Harry S. Dent Jr.'s Blog, page 162

March 5, 2015

The Stock Market: Spreading Like Wildfire Across Social Media!

Our bodies should come with some sort of meter that measures how many months of pain-free living we have left, so that once we cross over into our late 40s, we’re prepared for the aches and pain that inevitably assault us.

Of course, the ailments that those of us in generation X feel pale in comparison to the health problems that the boomers face.

At this point, their entire generation has crossed over the great divide of age 52, the point at which their spending on pharmaceuticals and other health care items ramps up exponentially.

With more than 100 million people now driving up their health care spending, this sector should experience phenomenal growth for years to come. The fact that most developed nations around the world have large, aging populations just adds more fuel to the health care fire.

But you knew that.

No one is surprised to read that people over 50 consume health care at a faster clip than younger people.

No one is surprised to read that nations across the globe are aging.

What might surprise you is how you can now leverage this knowledge — by pairing it with a new source of information — to find profitable investments.

While our research combines population trends and predictable consumer buying patterns to estimate how economies will change for years to come, it doesn’t tell us exactly when to buy and sell.

For that, we have to look elsewhere. And that’s where our resident Marine, Ben Benoy, comes in. When he’s not out on training missions (like he is today through Sunday), or fine-tuning his unique trading strategy, he’s scouting one particular area of the internet…

Most companies develop new products and services over time. They ask potential buyers what features and benefits are most important to them, and then roll out their new wares amidst a marketing campaign. Health care companies, and more specifically, drug companies, do it differently.

They know ahead of time what sort of demand exists for a given treatment because their potential market is based on the number of people diagnosed with a certain disease or condition. The problem with developing new drugs is the cost and scope of clinical trials and approvals required before they can sell the medicine.

Now, there’s good reason for the process, even though it currently seems more onerous than it needs to be. Still, every step along the path to approval leaves a new drug open to the possibility of failure.

So drug companies pile a bunch of money into what they see as the most lucrative potential areas of treatment, and then wait as the results of each clinical trial and every approval hearing is released.

When such news is released, it spreads across the internet in seconds. Of course, watching for and trading on this data is common. It makes sense that investors would want to get involved with a promising new drug, or quickly get out of a company whose latest compound just failed in a clinical trial.

But this approach doesn’t give you an edge, since the information is available to everyone, including high-frequency traders and professionals who can react faster than anyone else.

That’s why, instead of watching the releases on clinical trials or approval hearings, Ben watches how other people react to the news. In particular, he tracks whether people think the stock of a drug company is set to go higher, or is expected to drop.

Using software that he developed and programmed, Ben monitors what people are saying on social media sites like Twitter and Facebook about different biotechnology companies.

His program also keeps track of what each individual said about the stock of each company (whether they expected it to rise or fall), and then compiles a virtual track record for them. This way, it can give more weight to those who have been right in the past, and better predict which companies are likely to yield profits in the future.

The best part of Ben’s program is that it’s unique, and that’s not a word I throw around. Ben’s nearest competitors simply track the number of times a company is mentioned without the level of sophistication that he brings to the process.

In this way, Ben has combined the best of both worlds — our existing research and his new approach. In the sector that our analysis identifies as one of the most favored for years to come, Ben uses social media in a way that no one else does to parse out positive and negative trending information, resulting in high probability trades.

Because this is something you’ve likely never seen before, and there’s so much more to it than I can do justice in this piece, we asked Ben to record a series of three videos to explain exactly what his program can do. If you want to watch them, simply add your name to the mailing list and we’ll send you the first one on Monday.

Rodney

P.S. We’ve also asked Ben if he can develop something like that body meter I mentioned at the beginning. We’re still waiting for a reply on that one…

March 4, 2015

Is Economic Volatility a Bad Thing? Not for Brokerage Firms!

Unlike the smooth ride of 2013, last year shaped up to be a bit more volatile.

And December, in particular, closed with a bang. Stocks dropped more than 5% over eight days in early December, only to spike 6% higher by month’s end.

The Volatility Index (VIX) — the most commonly quoted measure of stock market volatility — ended December at levels that were 40% higher than in 2013. In sum, after sharp sell-offs in October and December, we closed the year with 12-month volatility at its highest level since 2011.

And while heightened volatility can be frustrating for passive investors, there’s one type of company that loves a healthy dose of volatility.

I’m talking about… brokerage firms.

In a way, brokerage firms have the best of both worlds… and can do well in rising and falling markets.

That’s because brokerage firms make money when their clients make trades. It’s usually of little importance to them whether you make or lose money — they collect their transaction fees either way.

The brokerage firm I formerly consulted for showed a clear correlation between brokerage fee revenue and market activity, meaning both volume of shares traded and volatility.

Simply put: When investors are buying and selling… brokerage firms’ registers are ringing.

Last October, as the market sold off by nearly 10%, volume traded on the SPDR S&P 500 ETF (NYSE: SPY) clocked in at 3.96 billion shares — the highest monthly volume recorded since the summer sell-off of 2011.

And as I mentioned above, December ended at the highest level of volatility since the summer of 2011.

More importantly, this active-trader trend seems to be carrying over into 2015.

Most of the major brokerage firms have reported January figures — what the industry calls DARTs (Daily Average Revenue Trades) — and the numbers are strong, showing increases in trading activity in the range of 5% to 16%, month-over-month.

Not surprisingly, amid this flurry of investor activity, brokerage firms’ stocks have been popping up on my radar.

While the S&P 500 has gained just under 7% in the last six months, brokerage firms have done much better, mounting gains of 10% (TD Ameritrade), 16% (E-Trade), 21% (CME Group), and 29% (Interactive Brokers).

What’s more, the iShares U.S. Broker-Dealers ETF (NYSE: IAI) is now showing outperformance momentum, relative to both the S&P 500 and the financial sector (XLF).

All told, this niche of the financial sector is really heating up and is poised to outperform over the next two to three months.

I shared this analysis with Cycle 9 Alert subscribers yesterday. And I gave them specific instructions on how to play this trend. Click here for details.

Adam

Retirement, Savings, Life Expectancy…The Numbers Don’t Add Up

The Society of Actuaries should have bumper stickers.

They could say things like, “I’ve Got Your Number,” or “Who’s Counting?” or some other pithy remark. The point is, I don’t think that actuaries — and their affinity group — get much respect, and yet they should.

Not because everyone wants to join this club, but because the organization wields such power, even though most people have never heard of them.

Actuaries are the people that calculate the probability of something happening, particularly analyzing risk-related events like hurricanes and floods. Some of their most notable work is figuring out how long people will live on average, which is very useful for insurance companies and other firms that key off of people’s longevity.

While most people can’t exactly describe what an actuary does, the Society of Actuaries just told most Americans something very personal about themselves — when it comes to retirement, they’re even worse off than they thought. And there’s one reason for that…

The Society just released its latest estimates of longevity, the first revision since 2000. A 65-year-old man is expected to reach 86.6 years of age, up 2.0 years from the estimate in 2000, while a 65-year-old woman’s life expectancy has been increased by 2.4 years.

That sounds really good until you realize we all have to pay for it!

The news is hitting home for companies that offer pensions because they’re legally required to use the Society’s life expectancy tables in calculating their pension obligations. Adding a couple of years onto every future retiree’s stream of payments means that a lot more money will go out the door.

Take the case of General Motors… the life expectancy change added $2 billion in pension liabilities. The consulting firm Towers Watson estimates that the change could cost the pension plans of the 400 largest U.S. companies roughly $72 billion. That’s a lot of cash.

But, according to analysts, the story isn’t all that bad.

Luckily, private pensions have been winding down. Just 16% of private-sector employees participated in defined benefit pension programs, with 15.7 million active members. That’s 48% less than the number of people covered by such plans in 1980.

So, luckily, a bunch of private companies won’t be footing the bill for longer payments to as many people as they would have in the past.

But here’s the catch — those people still exist. Not the same ones from the 1980s, but private-sector employees in general. If they aren’t covered by private pension funds from their employers, then here’s the question: who is responsible for their retirement?

They are.

This is where the message from the Society of Actuaries to the average American comes into play. The typical American at 65 is not covered by a pension, but is still expected to live a couple of years longer than he was in 2000. The retirement funding for this person comes partly from Social Security (with its own problems) and partly from his own savings.

Hmm…

The Federal Reserve released the results of its 2013 Survey of Consumer Finances (SCF) last year. According to that study, only 56.5% of 45- to 54-year-olds had a retirement account, a sizeable drop from the 65.4% of people in the same age range who had retirement accounts in 2007. Those who actually had a retirement account in 2013 had just $87,000 in it.

This is the median, so 50% of the people had more than this, while 50% had less.

The average American has fewer retirement benefits, little in savings and will live longer.

Of course, there is that other type of employee, the one that works for a government entity. According to the latest release from the Census Bureau, there are 3,992 pension plans for states and local entities, covering 14,222,906 people. These plans had total assets of $2,715 billion and obligations of $3,615 billion, leaving them underfunded by roughly $900 billion.

Keep in mind that these are 2013 figures and will change with the new actuarial report. Increasing the life expectancy of the membership will result in immediate higher obligations with no change in assets, making the plans even more underfunded.

But the people covered by the public pensions don’t have to worry too much, their benefits are covered by states, cities, and other entities that have to come up with the money to make good on their promises.

To get the money, they’ll have to raise taxes, which means mostly going back to the same people that are no longer covered by private pensions and have too little saved for their own retirement.

Yep. We’re toast.

Rodney

March 3, 2015

And There You Have It! The Fed’s Mandated Failure

Let me be clear, the Fed didn’t create the mess we’re in! The Fed simply evolved from saving the world from temporary financial chaos in 2008 to virtually controlling financial markets today.

The Fed has been fighting demographics and the “winter” economic season since bailing out financial institutions after much loose lending and risky investments leading to turmoil in 2008. A natural decrease in consumer spending and an increase in saving by aging baby boomers was seen by Harry many years ago.

demographics alone should have resulted in a natural pullback in stocks, deleveraging of debt along with deflationary pressures in this “winter” economic season.

The Fed helped avert financial calamity initially but didn’t stop there. Zero interest rates weren’t enough. The Fed realized that deflation was a major concern and Ben Bernanke (Fed Chair) started printing money to create inflation.

I won’t get into the details of the QE (quantitative easing) programs that just recently ended… except to say that Fed tinkering went far beyond their mandates in my opinion.

The Fed is mandated by congress to direct the nation’s monetary policy to “influence conditions to pursue maximum employment, stable prices and moderate long-term interest rates.”

U.S. employment has gone through a reset since 2008. According to the Bureau of Labor Statistics (BLS), the official unemployment rate is back below 6% while the estimate for U-6 (includes short-term discouraged workers) dropped to about 12%. When you take a look at John Williams’ Shadow Government Statistics, ShadowStats Alternate Unemployment Rate sits at 23.2% and hasn’t dropped since the beginning of the crisis in 2008.

Dent Research has found that much of that job growth has been in lower paying jobs. Lower paying jobs means low or no wage growth and lower consumer spending. So even though the BLS calculates we are near full employment (since they don’t count millions of adults not employed or under employed), wage growth is still absent.

Price stability is also important to the Fed and was the main driver for the multi-trillion dollar QE program. The Fed set an inflation target for the consumer price index (CPI) of 2%, and it’s not been reached after six years of zero interest rates and QE.

Could the Fed have confused consumer price stability for stock prices? Is it possible that they confused employment growth and wage growth for stock market appreciation? The S&P is up about 260% since the beginning of 2009. The Dow Jones Industrial is up about 257% in the same time frame with no significant pullbacks along the way.

I do believe the Fed should help maintain the stability of our financial system, as it relates to banking and it should provide certain financial services to depository institutions. But someone should also be responsible for supervising and regulating our banking system to ensure stability of the system.

The Fed shouldn’t be authorized to pursue maximum employment or stabilize prices by printing money. The U.S. Treasury should not benefit from the interest received on printed money. According to data from the Federal Reserve System, more than $500 billion has been transferred to the Treasury since 2008!

Power to control monetary policy, or at the very least, the ability to print needs to be taken away from the Fed. But how will that happen since a big chunk of the created money is going to the U.S. Treasury?

If it did happen, politicians might actually have to figure out how to raise taxes or maybe cut expenditures.

Good luck with that!

Lance

When Debt Addiction Gets the Best of Us

Many economists talk as if we have gone through a long period of austerity and that we have deleveraged the U.S. and the global economy. This is simply not true.

We added more debt globally from 2008 to 2014 (that’s a whopping $57 trillion) than we did from 2001 through 2007 ($55 trillion).

We’re not off our debt addiction at all! That monkey is still on our back. And not only ours… it’s hanging on the world over!

Here are the facts from the most recent (and even better) McKinsey Global Institute report on global debt entitled Debt and (Not Much) Deleveraging.

The tech bubble in stocks started in mid- to late 1994. But the debt bubble really accelerated back in 2000…

And it picked up speed alongside the real estate bubble.

Global debt has grown from $87 trillion in the fourth quarter of 2000 to $199 trillion in the second quarter of 2014, almost 130% in 13.5 years. It’s already well over $200 trillion by now.

Government debt has increased the most in a slowing global economy, and then corporate debt. But household and financial sector debt have grown even though they’ve deleveraged to some degree in countries like the U.S., Ireland and Spain.

The financial sector debt in 2008 to 2014 slowed the most with a measly 2.9% growth compared to 9.4% from 2000 to 2007. Household debt dropped all the way down to 2.8% from 8.5%.

Corporate debt grew a little faster at 5.9% versus 5.7%… not that companies were making major capital expenditures… they were way too busy buying up their own stock and doing leveraged buyouts with near free money. Government debt grew much faster at 9.3% in comparison to 5.8% as Keynesian deficits were exploding almost everywhere to offset the slowing private sector.

The countries with the highest total debt are: Netherlands 687%, Ireland 681%, Singapore 628%, Japan 517%, Denmark 537%, U.K. 435% and Spain 402%.

How do you like those numbers?

The countries with the highest financial sector debt, which by the way is the riskiest and deleverages the fastest, are: Netherlands 362%, Ireland 291%, Singapore 246%, Denmark 235% and U.K. 183%.

Most economists don’t see these countries as prone to fail, with the exception of Ireland. But frankly, it just doesn’t look that way to me!

The highest household debt countries are: Denmark 129%, Finland 124%, Netherlands 115%, Australia 113% and Canada 92%. These are the countries that report the highest happiness ratings… maybe they are just high on debt!

The truth is that these countries have some of the highest real estate prices and valuations and that in turn forces their consumers to take on more personal debt as mortgages are 74% of household debt globally.

Now let’s talk about corporate debt. The countries featured here are: Singapore 201%, Ireland 189%, Belgium 136%, Netherlands 127%, China 125% and France 121%. Despite appearing so sound, Singapore keeps featuring horribly when you look not only at its debt but its sky-high real estate.

As you can see, debt is running rampant globally. Let’s turn and look at government debt and the numbers are just staggering… but not surprising.

Japan comes in at 234%, Greece at 183%, Portugal has 148%, Belgium ranks in at 135%, Spain at 132% and Sweden at 129%.

There’s no way there can’t be a major financial crisis in the years ahead. Most major countries have slowing demographics, burdensome debt, sky-high real estate, high export exposure… or all of the above.

The more we look at all the facts and all the different angles there are… few countries will not see major economic downturns and financial crises. Canada and Australia face much higher risks from exports and real estate than they did the last time around.

Note that the U.S. holding 269% total debt to GDP did not come out in any of the extremes.

That simply means we are one of the best houses in a bad neighborhood.

That fact, as well as the massive amounts of dollars across the globe that’ll be destroyed when debt and financial asset bubbles burst, will keep the dollar king for years to come.

Harry

P.S. Follow me on Twitter @harrydentjr.

March 2, 2015

Trading Strategies: Do You Know Your Bread From Your Butter?

Get ready to buy.

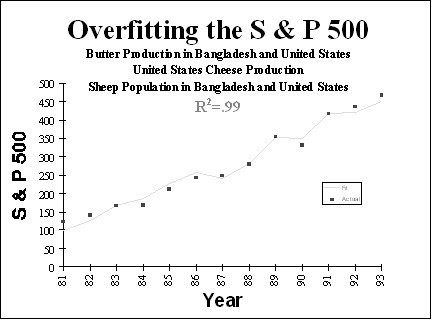

Our most reliable technical indicator — one that has historically been 99% accurate — is suggesting that stocks are poised for a major breakout.

Bangladesh butter production surged in February, as moderating grain prices allowed Bangladeshi dairy farmers to boost production by getting higher milk yields from their existing stock of cows. Meanwhile, butter production in neighboring India dropped significantly in February, as a change in government farm subsidies forced Indian dairy farmers to cull their herds.

With Bangladeshi butter production set to rise further, we should be looking at a massive rally in the S&P 500 throughout March and April.

By now, I sincerely hope you realize I’m joking.

Whether the S&P 500 goes up, down or sideways over the next two months will have absolutely nothing to do with Bangladeshi butter production. But in a paper published two decades ago, David Leinweber and Dave Krider found that butter production in Bangladesh had the tightest correlation to the S&P 500 of any data series they could find.

It wasn’t GDP growth and it wasn’t earnings… it was Bangladeshi butter, which explained 99% of the S&P 500’s movements.

The authors weren’t quacks. They knew the correlation was a random coincidence and completely meaningless. But they published the paper to get a good laugh.

Stay with me here… they wanted to make an important point about number crunching. Correlation does not mean causation and if your model doesn’t make intuitive sense… it’s probably bogus.

I’m not bashing quantitative models here. Done right, they can help you build a really solid trading system. Various value and momentum models have been proven to work over time.

But the trading system needs to reflect some sort of fundamental reality or it’s one small step removed from voodoo.

Adam touched on the same idea two weeks ago in Economy and Markets. As Adam wrote, “Computers, databases and statistically sound algorithms can only refine the discovery and implementation of a fundamentally sound investment strategy. At the end of the day, computer algorithms or not, you still need a rock-solid investment strategy.”

The model isn’t the strategy. It’s a tool to help you execute… nothing less, nothing more.

Whenever you see someone touting a trading strategy, ask for an explanation of why it works. Back-tested returns aren’t good enough. If they can’t explain the fundamentals behind their model, it’s probably just a matter of time before they blow up.

Oh, and one more thing about Bangladeshi butter. Leinweber wrote in Forbes a few years ago that he still gets phone calls — 20 years later — asking for current butter production figures.

Charles

A Shared Economy? Imagine the Possibilities.

Across America, yard work is a sport. Even though lawn services call constantly, there are many of us that attack our own lawns and hedges every week, trying to keep them under control. To assist me in my efforts, I own a lawnmower, a string trimmer, an edger, and a blower.

Because my yard is small, I use each of them for less than 20 minutes. My next-door neighbor does the same thing — he cares for his own yard, and owns the same pieces of equipment that I have. He also has a similar sized lot.

Which brings up a question. Why don’t we share?

I know my lawn equipment cost around $800, and I’d imagine his did as well. This equipment sits idle the entire week, except for the brief 20 minutes that it’s used, and yet the notion of sharing such things is almost foreign. I also have a pressure washer, which gets used three to four times a year and a small air compressor that gets turned on maybe once a year.

Still, I thought nothing of buying them.

It’s part of American culture to own things outright, as if we somehow get more pleasure or utility from items that are possessions instead of shared with or borrowed from others. At least, that’s how it was.

Whether it’s a generational idea, a product of the financial crisis, or something else entirely, the shared economy is picking up steam.

The most visible sign of this is Airbnb, the website that serves as a clearing house for those that have an extra home, bed, or sofa to share, and those that want such accommodations. Just to be clear, this sharing is actually renting… no matter what Airbnb or anyone else says.

When one party with an asset allows a second party to use their property for a limited period of time in exchange for payment, it’s rent. There are no two ways about it.

Airbnb allows people who own underutilized assets to share them with others for a price, thereby increasing the efficiency of the asset in general. This would be the same as if I paid my neighbor $5 per week to use his lawn equipment, or $20 each time I used his pressure washer.

There’s nothing new under the sun about the transactions; they’re rental agreements.

What is new about these arrangements by Airbnb, Uber, and others is that they give consumers who own underutilized assets the ability to engage them in commerce. Renting out a room is as simple as signing up with Airbnb. Renting out your car (with you as the driver) is as easy as signing up with Uber.

For years there have been websites that allow the sharing of small appliances and tools, such as vacuums and electric drills for a fee. It’s as if we’re cataloging a vast library of items that can be “checked out” and then returned. The items aren’t being created, because they already exist. They’re just sitting idle at the moment.

Which brings me to H&R Block.

If I share my lawn tools with my neighbor, no one cares… as long as there is no exchange of value, particularly cash. If there’s any remittance or similar sharing done in exchange for the lawn equipment, then we’ve just crossed the line from friends to parties in a transaction.

The difference is the first one makes for good neighbors, while the second makes for IRS headaches.

In the world of taxes, individuals have to report any income received through barter or exchange by estimating the fair value of what was received. In the case of Airbnb and Uber, those providing the services must report the funds they receive as income.

The IRS wants its slice of the pie, no matter how the transactions were framed or discussed, which makes sense.

Imagine if we all offered our spare bedrooms through Airbnb and drove the hotel industry to zero. Taxing authorities including cities, states, and the federal government would lose significant revenue.

The service is still offered and paid for, but the channel through which business is conducted has switched. Instead of businesses organized to provide lodging with all of the necessary staff and licenses, it’s now a bunch of moms and pops letting strangers stay in Junior’s old room for a fee.

It’s still commerce and the government still wants its slice, which makes H&R Block, as well as Jackson Hewitt, Liberty Tax, and so many other tax preparation firms very happy.

Joining the sharing economy as a provider brings with it the responsibility of reporting income to the appropriate taxing authorities. Airbnb has this message concerning local taxes on its website:

Your state or locality may impose a tax on the rental of rooms. In many places this is known as an occupancy tax, but may also be known as a lodging tax, a room tax, a use tax, a tourist tax, or hotel tax. We expect all hosts to familiarize themselves with and follow their local laws and regulations.

Keep in mind this is outside of reporting personal income to the IRS.

Tax compliance is difficult at best. As individuals join the sharing revolution, they’ll not only make a few extra bucks but also greatly complicate their tax returns.

Every time a new service emerges, allowing individuals to make a buck off of stuff they already own by listing it online, I’d imagine the management teams of the national tax prep services smile a bit bigger, and have a dance in their step.

Rodney

P.S. There’s an interesting subject featured in today’s Ahead of the Curve by Charles Sizemore — it’s about butter. Yes… butter. Read on…

February 27, 2015

Biotech Developments: Map of Human Epigenome Released!

Punxsutawney Phil, our furry weather forecaster, definitely earned his paycheck this year, calling for six more weeks of winter on February 2. What he failed to warn us was that we’d ensure blizzards and ice storms throughout the month!

You might laugh, but this ritual of following a simple groundhog can tell us a lot about how we as humans like to operate. Any self-respecting adult knows that Phil’s handlers make the “Shadow/No-Shadow” call days in advance. So why has this ritual continued since 1887?!

A psychologist will tell you that humans perform rituals because it reduces our anxiety and increases our confidence. True enough, but is there something in our DNA that can explain this almost irrational tendency?

More than 10 years ago, the Human Genome Project gave us a map of the genes that make up human DNA. Thanks to huge leaps in advanced computing, a regular person can now get their DNA mapped for only $1,000 (it cost $100 million in 2001!).

This month, researchers at MIT released the first map of the human epigenome, which captures all the chemical reactions taking place. With this information we can better understand why and how certain genes turn off and on in human cells.

Mapping the human epigenome has revealed vital clues into why cells mutate due to disease, and is a key step in eradicating cancer.

Think about it. This is an epic feat! It required a total of 150 billion genome sequencing reads in 111 different cell types. To do that, scientists have had to maximize the latest advances in semiconductor chip manufacturing for advanced computing.

That tells me we’re witnessing a major nexus point between chip manufacturing, supercomputing, artificial intelligence, and biotechnology gene mapping research, all of which is providing disruptive, life-changing technology like never before seen.

And that’s the space I play in with my Biotech Intel Trader service. Besides fascinating, it’s lucrative, especially when using the unique indicators I’ve uncovered. You can find more details here.

As for whether we have any idea of what physical chemistry is involved in our superstitious behavior… well, we’re not there yet, but I don’t think it will take us much longer.

Ben

Don’t Turn A Blind Eye! Student Loan Debt Affects Us All

There used to be an interesting warning etched into the side mirrors on cars. It read: “CAUTION — OBJECTS IN MIRROR ARE CLOSER THAN THEY APPEAR.”

It always struck me as odd that the warning was necessary. Are a bunch of people driving around and thinking: “That truck in my mirror is only two inches tall and looks to be far back, so I’ll just move on over”? Don’t they verify the position — and size — of traffic by turning their heads? Maybe. Maybe not. It’s entirely possible that the warning is necessary, since people time and again show they are very bad at judging risk, right up until something very bad happens.

That warning came to mind as I read a reasoned, lengthy rebuttal to fears about student loans holding back millennials. The writer pointed out that only a small minority of people has any student loan debt at all, and of those that do, the true amount of debt — not the average — is manageable. Hmm.

This line of thinking ignores a few basic facts…

It’s true that most Americans don’t have student loan debt. That’s because most Americans didn’t go to college, and a majority of millennials still don’t go on to higher education. These young workers tend to hold jobs with significantly lower pay than those taken by college grads, and they also have fewer opportunities to move up. The fact that they don’t have student loan debt is not much of a positive.

At the same time, those with post-graduate degrees tend to have the highest amounts of debt. The argument goes that these people also have the highest earnings, so who cares?

I care, and so should we all.

Just because debt rises with income potential doesn’t mean that the debt is inconsequential or otherwise manageable. For the newly-minted physician or lawyer with $150,000 in debt, the monthly payment of $1,200 is still money they could have spent elsewhere, helping our economy grow.

But perhaps the greatest blind spot in the reflection on student loan debt was the lack of analysis on what happens when the debts go sour. Looking at how many people fall behind on their loans by more than three months, or the 90-plus day delinquency rate, should give us some indication of whether or not the funds are used wisely in our society, and are therefore manageable. The answer, once we’ve delved into the numbers, isn’t positive.

The Federal Reserve Bank of New York recently published data on credit in the U.S. Student loans have grown dramatically over the past decade. They now stand at $1.12 trillion. That’s more than every type of loan available, save mortgages.

Stop and think about that for a minute. A trillion is such an inconceivable number that we tend to just feign shock and then quickly dismiss it, because it’s hard to understand. Tony Robbins describes this well in his seminars.

He asks: “How long is one million seconds?” The answer is 11.5 days. How about a billion seconds? It doesn’t sound like that much more, but it is 32 years! The difference is dramatic. As for a trillion seconds? That’s 32,000 years. Moving from a million, to a billion, to a trillion is so big of a change as to almost defy comprehension.

Student loans have another distinction — they have the highest rate of delinquency among the major types of debt that the New York Fed tracks, clocking in at 11.3%. The problem is that this figure is misleading. Because of how student loans are treated, the real number is much higher.

When students sign on the dotted line to take out loans, their repayment doesn’t begin immediately. Their loans are put on hold while they’re in school. This makes sense, but it is ignored in the 11.3% delinquency figure, which is based on all loans outstanding.

Along with in-school status, there are several other student loan classifications that shrink the pool of loans currently being repaid. Using data from the National Student Loan Data System and combining direct loans with Federal Family Education Loans (FFELs), the total of all loans backed by the government fall into these categories:

The 11.3% delinquency rate has to be adjusted for the fact that barely more than half of all student loans are in repayment. Dividing 11.3% by 51.78%, the percentage of delinquent loans among those actually in repayment soars to 21.8%, or slightly more than one in five.

If student loans are so efficient at providing people access to education, which greatly increases their earning potential, then why are so many loans delinquent, and almost 10% of all loans in default?

When it comes to such debt, I think the warning should be:

“CAUTION — LOANS OF THIS TYPE ARE MORE DANGEROUS TO YOUR FINANCIAL FUTURE THAN THEY APPEAR.”

The proof of the warning is showing itself in other areas, like the severe drop in the number of young first-time homebuyers. Without strong participation from the millennials, the housing industry can’t recover, which means we won’t see a rebound in construction-related, middle-income employment, and we won’t enjoy the economic benefits of credit creation through mortgage lending.

This hole in our economic recovery will hold back the gains we anticipate from the rising millennial class as they walk up their own spending wave, and will impede our growth for years to come.

Rodney

P.S. The habit of glossing over breakdowns in our economy and financial system is all too real; we read it every day in the financial press and hear it from central bankers and regulators. For an unvarnished, spot-on description of where things really stand, watch this interview with David Stockman and Harry Dent…

February 26, 2015

Singapore: The Next Global Domino to Fall in Real Estate

Singapore has the highest standard of living of any country in Asia and higher than the U.S. There are two reasons for this:

It’s one large city that’s very strategically located.It has high value-added jobs from a heavy concentration of finance and trade, rather than mere manufacturing.That’s why it’s called the Monte Carlo of Asia…

The problem is, because it’s 100% urban and has limited land, it has some of the most expensive real estate in the world.

Why is that a problem?

Well, take a look at this chart…

You can see how real estate prices in Singapore have risen 68% since early 2009… and 110% since the 1999 low after the Southeast Asian financial crisis.

Once the country’s government began actively attracting foreign professionals and investors, the value of prime properties rose 80% from 2004 to 2013, increasing on top of already high global prices.

Today, the price of central-city real estate is $18,406 per square meter versus $10,381 in New York. The average home price adjusted for purchasing power parity is $10,382 per square meter versus $6,728 in London and $6,111 in Paris. That’s extreme, when you consider that residents of Singapore pay 78% more than New Yorkers while they make 25% less on average.

That’s clearly a bubble… and as I constantly reiterate: Bubbles ALWAYS burst.

In the beginning, they burst from their own extremes. In the U.S., the subprime crisis triggered the fall, but when you look at China today, cracks are appearing due to massive overbuilding and vacancies.

Singapore has its own trigger as well.

Like Hong Kong, it is a wealthy and developed country city. It features high-level middle-class households and not just marginal ones. Recently, there’s been a public backlash against foreign buyers who are bidding up real estate and making it unattainable for the everyday, $60,000-a-year household.

This happened in Hong Kong and in San Francisco also, but in different ways. In San Francisco, the locals particularly hate large tech companies like Google, who are forcing them out of their neighborhoods in the Bay Area.

In Singapore, however, the government decided to react to the public sentiment. After all, it’s a democracy. Those in charge instituted a succession of strong measures to curb foreign buying and speculation in general.

The first was an up-front property sales tax of 18% for foreign buyers… ouch!

The second was additional taxes on properties that were flipped: 16% within one year and 12% within two years.

So, foreign buyers flipping real estate in Singapore are now being taxed 18% on the front-end and as much as 16% on the back-end… for a total slap in the face of 34%!

The third step Singapore’s government took was to cap the amount of debt a borrower is allowed to take on compared to their income.

How effective were these measures? In 2014, new property sales were half of those registered in 2013. So unsurprisingly, residential prices fell 4% in 2014. Double-digit declines are forecast for 2015 and I would see more than that as likely.

At the W Residences, one of the newest high-end developments in the country, fewer than half of the units have been sold. Most of the expatriate professionals living there rent now instead of owning a property.

Even worse hit has been Sentosa Cove that attracts ultra-wealthy Chinese, Malaysians and Indonesians. There you have extravagant homes, including one designed like an Egyptian tomb. But now few people are buying and the ones that enter are largely leasing.

Sentosa had become the poster child for the extreme rising inequality in the country. Now it is suffering from the natural revolt that inevitably follows, especially in more affluent middle- and upper-middle-class societies where the people have more power.

In short, serious fissures are now showing in Singapore’s real estate market. Recently, an apartment that was bought in 2007 for 7 million Singapore dollars was sold for 4 million Singapore dollars. That’s a painful 43% loss. And it’s only the beginning as this domino begins to tumble.

There is also a massive load of commercial properties set to be completed in 2016, just in time for the global bust to manifest in full force. Commercial properties should be an absolute blood bath, especially as the China bubble continues to burst.

My view for years has been that the real estate bubble globally (and nationally) is much more varied due to different supply and demand pressures around the world. The best cities are almost all in bubbles. Japan first, and then the U.S., then Ireland, then Spain have led the popcorn popper of bursts around the world. Now China and Singapore are starting to pop.

In fact, Singapore is a disaster waiting to happen.

I see all major bubbles bursting in the next several years. The more cities that crack, the more it breaks this grand illusion that real estate never goes down, especially in the best places and on the high-end.

History says that it is especially in the best and priciest cities and developments that you see the greatest bubbles burst when they finally go bang.

Be forewarned.

Harry

P.S Follow me on Twitter @harrydentjr.