Harry Sit's Blog, page 6

September 11, 2024

2024 2025 Tax Brackets, Standard Deduction, Capital Gains, QCD

My other post listed 2024 2025 401k and IRA contribution and income limits. I also calculated the inflation-adjusted tax brackets and some of the most commonly used numbers in tax planning for 2025 using the published inflation numbers and the same formula prescribed in the tax law. These calculations have been confirmed by the IRS Rev. Proc. 2024-40.

Table of Contents2024 2025 Standard Deduction2024 2025 Tax Brackets2024 2025 Capital Gains TaxNet Investment Income Tax2024 2025 Estate and Trust Tax Brackets2024 2025 Qualified Charitable Distributions (QCD) Limit2024 2025 2026 Medicare Part B and Part D IRMAA2024 2025 Gift Tax Exclusion2024 2025 Savings Bonds Tax-Free Redemption for College Expenses2024 2025 Standard DeductionYou don’t pay federal income tax on every dollar of your income. You deduct an amount from your income before you calculate taxes. About 90% of all taxpayers take the standard deduction. The other ~10% itemize deductions when their total deductions exceed the standard deduction. In other words, you’re deducting a larger amount than your allowed deductions when you take the standard deduction. Don’t feel bad about taking the standard deduction!

The basic standard deduction in 2024 and 2025 are:

20242025Single or Married Filing Separately$14,600$15,000Head of Household$21,900$22,500Married Filing Jointly$29,200$30,000Basic Standard DeductionSource: IRS Rev. Proc. 2023-34, Rev. Proc. 2024-40.

People who are age 65 and over have a higher standard deduction than the basic standard deduction.

20242025Single, age 65 and over$16,550$17,000Head of Household, age 65 and over$23,850$24,500Married Filing Jointly, one person age 65 and over$30,750$31,600Married Filing Jointly, both age 65 and over$32,300$33,200Standard Deduction for age 65 and overSource: IRS Rev. Proc. 2023-34, Rev. Proc. 2024-40.

People who are blind have an additional standard deduction.

20242025 estimatesSingle or Head of Household, blind+$1,950+$2,000Married Filing Jointly, one person is blind+$1,550+$1,600Married Filing Jointly, both are blind+$3,100+$3,200Additional Standard Deduction for BlindnessSource: IRS Rev. Proc. 2023-34, Rev. Proc. 2024-40.

2024 2025 Tax BracketsThe tax brackets are based on taxable income, which is AGI minus various deductions. The tax brackets in 2024 are:

SingleHead of HouseholdMarried Filing Jointly10%$0 – $11,600$0 – $16,550$0 – $23,20012%$11,600 – $47,150$16,550 – $63,100$23,200 – $94,30022%$47,150 – $100,525$63,100 – $100,500$94,300 – $201,05024%$100,525 – $191,950$100,500 – $191,950$201,050 – $383,90032%$191,950 – $243,725$191,950 – $243,700$383,900 – $487,45035%$243,725 – $609,350$243,700 – $609,350$487,450 – $731,20037%Over $609,350Over $609,350Over $731,2002024 Tax BracketsSource: IRS Rev. Proc. 2023-34.

The 2025 tax brackets will be:

SingleHead of HouseholdMarried Filing Jointly10%$0 – $11,925$0 – $17,000$0 – $23,85012%$11,925 – $48,475$17,000 – $64,850$23,850 – $96,95022%$48,475 – $103,350$64,850 – $103,350$96,950 – $206,70024%$103,350 – $197,300$103,350 – $197,300$206,700 – $394,60032%$197,300 – $250,525$197,300 – $250,500$394,600 – $501,05035%$250,525 – $626,350$250,500 – $626,350$501,050 – $751,60037%Over $626,350Over $626,350Over $751,6002025 Tax BracketsSource: IRS Rev. Proc. 2024-40.

A common misconception is that when you get into a higher tax bracket, all your income is taxed at the higher rate and you’re better off not having the extra income. That’s not true. Tax brackets work incrementally. If you’re $1,000 into the next tax bracket, only $1,000 is taxed at the higher rate. It doesn’t affect the income in the previous brackets.

For example, someone single with a $70,000 AGI in 2024 will pay:

First 14,600 (the standard deduction)0%Next $11,60010%Next $35,550 ($47,150 – $11,600)12%Final $8,25022%Progressive Tax RatesThis person is in the 22% tax bracket but only a tiny fraction of the $70,000 AGI is taxed at 22%. Most of the income is taxed at 0%, 10%, and 12%. The blended tax rate is only 10.3%. If this person doesn’t earn the final $8,250, he or she is in the 12% bracket instead of the 22% bracket but the blended tax rate only goes down slightly from 10.3% to 8.8%. Making the extra income doesn’t cost this person more in taxes than the extra income.

Don’t be afraid of going into the next tax bracket.

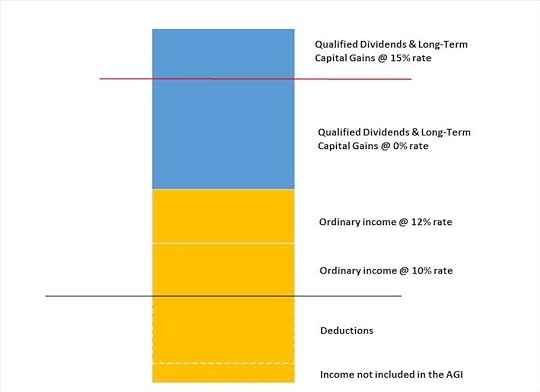

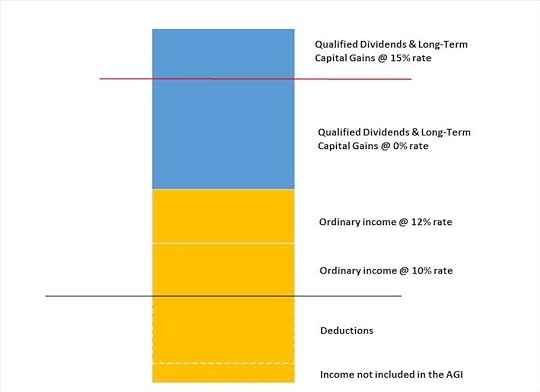

2024 2025 Capital Gains TaxWhen your other taxable income (after deductions) plus your qualified dividends and long-term capital gains are below a cutoff, you will pay 0% federal income tax on your qualified dividends and long-term capital gains under this cutoff.

This is illustrated by the chart below. Taxable income is the part above the black line, after subtracting deductions. A portion of the qualified dividends and long-term capital gains is taxed at 0% when the other taxable income plus these qualified dividends and long-term capital gains are under the red line.

The red line is close to the top of the 12% tax bracket but they don’t line up exactly.

20242025Single or Married Filing Separately$47,025$48,350Head of Household$63,000$64,750Married Filing Jointly$94,050$96,700Maximum Zero Rate Amount for Qualified Dividends and Long-term Capital GainsSource: IRS Rev. Proc. 2023-34, Rev. Proc. 2024-40.

For example, suppose a married couple filing jointly has $70,000 in other taxable income (after deductions) and $25,000 in qualified dividends and long-term capital gains in 2024. The maximum zero rate amount cutoff is $94,050. $24,050 of the qualified dividends and long-term capital gains ($94,050 – $70,000) is taxed at 0%. The remaining $25,000 – $24,050 = $950 is taxed at 15%

A similar threshold exists on the upper end for qualified dividends and long-term capital gains. When your other taxable income (after deductions) plus your qualified dividends and long-term capital gains are above a cutoff, you will pay 20% federal income tax instead of 15% on your qualified dividends and long-term capital gains above this cutoff.

20242025Single$518,900$533,400Head of Household$551,350$566,700Married Filing Jointly$583,750$600,050Married Filing Separately$291,850$300,000Maximum 15% Rate Amount for Qualified Dividends and Long-term Capital GainsSource: IRSRev. Proc. 2023-34, Rev. Proc. 2024-40.

Net Investment Income TaxNet Investment Income Tax (NIIT) is a 3.8% tax on the portion of interest, dividends, and capital gains that makes your modified adjustable gross income exceed these thresholds:

MAGI ThresholdSingle$200,000Head of Household$200,000Married Filing Jointly$250,000Married Filing Separately$125,000Net Investment Income Tax MAGI ThresholdThese thresholds are fixed by law. They are not adjusted for inflation. You pay a 3.8% tax on the amount your MAGI exceeds these thresholds or your total interest, dividends, and capital gains, whichever is less.

Suppose you’re married filing jointly and you have $300,000 MAGI, which includes $10,000 in interest, dividends, and capital gains. Although your MAGI exceeds the $250,000 threshold by $50,000, you will pay 3.8% in NIIT on only $10,000 because you have only $10,000 in net investment income.

Suppose you’re married filing jointly and you have $260,000 MAGI, which includes $150,000 in interest, dividends, and capital gains. Although you have $150,000 in net investment income, you will pay 3.8% in NIIT only on $10,000 because your MAGI exceeds the $250,000 threshold by only $10,000.

2024 2025 Estate and Trust Tax BracketsEstates and trusts have different tax brackets than individuals. These apply to non-grantor trusts and estates that retain income as opposed to distributing the income to beneficiaries. Grantor trusts (including the most common revocable living trusts) don’t pay taxes separately. The income of a grantor trust is taxed to the grantor at the grantor’s tax brackets.

Here are the tax brackets for estates and trusts in 2024 and 2025:

2024202510%$0 – $3,100$0 – $3,15024%$3,100 – $11,150$3,150 – $11,45035%$11,150 – $15,200$11,450 – $15,65037%over $15,200over $15,650Estate and Trust Tax BracketsSource: IRS Rev. Proc. 2023-34, Rev. Proc. 2024-40.

2024 2025 Qualified Charitable Distributions (QCD) LimitPeople older than 70-1/2 can make Qualified Charitable Distributions (QCD) from their Traditional IRA directly to qualifying charitable organizations. QCDs count toward the Required Minimum Distribution (RMD).

Your total QCDs can’t exceed $105,000 in 2024. The limit will go up to $108,000 in 2025.

The QCD limit is per person. If you’re married, both you and your spouse can make QCDs up to the limit separately from your respective IRAs.

Source: IRS Notice 2023-75, author’s calculations.

2024 2025 2026 Medicare Part B and Part D IRMAAPeople on Medicare Part B and Part D pay a higher Medicare premium when their Modified Adjusted Gross Income from two years ago crosses certain thresholds. I track these in Medicare Part B IRMAA Premium MAGI Brackets.

2024 2025 Gift Tax ExclusionEach person can give another person up to a set amount in a calendar year without having to file a gift tax form. Not that filing a gift tax form is onerous, but many people avoid it if they can. This gift tax exclusion amount will increase from $18,000 in 2024 to $19,000 in 2025.

20242025Gift Tax Exclusion$18,000$19,000Gift Tax ExclusionSource: IRS Rev. Proc. 2023-34, Rev. Proc. 2024-40.

The gift tax exclusion is counted by each giver to each recipient. As a giver, you can give up to $18,000 each in 2024 to an unlimited number of people without having to file a gift tax form. If you give $18,000 to each of your 10 grandkids in 2024, you still won’t be required to file a gift tax form. Any recipient can also receive a gift from an unlimited number of people. If a grandchild receives $18,000 from each of his or her four grandparents in 2024, no taxes or tax forms will be required.

2024 2025 Savings Bonds Tax-Free Redemption for College ExpensesIf you cash out U.S. Savings Bonds (Series I or Series EE) for college expenses or transfer to a 529 plan, your modified adjusted gross income must be under certain limits to get a tax exemption on the interest. See Cash Out I Bonds Tax Free For College Expenses Or 529 Plan.

Here are the income limits in 2024 and my estimates for 2025. The limits are in a phase-out range. You get a full exemption if your income is below the lower number in the range. You get no exemption if your income is above the higher number in the range. You get a partial exemption if your income falls within the range.

20242025Single, Head of Household$96,800 – $111,800$99,500 – $114,500Married Filing Jointly$145,200 – $175,200$149,250 – $179,250Income Limit for Tax-Free Savings Bond Redemption for Higher EducationSource: IRS Rev. Proc. 2023-34, Rev. Proc. 2024-40.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2024 2025 Tax Brackets, Standard Deduction, Capital Gains, QCD appeared first on The Finance Buff.

August 30, 2024

2024 2025 Cap on Paying Back ACA Health Insurance Subsidy

[Updated on August 30, 2024.]

The ACA health insurance subsidy, aka the premium tax credit, is set up such that, for the most part, it doesn’t matter how much subsidy you receive upfront when you enroll. The upfront subsidy is only an estimate. The final subsidy will be squared up when you file your tax return next year.

If you didn’t receive the subsidy when you enrolled but your actual income qualifies, you get the subsidy as a tax credit when you file your tax return. If the government paid more subsidies than your actual income qualifies for, you pay back the difference on your tax return.

Repayment CapThere’s a cap on how much you need to pay back. The cap varies depending on your Modified Adjusted Gross Income (MAGI) relative to the Federal Poverty Level (FPL) and your tax filing status. It’s also adjusted for inflation each year. Here are the caps on paying back the subsidy for 2024 and 2025.

MAGI2024 Coverage2025 Coverage< 200% FPLSingle: $375Other: $750Single: $375

Other: $750< 300% FPLSingle: $950

Other: $1,900Single: $975

Other: $1,950< 400% FPLSingle: $1,575

Other: $3,150Single: $1,625

Other: $3,250>= 400% FPLNo CapNo CapACA APTC Repayment Cap

Source: IRS Rev. Proc. 2023-34, author’s calculations.

No Cap Above 400% of FPLThe repayment caps in 2024 and 2025 apply only when your actual income is below 400% of FPL. There’s no repayment cap if your actual income exceeds 400% of FPL — you will have to pay back 100% of the difference between what you received and what your actual income qualifies for.

Large Change in IncomeThe caps are also set sufficiently high such that the amount you need to pay back will fall below the cap unless there’s a big difference between your actual income and your estimated income at the time of enrollment.

For example, suppose you’re married filing jointly and you estimated your income would be $50,000 in 2024 when you enrolled. Suppose by the time you file your tax return, your income turns out to be $60,000. Because your income is $10,000 higher than you originally estimated, you qualify for a lower subsidy now. You will be required to pay back the $1,596 difference. The cap doesn’t really help you because this $1,596 difference is well under the $3,150 repayment cap.

In addition, because you’re required to notify the healthcare marketplace of your income changes during the year in a timely manner so that they can adjust your advance subsidy, normally the difference between the advance subsidy you received and the subsidy you finally qualify for should be well under the cap. The cap helps only when your income increases close to the end of the year to make it too late to adjust your advance subsidy.

Easier for SinglesStill, a late income change can happen, and the change can be large enough to make the difference in the health insurance subsidy higher than the repayment cap. This is true especially when you’re single with a lower repayment cap.

For example, suppose you’re single and you estimated your income would be $30,000 in 2024 when you enrolled. Suppose in December 2024 you decide to convert $20,000 from a Traditional IRA to a Roth IRA. This pushes your income to $50,000. The extra $20,000 income lowers your health insurance subsidy by $2,866, but because your repayment cap is $1,575, you only need to pay back $1,575. You get to keep the other $1,291. In this case, you’re better off asking for the subsidy upfront during enrollment. If you only wait until you file your tax return, you won’t benefit from the repayment cap.

Bottom line: You should try to estimate your income conservatively and qualify for as much subsidy as you can upfront when you enroll. Maybe it won’t help. Maybe it will.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2024 2025 Cap on Paying Back ACA Health Insurance Subsidy appeared first on The Finance Buff.

August 22, 2024

How to Keep a Google Voice Number Permanent for 2FA

It was reported in the news that an obscure background-check company National Public Data was hacked. Hackers published on the dark web millions of stolen names, dates of birth, Social Security Numbers, current and previous addresses, phone numbers, and email addresses.

This hack follows many other hacks. You should assume by now that your name, date of birth, Social Security Number, address, phone number, and email address are all out in the open. So freeze your credit and protect your tax return (see How To Freeze and Unfreeze Your Credit With Experian, Equifax, and TransUnion and Stop Tax Return Fraud: Sign Up for the IRS IP PIN Program).

Password Reset AttackWe should also realize that many financial institutions use this same set of personal information to handle password resets. Thieves don’t need to crack your complicated long password when they can easily reset the password by giving your name, date of birth, Social Security Number, and zip code.

The best practice to secure your financial accounts is to use security hardware for 2-factor authentication (see Security Hardware for Vanguard, Fidelity, and Schwab Accounts). However, most banks and credit unions don’t support security hardware, which is another reason to ditch banks and use a broker.

Many financial institutions will send a one-time code to the phone number on file. In that case, as someone said on the Bogleheads forum, the security of your account rests in the hands of the customer service rep of your cell phone provider.

If someone has access to my phone number + easy to discover tidbits of information about me (name, date of birth, social security number, and home zip code). They can get my username, reset password, log in to the account, and conduct business as normal. Is that true? Yes, I have tried it myself (and maybe you should give it a try too).

If someone convinces your cell phone provider that you lost your phone, or they trick you into reading them the one-time code from the cell phone provider, they can transfer your phone number to a phone that they control. Now the security codes from your financial accounts will go to their phone. They reset your password and gain access to your accounts.

Use Google VoiceOne way to prevent your phone number from being transferred away is to use a Google Voice number for your financial accounts. Google Voice gives you a number that can receive text messages. The messages appear in the Google Voice app or on Google Voice’s website. A Google Voice number can be transferred to another provider only by logging into your Google account. Your Google Voice number is secure after you secure your Google account with a hardware security key.

Google requires some outbound activities on the Google Voice number once in a while to keep the number active. Google will revoke the number if they don’t see such activities. The required activities include:

Making a call or answering a callSending a text messageListening to the voicemailOnly receiving text messages doesn’t count. Google sends a warning email if they don’t see any of these activities periodically. They give you 30 days to generate the required activities to keep your Google Voice number.

Make Google Voice Number PermanentGenerating the required outbound activities after receiving a warning email works fine. Still, it would be a bummer to lose the Google Voice number that you use for important financial accounts if you miss the deadline. There’s a way to make your Google Voice number permanent and not risk having it revoked by Google. It takes a one-time effort and costs a little money but it’s worth it.

Here’s what you need:

A spare old unlocked phoneA month of minimal cell phone service on a new lineA $20 payment to GoogleThe idea is that you activate a new line for minimal service from a cell phone provider and you transfer (“port”) that new phone number to Google Voice. Google Voice treats a ported-in number as yours to keep. They won’t take it away even if you don’t have any outbound activities on that number.

As a bonus, after you port in a new number to Google Voice, you can keep your original Google Voice number as a secondary number in your account, which is also not subject to the outbound activity requirements. This gives you two permanent Google Voice numbers. You can use one number and have your spouse use the other number, or you can use one number for financial accounts and the other number for non-financial accounts.

You can add a new line for a month to the family plan with your current cell phone provider. If that costs too much, several low-cost cell phone providers offer talk-and-text plans for $10/month or less. They’ll send you a SIM card if your spare old phone needs a SIM card. Or they can work with eSIM if your old phone supports eSIM. You only need to activate the new line and confirm it’s working before you ask Google to port that number to Google Voice.

You’ll need the account number and the port-out PIN from the cell phone provider. Search for the name of your provider and “port-out PIN” to find out how to obtain that information. Google charges $20 for porting the number. It takes 1-2 days to complete. Google will send an email when it’s done. That email also tells you how to keep your original Google Voice number as a permanent secondary number. You can test your new Google Voice number by texting to it and seeing the text in the Google Voice app or website.

I did this last month. Getting a new phone number with minimal service on a spare old phone and porting the number to Google Voice took some legwork. It cost less than $30 and now I have two permanent Google Voice numbers. Knowing those numbers won’t be taken away makes it worth the effort.

***

I use a Google Voice number as the phone number on file in all my financial accounts. Even if an account supports security hardware or an authenticator app, it often still sends security codes and alerts to the phone number on file. I want that phone number securely under my control.

I turn on 2-factor authentication in all accounts:

1. If the account supports security hardware (Yubikey or Symantec VIP token), I use security hardware.

2. If the account supports authenticator apps (Google Authenticator, Microsoft Authenticator, Authy, …), I use an authenticator app.

3. If an account only supports sending security codes by text message, I give my Google Voice number and receive the code in the Google Voice app.

4. If an account doesn’t accept a Google Voice number, I close my account.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Keep a Google Voice Number Permanent for 2FA appeared first on The Finance Buff.

August 14, 2024

2025 Social Security Cost of Living Adjustment (COLA)

Retirees on Social Security receive an increase of their Social Security benefits each year known as the Cost of Living Adjustment or COLA. The COLA was 3.2% in 2024. Retirees on Social Security will once again receive a COLA in 2025 but it won’t be as big as the one in 2024 because inflation has cooled down.

Table of ContentsAutomatic Link to InflationCPI-WQ3 Average2025 Social Security COLAMedicare PremiumsRoot for a Lower COLAAutomatic Link to InflationSome retirees think the COLA is given at the discretion of the President or Congress and they want their elected officials to take care of seniors by declaring a higher COLA. They blame the President or Congress when they think the increase is too small.

It was done that way before 1975 but the COLA has been automatically linked to inflation for nearly 50 years. How much the COLA will be is determined strictly by the inflation numbers. The COLA is high when inflation is high. It’s low when inflation is low. There’s no COLA when inflation is zero or negative, which happened in 2010, 2011, and 2016.

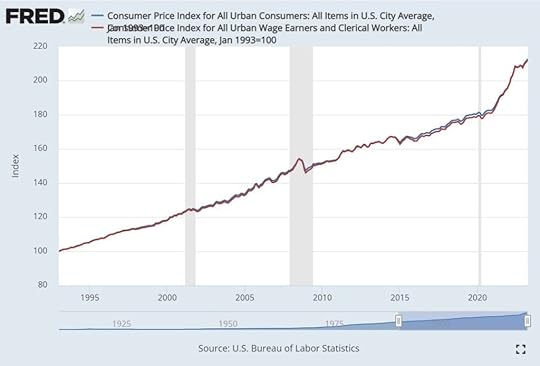

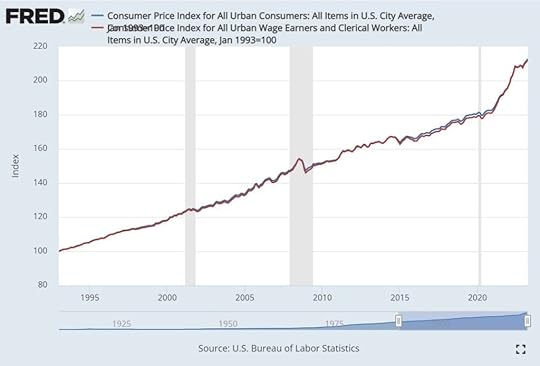

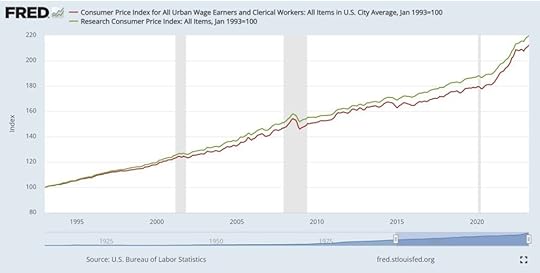

CPI-WSpecifically, the Social Security COLA is determined by the increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). CPI-W is a separate index from the Consumer Price Index for All Urban Consumers (CPI-U), which is more often referenced by the media when they talk about inflation.

CPI-W tracks inflation experienced by workers. CPI-U tracks inflation experienced by consumers. There are some minor differences in how much weight different goods and services have in each index but CPI-W and CPI-U look practically identical when you put them in a chart.

CPI-W and CPI-U 1993-2023

CPI-W and CPI-U 1993-2023The red line is CPI-W and the blue line is CPI-U. They differed by only smidges in 30 years.

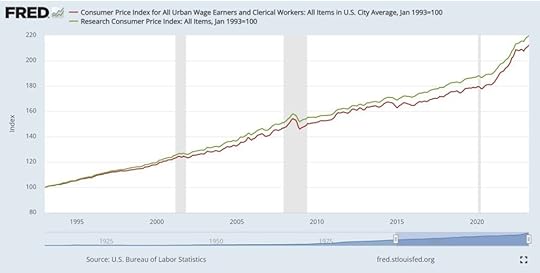

There’s also a research CPI index called the Consumer Price Index for Americans 62 years of age and older, or R-CPI-E. This index weighs more by the spending patterns of older Americans. Some researchers argue that the Social Security COLA should use R-CPI-E, which has increased more than CPI-W in the last 30 years.

CPI-W and R-CPI-E 1993-2023

CPI-W and R-CPI-E 1993-2023The green line is R-CPI-E. The red line is CPI-W. R-CPI-E outpaced CPI-W in 30 years between 1993 and 2023 but not by much. Had the Social Security COLA used R-CPI-E instead of CPI-W, Social Security benefits would’ve been higher by 0.1% per year, or a little over 3% after 30 years. That’s still not much difference.

Regardless of which exact CPI index is used to calculate the Social Security COLA, it’s subject to the same overall price environment. Congress chose CPI-W 50 years ago. That’s the one we’re going with.

Q3 AverageMore specifically, Social Security COLA for next year is calculated by the increase in the average of CPI-W from the third quarter of last year to the third quarter of this year. You get the CPI-W numbers in July, August, and September. Add them up and divide by three. You do the same for July, August, and September last year. Compare the two numbers and round the change to the nearest 0.1%. That’ll be the Social Security COLA for next year.

2025 Social Security COLAThe average of CPI-W from the third quarter in 2024 increased by 2.5% compared to the average of CPI-W from the third quarter in 2023. Therefore, the 2025 Social Security COLA will be 2.5%. It is lower than the 3.2% Social Security COLA in 2024 because inflation has come down.

Medicare PremiumsIf you’re on Medicare, the Social Security Administration automatically deducts the Medicare premium from your Social Security benefits. The Social Security COLA is given on the “gross” Social Security benefits before deducting the Medicare premium and any tax withholding.

Medicare announced that the standard Part B premium will increase from $174.60/month in 2024 to $185/month in 2025. The increase in healthcare costs is part of the cost of living that the COLA is intended to cover. You’re still getting the full COLA even though a part of the COLA will be used toward the increase in Medicare premiums.

Retirees with a higher income pay more than the standard Medicare premiums. This is called Income-Related Monthly Adjustment Amount (IRMAA). I cover IRMAA in 2024 2025 2026 Medicare IRMAA Premium MAGI Brackets.

Root for a Lower COLAPeople intuitively want a higher COLA but a higher COLA can only be caused by higher inflation. Higher inflation is bad for retirees.

Whether inflation is high or low, your Social Security benefits will have the same purchasing power. You should think more about the purchasing power of your savings and investments outside Social Security. When inflation is high, even though your Social Security benefits get a bump, your other money loses more value to inflation. Your savings and investments outside Social Security will last longer when inflation is low.

You want a lower Social Security COLA, which means lower inflation and lower expenses.

Some people say that the government deliberately under-reports inflation. Even if that’s the case, you still want a lower COLA.

Suppose the true inflation for seniors is 3% higher than the inflation numbers reported by the government. If you get a 3% COLA when the true inflation is 6% and you get a 7% COLA when the true inflation is 10%, you are much better off with a lower 3% COLA together with 6% inflation than getting a 7% COLA together with 10% inflation. Your Social Security benefits lag inflation by the same amount either way, but you’d rather your other money outside Social Security loses to 6% inflation than to 10% inflation.

Root for lower inflation and lower Social Security COLA when you are retired.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2025 Social Security Cost of Living Adjustment (COLA) appeared first on The Finance Buff.

2025 Social Security Cost of Living Adjustment (COLA) Projection

Retirees on Social Security receive an increase of their Social Security benefits each year known as the Cost of Living Adjustment or COLA. The COLA was 3.2% in 2024. Retirees on Social Security will once again receive a COLA in 2025 but it won’t be as big as the one in 2024 because inflation has cooled down.

Table of ContentsAutomatic Link to InflationCPI-WQ3 Average2025 Social Security COLAMedicare PremiumsRoot for a Lower COLAAutomatic Link to InflationSome retirees think the COLA is given at the discretion of the President or Congress and they want their elected officials to take care of seniors by declaring a higher COLA. They blame the President or Congress when they think the increase is too small.

It was done that way before 1975 but the COLA has been automatically linked to inflation for nearly 50 years. How much the COLA will be is determined strictly by the inflation numbers. The COLA is high when inflation is high. It’s low when inflation is low. There’s no COLA when inflation is zero or negative, which happened in 2010, 2011, and 2016.

CPI-WSpecifically, the Social Security COLA is determined by the increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). CPI-W is a separate index from the Consumer Price Index for All Urban Consumers (CPI-U), which is more often referenced by the media when they talk about inflation.

CPI-W tracks inflation experienced by workers. CPI-U tracks inflation experienced by consumers. There are some minor differences in how much weight different goods and services have in each index but CPI-W and CPI-U look practically identical when you put them in a chart.

CPI-W and CPI-U 1993-2023

CPI-W and CPI-U 1993-2023The red line is CPI-W and the blue line is CPI-U. They differed by only smidges in 30 years.

There’s also a research CPI index called the Consumer Price Index for Americans 62 years of age and older, or R-CPI-E. This index weighs more by the spending patterns of older Americans. Some researchers argue that the Social Security COLA should use R-CPI-E, which has increased more than CPI-W in the last 30 years.

CPI-W and R-CPI-E 1993-2023

CPI-W and R-CPI-E 1993-2023The green line is R-CPI-E. The red line is CPI-W. R-CPI-E outpaced CPI-W in 30 years between 1993 and 2023 but not by much. Had the Social Security COLA used R-CPI-E instead of CPI-W, Social Security benefits would’ve been higher by 0.1% per year, or a little over 3% after 30 years. That’s still not much difference.

Regardless of which exact CPI index is used to calculate the Social Security COLA, it’s subject to the same overall price environment. Congress chose CPI-W 50 years ago. That’s the one we’re going with.

Q3 AverageMore specifically, Social Security COLA for next year is calculated by the increase in the average of CPI-W from the third quarter of last year to the third quarter of this year. You get the CPI-W numbers in July, August, and September. Add them up and divide by three. You do the same for July, August, and September last year. Compare the two numbers and round the change to the nearest 0.1%. That’ll be the Social Security COLA for next year.

2025 Social Security COLAWe won’t have all the CPI-W data for Q3 2024 until October 10, 2024 but we can make projections based on the data we have now.

If consumer prices in August and September 2024 stay at the same level as in July 2024, the 2025 Social Security COLA will be 2.4%.

If consumer prices in August and September 2024 go up at a pace of 3% annualized (approximately 0.25% in each month), the 2025 Social Security COLA will be 2.7%.

I estimate that the 2025 Social Security COLA will be between 2.4% and 2.7%. This is lower than the 3.2% Social Security COLA in 2024 because inflation has come down.

Medicare PremiumsIf you’re on Medicare, the Social Security Administration automatically deducts the Medicare premium from your Social Security benefits. The Social Security COLA is given on the “gross” Social Security benefits before deducting the Medicare premium and any tax withholding.

Medicare announces the premium for next year around the same time Social Security announces the COLA but not necessarily on the same day. The increase in healthcare costs is part of the cost of living that the COLA is intended to cover. You’re still getting the full COLA even though a part of the COLA will be used toward the increase in Medicare premiums.

Retirees with a higher income pay more than the standard Medicare premiums. This is called Income-Related Monthly Adjustment Amount (IRMAA). I cover IRMAA in 2024 2025 2026 Medicare IRMAA Premium MAGI Brackets.

Root for a Lower COLAPeople intuitively want a higher COLA but a higher COLA can only be caused by higher inflation. Higher inflation is bad for retirees.

Whether inflation is high or low, your Social Security benefits will have the same purchasing power. You should think more about the purchasing power of your savings and investments outside Social Security. When inflation is high, even though your Social Security benefits get a bump, your other money loses more value to inflation. Your savings and investments outside Social Security will last longer when inflation is low.

You want a lower Social Security COLA, which means lower inflation and lower expenses.

Some people say that the government deliberately under-reports inflation. Even if that’s the case, you still want a lower COLA.

Suppose the true inflation for seniors is 3% higher than the inflation numbers reported by the government. If you get a 3% COLA when the true inflation is 6% and you get a 7% COLA when the true inflation is 10%, you are much better off with a lower 3% COLA together with 6% inflation than getting a 7% COLA together with 10% inflation. Your Social Security benefits lag inflation by the same amount either way, but you’d rather your other money outside Social Security loses to 6% inflation than to 10% inflation.

Root for lower inflation and lower Social Security COLA when you are retired.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2025 Social Security Cost of Living Adjustment (COLA) Projection appeared first on The Finance Buff.

August 7, 2024

Ditch Banks — Go With Money Market Funds and Treasuries

Banks and credit unions offer savings accounts and CDs. Brokers such as Vanguard, Fidelity, and Charles Schwab offer money market funds and Treasuries. They serve similar purposes at a high level. Both a savings account and a money market fund allow flexible deposits and withdrawals. Both CDs and Treasuries offer a fixed interest rate for a fixed term.

Banks and Credit UnionsBrokersFlexible Deposits and WithdrawalsHigh Yield Savings AccountMoney Market FundFixed TermCDsTreasuriesWhile most discussions on these products from banks and brokers center around having FDIC insurance or not (see No FDIC Insurance – Why a Brokerage Account Is Safe), many people don’t realize that there’s a fundamental difference between the roles banks and brokers play. I mentioned this difference in my Guide to Money Market Fund & High Yield Savings Account. It’s worth highlighting it again.

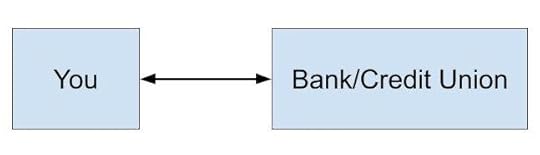

The fundamental difference is that banks and credit unions offer a two-party private contract while a broker serves as an intermediary between you and the public market.

Two-Party Private Contract

A two-party private contract means anything goes as long as one party makes the other party agree to the terms. If a bank gets you to agree to a 0.04% rate in a savings account or a 0.05% rate in a 10-month CD (these are actual current rates from a large bank), that’s what you’ll get regardless of what the rate should be. The bank sets the rate. They don’t need to justify it. You get a bad contract if you aren’t aware of the going rate.

A bad contract doesn’t have to be this obvious. It’s been over a year now since the Fed raised the short-term interest rates above 5%. The rate on a “good” online high-yield savings account such as the one from Ally Bank is currently 4.2% while a money market fund pays 5% or more. It’s 4.2% from the bank only because the bank says so. You’re paying a “familiarity penalty” when you stay with Ally.

I’m not picking on Ally specifically. It works the same at Marcus, Synchrony, Amex, Discover, Capital One, or Barclays. Ken Tumin, the founder of DepositAccounts.com, made this observation in April 2024:

The well-established online banks are also benefiting from customer inertia. Their online savings account rates are about 100 bps under what you can get from MMFs, T-bills and the top OSAs. https://t.co/n6p4DNr93e

— Ken Tumin (@KenTumin) April 14, 2024

If you take a step back and ask why banks can benefit from customer inertia in the first place, you realize that’s the nature of a two-party private contract. Customers must take the initiative to break out of a bad contract.

Some banks play tricks by offering a new savings account under a different name with competitive rates while keeping the rate low on the existing savings accounts. The rate is low on the existing account only because that’s the contract you agreed to. The bank isn’t obligated to move you to the new program because that’s not in the contract. Nor does the bank have to tell you that you can switch to the new program to get a higher rate. It’s up to you to find out and take action.

Rates at many large credit unions aren’t any better. I’m a member of a well-regarded credit union. It’s the largest credit union in the country by far, with three times the assets of the second-largest credit union. The rate on its savings account is 1.5% when you have $50,000 in the account. That’s 3.5% lower than the yield in a money market fund.

A good contract today can turn into a bad contract tomorrow. How the contract will change is in the contract itself. A bank offers 5.0% APY on a 13-month CD today. That’s an OK rate but what happens after 13 months? You agree in the contract it will automatically renew to a 12-month CD at a rate set by the bank at that time unless you take specific actions to stop it within a short window. Guess what rate the bank will set on its 12-month CD? Almost always a bad one. It works this way because you agreed to the contract.

When you have a two-party private contract, your interest is in direct conflict with the other party in the contract. The onus is on you to know whether the contract is good or bad. It’s on you to watch when a good contract turns into a bad contract. Caveat emptor. You’ll have to jump from contract to contract if you don’t want to get stuck in a bad contract.

Some people are more alert in monitoring and jumping. They have a chance to “beat the market” but they pay for it with a heavy mental workload and time spent on opening new accounts and closing old accounts. Many fail to be vigilant at some point. They start paying the “familiarity penalty” because it’s too tiring otherwise.

Market Intermediary

A broker acts as an intermediary. They get you the market rate and take a cut. A broker doesn’t set the rate. The market does. The broker only sets its cut.

A money market fund gets you the market rate on money market securities minus the cut by the fund manager. Some fund managers take a bigger cut than others but the difference between major players is much smaller and more stable than the difference between rates offered by different banks and credit unions. If you use a money market fund with the smallest cut, such as one from Vanguard, you almost guarantee you’ll have the best rate in a money market fund at all times.

You still pay a “familiarity penalty” when you use a money market fund from Fidelity or Schwab versus one from Vanguard but the difference is in the 0.2%-0.3% range whereas the “familiarity penalty” in bank savings accounts can be more than 1%. The “familiarity penalty” is zero or negligible in buying Treasuries through Fidelity, Schwab, or Vanguard.

Treasuries don’t trick you into renewing at a bad rate. They automatically pay out at maturity. You’ll get the market rate when you buy again. If the broker offers the “auto roll” feature and you enable it at your choice, your Treasuries will automatically renew at the market rate. You can rest assured that you won’t be cheated.

Money market funds and Treasuries paid very little when the Fed kept interest rates at zero and ran several rounds of Quantitative Easing a few years ago. That wasn’t money market funds’ fault or brokers’ fault. Those were the market rates at that time. Like investing in index funds, you give up the dream of “beating the market” when you put your money in money market funds and Treasuries but you also consistently get the market rates at all times. It doesn’t require keeping your guard up, monitoring carefully, or jumping.

If you want to consistently earn a good yield with low maintenance, ditch banks and credit unions. If you normally keep money in a savings account at a bank or a credit union, put the money in a money market fund. Here are some choices at Vanguard, Fidelity, and Schwab:

VanguardFidelitySchwabDefaultVMFXXSPAXXNoneHigher yield, higher riskSPRXX or FZDXXSWVXXHigher quality, higher state tax-exemptionVUSXXFDLXXSNSXXSelect Money Market Funds at Major Retail BrokersIf you normally buy a CD from a bank or a credit union, buy a Treasury of the same term at Vanguard, Fidelity, or Schwab. See How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy Treasury Bills & Notes On the Secondary Market.

I used to have many accounts with banks and credit unions. I have only $60 in bank accounts now. My cash is in money market funds and Treasuries in a brokerage account.

The Fed has signaled that they may lower interest rates soon. I don’t think they will cut rates all the way back to zero again. If one day banks and credit unions start paying more on their savings accounts and CDs than money market funds and Treasuries, which I doubt will happen, I will still stick to money market funds and Treasuries because I like the transparency and fairness. I’d rather get the market rate at all times than count on the benevolence of a bank or a credit union.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Ditch Banks — Go With Money Market Funds and Treasuries appeared first on The Finance Buff.

July 22, 2024

2024 2025 Tax Brackets, Standard Deduction, Capital Gains, etc.

My other post listed 2024 2025 401k and IRA contribution and income limits. I also calculated the inflation-adjusted tax brackets and some of the most commonly used numbers in tax planning for 2025 using the published inflation numbers and the same formula prescribed in the tax law.

Table of Contents2024 2025 Standard Deduction2024 2025 Tax Brackets2024 2025 Capital Gains Tax2024 2025 Estate and Trust Tax Brackets2024 2025 Gift Tax Exclusion2024 2025 Savings Bonds Tax-Free Redemption for College Expenses2024 2025 Standard DeductionYou don’t pay federal income tax on every dollar of your income. You deduct an amount from your income before you calculate taxes. About 90% of all taxpayers take the standard deduction. The other ~10% itemize deductions when their total deductions exceed the standard deduction. In other words, you’re deducting a larger amount than your allowed deductions when you take the standard deduction. Don’t feel bad about taking the standard deduction!

The basic standard deduction in 2024 and my estimate for 2025 are:

20242025 estimatesSingle or Married Filing Separately$14,600$15,050Head of Household$21,900$22,500Married Filing Jointly$29,200$30,100Basic Standard DeductionSource: IRS Rev. Proc. 2023-34, author’s calculations.

People who are age 65 and over have a higher standard deduction than the basic standard deduction.

20242025 estimatesSingle, age 65 and over$16,550$17,050Head of Household, age 65 and over$23,850$24,550Married Filing Jointly, one person age 65 and over$30,750$31,700Married Filing Jointly, both age 65 and over$32,300$33,300Standard Deduction for age 65 and overSource: IRS Rev. Proc. 2023-34, author’s calculations.

People who are blind have an additional standard deduction.

20242025 estimatesSingle or Head of Household, blind+$1,950+$2,000Married Filing Jointly, one person is blind+$1,550+$1,600Married Filing Jointly, both are blind+$3,100+$3,200Additional Standard Deduction for BlindnessSource: IRS Rev. Proc. 2023-34, author’s calculations.

2024 2025 Tax BracketsThe tax brackets are based on taxable income, which is AGI minus various deductions. The tax brackets in 2024 are:

SingleHead of HouseholdMarried Filing Jointly10%$0 – $11,600$0 – $16,550$0 – $23,20012%$11,600 – $47,150$16,550 – $63,100$23,200 – $94,30022%$47,150 – $100,525$63,100 – $100,500$94,300 – $201,05024%$100,525 – $191,950$100,500 – $191,950$201,050 – $383,90032%$191,950 – $243,725$191,950 – $243,700$383,900 – $487,45035%$243,725 – $609,350$243,700 – $609,350$487,450 – $731,20037%Over $609,350Over $609,350Over $731,2002024 Tax BracketsSource: IRS Rev. Proc. 2023-34.

My estimated 2025 tax brackets are:

SingleHead of HouseholdMarried Filing Jointly10%$0 – $11,950$0 – $17,050$0 – $23,90012%$11,950 – $48,550$17,050 – $64,950$23,900 – $97,10022%$48,550 – $103,500$64,950 – $103,500$97,100 – $207,00024%$103,500 – $197,600$103,500 – $197,600$207,000 – $395,20032%$197,600 – $250,925$191,950 – $250,900$395,200 – $501,85035%$250,925 – $627,300$250,900 – $627,300$501,850 – $752,75037%Over $627,300Over $627,300Over $752,750Estimated 2025 Tax BracketsSource: author’s calculations.

A common misconception is that when you get into a higher tax bracket, all your income is taxed at the higher rate and you’re better off not having the extra income. That’s not true. Tax brackets work incrementally. If you’re $1,000 into the next tax bracket, only $1,000 is taxed at the higher rate. It doesn’t affect the income in the previous brackets.

For example, someone single with a $70,000 AGI in 2024 will pay:

First 14,600 (the standard deduction)0%Next $11,60010%Next $35,550 ($47,150 – $11,600)12%Final $8,25022%Progressive Tax RatesThis person is in the 22% tax bracket but only a tiny fraction of the $70,000 AGI is taxed at 22%. Most of the income is taxed at 0%, 10%, and 12%. The blended tax rate is only 10.3%. If this person doesn’t earn the final $8,250, he or she is in the 12% bracket instead of the 22% bracket but the blended tax rate only goes down slightly from 10.3% to 8.8%. Making the extra income doesn’t cost this person more in taxes than the extra income.

Don’t be afraid of going into the next tax bracket.

2024 2025 Capital Gains TaxWhen your other taxable income (after deductions) plus your qualified dividends and long-term capital gains are below a cutoff, you will pay 0% federal income tax on your qualified dividends and long-term capital gains under this cutoff.

This is illustrated by the chart below. Taxable income is the part above the black line, after subtracting deductions. A portion of the qualified dividends and long-term capital gains is taxed at 0% when the other taxable income plus these qualified dividends and long-term capital gains are under the red line.

The red line is close to the top of the 12% tax bracket but they don’t line up exactly.

20242025 estimatesSingle or Married Filing Separately$47,025$48,425Head of Household$63,000$64,850Married Filing Jointly$94,050$96,850Maximum Zero Rate Amount for Qualified Dividends and Long-term Capital GainsSource: IRS Rev. Proc. 2023-34, author’s calculations.

For example, suppose a married couple filing jointly has $70,000 in other taxable income (after deductions) and $25,000 in qualified dividends and long-term capital gains in 2024. The maximum zero rate amount cutoff is $94,050. $24,050 of the qualified dividends and long-term capital gains ($94,050 – $70,000) is taxed at 0%. The remaining $25,000 – $24,050 = $950 is taxed at 15%

A similar threshold exists on the upper end for qualified dividends and long-term capital gains. When your other taxable income (after deductions) plus your qualified dividends and long-term capital gains are above a cutoff, you will pay 20% federal income tax instead of 15% on your qualified dividends and long-term capital gains above this cutoff.

20242025 estimatesSingle$518,900$534,200Head of Household$551,350$567,550Married Filing Jointly$583,750$600,950Married Filing Separately$291,850$300,450Maximum 15% Rate Amount for Qualified Dividends and Long-term Capital GainsSource: IRSRev. Proc. 2023-34, author’s calculations.

2024 2025 Estate and Trust Tax BracketsEstates and trusts have different tax brackets than individuals. These apply to non-grantor trusts and estates that retain income as opposed to distributing the income to beneficiaries. Grantor trusts (including the most common revocable living trusts) don’t pay taxes separately. The income of a grantor trust is taxed to the grantor at the grantor’s tax brackets.

Here are the tax brackets for estates and trusts in 2024 and my estimates for 2025:

20242025 estimates10%$0 – $3,100$0 – $3,15024%$3,100 – $11,150$3,150 – $11,45035%$11,150 – $15,200$11,450 – $15,65037%over $15,200over $15,650Estate and Trust Tax BracketsSource: IRS Rev. Proc. 2023-34, author’s calculations.

2024 2025 Gift Tax ExclusionEach person can give another person up to a set amount in a calendar year without having to file a gift tax form. Not that filing a gift tax form is onerous, but many people avoid it if they can. This gift tax exclusion amount will increase from $18,000 in 2024 to $19,000 in 2025.

20242025 estimateGift Tax Exclusion$18,000$19,000Gift Tax ExclusionSource: IRS Rev. Proc. 2023-34, author’s calculations.

The gift tax exclusion is counted by each giver to each recipient. As a giver, you can give up to $18,000 each in 2024 to an unlimited number of people without having to file a gift tax form. If you give $18,000 to each of your 10 grandkids in 2024, you still won’t be required to file a gift tax form. Any recipient can also receive a gift from an unlimited number of people. If a grandchild receives $18,000 from each of his or her four grandparents in 2024, no taxes or tax forms will be required.

2024 2025 Savings Bonds Tax-Free Redemption for College ExpensesIf you cash out U.S. Savings Bonds (Series I or Series EE) for college expenses or transfer to a 529 plan, your modified adjusted gross income must be under certain limits to get a tax exemption on the interest. See Cash Out I Bonds Tax Free For College Expenses Or 529 Plan.

Here are the income limits in 2024 and my estimates for 2025. The limits are in a phase-out range. You get a full exemption if your income is below the lower number in the range. You get no exemption if your income is above the higher number in the range. You get a partial exemption if your income falls within the range.

20242025 estimatesSingle, Head of Household$96,800 – $111,800$99,650 – $114,650Married Filing Jointly$145,200 – $175,200$149,500 – $179,500Income Limit for Tax-Free Savings Bond Redemption for Higher EducationSource: IRS Rev. Proc. 2023-34, author’s calculations.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2024 2025 Tax Brackets, Standard Deduction, Capital Gains, etc. appeared first on The Finance Buff.

July 21, 2024

2024 2025 401k 403b 457 IRA FSA HSA Contribution Limits

Retirement account contribution limits are adjusted for inflation each year. Inflation has moderated in recent months. Some contribution limits and income limits are projected to go up in 2025.

Before the IRS publishes the official adjustments for the next year in late October or early November, I calculate them using the published inflation numbers by the same rules the IRS uses as stipulated by law. I’ve maintained a track record of 100% accuracy ever since I started doing these calculations.

Some projections sit on a borderline. They can go a little higher or lower depending on the upcoming inflation data.

Table of Contents2024 2025 401k/403b/457/TSP Elective Deferral Limit2024 2025 Annual Additions Limit2024 2025 SEP-IRA Contribution Limit2024 2025 Annual Compensation Limit2024 2025 Highly Compensated Employee Threshold2024 2025 SIMPLE 401k and SIMPLE IRA Contribution Limit2024 2025 Traditional and Roth IRA Contribution Limit2024 2025 Deductible IRA Income Limit2024 2025 Roth IRA Income Limit2024 2025 Healthcare FSA Contribution Limit2024 2025 HSA Contribution Limit2024 2025 Saver’s Credit Income LimitAll Together2024 Tax Brackets and Standard Deduction2024 2025 401k/403b/457/TSP Elective Deferral LimitThe 401k/403b/457/TSP contribution limit is $23,000 in 2024. I estimate it will go up by $1,000 to $24,000 in 2025 (or $23,500 if inflation is low).

If you are age 50 or over by December 31, the catch-up contribution limit is $7,500 in 2024. I estimate it will go up by $500 to $8,000 in 2025 (or $7,500 if inflation is low).

If your age is 60 through 63 by December 31, 2025, your catch-up contribution limit is 150% of the normal catch-up contribution limit. It’ll be $12,000 in 2025 (or $11,250 if inflation is low).

If your prior year’s wages from the employer were over $145,000, your 2024 catch-up contribution must go to a Roth subaccount in the plan. The limit is the same at $145,000 in 2025. The IRS has temporarily suspended enforcement of this rule.

Employer match or profit-sharing contributions aren’t included in these limits. If you work for multiple employers in the same year or if your employer offers multiple plans, you have one single employee contribution limit for 401k, 403b, and the federal government’s Thrift Savings Plan (TSP) across all plans.

The 457 plan limit is separate from the 401k/403b/TSP limit. You can contribute the maximum to both a 401k/403b/TSP plan and a 457 plan.

2024 2025 Annual Additions LimitThe total contributions from both the employer and the employee to all defined contribution plans by the same employer is $69,000 in 2024. I estimate it will increase to $70,000 in 2025 (or $71,000 if inflation is high).

The age-50-or-over catch-up contribution is separate from this limit. If you work for multiple employers in the same year, you have a separate annual additions limit for each unrelated employer.

2024 2025 SEP-IRA Contribution LimitIf you have self-employment income, you can contribute a percentage of your self-employment income to a SEP-IRA. The SEP-IRA contribution limit is always the same as the annual additions limit for a 401k plan. It is $69,000 in 2024, and I estimate it will increase to $70,000 in 2025 (or $71,000 if inflation is high).

Because the SEP-IRA doesn’t allow employee contributions, unless your self-employment income is well above $200,000, you have a higher contribution limit if you use a solo 401k. See Solo 401k When You Have Self-Employment Income.

2024 2025 Annual Compensation LimitThe maximum annual compensation that can be considered for making contributions to a retirement plan is always 5x the annual additions limit. Therefore the annual compensation limit is $345,000 in 2024. I estimate it will increase to $350,000 in 2025 (or $355,000 if inflation is high).

2024 2025 Highly Compensated Employee ThresholdIf your employer limits your contribution because you’re a Highly Compensated Employee (HCE), the minimum compensation to be counted as an HCE is $155,000 in 2024. I estimate it will go up to $160,000 in 2024.

2024 2025 SIMPLE 401k and SIMPLE IRA Contribution LimitSome smaller employers offer a SIMPLE 401K or a SIMPLE IRA plan instead of a regular 401k plan. SIMPLE 401k and SIMPLE IRA plans have a lower contribution limit than standard 401k plans. The contribution limit for SIMPLE 401k and SIMPLE IRA plans is $16,000 in 2024. I estimate it will go up to $16,500 in 2025.

If an employer has fewer than 25 employees or if a larger employer contributes more to the plan, the contribution limit to their SIMPLE IRA plan is 10% higher. It will be $18,150 in 2025.

If you are age 50 or over by December 31, the catch-up contribution limit in a SIMPLE 401k or SIMPLE IRA plan is $3,500 in 2024. I estimate it will go up by $500 to $4,000 in 2025.

If your age is 60 through 63 by December 31, 2025, your catch-up contribution limit is 150% of the normal catch-up contribution limit. It’ll be $6,000 in 2025.

Employer contributions to a SIMPLE 401k or SIMPLE IRA plan aren’t included in these limits.

2024 2025 Traditional and Roth IRA Contribution LimitYou need taxable compensation (“earned income”) to contribute to a Traditional or Roth IRA but there’s no age limit. The Traditional IRA or Roth IRA contribution limit is $7,000 in 2024. It will stay the same at $7,000 in 2025.

If you are age 50 or over by December 31, the catch-up limit is $1,000 in 2024. It will stay the same at $1,000 in 2025.

The IRA contribution limit is shared between the Traditional IRA and the Roth IRA. If you contribute the maximum to a Roth IRA, you can’t contribute the same maximum again to a Traditional IRA, and vice-versa.

The IRA contribution limit and the 401k/403b/TSP or SIMPLE contribution limit are separate. You can contribute the respective maximum to both a 401k/403b/TSP/SIMPLE plan and a Traditional IRA or Roth IRA.

2024 2025 Deductible IRA Income LimitThe income limit for taking a full deduction for your contribution to a Traditional IRA while participating in a workplace retirement plan in 2024 is $77,000 for single filers and $123,000 for a married couple filing jointly. The deduction completely phases out when your income goes above $87,000 in 2024 for singles and $143,000 for married filing jointly.

The full-deduction limits will go up in 2025 to $79,000 for single filers and to $126,000 for a married couple filing jointly. The deduction will completely phase out when your income goes above $89,000 in 2025 for singles; and above $146,000 for married filing jointly.

When you’re not covered in a workplace retirement plan but your spouse is, the income limit for taking a full deduction for your contribution to a Traditional IRA is $230,000 in 2024. The deduction completely phases out when your joint income goes above $240,000 in 2024.

The full-deduction limit will go up to $237,000 in 2025. The deduction completely phases out when your joint income goes above $247,000 in 2025.

When you exceed the income limit for taking a deduction for contributing to a Traditional IRA, consider contributing to a Roth IRA instead.

2024 2025 Roth IRA Income LimitThe income limit for contributing the maximum to a Roth IRA depends on your filing status. It’s $146,000 for singles and $230,000 for married filing jointly in 2024. These limits will go up to $150,000 for singles and $237,000 for married filing jointly in 2025.

You can’t contribute anything directly to a Roth IRA when your income goes above $161,000 in 2024 for singles and $240,000 in 2024 for married filing jointly. These limits will go up to $165,000 for singles and $247,000 for married filing jointly in 2025.

Your contribution eligibility is prorated in the income phase-out range. When you exceed the income limit for contributing to a Roth IRA, consider doing the Backdoor Roth.

2024 2025 Healthcare FSA Contribution LimitThe Healthcare FSA contribution limit is $3,200 per person in 2024. It will go up to $3,300 in 2025.

Some employers allow carrying over some unused amount to the following year. The maximum amount that can be carried over to the following year is set to 20% of the contribution limit in the current tax year. As a result, the carryover limit is $640 per person in 2024. It will go up to $660 in 2025.

2024 2025 HSA Contribution LimitYou need to have a High Deductible Health Plan with no other coverage to contribute to a Health Savings Account (HSA). Not all high-deductible health insurance is HSA-eligible. Medicare or your spouse having a general-purpose healthcare FSA counts as having other coverage, which makes you ineligible to contribute to an HSA.

You don’t need taxable compensation (“earned income”) to contribute to an HSA.

The HSA contribution limit for single coverage is $4,150 in 2024. The HSA contribution limit for family coverage is $8,300 in 2024. These limits will go up to $4,300 for single coverage and $8,550 for family coverage in 2025. The new limits were announced previously in the spring. Please see HSA Contribution Limits.

Those who are 55 or older by December 31 can contribute an additional $1,000. If you are married and both of you are 55 or older by December 31, each of you can contribute the additional $1,000 but they must go into separate HSAs in each person’s name.

2024 2025 Saver’s Credit Income LimitThe income limits for receiving a Retirement Savings Contributions Credit (“Saver’s Credit”) in 2024 for married filing jointly are $46,000 (50% credit), $50,000 (20% credit), and $76,500 (10% credit). These limits in 2025 will go up to $47,500 (50% credit), $51,500 (20% credit), and $79,000 (10% credit).

The limits for singles are half of the limits for married filing jointly. The 2024 limits are $23,000 (50% credit), $25,000 (20% credit), and $38,250 (10% credit). The 2025 limits will be $23,750 (50% credit), $25,750 (20% credit), and $39,500 (10% credit)

All Together20242025 estimateIncrease401k, 403b, or 457 plan employee contributions limit$23,000$23,500 or $24,000$500 or $1,000401k, 403b, or 457 plan ages 50-59 and 64+ catch-up contributions limit$7,500$7,500 or $8,000None or $500401k, 403b, or 457 plan ages 60-63 catch-up contributions limit$7,500$11,250 or $12,000$3,750 or $4,500SIMPLE 401k or SIMPLE IRA contributions limit$16,000$16,500$500SIMPLE IRA contributions limit at certain eligible employers$17,600$18,150$550SIMPLE 401k or SIMPLE IRA ages 50-59 and 64+ catch-up contributions limit$3,500$4,000$500SIMPLE 401k or SIMPLE IRA ages 60-63 catch-up contributions limit$3,500$6,000$2,500Maximum annual additions to all defined contribution plans by the same employer$69,000$70,000 or $71,000$1,000 or $2,000SEP-IRA contributions limit$69,000$70,000 or $71,000$1,000 or $2,000Highly Compensated Employee definition$155,000$160,000$5,000Annual Compensation Limit$345,000$350,000 or $355,000$5,000 or $10,000Traditional and Roth IRA contribution limit$7,000$7,000NoneTraditional and Roth IRA age 50+ catch-up contribution limit$1,000$1,000NoneDeductible IRA income limit, single, active participant in workplace retirement plan$77,000 – $87,000$79,000 – $89,000$2,000Deductible IRA income limit, married, active participant in workplace retirement plan$123,000 – $143,000$126,000 – $146,000$3,000Deductible IRA income limit, married, spouse is active participant in workplace retirement plan$230,000 – $240,000$237,000 – $247,000$7,000Roth IRA income limit, single$146,000 – $161,000$150,000 – $165,000$4,000Roth IRA income limit, married filing jointly$230,000 – $240,000$237,000 – $247,000$7,000Healthcare FSA Contribution Limit$3,200$3,300$100HSA Contribution Limit, single coverage$4,150$4,300$150HSA Contribution Limit, family coverage$8,300$8,550$250HSA, age 55 catch-up$1,000$1,000NoneSaver’s Credit income limit, married filing jointly$46,000 (50%)$50,000 (20%)

$76,500 (10%)$47,500 (50%)

$51,500 (20%)

$79,000 (10%)$1,500 (50%)

$1,500 (20%)

$2,500 (10%)Saver’s Credit income limit, single$23,000 (50%)

$25,000 (20%)

$38,250 (10%)$23,750 (50%)

$25,750 (20%)

$39,500 (10%)$1,250 (50%)

$1,250 (20%)

$1,750 (10%)

Source: IRS Notice 2023-75, author’s calculations.

2024 Tax Brackets and Standard DeductionI also have the 2024 income tax brackets, standard deduction, capital gains, and gift tax exclusion limit. Please read 2024 Tax Brackets, Standard Deduction, Capital Gains, etc.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2024 2025 401k 403b 457 IRA FSA HSA Contribution Limits appeared first on The Finance Buff.

July 13, 2024

Brokerage Transfer Bonus Made Easy for Total Beginners

Although I stopped chasing bank and brokerage bonuses, it’s still a valid way to make some money. You can easily make $5,000 or more each year with a large enough account. The bonus can fund nice-to-have toys or experiences or simply add to your long-term investments.

I’m not saying you should or shouldn’t do it. If you’re interested but haven’t done it before, here are some pointers to help you pull it off more easily.

Table of ContentsThe Big PictureChoose a Bonus PromotionTransfer an IRAIdentify Shares to TransferOpen a New AccountSubmit Transfer RequestTurn On Dividend ReinvestmentSet Calendar RemindersThe Big PictureSome brokers want to attract new customers and more activities. Offering a bonus to actual customers can be more effective than spending millions on advertising. You receive a bonus from the broker by participating in the promotion. They get to show growth to Wall Street. Win-win.

Choose a Bonus PromotionMany promotion offers are listed in Best Brokerage Bonuses on the Doctor of Credit blog at any time. Some offers are from larger brokers you’ve heard of. Some are from smaller brokers you didn’t know. All offers require that you hold the transferred assets at the new broker for some time. I would favor offers from a larger institution with a shorter required holding period.

For instance, as I’m writing this, WeBull offers a 2% bonus with a 2-year holding period and Wells Fargo offers a $2,500 bonus for transferring $250,000. Although WeBull’s bonus is twice as large ($5,000 versus $2,500 for transferring $250,000), Wells Fargo’s promotion only requires holding the transferred assets for 90 days. You get the bonus sooner and the assets can move again after 90 days to earn another bonus elsewhere. Wells Fargo is also a better-known institution than WeBull. I would pick Wells Fargo’s offer over WeBull’s.

Transfer an IRAIf the promotion doesn’t exclude IRAs, it’s easier to transfer an IRA than a taxable brokerage account. Although the cost basis for holdings in a taxable account should transfer over to the new broker, there’s a risk that it doesn’t or it’s messed up by the transfer. You avoid this risk by transferring an IRA (either Traditional or Roth), where the cost basis doesn’t matter.

If the bonus is paid into an IRA, it counts as earnings in the IRA. You can still receive the bonus in the IRA even if you already maxed out the IRA contributions for the year or you’re no longer eligible to contribute. The specific Wells Fargo promotion I used as an example pays the bonus into a checking account, which makes it taxable, but other promotions usually pay the bonus to the account transferred.

There are no tax consequences when you match the IRA type to transfer: Traditional-to-Traditional or Roth-to-Roth. There won’t be any 1099 forms for the transfer.

Transferring an IRA avoids complications otherwise present in a taxable account. Because an IRA is always in only one person’s name, if you’re married, you and your spouse can sign up for the promotion separately and double up on the bonus by transferring your respective IRAs.

Identify Shares to TransferYou don’t need to transfer the entire IRA. Identify some shares that you won’t touch. Those shares can go to the new broker.

Don’t sell the shares. You’re only moving the same shares “in kind” from one broker to another. The values of those shares will be the same no matter where they’re held. Individual stocks and ETFs are easier to transfer than mutual funds. Keep any cash in your existing account.

If you intend to trade some of the shares, leave those in the existing account. Rebalancing and withdrawing from the IRA usually involves only a small percentage of your holdings. For example, suppose you have 10,000 shares in a holding, 8,000 shares can be transferred to the new broker. You use the remaining 2,000 shares in your existing IRA to rebalance or take withdrawals.

The idea is that you’ll split your IRA into an “at-home” account and a “traveling” account. You still do everything you normally do in the “at-home” account that you’re already familiar with. The “traveling” account contains holdings you won’t touch. It travels from one place to another to earn bonuses. You won’t do any trading in the “traveling” account at the new broker besides turning on automatic dividend reinvestment. You don’t need to learn how the new account works. It only sits idle waiting for the bonus.

Open a New AccountAfter you identify which IRA and which shares you’ll transfer, you open an empty new account of the same type at the new broker. Be sure to read the promotion requirements. This part is critical to receive the bonus. If you need to enter a promo code when you open the account, include the promo code. If you must use a specific link, use the link. If you must visit a branch, visit a branch.

Make sure to match the exact spelling of your name and your Social Security Number between your existing and new accounts. Set up your online login, password, and 2-factor authentication at the new broker. Designate beneficiaries for your new IRA.

Submit Transfer RequestInter-broker transfers go through a system called ACATS, which stands for Automated Customer Account Transfer Service. You always initiate it at the receiving broker. You give them your account number at the sending broker with a recent account statement. You request a partial account transfer with the positions and the number of shares you identified. It takes a week or two to complete.

If the sending broker charges you a transfer fee, you can request a reimbursement from the receiving broker. If they don’t reimburse you, chalk it up as being covered by the transfer bonus you’ll receive.

Turn On Dividend ReinvestmentTurn on dividend reinvestment at the new broker after your transferred assets arrive. Now the new account will run on autopilot while it waits for the bonus.

Set Calendar RemindersSet a calendar reminder for when you expect the bonus to show up based on the terms of the promotion plus 7-10 days. I received the promised bonus in all the promotions that I participated in before. Some of them might have been late by a few days but they always came.

Set another calendar reminder for when your assets are free to move again without losing the promotion bonus. Give a liberal buffer. If the promotion requires a 90-day holding period, hold your assets at the new broker for 120 days. Look for the next destination for your “traveling” account after you’ve fully satisfied the terms of the promotion. Your next transfer can be a full-account transfer of this “traveling” account to its next destination.

***

It takes some time to plan and execute for the first time but it isn’t too difficult. It gets easier the second time or the third time around. You decide whether it’s worth making $5,000 a year with this endeavor.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Brokerage Transfer Bonus Made Easy for Total Beginners appeared first on The Finance Buff.

July 10, 2024

Why I Stopped Chasing Bank and Brokerage Bonuses

I met the blogger Frugal Professor last week when he traveled to my area for a family gathering. I learned from his blog post that he earned over $5,000 tax-free by transferring a Roth IRA to Robinhood.

That specific promotion has since ended. I knew about the promotion when it was active but I didn’t jump on it. I would’ve done it years ago but not anymore. I stopped chasing these promotion bonuses from banks and brokers.

A bank account promotion usually asks you to deposit a minimum sum to a new or existing account and keep the money there for a minimum number of days or months. Sometimes the account requires direct deposits, sometimes not. You get a promotion bonus credited to your account when you have met the requirements. The bank account bonus is taxable.

A credit card promotion usually asks you to sign up for a card and spend a minimum amount in the first X statement cycles. You get bonus points after you fulfill your end of the deal. Some cards have an annual fee. The value of the signup bonus is higher than the annual fee. You close the card before the next annual fee hits. The bonus points earned on a personal card aren’t taxable because they’re treated as a discount on your purchases.

A brokerage account promotion typically asks you to transfer assets into a new or existing account and hold them there for some time. The assets transferred can be existing holdings. You’re only changing where they’re held. You don’t trigger taxes when you don’t sell your holdings. Whether the bonus credited to your account is taxable depends on the account type. It’s taxable if it’s credited to a taxable account. It’s tax-deferred if it’s credited to a Traditional IRA. You pay tax eventually when you withdraw from the Traditional IRA. It’s tax-free if it’s credited to a Roth IRA.

The promotions are legit. I did many of them in the past. It wasn’t difficult to follow the terms of the promotions and they all paid as advertised. I was never cheated out of a bonus. Based on his comments in the blog post, Frugal Professor sets the threshold to make a move at $1,000:

[M]ost promotions below $500 aren’t worth my time. At $1k, I start to get a little interested. At a few thousand, they are usually worth the effort. These days, checking account (or most CC [credit card]) bonuses don’t get me interested, but brokerage bonuses seem to be pretty lucrative. Move $250k from broker A to broker B, collect a $2.5k bonus (taxable), netting $1.75k after-tax, leave for 90 days. Rinse, repeat. Probably a few hours of effort yielding an attractive after-tax dollars per hour.

He expects to make at least $5,000 a year from these bonuses. $5,000 is a lot of money. My wife bought a mountain bike recently for $2,500. $5,000 would give us two mountain bikes. That’d be nice, right? And every year? I see many new toys.

At around the time this Robinhood promotion was going on, my phone popped up this photo I took when I left the building on my last day of work six years ago:

It reminded me that I didn’t leave my full-time job to make more money. I would’ve earned much more by staying at that job if I had wanted more money. If I must do something now to make some money, I want it to be useful to other people as well, such as publishing a new edition of my books or doing a better job at maintaining the Advice-Only Directory. It takes more time and it isn’t as lucrative as getting a bonus from a bank or a broker but I feel I’m adding more value. Of course I can do both but I’m using this self-imposed boundary to focus on a mission.

Everything has its time. There’s nothing wrong with earning promotion bonuses from banks and brokers. I did it many times in the past. The time has passed for me but that doesn’t have to be the case for everyone else. You’ll get the promised bonus if you follow the terms of the promotion. It doesn’t take that much time. It gets easier after you do a few of them. The bonus can fund many nice-to-have toys and experiences.

If you’re interested in these bonuses, you can follow The Final, Definitive Thread on Brokerage Transfer Bonuses on Bogleheads (jump to the last page and read backward for the latest active bonuses) or the Doctor of Credit blog, which features many types of promotions including ones that fall below the $1,000 threshold set by Frugal Professor.

If you don’t chase them, that’s OK too. I’m going for simplicity these days. Fewer accounts, fewer movements, everything on autopilot. I want to see a perpetual motion machine.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Why I Stopped Chasing Bank and Brokerage Bonuses appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower