Retirees, a Rich Life Does Not Require Spending More Money

“How much can I safely withdraw from my portfolio?” is a frequently asked question among pre-retirees and new retirees. Ben Felix said it was 2.7%. Morningstar said it was 4.0%. Bill Bengen said it was 4.7%. Dave Ramsey said it was 8%. The higher the safe withdrawal rate, the more retirees can spend from their investment portfolios.

Researchers developed methods to raise the safe withdrawal rate. Some suggested using a guardrail system. Some suggested using annuities, whole life insurance, or a reverse mortgage. In any case, the implied message is that it’s desirable to have a higher withdrawal rate.

You also hear that it’s a challenge for new retirees to switch from saving to spending. Some financial advisors say a big part of their role is to encourage clients to spend more money. I also know YouTube and podcast shows that scold people for not living a rich life. A popular book Die With Zero encourages people to spend more money when they’re still young.

No doubt some people want to spend more but irrationally fear that doing so will jeopardize their future. Suggestions for overcoming this irrational fear include buying annuities, building a TIPS ladder, setting aside money in a separate “fun money” account, and creating spending targets and color-coded tracking systems to give oneself “permission to spend.”

However, I would say this emphasis on withdrawals and spending in retirement is misplaced. What matters in retirement is enjoyment and life satisfaction. Spending is a poor proxy for enjoyment and life satisfaction. The best things in life are (nearly) free. It’s OK not to spend more money when you go for enjoyment and life satisfaction.

Spending Requires Time and AttentionSpending always involves choices, which require time and attention to sort through. Retirees don’t need another job in figuring out how to spend their money. They may prefer to direct their time and attention elsewhere.

My wife and I spent several hundred thousand dollars on all sorts of materials and labor when we built our house last year. We’re happy with the final results but the process of spending all that money took a lot of time and mental energy.

Should we use this 10″ x 2.5″ blue rectangular tile or this 4″ x 4″ white square tile for our kitchen backsplash?

We want to paint the interior walls white. Does that mean White Dove, White Heron, Cloud White, or any other 50 shades of white?

We have hard water here. Do we want a water softener that uses salt pellets or a saltless water filtration and conditioning system?

Some people might say the problem was because we bought things and it would be better to spend money on experiences. Setting aside whether living in a house in which everything was hand-picked by ourselves is an experience, spending on experiences also requires choices, time, and attention.

Low Perceived ValueDid you say international travel? Where to go? When? For how long? Need visa? Which airline to use? Buy the tickets now or wait? Economy, Premium Economy, or Business Class? Use cash or points? Where to stay? What to see? Sign up for a tour or go on our own?

Observers of retirees not spending as much as they can afford mistakenly think those retirees must be afraid of running out of money. Besides not wanting to waste their precious time and energy on spending, retirees aren’t spending as much because they don’t see value in additional spending.

When we were building our house, I saw some neighbors put in these exposed beams on their ceilings:

I lost interest when I learned they were three-sided empty boxes purely for decoration.

Some other neighbors chose Wolf, Sub-Zero, and Thermador kitchen appliances. I’m sure those high-end appliances have some features normal appliances don’t have. I wasn’t interested in finding out what those features were because mainstream appliances had always worked well for me.

A home in the neighborhood was advertised as a furnished rental. It said all their furnishings came from RH. When I mentioned this to my wife, she asked “What’s RH?“

I’m driving a 2005 Honda Accord. It’s been with me for 20 years. I know how it works. It takes me wherever I want to go. I can afford a new car but a new car would still take me to the same places. I don’t see why I should spend time figuring out whether I should want an EV, a hybrid, or a gas-powered car, which brand, model, trim, and options, or whether they’re still charging thousands over MSRP with a long wait to get a new car.

I’m not depriving myself of decorative faux beams, high-end appliances, upscale home furnishings, or a new car when I’m happy with what I have now. Getting out of my way to get them would be a distraction.

Spending Is a Poor Proxy for EnjoymentI spent a full month in Switzerland in the summer of 2022. I enjoyed it and wrote a blog post about it. The trip cost over $10,000 all-in.

A neighbor gave away a 20-year-old cheap bike by the curb last year. Walmart sells a new bike much better than this for under $200 today.

I pumped some air into the tires and it still worked. I hadn’t ridden a bike since college. I started riding it in the neighborhood, in town, and eventually on a gravel road by a lake, which gave me this view in the spring:

Riding a bike got me to places I hadn’t been. I rode this old cheap bike over 60 times in a year.

Looking back, I can honestly say that the cheap bike gave me more joy than the $10,000 vacation in Switzerland. I enjoyed both but it doesn’t mean that expensive international travel (experience!) must be more enjoyable than a cheap bike (things!).

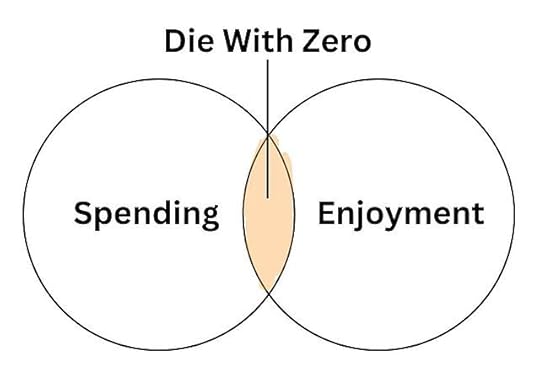

And that’s my biggest problem with the book Die With Zero. It falsely equates spending with enjoyment as if the more you spend the more you’ll enjoy life. Spending can induce or enhance some enjoyment but there’s only a thin overlap between the two. Fixating on spending misses the true source of enjoyment.

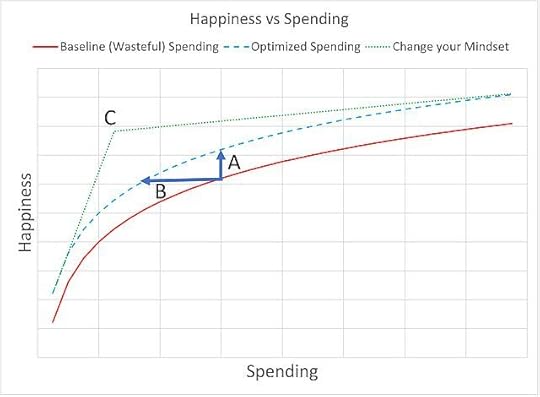

The blogger Frugal Professor included this chart in his blog post The Spending Tradeoff — Opportunity Costs vs Utility. The green dotted line shows the relationship between spending and happiness when you have a different mindset.

Happiness vs Spending, Frugal Professor. Used with permission.

Happiness vs Spending, Frugal Professor. Used with permission.He concluded that if you shift your mindset, you unlock a superpower in which your happiness is largely uncorrelated with your spending once you hit a modest point C.

The Best Things in Life Are FreeAn advantage of retirement is having more free time. I can’t believe the endless enjoyable activities that cost little to no money.

I do beginner yoga by following videos by Yoga With Adriene on YouTube. It’s free.

I do some bodyweight exercises — pushups, squats, plank, lunges, and bird dogs. You need at most a $20 exercise mat.

I take a book to read on my favorite park bench under a tree by a pond. It’s free.

My Favorite Park Bench on YouTubeI learned history when I watched a 6-hour documentary series The U.S. and the Holocaust by Ken Burns. It’s free on Kanopy through the public library. Kanopy also has The Criterion Collection films and educational courses by The Greatest Courses.

The U.S. and the Holocaust on YouTubeI walk up a hill when I’m not riding a bike. It’s free and it’s good for both physical and mental health. This was the view last week (our home is down there in the middle):

We had booked travel to the Dolomites region of Italy this summer.

Dolomites, Italy: Tirolean Culture and Alpine Adventures – Rick Steves’ Europe Travel Guide on YouTubeAs the dates drew closer, we asked why we wanted to be tourists in Italy when we were enjoying our activities locally. Our home is more comfortable than a hotel. The food we cook is healthier than restaurant food. We don’t need to deal with potential flight delays, crowds, theft, or getting sick.

So we canceled the trip (experience!) and used the money to buy two new bicycles (things!). We had so much fun learning mountain biking as beginners. Every ride put a big smile on our faces. I rode 19 times for a total of 28 hours since I bought the bike at the end of August. I’m in the back in this compiled video:

Beginner Mountain Biking – Fall 2024 on YouTubeI agree with Christine Benz when she said this on X:

Contrarian point of view: The whole "spend on experiences" mantra is overstated.

— Christine Benz (@christine_benz) September 4, 2024

The most worthwhile experiences involve connecting with other human beings and that can be done very cheaply AND OFTEN–e.g., walking with a friend or inviting people to dinner.

No bucket lists!

“Memory dividends” don’t only come from a once-in-a-lifetime experience such as flying 50 friends to an island, renting out an entire hotel, and booking your favorite band for a private performance (this was an example in the book Die With Zero). They also come from more frequent simple joys that cost nearly nothing.

OK to UnderspendA rich life isn’t about spending money. The best things in life are free. You won’t worry much about the safe withdrawal rate if you look for enjoyment and life satisfaction in the right places. It isn’t a character flaw if you’re not spending as much as you can afford.

I like this answer to the question Why is determining a withdrawal rate or method so difficult? on the Bogleheads Forum:

For most of us here, the only way to make this difficult is an effort to try to spend as much as you possibly can without running out.

We are not trying to do that, so it’s not difficult for us.

Wanderingwheelz

It’s not difficult for us either. We focus on enjoying the best things in life regardless of whether it requires spending money. If it does, we spend the money (we paid $6,000 for our two bicycles). Otherwise we don’t concern ourselves with whether we’re “underspending.”

What do you do when the money pile grows and grows?

Giving, whether to family or charities, is completely different from spending. Money given to young people and charities means a lot to them. Seeing the results of your help brings back enjoyment and life satisfaction. Look for ways to give to family and charities. Give early and give often.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Retirees, a Rich Life Does Not Require Spending More Money appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower