Harry S. Dent Jr.'s Blog, page 166

February 4, 2015

Will College Tuition Ever Stop Increasing?

It’s not often you get to say you have something in common with a billionaire, let alone with Mark Cuban (owner of the Dallas Mavericks and one of the stars on Shark Tank, my favorite TV show).

He says that American colleges are in serious trouble and that over a trillion dollars in student loans will put many of them out of business.

I not only 100% agree… I’ve been saying that for years!

It’s not just the loans. It’s that the bubble in rising education costs will end when students can no longer get loans to pay increasingly outrageous tuitions… never mind pay off those ridiculous amounts.

As Rodney said the other day, you could buy a small house for the same amount of money that universities are asking just so you can walk away with a piece of paper.

And our government has been encouraging this madness! Still is, in fact. It’s subsidizing these loans just like it did with mortgages, and that led right to the 2008 subprime crisis. Now its interference in higher education has allowed costs to continue to increase at the highest rate of any major sector in our economy.

The result?

Yet another massive bubble that will burst ahead, leaving behind a swath of financially-ruined students… the very people we’re relying on to move our economy forward.

How stupid and shortsighted!

What we need is not more subsidies or more government intervention. Instead, we need the government to step out of the way so that the natural reset and deflationary cycle can take its course. That’s the only way the education and health care system can rebalance and once again be a boon to the young and old, instead of a burden. Tomorrow, Rodney plans to tell you a story that shows how messed up the health care system is, so be sure to check it out.

Something is Very Wrong in NeverlandThe education bubble is the most extreme we’ve seen in recent decades (the student loan bubble is another problem entirely). There is simply no justification for the extent to which the cost of education has increased. High bureaucracy, tenure and the high real-estate costs of glorious campuses is completely unnecessary when you can interact with the best experts in the world via a virtual classroom.

Yet colleges and universities still have households over a barrel. Most families want nothing more than to give their kids a good college education so they can look forward to a bright future and enjoy a good life.

So college costs keep rising, faster than anything else in the CPI basket, and we just grin and bear it.

Only, it can’t and won’t go on like this for much longer.

Look at this chart.

It shows the steep rise in baby boom spending on education. That peaks at age 51, and as you can see in the chart above, this unprecedented demand resulted in a sharp price increase from 1984 to 2012. Then the spending will first drop steeply into 2019 and again from 2022 to 2024.

The actual attendees, the millennial generation, saw their first wave peak in graduations on a 22-year lag also in 2012 and now that trend drops down sharply into 2019.

That means, the spending trends are now heading down, especially into 2019. So if there’s going to be a crisis — and I believe there MUST be — that’s when it will come.

My apologies to any professors reading this, as I considered you to be one of the top risk-adjusted professions until now, like union auto workers in the past. Don’t get me wrong, I love your high education and longer-term views of life. But it’s time for your industry to reset.

With a declining spending curve and the inevitable student loan catastrophe, colleges are about to see applications fall off a cliff. Private colleges, more than public, will face major headwinds over the next decade.

Many will fail or have to retrench their tenured professors and reduce their high real estate costs.

The ones that will survive will have embraced the online world and be less capital-intensive. Many will still have campuses, but they’ll sell off or lease more of their real estate and research facilities. That will be good for the emerging millennial generation and the young people that follow them.

So if you have kids or grandkids that will move through the higher education system, think smart. Help them find better alternatives to the traditional campus experience. That will save your pocket, their credit, and their future.

If you’re a professor, embrace technology. Warn any friends you have who work at colleges. Don’t be lulled into a false sense of security by the brick and mortar that currently holds students prisoner.

And whatever you do, look to education in the technological realm as profitable investments to make after the next big crash.

Harry

Follow me on Twitter @harrydentjr

Where Do the Unemployed Go? Back to School…

People, en masse, are a powerful force.

That’s the Dent Research thesis in a nutshell.

We’ve long shown how people’s predictable spending patterns drive economic booms and busts. Since consumer spending makes up around 70% of developed nations’ GDP, “as consumers go, so goes the economy.”

The same people-driven trends can be seen in the education sector.

For instance, historical patterns have shown that enrollment in higher education tends to tick higher alongside unemployment rates. This correlation has a logical basis, for a few reasons:

Unemployed job-seekers know their chances of securing a position increase once they obtain additional degrees (as does their earning potential)Unemployed job-seekers, arguably, have “time to spare,” assuming their job search doesn’t consume more than 40 hours a weekAnother (more insidious) incentive for the unemployed to enroll in higher education is their eligibility to receive student loans… the proceeds of which are supposed to be limited to educational expenses, although who’s to know if a bit is used to pay the rent or buy groceries, right?

Regardless of the reason, here’s a chart that shows the correlation between the U.S. unemployment rate and the stock price of online education pioneer, Apollo Group (Nasdaq: APOL), which operates University of Phoenix. (If you watched this year’s Super Bowl, you know it was played in University of Phoenix Stadium, in Phoenix, AZ.)

Stock prices are inherently more volatile than unemployment rates, so I’ve taken a 12-month average of Apollo Group’s stock price (in orange) to smooth that out. And I’ve plotted the U.S. unemployment rate (in blue) alongside.

As you can see, the correlation between these two data streams is remarkably high, at around 90% (i.e. 0.9). However, the magnitude of Apollo Group’s share price gains, in response to rising unemployment, has varied over the last decade.

From January 2000 to June 2003, the unemployment rate climbed from 4% to a peak of 6.3%. Meanwhile, the 12-month average of Apollo Group’s share price gained a whopping 320% during this time ($11 to $47). And even after the unemployment rate peaked, Apollo’s stock continued to climb, to as high as $93 in May 2004.

The next round of joblessness didn’t treat Apollo’s stock equally well.

Between March 2007 and October 2009, unemployment increased from 4.4% to 10% — or three percentage points more than the 2000-2003 increase. But Apollo Group’s stock only climbed from $46 to $70, a gain of around 50%, during this time.

What’s my point?

Well, finding correlation-based relationships, such as this, can provide a hugely valuable timing tool over sufficiently long-term horizons. But, the magnitude of future price moves don’t always compare to previous ones.

Still, this is one example of the people-driven brand of economics we practice at Dent Research. And it’s this type of analysis that you find in our flagship newsletter, Boom & Bust.

Best,

Adam

February 3, 2015

Is the Fed Losing Credibility?

I absolutely agree with Rodney. Central Bank or government involvement is the last thing we need in our efforts to revive the middle class. So I say the Fed should keep its nose out of our employment situation and focus more of its efforts on understanding its limitations. That is, it doesn’t have the power to beat economic forces that have been in action longer than they’ve been in business.

Harry and Rodney have been writing about the economic winter season we’re living through now long before I joined them eight years ago. And long before Ben Bernanke took over as Fed chair in 2006 and then when he began trying to fight deflation by printing money.

Under Bernanke’s reign, the Fed created $4 trillion over six years, yet wage growth remains stagnant at best. Inflation was negative for the month of December, well below the Fed’s 2% target for the year. And there’s been some job growth, but the quality of those jobs is questionable.

The reality is, the standard of living for the average consumer has been in decline for many years now, no thanks to the Fed.

While stock market participants have enjoyed the Fed’s practice of providing “crack” to the economy, savers and those counting on safe returns from interest rates (retirees) have suffered.

That’s nothing for the Fed to be proud of, in my opinion.

Last Tuesday and Wednesday, the Federal Open Market Committee (FOMC) held their regularly scheduled meeting to set monetary policy and agreed not to raise rates from zero to 0.25% on the federal funds rate.

The FOMC seems to believe the labor market has improved with strong job gains and a lower unemployment rate. They also believe that lower energy prices that are worrisome to inflation are temporary and that the inflation rate will gradually, over the medium term, rise to the 2% they are looking for.

In the meantime, the Fed’s asset purchases will remain the same. That is, they’ll maintain their policy of reinvesting principal payment of debt and rolling over maturing Treasury securities at auction. So, they’re not changing the money supply by selling off any current holdings.

And they’ve promised to be “patient” and look closely at the data and economic conditions that may warrant keeping the target federal funds rate low or below normal levels for a long time.

As far as I’m concerned, that tells me the Fed thinks there may be trouble ahead.

Following the Fed’s statement, the rate on the U.S. 30-year bond hit another all-time low of 2.29%. I’m not surprised. It’s obvious that no one believes that the Fed is going to raise rates any time soon!

Could the Fed already be losing credibility?

Will the equity bubble, the bond bubble and all of the other bubbles the Fed has helped to create finally burst?

To us, the Fed never really had any credibility to begin with, but I think others are now beginning to see that for themselves.

And we believe those bubbles must burst. There’s simply no other way.

I hope the Fed stands aside during the next crisis to force our elected officials to finally deal with taxes, spending and regulation in a meaningful way.

The bubbles need to burst, as Harry has said on many occasions! Our economy and markets need to correct, before they can recover.

Lance

Keep Tax Increases at Bay: Buy Local

The problem with the middle class is that it’s shrinking… that much is obvious. There seem to be two basic approaches to reversing this trend. The government can either raise taxes on high-income earners so that funds can be redistributed in the form of tax credits or deductions to others, or lower taxes on businesses so that companies are more profitable and can afford to pay their employees more.

How about neither one? That’s my vote, since I don’t think either program has much chance of moving families very far up the income ladder.

In trying to bring back the middle class, we’re fighting a trend that is much larger than one administration or another. We’re trying to recreate something that was an anomaly — the 1950s and 1960s.

It won’t happen.

I covered this topic in depth in the October 2012 issue of Boom & Bust, and the situation hasn’t change. This is not a domestic political issue — it is geopolitical, and rooted in global economics.

Before WWII there was a high level of inequality in our economy. As the U.S. industrialized, owners of capital did pretty well. With a steady flow of new workers moving to cities from rural areas, they could keep wages low since they could simply hire new employees if the current crop demanded more income.

Labor unions were formed to help bring about better working conditions and better benefits. The one tool that labor unions could use was the solidarity of workers to either slow down work in a factory or bring it to a complete stop. Either action would cost the business owners money.

The problem was that simply organizing labor didn’t change the facts on the ground — there were more people willing to work than there were jobs available, which kept a lid on wages.

The start of WWII changed all of this.

The U.S. ramped up production of war supplies ahead of December 1941, and then engaged in the war completely. Suddenly workers were scarce.

Many expected the end of the war to bring a recession, since production of war goods would stall, but it didn’t happen. WWII was different. Not only had the industrial base of Europe and Japan been obliterated, but U.S. infrastructure had emerged unscathed. Suddenly, the U.S. was the provider of food and industrial goods to much of the world.

This tremendous increase in business required a lot of investment capital and a lot of workers. This gave employees the upper hand… at least for a while.

As Europe and Japan rebuilt, they slowly took business away from the U.S. By the early 1970s, Europe was back online and Japan had become a low-cost producer of goods. At the same time, the boomers hit the workforce, which added more potential employees to the economy.

This combination of adding workers and losing business to overseas markets started the downtrend in wages in the U.S. from what had been an exceptional period for workers.

The issue of rising inequality isn’t about too little or too much taxation.

Raising taxes will simply drive those who can afford to avoid them further down the rabbit hole of misallocated funds as they seek out and use more loopholes.

Lowering taxes will provide more income to owners of capital, but there’s little proof that this necessarily leads to workers earning more.

To change this situation, Americans will have to change the supply and demand for employees. We can make more goods and provide more services here, which would lead to more work, or we can shrink the number of people available for work.

Or even better, we can do both. Only, that’s easier said than done.

If we made more goods and provided more services domestically, then Americans would have to be willing to buy them, even at a premium. It’s amazing that so many people are focused on where their food comes from, but don’t take the same approach when asking where their shoes, shirts, cups, watches, sheets, or anything else originated.

We all know if a car is domestic or foreign, and many goods are aspirational based on where they come from, like Swiss watches and Italian suits, but a lot of daily living goods aren’t in those categories.

Unfortunately, at this point, many things aren’t made in the U.S. at all, so choosing an American brand is impossible. But even if people could buy American, would they?

Would people specifically pay 10%, 20%, or even 40% more to purchase an item made domestically just to support American employment? This extra cost comes right out of family budgets, where they would have less to spend on themselves, or less to save for education or retirement.

That sounds like a hard sell.

As for changing the supply of workers, that is already happening naturally. The baby boomers are aging out of the economy. While many more boomers than their predecessors are working past age 65, the overwhelming majority of them still retire at the traditional age. As this large group exits the workforce, there will be more opportunities, and hopefully more income, for younger workers. Unfortunately, this change in the complexion of our workforce will take another 10 years to occur.

So for now, our best option is to buy American — not 100%, or even close, but a bit more than we do today — and to encourage our family, friends, peers and colleagues to do the same. This would be the quickest way to provide greater opportunities for workers, and bypass the inefficient involvement of the government.

Rodney

P.S. In the summer of 2013 we noted that an iconic American company was on the brink of failure. The company was Radio Shack, and it had failed to keep up with changing American buying habits. It had a large bond payment due in August of that year, and the company was low on cash. Just before the funds were due, the firm secured new financing, which was surprising. Unfortunately nothing else changed. Now Radio Shack was just officially delisted from the stock exchange, as the firm prepares to enter bankruptcy.

Follow me on Twitter @RJHSDent

Ahead of the Curve with Lance GaitanIs the Fed Losing Credibility?February 2, 2015

China’s Economy Spells Trouble for Luxury Brands

As Harry says, the emerging world’s uber wealthy have driven high-end real estate prices higher. And the emerging world’s aspirational rich have driven the boom in luxury goods — from high-end handbags to fine wines — over the past decade.

For example, just look at the granddaddy of all luxury goods companies: LVMH Moet Hennessy Louis Vuitton. The company, which is based in France, is the largest luxury conglomerate in the world. It’s best known for the expensive Louis Vuitton purses, but also owns the Dom Pérignon and Möet & Chandon champagne brands, the Hennessey cognac brand and the Glenmorangie scotch whisky brand, to name a few. It also owns the Tag Heuer and Zenith lines of high-end Swiss watches. It even runs a partnership with global diamond leader De Beers.

In short, it’s a one-stop shop for luxury goods.

It’s also completely dependent on well-heeled Chinese shoppers.

About 30% of LVMH’s revenues come from Asia, not including Japan. Most of these sales are in stores on the streets of China and Hong Kong. Then there’s the spending Chinese tourists do in the company’s American and European stores.

Estimates are informal, but as much as half of the spending in LVMH’s flagship Paris store is believed to be done by Chinese shoppers.

It’s not just LVMH. British luxury retailer Burberry gets 36% of its revenues from the Asia Pacific region with most of this coming from China and Hong Kong. And large chunks of the 39% of its European sales are made to Chinese tourists.

Swiss watches? Same story.

Swatch Group, the maker of Omega and several other luxury Swiss watch brands, gets nearly 40% of its sales from China. Including Chinese tourists buying watches in Europe, the number is estimated to be more than half of sales.

The Economist estimated last year that, industry-wide, about half of all luxury spending in the world is done by Chinese shoppers, either in their home market or abroad as tourists.

All of this was good and well when China was growing at a blistering pace. Now, it’s looking more and more like a liability.

Last year China’s economy grew at its slowest rate since 1990, and is expected to slow again this year. Construction spending has been the driving force behind much of this growth, particularly real estate construction. Yet at least a fifth of new real estate is sitting unoccupied… even as new capacity continues to be built.

Without a doubt, the Chinese economy is a bubble waiting to burst, helped even further along by the country’s crackdown on corruption, which has already sapped demand from the luxury goods sector. In years past, the best way to curry favor with a powerful politician or businessman was to offer him a limited-edition bottle of wine… or perhaps a gold watch. Today, those sorts of arrangements will get you thrown in jail.

When China experiences its hard landing and has the major social unrest that will come with it, no wealthy Chinese citizen will want to be seen in public holding a purse that costs a year’s wages for a laborer.

I expect the stock prices of luxury goods to reflect Chinese weakness long before we see it in the official GDP reports.

Charles

Goodbye Money Laundering: The Slide in Luxury Real Estate

Couldn’t happen to a nicer group of people: ultra-rich criminals, drug dealers, despots and the mafia globally. I’m being sarcastic, of course.

It seems the greatest scheme for international money laundering is rapidly coming to an end and it couldn’t come soon enough. Unfortunately, this will have some negative effects on real estate in the super-expensive cities across the county because buying of high-priced condos for cash in places like New York, Miami, L.A. and San Francisco is going to come to a screeching halt.

Did you know that the National Association of Realtors gets a major exemption from Anti-Money-Laundering provisions?! That’s something I read about only recently in a Zero Hedge article. And it’s another fine example of our perverted special interests-driven political system!

It’s disgraceful that all a foreign government official or ultra-rich and shady business person has to do to buy an expensive condo without scrutiny is get cash into the U.S. (legally or illegally, on their private plane or strapped to a mule’s chest). When they finally flip it, they’ve successfully laundered money in the world’s reserve currency.

Well, cracks are appearing in the ultra-luxury market that these bad-guys move in…

The Strong Dollar’s Effect on Foreign BuyersI used to live in Miami and still go there often. When I’m asked to describe why South Beach and downtown Miami have an even greater bubble than the last one, while most cities don’t, I have a standard reply: “Brazilian drug dealers with bags of cash.” They are the types driving the top 1% of real estate in such cities and that has been where most of the action and gains have been.

Along with the rest of the law-abiding ultra-rich, they’re driving the most extreme bubbles in our largest cities because they have to have large places to park their money and they feel high-end real estate is much safer than stocks and bonds…

They’re about to find out just how wrong they are about that.

At the top of the 1929 bubble you would have lost dearly on almost all financial assets, but you would have done way better in stocks over the next decade than Manhattan real estate, and you would have roughly doubled your money in high quality bonds. And I believe it will be the same in the years ahead.

Today, in New York, about 30% of the $2 million-plus real estate market, where most of the actions and gains have been occurring, is bought by foreign buyers; typically Russian, Middle Eastern, South American and Chinese.

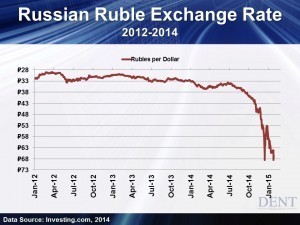

As I explained in Boom & Bust last month, the Russians will be the first to go. The ruble has fallen 55% versus the dollar so a $5 million condo now costs $11.1 million at the rate of exchange from June 2014. That’s gotta hurt those Russian mafia bosses!

The Brazilian real has fallen 20% against the dollar in the last year alone. And that’s going to hurt the drug lords in Miami — their playground — big time.

Many emerging country fortunes have been made in commodity industries and those bubbles, like oil, keep bursting and destroying wealth, so the Middle Eastern ultra-rich are feeling the pain now as well.

And we have the dollar wrecking ball to thank. As the dollar gains in strength, it hits commodities, U.S. exports, and now ultra-rich foreign buyers.

Well, no more! The ultra-rich will be punished as the most expensive real estate in the world slides the furthest and fastest. As these foreign buyers rapidly disappear, there will be no-one able or willing to buy at today’s prices, so these guys will learn the very painful lesson that real estate can — and does — go down in value.

The richest are going to get their asses kicked the hardest in this next crash, not Homer Simpson.

Mark my words on this. If you know anyone dabbling in that market, give them my warning. Their real estate is about to get very illiquid, very fast. They should get out now, while they still can.

And as for you, remember to protect your assets against insidious bubbles so you don’t’ suffer when they inevitably burst.

Harry

January 30, 2015

Debt, the ECB and Robin Hood

European Central Bank (ECB) President Mario Draghi and his band of Merry Men have it backward.

They’re supposed to imitate Robin Hood by stealing from the rich and giving to the poor. Instead, they’ve implemented a program that steals from the poor and gives to the rich, all in the name of saving the economy of the euro zone.

Of course, these days, that’s what central bankers seem to do best.

The implementation of a massive quantitative easing (QE) program by the ECB was talked to death over the past four months. At each ECB meeting the members would drag out the topic of QE, beat it up for a while, then decide to wait just a little bit longer.

At the same time, when members of the ECB gave presentations around the world, they were sure to mention how a bond-buying program (let’s not call it QE, because that would make people think they are printing money… which they are) would help lift inflation in the euro zone.

Given the theory of money in economics this makes sense, but given the reality of everyday life, it’s utter nonsense.

The FactsIn theory, a central bank creates money out of thin air and buys bonds from investors, banks, pension funds, etc. who already own bonds. This drives up demand for them, drives down interest rates, and puts more funds in the hands of the people who sold the bonds.

At this point, some portion of the money paid out for the bonds will end up as deposits at banks instead of being invested elsewhere.

So far, so good, but this is where things get tricky.

Lower interest rates are supposed to entice consumers and businesses who had been on the fence about borrowing money to pull the trigger. The lower cost of money (interest on loans) will suddenly be too much to resist, and they’ll jump at the chance to take on gobs of debt to buy more stuff (houses, cars, manufacturing plants, etc.).

At the same time, the huge influx of bank deposits is supposed to prod banks to make more loans.

If they sit on deposit balances, then they’re not earning any return on lending, while they must pay depositors for their capital. The lower rate of interest just increases the urgency to lend because banks need every dollar of income they can get.

That’s the theory, anyway. Then there’s reality.

Banks in the euro zone, and in the U.S., for that matter, are not overrun with consumers and businesses that want to borrow. With minimal wage gains and aging populations, consumers across the euro zone are much more interested in preserving their wealth and standard of living than taking on new debt.

As for businesses, without a bunch of new clients, what’s the point in borrowing to expand? Even if a business sought new capital, it could borrow directly from investors by issuing bonds and bypass the hassle of bank loans.

As for banks needing to lend money so that they can make ends meet… that ship sailed a long time ago. Banks have been raising fees for years to make up for lost income on loans, and in the euro zone banks charge penalty interest on large depositors instead of paying them interest.

The upshot is that the domino effect of creating money to buy bonds, which entices borrowers to take out more loans and banks to make more loans, which puts more money chasing goods into the economy, thereby creating inflation and growth… does not work.

But there is one area that is a proven money maker — bonds.

Less Talk, More ActionWhile the ECB was gabbing about how it would initiate a bond-buying program in the future, traders around the world were busy scooping up bonds across the euro zone before the program got off the ground. Professional investors don’t simply use a portion of their funds to buy bonds, they use portfolio margin, which can give them up to 10 times leverage on their actual money.

By the time of the ECB’s announcement, Bank of America Merrill Lynch estimated that a full 25% of the $5.8 trillion government bonds in the euro zone were trading at a negative yield. After the announcement, interest rates fell further, handing traders an instant profit on their positions.

This would be like directors of Fannie Mae (FNMA) telling everyone for months that they intend to buy homes of a certain size in a certain neighborhood, no matter what the price. If you could buy a home, or several, in that neighborhood with only 10% down, then you’d make a very tidy profit when FNMA finally started buying.

Of course, individuals don’t typically use portfolio margin, or any margin at all. The benefits of this almost entirely flow to professionals in the financial markets.

That being said, there is something left over for the lowly citizens of the euro zone — the falling euro. In the months ahead of the ECB announcement, the euro fell from $1.35 to $1.17. In the days after the announcement, the euro fell further, touching $1.11.

Again, this is part of the plan of the ECB, to drive down the currency so that exports are cheaper and more of them can be sold. The problem is that the positive effects are limited to exporting companies, and don’t necessarily flow down to workers and certainly not down to all workers.

But all consumers do feel the effects of a cheaper currency — it makes imports more expensive.

At the end of the day, the move by President Draghi and the ECB made traders richer and everyday consumers poorer.

Maybe the goal wasn’t to play Robin Hood, but the Sheriff of Nottingham instead.

Rodney

P.S. With Apple reporting record-breaking earnings this week, our Biotech Intel Trader editor, Ben Benoy decided to dig in behind the scenes of this hi-tech company. And he found out they’re not only about communication and music. Read more below…

Ahead of the Curve with Ben BenoyBiotech InvasionBiotech Invasion

This week we saw Apple (Nasdaq: AAPL) make corporate history by reporting a record quarterly profit of $18 billion in net income, largely in part to selling more than 74.5 million iPhones in the last three months of 2014.

While most view Apple as a consumer goods and electronic equipment company, those wearing technology lenses are starting to realize they actually have a strong play as an emerging biotech company.

Sound crazy? Let me explain…

In 2014, Apple’s biggest announcement wasn’t about a larger iPhone, it was the introduction of the HealthKit. It was their first public attempt of entering into the health care industry.

I say public, because Apple has been building their iPhones with micro-electromechanical sensors (MEMS) for years now and they are the underlying technology behind tracking basic health metrics such as activity, sleep and heart rate.

However, until this past year, the software associated with taking advantage of these finely tuned sensors and displaying their hordes of data was not commercially available on the iPhone.

And it’s here where HealthKit came into play.

Think of HealthKit as the “iTunes” of the health tracking industry. Apple revolutionized the music industry by creating a one-stop shop platform where everyone could buy songs on demand for just 99 cents.

HealthKit is revolutionizing the health care industry by creating a central hub for all your fitness and health data to be collected, displayed and distributed.

The application has been engineered to collect data from numerous health tracking devices — not only from your iPhone — and it was also built with interfaces for software developers to easily pull the data for use in health apps you can download from the Apple App store.

Once again, we’re seeing a major shift in how we use our mobile communication devices.

Many of us switched from flip phones to smartphones in the mid-2000s in order to take advantage of email, Internet and GPS on the go. Now our smartphones will be even more sophisticated by tracking our health and providing vital data to physicians who can leverage this to make better decisions for diagnosis and follow-up treatment.

Remember the days of Star Trek and watching Captain Kirk speak into his communication device to say to Scotty: “Beam me up!” Today with wearable health trackers that link to smartphones, Captain Kirk can tell Scotty to check his heart rate, temperature and blood pressure as well.

The Apple Watch is rolling out this year and will be considered Apple’s first true medical device since it is chock-full of highly advanced sensors that constantly gather data off your wrist. The first generation will track activity just like regular fitness trackers, provide access to apps for messaging, email and… tell time.

Apple does have some stiff competition from Google, Microsoft and Samsung in the health tracking space. Google is developing sensors that can be packaged into Band-Aids, clothing, and even contact lenses.

Their contact lens can measure glucose levels in a person’s tears and transmit the data via an antenna thinner than a human hair. This will be a major game changer for those with diabetes who constantly have to prick their fingers for blood sampling.

At the end of the day we’re all turning into big walking sensors, which should hopefully improve the way we live our lives. With groundbreaking advances in sensor technology, the industry has found a way to take our regular old phones and watches and essentially turn us into low orbiting space crafts.

How do we take advantage of this new wave of health care tracking? I’ve outlined one approach in a special report for my Biotech Intel Trader service and it centers on setting your sights on advanced sensor and chip makers who own patents to this technology and sell it to the big device manufacturers such as Apple.

As always, I will continue to monitor the market’s latest health and biotech technology trends via my social media collective intelligence tool and keep you updated on the latest trends.

Happy Hunting,

Ben

January 29, 2015

Gold Isn’t the Next Currency

We always get questions about gold.

And they typically come down to a couple of questions: “Can you tell me why gold would keep going down when central banks continue to print money like crazy?”

Or: “Isn’t gold the only real currency?”

To the currency issue:

1. Try to go buy something locally with gold coins from bread to a new car.

2. Gold is no longer expanding in line with the global economy like technology and services are.

3. All the gold in the world would fit into an Olympic-sized swimming pool.

Gold was a great standard for monetary systems up until the industrial revolution when it was a shining example of the commodity economy — a very concentrated value per weight and size.

Today, it isn’t representative of the information-based economy and it’s too costly to be a medium of exchange. What does it cost to produce a dollar? Maybe a couple of cents?

What does it cost to produce a dollar’s worth of gold?

A dollar.

New Currency OptionsNow we need a new standard, but one hasn’t yet emerged. Although it will likely further down the road and probably in the vein of digital currency and the bitcoin concept.

But bitcoin ain’t it either at this point, as it is too volatile and unproven. And gold will not be the new standard either.

What we do need is a standard for money creation that limits it more in line with the economic growth as the bubbles of this era and unprecedented money printing have clearly demonstrated… and wait until these great bubbles burst!

The new standard is more likely to be a combination of personal credit valued in real time digitally, and corporate and country credit likewise, depending on ever-changing credit quality.

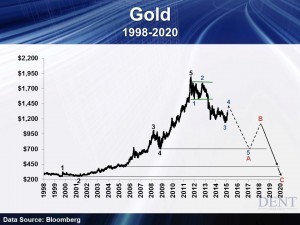

First, I’ve forecasted that gold was extremely oversold after its fall to below $1,200, in late 2013 and then again into late 2014. I’ve also been expecting a bounce to somewhere between $1,340 and $1,400 — and that appears to have begun back in early November.

But the primary trend for gold is the same as that of the overall commodity markets. It’s headed down over the next several years, with an ultimate price target as low as $250 where it bottomed in 2000 and the last bubble began.

We’ve been forecasting for many years that gold is an inflation hedge primarily and a crisis hedge secondarily. This isn’t an inflationary era despite unprecedented money printing since late 2008 due to demographic decline, debt deleveraging and excess capacity created from the bubble era.

Historically, debt and financial asset bubbles always lead to deflation when they burst, not inflation. Unprecedented money printing has been required to simply offset deflation and hold off another great depression.

Most didn’t believe us when we said that at first, but now it should be obvious. The chart below shows the story.

Gold bubbled up along with most commodities in the bubble boom of the Roaring 2000s. However, it didn’t protect investors when the financial meltdown accelerated in the second half of 2008.

It fell 33%, and silver dropped 50%, while the U.S. dollar surged up 27%. The dollar was the safe haven as we predicted.

Gold was one of the few commodities to surge to new highs in September of 2011 as central banks went nuts printing money to save financial institutions and to rekindle the bubble. Investors naturally thought such unprecedented money printing would create inflation, and even hyperinflation on a lag.

Guess what? It didn’t… even after six years.

Gold collapsed in early 2013 out of a three-year trading range that should have broken out to the upside after rising so strongly into a peak of $1,934. Such surges followed by sideways trading almost always continue up in the same direction to a final bubble peak before they collapse.

But the big surprise instead was that inflation fell in most developed countries in 2013 even after the U.S. accelerated with QE3 and Japan went off the reservation with stimulus to follow.

The key insight is that central banks only create a minor amount of the money in the economy. Money and wealth are created by fractional reserve money creation through loans (at 10% reserves against deposits) and by appreciation of financial assets.

If most of the money created went into loans by banks then inflation would be a real threat, but that’s not what happened.

Massive global quantitative easing (QE) of around $11 trillion since late 2008 has substituted for the lack of lending and instead fed a final speculative bubble in financial assets… no inflation, just greater bubbles.

Gold was expecting inflation, so it collapsed dramatically from $1,800 to $1,180 into late 2013. It traded sideways in 2014 and made slight new lows in early November around $1,150.

It’s due for a more substantial bounce, but there is little chance that it’ll break back up into that long trading range between $1,525 and $1,800 after it broke out of it so conclusively. Gold has gotten some extra impetus recently from the ECB printing surge to offset the tapering of the U.S. due to the currency volatility and terror surge in Europe.

This could last for months, but not years.

I expect gold to rise toward $1,400 and then collapse again. The next stop is the support at the 2008 low of near $700. I see that likely by early 2017, if not earlier.

Yet, the ultimate support is where the bubble began in 2000 around $250, or $400 at a minimum where the last two support lines come through in the chart.

The chart above strongly argues that the break below $1,525 was a sign that the gold bubble was over! Gold bugs have still not accepted that and are still predicting new highs ahead, as high as $5,000 or more.

Dream on!

Gold peaked longer term with the broad commodity price peak in 1980, and it has peaked with the broad commodity price peak between mid-2008 and early 2011.

We gave our strongest sell signal for gold and silver on April 25, 2011 when silver peaked at $49 and gold was just below its final peak of $1,934.

If you didn’t heed us then… listen now and sell or lighten up. It’s more likely that it will have a continued rally in early to mid-2015 to $1,340 to $1,400. Then again, if gold disappoints rapidly again, it’ll signal a new low around $700 when it breaks below $1,150 conclusively.

Sell on this rally ahead and don’t wait for that next break of $1,150.

We have to give up this concept that gold is money. It was for a long time, but it can’t be in the future, and it would be too expensive and limiting if it were.

Harry

Ahead of the Curve with John Del VecchioA Bullish CrowdA Bullish Crowd

One area I watch constantly is the sentiment of the market. On an individual basis, many investors can make profitable and timely market calls. And, some do it consistently.

However, as a group, human beings are terrible at market forecasting. I suspect this is because we feel more comfortable going with the crowd and doing what others are doing rather than being an outsider with a variant perception of the market.

As a result, I like to bet against the crowd… and currently, the crowd is too bullish.

This first chart is a survey from the National Association of Active Investment Managers. Each week, these active managers are asked to prove their overall equity exposure to the markets. As the chart illustrates, the allocations are still more than 80%, which is too optimistic. In fact, while this level occurs approximately 1/3 of the time, the annualized returns are negative 1%.

It’s unlikely that you’ve seen this chart before. So, as a fun exercise, it’s worth looking at market extremes to see how the crowd behaves. At the bottom of the recent meltdown last October, 2014 active investors were less than 15% allocated to stocks.

At the bottom of the European crisis in 2011, active managers were not allocating to equities. The same can be said for the bottom in March 2009. By that time, they had withdrawn exposure at the exact point that was a generational buying opportunity in stocks!

Conversely, at the highs of 2007 and 2008, the crowd was overexposed to equity markets, right before they fell sharply and erased many years’ worth of gains. There are times when the crowd gets it right but the extremes are often at key market turning points.

Sentiment will have to fall sharply before I’d get aggressive in buying stocks again.

The second chart shows the composite sentiment among a group of indicators including individual investors, financial advisors, asset flows into market timing mutual funds, and other investors and traders.

Sentiment is starting to fall, which is good. At a current level of 60.5%, it’s inching its way down from an overly optimistic level (it fell five points in one week).

It’s worth pointing out that the recent high of 73.3 was the second highest level in the last 15 years. In fact, this analysis has been conducted since 1984, and it’s shown that it’s never been profitable to own stocks when sentiment is 70% until the indicator has fallen to the lower threshold.

That’s when the weak hands in the market have been completely wiped out.

So, while sentiment is becoming less bullish (a good thing for wanting to allocate stocks) it still needs to slide further before getting constructive on equities. In fact, it’ll have to drop below the lower boundary of 55 and likely much lower until one should get very bullish.

What could cause sentiment to fall further?

Well, we’re in the midst of earnings season. This alone will cause volatility in the markets.

Oil prices remain volatile and in a downtrend. Quantitative easing is cranking again in Europe. Negative surprises in these areas could certainly give investors pause.

Once the crowd has had enough, it’ll be time to jump back in. Even if for just an intermediate-term trade.

John