Harry S. Dent Jr.'s Blog, page 163

February 26, 2015

Earnings Season: The Good, the Bad and the Ugly

Earnings season is almost behind us but it’s interesting to note that almost 80% of the quarterly releases met or exceeded consensus estimates for the S&P 500. That’s the good news!

The bad news is that earnings estimates are coming down. In fact, current quarter earnings estimates are being revised down with reckless abandon.

For the week, there were only 162 upward revisions compared with 236 downward revisions. Only 85 remained unchanged.

What’s more is the magnitude of the revisions. According to Bloomberg research, earning estimates are down 5% from their peak, something that has only occurred six times since 1991… and three of those coincided with recessions in 1991, 2001, and 2008.

Analysts move in herds and are slow to adjust their estimates too far in one direction or the other. So all of this revision is a warning sign for me.

Besides, the market sentiment is too bullish for my liking.

Sentiment Trader tracks the market opinions of “smart money” and “dumb money.” The smart money represents investors who are often adept at navigating the markets profitably while the dumb money is pretty good at handing their money over to the markets in the form of losses. As you can imagine, the smart money and dumb money often disagree.

But currently that’s not the case. Both groups are wildly bullish on the market. In fact, they’re so optimistic that the combined bullishness has been exceeded only once before, in 2004.

A quick pullback in the markets then pulled the sentiment way down before the market trend resumed its upward march to the pre-crash highs in 2008.

That’s another warning sign for me. Both sides don’t agree often. In fact, the combined sentiment has only been this bullish 10 times in the last 15 years. And right now, nearly everyone is leaning on the same side of the boat. When they all try to run to the other side at the same time (sell stocks), the boat is likely to capsize.

Get your life jacket ready. You’re going to need it.

John

February 25, 2015

Did Equity Market Volatility Pay Off? Risk-Appetite Has Returned

The nerves of equity market participants have certainly been tested over the last three months. Since last November, major U.S. indices have chopped up and down with above-average volatility… but, frustratingly, with little net movement.

Now, it seems newfound bullish sentiment is beginning to show in the form of higher prices. As I told Cycle 9 Alert subscribers yesterday, signs of investors’ bullishness abound.

For one, small-cap stocks (i.e. the Russell 2000) continue to outperform their large-cap cousins (S&P 500 and Dow). Here’s a chart that shows this bullish sentiment indicator…

But there are several more indications of bullish sentiment re-emerging. Here are just a few:

The ratio of advancing stocks to declining stocks continues to climb. This index has now made a new high, breaking above the level we saw last September. Broad-based participation (i.e., a wide range of stocks trading higher) is a sign that a bullish trend has legs to run.The ratio of consumer discretionary to consumer staples stocks continues to climb. This suggests investors are investing in higher risk, higher return sectors instead of “defensive” sectors.Many sectors have now broken to new price highs, including: materials (XLB), consumer discretionary (XLY), technology (XLK), health care (XLV) and industrials (XLI).In total, these are all indicators that investors’ confidence and risk-appetite has returned. And as a bullish breakout has been in the works for a few weeks now, we’re starting to see this bullishness show in the form of higher prices.

I’ve had Cycle 9 Alert subscribers positioned in two bullish sectors for several weeks and we’re now reaping the rewards. I’ve also recently showed them how to make a low-risk play on the still-beleaguered energy sector.

For more details click here.

Adam

The Dilemma of Real Estate: Buy, Sell, or Rent?

Sometimes we have control in our lives. Sometimes, it’s only “perceived” control. I’ll give you an example.

I moved to Tampa, Florida in 2005, at the height of the real estate bubble. At Dent Research we’d been talking about a top in the real estate market around 2004 to 2005, based on demographic cycles.

We were so convinced that Harry Dent sold his home in Miami in 2003 and rented. You would think that on moving to Tampa I would’ve rented as well, given what I do for a living and what our research suggested… but that wasn’t the case.

When I moved I had to deal with three kids in school, so the school district was paramount. In the school district we chose, there was nothing but townhouses and apartments for rent, and few homes for sale.

We ended up buying a home, but one more modest than we might have chosen because of our forecasts. This turned out to be a good idea.

While I did lose money when we sold our first home in Tampa, I didn’t lose as much as I would have if we’d purchased a bigger, more expensive home.

It turns out that many public schools in Florida are lacking, so we ended up sending our kids to private high schools. We moved to a second home in Tampa to be closer to their new schools.

Which means I got the pleasure of buying a home instead of renting as our research suggested, and then losing money on the house as well as paying private school tuition. This definitely falls in the category of “perceived” control.

And it gets better.

When we moved closer to downtown, we were happy renters… for about a month. Then I was informed by my lovely wife that we would be buying a home so that we could paint, renovate, etc. to make it our own. I now own a different home in Tampa.

Real estate can be very personal.

On paper, I can make a great case for renting and not owning. But every day we have to live with the decision, including relying on others to fix things, not having the exact appliances and trim we want, and knowing that the rent can change at the end of the lease or the owner can simply choose not to renew at all.

So while our research suggests that people should not hold real estate right now because it’s due for another downturn, we try to remind people that not all financial decisions are unemotional. There can be many other factors to consider, like harmony in the home.

And then there’s investment property.

After many a speech I’ve had people come up and ask: “What about my property in (enter cool location here)?”

They heard our words that property should be sold, but they didn’t pay attention to the nuance. If investors — like homeowners — have reason to sell in the next couple of years, then we suggest they sell sooner rather than waiting.

The market has rebounded, but housing hasn’t run-up dramatically during this tepid recovery. When the economy rolls back over, potential real estate buyers will disappear in an instant.

It seems that many people learned their lesson during the last housing bust — real estate can be very illiquid, so no one wants to get stuck with it.

But if there is no impending reason to sell the property in the next few years, as long as you’re earning decent cash flow, there’s no reason to let go of it. In fact, there’s probably a great reason to hang onto it — what will you purchase with the proceeds that provides the same sort of income?

This dilemma has to be considered. Bond yields are exceptionally low, dividend stocks are expensive, and bank products pay nothing. Rent-producing properties are a good way to ride out the economic winter, since the tough economic times create even more renters as previous homeowners either don’t want to purchase another home or can’t.

In the meantime, young, would-be homeowners aren’t yet able to buy.

Given the appreciation in home prices over the past several years, now is not a great time to buy a rental property… but that doesn’t mean existing holdings must be sold.

At least in this area of real estate investing, the decisions are typically less emotional, so you can have real control over the outcome.

Rodney

February 24, 2015

Go Greeced Lightning! Their Position of Power in the Global Economy

Interest rates have spiked since the beginning of February. The 10-year U.S. Treasury note was trading well below 1.70% at the end of January and was at 2.13% just three weeks later.

Rates had probably moved too low and too quickly. Even so, U.S. rates were still well above other industrialized nations like Germany, France, Britain and even Italy. Deflation and poor economic conditions seemed to justify the lower turn and yet the Fed seemed fixed on an increase in rates because employment had improved and the inflation target of 2% should be hit at some point in the future.

Until a couple weeks ago, the market didn’t seem convinced of a rate hike anytime soon. A look at the minutes from the FOMC’S (Federal Open Market Committe) last meeting showed concern about wage growth and a dampening of the recovery when rates are raised.

So, even though the Fed realizes it’ll need to raise rates, they’re not in agreement as to when they’ll do so.

Ahead of the minutes of the previous Fed meeting being released, the rise in rates may have been the market attempting to price in a future rate hike. The 10-year note moved from a sub-1.70% yield to just under 2.0% in less than 2 weeks.

Interest rates then seemed to stabilize and looked to be set for a pull-back based on deteriorating economic news. That was until Greece demanded that their loan agreement be re-worked with more flexibility and less stringent austerity conditions.

Greece’s current agreement expires at the end of the month and speculation has been back and forth from a Greek exit from the euro as well as their acceptance of current loan terms. Right now no one seems too sure of the outcome.

The result has been a further spike in interest rates reflecting higher perceived risk in government bonds.

We’ll be monitoring the situation closely since Greece’s potential default could have serious ripple effects across the euro zone. If Greece defaults and exits the euro, it could trigger more dominos to fall and the eventual demise of the euro zone as Spain, Italy and others would likely also demand concessions to their loan agreements.

If Greece agrees to the euro zone’s (Germany’s) terms, the spotlight will return to our economic situation here in the U.S. and the speculation will be on future Fed actions.

If Greece defaults and the domino falls, the 2008 financial crisis could look like small potatoes compared to a likely 2015 government bond debacle.

Lance Gaitan

Terror in the Middle East: Scarcity, Poverty and Cultural Change

I always remember the early scene in the infamous film Lawrence of Arabia. Omar Sharif sees at a great distance, someone stealing water from his well. He shoots the person and asks questions later.

In a desert society, everything is scarce… especially water. Everyone fights over it and no one trusts their neighbors. It’s a kill or be killed environment… survival of the fittest at its most extreme.

Even after Lawrence united the Arabs against, and defeated, the Ottoman Empire with the help of the British, the Arabs still couldn’t agree and left the scene not united as Lawrence envisioned.

No wonder there is so much hate and civil war in this most volatile region of the world economy.

But that is only the first reason…

The second is that this is the only region that is more than 90% Muslim. It’s the most concentrated in the world, more so than the largest Muslim populations in larger countries like Indonesia or Bangladesh.

But these non-Arab countries don’t have radical insurgencies or major civil wars as what we’re seeing occurring throughout the Middle East and North Africa!

The third and, perhaps most important, is that most of this Arab region saw one of the most extreme shocks in inequality of wealth as well as the collision of western and ancient cultures when these more backward societies suddenly saw the influx of oil wealth.

Other Muslim countries, like Indonesia, have gradually progressed and become more third world middle-class.

And then there is poverty where the correlation is crystal clear. It’s clearly the poorest countries with high Muslim populations that have insurgencies and radical jihad Islam groups like ISIS in Syria, Boko Haram in Nigeria and Al-Qaeda in Yemen as the chart below shows.

Somalia is the poorest at $600 per GDP capita and known for its piracy. Yemen at $2,500 has now become the new headquarters for Al-Qaeda. Nigeria appears to be less Muslim and less poor, but the rural northeastern area where Boko Haram has emerged, is much more like Niger with $800 per capita GDP and 99% Muslim.

Afghanistan and Pakistan clearly fall into this poor and highly Muslim category.

The richer countries inside, and even more outside, the Middle East and North Africa are more middle-class while still highly Muslim. You can see Indonesia at $5,200 and Turkey at $15,300, despite being 99% Muslim.

These countries don’t have insurgencies but in the Middle East and North Africa they are rich enough to revolt and have civil wars as in Libya, Tunisia, Egypt, Syria and Iraq. Countries like Indonesia, Bangladesh and Turkey with high Muslim populations don’t have insurgencies or civil wars to speak of, and for that matter, nor does Iran.

I spent weeks in Java and Bali in Indonesia. The town of Borobudur in central Java was 98% Muslim. They were the nicest people I’ve met anywhere in the emerging world with no anti-western attitudes.

At first, kids or adults approached me, and quite honestly, I expected they would want to beg. No.

They just wanted to know what movie stars we were, as we were obviously from America. They thought I was the Highlander guy and my wife was Sharon Stone… they were a lot closer on my wife.

So Islam is not the primary problem. It’s the clash of civilizations and poverty. It’s the same inequality and dominance of that 1% that we face here in the U.S.

Globally 1% of households control 46% of the wealth, almost as extreme in the U.S. at 51%.

So, here’s the crucial question…

What causes radical Islam terrorist insurgence?

The fierce tribal history of scarcity and mistrust in the Arab world of deserts.The sudden clash of West vs. Islam when oil wealth suddenly emerged.The Middle East and North Africa are the one region that is more than 90% Muslim.The poorest Muslim countries have insurgencies, and not in the middle-class ones.The more middle-class countries inside the Middle East and North Africa have civil wars, but not insurgencies. The more middle-class countries outside of the Middle East and North Africa don’t have insurgencies or substantial civil wars — and that is the great majority of Muslims in the world.

It’s the most extreme income inequality and culture clashes that are causing growing problems everywhere. And when you get down to it… the central bank’s quantitative easing only exacerbates that.

It doesn’t matter what country it’s in. Free money only worsens the situation. It cannot and will not improve it.

With our proprietary Geopolitical Cycle continuing to point down into late 2019, expect things to get worse on the terror front as they obviously already are with the recent attacks in Europe and now the call for attacks on malls in North America. The implosion will be sudden and violent.

Harry

P.S Follow me on Twitter @harrydentjr

February 23, 2015

Want to Build a Safe Income Portfolio? Don’t Chase Yield!

If something looks too good to be true… you can bet that it is.

And nowhere is this truer than in the world of income investing. As investors, we’re drawn to high yields like moths to a flame. But incredibly appealing high dividends are generally only made possible by one of the following scenarios:

The stock or fund is highly leveraged… and thus, at risk to any unexpected shifts in Fed policy. Closed-end funds and mortgage REITs can fall into this trap.The stock is paying out a “return of capital” in addition to the regular dividend, or simply returning your original investment back to you. This is common with certain oil and gas trusts.The market is pricing in a steep dividend cut and the current high yield you see is about to go up in smoke. A typical red flag for companies in distress.All of these scenarios can be devastating when you don’t see them coming but the third is by far the worst.

Think about it…

When you do speculative trading, you go into it knowing that you could take losses. It’s part of the game. But when you’re investing for income, that’s generally money you can’t afford to lose. If you’re retired, you might need it to meet your basic living expenses.

So, what can we do?

Here’s my suggestion. Ignore the siren song of high yields and look for the dividend growth instead. It requires a little patience, but it’s a lot more likely to give you a safe retirement.

Let’s consider two hypothetical stocks each priced at $100… one that sports a dividend yield of 7% and one that sports a still pretty respectable yield of 3%. This amounts to cash dividends of $7 per year and $3 per year, respectively.

Let’s now assume the high yielder keeps its dividend constant, while the low-yielder is growing its dividend at 20% per year. Five years later, that 3% payer will be paying out $7.46 per year in dividends, whereas the 7% payer will still be paying $7.

On your original cost basis, the “low yielding “stock sports a 7.5% dividend yield after five years. That’s not too shabby. It just requires a little patience.

Now, I should throw out one big warning here: Nothing in the world of investments is permanent. And more importantly, this is not an endorsement of a blind buy-and-hold strategy.

Today, a stock can raise its dividend at a healthy clip and then fall into financial ruin tomorrow. And in a severe bear market, pretty much all stocks get clobbered together. But if your goal is building a durable income stream, you shouldn’t overlook dividend growth.

Charles

Lending Club. BancAlliance. Friend or Foe?

There was a time when community banks were friendly places.

Bank employees and managers worked hard to build trust with people in the area, trying to attract depositors, as well as potential lending clients. But that was, to quote Star Wars… long ago, in a galaxy far, far away.

Today, deposits are not hard to come by. Cash seems to be everywhere. The problem is… what to do with it?

Over the last decade small banks have been phasing out small personal loans, which left them over-weighted in business loans as well as asset-backed loans. When there weren’t enough people in their area applying, and qualifying, for such loans, the banks would buy bonds.

Now that the Fed and every other central bank has driven interest rates below the rate of inflation (if not below zero) bonds aren’t paying enough interest to justify the investment.

This situation leaves small banks in a predicament. If they don’t earn solid returns on their lending and investing, then they have to make up the shortfall by paying less interest to depositors, charging higher fees on services, or a combination of the two. Neither of these approaches endears local banks in their communities, so they’ve looked far afield for a better way.

They’ve found one, but it involves taking opportunities away from retail investors.

As small banks shifted their focus away from small, uncollateralized personal loans, they also allowed their underwriting skills in this area to diminish. When other lending opportunities dried up, the banks could not, or did not want to, restart this type of lending in-house.

Looking at trends in the industry, banks found what could be a great fit — Lending Club.

I’ve written about Lending Club before. It’s a peer-to-peer (P2P) lending organization that matches those with money to lend with those who are seeking a loan.

Potential lenders sign up with the service and deposit money into their accounts. Potential borrowers fill out applications that, upon approval, earn the borrowers a spot on the Lending Club website where lenders can review the borrowing requests.

Many metrics about the borrowers are included in the descriptions, like borrowing and repayment history, credit score, etc., and there’s even a ranking from Lending Club itself. All of this gives the lenders more information to use when determining where to lend their funds.

Lenders can spread their funds around in small increments, putting as little as $25 into each loan they fund. This means that lenders are spreading their risk of non-payment among many borrowers, and any single borrower can receive funds from many different lenders.

Since its inception in 2006, Lending Club has made more than $6 billion in loans. These loans typically have higher interest rates than mortgages or car loans but have lower rates than credit cards, which make the loans attractive to borrowers. The loans also tend to have interest rates higher than rates on bonds, which also makes lending money through the program attractive to investors.

That’s until the community banks get involved.

Recently, a group of 200 community banks announced they’ve created BancAlliance, which will funnel $5 billion to Lending Club to be used in funding loans. In the second quarter of 2014, Lending Club funded just under $1.2 billion in loans, which means that the new funds from BancAlliance represent more than a year’s worth of funding for Lending Club and could displace all of the current lenders in the program.

This is a smart move by the banks because they can rely on Lending Club’s proven process for vetting borrowers and assigning them different risk classifications. This allows the banks to put their excess funds to work making small personal loans without having to recreate lending expertise in this area.

Arguably borrowers who use the service will also benefit because more dollars will be chasing their loans, which should drive down the interest rates they must pay to borrow funds.

While that’s good for the banks and borrowers, it does mean that investors who use Lending Club to make loans will have to work a little harder, and probably settle for smaller returns. The members of BancAlliance will have parameters on what types of loans they will fund, and what types of borrowers will qualify.

Given the size of the funding involved, this will most likely shut individual lenders out of whatever categories fit the metrics approved by BancAlliance.

In the larger picture, this new arrangement highlights the difficulty that all fixed-income investors have when trying to put their funds to work. Yield is so hard to come by that investors are willing to consider investments today that they would have dismissed out of hand before the financial crisis.

Part of this has to do with the activities of central banks as mentioned above, but it also has to do with where we are in the economic cycle.

Almost every country in the developed world is struggling with weak economic growth while their populations age and seek out guaranteed income. These two trends favor fixed-income investing, which in turn drives down interest rates as more money chases cash flow investments.

As the boomers continue passing through the retirement door over the next several years, this trend will only get worse, and make yield even harder to find.

This is one of the most common questions we receive at Dent Research, and it’s why I wrote about the possibility of continued low interest rates in Boom & Bust this month, where Adam O’Dell highlighted a great opportunity for income investors.

Rodney

P.S. Charles explores how to build a portfolio with a safe income in today’s Ahead of the Curve. Read up on his tips now.

February 20, 2015

Look Out! Is China’s Real Estate Bubble Ready To Burst?

I’ve been warning that the greatest threat to the global economy is the bursting of China’s real estate bubble. It’s the largest and most extreme in the world. Prices for Shanghai real estate have gone up 650% since 2000 and 86% since the last peak in 2007.

Here’s my question… what’s driving this bubble?

The answer lies in the movement of 220 million people from rural to urban areas over the last 12 years — the greatest and fastest urbanization rate in history.

And what do these new unskilled people do for a living? They build condos for no one.

China has massive ghost cities with little or no residents. It has 27% of its condos in urban areas that are standing there… vacant.

221 million people are unregistered citizens of these cities with no social benefits from education to health care.

The Chinese government is walking a tight rope…

They’re curbing their runaway shadow banking system and then encouraging bank lending.

But the recent surge in bank lending only caused a temporary bounce in housing prices, which is already failing again as the following chart shows.

Home prices in the first tier, which consists of the largest cities, has already seen the biggest decline yet — from more than 19% in late 2013 down to -4% recently — a swing of 23% points. That compares to the decline from slightly above 12.5% in late 2007 to -7% in early 2009, a swing of 19.5% points.

The second and third tier cities are now down 5%, even more than the first tier.

Out of 70 markets, 64 of them fell in January after 67 out of 70 fell in December. This is looking very serious.

The key thing to remember is that the Chinese have 75% of their net worth and savings in real estate versus 28% in the U.S. as the chart below shows.

These condos are not only overvalued but they’re often empty and not owned by the developers that couldn’t sell them. They’re bought by Chinese investors… especially the top 10% that control 60% of the income in the Chinese economy.

When the wealth of these investors and consumers implodes, so will the Chinese economy and the huge portion that comes from building real estate, infrastructure and factories for no one.

One thing to note is that the affluent Chinese are also the most aggressive buyers of high-end real estate in the leading English-speaking cities around the world now. The Russians and Middle-Eastern buyers are receding due to the crash in oil prices and the drop in the Russian ruble.

We’ve been warning about this for years… the crash of the Chinese bubble will be the biggest factor in the next great global crash and the central banks in the U.S. and Europe will be able to do little about it. China’s real estate implosion will set off a global crash in all of the cities that have thus far managed to defy the 2008 crash.

As for cities like New York, L.A., London, Vancouver, Singapore, Sydney and many more? Don’t think they won’t fall.

Harry

P.S. Follow me on Twitter @harrydentjr.

Precision Biotech Part 2: How Is Our Medical Data Analyzed?

The last several weeks we’ve been focusing on wearable devices that monitor your health and the precision medicine initiative, which focuses on high-tech means and methods for archiving your biological data for advanced and customized medicine.

Let’s turn our attention to where the data from these wearable devices and traditional lab testing equipment would go for analysis. Part of the precision medicine initiative is to develop a voluntary national research cohort of a million or more people to donate their medical data for analysis and development of better precision treatments and medicine.

There will be a secure government database containing a million or more medical files that contain essential information for doctors to review. These files would include genes, metabolites (chemical make-up), microorganisms, environmental, and lifestyle data.

All of which help doctors to diagnose and treat their patients more efficiently.

You may be skeptical because you’ve seen that the Veterans Administration (VA) has been featured in several news segments covering their poor handling of medical records. And you have a point.

But here’s where we turn away from a government-owned facility to one that is private.

The private industry is currently developing precision medicine-type analysis centers where genomes can be mapped and stored on a smaller scale.

This data will greatly enhance the diagnosis and treatment options for a variety of horrible diseases, with cancer being one of the most formidable foes. The formerly profiled NantWorks conglomerate is only one of a handful of companies that intends to fight cancer with this precision technology.

There will be constant changes in stockpiling this type of medical data… the primary reason being privacy options. But there is an upside to providing this important medical information.

It gives doctors solid statistics in order to diagnose and treat ailments that crop up in any given patient. They’ll be able to compare the chemical and biological make-up of the patients in question, and be able to treat them in a more efficient and targeted manner.

If you’ve missed the first part of this series, you can read up on this important feature that has cropped up in our health care system. It’ll be an essential part of lives in just a few short years and will serve to enhance the care we get from our doctors.

If you’re interested in learning more about game-changing bio-news and would like to take advantage of the market plays available, check out the latest health and biotech technology trends through my Biotech Intel Trader service. Click here for more information.

Ben

P.S. For those of you who have missed my previous articles, you can read up on everything here.

February 19, 2015

Don’t Be Fooled! The Truth Behind Those Unemployment Figures

Many market observers have acknowledged that the economic recovery since the Great Recession has been tepid at best. Politicians like to point to the declining unemployment rate that tie into their successful policies in getting Americans back to work.

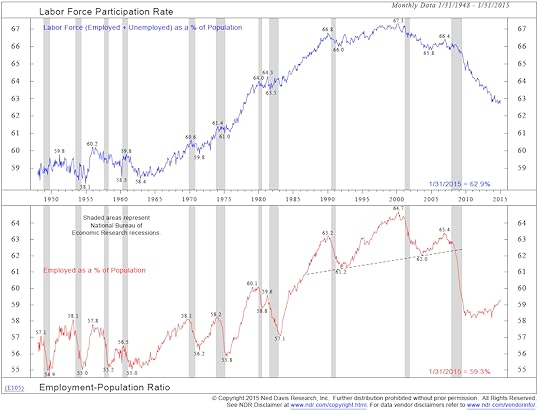

But, in my opinion, government statistics are misleading in the best of circumstances. One of the biggest concerns I have about the economy is that the labor force participation rate is at generational lows.

The chart below illustrates that the participation rate was 62.9% on January 31, 2015 or at about at a 35-year low. Furthermore, it’s been in serious decline despite the massive economic stimulus provided by the Federal Reserve since 2009!

Let’s dig a little deeper into the numbers because I think they point to some very serious issues facing our economy in the near future. First, from looking at participation by age group, it reveals some dangerous trends.

The 16- to 24-year-old age group is at 55.1%… that’s around the same level it was in 1965. These people represent the future of our country. But, only slightly more than half are actually working.

Sure, some may be in school but the next group is also stagnant.

The 25- to 54-year-olds are at 81.1% participation. In absolute terms this may seem high, but it’s actually been at a virtual standstill since 1990 and has dipped to levels equal to those from 1985.

So, in 30 years, no net progress here!

This is the group that has the most impact on our economy. According to Dent Research, spending accelerates in the 30s to 40s and tops out at around 54 years old.

Finally, the 55 and over year olds are at 40%, which is approximately at 40-year high! Sounds good, right?

Well, not so fast.

People are working well past 65 or so because they aren’t prepared for retirement, incomes are stagnant and they still have bills to pay. They have to work, whether they want to or not!

Furthermore, Dent Research statistics show that these people are past their spending prime. Therefore, the fact that they’re taking up more of the working population doesn’t necessarily translate into large increases in consumption.

According to the Census Bureau, real median household incomes continue to plunge. In 2013, they hit $51,939 per household compared with nearly $57,000 in 1999 and $56,436 near the market peak in 2007 before the last crisis.

These statistics are of major importance because about 70% of the economy is driven by consumption (approximately 70%) and fewer people are actually in the labor force regardless of what the misleading unemployment rate might state. Further compounding this problem is that wages are not growing.

So, what does this mean for investors?

The group that is willing to buy is growing smaller on a daily basis. The demand side of the equation has been squeezed dry. Companies can only cut costs so much and buy back stock to prop up earnings. But eventually, you need sales!

And, who can buy anything if they don’t have a reasonable paying job?! Meanwhile, they’re stuck on the same income they were before the crisis even began eight years ago.

In my opinion, the financial engineering by public companies is stretched to the max. In the absence of accelerating revenue opportunities, the multiple stocks trade at relative to revenue and earnings will begin to flatten out or shrink.

And, that means muted stock returns over the next decade.

Keep reading for more updates on what’s around the corner.

John