How To Report 2024 Backdoor Roth In TurboTax (Updated)

Updated on January 26, 2025 with updated screenshots from TurboTax Deluxe downloaded software for the 2024 tax year. If you use other tax software, see:

How To Report Backdoor Roth In H&R Block SoftwareHow to Report Backdoor Roth In FreeTaxUSAIf you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you must report both the contribution and the conversion in the tax software. For more information on Backdoor Roth in general, see Backdoor Roth: A Complete How-To.

Table of ContentsWhat To ReportUse TurboTax DownloadConvert Traditional IRA to RothEnter 1099-RConverted to RothBasisNon-Deductible Contribution to Traditional IRAConverted, Did Not RecharacterizeBasisMake It NondeductibleTaxable Income from Backdoor RothTroubleshootingFresh StartConversion Is TaxedSelf vs SpouseWhat To ReportYou report on the tax return your contribution to a Traditional IRA *for* that year, and you also report your conversion to Roth *during* that year.

For example, when you are doing your tax return for 2024, you report the contribution you made *for* 2024, whether you actually did it during 2024 or between January 1 and April 15, 2025. You also report your conversion to Roth *during* 2024, whether the contribution was made for 2024, 2023, or any previous years.

Therefore a contribution made during 2025 for year 2024 goes on the tax return for year 2024. A conversion done during 2025 after you contributed for 2024 goes on the tax return for 2025.

You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finishing your conversion in the same year. I call this a “planned” Backdoor Roth or a “clean” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for 2024 in 2024 and convert it during 2024. Contribute for 2025 in 2025 and convert it during 2025. This way everything is clean and neat.

If you are already off by one year, it depends on whether you’re handling the contribution part or the conversion part right now. If you contributed to a Traditional IRA for 2024 in 2025 and converted in 2025 or if you recharacterized a 2024 Roth contribution in 2025 and converted in 2025, please follow Split-Year Backdoor Roth IRA in TurboTax, 1st Year. If you contributed to a Traditional IRA for 2023 in 2024 and converted in 2024 or if you recharacterized a 2023 Roth contribution in 2024 and converted in 2024, please follow Split-Year Backdoor Roth IRA in TurboTax, 2nd Year. If you recharacterized your 2024 Roth contribution in 2024 and converted in 2024, please follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year.

Use TurboTax DownloadThe screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

Here’s the planned “clean” Backdoor Roth scenario we will use as an example:

You contributed $7,000 to a traditional IRA in 2024 for 2024. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2024, the value grew to $7,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments to the screens shown here.

Before we start, suppose this is what TurboTax shows:

We will compare the results after we enter the Backdoor Roth.

Convert Traditional IRA to RothThe tax software works on income items first. Even though the conversion happened after the contribution, we enter the conversion first.

When you convert from a Traditional IRA to a Roth IRA, you will receive a 1099-R form. Complete this section only if you converted *during* 2024. If you only converted during 2025, you won’t have a 1099-R until next January. Please follow Split-Year Backdoor Roth IRA in TurboTax, 1st Year. If your conversion during 2024 was against a contribution you made for 2023 or a 2023 contribution you recharacterized in 2024, please follow Split-Year Backdoor Roth IRA in TurboTax, 2nd Year.

In our example, we assume by the time you converted, the money in the Traditional IRA had grown from $7,000 to $7,200.

Enter 1099-R

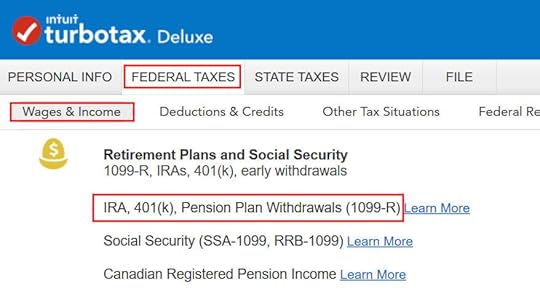

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

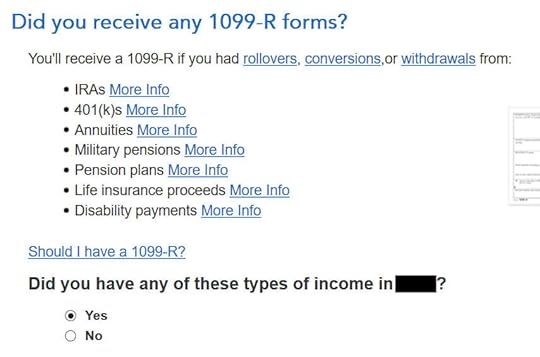

As you work through the interview, you will eventually come to the point of entering the 1099-R. Select Yes, you have this type of income. Import the 1099-R if you’d like. I’m choosing to type it myself.

Just the regular 1099-R.

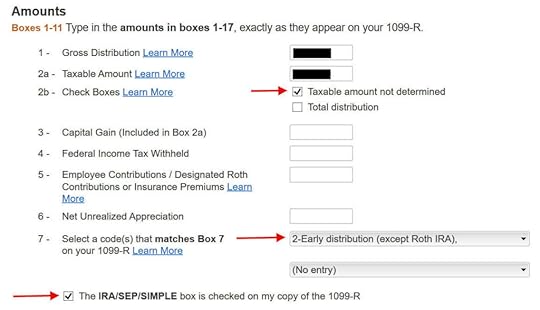

Box 1 shows the amount converted to the Roth IRA. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” Pay attention to the code in Box 7 and the IRA/SEP/SIMPLE box. Make sure your entry matches your 1099-R exactly.

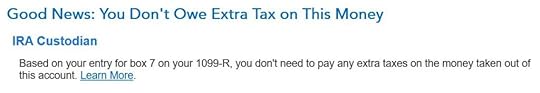

You get this Good News, but …

Your refund in progress drops a lot. We went from $2,384 down to $858. Don’t panic. It’s normal and temporary.

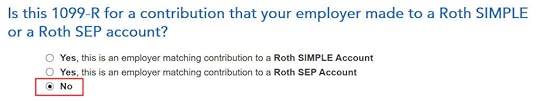

It has nothing to do with an employer.

Didn’t inherit it.

Converted to Roth

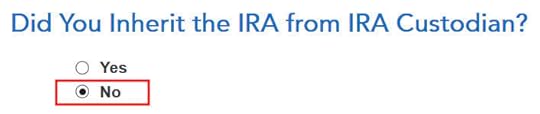

First click on “I moved …” then click on “I did a combination …” Enter the amount you converted in the box. It’s $7,200 in our example. Don’t choose the “I rolled over …” option. A Roth conversion is not a rollover.

No, you didn’t put the money in an HSA.

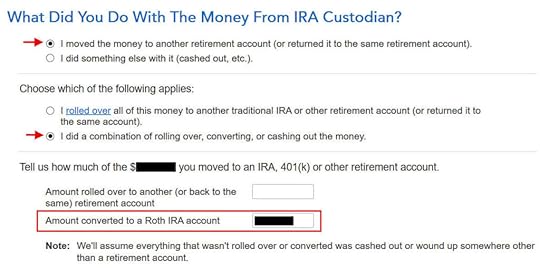

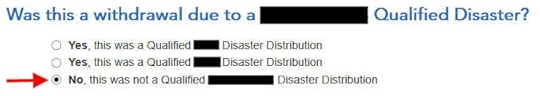

It wasn’t due to a disaster.

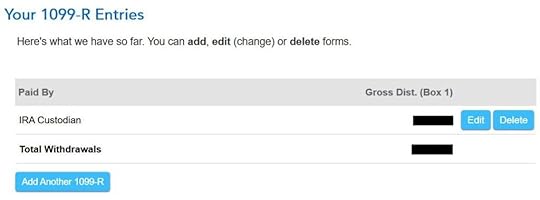

You get a summary of your 1099-R’s. Repeat the previous steps to add another if you have more than one. If you’re married and both of you did a Backdoor Roth, enter the 1099-R for both of you, but pay attention to select whose 1099-R it is. Don’t accidentally assign two 1099-R forms to the same person.

Basis

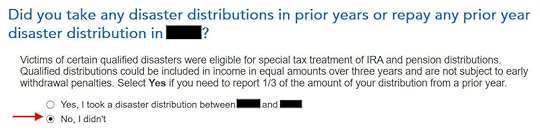

Didn’t take or repay any disaster distribution.

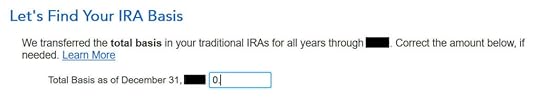

Here it’s asking about the carryover from the prior year. When you did a clean “planned” Backdoor Roth as in our example — contributed for 2024 in 2024 and converted before the end of 2024 — you can answer No here but answering Yes with a 0 has the same effect as answering No and it allows you to correct errors.

If you answered Yes to the previous question and you did your previous year’s return correctly also in TurboTax, your basis from the previous year will show up here. If you did your previous year’s tax return wrong, fix your previous return first.

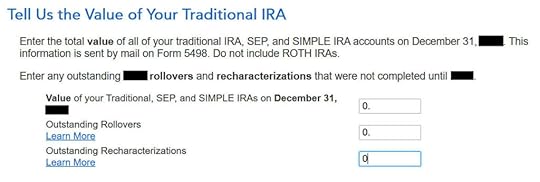

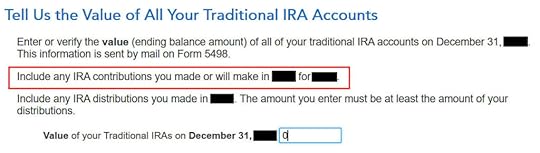

Enter the values of ALL your Traditional, SEP, and SIMPLE IRAs at the end of the year. We don’t have anything in traditional, SEP, or SIMPLE IRAs after we converted it all. If your account posted earnings after you converted and you left the earnings in the account, get the value from your year-end statement and put it in the first box.

That’s it so far on the income side. Continue with other income items. The refund in progress is still temporarily depressed. Don’t worry. It will change.

Non-Deductible Contribution to Traditional IRANow we enter the non-deductible contribution to a Traditional IRA *for* 2024.

If you contributed for 2024 between January 1 and April 15, 2025 or if you recharacterized a 2024 contribution in 2025, please follow Backdoor Roth in TurboTax: Recharacterize and Convert, 1st Year. If your contribution during 2024 was for 2023, make sure you entered it on the 2023 tax return. If not, fix your 2023 return first by following the steps in Backdoor Roth in TurboTax: Recharacterize and Convert, 1st Year.

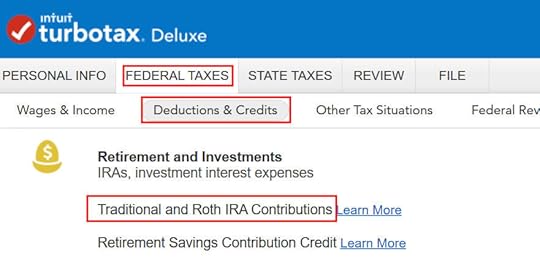

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

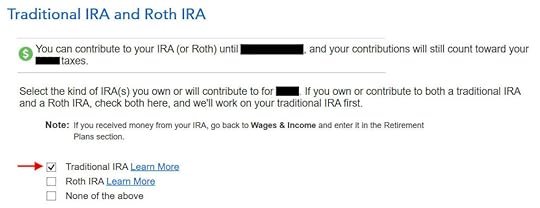

Because we did a clean “planned” Backdoor Roth, we check the box for Traditional IRA.

TurboTax offers an upgrade but we don’t need it. Choose to continue in TurboTax Deluxe.

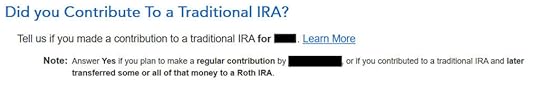

We already checked the box for Traditional but TurboTax just wants to make sure. Answer Yes here.

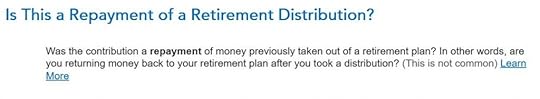

It was not a repayment of a retirement distribution.

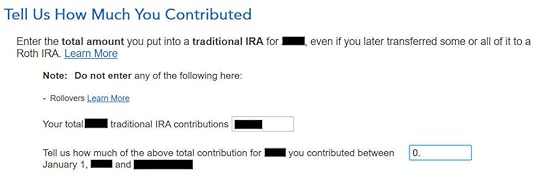

Enter the contribution amount. It’s $7,000 in our example. Because we contributed for year 2024 in 2024, we put zero in the second box. If you contributed for 2024 between January 1 and April 15, 2025, enter the contribution in both boxes.

Right away our federal refund in progress goes back up! We started with $2,384. It went down to $858. Now it comes back to $2,335. The $49 difference is because we have to pay tax on the $200 in earnings when we contributed $7,000 and converted $7,200. If you had less earnings, your refund numbers would be closer still.

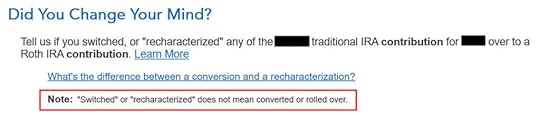

Converted, Did Not Recharacterize

This is a critical question. Answer “No.” You converted the money, not switched or recharacterized.

You may not get this question if you already entered your W-2 and it has Box 13 for the retirement coverage checked. Answer yes if you’re covered by a retirement plan but the box on your W-2 wasn’t checked.

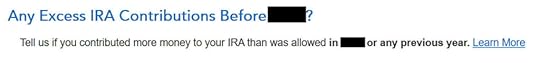

No excess contribution.

Basis

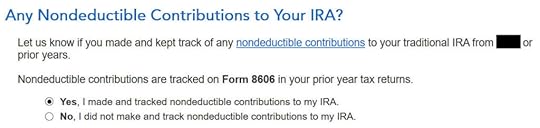

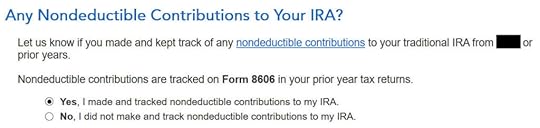

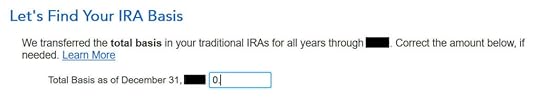

TurboTax asks the same question we saw before. For a clean “planned” Backdoor Roth, we can answer No but answering Yes with a 0 has the same effect and it allows you to correct errors.

If you did your taxes correctly on TurboTax last year, TurboTax transfers the number here. If you made non-deductible contributions for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

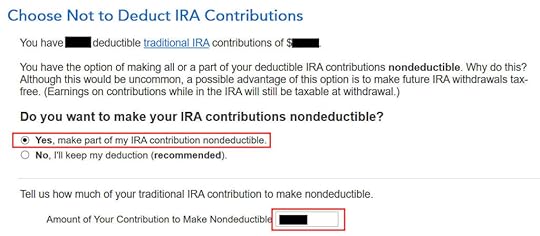

Make It Nondeductible

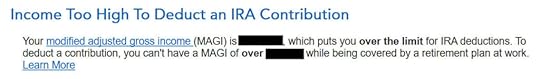

TurboTax shows this screen if it sees that you qualify for a deduction for the Traditional IRA contribution. If you take the deduction it’ll make your Roth conversion taxable, which creates a wash. It’s simpler if you make your full IRA contribution nondeductible, and then your Roth conversion won’t be taxable. Enter the amount that TurboTax says is deductible.

Because we did a clean “planned” Backdoor Roth, we don’t have anything left after we converted everything before the end of the same year. If you have a small balance left because of interest, enter the value from your year-end statement here.

We know our income was too high. That’s why we did the Backdoor Roth.

The IRA deduction summary shows a $0 deduction, which is expected.

Taxable Income from Backdoor RothAfter going through all these, would you like to see how you are taxed on the Backdoor Roth?

Click on Forms on the top right.

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b. They show a $7,200 distribution from the IRA and only $200 of the $7,200 is taxable in our example. That’s the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth.

When you’re done examining the form, click on Step-by-Step on the top right to go back to the interview.

Tah-Dah! You put money into a Roth IRA through the backdoor when you aren’t eligible to contribute to it directly. That’s why it’s called a Backdoor Roth. You pay tax on a small amount of earnings between contribution and conversion. That’s negligible relative to the benefit of having tax-free growth on your contribution for many years.

TroubleshootingIf you followed the steps and you are not getting the expected results, here are a few things to check.

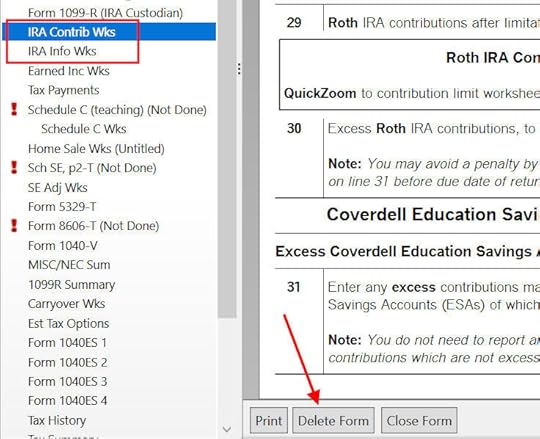

Fresh StartIt’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

Click on Forms on the top right.

Find “IRA Contrib Wks” and “IRA Info Wks” in the left navigation pane and click on “Delete Form” to delete them. Then you can start over by following the steps above.

Conversion Is Taxed

Conversion Is TaxedIf you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. Taking this deduction also makes your Roth IRA conversion taxable. You can see this deduction on Schedule 1 Line 20, which reduces your AGI.

The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal and it doesn’t cause any problems when you indeed don’t have a retirement plan at work.

It’s less confusing if you decline the tax deduction, which also makes your conversion non-taxable. See the Make It Nondeductible section.

Self vs SpouseIf you are married, make sure you don’t have the 1099-R and IRA contribution mixed up between yourself and your spouse. If you inadvertently entered two 1099-Rs issued to you instead of one for you and one for your spouse, the second 1099-R to you will not match up with a Traditional IRA contribution made by your spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How To Report 2024 Backdoor Roth In TurboTax (Updated) appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower