How to Split an Existing I Bond for Multiple Beneficiaries

When savings bonds were only on paper, there was no account. The co-owner or the beneficiary had to be printed on the paper bond itself. The paper bond had room for only one co-owner or beneficiary.

After Treasury started issuing savings bonds in the online TreasuryDirect account, they continued with this setup. You have an online account but you can’t set your second owner or beneficiary at the account level as you normally do in your other investment accounts. You set it at the holdings level — bond by bond — and each bond can have only one person as the second owner or the beneficiary. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

Table of ContentsSplit for Multiple BeneficiariesCustom Linked AccountOpen Custom Linked AccountPartial Transfer(Optional) Wait a Few DaysTransfer BackSplit for Multiple BeneficiariesIf you have two children, you can’t name both of them as 50/50 beneficiaries on the same bond. You’ll have to buy two bonds, one with each child as the beneficiary. See How to Buy I Bonds.

What if you didn’t realize this and you only placed one order for $10,000? How do you split your existing $10,000 bond into two $5,000 bonds and name a different child for each half?

There’s no direct way to do this in TreasuryDirect, but I figured out an indirect way.

Custom Linked AccountTreasuryDirect lets you open a Custom Linked Account linked to your main account. It’s like a sub-account or a goal savings account. In their words:

This is a flexible account you can establish to meet specific financial goals. You can even create a customized name, such as “Vacation Fund,” for the account. We offer the same convenient capabilities as in your Primary TreasuryDirect account.

The Custom Linked Account can only be accessed through your main account. Having a Custom Linked Account doesn’t increase your annual purchase limit. It only lets you separate your holdings for organization purposes. Most people don’t need a Custom Linked Account. We will use it to split your existing bond.

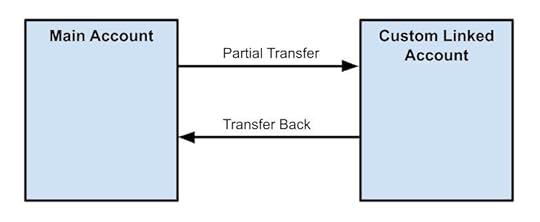

The idea is that you do a partial transfer of your existing bond to this Custom Linked Account. This will split your existing bond into two places — one part is in the Custom Linked Account and the other part stays in the main account. If you need to split an existing bond into more than two parts, repeat the partial transfer. After you’re done with splitting, you transfer the split parts back to your main account.

Transferring parts of an existing bond back and forth between your main account and your Custom Linked Account doesn’t trigger taxes. Nor does it eat into your annual purchase limit.

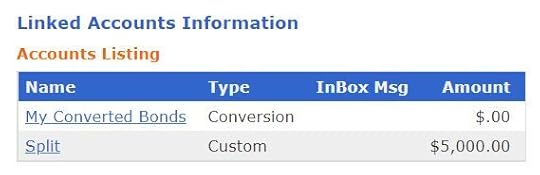

If you already have a Conversion Linked Account from depositing paper bonds to your TreasuryDirect account, you can also use that one to hold the splits. You don’t need to open a Custom Linked Account.

Open Custom Linked AccountI’m showing how to split using a Custom Linked Account even though I already have a Conversion Linked Account.

To open a Custom Linked Account, go to ManageDirect and then click on “Establish a Custom Linked Account.”

You’ll be prompted to answer a security question. Then it will ask you to give a personalized name for this new account and whether to use the same email address or a new email address. I just called this new account “Split” because I’ll use it to split an existing bond.

Your existing personal information and bank account information will copy over to the Custom Linked Account but we’re not going to buy new bonds in this account. After you submit the information, you will see an account number for the Custom Linked Account on the top right. Copy the account number. You’ll need it when you do the partial transfer.

Partial Transfer

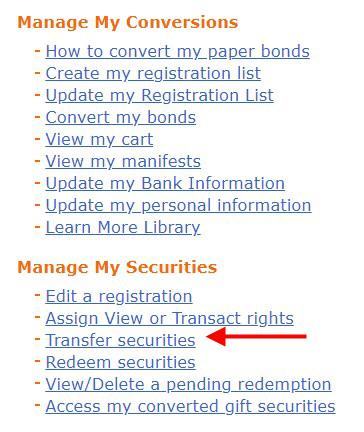

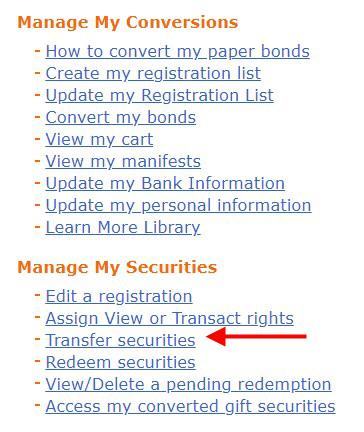

Click on the link to your main account on the top right to go back to your main account. Go to ManageDirect and then click on “Transfer securities.”

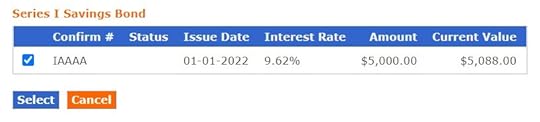

Select one of your existing bonds. You can only split one bond at a time.

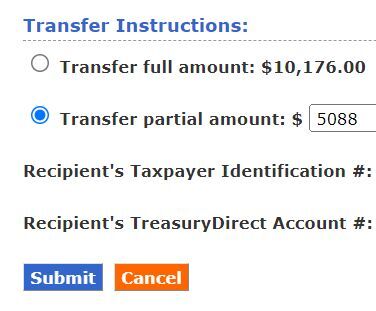

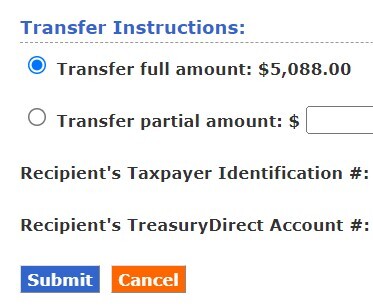

Choose “Transfer partial amount.” I divided the current value by two because I’m splitting this bond 50/50. If you’d like to split it three-way or in different percentages, adjust your partial amount off of the full amount including interest. Give your own Social Security Number as the “Recipient’s Taxpayer Identification #” because you’re transferring to a Custom Linked Account owned by yourself. You give the account number of the Custom Linked Account as the “Recipient’s TreasuryDirect Account #“.

The transfer happens immediately. If you’d like to split your bond into more than two parts, just repeat this process.

(Optional) Wait a Few DaysYou may be able to transfer the split part from your Custom Linked Account back to your main account right away, but I waited a few days just in case it needed to age a little bit and get settled in the new home. I wasn’t in any hurry anyway. This may not be necessary but I figured it couldn’t hurt.

Transfer BackThe process to transfer the split-off bond from the Custom Linked Account back to the main account is just the reverse of the previous move.

Log in to your main account. Scroll to the bottom to find your list of linked accounts. Click on the link for the Custom Linked Account.

Go to ManageDirect, and then click on “Transfer securities.”

Answer the security question. If you split your bond into more than two parts, you can select all the bonds in the Custom Linked Account. If you only have one bond in the Custom Linked Account, select it and choose “Transfer full amount” this time.

Give your own Social Security Number as the “Recipient’s Taxpayer Identification #” and give the account number of your main account as the “Recipient’s TreasuryDirect Account #“.

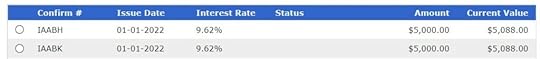

Click on the link to your main account on the top right to go back to your main account. Click on Current Holdings. You’ll see all the parts of your original bond.

Now you can assign a different second owner or beneficiary for each part. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Split an Existing I Bond for Multiple Beneficiaries appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower