Harry S. Dent Jr.'s Blog, page 175

November 14, 2014

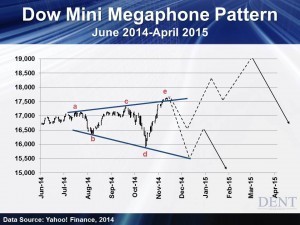

Dow Jones Creates a Pattern

The overarching pattern in stocks that I have been following for years is called a megaphone pattern. This is simply a series of higher highs and lower lows. The S&P 500 traced out a large megaphone pattern with three tops in 1965, 1968 and 1972 just before the big crash of 1973.

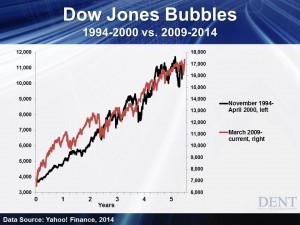

The first major bubble in the Dow began in November of 1994 and topped six years later in January 2000. That was the first high. The low came during the October crash of 2002.

The second high (and higher than the previous one) came in October 2007 and soon followed by the lower low of March 2009. Now we’re potentially seeing the final top forming.

To chart this pattern I simply draw a trend line through the tops and the bottoms. The top comes through presently around Dow 17,400 and the next lower low would project to somewhere between the levels of 5,500 and 16,500… depending on when that bottom trend line is hit.

The final top (or E wave) can often go a little above the trend line as it has recently been hitting 17,638.

It shouldn’t go much higher than 17,700…

If this megaphone pattern continues to play out, then the big crash would seem more likely to occur in the 2015 to 2016 time frame, as it did back in 1973 to 1974, just after the last major long-term stock peak from the Bob Hope generation spending wave.

If the broader Dow megaphone pattern is violated then stocks could head substantially higher. The only resistance level left for stocks would then be the 2000 peak for the Nasdaq at 5,050.

That would represent a major B wave peak and it would be very unlikely that it would be exceeded, or at least not by much and imply a Dow as high as 19,000 and an S&P 500 as high as 2,200 — which is around 8% higher than it is currently.

Such targets would make this bubble roughly equal in percentage terms to the extreme bubble that peaked in early 2000, hence that would be a very credible topping point.

Time to RallyI’m in total agreement with an observation Adam O’Dell made last week. He said that in the last several months the market has been reaching higher highs and lower lows and that if the next correction likely just ahead sees a lower low after the extreme spike from October 15, then a top is likely been put in.

If it doesn’t, then the markets are likely heading to substantially higher levels.

The higher highs and lower lows Adam was referring to form a mini megaphone pattern as the chart below shows. The July peak was the first high. The second peak was in September followed by a lower low on October 15.

The current rally would represent the E wave if this megaphone pattern continues to play out. The target for the next lower low would be around 15,500 and should occur by mid-December or so.

If we see such a lower low, then it’s highly likely we put in a top in November. If we instead get a correction in early to mid-December and we’re not seeing a lower low and/or the market is starting to rebound strongly, then we’re very likely to break above the broader megaphone pattern and see substantial new highs in the months ahead before a final peak.

My best short-term cycle expert, Andy Pancholi in London, has a minor turn date around November 14 for stocks and a major set of turn dates between late February and mid-April, especially around mid-March.

We’re likely to either see substantial new highs or a crash into this March time frame. Stocks are now as overbought as they were oversold on October 15, so a correction is very likely in the coming weeks.

In the chart above I’ve outlined two potential scenarios: the first with a peak in mid-November and the second with a peak around March of 2015 near 19,000 on the Dow. Hopefully, one of these two scenarios will be validated by mid-December 10 and even more so by year-end or early January.

On average mid-October through early January is the best seasonal period for stocks on average. However this is not the case when there are major tops like 2007 or 1929.

What’s the Smart Money Doing?Adam noted that the advance/decline line (which shows more selective buying of larger cap stocks) is not confirming the new highs in stocks as of yet, but it certainly would if we break well above the broader megaphone pattern. I commented last week that rising trends in buying power and falling trends in selling pressure on this recent rally is the one major indicator that would suggest that the top has not been put in yet.

This indicator is saying that the “smart money” is not exiting yet. But what if they react differently this time when the Fed seems to be guaranteeing that the markets won’t fall very much?

I’ve commented many times that the rally we’ve been experiencing since March of 2009 has been the trickiest in history because it’s an artificial rally fueled almost solely by unprecedented stimulus measures. Many technical indicators and leading indicators simply don’t work anymore because the markets have been essentially taken over by central banks.

The one thing that has worked better is the visible patterns in stocks like head-and-shoulders, channels, wedges and megaphone patterns. Although I had a key wedge that was broken on the downside on October 15… this sharp rally occurred to new highs despite of it.

I still warn that it’s better to get out a little early than too late as such an artificial bubble rally will likely see a swift and violent crash when it does finally top. The Nasdaq crashed 40% in its first 2.5 months of the down wave in 2000.

If, by December 10 or so, we do see the markets holding well above the October 15 lows then the odds are the markets are going higher. Investors who have sold could then choose to get back in altogether or in steps and increasing your exposure if we do break to new highs above the levels achieved in November.

I wish this market wasn’t so hard to read but that’s the hand we’ve been dealt. But make no mistake, this is a bubble and the lagging performance of small-caps is a clear sign that the end is near.

Harry

Ahead of the Curve with Ben Benoy Keep Your Eye on the BallU.S. Economy Needs the Taxpayer

U.S. taxpayers bailed out millions of home loans. We backstopped Fannie Mae and Freddie Mac and lent hundreds of billions of dollars to banks that were all but bankrupt. The bad guy in this story is the greedy banker, who would do anything to write another mortgage.

His weapons of choice were loans with lax lending standards (liar’s loans, NINJA loans, etc.) and the targets were consumers with marginal credit.

When it was all over but the crying, Congressmen were outraged. They vowed that taxpayers would never again foot the bill for such a meltdown, that lenders would be held accountable and that consumers would be protected from predatory loans they couldn’t possibly repay.

Apparently, the voice of reason had spoken. Right…

Yes, banks have been penalized with multi-billion dollar fines for their previous lending practices, and yes, lending standards have tightened dramatically. But a funny thing happened on the way to fiscal responsibility — the economy suffered.

Without all the go-go juice of easy credit being extended to marginal buyers who would then bid up the price of homes, the real estate industry has been left to survive on the slow stream of business created by high-quality borrowers who can come up with a 20% down payment and have a low debt-to-income ratio.

It’s been awful! There just aren’t enough of these folks willing to buy homes for the real estate market to recover. At this point, the voice of reason was shouted down.

So, of course, our fearless leaders caved.

Congressmen demanded easier lending standards and Mel Watts, the new Director of the Federal Housing Finance Agency, which oversees Fannie Mae and Freddie Mac, was given his position specifically for him to ease the terms on which these two giants would guarantee loans.

As for banks being on the hook, well, not so much anymore. Lenders have bigger loopholes they can use to cast off any responsibility for lending money.

As the dust settles, loans originated with a 3% to 5% down payment can qualify for a government guarantee and banks have been given a list of characteristics that would make a loan eligible to be put back to the bank. All the banks have to do is dot their “I’s” and cross their “T’s” and they’ll be free of any liability.

Of course, we as a nation will still be making loans to marginal borrowers who don’t have to put up much cash. When the next downturn in real estate happens, these borrowers will be faced with the not-so-tough choice of walking away from a home that is 15% to 20% underwater, in which case their modest down payment is long gone.

Just like in the financial crisis, homeowners that are way under water will make their credit card and car payments, but won’t bother to pay for the home anymore. What would be the point? Like last time, they can live in the home rent and mortgage free for many months, because who will kick them out?

And who’s the poor sap that’s on the hook to eat the loss on the mortgage? Once again, it’s the taxpayer.

If this weren’t bad enough, the newest crop of sub-prime borrowers to be targeted by lenders are none other than boomerang borrowers — those who lost their homes in foreclosure or a short sale after the financial crisis but are now back in the market to buy a home.

I would ask: “How is any of this a good idea?” But I know the answer.

When the government can’t manufacture a strong economy through gimmicks like cash for clunkers or outrageous monetary policy such as QE (insert latest number here) programs, they will try anything to move the needle of growth.

If it means putting the taxpayer back on the hook for something that was catastrophic before… well, so be it.

I often wish that Congress and the Administration wouldn’t try so hard to help us. I’m not sure we can afford any more of their assistance.

Rodney

The Markets and Capitalism

Adam Smith was the first brilliant economist to espouse the “invisible hand” of free-market capitalism — how the natural self-interests of individuals create a system of innovation and growth that improves our standard of living in a network of growth and evolution…

If only we’d allow it to happen without the excessive intervention by governments, organizations and special interests to counter it…

Throughout the history of the world special interests have consistently countered its natural development. Governments want to control the economy and make it work for their interests.

