Choose Tax Withholding at TreasuryDirect When You Sell I Bonds

When you earn interest in a bank account or a CD, the bank typically does not withhold taxes. The bank sends a 1099 form for the interest after the end of the year. You report the interest income from the 1099 form on your tax return.

It works similarly when you sell I Bonds at TreasuryDirect. By default, TreasuryDirect doesn’t withhold any taxes from the proceeds. You download the 1099-INT form from TreasuryDirect next year and report the interest on your tax return.

Some people prefer to pay taxes through tax withholding as opposed to paying quarterly estimated taxes. Taxes paid through withholding are assumed to have been paid throughout the year. It helps with some timing issues.

If you’d like to have TreasuryDirect withhold taxes when you sell I Bonds, here’s how to do it.

Log in and click on “ManageDirect” on the top.

Click on “Update my personal information” under the heading “Manage My Account.”

Answer a security question. Scroll to the bottom. Change the “Withholding Rate” from the default 0% to your desired rate (up to 50%). This new withholding rate will be used on all future sales. If you buy regular Treasuries at TreasuryDirect, it affects payments from those regular Treasuries as well.

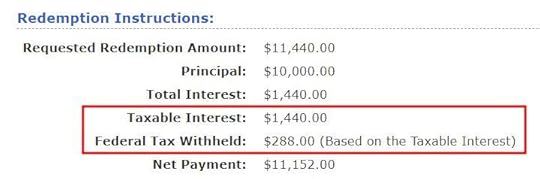

The withholding rate applies only when you sell I Bonds. It doesn’t reduce the increase of the redemption value while you still hold I Bonds. You will see this on the review page when you sell I Bonds:

I set the withholding rate to 20% for this test. TreasuryDirect knows how much interest is included in the sale. The 20% only applies to the interest portion, not to the gross amount. TreasuryDirect does not withhold state taxes because I Bonds are exempt from state taxes.

If you choose to have TreasuryDirect withhold taxes, the withholding amount will be on the 1099-INT form together with the interest amount. Tax software will take that into account when you enter the 1099 form. Make sure you download the 1099 form from TreasuryDirect next year. TreasuryDirect will send an email when the form is ready but you should set a reminder on your calendar in case you miss the email.

Having TreasuryDirect withhold taxes from the sale is completely optional. I don’t choose to do that because I prefer to pay quarterly estimated taxes. Also, don’t choose tax withholding if you elected to pay taxes on I Bonds each year as opposed to deferring taxes until you sell, otherwise you’ll pay taxes twice and must get it back from a refund.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Choose Tax Withholding at TreasuryDirect When You Sell I Bonds appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower