Harry S. Dent Jr.'s Blog, page 173

December 3, 2014

Healthcare and Biotech

Over the holidays, I found myself commiserating with my father about the fact that no one warns you that the human body starts to break down around age 45. We don’t bounce back from an injury like we used to, and those small, irritating pains become “conditions” that must be addressed.

Our bodies should come with some sort of meter that measures how many months of pain-free living we have left. After that, we know that we’ll become all too familiar with drug names and co-pays.

Of course, whatever ailments those of us in Gen-X are feeling surely pale in comparison to the health-care problems faced by the boomers. At Dent Research, we measure populations empirically, from the bottom to the top of population waves. The boomer generation wave started in the late 1930s and peaked in 1961, and includes more than 90 million people.

At this point, the entire generation has crossed over the great divide of age 52.

This isn’t the age when AARP kicks in, or when the typical person starts to forget where he put the car keys. Instead, per the Consumer Expenditure Survey, 52 is the age at which spending on pharmaceuticals and other health-care items ramps up exponentially.

With over 90 million people driving up their health-care spending, this sector should experience phenomenal growth for years to come. The fact that most developed nations around the world have large, aging populations just adds more fuel to the health-care fire.

But you knew that.

With Age Come DrugsNo one is surprised to read that people over 50 consume health care at a faster clip than younger people. No one is surprised to read that nations across the globe are aging. What might surprise you is how we can now leverage this knowledge — by combining it with a new source of information — to find profitable investments.

Our research combines population trends and predictable consumer buying patterns to estimate how economies will change for years to come. The great thing about the data we use is that it changes very slowly over long time frames.

This gives us great insight when forecasting overall economic expansion or contraction, and even points out which sectors of an economy should outperform or lag behind. The data shows health care as one of the clearest winners for years to come, but it doesn’t identify which companies are most likely to profit from these trends, and doesn’t tell us when to buy or sell.

For that, we have to look elsewhere. Like just about everything else these days, the answer is on the Internet… but probably not in the format you’re thinking about.

Most companies develop new products and services over time, asking potential buyers what features and benefits are most important to them, and then roll out their new wares amidst a marketing campaign. Health-care companies, and more specifically, drug companies, are different.

They know ahead of time what sort of demand exists for a given treatment because their potential market is based on the number of people diagnosed with a certain disease or condition. The problem with developing new drugs is the cost and scope of clinical trials and approvals required before the medicine can be sold.

Now, there’s good reason for the process, even though it currently seems more onerous than it has to be. That being said, every step along the path to approval leaves a new drug open to the possibility of failure.

So drug companies pile a bunch of money into what are seen as the most lucrative potential areas of treatment, and then wait on pins and needles as the results of each clinical trial and every approval hearing is released.

As information on drug trials and approval hearings is released, it spreads across the Internet in seconds. Watching for and trading on this data is common. It makes sense that investors would want to get involved with a promising new drug, or quickly get out of a company whose latest compound just failed in a clinical trial.

But this approach doesn’t give you an edge, since the information is available to everyone, including high-frequency traders and professionals that can react faster than the average Joe.

That’s why instead of watching the releases on clinical trials or approval hearings, it’s more advantageous to watch how other people react to the news. In particular, we want to track whether people think the stock of a drug company is set to go higher, or is expected to drop.

New Tool for An Old ProblemBen Benoy is the latest addition to the Dent Research team, and his research does exactly that. Using software that he developed and programmed, Ben monitors what people are saying on the Internet through social media sites like Twitter and Facebook about different biotechnology companies.

Ben’s program also keeps track of what each individual said about the stock of each company (expected to rise or fall), and then compiles a virtual track record for them. This way, his program can give more weight to those who have been right in the past, and better predict which companies are likely to yield profits.

The best part of Ben’s program is that it’s unique; his nearest competitors simply track the number of times a company is mentioned without the level of sophistication that Ben brings to the process. In this way, Ben has combined the best of both worlds — our existing research and his new approach.

In the sector that our analysis identifies as one of the most favored for years to come, Ben uses social media in a way that no one else does to parse out positive and negative trending information, resulting in high probability trades.

With health care representing a growing share of GDP as our population ages, finding a better way to profit from it than simply buying an industry ETF can help us all.

Now if only Ben could use his Internet skills to find the cure for back pain or failing eye sight…

Rodney

December 2, 2014

Innovation Sparks Wealth

Most people almost always reject radically new things or ideas at first. Ask Galileo or Jesus. That’s why it takes extreme personalities to take the necessary risks and to persevere against all odds, criticism and rejection.

I should know. I’m such a personality.

I’m an entrepreneur and innovator in the arena of economics. If it hadn’t been that, it would have been some other kind of arena. It’s just in my blood.

I began my career as a high-level business-strategy consultant at Bain and Company, but I ended up developing my greatest breakthrough insights into economics when I started working with entrepreneurial companies in the early 1980s.

Entrepreneurs are the 0.1% to 1% who create all of the major innovations in the economy and among them I felt at home. But I also learned the most from them…

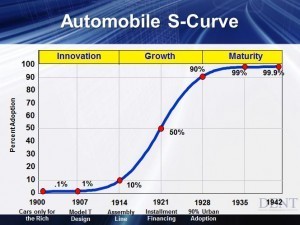

You can see the future by watching what the leading edge innovators are doing today. Everyone else simply follows behind them on an S-curve.

You see, entrepreneurs think differently. They’re like the random mutations that create changes in genetics, only they’re changing humanity… or, at the very least, society.

The thing is, most mutations and entrepreneurs fail! Even the most astute and well-funded venture capitalists only make it big on one out of 11 investments. That first part of the S-curve, from 0.1% to 10% is a minefield filled with the rotting remains of failed innovations.

The innovations that survive to the tipping point, at 10% market penetration, are the killer apps that blaze into the mainstream. When you think of social media and companies like Facebook and Twitter, you can see them moving into the mainstream pretty quickly after the last year or so.

And no biotech is one of the leading-edge sectors among others like robotics, alternative energy and nanotechnology. They’re just starting to move from the fringes of the leading edge into early mainstream applications.

Stiff CompetitionMany innovative firms have already failed in these emerging fields. But today new leaders are taking up the charge and are leading into the forefront. Many such firms will have to bring in management and systems to keep up with the 10% to 90% growth phase ahead.

For every great strength entrepreneur’s display, they also have major weaknesses as Peter Drucker, the greatest management guru of our time, points out.

Those who drive the innovation phase (0.1% to 10%) are rarely suited to manage the growth phase that follows soon after. These individuals are the rule breakers, experimenters, perfectionists, all of which interfere with the process of infiltrating the mainstream.

Henry Ford is the perfect example. He played a huge part in the creation of the first middle class in our economy’s history through his innovations with the Model T and the assembly line. But he was also known as a tyrant and dictator.

Those weaknesses allowed Alfred Sloan, the greatest organizational innovator of the 1920s on to trump Ford in the end at General Motors.

Take A Bite Out of the AppleA more contemporary example is Steve Jobs. From the very beginning, he had a similar vision to Ford, but instead of cars, he saw computers bringing power to everyday people. He was a tyrant and very stubborn, much like Ford.

And as a result, he was eventually kicked out of his own company when Microsoft beat Apple by becoming the standard operating system for all computers outside of Apple.

This is what entrepreneurs do! We’re different. We’re highly creative. We advance precisely by breaking the rules… and accept that the failure rates are astronomical.

It’s thanks to such entrepreneurs that we enjoy an ever-increasing standard of living. And it’s thanks to them that there are always new and exciting investment opportunities that we can take advantage of.

That’s where Adam O’Dell, Rodney Johnson, Ben Benoy and I come in. We strive to find those investments for you. We work to develop systems and tools that maximize your investment gains while minimizing your losses in a time period when traditional investment strategies just don’t work anymore.

Ben Benoy is the latest addition to our strategic investment team. He has found a way to combine the new intelligence from social media, such as Facebook and Twitter, to find the best opportunities in the hottest emerging high-tech arena — biotech. His returns prove that such a combination is powerful.

We will continue to push the leading edge to bring you the best economic research and alternative investment opportunities — ones that can thrive in the “new normal” of increasing volatility and in markets that are pointing down much more so than up.

Harry

December 1, 2014

The Economic Addiction

I watched the movie Flight (with Denzel Washington) last night. It’s a dramatic story about addiction… and lying about addiction… aka denial!

You see, the thing about addiction is this. First, you have to admit you have a problem… that you’re addicted to something. Of course, there are many things to be addicted to.

It could be something as simple as sugar or chocolate, cigarettes or alcohol… or even much harder drugs, from sleeping pills to pain pills to heroin. You could even be addicted to talking too much, being right, dominant or even of being a workaholic.

You could even be addicted to quantitative easing, stimulus or easy credit (a little something, I like to call financial crack)…

But back to the movie…

Whip (Denzel) is an alcoholic pilot so adept that he landed a failing plane while high on alcohol and cocaine. He continued to lie about his addiction until the final testimony, when he just couldn’t lie “one more time” and finally admitted he was an alcoholic. He went to prison where he sobered up…

But what has this got to do with financial crises?

Monkey On Our BackQuite simply, we’re addicts. We’ve been addicted to debt and Keynesian economic policies since the 1970s. Debt has grown much faster than the economy for over four decades. Now we are facing the greatest debt crisis since the 1930s…

Surprise, surprise, surprise!

ALL addictions are characterized by denial.

And ALL debt bubbles in history end up in periods of austerity… when we’re finally forced to admit our problems and rebalance or “detox” and get the addiction out of our system. We have to get straight and grow again. That is the picture of our economy over the next several years.

It’s human nature to strive to be better and have a better life. We mostly do that through working harder, innovating better technologies, better government and private systems for prosperity.

But we also have a natural inclination to go beyond that and try to cheat to accelerate such trends. We use strategies like borrowing more than we can afford to get ahead. Then when such debt bubbles go beyond natural means and sustainability, we learn to lie about it to defend such strategies.

We deny, deny, deny.

We end up like frogs in water that is slowly starting to boil. We don’t realize we’re in trouble until it’s too late to jump out.

It’s natural and fiscally responsible to finance your house over the next 30 years in which you’ll raise your family. It is NOT natural to borrow against rising home values to buy a house that is more than you can afford, speculate in real estate or to fund your child’s education in private schools… or to speculate in technology stocks that are totally unproven.

It’s natural for businesses to finance a plant that will generate profits over 20 years, but NOT to speculate in new businesses or markets that are unproven, or to buy back their own stock with cheap debt.

Our economy and the great boom we enjoyed from 1983 to 2007 was driven by the baby boomers as they ascended in their predictable productivity, income and spending cycle. And it was characterized by growing speculation ever since the mid-1990s, rather than by productive investment in the future.

Everyone wanted to make money from stock or real estate speculation and retire early or even — stop working forever. We became addicted to the idea and took a shortcut in order to achieve it.

Now We Pay the PriceRetiring early and on speculation is not the “American Dream” and is simply not workable.

We’re simply out of touch with reality after nearly three decades of the highest growth, productivity and investment gains in history. But such booms and debt bubbles are always, and I mean always, followed by periods of austerity to rebalance and deleverage.

The truth is that we should be retiring at age 75, not 65, especially given our much higher life expectancies today. And governments should be actively working to restructure our massive debts in the most civilized manner, like a Chapter 11 debt restructuring, rather than flooding the economy with artificial money to cover over the crisis and push it down the road.

It’ll require a major financial crisis to get us back into reality… not more of the crack we’re addicted to.

So, plan on that!

Work now to protect yourself from the next great financial crisis to hit, likely between early 2015 and 2020 to 2022.

Harry

November 28, 2014

Investing With An Edge

We all have “tippers” or indicators we use to assist us in our decision-making. The true question is: “How reliable are your indicators at beating the market over time?” Let’s look at some characteristics of strong predictive tippers and you can decide how yours really shake out.

Are your tippers generated by a man, a machine or a mix of the two? We all follow various sources but we usually tend to follow a rigorous pattern. Personally, I believe that “standing on the shoulders of giants” and taking a hybrid approach offers the best forecasting capability.

Taking millions of data points and crunching complex algorithms is best performed through leveraging machine automation. Then the human takes over and uses their higher-level cognitive filter to sort out those powerful machine generated numbers and balance out the approach.

Do your tippers work well with indicators or do they stand-alone? In order to make a well-rounded decision, we should have several points of view. But when those multiple approaches are finally selected, they should be complementary and not contrarian.

Rest Easy At NightOften times if you use several opposing approaches for financial reasons, you’ll find yourself constantly starting back at ground zero on your strategy because one of them is always going down.

We all like to sleep at night, right? So, if you use complementary tactics like social media analytics alongside the technical and fundamental data, you get a steady building-block approach to making sounder decisions… and you’ll get a great night’s sleep.

At the end ask yourself: What is the frequency of my tippers? Are they matching the frequency of my trading? Most people like to bundle their tippers together until there’s a critical mass of momentum in one general direction and it’s there that they can take advantage of it. If your tipper sources don’t allow you to gather enough information together to make a confident decision then it’s time to either add more sources or you change your trading style.

As a U.S. Marine Corps Communications Officer, I’m obsessed with capturing and processing the best information for making critical decisions and have found social media analytics are always at the top of my list. And if you’d like to see more on this subject, you can read more about it here.

Deflation, Already in the Economy?

There was an op—ed article in the Wall Street Journal on November 14 entitled “Who’s Afraid of a Little Deflation?” by John H. Cochrane. The big fear today in Europe is that they’re on the edge of 0% inflation and could easily slip into mild deflation.

Economists there from Christine Lagarde (IMF Director) to Mario Draghi of the ECB are warning that deflation could send Europe into a downward spiral. Lagarde called it an “ogre” that could “prove disastrous for the recovery.”

Cochrane argues that these fears are overplayed as this is not the 1920s or 1930s when the last great debt and financial bubble emerged and burst, as back then central banks were not willing to step in and provide endless liquidity to keep a spiral of bank and business failures from creating such a sharp downward spiral.

Japan’s ComaHe rightly uses the example of Japan that, on average, has had zero inflation for two decades and on—and—off minor deflation. They haven’t had massive bank failures or bank runs.

But I would argue that Japan has been experiencing a very difficult situation…

They’re economy has been in a coma economy since 1997 when they started to run their printing presses and created such flood of money. Their goal was to offset the deflationary spiral that would have occurred naturally much like in the 1930s.

I would argue that Japan has had to keep accelerating the level of money printing and fiscal deficits – as with any drug – to keep the economy from falling into deeper deflation. This isn’t a good sign and never ends well.

Japan’s stocks have never come anywhere near their late 1989 highs when the Nikkei neared 40,000. They have continued to fall to new lows on each global downturn. Stocks were down 80% at their lowest point in early 2009 and are still down 60% today.

Japan’s real estate fell 60% and it’s still down that much today… 23 years after its peak in 1991!

Japan has had zero average GDP growth for the last two decades. They are indeed in a coma! Does that sound OK? No pain, no gain is what I see from Japan’s history.

I strongly believe that Japan will never come out of its coma in the long run if it continues these policies that don’t allow the economy, its debts and financial leverage/speculation to rebalance.

So, yes, Japan’s endless quantitative easing (QE) may have prevented a massive bank and business meltdown as in the 1930s.

In the case of our country, that sharp purge quickly flushed debt and financial speculation and leverage out of the U.S. economy. Yes, we had the greatest crisis in U.S. history but we came screaming out of it and not just for years, but for decades.

Japan has not come screaming out of its crisis that started in 1990—1992 and I was the only one that predicted that crash back in 1988 – 1989. Why? I was looking at Japan’s massive real estate and stock bubbles against the sharp decline in their demographic numbers.

Quantitative Easing on the ContinentGermany and much of Europe is heading into an even sharper demographic downturn in the next several years, with many countries heading down for decades. Demographic trends for the U.S. head lower into 2020 – 2022 and the healthiest affluent sector will follow Homer Simpson’s peak at age 46 in 2007 with a peak at age 53 in 2014.

Central banks have had to continue running massive QE for 6 years now with mediocre results. Just as the Fed finally tapered off in the U.S., Europe stepped in strongly again and Japan continues to up its QE. That’s why stock markets are still going up even in the U.S.

It’s a global market and this “funny” money has to go somewhere and it’s not going into loans or productive investment. It’s going into speculation.

What central banks should most fear is not inflation from excess money printing but the very bubble they have now created artificially bursting from its own excesses.

Cochrane states: “Nowhere, ever, has an economy such as ours or Europe’s, with fiat money, an interest rate target, massive excess bank reserves and outstanding government debt, experienced the dreaded deflation spiral.”

But I argue that this is the first time we have faced a major crisis with such endless money printing and liquidity. We don’t know how it works out in the end. I just know from observing everything else in life, especially addictions, that it works out worse rather than better even though you put off hitting bottom and then the initial detox by taking more of the drug.

I agree with Cochrane that because of these new and unprecedented policies of long term QE, rather than short term liquidity injections to prevent short term crises, there is a temporary new normal. The result will either be near zero inflation and a coma economy like Japan for decades, or mild deflation at worst rather than the sharp and violent deflation we saw in the early 1930s…

Until something goes wrong!

I see the most likely scenario being that a series of global events – from Germany continuing to fall into recession, the China bubble bursting, Putin moving into Ukraine when he gets the right shot, to a second demographic cliff for the affluent in the U.S. – will cause an even sharper downturn and it will ignite such a deflationary spiral that central banks won’t be able to react fast enough.

The subprime crisis came out of nowhere and we had the worst recession and stock crash since the 1930s and the banks didn’t see it coming and were completely unable to catch up. But how do central banks have the credibility to come back and print even more money when such unprecedented stimulus failed?

I don’t know exactly how the next crisis will occur but every major indicator I have says it is coming, sooner rather than later… and I’m looking at between now and early 2020.

If we can get something for nothing and central banks have found the new “ark of the covenant” then I will have to change my outlook and I’m not planning on doing that.

Harry

November 27, 2014

What’s on Your Chalkboard?

When Thanksgiving is mentioned, many people think of food, which has special meaning in my house because my wife loves to cook. Given how well and how much she cooks, if I didn’t exercise almost daily I’d probably look like the Stay-Puft marshmallow man from the movie Ghostbusters.

So it’s no surprise that Thanksgiving is her favorite holiday… but it’s not because of the food. While she enjoys the preparation and the feast, she loves Thanksgiving for what it is not.

There are no presents. The holiday isn’t based on a military battle, a turning point in political history or a major scientific achievement. In fact, the day is not set aside to commemorate anything man-made at all.

Instead, the day is based on one very clear notion — the giving of thanks…

The original feast was held in the autumn of 1621 to give thanks for the first successful harvest. The meal was a celebration of the bounty that was bestowed upon the Pilgrims and they invited the neighboring Indians to join them.

The Pilgrims were not celebrating their ability to till the land or plant the seed. They were joyful that the combination of what they could do and what they couldn’t control — weather, soil, etc. — resulted in a bountiful harvest.

Like most of the population, I don’t do a lot of farming, but I still enjoy a tremendous bounty in my life that stems from a combination of what I can do or control and that which is beyond me. The struggle is in pausing long enough to take the time required to appreciate fully and to be thankful for, what I’ve been given.

In this respect, the Pilgrims were lucky. Their Thanksgiving did not include driving, flying or otherwise traipsing from one family member’s home to another. They simply gathered in one place and gave thanks that their crops had grown. Today things are a bit more complicated but remembering the people and blessings that have enriched our lives doesn’t have to be.

A Good IdeaWhile recently dining with friends, we discussed our plans for Thanksgiving. As usual, my family will make the trek to a relative’s home about 500 miles away and then cover another 300 miles to see a dear friend before heading home. Long-time readers know that I love a good road trip, and there’s no better reason for one than spending time with family and friends.

Our dinner companions told us they celebrate Thanksgiving at home, typically with just a guest or two, which was surprising, because these people meet the world with open hearts. They are engaged in many activities involving their daughters, their church and their community.

Even though their extended families live far away, it seemed strange to me that our friends would choose to gather with such a small group. Then they explained how they celebrate and it all made sense.

Starting right after Halloween, they decorate for fall, turning their home into the Martha Stewart version of a pumpkin patch, with the requisite gourds and colorful arrangements of leaf-adorned materials.

But something else in their home plays an important role during this holiday season — a blackboard.

It’s not just any blackboard, it’s a four-foot by eight-foot framed blackboard mounted sideways on a wall, as if it were a full-length mirror. In the days of November leading up to Thanksgiving, everyone who passes through the home is asked to write something for which they are thankful on the board. It can be small or large, fleeting or permanent.

People of all ages and sizes put their notes on the board, and then on Thanksgiving Day the family reviews the entries, taking special note of the events, things and people for whom they are thankful.

What a great idea!

I’m spending this holiday with family and friends for whom I’m truly grateful but there are many other people for whom I’m grateful that I won’t get to see. These people — in states across the nation — are on my personal blackboard.

They are joined by descriptions of opportunities and other blessings that have come my way. The old saws of health and happiness make it onto the board but as well as very specific items, like sailing with my family last spring, the recent growth in our business and my son’s travels out west last summer.

Thanksgiving is an entire day dedicated to looking outside of ourselves, recognizing what has been given to us throughout the last year and throughout our lives. No presents, no gimmicks… no politics.

What’s on your blackboard?

Happy Thanksgiving,

Rodney

November 26, 2014

Purchasing Power and the Holidays

‘Tis the season of traditions…

And… predictable spending patterns!

I’m not a big fan of our materialistic, consumer culture… but I do see predictable, seasonal spending patterns for what they are: great investment opportunities.

Earlier this week, I shared with Cycle 9 Alert subscribers some interesting stats that describe the predictability of the prime holiday shopping season from the perspectives of the retailer, the consumer and the investor:

• Retailers earn an outsized share of their revenue — between 20% and 40% — in November and December alone.

• Consumers spend, on average, 12% more in the fourth quarter (Oct — Dec) than in the first quarter (Jan — March).

• Investors who focused on consumer discretionary stocks in September, October or November — and held them for three months — have enjoyed better-than-average odds of success, generating gains 77% of the time.

And this year, in particular, consumers are expected to have more excess cash than in recent years (and it’s likely burning a hole their pockets).

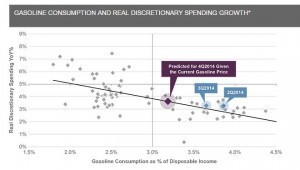

Check out this chart from Guggenheim Partners, which shows that our consumers spend less money on gas… they, predictably, spend more money on discretionary items.

Now, click here to see the investment recommendation poised to capitalize on this trend.

There’s still time to get into this opportunity. And if it pays off quickly, it might just put some extra holiday-shopping bucks in your pocket!

Happy Thanksgiving!

Adam

Creative Destruction Gets Blocked

Governments around the world collude with the largest financial institutions to keep the greatest debt and financial-asset bubble in modern history from busting after it started to do so violently in late 2008.

Their actions are nothing new.

They’ve colluded through low interest rates, stimulus and the “wealth effect” for decades. I’m talking since the creation of the Fed in 1913, the New Deal in 1934, the endless trade and budget deficits (and Nixon) that broke the gold standard in 1971, and in 2000 under a Republican president.

Will they succeed?

Not a chance.

You don’t mess with Mother Nature or the Invisible Hand.

If you want to read a book that will make you sick to the stomach with its detailed and astute analysis of the confluence of political and financial institutions to create a debt and financial bubble that makes the Roaring ’20s look like child’s play then read The Great Deformation by David Stockman.

There will not likely be a greater book than this one at this time on this subject, nor a timelier one. It covers the political side of this bubble from the eyes of an insider who was Reagan’s budget director and a trader at Salomon Brothers from 1985 and at the Blackstone Group recently.

This guy has seen, heard and done it all.

His book is long and detailed, but well worth the read, even if you just skim through it for the key events of most interest to you.

In fact, it’s very much like Niall Ferguson’s The Ascent of Money, in which he outlines the growth of financial leverage and bubbles over many centuries. Stockman does this over the last century and there is simply no other book to rival it in the political and financial realm.

My point is this: When you think you’re greater than larger, universal forces — like Mother Nature or the Invisible Hand — you’re cruising for a bruising.

Just ask the later Roman emperors… the mid-western real-estate speculators from the 1830s… the railroad tycoons and speculators of the early 1870s… the stock speculators of 1929… the gold speculators that sprouted up in 1980… the tech-stock traders of early 2000… the real-estate flippers from 2006… or the Wall Street wizards of leverage buyouts, mortgage-backed securities, collateralized debt obligations and credit default swaps of 2007.

Governments and their central banks have simply decided: “We won’t have another financial meltdown or Great Recession like we had in 2008 and 2009.” They won’t allow the greatest debt bubble in history to deleverage like such bubbles did from as early as the 1700s up to the 1930s.

They’re not willing to admit they conspired with major financial institutions to create the greatest bubble in modern history through the generation of unprecedented debt and leverage.

And now they’re “protecting” the everyday household by bailing out the very financial institutions that created the bubble with government’s great help.

This is the greatest BS story I’ve ever heard.

Governments never let markets correct the imbalances in debt and speculation. They’ve stepped in every time and supported the economy and markets by lowering interest rates and injecting more money where needed.

They give accolades to the Invisible Hand, but the truth is they don’t trust God, Mother Nature or the free markets at all, because they know there are consequences for their actions and they simply don’t want to accept them.

We don’t want our athletes to take steroids to perform better — although some of us secretly do — so why would we want to put our economy on steroids or crack? Such things never end well!

Have you ever seen someone die from overuse of steroids, or an overdose of crack or heroine? It’s ugly.

Back in the late ’90s, I watched an exercise trainer literally shrivel up and die within weeks. He’d been a weight-lifter who’d taken steroids for decades. It finally caught up with him, suddenly and painfully!

There will always be consequences for cheating by over-stimulating. Isn’t it enough that natural processes already grow exponentially, despite cyclical set-backs, as George Gilder and our research clearly shows?

Do we need to stimulate the natural process even more?

Governments and financial institutions seem to think so.

I think they’re selfish, short-sighted, greedy and stupid… like most of the people that elect them.

Governments can only fight natural forces so long. The “Great Reckoning” is coming. Expect it between 2015 and 2022.

Cheers to David Stockman, an intelligent realist in a world turned upside down!

Harry

November 25, 2014

Innovation on Wall Street

Over the past five years I built a system with an 82.2% win ratio in picking stocks utilizing social-media data. I used my experience of being a Marine Corps Communications Officer along with the knowledge I gained earning my Master’s degree in Systems Engineering from Georgia Tech.

Yet, it seems like every day, I have to answer questions about how and why social media can be harnessed and utilized as a financial instrument to beat the market. It’s a never-ending struggle.

There are two camps of people in today’s world. Those who embrace some form of online social media to keep connected with others and then there are those who’ll always go out of their way to avoid it.

Online or OfflineAs expected, these two groups are always at odds with each other…

But the biggest irony between these opposing sides is that few of them know how to profit off of these social-media platforms.

Most savvy social-media users are prolific at posting their latest pictures or sharing a witty comment in a 140-character tweet. They focus on building an online persona and are used to getting information instantly and on-demand.

They have little regard for those who try to stay “off-line” and view anyone not following them on social media as dinosaurs.

Those who shun social-media platforms truly value their privacy and wonder why their 14-year-old niece is posting pictures of her outfits and of what she eats every day for the entire world to see.

This group treasures true conversation and doesn’t want to be bombarded by hordes of garbage information. They have their own traditional trusted information sources that they read or watch and feel anything else is a waste of their time.

Both of these groups have fair and legitimate reasons for living the way they do, however they could both benefit by taking a step back and viewing social media for what it really is… an unlimited and largely untapped data-set that we can leverage to make better decisions and beat the market.

As the son of a public school librarian you better believe that I knew what the card catalog and Dewey decimal system was by the time I started kindergarten. In my Mom’s library, every book had its place. They were all organized and controlled down to the last square inch of shelf space.

What made all this possible was that we actually did use the Dewey decimal system and we had inventory in place so that anytime anyone needed a particular book on any given subject, she knew exactly where to find it.

Most of us take for granted those days of manually tagging and indexing everything because social media does it all automatically now. Social media has become our “super librarian” and most of us don’t even take advantage of it.

Everything captured in social media has visible and invisible tags associated with it that are utilized for indexing and sorting so it’s easily searchable on the Internet. Visible tags are things like the exact words or pictures we see when reading this media. Invisible tags are items that form metadata like message time-stamps, IP addresses, and geo-location tags.

As an individual, you could probably read a couple thousand social-media messages per day and try to perform some mental gymnastics in your head on what the general market felt on a particular topic to make a play.

Good luck with that because for most, including myself, “the juice would not be worth the squeeze” due to time and accuracy constraints.

However, this doesn’t mean that this “collective intelligence” derived from social media should be thrown away. And that’s why we built a system that captures those 2.4 million financial social-media messages per day, reads their tags, and recommends plays where others aren’t even looking. And that’s how you get your edge.

After five years of trial and error, I figured out that the indicators that correlate the most with stock price movement are the changes in a stock’s baseline of message volume, message sentiment (buy/hold/sell), author reputation, and message manipulation. My system has set up automatic indicators for each of these across more than 7,000 U.S- based stocks… and it alerts me to the opportunities others miss because they don’t believe in monitoring social media at a collective intelligence level.

Deep down, I kind of hope that a certain portion of the financial industry remains skeptical on utilizing social media to aid their decisions because I know that it’s just one more person I’ll beat on the other side of a trade.

If you’re are interested in learning more about trading with social-media indicators, check out my trading service, Biotech Intel Trader here.

Stay tuned as I continue to monitor social-media opportunities across the markets!

Ben

November 24, 2014

Debt and Income

The real money machine in our economy is credit. We deposit money, the bank keeps a small percentage of it around to cover withdrawals and the rest is lent out. This double counting doesn’t stop with the first loan. That money gets deposited somewhere and the process starts all over again.

Eventually, $1,000 of new money deposited in a bank will grow to represent $10,000 in deposits elsewhere through credit creation. What happens when people stop, or even significantly slow, their borrowing? The economy fails to grow, inflation falls, and wages flat-line…

Does this sound familiar?

To be sure, some forms of consumer credit are expanding, as every parent with a kid in college knows. Student loan debt grew 57% from 2009 through October 2014, while car loans increased by 31% over the same time frame.

Cars and student loans can almost be viewed as necessities of life in America, so growth in these areas is not surprising. However, credit card debt is still 8% lower than it was at the end of 2009 and mortgage debt is growing at a snail’s pace.

Then there’s the small business side…

The National Federation of Independent Business reports that only 28% of their survey respondents use credit on a regular basis, which is a record low. They also report that only 4% said that all their credit needs were not met and that is another historic low.

Meanwhile, the Federal Reserve’s third-quarter survey of senior loan officers reflected that banks are on average keeping their lending standards the same, or slightly easing them, which makes credit easier to get. Among the reasons for easing lending standards, 80% of respondents cited increased competition from other banks or non-banks as a very important reason for the change.

So people are not borrowing as much to fund daily purchases, small businesses aren’t using as much credit as they have in the past and don’t want more and banks are starting to fight over clients.

All of this falls in line with our view of where we are today — basically the midway point of the economic winter season.

We’re in a sluggish period marked by moderate consumption as we live through the transition of the boomers from big spenders to savers. While the savings rate of the country doesn’t reflect a tremendous shift, the first step in this direction is to quit spending on credit.

Of course, one man’s spending is another man’s income. As we’ve ratcheted down our spending a bit, overall economic growth has slowed which decreased job opportunities and led to flat wages.

The path forward relies on the next generation of big spenders — the millennials — to ramp up their own spending on credit for homes, more cars and daily living as they establish households and start their families.

This trend should already be established and starting to ramp up but this process is currently held back. Millennials are struggling to make a good living and yet many already have a mountain of (student loan) debt.

This isn’t the type of borrowing and spending that leads to a sustained recovery.

Eventually the Federal Reserve will try to slowly allow excess bank reserves to flow into the economy, which will only increase the competition among banks to get more clients (our upcoming December Boom & Bust covers excess reserves in depth). Many people expect this move to unleash the inflation genie that has been kept in the bottle, even while the Fed printed trillions of new dollars.

But what happens if, instead of being lent out, the extra money just sits there for lack of demand for loans?

Our estimate is that the economy will remain slow for several more years and interest rates will continue to freefall.

Rodney

Ahead of the Curve with Adam O’Dell Doves Drive Bulls to Bucks