Follow This Rule to Avoid Long Holds and Account Restrictions

I read this post on Reddit a while ago: Vanguard closed my account for fraudulent activity.

I sold a property, received my payment via check and decided to invest the money in Vanguard. I opened a Vanguard account online and linked my bank, transferred $10 to my Cash Plus account, opened a brokerage account and deposited my check on Friday to the brokerage account. The check was accepted. On Tuesday, I received a call from the check issuer that the check cleared. I logged in Vanguard and I can see it was processed but not available till after 7 days. Everything seems easy, so I thought. Later the same day, I tried to log in and I got an error message, “Access to your account has been disabled. Please contact us.” I called Vanguard and spoke to a rep. They told me my account is being reviewed by the research team and they will be contacting me in 72 hours. I waited 72 hours and called again. Same response. 2 days later, I received a voicemail from the Vanguard fraud team.

“Hello, this is the fraud team calling to let you know the account you inquired about has been restricted due to fraudulent activity. The attempts to bring funds into the account have been rejected. Any electronic bank transfer can be recalled through your bank. Again the account is permanently restricted and there will not be a follow-up to this issue.”

This poster eventually got the money back when Vanguard returned the money to the check issuer.

This type of fraud restriction isn’t limited to Vanguard. Fidelity has had a wave of fraud attacks recently. Criminals recruited existing customers as collaborators (“mules”) for a 50/50 split to make fake deposits and withdraw the money.

Fidelity turned up their anti-fraud measures to thwart these attacks. Many customers reported seeing their accounts restricted, debits declined, Bill Pay canceled, mobile deposit limit cut to $1,000, or the deposit hold times extended to up to 21 days. No doubt many of these are false positives. Attacks from existing customers recruited as mules are the most difficult to combat. It’s hard to distinguish who’s legit and who’s knowingly or unknowingly working with criminals.

I use Fidelity for all my spending. As I mentioned in the previous post Ditch Banks — Go With Money Market Funds and Treasuries, I have under $100 in outside bank accounts. All my cash is in a Fidelity account in money market funds and Treasuries. All my bills are paid out of this Fidelity account. It’ll cause problems if Fidelity restricts my account. I’m not concerned about that possibility because I follow this one simple rule:

Make all deposits by ACH push.

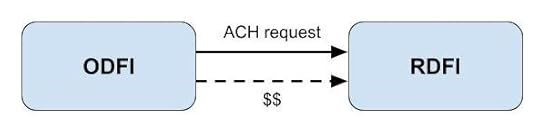

An ACH push is initiated at the same place where the money currently resides (see ACH Push or Pull: The Right Way to Transfer Money). Employer or government direct deposits also come in by ACH push. I make all deposits to my Fidelity account by ACH push. For example, when I transfer the credit card rewards earned in a Bank of America account to Fidelity, I initiate the ACH at Bank of America (see How to Link Another Account to Bank of America for ACH Push).

Money received by ACH push is trusted money. It’s available right away because the receiving institution isn’t responsible for it. You have nothing to worry about having your account flagged for fraud when all the money coming into the account comes by ACH push.

The Reddit poster at the beginning of this post didn’t follow this rule. I venture to say that everyone who had their Fidelity account restricted recently also didn’t follow this rule. Check deposits and ACH pulls are untrusted by the receiving institution. Not every check deposit or ACH pull will get the account restricted for fraud concerns but those who had their account restricted most likely had made check deposits or ACH pulls.

My Fidelity account is functioning normally as usual. I wouldn’t have known this storm was happening if I hadn’t read Reddit. My mobile check deposit limit is still a whopping $500,000 per day although I have no physical checks to deposit. All debits for estimated taxes, credit card bills, utility bills, and PayPal and Venmo payments went out without a hitch. I don’t know what the hold time will be if I do an ACH pull right now because I don’t make deposits by ACH pull anyway. I initiated another ACH push from Bank of America to my Fidelity account as a test. The money arrived the next day and it was available immediately as expected. No hold.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Follow This Rule to Avoid Long Holds and Account Restrictions appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower