Harry S. Dent Jr.'s Blog, page 169

January 13, 2015

The Fed and Taxpayers

We have $98.7 billion reasons to be mad.

That’s how much of our money, taxpayer money, the Federal Reserve gave to the U.S. government in 2014. Over just the last five years, the Fed has funneled $421 billion, or almost half a trillion dollars of our money, to the U.S. Treasury.

The Fed takes this money from us without asking and uses it with no oversight by any elected official. When the funds flow back to the Fed, they simply hand it over to the U.S. government. Some people mistakenly think this gravy train is coming to an end.

No such thing will happen.

The Fed will continue earning record amounts of interest, and will keep funding the U.S. government instead of returning the funds to the proper owners… us.

Show Me The MoneyWhen the Fed buys bonds, it does so with newly created money. The process is so simple, and yet so profound that it makes your head hurt. The Fed always buys bonds from a bank that has an account at the Fed. When the bank (electronically) delivers bonds, the central bank simply changes the amount of money that the bank has on deposit with the Fed.

It’s like going onto a spreadsheet and changing a number. Voila! The bank now has more funds in its account at the Fed, and the Fed has bonds.

The loser in all this is everyone who holds U.S. dollars. The value of our dollars is diluted by however much the Fed prints. Since the financial crisis, the Fed has printed more than $3 trillion, which is roughly 30% of the total amount of U.S. currency outstanding plus deposits in 2007.

The full effect of the dilution has not happened yet because banks have not lent out or invested the money they received from the Fed. Instead, banks are holding $2.7 trillion in excess reserves at the Fed because, since 2008, the Fed has paid interest on this money (I covered this topic in depth in the December issue of Boom & Bust).

Last year the Fed paid about $6.7 billion in interest on excess reserves as well as on required reserves.

The Fed gets money by collecting interest on the bonds it owns, which now total around $4 trillion (the Fed had $900 billion in bonds before 2008).

But the Fed collects more interest each year on the bonds it owns than it costs to pay its bills, including interest to banks and funding the newly-created Consumer Finance Protection Bureau. The Fed delivers all of its excess cash (which some call profit, but that is a misleading term) to the U.S. Treasury in exchange for… nothing.

It’s a gift.

But it’s not a free gift. Remember, the Fed originally bought bonds with newly created dollars that dilute all of the dollars in our pockets.

What the Fed should do with the excess funds it receives is simply reverse the original transaction. Whereas the Fed increased the size of the bank’s account when the Fed bought bonds, the Fed could reduce the size of its own account after paying all of its bills.

If it did this, then every dollar the Fed wiped out of existence would strengthen all the remaining dollars outstanding. This would give back to all of us at least some of what the Fed took in the first place.

Fat chance.

Instead, the funds will keep flowing to the U.S. Treasury, and people bad at math will keep talking about how “great” it is that the Fed gives cash to the government so that the government doesn’t have to borrow as much. They don’t understand that this is an un-voted confiscation of our dollars with no oversight!

Now many of these same people are concerned that as the Fed raises short-term interest rates, it’ll owe so much to the banks in the form of interest that there won’t be any (of our) money left to hand over to the U.S. Treasury.

There’s no reason to worry. The Fed won’t run out of (our) money any time soon.

The Fed earned north of $110 billion last year on its $4 trillion bond portfolio. As noted above, it paid 0.25% interest on $2.775 trillion of bank reserves, or $6.7 billion. If the reserves remain the same and the short-term interest rate goes up to 1.25%, then the Fed would owe the banks an additional $27.75 billion.

This would still leave the Fed sending around $71 billion to the U.S. Treasury at the end of the year.

But this assumes that the Fed would keep earning the same interest on its own bonds, which is not true. The Fed not only receives interest during the year, it also receives principal payments as bonds mature or, are called away.

When this happens the Fed doesn’t hold onto the cash or send it to the U.S. Treasury, instead the Fed buys more bonds in order to keep its holdings at the current level. In a rising interest rate environment, the Fed will be purchasing bonds that pay more interest at the same time that it owes more interest to banks.

For those that stay up at night worrying about the Fed having too little (of our) cash to hand over to the U.S. Treasury, don’t worry. It appears the gravy train will keep running for years to come, no matter how mad the rest of us become.

Rodney

January 12, 2015

Cautious Stock Market Strategy

Stock markets took us on a roller-coaster ride last week, with sharp drops on Monday and Tuesday, equally sharp rallies on Wednesday and Thursday, and then a pullback on Friday.

So far, January is shaping up to be the mixed bag that historical tendencies have suggested. Meaning, even though the November through April timeframe is the year’s most bullish season, positive gains in January are no sure bet.

This year, a number of question marks seem to have investors leaning back on their heels. These include: plummeting oil prices, geopolitical turmoil (including the most recent terror attacks in France) and continued divergence between the world’s major economies — U.S., Japan, the euro zone and emerging-markets, namely China.

And, of course, all eyes are on the world’s central banks, which, I suspect, will be taking divergent policy courses beginning this year. The ECB is expected to deliver a stimulus package later this month… and, depending on the size of the plan, it could spur new trends in short order.

Let’s take a closer look at these trends as we go around the market in 10 seconds…

• Global stock markets mostly ended the week higher, with the strongest performance seen in Chinese (FXI) and emerging-market (EEM) stocks. European shares were essentially flat, as investors wait for definitive word from the ECB regarding its widely-anticipated stimulus plan.

• Bond markets rose across the board as interest rates dropped sharply lower, with the 10-year Treasury rate falling below 2% to match its October 2014 low. The downtrend in rates is a continued symptom of deflationary pressures that we’ve talked about for years. Plummeting energy prices are adding fuel to the fire.

• Commodity markets were split. Oil and natural gas continued to slide lower, while gold and silver edged higher. The U.S. dollar continued its bullish climb last week, putting downward pressure on the commodity sector as a whole. Expect this trend to last awhile longer.

Investors are decidedly cautious as this new year begins. It seems everyone is a bit hesitant to commit to new, bullish positions until some questions are resolved.

The bullish breakout in small-cap stocks is now being tested, but a renewed push by the bulls could put the lagging index back above 1,200 — that’s the level I’d like to see broken to the upside before calling the bullish trend in equities alive and well.

For now, we’re well-balanced and should wait for a clearer trend to emerge. Stay tuned.

Adam

Commodities and Truck Sales

We own a 2005 Chevy Suburban that I drove off the lot brand new. The truck-based SUV has over 170,000 glorious miles on it. All of my children learned to drive in it, which means they’re now qualified to pilot vehicles of any size, including M1 tanks.

While the older two kids have long since gone off to college in other, smaller vehicles, the youngest is still in high school and recognizes the virtues of driving the biggest vehicle in the school parking lot.

Did I mention she’s a girl at an all-girl’s school?

The Suburban is never lost in the parking lot. She might be able to find it because it has a Texas flag emblem over the Chevy symbol on the front grill, or perhaps it is visible because it’s three feet longer, two feet wider, and four feet taller than every other car out there.

She can haul (at least) seven of her closest friends out to the beach or to a party, and other drivers ease out of her way when they see that big SUV coming toward them.

What’s not to love?

Still, it is 10 years old, and chances are my daughter will end up in college over 1,000 miles away. So sometime in the next year she will need a new (or rather, newer) car, and she already has a model picked out — the Ford F-150. As the conversation about her next vehicle has gone on over the past year, I’ve found myself wishing she had a second choice… not because I have a problem with her driving a truck, I just didn’t want to pay for one. They’ve gotten really expensive.

But that might be about to change.

Land of TrucksWe visited family in Texas over the holidays. While there, I couldn’t help but notice that, as they would say in local parlance, you couldn’t swing a dead cat without hitting a brand new F-150, Silverado, or Ram Truck.

It seemed as if every other vehicle was a shiny new pickup truck, and we all know why. The fracking boom has been in full force for five years, and Texas is the epicenter of the business.

With oil and money flowing like water, new trucks have been flying off of dealership lots. They are one of the symbols of success in Texas. Nothing says you’ve made it in oil country like a truck that costs more than a small home.

Now that oil has dropped more than 50% in the last six months and the number of oil rigs in operation has begun to fall, the easy flow of money in the oil patch might be drying up. With a break-even cost of $50 to $55, companies that are drilling new wells are taking a big chance.

Oil sits under $50 as I write this, so companies drilling new wells are losing money before they even start. That’s not a good business practice.

As I’ve written in these pages before, the Saudis don’t feel any pressure to cut oil production. They would rather see weak producers in the U.S. get choked out, and watch geopolitical foes like Iran and Russia squirm with ballooning budget deficits than slow down oil production and help all oil producers out of a jam.

With so much production available and demand softening as economies around the world slow down, it’s possible that the price of oil will remain low… at least for the rest of the year.

Which brings me back to pickup trucks.

Cheaper fuel prices make owning a big vehicle a bit easier on the wallet, and perhaps low oil prices will give some people the extra push they need to drive one. But there’s no doubt that as the oil industry suffers with the drop in oil prices budgets for new pickups will be slashed.

Meanwhile, individuals who work in the oil field are potentially facing layoffs and slowdowns, which aren’t conducive to new vehicle purchases either.

Just as this domino effect has occurred to me, I’m sure the VP’s of North American sales at Ford, GM, and Chrysler have all seen the writing on the wall as well.

Given that most of the profit in the auto industry comes from trucks and SUVs, I’d guess that executives at these companies aren’t nearly as happy about the prospect of falling truck prices as I am.

Rodney

Ahead of the Curve with Adam O’Dell Cautious New YearJanuary 9, 2015

Japan’s Demographic Decline

It’s one thing to naturally have fewer kids as a country urbanizes and gets more wealthy. It costs more to raise and educate kids in such a society and so couples naturally choose to have fewer kids and educate them better. Every developed country has seen such trends, as have the urban populations of emerging countries.

But there’s something different in Japan, something downright scary. They not only have one of the lowest birth rates per 100,000 women of 1.41 vs. a 2.1 replacement rate, but single and married people increasingly have no interest in sex or romantic relationships.

I’ve commented on this before, but there is a good 2011 report by Japan’s population center that has more detail on this dangerous trend.

The one thing that Japan, East Asia and southern Europe share is that women get virtually no help from the government, corporations or their husbands when they have kids.

But in Japan it goes farther…

No Wedding BellsHere are some key findings:

1. 45% of women and 25% of men 16 to 24 are “not interested in or despised sexual contact.”

2. More than 49% of Japanese citizens are single.

3. 40% of unmarried men and 61% of unmarried women age 18 to 34 are not in any kind of romantic relationship.

4. 23% of women and 27% of men say “they are not interested in any kind of romantic relationship.”

5. 39% of Japanese women and 36% of men of child-bearing age, 18 to 34, have never had sex.

6. Women in their early 20s have a 25% chance of never getting married and a 40% chance of never having kids.

Japanese laws and social customs make it extremely difficult for women to have a career and a family. Women who get pregnant, or even just marry, are generally expected to quit work and become a housewife.

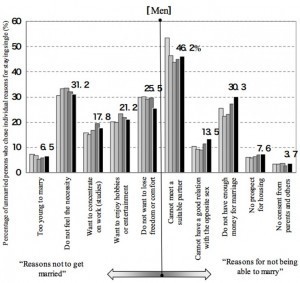

The following chart shows men’s reasons for staying single. I’ll quote the survey results for women as well and they’re mostly similar. The survey was taken periodically between 1987 and 2011. There are 5 surveys in order but I’ll quote the most recent one in 2011.

Source: National Institute of Population and Social Security Research of Japan

The key reasons were:

1. 46.2% of men and 51.3% of women: “cannot meet a suitable partner.”

2. 31.2% of men and 30.4% of women: “don’t feel the necessity.”

3. 30.3% of men and 16.5% of women: “do not have enough money.” (Here’s where men differed the most for obvious reasons and a poor economy.)

4. 25.5% of men and 31.1% of women: “do not want to lose freedom or comfort.” (This is where women rated higher due to conflict with career ambitions for them.)

On top of this extraordinarily high lack of interest in sex and having families, the Japanese live longer than any other wealthy country in the world, with a life expectancy of 84 vs. 79 in the U.S. and 80 to 81 in most of Europe.

That means they retire longer and require more support from a dwindling workforce.

In 2012, Japan’s population fell 212,000 with 1,256,254 deaths vs. 1,037,101 births making up almost all of that difference and further hampered by very minor immigration. Japan’s population is projected to fall from a peak of 128 million recently to about 97 million by 2050… that’s a decline of 24%.

Much worse and even more critical is the enormous fall in workforce growth of the population aged 15 to 64. It peaked in the mid-1990s at 87 million and is projected to fall to 48 million by 2050. A whopping 45%!

By 2050, that 48 million workforce will be supporting 37 million elderly aged 65 and over.

If this isn’t economic suicide, or Hara-kiri, I don’t know what is.

Harry

Ahead of the Curve with Ben BenoySelf-Tracking HealthDIY Health Care

If you’re a technology geek in any way, then you wait every year with bated breath to see what gets rolled out at the Consumer Electronics Show (CES) in Las Vegas. Much to my liking, there was plenty of health tech to see this year.

If I had to touch on an overall theme that crossed over all the gadgets at the show, it would be self-tracking health.

We’re starting to see a ground swell of health-related technology that leverages the number one existing tech device we’re dependent on today… our smartphone.

The start-up Cellscope developed a small ear probe that clips on to your iPhone camera allowing you to stream video of an ear canal to a doctor for analysis. The company has doctors on call that can analyze the video stream and provide a diagnosis in under two hours, so families can receive care more efficiently rather than making repeated visits to the doctor’s office with kids suffering from chronic ear infections.

If you’re looking for a discount on your health insurance, there’s Oscar and their wearable device, MisFit Flash. This start-up company pays consumers bonuses for meeting their fitness goals and transmits data to their insurers via their smartphone.

Access to health information can be a double-edged sword.

We all remember the train wreck that WebMD (Nasdaq:WBMD) turned into after the dotcom bubble popped in the early 2000’s. At first, everyone thought they could just go online and read up on their health issues and perform a 90% proven diagnosis.

In my opinion, this led to an entire generation of hypochondriacs.

As it turns out, you still need a trained health care professional in the loop for analysis and diagnosis. And this is where health care technology companies are focusing their attention.

Across the board, companies are focusing on how to leverage existing technology to collect and share health data with trained professionals at the speed of a supercomputer. Bolstering this is the massive amount of data that’s stored to assist physicians in the diagnosis and treatment of tough mutating diseases, such as cancer.

I recently wrote about NantWorks, its founder Patrick Soon-Shiong and his recent partnership with Blackberry. This week at CES, they unveiled the HBox, a health hub that securely gathers, tracks and communicates with your health care provider. It enables your physician to track a wealth of information without the trouble of an office visit.

Soon-Shiong went so far as to compare the technology to a familiar app we all use: “Imagine us having the ability like Google Maps to browse every single patient’s genome, find the abnormal letter in real-time and tell the doctor what treatment to give.”

HBox will soon be rolled out to approximately 100,000 patients with pre-hypertension or hypertension to monitor their weight, blood pressure, heart-rate and medication in real-time. This will allow the patient’s physicians to track, diagnose and treat them much faster than conventional methods.

I saw an aspirin commercial recently featuring EMTs walking up to a man sitting at a sports game and letting him know they were there for his heart attack. The hook is “heart attacks don’t give notice.”

But given the current trajectory of health tracking technology… we may not be too far off.

I currently track trends surrounding healthcare and biotech utilizing my Social Media Collective Intelligence system and provide alerts in my Biotech Intel Trader service.

As always, I will continue to monitor the market’s social media collective intelligence and keep you updated on the latest trends.

Ben

January 8, 2015

Swiss Government Won’t Welcome Your Money

You know the world is crazy when banks charge negative interest on deposits. This is exactly what is happening in Switzerland as the small nation tries to fend of the monetary policy of the euro zone.

Good luck with that.

Switzerland has its own currency, the Swiss franc. In 2011 the PIIGS of the euro zone (Portugal, Italy, Ireland, Greece and Spain) were in tough shape. The integrity of the euro was in question as the Greek economy showed signs of collapse. Investors large and small fled the euro, rushing into other currencies like the Swiss franc.

As large pools of money sold euros and bought Swiss francs, the value of the franc soared against the euro. While the lofty currency allowed the Swiss consumers to buy more foreign goods, it meant that foreigners had to spend more on Swiss items, like Swatch watches and Swiss vacations.

Apparently the Swiss weren’t comfortable standing idly by as exports fell and tourism dropped off, so the Swiss National Bank (SNB) put in place a downside limit of 1.20 on how many Swiss francs one euro can purchase. If the exchange rate fell lower (meaning the franc was stronger), the SNB would print new francs and use them to buy euros, keeping the exchange rate at 1.2.

This action calmed the markets somewhat, but only for a while.

The AftermathOver the last 12 months inflation in the euro zone has dropped near zero, while GDP growth is tepid at best. The unemployment rate is stuck above 10%, and Greece is about to hold an election in which a far-left party that favors repudiating debt is polling ahead of other parties.

Citing weakness across the euro zone, ECB policy makers announced they could soon start their own quantitative easing (QE) program. All of these things have combined to push the euro to decade lows, causing other currencies to soar… except for the Swiss franc.

As long as the SNB keeps its exchange rate pegged at 1.20 or higher, the euro can’t lose more value against the franc, which gives investors a free pass to exchange their falling euros into nice, strong francs at the artificially high level of 1.2.

Not being stupid, money managers, pension fund managers, and everyone else who handles large amounts of euros are rushing to exchange euros for francs. In an effort to shrink the amount of money coming in, the SNB has instituted negative interest rates on deposits.

The hope is that if investors have to pay a penalty in negative interest rates once they exchange euros for francs, they might be less inclined to make the trade in the first place. This is a great theory, but it misses the bigger point.

The euro zone is stuck in a low inflation or even deflationary environment, so funds stuck in that currency are going to suffer in the weeks and months ahead. Paying a small price, such as a negative interest rate on deposits, to hold funds in a different currency is worth it, especially if the exchange rate is artificially high in the first place.

The best thing the Swiss can do is get rid of the limit on the exchange rate and let the valuation float with the market. This will cause some pain in the short run, but it’s much better than continually printing new francs to buy euros as they flood the small country.

In the larger picture, the fact that Switzerland has to resort to such measures in the first place indicates how difficult the situation in the euro zone has become. For years we’ve pointed out the two big problems in Europe – an overhang of debt and aging populations.

Monetary policy and exchange rates won’t make these problems go away. The good news is that anyone living outside of the euro zone should be able to take a cheaper European vacation in the years to come.

Rodney

January 7, 2015

Markets of 2014

In some ways, 2014 was an odd year.

Even though the broad market ended better than 10% higher, things were decidedly choppier and more volatile than in 2013. We saw a wider dispersion between top- and bottom-performing sectors. And, interestingly, there was a changing of the guard with respect to the top-performers of 2013 and 2014.

By and large, there was very little correlation between 2013’s sector trends and 2014’s.

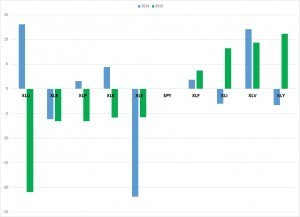

Here’s a chart that shows this…

Each sector’s performance — relative to the S&P 500 — is plotted, for both 2013 (green bars) and 2014 (blue bars). And the chart is sorted based on 2013 performance.

As you can see, there’s not much of a pattern here. Here are a few examples…

• Negative Reversals: The Consumer Discretionary (XLY) and Industrials (XLI) sectors outperformed in 2013, but underperformed in 2014.

• Positive Reversals: The Utilities (XLU), Technology (XLK) and Consumer Staples (XLP) sectors underperformed in 2013, but outperformed in 2014.

• Positive Trends: The Health Care (XLV) and Financials (XLF) sectors outperformed in 2013… and that outperformance continued on through 2014.

• Negative Trends: The Materials (XLB) and Energy (XLE) sectors underperformed in 2013… and they continued to underperform in 2014.

In a sense, the lack of correlation between sector performance in 2013 and 2014 shows the difficulty in a buy-and-hold strategy.

And it shows why I recommend Cycle 9 Alert subscribers to hold their positions for two to three months at a time.

• On medium-term “swing” trades, there were good gains to be made in each and every sector.

• By buying bullish call options on a popular health care ETF, we captured a net gain of 74% between January and March.

• We made a bullish play on a utility sector stock between mid-March and early-June… and that trade handed us a net gain of 54%.

And a bullish play on the financial sector netted us 84% between August and early December.

All told, Cycle 9 Alert is a great place to learn which sectors are moving up… and which are headed down. And, of course, I give specific instructions on which plays to make… and how to position yourself to capture double-digit returns in just two to three months.

Adam

Government’s Election Surprise

As we move into 2015, the presidential race in the U.S. is starting to look a bit clearer… but is that an illusion? Hillary Clinton is once again seen as the clear front-runner for the Democrats.

But how did that work out last time?

Elizabeth Warren is the up-and-coming feisty reformist option, but she has shown no stated interest thus far. Jeb Bush looks like he’ll enter, especially since the Republican Party has no other centrist candidate to compete with Clinton.

Rand Paul would certainly lose, just like Barry Goldwater did against LBJ in the 1964 election. Chris Christy is next on the tier after Jeb, but has come off looking more like Tony Soprano after the bridge scandal (even though he wasn’t found guilty).

Middle of the AisleI’m not Republican or Democrat, and we’re not partisan at Dent Research. I can favor each party on different issues over time, but I’m more swayed by the economic cycles we study that greatly affect those same issues.

If one party was just dead wrong (as the parties usually think of each other), they wouldn’t still exist after decades, centuries and millennia of political evolution.

In a bubble period, like the one we have now, where the rich are getting richer, history would clearly say that the Democrats will do better in the future, possibly for decades. In a period of high inflation and lagging innovation, like during the 1970s, the Republicans will do better in the future (there were 12 years of Republicans from 1980 – 1992 alone).

Looking at the broader aspect of our research, Republicans clearly tend to do better in the inflationary summer and the bubble boom fall seasons of our 80-Year Four-Season Economic Cycle; as you can see with 26 years of Republicans from 1969 to 2008, as opposed to only 14 years for the Democrats during those same seasons. That’s 65% for Republicans over a span of 40 years — or half the 80-year economic cycle.

You can probably guess what happens in the other half.

From 1933 to 1969, we had 28 out of 36 years of Democrats in the winter and spring seasons. Democrats seemed to dominate even more when major financial bubbles finally burst. It’s then that the everyday person begins to prosper once again due to the trickle-down impact from massive innovations that sprout in the summer and fall seasons, as well as the natural political backlash when the rich get so stinking rich.

The wild card for me is simply the economy and that is precisely my area of expertise.

More broadly, since 2008 the economy has favored the Democrats and should continue to do so at least into 2036 through the continued winter and upcoming spring season. But other historical factors could disfavor the Democrats in the coming election of 2016.

In the short term, if the economy continues to stabilize and improve as it has in recent years, the establishment candidates would be favored, Bush and Clinton… and more so Clinton in the incumbent party.

But what if we’re right and we see an even greater crash and global financial crisis between early 2015 to early 2017 than the one we experienced back in 2008? Don’t you think that would change things a bit?

I think it would change things entirely.

The more passionate, change-oriented candidates would become much more attractive: Elizabeth Warren and Jim Webb on the left, Chris Christy and Rand Paul on the right — like Obama in 2008 running in a bad and crashing economy. Remember… he came out of nowhere and beat the clear establishment Democratic presidential candidate and favorite, Hillary Clinton!

Looking Back at HistoryBut did you know that no Democrat has ever been elected directly to follow a Democrat since the Civil War?

There have only been Democratic vice presidents that have succeeded after the death of their presidents, like Truman and LBJ (even though both got re-elected at the end of the term).

The only Republican president to be elected after a Republican was George H. W. Bush, and Gerald Ford succeeded Richard Nixon when he was impeached, so it’s not that different on the Republican side. The Bush election occurred in a very good economy with no recent recessions.

Bad presidents only get one term and are usually followed by the opposite party and the more popular two-term presidents are in long enough for the economy to tend to change for the worse and to naturally tip the scales to the other side.

But as soon as there was a recession in the early 1990s, the Democrats took back over in 1994 with Bill Clinton voted in for two terms in another great economy that you couldn’t have screwed up if you tried. But he was followed by George W. Bush just after the tech wreck began and he was also voted in for two terms… the economy crashed and Obama came in after the 2008 financial crisis had begun.

History, other than the broad leaning toward Democrats in the winter and spring seasons which is a powerful concept in and of itself, would argue that the Democrats won’t be favored with or without a bad economy… even if there is another financial crisis.

So, it’s kind of a toss-up at this point.

Again, I am not a political expert or a pundit, but if I had to guess… I think it could come down to Warren vs. Christy in the bad economy I forecast.

Warren has the clearest “we need to reform the corrupt financial system to favor the everyday person” that FDR brought in the winter season of the 1930s. She is more than passionate and very communicative. Hillary has the intelligence and ideals, but she lacks the personality and charisma that her husband has.

Christy has that “roll up your sleeves and tackle the problem head on” approach that could work in a financial and debt crisis that the Republicans have continually warned about. And I always thought Romney should have taken that “turnaround manager” approach from his Bain experience but unfortunately, he didn’t.

If 6 years of unprecedented stimulus under Obama’s reign fails, then this has to favor the Republicans, and it’ll likely favor Christy more than it will Bush.

But when the average person sees another financial crisis out of their control, especially after the stimulus that favored the rich more than ever… they’re going to be very angry and Warren would be the best advocate for them.

My summary insights are that the passionate for change outliers will have the best chances in another financial meltdown. But put a gun to my head and I think that a candidate like Warren could beat a candidate like Christy due to the larger cycle showing the rich falling and the middle class rising, yet again.

If someone like Christy wins (or even Bush), he is likely to be a one-term president as the economy is likely to get worse into 2019 – 2020 judging by all of our key cycles. If the Republicans can’t turn the economy around and they created the bubble from 2000 – 2007 in the first place under Bush, then they look bad.

If someone like Warren (or even Clinton) wins, it’s harder to predict the 2020 election since a consistently bad economy always disfavors the incumbent. But given that 2008 to approximately 2036 is a Democratic and middle class-favored era, a Democrat could get re-elected if there is only a marginally worse economy as I expect there to be after late 2016 or early 2017… but only if the worst part of the next crisis hits by then.

And I do expect it.

We’ll see and comment ahead, but don’t expect the 2016 election to shape up anything like the political pundits are expecting… it’s likely to be an outlier!

Harry

Ahead of the Curve with Adam O’DellMarkets in 2014January 6, 2015

Economic Accountability

I don’t hate all lawyers. One of my best friends on the planet is a lawyer. They provide a useful service in a republic, clarifying rights and regulations as well as assisting people and companies that are entering and dissolving legally binding relationships.

With that being said, I am convinced that our legal system has run amok, and the hacking of Sony Pictures simply proves the point.

The Obama administration announced that they have enough evidence to prove that North Korea hacked Sony Pictures in retaliation for the filming of The Interview. The movie depicts the assassination of the current leader of North Korea, Kim Jong-un and it was set to be released by Sony on Christmas Day.

In response to the subject matter, North Korea infiltrated Sony’s computer system, stole confidential information including emails, payroll records, and even movies themselves, and then released the information to the public.

The hackers left threatening messages in the computer system, informing Sony that if the film was released, violence would ensue.

More threats from North Korean representatives followed, claiming that the production of the film was an act of aggression, and showing the film would bring about terrible consequences. These threats were aimed not just at Sony, but also at theaters and any other distribution network.

The broad theater release of the movie was canceled, and it was eventually slated for release over the internet on www.crackle.net as well as in select theaters around the country.

I’m sure that Sony executives were embarrassed by some of the emails that were released and furious at the distribution of stolen movies over the internet, but I don’t believe for a minute that Sony was quaking in fear at the thought of North Korea raining down missiles on their Los Angeles location.

It’s also implausible that North Korea could cause much harm on the many theaters where The Interview was going to be shown.

Who are You Going to Call?It wasn’t the North Koreans that theater owners and Sony executives were worried about. It was lawyers.

Imagine The Interview being played in a theater when some nut case runs in, yelling in Korean and begins harming people. The attacker could be acting alone, with a long history of mental illness and outbursts, but none of that would matter.

Someone would sue the theater as well as Sony Pictures, claiming they knew, absolutely knew that something like this would happen, and therefore should be held liable in both criminal and civil court.

If someone can sue McDonald’s for serving coffee that’s too hot and win… it’s not a stretch to imagine that someone will sue a theater and a movie company if anything bad should happen, especially when the ludicrous threats were made publicly.

Whether the harm comes from North Korea or not wouldn’t matter.

Given that the movie would have been shown in hundreds of locations, there would be no way to provide adequate safety to guard against anything bad happening. With the threat of a multi-billion dollar lawsuit potentially following the release of what is reportedly a weak comedy, it’s easy to see how the decision to cancel the release to theaters made sense.

Even if the theaters asked patrons to sign a release of liability or some other form acknowledging the threats, that would not have stopped the lawsuits.

Pointing the FingerIn a broad sense, this situation mirrors our national retreat from personal responsibility. When something bad happens, we look for who is to blame, even if part of the blame belongs to us.

The financial crisis comes to mind, when millions of people claimed they were the victims of predatory lending. The term itself seems odd.

Were people forced to borrow? Was a gun put to their head so that they would sign on the hundreds of dotted lines that it takes to buy a home?

Fraud is a different story. If there was lying and cheating going on (Countrywide Mortgage and S&P Rating Services, I’m talking about you), then those cases should have been prosecuted.

But predatory lending? Where’s the lawsuit for gullible buying? This would be the one filed by the rest of America, people who paid their bills and did not take on debt far beyond their means, and yet still got clobbered financially in the downturn.

There’s a long list of people involved in the financial crisis who cried, “Not me!” when things fell apart. As a society, we let them off the hook, further cementing the notion that when something bad happens, you can always find a scapegoat, or at least someone who can be squeezed for cash to mitigate some of the financial pain.

Unfortunately, if we look out across the economic horizon, there’s a huge problem looming that could make the crisis of ’08 seem like a cakewalk.

It’s the long-term financial burden of the baby boomers. Their pension liabilities – both public and private – as well as their healthcare costs grow every day, and the boomers don’t have anywhere near enough funds in savings to maintain their standard of living.

The burden of fixing these problems won’t stay with the boomers, it can’t. They will look for someone to pick up the slack. Eventually, their gaze will land on the one class of people that always seem to end up paying the tab – the American taxpayer.

As we start the New Year, do your best to shrink your taxable footprint. Not only will it give you a raise, as I mentioned last week, but it could also diminish the amount you have to pay when other people get into financial trouble.

Rodney

January 5, 2015

Markets Pushing Positive

Friday was the first official trading day of 2015. The risk-on mood that emerged in the middle of December faded a bit last week as investors sold stocks and bought bonds.

Of course, one day… even one week… of weak stock prices isn’t much of a trend.

The long-term and dominant trend in stocks is still up. And with positive seasonality through April, stocks could continue to trade higher once investors fully settle into their trading routine for this new year.

I’m watching for good opportunities to buy into dips. And, as always, I’m keeping an eye open for smart ways to hedge our portfolio.

As I emphasized at our Irrational Economic Summit in October, I believe 2015 will be defined by divergent trends spurred by central bank policies which can no longer be expected to move in lock-step, as they did in the wake of the 2008 global financial crisis.

In short, 2015 should be chock full of opportunities.

Let’s take a closer look at these trends as we go around the market in 10 seconds…

• Global stock markets were weak, with the exception of Chinese shares which bucked the downtrend and rose 3.3%. Small-cap stocks (IWM) lost just 0.7% — a milder loss than the S&P 500 and a sign that some investors are now willing to buy the discount in this niche.

• Bond markets rose, led higher by a strong 1.2% gain in Treasury bonds (IEF). Meanwhile, junk bonds lost 1% and emerging-market bonds fell 1.4%. Our “high-quality” bond spread trade (long IEF, short JNK) gained a nice 2.2%, proving its ability to act as a smart hedge during periods of risk aversion.

• Commodity markets continue to show weakness, as oil (USO) dropped another 5.5%, sending prices to a five and a half-year low. Be happy if you avoided the temptation to buy into the early stages of oil’s “pullback” as it has devolved into a very deep, money-destroying selloff. In fact, USO is down a full 27% since December 1, around the time I recommended NOT making any long investments in oil or energy stocks, even as tempting as it was to “buy the discount.” This market epitomizes the pain that can be inflicted when investors try to catch a falling knife.

I’ll be watching closely this week to see how investors react to the first full week of 2015.

If you’d like to have a better look at my Cycle 9 Alert, you can read up on it here.

Adam