How To Harvest Tax Loss Between an ETF and a Mutual Fund

Mutual funds are priced once a day after the markets close. The fund tallies up the value of all its holdings and calculates a Net Asset Value (NAV) per share. All the buy orders and sell orders the fund received before the markets closed on this day transact at this NAV. Everyone pays the same price on the same day but you don’t know what the price will be at the end of the day when you place your order.

ETFs are priced in the market throughout the day. Their prices change by the second. You see the price when you place your order but you don’t know whether this price is high or low relative to prices at a later time in the day or when the markets close.

In some ways, ETFs’ up-to-the-second pricing is an advantage. If the market is going up, there’s an opportunity to buy earlier in the day at a lower price. If the market is going down, there’s an opportunity to sell before it goes further down by the end of the day. You can also use limit orders to have your order execute only when the price meets a preset point, whereas mutual funds only accept market orders at the to-be-determined NAV.

However, the ever-changing prices can also be a hindrance. In general, you have to place your ETF orders when the market is open. Because you may be busy with work or other activities during those hours, you may prefer to put in your orders in the evening or on weekends. If you enter a market order for an ETF when the market is closed, your order will execute when the market first opens. Prices are sometimes volatile in the opening minutes and you may not get a fair price. If you enter a limit order for an ETF when the market is closed, your order may not be executed when the market moves away from the price you set in the limit order.

When you find time during trading hours to place an ETF order, you still can’t be sure how the price you see at that moment compares with the price of a mutual fund set after the end of the day. This comes into play when you harvest tax losses between an ETF and a mutual fund.

When you harvest tax losses, you sell one investment and you buy something similar. If you’re selling an ETF and buying a mutual fund, a big rally at the close will raise the price of the mutual fund, which makes you buy high and sell low. If you’re buying an ETF and selling a mutual fund, a large selloff at the close can also make you buy high and sell low.

Ideally you want to make your ETF order execute as close to 4:00 pm Eastern Time as possible in order to match the price movement in the mutual fund. It’s difficult when your schedule doesn’t allow it.

Market On Close OrdersThe Market On Close (MOC) order type comes to the rescue.

A Market On Close order is a market order that’s executed at the closing price. It makes an ETF order behave like a mutual fund order. Instead of your order executing immediately (market order) or at a preset price (limit order), your Market On Close order will execute at the closing price, whatever it happens to be.

Most of the mainstream brokers for retail investors except Vanguard support Market On Close orders for ETFs. Here’s how to enter a Market On Close order with Fidelity:

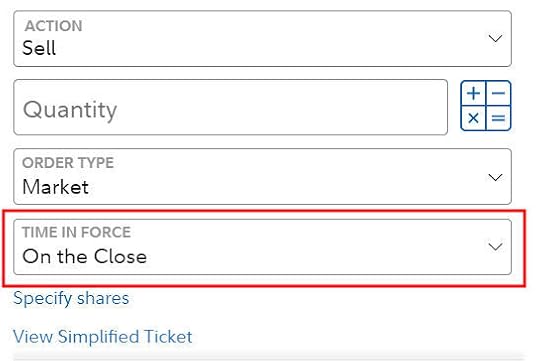

Choose “Market” in the Order Type field and “On the Close” in the “Time in Force” field.

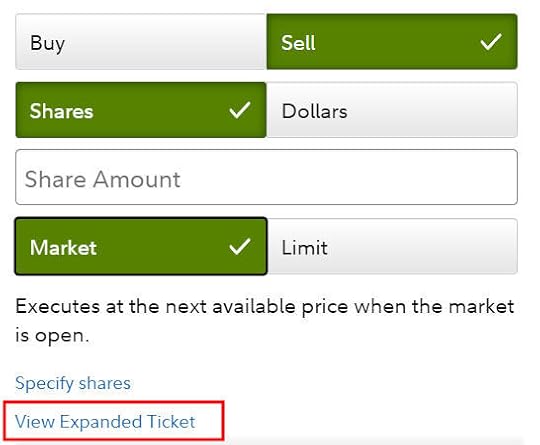

If your order entry screen looks like this, you’re on the Simplified Ticket. Click on the “View Expanded Ticket” link to open up more options.

Here are a few other things to keep in mind about Market On Close orders:

1. You can enter a Market On Close order only in whole shares. Fidelity supports trading fractional shares and trading in dollars but not for the Market On Close order type.

2. You can enter a Market On Close order only after the market opens and before a cutoff time prior to the close. Fidelity sets the cutoff at 3:40 pm Eastern Time, 20 minutes before the close. Charles Schwab has the cutoff at 3:45 pm Eastern Time.

3. A Market On Close order can’t be canceled after 3:58 pm Eastern Time.

If you prefer the simplicity of mutual funds, using Market On Close orders makes buying and selling ETFs close to the experience in buying and selling mutual funds. More importantly, when you harvest tax losses between an ETF and a mutual fund, using a Market On Close order makes both your ETF order and your mutual fund order execute at the closing price. This minimizes the price fluctuation between your orders.

It’s too bad Vanguard doesn’t support Market On Close orders. Consider using a different broker if you’d like to use Market On Close orders.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Harvest Tax Loss Between an ETF and a Mutual Fund appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower