Harry Sit's Blog, page 5

December 19, 2024

ChexSystems Security Freeze: Login, Report, and Score

We all should assume by now that our names, addresses, phone numbers, and Social Security Numbers are all out there in the open after all the hacks. We can only protect ourselves by adding two-factor authentication to all our accounts (ideally with security hardware or Google Voice numbers protected by security hardware).

ChexSystems Security FreezeFreezing our credit helps prevent identity thieves from applying for credit in our names. Getting an IP PIN from the IRS helps prevent thieves from filing a fraudulent tax return using our information.

It’s less known that we should also place a security freeze with ChexSystems. ChexSystems is a credit reporting agency that provides information about the use of bank accounts. Banks and credit unions may report you to ChexSystems if you bounce checks or otherwise cause a negative balance in your bank account. When you open a new account at another bank or credit union, they may check your reputation with ChexSystems. According to Wikipedia, 80% of commercial banks and credit unions in the U.S. use ChexSystems to screen applications for checking and savings accounts.

If someone opens a bank account in your name and defrauds the bank, the bank will report the incident under your name and Social Security Number. It will make it more difficult when you want to open a new account. Placing a security freeze at ChexSystems helps prevent fraud by someone opening a bank account in your name.

Opening a fake account in your name is also often the first step in stealing money from your real accounts. Banks scrutinize transfer requests less when they see the money is going to another account in your name (but the receiving account is actually controlled by the thieves). You make your accounts safer by blocking that exit path when you prevent thieves from opening a fake account in your name.

To place a security freeze with ChexSystems, go to chexsystems.com, click on “Security Freeze” at the top, and then click on “Place a Freeze.” You’ll be asked to register with ChexSystems. You’ll receive a 12-digit Security Freeze PIN after you place the freeze. This PIN is required to thaw the freeze before you open a new bank account.

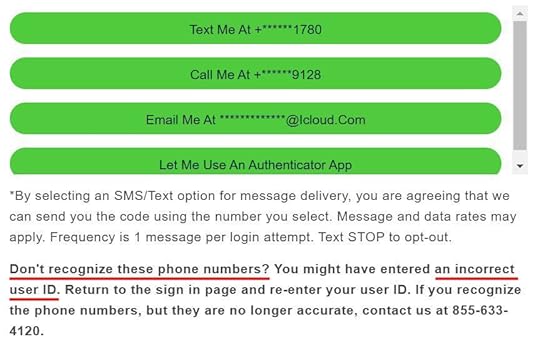

Consumer ID from the PastI placed a security freeze with ChexSystems several years ago. ChexSystems sent me an 8-digit Consumer ID and a 12-digit Security Freeze PIN by mail at that time. I saw something like this when I tried to use the 8-digit Consumer ID to log in at ChexSystems:

It threw me off for a minute because I didn’t recognize the displayed phone numbers or the email address. Then I read the footnote and realized it only meant that I couldn’t use the 8-digit Consumer ID to log in. ChexSystems changed its system. The new consumer portal requires a username and a password separate from the Consumer ID. It displays random phone numbers and email addresses when it doesn’t recognize the username.

I needed to re-register with the new consumer portal and create a username and a password when I only had an 8-digit Consumer ID from the past. The existing 12-digit Security Freeze PIN is still good.

Disclosure and ScoreBanks and credit unions only report negative feedback to ChexSystems. They don’t say how good you are. They only give you a black mark when they don’t like something. You should see nothing has been reported to ChexSystems.

You can check your records after you place the security freeze. You see these two options on the top under “Request Reports”: Consumer Disclosure and Consumer Score Report.

You can request the Consumer Disclosure but you won’t get it instantly. ChexSystems will email you in a few days when the report is ready. The Consumer Disclosure report lists any negative information ChexSystems received from banks and credit unions. A blank section is a good report. You should file a dispute if you see something inaccurate there. This disclosure report also shows who inquired about your reputation with ChexSystems in the last five years.

The Consumer Score Report is available right away after you request it. It shows a score similar to a credit score. The consumer scores range from 100 to 899. A higher score indicates a lower risk.

My score was 648. It sounds low but it’s apparently a good enough score. I never had any problems with opening bank accounts. I found another blogger saying his ChexSystems score was 652 and he had never been declined for a bank account either. It sounds like I’m in good company.

Check your ChexSystems score if you’re curious but the most important part here is to place the security freeze.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post ChexSystems Security Freeze: Login, Report, and Score appeared first on The Finance Buff.

December 15, 2024

How to Link An Account to Bank of America for ACH Push

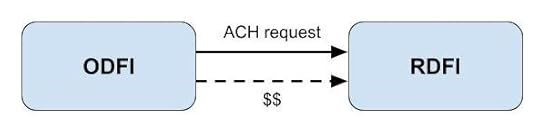

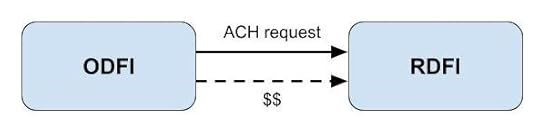

I mentioned in previous posts that the best way to transfer money between two accounts you own at different institutions is by an ACH push. When you’re moving money from Bank A to Bank B, ask Bank A to send the money to Bank B. Don’t ask Bank B to grab the money from Bank A. Following this one simple approach avoids 99% of problems with money transfers.

Wire transfers are faster than an ACH push but there’s usually a fee for sending and/or receiving a wire. Most banks don’t charge a fee for an ACH push. The money from an ACH push is available immediately at the receiving end and you avoid getting your account flagged for fraud. See ACH Push or Pull: The Right Way to Transfer Money and Follow This Rule to Avoid Long Holds and Account Restrictions.

Bank of America is the second largest bank in the U.S. after JPMorgan Chase. It has a good credit card rewards program (see Bank of America Travel Rewards Card Pays 2.625% on Everything). However, some parts of its online banking interface are tricky to figure out. The way to set up auto pay on Bank of America credit cards is the most convoluted I have seen. Adding an external account for ACH push out of Bank of America isn’t as bad but it isn’t straightforward either. Here’s a walkthrough.

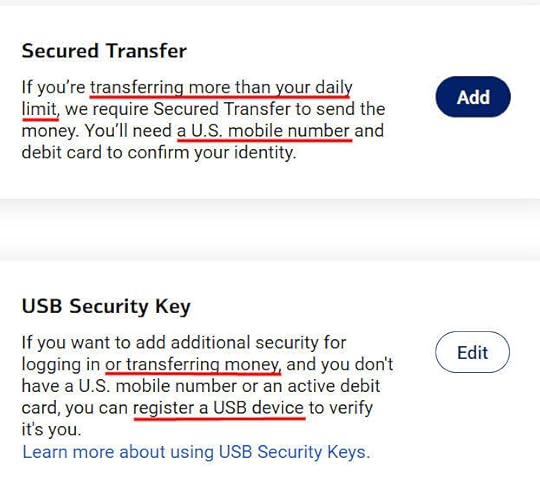

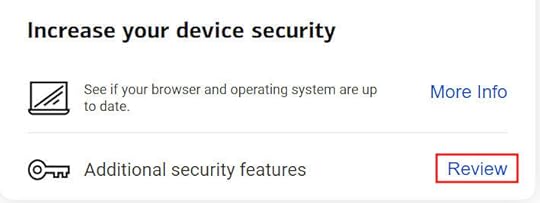

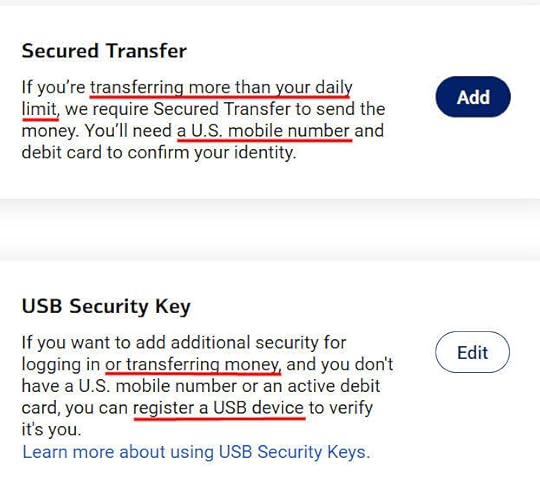

Enroll in Secured TransferSecured Transfer at Bank of America means adding a mobile phone number or a hardware security key to authorize transfers. If you don’t enroll in Secured Transfer, your transfers may be limited to $1,000 per day. You can transfer $50,000 or more in one go after you enroll in Secured Transfer.

Click on “Security Center” on the top and then “Set up two-factor authentication.”

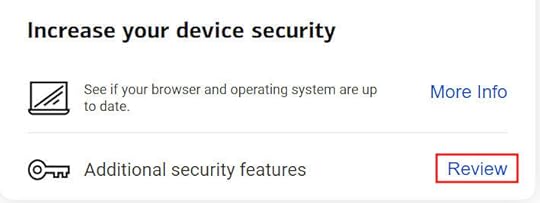

Scroll down to find “Additional security features” in the “Increase your device security” box. Click on the link next to it. Mine says “Review” because I already set it up. The link says something else when you don’t have it yet.

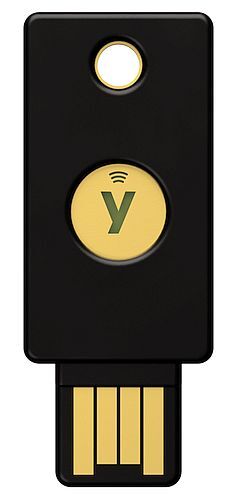

The first option uses a mobile phone number to receive security codes. The second option uses a hardware security key such as a Yubikey.

If you already have Yubikeys, it’s better to use your existing Yubikeys. You can register multiple Yubikeys. If you don’t have Yubikeys, it’s worth buying at least two Yubikeys and using them to secure your financial accounts and email accounts. See Security Hardware for Vanguard, Fidelity, and Schwab Accounts and Secure Your Email Account to Prevent Wire Fraud.

If you don’t want to use a Yubikey, a mobile phone number also works but it’s less secure.

Add External Account

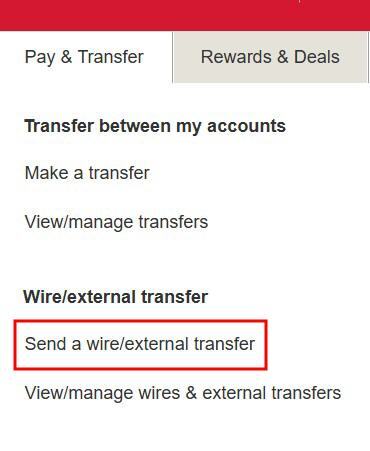

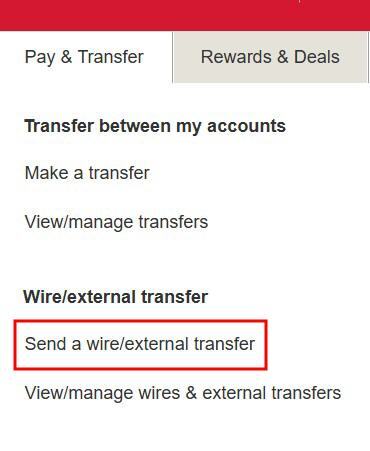

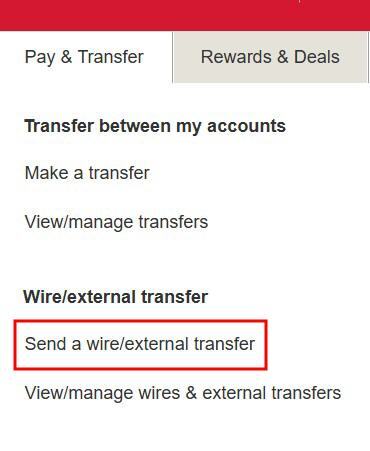

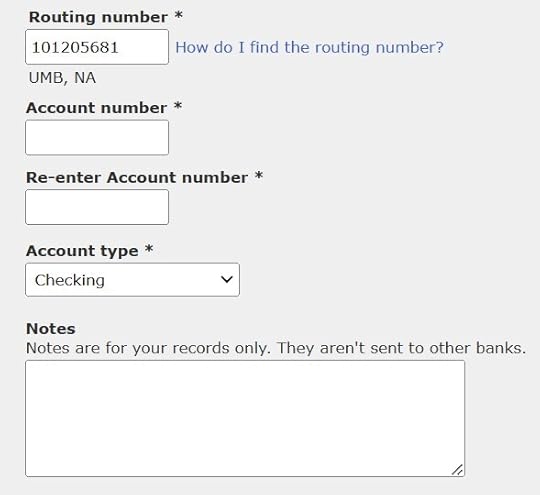

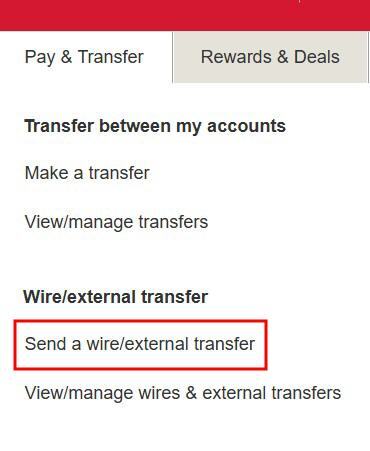

After enrolling in Secured Transfer, click on “Pay & Transfer” in the top menu and then “Send a wire/external transfer.”

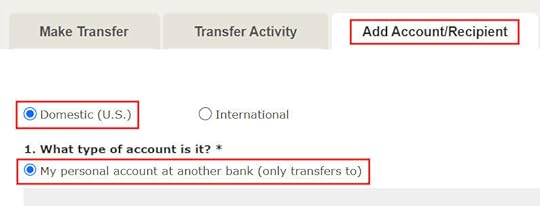

Click on the “Add Account/Recipient” tab. Select “Domestic” and “My personal account at another bank (only transfers to).” Selecting “only transfers to” means you will use this link only to push money from Bank of America to the external account. To push money from your other account to Bank of America, you would add the Bank of America account as a linked account at your other bank.

Selecting “only transfers to” is important when you’re linking a brokerage account such as a Fidelity account. If you select “both transfers from and to” Bank of America will ask you to log in online to prove that you own the external account. You can’t pass this verification when your brokerage account isn’t with the bank that owns the routing number. The verification isn’t required if you select “only transfers to.”

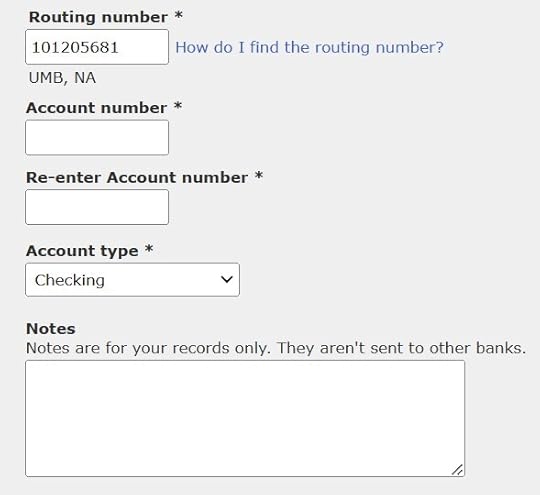

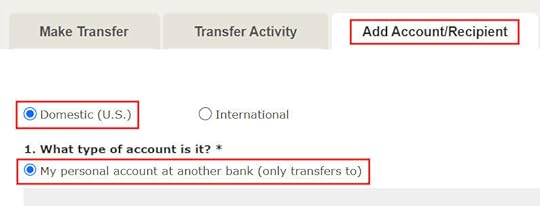

Enter the routing number and the account number of your other account. Adding an external account for “only transfers to” doesn’t require verification. You should make sure to enter the correct routing number and account number.

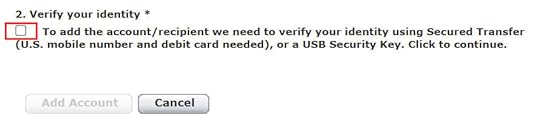

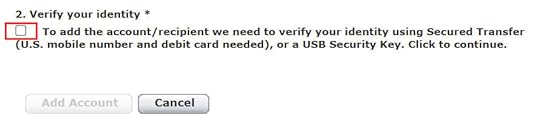

The “Add Account” button isn’t enabled until you check the box to verify your identity. Bank of America will ask for the Yubikey or the security code sent to the number you set up in Secured Transfer.

Send an ACH PushSending an ACH only works in online banking. Bank of America’s Android mobile app doesn’t support it.

Click on “Pay & Transfer” in the top menu and then “Send a wire/external transfer.”

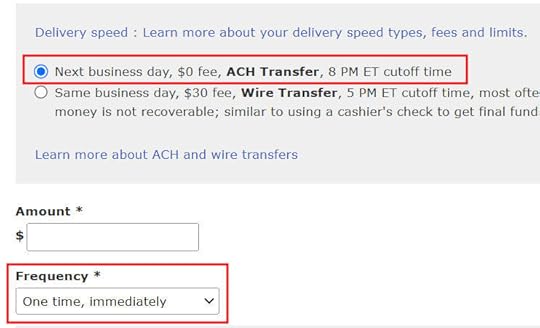

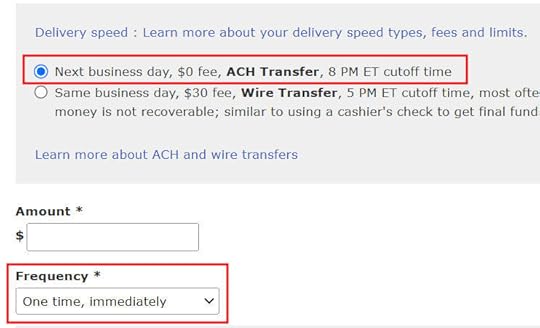

Choose the source and destination accounts. Bank of America used to charge $3 for slow ACH. Now it’s free and the transfer arrives on the next business day if you request it before 8 p.m. Eastern Time. Bank of America will ask you to use your Yubikey or the security code to confirm the transfer when you’re sending a large amount.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Link An Account to Bank of America for ACH Push appeared first on The Finance Buff.

December 1, 2024

Streaming Ballet, Opera, Jazz, and Classical Music Performances

When I researched which public libraries offered Kanopy for streaming movies and documentaries, I read that some libraries also offered streaming ballet, opera, jazz, and classical music performances through a service called medici.tv. medici.tv is a company based in Paris. It says this on its website:

medici.tv is recognized as the world’s leading classical music channel. Each year, we are proud to bring 150+ exceptional live performances from top artists and ensembles to passionate music fans worldwide. Our platform is home to the world’s largest video-on-demand catalogue in the classical music industry with over 4,000 concerts, operas, ballets, documentaries, master classes and jazz programs available to stream in HD.

I tried it by watching a ballet Kaguyahíme: The Tale of the Bamboo Cutter by the Tokyo Ballet. It was based on a lovely story from the 10th century in Japan. Short of going to Tokyo to see it in person, the experience was as good as it could get.

In addition to recorded performances, medici.tv also streams live events. The upcoming events calendar shows it’ll broadcast the season opening performance at the La Scala opera house in Milan on December 7. You get to watch a world class performance live at home. Unbelievable!

Access Through LibrarySome public libraries provide access to medici.tv through a proxied login. The library redirects you to medici.tv’s website after you enter your libary card and PIN on the library’s website. You choose a performance and watch it in the browser on your computer or tablet or cast it to your TV via AirPlay or Chromecast.

The library I used provides access to medici.tv indirectly through another streaming service Hoopla. You first create an account with Hoopla using your library card and PIN. Then you borrow a 7-day BingePass for medici.tv in Hoopla. Hoopla sends you to medici.tv’s website with a temporary login good for 7 days.

I installed the Hoopla app on a tablet. The workflow looks like this:

Find the BingePass for medici.tv in the Hoopla app on the tabletBorrow it from the libraryClick on Play. Hoopla app launches a new browser tab for medici.tv.Find a performance on medici.tv’s website. Click on play to watch it in the browser on the tablet or cast the stream to a TV via AirPlay or Chromecast.Subscribe DirectlyAccessing through the library works if you watch this type of performances only ocasionally. You get the best experience by subscribing to medici.tv directly if you watch regularly. medici.tv has an app for Apple, Google, and Roku devices.

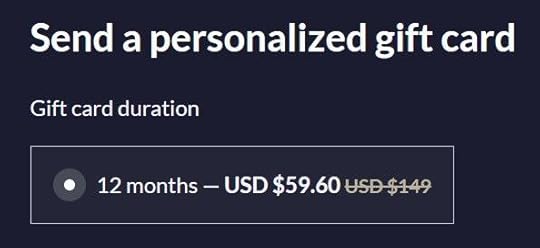

Unlike Kanopy, you can subscribe to medici.tv even if your library doesn’t provide it. As I’m writing this, medici.tv is offering a 12-month gift card for $59.60 (not an affiliate link). I just bought one for yourself. If your parents enjoy this type of performances, buy a gift card for them and help them set it up.

When you don’t have an account with medici.tv, it asks you to create one during checkout but that account isn’t required to have an active subscription. You activate the gift card to get the subscription after you receive the gift card by email.

If you enjoy ballet, opera, jazz, and classical music performances, $60 brings tremendous value for one full year. It’s another example of the best things in life being nearly free.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Streaming Ballet, Opera, Jazz, and Classical Music Performances appeared first on The Finance Buff.

November 26, 2024

How to Link Another Account to Bank of America for ACH Push

I mentioned in previous posts that the best way to transfer money between two accounts you own at different institutions is by an ACH push. Wire transfers are faster but there’s usually a fee for sending and/or receiving a wire. Most banks don’t charge a fee for an ACH push. The money from an ACH push is available immediately at the receiving end and you avoid getting your account flagged for fraud. See ACH Push or Pull: The Right Way to Transfer Money and Follow This Rule to Avoid Getting Your Account Restricted for Fraud.

Bank of America is the second largest bank in the U.S. after JPMorgan Chase. It has a good credit card rewards program (see Bank of America Travel Rewards Card Pays 2.625% on Everything). However, some parts of its online banking interface can be a little tricky to figure out. Here’s a walkthrough on how to link another account for ACH push out of Bank of America.

Enroll in Secured TransferSecured Transfer at Bank of America means adding a mobile phone number or a hardware security key to authorize transfers. If you don’t enroll in Secured Transfer, your transfers may be limited to $1,000 per day. You can transfer $50,000 or more in one go after you enroll in Secured Transfer.

Click on “Security Center” on the top and then “Set up two-factor authentication.”

Scroll down to find “Additional security features” in the “Increase your device security” box. Click on the link next to it. Mine says “Review” because I already set it up. The link may say something else if you don’t have it yet.

The first option uses a mobile phone number to receive security codes. The second option uses a hardware security key such as a Yubikey. If you already have a Yubikey, it’s better to use your existing Yubikey. You can register multiple Yubikeys. If you don’t have a Yubikey, it’s worth buying at least two Yubikeys and using them to secure your financial accounts and email accounts. See Security Hardware for Vanguard, Fidelity, and Schwab Accounts and Secure Your Email Account to Prevent Wire Fraud.

Add External Account

After you enroll in Secured Transfer, click on “Pay & Transfer” and then “Send a wire/external transfer.”

Click on the “Add Account/Recipient” tab. Select “Domestic” and “My personal account at another bank (only transfers to).” Selecting “only transfers to” means you will use this link only to push money from Bank of America to the external account. To push money from your other account to Bank of America, you would add the Bank of America account as a linked account at your other bank.

Selecting “only transfers to” is important when you’re linking a brokerage account such as a Fidelity account at Bank of America. If you select “both transfers from and to” Bank of America will ask you to log in online to prove that you own the external account. You can’t pass this verification because your brokerage account isn’t with the bank that owns the routing number. No such verification is required if you select “only transfers to.”

Enter the routing number and the account number of your other account. Here I’m showing the routing number owned by UMB Bank that Fidelity uses for ACH transfers. Adding an external account for “only transfers to” doesn’t require verification. You should make sure to enter the correct routing number and account number.

The “Add Account” button isn’t enabled until you check the box to verify your identity. Bank of America will ask for the Yubikey or the security code sent to the number you set up in Secured Transfer.

Send an ACH PushSending an ACH only works in online banking. Bank of America’s mobile app doesn’t support it.

Click on “Pay & Transfer” and then “Send a wire/external transfer.”

Choose the source and destination accounts. Bank of America used to charge $3 for slow ACH. Now it’s free and the transfer arrives on the next business day if you request it before 8 p.m. Eastern Time. Bank of America will ask you to use your Yubikey or the security code to confirm the transfer when you’re sending a large amount.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How to Link Another Account to Bank of America for ACH Push appeared first on The Finance Buff.

November 19, 2024

Get Kanopy Streaming From a Library as a Non-Resident

I mentioned in the previous post Retirees, a Rich Life Does Not Require Spending More Money that I learned history by watching a 6-hour documentary series The U.S. and the Holocaust on Kanopy.

New Ken Burns documentary ‘The U.S. and the Holocaust’ examines America’s response on YouTubeKanopy is a streaming video platform like Netflix. In addition to documentaries and The Great Courses, it has critically acclaimed movies and Oscar and film festival winners. The movies and documentaries aren’t necessarily new releases but the quality is great. It’s also ad-free. You can watch online on a computer, in its app on an Apple or Android phone or tablet, or through a streaming device or Smart TV platform such as Apple TV, Roku, or Google TV.

You can’t subscribe to Kanopy directly. Kanopy only sells to public and college libraries. It’s free if your library provides it. You create an account with Kanopy using your library card number and PIN. Then you look for the Kanopy app on your streaming device or Smart TV.

Public libraries are funded by property taxes. What the library in your city or county makes available depends on its budget, which depends on the population of the city or county. My small county has only one library branch in the entire county. It doesn’t have many books. Nor does it offer Kanopy. I had to get a library card from a different library to access Kanopy.

Larger Library in the StateIf your library doesn’t offer Kanopy, you may be able to get a card from a library that does in a major city in your state. You may not borrow any physical materials from that bigger library but the card is good for accessing digital materials such as Kanopy.

For example, Cleveland Public Library gives a library card to any resident in the state of Ohio. You don’t have to live in Cleveland.

When You Visit Another City

Permanent residents of Ohio are eligible for a free library card. Persons who go to school in Ohio, work on a permanent basis in Ohio, and those who own property in Ohio are also eligible for a free library card.

Cleveland Public Library

Some libraries in bigger cities allow visitors to apply for a card. If you have travel plans, you can check the policy of the library in that area. The card is still good after you go home.

For example, Santa Clara County Library in California only requires an address anywhere in the country. You can’t apply for a card online but you can apply in person when you happen to visit the area.

Pay as a Non-Resident

If you do not reside in the County but do have a United States mailing address, a Full-Membership Library Card can be provided to you, free, during your next library visit.

Santa Clara County Library

Some libraries specifically allow out-of-area residents to pay for a card. You don’t even need to live in the same state. It’s fair to charge a fee to non-residents because libraries are funded by property taxes.

For example, Houston Public Library allows residents outside Texas to purchase a card for $40 a year.

E-Books and Audiobooks

Apply for your library card in person at any Houston Public Library or online. Permanent Texas residents may join the library free of charge with proof of residency. Non-residents can purchase a temporary library card for $40/family, which is valid for 12 months.

Houston Public Library

Besides movie streaming through Kanopy, many libraries also provide e-books and audiobooks through the Libby app from Overdrive, which owns Kanopy. If your library provides these but you’ve never tried them, it’s worth setting them up.

To me, Kanopy is worth paying an annual fee when the library in my county doesn’t offer it. It’s great if your library offers it for free. In the worst case, if you pay a fee and don’t like it, chalk it up as contributing a small amount to support a public library.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Get Kanopy Streaming From a Library as a Non-Resident appeared first on The Finance Buff.

November 6, 2024

Retirees, a Rich Life Does Not Require Spending More Money

“How much can I safely withdraw from my portfolio?” is a frequently asked question among pre-retirees and new retirees. Ben Felix said it was 2.7%. Morningstar said it was 4.0%. Bill Bengen said it was 4.7%. Dave Ramsey said it was 8%. The higher the safe withdrawal rate, the more retirees can spend from their investment portfolios.

Researchers developed methods to raise the safe withdrawal rate. Some suggested using a guardrail system. Some suggested using annuities, whole life insurance, or a reverse mortgage. In any case, the implied message is that it’s desirable to have a higher withdrawal rate.

You also hear that it’s a challenge for new retirees to switch from saving to spending. Some financial advisors say a big part of their role is to encourage clients to spend more money. I also know YouTube and podcast shows that scold people for not living a rich life. A popular book Die With Zero encourages people to spend more money when they’re still young.

No doubt some people want to spend more but irrationally fear that doing so will jeopardize their future. Suggestions for overcoming this irrational fear include buying annuities, building a TIPS ladder, setting aside money in a separate “fun money” account, and creating spending targets and color-coded tracking systems to give oneself “permission to spend.”

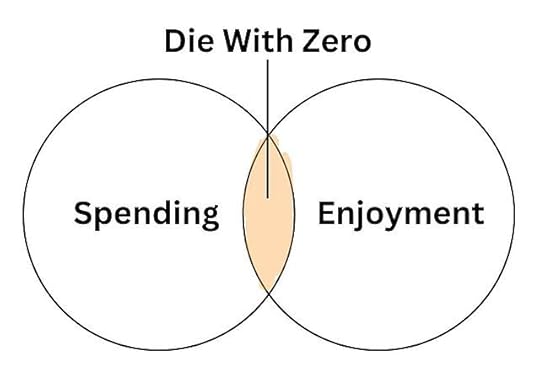

However, I would say this emphasis on withdrawals and spending in retirement is misplaced. What matters in retirement is enjoyment and life satisfaction. Spending is a poor proxy for enjoyment and life satisfaction. The best things in life are (nearly) free. It’s OK not to spend more money when you go for enjoyment and life satisfaction.

Spending Requires Time and AttentionSpending always involves choices, which require time and attention to sort through. Retirees don’t need another job in figuring out how to spend their money. They may prefer to direct their time and attention elsewhere.

My wife and I spent several hundred thousand dollars on all sorts of materials and labor when we built our house last year. We’re happy with the final results but the process of spending all that money took a lot of time and mental energy.

Should we use this 10″ x 2.5″ blue rectangular tile or this 4″ x 4″ white square tile for our kitchen backsplash?

We want to paint the interior walls white. Does that mean White Dove, White Heron, Cloud White, or any other 50 shades of white?

We have hard water here. Do we want a water softener that uses salt pellets or a saltless water filtration and conditioning system?

Some people might say the problem was because we bought things and it would be better to spend money on experiences. Setting aside whether living in a house in which everything was hand-picked by ourselves is an experience, spending on experiences also requires choices, time, and attention.

Low Perceived ValueDid you say international travel? Where to go? When? For how long? Need visa? Which airline to use? Buy the tickets now or wait? Economy, Premium Economy, or Business Class? Use cash or points? Where to stay? What to see? Sign up for a tour or go on our own?

Observers of retirees not spending as much as they can afford mistakenly think those retirees must be afraid of running out of money. Besides not wanting to waste their precious time and energy on spending, retirees aren’t spending as much because they don’t see value in additional spending.

When we were building our house, I saw some neighbors put in these exposed beams on their ceilings:

I lost interest when I learned they were three-sided empty boxes purely for decoration.

Some other neighbors chose Wolf, Sub-Zero, and Thermador kitchen appliances. I’m sure those high-end appliances have some features normal appliances don’t have. I wasn’t interested in finding out what those features were because mainstream appliances had always worked well for me.

A home in the neighborhood was advertised as a furnished rental. It said all their furnishings came from RH. When I mentioned this to my wife, she asked “What’s RH?“

I’m driving a 2005 Honda Accord. It’s been with me for 20 years. I know how it works. It takes me wherever I want to go. I can afford a new car but a new car would still take me to the same places. I don’t see why I should spend time figuring out whether I should want an EV, a hybrid, or a gas-powered car, which brand, model, trim, and options, or whether they’re still charging thousands over MSRP with a long wait to get a new car.

I’m not depriving myself of decorative faux beams, high-end appliances, upscale home furnishings, or a new car when I’m happy with what I have now. Getting out of my way to get them would be a distraction.

Spending Is a Poor Proxy for EnjoymentI spent a full month in Switzerland in the summer of 2022. I enjoyed it and wrote a blog post about it. The trip cost over $10,000 all-in.

A neighbor gave away a 20-year-old cheap bike by the curb last year. Walmart sells a new bike much better than this for under $200 today.

I pumped some air into the tires and it still worked. I hadn’t ridden a bike since college. I started riding it in the neighborhood, in town, and eventually on a gravel road by a lake, which gave me this view in the spring:

Riding a bike got me to places I hadn’t been. I rode this old cheap bike over 60 times in a year.

Looking back, I can honestly say that the cheap bike gave me more joy than the $10,000 vacation in Switzerland. I enjoyed both but it doesn’t mean that expensive international travel (experience!) must be more enjoyable than a cheap bike (things!).

And that’s my biggest problem with the book Die With Zero. It falsely equates spending with enjoyment as if the more you spend the more you’ll enjoy life. Spending can induce or enhance some enjoyment but there’s only a thin overlap between the two. Fixating on spending misses the true source of enjoyment.

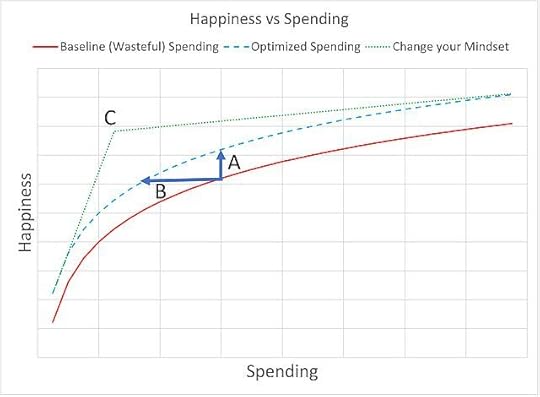

The blogger Frugal Professor included this chart in his blog post The Spending Tradeoff — Opportunity Costs vs Utility. The green dotted line shows the relationship between spending and happiness when you have a different mindset.

Happiness vs Spending, Frugal Professor. Used with permission.

Happiness vs Spending, Frugal Professor. Used with permission.He concluded that if you shift your mindset, you unlock a superpower in which your happiness is largely uncorrelated with your spending once you hit a modest point C.

The Best Things in Life Are FreeAn advantage of retirement is having more free time. I can’t believe the endless enjoyable activities that cost little to no money.

I do beginner yoga by following videos by Yoga With Adriene on YouTube. It’s free.

I do some bodyweight exercises — pushups, squats, plank, lunges, and bird dogs. You need at most a $20 exercise mat.

I take a book to read on my favorite park bench under a tree by a pond. It’s free.

My Favorite Park Bench on YouTubeI learned history when I watched a 6-hour documentary series The U.S. and the Holocaust by Ken Burns. It’s free on Kanopy through the public library. Kanopy also has The Criterion Collection films and educational courses by The Greatest Courses.

The U.S. and the Holocaust on YouTubeI walk up a hill when I’m not riding a bike. It’s free and it’s good for both physical and mental health. This was the view last week (our home is down there in the middle):

We had booked travel to the Dolomites region of Italy this summer.

Dolomites, Italy: Tirolean Culture and Alpine Adventures – Rick Steves’ Europe Travel Guide on YouTubeAs the dates drew closer, we asked why we wanted to be tourists in Italy when we were enjoying our activities locally. Our home is more comfortable than a hotel. The food we cook is healthier than restaurant food. We don’t need to deal with potential flight delays, crowds, theft, or getting sick.

So we canceled the trip (experience!) and used the money to buy two new bicycles (things!). We had so much fun learning mountain biking as beginners. Every ride put a big smile on our faces. I rode 19 times for a total of 28 hours since I bought the bike at the end of August. I’m in the back in this compiled video:

Beginner Mountain Biking – Fall 2024 on YouTubeI agree with Christine Benz when she said this on X:

Contrarian point of view: The whole "spend on experiences" mantra is overstated.

— Christine Benz (@christine_benz) September 4, 2024

The most worthwhile experiences involve connecting with other human beings and that can be done very cheaply AND OFTEN–e.g., walking with a friend or inviting people to dinner.

No bucket lists!

“Memory dividends” don’t only come from a once-in-a-lifetime experience such as flying 50 friends to an island, renting out an entire hotel, and booking your favorite band for a private performance (this was an example in the book Die With Zero). They also come from more frequent simple joys that cost nearly nothing.

OK to UnderspendA rich life isn’t about spending money. The best things in life are free. You won’t worry much about the safe withdrawal rate if you look for enjoyment and life satisfaction in the right places. It isn’t a character flaw if you’re not spending as much as you can afford.

I like this answer to the question Why is determining a withdrawal rate or method so difficult? on the Bogleheads Forum:

For most of us here, the only way to make this difficult is an effort to try to spend as much as you possibly can without running out.

We are not trying to do that, so it’s not difficult for us.

Wanderingwheelz

It’s not difficult for us either. We focus on enjoying the best things in life regardless of whether it requires spending money. If it does, we spend the money (we paid $6,000 for our two bicycles). Otherwise we don’t concern ourselves with whether we’re “underspending.”

What do you do when the money pile grows and grows?

Giving, whether to family or charities, is completely different from spending. Money given to young people and charities means a lot to them. Seeing the results of your help brings back enjoyment and life satisfaction. Look for ways to give to family and charities. Give early and give often.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Retirees, a Rich Life Does Not Require Spending More Money appeared first on The Finance Buff.

October 6, 2024

Roll Over an Unnecessarily Complicated SIMPLE IRA

My wife mentioned to her friends that I know a thing or two about personal finance and investing. One of her friends — I’ll call him Jake (not his real name) — changed jobs recently. He asked me to look at his retirement plan account from his previous employer.

I asked Jake what type of account it was. He didn’t know. He thought it was a Roth IRA but I told him an employer plan wouldn’t be a Roth IRA because a Roth IRA is a personal account. He sent me a recent statement, which shows it’s a SIMPLE IRA.

Lower Contribution LimitsA SIMPLE IRA is an oddball in workplace retirement plans. It can only be offered by a small employer with no more than 100 employees. The employer sets up a SIMPLE IRA plan and each employee sets up a SIMPLE IRA under the plan.

Both the employee and the employer contribute to the account, as they do in a 401(k) plan. The annual contribution limit is lower. The employee contribution limit in a SIMPLE IRA is about 30% less than the employee contribution limit in a 401(k). The age-50+ catch-up contribution limit is less than half of the same limit in a 401(k). Don’t ask me why.

SECURE Act 2.0 raised the SIMPLE IRA contribution limit by 10% for employers with 25 or fewer employees. Employers with 26-100 employees can also have the higher contribution limit if they increase their match or non-elective contributions.

There was no Roth version of SIMPLE IRA before 2023. All contributions before 2023 were pre-tax. SECURE Act 2.0 authorized Roth SIMPLE IRA starting in 2023 but it’s optional. Each employer’s plan must allow it before employees can choose the Roth option. Most brokers haven’t updated their plans to allow it yet. For example, both Fidelity’s and Schwab’s SIMPLE IRA plans still only allow pre-tax contributions. As a result, most employers haven’t been able to update their SIMPLE IRA plans to add the Roth option yet.

Expensive BrokerThe employer usually sets up a SIMPLE IRA plan with a broker. It’s helpful if the employer knows better to set up the SIMPLE IRA plan with a mainstream broker such as Fidelity or Charles Schwab but many small employers are sold the SIMPLE IRA plan by an expensive full-service broker.

The SIMPLE IRA plan is an employer-sponsored plan but the SIMPLE IRA accounts under the plan are technically personal accounts. Unlike a 401(k), a SIMPLE IRA plan doesn’t offer a menu of investment options. Each employee can invest in anything they want in the SIMPLE IRA. The full-service broker can charge loads and/or asset management fees in the SIMPLE IRA.

In theory, an employee can open a SIMPLE IRA at any financial institution of their choice under some SIMPLE IRA plans (“5304 SIMPLE”). In practice, employees don’t know they have this choice. The employer also discourages setting up accounts elsewhere because they want to send payroll contributions to only one place. It’s next to impossible for an employee to open a SIMPLE IRA at a different broker without the employer’s participation. As a result, employees go with the flow and use the broker chosen by the employer.

Jake’s SIMPLE IRA was like that. His former employer had a full-service broker “help” all the employees with investments in their SIMPLE IRA. The broker put three actively managed mutual funds in his account. Those funds were C shares with an expense ratio of 1.4% – 1.9% plus a backend load of 1% on shares sold within 12 months.

Escape Hatch After Two YearsOne upside of a SIMPLE IRA is that it has an escape hatch after two years. Unlike a 401(k) account, which has to stay with the employer’s plan until the employee terminates employment or reaches age 59-1/2, an active employee can roll over the SIMPLE IRA after participating in the SIMPLE IRA plan for two years.

If you have a bad SIMPLE IRA with an expensive broker, you can transfer it to a Traditional IRA after bearing it for two years. New contributions will still go into the SIMPLE IRA but you can roll over the existing money to a Traditional IRA for lower fees and keep rolling over once a year or however frequently you prefer. The broker that has your SIMPLE IRA may charge a transfer-out fee for each transfer.

You’re stuck if you’re still within the first two years. Even if you already terminated employment, a SIMPLE IRA can only roll over to another SIMPLE IRA in the first two years. In theory, you can set up a SIMPLE IRA elsewhere to accept the rollover. In practice, it’s difficult to find a broker to set up a SIMPLE IRA on your own without an employer.

Rollover to Traditional IRAFortunately, Jake already had the SIMPLE IRA for longer than two years. I called both Fidelity and Schwab to confirm that they could accept the existing C shares mutual funds in his SIMPLE IRA and they wouldn’t charge a commission to sell those funds. I told Jake he could open a Traditional IRA with either Fidelity or Schwab and submit a Transfer of Assets request through the new account. He chose Fidelity. The shares came over after a week. The broker for the SIMPLE IRA charged him $125 for the transfer.

I suggested waiting until the purchase history came over through the ACATS transfer before selling those expensive actively managed funds. This reduced the backend load charged by the funds because the backend load doesn’t apply to older shares. I also suggested buying a Fidelity Freedom Index Fund with the proceeds. Fidelity didn’t charge a fee for selling the expensive funds or buying the target date index fund. The expense ratio of the Fidelity Freedom Index Fund is 0.12%, which is less than 1/10th of the expense ratio of those old funds. I showed Jake how to turn on dividend reinvestment.

Jake is happy when it’s all done. I’m happy I was able to help him. The rollover was unnecessarily complicated because his SIMPLE IRA was with an expensive broker. His former employer didn’t know better. He had no choice but to go with whatever the employer had set up. Jake is in his twenties. Getting a retirement account out of the hands of an expensive broker at an early age will have a positive impact on his retirement.

If you’re reading this blog, you know more about these subjects than people in your circles. Young people working for small employers especially tend to have bad retirement plans. Let them know you have this knowledge. Help them when they ask. It’s rewarding to set a young person on the right track.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Roll Over an Unnecessarily Complicated SIMPLE IRA appeared first on The Finance Buff.

Rolling Over an Unnecessarily Complicated SIMPLE IRA

My wife mentioned to her friends that I know a thing or two about personal finance and investing. One of her friends — I’ll call him Jake (not his real name) — changed jobs recently. He asked me to look at his retirement plan account from his previous employer.

I asked Jake what type of account it was. He didn’t know. He thought it was a Roth IRA but I told him an employer plan wouldn’t be a Roth IRA because a Roth IRA is a personal account. He sent me a recent statement, which shows it’s a SIMPLE IRA.

Lower Contribution LimitsA SIMPLE IRA is an oddball in workplace retirement plans. It can only be offered by a small employer with no more than 100 employees. The employer sets up a SIMPLE IRA plan and each employee sets up a SIMPLE IRA under the plan.

Both the employee and the employer contribute to the account, as they do in a 401(k) plan. The annual contribution limit is lower. The employee contribution limit in a SIMPLE IRA is about 30% less than the employee contribution limit in a 401(k). The age-50+ catch-up contribution limit is less than half of the same limit in a 401(k).

SECURE Act 2.0 raised the contribution limit by 10% for employers with 25 or fewer employees. Employers with 26-100 employees can also have the higher contribution limit if they increase their match or non-elective contributions.

There’s no Roth version of a SIMPLE IRA. All contributions to a SIMPLE IRA are pre-tax.

BrokerThe employer usually sets up a SIMPLE IRA plan with a broker. It’s helpful if the employer knows better to set up the SIMPLE IRA plan with a mainstream broker such as Fidelity or Charles Schwab but many small employers are sold the plan by an expensive full-service broker.

Unlike a 401(k), a SIMPLE IRA plan doesn’t offer an investment options menu. Each employee can invest in anything they want in the SIMPLE IRA. The full-service broker can charge loads and/or asset management fees in the SIMPLE IRA.

Such is the case with Jake’s SIMPLE IRA. His former employer had a full-service broker “help” all the employees with their investments in the SIMPLE IRA. The broker put three actively managed mutual funds in his account. Those funds are C shares with an expense ratio of 1.4% – 1.9% plus a backend load of 1%.

Two-Year Jail TimeOne upside of a SIMPLE IRA is that it has an escape hatch after two years. Unlike a 401(k) account, which has to stay with the employer’s plan until the employee terminates employment or reaches age 59-1/2, an active employee can roll over the SIMPLE IRA after participating in the SIMPLE IRA plan for two years.

If you have a bad SIMPLE IRA with an expensive broker, you can transfer it to a Traditional IRA after bearing it for two years. New contributions will still go into the SIMPLE IRA but you can roll over the existing money to a Traditional IRA for lower fees and keep rolling over once a year or however frequently you prefer. The broker that has your SIMPLE IRA may charge a transfer-out fee for each transfer.

You’re stuck if you’re still within the first two years. Even if you already terminated employment, a SIMPLE IRA can only roll over to another SIMPLE IRA in the first two years. In theory, you can set up a SIMPLE IRA on your own to accept the rollover. In practice, it’s quite difficult to find a broker to set up a SIMPLE IRA without an employer’s participation.

Rollover to Traditional IRAFortunately, Jake already had the SIMPLE IRA for longer than two years. I told him he could open a Traditional IRA with either Fidelity or Schwab and submit a Transfer of Assets request through the new account. Jake chose Fidelity. The shares came over in about a week.

I suggested waiting until the purchase history came over through the ACATS transfer before selling those expensive actively managed funds. This reduced the backend load charged by the funds because the backend load drops off on older shares. I also suggested buying a Fidelity Freedom Index Fund with the proceeds. Fidelity didn’t charge a fee for selling the expensive funds or buying the target date index fund. I showed Jake how to turn on dividend reinvestment.

Jake is happy when it’s all done. I’m happy I was able to help him. The rollover was unnecessarily complicated because his SIMPLE IRA was with an expensive broker. His former employer didn’t know better. Nor did he. He just went with whatever the employer had set up. Jake is 29. Getting a retirement account out of the hands of an expensive broker at an early age has a positive impact on his retirement.

If you’re reading this blog, you know more than people in your circles. Young people working for small employers especially tend to have bad retirement plans. Let them know you have this knowledge. Help them when they ask. It’s rewarding to set a young person on the right track.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Rolling Over an Unnecessarily Complicated SIMPLE IRA appeared first on The Finance Buff.

September 18, 2024

Follow This Rule to Avoid Long Holds and Account Restrictions

I read this post on Reddit a while ago: Vanguard closed my account for fraudulent activity.

I sold a property, received my payment via check and decided to invest the money in Vanguard. I opened a Vanguard account online and linked my bank, transferred $10 to my Cash Plus account, opened a brokerage account and deposited my check on Friday to the brokerage account. The check was accepted. On Tuesday, I received a call from the check issuer that the check cleared. I logged in Vanguard and I can see it was processed but not available till after 7 days. Everything seems easy, so I thought. Later the same day, I tried to log in and I got an error message, “Access to your account has been disabled. Please contact us.” I called Vanguard and spoke to a rep. They told me my account is being reviewed by the research team and they will be contacting me in 72 hours. I waited 72 hours and called again. Same response. 2 days later, I received a voicemail from the Vanguard fraud team.

“Hello, this is the fraud team calling to let you know the account you inquired about has been restricted due to fraudulent activity. The attempts to bring funds into the account have been rejected. Any electronic bank transfer can be recalled through your bank. Again the account is permanently restricted and there will not be a follow-up to this issue.”

This poster eventually got the money back when Vanguard returned the money to the check issuer.

This type of fraud restriction isn’t limited to Vanguard. Fidelity has had a wave of fraud attacks recently. Criminals recruited existing customers as collaborators (“mules”) for a 50/50 split to make fake deposits and withdraw the money.

Fidelity turned up their anti-fraud measures to thwart these attacks. Many customers reported seeing their accounts restricted, debits declined, Bill Pay canceled, mobile deposit limit cut to $1,000, or the deposit hold times extended to up to 21 days. No doubt many of these are false positives. Attacks from existing customers recruited as mules are the most difficult to combat. It’s hard to distinguish who’s legit and who’s knowingly or unknowingly working with criminals.

I use Fidelity for all my spending. As I mentioned in the previous post Ditch Banks — Go With Money Market Funds and Treasuries, I have under $100 in outside bank accounts. All my cash is in a Fidelity account in money market funds and Treasuries. All my bills are paid out of this Fidelity account. It’ll cause problems if Fidelity restricts my account. I’m not concerned about that possibility because I follow this one simple rule:

Make all deposits by ACH push.

An ACH push is initiated at the same place where the money currently resides (see ACH Push or Pull: The Right Way to Transfer Money). Employer or government direct deposits also come in by ACH push. I make all deposits to my Fidelity account by ACH push. For example, when I transfer the credit card rewards earned in a Bank of America account to Fidelity, I initiate the ACH at Bank of America (see How to Link Another Account to Bank of America for ACH Push).

Money received by ACH push is trusted money. It’s available right away because the receiving institution isn’t responsible for it. You have nothing to worry about having your account flagged for fraud when all the money coming into the account comes by ACH push.

The Reddit poster at the beginning of this post didn’t follow this rule. I venture to say that everyone who had their Fidelity account restricted recently also didn’t follow this rule. Check deposits and ACH pulls are untrusted by the receiving institution. Not every check deposit or ACH pull will get the account restricted for fraud concerns but those who had their account restricted most likely had made check deposits or ACH pulls.

My Fidelity account is functioning normally as usual. I wouldn’t have known this storm was happening if I hadn’t read Reddit. My mobile check deposit limit is still a whopping $500,000 per day although I have no physical checks to deposit. All debits for estimated taxes, credit card bills, utility bills, and PayPal and Venmo payments went out without a hitch. I don’t know what the hold time will be if I do an ACH pull right now because I don’t make deposits by ACH pull anyway. I initiated another ACH push from Bank of America to my Fidelity account as a test. The money arrived the next day and it was available immediately as expected. No hold.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Follow This Rule to Avoid Long Holds and Account Restrictions appeared first on The Finance Buff.

Follow This Rule to Avoid Getting Your Account Restricted for Fraud

I read this post on Reddit a while ago: Vanguard closed my account for fraudulent activity.

I sold a property, received my payment via check and decided to invest the money in Vanguard. I opened a Vanguard account online and linked my bank, transferred $10 to my Cash Plus account, opened a brokerage account and deposited my check on Friday to the brokerage account. The check was accepted. On Tuesday, I received a call from the check issuer that the check cleared. I logged in Vanguard and I can see it was processed but not available till after 7 days. Everything seems easy, so I thought. Later the same day, I tried to log in and I got an error message, “Access to your account has been disabled. Please contact us.” I called Vanguard and spoke to a rep. They told me my account is being reviewed by the research team and they will be contacting me in 72 hours. I waited 72 hours and called again. Same response. 2 days later, I received a voicemail from the Vanguard fraud team.

“Hello, this is the fraud team calling to let you know the account you inquired about has been restricted due to fraudulent activity. The attempts to bring funds into the account have been rejected. Any electronic bank transfer can be recalled through your bank. Again the account is permanently restricted and there will not be a follow-up to this issue.”

This type of fraud restriction isn’t limited to Vanguard. Fidelity has had a wave of fraud attacks recently. Criminals recruited existing customers as collaborators (“mules”) for a 50/50 split to make fake deposits and withdraw the money.

Fidelity turned up their counter-fraud measures to thwart these attacks. Many customers reported seeing their accounts restricted, debits declined, Bill Pay canceled, mobile deposit limit cut to $1,000, or the deposit hold times extended to up to 21 days. No doubt many of these are false positives. Attacks from within are the most difficult to combat. It’s hard to distinguish who’s legit and who’s knowingly or unknowingly working with criminals.

I use Fidelity for all my spending. As I mentioned in the previous post Ditch Banks — Go With Money Market Funds and Treasuries, I have under $100 in outside bank accounts. All my cash is in a Fidelity account in money market funds and Treasuries. All my bills are paid out of this Fidelity account. It’ll cause problems if Fidelity restricts my account. I’m not concerned about that possibility because I follow this one simple rule:

Make all deposits by ACH push.

An ACH push is initiated at the same place where the money currently resides (see ACH Push or Pull: The Right Way to Transfer Money). Employer or government direct deposits also come in by ACH push. I make all deposits to my Fidelity account by ACH push. For example, when I transfer the credit card rewards earned in a Bank of America account to Fidelity, I initiate the ACH at Bank of America.

Money received by ACH push is trusted money. It’s available right away because the receiving account isn’t responsible for it. You have nothing to worry about having your account flagged for fraud when all the money coming into the account comes by ACH push.

The Reddit poster at the beginning of this post didn’t follow this rule. I venture to say that everyone who had their Fidelity account restricted also didn’t follow this rule. Check deposits and ACH pulls are untrusted by the receiving institution. Not every check deposit or ACH pull will get the account restricted or flagged for fraud but those who had their account restricted most likely had made check deposits or ACH pulls.

My Fidelity account is functioning normally as usual. I wouldn’t have known this storm was happening if I hadn’t read Reddit. My mobile check deposit limit is still a whopping $500,000 per day although I have no physical checks to deposit. All debits for estimated taxes, credit card bills, utility bills, and PayPal and Venmo payments went out without a hitch. I don’t know what the hold time will be if I do an ACH pull right now because I don’t make deposits by ACH pull anyway. I just initiated another ACH push from Bank of America to my Fidelity account. I expect it to be available immediately upon arrival as usual.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Follow This Rule to Avoid Getting Your Account Restricted for Fraud appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower