2023 I Bonds Interest in TurboTax, H&R Block, FreeTaxUSA

Many people bought I Bonds when inflation was high. Many people cashed out I Bonds to buy new I Bonds or TIPS when the fixed rate on I Bonds and TIPS yields went up last year. Others simply cashed out I Bonds to do something else with the money.

By default, you pay tax on all the interest earned when you cash out I Bonds. Here’s how to report the interest income in tax software TurboTax, H&R Block, and FreeTaxUSA.

Table of ContentsFind the 1099 FormSave the 1099 FormCheck Every AccountRead the 1099 FormEnter Into Tax SoftwareTurboTaxH&R BlockFreeTaxUSAPay Tax AnnuallyFind the 1099 FormTreasuryDirect sends an email in late January when the 1099 form is ready. You must get the 1099 form online from your TreasuryDirect account. TreasuryDirect doesn’t mail the 1099 form to you. Here’s how to find the 1099 form in the TreasuryDirect account.

Log in to your TreasuryDirect account and click on ManageDirect on the top.

Scroll down to find the link for the previous year under the heading Manage My Taxes.

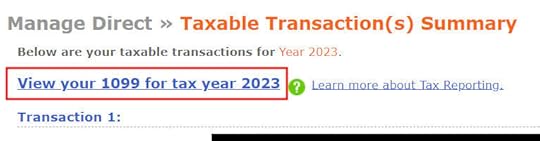

You see a list of your taxable transactions in the previous year. Your 1099 form is behind the link “View your 1099 for tax year 20xx” before the list starts.

Save the 1099 FormClicking on that link brings you to the 1099 form. It’s just a web page, not a PDF file. It doesn’t look like a 1099 form but that’s just how TreasuryDirect does it.

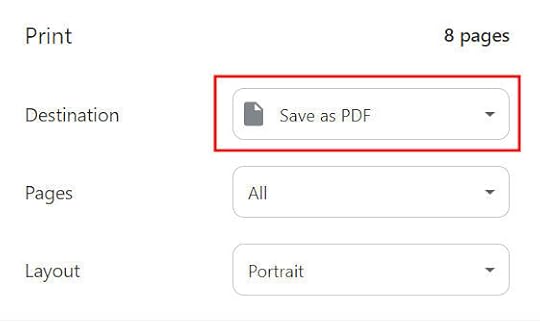

You can save it as a PDF by using the print function of your browser (Ctrl + P on a Windows computer or Command + P on a Mac). The mainstream browsers have a “Save as PDF” feature when you print (see instructions for Chrome, Safari, and Firefox).

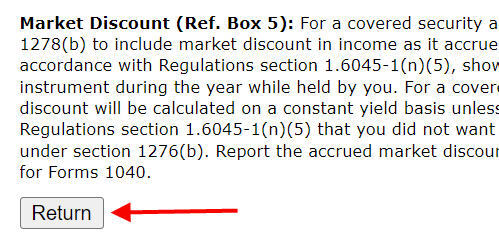

After you save the 1099 form as a PDF, be sure to scroll to the bottom of that page and click on the Return button. Bad things will happen if you click on the back button in your browser!

Check Every AccountIf you have multiple TreasuryDirect accounts (spouse, children, business, trust, …), repeat the steps above in each account. If you deposited paper bonds into your TreasuryDirect account into a Conversion Linked Account and you cashed out bonds in the Conversion Linked Account without transferring the bonds to your main account, go into the Conversion Linked Account and find the 1099 form there.

It’s a good habit to just log in to every TreasuryDirect account you have and look for the 1099 form. You’ll hear from the IRS for under-reporting your income if you have a 1099 form sitting there in an account you didn’t check and you don’t include the interest on your tax return.

Read the 1099 FormMost banks and brokers present the 1099 form as a summary followed by supporting details. TreasuryDirect takes the opposite approach. They present the details first, followed by a total at the end.

TreasuryDirect’s 1099 form also includes a bunch of irrelevant information. My 1099 form is 8 pages long when I need only one number from it. You have to hunt for the small bits you need.

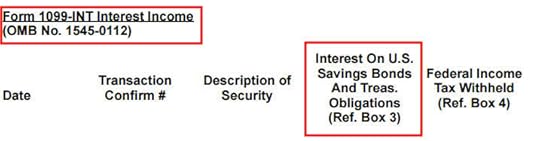

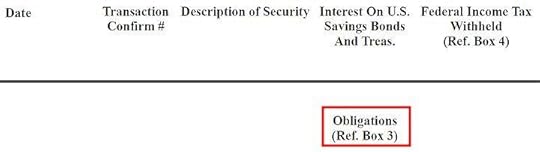

If you only had I Bonds in the TreasuryDirect account, not regular Treasuries or TIPS, you only need to look at the 1099-INT section. The interest is in the column labeled “Interest on U.S. Savings Bonds And Treas. Obligations (Ref. Box 3).” The Box 3 part is important because it tells you where the number goes when you enter it into tax software. Because it was a web page saved as a PDF, this heading may break across two pages. A reader sent me this screenshot of his 1099 form:

The important Box 3 part is easily missed when it shows up on a different page.

If you chose to have TreasuryDirect withhold taxes when you cashed out I Bonds (see Voluntary Tax Withholding on Selling I Bonds at TreasuryDirect), the tax withheld number is reported in the column after the interest. Note that it goes into Box 4 when you enter it into tax software.

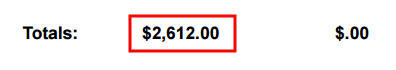

Look past the detailed listing of each sale to find the total at the end of the 1099-INT section. That’s the number you need for your tax software.

Enter Into Tax SoftwareGetting the 1099 form, saving it as a PDF, hunting for the number you need from the 1099 form, and repeating the process for multiple accounts are the most difficult parts of this journey. Entering the number into tax software is relatively straightforward.

We start with TurboTax. Please skip over to H&R Block or FreeTaxUSA if you don’t use TurboTax.

TurboTax

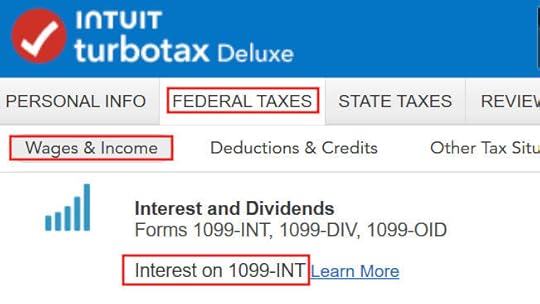

Go to Federal Taxes -> Wages & Income -> Interest on 1099-INT in TurboTax. You’ll have to type it in yourself because TreasuryDirect doesn’t support importing the 1099 form.

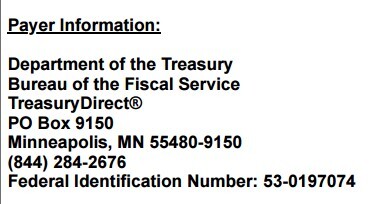

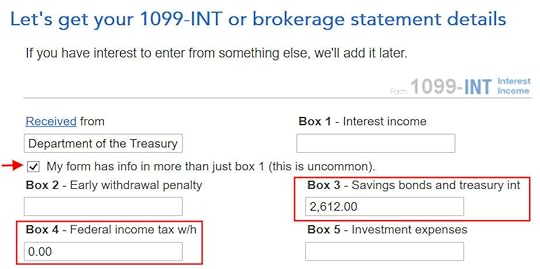

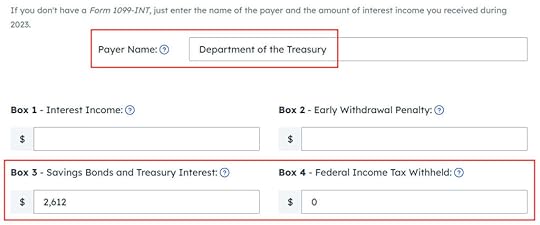

Enter the payer as “Department of the Treasury” because that’s how the Payer Information shows on the 1099 form from TreasuryDirect.

Check that box “My form has info in more than just box 1 (this is uncommon).” to expand the form because we need to put our number in Box 3 (and Box 4 if you had taxes withheld). Enter the totals in Box 3 and Box 4. Leave Box 1 blank. Click on Continue at the bottom.

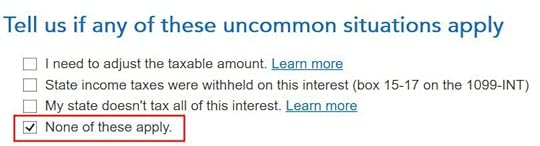

Check on the box “None of these apply.” on the next screen. The state income tax exemption is automatic when you enter the interest in Box 3 on the previous screen.

Repeat the above steps if you have multiple 1099-INT forms from TreasuryDirect. Click on Done on the 1099-INT summary screen after you’re done with all the 1099-INT forms.

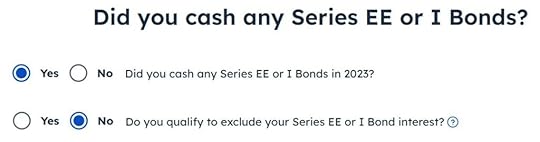

TurboTax asks whether you cashed Series EE or I U.S. savings bonds in case you qualify for the tax exemption (see Cash Out I Bonds Tax Free For College Expenses Or 529 Plan). Answer Yes if you want TurboTax to check your eligibility. Answer No if you didn’t use the money for college expenses or put it into a 529 plan or if you know for sure you don’t qualify because your income is above the limit.

H&R Block

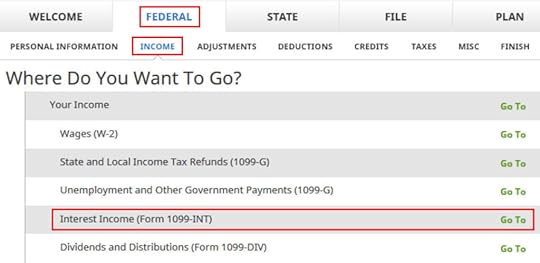

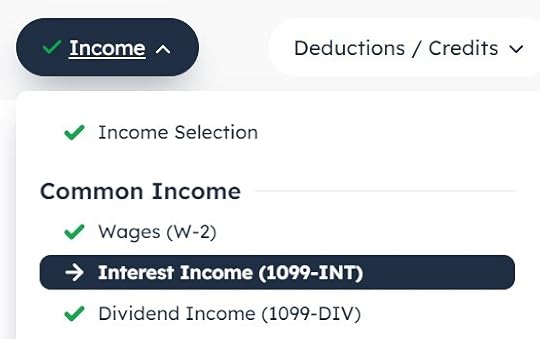

H&R Block tax software has it under Federal -> Income -> Interest Income (Form 1099-INT). Enter one manually because TreasuryDirect doesn’t support importing the form.

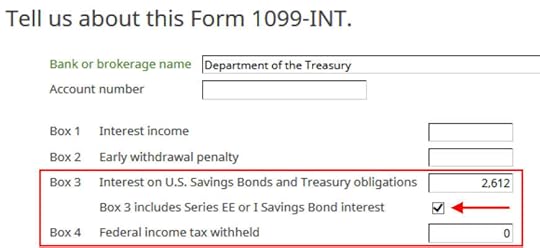

Enter “Department of the Treasury” as the bank or brokerage name. The account number may be optional but you’ll find it on the 1099 form if you need it. Enter the totals from the 1099 form into Box 3 and Box 4 and check that box “Box 3 includes Series EE or I Savings Bond interest.”

Leave Box 1 blank. The state income tax exemption is automatic when you enter the interest in Box 3.

Repeat the process if you have multiple 1099 forms from TreasuryDirect.

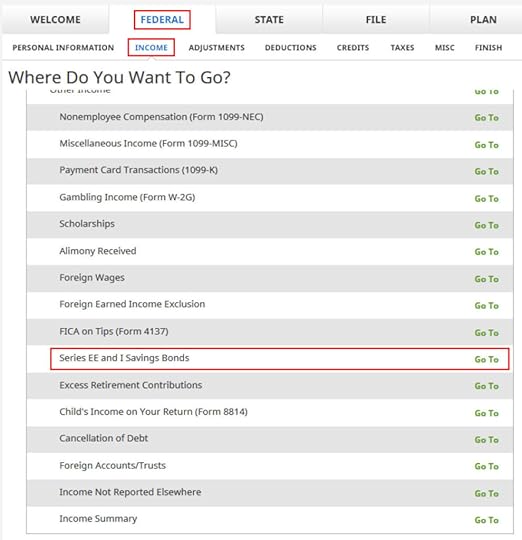

H&R Block doesn’t ask you about using money from savings bonds for college expenses or putting it into a 529 plan right away. If you think you might qualify for the tax exemption (see Cash Out I Bonds Tax Free For College Expenses Or 529 Plan), scroll down toward the bottom of the Income section and go into “Series EE and I Savings Bonds.”

FreeTaxUSA

FreeTaxUSA

Go to the “Interest Income (1099-INT)” section under Common Income. Click on “Add Interest Income” on that page.

Enter “Department of the Treasury” as the Payer Name, the total interest in Box 3, and the tax withheld in Box 4. Leave Box 1 blank. The state income tax exemption is automatic when you enter the interest in Box 3.

Repeat the process if you have more than one 1099-INT from TreasuryDirect.

FreeTaxUSA asks whether you potentially qualify for the tax exemption (see Cash Out I Bonds Tax Free For College Expenses Or 529 Plan). Answer Yes to the second question if you used the money for college expenses or put it into a 529 plan. Answer No if you didn’t do that or if you know for sure you don’t qualify because your income is too high.

Pay Tax AnnuallyYou are on your own if choose to pay tax on I Bonds interest annually as opposed to waiting until you cash out (see I Bonds Tax Treatment During Your Lifetime and After You Die). You won’t get a 1099 form from TreasuryDirect when you don’t sell your I Bonds. You’ll have to make up a 1099 form for the tax software.

Use the Savings Bond Calculator to calculate the change in redemption value for each bond from the prior December to last December. Report the total change as your interest for the year in Box 3 of the made-up 1099-INT.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2023 I Bonds Interest in TurboTax, H&R Block, FreeTaxUSA appeared first on The Finance Buff.

Harry Sit's Blog

- Harry Sit's profile

- 1 follower