Crony capitalists and businesses want to lobby these governments and create monopolies that consistently counter competition.

Workers want unions and welfare protections guaranteeing higher wages for less work and protection against job loss…

And they want a guaranteed retirement.

It’s important to understand that the very essence of the free-market capitalist system is that it makes everyone… governments, businesses and workers more accountable. That concept works against our natural inclinations to have things get better and better and then, we get to go to heaven (retirement).

The truth is that we want life to grow incrementally and then, never have setbacks. We want the good without the bad, the booms without the busts, the inflation without the deflation, and so on…

Life and the free-market system, reflecting that very concept in all its glory, thrive on the dynamics generated by such polar opposites.

Ask yourself: did you learn more from your successes or your failures? You learn from both but the real truth is that you learn more from your failures. Those changes are codified into new and more successful behaviors… until you fail again and, of course, learn again.

In the economy, the greatest innovations largely come from the challenges of down periods and the extremes of inflation and deflation (summer and winter seasons) and not from the great booms. The innovations of such challenging periods then move into society and increase our standard of living in the booms that follow when success reigns… but truth be told, success only makes you more complacent and arrogant and that leads to failure yet again.

You don’t get success without failure and because of that, failure is critical to the free-market system and progress, just as George Gilder espouses… and David Stockman, Lacy Hunt, Adam Smith, Milton Friedman and yours truly.

That’s why we espouse free-market capitalism despite the fact that we secretly hate it and fight it every single step of the way.

That’s why we have people like George Gilder, David Stockman and Lacy Hunt as keynote speakers at our Irrational Economic Summits every year. It’s only wishful thinking to be able to have phenomenal individuals like Adam Smith and Milton Friedman to speak at our Summit because they’re no longer with us.

George Gilder’s theme in our 2013 conference from his book Knowledge and Power was at its core one key concept: Failure is critical to the free-market system and is prevented by standing government policies and the manipulation of the economy which stifles innovation despite its best efforts. Thank God that innovation happens despite our best efforts against it.

David Stockman’s book The Great Deformation is subtitled “The Corruption of Capitalism in America.” I really couldn’t say it better than that. In his talk at our 2014 conference, he got a standing ovation and the questions from the audience never ended and during his presentation he referred to my term “the Great Reset.” And he noted why my term resonated with him.

He stated clearly that we would have to see a great deflation to rebalance our economy. That’s what the natural life cycle, and the free-market capitalist system does. It innovates… it grows… and it rebalances. It’s creative destruction.

Lacy Hunt will be speaking at our next conference in September 2015, but at a previous conference he explained how money velocity goes through clear stages and why we are not getting inflation despite the most massive money printing in history. His analysis shows we are clearly headed into a deflationary period to reset the debt and financial asset bubble.

No one. Not governments or businesses or individuals want the resets or rebalances that come naturally because they’re painful. We simply don’t like pain and that is a non-acceptance of life as it is! That is delusion or illusion.

Let me pose a question. What will you choose? Truth or consequences? The truth about life is you get both.

You don’t get truth without consequences. We don’t want the consequences so we ignore the truth. But the truth and the inevitable consequences always win in the end…

And that’s why we get great resets to bring that reality right up against our unrealistic assumptions about life and its nature that is both exponential and cyclical.

Not since the 1920s and 1930s have we found ourselves in such a great delusion. It’s a one that constantly fights against the truth and free markets. Governments are printing money to offset the inevitable consequences of the greatest debt and financial bubble in modern history.

Debt, like any drug addiction, is a financial drug and it’s used beyond the natural means to finance homes for our kids and cars. When it goes to extremes and creates financial bubbles and extreme income inequality, it has to fail and rebalance… and it will do so painfully, now even more painfully given that governments have refueled an even larger bubble.

It’ll be like a drug addict coming off of heroin. But that’s really the only option in the end: debt detox!

This is what I see happening between early 2015 and early 2020, when the most comprehensive cycles I’ve tracked throughout history are pointing down at the same time for the first time since the early 1930s and the mid-1970s.

When that comes together, despite all government efforts trying to prevent it and just like the unprecedented global monetary and fiscal stimulus… the natural forces take back over and reinstate the very free-market system of innovation and progress that we love… and hate.

Watch the free-market system come back with a vengeance from 2015 to 2020 and protect your assets against “the Great Reset” ahead that will bring financial assets back to reality and will restructure the unprecedented debt bubble of 2000 to 2008 and every other financial bubble that stemmed from it… from stocks to real estate to commodities to high-yield bonds.

Asset allocation will not protect you when almost all asset classes go down as they did in 2008.

Be safe and not sorry… but do it sooner than later!

Harry

November 11, 2014

Robotics and the Business Cycle

Unlike others that try to peer into the economic future, I’m not waiting for flying cars. I’m not anxious for a time when people have even more opportunities to wreak havoc on my daily life by flying near my home and office.

That being said, I am very interested in the next step in technological change in the workforce. Just as desktop computing, voicemail, and email erased much of the need for secretaries, robots are quickly gaining ground in areas such as machine operation in manufacturing… but they might not be ready to replace retail clerks just yet.

The hard part of working with robots in manufacturing was the need to keep a safe distance. Without the ability to recognize and appropriately respond to the presence of people or other fragile objects, early robots were useful for tasks such as welding and transport, but were very dangerous…

Now, several robot companies have solved this issue. Universal Robots of Denmark is one manufacturer of a new class of machines called collaborative robots. These units work with humans without the fear of injury, so the robots can be part of a manufacturing process that requires the judgment of people, but can also benefit from the precision and durability of a robot.

Imagine a part that is being welded or treated with chemicals. A person can’t hold such items without protective gear or some other method of separation. Robots can hold the parts while they are worked on, as well as move the parts around while they are still hot or otherwise dangerous.

The cost of the collaborative robots has fallen to as low as $20,000 making them affordable for even the smallest of operations. Compare that with the wage of a machine shop operator of $22.42 per hour as reported by the Bureau of Labor Statistics.

This operator, who gets sick days, holidays, time off every day after work and benefits will cost a company roughly $44,000 per year. The robot, which can operate 24 hours per day and never calls in sick, would save the company money over hiring the operator in just under six months. And that’s if they simply worked the same hours.

Of course, not every new use of a robot turns out to be a great idea.

Can You Help Me, Robot?Lowe’s Home Improvement is rolling out two retail robots in a subsidiary store, Orchard Supply Hardware, in San Jose, CA. The units will greet customers at the door and ask if they need assistance.

Customers can ask where products are located, place a bolt, nut or nail on a 3D scanner that will determine the exact size and where replacement pieces are located in the store. It’ll even provide video conferencing with personnel who can assist clients with their needs for projects.

The robots then travel with the customers to the appropriate location in the store to locate the exact product in question. This all sounds great but it misses part of the experience of home improvement stores, as well as other retail outlets.

Many shoppers — me included — don’t know exactly what they want or need.

Waiting around to video conference with an expert isn’t the same as standing in the aisle with an employee talking through a project. The interaction with a live person can include pauses and alternative scenarios for completing tasks.

Imagine standing in a hardware store, staring at a screen and telling a person sitting in a room somewhere that you’re not really sure what you need. The expert might talk through some of the issues but there will be a sense of urgency to end the conference. There is an awkwardness to silence on calls, even when they are live video feeds.

Real Steal Robot

Real Steal RobotOf course, the reason for putting the robots in hardware stores is the same reason for putting them on factory floors — increasing productivity per dollar spent. Robot guides don’t have to take breaks or stop working after eight hours, so arguably Lowe’s could replace a large part of their staff simply because the company wouldn’t have to run more than one shift of workers that assist clients in stores.

Whether this cost savings is enough to roll out the initiative to other stores remains a question, as does the actual client experience of interacting with one of these robots.

Both of these developments — collaborative and guide robots — increase the speed at which people are being replaced in the workplace. Such displacements have happened throughout history, constantly killing different types of employment, driving would-be weavers, carriage makers, secretaries and now machine operators into other jobs.

While there’s no doubt that society as a whole is better off with greater productivity, the picture isn’t so bright for the would-be machine operator. With median income falling as the middle class loses ground, we need a faster method for retraining displaced workers and training those new to the workforce in jobs that are unlikely to be automated in the near future.

Otherwise, we’ll end up with many potential workers who can’t even get a job at McDonald’s… because that company is also automating the ordering process.

Rodney

November 10, 2014

The Dollar’s Crucial Role in the Commodity Cycle

The U.S. dollar is falling and it’ll ultimately crash and go down to near zero. Not true… that’s what the gold bugs keep harping on but it’s not true.

This misinformation is very representative of what’s going on in the global economy and it’s almost as bad as the liberal economists and analysts who believe we should just print as much money as necessary to keep the economy growing.

Let’s just start with the truth.

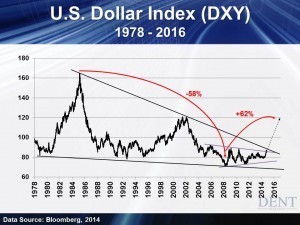

The U.S. dollar did fall dramatically from 1985 into early 2008. And it fell by a staggering 58%.

That’s a major devaluation for a reserve currency that’s usually valued higher than normal due to the fact that dollars are bought at a higher pace because they’re used for global transactions.

What most people don’t realize is that the U.S. did lead the debt bubble from 1983 to 2008.

The Recipe for DevaluationThere were several factors that caused that sharp devaluation. Total debt in the U.S. grew at 2.54 times its GDP for a span of 25 years and the country experienced near constant trade deficits since 1970. In an effort to compensate these, the largest economy in the world circulated more dollars overseas in foreign exchange reserves.

We flooded our economy and the world with dollars and that is what caused that devaluation of 58% despite the fact that the U.S. was experiencing the greatest boom in the world’s history.

What’s happening now is the beginning of a great deleveraging of the debt and financial asset bubble — the greatest in modern history.

Over the next several years, more dollars will be destroyed than any other currency and that will rebalance the great devaluation of 1985 to 2007. The dollar will continue to go up. Not forever… but at least over the next few years when this deleveraging is likely to be at its worst.

The chart below shows the U.S. dollar index from 2008 to present against the six major currencies of the world.

So let me ask you this: Has the dollar been crashing? No, it’s been trending up since the last great recession started in early 2008. And it continues to trend up even in this new bubble despite the fact that we’ve printed more and more dollars up until October of 2014.

Why? The European Central Bank (ECB) printed more than we did into early 2012 due to an even greater crisis that has persisted longer for them, and they have started printing again to buy sovereign bonds. In early 2013, Japan went off the reservation printing at two to three times its past rate… outstripping the U.S. And on October 31, they announced an even greater increase of 15% to 20%.

The reason the dollar has appreciated more recently has to do with greater money printing from other governments while we finally tapered for the first time over the last year.

One of the most important insights is that the U.S. dollar has only risen since the great crisis — it’s not falling or crashing. It spiked 27% in the worst of the last great financial crisis of late 2008 when gold crashed 33% and silver 50%. It was the safe haven, not gold and silver.

But now even in the strongest period of the money-printing led recovery, gold has fallen 40% from its peak in 2011 and silver 67%.

Why? All of this money printing has still seen inflation flat to falling in most developed countries and back near deflation levels in Europe. Even Japan’s off-the-charts money printing cannot get inflation back up to a measly 2%.

The recent desperate acceleration of Quantitative Easing (QE) for Japan, and now again in Europe, only reflects the even greater debt problem of those countries and their even slower demographic trends. They’re printing more out of weakness and not out of strength.

So here we are… the best house in a bad neighborhood.

At some point we’ll have to print some money again when our forecasted slowdown of 2015 sets in and there are already many signs of it. But if we do begin printing again, the weaker countries will do it as well and even more so.

The most important observation from the dollar index above is that it’s at a key resistance point around 87 to 89, so if it breaks up it could advance to 104 and ultimately higher. This could possibly happen by late 2016 or early 2017 more or less before trends work against it again.

But the dollar is currently overbought and could correct for days or maybe longer, before it breaks up again. If it does break back up strongly above 89 it will be a sign that commodity prices are trending even lower and that the global economy is slowing even more and that U.S. exports will slow even more.

But a higher dollar will bring greater value to the 50% of earnings of S&P 500 companies that will be worth more in higher valued dollars. That’s the wild card at first.

All things considered, a higher dollar will be a sign that the global slowdown is accelerating and that the great deflation is coming.

So have more in U.S. dollars and safe government bonds… not stocks and commodities. The signal will be if the U.S. dollar breaks much above 89 in the days or weeks ahead.

Harry

Ahead of the Curve with Adam O’DellWeathering Market Volatility

Weathering a Volatile Market Cycle

It’s just two months until we hit 2015 and as we watch what’s happening in markets we can definitely see that the first week of November proved to be mild compared to the wild ride we had in October.

We’re now entering a season that’s historically favorable to stocks. And the wave of buying activity we saw two weeks ago shows there’s still buying pressures in the market. These two factors may well work together to support prices through year-end.

That said, a number of observations tell me that investors are still putting the “caution” in “cautiously optimistic.”

A preference for high-quality assets shone through last week, suggesting investors want to stay invested… but are leaning toward a defensive stance.

For instance, U.S. stocks made gains last week while foreign stocks — which are perceived to be riskier — lost a bit of ground.

Bond markets were also split. While Treasury’s (high-quality) gained, there were several bond niches that drifted lower… emerging market bonds (higher risk), included there.

And classic “defensive” sectors — like Consumer Staples and Utilities — have been outperforming in the aftermath of the October shakedown.

But the recovery from mid-October’s selling climax is still feeble, as a handful of technical indicators are not yet confirming stocks’ newfound strength.

One of these is the cumulative advance-decline line. It measures the total number of individual stocks that are trading higher relative to the number of individual stocks that are trading lower. And it acts as a useful gauge of a market rally’s health. Specifically, when a broad stock market index, like the S&P 500, is trending higher — making higher highs and higher lows — you want to see the advance-decline line tracing out a similar pattern.

But currently… it’s not.

While the S&P 500 has recently broken to new highs… the advance-decline line is still working to push above its early-September peak. Take a look…

I’ll continue monitoring this technical indicator because if it fails to break to new highs in the near future, it could be a sign that the market’s newfound strength is short-lived.

Either way, the Boom & Bust portfolio has weathered market volatility quite well. If you’d like to see which positions are featured as the best and worst performers of this week, click here.

November 7, 2014

U.S. Economy and Mid-Terms, What Now?

A new balance of power has been ushered into the Senate.

The United States Marine Corps taught me to embrace fresh leadership because that’s one of the principal mechanisms that keeps our institutions truly focused on their core values and ethos.

The Republicans have gained back the Senate and we’re now watching all the direct and indirect plays from this event. General election winners will take office in January 2015, but what happens between now and then?

Our short-term sentiment indicators are pointing to an overall market downturn in the next several weeks and we need to get prepared.

Since the beginning of the year, my system has generated eight negative alert signals for the broader market. Seven of those alerts were followed by negative corrections within two to four weeks, including the big drop in October.

After last week’s new highs on the S&P and on the Dow, we received two more negative alert signals.

My Social Media Collective Intelligence system (SMCI) closely follows the baseline sentiment (buy/hold/sell) of 2.4 million financial chatter messages per day. The system sends out alerts whenever there’s a major shift in sentiment from one position to another that has historically predicted price movements.

One technique we’re able to harness through this powerful tool is a reputation engine.

Financial chatter messages show direction from the author’s written sentiment (buy, hold, or sell) which our system captures through a variety of techniques. If the author says buy and the stock price goes up, that author’s reputation score goes up. If the author says buy and the stock price goes down, their reputation score will go down.

Most message authors go through cycles of winning streaks. And we’re watching them so that we can generate our alert signals in a timely manner. Right now our front-running authors are seeing a slight downturn in the market over the next several weeks.

If you’re interested in seeing how to take advantage of these downturn opportunities, you can get more information here.

As always, I’ll continue to monitor the market’s social media collective intelligence and keep you updated on the latest trends.

Happy Hunting,

Ben

Purchasing Power in Nickels and Dimes

The U.S. Postal Service is branching out. The service has been running a test program of delivering groceries in the San Francisco area, and just won approval to keep the program going for another two years.

The goal is to eventually roll out grocery delivery to other towns, like Las Vegas and Phoenix.

Obviously, the Post Office is looking for ways to earn additional revenue without raising the price of postage. Given that the service keeps running at a deficit, the desire to provide more services is understandable, but misdirected.

If they really wanted to fix their revenue problem, all they have to do is take a page out of the health care industry’s playbook.

By most accounts, the growth rate for health-care spending has been edging lower for years. The 9% growth rate of the 1990s and early 2000s has given way to growth rates under 4%.

Everyone in government seems to be crowing about this, but from the standpoint of the consumer, the moderating costs are hard to reconcile.

Maybe it’s because our costs haven’t actually flat-lined; they’ve just shifted from one provider to another…

Instead of paying our health care dollars to insurers, we now get the pleasure of paying insurers, providers, plus a host of other people we didn’t even know existed for services that were previously included.

A recent trip to the doctor illustrates the point. Instead of paying the doctor for an office visit where he examined an injured shoulder and administered a shot, now patients get the joy of paying for the office visit, paying for the medicine and paying for the administration of the shot.

If a medical condition requires a trip to the hospital, then all bets are off. While the facility might be “in-network,” chances are the emergency room doctor is not, since a majority of these physicians are contract workers.

So the patient pays the triage level fee to the hospital (this fee estimates the acuteness of the problem, the more serious the condition, the higher the fee), the fees for any services rendered by the hospital (shots, x-rays, medicine administered, braces, slings, etc.), and then a separate, typically four-figure bill to the physician.

The trend is obvious. Take items that were covered by previous billing, separate them out, and charge for them. Voilá! The basic charge hasn’t been increased, therefore costs are contained and yet consumers still have to cough up more money for the same service.

I fully expect doctors and hospitals to start charging diagnosis fees, explanation fees, appointment reminder fees, appointment or admission fees, etc.

And this trend is occurring outside of health care as well.

Baggage fees? Really? My bags, I’m guessing, always flew with the plane. The cost of transporting me was actually the cost of transporting me and my bags. Only now, they are charged separately.

Spirit Airlines in the U.S. gets the award for the most fees, since they charge for bags, seat assignments, snacks, and now carry-on items. But hey, their tickets fares are low, so there’s no inflation or cost increases in air travel!

How about cellphones?

With a family of five, I’m pretty up to speed on cellphone replacement. When I recently called Verizon to replace a phone, I was informed that the phone I requested was available for free with a contract renewal.

As we went through the process, the representative eventually asked if I wanted to put the activation fee on the monthly bill or use a different payment method. I asked: “What activation fee?” He told me it’s part of the upgrade.

I replied that, in that case, the upgrade wasn’t free as it required me to pay something. And not only did I have to pay something, but I was being told to pay for something I had to do once the phone arrived!

Which brings me back to the post office…

They’re going about this all wrong. In the spirit of the new business culture in America, the postal service should simply implement home pickup fees, sorting fees, and delivery fees. We all want our mail picked up, sorted, and delivered, right?

That way the cost of a stamp could remain the same for many years, bypassing any nasty claims of inflation or higher costs, and yet it would still mean that consumers pay more.

I guess the last few words sum it all up … consumers pay more… no matter what we’re told by government statistics, the claims of politicians or slick advertising.

Rodney

Ahead of the Curve with Ben Benoy U.S. Economy and the Mid-Terms, What Now?

Dow Jones Showing Strong Signals

We just saw the first serious correction of 9.9% in two and a half years that at least started to break the most serious uptrend levels on the downside when the S&P 500 broke below 1,860 on October 15.

But then we saw stocks rally to slight new highs in half the time it took to do the down damage. This was the strongest two-week rally in the entire bull market since March of 2009.

Welcome to the “markets on crack.”

With interest rates at zero short-term and zero adjusted for inflation long-term, speculators are having the party of their lives with the ability to leverage as high as 30 to 50 times and basically hijacking the markets courtesy of the Fed and the central banks around the world.

These highly leveraged traders and high-frequency models have moved from 15% plus of the trading volume to 50% plus. That’s a huge leap. Now, they can push up the markets on their own buying power…

Bubbles tend to absorb everything and everybody around them, they’re similar to black holes in space that are so powerful that not even light escapes… that is principle No. 7 in Chapter 5 of The demographic cliff.

Now these powerful traders are doing that more than ever compared to the fundamentals which are weaker than any major bubble in history. They love to keep the markets going up with endless monetary stimulus that funnels more money into stocks that have nowhere else to go due to low interest rates and falling commodity prices.

But what they love even more are the short-term swings that they play on both sides at the expense of “real” investors looking for longer term gains to meet retirement and portfolio needs.

Your loss is their gain in the short-term.

I’ve been watching for a final 7% to 10% sell-off followed by a move to slight new highs as occurred in the last top between July and October of 2007.

The last correction temporarily crossed an important line in the sand as I watched the S&P 500 break below a key trend line for the rally at 1,850 and 1,860 on October 15. Those numbers convinced me that stocks had likely finally peaked on September 19 at an S&P 500 of 2,020 and a Dow of 17,350.

At 17,350, the Dow was right at the top of the giant Megaphone pattern top trend line I’ve been preaching about now for several months — it keeps bumping up against it and fails. Once again, it’s back there now and is already testing it at near 17,500 on November 5.

But as usual traders decided to fake everyone out with a violent correction and then slammed it into back up harder than ever. Their statement was: “Don’t consider not buying on the dips or you will lose more chips; don’t even think of going short or we will force you to abort.”

I am no longer surprised that experts across the board argue that we aren’t in a bubble. I, of course, keep arguing that this is without a doubt the greatest bubble since the tech bubble that extended from November 1994 into March of 2000.

This is an aftershock, not quite as strong as the original tech bubble, but it is equally as extreme as the broader stock bubble in indices like the Dow.

So, let me ask you the obvious question — Does this look close to peaking or what? If it looks like a bubble, quacks like a bubble… it’s a bubble!

Stocks are now as overvalued as they were undervalued on October 15 when the S&P 500 hit as low as 1,820.

I would be most concerned if it broke much over 17,500 on the Dow as that is where the most pronounced line in the sand is on stocks and it’s also the final level of upside resistance that has really held for months now. That’s not likely to happen near-term.

If it doesn’t happen by November 14 or so, then the trends will likely move down again… and they will probably be more extreme than last time because of the parabolic rise in the span of a few short weeks, which more often than not does suggest a bigger crash to follow.

If we’re still near 17,500 on the Dow or less by November 10 to 14, I’d say “it’s a good day to die” — to start or complete your selling process for stocks or at the very least keep trimming in your passive 401(k) and retirement plans.

Overall, I can’t predict exactly when stocks or any bubble will peak, and neither can anyone else for that matter. As far as our track record goes, we were very close with housing in late 2005 and closer still on the tech bubble peak in early 2000.

And for the record, we have been early on some and late on others. And truth be told, this one is even trickier because of the Fed-manipulated market.

In recent months, most of our shorter term indicators have already suggested we’re nearing a top. Two weren’t confirming. One of those, the advance decline line which shows more selective buying of large-cap vs. small-cap stocks, is now diverging from the new high in stocks (as long as they don’t go much higher near-term).

There is one indicator that has not confirmed a major top yet, and that is a divergence between buying power and selling pressure that finally suggests even the smart money is exiting ahead of everyone else.

But what if they don’t exit this time and they think: “The Fed has our backs, a major correction is no longer likely — so why don’t we stay in and keep jerking off other investors on the way up?”

I don’t know the answer to that one. I just keep advising to sell more on rallies and new highs like this one. This more dangerous and unprecedented “artificial” bubble looks like it is finally more likely to blow!

What I know for sure is this… the downside is way greater than the upside.

Don’t look a gift horse in the mouth.

November 5, 2014

Bullish Oil Play But Not Yet

As I told Cycle 9 Alert subscribers yesterday… it’s extremely tempting to buy oil now that prices have dropped so sharply.

But don’t do it! Not just yet at least… just hear me out.

The United States Oil Fund LP ETF (NYSE: USO) is down a whopping 26% since mid-June. It’s trading at its lowest price since May 2009 and is deeply oversold.

Contrarians the world over must be thinking: “How much worse could it get for oil?” While they itch to buy.

Indeed, whenever oil prices find their footing we can expect to see a fairly sharp bounce higher.

But I think it’s still a bit too early to try catching this falling knife. Here’s my reasoning:

• Oil hit oversold levels (like we’re seeing now) in October 2008… but prices continued to fall for another 20 weeks, not finding their footing until March 2009.

• USO had a support level at $30 but this was strongly broken this week… so the ETF could fall as low as $23 — the 2009 low — before finding eager buyers.

• Seasonality will continue to be a headwind for oil prices through January or February.

From a seasonal standpoint, bullish oil positions (i.e. long USO) are best when added in January, February, March and April.

So, as tempting as it is to recommend stepping in now to buy oil’s fat discount… I think you’re wiser to wait a few months. Historically, oil prices have a tendency to slide lower during November through January. And this year, oil’s sharp sell-off has the look of a “falling knife” that could be costly for anyone trying to catch it.

What’s more, while the United States Oil Fund LP ETF (NYSE: USO), which tracks the price of WTI Crude Oil, is already down 26% in less than five months, a quick comparison of its price to the price of Brent Crude Oil (NYSE: BNO) shows USO has room to fall even lower through year-end.

Here’s a ratio chart plotting the price of WTI Crude (USO) versus the price of Brent Crude (BNO). As you can see, the ratio is in a long-term downtrend and has recently turned lower after hitting a wall of resistance (red line).

I fully expect to get Cycle 9 Alert subscribers into a bullish oil play at bargain-basement prices. But not until the time is right!

Learn more about my seasonality research and how it helped subscribers secure a 73% gain during the energy sector’s “sweet spot” season here.

Adam