Split-Year Backdoor Roth IRA in TurboTax, 1st Year

The best way to do a backdoor Roth is to do it “clean” by contributing *for* and converting in the same year — contribute for 2023 in 2023 and convert in 2023, contribute for 2024 in 2024 and convert in 2024, and contribute for 2025 in 2025 and convert in 2025. Don’t split them into two years such as contributing for 2022 in 2023 and converting in 2023 or contributing for 2023 in 2024 and converting in 2024. If you did a “clean” backdoor Roth, please follow How To Report Backdoor Roth In TurboTax (Updated).

However, many people didn’t know they should’ve done it “clean.” Some people thought it was natural to contribute to an IRA for 2023 between January 1 and April 15 in 2024. Some people contributed directly to a Roth IRA for 2023 in 2023 and only found out their income was too high when they did their taxes in 2024. They had to recharacterize the previous year’s Roth IRA contribution as a Traditional IRA contribution and convert it again to Roth after the fact.

When you contribute for the previous year and convert (or recharacterize and convert in the following year), you have to report them on your tax return in two different years: the contribution in one year and the conversion in the following year. It’s more confusing than a straight “clean” backdoor Roth but that’s the price you pay for not knowing the right way. This post shows you how to do the contribution part in TurboTax for the first year. The follow-up post Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year shows you how to do the conversion part in TurboTax for the second year.

If you recharacterized your 2023 contribution in 2023 and converted in 2023, please follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year.

I’m showing two examples — (1) a direct contribution to a Traditional IRA for the previous year; and (2) recharacterizing a Roth contribution for the previous year as a Traditional contribution. Please see which example matches your scenario and follow along accordingly.

Table of ContentsUse TurboTax DownloadContributed for the Previous YearContributed to Traditional IRAConverted, Did Not RecharacterizeBasisMake It NondeductibleForm 8606Break the CycleRecharacterized Before ConvertingContributed to Roth IRARecharacterizedRoth BasisMake It NondeductibleForm 8606Switch to Clean Backdoor RothUse TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

Contributed for the Previous YearHere’s the example scenario for a direct contribution to the Traditional IRA:

You contributed $6,500 to a Traditional IRA for 2023 between January 1 and April 15, 2024. You then converted it to Roth in 2024.

Because your contribution was *for* 2023, you need to report it on your 2023 tax return by following this guide. Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion when you do your 2024 tax return. Come again next year to follow Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

If you contributed to a Traditional IRA in 2023 for 2022, everything below should’ve happened in your 2022 tax return. In other words,

You contributed $6,000 to a Traditional IRA for 2022 between January 1 and April 15, 2023. You then converted it to Roth in 2023.

Then you should’ve gone through the steps below in your 2022 tax return. If you didn’t, you should fix your 2022 return. The conversion part is covered in Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

If you’re married and both you and your spouse did the same thing, you must follow the same steps below once for you and once again for your spouse.

If you first contributed to a Roth IRA and then recharacterized it as a Traditional contribution, please jump over to the next example.

Contributed to Traditional IRA

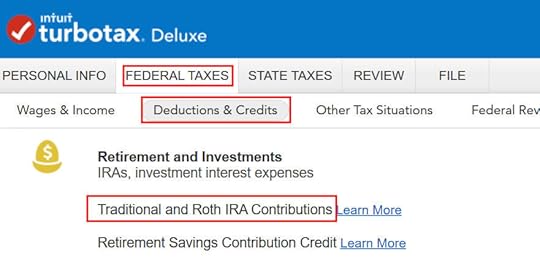

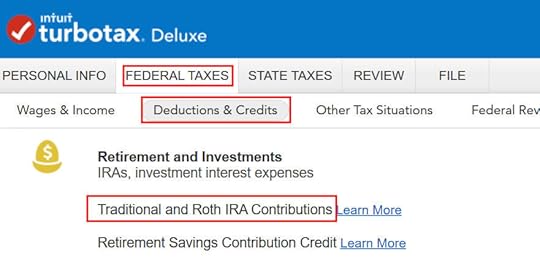

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

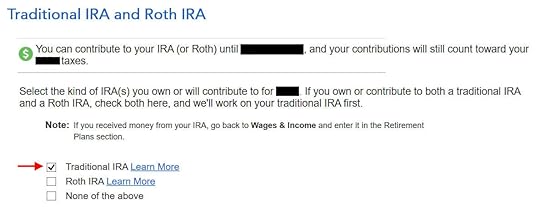

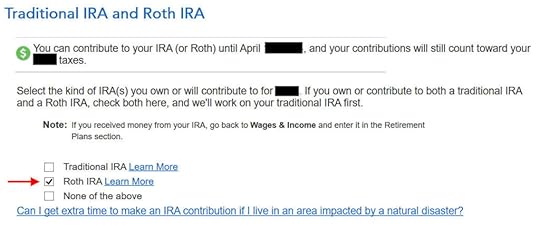

Check the box for Traditional IRA because you contributed to the Traditional IRA directly. See the next example if you contributed to a Roth IRA first and then recharacterized it.

TurboTax offers an upgrade but we don’t need it. Choose to continue in TurboTax Deluxe.

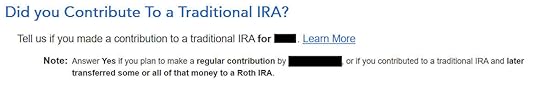

We already checked the box for Traditional but TurboTax just wants to make sure. Answer Yes here.

It was not a repayment of a retirement distribution.

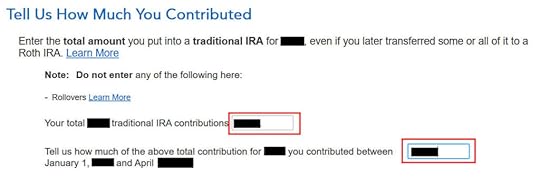

Enter your contribution amount in both boxes. The first box says you contributed. The second box says you contributed in 2024, not in 2023.

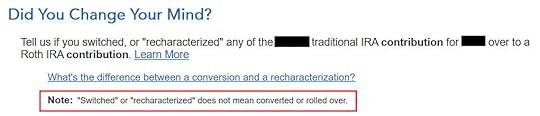

Converted, Did Not Recharacterize

This is a critical question. Answer “No.” You converted the money, not switched or recharacterized.

You may not get this question if TurboTax sees that you’re covered by a retirement plan at work from Box 13 in your W-2. Answer yes if you’re covered by a retirement plan but the box on your W-2 wasn’t checked.

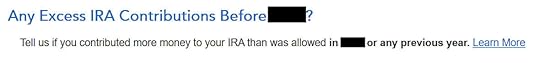

You have excess contributions only if you contributed over the limit. Don’t do that.

Basis

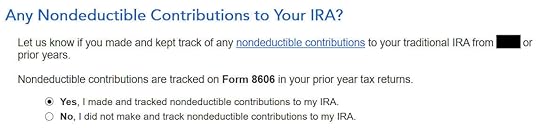

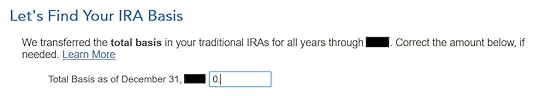

You can answer “No” if this is the first time you contributed to a Traditional IRA but answering “Yes” with a 0 has the same effect and it allows you to correct errors.

This is normally zero if this is the first time you contributed to a Traditional IRA. If you put in a number because you didn’t understand what it was asking, now is the chance to correct it.

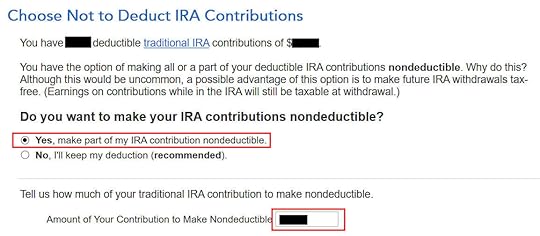

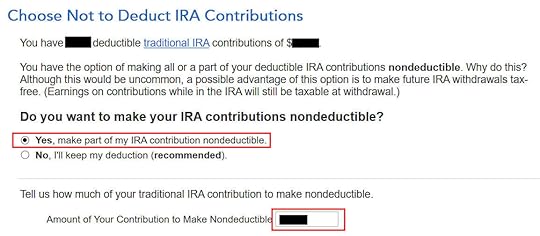

Make It Nondeductible

TurboTax won’t show you this if it sees clearly that your income is too high to qualify for a deduction. If you see this question, it means you have the option to take a deduction or decline the deduction. Taking the deduction in 2023 will make your conversion in 2024 taxable. It’s simpler if you make your full Traditional IRA contribution nondeductible, and then your 2024 Roth conversion won’t be taxable. Enter the amount of your contribution in the last box. It was $6,500 in our example.

Your Traditional IRA deduction is zero, which is OK because it makes your conversion in 2024 not taxable.

Form 8606Let’s take a look at Form 8606. Click on Forms on the top right.

Find “Form 8606-T” (and “Form 8606-S” for your spouse) in the list of forms in the left pane. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2024. It’ll make your conversion in 2024 not taxable.

Break the CycleWhile you’re at it, you should break the cycle of contributing for the previous year and create a new habit of contributing for the current year. Contribute to a Traditional IRA for 2024 in 2024 and convert in 2024.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

Recharacterized Before ConvertingNow let’s look at our second example scenario.

You contributed $6,500 to a Roth IRA for 2023 in 2023. You realized that your income was too high when you did your taxes in 2024. You recharacterized the Roth contribution for 2023 as a Traditional contribution before April 15, 2024. The IRA custodian moved $6,600 from your Roth IRA to your Traditional IRA because your original $6,500 contribution had some earnings. Then you converted it to Roth in 2024.

Because your contribution was for 2023, you need to report it on your 2023 tax return by following this guide. Because you converted in 2024, you won’t get a 1099-R for your conversion until January 2025. You will report the conversion when you do your 2024 tax return. Come back again next year to follow Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

Similar to our first example, if you did the same in 2023 for 2022, you should’ve done everything below when you did your taxes for 2022. In other words,

You contributed $6,000 to a Roth IRA for 2022 in 2022. You realized that your income was too high when you did your 2022 taxes in 2023. You recharacterized the Roth contribution for 2022 as a Traditional contribution before April 15, 2023. The IRA custodian moved $6,100 from your Roth IRA to your Traditional IRA because your original $6,000 contribution had some earnings. Then you converted it to Roth in 2023.

Then you should’ve taken all the steps below last year in your 2022 tax return. If you didn’t, you need to fix your 2022 return. The conversion part is covered in Backdoor Roth in TurboTax: Recharacterize & Convert, 2nd Year.

Contributed to Roth IRA

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

Check the box for Roth IRA because you originally contributed to a Roth IRA.

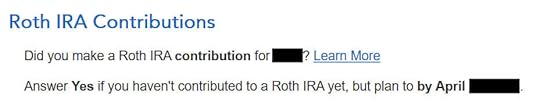

We already checked the box for Roth IRA but TurboTax just wants to make sure.

It was not a repayment of a retirement distribution.

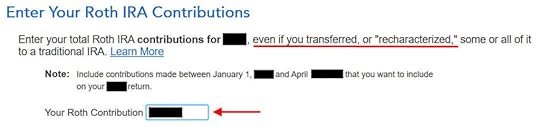

Enter the amount of your original Roth contribution. It was $6,500 in our example.

Recharacterized

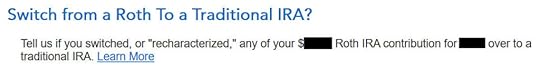

Now we confess that we recharacterized the contribution as a Traditional IRA contribution. Answer Yes here.

The amount here is relative to the original contribution amount. If you recharacterized the whole thing, enter $6,500 in our example, not $6,600 which was the amount with earnings that the IRA custodian moved into the Traditional IRA.

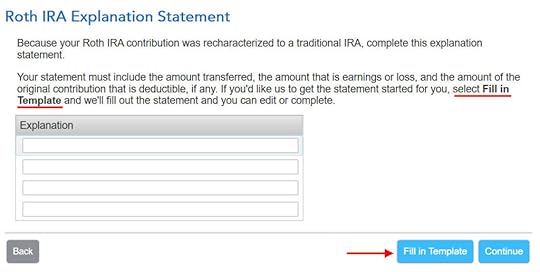

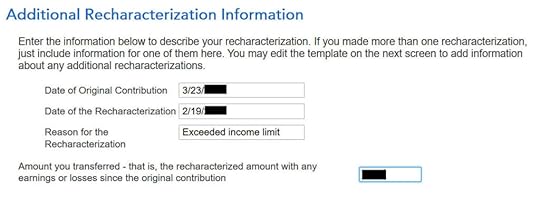

The IRS wants a statement to explain the recharacterization. Click on “Fill in Template.”

Fill in the dates of your original contribution and your recharacterization. The amount in the last box includes earnings. It’s $6,600 in our example.

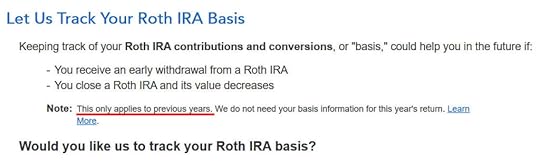

Roth Basis

If you take up this offer from TurboTax to track your Roth IRA basis, it’s going to ask you questions about previous years, which is more trouble than it’s worth to me. I answered No. You don’t need to track your Roth IRA basis if you’re planning to withdraw from your Roth account only after age 59-1/2 and after you’ve had your first Roth IRA for five years. See Roth IRA Withdrawal After 59-1/2 in TurboTax.

No excess contributions.

Make It Nondeductible

TurboTax shows this only when it sees your income qualifies for a deduction. You have the option to take the deduction or decline the deduction. Taking the deduction in 2023 will make your conversion in 2024 taxable. It’s simpler if you make your full contribution nondeductible and then your 2024 Roth conversion won’t be taxable. Enter the amount of your original contribution in the last box. It was $6,500 in our example.

Your Traditional IRA deduction is zero, which is OK because it makes your conversion in 2024 not taxable.

Form 8606Let’s take a look at Form 8606. Click on “Forms” on the top right.

Find “Form 8606-T” (and “Form 8606-S” for your spouse) in the list of forms in the left pane. You should see that only lines 1, 3, and 14 are filled in with your original contribution amount. After recharacterizing, it’s as if you contributed directly to a Traditional IRA in the first place. It’s important to see the number in Line 14. This number will carry over to 2024. It’ll make your conversion in 2024 not taxable.

Switch to Clean Backdoor RothWhile you are at it, you should switch to a clean backdoor Roth for 2024. Rather than contributing directly to a Roth IRA, seeing that you exceed the income limit, recharacterizing it, and converting it again, you should simply contribute to a Traditional IRA for 2024 in 2024 and convert it to Roth in 2024 if there’s any possibility that your income will be over the limit again.

You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2023 contribution and your 2024 contribution in 2024. Then you will start 2025 fresh. Contribute for 2025 in 2025 and convert in 2025.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Split-Year Backdoor Roth IRA in TurboTax, 1st Year appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower