2 Ways to Use Fidelity as a Bank Account

[Rewritten on June 20, 2024 after Fidelity made a money market fund available as the default option in the Cash Management Account. Also added a section on debit card security.]

Fidelity Investments is best known as an administrator for workplace retirement plans and an online broker for retail investors. In addition to 401k/403b accounts, Traditional and Roth IRAs, HSAs, and taxable brokerage accounts, Fidelity also offers accounts that can be used for the same purpose as a checking account and a savings account.

Because Fidelity is interested in having a full relationship with its customers for both banking and investing and its primary focus is on the investing part, it’s in a good position to offer better rates and features than banks in the banking part.

This is not a sponsored post. Fidelity isn’t paying me to promote it. I’m only writing as a satisfied customer of over 20 years. Here are two ways to use a Fidelity account to manage day-to-day spending and savings.

Table of Contents1. CMA as CheckingIncluded FeaturesChoose Core PositionRouting Number and Account NumberLimitationsSecure Your Debit CardLink to External Account2. CMA as Checking/Savings ComboBuy Another Money Market FundCash Manager Not NeededAdd Treasury Bills or Brokered CDs1. CMA as CheckingFidelity Cash Management Account (CMA) is a separate account type from Fidelity’s regular taxable brokerage account officially called “The Fidelity Account.” You have to choose the account type when you open the account. A Cash Management Account can’t be changed to a regular taxable brokerage account after you open the account. Nor can an existing regular taxable brokerage account be changed to a CMA.

Included FeaturesThe Cash Management Account is specifically designed to meet banking needs. It has pretty much everything people need for a checking account and nearly everything is free.

– FDIC-insured balance (2.72% APY as of June 19, 2024) or a money market fund (4.95% 7-day yield as of June 19, 2024).

– No minimum balance. No maintenance fee. Does not require direct deposit.

– Provides a routing number and an account number for direct deposits and direct debits.

– Accepts check deposits by mobile app or in person at a Fidelity branch.

– Free checkbook. No minimum amount for writing a check.

– Free Visa debit card for purchase, ATM withdrawal, and teller cash advance. It does not require using the debit card a minimum number of times per month.

– No fee to use any ATM worldwide. Reimburses the ATM fee charged by the machine.

– Free Bill Pay service with eBill.

– Free same-day ACH. Push $100,000 per business day out of Fidelity and pull $250,000 per business day into Fidelity by online self-service. Call customer service to transfer a higher amount.

– Free wire transfers. Same $100,000 per business day by online self-service. Call customer service to wire a higher amount.

Choose Core PositionThe “core position” in a Fidelity account is the default holding. Money coming into the account lands in the core position and money going out of the account is withdrawn from the core position first.

You have a choice to keep your core position either in FDIC-insured banks or in a money market fund. The money market fund isn’t FDIC-insured but its underlying holdings are short-term government securities. I’m comfortable keeping my money in the money market fund for a higher yield. See No FDIC Insurance – Why a Brokerage Account Is Safe.

To switch from the FDIC-Insured Deposit Sweep Program to the Fidelity Government Money Market Fund (SPAXX), click on the “Positions” tab and select your cash balance. You will see a “Change Core Position” button.

Your chosen core position stays effective until you change it again. If you make Fidelity Government Money Market Fund (SPAXX) your core position, your existing core balance and all future deposits will automatically go into the money market fund.

The 4.95% yield from the money market fund is higher than the yield on many high-yield savings accounts as of June 19, 2024. For example, Ally Bank pays only 4.2% on its high-yield savings account, which doesn’t have all the checking features such as Bill Pay.

Routing Number and Account NumberYou see the routing number and the account number for direct deposits and direct debits when you click on the routing number link below the account name.

Choose “checking” as the account type if you’re asked to select one.

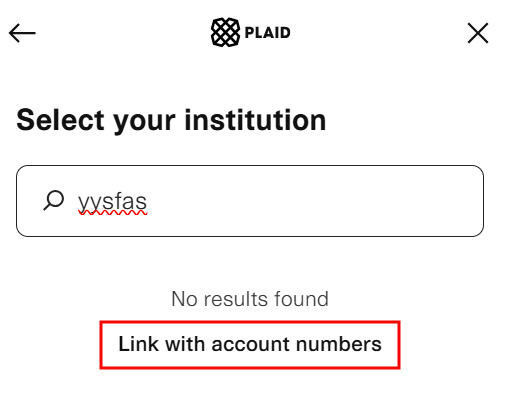

If your bank uses Plaid to add a Fidelity account as a linked bank account, search for a non-existent bank and then click on “Link with account numbers.” It will make Plaid use a micro-deposit to verify your Fidelity account.

You go back to verify the link after you receive the micro-deposit in your Fidelity account.

LimitationsFidelity Cash Management Account has some limitations that aren’t a deal-breaker to me.

– Does not accept deposits of physical cash or money orders.

– Does not support Zelle in the account. You can link the debit card in the Zelle mobile app.

– Does not link instantly through Plaid (must go through micro-deposits).

– Does not offer sub-accounts for tracking different goals.

– Does not provide cashier’s checks.

– Recurring ACH pushes out of Fidelity only support monthly and annual frequencies. Recurring ACH pulls into Fidelity only support weekly, biweekly, and monthly frequencies.

– 1% transaction fee on debit card purchases in foreign countries. This fee doesn’t apply to international ATM withdrawals.

– ACH pulls and check deposits are held for up to five business days. The money still earns interest. It’s just not available for withdrawal while it’s on hold. You won’t be subject to the hold if you know the right way to transfer money.

I use my otherwise dormant Bank of America checking account on those rare occasions when I need to deposit physical cash, get a cashier’s check, or set up recurring transfers on an odd schedule. I don’t use a debit card for purchases or track my savings by separate goals.

The hold time on ACH pulls and check deposits will shrink over time for established accounts on smaller amounts. My ACH pulls and check deposits are usually available for withdrawal in two business days. I do an ACH push from the other side when I need it to be available immediately.

Secure Your Debit CardThe account automatically comes with a Visa debit card. The debit card can be used for purchases without a PIN when it’s run as a credit card. This creates a problem in case your debit card is lost or stolen. A user posted on Reddit that he or she was having a hard time getting the money back after thieves bought $6,000 worth of gift cards with the stolen debit card.

It’s better not to carry the debit card with you in your wallet. If you prefer to use a debit card for purchases, put the debit card in Apple Pay or Google Pay and tap your phone to pay. It’s more difficult for criminals to crack a phone than to tap your lost or stolen debit card everywhere. If you normally don’t use a debit card for purchases, keep it at home and only take it with you when you anticipate needing to withdraw cash at an ATM.

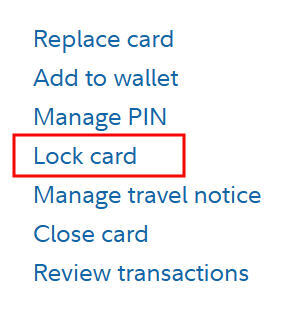

You can also lock your debit card on Fidelity’s website or in the Fidelity mobile app. Locking the card makes it decline all transactions. I previously used the debit card in Venmo to pay friends for shared expenses. Venmo also works with a bank account. I added the Fidelity account as a bank account and removed the debit card from Venmo. Now my debit card is securely locked at all times. I’ll only unlock it when I need to use it to withdraw cash.

To lock the debit card online, open a new tab in your browser after you log in to Fidelity and go to fidelitydebitcard.com. Find your debit card and click on “Lock card.”

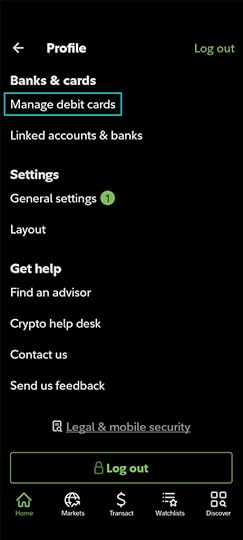

If you install the Fidelity mobile app on your phone, you can unlock the debit card right before you need to use the card to withdraw cash and lock it again when you’re done. Tap the head icon on the top right to find “Manage debit cards” in your profile in the Fidelity app. Tap “Lock or unlock card” on the next screen to lock or unlock the card.

Link to External Account

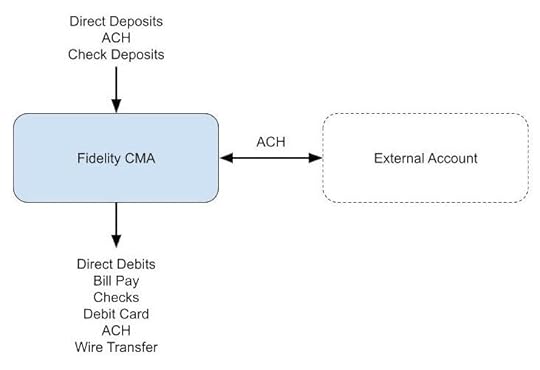

Link to External AccountWhen you use a Fidelity CMA as your checking account, you can link it to an external account as you normally do with a checking account. For example, the settlement fund in a Vanguard brokerage account pays 5.27% as of June 19, 2024. You can use Vanguard as your savings account to earn a slightly higher yield while using the Fidelity CMA as your checking account. The bulk of your cash earns 5.27% at Vanguard while the amount you need for spending earns 4.95% in the Fidelity CMA.

2. CMA as Checking/Savings Combo

2. CMA as Checking/Savings ComboInstead of linking to an external savings account, you can put the money in a different money market fund in the Cash Management Account and keep both checking and savings in the same account.

Buy Another Money Market FundAlthough the CMA is designed for banking needs, it’s still a brokerage account. With some exceptions (no margin or options), you can buy in the CMA pretty much everything available in a regular brokerage account. This includes stocks, bonds, brokered CDs, mutual funds, and ETFs.

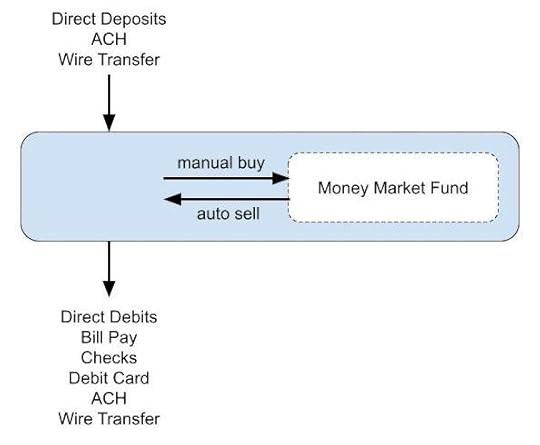

The CMA becomes a checking/savings combo when you buy a different money market fund in it. The core balance in the CMA serves as the checking part and the manually purchased non-core money market fund serves as the savings part. Fidelity will automatically sell from the non-core money market fund when your core balance in the CMA is insufficient to cover a debit. This is like having free automatic overdraft transfers from savings to checking.

Some people prefer to buy Fidelity Money Market Fund (SPRXX) or Fidelity Money Market Fund Premium Class (FZDXX). Their yields were 5.02% and 5.14% respectively as of June 19, 2024, which were slightly higher than the 4.95% yield on Fidelity Government Money Market Fund (SPAXX) in the core position. Some people prefer to buy Fidelity Treasury Only Money Market Fund (FDLXX), which had a 4.93% 7-day yield as of June 19, 2024 but more of the income is exempt from state income taxes. None of the these funds can be set as the default core position but you can buy them manually. See Which Fidelity Money Market Fund Is the Best at Your Tax Rates.

Because Fidelity will automatically sell from the non-core money market fund to cover debits, if you’re so inclined, you can be aggressive in keeping the core balance in the CMA close to zero while keeping the bulk of your account in a different money market fund earning a slightly higher yield. Or you can set a maximum target balance alert with the Cash Manager to buy more shares of the non-core money market fund when you have excess cash in the “checking” part.

Some people prefer to just keep everything in the default Fidelity Government Money Market Fund (SPAXX) because the extra yield from a non-core money market fund is quite small.

Cash Manager Not NeededYou may have seen some convoluted setups using the Cash Manager overdraft feature in the Fidelity CMA. It’s unnecessary and undesirable.

The only thing remotely useful in the Cash Manager is the maximum balance alerts. An alert only tells you that your CMA core balance exceeded the maximum target balance. It doesn’t automatically buy a non-core money market fund in the CMA for you. You still have to buy it manually if you want.

You don’t need an alert for the CMA core balance dropping below a minimum balance when you have enough savings in a non-core money market fund held in the CMA. Selling from the non-core money market fund held within the CMA to cover debits works out of the box. It happens automatically anyway even if you don’t set up anything in the Cash Manager.

The Cash Manager has a “self-funded overdraft protection” feature to link the CMA to another Fidelity account or an external bank account. This is unnecessary and undesirable when you want the CMA to stand by itself. You don’t want unauthorized debits to affect your other accounts.

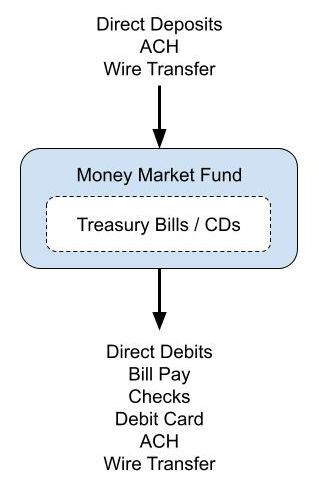

Add Treasury Bills or Brokered CDsIf you’d like to take it one step further, you can also buy Treasury Bills or brokered CDs in the CMA when you have money that you know you won’t need for some time. The CMA then becomes a checking/savings/CD combo. The money automatically goes into the “checking” part when the Treasury Bill or brokered CD matures. For example, the amount set aside for the next property tax bill can go into a Treasury Bill or a brokered CD. See How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy CDs in a Fidelity Brokerage Account.

Please note if you enable the “auto roll” feature when you buy new-issue Treasury Bills or brokered CDs in the CMA, the amount for the next roll reduces your “available to withdraw” number for a few days during the roll. A debit may fail if you don’t have enough available to withdraw. It’s not a problem if you don’t use auto roll or if you keep a substantially higher amount in a money market fund than the amount for the next roll.

Using a Fidelity CMA for spending and savings becomes truly set-and-forget. All deposits automatically earn about a 5% yield as of June 19, 2024. All debits come out of this money market fund. It’s like using a savings account as a checking account. You can manually buy a non-core money market fund but you don’t have to. The yield on the default Fidelity Government Money Market Fund (SPAXX) is close enough to the yield on another Fidelity money market fund.

You can still buy Treasury Bills or brokered CDs to set aside money for specific bills in the future. Please note the caveat on “auto roll” and “available to withdraw” mentioned above. It’s better to do it in a different brokerage account if you prefer to use “auto roll.”

***

The biggest draw of using the Fidelity CMA for spending and short-term reserves is the checking features. You effectively use a savings account as a checking account and earn a good yield from the first dollar. Everything is seamlessly together.

A Vanguard money market fund and some less well-known high-yield savings accounts pay more but they don’t offer checking features. When you pair it with a checking account that pays close to zero, the blended yield on all your cash goes down. For example, if you have $5,000 in a checking account that pays 0.1% and you have $50,000 in a Vanguard money market fund that pays 5.27%, your blended yield on $55,000 is 4.8%. You might as well put the whole $55,000 in a Fidelity CMA earning 4.95% and eliminate the need to watch your checking account balance and transfer back and forth between two accounts.

Transitioning a checking account takes some time and effort. Banks know it. That’s why they pay you close to zero in checking accounts. They bet that you think it takes too much work to switch. Don’t fall for it. It’s easier than you think when you take your time to make the move.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2 Ways to Use Fidelity as a Bank Account appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower