Split-Year Backdoor Roth IRA in TurboTax, 2nd Year

The previous post Split-Year Backdoor Roth IRA in TurboTax, 1st Year dealt with contributing to a Traditional IRA for the previous year and recharacterizing a previous year’s Roth IRA contribution as a Traditional IRA contribution. This post handles the conversion part.

We cover two example scenarios. Here’s the first:

You contributed $6,000 to a Traditional IRA for 2022 in 2023. The value increased to $6,200 when you converted it to Roth in 2023. You received a 1099-R form listing this $6,200 Roth conversion.

You should’ve already reported the contribution part on your 2022 tax return by following Split-Year Backdoor Roth IRA in TurboTax, 1st Year. The IRA custodian sent you a 1099-R form for the conversion in 2023. This post shows you how to put it into TurboTax.

Here’s the second example scenario:

You contributed $6,000 to a Roth IRA for 2022 in 2022. You realized that your income was too high when you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Traditional contribution before April 15, 2023. The IRA custodian moved $6,100 from your Roth IRA to your Traditional IRA because your original $6,000 contribution had some earnings. The value increased again to $6,200 when you converted it to Roth in 2023. You received two 1099-R forms, one for $6,100 and another for $6,200.

You should’ve already reported the recharacterized contribution on your 2022 tax return by following Split-Year Backdoor Roth IRA in TurboTax, 1st Year. The IRA custodian sent you two 1099-R forms, one for the recharacterization, and the other for the conversion. This post shows you how to put both of them into TurboTax.

If you contributed for 2023 in 2024 or if you recharacterized a 2023 contribution in 2024, you’re still in the first year of this journey. Please follow Split-Year Backdoor Roth in TurboTax, 1st Year. If you recharacterized your 2023 contribution in 2023 and converted in 2023, please follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year.

If neither of these example scenarios fits you, please consult our guide for a normal “clean” backdoor Roth: How To Report Backdoor Roth In TurboTax (Updated).

If you’re married and both you and your spouse did the same thing, you should follow the steps below once for yourself and once again for your spouse.

Table of ContentsUse TurboTax Download1099-R for RecharacterizationNo Need to Amend1099-R for ConversionConvertedBasisClean Backdoor Roth On TopConverted, Did Not RecharacterizeMake It NondeductibleTaxable IncomeUse TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

1099-R for RecharacterizationThis section only applies to the second example scenario. If you didn’t recharacterize (the first example scenario), please skip this section and jump over to the conversion section.

We handle the 1099-R form for recharacterization first. This 1099-R form has a code ‘R’ in Box 7.

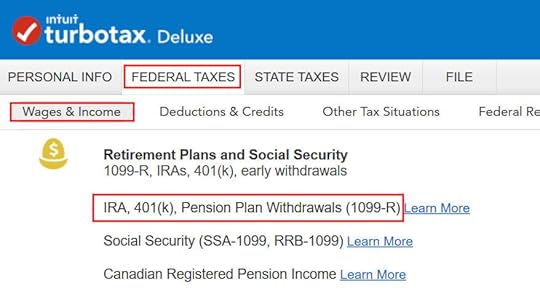

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

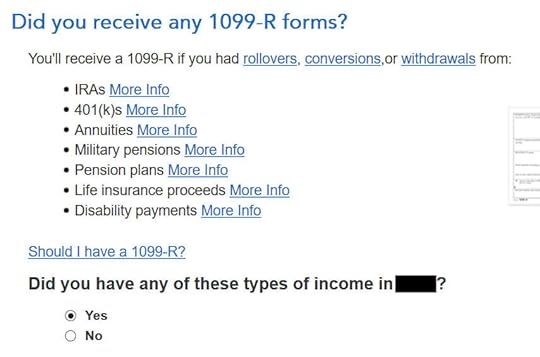

Confirm that you have received a 1099-R form. Import the 1099-R if you’d like. I’m choosing to type it myself.

It’s a regular 1099-R.

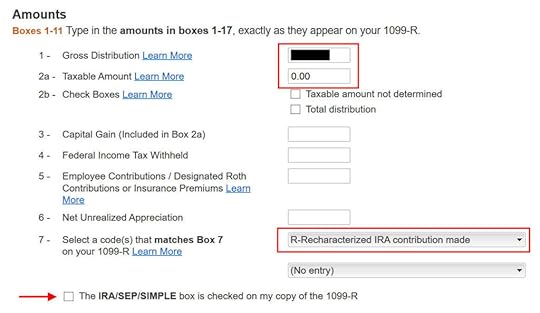

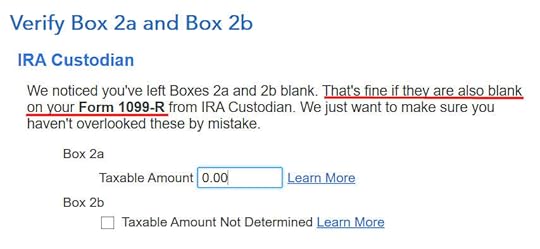

The amount that moved from your Roth IRA to your Traditional IRA shows in Box 1. The taxable amount in Box 2a is zero. The two checkboxes in Box 2b aren’t checked. The code in Box 7 is “R.” The “IRA/SEP/SIMPLE” box under Box 7 may or may not be checked. It’s not checked in our sample 1099-R.

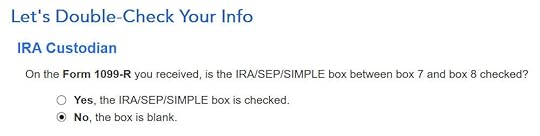

That box is blank in our 1099-R, and that’s OK.

It’s normal to see zero in Box 2a and blank in Box 2b. TurboTax just wants to double-check.

Not a Public Safety Officer.

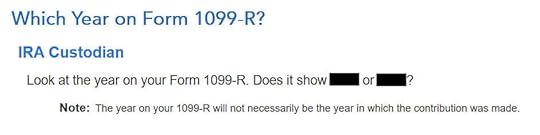

When you’re doing taxes for 2023, chances are the 1099-R form is for 2023. Click on the button that matches the year on the form.

No Need to Amend

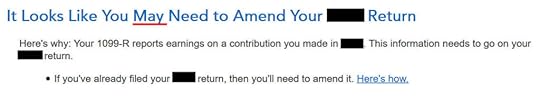

This is unnecessary if you already reported the recharacterization in the previous year’s tax return as shown in our previous post. You only need to amend your previous tax return if you didn’t follow those steps.

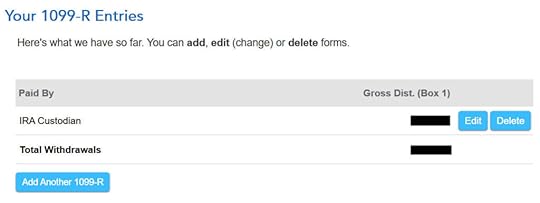

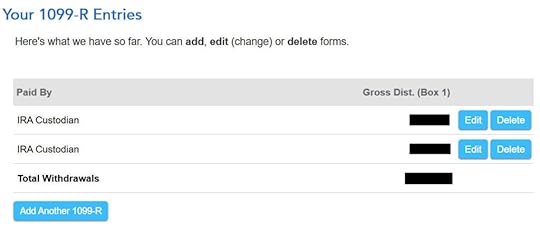

You’re done with the first 1099-R form. Click on “Add Another 1099-R” to add the second one if you don’t already have both 1099-R forms imported.

1099-R for Conversion

The second 1099-R form is also a regular 1099-R.

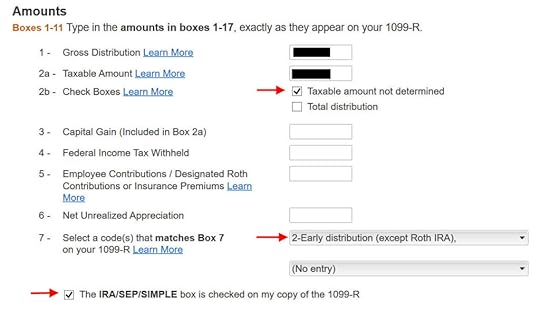

It’s normal to see the conversion reported in Box 2a as the taxable amount when Box 2b is checked to say “Taxable amount not determined.” The code in Box 7 is ‘2‘ when you’re under 59-1/2 or ‘7‘ when you’re over 59-1/2. The “IRA/SEP/SIMPLE” box is checked on this 1099-R form for the conversion.

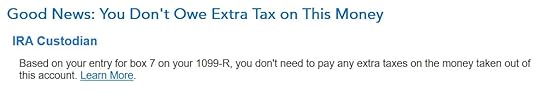

It says that you don’t owe extra tax on this money. If your refund meter drops, don’t panic. It’s normal and temporary.

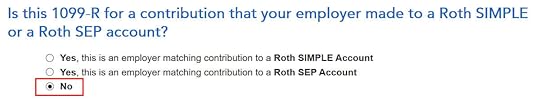

It’s not a Roth SIMPLE or a Roth SEP.

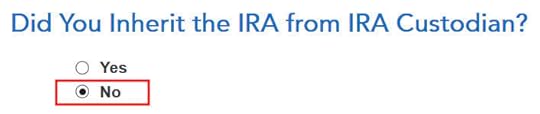

Did not inherit it.

Converted

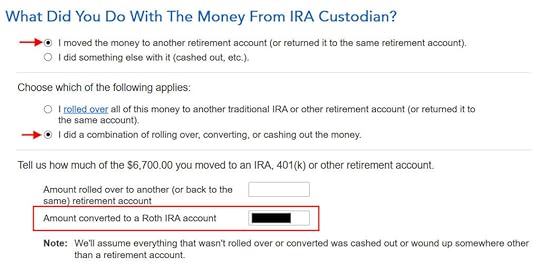

First click on “I moved …” then click on “I did a combination …” Enter the amount you converted to Roth in the box. Don’t choose the “I rolled over …” option. A rollover means Traditional-to-Traditional. Converting to Roth isn’t a rollover.

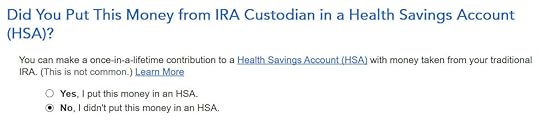

Didn’t put it in an HSA.

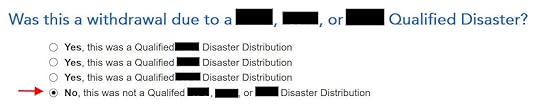

Not due to a disaster.

Now the 1099-R summary includes both 1099-R forms. Keep going by clicking on “Continue.”

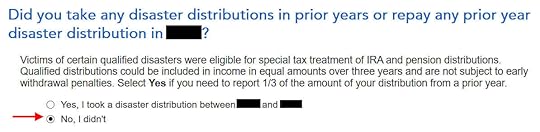

No disaster distributions.

Basis

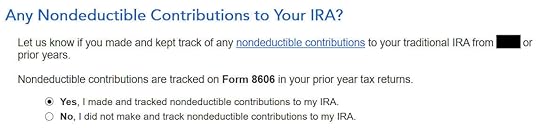

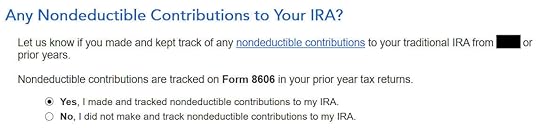

Choose “Yes.” If you recharacterized a 2022 Roth IRA contribution in 2023, it counts as a nondeductible Traditional IRA contribution for 2022.

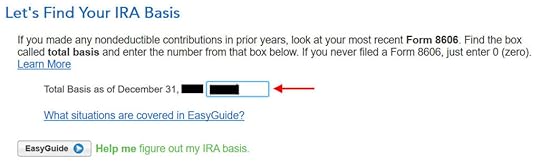

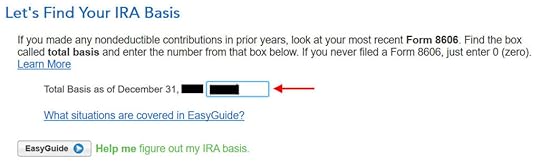

TurboTax should populate this value from last year’s return. It’s $6,000 in our example. If it doesn’t auto-populate, get the value from your last year’s Form 8606 Line 14, which was generated when you followed the previous post Split-Year Backdoor Roth IRA in TurboTax, 1st Year.

The refund meter goes up after you enter the total basis.

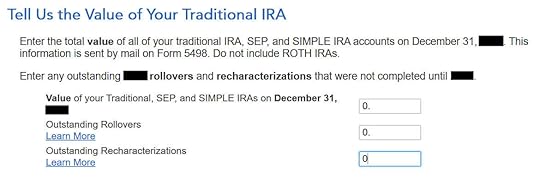

This is normally zero if you converted everything. If you have a few dollars left in the account from earnings posted after you converted, enter the value from your year-end statement in the first box.

Clean Backdoor Roth On TopIf you also did a “clean” backdoor Roth in 2023 on top of converting your contribution for 2022, in other words, you also contributed to a Traditional IRA for 2023 in 2023 and converted both your 2022 contribution and your 2023 contribution in 2023, your 1099-R includes converting two year’s worth of contributions in a single year. All the steps in the previous section are still the same except that you have a larger amount on your 1099-R form.

The basis from the previous year’s tax return took care of one-half of the conversion. You also need to report your 2023 Traditional IRA contribution.

Skip this section if you didn’t contribute to a Traditional IRA for 2023.

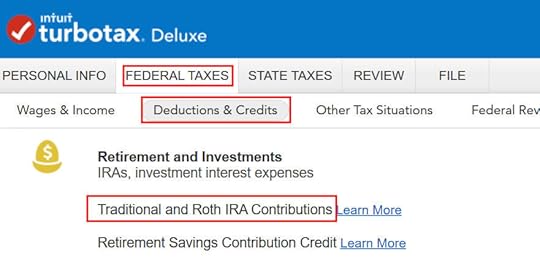

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

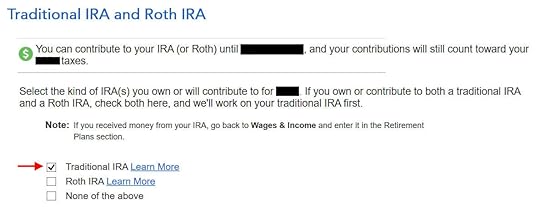

Check the box for Traditional IRA because you contributed to a Traditional IRA.

If TurboTax offers an upgrade, decline it and choose to continue in TurboTax Deluxe.

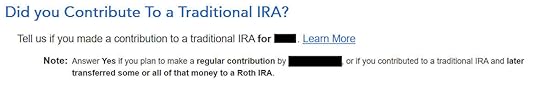

Answer Yes here to confirm that you contributed to a Traditional IRA.

It was not a repayment of a retirement distribution.

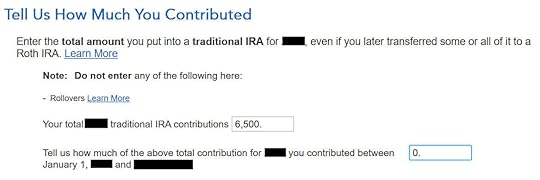

Enter the amount you contributed. Put zero in the second box because you contributed for 2023 in 2023. Your refund meter should go up now.

Converted, Did Not Recharacterize

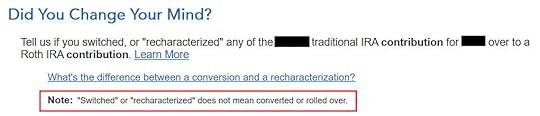

This is a critical question. Answer “No.” You converted the money, not switched or recharacterized.

You may not get this question if you already entered your W-2 and it has Box 13 for the retirement coverage checked. Answer yes if you’re covered by a retirement plan but the box on your W-2 wasn’t checked.

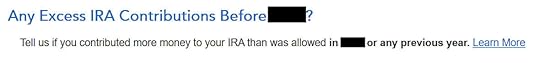

No excess contribution.

We answered this question before but TurboTax asks again. Choose Yes.

TurboTax populates the same answer as before. It’s $6,000 in our example.

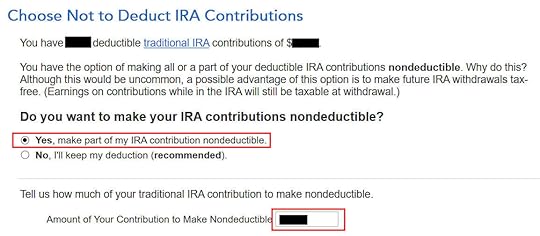

Make It Nondeductible

TurboTax shows this screen if it sees that you qualify for a deduction for the Traditional IRA contribution. If you take the deduction it’ll make your Roth conversion taxable, which creates a wash. It’s simpler if you make your full IRA contribution nondeductible, and then your Roth conversion won’t be taxable.

The IRA deduction summary shows a $0 deduction, which is expected.

Taxable IncomeYou’re done with the two 1099-R forms. Let’s look at how they show up on your tax return. Click on “Forms” on the top right.

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b. They show a distribution from the IRA and only $200 is taxable. That’s the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth. The taxable amount would be zero if you didn’t have any earnings.

Form 8606 shows these for our example:

Line #Amount16,500 (only if you also did a “clean” backdoor Roth on top, otherwise blank.)26,0003The sum of Line 1 and Line 25The same as Line 313The same as Line 314016The amount on your 1099-R with a code 2 or 717The same as Line 318The difference between Line 16 and Line 17Form 8606When you’re done examining the form, click on Step-by-Step on the top right to go back to the interview.

Learn the Nuts and Bolts

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Split-Year Backdoor Roth IRA in TurboTax, 2nd Year appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower