filing Jointly: <= $386,0003.2x StandardSingle: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $397,0003.4x StandardSingle: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $397,0002024 IRMAA Brackets

Source: Medicare Costs, Medicare.gov

The standard Part B premium is $174.70 in 2024. Higher-income Medicare beneficiaries also pay a surcharge for Part D. The income brackets are the same. The Part D IRMAA surcharges are relatively smaller in dollars.

I also have the tax brackets for 2024. Please read 2024 Tax Brackets, Standard Deduction, Capital Gains, etc. if you’re interested.

2025 IRMAA BracketsWe have four data points out of 12 right now for the IRMAA brackets in 2025 (based on 2023 income). However, you can make some preliminary estimates and give yourself some margin to stay clear of the cutoff points.

If annualized inflation from January 2024 through August 2024 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2025 numbers:

Part B Premium2025 Coverage (2023 Income)0% Inflation2025 Coverage (2023 Income)

3% InflationStandardSingle: <= $105,000

Married Filing Jointly: <= $210,000

Married Filing Separately <= $105,000Single: <= $105,000

Married Filing Jointly: <= $210,000

Married Filing Separately <= $105,0001.4x StandardSingle: <= $132,000

Married Filing Jointly: <= $264,000Single: <= $133,000

Married Filing Jointly: <= $266,0002.0x StandardSingle: <= $164,000

Married Filing Jointly: <= $328,000Single: <= $166,000

Married Filing Jointly: <= $332,0002.6x StandardSingle: <= $197,000

Married Filing Jointly: <= $394,000Single: <= $198,000

Married Filing Jointly: <= $396,0003.2x StandardSingle: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $395,000Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $395,0003.4x StandardSingle: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $395,000Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $395,000Projected 2025 IRMAA Brackets

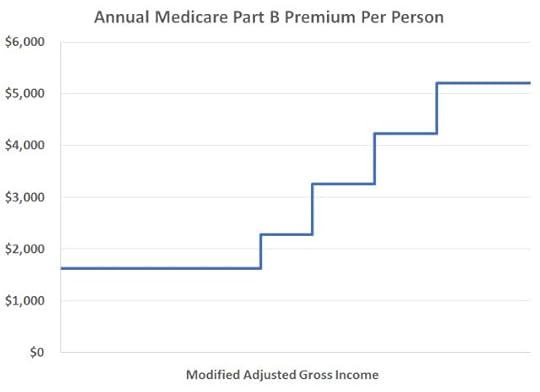

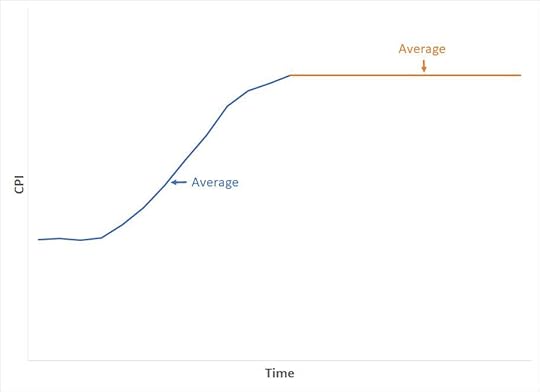

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months.

To use exaggerated numbers, suppose gas prices went up from $3/gallon to $3.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.20/gallon. When gas price inflation becomes 0%, it means it stays at the current price of $3.50/gallon. The average for the next 12 months is $3.50/gallon. Brackets based on an average gas price of $3.50/gallon in the next 12 months will be higher than brackets based on an average gas price of $3.20/gallon in the previous 12 months.

If you really want to get into the weeds of the methodology for these calculations, please read this reply on comment page 2 and this other comment on page 4.

2026 IRMAA BracketsWe have no data right now for the IRMAA brackets in 2026 (based on 2024 income). We can only make some preliminary estimates and plan for some margin to stay clear of the cutoff points.

If annualized inflation from January 2024 through August 2025 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2026 numbers:

Part B Premium2026 Coverage (2024 Income)0% Inflation2026 Coverage (2024 Income)

3% InflationStandardSingle: <= $105,000

Married Filing Jointly: <= $210,000

Married Filing Separately <= $105,000Single: <= $108,000

Married Filing Jointly: <= $216,000

Married Filing Separately <= $108,0001.4x StandardSingle: <= $132,000

Married Filing Jointly: <= $264,000Single: <= $136,000

Married Filing Jointly: <= $272,0002.0x StandardSingle: <= $164,000

Married Filing Jointly: <= $328,000Single: <= $170,000

Married Filing Jointly: <= $340,0002.6x StandardSingle: <= $197,000

Married Filing Jointly: <= $394,000Single: <= $204,000

Married Filing Jointly: <= $408,0003.2x StandardSingle: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $395,000Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $392,0003.4x StandardSingle: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $395,000Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $392,000Projected 2026 IRMAA BracketsRoth Conversion Tools

When you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with Social Security and Medicare IRMAA and Roth Conversion with TurboTax What-If Worksheet.

Nickel and DimeThe standard Medicare Part B premium is $174.70/month in 2024. A 40% surcharge on the Medicare Part B premium is about $840/year per person or about $1,700/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $206,000 in income, they’re already paying a large amount in taxes. Does making them pay another $1,700 make that much difference? It’s less than 1% of their income but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income and don’t accidentally cross a line for IRMAA.

IRMAA AppealIf your income two years ago was higher because you were working at that time and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

Death of spouseMarriageDivorce or annulmentWork reductionWork stoppageLoss of income from income producing propertyLoss or reduction of certain kinds of pension incomeYou file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you had a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For LifeIf your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, when your income comes down in the following year, your IRMAA will also come down automatically. It’s not the end of the world to pay IRMAA for one year.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2024 2025 2026 Medicare Part B IRMAA Premium MAGI Brackets appeared first on The Finance Buff.

2023 2024 2025 Medicare Part B IRMAA Premium MAGI Brackets

[Updated on September 13, 2023 after the release of the inflation number for August 2023.]

Seniors 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B which covers doctors’ services and Medicare Part D which covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

Table of ContentsWhat Is IRMAA?MAGI2023 IRMAA Brackets2024 IRMAA Brackets2025 IRMAA BracketsNickel and DimeIRMAA AppealNot Penalized For LifeRoth Conversion ToolsWhat Is IRMAA?Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. This applies to both Traditional Medicare (Part B and Part D) and Medicare Advantage plans.

According to the Medicare Trustees Report, 7% of Medicare Part B beneficiaries paid IRMAA. The extra premiums they paid lowered the government’s share of the total Part B and Part D expenses by two percentage points. Big deal?

MAGIThe income used to determine IRMAA is your Modified Adjusted Gross Income (MAGI) — which is your AGI plus tax-exempt interest and dividends from muni bonds — from two years ago. Your 2021 MAGI determines your IRMAA in 2023. Your 2022 MAGI determines your IRMAA in 2024. Your 2023 MAGI determines your IRMAA in 2025.

There are many definitions of MAGI for different purposes. The MAGI for subsidies on health insurance from the ACA marketplace includes untaxed Social Security benefits. The MAGI for IRMAA doesn’t include untaxed Social Security benefits. If you read somewhere else that says that untaxed Social Security benefits are included in MAGI, they’re talking about a different MAGI, not the MAGI for IRMAA.

You can use Calculator: How Much of My Social Security Benefits Is Taxable? to calculate the taxable portion of your Social Security benefits.

As if it’s not complicated enough while not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. As a result, they pay 1.4 times, 2.0 times, 2.6 times, 3.2 times, or 3.4 times the standard Medicare premium.

The threshold for each bracket can cause a sudden jump in the monthly premium amount you pay. If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married filing a joint tax return and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

* The last bracket on the far right isn’t displayed in the chart.

So if your income is near a bracket cutoff, see if you can manage to keep it down and make it stay in a lower bracket. Using the income from two years ago makes it more difficult to manage.

2023 IRMAA BracketsThe income on your 2021 IRS tax return (filed in 2022) determines the IRMAA you pay in 2023.

Part B Premium2022 Coverage (2020 Income)2023 Coverage (2021 Income)StandardSingle: <= $91,000Married Filing Jointly: <= $182,000

Married Filing Separately <= $91,000Single: <= $97,000

Married Filing Jointly: <= $194,000

Married Filing Separately <= $97,0001.4x StandardSingle: <= $114,000

Married Filing Jointly: <= $228,000Single: <= $123,000

Married Filing Jointly: <= $246,0002.0x StandardSingle: <= $142,000

Married Filing Jointly: <= $284,000Single: <= $153,000

Married Filing Jointly: <= $306,0002.6x StandardSingle: <= $170,000

Married Filing Jointly: <= $340,000Single: <= $183,000

Married Filing Jointly: <= $366,0003.2x StandardSingle: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $409,000Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $403,0003.4x StandardSingle: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $409,000Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $403,0002023 IRMAA Brackets

Source: Medicare Costs, Medicare.gov

The standard Part B premium is $164.90 in 2023.

Higher-income Medicare beneficiaries also pay a surcharge for Part D. The income brackets are the same. The Part D IRMAA surcharges are relatively smaller in dollars.

2024 IRMAA BracketsWe have all 12 data points out of 12 for the IRMAA brackets in 2024 (based on 2022 income). Medicare will make the official announcement soon.

Part B Premium2023 Coverage (2021 Income)2024 Coverage (2022 Income)StandardSingle: <= $97,000Married Filing Jointly: <= $194,000

Married Filing Separately <= $97,000Single: <= $103,000

Married Filing Jointly: <= $206,000

Married Filing Separately <= $103,0001.4x StandardSingle: <= $123,000

Married Filing Jointly: <= $246,000Single: <= $129,000

Married Filing Jointly: <= $258,0002.0x StandardSingle: <= $153,000

Married Filing Jointly: <= $306,000Single: <= $161,000

Married Filing Jointly: <= $322,0002.6x StandardSingle: <= $183,000

Married Filing Jointly: <= $366,000Single: <= $193,000

Married Filing Jointly: <= $386,0003.2x StandardSingle: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $403,000Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $397,0003.4x StandardSingle: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $403,000Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $397,0002024 IRMAA Brackets

I also project the Social Security COLA and the tax brackets for next year. Please read 2024 Social Security Cost of Living Adjustment (COLA) Projections and 2024 Tax Brackets, Standard Deduction, Capital Gains, etc. if you’re interested.

2025 IRMAA BracketsWe have no data right now for the IRMAA brackets in 2025 (based on 2023 income). However, you can make some preliminary estimates and give yourself some margin to stay clear of the cutoff points.

If annualized inflation from September 2023 through August 2024 is 0% (prices staying flat at the latest level) or 3% (approximately a 0.25% increase every month), these will be the 2025 numbers:

Part B Premium2025 Coverage (2023 Income)0% Inflation2025 Coverage (2023 Income)

3% InflationStandardSingle: <= $105,000

Married Filing Jointly: <= $210,000

Married Filing Separately <= $105,000Single: <= $106,000

Married Filing Jointly: <= $212,000

Married Filing Separately <= $106,0001.4x StandardSingle: <= $132,000

Married Filing Jointly: <= $264,000Single: <= $134,000

Married Filing Jointly: <= $268,0002.0x StandardSingle: <= $164,000

Married Filing Jointly: <= $328,000Single: <= $167,000

Married Filing Jointly: <= $334,0002.6x StandardSingle: <= $197,000

Married Filing Jointly: <= $394,000Single: <= $200,000

Married Filing Jointly: <= $400,0003.2x StandardSingle: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $395,000Single: < $500,000

Married Filing Jointly: < $750,000

Married Filing Separately < $394,0003.4x StandardSingle: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $395,000Single: >= $500,000

Married Filing Jointly: >= $750,000

Married Filing Separately >= $394,000Projected 2025 IRMAA Brackets

Because the formula compares the average of 12 monthly CPI numbers over the average of 12 monthly CPI numbers in a base period, even if prices stay the same in the following months, the average of the next 12 months will still be higher than the average in the previous 12 months. To use exaggerated numbers, suppose gas prices went up from $3/gallon to 4.50/gallon over the last 12 months. The average gas price in the last 12 numbers was maybe $3.70/gallon. When gas price inflation becomes 0%, it means it stays at $4.50/gallon. The average for the next 12 months is $4.50/gallon. Brackets based on an average gas price of $4.50/gallon will be higher than brackets based on an average gas price of $3.70/gallon.

If you really want to get into the weeds of the methodology for these calculations, please read comment #79 and comment #164.

Nickel and DimeThe standard Medicare Part B premium is $164.90/month in 2023. A 40% surcharge on the Medicare Part B premium is about $800/year per person or about $1,600/year for a married couple both on Medicare.

In the grand scheme, when a couple on Medicare has over $194,000 in income, they’re already paying a large amount in taxes. Does making them pay another $1,600 make that much difference? It’s less than 1% of their income but nickel-and-diming just makes people mad. People caught by surprise when their income crosses over to a higher bracket by just a small amount are angry at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income and don’t accidentally cross a line for IRMAA.

IRMAA AppealIf your income two years ago was higher because you were working at that time and now your income is significantly lower because you retired (“work reduction” or “work stoppage”), you can appeal the IRMAA initial determination. The “life-changing events” that make you eligible for an appeal include:

Death of spouseMarriageDivorce or annulmentWork reductionWork stoppageLoss of income from income producing propertyLoss or reduction of certain kinds of pension incomeYou file an appeal with the Social Security Administration by filling out the form SSA-44 to show that although your income was higher two years ago, you had a reduction in income now due to one of the life-changing events above. For more information on the appeal, see Medicare Part B Premium Appeals.

Not Penalized For LifeIf your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes. If your higher income two years ago was due to a one-time event, such as realizing capital gains or taking a large withdrawal from your IRA, when your income comes down in the following year, your IRMAA will also come down automatically. It’s not the end of the world to pay IRMAA for one year.

Roth Conversion ToolsWhen you manage your income by doing Roth conversions, you must watch your MAGI carefully to avoid accidentally crossing one of these IRMAA thresholds by a small amount and triggering higher Medicare premiums.

I use two tools to help with calculating how much to convert to Roth. I wrote about these tools in Roth Conversion with Social Security and Medicare IRMAA and Roth Conversion with TurboTax What-If Worksheet.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2023 2024 2025 Medicare Part B IRMAA Premium MAGI Brackets appeared first on The Finance Buff.

September 10, 2023

3 Lessons Learned From a Botched Money Transfer

We talked about the right way to transfer money in the previous post ACH Push or Pull. I read this story online related to using Fidelity as a checking or savings account. I’m not linking to it because I don’t intend to shame anyone. Let’s see what lessons we can learn from this case study of a transfer gone awry.

Use Push

I had over $6,000 in a money market fund in my Fidelity Cash Management Account one day. I transferred an additional $20,000 from another institution to that account.

Once the money arrived at Fidelity, it was available to invest as always but not to withdraw (the holding period was 7 days). Fair enough. I then invested it in the same money market fund.

Then I decided to move the money to my other Fidelity brokerage account to keep it (away) from my checking needs. So I called a rep who did that (or so I thought!). I’m now supposed to have $6,000 in my Cash Management Account as if nothing happened, but no, when the rep moved the $20k and because of the holding period, the system used first the $6,000 already cleared. Anyway, I didn’t notice that whole mess and bounced some credit card payments.

Most problems in transferring money are caused by initiating the transfer at the wrong place. If you remember only one thing from the previous post ACH Push or Pull, it’s that you should use a push when you have a choice. There are exceptions but in general, your first choice should be a push. In other words, initiate the transfer at the origin where the money currently resides, not at the intended destination. Push the money out. Don’t pull it in.

If the first transfer in this story had been initiated at the other institution (a push to Fidelity), all the subsequent problems wouldn’t have happened. Money received from a push has no hold. It’s fine to invest it or transfer it again to another account.

Go DirectWhen people travel by air, most people prefer a direct flight. It takes less time. Having fewer stops means fewer things can go wrong.

The same principle applies to transferring money. If it’s intended to be kept away from checking needs, transfer it directly to the final destination. Don’t create hops.

Even a pull directly into the brokerage account would’ve worked in the story. The Cash Management Account used as a checking account wouldn’t have been affected if the money had been pulled directly into the brokerage account. Credit card payments from the checking account wouldn’t have bounced.

The money pulled into the brokerage account would’ve still had a hold but it could be invested immediately. The hold wouldn’t have been noticed because withdrawals weren’t taken out of the brokerage account.

Let It AgeIf a money transfer landed in the wrong account by mistake, don’t exacerbate the mistake by making a back-to-back transfer. Slow down. Let it age. It makes no difference which account the money is in after it’s already invested. Just wait a week and let everything settle.

Besides fund availability problems, rapid back-to-back transfers can trigger anti-money laundering flags. Some banks and credit unions restrict or close accounts when they see an account is used as a “hub” with fast in-and-out transfers. This goes hand-in-hand with “Go Direct.” If money needs to go from A to B, don’t make an interim stop at C.

***

The transfer in the story went poorly because it took the most problematic path. These would’ve been better ways to make the transfer in question in the order of preference:

A push directly to the brokerage account.A push into the Cash Management Account followed by an internal transfer to the brokerage account.A pull directly into the brokerage account.A pull into the Cash Management Account. Transfer to the brokerage account only after it completely settles.Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 3 Lessons Learned From a Botched Money Transfer appeared first on The Finance Buff.

August 30, 2023

Voluntary Tax Withholding on Selling I Bonds at TreasuryDirect

Many people bought I Bonds last year when rates were high. As inflation has come down and interest rates have gone up elsewhere, some are planning to sell their I Bonds to buy new I Bonds at a higher fixed rate. I Bonds purchased between May 2020 and October 2022 have a 0% fixed rate for life. The fixed rate on new I Bonds to be announced on November 1 may potentially go higher, possibly to 1.5%. See Cash Out Old I Bonds to Buy New Ones for a Better Rate.

I chose to buy TIPS for better inflation protection than I Bonds after I sold some of my I Bonds on August 1. The money went into Fidelity’s TIPS fund (ticker FIPDX). The yield on 5-year TIPS is above 2% as I’m writing this on August 30, 2023. I’m planning to sell more older I Bonds on October 1 to buy more shares in that TIPS fund. Please read more on this in Better Inflation Protection with TIPS Than I Bonds.

Most people go by the default tax treatment on I Bonds and defer taxes on the interest until they sell (see I Bonds Tax Treatment During Your Lifetime and After You Die). By default, TreasuryDirect doesn’t withhold any taxes from the proceeds because the IRS doesn’t require tax withholding on interest payments. Banks typically don’t withhold taxes when they pay interest in savings accounts or CDs either. You download a 1099 from TreasuryDirect next year and report the interest income on your tax return.

Some people prefer to have taxes withheld even when tax withholding isn’t required. Taxes paid through withholding are assumed to have been paid throughout the year. It helps with some timing issues.

If you’d like to have TreasuryDirect withhold taxes when you sell I Bonds, here’s how to do it.

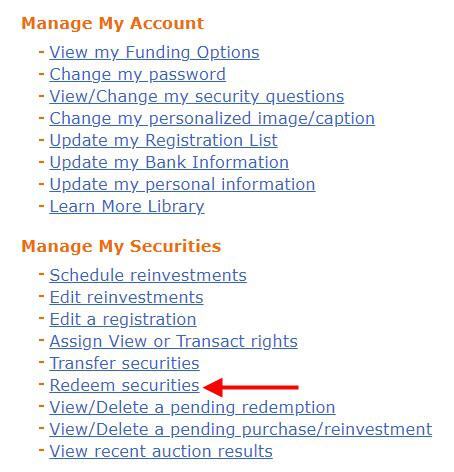

Log in to your TreasuryDirect account and click on “ManageDirect” on the top.

Click on “Update my personal information” under the heading “Manage My Account.”

Answer a security question. Scroll to the bottom. Change the “Withholding Rate” from the default 0% to your desired rate (up to 50%). This new withholding rate will be used on all future sales. If you buy regular Treasuries at TreasuryDirect, it affects payments from those regular Treasuries as well.

The withholding rate applies only when you sell I Bonds. It doesn’t reduce the interest credited to your I Bonds while you still hold them.

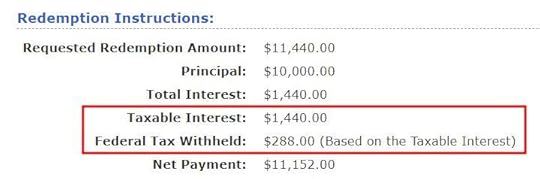

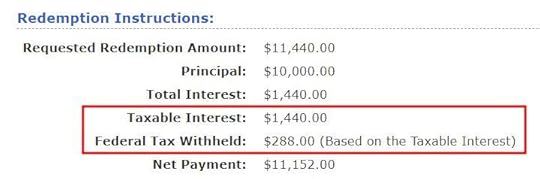

To sell (cash out) your I Bonds, go back to ManageDirect and click on “Redeem securities.” You will see this on the review page after you select the I Bonds to cash out:

I set the withholding rate to 20% for this test. TreasuryDirect knows how much interest is included in the sale. The withholding rate only applies to the interest portion, not to the gross amount. TreasuryDirect does not withhold state taxes because I Bonds are exempt from state taxes.

If you choose to have TreasuryDirect withhold taxes, the amount withheld for federal income tax will be in Box 4 of Form 1099-INT together with the interest amount in Box 3. Tax software will take them into account when you enter both amounts from the 1099 form. Make sure you download the 1099 form from TreasuryDirect next year. TreasuryDirect will send an email when the form is ready but you should set a reminder on your calendar in case you miss the email.

Having TreasuryDirect withhold taxes from the sale is completely optional. I choose not to do that because I prefer to pay quarterly estimated taxes myself, but it works perfectly well if you prefer withholding.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Voluntary Tax Withholding on Selling I Bonds at TreasuryDirect appeared first on The Finance Buff.

Choose Tax Withholding at TreasuryDirect When You Sell I Bonds

When you earn interest in a bank account or a CD, the bank typically does not withhold taxes. The bank sends a 1099 form for the interest after the end of the year. You report the interest income from the 1099 form on your tax return.

It works similarly when you sell I Bonds at TreasuryDirect. By default, TreasuryDirect doesn’t withhold any taxes from the proceeds. You download the 1099-INT form from TreasuryDirect next year and report the interest on your tax return.

Some people prefer to pay taxes through tax withholding as opposed to paying quarterly estimated taxes. Taxes paid through withholding are assumed to have been paid throughout the year. It helps with some timing issues.

If you’d like to have TreasuryDirect withhold taxes when you sell I Bonds, here’s how to do it.

Log in and click on “ManageDirect” on the top.

Click on “Update my personal information” under the heading “Manage My Account.”

Answer a security question. Scroll to the bottom. Change the “Withholding Rate” from the default 0% to your desired rate (up to 50%). This new withholding rate will be used on all future sales. If you buy regular Treasuries at TreasuryDirect, it affects payments from those regular Treasuries as well.

The withholding rate applies only when you sell I Bonds. It doesn’t reduce the increase of the redemption value while you still hold I Bonds. You will see this on the review page when you sell I Bonds:

I set the withholding rate to 20% for this test. TreasuryDirect knows how much interest is included in the sale. The 20% only applies to the interest portion, not to the gross amount. TreasuryDirect does not withhold state taxes because I Bonds are exempt from state taxes.

If you choose to have TreasuryDirect withhold taxes, the withholding amount will be on the 1099-INT form together with the interest amount. Tax software will take that into account when you enter the 1099 form. Make sure you download the 1099 form from TreasuryDirect next year. TreasuryDirect will send an email when the form is ready but you should set a reminder on your calendar in case you miss the email.

Having TreasuryDirect withhold taxes from the sale is completely optional. I don’t choose to do that because I prefer to pay quarterly estimated taxes. Also, don’t choose tax withholding if you elected to pay taxes on I Bonds each year as opposed to deferring taxes until you sell, otherwise you’ll pay taxes twice and must get it back from a refund.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Choose Tax Withholding at TreasuryDirect When You Sell I Bonds appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower